How to Price Catastrophe Bonds for Sustainable Earthquake Funding? A Systematic Review of the Pricing Framework

Abstract

1. Introduction

- RQ1: What financial risk variables are involved in ECB pricing?

- RQ2: What earthquake risk variables are involved in ECB pricing?

- RQ3: What are the main methods used to model financial risk variables?

- RQ4: What are the main methods used to model earthquake risk variables?

- RQ5: What type of claim trigger index is used?

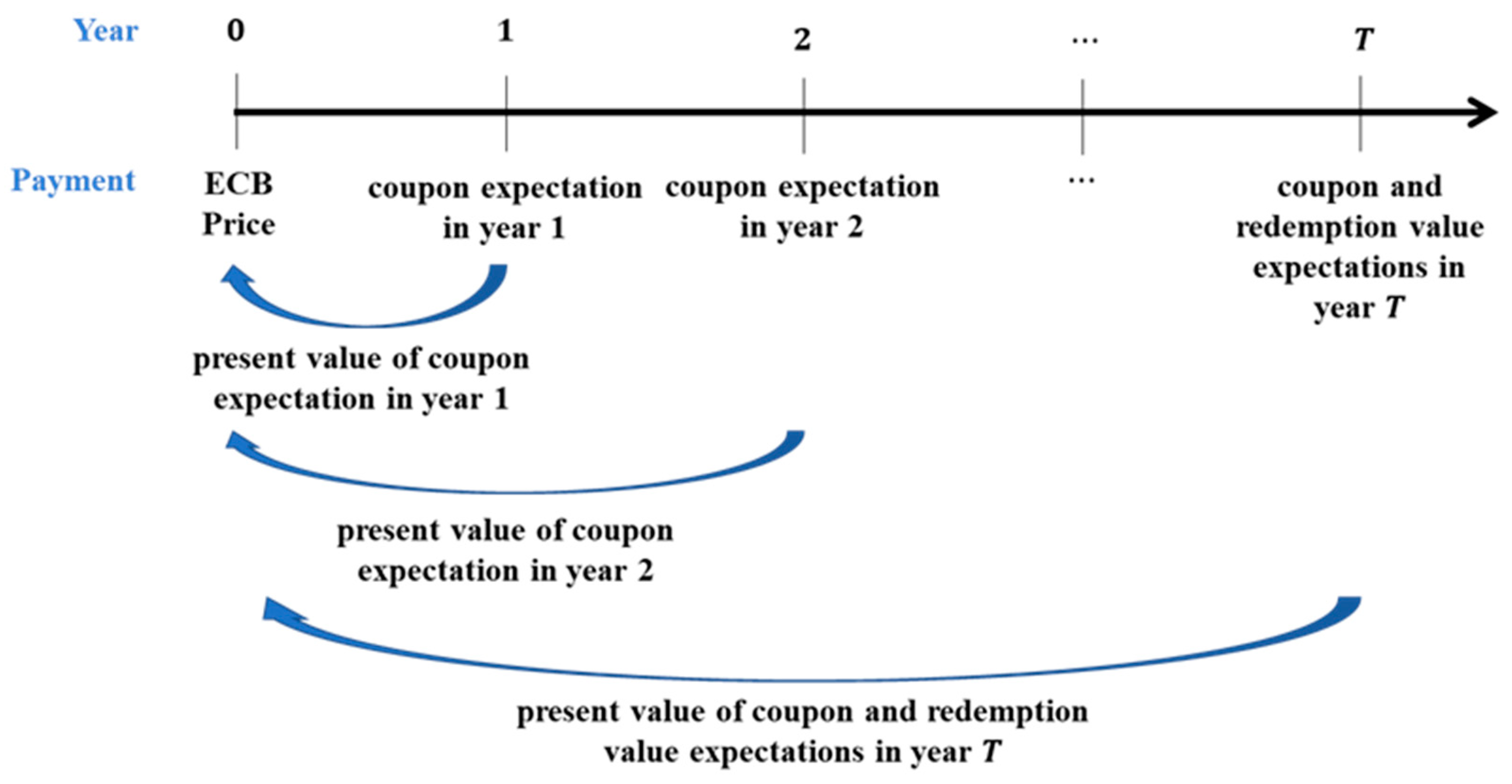

- RQ6: What are payment schemes of coupon and redemption value from the ECB?

- RQ7: What are the solution forms of the ECB’s pricing models?

- RQ8: What is the method of determining the solution for a model that does not have a closed form?

2. Research Methodology

- (a)

- Article type: a research or conference article written in English.

- (b)

- The article was published before 22 March 2023 in a peer-reviewed international journal indexed by Scopus, Science Direct, or Dimensions.

- (c)

- The article contains the following words in the title, abstract, or keywords: “Earthquake” AND (“Catastrophe Bond” OR “Catastrophic Bond” OR “CAT Bond”) AND (“Pricing” OR “Price” OR “Valuation” OR “Valuing”).

- (a)

- Removal of duplicate and unavailable articlesArticles that have been collected may be simultaneously indexed in more than one database. Thus, duplicates are possible, so the duplicates must be deleted. In addition, it is possible that the articles that have been collected are not available to the publishers. Therefore, those unavailable articles were also deleted.

