Analysis on the Effectiveness and Mechanisms of Public Policies to Promote Innovation of High-Tech Startups in Makerspaces

Abstract

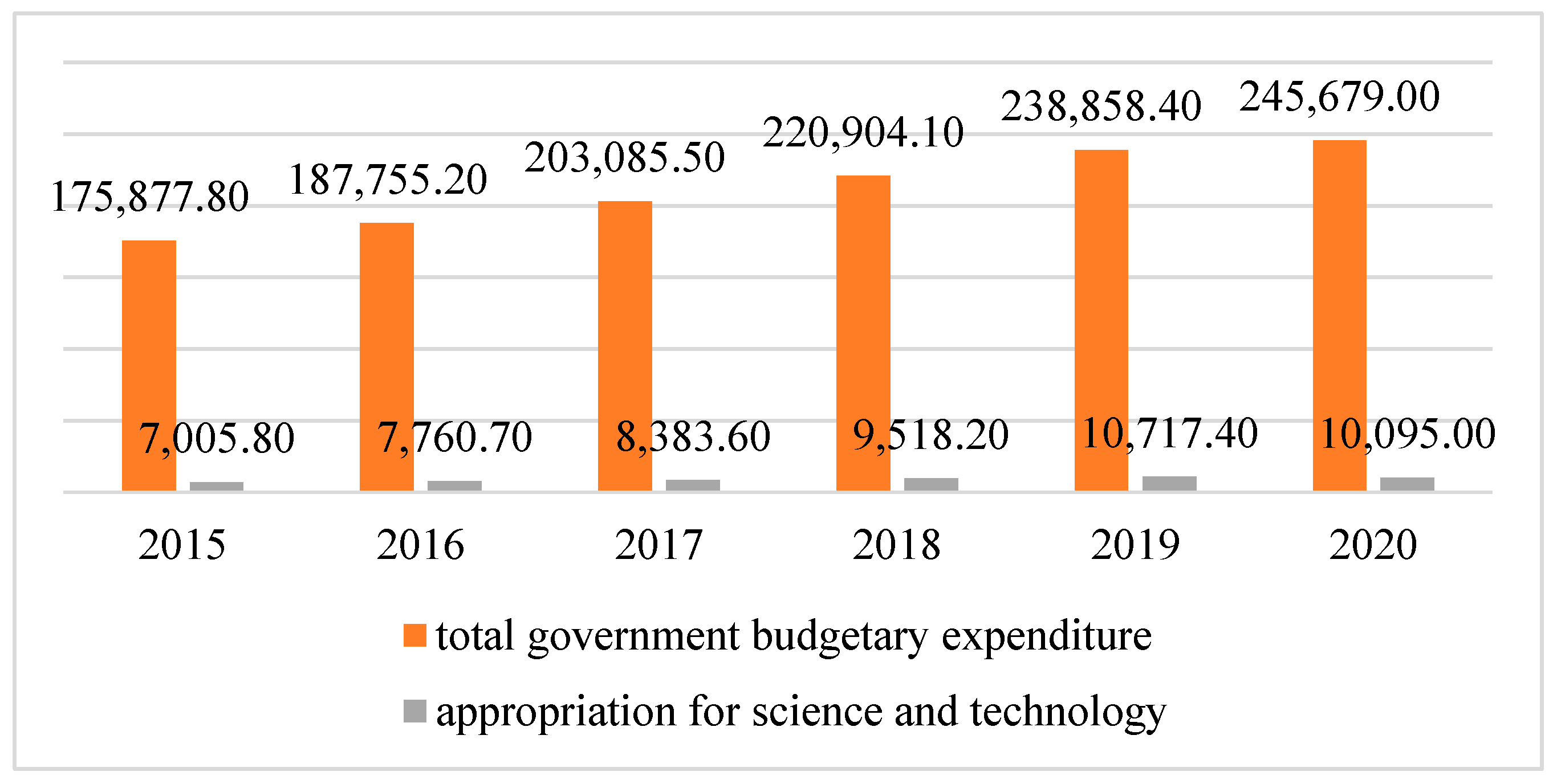

1. Introduction

- Do policy incentives have the desired effect of driving innovative activities and enhancing the innovative capabilities and performance of high-tech startups?

- Through what mechanisms do policy incentives affect the innovativeness of high-tech startups?

