1. Introduction

A national or regional ability to achieve steady economic growth depends largely on energy supply, and energy security is crucial to national security overall, particularly in developing countries [

1]. Since the reform and opening in 1978, China’s economic growth has moved into a stage of rapid expansion. But as the economy grows quickly, China’s energy consumption keeps rising, placing a great deal of strain on the country’s energy supply and exacerbating issues like air and water pollution [

2,

3]. At the same time, as the country’s population grows and industrialization picks up speed, coupled with its relatively limited domestic energy reserves, national energy security concerns will unavoidably face new challenges. The necessity to strengthen the development of security capacities in critical sectors and guarantee the security of energy and resources was made abundantly evident during the 20th National People’s Congress of China in 2022. Energy consumption at the current stage of development is crucial to economic growth and lays the groundwork for the nation to achieve sustainable development. Thus, it is essential to investigate the subject of energy consumption in China [

4]. On the one hand, the rapid growth of the Chinese economy and advancements in living standards are driving up consumer demand for energy. However, excessive energy use results in financial losses and social burdens, in addition to aggravating resource scarcity and environmental contamination. On the other hand, people’s need for clean, efficient energy is growing as urbanization picks up speed. The emergence of highly energy-intensive sectors will also result in significant emissions of pollutants, endangering both the environment and public health and the need to address the problems associated with energy use, raise living and productivity standards, and increase people’s sense of gain, security, and contentment [

5]. Furthermore, one of the most significant challenges facing the world today is climate change, and focusing on energy consumption issues is also beneficial for addressing the challenges of global climate change. In summary, China needs to focus more on energy consumption issues, implement effective policies that promote energy transformation and green development, achieve coordinated development between economic development and environmental protection, meet the populace’s needs for a better quality of life, and raise its standing internationally [

6,

7].

China has implemented several laws and initiatives to curb energy use and to support sustainable development and environmental preservation, including the development of renewable energy sources, energy consumption quotas, and green financing support [

8]. Among them, environmental protection tax (EPT) is widely used as an economic means to promote sustainable development.

The Environmental Protection Tax Law of the People’s Republic of China, promulgated and implemented in 2018, is the first single-line tax law specifically reflecting “green taxation” since the establishment of the People’s Republic of China (PRC). It marks an important step in promoting the green tax system in China. In theory, EPT can promote the development of renewable energy and reduce the use of fossil fuels by regulating energy production and consumption behavior, thereby alleviating environmental and energy problems [

9,

10]. First, levying for environmental conservation, like those on carbon emissions, can raise the cost of fossil fuels, make them less competitive, and encourage firms to choose renewable energy instead. Taxing for environmental protection can help lower emissions of pollutants by encouraging firms to use clean manufacturing methods. Second, by encouraging firms to use clean manufacturing technology, environmental protection levies can also lower the emissions of pollutants. The government has the authority to tax the emissions of businesses that produce large amounts of pollution and to offer tax breaks or subsidies to those that take steps to lower their emissions. This will encourage businesses to spend money on equipment and technology for environmental protection, increase production effectiveness, and lessen their negative effects on the environment. Thus, how does EPT affect the amount of urban energy consumption in China? What is the impact mechanism? Does its influence exhibit notable heterogeneity? Investigating these problems is of great importance to encourage the transformation of urban energy consumption structure, the reduction of environmental pollution in urban areas, and the realization of high-quality urban growth [

11,

12].

