1. Introduction

Climate change, urban migration, energy insecurity, and growing energy demand are significant challenges facing the human population. On the positive side, rapid changes driven by the fourth industrial revolution (4IR), digital transformation, and emerging technologies, such as the Internet of Things (IoT) or Intelligent Sustainable Systems, are positively affecting sustainable energy targets and energy efficiency goals. The relationship between the concepts of “green growth” and sustainable development is continuously validated through the process of “green investments and green jobs,” which amplifies the growth ratios, leading to the conclusion that these paradigms are complementary [

1]. Nevertheless, to what extent these measures and investments in efficient energy production and consumption impact economic output and growth have been a question of many academic debates. To be able to answer this question, it is crucial to identify the multidimensional function of energy in the integrated (macro) economic framework.

Recent studies, such as those conducted by international organizations IRENA and WBIF, have documented the vital role of renewable energy for the southeastern European (SEE) region. Technical renewable energy potential in the SEE region sums up to approx. 740 GW, of which wind and solar power are mostly unexploited, 532 GW and 120 GW, respectively, with the potential to grow in 2030 and 2050 by more than 650 GW [

2].

Due to its vast and unexploited potential for diverse sources of renewable energy, the SEE region and the Western Balkans have been considered of great geopolitical interest and significant contributors to the current and future energy strategy of the European Union. Therefore, exploring the relationship between renewable energy consumption and economic growth for selected SEE countries is especially valuable for future policymakers to drive the agenda of the renewable energy–growth nexus.

Screening the relevant academic literature, only a few most relevant articles with empirical analysis of related countries have been identified as highly pertinent. Akar (2016) [

3] used panel data for 12 Balkan countries from 1998 to 2011 to evaluate the statistical significance between renewable energy consumption, trade openness, natural gas rents, and economic growth. Furthermore, an empirical evaluation of the link between renewable energy consumption and economic growth was performed by Esseghir and Khouni (2014) [

4]. The two authors studied the relationship between energy consumption and economic growth for a panel of 38 countries where some SEE countries were included, namely, Albania, Bosnia and Herzegovina, Bulgaria, Croatia, Greece, Romania, Slovenia, and Turkey. Furthermore, Acaravci and Ozturk (2010) [

5] investigated the causal relationship between energy and economic growth in Albania, Bulgaria, Hungary, and Romania from 1980 to 2006, performing a two-step procedure from the Engle and Granger model. The two authors concluded that evidence of a two-way bidirectional Granger causality between energy and economic growth exists only in Hungary. In the case of Albania, Bulgaria, and Romania, no causal relationship could be estimated.

The principal goal of this research was to investigate whether (renewable) energy plays a crucial role in enabling growth in SEE countries based on the theoretical principles of the conventional neoclassical one-sector aggregate production function and the rationale that economic growth and energy consumption are “jointly determined”; the higher the rate of economic growth, the more energy consumption is required and vice versa [

6]. Energy consumption and renewable energy consumption are both “pro-growth” variables that indicate that an increase in (renewable) energy consumption means an expansion in economic growth [

7].

Additionally, to attain sustainable economic growth targets and overall efficiency of the energy system (management of the energy sources via smart grids and cheaper energy systems in the context of socio-economic costs), gross domestic product (GDP) growth rates in these nine SEE countries should be evaluated concerning energy efficiency to draw meaningful policy implications and promote allocation of investments into suitable projects.

Furthermore, foreign direct investments (FDI) will not be used explicitly as an independent variable or, in other words, substitute for a standard input in the neoclassical growth models, such as labor and capital [

8], but as a stand-alone control variable to evaluate how GDP growth rates will be affected by FDI inflows in relation to the correlation matrix with other explanatory variables.

The novelties of this research focus in this article will be multiple, starting with the contribution to the scarce empirical research carried out on the sample of SEE countries [

4,

6]. There is more extensive research with a focus on the qualitative assessment of the regulatory framework, renewable energy potential, as well as a comparative overview of the progress towards energy reforms without modeling and empirically testing the link between renewable energy and economic growth and without formal statistical analysis [

9,

10].

Furthermore, the expected contribution of this research continues with a different and comprehensive approach that distinctly models the relationships between economic growth and non-renewable and renewable energy variables while controlling for country specifics and de-trending the variables where serial correlation is detected.

In most of the reviewed literature, energy use/total energy consumption is analyzed through a single aspect of energy use (most frequently per capita energy consumption). In this research, we include several key indicators of energy use, namely, total energy use (where energy is a good or a service), the energy intensity level of primary energy in the total economic output (energy intensity), and renewable energy consumption as a percentage of total final energy consumption. Therefore, such a distinct way to model energy impact on growth allows us to capture both the supply and the demand side perspectives of the (efficient) use of energy.

Besides the very comprehensive model design and conceptualization of the relationship between the variables deeply embedded in the relevant theory and based on the vast screened literature covering these specific research domains, the added value of this research lies in its contribution to the econometric field of studies. Conclusive and robust empirical results produced by several model estimations, which included different specifications for the given choice of the moment conditions, are considered fundamental contributions to the econometrical field of panel data estimation and endogeneity.

Finally, the empirical findings will influence current research in further clarifying the role of energy in economic growth theory and therefore contribute to developing future countries’ objectives through adequate policy agendas to exploit their energy potential further and ignite economic growth.

2. Literature Review

The role of energy in the economy is manifold, represented as input (GDP created per unit of energy), output (distributing energy as goods or services consumed), and finally as the sector. Since the reputable work of Kraft and Kraft (1978) [

11], the correlation between energy consumption and economic growth has been the focus of many empirical energy economics studies. One central question driving this academic research is whether energy consumption promotes economic growth and (or) economic growth accelerates energy consumption.

The fundamental pillars of energy-led growth from the theoretical standpoint may be categorized into four known hypotheses, each having quite different effects on energy and economic growth policies, namely:

The neutrality hypothesis which entails no causality between energy consumption and economic output.

