The Nexus between Green Finance and Carbon Emissions: Evidence from Maturity Mismatch in China

Abstract

1. Introduction

2. Literature Review and Research Hypotheses

2.1. Literature Review

2.1.1. The Concept and the Measurement of Green Finance

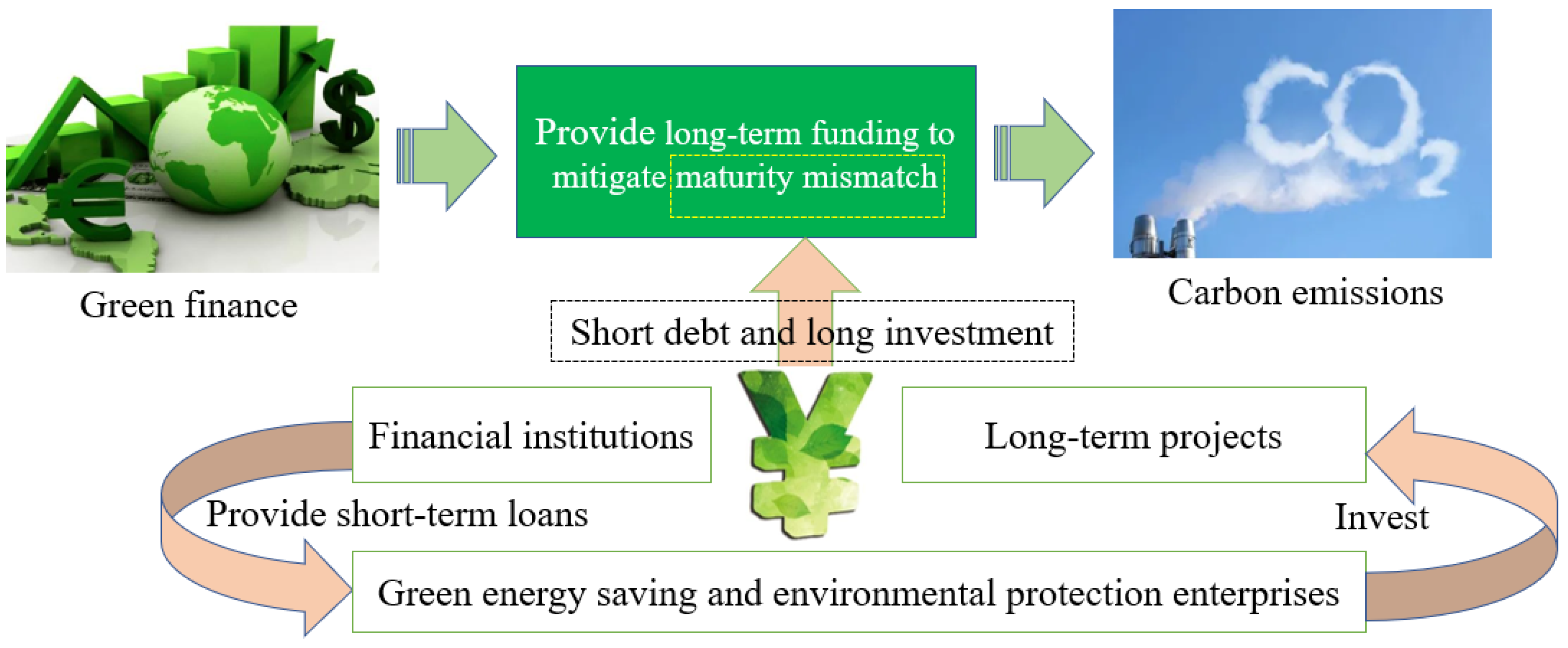

2.1.2. The Impact Mechanisms of Green Finance on Carbon Emissions

2.1.3. The Causes and Effects of Maturity Mismatch

2.2. Research Hypotheses

2.2.1. Green Finance and Carbon Emissions

2.2.2. Green Finance and Maturity Mismatch

3. Research Design

