Investigating the Correlation between Air Pollution and Housing Prices in Seoul, South Korea: Application of Explainable Artificial Intelligence in Random Forest Machine Learning

Abstract

1. Introduction

2. Materials and Methods

2.1. Study Area

2.2. Materials

2.2.1. Apartment Prices

2.2.2. PM Concentrations

2.3. Methods

2.3.1. Hedonic Price Model

2.3.2. Random Forest

2.3.3. Model Evaluation

2.3.4. Explainable Artificial Intelligence

3. Results and Discussions

3.1. Spatial Distribution of PM Concentrations

3.2. Descriptive Statistics

3.3. Model Evaluation Comparison

3.4. Regression Analysis

3.5. Machine Learning Algorithm

3.5.1. Hyperparameter Tuning

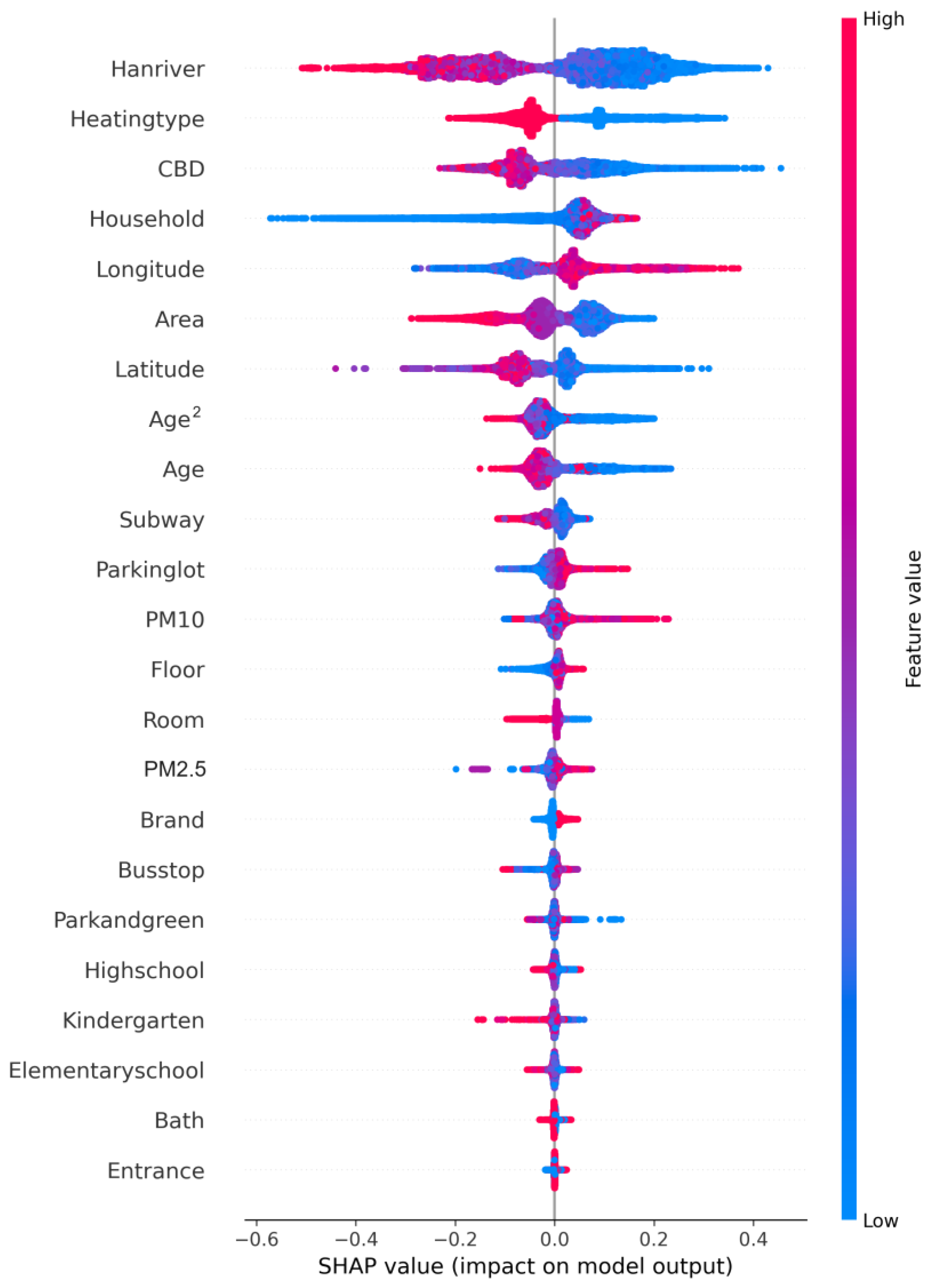

3.5.2. Importance of Features

3.5.3. Effect of Features

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Yuan, M.; Song, Y.; Huang, Y.; Shen, H.; Li, T. Exploring the Association between the Built Environment and Remotely Sensed PM2.5 Concentrations in Urban Areas. J. Clean. Prod. 2019, 220, 1014–1023. [Google Scholar] [CrossRef]

