Impact of Heterogeneous Environmental Regulations on Green Innovation Efficiency in China’s Industry

Abstract

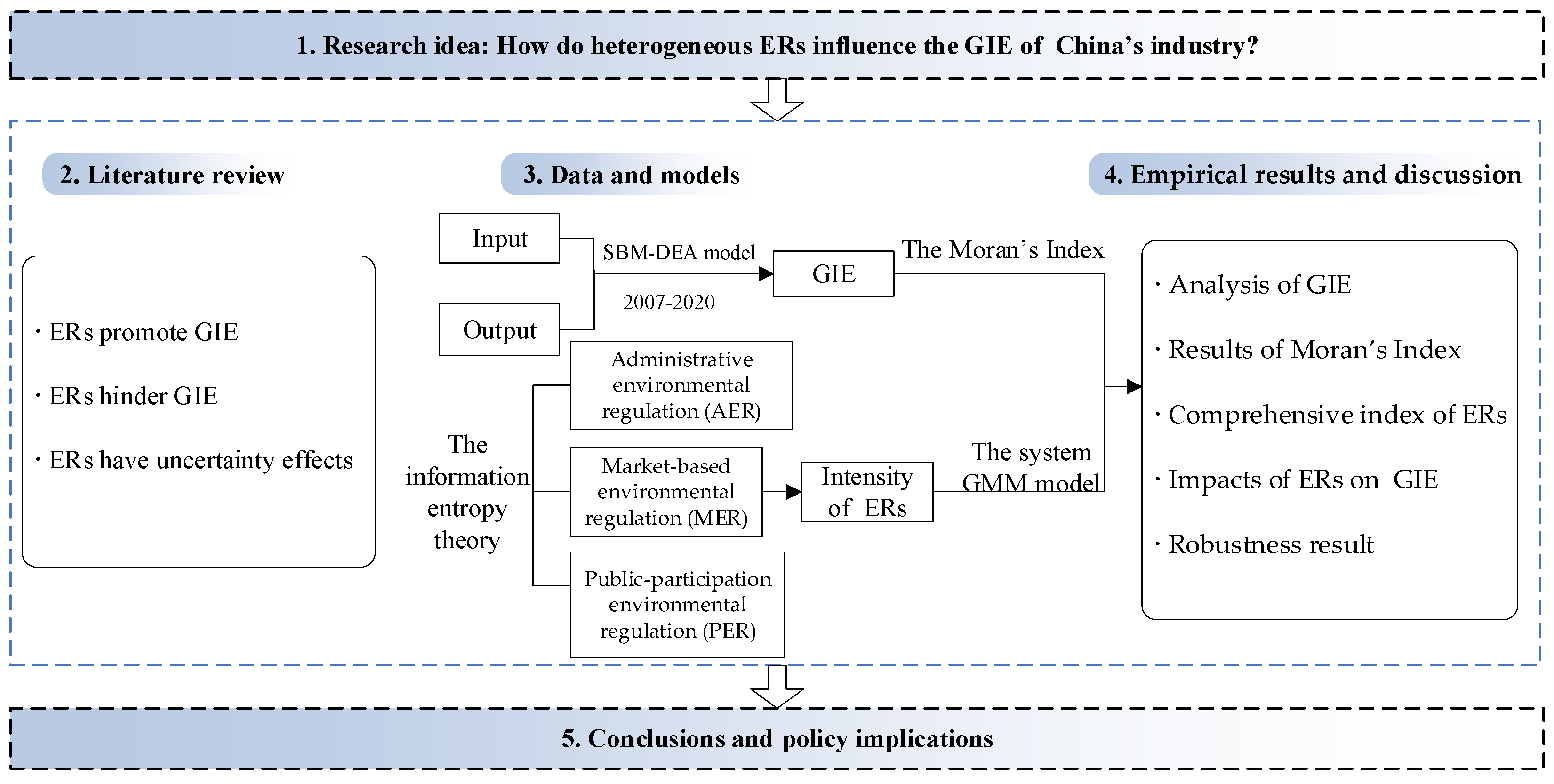

1. Introduction

2. Literature Review

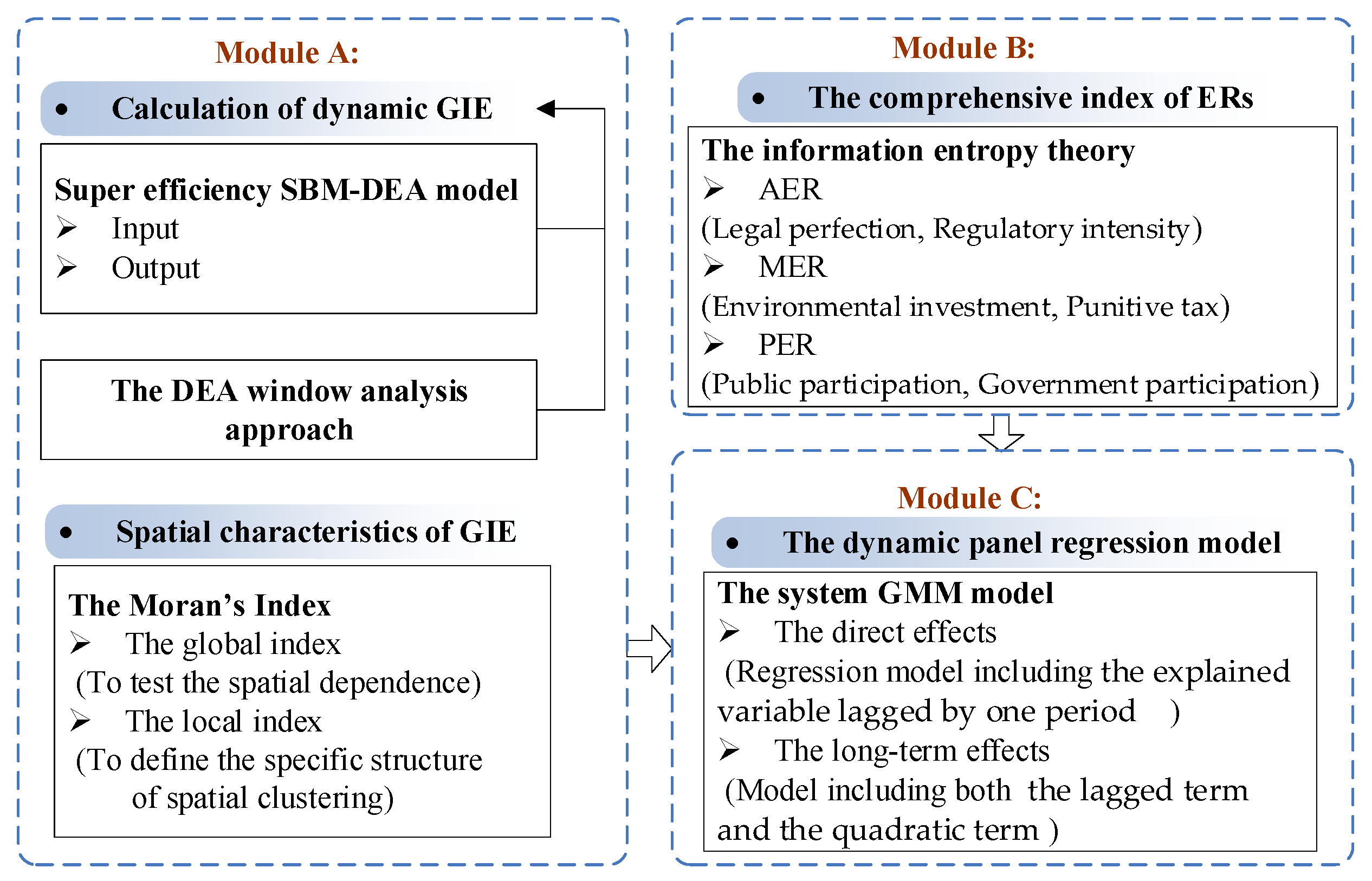

3. Data Sources and Methods

3.1. Data Definitions

3.1.1. Green Innovation Efficiency

3.1.2. Environmental Regulations

3.1.3. Description of Regression Variables

3.2. Methods

3.2.1. The Dynamic Super-Efficiency SBM-DEA Model

3.2.2. Moran’s Index

3.2.3. Information Entropy Theory

3.2.4. System GMM Model

3.3. Data Sources

4. Empirical Results and Discussion

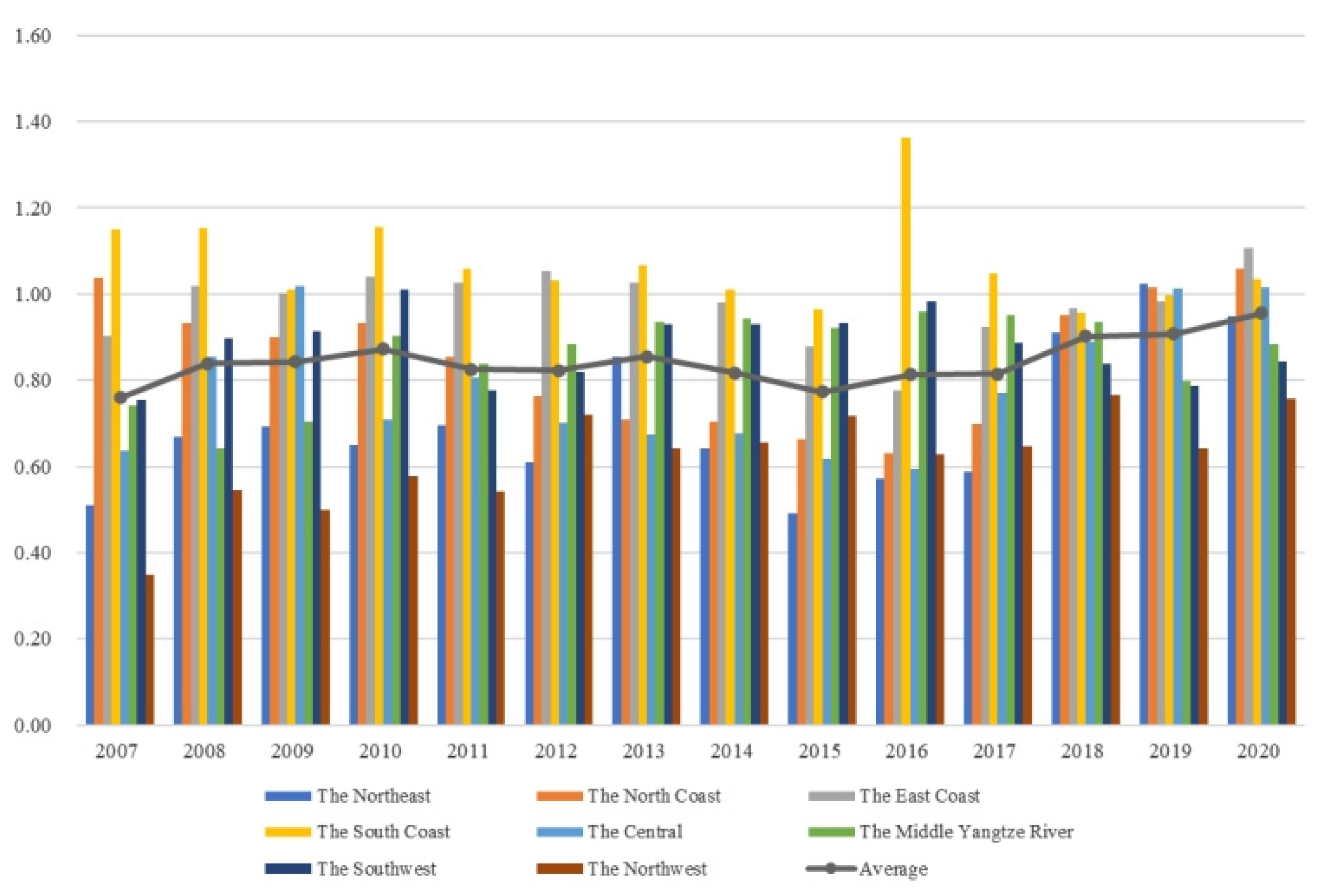

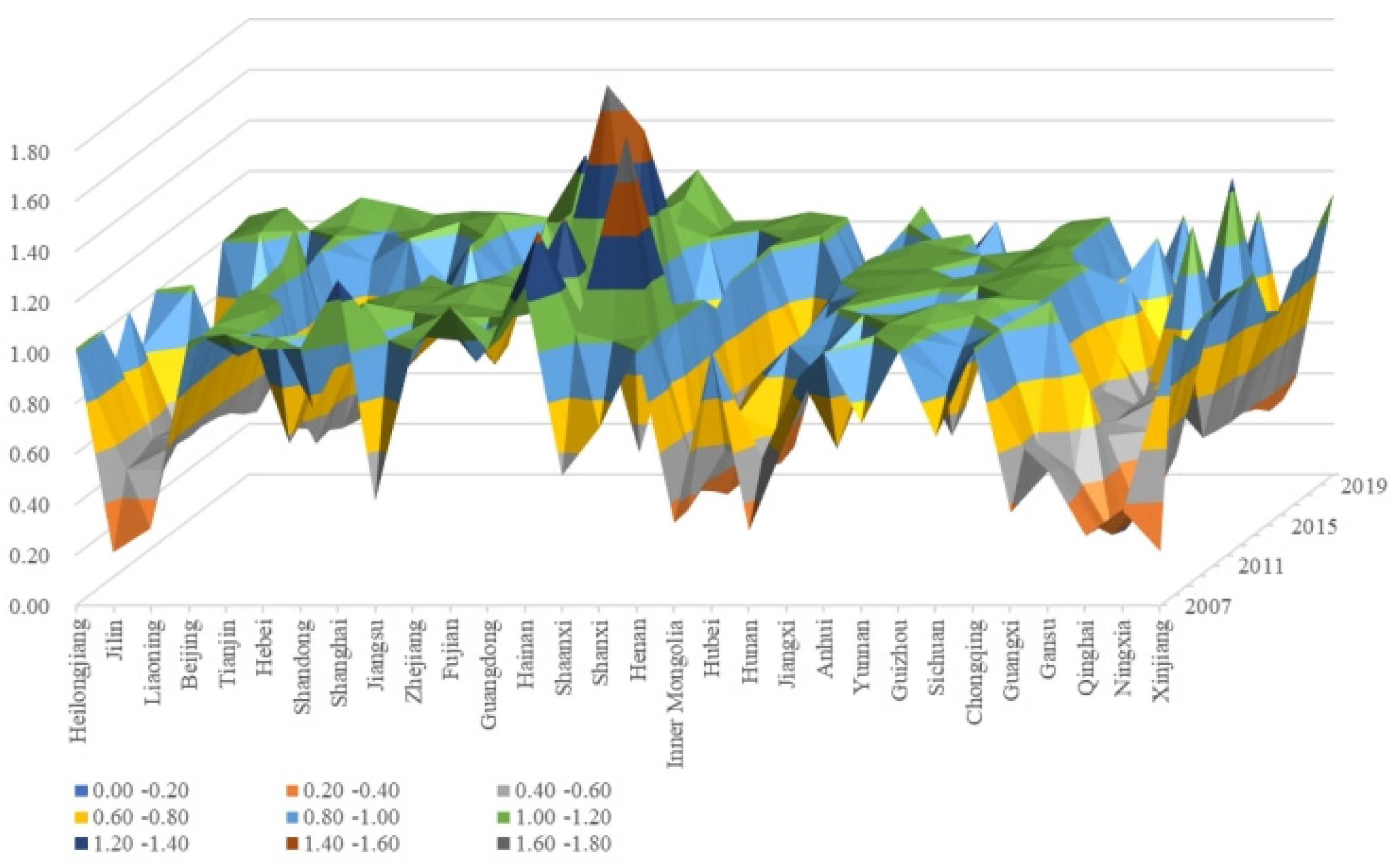

4.1. Analysis of GIE in China’s Industry

4.2. The Results of Moran’s Index

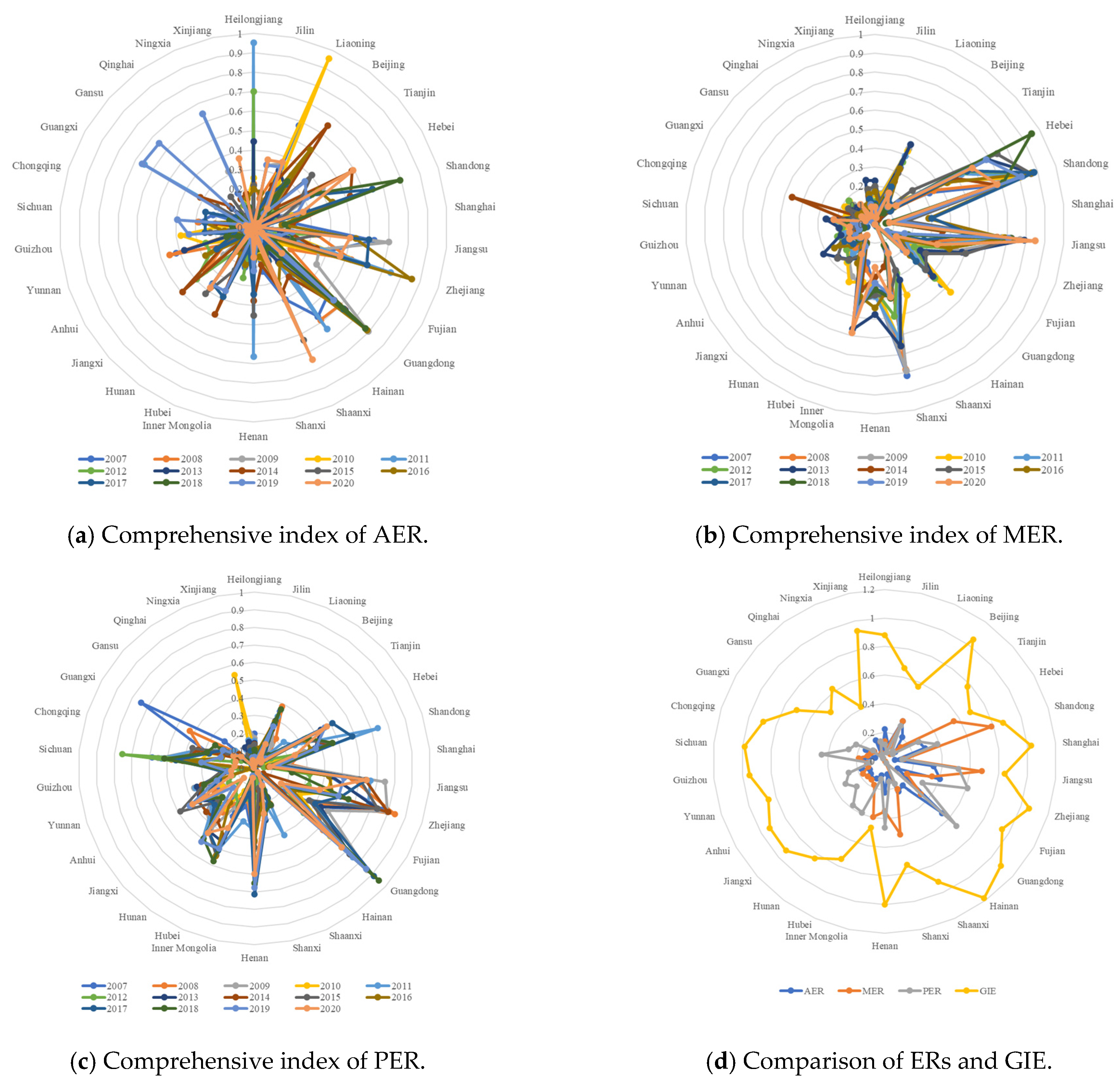

4.3. The Comprehensive Index of ERs

4.4. Heterogeneous Impacts of ERs on Industrial GIE

4.5. Robustness Result

5. Conclusions and Policy Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Adam, Z. Green Development-Environment and Sustainability in a Developing World; Routledge: London, UK, 2009. [Google Scholar]