The conservation hypothesis which means a unidirectional causality runs from economic growth to energy consumption.

The growth hypothesis demands a unidirectional causality runs from energy consumption to economic growth.

The feedback hypothesis which means there is a bidirectional causality between energy consumption and economic growth [

12].

These represent different perspectives or theories regarding the relationship between energy consumption and economic growth, while the actual nature of the relationship in the energy–growth nexus remains complex and varies across countries, regions, and time periods. The degree of significance of relationships between these variables also varies depending on how developed the country is. In more developed OECD countries, causality from energy to GDP is more significant than in the less developed countries. Research results that are evidence of this pattern have significant practical implications: Reducing energy consumption will have more effect on GDP in developed countries than in less developed ones [

13,

14].

Up to this date, empirical research continues to explore these hypotheses and investigate the specific dynamics of energy–growth interactions in multivariate econometric models, usually including more than a few additional parameters of economic growth. A survey of the literature on total energy and growth nexus produced diverse results in the context of the causality direction and magnitude of total energy consumption on economic growth in the short and long run [

15,

16]. The dominant findings are in line with the growth hypothesis, which suggests a unidirectional causality running from total energy to economic growth [

17]. Following this hypothesis, increased energy consumption is associated with higher economic growth [

18,

19].

Additionally, the feedback hypothesis, which proposes a bidirectional relationship and feedback effects between energy consumption and economic growth, is also supported by vast empirical results. This implies that changes in energy consumption can influence economic growth, while economic growth can also impact energy consumption in a reciprocal manner [

20,

21,

22].

In addition to its evident positive climate impact, the utilization of renewable energy sources (RES) also plays a significant role in ensuring the long-term sustainability of the overall economy [

23,

24]. Like total energy consumption, the specific questions that drive research on the renewable energy and economic growth nexus are focused on the causal relationship between two relevant variables. Existing research recognizes the critical role of renewable energy consumption for economic growth, revealing that efficient energy use contributes positively to economic output by directly reducing energy demand, import requirements, and resource depletion [

25,

26].

Team Apergis N. and Payne, J.E. (2010, 2011, 2012) [

23,

24,

27] were among the first pioneers to start exploring the relationship between renewable energy consumption and economic growth using heterogeneous panel cointegration and error correction models. Their study of the link between RES and economic growth in 20 OECD countries from 1985 to 2005 revealed a long-term positive and statistically significant cointegration between RES, real GDP, gross fixed capital formation (GFCF), and the labor force. Granger’s results validated the bidirectional causality or feedback hypothesis [

23].

One of the most cited articles involving the relationship between renewable energy and economic growth is by Menegaki (2011) [

28] who evaluated the causal relationship between economic growth and renewable energy for 27 European countries in a multivariate panel data framework (including the variables final energy consumption, greenhouse gas emissions, and employment) for the period of 1997–2007. Menegaki (2011) [

28] used a random effect model and failed to detect any causation between renewable energy consumption and GDP in favor of the neutrality hypothesis. There are several limitations of this research, namely, the short sample size, which probably is the reason why any causality could not be detected, as well as using the RE modeling techniques, which might not be so robust when there is endogeneity or cross-sectional dependence for which the authors did not test.

Bhattacharya et al. (2016) [

25] evaluated the effects of renewable energy consumption on the economic growth of 38 selected countries that were the largest RES consumers between 1991 and 2012. The authors found evidence favoring heterogeneity between different groups of countries in the context of their renewable energy use and their impact on economic growth. The panel estimated that long-run output elasticities indicate a positive and significant relationship between renewable energy and economic output for 57% of the selected countries.

In the latest study by Rahman and Velayutham (2020) [

29], the two authors mention a new strand of empirical research that explores the nexus between energy consumption and economic growth where the impacts on economic growth are separated by renewable and non-renewable energy consumption. Their findings also contribute to this specific body of research since the two authors in this article explore the relationship between renewable and non-renewable energy consumption and economic growth using panel data for five south Asian countries from 1990 to 2014. Rahman and Velayutham [

29] used fully modified least squares (FMOLS) and dynamic ordinary least squares (DOLS) estimation techniques and Pedroni (1999, 2004) and Kao (1999) tests for long-run cointegration between variables to find positive impacts of both renewable and non-renewable energy on economic growth. The study also identified a unidirectional causality running from economic growth to renewable energy consumption in evidence of the conservation hypothesis for a selected panel of south Asian countries [

29].

Most prominent scholars in energy economics have recognized the importance of looking individually into renewable and non-renewable energy variables and evaluating their impact on growth. Apergis and Payne (2012) [

27] studied the correlation between renewable and non-renewable energy consumption and economic growth for 80 countries between 1990 and 2007 in a multivariate panel framework. To identify a long-run equilibrium relationship, the Pedroni (1999, 2004) heterogeneous panel cointegration test has been performed, and positive, statistically significant coefficient estimates have been obtained. The panel error-correction model discovered bidirectional causation between renewable and non-renewable energy consumption and short- and long-term economic growth.

Tugcu, Ozturk, and Aslan (2012) [

30] tested the long-run causal relationship between renewable and non-renewable energy consumption and economic growth, comparing the two to determine which energy consumption is more important for the economic growth of G7 countries. The results show the presence of the growth hypothesis only in the case of Japan for the causality between non-renewable energy consumption and economic growth, and the feedback hypothesis was validated for the rest of the countries. For further research, the three authors suggest using the augmented production function, which proved more successful in increasing the model’s explanatory power.