- Apte, J.S.; Marshall, J.D.; Cohen, A.J.; Brauer, M. Addressing Global Mortality from Ambient PM2.5. Environ. Sci. Technol. 2015, 49, 8057–8066. [Google Scholar] [CrossRef] [PubMed]

- Tang, M.; Niemeier, D. How Does Air Pollution Influence Housing Prices in the Bay Area? Int. J. Environ. Res. Public Health 2021, 18, 12195. [Google Scholar] [CrossRef]

- Rajagopalan, S.; Landrigan, P.J. Pollution and the Heart. N. Engl. J. Med. 2021, 385, 1881–1892. [Google Scholar] [CrossRef]

- Vohra, K.; Vodonos, A.; Schwartz, J.; Marais, E.A.; Sulprizio, M.P.; Mickley, L.J. Global Mortality from Outdoor Fine Particle Pollution Generated by Fossil Fuel Combustion: Results from GEOS-Chem. Environ. Res. 2021, 195, 110754. [Google Scholar] [CrossRef]

- Lin, S.; Liu, X.; Le, L.H.; Hwang, S.-A. Chronic Exposure to Ambient Ozone and Asthma Hospital Admissions among Children. Environ. Health Perspect. 2008, 116, 1725–1730. [Google Scholar] [CrossRef]

- Krämer, U.; Herder, C.; Sugiri, D.; Strassburger, K.; Schikowski, T.; Ranft, U.; Rathmann, W. Traffic-Related Air Pollution and Incident Type 2 Diabetes: Results from the SALIA Cohort Study. Environ. Health Perspect. 2010, 118, 1273–1279. [Google Scholar] [CrossRef] [PubMed]

- Cohen, A.J.; Brauer, M.; Burnett, R.; Anderson, H.R.; Frostad, J.; Estep, K.; Balakrishnan, K.; Brunekreef, B.; Dandona, L.; Dandona, R. Estimates and 25-Year Trends of the Global Burden of Disease Attributable to Ambient Air Pollution: An Analysis of Data from the Global Burden of Diseases Study 2015. Lancet 2017, 389, 1907–1918. [Google Scholar] [CrossRef] [PubMed]

- Wei, J.; Liu, S.; Li, Z.; Liu, C.; Qin, K.; Liu, X.; Pinker, R.T.; Dickerson, R.R.; Lin, J.; Boersma, K.F.; et al. Ground-Level NO 2 Surveillance from Space Across China for High Resolution Using Interpretable Spatiotemporally Weighted Artificial Intelligence. Environ. Sci. Technol. 2022, 56, 9988–9998. [Google Scholar] [CrossRef]

- Loomis, D.; Huang, W.; Chen, G. The International Agency for Research on Cancer (IARC) Evaluation of the Carcinogenicity of Outdoor Air Pollution: Focus on China. Chin. J. Cancer 2014, 33, 189. [Google Scholar] [CrossRef]

- Zhang, H.; Chen, J.; Wang, Z. Spatial Heterogeneity in Spillover Effect of Air Pollution on Housing Prices: Evidence from China. Cities 2021, 113, 103145. [Google Scholar] [CrossRef]

- Chen, X.; Ye, J. When the Wind Blows: Spatial Spillover Effects of Urban Air Pollution in China. J. Environ. Plan. Manag. 2019, 62, 1359–1376. [Google Scholar] [CrossRef]

- Zhao, D.; Sing, T.F. Air Pollution, Economic Spillovers, and Urban Growth in China. Ann. Reg. Sci 2017, 58, 321–340. [Google Scholar] [CrossRef]

- Huang, Z.; Skidmore, M. The Impact of Wildfires and Wildfire-Induced Air Pollution on House Prices in the United States. Land Econ. 2024, 100, 22–50. [Google Scholar] [CrossRef]

- Hong, J.; Choi, H.; Kim, W. A House Price Valuation Based on the Random Forest Approach: The Mass Appraisal of Residential Property in South Korea. Int. J. Strateg. Prop. Manag. 2020, 24, 140–152. [Google Scholar] [CrossRef]

- Adetunji, A.B.; Akande, O.N.; Ajala, F.A.; Oyewo, O.; Akande, Y.F.; Oluwadara, G. House Price Prediction Using Random Forest Machine Learning Technique. Procedia Comput. Sci. 2022, 199, 806–813. [Google Scholar] [CrossRef]

