Sustainability Unleashed through Innovation: Knowledge-Driven Strategies Igniting Labor Productivity in Small- and Medium-Sized Engineering Enterprises

Abstract

1. Introduction

- (a)

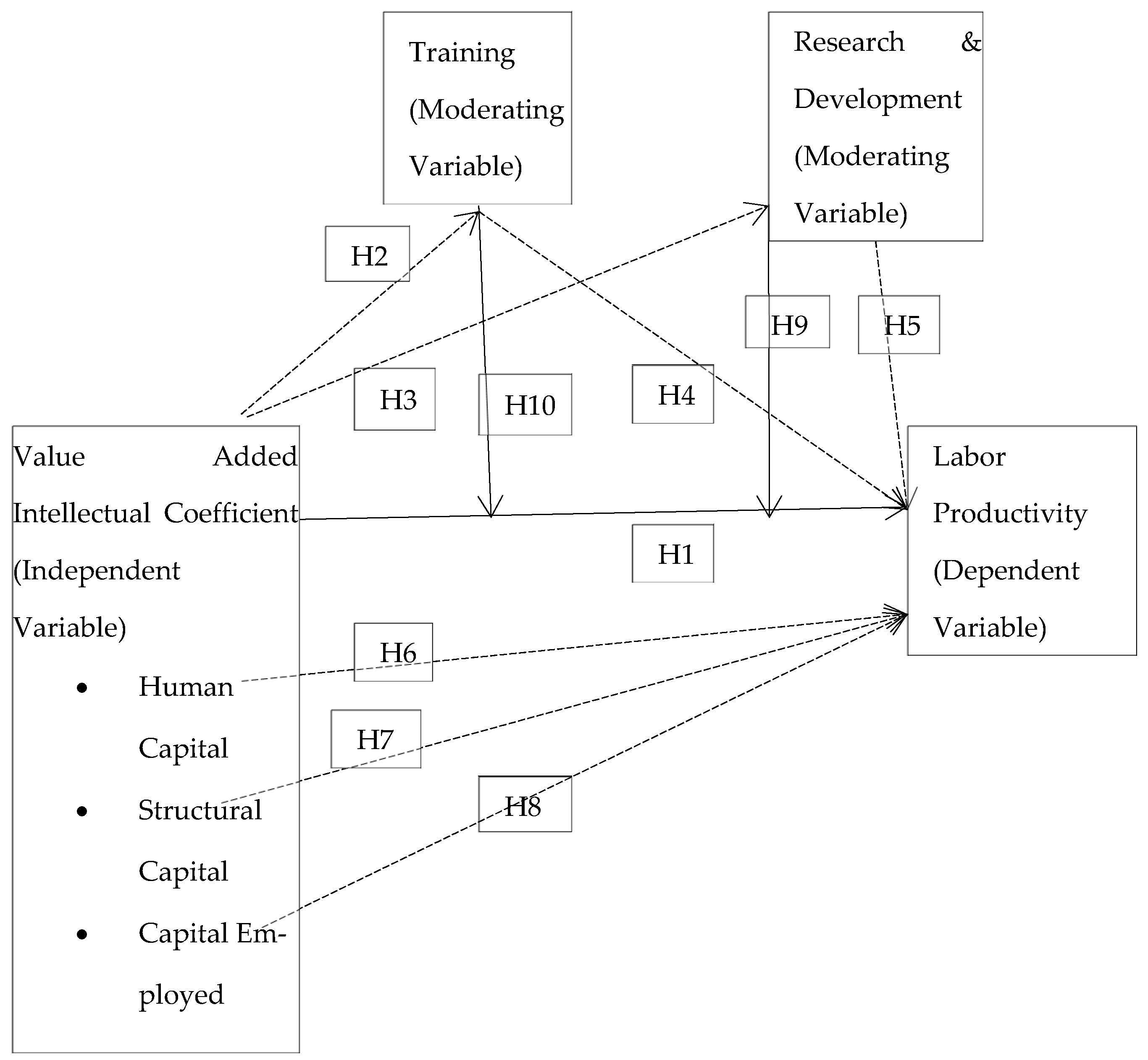

- What constitutes the accurate metrics for knowledge-based performance drivers (KBPDs)? The prevailing challenge resides in the existence of multiple pivotal variables within knowledge management (KM) and several theoretical models available for selection, contingent upon the contextual requirements, aimed at achieving knowledge-based performance and productivity. For instance, critical KM variables, such as technology, structure, and organizational culture [19], do not necessarily align directly with performance enhancement for value creation. Furthermore, various theoretical models [20] regarding knowledge productivity are available in the literature. Consequently, identifying the precise variables associated with value addition, performance, productivity, and intellectual capital is paramount for researchers.

- (b)

- How do human capital, structural capital, and employed capital contribute to labor productivity, particularly in the presence of essential inputs from research and development (R&D) and training? While this question has been scrutinized in the context of small- and medium-sized enterprises (SMEs) within developing countries, and amid the backdrop of industry 4.0 [21], these evaluations have predominantly emanated from the vantage points of the Human Capital Index [22] and the innovation perspective [23]. However, this inquiry needs to be thoroughly examined from the lens of intangible and financial productivity and performance.

- (c)

- How does the model governing the inputs of intellectual capital (encompassing structural capital, human capital, and employed capital) impact labor productivity, particularly in moderating factors like R&D and training? Given the significance of this question to engineering managers and capital investors, numerous researchers have endeavored to simplify firms’ potential utilization of knowledge through their unique models [24].