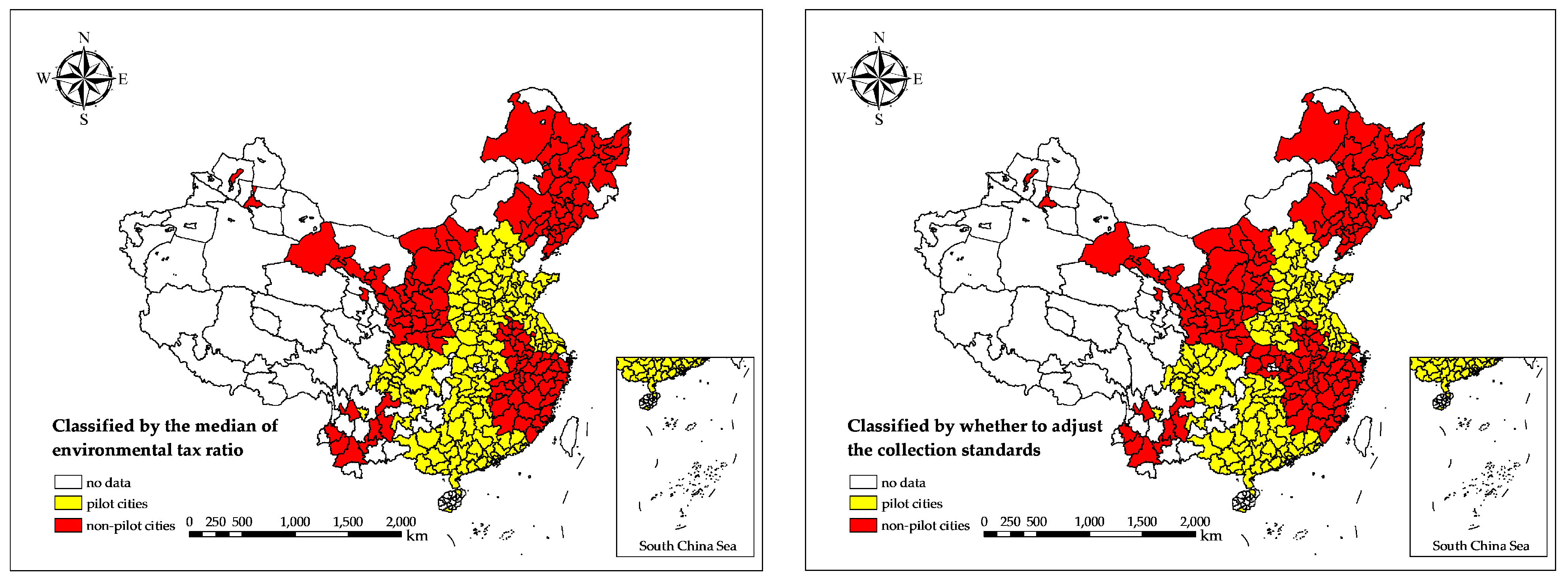

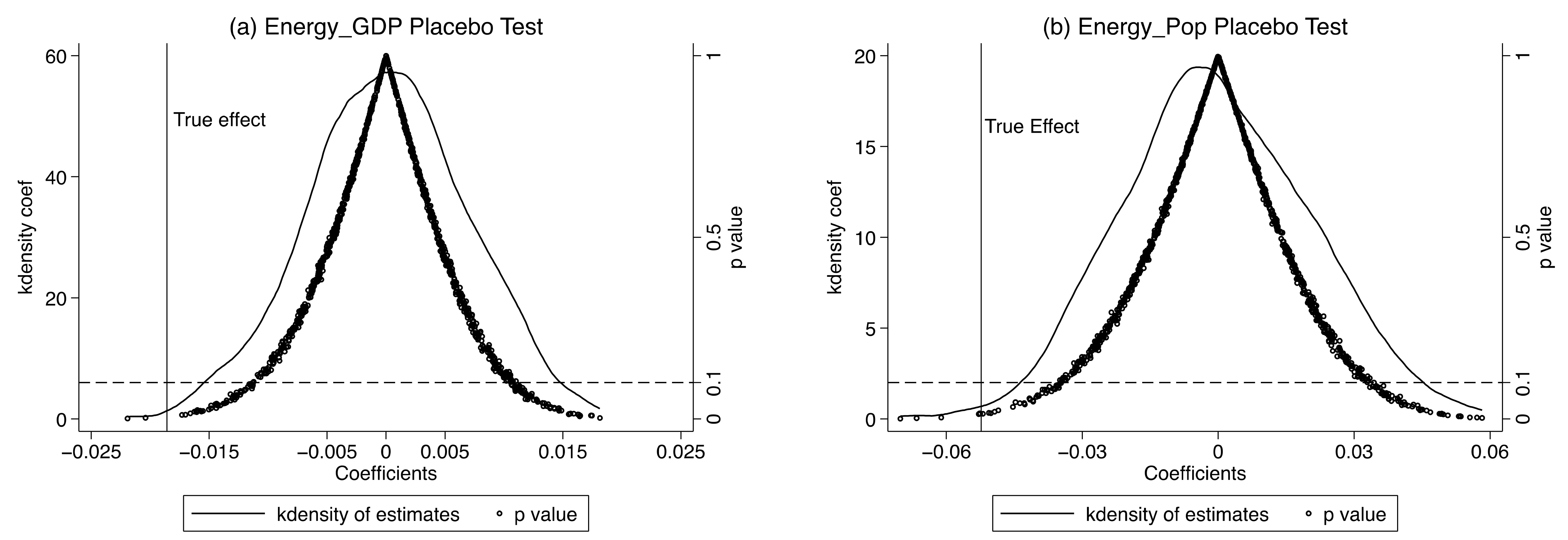

This study takes the implementation of the Environmental Protection Tax Law of the People’s Republic of China as an event shock, selects panel data from 284 prefecture-level cities in China from 2009 to 2021, and uses an intensity difference-in-differences (I-DID) model to explore the impact of EPT on urban energy consumption. Compared to previous relevant studies, the main contributions listed in this paper are as follows: Firstly, we gathered three types of urban energy data to calculate the overall amount of urban energy consumption. We then dissected the energy consumption situation and the characteristics of its spatial distribution across different areas. Secondly, this paper uses the I-DID model to comprehensively evaluate the dynamic impact of the implementation of EPT, leading to more trustworthy results. Finally, this study confirms the fact that in order to lower urban energy consumption, EPT can encourage technological innovation, improve industrial upgrading, and increase economic openness.

The rest of the study is organized as follows. The relevant research on energy use and EPT is reviewed in

Section 2. In

Section 3, the institutional foundation of EPT is further stated, and the impact mechanism of EPT on urban energy consumption is also examined. The I-DID model, variables, and data used for empirical analysis are discussed in

Section 4. The analysis of the empirical results is shown in

Section 5.

Section 6 concludes the study.

2. Literature Review

This study reviews relevant literature on energy consumption and EPT and gives a general overview of the current state of academic research on the subject. These studies mainly cover the influencing factors of energy consumption, the economic and environmental effects of environmental regulations, and the application of difference-in-differences models in various fields. The following is a review of research relevant to the subject.

First off, researching the factors influencing the consumption of energy has long been a focus of the academic community. Academics are also deeply worried about environmental contamination and resource depletion resulting from excessive energy use since economic progress necessitates a steady and sufficient supply of energy. At present, economic growth, industrial structure, technological innovation, and economic openness are the main subjects of research on the factors influencing energy consumption [

13,

14,