In more recent research, Fareed and Pata (2023) [

31] used advanced Fourier-based cointegration and causality methods to analyze the impact of renewable and non-renewable energy consumption on economic growth in the top ten renewable energy-consuming countries over the period of 1970–2019. The long-term findings indicate that in eight of the ten countries, non-renewable energy contributed to economic growth. On the other hand, renewable energy had a positive impact on economic growth specifically in Brazil, the United Kingdom, and France. According to the results of the Fourier causality test, renewable energy was found to cause economic growth in the United Kingdom, the United States, India, Italy, and Spain. This implies that implementing energy conservation policies could potentially hinder economic growth in five out of the ten countries based on the policy implications derived from the findings.

The collective findings indicate that while non-renewable energy remains a more significant driver of economic growth, renewable energy also plays a notable role in stimulating economic expansion, although to a lesser extent. [

17,

18,

21,

30,

31]

3. Research Design, Methods, and Data

3.1. Theoretical Approach and the Model

The specific questions that are considered in this research are defined as follows:

Table 1 presents the research hypotheses related to energy–growth nexus that were tested. Two central questions were focused on exploring the relationship between the consumption of renewable energy and non-renewable energy, respectively, and economic growth based on the data for 9 southeastern European (SEE) countries in an integrated panel data framework. Another question that drove this research was an investigation of existence of causality and its direction between above-mentioned key energy variables and economic growth.

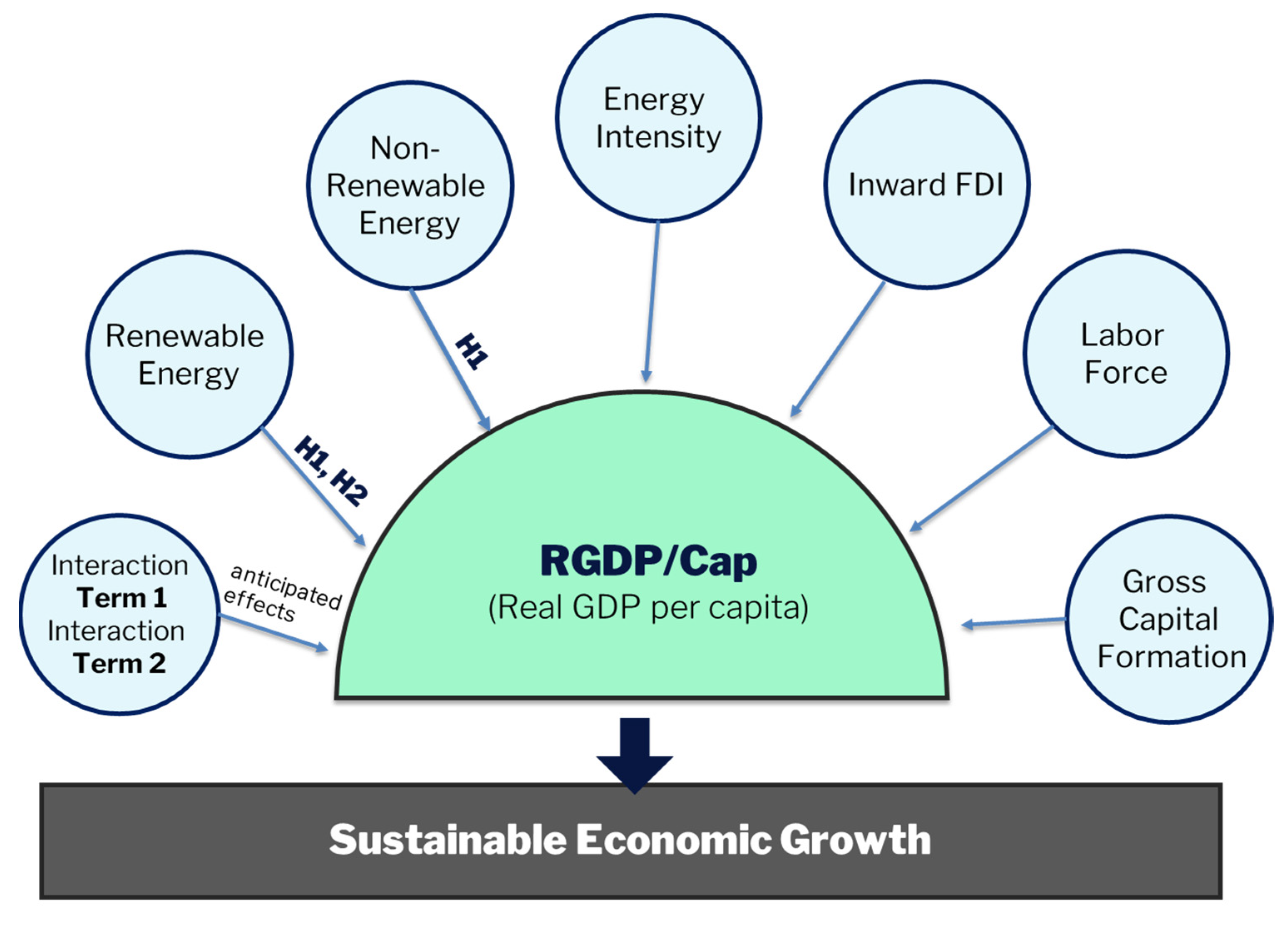

The theoretical framework adopted in this research is based on neoclassical growth theory and Solow growth model augmented by the energy-led theory of economic growth. Most growth models rely on creating a dynamic system of variables that can describe the changes or developments in the overall consumption and output (either in aggregate or per capita terms) and the total capital in the economy. These variables form the core elements of fundamental growth modeling concepts, and the following illustration presents the model specification, including the relevant growth factors and variables for this research.