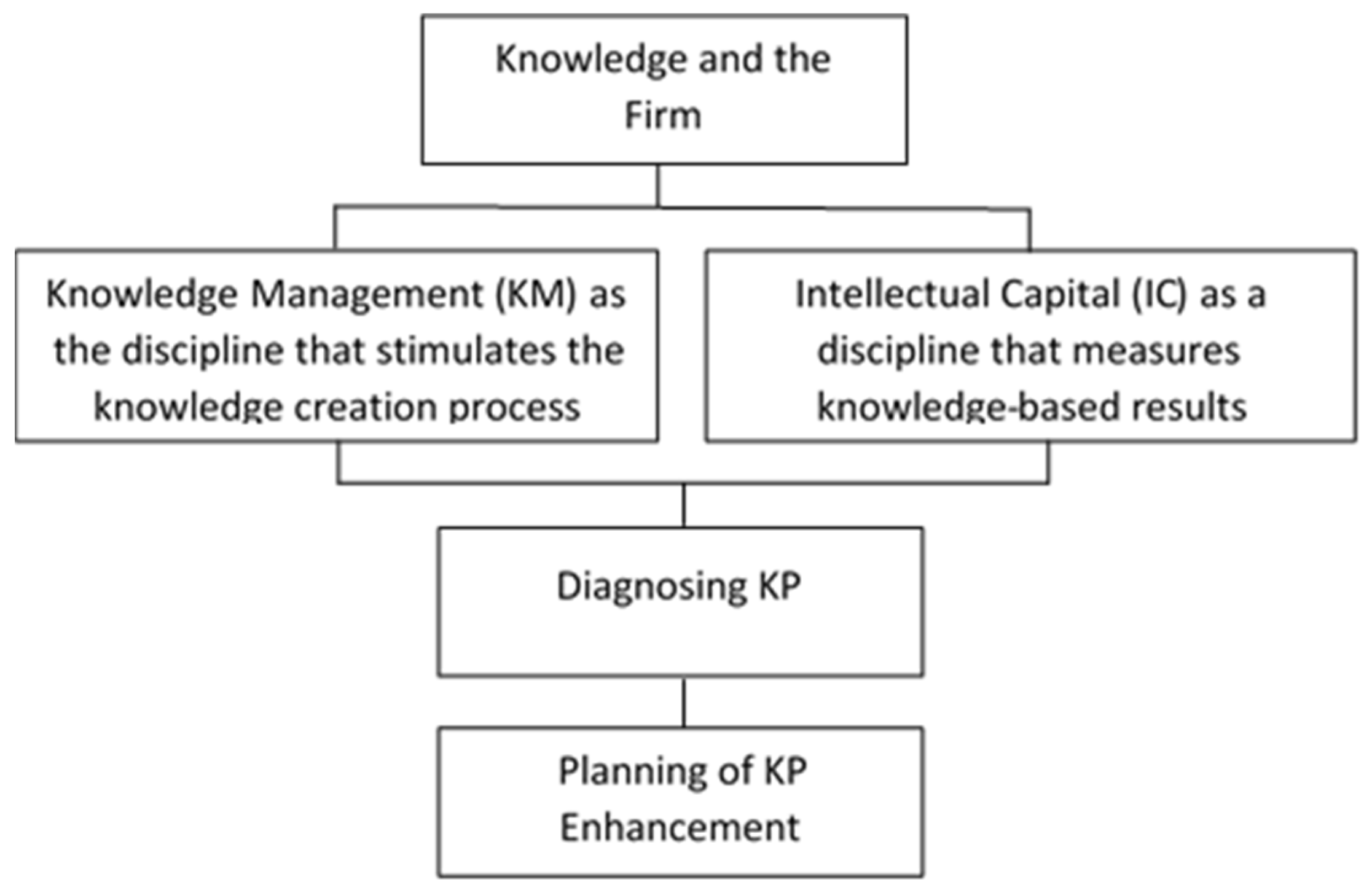

2. Theoretical Framework

2.1. Underlying Theory and Gap

2.2. Analysis of Relevant Literature

2.3. Studies on VAIC, LP, R&D, and Training

2.4. The Relationship between the VAIC with Labor Productivity, R&D, and Training

“Defined simply as value added divided by Intellectual Capital. Value Added is the difference between sales and all inputs, except labor expenses.”[48]

- The VAIC uses audited secondary data, most of which are publicly available and authentic.

- It measures knowledge-based performance drivers, which are synonymous with the intellectual capital efficiency (ICE).

- It measures the firm performance and gives a finite value to be compared inter- and intrapopulation.

- The VAIC defines R&D and training as fundamental performance drivers.

- The VAIC measures the efficiency of intellectual and financial capital, which is a bonus.

2.5. Research Gap

- (a)

- Rembe and Israel initially performed NIC in Sweden in 1999. Later on, IC assessments were followed in Denmark and Norway by Malhotra in 2003. In 2004, Bontis modified the components of IC from an organizational level to a national level (NIC).

- (b)

- Fifty-one per cent of the studies readopted the concepts of other authors; twenty-eight per cent developed a new concept, and twenty-one per cent did not refer to any mentioned multiple concepts. The concept of IC is chiefly adopted at the organizational level, followed by the regional and national levels.

- (c)

- A total of 13.5% of all studies used the VAIC.

- (d)

- A total of 11 of a group of 777 studies involved the NIC.

3. Methodology

4. Results and Discussion

| IV | MV | DV | Latent Factor | X Var | Cumm X Var | Y Var | Cumm Y Var (R-Sq.) | Adj R-Sq. | Sig | Hypothesis Not Rejected/Reject |