15]. In particular, from the perspective of economic growth, economic development speeds up the rate of urbanization and industrialization in developing countries, which is followed by a dramatic rise in the demand for energy. In contrast, developed economies are shifting towards using more renewable energy. For instance, Gozgor et al. [

5] discovered that the usage of renewable energy is encouraged by the growing degree of economic globalization after analyzing group data from 30 OECD nations between 1970 and 2015. Zaharia et al. [

6] studied the panel data of 28 EU countries from 1995 to 2014 by bibliometrics and found that economic parameters were positively correlated with energy consumption. From the standpoint of industrial structure, established industries’ reliance on energy may be effectively reduced, and resource utilization efficiency can be increased, by fostering the growth of high-tech businesses and establishing new industries. For example, Xu et al. [

16] analyzed the data from Shanxi Province in China from 1980 to 2018, using cointegration techniques, and found that relevant characteristics, such as industrial structure, had a favorable impact on energy usage. In order to achieve resource conservation and increase production efficiency, technological innovation promotes the restructuring and agglomeration of the manufacturing sector. It also uses digital technology and artificial intelligence to promote energy structure upgrades and reduce energy consumption. For instance, Murad et al. [

17] examined panel data in Denmark from 1970 to 2012 using the autoregressive distributed lag approach and discovered that increased technological innovation can lower Denmark’s energy usage. Chen and Lei [

18] showed that by utilizing panel quantile techniques to evaluate data from 30 nations globally between 1980 and 2014, renewable energy may be generated at reduced prices while increasing energy efficiency to fulfill energy demand. However, Acheampong et al. [

19] used panel data from the EU between 1995 and 2019 using SYS GMM to find an inverted U-shaped link between technological innovation and energy usage. Through opening to the outside world, cutting-edge energy technology and related information can lessen resource use and negative effects on the environment. For instance, Chen et al. [

7] used GMM to estimate the dynamic panel model of 30 provinces in China from 2005 to 2018, and they discovered that trade openness contributed to lower energy usage. On the other hand, Kyophylavong et al. [

20] maintain the opposing viewpoint. They examine Thailand’s trade openness and energy consumption using Bayer and Hank cointegration techniques and discover a relationship between the two: trade openness and energy consumption lead to each other.