- Wu, C.; Du, Y.; Li, S.; Liu, P.; Ye, X. Does Visual Contact with Green Space Impact Housing Pricesʔ An Integrated Approach of Machine Learning and Hedonic Modeling Based on the Perception of Green Space. Land Use Policy 2022, 115, 106048. [Google Scholar] [CrossRef]

- Xue, C.; Ju, Y.; Li, S.; Zhou, Q. Research on the Sustainable Development of Urban Housing Price Based on Transport Accessibility: A Case Study of Xi’an, China. Sustainability 2020, 12, 1497. [Google Scholar] [CrossRef]

- Khosravi, M.; Arif, S.B.; Ghaseminejad, A.; Tohidi, H.; Shabanian, H. Performance Evaluation of Machine Learning Regressors for Estimating Real Estate House Prices. Preprints 2022, 2022090341. [Google Scholar] [CrossRef]

- Abidoye, R.B.; Chan, A.P.C. Improving Property Valuation Accuracy: A Comparison of Hedonic Pricing Model and Artificial Neural Network. Pac. Rim Prop. Res. J. 2018, 24, 71–83. [Google Scholar] [CrossRef]

- Ma, L.; Sun, B. Machine Learning and AI in Marketing–Connecting Computing Power to Human Insights. Int. J. Res. Mark. 2020, 37, 481–504. [Google Scholar] [CrossRef]

- Rai, A. Explainable AI: From Black Box to Glass Box. J. Acad. Mark. Sci. 2020, 48, 137–141. [Google Scholar] [CrossRef]

- Pinjaman, S.; Kogid, M. Macroeconomic determinants of house prices in Malaysia. J. Ekon. Malays. 2020, 54, 153–165. [Google Scholar] [CrossRef]

- Zou, C. The House Price Prediction Using Machine Learning Algorithm: The Case of Jinan, China. Highlights Sci. Eng. Technol. 2023, 39, 327–333. [Google Scholar] [CrossRef]

- Aziz, A.; Anwar, M.M.; Abdo, H.G.; Almohamad, H.; Al Dughairi, A.A.; Al-Mutiry, M. Proximity to Neighborhood Services and Property Values in Urban Area: An Evaluation through the Hedonic Pricing Model. Land 2023, 12, 859. [Google Scholar] [CrossRef]

- Hussain, T.; Abbas, J.; Wei, Z.; Nurunnabi, M. The Effect of Sustainable Urban Planning and Slum Disamenity on the Value of Neighboring Residential Property: Application of the Hedonic Pricing Model in Rent Price Appraisal. Sustainability 2019, 11, 1144. [Google Scholar] [CrossRef]

- Won, J.; Lee, J.-S. Investigating How the Rents of Small Urban Houses Are Determined: Using Spatial Hedonic Modeling for Urban Residential Housing in Seoul. Sustainability 2017, 10, 31. [Google Scholar] [CrossRef]

- Jun, M.-J. Quantifying Welfare Loss Due to Longer Commute Times in Seoul: A Two-Stage Hedonic Price Approach. Cities 2019, 84, 75–82. [Google Scholar] [CrossRef]

- Yazdani, M. Machine Learning, Deep Learning, and Hedonic Methods for Real Estate Price Prediction. arXiv 2021, arXiv:2110.07151. [Google Scholar] [CrossRef]

- Chen, Y.; Luo, Z. Hedonic Pricing of Houses in Megacities Pre-and Post-COVID-19: A Case Study of Shanghai, China. Sustainability 2022, 14, 11021. [Google Scholar] [CrossRef]

- Soltani, A.; Heydari, M.; Aghaei, F.; Pettit, C.J. Housing Price Prediction Incorporating Spatio-Temporal Dependency into Machine Learning Algorithms. Cities 2022, 131, 103941. [Google Scholar] [CrossRef]

- Belcher, R.N.; Chisholm, R.A. Tropical Vegetation and Residential Property Value: A Hedonic Pricing Analysis in Singapore. Ecol. Econ. 2018, 149, 149–159. [Google Scholar] [CrossRef]

- Xiao, Y.; Hui, E.C.; Wen, H. Effects of Floor Level and Landscape Proximity on Housing Price: A Hedonic Analysis in Hangzhou, China. Habitat Int. 2019, 87, 11–26. [Google Scholar] [CrossRef]

- Kalliola, J.; Kapočiūtė-Dzikienė, J.; Damaševičius, R. Neural Network Hyperparameter Optimization for Prediction of Real Estate Prices in Helsinki. PeerJ Comput. Sci. 2021, 7, e444. [Google Scholar] [CrossRef] [PubMed]

- Li, S.; Jiang, Y.; Ke, S.; Nie, K.; Wu, C. Understanding the Effects of Influential Factors on Housing Prices by Combining Extreme Gradient Boosting and a Hedonic Price Model (XGBoost-HPM). Land 2021, 10, 533. [Google Scholar] [CrossRef]