Figure 1 presents the model specification, encompassing the relevant factors or variables, their interdependencies, and their influence on economic growth. Energy variables, including renewable, non-renewable energy, and energy intensity, affect economic growth through several mechanisms, namely, fueling industrial production, creating job opportunities, and stimulating key sectors of the economy. Secondly, renewable energy consumption has an additional positive multiplier effect on economic growth, driving innovation and technological advancements and fostering economic competitiveness and foreign investments. Energy intensity quantifies the effectiveness of energy utilization in economic production. A decline in energy intensity means enhanced energy efficiency, which has the potential to foster economic growth. Foreign direct investment plays a crucial role in economic growth by providing needed additional capital, innovative technology, expertise, as well as market access. All these aspects contribute to the advancement of economic growth. Labor force and gross capital formation are interconnected drivers of economic growth due to their contribution to overall productive capacity of the economy. More precisely, the existence of efficient workforce, coupled with adequate investment in capital formation, leads to increased production, technological advancements, innovation, and improved overall economic performance. Finally, the model also included additional factors specified over interaction effects.

The main theoretical pillars for the analysis were based on the model of effects of non-renewable and renewable energy on GDP growth rates in the neoclassical framework and an extended version of the Solow growth model [

32], which supports the theory that economic growth is a function of capital, labor, and energy supply.

However, the final model used in this research was constructed based on the diverse selected model framework (an amalgam of past research), targeting different relationships between the vital subject variables, namely, the extended Solow growth model and the integrated input–output model approach used by Stern (2011) [

32] and Arbex and Perobelli (2010) [

33]. The model proposed by Wang (2012) [

34] was adopted to represent energy efficiency through the energy intensity variables as its closest proxy. Hasanov et al.’s (2017) [

35] rationale was adopted to include the role of FDI in the augmented production function as a control variable since it has been a common practice to proxy capital stock with investments to analyze the energy–growth nexus [

35].

The general form of a regression model with interaction terms can be written as follows:

where

and

are the interaction terms between independent variables.

3.2. Econometric Approach

In the previous section, we reviewed the theoretical framework and conceptualized the model fit that is most suitable for an estimate of the effects of overall and renewable energy on sustainable growth, including the energy efficiency consideration in the model design via their closest proxies.

The final model is based on a three-factor production function, namely, capital, labor, and energy (KLE), broadening the model beyond the elementary factors, labor, and capital with several distinct energy variables and additional factors based on their theoretical advantages. The methodological approach taken follows the research of Ghali and El-Sakka (2004) [

36], Soytas and Sari (2006) [

37], Apergis and Payne (2010, 2011) [

23,

24], Koçak and Sarkgunesi (2017) [

38], Ozcan and Ozturk (2019) [

39], and finally, Rahman and Velayutham (2020) [

29].

The final model equation that investigates the long-term impact of renewable and non-renewable energy consumption on economic growth is written as follows:

The dependent variable represents the natural logarithm of real GDP per capita for a specific country i in period t. indicates the percentage of renewable energy consumption for a specific country i in period t. indicates the percentage of non-renewable energy consumption for a specific country i in period t. represents the energy intensity level of primary energy consumed, specifically the ratio of energy use to GDP. denotes inward FDI stock as a percentage share of GDP for a specific country i in period t. represents the labor force participation rate (ages 15–64) as a percentage of the total population, and represents total capital formation as a percentage of GDP in a specific country i in period t.

Dummies are included for time (years) and units (country) to account for time and country-specific effects. A binary dummy variable is introduced to control for EU membership, taking a value of 1 if a country is formal member of EU and 0 otherwise. In addition, a dummy variable is included to control for most underdeveloped countries in the sample, namely, B&H and Albania. represents additional factors specified over interaction effects, and εit is a random error term.

To ensure a scholarly approach to the quality of inference, the econometric analysis started with the investigation of the dataset in detail, identifying a possibility for endogeneity bias and running various steps of the estimation, starting from fixed effects (FE) estimation and concluding with FMOLS.

The goal was primarily to investigate and evaluate the link between renewable energy consumption and economic growth in a specific country over time, employing panel regression estimation techniques. Considering the model designed based on the theoretical framework described in the previous sections, it was more likely to suspect that the omitted effects are correlated with the explanatory variables. More precisely, the variation across countries was not assumed to be random; therefore, the fixed effects estimator would be more suitable.

It was suspected that the estimation results would be overly sensitive to the assumption of cross-sectional dependence; therefore, Westerlund ECM cointegration test with a robust bootstrapping option was recommended. Unit root tests were used to formally confirm whether the variables were stationary and to identify the order of integration of each variable. Furthermore, it was highly recommended to test for the presence of cross-sectional dependency across all 9 SEE countries. The null hypothesis of homoscedasticity of the residuals was employed [

40].

The FMOLS estimation-based approach was used to obtain coefficients since this technique tackles non-exogeneity, serial correlation, and cross-sectional dependence and ensures that results are asymptotically efficient and robust estimates. Before proceeding with FMOLS, it is necessary to test normality assumption and, if required, use standardized variables.

Furthermore, due to the endogeneity bias suspected in the research design and the result of our theoretical claims, we already presumed that ordinary least squares (OLS), fixed, or random effects estimation would generate bias and inefficient results. The theoretical assumptions led us to conclude that the variance of the error term may vary across countries, which is known as a heterogeneous variance. In such cases, panel FMOLS with heterogenous variance may not be appropriate, and alternative estimation methods may be required. To capture these biases, a final robustness check was performed using panel corrected standard error (PCSE). PCSE estimation is an accepted method in panel data analysis that adjusts for heteroscedasticity and autocorrelation in the error term using panel-specific estimates of the error variance. These models are generally used with panel data and provide consistent results in the presence of diverse sources of endogeneity [

41].

