Financing and Management Strategies for Expanding Green Development Projects: A Case Study of Energy Corporation in China’s Renewable Energy Sector Using Machine Learning (ML) Modeling

Abstract

1. Introduction

2. Literature Review

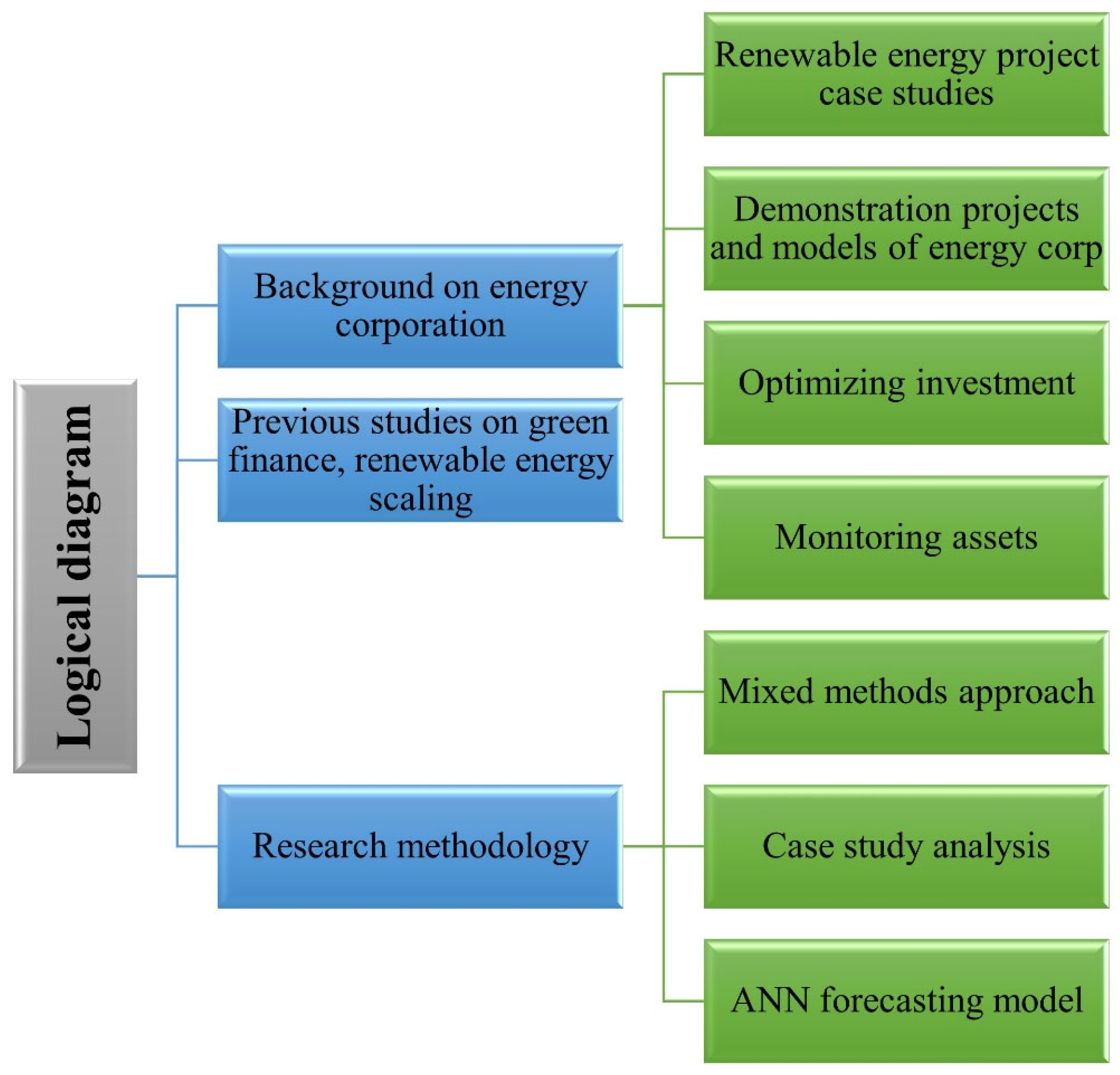

3. Research Methodology

3.1. Renewable Energy Case Study Insights

3.2. Case Studies of Demonstration Projects and Models

3.3. Scaling Renewable Energy: Challenges and Opportunities

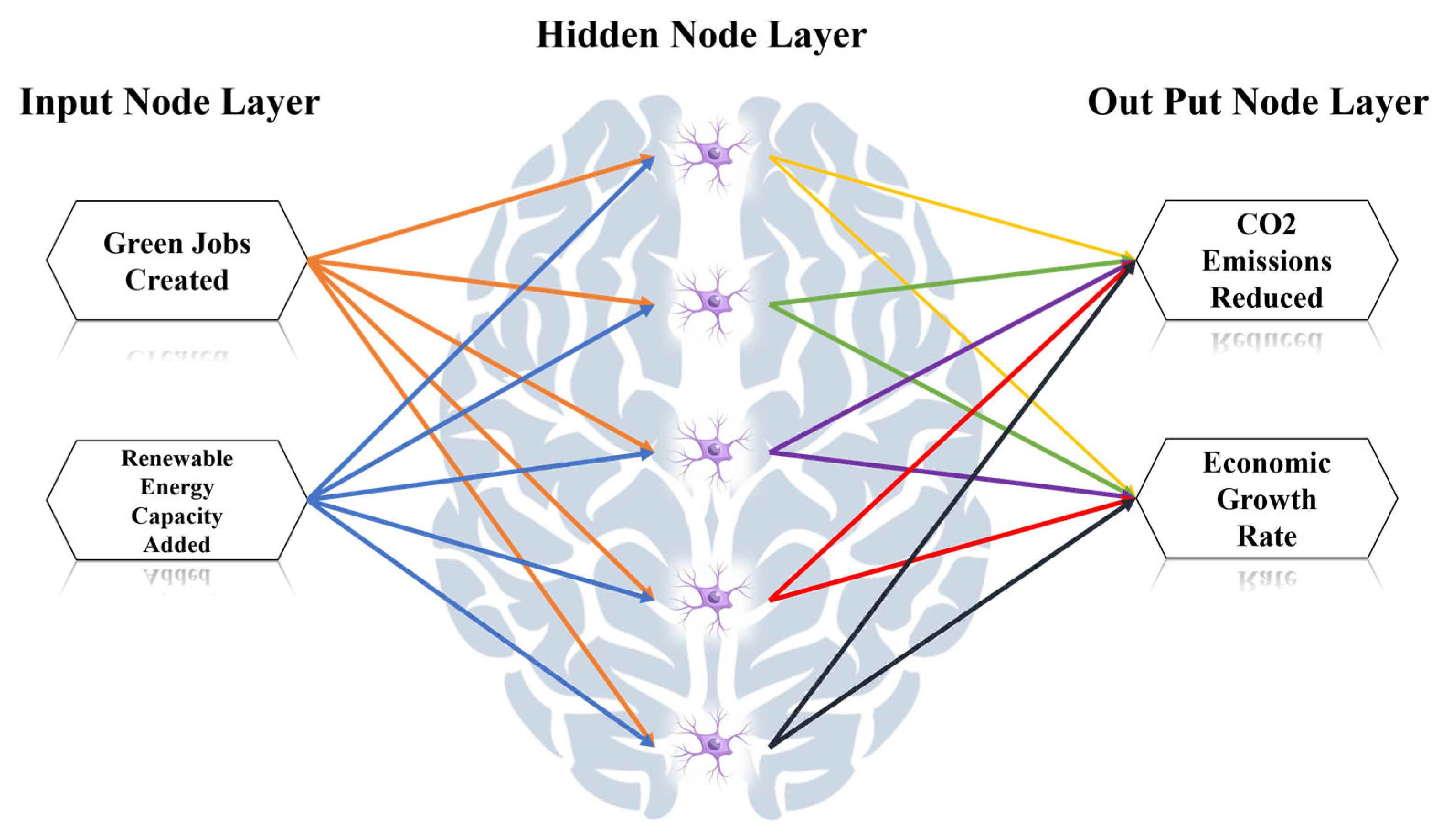

3.4. Forecasting CO2 Emissions and Economic Growth Using Artificial Neural Networks

3.5. Optimizing Investment through Strategic Partnerships

3.6. Monitoring Assets and Maximizing Value through IOT and Big Data

3.7. Optimizing Asset Performance through IoT and Data Analytics

3.8. Financing Large-Scale Expansion through Green Bonds

3.9. Managing Social and Environmental Impacts through Stakeholder Engagement

3.10. Strategic Research and Development

3.11. Manufacturing for Scale

3.12. Improving Asset Availability

3.13. Complementary Battery Storage

3.14. Enhancing Grid Flexibility

3.15. Maximizing Co-Benefits

4. Results and Discussion

4.1. Ensuring Availability Guarantees in Power Purchase Agreements

4.1.1. Proactive Maintenance and Repair

4.1.2. Redundant Infrastructure Design

4.2. Cybersecurity Best Practices

4.2.1. Reliable Operations

4.2.2. Theoretical and Practical Implication

4.2.3. Limitations and Future Research

5. Conclusions

- The transition to renewable energy in China is a critical step towards achieving sustainability and reducing reliance on fossil fuels.

- The case of the Energy Corporation highlights the potential for Chinese companies to drive the renewable energy transition through financing models and innovative management technologies.

- The Energy Corporation can contribute to China’s renewable energy goals by strategically financing expansion into renewable energy projects and utilizing partnerships, green bonds and other financial instruments.

- The integration of management technologies, such as big data platforms, enables effective monitoring and optimization of dispersed assets, enhancing operational efficiency.

- Stakeholder engagement is crucial for balancing social and environmental impacts and creating shared value with local communities.

- Case studies of the Energy Corporation and other renewable energy leaders provide valuable insights and serve as benchmarks for sustainability in the industry.

- Strategic pathways for the Energy Corporation involve forging partnerships, developing centralized platforms, pioneering the green bond market, coordinating projects and engaging in transparent multi-stakeholder engagement.

- The Energy Corporation can contribute to China’s climate targets through a nationwide scale-up of renewable energy, leveraging partnerships, financing models, optimized operations and effective impact management.

- The expansion of renewable energy in China showcases integrated solutions that balance environmental, economic and social priorities, setting an example for other industries and nations.