- What is the role of makerspaces as platforms for policy implementation, service delivery, and entrepreneurial ecosystem construction, in the process of policy influencing the innovative behavior of startups?

2. Background and Theoretical Foundation

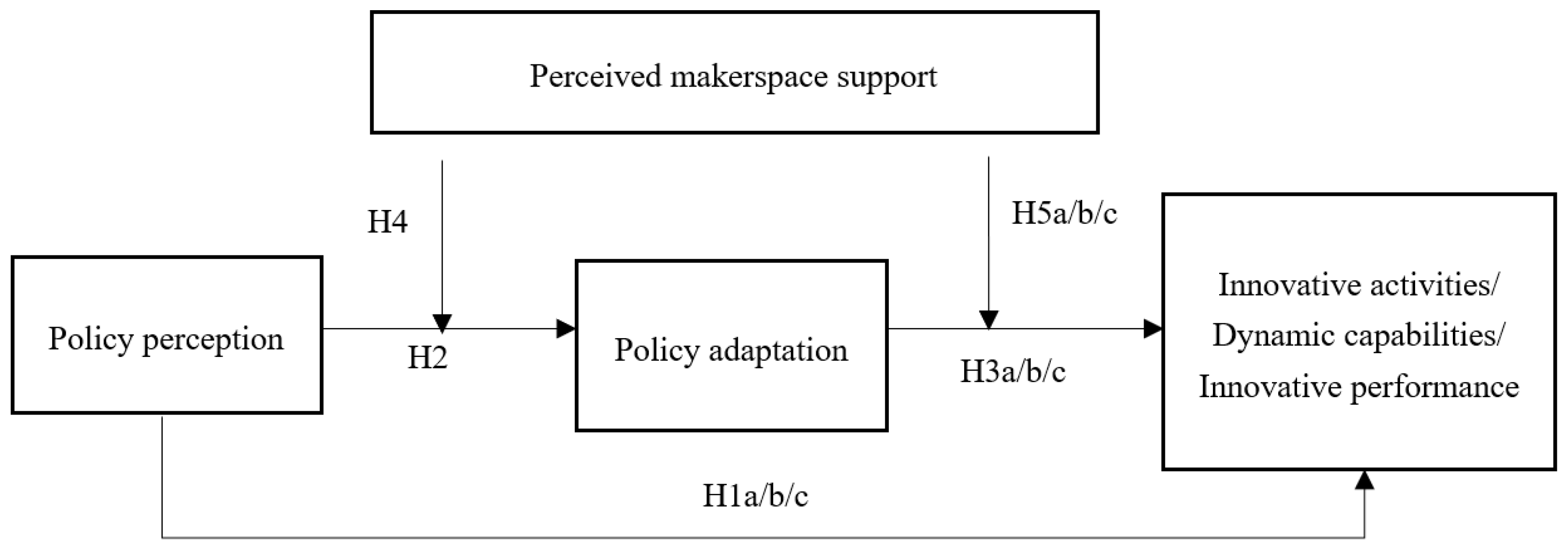

3. Hypotheses Development

3.1. Policy Perception and Innovative Activities

3.2. Policy Perception and Dynamic Capability

3.3. Policy Perception and Innovative Performance

3.4. Mediating Effect of Policy Adaptation

3.5. Moderating Effect of Makerspace Support

4. Methodology

4.1. Research Design

4.2. Sample and Data

4.3. Variable Measures

5. Empirical Analysis

5.1. Reliability Analysis

5.2. Validity Analysis

5.3. Descriptive Analysis

5.4. Results of Mediating Effect

5.5. Results of Moderating Effect

5.6. Results of Moderated Mediating Effect

5.7. Further Test

6. Discussion

6.1. Theoretical Implications

6.2. Practical Implications

6.3. Limitations and Future Research

7. Conclusions

- Chinese policy incentives indeed drive innovative activities and enhance the innovative capabilities and performance of high-tech startups. When the startups in makerspaces perceive that the government’s policies are supportive of their own innovation, their confidence and motivation to innovate are enhanced, and their innovative activities, capabilities, and performance increase. When the startups perceive that the threshold of government EIP support is low and it is easy to obtain the corresponding project support, this will also improve their enthusiasm and capability to innovate.