- Wang, J.; Hu, M.; Rodrigues, J.F.D. The evolution and driving forces of industrial aggregate energy intensity in China: An extended decomposition analysis. Appl. Energy 2018, 228, 2195–2206. [Google Scholar] [CrossRef]

- Liu, L.J.; Jiang, J.Y.; Bian, J.C.; Liu, Y.Z.; Lin, G.H.; Yin, Y.K. Are environmental regulations holding back industrial growth? Evidence from China. J. Clean. Prod. 2021, 306, 127007. [Google Scholar] [CrossRef]

- Hille, E.; Möbius, P. Environmental Policy, Innovation, and Productivity Growth: Controlling the Effects of Regulation and Endogeneity. Environ. Resour. Econ. 2019, 73, 1315–1355. [Google Scholar] [CrossRef]

- Sheng, Q.; Pan, Y.X.; Feng, Y.C. Identifying and assessing the multiple effects of informal environmental regulation on carbon emissions in China. Environ. Res. 2023, 237, 116931. [Google Scholar] [CrossRef] [PubMed]

- Shen, W.F.; Shi, J.N.; Meng, Q.G.; Chen, X.L.; Liu, Y.F.; Cheng, K.; Liu, W.B. Influences of Environmental Regulations on Industrial Green in China. Sustainability 2022, 14, 4717. [Google Scholar] [CrossRef]