- Continued cost reduction efforts are crucial to accelerate the energy transition and maximize climate benefits, including strategic research and development, manufacturing advancements, operational optimizations and integration of complementary storage and grid infrastructure.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Zhang, L.; Saydaliev, H.B.; Ma, X. Does green finance investment and technological innovation improve renewable energy efficiency and sustainable development goals. Renew. Energy 2022, 193, 991–1000. [Google Scholar] [CrossRef]

- Rana, M.W.; Zhang, S.; Ali, S.; Hamid, I. Investigating green financing factors to entice private sector investment in renewables via digital media: Energy efficiency and sustainable development in the post-COVID-19 era. Sustainability 2022, 14, 13119. [Google Scholar] [CrossRef]

- Sun, G.; Li, G.; Dilanchiev, A.; Kazimova, A. Promotion of green financing: Role of renewable energy and energy transition in China. Renew. Energy 2023, 210, 769–775. [Google Scholar] [CrossRef]

- Ali, S.; Yan, Q.; Irfan, M.; Ameer, W.; Atchike, D.W.; Acevedo-Duque, Á. Green investment for sustainable business development: The influence of policy instruments on solar technology adoption. Front. Energy Res. 2022, 10, 874824. [Google Scholar] [CrossRef]

- Sun, L.; Yin, J.; Bilal, A.R. Green financing and wind power energy generation: Empirical insights from China. Renew. Energy 2023, 206, 820–827. [Google Scholar] [CrossRef]

- Kylili, A.; Thabit, Q.; Nassour, A.; Fokaides, P.A. Adoption of a holistic framework for innovative sustainable renewable energy development: A case study. Energy Sources Part A Recovery Util. Environ. Eff. 2021, 43, 1–21. [Google Scholar] [CrossRef]

- Liu, Z.; Xu, J.; Wei, Y.; Hatab, A.A.; Lan, J. Nexus between green financing, renewable energy generation, and energy efficiency: Empirical insights through DEA technique. Environ. Sci. Pollut. Res. 2021, 30, 1–14. [Google Scholar] [CrossRef] [PubMed]

- Abbas, M.G.; Wang, Z.; Bashir, S.; Iqbal, W.; Ullah, H. Nexus between energy policy and environmental performance in China: The moderating role of green finance adopted firms. Environ. Sci. Pollut. Res. 2021, 28, 63263–63277. [Google Scholar] [CrossRef] [PubMed]

- Wang, S.; Sun, L.; Iqbal, S. Green financing role on renewable energy dependence and energy transition in E7 economies. Renew. Energy 2022, 200, 1561–1572. [Google Scholar] [CrossRef]

- Razzaq, A.; Sharif, A.; Ozturk, I.; Skare, M. Asymmetric influence of digital finance, and renewable energy technology innovation on green growth in China. Renew. Energy 2023, 202, 310–319. [Google Scholar] [CrossRef]

- Cao, J.; Law, S.H.; Samad, A.R.B.A.; Mohamad, W.N.B.W.; Wang, J.; Yang, X. Effect of financial development and technological innovation on green growth—Analysis based on spatial Durbin model. J. Clean. Prod. 2022, 365, 132865. [Google Scholar] [CrossRef]

- Fang, Z. Assessing the impact of renewable energy investment, green technology innovation, and industrialization on sustainable development: A case study of China. Renew. Energy 2023, 205, 772–782. [Google Scholar] [CrossRef]

- Sadiq, M.; Amayri, M.A.; Paramaiah, C.; Mai, N.H.; Ngo, T.Q.; Phan, T.T.H. How green finance and financial development promote green economic growth: Deployment of clean energy sources in South Asia. Environ. Sci. Pollut. Res. 2022, 29, 65521–65534. [Google Scholar] [CrossRef] [PubMed]

- Ibrahim, R.L.; Al-mulali, U.; Ozturk, I.; Bello, A.K.; Raimi, L. On the criticality of renewable energy to sustainable development: Do green financial development, technological innovation, and economic complexity matter for China? Renew. Energy 2022, 199, 262–277. [Google Scholar] [CrossRef]

- Shang, M.; Ma, Z.; Su, Y.; Shaheen, F.; Khan, R.; Mohd Tahir, L.; Sasmoko; Answer, M.K.; Zaman, K. Understanding the importance of sustainable ecological innovation in reducing carbon emissions: Investigating the green energy demand, financial development, natural resource management, industrialisation and urbanisation channels. Econ. Res.-Ekon. Istraživanja 2023, 36, 2137823. [Google Scholar] [CrossRef]

- Raihan, A.; Pavel, M.I.; Muhtasim, D.A.; Farhana, S.; Faruk, O.; Paul, A. The role of renewable energy use, technological innovation, and forest cover toward green development: Evidence from Indonesia. Innov. Green Dev. 2023, 2, 100035. [Google Scholar] [CrossRef]

- Chang, L.; Qian, C.; Dilanchiev, A. Nexus between financial development and renewable energy: Empirical evidence from nonlinear autoregression distributed lag. Renew. Energy 2022, 193, 475–483. [Google Scholar] [CrossRef]

- Mngumi, F.; Shaorong, S.; Shair, F.; Waqas, M. Does green finance mitigate the effects of climate variability: Role of renewable energy investment and infrastructure. Environ. Sci. Pollut. Res. 2022, 29, 59287–59299. [Google Scholar] [CrossRef] [PubMed]

- Metawa, N.; Dogan, E.; Taskin, D. Analyzing the nexus of green economy, clean and financial technology. Econ. Anal. Policy 2022, 76, 385–396. [Google Scholar] [CrossRef]

- Li, F.; Zhang, J.; Li, X. Research on supporting developing countries to achieve green development transition: Based on the perspective of renewable energy and foreign direct investment. J. Clean. Prod. 2022, 372, 133726. [Google Scholar] [CrossRef]

- Raihan, A. Economy-energy-environment nexus: The role of information and communication technology towards green development in Malaysia. Innov. Green Dev. 2023, 2, 100085. [Google Scholar] [CrossRef]

