How Does Trade Policy Uncertainty Affect Supply Chain Efficiency: A Case Study of Listed Companies of Chinese Port Industry

Abstract

1. Introduction

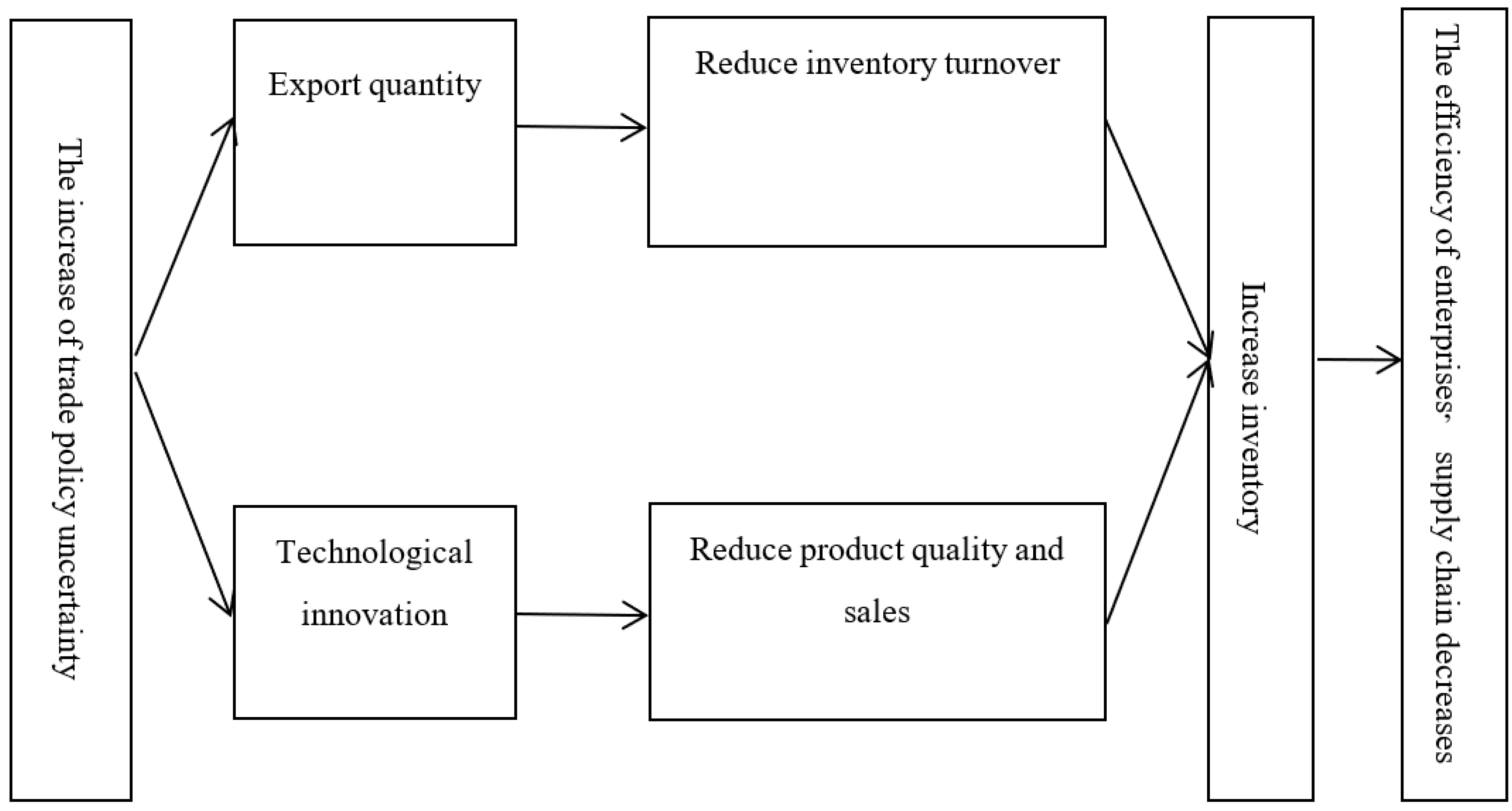

2. Theoretical Analysis and Research Hypothesis

2.1. Export Quantity Channels

2.2. Technological Innovation Channels

3. Research Design

3.1. Measurement Model Setting

3.2. Measurement of Key Variables

3.2.1. Trade Policy Uncertainty (TPU)

3.2.2. Enterprise’s Supply Chain Efficiency (EFF)

3.2.3. Sources of Data

4. Empirical Results

4.1. Basic Results

4.2. Robustness Checks

4.2.1. Other Measures of Supply Chain Efficiency

4.2.2. Alternative Measures of Trade Policy Uncertainty

4.2.3. Other Ways

- Anticipatory effect:

- 2.