|---|---|---|---|---|---|---|---|---|---|---|

| VAIC | LP | 1 | 1 | 1 | 0.169 | 0.169 | 0.168 | 0.000 | Not Rejected | |

| VAIC | - | Trg | 1 | 1 | 1 | 0.012 | 0.012 | 0.011 | 0.003 | Not Rejected |

| VAIC | - | Rnd | 1 | 1 | 1 | 0.029 | 0.029 | 0.015 | 0.056 | Rejected |

| Trg | - | LP | 1 | 1 | 1 | 0.03 | 0.03 | 0.029 | 0.000 | Not Rejected |

| RnD | - | LP | 1 | 1 | 1 | 0.036 | 0.016 | 0.011 | 0.054 | Rejected |

| HC | - | LP | 1 | 1 | 1 | 0.043 | 0.043 | 0.042 | 0.005 | Not Rejected |

| SC | - | LP | 1 | 1 | 1 | 0.31 | 0.31 | 0.309 | 0.000 | Not Rejected |

| CE | - | LP | 1 | 1 | 1 | 0.014 | 0.014 | 0.012 | 0.008 | Not Rejected |

| VAIC | Rnd | LP | 1 | 1 | 1 | 0.144 | 0.144 | 0.13 | 0.053 | Rejected |

| VAIC | Trg | LP | 1 | 1 | 1 | 0.184 | 0.184 | 0.183 | 0.058 | Rejected |

| N | Minimum | Maximum | Mean | Std. Deviation | |

|---|---|---|---|---|---|

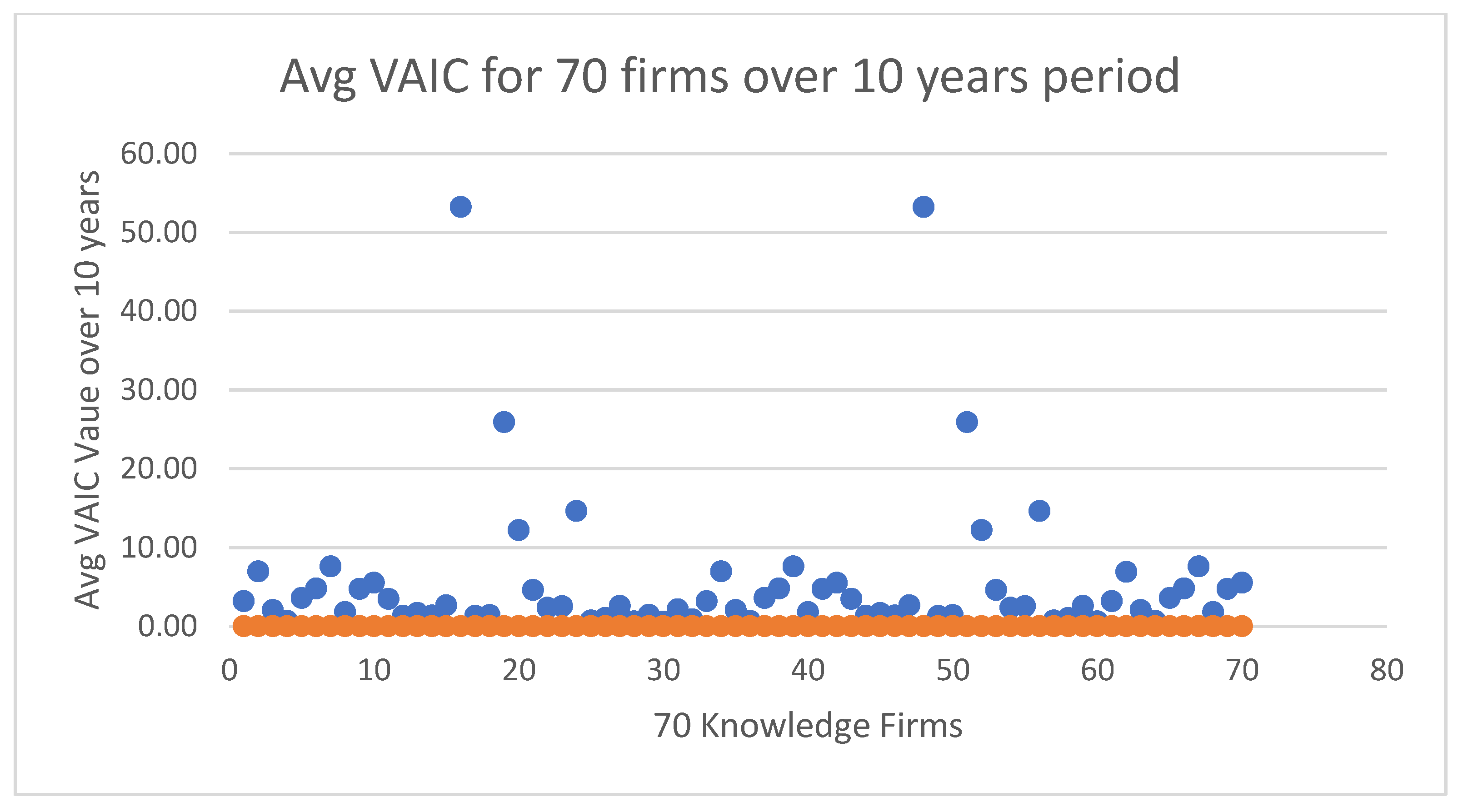

| VAIC | 700 | 0.03299406 | 97.08453160 | 8.1877977697 | 11.51223896556 |

| LP | 700 | 0.04317789 | 51.22707659 | 12.1790261212 | 10.88981383452 |

| VAIC | LP | RnD | Trg | HC | SC | ||

|---|---|---|---|---|---|---|---|

| VAIC | Pearson’s correlation | 1 | 0.411 ** | 0.054 | 0.111 ** | −0.036 | 0.227 ** |

| Sig. (2-tailed) | 0.000 | 0.156 | 0.003 | 0.348 | 0.000 | ||

| N | 700 | 700 | 700 | 700 | 700 | 700 | |

| LP | Pearson’s correlation | 0.411 ** | 1 | −0.060 | 0.174 ** | 0.208 ** | 0.557 ** |

| Sig. (2-tailed) | 0.000 | 0.113 | 0.000 | 0.000 | 0.000 | ||

| N | 700 | 700 | 700 | 700 | 700 | 700 | |

| RnD | Pearson’s correlation | 0.054 | −0.060 | 1 | 0.383 ** | 0.317 ** | 0.148 ** |

| Sig. (2-tailed) | 0.156 | 0.113 | 0.000 | 0.000 | 0.000 | ||

| N | 700 | 700 | 700 | 700 | 700 | 700 | |

| Trg | Pearson’s correlation | 0.111 ** | 0.174 ** | 0.383 ** | 1 | 0.306 ** | 0.366 ** |

| Sig. (2-tailed) | 0.003 | 0.000 | 0.000 | 0.000 | 0.000 | ||

| N | 700 | 700 | 700 | 700 | 700 | 700 | |

| HC | Pearson’s correlation | −0.036 | 0.208 ** | 0.317 ** | 0.306 ** | 1 | 0.605 ** |

| Sig. (2-tailed) | 0.348 | 0.000 | 0.000 | 0.000 | 0.000 | ||

| N | 700 | 700 | 700 | 700 | 700 | 700 | |

| SC | Pearson’s correlation | 0.227 ** | 0.557 ** | 0.148 ** | 0.366 ** | 0.605 ** | 1 |

| Sig. (2-tailed) | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||

| N | 700 | 700 | 700 | 700 | 700 | 700 | |

| CE | Pearson’s correlation | 0.007 | 0.118 ** | 0.015 | 0.316 ** | 0.154 ** | 0.246 ** |

| Sig. (2-tailed) | 0.854 | 0.002 | 0.683 | 0.000 | 0.000 | 0.000 | |

| N | 700 | 700 | 700 | 700 | 700 | 700 | |

| Model | Variables Entered | Variables Removed | Method | |||

|---|---|---|---|---|---|---|

| 1 | Trg, VAIC, HC, CE, RnD, SC, VAIC_RnD, VAIC_Trgb | Enter | ||||

| Dependent Variable: LP | ||||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate | ||

