Abstract

Deepening the development of digital inclusive finance, dredging the impact of digital inclusive finance on the innovation path of small and medium-sized enterprises (SMEs), and strengthening financial supervision and government support are of great significance to promoting the technological innovation of SMEs. This paper selects listed companies on the New Third Board as research samples and analyzes and empirically tests the relationship between digital inclusive financial and technological innovation of small and medium-sized enterprises. The results show that digital inclusive finance can significantly promote the technological innovation level of SMEs, especially the higher the degree of digitalization, the more obvious the promotion effect. Upon further testing, it was more pronounced in the sample of high-tech industries and eastern SMEs. Digital inclusive finance can effectively alleviate the financing constraints of SMEs, thereby promoting the technological innovation of SMEs. Reasonable financial supervision and adaptive government subsidies have a positive regulating effect on the innovation incentive effect of digital inclusive finance.

1. Introduction

In the post-epidemic era, the world will face a series of severe challenges such as rapid economic decline, industrial chain restructuring, and intensified financial risks, and technological innovation has increasingly become a breakthrough for countries to cope with the impact of public health events and achieve economic growth [1]. Based on China’s major strategic achievements in epidemic prevention and control, how to accelerate digital transformation and drive high-quality economic development with scientific and technological innovation has become an urgent problem to be solved. As the backbone of building an innovative country, small and medium-sized enterprises (SMEs) should seize opportunities and cope with challenges in the context of complex changes in the macro environment and continuous adjustment of industrial structure [2]. However, the technical route for the development of China’s SMEs has not yet been finalized, and the profit model has not yet stabilized. The traditional financial model led by banks cannot achieve the dual performance goals of economic and social benefits of SMEs due to risk uncertainty, adverse selection, credit discrimination, and other phenomena [3]. The funds required for enterprise innovation are difficult to meet the needs of high-quality R&D and innovation by relying only on endogenous financing, and financing constraints have become the “stumbling block” for enterprises to carry out innovation activities.

The mature experience of the international market tells us that the support of capital is particularly important, and scientific and technological innovation is inseparable from the optimal allocation of resources guided by the market and the government and the improvement of the incentive and constraint mechanism. Developed countries such as the United Kingdom and the United States attach great importance to the development of digital inclusive finance. The digital inclusive financial business in the United States includes not only traditional financial business but also new financial services such as robot consulting and big data wealth management, building a complete digital inclusive financial chain [4]. The UK has also been focusing on nurturing the fintech sector. In 2010, the UK established the Digital Technology Cluster Science and Technology City in London. The UK’s Financial Supervisory Authority launched the Financial Regulatory Sandbox in 2016 to provide a safe “test zone” for fintech development [5]. Digital inclusive finance, Internet finance, and financial technology are a series of digital technology and financial services innovations with a combined genealogical concept [6]. Digital inclusive finance was first proposed at the 2016 Hangzhou G20 Summit, and generally refers to all formal financial service actions that promote inclusive finance through the use of digital financial services [7], has better data processing advantages than inclusive finance, higher low-risk than Internet finance, and more accurate inclusiveness than digital finance [8].

Can digital inclusive finance truly alleviate the financing problems of SMEs and improve their technological innovation capabilities? Is the effect of digital inclusive finances on the innovation incentives of SMEs in different regions and industries heterogeneous? Is its influence process and its transmission mechanism regulated by external factors? This series of problems needs to be excavated and condensed. Therefore, objectively and accurately evaluating the stimulating effect of digitally inclusive financial business on the innovation of SMEs can not only provide new ideas for supporting the technological innovation of SMEs but also have important theoretical significance and practical value for the development and improvement of digitally inclusive finance in the future. Based on the above background, this paper intends to discuss the relationship between digital inclusive financial and technological innovation of SMEs. The significance and contribution of this paper are reflected in the following three aspects. First, taking the listed companies on the New Third Board (2011–2020) as the research object, the inclusive characteristics of digital inclusive finance are analyzed from a more micro level, which not only expands the research perspective of the micro effect of digital inclusive finance but also enriches the relevant research results on the driving factors of technological innovation of SMEs. Second, it further clarifies the role mechanism of digital inclusive finance in promoting technological innovation of SMEs and provides a new basis for empowering technological innovation of SMEs. Third, from the perspective of financial supervision and government subsidies, it provides policy suggestions for narrowing the digital divide and better realizing the “government-enterprise-financial institution” multi-party linkage mechanism under macro-control.

The rest of the structure of this paper is as follows: the second part is a literature review; the third part is the theoretical analysis and research hypotheses; the fourth part is the study design, including the selection of data, the measurement of variables and the construction of models; the fifth part is empirical testing; the six parts are endogenous analysis and robustness analysis; the seventh part is the conclusions and revelations and limitations of the study.

2. Literature Review

COVID-19 has hit global economic activity multiple times from both the supply and demand sides. A study analyzing 739 publicly traded companies in 12 countries in the Middle East and North Africa from 2011 to 2020 found that the COVID-19 crisis harmed company performance in most industries and increased overall corporate risk [9]. At the same time, fintech uses emerging cutting-edge technologies such as big data, cloud computing, and artificial intelligence to transform and innovate traditional financial services or businesses, resulting in emerging financial products, financial services, or financial models that provide important support for economic recovery in the post-epidemic era. However, using data from 37 commercial banks in Vietnam between 2010 and 2020, foreign scholars found that the development of fintech has hurt financial stability [10]. Therefore, strengthening financial supervision and promoting a virtuous cycle of “science and technology-industry-finance” is an important measure to achieve self-reliance and self-improvement in science and technology.

With the integration of digital inclusive finance and various industries and the increasing status of SMEs in innovation, the research on digital inclusive finance and SME innovation has gradually been enriched. Scholars focused on the direct impact of digital inclusive finance on the innovation of SMEs and found that digital inclusive finance plays an important role in promoting SME innovation. Yang et al. used data from 2011 to 2017 listed companies on China’s SME Board and ChiNext Board and found that digital inclusive finance can have a long-term and “structural” role in driving innovation for SMEs, that is, with the improvement of enterprise innovation level, it shows a trend of first strengthening and then weakening [11]. In addition, after breaking down the innovation indicators, it is found that digital inclusive finance promotes innovation input more than innovation output [12]. Cao et al. used the data from China’s A-share SME Board from 2011 to 2020 to construct a panel threshold model, revealing the single-threshold effect of digital inclusive finance coverage breadth and the double-threshold effect of enterprise market position [13].