3.1. Model Specification

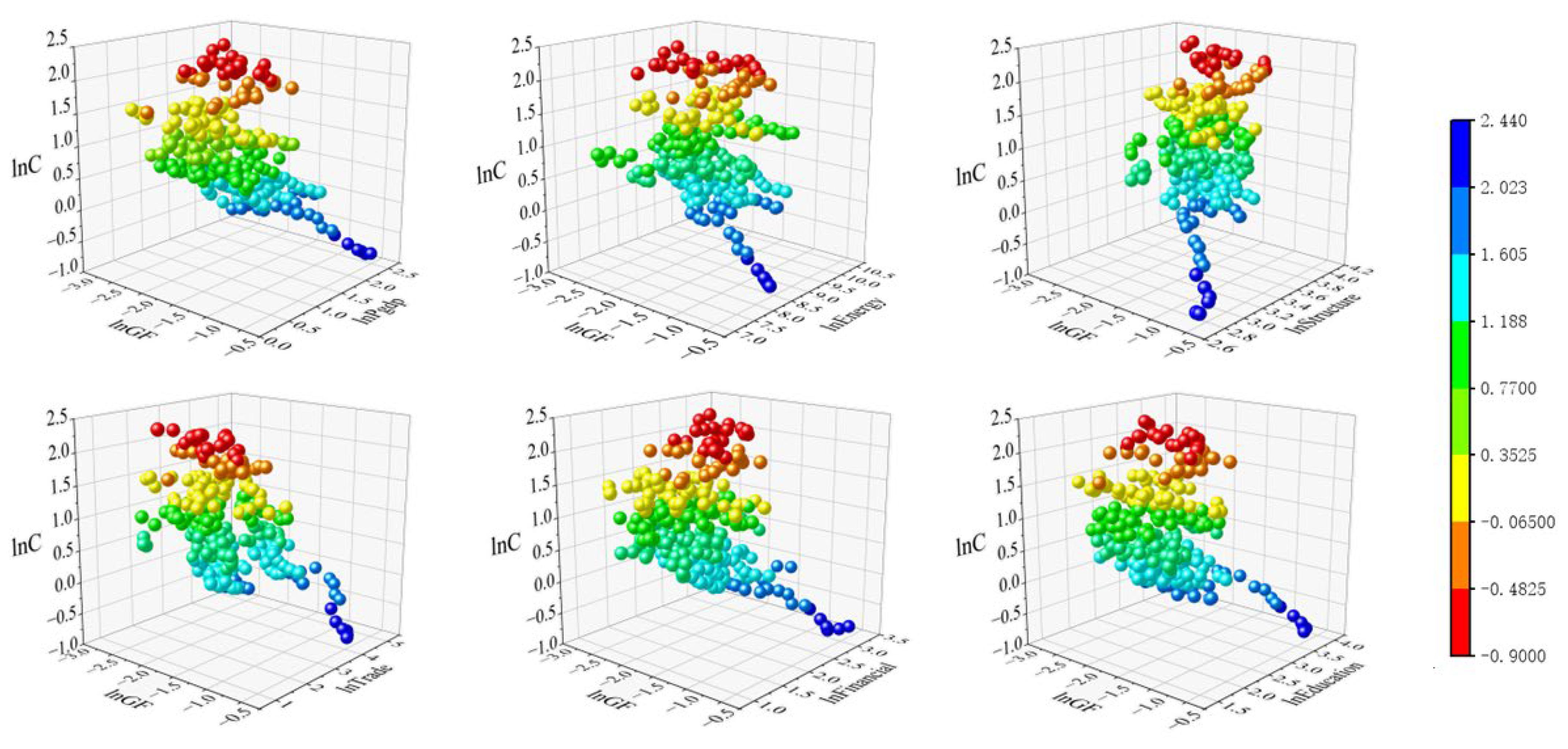

3.2. Variable Settings

3.2.1. Carbon Intensity (C)

3.2.2. Green Finance (GF)

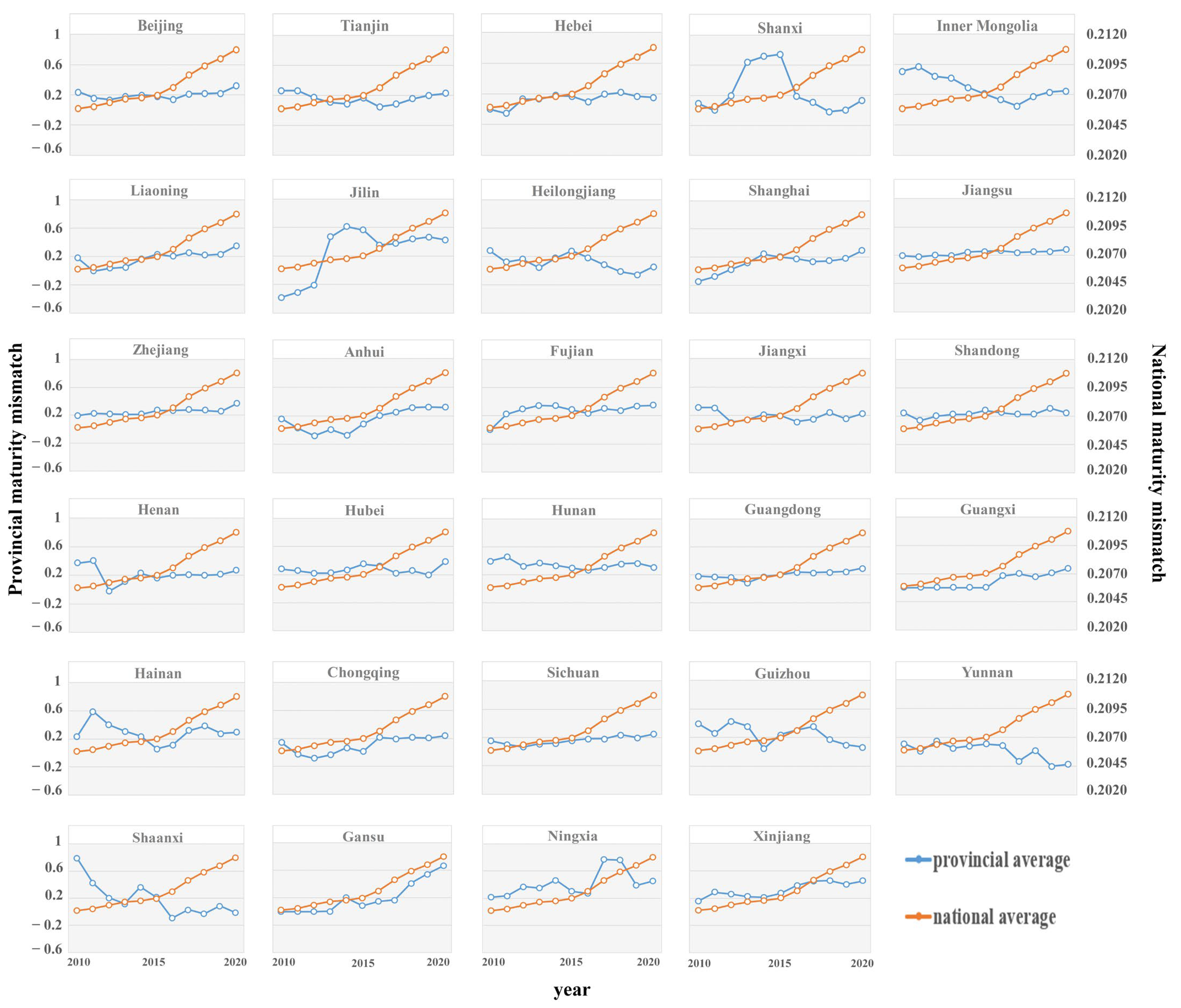

3.2.3. Maturity Mismatch (Mis)

3.2.4. Control Variables

3.3. Data Sources and Processing

4. Results and Discussion

4.1. Impact of Green Finance on Carbon Emissions

4.1.1. Baseline Regression

4.1.2. Robustness Tests

- 1.

- Endogeneity test

- 2.

- Replace explained variables

- 3.

- Replace explanatory variables

- 4.

- Replace regression model

- 5.

