Abstract

With the increasing severity of environmental threats, the role of governance in environmental protection is particularly important. This paper examines the policy effects of environmental regulation and its implementation and regulatory heterogeneity on green innovation from the perspective of a policy combination formed by demand–pull environmental taxes and supply–push R&D tax incentives, aiming to investigate the targeted effects of green innovation induced by regulatory policies in the tax environments of developing countries. Based on the data on China’s listed manufacturing enterprises from 2013 to 2021, this article uses the DID model to perform a fixed-effect test. The findings show that both environmental taxes and R&D tax incentives can promote the green innovation of enterprises, and their combination has a mutually reinforcing joint effect. Furthermore, an environmental tax can inhibit the strategic innovation problems of R&D tax incentives and improve the quality of green innovation. This paper also reveals that the tax enforcement environment positively affects the induction of green innovation from the perspective of policy implementation and supervision. Finally, the heterogeneity test examines the differences in the effects of policy implementation from the aspects of political association and whether manufacturing firm is a high-tech enterprise. The results of this paper provide a reference for improving the effectiveness of environmental regulatory policy portfolios from the aspects of pre-design optimization and post-implementation and supervision, enriching the evidence for the narrow Porter hypothesis in developing countries.

1. Introduction

The fifth International Conference on Environment Pollution and Prevention (ICEPP) proposed that industrialization has brought economic prosperity, while additionally resulting in obvious stress on Earth’s basic life-supporting systems and pushing its environmental impacts closer to the threshold limits of tolerance. In 2007, the Intergovernmental Panel on Climate Change (IPCC)’s Fourth Assessment Report (AR4) predicted that 20–30% of the world’s species would face extinction if global temperatures rose above 1.5 °C. If the average temperature rises by more than 3.5 °C, 40–70% of the world’s species will face extinction. In 2022, the IPCC AR6 warned that global action to mitigate and adapt to climate change is urgent, and unless the world achieves net-zero emissions through deep reductions in greenhouse gas by 2050, the Paris Agreement’s targets of 1.5 degrees Celsius and 2 degrees Celsius will be missed. With these increasingly urgent environmental threats, the world has fully entered the era of “carbon neutrality,” and countries will strive to achieve carbon neutrality by the middle of this century. As a typical developing country and currently the world’s largest carbon emitter [1], how to achieve a “win-win” situation between economic efficiency and environmental protection is a major challenge that China is facing. The Chinese government has implemented unprecedented environmental regulatory policies to transition to a low-carbon economy. Green innovation is a key factor in coordinating economic growth and environmental protection [2], and the “Made in China 2025” plan proposes to combine “innovation-driven” and “green development” as a new direction for the transformation of manufacturing to solve the contradiction between economic development and energy and environmental sustainability.

Using better methods, information, and education, and changing ideas to transform consumption concepts and reduce consumers’ demand for polluting products from the source is the most direct and efficient method to solve pollution [3]. However, this is a long-term process, especially in large developing countries, and environmental pollution is ever more urgent. R&D innovation and green environments are public goods, that is, they are non-competitive and non-exclusive, and the dual externalities of green innovation will lead to the private benefits of green innovation being lower than the social benefits. The market failure caused by the dual externalities of green innovation provides a theoretical basis for government intervention. A systematic review shows that the selected types of regulatory and economic and financial instruments are generally associated with positive impacts on environmental, technological, and innovation outcomes [4]. China’s environmental regulatory policy has long been dominated by command and control [5], and local officials are the makers and implementers of such policies. Due to their demands of mandatory and quick results, imperative environmental regulation policies have played a positive role in solving short-term and urgent environmental problems. However, compared to the large execution costs and negative economic and social effects of the command-and-control type policies, environmental regulatory policies which act on market mechanisms can provide more flexible and effective incentives for innovation [6], and tax tools play a stronger role in technological innovation than simple administrative orders [7].

In recent years, China has advocated for the adoption of market-based environmental regulation, using means such as taxation based on market mechanisms to guide market players to protect and improve the environment. China’s first “green tax law,” the “Environmental Protection Tax Law,” was officially implemented in 2018 and is currently the most important market-based environmental regulation policy in China. At the same time, because of the core position of scientific and technological innovation in the overall process of China’s modernization, China has continued to increase policy support for scientific and technological innovation. In 2022, the ratio of additional tax deductions for enterprise research and development has increased by 100%. The purpose of this paper is to examine the impact and synergy effects of environmental taxes and R&D tax incentives on corporate green technology innovation in the institutional environment of a developing country such as China, and to examine the impact of the environmental characteristics of tax enforcement on the effect of tax policies in developing countries.

The marginal contributions of this paper are threefold. First, China’s environmental regulatory policy has long been dominated by a command-and-control approach. Empirical research on the combination of market-based environmental regulatory policies such as taxation and subsidies is relatively lacking [7]. This paper examines the effects of the combination of market-based tax policies that combine demand–pull environmental taxes and supply–push R&D tax incentives on enterprises’ green innovation to provide ideas for the design and application of the best policy mix for environmental taxes and innovation subsidies.

Second, the combination of environmental regulation and financial subsidy policies can have a multiplier effect [8]. According to the narrow Porter hypothesis, the rational formulation and implementation of environmental regulatory policies stimulates innovation [9]. This paper finds that the linkage between the supply and demand of environmental taxes and R&D tax incentives can play a mutually reinforcing role in strengthening the “innovation offsets” of environmental regulatory policies. R&D tax incentives can directly alleviate the cost of environmental taxes to stimulate the supply of innovation, whereas environmental taxes trigger companies to demand substantial innovation and can inhibit the problem of strategic R&D promoted by the R&D tax incentive, such as poor R&D quality, and improve the quality of green innovation.

Third, the imperfect monitoring and implementation of environmental regulatory policies will affect the effectiveness of policies [10]. Strong tax enforcement will standardize the tax payment behavior of enterprises and curb their tax avoidance activities [11]. Local taxation in the context of a weak legal system and law enforcement environment in developing countries directly affects the collection of environmental taxes and the implementation of R&D tax incentives, thereby influencing the effectiveness of environmental regulatory policies. This article further discusses the differences between two market-based tax policies in different tax law enforcement contexts in terms of their environmental performance, providing empirical evidence for the narrow Porter hypothesis in developing countries.