This innovation-driven effect of digital inclusive finance on SMEs is heterogeneous in terms of firm size, nature of ownership, level of internal control, region, and life cycle. Yang et al. divided enterprises with more than 100 employees, 20~100 employees, and less than 20 employees into medium-sized enterprises, small enterprises, and microenterprises, respectively, and found that technological innovation of small enterprises and microenterprises is more dependent on the support of digital inclusive finance [12]. Digital inclusive finance should not cause “financing discrimination” to private enterprises and state-owned enterprises based on its inclusive characteristic but should have a skewed “supporting role” [14]. Yu and Dou grouped enterprises according to whether the two powers were separated and the shareholding ratio of management, which verified that digital inclusive finance has a more prominent impact on the innovation of SMEs with poor internal governance quality with efficient information processing platforms [15]. Liu et al. established a research framework of “digital inclusive finance-enterprise life cycle-enterprise technology innovation”, and empirical studies show that digital inclusive finance has the greatest impact on the technological innovation of enterprises in the growth stage, followed by mature enterprises, which has the least impact on enterprises in the recession period [16]. Zhang et al. used city-level panel data for empirical analysis and found that digital inclusive finance improved the financing environment for SMEs and individual practitioners, effectively supplemented traditional finance, and promoted the improvement of urban innovation [17]. Therefore, in regions where the development of traditional finance lags, the incentive effect of digital inclusive finance on the technological innovation of SMEs is more significant [11,18].

In recent years, most of the discussions among scholars have focused on the path and mechanism of digital inclusive finance to affect the innovation of SMEs. Digital inclusive finance stimulates innovation in SMEs by alleviating financing constraints and reducing the intermediary effect of financing costs [11,15,18,19,20]. First, the development of digital inclusive finance can lower the threshold of financial services, broaden the source of funds for SMEs, improve the availability of innovation funds, and ease the constraints of innovation financing. Secondly, digital inclusive finance has unique data collection and processing capabilities, which can better play the functions of information screening and risk screening, and reduce the innovative financing costs of SMEs. Finally, digital inclusive finance can help alleviate the problem of information asymmetry and improve the efficiency of innovation financing for SMEs. Moreover, entrepreneurship [20] and corporate reputation [13] play a positive moderating role in this influence path. When SMEs face financing problems in innovation activities, entrepreneurs with strong entrepreneurial spirit are more motivated to broaden their sources of funds, actively explore digital technology support and financial service model innovation, explore diversified financial support, and continue to promote enterprise innovation activities. A good reputation is an enterprise’s exclusive and strategic intangible capital, which will send a good signal to the market resource provider that the enterprise can trust, and further amplify this signal through digital inclusive finance.

The above literature provides a reference for the research of this paper. Sorting out the existing research, there are roughly the following characteristics and areas that need to be expanded: First, most of them take ChiNext and small and medium-sized board enterprises as the main research body, but these enterprises are relatively mature in development, and their financing channels are relatively diversified and lack representativeness. Secondly, in terms of the impact of heterogeneity, the existing literature mainly analyzes the differences in the characteristics of enterprises, and there are few studies on the differences in industries and geographical locations of enterprises. Third, some scholars have empirically tested the internal regulatory factors in the process of digital inclusive finance in promoting the innovation of SMEs, but there is a lack of research on the regulatory effect of government intervention (such as financial regulation and government subsidies).

Given this, this paper intends to select the panel data of enterprises listed on the New Third Board from 2011 to 2020, combined with the development indicators of digital inclusive finance, to discuss whether digital inclusive finance can provide the impetus for technological innovation of SMEs, as well as the heterogeneity of enterprises in different industries and regions. A further empirical test is whether financing constraints play an intermediary role under the framework of “digital inclusive finance-scientific and technological innovation of SMEs”, and whether financial supervision and government subsidies play a regulating role.

3. Theoretical Analysis and Hypothesis Presentation

3.1. Digital Financial Inclusion and Technological Innovation for SMEs

Corporate technological innovation is the process of absorbing new inputs and transforming them into relevant capabilities. The STI model was proposed by Griliches as the first to propose science and technology, i.e., R&D, human capital, and infrastructure, as key inputs for innovation [21]. Jensen et al. found that firms can use more implicit information to innovate incrementally through learning and collaboration in practice, the DUI model [22]. Parrilla and Elola compared the STI model, the DUI model, and the STI+DUI model and showed that the innovation output of SMEs is more sensitive to the STI drivers [23]. From this perspective, R&D investment is the core element that fuels technological innovation in SMEs. Firms require large R&D investments to carry out technological innovation activities, and longer R&D cycles and uncertainties introduce a risk premium [24]; thus, continuous and stable financial support is critical to the successful implementation of technological innovation activities.

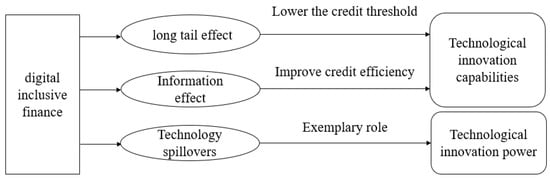

As a new financial industry formed by the deep integration and development of traditional financial services with new-age technologies such as the Internet, big data, and cloud computing, digital inclusive finance, is inclusive, diversified, efficient, and comprehensive, and better fits with the technological innovation needs of micro subjects by bringing into play the long-tail effect, information effect, and competition effect [19,25].

- (1)

- Long-tail effect.

The long-tail theory states that 80% of the financing needs of a large group of SMEs are not met, and most financial resources are in the hands of a few large enterprises [26]. The rapid development of the Internet, which transcends time and space and is highly geographically penetrating, benefits digital inclusive finance, expanding the coverage of credit resources and increasing the availability of credit to the “long tail” [27], making the long-tail market more liquid. Digital inclusive finance provides diversified financing options, further expanding multidimensional access to finance and driving demand for technological innovation from the front end of the curve to the long tail. SMEs have an unprecedented expansion of options to undertake technological innovation with motivational support that can rival that of large enterprises, and their development potential is gradually coming to the fore [28].

- (2)

- Information effects.

According to Myers and Majlufa’s information asymmetry theory [29], under imperfect capital market conditions, information asymmetry exists between internal and external firms, and external investors will require firms to pay a risk premium, increasing the cost of external financing. Digital inclusive finance is based on the collection, processing, and profiling of massive data, which is no longer limited to the structured data provided by enterprises themselves, lowering the degree of information asymmetry between fund supply and demand, and saving the time cost and transaction cost of enterprises seeking funds for technological innovation projects [30]. The use of funds in the process of technological innovation by enterprises can be tracked and monitored in real time, and a credit evaluation mechanism can be established for SMEs to avoid the problem of adverse selection and the moral hazard of traditional financial services [31].

- (3)

- Technology spillover effect

According to the technology spillover theory, leading technology enterprises’ involuntary and unconscious technology diffusion will have a positive impact on the technological progress of other enterprises [32]. The development of digital inclusive finance will serve as an example of technological innovation in other industries as a result of the deep integration of finance and digital technology, and its technological spillover effect will promote digital transformation and technological upgrading in various industries. Furthermore, with the full reach of digital inclusive finance, the emerging financial industry will completely overturn the traditional financial service model, forcing traditional financial institutions to constantly improve their service efficiency and quality to compete [33]. SMEs are bound to actively engage in technological innovation activities when they have access to sufficient capital. Based on the preceding analysis, the following hypotheses are proposed in this paper.