| 1 | 0.653 a | 0.427 | 0.420 | 8.29242554979 | ||

| ANOVAa | ||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | |

| 1 | Regression | 35,376.898 | 8 | 4422.112 | 64.308 | 0.000 b |

| Residual | 47,516.146 | 691 | 68.764 | |||

| Total | 82,893.044 | 699 | ||||

| Coefficients | ||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | T | Sig. | ||

| B | Std. Error | Beta | ||||

| 1 | (Constant) | 8.361 | 0.498 | 16.781 | 0.000 | |

| VAIC | 0.295 | 0.032 | 0.312 | 9.084 | 0.000 | |

| VAIC_RnD | 0.125 | 0.011 | 0.127 | 2.277 | 0.053 | |

| VAIC_Trg | 0.154 | 0.015 | 0.160 | 1.828 | 0.058 | |

| HC | 0.234 | 0.021 | 0.223 | 1.328 | 0.005 | |

| SC | 0.457 | 0.049 | 0.443 | 10.728 | 0.000 | |

| CE | 0.579 | 0.057 | 0.524 | 2.069 | 0.008 | |

| RnD | 0.261 | 0.022 | 0.241 | 1.197 | 0.054 | |

| Trg | 0.254 | 0.025 | 0.248 | 0.959 | 0.000 | |

4.1. Hypothesis Testing Results

4.2. Descriptive Statistics

4.3. Pearson’s Correlation

4.4. Multivariate Regression Model Testing

5. Findings and Conclusions

5.1. Findings

5.2. Conclusions

5.3. Limitations

5.4. Future Work

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Valuing Investments in Intellectual Capital: International Journal of Technology Management: Vol 18, No. 5–8. Available online: https://www.inderscienceonline.com/doi/10.1504/IJTM.1999.002779 (accessed on 29 June 2021).

- The Connenction between Global Innovation Index and Economic Well-Being Indexes|Applied Studies in Agribusiness and Commerce. Available online: https://ojs.lib.unideb.hu/apstract/article/view/6514 (accessed on 24 November 2023).

- Building a Knowledge Economy in South Africa|South African Journal of Science. Available online: https://journals.co.za/doi/abs/10.10520/EJC96995 (accessed on 15 June 2022).

- Chen, M.-C.; Cheng, S.-J.; Hwang, Y. An empirical investigation of the relationship between intellectual capital and firms’ market value and financial performance. J. Intellect. Cap. 2005, 6, 159–176. [Google Scholar] [CrossRef]

- Marimuthu, M.; Arokiasamy, L.; Ismail, M. Human Capital Development and Its Impact on Firm Performance: Evidence from Developmental Economics. J. Int. Soc. Res. 2009, 2. Available online: http://scholars.utp.edu.my/id/eprint/12047 (accessed on 1 October 2023).

- Wang, Y. What are the biggest obstacles to growth of SMEs in developing countries?–An empirical evidence from an enterprise survey. Borsa Istanb. Rev. 2016, 16, 167–176. [Google Scholar] [CrossRef]

- The Impact of Corporate Social Responsibility (CSR) Knowledge on Corporate Financial Performance: Evidence from the European Banking Industry. Available online: https://www.iris.unicz.it/handle/20.500.12317/77030 (accessed on 24 November 2023).

- Gangi, F.; Salerno, D.; Meles, A.; Daniele, L.M. Do Corporate Social Responsibility and Corporate Governance Influence Intellectual Capital Efficiency? Sustainability 2019, 11, 1899. [Google Scholar] [CrossRef]

- Eid, R. The Association between Intellectual Capital and Performance of Bahraini Listed Firms. 2018. Available online: https://www.semanticscholar.org/paper/The-Association-between-Intellectual-Capital-and-of-Eid/a063b3dfc927905e368bc419c69012724ed79234 (accessed on 15 June 2022).

- Bontis, N.; Keow, W.C.C.; Richardson, S. Intellectual capital and business performance in Malaysian industries. J. Intellect. Cap. 2000, 1, 85–100. [Google Scholar] [CrossRef]

- Venugopal, D.; Nambi, S.T.; Lakshmanan, M. A Data Envelopment Analysis Approach to Performance Efficiency of Intellectual Capital–Case of Titan Company Limited #. SDMIMD J. Manag. 2018, 9, 1–8. [Google Scholar] [CrossRef]

- Ge, F.; Xu, J. Does intellectual capital investment enhance firm performance? Evidence from pharmaceutical sector in China. Technol. Anal. Strateg. Manag. 2021, 33, 1006–1021. [Google Scholar] [CrossRef]

- Kefela, G.T. Knowledge-based economy and society has become a vital commodity to countries. Int. NGO J. 2010, 5, 160–166. [Google Scholar]

- O’Regan, N.; Ghobadian, A. The importance of capabilities for strategic direction and performance. Manag. Decis. 2004, 42, 292–313. [Google Scholar] [CrossRef]

- Gashenko, I.V.; Khakhonova, N.N.; Orobinskaya, I.V.; Zima, Y.S. Competition between human and artificial intellectual capital in production and distribution in Industry 4.0. J. Intellect. Cap. 2020, 21, 531–547. [Google Scholar] [CrossRef]

- Ullah, A.; Pinglu, C.; Ullah, S.; Qian, N.; Zaman, M. Impact of intellectual capital efficiency on financial stability in banks: Insights from an emerging economy. Int. J. Financ. Econ. 2023, 28, 1858–1871. [Google Scholar] [CrossRef]

- Hsu, S.T.; Cohen, S.K. Revisiting the R&D investment-performance relationship: The moderating effects of factor market characteristics. J. Eng. Technol. Manag. JET-M 2020, 57, 101570. [Google Scholar]

- Griffiths, W.; Webster, E. What governs firm-level R&D: Internal or external factors? Technovation 2010, 30, 471–481. [Google Scholar] [CrossRef]

- Allameh, S.M.; Zare, S.M.; Davoodi, S. mohammad reza Examining the impact of KM enablers on knowledge management processes. Procedia Comput. Sci. 2011, 3, 1211–1223. [Google Scholar] [CrossRef]

- Khan, M.; Luintel, K.B. Sources of Knowledge and Productivity: How Robust Is the Relationship? OECD: Paris, France, 2006. [Google Scholar]

- Sima, V.; Gheorghe, I.G.; Subić, J.; Nancu, D. Influences of the Industry 4.0 Revolution on the Human Capital Development and Consumer Behavior: A Systematic Review. Sustainability 2020, 12, 4035. [Google Scholar] [CrossRef]