2. Literature Review and Hypothesis Development

Research on the impact of environmental regulation on green innovation behavior has always been a cutting-edge academic topic. There are two main types of environmental regulation methods, one is market-based policy tools, which can be achieved through price controls such as carbon tax and environmental protection tax; quantitative controls, such as emissions trading, can also be used. Second, command-type policy tools are characterized by government administrative control, also known as “command and control” policies. These policies include imposing mandatory emission reduction targets and standards on enterprises and have traditionally been more-often adopted by policymakers. “The Potter hypothesis” argues that, if properly designed, environmental regulation (especially market-based tools) can achieve “innovative compensation” [12]. Jaffe and Palmer (1997) further put forth the narrow Porter hypothesis, which holds that only well-designed and effectively implemented policies can achieve these results. The research on environmental regulatory policies that stimulate innovation is divided into two categories: demand–pull policies and supply–push policies [13,14]. Government innovation can be encouraged in two ways: On the one hand, measures can be taken to reduce the private costs of producing innovation and to form a technologies supply push, for example, via direct government funding, tax breaks, and support for R&D education and training. On the other hand, measures can also be taken to increase the private returns of successful innovations, creating demand pulls, such as environmental taxes, regulations, and intellectual property protection. The role of these policies in innovation has been hotly debated, and there is consensus that both types of policy instruments are necessary [15].

The previous literature has not reached a consistent conclusion on the policy effects of environmental taxes. When the proportion of environmental taxes collected becomes more extensive and regulation becomes more substantive, the collection of environmental taxes will significantly increase the production costs of enterprises [16]. Regarding the evidence on the effect of China’s environmental tax policy, some scholars have pointed out that, within a certain tax range, “environmental dividends” and “social dividends” can be achieved [17,18]. Jiang et al. (2023) found that environmental tax collection and corporate green innovation have U-shaped relationships which innovation is first suppressed and then promoted [19]. Based on China’s provincial panel data, Song et al. (2020) found that environmental taxes can promote green product innovation [20]. Long et al. (2022) proposed that environmental taxes have little effect on promoting green innovation and that direct government environmental subsidies can promote green innovation [21]. In the study of microenterprises, some scholars believe that environmental taxes can promote microenterprise innovation [22,23,24].

At present, the existing theories and empirical evidence on the impact of government subsidies on green innovation have not reached clear conclusions in terms of size or even direction. R&D innovation and green environment have the characteristics of public goods; that is, they are non-competitive and non-exclusive, and the dual externalities of green innovation will lead to the private benefits of green innovation being lower than the social benefits [25]. The dual externalities of green innovation can lead to market failure, which provides theoretical support for government funding for green innovation, including direct subsidies, tax incentives, and loan discounts. However, whether government subsidies can promote corporate innovation has not been unanimously answered. Dimos and Pugh (2016) found, by analyzing 52 micro-studies published internationally on R&D inputs or outputs between 2000 and 2016, that the existing research presents three conflicting results on the relationship between government R&D subsidies and corporate R&D: complementary, no impact, and even crowding out [26]. Compared with subsidy policies, tax policies create a greater incentive for manufacturers to invest in low-carbon products [27]. The combination of environmental taxes and innovation subsidies is more effective than the promotion of green innovation by a single policy. Guellec and Potterie (2003) further analyzed country-level data and found that tax incentives would fail if companies failed to understand the long-term nature of government R&D tax incentives [28]. Tax cuts can indeed incentivize companies to invest more in research and development [29], but weaker legal oversight also condones companies’ opportunistic behavior [30]. Corporate innovation, as measured by patent applications, sometimes manifests itself as a strategic behavior [31,32]. Jia and Ma (2017) analyzed data at the firm level in China and found that R&D tax incentives had no positive impact on state-owned and non-high-tech enterprises [33].

The research methods used in the literature on green innovation include empirical studies, mathematical modeling, and literature reviews. Mathematical modeling includes analysis of variance, structural equation modeling, the difference in differences model (DID), data envelopment analysis (DEA), and so on.

2.1. The Effect of Environmental Taxes and R&D Tax Incentive on Green Innovation

Environmental taxes indirectly induce enterprises’ demand for green innovation by increasing external pressure via raising the cost of pollution (demand-side effect). Market demand is an important driver of product innovation. In the current stage of sewage charges, when an environmental tax has not been implemented, the low collection standards and enforcement issues regarding sewage fees have raised concerns among the government and all sectors of society about the effectiveness of the sewage fee system [34]. Green innovation incentives will change the original innovation plan of enterprises in order to maximize profits, while short-term costs and risks are less likely to affect enterprises’ green innovation decisions. In 2018, an environmental tax was officially implemented, which was collected and managed by the tax department and the environmental protection department. The environmental protection department monitored and managed the taxable pollutants, and the tax department collected the environmental tax through information sharing. The excessive collection of environmental taxes will attract the attention of environmental protection authorities, and related products may be further restricted; for example, production lines can be suspended, production can be suspended, etc. Environmental taxes increase the demand for green technologies, and to comply with policies and laws, enterprises will upgrade their production lines to carry out cleaner production [35]. At the same time, the goals of “carbon peaking” in 2030 and “carbon neutrality” in 2060 show China’s determination to transition to a low-carbon economy and, thus, indicate a future demand for green innovative technologies and a return on success. Higher expected returns will spur companies to increase their green innovation efforts. Therefore, the legal authority of environmental taxes, as well as the expectation of an increase in long-term pollution costs in the future, will prompt enterprises to optimize their economic structure and carry out green innovation.

High-intensity government R&D tax incentives can partly compensate enterprises for current green innovation costs and R&D risks, thereby stimulating green innovation (supply-side effect). China’s R&D tax incentive stipulates that an enterprise’s R&D expenses can enjoy a 100% super-deduction when calculating the taxable income of the enterprise. Opportunism in public bureaucracies and self-interested selection procedures by companies that take advantage of information asymmetries can reduce the effectiveness of direct government subsidies. Unlike direct government subsidies, policies that incentivize through R&D taxes work relatively well. In terms of the legality of the R&D super-deduction policy, there is no approval process for enterprises to receive tax benefits, and it is a legal right for enterprises that meet the regulations to enjoy the R&D super-deduction, reducing the opportunism of government departments in selecting individual enterprises for funding. The R&D tax incentive is also universal: except for six restricted industries, all other innovative enterprises can enjoy it fairly through the relevant documents and tax benefits. Finally, there is the penalty cost of tax deductions for non-compliance. The tax authorities will conduct tax inspections on the amount of R&D tax relief enjoyed by enterprises, investigating their tax incentives and tax exemptions in the context of tax enforcement. The responsibilities of R&D tax incentive inspection and law enforcement personnel are more stringent, and if an enterprise violates the conditions of the incentives, it will be subject to late fees and fines.