- (b)

- Selection of articles in the title and abstract sectionsAt this stage, the selection of articles was conducted by reading the title and abstract sections. These parts of the articles were chosen because they best represent the article. In addition, this approach shortens the selection time. Articles whose titles and abstracts do not relate to the research topic were excluded at this stage.

- (c)

- Selection of articles through reading all sections thoroughlyThe articles obtained from stage two were reselected by reading them thoroughly, one by one. This step was conducted to ensure that the selected articles are relevant to the research topic. The articles obtained at this stage were then reviewed.

3. Results

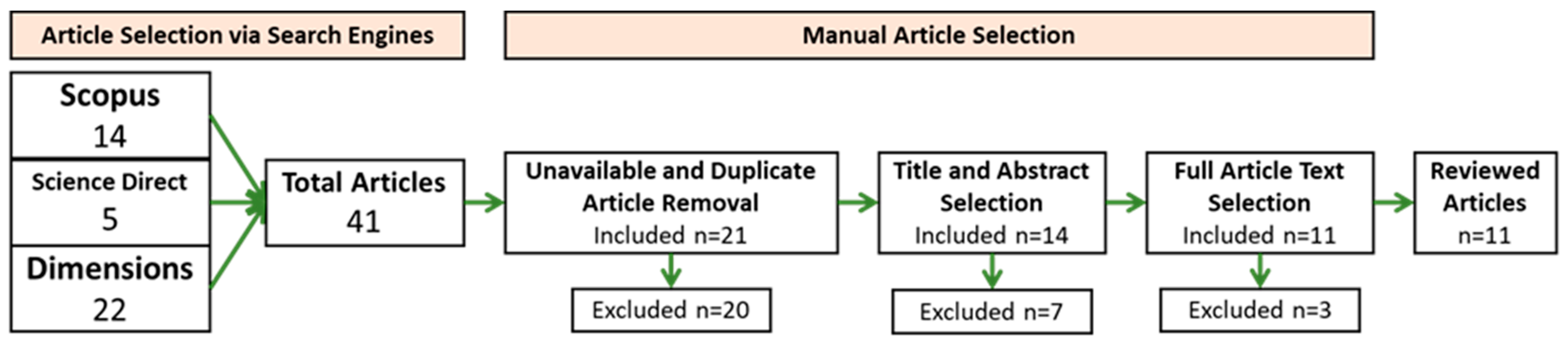

3.1. Article Collection and Selection Results

3.2. Description of Articles

3.3. Pricing Framework Analysis

- (a)

- represents the nominal interest rate at the end of -th years, , which is inconstant and is compounded once a year. The value of this nominal interest rate fluctuates only on an annual basis. This form is used by Shao et al. [42].

- (b)

- (c)

- (a)

- (b)

- (a)

- (b)

- Shao et al. [42] added an inconstant inflation rate to the model () so that returns from investors are more accurate.

- (c)

- Zimbidis et al. [41] used a variable deposit interest rate () due to the reinvestment of ECB sales proceeds from investors into risk-free assets.

- (d)

- Romaniuk [40] added the assumption that the value of the ECB assets is inconstant ().

- (e)

- Kang et al. [46] involved the variable annual liability of the sponsor ().

- (a)

- represents the constant earthquake intensity. This means that the average earthquake frequency is assumed to be the same for each time interval of the same length. This form of the parameter is used by Tang and Yuan [44], Kang et al. [46], Wei et al. [9], Aghdam et al. [48], Mistry and Lombardi [47], and Anggraeni et al. [49].

- (b)

- represents the inconstant earthquake intensity at time , . This means that the average frequency of earthquakes for each interval of the same length can differ. This parameter shape is used by Hofer et al. [45].

- (a)

- Financial lossThe financial loss represents the economic loss experienced due to the earthquake. Out of the eleven articles, six use this variable: Tang and Yuan [44], Hofer et al. [45], Kang et al. [46], Mistry and Lombardi [47], Wei et al. [9], and Aghdam et al. [48]. This variable is used in three forms, namely , , and . with represents the financial loss from the -th single earthquake, with represents the aggregate financial loss from the earthquake until time , and is a form specifically from with a jumping number of losses.

- (b)

- Earthquake magnitudeOut of the eleven articles, five use earthquake magnitude variables, namely, Zimbidis et al. [41], Shao et al. [42], Gunardi and Setiawan [43], Wei et al. [9], and Anggraeni et al. [49]. This variable is divided into three forms, namely , , and . with represents the magnitude of the i-th single earthquake, with represents the maximum magnitude of the earthquake in year , and is the form specifically from with a continuous time index.

- (c)

- Earthquake Epicenter Depth

- (d)

- Earthquake-prone zoneThree of the eleven articles considered the zone variable of , namely Hofer et al. [45], Mistry and Lombardi [47], and Anggraeni et al. [49]. This variable is added because these three articles set ECB prices for different regions within a country. Furthermore, Hofer et al. [45] accounted for the correlation of ground movement between the insured zones in the ECB (), and Mistry and Lombardi [47] considered the spatial seismic hazard in terms of peak ground acceleration (PGA) ().