- Zhao, T.; Zhou, H.H.; Jiang, J.D.; Yan, W.Y. Impact of Green Finance and Environmental Regulations on the Green Innovation Efficiency in China. Sustainability 2022, 14, 3206. [Google Scholar] [CrossRef]

- Huang, J.H.; Yang, X.G.; Cheng, G.; Wang, S.Y. A comprehensive eco-efficiency model and dynamics of regional eco-efficiency in China. J. Clean. Prod. 2014, 67, 228–238. [Google Scholar] [CrossRef]

- Korhonen, J.; Pätäri, S.; Toppinen, A.; Tuppura, A. The role of environmental regulation in the future competitiveness of the pulp and paper industry: The case of the sulfur emissions directive in northern Europe. J. Clean. Prod. 2015, 108, 864–872. [Google Scholar] [CrossRef]

- Zhang, J.X.; Kang, L.; Li, H.; Ballesteros-Pérez, P.; Skitmore, M.; Zuo, J. The impact of environmental regulations on urban Green innovation efficiency: The case of Xi’an. Sustain. Cities Soc. 2020, 57, 102123. [Google Scholar] [CrossRef]

- Zhang, J.X.; Ouyang, Y.; Ballesteros-Pérez, P.; Li, H.P.; Philbin, S.; Li, Z.L.; Skitmore, M. Understanding the impact of environmental regulations on green technology innovation efficiency in the construction industry. Sustain. Cities Soc. 2021, 65, 102647. [Google Scholar] [CrossRef]

- Xu, Y.J.; Liu, S.G.; Wang, J.Y. Impact of environmental regulation intensity on green innovation efficiency in the Yellow River Basin, China. J. Clean. Prod. 2022, 373, 133789. [Google Scholar] [CrossRef]

- Cai, X.; Zhu, B.Z.; Zhang, H.J.; Li, L.; Xie, M.Y. Can direct environmental regulation promote green technology innovation in heavily polluting industries? Evidence from Chinese listed companies. Sci. Total Environ. 2020, 746, 140810. [Google Scholar] [CrossRef] [PubMed]

- Sun, Z.Y.; Wang, X.P.; Liang, C.; Cao, F.; Wang, L. The impact of heterogeneous environmental regulation on innovation of high-tech enterprises in China: Mediating and interaction effect. Environ. Sci. Pollut. Res. 2021, 28, 8323–8336. [Google Scholar] [CrossRef]

- Peng, H.; Shen, N.; Ying, H.Q.; Wang, Q.W. Can environmental regulation directly promote green innovation behavior? based on situation of industrial agglomeration. J. Clean. Prod. 2021, 312, 128044. [Google Scholar] [CrossRef]