Hypothesis 1a.

Environmental taxes can positively promote green innovation.

Hypothesis 1b.

R&D tax incentives can positively promote green innovation.

2.2. The Mixed Effect of the Combination of Environmental Taxes and R&D Tax Incentives on Green Innovation

Acemoglu et al. (2012) discovered, through numerical simulations, that the combination of environmental regulation policies and financial subsidy policies can produce a multiplier effect on technological innovation. A joint tax–subsidy policy can lead to higher social welfare and higher investment levels in green innovation than a single tax or subsidy policy. On the demand side, the external environmental tax costs ensure that a company’s new technologies are constantly improving, and expectations for the return of successful green innovation indirectly increases the incentives for investment in green innovation. On the supply side, the R&D tax incentive further reduces the R&D cost of enterprises’ innovation needs due to environmental taxes. The mutual feedback between the two tax policies forms the linkage between the supply and demand of green innovation, and the mixed effect is stronger than the unilateral effect [36].

Hypothesis 2.

The combination of environmental taxes and R&D tax incentives can produce amplified mixing effects on green innovation.

2.3. Environmental Taxes, R&D Tax Incentives and Green Innovation Quality

Roychowdhury (2006) argues that the manipulation of R&D expenses is an effective method to manage the surplus of the actual business activities of companies [37]. China’s R&D tax incentive policy only stipulates that only the R&D expenses incurred by enterprises in the current year can receive tax deductions and the results of those R&D efforts are not assessed, which provides an opportunity for enterprises to manipulate their R&D expenses to make strategic innovations to obtain more tax deductions. There is a structural imbalance in China’s innovation activities, resulting in low-quality technological innovation and fewer patents for new inventions than for new utility models and designs. Enterprises may unilaterally pursue innovative quantity rather than quality to obtain more tax incentives. Environmental taxes increase the environmental costs for businesses and stimulate the demand for substantive green innovative technologies in enterprises. If the environmental regulatory cost savings and benefits brought on by substantive innovation are greater than the R&D costs, the company will choose to pursue the R&D of invention patents to maximize the long-term profits of the enterprise [38].

Hypothesis 3.

Environmental taxes can address the strategic innovation problem of R&D tax incentives and improve the quality of green innovation.

2.4. The Impact of Policy Implementation and the Regulatory Environment on the Policy’s Effect

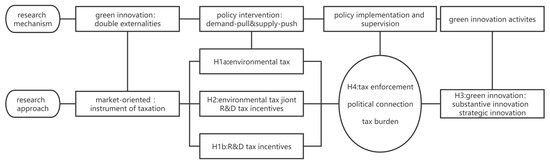

China’s environmental tax is a tax law formulated at the national level. Within the scope of the law, each province sets specific tax standards according to regional conditions, and the collection of environmental taxes varies from place to place. R&D tax incentives are formulated by the state and implemented according to unified implementation standards nationwide. The inadequate monitoring and enforcement of environmental regulatory policies will also affect the effectiveness of those policies. Strong tax enforcement will regulate the tax payment behavior of enterprises and curb their tax avoidance activities. The level of tax enforcement will affect the implementation effects of environmental taxes and R&D tax incentives. When the tax enforcement environment is weak, the collection and inspection of environmental taxes and the communication of information with the environmental protection department are prone to being exploited by loopholes. A lower cost of tax avoidance for companies weakens the pressure put on them by the cost of pollution imposed by the environmental tax and diminishes their incentive to innovate. At the same time, it is also easier for businesses to carry out lower-quality innovation to obtain more tax incentives, weakening the promotion of green innovation by these two tax policies. When tax enforcement is strong, however, the opportunities for tax avoidance and rent-seeking in the tax policy are relatively small. Thus, demand for green innovation can be better stimulated by environmental taxes and innovation can be better promoted by R&D tax incentives according to policy expectations, thus improving the policy’s implementation effect. For a clearer understanding of the content of this article, Figure 1 shows the empirical research framework.

Figure 1.

Empirical research framework.

Hypothesis 4.

The level of tax enforcement positively promotes the implementation effect of environmental taxes and R&D tax incentives on green innovation.

3. Materials and Methods

3.1. Sample Selection and Data Sources

This paper uses sample data from China’s A-share-listed manufacturing companies from 2013 to 2021. The green innovation of enterprises is measured using green patent authorization data, and the patent and financial data of enterprises are sourced from the State Intellectual Property Office of the People’s Republic of China and the Wind Database, respectively. The identification of green patents follows the internationally accepted standards published by WIPO. The data on the provincial tax enforcement environment come from China’s National Bureau of Statistics. In the data filtering process, incomplete and unreasonable data were filtered out. The final sample included 2179 listed companies and 12,085 observations.

3.2. Variable Definition

3.2.1. Explanatory Variables

The core explanatory variable is the dummy variable treated × period (DID), which is used to compare the impact of the improved standards for taxable pollutants both before and after the environmental tax reform with the green innovation behavior of enterprises in unchanged regions. The time dimension, as the first difference, compares the impact before and after the environmental tax reform. The regional dimension is used as the second difference, comparing the impact of the difference in the intensity of environmental regulation in the regions with increased and unchanged environmental tax rates.

R&D tax incentives (TC) are measured by the amount of tax incentives collected by the enterprise based on the R&D super-deduction. The total tax reduction is divided by the total assets to remove the impact of the size of the company. The formula is as follows: R&D tax incentives = (corporate income tax rate × super-deduction rate × R&D investment)/total assets of enterprises. According to the specific policy of R&D tax incentives, from 2013 to 2016, the super-deduction rate for the R&D expenses of manufacturing companies is 50%. In 2017 and 2018, this rate was 75% for high-tech and 50% for other enterprises. In 2019 and 2020, the value of the super-deduction rate for all enterprises was 75% and was 100% for the entire manufacturing industry in 2021.