- (a)

- Almost all articles that consider the nominal interest rate variable described it using the Cox–Ingersoll–Ross model, proposed by Cox et al. [50]. This model is widely used because the estimated nominal interest rate is guaranteed to be positive. It generally corresponds to the actual situation, except in Japan and Switzerland. Meanwhile, some studies do not use the Cox–Ingersoll–Ross model to describe the nominal interest rate. Shao et al. [42] used the ARIMA model (1, 1, 1), and Tang and Yuan [44] used the Vasicek model [51].

- (b)

- Each article involves an inconstant coupon rate used a different method to describe it. Zimbidis et al. [41] used geometrical Brownian motion, Tang and Yuan [44] used the Vasicek model, Shao et al. [42] used the Cox–Ingersoll–Ross model, and Anggraeni et al. [49] used Singh’s Fuzzy Time Series [52].

- (c)

- The inflation rate included by Shao et al. [42] was accommodated using the ARIMA model (1, 0, 0).

- (d)

- The dynamical ECB asset in Romaniuk [40] was described using geometrical Brownian motion.

- (e)

- (a)

- Six articles used the compound Poisson process to model the frequency, financial loss, and magnitude of earthquakes in an integrated manner. These articles were written by Tang and Yuan [44], Hofer et al. [45], Mistry and Lombardi [47], Wei et al. [9], Aghdam et al. [48], and Anggraeni et al. [49]. This method is an efficient means of modeling all three variables. The compound Poisson process has two forms: the homogeneous and inhomogeneous compound Poisson processes. The differences and similarities between the two are given in Table 7.Table 7 shows that the homogeneous compound Poisson process uses the assumption of constant earthquake intensity (), while the other uses the assumption of inconstant earthquake intensity (). Moreover, the financial losses () and magnitudes () of single earthquakes are assumed not to affect each other. In addition to the compound Poisson process, another model uses a compound negative-binomial process, namely Kang et al. [46].

- (b)

- The articles generally modeled the financial loss and magnitude of the -th earthquake ( and ) using the extreme value theory through the block maxima and peaks over threshold methods. This indicates that only earthquakes with financial losses and extreme magnitudes are considered in the data selection. Apart from these two methods, some articles used other approaches to model the loss and magnitude of the -th earthquake. Romaniuk [40] and Kang et al. [46] used exponential and lognormal distributions to model financial loss, respectively. Finally, Shao et al. [42] used the gamma distribution to model earthquake magnitudes.

- (c)

- Various methods are used to account for earthquake-prone-zone variables. Anggraeni et al. [49] used the K-means clustering algorithm to model the earthquake-prone zone (). Hofer et al. [45] used the ground motion prediction equation proposed by Bindi et al. [53]. Mistry and Lombardi [47] accommodated it using a high-spatial-resolution hazard and exposure model.

- (a)

- The binary scheme provides two possible payments of redemption values and coupons. If the claim of the ECB occurs within its term, the coupons and redemption values are paid in proportion or not at all. More specifically, the value of this proportion is in the interval and is measured in various ways using various methods. The notation of the proportion value in Table 9 is written as [46,47]. Then, if a claim for ECB does not occur within its term, the coupons and redemption values are paid in full to the investor.

- (b)

- The piecewise scheme provides more than two possible coupon and redemption value payments. Many of these possibilities are countable. The minimum value of the coupons and redemption values is zero. This value is obtained when the claim trigger index exceeds its maximum limit. Then, the maximum value of the coupon is two to three times that of the standard coupon ( or ). Then, the maximum value of the redemption value is . These maximum values of coupons and redemption values occur when the claim trigger index value is in the interval with the smallest values. The notation of the proportion of coupon or redemption value payments in Table 9 is written as [43], [43], and [49].

- (c)

4. Discussion

- (a)

- Each country has a different resilience level when facing the risk of earthquakes. This resilience includes economic resilience and mitigation when an earthquake occurs [60]. In this regard, countries with low resilience should logically have higher ECB prices and vice versa. Therefore, this resilience variable can be considered in the development of new models. By including this variable, earthquake severity can be measured better so that the estimated ECB price will be fairer.

- (b)

- Earthquake-prone-zone clustering, as seen in Hofer et al. [45], Mistry and Lombardi [47], and Anggraeni et al. [49], generally still used earthquake severity attributes in the form of magnitude and depth. The clustering of earthquake-prone zones can also use other attributes, such as the distance of the zones from active faults, volcanoes, or subduction areas. Therefore, this can be used as a research opportunity in the future.

- (c)

- Almost every model used the Monte Carlo method to determine the solution for the ECB pricing model. This method has weaknesses in terms of computation time efficiency. In other words, the determination of the solution is computed hundreds to thousands of times iteratively. Therefore, developing a more efficient model solution determination method constitutes a further area for future research. For example, studies may use the method of approximating the cumulative distribution function of the compound Poisson process developed by Chaubey et al. [61] and Reijnen et al. [62]. This method makes the computational process faster because it is based on the parameter values of the compound Poisson process.

- (d)

- The ARIMA and Vasicek models that describe inconstant nominal interest rates or coupon rates can produce negative values. This problem is overcome by the Cox–Ingersoll–Ross model, where the forecast value is guaranteed to be positive. However, the volatility described in this model does not consider jumps when economic crashes occasionally occur [49]. Therefore, future research may seek to address this problem.