Hypothesis 1 (H1).

Digital inclusive finance can boost SMEs’ technological innovation.

The mechanism of digital inclusive finance on the technological innovation of SMEs is shown in Figure 1.

Figure 1.

The mechanism of digital inclusive finance on the technological innovation of SMEs.

3.2. The Impact Mechanism of Digital Inclusive Finance on Technological Innovation of SMEs: Easing Financing Constraints

Finance is a critical component of the microenterprise technological innovation environment, which means that the effective supply of financial markets can have a direct impact on the development of technological innovation activities [34]. In the absence of financial, policy, and market support systems necessary for technological innovation, firms cannot effectively utilize their factor endowments and technological innovation activities do not develop in a balanced manner [35].

Due to the non-competitive neutrality of commercial banks in China’s credit market [3], large state-owned enterprises are favored by banks and other financial institutions for a long time due to their high qualifications, while SMEs are forced to accept higher financing costs and lower financing limits, and the “Matthew effect” of credit resource allocation among enterprises occurs [36]. Financial exclusion in the traditional financial system reduces the efficiency of resource allocation and exposes SMEs to liquidity constraints, thus losing access to high-return projects [37].

Digital inclusive finance is a digital innovation of traditional financial products and business models. P2P, microfinance, third-party payment, and crowdfunding are examples of multi-channel and diverse financial services that can greatly reduce the financing threshold of SMEs and thus alleviate their financing constraints [19]. According to some studies, the number of local bank branches and the degree of development of digital inclusive finance can alleviate SMEs’ financing constraints, and the roles of these two can be swapped [38]. Digital inclusive finance improves the exclusion of the traditional financial system and releases digital financial dividends through multiple types of financial support, cross-regional mobility of financial resources, and relaxation of access barriers to financing [39]. From this, hypothesis 2 is proposed.

Hypothesis 2 (H2).

Digital inclusive finance enables SMEs to innovate technology by easing financing constraints.

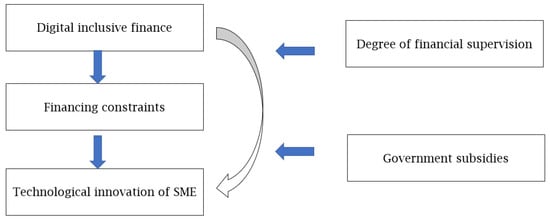

3.3. Moderating Effect Analysis

Digital inclusive finance is a product of financial innovation driven by iterations of cutting-edge technologies such as big data, artificial intelligence, and cloud computing, and it remains primarily a type of finance [35]. Finance’s eternal themes are innovation and risk, and financial fragility theory contends that the existence of information asymmetry, asset price volatility, and financial liberalization in financial markets leads to cross-contamination of financial risks such as credit risk, operational risk, market risk, and affirms the role of government intervention. Government intervention is usually reflected in government support for technological innovation in SMEs through taxation, subsidies, and the creation of a favorable financing environment and optimal financial resource allocation [40]. In an imperfect market mechanism, the “visible hand” of the government can compensate for the lack of marginal revenue generated by firms’ innovation activities [41].

3.3.1. Degree of Financial Supervision

According to Huang, the government’s most significant contribution to the good development of digital inclusive finance in China is that it has not been killed in the cradle, and government regulators have accommodated such innovations [42]. Digital technology applications can compensate for the pain points of traditional financial services such as imperfect credit system construction and inefficiency, but the complex technical processing of digital inclusive finance leads to more insidious problems such as financial fraud, data leakage, and systemic risk spillover, which brings new challenges to the traditional financial regulatory system [43]. Active and effective financial regulation can identify risk vulnerabilities in digital inclusive finance promptly, prevent vicious competition among financial institutions, and ensure the balanced development of fintech and the real economy [44]. On the contrary, the lag of financial regulation can amplify the complexity and volatility characteristics of digital fintech [35], and the release of the innovation-driven effectiveness of digital inclusive finance is hampered. Therefore, it is hypothesized that the degree of financial regulation can regulate the innovation-driving effect of digital inclusive finance.

Hypothesis 3a (H3a).

The degree of financial supervision positively moderates the relationship between digital inclusive finance and the technological innovation of SMEs.

3.3.2. Government Subsidies

According to government intervention theory, the government can effectively regulate the problem of risk propagation in the innovation R&D market through macro regulation [45], and the government provides resources for SME innovation in the form of subsidies, which helps SMEs to graft the market and government resources to improve their risk-taking capacity and play a buffering role against the risks associated with the resources consumed by innovation activities [46]. In addition, government subsidy funds do not have the performance pressure from the repayment mechanism of external financing, providing a relaxed trial-and-error environment for firms [47]. The qualification requirements of government subsidies serve as a screening mechanism, and the positive signals released by government subsidies serve as a guide in investment behavior [48], helping investors to screen out firms with high growth potential and high marginal returns. In this respect, the “certification effect” of government subsidies can be useful for better supporting the technological innovation incentives of SMEs through digital inclusive finance [49]. Zheng et al. found that government subsidies have a positive incentive effect on the innovation performance of high-tech enterprises by providing direct financial support [50]. Liu et al. confirmed that environmental uncertainty has a U-shaped inversion relationship with firms’ innovation inputs, and government subsidies can suppress the impact of environmental uncertainty on firms’ innovation [51]. Therefore, it is hypothesized that government subsidies can regulate the innovation-driving effect of digital inclusive finance.

Hypothesis 3b (H3b).

Government subsidies positively moderate the relationship between digital inclusive finance and the technological innovation of SMEs.

The theoretical model diagram is summarized in Figure 2 based on the preceding analysis.

Figure 2.

Theoretical model.

4. Research Design

4.1. Sample Selection and Data Source

The research object in this paper is the listed enterprises on China’s New Third Board from 2011 to 2020 and makes the following screening. (1) Financial enterprises are excluded because of their special business nature and industry supervision characteristics, which do not conform to the development law of general enterprises [18]. (2) Exclude the enterprise’s listed ST and PT in the sample period. (3) Based on data availability and continuity, enterprises that only retain continuous data for more than five years [35]. Other variables, except dummy variables, must be shrunk to less than 1% and more than 99% to avoid the influence of extreme values. Finally, 25,089-panel datasets of “Enterprise-Year” were obtained. At the micro level, enterprise financial data is derived from the Wind database and the digital inclusive financial index is based on the Peking University Digital Inclusive Financial Index (2011–2020).