- Lin, H.; Li, R.; Hou, S.; Li, W. Influencing factors and empowering mechanism of participation in e-commerce: An empirical analysis on poor households from Inner Mongolia, China. Alex. Eng. J. 2021, 60, 95–105. [Google Scholar] [CrossRef]

- Wadho, W.; Chaudhry, A. Innovation and firm performance in developing countries: The case of Pakistani textile and apparel manufacturers. Res. Policy 2018, 47, 1283–1294. [Google Scholar] [CrossRef]

- Yuan, B.; Xia, H.; Guo, C. An evaluation index system for intellectual capital evaluation based on machine learning. Alex. Eng. J. 2021, 60, 1519–1524. [Google Scholar] [CrossRef]

- Qurashi, I.A.; Khalique, M.; Ramayah, T.; Bontis, N.; Yaacob, M.R. Impact of intellectual capital on innovation in pharmaceutical manufacturing SMEs in Pakistan. Int. J. Learn. Intellect. Cap. 2020, 17, 61–76. [Google Scholar] [CrossRef]

- Khalique, M.; Shaari, J.A.N.; Isa, A.H.M.; Ageel, A. Role of Intellectual Capital on the Organizational Performance of Electrical and Electronic SMEs in Pakistan. Int. J. Bus. Manag. 2011, 6, p253. [Google Scholar] [CrossRef]

- Pulic, A.; Kolakovic, M. Value creation efficiency in the new economy. Glob. Bus. Econ. Rev. 2003, 5, 111–128. [Google Scholar] [CrossRef]

- Freeze, R.D.; Kulkarni, U. Knowledge management capability: Defining knowledge assets. J. Knowl. Manag. 2007, 11, 94–109. [Google Scholar] [CrossRef]

- Sveiby, K.-E. Methods for Measuring Intangible Assets. 2018. Available online: https://harisportal.hanken.fi/sv/publications/methods-for-measuring-intangible-assets (accessed on 1 October 2023).

- Cohen, W.M.; Levinthal, D.A. Absorptive Capacity: A New Perspective on Learning and Innovation. Adm. Sci. Q. 1990, 35, 128–152. [Google Scholar] [CrossRef]

- Aken, J.E. Management Research Based on the Paradigm of the Design Sciences: The Quest for Field-Tested and Grounded Technological Rules. J. Manag. Stud. 2004, 41, 219–246. [Google Scholar] [CrossRef]

- Reimann, P. Design-Based Research. In Methodological Choice and Design: Scholarship, Policy and Practice in Social and Educational Research; Markauskaite, L., Freebody, P., Irwin, J., Eds.; Methodos Series; Springer: Dordrecht, The Netherlands, 2011; pp. 37–50. ISBN 978-90-481-8933-5. [Google Scholar]

- Wang, F.; Hannafin, M.J. Design-based research and technology-enhanced learning environments. Educ. Technol. Res. Dev. 2005, 53, 5–23. [Google Scholar] [CrossRef]

- Bhattacharjee, S.; Akter, R. Intellectual capital efficiency and firm performance: Evidence from an emerging knowledge-economy. Int. J. Learn. Intellect. Cap. 2022, 19, 30–52. [Google Scholar]

- Sukardi, S.; Wildan, W.; Subhani, A. Resource-Based View Experiential Learning Model Design: Towards Strengthening Vocational High School Students’ Entrepreneurial Competencies. In Proceedings of the 4th International Conference on Vocational Education and Technology, IConVET 2021, Singaraja, Bali, Indonesia, 27 November 2021. [Google Scholar] [CrossRef]

- Stam, C.D. Knowledge Productivity: Designing and Testing a Method to Diagnose Knowledge Productivity and Plan for Enhancement. 2007. Available online: https://research.utwente.nl/en/publications/knowledge-productivity-designing-and-testing-a-method-to-diagnose (accessed on 24 February 2022).

- Valizadeh Morady, M. Intellectual capital measuring methods. Eur. Online J. Nat. Soc. Sci. 2013, 2, 755–762. [Google Scholar]

- Pulic, A. Intellectual capital–does it create or destroy value? Meas. Bus. Excell. 2004, 8, 62–68. [Google Scholar] [CrossRef]

- Does Intellectual Capital Efficiency Improve Firm Performance in BRICS Economies? A Dynamic Panel Estimation|Emerald Insight. Available online: https://www.emerald.com/insight/content/doi/10.1108/MBE-12-2015-0055/full/html?skipTracking=true (accessed on 13 October 2022).

- Hussi, T.; Ahonen, G. Managing intangible assets—A question of integration and delicate balance. J. Intellect. Cap. 2002, 3, 277–286. [Google Scholar] [CrossRef]

- Edvinsson, L.; Malone, M.S. Intellectual Capital: The Proven Way to Establish Your Company’s Real Value by Measuring Its Hidden Brainpower; New Ed edition; PIATKUS BOOKS: London, UK, 1998; ISBN 978-0-7499-1850-7. [Google Scholar]

- Roos, G.; Roos, J. Measuring your company’s intellectual performance. Long Range Plann. 1997, 30, 413–426. [Google Scholar] [CrossRef]

- Salojärvi, S.; Furu, P.; Sveiby, K.-E. Knowledge management and growth in Finnish SMEs. J. Knowl. Manag. 2005, 9, 103–122. [Google Scholar] [CrossRef]

- Guimon, J. MERITUM and Danish Guidelines for Reporting on Intangibles: A Comparative Study. IUP J. Account. Res. Auidt Pract. 2009, 8, 17–29. [Google Scholar]

- Rohana, N.; Razak, A. The Relationship of Intellectual Capital, Innovation and Organizational Performance: A Preliminary Study in Malaysian SMEs. 2018. Available online: https://www.macrothink.org/journal/index.php/ijmis/article/download/15/17 (accessed on 1 October 2023).

- Bykova, A.; Molodchik, M. Applying the VAIC Model to Russian Industrial Enterprises; Social Science Research Network: Rochester, NY, USA, 2012; Available online: https://papers.ssrn.com/abstract=2001341 (accessed on 25 January 2018).