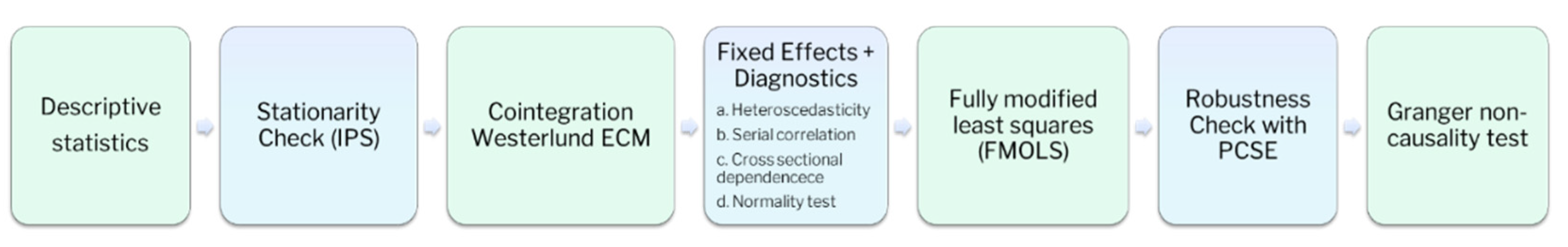

Finally, to gain additional information about estimated dependencies between economic output and renewable energy, test for causal mechanisms, and determine whether the variables are truly exogenous, the Granger non-causality test was performed based on the Dumitrescu and Hurlin (2012) approach. The econometric results were obtained using the Stata software tool for statistical analysis. The econometric strategy adopted in this research is best depicted with the following

Figure 2.

The procedure illustrated in

Figure 2 and the use of econometric methods was gathered by considering the findings of previous empirical studies and adopting recognized standards.

3.3. Data Collection

The empirical analysis covers southeast Europe’s geographical region and consists of countries that are either member states of the European Union or the contractual parties of the Energy Community Treaty. Economies included in the sample are Bulgaria, Croatia, Romania, Slovenia, Albania, Bosnia and Herzegovina, North Macedonia, the Republic of Moldova, and Serbia.

Kosovo and Montenegro belong to the Energy Community but are not included in the empirical analysis due to a lack of data. Data points were compiled from two different data sources. Energy data was retrieved from World Development Indicators (WDI) to ensure its compatibility across all the selected countries in the panel. Real GDP and FDI inward stock variables were retrieved from Vienna Institute for International Economic Studies (WIIW). Population estimates from the World Bank data source were used to compute the per capita values.

The aim was to build a balanced sample to include data points on the most recently available years and, at the same time, eliminate extensive missing observations. Driven purely by data availability for the respective countries and specific variables, the total sample includes 18-year time-series data points for 9 cross-sectional units, which total 162 observations and a strongly balanced panel data set.

Table 2 presents the variables used in this study along with their respective names, abbreviations, data sources, and fundamental descriptive statistics. The basic statistics demonstrate high heterogeneity across countries in almost all the variables except energy intensity, labor force, and capital. A slight deviation from the anticipated total of 100% between renewable and non-renewable energy sources is presumed to stem from potential measurement errors, particularly inaccuracies in the process of data collection.

4. Empirical Analysis and Results

Even though careful analysis has been dedicated to the research design and conceptualization of the model, fit empirical analysis confirmed that specific econometric issues need to be accounted for by carefully selecting the estimation method. As the unit root tests provided strong evidence that all series are first-order integrated, and diagnostic tests supported concerns regarding serial correlation, heteroskedasticity, and cross-sectional dependence in the panel, the final coefficients for policy recommendations and interpretation were estimated using the FMOLS method for heterogeneous cointegrated panels.

The output of the panel unit root examination in

Table 3 reveals that the selected variables are first-order stationary. More precisely, the null hypothesis that the panels have unit roots may not be rejected. All the variables are non-stationary at the level. The results therefore indicate that our variables are integrated into order one at levels.

Subsequently, the first differences were inspected to test unit roots and determine their stationarity. The null hypothesis of the unit root test for all variables is rejected at a 95% critical value, indicating a strong case for the presence of unit roots in all variables across countries, as well as the hypothesis of first-order integration in first differences.

These results suggest that it is possible to continue with panel cointegration and causality methods to inspect whether a stable, long-run relationship exists among the subject variables. More precisely, the Pedroni (1999; 2004; 2007) test for heterogeneous panels and the error-correction-based Westerlund (2007) cointegration tests for panel data were performed. The Pedroni test is based on the residuals obtained from a static model relationship. In contrast, the Westerlund test is based on a dynamic model and accounts for cross-sectional dependence using the bootstrap approach. Furthermore, the Westerlund approach accounts for the likely structural breaks in economic and energy impacts in economies in transition, which are often neglected in many empirical studies. The Pedroni test was performed with a maximum of four variables, while only one explanatory variable was included with the Westerlund error correction cointegration test.

Results of the Pedroni cointegration test in

Table 4 demonstrate that in the case of renewable and non-renewable energy, each country follows a different long-run course that points in the direction of factor parameter heterogeneity across countries.

To confirm the non-existence of cointegration and further evaluate whether the individual panel members are error-correcting, the Westerlund (2007) test was performed and outcomes are reported in the

Table 5. The error correction model estimated the cointegration vector between energy variables and real GDP. The four tests in Westerlund’s (2007) approach are based on structural dynamics and include the bootstrapping option, producing very robust critical values in the case of cross-sectional dependence.

The Westerlund ECM test has confirmed the Pedroni test results for renewable and non-renewable energy, where, in both tests, the null hypothesis of no cointegration may not be rejected. Failing to reject the null hypothesis does not necessarily mean that there is no relationship between the variables, and there might be short-term dynamics that are not captured by the cointegration test, or there may be other forms of dependence or causality that will be investigated using other econometric techniques in the following text.

The selected nine SEE countries belong to the same geographical region, but they are very different in the level of their economic development, with some being formal members of the EU and some not. Therefore, individual fixed effects per country were suspected, and we confidently estimated the FE estimation that focuses on short-term dynamics and controls unobserved heterogeneity across the cross-sectional units.