In recent years, the academic community has performed in-depth research and discussions on the subject since the implementation of various environmental protection measures has had a significant impact on the economy and environmental governance. On the one hand, there are four primary points in the academic community on the economic effects of environmental regulation [

21,

22,

23]. Firstly, scholars generally believe that environmental regulation is closely related to economic growth. Furthermore, the majority of scholars believe that environmental regulation and economic growth exhibit an inverse U-shaped relationship in which environmental regulation first hinders and then promotes economic growth. Secondly, some researchers believe that environmental regulations can optimize and upgrade industrial structures through technological innovation and other means. By using a unique spatial matrix and panel data from 30 provinces in China during 2008–2019, Zhou et al. [

24] discovered that there is an inverted U-shaped linkage between economic development and environmental restrictions. However, Abdullah and Morley [

11] utilized the standard Granger causality method to analyze panel data from 25 EU countries between 1995 and 2006 and suggested that raising environmental taxes does not seem to have any substantial economic impact. Based on panel data from 283 prefecture-level cities in China between 2003 and 2018, Lin and Xie [

25] built a comprehensive evaluation method and discovered that urban environmental protection measures significantly promote industrial structure optimization and transformation. Thirdly, it is expected that green total factor productivity will increase as a result of environmental regulation. Cheng and Kong [

12] analyzed Chinese provinces between 2000 and 2019 with a dynamic spatial panel model and found that coordinating multiple policies is more effective in promoting GTFP growth than a single policy. Fourthly, some scholars have also noticed that environmental regulations can have an impact on employment. According to Raff and Earnhart [

26], there is a decrease in output and employment in the environmental sector when environmental standards are strictly enforced. On the other hand, environmental regulation’s ability to reduce and regulate pollution and environmental harm is an aspect of the academic community’s study on the effects of environmental governance [

27,

28]. For instance, Wang et al. [

29] used a system GMM model to study 30 provinces in China from 2005 to 2015 and found an inverted U-shaped relationship between environmental regulations and corporate environmental responsibility. Meanwhile, Collins et al. [

30] analyzed over 25,000 manufacturing factories in the United States from 1998 to 2012 and found that targeted environmental strategies can reduce toxic emissions without reducing employment. Zhang et al. [

31] also found that environmental regulation can encourage companies to practice environmental responsibility through D&O insurance.

In academic research, the difference-in-differences (DID) model is a research method used to evaluate the effects of policy implementation and is widely used in fields such as economics and ecology [

32,

33,

34]. Ashenfelter [

35] first applied the DID method to the field of economics. Currently, the approach is being used by economists to deal with such problems as income inequality, industrial structure modernization, employment, and economic growth. For example, by using the DID model, Yang et al. [

36] revealed that carbon emission trading policies can improve both employment growth and carbon emission reduction. Sendstad et al. [

37] found, based on panel data from EU countries between 2000 and 2017, that a stable policy environment with credible policy commitments is crucial for incentivizing private company investment using the DID model. Ma et al. [

38] used the data of Chinese manufacturing listed companies from 2009 to 2018 and found that the accelerated depreciation policy of fixed assets can significantly promote enterprise R&D investment and fixed asset investment and reduce the level of enterprise financialization. In the field of ecology, DID models are often used to study issues such as pollution and carbon emissions. For example, Wu et al. [

39] used the DID model to study policy effects based on panel data of 30 provinces in China during 2006–2017 and 196 cities during 2011–2018. The results show that the development of the Internet has significantly improved energy conservation and emission reduction efficiency. Nawaz et al. [

40] evaluated the average causal effect of the treatment of determinants of expanding green financing and mitigating climate change in N–11 countries between 2005 and 2019 using the DID method and found that this decision had no significant impact among countries.

To sum up, the literature mentioned above indicates that scholars have studied energy consumption aspects in depth as well as how environmental regulations affect economic and environmental governance. In addition, more and more scholars are using the DID model to evaluate policy effects, providing strong theoretical support for the implementation of various policies. However, based on a large amount of existing research, it is not difficult to find that there are still three aspects that need further improvement, summarized as follows: Firstly, plenty of research has looked into how different factors impact energy consumption; however, there are not many studies on how environmental regulations limit energy consumption, particularly when it comes to the establishment of EPT systems in developing nations like China, which are currently experiencing economic growth. Secondly, the academic community has recognized the important role of environmental regulation, but the discussion on whether environmental regulation can weaken energy consumption is not sufficient, as energy consumption and pollutant emissions are closely related. Thirdly, in academic applications, the DID model has become quite mature and widely used, but this method still lacks research related to energy. Meanwhile, previous research on energy issues mainly used fixed effects models, but these models were unable to fully evaluate the policy effects of EPT on energy consumption. Therefore, this study uses the DID method to compensate for this deficiency.