- Based on the findings of the mediating effect, policy adaptation, as the startups’ interpretation of the innovation and entrepreneurship policies in their region, is the foundation for startups to adjust their own operations and development to adapt to the macro policy environment, reduce innovation and entrepreneurship risks, and improve the success rate of entrepreneurship. Therefore, innovation and entrepreneurship policy perception can positively influence the policy adaptation of startups in makerspaces, thus promoting the innovative activities, dynamic capability, and innovative performance of the startups in makerspaces.

- Makerspace support—as the platform for policy implementation, service delivery, and entrepreneurial ecosystem construction—is influential for startups’ innovative behaviors as it provides key resources based on policies such as finance, technology, and experts. The positive effect of policy perception on policy adaptation is enhanced when the perception of makerspace support is high, while the positive effect of policy perception on policy adaptation is weakened when the perception of makerspace support is low. In addition, the three dependent variables in the model are empirically tested under the “behavior-ability-outcome” paradigm. That is, based on the dynamic capability perspective, the innovative behavior of startups can enhance their dynamic capability, which in turn enables them to achieve higher innovative performance.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Variables | Dimensions | No. | Items | References |

|---|---|---|---|---|

| Policy perception | Perceived ease of use | PP1 | The current innovation and entrepreneurship policy is highly relevant to us. | [28,29] |

| PP2 | Learning the details of the innovation and entrepreneurship policy was easy for us. | |||

| PP3 | The threshold for us to respond to innovation and entrepreneurial policies is low. | |||

| PP4 | The cost for us to respond to innovation and entrepreneurial policies is low. | |||

| perceived usefulness | PP5 | The current innovation and entrepreneurship policy can effectively support enterprises. | ||

| PP6 | The current allocation of resources for innovation and entrepreneurship policies is reasonable. | |||

| PP7 | The current innovation and entrepreneurship policy can effectively promote innovation in enterprises. |

| Variables | No. | Items | References |

|---|---|---|---|

| Policy adaptation | PA1 | Be able to use current innovation and entrepreneurship policies to improve business performance. | [29,39,41] |

| PA2 | Be able to accurately understand the content of current innovation and entrepreneurship policies and obtain appropriate support from them. | ||

| PA3 | Be able to effectively adjust business planning to maintain operations in response to policy changes and policy trends. | ||

| Innovative activities | IB1 | The company has introduced new equipment, new materials, and new technologies in recent years. | [15,43] |

| IB2 | The company has developed new products in the last two years. | ||

| IB3 | The company has expanded its existing product range and market scope in the last two years. | ||

| IB4 | The quality of the new products produced by the company has been improved. | ||

| IB5 | The company has obtained more scientific and technological achievements and patents. | ||

| Dynamic capabilities | DC1 | Companies can absorb new knowledge from the market. | [44] |

| DC2 | Support various tangible and intangible knowledge sharing within the company. | ||

| DC3 | The company’s skills and knowledge are open to employees. | ||

| DC4 | Employees can significantly improve their productivity when they use the knowledge stored in the company. | ||

| DC5 | For employees with knowledge acquisition needs, companies will actively provide opportunities for them. | ||

| DC6 | When competing with competitors, companies are able to quickly incorporate new knowledge. | ||

| Innovative performance | IP1 | The new products developed by the company are well received in the market. | [42] |

| IP2 | The company is efficient in developing new products. | ||

| IP3 | The company’s new products have a high market share among similar products. | ||

| Makerspace support | PMS1 | The makerspace has helped our team/company greatly in developing the market. | [40] |

| PMS2 | The makerspace has helped our team/company greatly in business negotiations. | ||

| PMS3 | The makerspace provides our team/company with the talent resources we need. | ||

| PMS4 | The makerspace provides support for our team/business in terms of finances and taxation. | ||

| PMS5 | The makerspace provides support for our team/company in terms of technology, knowledge, and other specialized areas. |

References

- David, P.A.; Hall, B.H.; Toole, A.A. Is public R&D a complement or substitute for private R&D? A review of the econometric evidence. Res. Policy 2000, 29, 497–529. [Google Scholar] [CrossRef]

- Mazzucato, M. From market fixing to market-creating: A new framework for innovation policy. Ind. Innov. 2016, 23, 140–156. [Google Scholar] [CrossRef]

- Qiu, S.; Cao, Q.; Xie, P.; Huang, J. Money is not everything: Funding investment and dual performance of key universities in China. Technol. Anal. Strat. Manag. 2021, 1–15. [Google Scholar] [CrossRef]