- Barkat, W.; Beh, L.-S. Influence of Intellectual Capital Dimensions on Knowledge Process Capability and Organizational Performance. Asian J. Sci. Res. 2018, 11, 308–318. [Google Scholar] [CrossRef]

- Bassi, L.J.; Van Buren, M.E. Valuing investments in intellectual capital. Int. J. Technol. Manag. 1999, 18, 414–432. [Google Scholar] [CrossRef]

- Török, Á.; Tóth, J.; Balogh, J. Push or Pull? The nature of innovation process in the Hungarian food SMEs. J. Innov. Knowl. 2018, 4, 234–239. [Google Scholar] [CrossRef]

- Ma, H.R.; Lee, C.-J.; Oh, D.H. Identification of R&D Paradox after the Global Financial Crisis: Korean Case Focusing on the Smart Convergence and Conventional Industries. Sci. Technol. Soc. 2022, 27, 213–232. [Google Scholar] [CrossRef]

- Ortega-Argilés, R.; Vivarelli, M.; Voigt, P. R&D in SMEs: A Paradox? Small Bus. Econ. 2009, 33, 3–11. [Google Scholar]

- Latif, M.; Malik, M.; Aslam, S. Intellectual capital efficiency and corporate performance in developing countries: A comparison between Islamic and conventional banks of Pakistan. Interdiscip. J. Contemp. Res. Bus. 2012, 4, 405–420. [Google Scholar]

- Ståhle, P.; Ståhle, S.; Aho, S. Value added intellectual coefficient (VAIC): A critical analysis. J. Intellect. Cap. 2011, 12, 531–551. [Google Scholar] [CrossRef]

- Iazzolino, G.; Laise, D. Value added intellectual coefficient (VAIC): A methodological and critical review. J. Intellect. Cap. 2013, 14, 547–563. [Google Scholar] [CrossRef]

- Pulic, A. VAICTM an accounting tool for IC management. Int. J. Technol. Manag. 2000, 20, 702–714. [Google Scholar] [CrossRef]

- Shehata, M.E.; El-Gohary, K.M. Towards improving construction labor productivity and projects’ performance. Alex. Eng. J. 2011, 50, 321–330. [Google Scholar] [CrossRef]

- Chen, F.-C.; Liu, Z.-J.; Kweh, Q.L. Intellectual capital and productivity of Malaysian general insurers. Econ. Model. 2014, 36, 413–420. [Google Scholar] [CrossRef]

- Phusavat, K.; Comepa, N.; Sitko-Lutek, A.; Ooi, K. Productivity management: Integrating the intellectual capital. Ind. Manag. Data Syst. 2013, 113, 840–855. [Google Scholar] [CrossRef]

- Tran, N.P.; Vo, D.H. Human capital efficiency and firm performance across sectors in an emerging market. Cogent Bus. Manag. 2020, 7, 1738832. [Google Scholar] [CrossRef]

- Chowdhury, L.A.M.; Rana, T.; Azim, M.I. Intellectual capital efficiency and organisational performance: In the context of the pharmaceutical industry in Bangladesh. J. Intellect. Cap. 2019, 20, 784–806. [Google Scholar] [CrossRef]

- Petty, R.; Guthrie, J. Intellectual capitalliterature review: Measurement, reporting and management. J. Intellect. Cap. 2000, 1, 155–176. [Google Scholar] [CrossRef]

- Pedro, E.; Leitão, J.C.; Alves, H. Back to the Future of Intellectual Capital Research: A Systematic Literature Review. Manag. Decis. 2018, 56, 2502–2583. [Google Scholar] [CrossRef]

- Pulic, A. Measuring the performance of intellectual potential in knowledge economy. In Proceedings of the 2nd McMaster Word Congress on Measuring and Managing Intellectual Capital by the Austrian Team for Intellectual Potential; McMaster University: Hamilton, ON, Canada, 1998; pp. 1–20. [Google Scholar]

- Pulic, A. Basic Information on VAICTM. 1999. Available online: https://www.vaic-on.net (accessed on 1 October 2023).

- Pulic, A. The principles of intellectual capital efficiency-A brief description. Croat. Intellect. Cap. Cent. Zagreb 2008, 76. [Google Scholar]

- Pulic, A. MVA and VAIC Analysis of Randomly Selected Companies from FTSE 250; Austrian Intellectual Capital Research Center: Graz, Austria, 2000. [Google Scholar]

- Dunn, J.; Laing, G.; Hughes-Lucas, S. Applying the VAICTM model to Australian hotels. J. Intellect. Cap. 2010, 11, 269–283. [Google Scholar] [CrossRef]

- Venkatraman, N. The Concept of Fit in Strategy Research: Toward Verbal and Statistical Correspondence. Acad. Manag. Rev. 1989, 14, 423–444. [Google Scholar] [CrossRef]

- “Enterprise Surveys Indicators Data-World Bank Group”, World Bank. Available online: https://www.enterprisesurveys.org/en/enterprisesurveys (accessed on 10 November 2022).

- Bontis, N. Intellectual capital: An exploratory study that develops measures and models. Manag. Decis. 1998, 36, 63–76. [Google Scholar] [CrossRef]

- Blundell, R.; Bond, S.; Windmeijer, F. Estimation in dynamic panel data models: Improving on the performance of the standard GMM estimator. In Nonstationary Panels, Panel Cointegration, and Dynamic Panels; Baltagi, B.H., Fomby, T.B., Carter Hill, R., Eds.; Advances in Econometrics; Emerald Group Publishing Limited: Bingley, UK, 2001; Volume 15, pp. 53–91. ISBN 978-1-84950-065-4. [Google Scholar]

- Adegboye, A.C.; Iweriebor, S. Does Access to Finance Enhance SME Innovation and Productivity in Nigeria? Evidence from the World Bank Enterprise Survey. Afr. Dev. Rev. 2018, 30, 449–461. [Google Scholar] [CrossRef]

- Dollar, D.; Hallward-Driemeier, M.; Mengistae, T. Investment Climate and Firm Performance in Developing Economies. Econ. Dev. Cult. Chang. 2005, 54, 1–31. [Google Scholar] [CrossRef]

- Costamagna, R.; Idrovo Carlier, S.; Mendi, P. Initial informality as an obstacle to intellectual capital acquisitions: Empirical evidence from Latin America. J. Intellect. Cap. 2019, 20, 472–487. [Google Scholar] [CrossRef]

- Larsen, H.T.; Bukh, P.N.; Mouritsen, J. Intellectual Capital Statements and Knowledge Management: “Measuring”, “Reporting”, “Acting”. Aust. Account. Rev. 1999, 9, 15–26. [Google Scholar] [CrossRef]

- Nunnally, J.C. An Overview of Psychological Measurement. In Clinical Diagnosis of Mental Disorders; Wolman, B.B., Ed.; Springer: Boston, MA, USA, 1978; pp. 97–146. ISBN 978-1-4684-2492-8. [Google Scholar]

- Chin, W.W. Commentary: Issues and Opinion on Structural Equation Modeling. MIS Q. 1998, 22, vii–xvi. [Google Scholar]

- Fornell, C. A Second Generation of Multivariate Analysis: Classification of Methods and Implications for Marketing Research. 2006. Available online: https://deepblue.lib.umich.edu/bitstream/handle/2027.42/35621/b1408124.0001.001.pdf?sequence=2 (accessed on 1 October 2023).