- Constructing parameter bounds

4.2. Heterogeneity Analysis of Green Finance’s Impact on Carbon Emissions

4.2.1. Heterogeneity of the Growth of Green Finance

4.2.2. Heterogeneity of Energy Consumption Structure

4.3. Mechanisms in Green Finance Carbon Emission Reduction

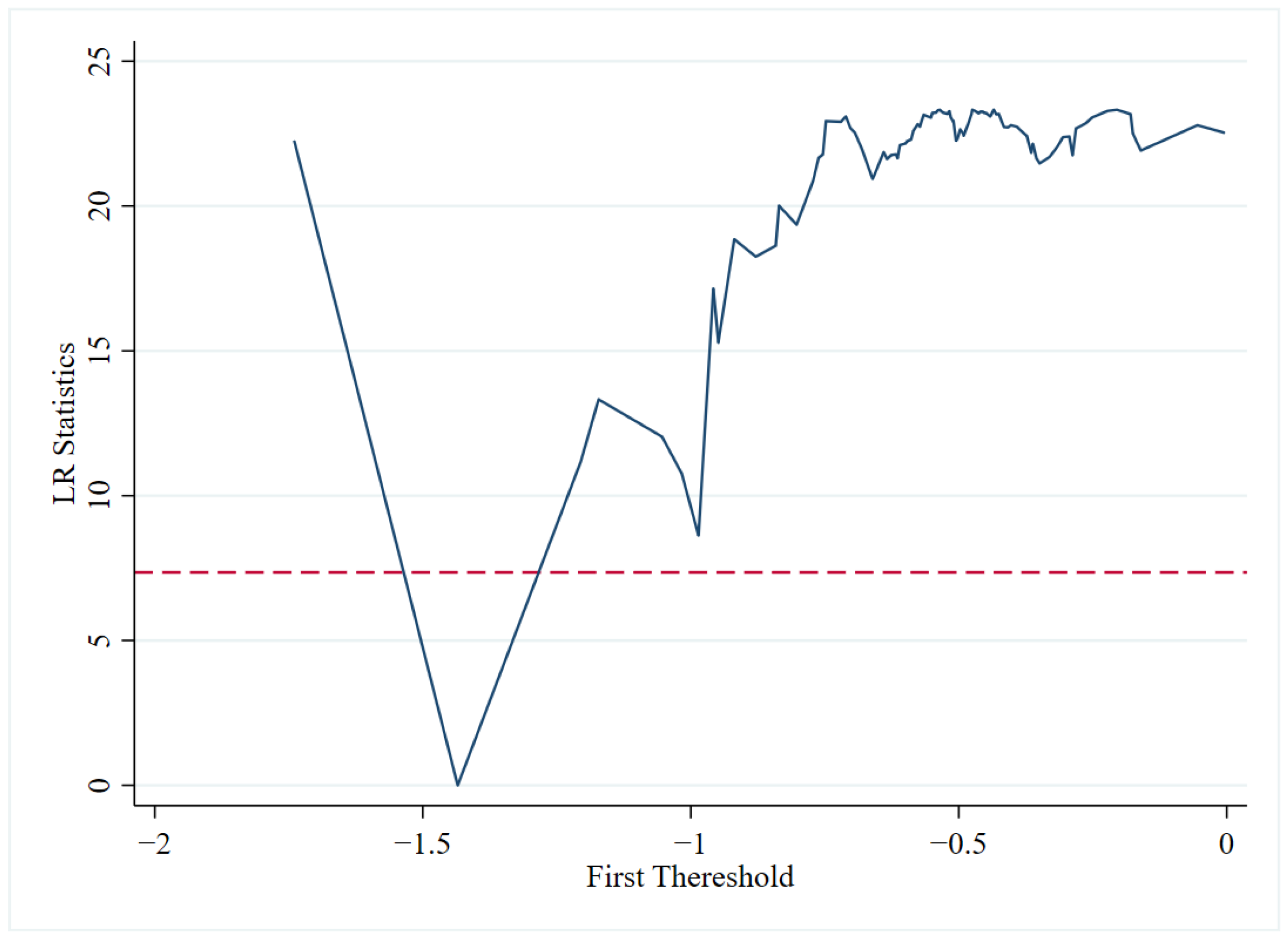

4.3.1. Mechanisms of Maturity Mismatch in Green Finance Carbon Emission Reduction

4.3.2. Mechanisms of Rationalization of Industrial Structure in Green Finance Carbon Emission Reduction

4.4. Further Analysis: Whether Green Finance Can Promote Synergies in Reducing Pollution and Carbon

5. Conclusion and Policy Implications

5.1. Conclusions

5.2. Policy Implications

5.3. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Safiullah, M.; Alam, M.S.; Islam, M.S. Do all institutional investors care about corporate carbon emissions? Energy Econ. 2022, 115, 106376. [Google Scholar] [CrossRef]

- Chen, J.; Li, J.; Li, G.; Zhang, J. How to recognize and characterize land use-based carbon emissions within city networks in the Beijing-Tianjin-Hebei region of China. Urban Clim. 2024, 53, 101789. [Google Scholar] [CrossRef]

- Shang, W.-L.; Song, X.; Chen, Y.; Yang, X.; Liang, L.; Deveci, M.; Cao, M.; Xiang, Q.; Yu, Q. Congestion and Pollutant Emission Analysis of Urban Road Networks Based on Floating Vehicle Data. Urban Clim. 2024, 53, 101794. [Google Scholar] [CrossRef]

- Lee, C.-C.; Lee, C.-C. How does green finance affect green total factor productivity? Evidence from China. Energy Econ. 2022, 107, 105863. [Google Scholar] [CrossRef]

- Xu, Y.; Li, S.; Zhou, X.; Shahzad, U.; Zhao, X. How environmental regulations affect the development of green finance: Recent evidence from polluting firms in China. Renew. Energy 2022, 189, 917–926. [Google Scholar] [CrossRef]

- Wang, H.; Gu, K.; Sun, H.; Xiao, H. Reconfirmation of the symbiosis on carbon emissions and air pollution: A spatial spillover perspective. Sci. Total Environ. 2023, 858, 159906. [Google Scholar] [CrossRef] [PubMed]

- Tian, Y.; Li, L. Will COVID-19 affect China’s peak CO2 emissions in 2030? An analysis based on the systems dynamics model of green finance. J. Clean. Prod. 2022, 356, 131777. [Google Scholar] [CrossRef]