- Trinh, H.H.; McCord, M.; Lo, D.; Squires, G. Do green growth and technological innovation matter to infrastructure investments in the era of climate change? Global evidence. Appl. Econ. 2023, 55, 4108–4129. [Google Scholar] [CrossRef]

- Zhang, H.; Xiong, P.; Yang, S.; Yu, J. Renewable energy utilization, green finance and agricultural land expansion in China. Resour. Policy 2023, 80, 103163. [Google Scholar] [CrossRef]

- Awawdeh, A.E.; Ananzeh, M.; El-khateeb, A.I.; Aljumah, A. Role of green financing and corporate social responsibility (CSR) in technological innovation and corporate environmental performance: A COVID-19 perspective. China Financ. Rev. Int. 2021, 12, 297–316. [Google Scholar] [CrossRef]

- Tien, N.H.; Phuc, N.T.; Thoi, B.V.; Duc, L.D.M.; Thuc, T.D. Green economy as an opportunity for Vietnamese business in renewable energy sector. Int. J. Res. Financ. Manag. 2019, 3, 26–32. [Google Scholar] [CrossRef]

- Chen, K.; Bian, R. Green financing and renewable resources for China’s sustainable growth: Assessing macroeconomic industry impact. Resour. Policy 2023, 85, 103927. [Google Scholar] [CrossRef]

- Ramzan, M.; Razi, U.; Quddoos, M.U.; Adebayo, T.S. Do green innovation and financial globalization contribute to the ecological sustainability and energy transition in the United Kingdom? Policy insights from a bootstrap rolling window approach. Sustain. Dev. 2023, 31, 393–414. [Google Scholar] [CrossRef]

- Ma, M.; Zhu, X.; Liu, M.; Huang, X. Combining the role of green finance and environmental sustainability on green economic growth: Evidence from G-20 economies. Renew. Energy 2023, 207, 128–136. [Google Scholar] [CrossRef]

- Wang, R.; Usman, M.; Radulescu, M.; Cifuentes-Faura, J.; Balsalobre-Lorente, D. Achieving ecological sustainability through technological innovations, financial development, foreign direct investment, and energy consumption in developing European countries. Gondwana Res. 2023, 119, 138–152. [Google Scholar] [CrossRef]

- Tong, L.; Jabbour, C.J.C.; Najam, H.; Abbas, J. Role of environmental regulations, green finance, and investment in green technologies in green total factor productivity: Empirical evidence from Asian region. J. Clean. Prod. 2022, 380, 134930. [Google Scholar] [CrossRef]

- Agrawal, R.; Agrawal, S.; Samadhiya, A.; Kumar, A.; Luthra, S.; Jain, V. Adoption of green finance and green innovation for achieving circularity: An exploratory review and future directions. Geosci. Front. 2023. [Google Scholar] [CrossRef]

- Udeagha, M.C.; Muchapondwa, E. Green finance, fintech, and environmental sustainability: Fresh policy insights from the BRICS nations. Int. J. Sustain. Dev. World Ecol. 2023, 30, 633–664. [Google Scholar] [CrossRef]

- Usman, M.; Balsalobre-Lorente, D.; Jahanger, A.; Ahmad, P. Are Mercosur economies going green or going away? An empirical investigation of the association between technological innovations, energy use, natural resources and GHG emissions. Gondwana Res. 2023, 113, 53–70. [Google Scholar] [CrossRef]

- Zhang, D.; Mohsin, M.; Taghizadeh-Hesary, F. Does green finance counteract the climate change mitigation: Asymmetric effect of renewable energy investment and R&D. Energy Econ. 2022, 113, 106183. [Google Scholar]

- Bashir, M.F.; Ma, B.; Shahbaz, M.; Jiao, Z. The nexus between environmental tax and carbon emissions with the roles of environmental technology and financial development. PLoS ONE 2020, 15, e0242412. [Google Scholar] [CrossRef] [PubMed]

- Abbasi, K.R.; Hussain, K.; Haddad, A.M.; Salman, A.; Ozturk, I. The role of financial development and technological innovation towards sustainable development in Pakistan: Fresh insights from consumption and territory-based emissions. Technol. Forecast. Soc. Chang. 2022, 176, 121444. [Google Scholar] [CrossRef]

- Li, C.; Razzaq, A.; Ozturk, I.; Sharif, A. Natural resources, financial technologies, and digitalization: The role of institutional quality and human capital in selected OECD economies. Resour. Policy 2023, 81, 103362. [Google Scholar] [CrossRef]

- Liu, Z.; Vu, T.L.; Phan, T.T.H.; Ngo, T.Q.; Anh, N.H.V.; Putra, A.R.S. Financial inclusion and green economic performance for energy efficiency finance. Econ. Chang. Restruct. 2022, 55, 2359–2389. [Google Scholar] [CrossRef]

- Wan, Q.; Miao, X.; Afshan, S. Dynamic effects of natural resource abundance, green financing, and government environmental concerns toward the sustainable environment in China. Resour. Policy 2022, 79, 102954. [Google Scholar] [CrossRef]

- Feng, H. The impact of renewable energy on carbon neutrality for the sustainable environment: Role of green finance and technology innovations. Front. Environ. Sci. 2022, 10, 924857. [Google Scholar] [CrossRef]

- Jahanger, A.; Balsalobre-Lorente, D.; Ali, M.; Samour, A.; Abbas, S.; Tursoy, T.; Joof, F. Going away or going green in ASEAN countries: Testing the impact of green financing and energy on environmental sustainability. Energy Environ. 2023, 1, 0958305X231171346. [Google Scholar] [CrossRef]