3.2.2. Explained Variables

Green Innovation (GI): most existing studies define green innovation activities broadly [36]. Green innovation includes the development of green products and processes. However, the green policy literature lacks a clear distinction between product innovation and process innovation. Since the development of green product innovation in China lags behind that of developed countries, in addition to a lack of available and persuasive data on green processes and the green product innovation of Chinese enterprises, this paper focuses on green technology innovation. Green technology innovation is a long process, with a state-authorized innovation patent being the substantive end result. Green innovation patents include green invention patents, green utility model patents, and design patents. Green invention patents are authorized for more innovative breakthroughs in technology, and utility model patents generally propose new technical solutions for the shape, structure, or combination of products and are at a lower level in terms of technological breakthroughs and technical complexity. Referring to the research of Zhao et al. (2022), this paper uses the number of green patents to measure the green innovation ability of enterprises and divides green innovation into substantive innovation and strategic innovation according to patent type, where invention patents represent substantive innovation of a higher quality and utility model patents and design patents are divided into strategic innovations of lower quality [24].

3.2.3. Grouping Variables

According to the narrow Porter hypothesis, the effective implementation and supervision of environmental regulatory policies can induce enterprise innovation. Tax enforcement is an important element of the regulatory environment for environmental taxes and R&D tax incentives. In addition to reducing tax competition by adjusting tax rates, local governments can also reduce the intensity of tax enforcement to compete with other local governments. This paper mainly observes the impact of local tax enforcement on the implementation effect of environmental regulatory tax policies.

Referring to the study of Xu et al. (2011), this paper uses the “tax handle” method to measure the overall strength of local tax enforcement by measuring the tax effort index [39]. The “tax handle” method contains two main indicators: one is the tax capacity, which refers to the theoretical or expected total statutory tax revenue of a region; the second is tax effort, which refers to the extent to which the regional government receives tax revenue based on its tax capacity. The functional relationship between the two is as follows:

The expression that can obtain tax effort from (a) is:

where Tax* represents the expected tax revenue and Tax represents the tax revenue received by the local government. Firstly, a fixed-effect model is constructed to measure the tax capacity of each region, and per capita GDP, openness, population density, industrial structure, and urbanization rate are added as explanatory variables. Secondly, the local government’s tax capacity Tax* is fitted according to the regression results of the first step. Finally, the local tax effort index is estimated, and the fitted equation is as follows:

Here, Tax* refers to tax capacity, which is the proportion of tax revenue to GDP in each region, and pgdp refers to the level of economic development, which is obtained by dividing the GDP of each region by its total population and applying the logarithm. Open refers to the degree of openness, expressed by dividing the GDP of the region by the total volume of imports and exports of the business unit. Density refers to the population density, and the number of permanent residents in each region divided by the land area of each region is logarithmic. Ind2 refers to the proportion of the secondary industry, that is, the proportion of the added value of the secondary industry to GDP in each region. Ind3 refers to the proportion of the added value that the tertiary industry contributes to the GDP in each region. Finally, urban refers to the level of urbanization, expressed as the ratio of the urban population of each region to the total population of the region.

3.2.4. Control Variables

Based on Yu et al.’s (2021) selection of variables, we use the control variables of firm size (Size), firm year (Age), leverage ratio (Lev), return on invested capital (ROIC), enterprise operating income (OI), total assets turnover (TATO), and expansion in fixed asset investment (FAI).

3.3. Model Design

This paper adopts a difference-in-difference model to examine the impact of environmental tax reform on enterprises’ green innovation. The environmental protection tax introduced in China in 2018 can be used as a quasi-natural experiment for exogenous economic systems. After the implementation of the environmental protection tax, according to their specific local conditions, some regions have increased the standards concerning taxable pollutants, while those in other regions have remained unchanged. This has created a situation which allows us to conduct a quasi-natural experiment where we can use the double difference method to study the effects of environmental regulation policies. The model is designed as follows:

where i and t represent the firm and year. GI, representing green technology innovation, is the explained variable. The core explanatory variable is the dummy variable Treated*Period (DID), which is used to indicate the excess impact of environmental taxes on manufacturing enterprises. TC stands for the R&D tax incentive, λi is the individual fixed effect, μt is the time fixed effect, and εi,t is the random error. Equation (4) is the baseline differential-difference model. Equation (5) is the difference-in-difference model which considers the bidirectional fixed effect, and Equations (5)–(7) show the interaction effect. We use the robust Hausman test for model selection, and the p-values of the basic regression models (5)–(7) are all 0.000, rejecting the null hypothesis of random effects. The fixed-effect model was thus chosen for this paper.

3.4. Descriptive Statistics

The sample studies spanned from 2013 to 2021 and involved 2179 companies, with a total of 12,085 observations. Table 1 shows the descriptive statistics of each variable. The average application value according to the studied green patents is 6751, and the standard deviation is 15,243, indicating that the overall level of green innovation of the listed manufacturing enterprises is low and that their innovation abilities vary greatly. The mean value of the R&D tax incentive is 0.297, and the standard deviation is 0.266. This indicates the universality of R&D tax incentives and the substantial amount of incentives that manufacturing enterprises receive, showing a small difference in the degree of preference between enterprises.

Table 1.

Descriptive statistics of variables.

4. Analysis of Empirical Results

4.1. Analysis of Regression Results

The Impact of Environmental Taxes and R&D Tax Incentives and Their Policy Combinations on Green Innovation

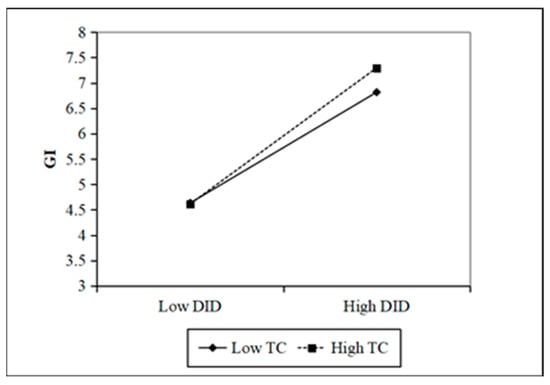

In Table 2, Column (1) represents the baseline random effects of the DID model. Column (2), which controls for individual and fixed effects, shows that environmental taxes promote green innovation in a significant positive direction. The results in Column (3) show that R&D tax incentives significantly promote green innovation. Column (4) shows the cross-product terms of the DID and TC models, and the coefficient is significant. Hypothesis 2, which proposes that environmental taxes and R&D tax incentives can have mutually reinforcing interactions, was tested. This shows that improving the collection standards for environmental taxes and the expected return on green innovation investment in the future results in a demand for green innovation of enterprises. R&D tax incentives, as a “technology promotion” policy, also stimulate the results of green innovation. Moreover, this mixed combination of the “demand–pull” and “supply–push” policies of environmental taxes and R&D tax incentives can strengthen the Porter effect more than a single policy can. Figure 2 shows the interaction between environmental taxes and R&D tax incentives more intuitively.