- Lv, C.; Bian, B.; Lee, C.-C.; He, Z. Regional gap and the trend of green finance development in China. Energy Econ. 2021, 102, 105476. [Google Scholar] [CrossRef]

- Zhang, H.; Geng, C.; Wei, J. Coordinated development between green finance and environmental performance in China: The spatial-temporal difference and driving factors. J. Clean. Prod. 2022, 346, 131150. [Google Scholar] [CrossRef]

- Gao, Y.; Sheng, Z.Z. The Carbon Emission Reduction Effect of Green Financial Reform Policies. China Environ. Sci. 2022, 42, 4849–4859. (In Chinese) [Google Scholar] [CrossRef]

- He, Y.; Liu, R. The impact of the level of green finance development on corporate debt financing capacity. Financ. Res. Lett. 2023, 52, 103552. [Google Scholar] [CrossRef]

- Hepburn, C.; Qi, Y.; Stern, N.; Ward, B.; Xie, C.; Zenghelis, D. Towards carbon neutrality and China’s 14th Five-Year Plan: Clean energy transition, sustainable urban development, and investment priorities. Environ. Sci. Ecotechnol. 2021, 8, 100130. [Google Scholar] [CrossRef] [PubMed]

- Huang, J.; An, L.; Peng, W.; Guo, L. Identifying the role of green financial development played in carbon intensity: Evidence from China. J. Clean. Prod. 2023, 408, 136943. [Google Scholar] [CrossRef]

- Sun, Y.; Guan, W.; Cao, Y.; Bao, Q. Role of green finance policy in renewable energy deployment for carbon neutrality: Evidence from China. Renew. Energy 2022, 197, 643–653. [Google Scholar] [CrossRef]

- Wang, J.; Tian, J.; Kang, Y.; Guo, K. Can green finance development abate carbon emissions: Evidence from China. Int. Rev. Econ. Financ. 2023, 88, 73–91. [Google Scholar] [CrossRef]

- Li, S.; Shao, Q. Greening the finance for climate mitigation: An ARDL–ECM approach. Renew. Energy 2022, 199, 1469–1481. [Google Scholar] [CrossRef]

- Wang, Y.; Wang, T.; Chen, L. Maturity mismatches of Chinese listed firms. Pac.-Basin Financ. J. 2021, 70, 101680. [Google Scholar] [CrossRef]

- Gong, Y.; Wei, X. Asset quality, debt maturity, and market liquidity. Financ. Res. Lett. 2019, 31, 285–293. [Google Scholar] [CrossRef]

- Diamond, D.W.; Dybvig, P.H. Bank Runs, Deposit Insurance, and Liquidity. J. Political Econ. 1983, 91, 401–419. [Google Scholar] [CrossRef]

- Chen, X.; Chen, Z. Can Green Finance Development Reduce Carbon Emissions? Empirical Evidence from 30 Chinese Provinces. Sustainability 2021, 13, 12137. [Google Scholar] [CrossRef]

- Lee, C.-C.; Wang, F.; Lou, R.; Wang, K. How does green finance drive the decarbonization of the economy? Empirical evidence from China. Renew. Energy 2023, 204, 671–684. [Google Scholar] [CrossRef]

- Xie, D.; Hu, S. Green Finance, Maturity Mismatch and Green Total Factor Productivity. Soft Sci. 2022, 8, 16. (In Chinese) [Google Scholar] [CrossRef]

- Wang, K.; Sun, X.; Wang, F. Green Financial Development, Debt Maturity Structure and Green Corporate Investment. Financ. Forum 2019, 24, 9–19. (In Chinese) [Google Scholar] [CrossRef]

- Wu, J.Y.; Opare, S.; Bhuiyan, M.B.U.; Habib, A. Determinants and consequences of debt maturity structure: A systematic review of the international literature. Int. Rev. Financ. Anal. 2022, 84, 102423. [Google Scholar] [CrossRef]

- Bhatnagar, S.; Sharma, D. Evolution of green finance and its enablers: A bibliometric analysis. Renew. Sustain. Energy Rev. 2022, 162, 112405. [Google Scholar] [CrossRef]

- Lan, J.; Wei, Y.; Guo, J.; Li, Q.; Liu, Z. The effect of green finance on industrial pollution emissions: Evidence from China. Resour. Policy 2023, 80, 103156. [Google Scholar] [CrossRef]

- Geng, Q.; Wang, Y.; Wang, X. The impact of natural resource endowment and green finance on green economic efficiency in the context of COP26. Resour. Policy 2023, 80, 103246. [Google Scholar] [CrossRef]

- Zhang, D.; Mohsin, M.; Taghizadeh-Hesary, F. Does green finance counteract the climate change mitigation: Asymmetric effect of renewable energy investment and R&D. Energy Econ. 2022, 113, 106183. [Google Scholar] [CrossRef]

- Qin, M.; Zhang, X.; Li, Y.; Badarcea, R.M. Blockchain market and green finance: The enablers of carbon neutrality in China. Energy Econ. 2023, 118, 106501. [Google Scholar] [CrossRef]

- Pang, L.; Zhu, M.N.; Yu, H. Is green finance really a blessing for green technology and carbon efficiency? Energy Econ. 2022, 114, 106272. [Google Scholar] [CrossRef]

- Sun, H.; Chen, F. The impact of green finance on China’s regional energy consumption structure based on system GMM. Resour. Policy 2022, 76, 102588. [Google Scholar] [CrossRef]

- Liu, Q.; Tang, L. Research on the accelerating effect of green finance on the transformation of energy consumption in China. Res. Int. Bus. Financ. 2022, 63, 101771. [Google Scholar] [CrossRef]

- Wang, R.; Zhao, X.; Zhang, L. Research on the impact of green finance and abundance of natural resources on China’s regional eco-efficiency. Resour. Policy 2022, 76, 102579. [Google Scholar] [CrossRef]

- Zhou, H.; Xu, G. Research on the impact of green finance on China’s regional ecological development based on system GMM model. Resour. Policy 2022, 75, 102454. [Google Scholar] [CrossRef]