- Hao, X.; Fu, W.; Albitar, K. Innovation with ecological sustainability: Does corporate environmental responsibility matter in green innovation? J. Econ. Anal. 2023, 2, 21–42. [Google Scholar] [CrossRef]

- Fu, W.; Irfan, M. Does green financing develop a cleaner environment for environmental sustainability: Empirical insights from association of southeast Asian nations economies. Front. Psychol. 2022, 13, 904768. [Google Scholar] [CrossRef] [PubMed]

- Lisha, L.; Mousa, S.; Arnone, G.; Muda, I.; Huerta-Soto, R.; Shiming, Z. Natural resources, green innovation, fintech, and sustainability: A fresh insight from BRICS. Resour. Policy 2023, 80, 103119. [Google Scholar] [CrossRef]

- Li, N.; Wu, D. Nexus between natural resource and economic development: How green innovation and financial inclusion create sustainable growth in BRICS region? Resour. Policy 2023, 85, 103883. [Google Scholar] [CrossRef]

- Hailiang, Z.; Iqbal, W.; Yin Chau, K.; Raza Shah, S.A.; Ahmad, W.; Hua, H. Green finance, renewable energy investment, and environmental protection: Empirical evidence from BRICS countries. Econ. Res. Ekon. Istraživanja 2023, 36, 2125032. [Google Scholar] [CrossRef]

- Ding, X.; Liu, X. Renewable energy development and transportation infrastructure matters for green economic growth? Empirical evidence from China. Econ. Anal. Policy 2023, 79, 634–646. [Google Scholar] [CrossRef]

- Li, H.; Chen, C.; Umair, M. Green finance, enterprise energy efficiency, and green total factor productivity: Evidence from China. Sustainability 2023, 15, 11065. [Google Scholar] [CrossRef]

- Jahanger, A.; Usman, M.; Murshed, M.; Mahmood, H.; Balsalobre-Lorente, D. The linkages between natural resources, human capital, globalization, economic growth, financial development, and ecological footprint: The moderating role of technological innovations. Resour. Policy 2022, 76, 102569. [Google Scholar] [CrossRef]

- Hammer, S.; Kamal-Chaoui, L.; Robert, A.; Plouin, M. Cities and Green Growth: A Conceptual Framework; OECD iLibrary: Paris, France, 2011. [Google Scholar]

- Hung, N.T. Green investment, financial development, digitalization and economic sustainability in Vietnam: Evidence from a quantile-on-quantile regression and wavelet coherence. Technol. Forecast. Soc. Chang. 2023, 186, 122185. [Google Scholar] [CrossRef]

- Tahir, T.; Luni, T.; Majeed, M.T.; Zafar, A. The impact of financial development and globalization on environmental quality: Evidence from South Asian economies. Environ. Sci. Pollut. Res. 2021, 28, 8088–8101. [Google Scholar] [CrossRef] [PubMed]

- Ali, M.; Seraj, M.; Türüç, F.; Tursoy, T.; Raza, A. Do banking sector development, economic growth, and clean energy consumption scale up green finance investment for a sustainable environment in South Asia: Evidence for newly developed RALS co-integration. Environ. Sci. Pollut. Res. 2023, 30, 67891–67906. [Google Scholar] [CrossRef] [PubMed]

- Raihan, A.; Rashid, M.; Voumik, L.C.; Akter, S.; Esquivias, M.A. The Dynamic Impacts of Economic Growth, Financial Globalization, Fossil Fuel, Renewable Energy, and Urbanization on Load Capacity Factor in Mexico. Sustainability 2023, 15, 13462. [Google Scholar] [CrossRef]

- Raihan, A.; Begum, R.A.; Said, M.N.M.; Pereira, J.J. Relationship between economic growth, renewable energy use, technological innovation, and carbon emission toward achieving Malaysia’s Paris agreement. Environ. Syst. Decis. 2022, 42, 586–607. [Google Scholar] [CrossRef]

- Shahbaz, M.; Haouas, I.; Sohag, K.; Ozturk, I. The financial development-environmental degradation nexus in the United Arab Emirates: The importance of growth, globalization and structural breaks. Environ. Sci. Pollut. Res. 2020, 27, 10685–10699. [Google Scholar] [CrossRef] [PubMed]

- Falcone, P.M.; Morone, P.; Sica, E. Greening of the financial system and fuelling a sustainability transition: A discursive approach to assess landscape pressures on the Italian financial system. Technol. Forecast. Soc. Chang. 2018, 127, 23–37. [Google Scholar] [CrossRef]

- Oosthuizen, J. Investigating the Effects of a Green Economy Transition on the Electricity Sector in the Western Cape Province of South Africa: A System Dynamics Modelling Approach. Ph.D. Dissertation, Stellenbosch University, Stellenbosch, South Africa, 2016. [Google Scholar]

- Koengkan, M.; Fuinhas, J.A.; Kazemzadeh, E. Do financial incentive policies for renewable energy development increase the economic growth in Latin American and Caribbean countries? J. Sustain. Financ. Invest. 2022, 14, 1–23. [Google Scholar] [CrossRef]

- Xiong, Y.; Dai, L. Does green finance investment impact on sustainable development: Role of technological innovation and renewable energy. Renew. Energy 2023, 214, 342–349. [Google Scholar] [CrossRef]