- Dynamic effect:

- 3.

- The policy impact node is 2017:

- 4.

- The sample interval is set from 2014 to 2018:

5. How Does Trade Policy Uncertainty Affect the Efficiency of Enterprise’s Supply Chain: A Test of Influencing Channels

5.1. Construction of Mediation Model

5.2. Regression Results of Mediation Model

- Checking the export quantity channel: Firstly, by observing the estimation results in column (1) of Table 6, it can be found that the estimation coefficient of the interaction term TradePUi15×PostTrump16t is significantly negative, indicating that the increase of TPU reduces the export quantity of enterprises. Secondly, the regression results in column (3) show that the estimated coefficient of intermediary variable Expansion is significantly positive, indicating that the increase in export quantity is conducive to improving the efficiency of the enterprise supply chain. Based on the above analysis, it can be seen that the mechanism of the increase of export quantity in TPU on the efficiency of the enterprise’s supply chain is an intermediary effect, which means that the increase of TPU will reduce the efficiency of the enterprise’s supply chain by reducing the export quantity, indicating that hypothesis 2 is valid: that is, the export quantity channel exists.

- Examining technological innovation channels: Firstly, by observing the estimation results of column (2), it can be found that the estimation coefficient of the interaction term TradePUi15 × PostTrump16t is significantly negative, indicating that the increase of TPU reduces the R&D investment of enterprises. Secondly, the regression results in column (4) show that the estimation coefficient of the intermediary variable INN is significantly positive, indicating that the increase in R&D investment is conducive to improving the efficiency of the enterprise’s supply chain. Based on the above analysis, it can be seen that the mechanism of action of technological innovation in the increase of TPU on the efficiency of the enterprise’s supply chain is shown as an intermediary effect, which means that the increase of TPU will reduce the efficiency of enterprise’s supply chain by reducing the R&D investment of enterprises, indicating that hypothesis 3 is valid: that is, the technological innovation channel exists.

- Examining export quantity channels and technological innovation channels: By observing the regression results in column (5), it can be found that the estimation coefficients of intermediary variables Expansion and INN are significantly positive, while the estimation coefficients of core explanatory variables, namely the interaction term TradePUi15 × PostTrump16t, are significantly negative. However, compared with the absolute value of the interaction item TradePUi15 × PostTrump16t in column (5) of Table 3, the estimated coefficient decreased, indicating that the increase of TPU will affect the supply chain efficiency of enterprises through both export quantity and technological innovation channels, which also verifies hypothesis 2 and hypothesis 3.

6. Concluding Remarks

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Duan, W.Q.; Jing, G.Z. Trade facilitation, global value chain embedment and supply chain efficiency. China Ind. Econ. 2021, 117–135. Available online: https://www.cnki.com.cn/Article/CJFDTotal-GGYY202102008.htm (accessed on 2 March 2023).

- Yuan, P.; Wang, Z. The Influence of Regional Integration on Supply chain efficiency: A Case Study of Advanced Manufacturing Industry in Yangtze River Delta. East China Econ. Manag. 2022, 36, 10–20. [Google Scholar]

- He, N.A. The key node role of port in supply chain. China Ocean. Shipp. 2019, 44–46. Available online: http://www.cnki.com.cn/Article/CJFDTotal-YYHW201911017.htm (accessed on 2 March 2023).

- Zhang, J.J. An empirical study on the relationship between port and foreign trade. Econ. Res. Guide 2019, 399, 161+174. Available online: https://www.fx361.com/page/2019/0624/5235283.shtml (accessed on 2 March 2023).