- (e)

- The financial and earthquake risk variables included in the eleven articles are assumed to be independent. However, both are possibly correlated. Therefore, considering the correlation of both represents a further future research opportunity.

5. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Podolskiy, E.A.; Nishimura, K.; Abe, O.; Chernous, P.A. Earthquake-Induced Snow Avalanches: I. Historical Case Studies. J. Glaciol. 2010, 56, 431–446. [Google Scholar] [CrossRef]

- Shin, J.Y.; Chen, S.; Kim, T.-W. Application of Bayesian Markov Chain Monte Carlo Method with Mixed Gumbel Distribution to Estimate Extreme Magnitude of Tsunamigenic Earthquake. KSCE J. Civ. Eng. 2015, 19, 366–375. [Google Scholar] [CrossRef]

- Rashid, M.; Ahmad, N. Economic Losses Due to Earthquake-Induced Structural Damages in RC SMRF Structures. Cogent Eng. 2017, 4, 1296529. [Google Scholar] [CrossRef]

- Chao, W.; Zou, H. Multiple-Event Catastrophe Bond Pricing Based on CIR-Copula-POT Model. Discret. Dyn. Nat. Soc. 2018, 2018, 5068480. [Google Scholar] [CrossRef]

- Ma, Z.-G.; Ma, C.-Q. Pricing Catastrophe Risk Bonds: A Mixed Approximation Method. Insur. Math. Econ. 2013, 52, 243–254. [Google Scholar] [CrossRef]

- Lee, J.-P.; Yu, M.-T. Valuation of Catastrophe Reinsurance with Catastrophe Bonds. Insur. Math. Econ. 2007, 41, 264–278. [Google Scholar] [CrossRef]

- Kalfin; Sukono; Supian, S.; Mamat, M. Insurance as an Alternative for Sustainable Economic Recovery after Natural Disasters: A Systematic Literature Review. Sustainability 2022, 14, 4349. [Google Scholar] [CrossRef]

- Kiohos, A.; Paspati, M. Alternative to Insurance Risk Transfer: Creating a Catastrophe Bond for Romanian Earthquakes. Bull. Appl. Econ. 2021, 8, 1–17. [Google Scholar] [CrossRef]

- Wei, L.; Liu, L.; Hou, J. Pricing Hybrid-Triggered Catastrophe Bonds Based on Copula-EVT Model. Quant. Financ. Econ. 2022, 6, 223–243. [Google Scholar] [CrossRef]

- Grosser, H.; Baumbach, M.; Berckhemer, H.; Baier, B.; Karahan, A.; Schelle, H.; Krüger, F.; Paulat, A.; Michel, G.; Demirtas, R.; et al. The Erzincan (Turkey) Earthquake (M s 6.8) of March 13, 1992 and Its Aftershock Sequence. Pure Appl. Geophys. 1998, 152, 465–505. [Google Scholar] [CrossRef]

- Ioki, K.; Tanioka, Y.; Kawakami, G.; Kase, Y.; Nishina, K.; Hirose, W.; Hayashi, K.; Takahashi, R. Fault Model of the 12th Century Southwestern Hokkaido Earthquake Estimated from Tsunami Deposit Distributions. Earth. Planets Sp. 2019, 71, 54. [Google Scholar] [CrossRef]

- Shao, J.; Papaioannou, A.D.; Pantelous, A.A. Pricing and Simulating Catastrophe Risk Bonds in a Markov-Dependent Environment. Appl. Math. Comput. 2017, 309, 68–84. [Google Scholar] [CrossRef]

- Cummins, J.D.; Mahul, O. Catastrophe Risk Financing in Developing Countries; The World Bank: Washington, DC, USA, 2008; ISBN 978-0-8213-7736-9. [Google Scholar]

- Ibrahim, R.A.; Sukono; Napitupulu, H. Multiple-Trigger Catastrophe Bond Pricing Model and Its Simulation Using Numerical Methods. Mathematics 2022, 10, 1363. [Google Scholar] [CrossRef]

- Jaimungal, S.; Chong, Y. Valuing Clustering in Catastrophe Derivatives. Quant. Financ. 2014, 14, 259–270. [Google Scholar] [CrossRef]

- Coval, J.D.; Jurek, J.W.; Stafford, E. Economic Catastrophe Bonds. Am. Econ. Rev. 2009, 99, 628–666. [Google Scholar] [CrossRef]

- Froot, K.A. The Market for Catastrophe Risk: A Clinical Examination. J. Financ. Econ. 2001, 60, 529–571. [Google Scholar] [CrossRef]

- Sukono; Ibrahim, R.A.; Saputra, M.P.A.; Hidayat, Y.; Juahir, H.; Prihanto, I.G.; Halim, N.B.A. Modeling Multiple-Event Catastrophe Bond Prices Involving the Trigger Event Correlation, Interest, and Inflation Rates. Mathematics 2022, 10, 4685. [Google Scholar] [CrossRef]

- Johnson, L. Catastrophe Bonds and Financial Risk: Securing Capital and Rule through Contingency. Geoforum 2013, 45, 30–40. [Google Scholar] [CrossRef]