- Pang, L.; Zhu, M.N.; Yu, H. Is green finance really a blessing for green technology and carbon efficiency? Energy Econ. 2022, 114, 106272. [Google Scholar] [CrossRef]

- Khan, M.K.; Abbas, F.; Godil, D.I.; Sharif, A.; Ahmed, Z.; Anser, M.K. Moving towards sustainability: How do natural resources, financial development, and economic growth interact with the ecological footprint in Malaysia? A dynamic ARDL approach. Environ. Sci. Pollut. Res. 2021, 28, 55579–55591. [Google Scholar] [CrossRef] [PubMed]

- Li, N.; Pei, X.; Huang, Y.; Qiao, J.; Zhang, Y.; Jamali, R.H. Impact of financial inclusion and green bond financing for renewable energy mix: Implications for financial development in OECD economies. Environ. Sci. Pollut. Res. 2022, 29, 25544–25555. [Google Scholar] [CrossRef] [PubMed]

- Ali, K.; Jianguo, D.; Kirikkaleli, D.; Mentel, G.; Altuntaş, M. Testing the role of digital financial inclusion in energy transition and diversification towards COP26 targets and sustainable development goals. Gondwana Res. 2023, 121, 293–306. [Google Scholar] [CrossRef]

- Qamruzzaman, M.; Jianguo, W. The asymmetric relationship between financial development, trade openness, foreign capital flows, and renewable energy consumption: Fresh evidence from panel NARDL investigation. Renew. Energy 2020, 159, 827–842. [Google Scholar] [CrossRef]

- Usman, M.; Jahanger, A.; Makhdum, M.S.A.; Balsalobre-Lorente, D.; Bashir, A. How do financial development, energy consumption, natural resources, and globalization affect Arctic countries’ economic growth and environmental quality? An advanced panel data simulation. Energy 2022, 241, 122515. [Google Scholar] [CrossRef]

- Huang, S.Z. Do green financing and industrial structure matter for green economic recovery? Fresh empirical insights from Vietnam. Econ. Anal. Policy 2022, 75, 61–73. [Google Scholar] [CrossRef]

- Wan, Y.; Sheng, N.; Wei, X.; Su, H. Study on the spatial spillover effect and path mechanism of green finance development on China’s energy structure transformation. J. Clean. Prod. 2023, 415, 137820. [Google Scholar] [CrossRef]

- Zhao, J.; Taghizadeh-Hesary, F.; Dong, K.; Dong, X. How green growth affects carbon emissions in China: The role of green finance. Econ. Res. Ekon. Istraživanja 2023, 36, 2090–2111. [Google Scholar] [CrossRef]

- Huibo, W.; Awan, R.U.; Qayyum, A.; Munir, A.; Khan, J.; Gulzar, F. How financial development affects green energy finance? Relationship between environmental regulation and economic performance. Environ. Sci. Pollut. Res. 2022, 29, 50427–50442. [Google Scholar] [CrossRef] [PubMed]

- Liu, J.; Fu, Q.A. Green finance, energy consumption, urbanization, and economic growth: Quantile based evidence from China. Environ. Sci. Pollut. Res. 2023, 30, 88155–88166. [Google Scholar] [CrossRef] [PubMed]

- Zafar, M.W.; Zaidi, S.A.H.; Mansoor, S.; Sinha, A.; Qin, Q. ICT and education as determinants of environmental quality: The role of financial development in selected Asian countries. Technol. Forecast. Soc. Chang. 2022, 177, 121547. [Google Scholar] [CrossRef]

- Ganda, F. The nexus of financial development, natural resource rents, technological innovation, foreign direct investment, energy consumption, human capital, and trade on environmental degradation in the new BRICS economies. Environ. Sci. Pollut. Res. 2022, 29, 74442–74457. [Google Scholar] [CrossRef] [PubMed]

- Azhgaliyeva, D.; Liddle, B. Introduction to the special issue: Scaling up green finance in Asia. J. Sustain. Financ. Invest. 2020, 10, 83–91. [Google Scholar] [CrossRef]

- Jia, Z.; Yang, X. Assessment of the role of renewable energy financing and information and communication technology in carbon neutrality: Evidence from RCEP economies. Environ. Sci. Pollut. Res. 2023, 30, 33636–33649. [Google Scholar] [CrossRef] [PubMed]

- Udeagha, M.C.; Ngepah, N. The drivers of environmental sustainability in BRICS economies: Do green finance and fintech matter? World Development Sustainability 2023, 3, 100096. [Google Scholar] [CrossRef]

- Zakari, A.; Oryani, B.; Alvarado, R.; Mumini, K. Assessing the impact of green energy and finance on environmental performance in China and Japan. Econ. Chang. Restruct. 2023, 56, 1185–1199. [Google Scholar] [CrossRef]

- Razzaq, A.; Sharif, A.; An, H.; Aloui, C. Testing the directional predictability between carbon trading and sectoral stocks in China: New insights using cross-quantilogram and rolling window causality approaches. Technol. Forecast. Soc. Chang. 2022, 182, 121846. [Google Scholar] [CrossRef]

- Hassan, T.; Khan, Y.; Safi, A.; Chaolin, H.; Wahab, S.; Daud, A.; Tufail, M. Green financing strategy for low-carbon economy: The role of high-technology imports and institutional strengths in China. J. Clean. Prod. 2023, 415, 137859. [Google Scholar] [CrossRef]

- Shahbaz, M.; Hye, Q.M.A.; Tiwari, A.K.; Leitão, N.C. Economic growth, energy consumption, financial development, international trade and CO2 emissions in Indonesia. Renew. Sustain. Energy Rev. 2013, 25, 109–121. [Google Scholar] [CrossRef]