Table 2.

Regression results of environmental taxes and R&D tax incentives on green innovation.

Figure 2.

The interaction between environmental taxes and R&D tax incentives.

Regarding the control variables, company size, age, OI, and green innovation ability are positively correlated, which is in line with the scale effect of green technology innovation. Companies with more strength, that are older and that are well run, have stronger foundations for green innovation. The ROIC is negative but not significantly so, and financial leverage is positively correlated with green innovation ability. Moreover, the LEV level of China’s listed manufacturing companies is generally high; as can be seen from Table 1, the average asset–liability ratio of these enterprises is 40%. Higher financial leverage also means that companies can use more external funds, have fewer financing constraints, and have enough funds to carry out technological innovation. The result of the TATO analysis is significantly negative, with high asset turnover indicating a company’s stronger operating capacity, which may be explained by the fact that a stronger operating capacity means that the company will spend more on selling expenses, which may crowd out funds for green innovation. FAI is positively correlated with the green innovation of enterprises, and the increase in the investment rate of fixed assets shows the expansion of enterprises for long-term development. When funds are sufficient, such as when they have sufficient financial leverage, expanding enterprises are more inclined to carry out green innovation, expanding both capital and technology.

4.2. Robustness Test

4.2.1. Parallel Trend Test

The use of the DID model must meet the parallel trend hypothesis; that is, the treatment group and the control group must show a consistent temporal trend of enterprise green innovation before the implementation of the policy. Referring to Deschênes et al. (2017) [40], this paper used the event study method to construct the following dynamic effect model of the impact of environmental protection taxes on enterprise green technology innovation:

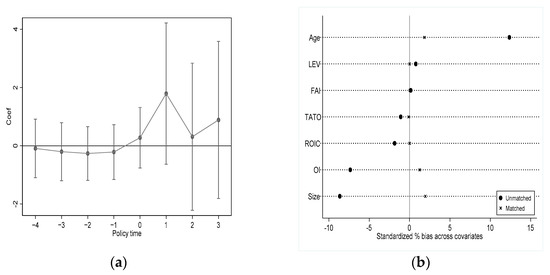

In the model, αi represents the difference between the experimental group and the control group before and after the policy reform. Among them, from Pre1 to Pre4 represents from the first to fourth years before the implementation of the policy; Current represents the year 2018 as the base period in which the policy was implemented; from Post1 to Post3 represents from the first to third years after the implementation of the policy. It can be seen from the results of Figure 3a that, before the environmental protection tax reform, the difference between the experimental group and the control group was not significant; that is, there was no systematic difference in the green innovation level of enterprises between the experimental group and the control group. The green innovation level of the two groups was significantly different after the implementation of the policy, and the model passed the parallel trend test.

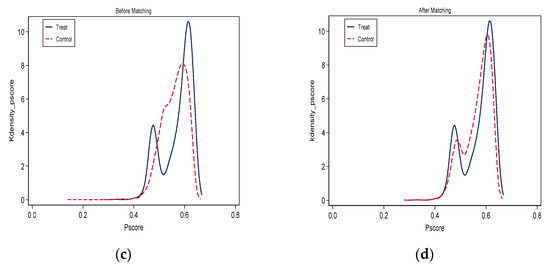

4.2.2. PSM-DID Regression Analysis

In DID-based quasi-natural experiments, sample heterogeneity can lead to selection bias, and control variables can have a significant impact on experimental results in addition to the independent variables. To reduce the impact of the above problems on the regression results and alleviate the endogenous problems caused by observable variables, we constructed a control group using the PSM method for PSM-DID regression analysis. Figure 3b shows the matching effect. After the propensity score was matched, the treatment and control groups had more common areas of support, and the overall difference between the control variables decreased and approached zero. Figure 3c,d show the difference between the two kernel density curves before and after matching. However, after fitting, the two curves are more consistent, and the gap between the mean of the treatment group and the control group was significantly reduced, thereby eliminating the interference of different control variables. Columns (1)–(3) in Table 3 show the regression analysis results of the PSM-DID. After sample matching, the regression results are consistent with the benchmark regression, which verifies the robustness of the benchmark regression.

Table 3.

Regression results of the robustness test.

Figure 3.

(a) Results of the parallel trend test; (b) covariate standardization bias test; (c) kernel density comparison before PSM; (d) kernel density comparison after PSM.

4.2.3. Placebo Test

The uniqueness of policy implementation is one of the basic assumptions of the DID model, which is to prove that policy is the main influencing factor. The core idea of the placebo examination is the use of a fictitious treatment group or fictitious policy time estimate, and if the difference in the estimator of the regression outcome is still significant, it indicates that the original estimate of the regression result may be biased. Changes in the variables to be explained are likely to be influenced by other policy changes or random factors. This paper sets the policy reform to be tested by a placebo in 2016 and 2017. The regression results are shown in Columns (4) and (5) of Table 3. None of the “pseudo-policy dummy variables” are found to be significant, which indicates that, in the absence of policy shocks, the green innovation behavior of enterprises does not change significantly, which supports the robustness of the benchmark regression’s conclusion.

4.3. Mechanism Analysis of Green Innovation Quality: Substantive Innovation or Strategic Innovation

Table 4 shows the impacts of the environmental taxes and R&D tax incentives, as well as their combination, on the quality of green innovation in enterprises. SGI stands for substantial green innovation, and TGI stands for strategic innovation. Columns (1) and (2) show that the environmental protection tax has a significant effect on the substantive green innovation of enterprises, but does not have a significant effect on strategic innovation. This shows that the increase in the substantial cost of the environmental protection tax and the expectation of successful returns on R&D in the future has increased the demand for high-quality green innovation. For environmental tax policies, strategic innovations with lower practicality than substantive innovations have limited benefits to enterprises. Columns (3) and (4) show that the promotion coefficient of the R&D tax incentives for substantial green innovation is smaller than that of strategic innovation in the full-sample case. Similar to the results of Zhao et al. (2022), there is a structural imbalance in China’s innovation activities, resulting in low-quality technological innovation and fewer new invention patents than utility model and design patents. This finding shows that, when enterprises can enjoy the benefits of R&D tax incentives, whether that be due to receiving more tax breaks or other reasons, the strategic innovation problem also exists in the field of green innovation, resulting in the low quality of green innovation. Columns (5) and (6) in Table 4 include the cross-product terms of the DID and TC to test the mixed effects of the combination of environmental taxes and R&D tax incentives on the quality of green innovation. The results show that the mixed effect of this policy mix on substantive green innovation is not significant, but it has a restraining effect on strategic innovation. This shows that the pressure on environmental costs caused by environmental taxes has increased enterprises’ demand for high-quality green innovation and inhibited the strategic innovation promoted by R&D tax incentives. However, the combination of environmental taxes and R&D tax incentives does not have a significant effect on substantive green innovation, which may be due to the time required for the effect of joint policies to appear, as well as the lagging effect of policy linkage due to the long-term and scale effects of high-quality green innovation.