- Xiao, Y.; Chen, X.; Li, Q.; Yu, X.; Chen, J.; Guo, J. Exploring Determinants of Housing Prices in Beijing: An Enhanced Hedonic Regression with Open Access POI Data. ISPRS Int. J. Geoinf. 2017, 6, 358. [Google Scholar] [CrossRef]

- Kemunto, M.G.; Nyangena, W. Residential Housing Demand in Nairobi; A Hedonic Pricing Approach. Am. J. Health Econ. 2016, 1, 64–85. [Google Scholar] [CrossRef]

- Kahveci, M.; Sabaj, E. Determinant of Housing Rents in Urban Albania: An Empirical Hedonic Price Application with NSA Survey Data. Eurasian J. Econ. Financ. 2017, 5, 51–65. [Google Scholar] [CrossRef]

- Xu, X.; Qiu, W.; Li, W.; Liu, X.; Zhang, Z.; Li, X.; Luo, D. Associations between Street-View Perceptions and Housing Prices: Subjective vs. Objective Measures Using Computer Vision and Machine Learning Techniques. Remote Sens. 2022, 14, 891. [Google Scholar] [CrossRef]

- Montero, J.-M.; Mínguez, R.; Fernández-Avilés, G. Housing Price Prediction: Parametric versus Semi-Parametric Spatial Hedonic Models. J. Geogr. Syst. 2018, 20, 27–55. [Google Scholar] [CrossRef]

- Wen, H.; Xiao, Y.; Zhang, L. Spatial Effect of River Landscape on Housing Price: An Empirical Study on the Grand Canal in Hangzhou, China. Habitat Int. 2017, 63, 34–44. [Google Scholar] [CrossRef]

- Wen, H.; Gui, Z.; Tian, C.; Xiao, Y.; Fang, L. Subway Opening, Traffic Accessibility, and Housing Prices: A Quantile Hedonic Analysis in Hangzhou, China. Sustainability 2018, 10, 2254. [Google Scholar] [CrossRef]

- Cui, N.; Gu, H.; Shen, T.; Feng, C. The Impact of Micro-Level Influencing Factors on Home Value: A Housing Price-Rent Comparison. Sustainability 2018, 10, 4343. [Google Scholar] [CrossRef]

- Duan, J.; Tian, G.; Yang, L.; Zhou, T. Addressing the Macroeconomic and Hedonic Determinants of Housing Prices in Beijing Metropolitan Area, China. Habitat Int. 2021, 113, 102374. [Google Scholar] [CrossRef]

- Hussain, T.; Abbas, J.; Wei, Z.; Ahmad, S.; Xuehao, B.; Gaoli, Z. Impact of Urban Village Disamenity on Neighboring Residential Properties: Empirical Evidence from Nanjing through Hedonic Pricing Model Appraisal. J. Urban Plan. Dev. 2021, 147, 04020055. [Google Scholar] [CrossRef]

- Seo, J.; Oh, J.; Kim, J. The Effects of Inundation Hazard Information on Residential Property Value: The Case of Seoul. J. Korean Apprais. Soc. 2020, 19, 165–185. [Google Scholar] [CrossRef]

- Bae, S. Effects of Urban Railway attributes on Housing Prices: Case of Apartments in Incheon Metropolitan City. Rev. Real Estate Urban Stud. 2020, 12, 63–81. [Google Scholar] [CrossRef]

- Kim, W.; Lee, S.; Jang, H.; Kim, J.; Hong, J. Analysis of Structural Change of Housing Preferences using Hedonic Price Model: Case Study of Apartment Transaction Data from 2006 to 2017 in Gangnam Area. Korea Real Estate Acad. Rev. 2019, 76, 137–150. [Google Scholar]

- Heo, S.; Chung, J. A Study on the Determinants of Apartment Price by Living Area in Sejong City’s Multifunctional Administration City. Korea Real Estate Acad. Rev. 2022, 86, 41–65. [Google Scholar] [CrossRef]

- Kim, H.N.; Kim, J.H.; Lee, J.H.; Huh, Y.K. Analysis of Factors Affecting Apartment Market Price Located Nearby Jangjeon Campus of Pusan National University. Archit. Inst. Korea-RA 2016, 18, 183–190. [Google Scholar]

- Huang, Z.; Chen, R.; Xu, D.; Zhou, W. Spatial and Hedonic Analysis of Housing Prices in Shanghai. Habitat Int. 2017, 67, 69–78. [Google Scholar] [CrossRef]

- Sun, H.; Wang, Y.; Li, Q. The Impact of Subway Lines on Residential Property Values in Tianjin: An Empirical Study Based on Hedonic Pricing Model. Discret. Dyn. Nat. Soc. 2016, 2016, e1478413. [Google Scholar] [CrossRef]