4.2. Variable Measurement

4.2.1. Explained Variable

The existing literature divides enterprise innovation activity measurement into two perspectives: innovation input and innovation output. The resources invested by SMEs in R&D activities are referred to as innovation input, which can be measured by R&D investment intensity (R&D expenditure/operating income) [52], R&D density (R&D expenditure/total assets) [53], and so on. The innovation output can be represented by the value of new products, patent applications, patent authorization, etc. In reality, the sales of new products and the process of a patent application and authorization are not only affected by internal factors such as R&D teams and R&D resources, but also by systematic factors such as policies, bureaucrats, and the market environment [54]. Therefore, there is greater uncertainty in measuring enterprise technological innovation from the perspective of innovation output. According to the theoretical analysis above, digital inclusive finance primarily assists SMEs in obtaining R&D resources by alleviating SMEs’ financing constraints, allowing them to carry out technological innovation activities. The change in the amount of R&D expenditure most directly and objectively reflects the technological innovation situation of SMEs. As a result, according to Nie et al., the intensity of R&D investment is used as a proxy variable for SMEs’ technological innovation [53].

4.2.2. Explanatory Variable

This paper uses the Peking University Digital Inclusive Finance Index (2011–2020) as a proxy variable for digital inclusive finance and conducts a more detailed analysis by combining its three dimensions: coverage (number of electronic accounts), depth of use (total actual use), and digital degree (mobility, materialization, credit, and facilitation) [55]. The index was created in collaboration with Peking University’s Digital Finance Research Center and Ant Technology Group. At present, it has been widely used by scholars in related fields. As compared with the R&D intensity of enterprises, the digital inclusive financial index is relatively large, so to unify the dimensions, referring to Sheng et al., the “digital inclusive financial index and its three dimensions/1000” is taken as the final empirical variable [56].

4.2.3. Intermediary Variable

The measurement indicators of financing constraints are mainly divided into comprehensive index type and single ratio type. The representative indicators of index type include the SA index, the WW index, and the KZ index. The single ratio type includes the financial expense ratio, asset-liability ratio, and the ratio of interest expense to total assets. This paper selects the SA index constructed by using the enterprise’s total assets (Size) and age (Age) as the proxy variable of financing constraints. The higher the SA index is, the more serious the financing constraints are. The calculation formula is . The reasons are as follows: First, the indicators used to construct the SA index have significant externalities, which can help to mitigate endogenous errors caused by other types of measurement variables [57]. Second, the construction indicators of the SA index are easy to obtain, calculate and understand.

4.2.4. Moderating Variables

- (1)

- Financial supervision degree (Supervision, according to the territorial principle of SMEs, the ratio of financial supervision expenditure of each province to the added value of the financial industry is used to measure the regional financial supervision degree, according to Wang et al. [58].

- (2)

- Government subsidies (Subsidy, measured by the proportion of government subsidies received by enterprises in total annual assets.

4.2.5. Control Variable

- (1)

- Control the “business scope” that affects the technological innovation of enterprises through the size and age of enterprises [9];

- (2)

- The proportion of fixed assets amplifies the operating leverage of enterprises, so the fixed asset ratio (Fix) is used to control the impact of the asset structure of enterprises on the experience risk of enterprises [59];

- (3)

- Non-standard audit opinions will increase the enthusiasm of enterprises for R&D and innovation [53], so it is necessary to control whether the audit opinion (Opin) is standard;

- (4)

- Control the role of executives with overseas backgrounds in promoting corporate R&D innovation through dual positions [60];

- (5)

- Return on equity (ROE) is a core indicator to measure the profitability of enterprises, representing the performance of enterprises, and is positively correlated with enterprise innovation [61], so it needs to be controlled;

- (6)

- The higher the gearing ratio of enterprises (Lev), the worse the solvency of SMEs and the less likely they are to obtain new loans [35], so they need to be controlled;

- (7)

- The management expense ratio (Mfee) is measured by the ratio of a company’s overhead to operating income [53].

See Table 1 below for details.

Table 1.

Variable Name and Measure.

4.3. Model Construction

Hausman confirmed that the p value is less than 0.1, indicating that the fixed effect model should be used. This paper employs the two-way fixed effect model and employs the robust standard error by default to eliminate the impact of changes in time and industry on the explained variables. The year is a dummy variable of time and Ind is a dummy variable of industry.

The dependent variable (, represents the technological innovation level of SMEs; the explanatory variables () is the digital inclusive financial index, i is a listed company, j is a province, t is time, and is a random error term.

5. Empirical Test

5.1. Descriptive Statistics

According to the descriptive statistical results in Table 2, the mean value (median) of SMEs’ technological innovation intensity is 0.08 (0.06), indicating a low proportion of SMEs’ R&D investment in operating income, and technological innovation shows a lack of motivation. The maximum value (0.67) and the minimum value (0) indicate that there is a large gap between SMEs’ technological innovation levels. The digital inclusive financial index has a mean (median) value of 0.31 and a standard deviation of 0.05, indicating that China’s digital inclusive financial development is good, but there are some differences between regions. It is noted that the mean value (median) asset-liability ratio of SMEs is 39.38 (39.01). When the leverage ratio is greater than 43.01%, the risk of innovation increases [62]. Therefore, the results show that the asset-liability ratio of SMEs is high and there are potential financial risks.

Table 2.

Descriptive Statistical Results.

A rule of thumb for determining the presence of multicollinearity is that the maximum variance inflation factor for explanatory variables should not exceed 10 [63]. As shown in Table 3, the variance expansion factor VIF is less than 10, indicating that there is basically no multicollinearity between variables, and the selection of each variable is reasonable.

Table 3.

Results of variance inflation factor.

5.2. Baseline Regression

Table 4 shows the baseline regression results between the digital inclusive financial index and its three sub-indexes and the technological innovation of SMEs. The coefficients of the “Digital Inclusive Financial Index” and “Digital Degree” in columns (1) and (4) are positive and pass the 1% statistical significance test. The coefficients of “Coverage” in column (2) are positive but not significant. The coefficients of “Depth of Use” in column (3) are significantly positive at the 10% level. To sum up, digital inclusive finance has a significant positive impact on promoting the technological innovation of SMEs. With the help of digital inclusive finance, SMEs will get out of the predicament of insufficient innovation motivation, and the innovation level will be strengthened, which verifies the establishment of H1.

Table 4.

Baseline Regression Results.

However, there is no significant correlation between digital inclusive finance coverage and SMEs’ technological innovation input, indicating that increasing digital inclusive finance coverage alone cannot promote SMEs’ technological innovation input, which is also consistent with Nie’s research findings [53]. Therefore, only by deeply mining digital inclusive financial services and paying attention to the deepening of digitalization, can SMEs improve their technological innovation level in essence.

The control variable regression results are largely consistent with expectations. The management expense rate coefficient is significantly positive, indicating that SMEs accumulate management talents and pay attention to the internal management level of enterprises, which is conducive to improving the enterprise’s innovation vitality. The coefficient of the asset-liability ratio is significantly negative, which indicates that SMEs with high asset-liability ratios have a too heavy financial burden, and the availability of credit is reduced, which cannot meet the large amount of liquidity required for innovative projects. The coefficient of net profit growth rate is significantly negative, which indicates that enterprises that focus on market expansion often neglect the importance of technological innovation.