- Sharma, P. Enterprise Value and Intellectual Capital: Study of BSE 500 Firms. Account. Financ. Res. 2018, 7, 123. [Google Scholar] [CrossRef]

- A Partial Least Squares Latent Variable Modeling Approach for Measuring Interaction Effects: Results from a Monte Carlo Simulation Study and an Electronic-Mail Emotion/Adoption Study|Information Systems Research. Available online: https://pubsonline.informs.org/doi/10.1287/isre.14.2.189.16018 (accessed on 25 November 2023).

- Bukhari, S.M.B.R.; Shoaib, M.; Nasir, A. Sustainable Growth and Profitability in the Pakistani Insurance Sector: An Intellectual Capital Perspective. Glob. Econ. Rev. 2021, VI, 131–148. [Google Scholar] [CrossRef]

- Ali, S.; Murtaza, G.; Hedvicakova, M.; Jiang, J.; Naeem, M. Intellectual capital and financial performance: A comparative study. Front. Psychol. 2022, 13, 967820. [Google Scholar] [CrossRef]

- Gul, S.; Khan, A.G.; Ajmair, M. Relationship between Human Capital and Labour Productivity. Pak. Soc. Sci. Rev. 2022, 6, 663–677. [Google Scholar] [CrossRef]

- The Effects of Intangible Assets on Firm Performance: An Empirical Investigation on Selective Listed Manufacturing Firms in DSE, Bangladesh|Emerald Insight. Available online: https://www.emerald.com/insight/content/doi/10.1108/AJB-11-2018-0065/full/html (accessed on 25 November 2023).

- Marti, J.M.V.; do Rosário Cabrita, M. Advancing the Intellectual Capital Theory- Some Ways Forward. Eur. Conf. Knowl. Manag. 2023, 24, 1399–1409. [Google Scholar] [CrossRef]

- Viedma, J. ICBS: Intellectual Capital Benchmarking Systems. J. Intellect. Cap. 2001, 2, 148–165. [Google Scholar] [CrossRef]

- Alhassan, A.L.; Asare, N. Intellectual capital and bank productivity in emerging markets: Evidence from Ghana. Manag. Decis. 2016, 54, 589–609. [Google Scholar] [CrossRef]

- Habib, M.; Abbas, J.; Noman, R. Are human capital, intellectual property rights, and research and development expenditures really important for total factor productivity? An empirical analysis. Int. J. Soc. Econ. 2019, 46, 756–774. [Google Scholar] [CrossRef]

- Manasserian, T.; Yang, X.; Lim, Y.T.; Seo, S.-Y. New Realities for International Trade and Political Implications for the Emerging Economies. J. Korea Res. Assoc. Int. Commer. 2007, 6, 67–84. [Google Scholar]

- González, X.; Miles-Touya, D.; Pazó, C. R&D, worker training and innovation: Firm-level evidence. Ind. Innov. 2016, 23, 694–712. [Google Scholar] [CrossRef]

- Qingdao Agricultural University, School of Management; Xu, J.; Liu, F. Korea University Business School The Impact of Intellectual Capital on Firm Performance: A Modified and Extended VAIC Model. J. Compet. 2020, 12, 161–176. [Google Scholar] [CrossRef]

- Phusavat, K.; Comepa, N.; Sitko-Lutek, A.; Ooi, K.-B. Interrelationships between intellectual capital and performance: Empirical examination. Ind. Manag. Data Syst. 2011, 111, 810–829. [Google Scholar] [CrossRef]

- Maji, S.G.; Goswami, M. Intellectual capital and firm performance in emerging economies: The case of India. Rev. Int. Bus. Strategy 2016, 26, 410–430. [Google Scholar] [CrossRef]

- Sarwar, S.Z.; Ishaque, A.; Ehsan, N.; Pirzada, D.S.; Nasir, Z.M. Identifying productivity blemishes in Pakistan automotive industry: A case study. Int. J. Product. Perform. Manag. 2012, 61, 173–193. [Google Scholar] [CrossRef]

- Wang, X.; Wang, L.; Wang, S.; Fan, F.; Ye, X. Marketisation as a channel of international technology diffusion and green total factor productivity: Research on the spillover effect from China’s first-tier cities. Technol. Anal. Strateg. Manag. 2021, 33, 491–504. [Google Scholar] [CrossRef]

| IC Measuring Method | Analysis and Relevance to the Proposed Research |

|---|---|

| Market Value to Book Value Ratio (MV/BV) | Shows how much the firm is valued beyond its financial strength. Since other external factors influence intellectual capital, this technique was not chosen. |

| Balanced Score Card (BSC) | The BSC metric shows the value growth at each firm’s stage from a financial, customer, and internal process perspective. Stage-wise results of IC were not required in the proposed research. |

| Skandia Navigator | Skandia Navigator measures intellectual capital through five components: financial, customer, process, renewal, development, and human. In the developing world, acquiring accurate data for these components is difficult. |

| Economic Value Added (EVA) | The EVA is related to budgeting, financial planning, goal targeting, stock pricing, and incentive compensation, but does not cater to gains of good project management or intellectual capital. EVA is primarily a financial performance measure. |

| Direct Intellectual Capital (DIC) method | The DIC method gives monetary value to intangibles, but is nonfinancial (contextual) and specific to each organization, so it cannot work in the proposed research. |

| Value-Added Intellectual Coefficient (VAIC) | The VAIC provides a definite value to intellectual capital efficiency, i.e., the firm performance of each firm, which other approaches do not [39]. Additionally, labor productivity gives a definite value productivity to each firm as well. |

| Market Capitalization (MC) and Return on Asset (ROA) methods | MC and ROA are just two metrics available to measure the firm performance. Since developing countries’ financial markets are unstable and do not reflect the correct market value of firms, this technique was not used in the proposed research. |