- Wang, Z.; Wang, X. Research on the impact of green finance on energy efficiency in different regions of China based on the DEA-Tobit model. Resour. Policy 2022, 77, 102695. [Google Scholar] [CrossRef]

- Wang, F.; Wang, R.; He, Z. The impact of environmental pollution and green finance on the high-quality development of energy based on spatial Dubin model. Resour. Policy 2021, 74, 102451. [Google Scholar] [CrossRef]

- Yin, X.; Xu, Z. An empirical analysis of the coupling and coordinative development of China’s green finance and economic growth. Resour. Policy 2022, 75, 102476. [Google Scholar] [CrossRef]

- Yang, Y.; Su, X.; Yao, S. Nexus between green finance, fintech, and high-quality economic development: Empirical evidence from China. Resour. Policy 2021, 74, 102445. [Google Scholar] [CrossRef]

- Saeed Meo, M.; Karim, M.Z.A. The role of green finance in reducing CO2 emissions: An empirical analysis. Borsa Istanb. Rev. 2022, 22, 169–178. [Google Scholar] [CrossRef]

- Bakry, W.; Mallik, G.; Nghiem, X.-H.; Sinha, A.; Vo, X.V. Is green finance really “green”? Examining the long-run relationship between green finance, renewable energy and environmental performance in developing countries. Renew. Energy 2023, 208, 341–355. [Google Scholar] [CrossRef]

- Zhou, M.; Li, X. Influence of green finance and renewable energy resources over the sustainable development goal of clean energy in China. Resour. Policy 2022, 78, 102816. [Google Scholar] [CrossRef]

- Ren, X.; Shao, Q.; Zhong, R. Nexus between green finance, non-fossil energy use, and carbon intensity: Empirical evidence from China based on a vector error correction model. J. Clean. Prod. 2020, 277, 122844. [Google Scholar] [CrossRef]

- Al Mamun, M.; Boubaker, S.; Nguyen, D.K. Green finance and decarbonization: Evidence from around the world. Financ. Res. Lett. 2022, 46, 102807. [Google Scholar] [CrossRef]

- Chai, S.; Zhang, K.; Wei, W.; Ma, W.; Abedin, M.Z. The impact of green credit policy on enterprises’ financing behavior: Evidence from Chinese heavily-polluting listed companies. J. Clean. Prod. 2022, 363, 132458. [Google Scholar] [CrossRef]

- Irfan, M.; Razzaq, A.; Sharif, A.; Yang, X. Influence mechanism between green finance and green innovation: Exploring regional policy intervention effects in China. Technol. Forecast. Soc. Chang. 2022, 182, 121882. [Google Scholar] [CrossRef]

- Huang, Y.; Chen, C.; Lei, L.; Zhang, Y. Impacts of green finance on green innovation: A spatial and nonlinear perspective. J. Clean. Prod. 2022, 365, 132548. [Google Scholar] [CrossRef]

- Shui, B. Major risk shocks, financial relief policies and loan maturity for MSMEs: Evidence from China. Financ. Res. Lett. 2023, 55, 103903. [Google Scholar] [CrossRef]

- Ee, M.S.; Huang, H.; Cheng, M. Do labor mobility restrictions affect debt maturity? J. Financ. Stab. 2023, 66, 101121. [Google Scholar] [CrossRef]

- Li, X.; Su, D. Surges and instability: The maturity shortening channel. J. Int. Econ. 2022, 139, 103679. [Google Scholar] [CrossRef]

- Si, D.-K.; Wang, M.; Ding, H. Capital account liberalization and corporate maturity mismatch: The role of bank competition. Pac.-Basin Financ. J. 2023, 82, 102137. [Google Scholar] [CrossRef]

- Li, J.; Ye, Y.; Li, J. Performance feedback and corporate maturity mismatch: Evidence from China. Res. Int. Bus. Financ. 2024, 67, 102109. [Google Scholar] [CrossRef]

- Wang, X. A macro-financial perspective to analyse maturity mismatch and default. J. Bank. Financ. 2023, 151, 106468. [Google Scholar] [CrossRef]

- Hu, Y.; Che, D.; Wu, F.; Chang, X. Corporate maturity mismatch and enterprise digital transformation: Evidence from China. Financ. Res. Lett. 2023, 53, 103677. [Google Scholar] [CrossRef]

- Xu, M.; Yang, Z.; Lin, Y.-E.; Li, G. Maturity mismatched investment, digital financial inclusion, and digital orientation: Evidence from China. Int. Rev. Financ. Anal. 2024, 91, 102957. [Google Scholar] [CrossRef]

- Zhitao, W.; Xiang, M. Financial mismatch on corporate debt default risk: Evidence from China. Pac.-Basin Financ. J. 2023, 80, 102077. [Google Scholar] [CrossRef]

- Luo, R.; Fang, H.; Liu, J.; Zhao, S. Maturity mismatch and incentives: Evidence from bank issued wealth management products in China. J. Bank. Financ. 2019, 107, 105615. [Google Scholar] [CrossRef]

- Li, Y.; Yu, C.; Shi, J.; Liu, Y. How does green bond issuance affect total factor productivity? Evidence from Chinese listed enterprises. Energy Econ. 2023, 123, 106755. [Google Scholar] [CrossRef]

- Zhang, S.; Wu, Z.; Wang, Y.; Hao, Y. Fostering green development with green finance: An empirical study on the environmental effect of green credit policy in China. J. Environ. Manag. 2021, 296, 113159. [Google Scholar] [CrossRef]

- Wang, T.; Liu, X.; Wang, H. Green bonds, financing constraints, and green innovation. J. Clean. Prod. 2022, 381, 135134. [Google Scholar] [CrossRef]

- Sheng, C.; Zhang, D.; Wang, G.; Huang, Y. Research on risk mechanism of China’s carbon financial market development from the perspective of ecological civilization. J. Comput. Appl. Math. 2021, 381, 112990. [Google Scholar] [CrossRef]

- Ding, Q.; Huang, J.; Chen, J. Does digital finance matter for corporate green investment? Evidence from heavily polluting industries in China. Energy Econ. 2023, 117, 106476. [Google Scholar] [CrossRef]