5.3. Mediation Effect Test

To further explore the mechanism of digital inclusive finance to promote technological innovation of SMEs, this part further deconstructs the process of digital inclusive finance “empowerment” on the basis of the previous analysis. In this paper, we use the intermediary effect model of Wen et al.to set up a stepwise regression equation [64].

As shown in Table 5, Column (2) shows the impact of digital inclusive finance on SME financing constraints. At the 1% level, the coefficient is significantly negative, indicating that digital inclusive finance has greatly eased SME financing constraints. Column (3) displays the results of the regression Equation (3). At the 5% level, the regression coefficient of digital inclusive finance and SME technological innovation is significant. The significance level is lowered, as is the regression coefficient. At the same time, the SA index has a significant negative impact on SME innovation at the 1% level, indicating that “financing difficulties and expensive problems” really hinder the level of SME technological innovation. It also confirms H2 that digital inclusive finance can provide adequate financial support for R&D projects of SMEs.

Table 5.

Digital Inclusive Finance, Financing Constraints, and SME’s Technological Innovation.

5.4. Analysis of the Moderating Effect

Table 6 investigates the role of financial supervision and government subsidies in moderating the relationship between digital inclusive finance and SMEs’ technological innovation. Column (1) is the test result of financial supervision’s moderating effect. The findings show that at the 5% level, the interaction between the digital inclusive financial index and the degree of financial supervision (Index Supervision) coefficient is significantly positive, indicating that financial supervision positively moderates the role of digital inclusive finance in promoting SMEs’ technological innovation. That is, the stronger the financial supervision is, the more conducive digital inclusive finance will be to giving play to the driving effect of SMEs’ technological innovation, which proves that H3a is valid. This demonstrates that financial supervision can effectively reduce financial market arbitrage, prevent liquidity risk, aid in the healthy and orderly development of digital inclusive finance, and better serve the real economy.

Table 6.

Moderating Effect of Financial Regulation and Government Subsidies.

Column (2) is the test result of the regulatory effect of government subsidies on the relationship between digital inclusive finance and the technological innovation of SMEs. The results show that at the 1% level, the interactive term of the digital inclusive financial index and government subsidies (Index Subsidy) is significantly positive. This means that government subsidies improve the role of digital inclusive finance in promoting SMEs’ technological innovation. H3b is supported. Government subsidies not only directly make up the funding gap for SMEs’ technological innovation activities, but also release a good “high-quality” investment signal for private investment, improve the capital market’s financing capacity for innovative R&D projects, promote the flow of financial resources between supply and demand for funds, and inject continuous vitality into SMEs’ technological innovation.

5.5. Heterogeneity Analysis

5.5.1. Industry Heterogeneity Analysis

In terms of the industries in which firms are located, high-tech SMEs have more technological innovation projects and face stronger financing constraints than non-high-tech firms [53]. First, SMEs in high-tech industries must continue to develop and innovate through technology to cope with the competitive pressure of technological backwardness in the industry, but they are deterred by the high capital investment required for the projects and the uncertainty of investment returns. Secondly, banks and other traditional financial institutions set high credit thresholds for high-tech SMEs due to safety and profitability considerations. Based on digital monitoring, financial institutions can obtain multi-dimensional and real-time information on funding trends of SME technology innovation projects, assess and identify project risks, make timely stop-loss measures, and make balanced judgments on project risks and returns to create maximum value.

Based on Nie, regressions were carried out by categorizing enterprises into high-tech and non-high-tech industries [53], and the results are shown in Table 7. In particular, the impact of digital inclusive finance on SMEs’ technological innovation is significantly positive at the 5% level in the sample of high-tech enterprises, but not in non-high-tech firms. As a result, the emergence of digital inclusive finance opens up a new avenue for high-tech firms to break the impasse of insufficient funds for technological innovation.

Table 7.

Industry Heterogeneity.

5.5.2. Analysis of Regional Distribution Heterogeneity

The technological innovation of SMEs depends on cooperation with other companies and is affected by the external environment such as geography [65]. Although digital inclusive finance has developed rapidly, as with most economic characteristics, regional differences are obvious [55]. For a long time, there has been a significant disparity in the economic, social, and cultural development of China’s eastern coastal and western inland areas. The financial resources in the eastern coastal areas are significantly greater than those in the western inland areas [66], and the level of digital finance development is high, whereas the central and western regions are still catching up, surpassing, and closing the gap [39]. Based on the findings of Shen et al., 31 provinces are divided into three sample groups: eastern, middle, and western based on the geographical location of the enterprises for regression [67]. The findings in Table 8 show that in the east, digital inclusive finance plays a more active role in promoting the technological innovation of SMEs, and has no significant impact on the central and western regions.

Table 8.

Analysis of regional heterogeneity.

6. Endogeneity and Robustness Test

6.1. Endogenetic Test

Many factors influence SMEs’ technological innovation. Even if some variables have been as closely controlled as possible, endogenous problems caused by missing variables cannot be avoided. It is, on the other hand, reverse causality. The advancement of SMEs’ technological innovation level may aid in the development of digital inclusive finance. To avoid errors caused by endogenous problems, the tool variable method is used to conduct two-stage least squares regression.

To begin, the Internet penetration rate of each province (data from the Statistical Report on China’s Internet Development) is chosen as a tool variable, following the practice of Xie et al. [68]. The Internet penetration rate reflects the infrastructure of regional financial services, which is closely related to the technical support services required by digital inclusive finance and meets the relevant requirements. Moreover, the Internet penetration rate is not directly related to whether enterprises carry out innovative R&D activities, but meets exogenous conditions. Furthermore, by Fu et al., the distance between the enterprise and Hangzhou (the sphere distance between the city where the sample enterprise is located and Hangzhou) is used as the primary explanatory variable of digital inclusive finance [69]. This is a natural geographical index with a high degree of homogeneity. Because Hangzhou was the first city to develop digital finance, technology spillover is influenced by the distance it can radiate, so the level of digital inclusive finance development in other cities is closely related to its distance from Hangzhou.

Table 9 displays the tool variable method test results. The F value of the first stage regression is greater than 10, indicating that no weak tool variable exists. The Hansen J test demonstrates that there is no over-identification and that the tool variable selection is effective. After the tool variable method alleviated the endogenous problem, digital inclusive finance continued to play a significant role in driving SMEs’ technological innovation, demonstrating that the benchmark regression’s core conclusion is robust.

Table 9.

2SLS Tool Variable Method.

6.2. High-Order Fixed Effect Model

The regression results in Table 10 show that digital inclusive finance still has a significant positive incentive effect on SMEs’ technological innovation when using a more robust high-order fixed effect model (Year Ind). The promotion of digitalization on the technological innovation level of SMEs is also stable.

Table 10.

High-order fixed effect model.