- Testa, F.; Iraldo, F.; Frey, M. The effect of environmental regulation on firms’ competitive performance: The case of the building & construction sector in some EU regions. J. Environ. Manag. 2011, 92, 2136–2144. [Google Scholar] [CrossRef]

- Hu, S.; Liu, S. Do the coupling effects of environmental regulation and R&D subsidies work in the development of green innovation? Empirical evidence from China. Clean Technol. Environ. Policy 2019, 21, 1739–1749. [Google Scholar]

- Luo, Y.S.; Salman, M.; Lu, Z.N. Heterogeneous impacts of environmental regulations and foreign direct investment on green innovation across different regions in China. Sci. Total Environ. 2021, 759, 143744. [Google Scholar] [CrossRef]

- Dong, Z.Q.; Wang, H. Local-neighborhood effect of green technology of environmental regulation. China Ind. Econ. 2019, 370, 104–122. [Google Scholar]

- Herman, K.S.; Xiang, J. Environmental regulatory spillovers, institutions, and clean technology innovation: A panel of 32 countries over 16 years. Energy Res. Soc. Sci. 2020, 62, 101363. [Google Scholar] [CrossRef]

- Anselin, L. Spatial Econometrics: Methods and Models; Springer Science & Business Media: Berlin/Heidelberg, Germany, 2013. [Google Scholar]

- Fan, F.; Lian, H.; Liu, X.Y.; Wang, X.L. Can environmental regulation promote urban green innovation Efficiency? An empirical study based on Chinese cities. J. Clean. Prod. 2021, 287, 125060. [Google Scholar] [CrossRef]

- Shao, X.Y.; Liu, S.; Ran, R.P.; Liu, Y.Q. Environmental regulation, market demand, and green innovation: Spatial perspective evidence from China. Environ. Sci. Pollut. Res. 2022, 29, 63859–63885. [Google Scholar] [CrossRef] [PubMed]

- Fang, Z.; Bai, H.; Bilan, Y. Evaluation research of green innovation efficiency in China’s heavy polluting industries. Sustainability 2020, 12, 146. [Google Scholar] [CrossRef]

- Xie, P.X.; Zhuo, L.; Yang, X.; Huang, H.R.; Gao, X.R.; Wu, P.T. Spatial-temporal variations in blue and green water resources, water footprints and water scarcities in a large river basin: A case for the Yellow River basin. J. Hydrol. 2020, 590, 125222. [Google Scholar] [CrossRef]

- Zheng, D.; Shi, M. Multiple environmental policies and pollution haven hypothesis: Evidence from China’s polluting industries. J. Clean. Prod. 2017, 141, 295–304. [Google Scholar] [CrossRef]

- Abualigah, L.; Elaziz, M.A.; Sumari, P.; Geem, Z.W.; Gandomi, A.H. Reptile Search Algorithm (RSA): A nature-inspired meta-heuristic optimizer. Expert Syst. Appl. 2022, 191, 116158. [Google Scholar] [CrossRef]

- Gyedu, S.; Heng, T.; Ntarmah, A.H.; He, Y.Q.; Frimppong, E. The impact of innovation on economic growth among G7 and BRICS countries: A GMM style panel vector autoregressive approach. Technol. Forecast. Soc. Chang. 2021, 173, 121169. [Google Scholar] [CrossRef]

- Zhang, Z.Y.; Li, R.F.; Song, Y.; Sahut, J.M. The impact of environmental regulation on the optimization of industrial structure in energy-based cities. Res. Int. Bus. Financ. 2024, 68, 102154. [Google Scholar] [CrossRef]

- Liu, Y.Q.; Zhu, J.L.; Li, Y.E.; Meng, Z.Y.; Song, Y. Environmental regulation, green technological innovation, and ecoefficiency: The case of Yangtze river economic belt in China. Technol. Forecast. Soc. Chang. 2020, 155, 119993. [Google Scholar] [CrossRef]

- Gao, P.; Wang, H. Fiscal Input, Environmental Regulation and Efficiency of Green Technological Innovation: Based on the Data of Large Industrial Enterprises from 2008 to 2015. Ecol. Econ. 2018, 34, 93–99. (In Chinese) [Google Scholar]

- Zhang, Y.; Wang, J.; Xue, Y.; Yang, J. Impact of environmental regulations on green technological innovative behavior: An empirical study in China. J. Clean. Prod. 2018, 188, 763–773. [Google Scholar] [CrossRef]

- Tone, K. A slacks-based measure of super-efficiency in data envelopment analysis. Eur. J. Oper. Res. 2002, 143, 32–41. [Google Scholar] [CrossRef]

- Fried, H.O.; Lovell, C.A.K.; Schmidt, S.S.; Yaisawarng, S. Accounting for Environmental Effects and Statistical Noise in Data Envelopment Analysis. J. Prod. Anal. 2002, 17, 157–174. [Google Scholar] [CrossRef]

- Tone, K. A slacks-based measure of efficiency in data envelopment analysis. Eur. J. Oper. Res. 2001, 130, 498–509. [Google Scholar] [CrossRef]

- Li, G.; Wang, P.; Pal, R. Measuring sustainable technology R&D innovation in China: A unified approach using DEA-SBM and projection analysis. Expert Syst. Appl. 2022, 209, 118393. [Google Scholar] [CrossRef]

- Charnes, A.; Cooper, W.W. Preface to topics in data envelopment analysis. Ann. Oper. Res. 1984, 2, 59–94. [Google Scholar] [CrossRef]

- Zhang, Y.J.; Hao, J.F. The evaluation of environmental capacity: Evidence in Hunan province of China. Ecol. Indic. 2016, 60, 514–523. [Google Scholar] [CrossRef]

- Moran, P.A.P. The interpretation of statistical maps. J. R. Stat. Soc. Ser. B (Methodol.) 1948, 10, 243–251. [Google Scholar] [CrossRef]

- Anselin, L. Local Indicators of Spatial Association-LISA. Geogr. Anal. 1995, 27, 93–115. [Google Scholar] [CrossRef]