- Deng, W. Empirical study on the impact of port efficiency on Chinese export trade. Logist. Sci. Technol. 2016, 8, 90–91. [Google Scholar]

- Hong, J.; Yue, L. Comparison of economic effects of China-Us trade frictions before and after the outbreak of COVID-19. Forum World Econ. Political 2021, 54–77. [Google Scholar]

- Huang, Y.; Luk, P. Measuring economic policy uncertainty in China. China Econ. Rev. 2020, 59, 101367. [Google Scholar] [CrossRef]

- Yu, M.; Zhi, K. Import liberalization and profit rate of firms. Econ. Res. J. 2016, 51, 57–71. [Google Scholar]

- Qian, X.F.; Gong, L.M. Trade policy uncertainty, regional trade agreements and Chinese manufacturing exports. China Ind. Econ. 2017, 81–98. Available online: http://ciejournal.ajcass.org/UploadFile/Issue/omsn5mtz.pdf (accessed on 2 March 2023).

- Mao, Q.; Xu, J. Trade policy uncertainty and firm savings behavior: A quasi-natural experiment study based on China’s WTO accession. Manag. World 2018, 34, 10–27. [Google Scholar]

- Zhang, G.; Wang, Y.; Li, K. The impact of trade liberalization on cash savings of manufacturing firms. J. Financ. Res. 2019, 471, 19–38. [Google Scholar]

- Mao, Q.L. Does trade policy uncertainty affect Chinese manufacturing firm’ imports? Econ. Res. J. 2020, 55, 148–164. [Google Scholar]

- Deng, X.F.; Ren, T. Trade policy uncertainty and firm’s innovation. J. Tech. Econ. Manag. 2020, 12, 28–33. [Google Scholar]

- Yuan, Y.; Sun, J.S. Environmental Efficiency of Chinese Listed Port Enterprises Based on DEA with Preference Information on Undesirable Outputs. Syst. Eng. 2017, 35, 85–91. [Google Scholar]

- Fu, L.; Meng, J.; Ying, L. Evaluation of supply chain efficiency based on a novel network of data envelopment analysis model. Int. J. Bifurc. Chaos 2016, 25, 61–70. [Google Scholar] [CrossRef]

- Jin, L. Analysis on factors and relationship of cross-border e-commerce supply chain efficiency. Proc. Bus. Econ. Stud. 2020, 153–155. Available online: http://www.cnki.com.cn/Article/CJFDTOTAL-SYJJ202022042.htm (accessed on 2 March 2023).

- Susanawati, L.; Akhmadi, H.; Fauzan, M.; Rozaki, Z. Supply chain efficiency of red chili based on the performance measurement system in Yogyakarta, Indonesia. Open Agric. 2021, 202–211. [Google Scholar] [CrossRef]

- Wang, J.; Cui, L.; Xu, M. The Influence of innovation ability of chain owner on supply chain efficiency: Evidence from port and hinterland supply chain. China Bus. Mark. 2022, 36, 16–28. [Google Scholar]

- Christopher, M. Managing the global supply chain. Int. Mark. Rev. 1998, 15, 432–433. [Google Scholar] [CrossRef]

- Qrunfleh, S.; Tarafdar, M. Lean and agile supply chain strategies and supply chain responsiveness: The role of strategic supplier partnership and postonement. Supply Chain. Manag.-Int. J. 2013, 18, 571–582. [Google Scholar] [CrossRef]

- Handley, K.; Limao, N. Trade and investment under policy uncertainty: Theory and firm evidence. Am. Econ. J. Econ. Policy 2015, 7, 189–222. [Google Scholar] [CrossRef]

- Wang, Y.; Wang, H.; Su, H. Trade policy uncertainty and the quantity and quality effect of China’s exports: Based on the Policy Background of Free Trade Agreement. Audit. Econ. Res. 2020, 35, 111–119. [Google Scholar]

- Liu, J.T.; Qu, L.N.; Wang, Z.R. Does trade policy uncertainty hold back China’s high-tech exports? Jiangxi Soc. Sci. 2021, 41, 96–107. [Google Scholar]

- Shao, Z.D.; Su, D.N. Industrial agglomeration and enterprise’s export domestic value-added: Localization path of GVC upgrading. Manag. World 2019, 35, 9–29. [Google Scholar]

- Wang, W. Research on the Impact of Trade Policy Uncertainty on Firm’s Technological Innovation: An Empirical Analysis Based on Listed High-tech Enterprises. Master’s Thesis, Zhongnan University of Economics and Law, Wuhan, China, 2021. [Google Scholar]

- Li, J.; Li, J.; Chen, R. Research on Dual Innovation Effect of Overseas Patent: Process Innovation or Product Innovation? World Econ. Stud. 2018, 41–55. Available online: http://www.cnki.com.cn/Article/CJFDTotal-JING201803013.htm (accessed on 2 March 2023).