3. Institutional Background and Research Hypotheses

3.1. Institutional Background

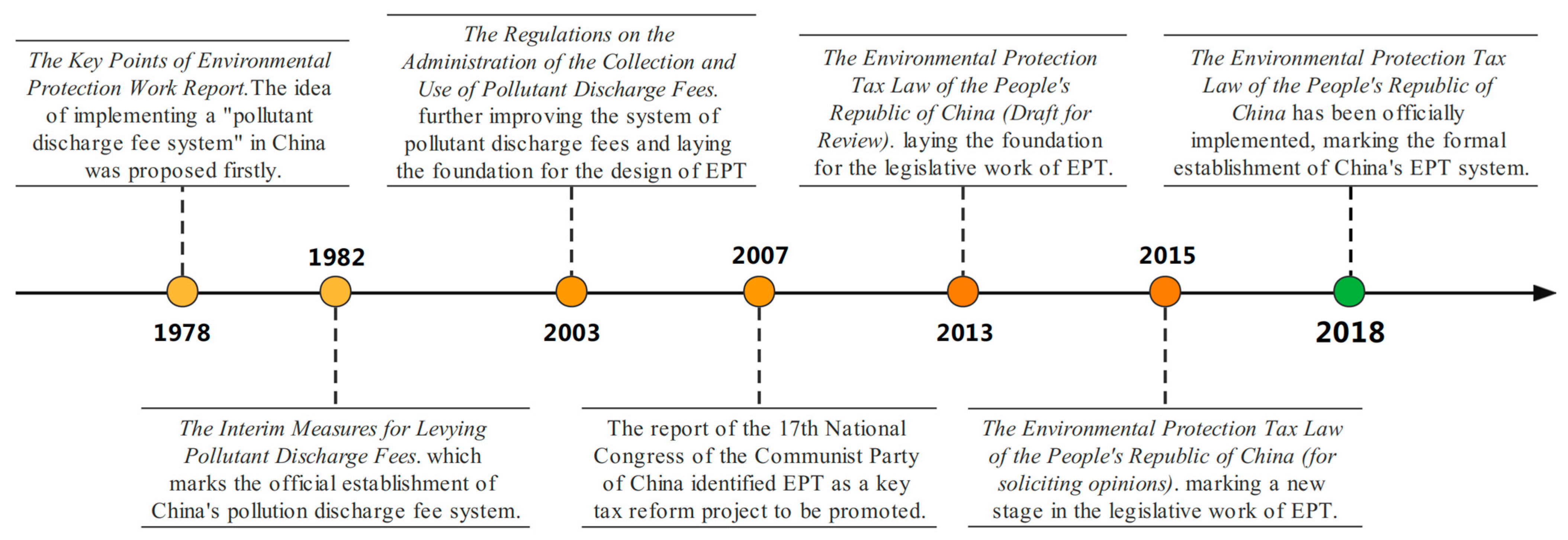

Before the reform and openness, light and heavy chemical industries dominated China’s industrial structure, which led to several environmental pollution issues. In 1978, the Chinese government originally suggested a pollution charge system, anticipating it would safeguard the environment and promote sustainable socioeconomic development. In 1982, the State Council issued the Interim Measures for Levying Pollutant Discharge Fees, which made unified provisions on the purpose of implementing pollution discharge fees and the collection, management, and use of pollution discharge fees, marking the official establishment of China’s pollution discharge fee system. The Regulations on the Administration of Collection and Use of Pollutant Discharge Fees published by the State Council in 2003 signaled an important turning point in the evolution of pollution fees from experimental use to official charging. Despite the reality that pollution fees have reduced pollutant emissions to some extent, issues with the actual implementation process, such as inadequate collection, poor fund management, and incomplete collecting scope, have emerged because of the lack of support from the legal system. This not only compromises the efficacy of environmental laws in practice, but it also impedes the advancement of technology for environmental protection. On the other hand, other hitherto unidentified sources of pollution have started to surface as China’s social economy continues to grow and expand, putting more pressure on us to safeguard the environment. The report of the 17th National Congress of the Communist Party of China proposed in 2007 to implement a financial and tax system that is conducive to scientific development, establish and improve mechanisms for paid use of resources and ecological compensation, and identify environmental protection tax as a key tax reform project to be promoted. It’s to solve the many difficulties encountered in implementing pollution discharge fees and introduce policies that are more in line with China’s national conditions.