- He, N.; Zeng, S.; Jin, G. Achieving synergy between carbon mitigation and pollution reduction: Does green finance matter? J. Environ. Manag. 2023, 342, 118356. [Google Scholar] [CrossRef] [PubMed]

- Xu, J.; Chen, F.; Zhang, W.; Liu, Y.; Li, T. Analysis of the carbon emission reduction effect of Fintech and the transmission channel of green finance. Financ. Res. Lett. 2023, 56, 104127. [Google Scholar] [CrossRef]

- Guo, Q.-T.; Dong, Y.; Feng, B.; Zhang, H. Can green finance development promote total-factor energy efficiency? Empirical evidence from China based on a spatial Durbin model. Energy Policy 2023, 177, 113523. [Google Scholar] [CrossRef]

- Ma, S.; Peng, Y.; Wu, W.; Zhu, F. Bank liquidity hoarding and corporate maturity mismatch: Evidence from China. Res. Int. Bus. Financ. 2022, 63, 101776. [Google Scholar] [CrossRef]

- Madaleno, M.; Dogan, E.; Taskin, D. A step forward on sustainability: The nexus of environmental responsibility, green technology, clean energy and green finance. Energy Econ. 2022, 109, 105945. [Google Scholar] [CrossRef]

- Cao, Y.; Zhang, Y.; Yang, L.; Li, R.Y.M.; Crabbe, M.J.C. Green Credit Policy and Maturity Mismatch Risk in Polluting and Non-Polluting Companies. Sustainability 2021, 13, 3615. [Google Scholar] [CrossRef]

- Shi, J.; Yu, C.; Li, Y.; Wang, T. Does green financial policy affect debt-financing cost of heavy-polluting enterprises? An empirical evidence based on Chinese pilot zones for green finance reform and innovations. Technol. Forecast. Soc. Chang. 2022, 179, 121678. [Google Scholar] [CrossRef]

- Yang, Z.; Gao, W.; Han, Q.; Qi, L.; Cui, Y.; Chen, Y. Digitalization and carbon emissions: How does digital city construction affect China’s carbon emission reduction? Sustain. Cities Soc. 2022, 87, 104201. [Google Scholar] [CrossRef]

- Zhang, Z.; Hao, L.; Linghu, Y.; Yi, H. Research on the energy poverty reduction effects of green finance in the context of economic policy uncertainty. J. Clean. Prod. 2023, 410, 137287. [Google Scholar] [CrossRef]

- Liu, X.; Liu, Y. Leverage, Short Debt Longevity and Corporate Performance. Econ. Res. 2019, 54, 127–141. (In Chinese) [Google Scholar]

- Gu, G.; Zheng, H.; Tong, L.; Dai, Y. Does carbon financial market as an environmental regulation policy tool promote regional energy conservation and emission reduction? Empirical evidence from China. Energy Policy 2022, 163, 112826. [Google Scholar] [CrossRef]

- Wan, Q.; Qian, J.; Baghirli, A.; Aghayev, A. Green finance and carbon reduction: Implications for green recovery. Econ. Anal. Policy 2022, 76, 901–913. [Google Scholar] [CrossRef]

- Benmelech, E.; Tzur-Ilan, N. The Determinants of Fiscal and Monetary Policies during the COVID19 Crisis; NBER Working Paper No. 27461; National Bureau of Economic Research: Cambridge, MA, USA, 2020. [Google Scholar] [CrossRef]

- Cortes, G.S.; Gao, G.P.; Silva, F.B.; Song, Z. Unconventional monetary policy and disaster risk: Evidence from the subprime and COVID-19 crises. J. Int. Money Financ. 2022, 122, 102543. [Google Scholar] [CrossRef] [PubMed]

- Li, Z.-Z.; Li, R.Y.M.; Malik, M.Y.; Murshed, M.; Khan, Z.; Umar, M. Determinants of Carbon Emission in China: How Good is Green Investment? Sustain. Prod. Consum. 2021, 27, 392–401. [Google Scholar] [CrossRef]

- Shen, Y.; Su, Z.W.; Malik, M.Y.; Umar, M.; Khan, Z.; Khan, M. Does green investment, financial development and natural resources rent limit carbon emissions? A provincial panel analysis of China. Sci. Total Environ. 2021, 755, 142538. [Google Scholar] [CrossRef] [PubMed]

- Zhou, K.; Li, Y. Carbon finance and carbon market in China: Progress and challenges. J. Clean. Prod. 2019, 214, 536–549. [Google Scholar] [CrossRef]

- Peng, W.; Lu, S.; Lu, W. Green financing for the establishment of renewable resources under carbon emission regulation. Renew. Energy 2022, 199, 1210–1225. [Google Scholar] [CrossRef]

- Xu, J.; Wang, J.; Li, R.; Gu, M. Is green finance fostering high-quality energy development in China? A spatial spillover perspective. Energy Strategy Rev. 2023, 50, 101201. [Google Scholar] [CrossRef]

- Ran, C.; Zhang, Y. The driving force of carbon emissions reduction in China: Does green finance work. J. Clean. Prod. 2023, 421, 138502. [Google Scholar] [CrossRef]

- Yan, X.; Yang, C.; Zhang, R. How does green finance derive the resource efficiency and decarbonization of the economy? Resour. Policy 2023, 85, 103934. [Google Scholar] [CrossRef]

- Lee, C.-C.; Wang, F.; Chang, Y.-F. Does green finance promote renewable energy? Evidence from China. Resour. Policy 2023, 82, 103439. [Google Scholar] [CrossRef]

- Lee, C.-C.; Wang, F. How does digital inclusive finance affect carbon intensity? Econ. Anal. Policy 2022, 75, 174–190. [Google Scholar] [CrossRef]

- Oster, E. Unobservable Selection and Coefficient Stability: Theory and Evidence. J. Bus. Econ. Stat. 2019, 37, 187–204. [Google Scholar] [CrossRef]

- Dantas, M.M.; Merkley, K.J.; Silva, F.B.G. Government Guarantees and Banks’ Income Smoothing. J. Financ. Serv. Res. 2023, 63, 123–173. [Google Scholar] [CrossRef]

- Wei, L.; Yang, Y. Research on the Impact of Mismatching Financial Resources on Carbon Emissions—Based on the perspective of green credit. J. Northwest Norm. Univ. (Soc. Sci.) 2023, 60, 126–133. (In Chinese) [Google Scholar] [CrossRef]