- Xiao, W. The Impact of Trade Policy Uncertainty on Chinese Firms’ Innovation. Master’s Thesis, Southwestern University of Finance and Economics, Chengdu, China, 2021. [Google Scholar]

- Cai, D.; Sun, Y.; Yang, L.; Feng, R. Sino-US trade policy uncertainty and firm’ s technological innovation based on quasi-natural experiment. J. Shenyang Univ. Technol. (Soc. Sci. Ed.) 2021, 14, 423–429. [Google Scholar]

- Chen, H.; Frank, M.Z.; Wu, O.Q. What actually happened to the inventories of American companies between 1981 and 2000. Manag. Sci. 2005, 51, 1015–1031. [Google Scholar] [CrossRef]

- Shi, B.; Shao, W. Measurement and its Determinants of Export Product Quality of Chinese Enterprises and its Determinants: A micro-perspective of Cultivating New Advantages in Export Competition. Manag. World 2014, 90–106. Available online: https://wap.cnki.net/touch/web/Journal/Article/GLSJ201409009.html (accessed on 2 March 2023).

| Variables | Indicators | Unit |

|---|---|---|

| Input variables | Employee | Person |

| Fixed asset | Hundred million yuan | |

| Operating cost | Hundred million yuan | |

| Output variables | Net profit | Hundred million yuan |

| Cargo throughput | Ten thousand tons | |

| NOX emission | Ten thousand tons | |

| Environmental variables | Local GDP per capita | Yuan |

| Age of establishment of enterprise | Year | |

| Scale of asset | Hundred million yuan |

| Variable Name | Variable Meaning | Observations | Mean | Standard Deviation | Minimum Value | Maximum Value |

|---|---|---|---|---|---|---|

| TPU | Trade policy uncertainty | 138 | 385.3814 | 1332.508 | 1.36 | 10,234.45 |

| EFF | Enterprise’s supply chain efficiency | 138 | 0.8036 | 0.2352 | 0.24 | 1 |

| scale | Enterprise’s scale | 138 | 274.5025 | 310.778 | 6.11 | 1559.25 |

| age | Enterprise’s age | 138 | 15.8986 | 7.3527 | 2 | 32 |

| loan | Enterprise’s finance constraint | 138 | 0.0968 | 0.1350 | 0.00 | 0.91 |

| pro | Enterprise’s profit rate | 138 | 0.3233 | 0.3798 | 0.00 | 3.06 |

| Variables | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| TradePUi15 × PostTrump16t | −0.0006 * (−1.52) | −0.0006 * (−1.48) | −0.0006 * (−1.47) | −0.0007 * (−1.90) | −0.0008 ** (−2.00) |

| scale | −0.0849 * (−0.58) | −0.0848 * (−0.57) | −0.1000 * (−0.69) | −0.2209 * (−1.37) | |

| age | 0.0063 * (0.00) | 0.1074 * (0.36) | 0.0460 * (0.15) | ||

| finance | −0.2162 ** (−2.13) | −0.1715 * (−1.64) | |||

| pro | 0.1456 * (1.67) | ||||

| cons | −0.4046 *** (−10.79) | 0.0208 * (0.03) | 0.0034 * (0.00) | 0.9931 * (0.84) | 1.2956 * (1.09) |

| firm-fixed effect | Yes | Yes | Yes | Yes | Yes |

| year-fixed effect | Yes | Yes | Yes | Yes | Yes |

| N | 138 | 138 | 138 | 138 | 138 |

| R2 | 0.2104 | 0.3852 | 0.3852 | 0.4108 | 0.4264 |

| Variables | (1) | (2) | (3) |

|---|---|---|---|

| Other Measurement Methods of Enterprise’s Supply Chain Efficiency | Economic Policy Uncertainty | ||