7. Conclusions and Discussion

7.1. Research Conclusions

The development of digital inclusive finance provides new opportunities for SMEs’ technological innovation in the context of the major strategy of “innovation-driven.” This paper firstly analyzes the theoretical mechanism of digital inclusive finance’s impact on SMEs’ technological innovation and then constructs a benchmark regression model and a mediating and moderating effect model with the help of 2011–2020 New Third Board listed companies’ data and provincial digital inclusive finance indices to empirically test the impact of digital inclusive finance on SMEs’ technological innovation. SMEs’ technological innovation and further verify the heterogeneous impact of digital inclusive finance on promoting SMEs’ technological innovation based on the industry nature and regional distribution of enterprises, and mainly obtain the following conclusions.

- (1)

- (The development of digital inclusive finance can empower technological innovation in SMEs and can effectively enhance the R&D intensity of SMEs, especially the degree of digitization of digital inclusive finance plays a central role. The core findings still hold after robustness tests using a higher-order fixed effects model and the use of the instrumental variables approach to address the endogeneity issue.

- (2)

- (Digital inclusive finance can alleviate SMEs’ financing constraints, stimulating technological innovation. Digital inclusive finance alleviates the phenomenon of financial exclusion in the traditional financial market, lowers the entry threshold for SME credit, fosters a favorable financial environment, and can better match the financing needs of SMEs’ technological innovation projects.

- (3)

- Effective financial regulation and appropriate government subsidies can enhance the driving effect of digital inclusion, and the degree of financial regulation and government subsidies show a positive moderating effect in the relationship of “digital inclusion–SME technology innovation”.

- (4)

- In comparison to non-high-tech industries and the central and western regions, digital inclusive finance has the potential to significantly boost technological innovation among SMEs in high-tech industries and the eastern region. Although digital inclusive finance can help to address the industry mismatch of credit resources in the traditional financial system, there are still some regional differences in development.

7.2. Theoretical Contribution

The marginal contribution of this paper, in theory, is reflected in the following three points: (1) This paper constructs the mechanism analysis model of digital inclusive finance on the technological innovation of SMEs, deepens the understanding of “long-tail theory”, “information asymmetry theory”, “technology spillover theory” and “government intervention theory”, and improves the relevant research on the technological innovation behavior of micro-enterprises in the development of digital inclusive finance. (2) From the perspectives of financing constraints, financial supervision, and government subsidies, the impact of digital inclusive finance on the technological innovation of SMEs was deeply discussed and analyzed, and the impact of financial supervision and government subsidies on the innovation driving effect of digital inclusive finance was quantified, which provided a theoretical basis for the healthy development of digital inclusive finance and related policy formulation in China. (3) Based on the different industries and spatial distribution, the heterogeneity analysis of the innovation driving-effect of digital inclusive finance further reveals the inclusive characteristics of digital inclusive finance that can reduce the misallocation of financial resources and make up for the shortcomings of traditional finance.

7.3. Practical Enlightenment

Through the theoretical analysis and empirical test of digital inclusive finance enabling SMEs’ technological innovation, the following enlightenment is obtained: First, financial technology can indeed play a positive role in promoting the real economy. We should vigorously develop digital inclusive finance, encourage traditional financial institutions to carry out digital transformation, create a multi-level financial service network, optimize the financial supply structure, and achieve the precise connection between digital inclusive finance and SMEs. Second, as 5G, blockchain, big data platforms, and cloud computing realize the deep integration of data elements and capital circulation process, the efficient flow of data among governments, enterprises, and individuals has been realized, and the financing needs of small and micro enterprises have been met to the greatest extent. Third, the popularity and penetration of digital inclusive finance need to be further expanded, the development of digital inclusive finance in central and western regions should be strengthened, and regional differences in digital inclusive finance should be continuously narrowed. Fourth, to avoid the digital divide and overlapping risks, we must uphold the regulatory and legal bottom line and strengthen the construction of the prudential regulatory framework in the field of digital inclusive finance from the perspective of business norms and technical security. Innovate regulatory technology, realize the complementary development of credit reporting institutions and digital inclusive finance, maintain the fairness of the capital lending market, and protect the financing rights and interests of SMEs’ innovative projects.

7.4. Research Limitations and Prospects

There are still some limitations of this study: (1) In this paper, a panel data model is constructed for empirical testing, and the threshold model and nonlinear smooth transformation model can also be considered for verification in the future. (2) The theoretical model of the impact of digital inclusive finance on the technological innovation of SMEs needs to be further deepened, and it is expected that the existing model can be expanded in the future, and the different impact mechanisms of digital inclusive finance on the technological innovation of SMEs are analyzed from other perspectives. (3) This paper uses the Peking University Digital Inclusive Finance Index to measure digital inclusive finance and new measurement methods can be explored in the future to enhance the robustness of the research results.

Author Contributions

Conceptualization, J.C.; Methodology, L.Z.; Software, L.Z.; Formal analysis, J.C. and L.Z.; Investigation, L.Z.; Resources, L.Z.; Data curation, L.Z. and Z.H.; Writing—original draft preparation, L.Z.; Writing—review and editing, L.Z.; Visualization, J.C. and Z.L.; Supervision, Z.L. and Z.H. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Patrucco, A.S.; Trabucchi, D.; Frattini, F.; Lynch, J. The impact of COVID-19 on innovation policies promoting Open Innovation. RD Manag. 2022, 52, 273–293. [Google Scholar] [CrossRef]

- Yang, L.; Zhang, Y. Digital financial inclusion and sustainable growth of small and micro enterprises—Evidence based on China’s new third board market listed companies. Sustainability 2020, 12, 3733. [Google Scholar] [CrossRef]

- Lu, H.L.; Wang, W.M.; Yan, Z.Q.; Hou, L. Competitive neutrality of financial policy and financing rescue of private enterprises: A quasi-natural experiment from public health emergencies. J. Financ. Res. 2021, 493, 95–114. [Google Scholar]

- Yin, Y.K.; Hou, R. The development logic, international experience and contribution of digital financial inclusion. Acad. Explor. 2017, 208, 104–111. [Google Scholar]

- Zhu, X.T.; Fang, X.Q.; Wang, X. Learn from domestic and foreign experience in the development of digital inclusive finance. Times Fortune 2023, 212, 34–36. [Google Scholar]

- Teng, L. Research on Financing Constraints of Small and Medium-Sized Enterprises from the Perspective of Digital Inclusive Finance. Ph.D. Dissertation, Sichuan University, Chengdu, China, 2021. [Google Scholar]

- Wu, J.W.; Gu, Z.Y. Literature review of digital inclusive finance. Financ. Account. Mon. 2018, 839, 123–129. [Google Scholar]

- Gong, M.G.; Li, H.J.; Dou, X.Y. Research progress, hotspot analysis and trend outlook of digital inclusive finance—Based on CiteSpace bibliometric analysis. Lanzhou Acad. J. 2022, 346, 45–57. [Google Scholar]