- Yuan, J.H.; Li, X.Y.; Xu, C.B.; Zhao, C.H.; Liu, Y.X. Investment risk assessment of coal-fired powerplants in countries along the belt and road initiative based on ANP-entropy-TODIM method. Energy 2019, 176, 623–640. [Google Scholar] [CrossRef]

- Lüdtke, N.; Panzeri, S.; Brown, M.; Broomhead, D.S.; Knowles, J.; Montemurro, M.A.; Kell, D.b. Information-theoretic Sensitivity Analysis: A general method for credit assignment in complex networks. J. R. Soc. Interface 2008, 5, 223–235. [Google Scholar] [CrossRef]

- Zhang, Y.J.; Hao, J.F.; Song, J. The CO2 emission efficiency, reduction potential and spatial clustering in China’s industry: Evidence from the regional level. Appl. Energy 2016, 174, 213–223. [Google Scholar] [CrossRef]

- Roodman, D. How to do xtabond an introduction to difference and system GMM in Stata. Stata J. 2009, 9, 86–136. [Google Scholar] [CrossRef]

- Li, R.; Ramanathan, R. Exploring the relationships between different types of environmental regulations and environmental performance: Evidence from China. J. Clean. Prod. 2018, 196, 1329–1340. [Google Scholar] [CrossRef]

- Wang, Y.; Sun, X.; Guo, X. Environmental regulation and green productivity growth: Empirical evidence on the Porter Hypothesis from OECD industrial sectors. Energy Policy 2019, 132, 611–619. [Google Scholar] [CrossRef]

| Reference | Impact of ERs on GIE | Spatial Characteristics | ER Index | Method |

|---|---|---|---|---|

| Zhang et al. [10] | Uncertain | × | Single | SBM-DDF model |

| Zhang et al. [11] | Uncertain | × | Single | Network DEA model; Tobit regression model |

| Xu et al. [12] | Positive | × | Multidimensional | SBM-DEA model; Threshold model |

| Cai et al. [13] | Positive | × | Multidimensional | Panel counting model |

| Sun et al. [14] | Positive | × | Single | Mediating effect; Interaction effect |

| Peng et al. [15] | Negative | × | Single | Mediation and moderation analysis |

| Testa et al. [16] | Negative | × | Multidimensional | Regression analysis |

| Hu and Liu [17] | Negative | × | Single | SBM-DEA model |

| Luo et al. [18] | Uncertain | × | Single | System-GMM model |

| Fan et al. [22] | Positive | √ | Multidimensional | SBM model; Moran’s Index |

| Shao et al. [23] | Heterogeneous | √ | Multidimensional | Mechanism analysis; Heterogeneity analysis |

| This paper | Heterogeneous | √ | Multidimensional | Dynamic super-efficiency SBM-DEA model; Moran’s Index; Information entropy theory; System GMM model |

| Category | Indicator | Specific Indicator | Unit |

|---|---|---|---|

| Input | Capital input | R&D expenditure | 10,000 CNY |

| R&D personnel | The full-time equivalent of R&D | Person-years | |

| Power/Resource input | Total electricity consumption | 100 million kWh | |

| Energy consumption | 10,000 tons standard coal | ||

| Output | Innovation output | Number of patent applications | Piece |

| Number of new product development projects | Piece | ||

| Economic output | Industrial added value | 10,000 CNY | |

| Undesirable output | Industrial wastewater discharge | 10,000 tons | |

| Industrial SO2 emissions | 10,000 tons | ||

| Industrial smoke/powder dust emissions | 10,000 tons |

| Category | Indicator | Specific Indicator | Unit |

|---|---|---|---|

| Administrative environmental regulation (AER) | Legal perfection | Newly issued local laws and regulations | Piece |

| Regulatory intensity | Environment-related administrative penalty cases | Piece | |

| Market-based environmental regulation (MER) | Environmental investment | Industrial pollution control completed investment | 10,000 CNY |

| Punitive tax | Amount of sewage charges released to the treasury | 10,000 CNY | |

| Public-participation environmental regulation (PER) | Public participation | Written letters related to environmental problems | Piece |

| Government participation | Number of People’s Congress recommendations undertaken by the government | Piece | |

| Number of People’s Congress proposals undertaken by the government | Piece |

| Variable | Mean | Std.dev. | Min | Max | Obs | VIF |

|---|---|---|---|---|---|---|

| GIE | 0.837 | 0.268 | 0.178 | 1.776 | 420 | — |

| AER | 0.180 | 0.200 | 0.00003 | 0.952 | 420 | 1.299 |

| MER | 0.235 | 0.202 | 0.0005 | 0.952 | 420 | 2.118 |

| PER | 0.247 | 0.202 | 0.001 | 0.951 | 420 | 2.539 |

| EDL | 39,563.172 | 23,291.955 | 7778 | 133,781.630 | 420 | 1.947 |

| IS | 0.423 | 0.083 | 0.160 | 0.620 | 420 | 1.866 |

| FDI | 35.811 | 35.282 | 0.026 | 149.511 | 420 | 1.951 |

| TMA | 772.614 | 712.469 | 27.530 | 3458.893 | 420 | 4.514 |

| Region | Province | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | Average |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Northeast ☐ | Heilongjiang | 1.014 | 1.017 | 1.009 | 0.860 | 1.007 | 0.820 | 1.010 | 0.960 | 0.559 | 0.517 | 0.531 | 1.001 | 1.007 | 1.022 | 0.881 |

| Jilin | 0.210 | 0.495 | 0.510 | 0.541 | 0.527 | 0.463 | 1.028 | 0.489 | 0.467 | 0.703 | 0.705 | 1.037 | 1.054 | 1.056 | 0.663 | |

| Liaoning | 0.304 | 0.497 | 0.559 | 0.549 | 0.556 | 0.543 | 0.521 | 0.476 | 0.446 | 0.500 | 0.531 | 0.695 | 1.006 | 0.768 | 0.568 | |

| North Coast × | Beijing | 1.044 | 1.025 | 1.028 | 1.049 | 1.069 | 1.053 | 1.065 | 1.074 | 1.179 | 0.981 | 1.011 | 1.023 | 1.023 | 1.096 | 1.051 |