- Dong, C.; Wu, H.; Zhou, J.; Lin, H.; Chang, L. Role of renewable energy investment and geopolitical risk in green finance development: Empirical evidence from BRICS countries. Renew. Energy 2023, 207, 234–241. [Google Scholar] [CrossRef]

- Xu, B. Exploring the sustainable growth pathway of wind power in China: Using the semiparametric regression model. Energy Policy 2023, 183, 113845. [Google Scholar] [CrossRef]

- Xu, A.; Qiu, K.; Zhu, Y. The measurements and decomposition of innovation inequality: Based on Industry—University—Research perspective. J. Bus. Res. 2023, 157, 113556. [Google Scholar] [CrossRef]

- Li, X.; Jiang, Y.; Xin, X.; Nassani, A.A.; Yang, C. The asymmetric role of natural resources, fintech and green innovations in the Chinese economy. Evidence from QARDL approach. Resour. Policy 2024, 90, 104731. [Google Scholar] [CrossRef]

- Li, B.; Wang, J.; Nassani, A.A.; Binsaeed, R.H.; Li, Z. The future of Green energy: A panel study on the role of renewable resources in the transition to a Green economy. Energy Econ. 2023, 127, 107026. [Google Scholar] [CrossRef]

- Hu, J.; Zou, Y.; Zhao, Y. Robust operation of hydrogen-fueled power-to-gas system within feasible operating zone considering carbon-dioxide recycling process. Int. J. Hydrogen Energy 2024, 58, 1429–1442. [Google Scholar] [CrossRef]

- Kong, L.; Wang, L.; Li, F.; Li, J.; Wang, Y.; Cai, Z.; Zhou, J.; Guo, J.; Wang, G. Life cycle-oriented low-carbon product design based on the constraint satisfaction problem. Energy Convers. Manag. 2023, 286, 117069. [Google Scholar] [CrossRef]

- Wu, B.; Chen, F.; Li, L.; Xu, L.; Liu, Z.; Wu, Y. Institutional investor ESG activism and exploratory green innovation: Unpacking the heterogeneous responses of family firms across intergenerational contexts. Br. Account. Rev. 2024. [Google Scholar] [CrossRef]

- Gao, H.; Liu, Z.; Yang, C.C. Individual investors’ trading behavior and gender difference in tolerance of sex crimes: Evidence from a natural experiment. J. Empir. Financ. 2023, 73, 349–368. [Google Scholar] [CrossRef]

- Luo, J.; Zhuo, W.; Liu, S.; Xu, B. The Optimization of Carbon Emission Prediction in Low Carbon Energy Economy Under Big Data. IEEE Access 2024, 12, 14690–14702. [Google Scholar] [CrossRef]

- Luo, J.; Zhuo, W.; Xu, B. A Deep Neural Network-Based Assistive Decision Method for Financial Risk Prediction in Carbon Trading Market. J. Circuits Syst. Comput. 2023, 33, 2450153. [Google Scholar] [CrossRef]

- Luo, J.; Wang, Y.; Li, G. The innovation effect of administrative hierarchy on intercity connection: The machine learning of twin cities. J. Innov. Knowl. 2023, 8, 100293. [Google Scholar] [CrossRef]

- Chen, C.; Pan, J. The effect of the health poverty alleviation project on financial risk protection for rural residents: Evidence from Chishui City, China. Int. J. Equity Health 2019, 18, 79. [Google Scholar] [CrossRef] [PubMed]

- Wang, R.; Zhang, R. Techno-economic analysis and optimization of hybrid energy systems based on hydrogen storage for sustainable energy utilization by a biological-inspired optimization algorithm. J. Energy Storage 2023, 66, 107469. [Google Scholar] [CrossRef]

- Li, Q.; Hu, J.; Yu, B. Spatiotemporal Patterns and Influencing Mechanism of Urban Residential Energy Consumption in China. Energies 2021, 14, 3864. [Google Scholar] [CrossRef]

- Zhang, S.; Zhang, C.; Su, Z.; Zhu, M.; Ren, H. New structural economic growth model and labor income share. J. Bus. Res. 2023, 160, 113644. [Google Scholar] [CrossRef]

- Zheng, C.; Chen, H. Revisiting the linkage between financial inclusion and energy productivity: Technology implications for climate change. Sustain. Energy Technol. Assess. 2023, 57, 103275. [Google Scholar] [CrossRef]

- Wang, Z.; Teng, Y.; Wu, S.; Chen, H. Does Green Finance Expand China’s Green Development Space? Evidence from the Ecological Environment Improvement Perspective. Systems 2023, 11, 369. [Google Scholar] [CrossRef]

- Sun, C.; Chen, J.; He, B.; Liu, J. Digitalization and carbon emission reduction technology R&D in a Stackelberg model. Appl. Econ. Lett. 2024, 1–6. [Google Scholar]

- Wang, K.; Hu, Y.; Zhou, J.; Hu, F. Fintech, Financial Constraints and OFDI: Evidence from China. Glob. Econ. Rev. 2023, 52, 326–345. [Google Scholar] [CrossRef]

- Hu, F.; Wei, S.; Qiu, L.; Hu, H.; Zhou, H. Innovative association network of new energy vehicle charging stations in China: Structural evolution and policy implications. Heliyon 2024, 10, e24764. [Google Scholar] [CrossRef] [PubMed]