Results of the FE model estimation in

Table 6 demonstrate a positive and statistically significant relationship between GDP growth and non-renewable energy but a statistically insignificant relationship between renewable energy and economic growth. Most of the variables’ coefficients have the a priori expected sign and significance except for labor force, where a significant negative correlation was found. The FE results show that inward FDI stock and renewable energy consumption are statistically insignificant across most estimated models.

When a new factor, more precisely, an interaction term between renewable energy and the EU dummy, is added to the model, the sign of the coefficient for renewable energy consumption turns statistically significant and is positively correlated with real GDP per capita. Interestingly, this is the most striking result to emerge from the FE estimation. Furthermore, large F statistics (or a small p-value) reject the null hypothesis in favor of the fixed group within the effects for the specified model.

As mentioned above, we have every reason to suspect that these results are biased and inconsistent due to the variety of econometric concerns suspected, such as heteroscedasticity, cross-sectional dependence, and mostly endogeneity. Therefore, we will not use this panel estimation output to interpret the coefficients in more detail as conclusive findings to be used for policy recommendations. In the next steps of the estimation process, we turned to diagnostic tests to improve the dependability of the empirical estimation and findings.

To verify the consistency of the above results of the FE model estimation, autocorrelation, and heteroscedasticity checks were performed with variable variance L.R. and Wooldridge autocorrelation tests.

The cross-sectional dependence in the error terms may occur due to the existence of common shocks and events, as well as other unobserved components, which may all be common to the selected sample of economies in transition [

42]. The hypothesis of cross-sectional dependence is more likely to be confirmed for developed EU and OECD countries since these economies share a higher economic degree of development and have undergone economic and financial integration during the last decade [

43,

44,

45]. Cross-sectional dependence is less likely in the selected data set for the nine selected economies in transition. The above-estimated FE models assume that the cross-sectional units (countries) are independent.

The results obtained in

Table 7 reject the null hypothesis that no first-order autocorrelation and serial correlation are detected. The null hypothesis of no heteroscedasticity is rejected, and heteroscedasticity is detected in all the above-tested models. The null hypothesis of cross-sectional independence may not be rejected for Pesaran and Friedman tests, while the Frees test rejects the null hypothesis of cross-sectional dependence since the Frees’ statistic is larger than the obtained critical values, and the null hypothesis of cross-sectional independence is rejected.

There is enough empirical evidence with these tests to suspect that the above-estimated coefficients in FE-estimated models may be biased and inefficient. An alternative method of panel estimation for heterogeneous slopes (FMOLS) was used to correct detected heteroscedasticity, cross-sectional dependence in the panels, and detected serial correlation. FMOLS tackles non-exogeneity and ensures that asymptotically efficient coefficients are obtained.

According to the FMOLS estimation revealed in

Table 8, the coefficients of all energy variables are statistically significant and according to the expected sign. The coefficients have a considerable magnitude of the effect of change on the dependent variable and are also consistent with expectations and the theory. Results show that renewable and non-renewable energy consumption is statistically significant and positively correlated with economic output. In the case of a 1% rise in renewable energy consumption, the corresponding increase in real per capita GDP ranges from 0.085% to 0.1%. On the other hand, a 1% hike in non-renewable energy consumption is expected to result in an average rise of 0.17% in real per capita GDP. These findings are like results obtained with FMOLS and DOLS estimation by Rahman (2020) [

29] and Apergis and Payne (2012) [

27]. In addition, the energy intensity remains with a negative coefficient and is statistically significant across all models.

Furthermore, the null hypotheses that FDI coefficients are equal to zero were rejected at a 10% significance level in 2 estimated models (Model 2 and Model 3). These results suggest that FDI, as measured by inward stock, does have a statistically significant effect on economic growth for nine SEE countries according to the results from these two specified FMOLS estimated models.

As previously mentioned in the section on econometric strategy, an interaction term between RES and an EU dummy was used to investigate the differences and impact of RES on real GDP depending on whether a country belongs to the EU or not. Two models with interaction terms were estimated, more precisely, Model 4, which elaborates on the renewable energy and EU dummy multiplicative term, and Model 5, involving the multiplicative term between FDI and RES. Model 4 revealed negative and statistically insignificant interaction terms between RES and EU dummies at 1%, 5%, and 10% confidence levels. Negative signs independent of the statistical significance of the interaction terms indicate the weakening effect of RES on economic growth in the EU member countries. The negative correlation points in the direction that EU membership does not mean that EU member states are in any more of a favorable position regarding the potential RES impact on economic output for the selected sample of countries. On the contrary, several studies have been published so far demonstrating that consumption of renewable and non-renewable energy drives economic growth in non-OECD countries, pointing out the theory that developing countries play an important role in the transition to renewable resources [

43,

44].

To be precise, the negative coefficient and declining correlation coefficient of renewable energy on economic growth, once the interaction term with the EU dummy was introduced, is not an insightful indicator for any other policy formulation based on these findings since it is not statistically significant.

Turning now to the empirical evidence provided by the estimation of Model 5, where the interaction term between RES and FDI was introduced, different insights emerged. According to the findings of the interaction term between RES and FDI, the sign of the correlation points to the clear conclusion that RES is more tightly coupled with GDP growth for countries with a higher level of FDI. However, the coefficient of the interaction term is not statistically significant and therefore could not be interpreted in the context of reliable empirical findings to support further policy recommendations.

The above-performed diagnostic tests demonstrated that the disturbances are heteroscedastic and contemporaneously correlated across our panels, which demand more robust estimation methods and model validation with plausible alternative model specifications. This validation process is usually performed by running robustness checks that test whether estimated effects of interest are sensitive to model specification changes or estimation technique changes.

When diagnostic tests lead to the conclusion that more robust estimation methods should be used, in the case of panel estimation methods, two options seem most applicable [

45], namely:

Due to possible common factors between the countries that belong to the same geographical region, to ensure that this correlation and heterogeneity in the analysis of the specified models are controlled, robust standard errors with PCSE methods were estimated.