| Tianjin | 1.072 | 0.945 | 0.997 | 1.050 | 1.043 | 0.502 | 0.476 | 0.456 | 0.394 | 0.424 | 0.546 | 0.917 | 0.990 | 1.066 | 0.777 | |

| Hebei | 1.011 | 1.019 | 0.561 | 0.616 | 0.480 | 0.494 | 0.462 | 0.449 | 0.441 | 0.484 | 0.537 | 1.013 | 1.016 | 1.028 | 0.686 | |

| Shandong | 1.017 | 0.737 | 1.009 | 1.012 | 0.824 | 1.007 | 0.837 | 0.837 | 0.634 | 0.632 | 0.702 | 0.847 | 1.039 | 1.042 | 0.870 | |

| East Coast + | Shanghai | 1.288 | 1.025 | 1.119 | 1.043 | 1.018 | 1.048 | 1.022 | 1.029 | 0.894 | 0.769 | 1.029 | 1.024 | 1.072 | 1.036 | 1.030 |

| Jiangsu | 0.412 | 1.009 | 0.823 | 1.039 | 1.030 | 1.032 | 1.019 | 0.886 | 0.713 | 0.592 | 0.628 | 0.805 | 0.799 | 1.018 | 0.843 | |

| Zhejiang | 1.011 | 1.021 | 1.063 | 1.037 | 1.032 | 1.077 | 1.042 | 1.029 | 1.031 | 0.971 | 1.118 | 1.075 | 1.078 | 1.265 | 1.061 | |

| South Coast ✭ | Fujian | 1.181 | 1.006 | 0.881 | 1.021 | 1.006 | 1.005 | 1.009 | 0.951 | 0.952 | 0.865 | 0.905 | 0.814 | 0.797 | 0.839 | 0.945 |

| Guangdong | 1.009 | 1.015 | 1.061 | 1.031 | 1.061 | 1.036 | 1.037 | 1.026 | 1.023 | 1.700 | 1.102 | 1.045 | 1.059 | 1.057 | 1.090 | |

| Hainan | 1.260 | 1.440 | 1.091 | 1.418 | 1.110 | 1.056 | 1.158 | 1.051 | 0.920 | 1.518 | 1.138 | 1.011 | 1.131 | 1.205 | 1.179 | |

| Central ◎ | Shaanxi | 0.514 | 1.041 | 1.015 | 1.010 | 0.922 | 1.011 | 1.011 | 1.008 | 0.823 | 0.698 | 0.829 | 1.018 | 1.004 | 1.001 | 0.922 |

| Shanxi | 0.702 | 1.006 | 1.776 | 0.484 | 1.017 | 0.496 | 0.477 | 0.418 | 0.397 | 0.396 | 0.651 | 0.505 | 1.006 | 1.008 | 0.739 | |

| Henan | 1.007 | 1.029 | 0.911 | 1.007 | 1.005 | 1.010 | 0.935 | 1.004 | 1.008 | 1.013 | 1.020 | 1.010 | 1.010 | 1.039 | 1.001 | |

| Inner Mongolia | 0.327 | 0.335 | 0.375 | 0.332 | 0.279 | 0.283 | 0.271 | 0.273 | 0.243 | 0.266 | 0.582 | 1.027 | 1.029 | 1.017 | 0.474 | |

| Middle Yangtze River ※ | Hubei | 1.008 | 0.573 | 0.677 | 0.764 | 0.683 | 0.740 | 0.751 | 0.705 | 0.661 | 0.771 | 0.854 | 0.841 | 0.770 | 0.650 | 0.746 |

| Hunan | 0.296 | 0.544 | 0.611 | 0.907 | 0.728 | 0.762 | 0.959 | 1.008 | 1.008 | 1.011 | 0.907 | 0.856 | 1.031 | 1.063 | 0.835 | |

| Jiangxi | 0.660 | 0.870 | 0.856 | 0.911 | 1.017 | 1.016 | 1.011 | 1.026 | 1.008 | 1.026 | 1.040 | 1.007 | 0.749 | 0.823 | 0.930 | |

| Anhui | 1.002 | 0.579 | 0.667 | 1.032 | 0.923 | 1.021 | 1.024 | 1.030 | 1.013 | 1.029 | 1.008 | 1.030 | 0.639 | 1.004 | 0.929 | |

| Southwest * | Yunnan | 0.718 | 1.029 | 1.034 | 1.031 | 0.826 | 0.918 | 1.017 | 1.014 | 0.912 | 1.025 | 0.887 | 0.536 | 0.530 | 0.497 | 0.855 |

| Guizhou | 1.002 | 1.018 | 1.025 | 1.073 | 0.511 | 0.582 | 1.027 | 1.013 | 1.010 | 1.015 | 1.009 | 1.009 | 1.018 | 1.001 | 0.951 | |

| Sichuan | 0.666 | 0.842 | 0.942 | 1.033 | 1.056 | 1.031 | 1.033 | 1.040 | 1.033 | 1.060 | 1.015 | 1.005 | 1.017 | 1.018 | 0.985 | |

| Chongqing | 1.016 | 1.018 | 1.015 | 0.828 | 0.935 | 1.008 | 1.012 | 1.008 | 1.030 | 0.920 | 0.798 | 0.628 | 0.606 | 0.679 | 0.893 | |

| Guangxi | 0.368 | 0.580 | 0.557 | 1.086 | 0.547 | 0.553 | 0.564 | 0.570 | 0.682 | 0.899 | 0.725 | 1.017 | 0.769 | 1.028 | 0.711 | |

| Northwest ⊙ | Gansu | 0.530 | 0.502 | 0.448 | 0.743 | 0.509 | 0.526 | 0.533 | 0.503 | 0.438 | 0.437 | 0.489 | 0.537 | 0.455 | 0.481 | 0.509 |

| Qinghai | 0.275 | 0.267 | 0.198 | 0.180 | 0.204 | 0.491 | 0.595 | 0.674 | 1.186 | 0.866 | 0.788 | 1.254 | 0.735 | 1.047 | 0.626 | |