| Ahonen, Edvinsson, and Roos [40,41,42] have discussed intangibles and firm performance in highly cited research | This highly cited research aimed not to find a definite intellectual capital measuring tool, but to contribute to the existing knowledge of intangibles. |

| Reference of Significant Studies | Relevance to Proposed Research |

|---|---|

| Knowledge management and growth in Finnish SMEs [43] measuring intangibles to understand and improve innovation management (MERITUM) [44] is similar to a Malaysian study on SMEs [45] | The proposed study presents actual comparable numbers on intellectual capital performance and productivity and uses knowledge management variables that deal with knowledge productivity, called knowledge-based performance drivers. The value-added intellectual coefficient is used to quantify KBPDs’ performance effects. |

| N. Bontis, W. C. C. Keow, and S. Richardson [10] compare intellectual capital components with firm performance, mostly financially | The proposed research compares intellectual capital plus employed capital with productivity. Annie Brookings, Goran Roos., Thomas Stewart and Nick Bontis emphasized the human factor in intellectual capital, so the VAIC was compared to labor productivity. |

| Bykova and Molodchik [46] compared the VAIC with labor productivity, firm size, sales growth, and profitability in the Russian industry | Because the proposed research is based on knowledge-oriented industry data, R&D and training were added to the investigation. |

| Barkat and Beh [47] investigated VAIC attributes and organizational performance in the textile sector of the same developing country as the proposed research | The proposed research uses the VAIC for performance measurement and labor productivity for productivity values in knowledge-intensive engineering SMEs. |

| R&D and training have been identified as critical factors for IC in a landmark study by Bassi and Buren [48]. Furthermore, several studies on SMEs [49,50,51] found that R&D spending negatively correlates with innovation and value addition in the developing world | The proposed research investigates the R&D spending paradox and training in knowledge-intensive engineering SMEs because these factors cannot be ignored. |

| Studies on the performance and productivity of knowledge-intensive firms in a developing country like Pakistan have been limited to the pharmaceutical [28], electronics [26], textile [47], and banking [52] fields. | The proposed research is more of a population cluster representative, i.e., it has data from more knowledge-intensive engineering firms from diverse geographical areas, is more rigorous, as it includes findings on training and R&D, and provides practical articulation to theoretical concepts on firm performance in developing countries at the national intellectual capital (NIC) level. |

| Variable | How to Calculate | Measures | Rationale |

|---|---|---|---|

| VAIC | The sum of IC and employed capital efficiency | Represents knowledge-based intellectual capital performance | The VAIC gives a definite value to intangible assets |

| Labor Productivity | Synonymous with productivity. It is output/input | The most vital productivity component (labor) | LP is the productivity most relevant to IC |

| Training | Primary data from the ES World Bank survey questionnaire. Secondary data from annual financial reports | Training investment | Vital prerequisites for HC and SC |

| R&D | Primary data from the ES World Bank survey instrument. Secondary data from annual financial reports | R&D investment in labor | Vital prerequisites for SC |

| Various Constituents | Formula | Elaboration |

|---|---|---|

| Value-Added (VA) | VA = OP + EC + D + A | VA is the value added OP is the operating profit EC is the employee cost expenses D is for depreciation A is for amortization |

| Intellectual Capital (IC) | IC = EC + SC SC = VA − HC | OP is the earnings minus taxes Depreciation is (Cost—Residual Value)/useful life Amortization is the asset cost minus the residual value of the lifetime |

| Human Capital Efficiency (HCE) | HCE = VA/HC | |

| Structural Capital Efficiency (SCE) | SCE = SC/VA | |

| Intellectual Capital Efficiency (ICE) | ICE = HCE + SCE | |

| Capital Employed Efficiency (CEE) | CEE = VA/CE | CE is for the total assets—current liabilities |

| Value-Added Intellectual Coefficient (VAIC) | VAIC = HCE + SCE + CEE | Pulic’s VAIC formula [27,38,63,64,65,66] |

| Criteria | Criteria Finalized | SMEDA | Bangladesh | India | USA/Canada/EU |

|---|---|---|---|---|---|

| Employees | <250 | <250 | >250 (Industry Policy 2010) | - | 500–1000 |

| Turnover/revenues | USD 43 M | <USD 1.6 M | - | - | USD 37–48 M |

| Fixed assets, plants, and machines minus buildings and land | <USD 0.66 | <USD 0.66 M | <USD 1.74 M | <USD 1.15 M | - |

| Technique | Usage |

|---|---|

| Generalized method of moments (GMM) | This method equates sample moments to parameter estimates, which was unnecessary here. |

| Partial least squares (PLS-SEM) | A small representative sample was used, but only a few interdependencies were expected in this research. |

| Data envelopment analysis (DEA) | Data envelopment analysis involves decision-making; therefore, it was not necessary for this research. |

| Tobit | The dependent variable is not skewed in one direction; Tobit was unnecessary. |

| Stochastic frontier analysis (SFA) | The SFA cannot consider multiple inputs and outputs. |

| SPSS- PLS | Suitable for this research, as descriptive data were available to find a causal relationship with Pearson’s correlation. |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Khalil, W.I.; Malik, M.O.; Ahsan, A. Sustainability Unleashed through Innovation: Knowledge-Driven Strategies Igniting Labor Productivity in Small- and Medium-Sized Engineering Enterprises. Sustainability 2024, 16, 424. https://doi.org/10.3390/su16010424

Khalil WI, Malik MO, Ahsan A. Sustainability Unleashed through Innovation: Knowledge-Driven Strategies Igniting Labor Productivity in Small- and Medium-Sized Engineering Enterprises. Sustainability. 2024; 16(1):424. https://doi.org/10.3390/su16010424

Chicago/Turabian StyleKhalil, Wali Imran, Muhammad Omar Malik, and Ali Ahsan. 2024. "Sustainability Unleashed through Innovation: Knowledge-Driven Strategies Igniting Labor Productivity in Small- and Medium-Sized Engineering Enterprises" Sustainability 16, no. 1: 424. https://doi.org/10.3390/su16010424

APA StyleKhalil, W. I., Malik, M. O., & Ahsan, A. (2024). Sustainability Unleashed through Innovation: Knowledge-Driven Strategies Igniting Labor Productivity in Small- and Medium-Sized Engineering Enterprises. Sustainability, 16(1), 424. https://doi.org/10.3390/su16010424