- Dziauddin, M.F. An Investigation of Condominium Property Value Uplift around Light Rail Transit Stations Using a Hedonic Pricing Model. IOP Conf. Ser. Earth Environ. Sci. 2019, 286, 012032. [Google Scholar] [CrossRef]

- Hawkins, J.; Habib, K.N. Spatio-Temporal Hedonic Price Model to Investigate the Dynamics of Housing Prices in Contexts of Urban Form and Transportation Services in Toronto. Transp. Res. Rec. 2018, 2672, 21–30. [Google Scholar] [CrossRef]

- Kang, Y.; Zhang, F.; Gao, S.; Peng, W.; Ratti, C. Human Settlement Value Assessment from a Place Perspective: Considering Human Dynamics and Perceptions in House Price Modeling. Cities 2021, 118, 103333. [Google Scholar] [CrossRef]

- Zhang, Y.; Dong, R. Impacts of Street-Visible Greenery on Housing Prices: Evidence from a Hedonic Price Model and a Massive Street View Image Dataset in Beijing. ISPRS Int. J. Geoinf. 2018, 7, 104. [Google Scholar] [CrossRef]

- Nguyen, T.T.M.; Nguyen, T.M.C. Analyzing the Impact of Accessibility on Property Price by Using Hedonic-Price Modelling for Supporting Urban Land Management towards TOD in Hanoi, Vietnam. IOP Conf. Ser. Mater. Sci. Eng. 2020, 869, 062039. [Google Scholar] [CrossRef]

- Polichetti, G.; Cocco, S.; Spinali, A.; Trimarco, V.; Nunziata, A. Effects of particulate matter (PM10, PM2.5 and PM1) on the cardiovascular system. Toxicology 2009, 261, 1–8. [Google Scholar] [CrossRef]

- Zhang, R.; Wang, G.; Guo, S.; Zamora, M.L.; Ying, Q.; Lin, Y.; Wang, W.; Hu, M.; Wang, Y. Formation of urban fine particulate matter. ACS Publ. 2015, 115, 3803–3855. [Google Scholar] [CrossRef]

- Zhang, S.; Zhou, Y.; Xu, P. Air Quality Affects House Prices—Analysis Based on RD of the Huai River Policy. Sustain. Cities Soc. 2022, 85, 104017. [Google Scholar] [CrossRef]

- Xue, W.; Li, X.; Yang, Z.; Wei, J. Are House Prices Affected by PM2.5 Pollution? Evidence from Beijing, China. Int. J. Environ. Res. Public Health 2022, 19, 8461. [Google Scholar] [CrossRef]

- Borja-Urbano, S.; Rodriguez Espinosa, F.; Luna-Ludeña, M.; Toulkeridis, T. Valuing the Impact of Air Pollution in Urban Residence Using Hedonic Pricing and Geospatial Analysis, Evidence From Quito, Ecuador. Air Soil Water Res. 2021, 14, 117862212110532. [Google Scholar] [CrossRef]

- Zou, G.; Lai, Z.; Li, Y.; Liu, X.; Li, W. Exploring the Nonlinear Impact of Air Pollution on Housing Prices: A Machine Learning Approach. Econ. Transp. 2022, 31, 100272. [Google Scholar] [CrossRef]

- Chen, X.; Shao, S.; Tian, Z.; Xie, Z.; Yin, P. Impacts of Air Pollution and Its Spatial Spillover Effect on Public Health Based on China’s Big Data Sample. J. Clean. Prod. 2017, 142, 915–925. [Google Scholar] [CrossRef]

- Sun, B.; Yang, S. Asymmetric and Spatial Non-Stationary Effects of Particulate Air Pollution on Urban Housing Prices in Chinese Cities. Int. J. Environ. Res. Public Health 2020, 17, 7443. [Google Scholar] [CrossRef] [PubMed]

- Dai, J.; Lv, P.; Ma, Z.; Bi, J.; Wen, T. Environmental Risk and Housing Price: An Empirical Study of Nanjing, China. J. Clean. Prod. 2020, 252, 119828. [Google Scholar] [CrossRef]

- Organization for Economic Cooperation and Development (OECD). Available online: https://data.oecd.org/air/air-pollution-exposure.htm (accessed on 15 July 2023).

- Beimer, J.; Francke, M. Out-of-Sample House Price Prediction by Hedonic Price Models and Machine Learning Algorithms. Real Estate Res. Q. 2019, 18, 13–20. [Google Scholar]

- Ho, W.K.O.; Tang, B.-S.; Wong, S.W. Predicting Property Prices with Machine Learning Algorithms. J. Prop. Res. 2021, 38, 48–70. [Google Scholar] [CrossRef]

- Ministry of Land, Infrastructure and Transport (MOLIT). Available online: https://rtdown.molit.go.kr/ (accessed on 3 June 2023).