| Ningxia | 0.373 | 0.377 | 0.381 | 0.369 | 0.436 | 0.826 | 0.424 | 0.410 | 0.403 | 0.403 | 0.377 | 0.330 | 0.333 | 0.386 | 0.416 | |

| Xinjiang | 0.214 | 1.032 | 0.968 | 1.013 | 1.020 | 1.036 | 1.020 | 1.038 | 0.842 | 0.807 | 0.931 | 0.942 | 1.042 | 1.112 | 0.930 |

| Year | Global Moran’s Index | Z-Stat Value | p-Value |

|---|---|---|---|

| 2007 | 0.271 | 2.431 | 0.015 |

| 2008 | 0.153 | 1.514 | 0.130 |

| 2009 | 0.046 | 0.676 | 0.499 |

| 2010 | 0.311 | 2.839 | 0.005 |

| 2011 | 0.158 | 1.555 | 0.120 |

| 2012 | 0.279 | 2.506 | 0.012 |

| 2013 | 0.238 | 2.195 | 0.028 |

| 2014 | 0.289 | 2.585 | 0.010 |

| 2015 | 0.376 | 3.280 | 0.001 |

| 2016 | 0.596 | 5.231 | 0.000 |

| 2017 | 0.360 | 3.161 | 0.002 |

| 2018 | −0.128 | −0.773 | 0.440 |

| 2019 | 0.035 | 0.569 | 0.570 |

| 2020 | 0.034 | 0.572 | 0.567 |

| Regulations | Global Moran’s Index | Z-Stat Value | p-Value |

|---|---|---|---|

| AER | 0.031 | 1.832 | 0.067 |

| MER | 0.107 | 4.224 | 0.000 |

| PER | 0.067 | 2.837 | 0.005 |

| Variables | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | (12) |

|---|---|---|---|---|---|---|---|---|---|

| GIE | GIE | GIE | GIE | GIE | GIE | GIE | GIE | GIE | |

| L.GIE | 0.469 *** | 0.660 *** | −0.556 *** | 0.622 *** | 0.749 *** | 0.473 ** | 0.329 *** | 0.826 *** | 0.851 *** |

| (0.000) | (0.000) | (0.000) | (0.002) | (0.000) | (0.048) | (0.004) | (0.000) | (0.000) | |

| AER | −0.314 ** | −0.294 ** | −2.037 *** | ||||||

| (0.012) | (0.012) | (0.001) | |||||||

| L.AER | 0.284 * | −0.182 * | |||||||

| (0.058) | (0.086) | ||||||||

| AER2 | 0.030 *** | ||||||||

| (0.001) | |||||||||

| MER | −0.613 * | −0.446 * | 1.273 * | ||||||

| (0.087) | (0.070) | (0.064) | |||||||

| L.MER | −0.624 | −0.744 ** | |||||||

| (0.111) | (0.015) | ||||||||

| MER2 | −0.016 * | ||||||||

| (0.052) | |||||||||

| PER | −0.008 | 0.109 | 0.483 | ||||||

| (0.959) | (0.517) | (0.561) | |||||||

| L.PER | 0.200 ** | 0.213 ** | |||||||

| (0.029) | (0.044) | ||||||||

| PER2 | −0.005 | ||||||||

| (0.636) | |||||||||

| EDL | 0.612 | 2.761 *** | 1.120 | 2.726 * | 5.292 *** | 4.625 ** | 2.875 * | 3.722 *** | 3.709 *** |

| (0.528) | (0.009) | (0.715) | (0.098) | (0.008) | (0.037) | (0.063) | (0.000) | (0.000) | |

| IS | −0.060 | 0.628 | −0.464 | 1.412 ** | 2.147 ** | 1.660 ** | 0.782 * | 0.664 ** | 0.573 * |

| (0.863) | (0.108) | (0.686) | (0.035) | (0.030) | (0.027) | (0.082) | (0.037) | (0.061) | |

| FDI | 0.067 | 0.119 * | 0.077 | 0.098 | 0.134 | 0.061 | 0.030 | 0.003 | −0.026 |

| (0.435) | (0.067) | (0.705) | (0.274) | (0.562) | (0.553) | (0.754) | (0.972) | (0.756) | |

| TMA | 0.007 | −0.005 | 0.016 * | 0.005 | 0.001 | 0.007 | 0.002 | −0.009 ** | −0.009 ** |

| (0.127) | (0.116) | (0.070) | (0.413) | (0.929) | (0.397) | (0.608) | (0.014) | (0.027) | |

| _cons | 43.139 ** | −8.968 | 153.314 ** | −31.281 | −73.248 ** | −51.097 * | 10.326 | −29.364 | −30.843 |

| (0.049) | (0.653) | (0.013) | (0.338) | (0.047) | (0.087) | (0.701) | (0.193) | (0.184) | |

| AR(2) test | (0.288) | (0.274) | (0.250) | (0.340) | (0.326) | (0.258) | (0.308) | (0.299) | (0.291) |

| Hansen test | (0.226) | (0.246) | (0.182) | (0.132) | (0.214) | (0.209) | (0.224) | (0.245) | (0.217) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hao, J.; Xu, W.; Chen, Z.; Yuan, B.; Wu, Y. Impact of Heterogeneous Environmental Regulations on Green Innovation Efficiency in China’s Industry. Sustainability 2024, 16, 415. https://doi.org/10.3390/su16010415

Hao J, Xu W, Chen Z, Yuan B, Wu Y. Impact of Heterogeneous Environmental Regulations on Green Innovation Efficiency in China’s Industry. Sustainability. 2024; 16(1):415. https://doi.org/10.3390/su16010415

Chicago/Turabian StyleHao, Junfang, Wanqiang Xu, Zhuo Chen, Baiyun Yuan, and Yuping Wu. 2024. "Impact of Heterogeneous Environmental Regulations on Green Innovation Efficiency in China’s Industry" Sustainability 16, no. 1: 415. https://doi.org/10.3390/su16010415

APA StyleHao, J., Xu, W., Chen, Z., Yuan, B., & Wu, Y. (2024). Impact of Heterogeneous Environmental Regulations on Green Innovation Efficiency in China’s Industry. Sustainability, 16(1), 415. https://doi.org/10.3390/su16010415