Table 4.

Regression results of the impact of policies on the quality of green innovation.

4.4. Analysis of Tax Enforcement’s Influence on Tax Policy’s Effect on Inducing Green Innovation

Table 5 shows the heterogeneity of the effects of environmental taxes and R&D tax incentives on enterprises’ green innovation policies under different levels of tax enforcement. The results in Columns (1) to (4) show that both environmental taxes and R&D tax incentives significantly promote green innovation for enterprises in a stronger tax enforcement environment. However, in a weak tax enforcement environment, the role of environmental taxes in promoting the green innovation of enterprises is not significant, which illustrates that environmental taxes are in the transitional stage just after implementation. In places where the level of tax collection and management is weak, due to the existence of tax collection, management strength, and management space, the cost pressure brought on by the environmental tax to enterprises is limited and is not sufficient to incentivize enterprises to increase R&D investment for green innovation. This shows the manifestation of the narrow Porter hypothesis in developing countries, which states that the effective implementation and regulation of environmental regulatory policies are important conditions for promoting enterprise innovation. However, in a weak tax enforcement environment, R&D tax incentives also significantly stimulate green innovation for enterprises and have a larger regional coefficient than high tax enforcement. This indicates that, for incentives that enterprises can enjoy immediately, the relaxed inspections under a weak tax enforcement environment are more conducive to enterprises carrying out green innovation to obtain tax relief for immediate profits. Columns (5) and (6) show the performance of the mixed effects of the policy combination on green innovation at different levels of tax enforcement, and the two policies are still mutually reinforcing in areas with high tax enforcement but not significantly so in areas with low enforcement, indicating that the mixed effect of the narrow Porter hypothesis is also applicable to the combination of these policies. The above results show that, in developing countries with relatively imperfect tax systems, the level of tax enforcement directly affects the implementation and supervision of environmental regulation tax policies and R&D tax subsidies, thereby influencing the stimulating effect of these policies on green innovation.

Table 5.

Regression results of influence of tax enforcement on policy effects.

4.5. Heterogeneous Policy Effects of Political Connection

We determine whether an enterprise is a state-owned enterprise or a private enterprise based on the information of the actual controller of the listed company. If the enterprise’s controller is the Central State-owned Assets Supervision and Administration Commission, the local State-owned Assets Supervision and Administration Commission, or other government departments, it is a state-owned enterprise. If the actual controlling shareholder is an individual, it is a private enterprise. We explore the differences in policy effects between state-owned enterprises and private enterprises. SOEs are considered to have some natural political connections with their governments, and the mechanism by which their long-term R&D decisions are influenced by the government differs from that of the private sector. The results of Table 6 show that both environmental taxes and R&D tax incentives have stronger stimulating effects on green innovation in SOEs than in private enterprises. In contrast, the mixed effect of the mutual promotion of the combined policy is not significant in SOEs but is significant in private enterprises. Due to the double negative externalities of green innovation, the nature of state-owned enterprises means that they are usually responsible for more political tasks and have more social responsibility beyond the assumption of profit maximization. Green innovation is an important goal of the government’s mission. Therefore, due to the scale of state-owned enterprises and the small financial pressure that they face, whenever a single policy is vigorously implemented, state-owned enterprises are strong responders; however, due to the poor flexibility in their R&D decision making, the combined policies have limited impact on them. Private enterprises, on the other hand, are more likely to be affected by the multiplier effect brought on by policy combinations.

Table 6.

Regression results of political connection’s influence on policy effect.

4.6. Heterogeneous Policy Effects of High-Tech Enterprises

The article determines whether a company is a high-tech enterprise based on whether the enterprise has been recognized as a high-tech enterprise by the agency managing China’s high-tech enterprise certifications. Both environmental taxes and R&D tax incentives are ultimately passed on to companies through corporate tax burdens. High-tech enterprises enjoy more tax incentives than non-high-tech enterprises, such as the R&D super-deduction and a lower 15% corporate income tax rate (the income tax rate for non-high-tech enterprises is 25%). When the tax burden of high-tech enterprises is relatively low, the marginal utility of the increased tax burden brought on by environmental taxes and the reduction in the tax burden brought on by R&D tax incentives is lower than that of non-high-tech enterprises, thereby weakening the impact of tax policies on green innovation. Columns (1), (2), (4), and (5) in Table 7 show that environmental taxes and R&D tax incentives stimulate green innovation for non-high-tech enterprises significantly more than for high-tech enterprises. Columns (3) and (6) show that the mixed effect of policies is significant in high-tech enterprises but not in non-high-tech enterprises. The reason for this may be that technological innovation by high-tech enterprises is a regular decision of these enterprises, and compared with non-high-tech enterprises, they are more flexible and sensitive to using existing linkage policies to adjust green innovation to maximize profits.

Table 7.

Regression results of high-tech enterprises’ influence on policy effect.

5. Conclusions and Implications

5.1. Conclusions

Starting from environmental tax and R&D tax incentive policies, this paper examines the impact of demand–pull and supply–push policies and their combination on enterprises’ green innovation output and innovation quality. The study further considers the heterogeneity of the innovation induced by policy implementation and the regulatory environmental impact from the perspective of tax enforcement. This study aims to enrich the empirical evidence for the narrow Porter hypothesis in developing countries. The main results can be summarized as follows. First, both environmental taxes and R&D tax incentives can positively promote the green innovation of enterprises, and the two policies combined can produce more positive mixed effects of mutual promotion. Second, environmental taxes can improve the quality of the green innovation of enterprises and fix the strategic innovation problems caused by R&D tax incentives. Third, a strong tax enforcement environment can positively promote policy implementation and supervision, and can thus affect the innovation induced by environmental regulation policies. Finally, the green innovation-inducing effect of environmental taxes and R&D tax incentives is greater in state-owned enterprises and non-high-tech enterprises.