- Setianto, A.; Triandini, T. Comparison of kriging and inverse distance weighted (IDW) interpolation methods in lineament extraction and analysis. J. Appl. Geol. 2013, 5, 21–29. [Google Scholar] [CrossRef]

- Dias, I.; Wijeweera, P. Assessing the Walk-Score of Walking Paths in Kandy City Area for Better Walking Experience for the Tourists. J. Inst. Eng. Sri Lanka 2021, 54, 27–38. [Google Scholar] [CrossRef]

- Pratama, Y. Identifying Public Facilities Surrounding MRT Stations Based on Pedestrian Walking Distance Using GIS-Based Buffer and Spatial Query Method (Case Study: Central and South Jakarta). SuperMap Cup, 15 August 2018. Available online: https://www.researchgate.net/publication/327754944_Identifying_Public_Facilities_Surrounding_MRT_Stations_Based_on_Pedestrian_Walking_Distance_using_GIS-Based_Buffer_and_Spatial_Query_Method_Case_study_Central_and_South_Jakarta (accessed on 21 May 2024).

- Etman, A.; Kamphuis, C.B.; Prins, R.G.; Burdorf, A.; Pierik, F.H.; van Lenthe, F.J. Characteristics of Residential Areas and Transportational Walking among Frail and Non-Frail Dutch Elderly: Does the Size of the Area Matter? Int. J. Health Geogr. 2014, 13, 7. [Google Scholar] [CrossRef] [PubMed]

- Abdul, H.N.; Mokhlas, H.; Tan, P.L.; Mustafa, M.; Sham, R. Towards Predicting the Walkability of Pedestrian Rail Commuters in Kuala Lumpur Conurbation. Int. J. Humanit. Arts Soc. Sci. 2015, 1, 48–61. [Google Scholar] [CrossRef]

- Malpezzi, S. Hedonic Pricing Models: A Selective and Applied Review. In Housing Economics and Public Policy; Blackwell Science Ltd.: Boston, MA, USA, 2001; Volume 10, pp. 67–89. [Google Scholar]

- Breiman, L. Random Forests. Mach. Learn. 2001, 45, 5–32. [Google Scholar] [CrossRef]

- Breiman, L. Bagging Predictors. Mach. Learn. 1996, 24, 123–1402. [Google Scholar] [CrossRef]

- Kiely, T.J.; Bastian, N.D. The Spatially Conscious Machine Learning Model. Stat. Anal. Data Min. 2020, 13, 31–49. [Google Scholar] [CrossRef]

- Kulkarni, V.; Sinha, P. Pruning of Random Forest Classifiers: A Survey and Future Directions. In Proceedings of the International Conference on Data Science & Engineering (ICDSE), Cochin, India, 18–20 July 2012; IEEE: Manhattan, NY, USA, 2012. [Google Scholar] [CrossRef]

- Karamanou, A.; Kalampokis, E.; Tarabanis, K. Linked Open Government Data to Predict and Explain House Prices: The Case of Scottish Statistics Portal. Big Data Res. 2022, 30, 100355. [Google Scholar] [CrossRef]

- Utama, C.; Meske, C.; Schneider, J.; Schlatmann, R.; Ulbrich, C. Explainable Artificial Intelligence for Photovoltaic Fault Detection: A Comparison of Instruments. Sol. Energy 2023, 249, 139–151. [Google Scholar] [CrossRef]

- Srivastava, P.R.; Mangla, S.K.; Eachempati, P.; Tiwari, A.K. An Explainable Artificial Intelligence Approach to Understanding Drivers of Economic Energy Consumption and Sustainability. Energy Econ. 2023, 125, 106868. [Google Scholar] [CrossRef]

- Lundberg, S.; Lee, S.-I. A Unified Approach to Interpreting Model Predictions. In Proceedings of the Advances in Neural Information Processing Systems (NIPS2017), Long Beach, CA, USA, 4–9 December 2017; Volume 30, pp. 4765–4774. [Google Scholar]

- Dou, M.; Gu, Y.; Fan, H. Incorporating Neighborhoods with Explainable Artificial Intelligence for Modeling Fine-Scale Housing Prices. Appl. Geogr. 2023, 158, 103032. [Google Scholar] [CrossRef]

- Sachit, M.S.; Shafri, H.Z.M.; Abdullah, A.F.; Rafie, A.S.M.; Gibril, M.B.A. Global spatial suitability mapping of wind and solar systems using an explainable ai-based approach. ISPRS Int. J. Geo-Inf. 2022, 11, 422. [Google Scholar] [CrossRef]

- Matin, S.S.; Pradhan, B. Earthquake-Induced Building-Damage Mapping Using Explainable Ai (Xai). Sensors 2021, 21, 4489. [Google Scholar] [CrossRef] [PubMed]

- Collini, E.; Palesi, L.A.I.; Nesi, P.; Pantaleo, G.; Nocentini, N.; Rosi, A. Predicting and Understanding Landslide Events with Explainable AI. IEEE Access 2022, 10, 31175–31189. [Google Scholar] [CrossRef]

- Potrawa, T.; Tetereva, A. How Much Is the View from the Window Worth? Machine Learning-Driven Hedonic Pricing Model of the Real Estate Market. J. Bus. Res. 2022, 144, 50–65. [Google Scholar] [CrossRef]

- Ministry of Land, Infrastructure and Transport (MOLIT). 5th Integrated Energy Supply Master Plan; MOLIT: Sejong, Republic of Korea, 2020.