- Zhao, S.; Zhang, L.; Peng, L.; Zhou, H.; Hu, F. Enterprise pollution reduction through digital transformation? Evidence from Chinese manufacturing enterprises. Technol. Soc. 2024, 77, 102520. [Google Scholar] [CrossRef]

- Xiao, D.; Liu, M.; Li, L.; Cai, X.; Qin, S.; Gao, R.; Liu, J.; Liu, X.; Tang, H.; Li, G. Model for economic evaluation of closed-loop geothermal systems based on net present value. Appl. Therm. Eng. 2023, 231, 121008. [Google Scholar] [CrossRef]

- Liu, X.; Zhu, C.; Kong, M.; Yin, L.; Zheng, W. The Value of Political Connections of Developers in Residential Land Leasing: Case of Chengdu, China. Sage Open 2024, 14, 21582440241245226. [Google Scholar] [CrossRef]

- Feng, J.; Wang, Y.; Liu, Z. Joint impact of service efficiency and salvage value on the manufacturer’s shared vehicle-type strategies. Rairo Oper. Res. 2024. [Google Scholar] [CrossRef]

- Rehman, Z.U.; Ijaz, N.; Ye, W.; Ijaz, Z. Design optimization and statistical modeling of recycled waste-based additive for a variety of construction scenarios on heaving ground. Environ. Sci. Pollut. Res. 2023, 30, 39783–39802. [Google Scholar] [CrossRef] [PubMed]

- Rehman, Z.; Khalid, U.; Ijaz, N.; Mujtaba, H.; Haider, A.; Farooq, K.; Ijaz, Z. Machine learning-based intelligent modeling of hydraulic conductivity of sandy soils considering a wide range of grain sizes. Eng. Geol. 2022, 311, 106899. [Google Scholar] [CrossRef]

- Khalid, U.; Ur Rehman, Z.; Mujtaba, H.; Farooq, K. 3D response surface modeling based in-situ assessment of physico-mechanical characteristics of alluvial soils using dynamic cone penetrometer. Transp. Geotech. 2022, 36, 100781. [Google Scholar] [CrossRef]

- Lv, X.L.; Chiang, H.D. Visual clustering network-based intelligent power lines inspection system. Eng. Appl. Artif. Intell. 2024, 129, 107572. [Google Scholar] [CrossRef]

- Li, T.; Wang, Z. The bifurcation of constrained optimization optimal solutions and its applications. AIMS Math. 2023, 8, 12373–12397. [Google Scholar] [CrossRef]

| Indicator | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

|---|---|---|---|---|---|

| Green Jobs | 10,000 | 12,500 | 14,800 | 16,200 | 18,000 |

| Renewable Energy Capacity (MW) | 100 | 150 | 250 | 350 | 500 |

| Energy Efficiency Savings (%) | 5 | 7 | 9 | 12 | 15 |

| Sustainable Consumption Growth (%) | 3 | 4 | 5 | 6 | 7 |

| Metric | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

|---|---|---|---|---|---|

| Waste Generation Reduction (%) | 10 | 15 | 20 | 25 | 30 |

| Product Lifespan Extension (years) | 2 | 2.5 | 3 | 3.5 | 4 |

| Recycled Materials Usage (%) | 20 | 25 | 30 | 35 | 40 |

| Circular Economy Business Growth (%) | 8 | 10 | 12 | 14 | 16 |

| Benefit | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

|---|---|---|---|---|---|

| Reduced CO2 Emissions (tons) | 50,000 | 60,000 | 70,000 | 80,000 | 90,000 |

| Improved Air Quality (AQI) | 80 | 75 | 70 | 65 | 60 |

| Resource Security Enhancement (%) | 10 | 12 | 15 | 18 | 20 |

| Economic Competitiveness Growth (%) | 5 | 6 | 7 | 8 | 9 |

| Year | Input: Green Jobs Created | Input: Renewable Energy Capacity Added (MW) | Output: CO2 Emissions Reduced (tons) | Output: Economic Growth Rate (%) |

|---|---|---|---|---|

| 1 | 10,000 | 100 | 50,000 | 3 |

| 2 | 2500 | 50 | 10,000 | 1 |

| 3 | 1800 | 100 | 20,000 | 2 |

| 4 | 1400 | 200 | 30,000 | 3 |

| 5 | 2000 | 400 | 40,000 | 4 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Han, C.; Yang, L. Financing and Management Strategies for Expanding Green Development Projects: A Case Study of Energy Corporation in China’s Renewable Energy Sector Using Machine Learning (ML) Modeling. Sustainability 2024, 16, 4338. https://doi.org/10.3390/su16114338

Han C, Yang L. Financing and Management Strategies for Expanding Green Development Projects: A Case Study of Energy Corporation in China’s Renewable Energy Sector Using Machine Learning (ML) Modeling. Sustainability. 2024; 16(11):4338. https://doi.org/10.3390/su16114338

Chicago/Turabian StyleHan, Chen, and Lu Yang. 2024. "Financing and Management Strategies for Expanding Green Development Projects: A Case Study of Energy Corporation in China’s Renewable Energy Sector Using Machine Learning (ML) Modeling" Sustainability 16, no. 11: 4338. https://doi.org/10.3390/su16114338

APA StyleHan, C., & Yang, L. (2024). Financing and Management Strategies for Expanding Green Development Projects: A Case Study of Energy Corporation in China’s Renewable Energy Sector Using Machine Learning (ML) Modeling. Sustainability, 16(11), 4338. https://doi.org/10.3390/su16114338