- Nowak, P.; Romaniuk, M. Valuing Catastrophe Bonds Involving Correlation and CIR Interest Rate Model. Comput. Appl. Math. 2018, 37, 365–394. [Google Scholar] [CrossRef]

- Burnecki, K.; Giuricich, M.N. Stable Weak Approximation at Work in Index-Linked Catastrophe Bond Pricing. Risks 2017, 5, 64. [Google Scholar] [CrossRef]

- Härdle, W.K.; Cabrera, B.L. Calibrating CAT Bonds for Mexican Earthquakes. J. Risk Insur. 2010, 77, 625–650. [Google Scholar] [CrossRef]

- Kunreuther, H.; Heal, G. Managing Catastrophic Risk; Working Paper; National Bureau of Economic Research: Cambridge, MA, USA, 2012. [Google Scholar]

- Grigoryan, A. Sovereign Parametric Catastrophe Bonds as an Example of Disaster Risk Financing Instrument in the Region of ECIS State of Play and Opportunities; United Nations Development Programme: Istanbul, Türkiye, 2020. [Google Scholar]

- Ando, S.; Fu, C.; Roch, F.; Wiriadinata, U. Sovereign Climate Debt Instruments: An Overview of the Green and Catastrophe Bond Markets. Staff Clim. Notes 2022, 2022, 28. [Google Scholar] [CrossRef]

- Deng, G.; Liu, S.; Li, L.; Deng, C.; Yu, W. Research on the Pricing of Global Drought Catastrophe Bonds. Math. Probl. Eng. 2020, 2020, 3898191. [Google Scholar] [CrossRef]

- Goda, K. Multi-Hazard Parametric Catastrophe Bond Trigger Design for Subduction Earthquakes and Tsunamis. Earthq. Spectra 2021, 37, 1827–1848. [Google Scholar] [CrossRef]

- Cummins, J.D. CAT Bonds and Other Risk-Linked Securities: State of the Market and Recent Developments. SSRN Electron. J. 2007, 11, 23–47. [Google Scholar] [CrossRef]

- Ibrahim, R.A.; Sukono, S.; Napitupulu, H.; Ibrahim, R.I.; Johansyah, M.D.; Saputra, J. Estimating Flood Catastrophe Bond Prices Using Approximation Method of the Loss Aggregate Distribution: Evidence from Indonesia. Decis. Sci. Lett. 2023, 12, 179–190. [Google Scholar] [CrossRef]

- Canabarro, E.; Finkemeier, M.; Anderson, R.R.; Bendimerad, F. Analyzing Insurance-Linked Securities. J. Risk Financ. 2000, 1, 49–75. [Google Scholar] [CrossRef]

- Linnerooth-Bayer, J.; Amendola, A. Global Change, Natural Disasters and Loss-Sharing: Issues of Efficiency and Equity. Geneva Pap. Risk Insur. Issues Pract. 2000, 25, 203–219. [Google Scholar] [CrossRef]

- Skees, J.R.; Barnett, B.J.; Murphy, A.G. Creating Insurance Markets for Natural Disaster Risk in Lower Income Countries: The Potential Role for Securitization. Agric. Financ. Rev. 2008, 68, 151–167. [Google Scholar] [CrossRef]

- Sukono; Juahir, H.; Ibrahim, R.A.; Saputra, M.P.A.; Hidayat, Y.; Prihanto, I.G. Application of Compound Poisson Process in Pricing Catastrophe Bonds: A Systematic Literature Review. Mathematics 2022, 10, 2668. [Google Scholar] [CrossRef]

- Anggraeni, W.; Supian, S.; Sukono; Halim, N.B.A. Earthquake Catastrophe Bond Pricing Using Extreme Value Theory: A Mini-Review Approach. Mathematics 2022, 10, 4196. [Google Scholar] [CrossRef]

- Page, M.J.; McKenzie, J.E.; Bossuyt, P.M.; Boutron, I.; Hoffmann, T.C.; Mulrow, C.D.; Shamseer, L.; Tetzlaff, J.M.; Akl, E.A.; Brennan, S.E.; et al. The PRISMA 2020 Statement: An Updated Guideline for Reporting Systematic Reviews. J. Clin. Epidemiol. 2021, 372, 178–189. [Google Scholar] [CrossRef] [PubMed]

- Rivero, T.S.; Nuñez, L.M.H.; Pires, E.U.; Bueno, O.F.A. ADHD Rehabilitation through Video Gaming: A Systematic Review Using PRISMA Guidelines of the Current Findings and the Associated Risk of Bias. Front. Psychiatry 2015, 6, 151. [Google Scholar] [CrossRef] [PubMed]

- Tao, Z.; Tao, X.; Li, P. Pricing Model for Earthquake CAT Bonds. In Proceedings of the 2009 International Conference on Business Intelligence and Financial Engineering, Beijing, China, 24–26 July 2009; pp. 740–744. [Google Scholar]

- Wu, D.; Zhou, Y. Catastrophe Bond and Risk Modeling: A Review and Calibration Using Chinese Earthquake Loss Data. Hum. Ecol. Risk Assess. 2010, 16, 510–523. [Google Scholar] [CrossRef]