- Jung, I.S.; Kim, J.Y.; Yoo, S.H. Analysis of the influence of residential heating method on apartment prices: An empirical study of Gyeyang-gu, Incheon, Korea. Korea Soc. Innov. 2022, 17, 177–193. [Google Scholar] [CrossRef]

- Korean Statistical Information Service (KOSIS). Available online: https://kosis.kr/statHtml/statHtml.do?orgId=101&tblId=DT_1B81A21&checkFlag=N (accessed on 8 January 2024).

- Pant, P.; Harrison, R.M. Estimation of the Contribution of Road Traffic Emissions to Particulate Matter Concentrations from Field Measurements: A Review. Atmos. Environ. 2013, 77, 78–97. [Google Scholar] [CrossRef]

- Zavei, S.J.A.P.; Jusan, M.M. Exploring housing attributes selection based on Maslow’s hierarchy of needs. Procedia Soc. Behav. Sci. 2012, 42, 311–319. [Google Scholar] [CrossRef]

| Classification | Values | Descriptions | |

|---|---|---|---|

| Dependent variable | Price | Numerical | Apartment transaction prices |

| Structure characteristics | Area | Numerical | Area of transacted apartment |

| Floor | Numerical | Floor of transacted apartment | |

| Entrance | Categorical | Entrance of transacted apartment (1: Stair 0: Otherwise) | |

| Room | Numerical | Number of rooms in transacted apartment | |

| Bath | Numerical | Number of baths in transacted apartment | |

| Dwelling characteristics | Age | Numerical | Age of transacted apartment |

| Age2 | Numerical | Square of the age of transacted apartment | |

| Household | Numerical | Number of households in transacted apartment | |

| Parking lot | Numerical | Parking lots per household in transacted apartment | |

| Heating | Categorical | Heating type of transacted apartment (1: individual 0: Otherwise) | |

| Brand | Categorical | Construction ranking of transacted apartment (1: Top 10 0: Otherwise) | |

| PM characteristics | PM2.5 | Numerical | Average PM2.5 concentration within a 400 m radius of transacted apartment |

| PM10 | Numerical | Average PM10 concentration within a 400 m radius of transacted apartment | |

| Accessibility characteristics | CBD | Numerical | Distance from the transacted apartment to the CBD |

| Han river | Numerical | Distance from the transacted apartment to the Han river | |

| Park and green | Numerical | Distance from the transacted apartment to the park and green area | |

| Bus stop | Numerical | Distance from the transacted apartment to the bus stop | |

| Subway exit | Numerical | Distance from the transacted apartment to the subway exit | |

| Kindergarten | Numerical | Distance from the transacted apartment to the kindergarten | |

| Elementary school | Numerical | Distance from the transacted apartment to the elementary school | |

| High school | Numerical | Distance from the transacted apartment to the high school | |

| Location characteristics | Longitude | Numerical | Longitude of transacted apartment |

| Latitude | Numerical | Latitude of transacted apartment | |

| Classification | Units | Min | Max | Mean | Std. Dev | |

|---|---|---|---|---|---|---|

| Dependent variable | Price | 10,000 ₩/m2 | 163.19 ($1394.79) | 4336.95 ($37,067.95) | 1036.15 ($8855.98) | 506.65 ($4330.34) |