In the second decade of the 21st century, the reform and development of China’s environmental protection tax have entered an accelerated period. In 2013, the Ministry of Finance, the State Administration of Taxation, and the Ministry of Environmental Protection jointly reported

the Environmental Protection Tax Law of the People’s Republic of China (draft for examination) to the State Council, laying the foundation for the legislative work on the environmental protection tax. In June 2015, the draft of

the Environmental Protection Tax Law of the People’s Republic of China (for soliciting opinions) was publicly solicited from the public, marking a new stage in the legislative work on the EPT. The Environmental Protection Tax Law was redrafted in early 2016 following several rounds of public comment and suggestion rounds, and it was accepted by the Standing Committee of the National People’s Congress. The People’s Republic of China formally enacted

the Environmental Protection Tax Implementation Regulations at the end of 2017, which said that the tax will replace pollution discharge levies that had been in place for almost 40 years and be implemented countrywide on 1 January 2018. Compared with pollution fees, the collection of EPT is more diverse and covers the protection and management of natural resources such as air, water, and soil, as well as the management of environmental pollutants such as solid waste and noise. Secondly, the tax basis for EPT is more scientific and reasonable. Through measuring and monitoring, the real quantity of taxable pollutants that taxpayers generate determines their pollution emissions. Once more, the EPT is legally traceable, and taxpayers must accept oversight and inspection as well as disclose and pay to the tax authorities in compliance with laws. This guarantees that environmental protection efforts are effectively implemented and reinforces the oversight of such efforts. Furthermore, the environmental tax has also introduced some new tax incentives, such as providing tax reduction and exemption benefits to eligible clean energy projects. Overall, the introduction of the EPT has become China’s first main type of green tax system, marking an important step forward in promoting green development. Simultaneously, it indicates how important it is and how consistently the Chinese government has adhered to the goal of fusing the development of an ecological civilization with the advancement of the economy and society (as shown in

Figure 1).

3.2. Research Hypothesis

EPT is a type of tax levied on environmental pollution and ecological damage, aimed at raising awareness of environmental protection among enterprises and individuals and reducing environmental pollution and resource waste. Hence, the implementation of the EPT inevitably involves issues related to energy consumption. On the one hand, enterprises will be encouraged to focus more on energy conservation, emission reduction, and environmental protection as a result of the collection of EPT. They will also be encouraged to optimize industrial processes to increase resource utilization efficiency and lower emissions of pollutants. On the other hand, high energy consumption also plays an important role in environmental pollution. Thus, tax measures are used to regulate energy consumption behavior, guide people to choose clean and low-carbon energy forms, and thus achieve the goal of reducing environmental pollution. For example, high-energy-consuming enterprises or individuals will bear higher tax burdens, prompting them to adopt renewable energy or low-carbon products to meet production and living needs, thereby promoting the development of the entire society’s energy structure in a cleaner direction. In brief, the collection of EPT is closely related to energy consumption and is also complementary. Specifically, EPT collection encourages individuals and businesses to adopt more environmentally friendly production and lifestyle choices while also directing energy consumption in a more sustainable direction and ultimately contributing to the goal of sustainable development. Consequently, we put up the following theory:

Hypothesis 1 (H1). Environmental protection tax policy can reduce urban energy consumption.

The first mechanism is the industrial upgrading effect. To be specific, the influence of environmental protection fees on industry upgrading is primarily examined in this study from two angles: government administration and technology research and development. From the standpoint of technological R&D, the introduction of an EPT drives up the cost of environmental pollution expenses, compelling businesses to upgrade their production equipment, introduce more sophisticated process technologies, or innovate their R&D efforts to achieve cleaner and more efficient production methods. In addition to requiring a significant financial outlay, research and development innovation also needs to draw in top-tier talent and technology, facilitate the shift in the industrial structure from one that is labor-intensive to one that is technology-intensive, and ultimately produce sophisticated and highly integrated production methods. From the perspective of government collection and administration, the scope of EPT is broader, and the tax rate is generally higher than the pollution fee. EPT is subject to stricter collection and administration procedures than pollution discharge fees. In terms of environmental protection fees, enterprises only need to pay according to the prescribed time, and tax authorities cannot effectively supervise and control them. In the case of EPT, taxpayers are required to furnish pertinent environmental proof materials to support their tax declaration, and tax authorities can conduct traceability checks on them. Additionally, to promptly identify and address unlawful and irregular actions, the EPT has built a more thorough reporting structure and encouraged public participation in environmental oversight. Therefore, the environmental protection tax system has strengthened tax management measures, and high standards of supervision have forced enterprises to reduce non-competitive products and services, thereby promoting industrial optimization and reform processes. Undoubtedly, industrial upgrading may accomplish sustainable development objectives and lower energy consumption by utilizing cutting-edge technology, refining the industrial structure, and creating appropriate policies. Therefore, this study presents the following research hypothesis:

Hypothesis 2 (H2). Environmental protection tax policies can reduce urban energy consumption by enhancing industrial upgrading.