- Almustafa, H.; Nguyen, Q.K.; Liu, J.; Dang, V.C. The impact of COVID-19 on firm risk and performance in MENA countries: Does national governance quality matter? PLoS ONE 2023, 18, e0281148. [Google Scholar] [CrossRef]

- Nguyen, Q.K. The effect of FinTech development on financial stability in an emerging market: The role of market discipline. Res. Glob. 2022, 5, 100105. [Google Scholar]

- Yang, X.M.; Yang, J. Digital Finance on Innovation Incentives for SMEs: Research on Effect Identification, Mechanism and Heterogeneity. J. Yunnan Univ. Financ. Econ. 2021, 37, 27–40. [Google Scholar]

- Yang, J.; Xiao, M.Y.; Lv, P. Does Digital Financial Inclusion Promote Technology Innovation of Small and Micro Enterprises?—An Empirical Study Based on China Small and Micro Enterprises Survey (CMES) data. J. Zhongnan Univ. Econ. Law. 2021, 247, 119–131+160. [Google Scholar]

- Cao, X.X.; Zhang, Z.W. Digital Finance and SME Technology Innovation: “Rain and Dew” or “Favor the Other”? J. Financ. Dev. Res. 2022, 487, 24–31. [Google Scholar]

- Song, X.L.; Wang, W.M.; Wang, G.Y. Can Digital Financial Inclusion Provide Momentum for SME Innovation: Empirical Evidence from New Third Board Listed Enterprises. Rev. Investig. Stud. 2023, 42, 120–137. [Google Scholar]

- Yu, P.; Dou, J.X. Digital financial inclusion, corporate heterogeneity and MSME innovation. Contemp. Econ. Manag. 2020, 42, 79–87. [Google Scholar]

- Liu, J.H.; Zhou, K.; Zhang, Y.; Wang, Q. Digital Financial Inclusion, Enterprise Life Cycle and Technology Innovation. Stat. Decis. 2022, 38, 130–134. [Google Scholar]

- Zhang, H.H.; Zhang, Y.; Jing, R. How the digitalization of financial inclusion affects urban innovation: Evidence from prefecture-level city panel data. Financ. Theory Pract. 2021, 506, 62–69. [Google Scholar]

- Lang, X.X.; Zhang, M.M.; Wang, J.N. Digital Financial Inclusion, Financing Constraints and SME Innovation: A Study Based on New Third Board Enterprise Data. South China Financ. 2021, 543, 13–25. [Google Scholar]

- Liang, B.; Zhang, J.H. Can China’s financial inclusion innovation ease the financing constraints of SMEs? Forum Sci. Technol. China 2018, 271, 94–105. [Google Scholar]

- Hu, Q.W.; Li, Z.; Zhang, G.C. The Impact of Digital Financial Inclusion on the Innovation Investment of SMEs: A Moderating Effect Based on Entrepreneurship. J. Indust. Technol. Econ. 2022, 41, 32–41. [Google Scholar]

- Griliches, Z. Issues in assessing the contribution of research and development to productivity growth. Bell J. Econ. 1979, 10, 92–116. [Google Scholar] [CrossRef]

- Jensen, M.B.; Johnson, B.; Lorenz, E.; Lundvall, B.-Å.; Lundvall, B.A. Forms of knowledge and modes of innovation. In The Learning Economy and the Economics of Hope; Antherm Press: New York, NY, USA, 2007; p. 155. [Google Scholar]

- Parrilli, M.D.; Elola, A. The strength of science and technology drivers for SME innovation. Small Bus. Econ. 2012, 39, 897–907. [Google Scholar] [CrossRef]

- Hall, B.H.; Lerner, J. The financing of R&D and innovation. In Handbook of the Economics of Innovation; Elsevier: Amsterdam, The Netherlands, 2010; pp. 609–639. [Google Scholar]

- Zhong, K.; Liang, P.; Wang, X.L.; Peng, W. Does Digital Inclusive Finance Help to Restrain the Real Economy from Going from Real to False--Analysis of Financial Asset Allocation Based on Entity Enterprises. Stud. Int. Financ. 2022, 418, 13–21. [Google Scholar]

- Zhang, Y.M.; Zhao, R.R. Research on the mechanism of shared finance to alleviate the financing constraints of small and medium-sized enterprises. Res. Financ. Econ. Issue 2019, 427, 58–65. [Google Scholar]

- Goldstein, I.; Jiang, W.; Karolyi, G.A. To FinTech and beyond. RFS 2019, 32, 1647–1661. [Google Scholar]

- Niu, R.F. An economic analysis of Internet finance supporting the financing of small and micro enterprises: Based on the perspective of “long tail theory”. Mod. Econ. Res. 2016, 415, 47–51. [Google Scholar]

- Myers, S.C.; Majluf, N.S. Corporate financing and investment decisions when firms have information that investors do not have. J. Financ. Econ. 1984, 13, 187–221. [Google Scholar] [CrossRef]

- Gomber, P.; Kauffman, R.J.; Parker, C.; Weber, B.W. On the fintech revolution: Interpreting the forces of innovation, disruption, and transformation in financial services. J. Manag. Inf. Syst. 2018, 35, 220–265. [Google Scholar] [CrossRef]

- Tao, Y.Q.; Zhang, J.L.; Zou, K.; Cao, Y.Y. Digital inclusive financial and the operating performance of small and medium-sized enterprises: Evidence from companies listed on the New Third Board. Rev. Invest. Stud. 2022, 41, 37–52. [Google Scholar]

- Shen, Y.; Guo, P. Internet Finance, Technology Spillover and Total Factor Productivity of Commercial Banks. J. Financ. Res. 2015, 417, 160–175. [Google Scholar]

- Zhang, Y.L.; Yu, Y.J.; Chen, Z.M. Artificial intelligence, SME financing and digital transformation of banks. China Indust. Econ. 2021, 405, 69–87. [Google Scholar]

- Hsu, P.H.; Tian, X.; Xu, Y. Financial development and innovation: Cross-country evidence. J. Financ. Econ. 2014, 112, 116–135. [Google Scholar] [CrossRef]

- Tang, S.; Wu, X.C.; Zhu, J. Digital Finance and Enterprise Technological Innovation: Structural Characteristics, Mechanism Identification and Effect Differences under Financial Supervision. Manag. World 2020, 36, 52–66+9. [Google Scholar]

- Wang, Y.C. Financial suppression and commercial credit secondary allocation function. Econ. Res. J. 2014, 49, 86–99. [Google Scholar]

- Honohan, P. Financial Development and Economic Growth, Financial Development, Growth and Poverty: How Close are the Links? Palgrave Macmillan UK: London, UK, 2004; pp. 1–37. [Google Scholar]

- Lu, Z.; Wu, J.; Li, H.; Nguyen, D.K. Local bank, digital financial inclusion and SME financing constraints: Empirical evidence from China. Emerg. Mark. Finance Trade 2022, 58, 1712–1725. [Google Scholar] [CrossRef]