The following

Table 9 summarizes the outcome of PCSE analysis for all specified models:

The most interesting aspect of the results is a significantly reduced rho, indicating a corrected temporal autocorrelation between the variables compared to the rho values in the FE estimation. What stands out in the results of the PCSE estimation is that most coefficients are of the same sign, statistical significance, and small variability in magnitude compared to the parameters received from the FMOLS estimation. We also emphasize that the results of these models are directly comparable. Comparing the two results from the FMOLS and PCSE empirical estimations and considering the consistency of obtained coefficients, the choice of PCSE estimation method is an acceptable alternative panel estimator considering the data properties of the selected sample. Furthermore, these results demonstrate reliable theoretical model fundamentals and indicate the low possibility of an important omitted variable that might be correlated with our instruments. In other words, it verifies that the specification of models is built on sound theoretical reasoning, increasing the validity of inferences.

Below

Table 10 is a comparative overview of the sign and statistical significance of the parameters across all three performed estimation methods (FE, FMOLS, and PCSE) and a priori expected coefficient signs.

In the phases of research design and model specification, endogeneity and the existence of reverse causality were considered an issue for the robustness and reliability of an estimation. The issue of endogeneity was tackled through the employment of the Dumitrescu-Hurlin (2012) approach to a Granger non-causality test utilizing a heterogeneous panel and results are presented in the

Table 11. The objective of this investigation is to test for non-causal linkages between the consumption of renewable energy and real per capita GDP. This causality test is recommended for heterogeneous panels where dependence between the countries is detected [

38].

Results of the p-values indicate the causal effect running from real GDP per capital towards renewable energy consumption. Therefore, the Granger causality test shows a unidirectional causality from economic growth to RES, confirming the conservation hypothesis for the nine selected SEE countries. The tests also reject the assumption of reverse causality and the presence of endogeneity in the model estimation results.

5. Discussion

The main empirical evidence points to the conclusion that renewable energy consumption and non-renewable energy consumption positively affect economic growth [

21,

23,

24,

25,

27,

29,

38,

46,

47]. The FMOLS estimation of the coefficients resulted in all energy variables being statistically significant and according to the expected sign. The coefficients have a significant magnitude of the effect of change on the dependent variable. The obtained results also confirm a significant and inverse relationship between energy intensity and economic growth, which is consistent throughout the estimation process. In addition, the statistically significant and inverse relationship between real GDP per capita and energy intensity is theoretically conclusive and points out the energy inefficiencies in the selected markets where energy efficiency improvements still need to be visible in these nine SEE countries [

48]. In conclusion, for the sample of a total of nine selected SEE countries, a dynamic panel model estimation resulted in a statistically significant coefficient of all energy variables, pointing out that energy is a critical growth factor in the output functions of the selected SEE countries and plays a major role as the transformation factor in the transition toward sustainable economic growth [

49,

50].

Gross fixed capital formation and FDI are equally important growth factors based on the magnitude of the elasticity’s coefficients, with GFCF being significant at the higher confidence level [

35,

49,

51]. A positive relationship between GFCF and real GDP indicates that growth-inducing policies might also focus on capital and other infrastructural-related productivity inputs, which is complementary to promoting energy efficiency measures [

50]. On the other hand, the labor force is not a significant growth factor since most of the studied economies are heavily dependent on the service sector, and generally, the industrial sector (which is underrepresented in the selected economies) is more energy intensive compared to the service sector. Furthermore, the negative correlation between labor force participation and economic growth shows an alarming indicator of SEE countries’ lack of labor force to contribute positively to economic growth as a viable input into production function. The key growth factor is also qualified human resources and a technically skilled workforce, which is scarce in most of these nine selected SEE countries and very affected by the continuous brain drain [

48]. These findings call for immediate action to retain and develop a skilled labor force through various public initiatives and educational programs.

Conclusions related to the interpretation of the interaction effect coefficients point to evidence that EU member states in the SEE region are not in any more of a favorable position regarding potential RES impact on economic output for the selected sample of countries based on the negative correlation between the interaction term RES*EUDummy and economic growth. However, the negative elasticity coefficient of RES on economic growth once the interaction term with the EU dummy has been introduced is not an insightful indicator for any other policy formulation based on these findings since it is not statistically significant.

Empirical results revealed positive and statistically insignificant interaction terms between RES and FDI. Although statistically insignificant, the obtained sign of the interaction term and magnitude indicates the reinforcement effect of FDI on economic growth once coupled with the consumption of RES. These empirical findings indicate that the impacts of these two regressors are intertwined and require delicate interpretation. More precisely, the effects of FDI on GDP per capita vary based on the level of renewables consumed, and the impacts of RES vary based on the FDI levels. From the perspective of further policy recommendations, the statistical significance of this interaction term at a 15% confidence level indicates that in countries with higher levels of FDI, consumption of RES positively impacts GDP growth more than countries with lower levels of FDI and vice versa.

The unidirectional causality from economic growth towards renewable energy validated the conservation hypothesis [

29,

31,

52]. According to the conservation hypothesis, the primary determinant of renewable energy consumption is real GDP growth rather than the other way around. Therefore, energy conservation policies do not hinder economic growth, and as economic activity and output levels increase, the demand for efficient energy use also rises. Higher levels of economic output ultimately result in higher consumption of renewable energy [

6,

52,

53,

54]. Furthermore, the presence of energy efficiency further facilitates the outcome of energy conservation. In summary, the conservation hypothesis suggests that economic growth drives renewable energy consumption, and energy efficiency plays a crucial role in promoting energy conservation.

The empirical findings indicate that achieving sustainable economic growth in the SEE region requires policies that prioritize investment promotion in RES with untapped potential. This approach is expected to foster sustainable economic growth in the long run [

39,

55].