- Ismail, E. The Complementary Compound Truncated Poisson-Weibull Distribution for Pricing Catastrophic Bonds for Extreme Earthquakes. Br. J. Econ. Manag. Trade 2016, 14, 1–9. [Google Scholar] [CrossRef]

- Romaniuk, M. Pricing the Risk-Transfer Financial Instruments via Monte Carlo Methods. Syst. Anal. Model. Simul. 2003, 43, 1043–1064. [Google Scholar] [CrossRef]

- Zimbidis, A.A.; Frangos, N.E.; Pantelous, A.A. Modeling Earthquake Risk via Extreme Value Theory and Pricing the Respective Catastrophe Bonds. ASTIN Bull. 2007, 37, 163–183. [Google Scholar] [CrossRef]

- Shao, J.; Pantelous, A.; Papaioannou, A.D. Catastrophe Risk Bonds with Applications to Earthquakes. Eur. Actuar. J. 2015, 5, 113–138. [Google Scholar] [CrossRef]

- Gunardi; Setiawan, E.P. Valuation of Indonesian Catastrophic Earthquake Bonds with Generalized Extreme Value (GEV) Distribution and Cox-Ingersoll-Ross (CIR) Interest Rate Model. In Proceedings of the 2014 International Conference on Actuarial Science and Statistics, AIP Conference Proceedings, Bandung, Indonesia, 21–23 October 2014; pp. 1–14. [Google Scholar]

- Tang, Q.; Yuan, Z. Cat Bond Pricing under a Product Probability Measure with POT Risk Characterization. ASTIN Bull. 2019, 49, 457–490. [Google Scholar] [CrossRef]

- Hofer, L.; Zanini, M.A.; Gardoni, P. Risk-Based Catastrophe Bond Design for a Spatially Distributed Portfolio. Struct. Saf. 2020, 83, 101908. [Google Scholar] [CrossRef]

- Kang, H.-B.; Chang, H.; Chang, T. Catastrophe Reinsurance Pricing-Modification of Dynamic Asset-Liability Management. Rom. J. Econ. Forecast. 2022, 25, 5–20. [Google Scholar]

- Mistry, H.K.; Lombardi, D. Pricing Risk-Based Catastrophe Bonds for Earthquakes at an Urban Scale. Sci. Rep. 2022, 12, 9729. [Google Scholar] [CrossRef] [PubMed]

- Aghdam, Y.E.; Neisy, A.; Adl, A. Simulating and Pricing CAT Bonds Using the Spectral Method Based on Chebyshev Basis. Comput. Econ. 2022, in press. [CrossRef]

- Anggraeni, W.; Supian, S.; Sukono; Halim, N.A. Single Earthquake Bond Pricing Framework with Double Trigger Parameters Based on Multi Regional Seismic Information. Mathematics 2023, 11, 689. [Google Scholar] [CrossRef]

- Cox, J.C.; Ingersoll, J.E.; Ross, S.A. A Theory of the Term Structure of Interest Rates. Econometrica 1985, 53, 385–407. [Google Scholar] [CrossRef]

- Vasicek, O. An Equilibrium Characterization of the Term Structure. J. Financ. Econ. 1977, 5, 177–188. [Google Scholar] [CrossRef]

- Singh, S.R. A Simple Method of Forecasting Based on Fuzzy Time Series. Appl. Math. Comput. 2007, 186, 330–339. [Google Scholar] [CrossRef]

- Bindi, D.; Pacor, F.; Luzi, L.; Puglia, R.; Massa, M.; Ameri, G.; Paolucci, R. Ground Motion Prediction Equations Derived from the Italian Strong Motion Database. Bull. Earthq. Eng. 2011, 9, 1899–1920. [Google Scholar] [CrossRef]

- Cummins, J.D.; Lalonde, D.; Phillips, R.D. The Basis Risk of Catastrophic-Loss Index Securities. J. Financ. Econ. 2004, 71, 77–111. [Google Scholar] [CrossRef]

- Zhang, N.; Huang, H. Assessment of World Disaster Severity Processed by Gaussian Blur Based on Large Historical Data: Casualties as an Evaluating Indicator. Nat. Hazards 2018, 92, 173–187. [Google Scholar] [CrossRef]

- Makariou, D.; Barrieu, P.; Chen, Y. A Random Forest Based Approach for Predicting Spreads in the Primary Catastrophe Bond Market. Insur. Math. Econ. 2021, 101, 140–162. [Google Scholar] [CrossRef]

- Domfeh, D.; Chatterjee, A.; Dixon, M. A Unified Bayesian Framework for Pricing Catastrophe Bond Derivatives. arXiv 2022, arXiv:2205.04520. [Google Scholar] [CrossRef]

- Li, J.; Cai, Z.; Liu, Y.; Ling, C. Extremal Analysis of Flooding Risk and Its Catastrophe Bond Pricing. Mathematics 2022, 11, 114. [Google Scholar] [CrossRef]

- Romaniuk, M. Analysis of the Insurance Portfolio with an Embedded Catastrophe Bond in a Case of Uncertain Parameter of the Insurer’s Share. In Proceedings of the 37th International Conference on Information Systems Architecture and Technology, Karpacz, Poland, 18–20 September 2017; Grzech, A., Świątek, J., Wilimowska, Z., Borzemski, L., Eds.; Springer: Berlin/Heidelberg, Germany; pp. 33–43. [Google Scholar]