5.2. Discussion

Consistent with the result of Zhang et al. (2022) [41], we verify the effect of environmental taxes on green innovation and the effect of the combination of environmental taxes and R&D subsidies to amplify policy effects. The difference in our study is that their research used enterprise patent data to examine the overall innovation of enterprises, whereas we examined the impact on corporate green innovation, which corresponds to the green function of environmental taxes more directly. Contrary to the result of Zhang et al. (2022), which was the promotion of technological innovation in the private sector being more pronounced following the implementation of environmental taxes, we found that the green innovation effect of environmental taxes is more significant in state-owned enterprises. The reason for this difference could be that this paper focused on green innovation, which is different from an enterprise’s other technological innovations. Because of the negative externalities of green environmental regulations and state-owned enterprises’ greater social responsibility beyond the assumption of profit maximization, they will be more active in green innovation. Furthermore, we examine the positive impact of the tax enforcement environment on the effectiveness of environmental tax policies and verify the important impact of a policy’s implementation and regulation on its effectiveness. This study enriches the research on the effect of the tax enforcement environment on the implementation of environmental policies.

5.3. Limitations and Further Developments

It is worth mentioning that this paper studies the achievements and quality of green technology innovation of enterprises according to macro-level tax policies, and no clear distinction is made between corporate green innovation processes, which can, to a certain extent, explain the impact mechanism of macro-level policies on enterprises’ green technology innovation. However, environmental regulation policies will also act on the green innovation process of an enterprise, as well as their green products and other innovation processes, which is a limitation of this paper. There are more examples of research on innovative green products conducted in developed countries compared to developing countries. Further research is needed to penetrate the entire innovation chain of enterprises in developing countries to more comprehensively examine the effect of policies in these nations.

5.4. Implications

In light of these results, some policy recommendations may be worth considering. While formulating reasonable policies, policymakers should pay more attention to improving enterprises’ expectations for future demand for green innovative technologies and successful returns on R&D, such as improving the marketization of green innovative technologies and products. Furthermore, policy formulation should fully consider the coordination with and support from existing policies using heterogeneous environmental regulatory means and should also focus on the scientific design of the policy mix. Policy design has shifted from forcing and encouraging innovation in advance to inducing innovation with considerable expectations for economic profit after the fact, thus making up for the uncertainty and high investment involved in innovation and promoting substantial green innovation. Finally, the effective implementation and supervision of policies also plays a more important role in the effectiveness of a policy, especially in developing countries. The legality and authority of tax policies should be maintained, and attention should be paid to creating a fair institutional environment for policy implementation.

Author Contributions

Conceptualization, Q.Z.; Data curation, Q.Z.; Formal analysis, Q.Z.; Investigation, X.D.; Methodology, Q.Z.; Software, Q.Z.; Supervision, J.L.; Visualization, Q.Z.; Writing—original draft, Q.Z.; Writing—review and editing, J.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the National Natural Science Foundation of China, Project Title: The Impact of Environmental Regulation on China’s Balanced Economic Development: A Study Based on the Perspectives of Region, Industry and Urban-Rural Areas, Approval Number: 71964032.

Institutional Review Board Statement

The study did not require ethical approval.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Walker, K.; Ni, N.; Huo, W. Is the Red Dragon Green? An Examination of the Antecedents and Consequences of Environmental Proactivity in China. J. Bus. Ethics 2013, 125, 27–43. [Google Scholar] [CrossRef]

- Magat, W.A. Pollution control and technological advance: A dynamic model of the firm. J. Environ. Econ. Manag. 1978, 5, 1–25. [Google Scholar] [CrossRef]

- O’Rourke, D.; Lollo, N. Transforming Consumption: From Decoupling, to Behavior Change, to System Changes for Sustainable Consumption. Annu. Rev. Environ. Resour. 2015, 40, 233–259. [Google Scholar] [CrossRef]

- Peñasco, C.; Anadón, L.D.; Verdolini, E. Systematic review of the outcomes and trade-offs of ten types of decarbonization policy instruments. Nat. Clim. Chang. 2021, 11, 257–265. [Google Scholar] [CrossRef]

- Wang, C.; Yang, Y.; Zhang, J. China’s sectoral strategies in energy conservation and carbon mitigation. Clim. Policy 2015, 15, S60–S80. [Google Scholar] [CrossRef]

- Blackman, A.; Li, Z.; Liu, A.A. Efficacy of Command-and-Control and Market-Based Environmental Regulation in Developing Countries. Annu. Rev. Resour. Econ. 2018, 10, 381–404. [Google Scholar] [CrossRef]

- Yi, Y.; Wei, Z.; Fu, C. An optimal combination of emissions tax and green innovation subsidies for polluting oligopolies. J. Clean. Prod. 2020, 284, 124693. [Google Scholar] [CrossRef]

- Acemoglu, D.; Aghion, P.; Bursztyn, L.; Hemous, D. The Environment and Directed Technical Change. Am. Econ. Rev. 2012, 102, 131–166. [Google Scholar] [CrossRef]

- Jaffe, A.B.; Palmer, K. Environmental Regulation and Innovation: A Panel Data Study. Rev. Econ. Stat. 1997, 79, 610–619. [Google Scholar] [CrossRef]

- Millimet, D.L.; Roy, J. Multilateral environmental agreements and the WTO. Econ. Lett. 2015, 134, 20–23. [Google Scholar] [CrossRef]

- Lennox, C.S.; Lisowsky, P.; Pittman, J.A. Tax Aggressiveness and Accounting Fraud. SSRN Electron. J. 2012, 51, 739–778. [Google Scholar] [CrossRef]

- Porter, M.E.; Van der Linde, C. Green and competitive: Ending the stalemate. Harv. Bus. Rev. 1995, 73, 120–134. [Google Scholar]

- Peters, M.; Schneider, M.; Griesshaber, T.; Hoffmann, V.H. The impact of technology-push and demand-pull policies on technical change—Does the locus of policies matter? Res. Policy 2012, 41, 1296–1308. [Google Scholar] [CrossRef]

- Hoppmann, J.; Peters, M.; Schneider, M.; Hoffmann, V.H. The two faces of market support—How deployment policies affect technological exploration and exploitation in the solar photovoltaic industry. Res. Policy 2013, 42, 989–1003. [Google Scholar] [CrossRef]