The second mechanism is the effect of economic openness. Specifically, by incentivizing businesses to adopt greener and more efficient technology and manufacturing methods, EPT fosters technological advancement and development. Concurrently, the collection of EPT will increase tax income allocated to environmental protection and related activities, and the growth of the environmental protection sector will stimulate the expansion of associated sectors, stimulating economic growth. These will assist in drawing in extra opportunities for global technological collaboration and investment. Environmental protection cooperation and exchanges between China and other nations will also be facilitated by the introduction of environmental protection fees. The government may enhance its technical prowess and environmental protection management capabilities by introducing world-standard environmental protection norms and technology. This would gradually broaden the country’s scope of influence on an international level. The development and environment for foreign investment in China will also be enhanced by the implementation of an EPT. Businesses may attain greater development prospects and draw in more foreign investors to invest and expand in China while still carrying out their environmental obligations. Cities may also acquire cutting-edge energy-saving and emission-reduction experiences and technologies through collaboration and technical exchange with overseas businesses, then implement them into local industries. This lowers energy consumption even further by enhancing the management quality and energy usage efficiency of businesses. Consequently, the next research hypothesis presented in this study is as follows:

Hypothesis 3 (H3). The environmental protection tax policy reduces urban energy consumption by promoting economic openness.

The third mechanism is the technological innovation effect. According to existing studies, EPT can improve the level of urban technological innovation in two aspects. Businesses will have to pay more to produce products as a result of environmental protection charges. Therefore, many businesses will take various steps to reduce environmental pollution, such as updating or improving production processes and equipment and developing green and environmentally friendly products, in order to avoid the cost pressure brought on by increased tax payments and to enhance their competitive advantage. All of these technologies cannot be applied without technological innovation, thus forming an “innovation compensation effect” [

41]. On the other hand, the government will devote more funds to building environmental protection infrastructure and technologies as a consequence of the implementation of environmental protection levies, providing better environmental governance services and support. This will provide the necessary financial support and policy guarantees for urban scientific and technological innovation, promoting the transformation and promotion of urban scientific and technological achievements. Government funding for environmental protection technology research, for instance, can draw additional academic institutions and businesses to the sector, fostering the growth and advancement of urban scientific and technical innovation. As is well known, developing new technologies or products and adopting more efficient and energy-saving manufacturing methods can reduce the demand for traditional energy while improving product performance and competitiveness. This helps to achieve sustainable development goals and reduce energy consumption (as shown in

Figure 2). Given this, the study hypothesis that follows is suggested in this study to be confirmed.

Hypothesis 4 (H4). Environmental protection tax policy reduces urban energy consumption by supporting technological innovation.

6. Conclusions and Policy Recommendations

Energy consumption is necessary for urban development, but too much energy use can seriously harm the environment and deplete resources, which will hinder cities’ ability to grow sustainably. In this context, this study uses panel data from 284 prefecture-level cities in China from 2009 to 2021 and an intensity difference-in-differences model to empirically test the impact and mechanism of environmental protection tax policy implementation on urban energy consumption. The results of the study indicate that EPT significantly reduces urban energy consumption, and this conclusion is still valid after a series of robustness tests. From the perspective of heterogeneity testing, the effect of EPT on urban energy consumption exhibits significant heterogeneity because of the notable differences in each city’s geographical location, population size, resource endowment, and level of industrial development. Specifically, EPT has a more significant inhibitory effect on urban energy consumption in central and western cities, small and medium-sized cities, non-resource-based cities, and non-old industrial bases. According to its mechanism of action, EPT has significantly reduced the amount of energy used in urban areas by encouraging the upgrading of the industrial structure of the city, expanding the degree of urban economic openness, and raising the standard of technological innovation in the city. Therefore, this paper proposes the following four policy suggestions as a result of the findings mentioned above.

Firstly, the government should accelerate the adjustment of the energy structure, improve energy utilization efficiency, and reduce reliance on fossil fuels. Specifically, the first is to strongly support the R&D, promotion, and application of cutting-edge technologies for energy saving and emission reduction as well as green production, therefore enhancing energy efficiency. The government can establish a dedicated Green Technology Innovation Fund to support the scientific research and commercialization of green clean technologies and energy conservation and emission reduction industries that meet environmental requirements. At the same time, relevant policies should be formulated to encourage enterprises to adopt these technologies, such as tax incentives and loan subsidies. Additionally, the government and academic institutions can foster talent development and scientific research cooperation by creating technology alliances and collaborative research projects, facilitating the dissemination and application of scientific and technical achievements to businesses, and advancing the growth of green technology, energy-saving, and emission-reduction industries. The second is to further lessen the unreasonable reliance on conventional fossil fuels by encouraging and supporting the study and development of new renewable energy sources. The government should boost technological innovation and R&D spending and encourage the advancement of renewable energy technology, such as increasing photovoltaic cell conversion efficiency, wind turbine performance, hydropower system efficiency and dependability, etc. Moreover, the government should encourage the use of new energy cars and renewable energy buildings to reduce emissions and environmental pollution from traditional fuel vehicles and encourage end-users to apply renewable energy to increase market share and stimulate demand.