- Tian, Y.; Zhao, Q.; Guo, L.H. Digital Inclusive Finance and the Realization of Common Prosperity—Based on the Perspective of Overall Prosperity and Shared Prosperity. J. Shanxi Univ. Financ. Econ. 2022, 44, 1–17. [Google Scholar]

- Li, D. Government Intervention, Digital Inclusive Financial, and SME Innovation. Master’s Thesis, Central China Normal University, Wuhan, China, 2020. [Google Scholar]

- Guo, Y. Signal Transmission Mechanism of Government Innovation Subsidy and Enterprise Innovation. China Indust. Econ. 2018, 366, 98–116. [Google Scholar]

- Huang, Y.P. Opportunities and risks of digital inclusive financial. New Financ. 2017, 343, 4–7. [Google Scholar]

- Huang, Y.P.; Tao, K.Y. China’s Digital Financial Revolution: Development, Impact and Regulatory Implications. Int. Econ. Rev. 2019, 144, 24–35+5. [Google Scholar]

- Zhang, Y.; Zhou, Y.H. The Impact of Digital Finance Development on the Operational Risk of Rural Financial Institutions—An Analysis Based on the Regulatory Effect of Financial Supervision Intensity. China Rural Econ. 2022, 448, 64–82. [Google Scholar]

- Song, Y.; Yang, N.; Zhang, Y.; Wang, J. Suppressing risk propagation in R&D networks: The role of government intervention. Chin. Manag. Stud. 2019, 13, 1019–1043. [Google Scholar]

- Pan, H.B.; Yang, C.Y.; Li, D.Y. How to stimulate the innovation of private enterprises—From the perspective of wealth concentration of actual controllers. J. Financ. Res. 2022, 502, 114–132. [Google Scholar]

- Howell, S.T. Financing innovation: Evidence from R&D grants. Am. Econ. Rev. 2017, 107, 1136–1164. [Google Scholar]

- Takalo, T.; Tanayama, T. Adverse selection and financing of innovation: Is there a need for R&D subsidies? J. Technol. Transf. 2010, 35, 16–41. [Google Scholar]

- Ye, C.H. Financing constraints, government subsidies and green innovation of enterprises. Stat. Decis. 2021, 37, 184–188. [Google Scholar]

- Zheng, C.M.; Li, P. The Influence of Government Subsidies and Tax Preferences on Enterprise Innovation Performance. Sci. Technol. Prog. Policy 2015, 32, 83–87. [Google Scholar]

- Liu, J.; Luo, F.K.; Wang, J. Environmental Uncertainty and Enterprise Innovation Investment—The Regulatory Effect of Government Subsidies and the Combination of Industry and Finance. South China Financ. 2019, 41, 21–39. [Google Scholar]

- Fu, L.M.; Wan, D.F.; Zhang, Y.H. Is VC a more active investor-- Evidence from innovation investment of GEM listed Nie, X.H. Research on the Path and Heterogeneity of Digital Finance Promoting the Technological Innovation of SMEs. J. Financ. Res. 2020, 30, 37–49. [Google Scholar]

- Nie, X.H. Research on the Path and Heterogeneity of Digital Finance Promoting the Technological Innovation of SMEs. West Forum. 2020, 30, 37–49. [Google Scholar]

- Liu, Y.Q. Research on the impact of digital finance on technological innovation of SMEs. J. Tech. Econ. Manag. 2022, 308, 51–56. [Google Scholar]

- Guo, F.; Wang, J.Y.; Wang, F.; Kong, T.; Zhang, X.; Cheng, Z.Y. Measuring China’s Digital Inclusive Financial Development: Index Compilation and Spatial Characteristics. China Econ. Q. 2020, 19, 1401–1418. [Google Scholar]

- Sheng, M.Q.; Zhang, Y.; Wang, S. Can the development of digital finance boost the technological innovation of traditional industrial enterprises. Stat. Inf. Forum 2021, 36, 12–22. [Google Scholar]

- Ju, X.S.; Lu, D.; Yu, Y.H. Financing constraints, working capital management, and enterprise innovation sustainability. Econ. Res. J. 2013, 48, 4–16. [Google Scholar]

- Wang, R.; Zhang, Q.J.; He, Q. Will financial supervision damage financial efficiency. Financ. Econ. Res. 2019, 34, 93–104. [Google Scholar]

- Sun, R.; Zou, G. Political connection, CEO gender, and firm performance. J. Corp. Financ. 2021, 71, 101918. [Google Scholar] [CrossRef]

- Huang, H.Y.; Wu, C.Z. The impact of executives’ overseas experience on corporate innovation performance from the perspective of combining two positions. Mark. Wkly. 2021, 34, 12–15. [Google Scholar]

- Wei, J.; Xiong, R.; Hassan, M.; Shoukry, A.M.; Aldeek, F.F.; Khader, J. Entrepreneurship, corporate social responsibilities, and innovation impact on banks’ financial performance. Front. Psychol. 2021, 12, 680661. [Google Scholar] [CrossRef]

- Wang, Y.Z.; Luo, N.S.; Liu, W.B. What kind of leverage ratio is conducive to enterprise innovation. China Indust. Econ. 2019, 372, 138–155. [Google Scholar]

- Chen, Q. Econometrics and Stata Applications, 1st ed.; Higher Education Press: Beijing, China, 2015; pp. 172–173. [Google Scholar]

- Wen, Z.L.; Fang, J.; Xie, J.Y.; Ouyang, J.Y. Methodological study of domestic mediation effects. Adv. Psychol. Sci. 2022, 30, 1692–1702. [Google Scholar] [CrossRef]

- Hervás-Oliver, J.-L.; Parrilli, M.D.; Rodríguez-Pose, A.; Sempere-Ripoll, F. The drivers of SME innovation in the regions of the EU. Res. Policy 2021, 50, 104316. [Google Scholar] [CrossRef]

- Lu, F.Z.; Xu, P.; Li, Z.W. Digital inclusive finance and urban innovation and entrepreneurship quality. Wuhan Univ. J. Philos. Soc. Sci. 2022, 75, 35–48. [Google Scholar]

- Shen, X.B.; Chen, Y.; Lin, B.Q. The Impact of Technological Progress and Industrial Structure Distortion on China’s Energy Intensity. Econ. Res. J. 2021, 56, 157–173. [Google Scholar]

- Xie, X.L.; Shen, Y.; Zhang, H.X.; Guo, F. Can digital finance promote entrepreneurship? China Econ. Q. 2018, 17, 1557–1580. [Google Scholar]

- Fu, Q.Z.; Huang, Y.P. The Heterogeneous Impact of Digital Finance on Rural Financial Demand: Evidence from China Household Finance Survey and Peking University Digital Inclusive Finance Index. J. Financ. Res. 2018, 461, 68–84. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).