- Norberg-Bohm, V. Stimulating ‘green’ technological innovation: An analysis of alternative policy mechanisms. Policy Sci. 1999, 32, 13–38. [Google Scholar] [CrossRef]

- Lans Bovenberg, A.; de Mooij, R.A. Environmental tax reform and endogenous growth. J. Public Econ. 1997, 63, 207–237. [Google Scholar] [CrossRef]

- He, P.; Ya, Q.; Chengfeng, L.; Yuan, Y.; Xiao, C. Nexus between Environmental Tax, Economic Growth, Energy Consumption, and Carbon Dioxide Emissions: Evidence from China, Finland, and Malaysia Based on a Panel-ARDL Approach. Emerg. Mark. Financ. Trade 2019, 57, 698–712. [Google Scholar] [CrossRef]

- Sun, Y.; Zhi, Y.; Zhao, Y. Indirect Effects of Carbon Taxes on Water Conservation: A Water Footprint Analysis for China. J. Environ. Manag. 2021, 279, 111747. [Google Scholar] [CrossRef] [PubMed]

- Jiang, Z.; Xu, C.; Zhou, J. Government environmental protection subsidies, environmental tax collection, and green innovation: Evidence from listed enterprises in China. Environ. Sci. Pollut. Res. 2022, 30, 4627–4641. [Google Scholar] [CrossRef]

- Song, M.; Wang, S.; Zhang, H. Could environmental regulation and R&D tax incentives affect green product innovation? J. Clean. Prod. 2020, 258, 120849. [Google Scholar] [CrossRef]

- Long, S.; Liao, Z. Economic incentive instruments and environmental innovation in China: Moderating effect of marketization. Sci. Public Policy 2022, 49, 553–560. [Google Scholar] [CrossRef]

- Yu, H.; Liao, L.; Qu, S.; Fang, D.; Luo, L.; Xiong, G. Environmental regulation and corporate tax avoidance: A quasi-natural experiments study based on China’s new environmental protection law. J. Environ. Manag. 2021, 296, 113160. [Google Scholar] [CrossRef]

- Huang, S.; Lin, H.; Zhou, Y.; Ji, H.; Zhu, N. The Influence of the Policy of Replacing Environmental Protection Fees with Taxes on Enterprise Green Innovation—Evidence from China’s Heavily Polluting Industries. Sustainability 2022, 14, 6850. [Google Scholar] [CrossRef]

- Zhao, A.; Wang, J.; Sun, Z.; Guan, H. Environmental taxes, technology innovation quality and firm performance in China—A test of effects based on the Porter hypothesis. Econ. Anal. Policy 2022, 74, 309–325. [Google Scholar] [CrossRef]

- Bloom, N.; Griffith, R.; Van Reenen, J. Do R&D tax credits work? Evidence from a panel of countries 1979–1997. J. Public Econ. 2002, 85, 1–31. [Google Scholar] [CrossRef]

- Dimos, C.; Pugh, G. The effectiveness of R&D subsidies: A meta-regression analysis of the evaluation literature. Res. Policy 2016, 45, 797–815. [Google Scholar] [CrossRef]

- Chen, W.; Hu, Z.-H. Using evolutionary game theory to study governments and manufacturers’ behavioral strategies under various carbon taxes and subsidies. J. Clean. Prod. 2018, 201, 123–141. [Google Scholar] [CrossRef]

- Guellec, D.; de la Potterie, B.V. From R & D to Productivity Growth: Do the Institutional Settings and the Source of Funds of R&D Matter? Oxf. Bull. Econ. Stat. 2004, 66, 353–378. [Google Scholar] [CrossRef]

- Hall, B.; Van Reenen, J. How effective are fiscal incentives for R&D? A review of the evidence. Res. Policy 2000, 29, 449–469. [Google Scholar] [CrossRef]

- Gilliam, T.A.; Heflin, F.; Paterson, J.S. Evidence that the zero-earnings discontinuity has disappeared. J. Account. Econ. 2015, 60, 117–132. [Google Scholar] [CrossRef]

- Dosi, G.; Marengo, L.; Pasquali, C. How much should society fuel the greed of innovators? Res. Policy 2006, 35, 1110–1121. [Google Scholar] [CrossRef]

- Hall, B.H.; Harhoff, D. Recent Research on the Economics of Patents. Annu. Rev. Econ. 2012, 4, 541–565. [Google Scholar] [CrossRef]

- Jia, J.; Ma, G. Do R & D tax incentives work? Firm-level evidence from China. China Econ. Rev. 2017, 46, 50–66. [Google Scholar] [CrossRef]

- Maung, M.; Wilson, C.; Tang, X. Political Connections and Industrial Pollution: Evidence Based on State Ownership and Environmental Levies in China. J. Bus. Ethics 2015, 138, 649–659. [Google Scholar] [CrossRef]

- Berrone, P.; Fosfuri, A.; Gelabert, L.; Gomez-Mejia, L.R. Necessity as the Mother of ‘Green’ Inventions: Institutional Pressures and Environmental Innovations: Necessity as the Mother of ‘Green’ Inventions. Strat. Manag. J. 2012, 34, 891–909. [Google Scholar] [CrossRef]

- Stucki, T.; Woerter, M.; Arvanitis, S.; Peneder, M.; Rammer, C. How different policy instruments affect green product innovation: A differentiated perspective. Energy Policy 2018, 114, 245–261. [Google Scholar] [CrossRef]

- Roychowdhury, S. Earnings management through real activities manipulation. J. Account. Econ. 2006, 42, 335–370. [Google Scholar] [CrossRef]

- Hering, L.; Poncet, S. Environmental policy and exports: Evidence from Chinese cities. J. Environ. Econ. Manag. 2014, 68, 296–318. [Google Scholar] [CrossRef]

- Xu, W.; Zeng, Y.; Zhang, J. Tax Enforcement as a Corporate Governance Mechanism: Empirical Evidence from China: Tax Enforcement and Corporate Governance. Corp. Gov. Int. Rev. 2010, 19, 25–40. [Google Scholar] [CrossRef]

- Deschênes, O.; Greenstone, M.; Shapiro, J.S. Defensive Investments and the Demand for Air Quality: Evidence from the NOx Budget Program. Am. Econ. Rev. 2017, 107, 2958–2989. [Google Scholar] [CrossRef]

- Zhang, C.; Zou, C.F.; Luo, W.; Liao, L. Effect of environmental tax reform on corporate green technology innovation. Front. Environ. Sci. 2022, 10, 1036810. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).