- Purwandari, T.; Sukono; Hidayat, Y.; Ahmad, W.M.A.W. Developing New Method in Measuring City Economic Resilience by Imposing Disturbances Factors and Unwanted Condition. Computation 2022, 10, 135. [Google Scholar] [CrossRef]

- Chaubey, Y.P.; Garrido, J.; Trudeau, S. On the Computation of Aggregate Claims Distributions: Some New Approximations. Insur. Math. Econ. 1998, 23, 215–230. [Google Scholar] [CrossRef]

- Reijnen, R.; Albers, W.; Kallenberg, W.C.M. Approximations for Stop-Loss Reinsurance Premiums. Insur. Math. Econ. 2005, 36, 237–250. [Google Scholar] [CrossRef]

| Type of Catastrophe | Losses (USD) | Fatalities (People) |

|---|---|---|

| Earthquakes | 1,266,348,909 | 961 |

| Extreme temperatures | 157,529,668 | 352 |

| Storms | 662,920,441 | 87 |

| Droughts | 461,086,035 | 51 |

| Landslides | 21,412,879 | 48 |

| Floods | 258,287,739 | 47 |

| Volcanic activity | 24,887,188 | 13 |

| Wildfires | 392,804,851 | 7 |

| Article Database | The Number of Articles |

|---|---|

| Scopus | 14 |

| Science Direct | 5 |

| Dimensions | 22 |

| Total | 41 |

| No. | Author(s) | Year | Number of Citations |

|---|---|---|---|

| 1 | Romaniuk [40] | 2003 | 9 |

| 2 | Zimbidis et al. [41] | 2007 | 32 |

| 3 | Shao et al. [42] | 2015 | 17 |

| 4 | Gunardi and Setiawan [43] | 2015 | 3 |

| 5 | Tang and Yuan [44] | 2019 | 11 |

| 6 | Hofer et al. [45] | 2020 | 13 |

| 7 | Kang et al. [46] | 2022 | 0 |

| 8 | Mistry and Lombardi [47] | 2022 | 2 |

| 9 | Wei et al. [9] | 2022 | 5 |

| 10 | Aghdam et al. [48] | 2022 | 0 |

| 11 | Anggraeni et al. [49] | 2023 | 0 |

| Author(s) | Financial Risk Variables | Earthquake Risk Variables |

|---|---|---|

| Romaniuk [40] | , , , | , |

| Zimbidis et al. [41] | , , , , , , | |

| Shao et al. [42] | , , , , , , | , |

| Gunardi and Setiawan [43] | , , , , , | |

| Tang and Yuan [44] | , , , , | , , , |

| Hofer et al. [45] | , , , , | , , , , , |

| Kang et al. [46] | , , , | , , , |

| Mistry and Lombardi [47] | , , , , | , , , , , , |

| Wei et al. [9] | , , , , | , , , , , , , |

| Aghdam et al. [48] | , , | , , , |

| Anggraeni et al. [49] | , , , , , | , , , , |

| Variable | Description |

|---|---|

| Redemption value in year | |

| The term of ECB | |

| The nominal interest rate at the end of the -th year, , which is inconstant and compounded once | |

| The nominal interest rate, which is constant and continuously compounding | |

| The nominal interest rate at time , , which is inconstant and continuously compounding | |

| The constant coupon rate | |

| The inconstant coupon rate at the end of the -th year, | |

| The coupon at the end of the -th year, | |

| The extra premium loading rate compounded continuously within one year | |

| The inconstant inflation rate at the end of the -th year, | |

| The inconstant return rate from bank deposits at the end of the -th year, | |

| The inconstant underlying asset at time , | |

| The liability worth of sponsors at time , | |

| The number of earthquakes that occur until time , | |

| The constant intensity of earthquakes | |

| The inconstant intensity of earthquakes at time , | |

| The financial loss of the -th earthquake, | |

| The aggregate earthquake financial until time , | |

| The aggregate earthquake financial with jumping until time , | |

| the magnitude of the -th earthquake, | |

| The maximum magnitude of earthquake until time , | |

| The maximum magnitude of earthquake at the end of the -th year, | |

| The annual earthquake depth corresponding to at the end of the -th year, | |

| The -th region zone insured in the ECB | |

| The first time an earthquake has occurred since the ECB was published | |

| The first time the earthquake loss exceeds its threshold value | |

| The first time the aggregate loss or maximum magnitude of the earthquake exceeds its threshold value | |

| The first time the aggregate loss and maximum magnitude of the earthquake exceed the threshold value | |

| The correlation of ground movement between insured zones in the ECB | |

| The spatial seismic hazard in terms of peak ground acceleration (PGA) | |

| The average time between two consecutive earthquake events |

| Author(s) | Main Methods Used to Model Financial Risk | Main Methods Used to Model Earthquake Risk |