- Hu, L.; Yuan, W.; Jiang, J.; Ma, T.; Zhu, S. Asymmetric effects of industrial structure rationalization on carbon emissions: Evidence from thirty Chinese provinces. J. Clean. Prod. 2023, 428, 139347. [Google Scholar] [CrossRef]

- Zhou, X.; Tang, X. Spatiotemporal consistency effect of green finance on pollution emissions and its geographic attenuation process. J. Environ. Manag. 2022, 318, 115537. [Google Scholar] [CrossRef] [PubMed]

- Zhang, H.; Duan, Y.; Yang, J.; Han, Z.; Wang, H. Can green finance improve China’s haze pollution reduction? The role of energy efficiency. Environ. Dev. 2023, 45, 100833. [Google Scholar] [CrossRef]

- Bi, S.; Hu, J.; Shao, L.; Feng, T.; Appolloni, A. Can public transportation development improve urban air quality? Evidence from China. Urban Clim. 2024, 54, 101825. [Google Scholar] [CrossRef]

- Kokkinos, K.; Karayannis, V.; Nathanail, E.; Moustakas, K. A comparative analysis of Statistical and Computational Intelligence methodologies for the prediction of traffic-induced fine particulate matter and NO2. J. Clean. Prod. 2021, 328, 129500. [Google Scholar] [CrossRef]

- Zhang, A.; Wang, S.; Liu, B. How to control air pollution with economic means? Exploration of China’s green finance policy. J. Clean. Prod. 2022, 353, 131664. [Google Scholar] [CrossRef]

| Method | Index and Representative Scholar |

|---|---|

| PCA | Government spending on energy production and environmental protection is divided by total spending [13,28] |

| SIM | Green bond indices [29,30]; GIV [31]; GC [32,33,34,35] |

| EM | GC, CF, GS, GIS, GIV multi index [27,36,37,38] |

| Tier 1 Indicators | Secondary Indicators | Tertiary Indicators | Indicator Measurement Methodology | Indicator Properties |

|---|---|---|---|---|

| Green finance (GF) | GC | The interest expense ratio of six energy-intensive industries 1 | Interest expenses incurred by six industries with high energy consumption/interest expenses of industries in the industrial sector | - |

| Amount of loans for environmental companies | Amount of loans for environmental companies | + | ||

| GS | Percentage of environmental firms’ market capitalization | The sum of the market capitalizations of the A-shares and environmental company enterprises | + | |

| The market value of energy-intensive businesses, expressed as a percentage | The total market value of listed companies in six high-energy-consuming industries/total market value of A-shares | - | ||

| GIV | The proportion of money invested in reducing environmental degradation | Amount invested in pollution of the environment/GDP | + | |

| Energy saving and environmental protection spending as a percentage | Total financial spending against financial expenditure on the energy-saving and environmental protection business | + | ||

| GIS | Share of agricultural insurance scale | Total insurance costs divided by agricultural insurance costs | + | |

| Ratio of insurance payouts for agriculture | Expenditures for and earnings from agriculture insurance | + | ||

| CF | Carbon emission loan intensity | Loan balance/carbon emissions | + |

| Variables | (1) N | (2) Mean | (3) Std. Dev. | (4) Min | (5) Max |

|---|---|---|---|---|---|

| lnC | 319 | 0.8104 | 0.7008 | −0.8924 | 2.4323 |

| lnGF | 319 | −1.8456 | 0.3653 | −2.6501 | −0.5434 |

| lnMis | 319 | −0.6077 | 0.9285 | −16.2365 | 0.1586 |

| lnPgdp | 319 | 1.4032 | 0.4300 | 0.2615 | 2.5508 |

| lnEnergy | 319 | 9.1086 | 0.5987 | 7.0464 | 10.3035 |

| lnStructure | 319 | 3.7464 | 0.2418 | 2.7600 | 4.0775 |

| lnTrade | 319 | 3.0000 | 0.8980 | 1.0043 | 5.0637 |

| lnFinancial | 319 | 1.9833 | 0.4358 | 0.9359 | 3.2458 |

| lnEducation | 319 | 2.5274 | 0.4133 | 1.6662 | 3.9217 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| lnC | lnC | lnC | lnC | lnC | lnC | |

| lnGF | −0.4807 *** (0.0554) | −0.0931 * (0.0530) | −0.0879 ** (0.0419) | −0.0953 ** (0.0418) | −0.0953 ** (0.0418) | −0.0701 ** (0.0272) |

| lnPgdp | −1.0022 *** (0.0674) | −1.1215 *** (0.1277) | −1.1215 *** | −1.3443 *** | ||

| (0.1277) | (0.0851) | |||||

| lnEnergy | 0.6829 *** (0.0724) | 0.7990 *** (0.0814) | 0.7990 *** | 0.7403 *** | ||

| (0.0814) | (0.0553) | |||||

| lnStructure | −0.1805 * (0.1007) | −0.0125 (0.1344) | −0.0125 | 0.1360 | ||

| (0.1344) | (0.0876) | |||||

| lnTrade | 0.0316 (0.0308) | 0.0439 (0.0328) | 0.0439 | 0.0457** | ||

| (0.0328) | (0.0223) | |||||

| lnFinancial | −0.0532 (0.0472) | 0.0077 (0.0538) | 0.0077 | 0.0728** | ||

| (0.0538) | (0.0358) | |||||

| lnEducation | 0.0552 (0.0473) | 0.0390 (0.0470) | 0.0390 | 0.0348 | ||

| (0.0470) | (0.0377) | |||||

| lnasset | 0.1172 | |||||

| (0.1072) | ||||||

| Constant | −0.0768 (0.1632) | 0.8589 *** (0.1060) | −3.6181 *** (0.7458) | −5.2901 *** (0.8505) | 7.0131 *** | −5.1526 *** |