Secondly, the government should continue to promote the sound implementation of the EPT system to assist economic and social progress and stable development. To be more precise, to protect the environment and encourage sustainable growth, both the national and local governments should create and enhance environmental protection tax laws. The central government should adjust the EPT rate according to the actual situation to balance the contradiction between tax revenue and environmental protection. For example, lower tax rates can be set to reduce government financial pressure, or higher tax rates can be set to enhance environmental regulation. Local governments should clarify the scope, tax rate, and purpose of EPT collection policies and regulations and ensure consistency with national environmental regulations. The second is making law enforcement and monitoring stronger during the policy-implementation process. The government can improve oversight and law enforcement activities in order to address the problems with environmental tax policy. This includes tougher environmental oversight and management of businesses or people, as well as harsher penalties for illicit activity. These measures can ensure that the implementation of environmental tax policies achieves the expected goals and reduces environmental damage. Thirdly, financial subsidies and other means can be used by the government to encourage and assist qualified businesses and individuals to take part in the construction of environmental protection projects, thereby lowering their environmental protection costs; furthermore, policies like tax exemptions and reductions can be implemented to encourage businesses to adopt more environmentally friendly methods of production.

Thirdly, to fully utilize the energy and growth potential for urban development, the government should speed up the establishment of a distinctive environmental tax collection and administration system. Adaptive modifications to the EPT systems are required considering the variations in geographical location, population density, resource endowment, and industrial development level among cities. For cities in different geographical locations. We need to strengthen industrial restructuring and encourage enterprises and individuals with higher emissions to improve energy efficiency or shift towards cleaner energy sources in order to reduce pollutant emissions. For cities with large populations, the government should adopt a goal-constrained approach, strengthen regulatory efforts, ensure that enterprises and individuals comply with environmental laws and regulations, and establish stricter and more specific environmental standards to promote the development of cities toward low-carbon and green directions. For resource-based cities, promote technological innovation and process improvement for resource-based enterprises, adopt advanced production technologies and equipment, and reduce energy consumption in the production process. Meanwhile, to lessen dependence on fossil fuels, the government should actively encourage the research and application of renewable energy sources, such as wind and solar power. For highly industrialized cities, it is necessary to strengthen environmental monitoring and management, strictly enforce environmental regulations and standards, impose severe penalties on the illegal discharge of pollutants, and establish an effective regulatory system while simultaneously promoting the optimization and adjustment of economic structure and gradually eliminating traditional industries with high energy consumption and pollution.

Lastly, make the most of the favorable impacts that different mechanism variables have on energy usage. More precisely, the industrial structure needs to be optimized and altered to decrease the amount of obsolete production capacity and improve the position of new industries in alternative development. This will save more resources overall, enhance the rate at which resources are used efficiently, and provide environmental protection. The second is to increase the country’s exposure to other countries and introduce more advanced technologies and management methods. By utilizing international market price signals, modifying domestic industrial structure and policy orientation to reduce energy consumption, fostering stronger economic cooperation with neighboring countries and regions, building stable oil and gas pipelines and transportation networks, and taking other steps, opening to the outside world can help improve energy efficiency by better integrating global resources and market information. Thirdly, we are committed to developing and utilizing renewable energy while promoting and implementing technologies to reduce emissions and improve energy efficiency. Research and development of new energy, energy-saving, and clean production technologies should receive more funding to increase energy utilization efficiency and to encourage businesses to implement technological transformation and updates, adopt more efficient machinery and processes, support the circular economy and resource-saving industrial models, and reduce energy consumption.

Although this study provides an in-depth analysis of the impact mechanism and effects of EPT on energy consumption in Chinese cities, there are still two shortcomings in the research process. Firstly, this study adopts the strength of the DID model to examine the causal effect between EPT and urban energy consumption, but the influence of spatial factors is ignored in the research method. To make up for this deficiency, a spatial DID model will be used for analysis in the future. Secondly, the research on energy consumption in Chinese cities in this study is based on three types of energy data, and the measurement of energy data is still not comprehensive, especially without considering the differences between clean energy and non-clean energy applications. In the future, we will adopt county-level energy consumption data to enrich existing research.