|---|---|---|

| Romaniuk [40] | Geometrical Brownian Motion | Exponential Distribution |

| Zimbidis et al. [41] | Geometrical Brownian Motion | Block Maxima |

| Shao et al. [42] | ARIMA (1, 1, 1), ARIMA (1, 0, 0), Cox–Ingersoll–Ross Model | Block Maxima, Gamma Distribution |

| Gunardi and Setiawan [43] | Cox–Ingersoll–Ross Model | Block Maxima |

| Tang and Yuan [44] | Vasicek Model | Block Maxima, Peaks Over Threshold, Homogeneous Compound Poisson Process |

| Hofer et al. [45] | Cox–Ingersoll–Ross Model | Inhomogeneous Compound Poisson Process, Ground Motion Prediction Equation |

| Kang et al. [46] | Lee–Yu Model, Cox–Ingersoll–Ross Model, Asset-Liability Management Model | Lognormal Distribution, Compound Negative Binomial Process |

| Mistry and Lombardi [47] | Cox–Ingersoll–Ross Model | High Spatial Resolution Hazard and Exposure Model, Homogeneous Compound Poisson Process |

| Wei et al. [9] | Cox–Ingersoll–Ross Model | Peaks Over Threshold, Homogeneous Compound Poisson Process, Copula |

| Aghdam et al. [48] | Cox–Ingersoll–Ross Model | Homogeneous Compound Poisson Jumping Process |

| Anggraeni et al. [49] | Singh’s Fuzzy Time Series | K-Means Clustering Method, Peaks Over Threshold, Homogeneous Compound Poisson Process, Copula |

| Compound Poisson Process Type | Difference | Similarity |

|---|---|---|

| Homogeneous | Homogeneous Poisson | and |

| Inhomogeneous |

| Author(s) | Type of Claim Trigger Index | ||

|---|---|---|---|

| Indemnity | Parametric | ||

| Aggregate Losses | Magnitude | Depth | |

| Romaniuk [40] | - | - | |

| Zimbidis et al. [41] | - | - | |

| Shao et al. [42] | - | ||

| Gunardi and Setiawan [43] | - | - | |

| Tang and Yuan [44] | - | - | |

| Hofer et al. [45] | - | - | |

| Kang et al. [46] | - | ||

| Mistry and Lombardi [47] | - | ||

| Wei et al. [9] | - | ||

| Aghdam et al. [48] | - | - | |

| Anggraeni et al. [49] | - | ||

| Author(s) | Coupon Payment Scheme | Redemption Value Payment Scheme |

|---|---|---|

| Romaniuk [40] | - | |

| Zimbidis et al. [41] | ||

| Shao et al. [42] | ||

| Gunardi and Setiawan [43] | ||

| Tang and Yuan [44] | ||

| Hofer et al. [45] | ||

| Kang et al. [46] | - | |

| Mistry and Lombardi [47] | for zero-coupon ECB for coupon-paying ECB | |

| Wei et al. [9] | ||

| Aghdam et al. [48] | - | |

| Anggraeni et al. [49] |

| Author(s) | Model Solution Form | Solution Determination Method |

|---|---|---|

| Romaniuk [40] | It has no closed-form solution | Iterative Stochastic Method, Monte Carlo Method |

| Zimbidis et al. [41] | It has no closed-form solution | Monte Carlo Method |

| Shao et al. [42] | It has no closed-form solution | Monte Carlo Method |

| Gunardi and Setiawan [43] | It has no closed-form solution | Monte Carlo Method |

| Tang and Yuan [44] | It has no closed-form solution | Wang Transformation Method |

| Hofer et al. [45] | It has no closed-form solution | Monte Carlo Method |

| Kang et al. [46] | It has no closed-form solution | Monte Carlo Method |

| Mistry and Lombardi [47] | It has no closed-form solution | Monte Carlo Method |

| Wei et al. [9] | It has a closed-form solution | - |

| Aghdam et al. [48] | It has no closed-form solution | Chebyshev Basis, Spectral Method, Expansion of the Gauss–Laguerre Quadrature |

| Anggraeni et al. [49] | It has no closed-form solution | Monte Carlo Method |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ibrahim, R.A.; Sukono; Napitupulu, H.; Ibrahim, R.I. How to Price Catastrophe Bonds for Sustainable Earthquake Funding? A Systematic Review of the Pricing Framework. Sustainability 2023, 15, 7705. https://doi.org/10.3390/su15097705

Ibrahim RA, Sukono, Napitupulu H, Ibrahim RI. How to Price Catastrophe Bonds for Sustainable Earthquake Funding? A Systematic Review of the Pricing Framework. Sustainability. 2023; 15(9):7705. https://doi.org/10.3390/su15097705

Chicago/Turabian StyleIbrahim, Riza Andrian, Sukono, Herlina Napitupulu, and Rose Irnawaty Ibrahim. 2023. "How to Price Catastrophe Bonds for Sustainable Earthquake Funding? A Systematic Review of the Pricing Framework" Sustainability 15, no. 9: 7705. https://doi.org/10.3390/su15097705

APA StyleIbrahim, R. A., Sukono, Napitupulu, H., & Ibrahim, R. I. (2023). How to Price Catastrophe Bonds for Sustainable Earthquake Funding? A Systematic Review of the Pricing Framework. Sustainability, 15(9), 7705. https://doi.org/10.3390/su15097705