Practical Implications

With the fourth industrial revolution and the impact of continuous innovation and digitalization on economic growth, energy is competing with numerous investment opportunities for the allocation of funds and prioritizing reforms and investment in sectoral priorities; therefore, estimating the marginal effects on energy consumption on the economic welfare of respective countries is much more than theoretical research questions and set of hypotheses.

The above-stated empirical results and main findings point toward these underlying policy recommendations:

Avoid conservational energy policies and instead streamline energy consumption towards more renewable energy sources and reduction of energy intensity.

Promote capital investments in renewable energy and energy efficiency projects and measures.

Restructure the role of the energy market to support such investments and attract foreign and domestic capital.

Ensure regional cooperation and compliance with international energy targets and goals for individual countries and regions.

Continuously raise awareness about sustainable economic growth and the role of energy efficiency.

There are multiple factors that influenced the neglect of RES investments in the SEE region, which can be attributed mainly to historical reliance on traditional energy sources based on multiple economic considerations, such as the low prices of imported fossil fuels and established fossil fuel infrastructure. However, the penetration of RES in final energy consumption is stalling mostly due to the absence of transparent and long-term policy frameworks and a supportive regulatory environment influenced by local politics and fossil fuel lobbies. [

56,

57].

Long-term planning needs to be included in SEE countries’ energy policies. Due to such an important and strategic role of energy in the geopolitical sphere, especially in SEE countries, policymakers need to extend the planning time horizon when evaluating different policy options. In many cases, in these countries, the “draft of energy strategies” are valid or, better said, binding (e.g., Macedonia, Serbia) for a maximum of up to four years.

Besides the long-term planning needs, the unpredictable and untransparent planning process is another significant barrier to more sustainable energy systems in non-EU countries [

56].

Simultaneously, there is a lack of clear assessment or strategic vision in the allocation of funds and issuance of permits for new projects, leading to a random and opaque process (e.g., funds continually go towards the coal plants projects, while countries are vocal on energy efficiency policies and targets).

Non-EU countries in the southeastern European (SEE) region must prioritize the establishment of a stable and transparent regulatory framework, placing a significant emphasis on fostering private–public partnerships. This approach is particularly crucial in building the essential investor confidence required to demonstrate political commitment and effectively diversify the energy mix while reducing reliance on fossil fuels [

58].

6. Conclusions and Recommendations

The research delivered in this article strengthens the theory that energy consumption positively affects economic growth. The empirical conclusions add to the growing body of research, especially empirical research specific to SEE countries and the Western Balkan, which is relatively scarce [

3,

4,

5,

17,

38,

39,

48,

50,

57]. This article extends the current literature by providing a more novel and combined multivariate modeling approach for testing the link between economic growth and renewable energy in the SEE region using several key indicators of energy use, namely, renewable energy (where energy is a good or a service) and the share of energy services in total economic output (energy intensity). Furthermore, the introduction of both interaction terms with renewable energy consumption as additional factors contributes to understanding the differences and behavioral impact of renewable energy on real GDP growth depending on whether a country belongs to the EU and depending on the country’s level of FDI. This approach improves the understanding of the impact of renewable energy consumption on growth depending on new relevant factors in the integrated model framework. Considering the empirical findings, this research points out more clearly the appropriate policy implications needed for subject countries to achieve their renewable energy targets and generate progress in the renewable energy sector, particularly for economies that are Contracting Parties of the Energy Community.

Nevertheless, it is important to mention that the findings in this article are subject to at least four limitations and constraints. These include the data availability or lack of data for the selected sample of nine SEE countries, the absence of fundamental criteria for selecting the cluster economies to be analyzed together (heterogeneity factor), the econometric approach, and the model specification suggesting potential additional variables for consideration in future research.

It is recommended that further research be undertaken with improvements in the following areas:

Research design (context and sample selection);

Model specification (new proxies for energy consumption or adding new variables);

Empirical strategy and chosen methods of estimation;

Embedding the perspective of circular economy to the forefront of our growth theories.

Future studies on the current topic should start with a different research design approach and model specification, starting with the sample selection process, incorporating new variables into the model, and choosing completely different empirical approaches. All nine SEE countries have heterogeneous energy consumption and very heterogeneous energy intensities of their economies as indicators of maturity in implementing energy efficiency measures. Due to this heterogeneity, for future scholars and experts, a different approach to the design of research and model specification would be recommended where the aggregate production function will incorporate the energy variables for each country separately. This means that for each country, a sample of time-serious data would be analyzed where each data set would be chosen based on the availability of data for a given country.

Furthermore, in addition to energy variables, these selected countries all have unique historical backgrounds, and their GDPs are distinctively different in structure, as well as very turbulent and drastic changes in their economies over time. Another important and differentiating factor is also EU membership. These are all reasons why another approach to model design would yield a different estimation and different statistical outcomes per country level [

49,

52,

55].

In this research, the FMOLS estimation method was chosen as the most suitable technique when the presence of panel data cointegration was detected. However, according to fourth generation econometric analysis techniques, vector autoregression and generalized impulse response functions, as well as panel data estimation techniques, such as the generalized method of moments (GMM) [

52,

59,

60], have always been a top choice and preferred method in dealing with endogeneity issues. As a recommendation for further research, another viable but rather complex alternative would be methodological design, including simultaneous equations modeling (SEM). SEM models the unobservable correlations in multiple equations. Some researchers prefer to specify the endogenous variables inside a simultaneous equation model.

Finally, for clarity and theoretical precision, at the beginning of this article, very explicit theoretical assumptions were presented upon which the model specification was constructed. The adopted integrated model framework used in this research needs to account for the scarcity of natural resources. However, for future researchers and practitioners, it goes without saying that the optimal growth path for the economies should account for the realities of declining natural resources. A strong recommendation for future research is to add this new circular economy perspective to the forefront of our growth theories to achieve sustainability.