| Structure characteristics | Area | m2 | 10.78 | 273.82 | 78.38 | 30.41 |

| Floor | Number | 1 | 67 | 9.51 | 6.26 | |

| Entrance | Dummy | 0 | 1 | 0.70 | 0.46 | |

| Room | Number | 1 | 8 | 2.91 | 0.738 | |

| Bath | Number | 1 | 4 | 1.62 | 0.51 | |

| Dwelling characteristics | Age | Number | 0 | 51 | 18.11 | 9.509 |

| Age2 | (Number)2 | 0 | 2601 | 418.42 | 381.60 | |

| Household | 100 households | 0.05 | 95.10 | 10.95 | 11.87 | |

| Parking lot | Number | 0.02 | 11.96 | 1.12 | 0.52 | |

| Heating | Dummy | 0 | 1 | 0.65 | 0.48 | |

| Brand | Dummy | 0 | 1 | 0.37 | 0.48 | |

| PM characteristics | PM2.5 | μg/m3 | 22.17 | 29.53 | 25.47 | 0.96 |

| PM10 | μg/m3 | 34.80 | 49.17 | 43.47 | 2.11 | |

| Accessibility characteristics | CBD | 100 m | 2.05 | 154.05 | 63.82 | 32.55 |

| Han river | 100 m | 0.54 | 147.97 | 42.19 | 34.24 | |

| Park and green | 100 m | 0.00 | 11.22 | 1.65 | 1.37 | |

| Bus stop | 100 m | 0.08 | 5.60 | 1.28 | 0.68 | |

| Subway exit | 100 m | 0.12 | 31.03 | 5.20 | 3.76 | |

| Kindergarten | 100 m | 0.00 | 19.51 | 3.04 | 2.21 | |

| Elementary school | 100 m | 0.22 | 17.60 | 3.27 | 1.56 | |

| High school | 100 m | 0.40 | 29.16 | 6.00 | 3.51 | |

| Location characteristics | Longitude | degree | 126.81 | 127.18 | 127.00 | 0.09 |

| Latitude | degree | 37.43 | 37.69 | 37.55 | 0.06 | |

| Classification | Hedonic Price Model | Random Forest |

|---|---|---|

| R2 | 0.676 | 0.962 |

| MAE | 0.195 | 0.059 |

| RMSE | 0.253 | 0.083 |

| Classification | Coef. | Std Err. | t | ||

|---|---|---|---|---|---|

| Intercept | −90.783 *** | 1.991 | −45.589 | ||

| Apartment characteristics | Structure characteristics | Area | −0.004 *** | 0.000 | −58.327 |

| Floor | 0.003 *** | 0.000 | 21.553 | ||

| Entrance | 0.027 *** | 0.003 | 9.529 | ||

| Room | 0.041 *** | 0.002 | 18.157 | ||

| Bath | 0.006 | 0.003 | 1.842 | ||

| Dwelling characteristics | Age | −0.035 *** | 0.000 | −98.170 | |

| Age2 | 0.001 *** | 0.000 | 92.040 | ||

| Household | 0.004 *** | 0.000 | 37.715 | ||

| Parking lot | 0.099 *** | 0.003 | 38.688 | ||

| Heating | −0.263 *** | 0.002 | −111.493 | ||

| Brand | 0.107 *** | 0.002 | 48.947 | ||

| Built environment characteristics | PM characteristics | PM2.5 | 0.062 *** | 0.001 | 42.373 |

| PM10 | −0.013 *** | 0.001 | −17.936 | ||

| Accessibility characteristics | CBD | −0.005 *** | 0.000 | −89.823 | |

| Han river | −0.002 *** | 0.000 | −31.026 | ||

| Park and green | −0.010 *** | 0.001 | −14.317 | ||

| Bus stop | 0.044*** | 0.001 | 29.906 | ||

| Subway exit | −0.014 *** | 0.000 | −50.700 | ||

| Kindergarten | 0.004 *** | 0.000 | 8.578 | ||

| Elementary school | −0.009 *** | 0.001 | −13.081 | ||

| High school | −0.006 *** | 0.000 | −19.608 | ||

| Location characteristics | Longitude | 1.094 *** | 0.013 | 83.650 | |

| Latitude | −1.104 *** | 0.027 | −40.427 | ||

| Classification | Hyperparameter Values |

|---|---|

| Estimators | 83 |

| Max features | auto |

| Max depth | 19 |

| Cross validation | 5 |

| Iteration | 100 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ko, D.; Park, S. Investigating the Correlation between Air Pollution and Housing Prices in Seoul, South Korea: Application of Explainable Artificial Intelligence in Random Forest Machine Learning. Sustainability 2024, 16, 4453. https://doi.org/10.3390/su16114453

Ko D, Park S. Investigating the Correlation between Air Pollution and Housing Prices in Seoul, South Korea: Application of Explainable Artificial Intelligence in Random Forest Machine Learning. Sustainability. 2024; 16(11):4453. https://doi.org/10.3390/su16114453

Chicago/Turabian StyleKo, Dongwon, and Seunghoon Park. 2024. "Investigating the Correlation between Air Pollution and Housing Prices in Seoul, South Korea: Application of Explainable Artificial Intelligence in Random Forest Machine Learning" Sustainability 16, no. 11: 4453. https://doi.org/10.3390/su16114453

APA StyleKo, D., & Park, S. (2024). Investigating the Correlation between Air Pollution and Housing Prices in Seoul, South Korea: Application of Explainable Artificial Intelligence in Random Forest Machine Learning. Sustainability, 16(11), 4453. https://doi.org/10.3390/su16114453