| BBCO | CCRO | EPU | |

| TradePUi15 × PostTrump16t | −0.0006 * (−1.68) | −0.0008 ** (−2.00) | |

| EPUi15 × PostTrump16t | −0.0004 ** (−2.00) | ||

| Control variables | Yes | Yes | Yes |

| cons | 1.8261 * (1.77) | 1.2956 * (1.09) | 1.2956 * (1.09) |

| firm-fixed effect | Yes | Yes | Yes |

| year-fixed effect | Yes | Yes | Yes |

| N | 138 | 138 | 138 |

| R2 | 0.3840 | 0.4264 | 0.4264 |

| Variables | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| Anticipatory Effect | Anticipatory Effect | Dynamic Effect | Policy Impact Node 2017 | Samples from 2014 to 2018 | |

| TradePUi15 × PostTrump16t | −0.0008 ** (−1.98) | −0.0008 * (−1.94) | −0.0008 ** (−2.03) | −0.0004 * (−0.31) | |

| TradePUi15 × Oneyearbefore | 0.0026 (0.45) | −0.0016 (−0.19) | |||

| TradePUi15 × Twoyearbefore | 0.0045 (0.66) | ||||

| TradePUi15 × dummy2013 | −0.0042 (0.59) | ||||

| TradePUi15 × dummy2014 | −0.0054 (0.75) | ||||

| TradePUi15 × dummy2015 | −0.0037 (0.61) | ||||

| TradePUi15 × dummy2016 | −0.0040 * (−0.54) | ||||

| TradePUi15 × dummy2017 | −0.0009 * (−1.66) | ||||

| TradePUi15 × dummy2018 | −0.0014 * (−1.37) | ||||

| TradePUi15 × dummy2019 | −0.0024 * (−1.25) | ||||

| TradePUi15 × dummy2020 | −0.0007 * (−1.42) | ||||

| Control variables | Yes | Yes | Yes | Yes | Yes |

| cons | −1.3332 * (−1.11) | −1.3297 * (−1.11) | −1.4283 * (−1.16) | −1.3042 * (−1.09) | −2.6947 * (−0.99) |

| firm-fixed effect | Yes | Yes | Yes | Yes | Yes |

| year-fixed effect | Yes | Yes | Yes | Yes | Yes |

| N | 138 | 138 | 138 | 138 | 63 |

| R2 | 0.4267 | 0.4300 | 0.4399 | 0.4269 | 0.3631 |

| Variables | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| Expansion | INN | EFF | EFF | EFF | |

| TradePUi15 × PostTrump16t | −0.0001 * (−0.15) | −0.0009 * (−1.20) | −0.00075 ** (−1.99) | −0.0006 * (−1.65) | −0.0006 * (−1.64) |

| Expansion | 0.3022 * (1.05) | 0.2880 * (1.08) | |||

| INN | 0.2009 *** (4.15) | 0.2002 *** (4.13) | |||

| Control variables | Yes | Yes | Yes | Yes | Yes |

| cons | −8.5616 *** (−2.01) | −6.5644 *** (−2.91) | −1.2914 * (−0.47) | −2.6141 ** (−2.27) | −0.1443 * (−0.06) |

| firm-fixed effect | Yes | Yes | Yes | Yes | Yes |

| year-fixed effect | Yes | Yes | Yes | Yes | Yes |

| N | 138 | 138 | 138 | 138 | 138 |

| R2 | 0.9921 | 0.7983 | 0.4326 | 0.5091 | 0.5147 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lin, B.; Yuan, L.; Lu, B. How Does Trade Policy Uncertainty Affect Supply Chain Efficiency: A Case Study of Listed Companies of Chinese Port Industry. Sustainability 2023, 15, 7140. https://doi.org/10.3390/su15097140

Lin B, Yuan L, Lu B. How Does Trade Policy Uncertainty Affect Supply Chain Efficiency: A Case Study of Listed Companies of Chinese Port Industry. Sustainability. 2023; 15(9):7140. https://doi.org/10.3390/su15097140

Chicago/Turabian StyleLin, Bo, Liu Yuan, and Bo Lu. 2023. "How Does Trade Policy Uncertainty Affect Supply Chain Efficiency: A Case Study of Listed Companies of Chinese Port Industry" Sustainability 15, no. 9: 7140. https://doi.org/10.3390/su15097140

APA StyleLin, B., Yuan, L., & Lu, B. (2023). How Does Trade Policy Uncertainty Affect Supply Chain Efficiency: A Case Study of Listed Companies of Chinese Port Industry. Sustainability, 15(9), 7140. https://doi.org/10.3390/su15097140