| (1.7589) | (0.5746) | |||||

| Individual fixation | No | Yes | No | Yes | Yes | Yes |

| Fixed time | No | Yes | No | Yes | Yes 319 | Yes |

| N | 319 | 319 | 319 | 319 | 290 0.8855 | |

| R2 | 0.2044 | 0.5507 | 0.7115 | 0.7367 | 0.7367 |

| Variables | (1) | (2) | (3) | |||

|---|---|---|---|---|---|---|

| lnGF | lnC | lnGF | lnC | lnGF | lnC | |

| GF1 | −0.0037 *** (0.0009) | −0.0025 *** (0.0009) | ||||

| GF2 | 0.3894 *** (0.0571) | 0.3568 *** (0.0576) | ||||

| lnGF | −0.3195 * (0.1871) | −0.2590 ** (0.1175) | −0.2740 ** (0.1098) | |||

| Control variables | yes | yes | yes | yes | yes | yes |

| Individual fixation | yes | yes | yes | yes | yes | yes |

| Fixed time | yes | yes | yes | yes | yes | yes |

| N | 319 | 319 | 290 | 290 | 290 | 290 |

| Phase I F-statistic | 15.9400 | 46.5500 | 27.6000 | |||

| LM test value | 17.6020 | 46.3030 | 53.5000 | |||

| (p) | 0.0000 | 0.0000 | 0.0000 | |||

| Variables | (1) | (2) | (3) |

|---|---|---|---|

| lnGF | −0.0953 ** (0.0418) | −0.0967 ** (0.0405) | |

| gfzone | −0.1022 *** (0.0361) | ||

| lnC1 | 0.5336 ** (0.2327) | ||

| AR (1) | 0.0090 | ||

| AR (2) | 0.3510 | ||

| Hansen test | 1.000 | ||

| Control variables | yes | yes | yes |

| Constant | −5.2901 *** (0.8505) | −5.8595 *** (0.8767) | −1.2180 (2.8780) |

| Individual fixation | yes | yes | yes |

| Fixed time | yes | yes | yes |

| N | 319 | 319 | 290 |

| R2 | 0.4369 | 0.7393 |

| Simple OLS without City-Level Controls to DID with All Controls | ||||||||

|---|---|---|---|---|---|---|---|---|

| Simplified Model | All OLS Controls | Bounding Values | ||||||

| Outcome OLS coefficient | −0.0931 | 2 0.5507 | −0.0953 | 2 0.7367 | 0.9577 | 1.0000 | −0.1001 | −0.1006 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| lnGF | −0.1697 *** (0.0571) | −0.1021 (0.0787) | 0.0370 (0.0623) | −0.1335 *** (0.0418) |

| Control variables | yes | yes | yes | yes |

| Constant | −3.5419 *** (1.0013) | −5.5562 *** (1.4252) | −4.2836 *** (1.4109) | −1.1506 (0.8192) |

| Individual fixation | yes | yes | yes | yes |

| Fixed time | yes | yes | yes | yes |

| N | 131 | 188 | 202 | 117 |

| R2 | 0.8333 | 0.6819 | 0.6799 | 0.9205 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| lnGF | −0.1818 *** (0.0628) | −0.6689 *** (0.2427) | −0.1015 ** (0.0412) | |

| lnMis | −0.3178 * (0.1724) | −1.9455 *** | ||

| (0.6831) | ||||

| lnGF × lnMis | −0.1672 * (0.0909) | −0.9907 *** | ||

| (0.3368) | ||||

| ISR | −0.4156 * | |||

| (0.2514) | ||||

| lnGF × ISR | 0.5873 ** | |||

| (0.2820) | ||||

| lnC1 | 0.2966 * | |||

| (0.1477) | ||||

| Threshold value | −1.4348 | |||

| −0.2145 *** (0.0487) | ||||

| −0.0913 ** (0.0395) | ||||

| AR (1) | 0.0030 | |||

| AR (2) | 0.7280 | |||

| Hansen test | 1.0000 | |||

| Control variables | yes | yes | yes | yes |

| Constant | −5.5704 *** (0.8649) | 1.1473 (2.2232) | −4.2878 *** (0.7504) | −4.6139 *** (0.8630) yes |

| Individual fixation | yes | |||

| Fixed time | yes | yes | ||

| N | 319 | 319 | 319 | 319 |

| R2 | 0.7400 | 0.7474 |

| Variables | lnPM2.5 | lnPM2.5 | lnSO2 | lnSO2 |

|---|---|---|---|---|

| lnGF | −0.0730 ** (0.03) | −0.0869 ** (0.04) | −0.4726 *** (0.11) | −0.7001 *** (0.17) |

| lnMis | −0.0621 (0.12) | −0.8559 * (0.47) | ||

| lnGF × lnMis | −0.0384 (0.06) | −0.4602 * (0.25) | ||

| Control variables | yes | yes | yes | yes |

| Constant | 2.1956 *** (0.59) | 2.0376 *** (0.60) | −11.5150 *** (2.30) | −12.4497 *** (2.34) |

| Individual fixation | yes | yes | yes | yes |

| Fixed time | yes | yes | yes | yes |

| N | 319 | 319 | 319 | 319 |

| R2 | 0.8351 | 0.8380 | 0.9016 | 0.9031 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, X.; Cui, J.; Wu, Y.; Yue, X.; Shen, J.; Guo, P. The Nexus between Green Finance and Carbon Emissions: Evidence from Maturity Mismatch in China. Sustainability 2024, 16, 4319. https://doi.org/10.3390/su16104319

Liu X, Cui J, Wu Y, Yue X, Shen J, Guo P. The Nexus between Green Finance and Carbon Emissions: Evidence from Maturity Mismatch in China. Sustainability. 2024; 16(10):4319. https://doi.org/10.3390/su16104319

Chicago/Turabian StyleLiu, Xiuli, Jing Cui, Yanrui Wu, Xiaohang Yue, Jun Shen, and Pibin Guo. 2024. "The Nexus between Green Finance and Carbon Emissions: Evidence from Maturity Mismatch in China" Sustainability 16, no. 10: 4319. https://doi.org/10.3390/su16104319

APA StyleLiu, X., Cui, J., Wu, Y., Yue, X., Shen, J., & Guo, P. (2024). The Nexus between Green Finance and Carbon Emissions: Evidence from Maturity Mismatch in China. Sustainability, 16(10), 4319. https://doi.org/10.3390/su16104319