- Jiang, Z.; Liu, Z. Policies and exploitative and exploratory innovations of the wind power industry in China: The role of technological path dependence. Technol. Forecast. Soc. Change 2022, 177, 121519. [Google Scholar] [CrossRef]

- Xu, S.; He, X.; Xu, L. Market or government: Who plays a decisive role in R&D resource allocation? China Financ. Rev. Int. 2019, 9, 110–136. [Google Scholar]

- Beck, N. Shifting Gears: Thriving in the New Economy; Wadsworth Plublishing Company: Detroit, MI, USA, 1992. [Google Scholar]

- Lazonick, W. The Chandlerian corporation and the theory of innovative enterprise. Ind. Corp. Change 2010, 19, 317–349. [Google Scholar] [CrossRef]

- Janáková, H. The Success Prediction of the Technological Start–up Projects in Slovak Conditions. Procedia Econ. Finance 2015, 34, 73–80. [Google Scholar] [CrossRef]

- Chen, Y.-F.; Tsai, C.-W.; Liu, H.-J. Applying the AHP Model to Explore Key Success Factors for High-Tech Startups Entering International Markets. Int. J. E-Adopt. 2019, 11, 45–63. [Google Scholar] [CrossRef]

- David, P.A. Understanding the Economics of QWERTY: The Necessity of History. In Economic History and the Modern Economics; Blackwell: London, UK, 1986; pp. 30–49. [Google Scholar]

- Spender, J.-C.; Corvello, V.; Grimaldi, M.; Rippa, P. Startups and open innovation: A review of the literature. Eur. J. Innov. Manag. 2017, 20, 4–30. [Google Scholar] [CrossRef]

- Luo, X.; Huang, F.; Tang, X.; Li, J. Government subsidies and firm performance: Evidence from high-tech start-ups in China. Emerg. Mark. Rev. 2021, 49, 100756. [Google Scholar] [CrossRef]

- Bu, X.; Cao, Q. Academic Research and Institutional Breakthrough: Theoretical Analysis Under COVID-19. J. Knowl. Econ. 2022, 1–23. [Google Scholar] [CrossRef]

- DiMaggio, P.J.; Powell, W.W. The Iron Cage Revisited: Institutional Isomorphism and Collective Rationality in Organizational Fields. Am. Sociol. Rev. 1983, 48, 147–160. [Google Scholar] [CrossRef]

- Scott, S.G.; Bruce, R.A. Determinants of innovative behavior: A path model of individual innovation in the workplace. Acad. Manag. J. 1994, 37, 580–607. [Google Scholar] [CrossRef]

- Barney, J.B. Firm Resources and Sustained Competitive Advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Long, S.; Liao, Z. Are fiscal policy incentives effective in stimulating firms’ eco-product innovation? The moderating role of dynamic capabilities. Bus. Strat. Environ. 2021, 30, 3095–3104. [Google Scholar] [CrossRef]

- Mohedano-Suanes, A.; Revilla-Camacho, M.; Garzón, D. Innovation orientation and long-term performance: The mediating role of market perception capability. Int. Entrep. Manag. J. 2021, 17, 741–757. [Google Scholar] [CrossRef]

- Cuvero, M.; Granados, M.L.; Pilkington, A.; Evans, R.D. The Effects of Knowledge Spillovers and Accelerator Programs on the Product Innovation of High-Tech Start-Ups: A Multiple Case Study. IEEE Trans. Eng. Manag. 2022, 69, 1682–1695. [Google Scholar] [CrossRef]

- Zheng, J.; Shi, L.; Jiang, T. What mechanism design helps to realize the innovation function of maker-spaces: A qualitative comparative analysis based on fuzzy sets. PLoS ONE 2022, 17, e0274307. [Google Scholar] [CrossRef]

- Li, X.; Shao, X.; Chang, T.; Albu, L.L. Does digital finance promote the green innovation of China’s listed companies? Energy Econ. 2022, 114, 106254. [Google Scholar] [CrossRef]

- Shao, X.; Zhong, Y.; Liu, W.; Li, R.Y.M. Modeling the effect of green technology innovation and renewable energy on carbon neutrality in N-11 countries? Evidence from advance panel estimations. J. Environ. Manag. 2021, 296, 113189. [Google Scholar] [CrossRef]

- Sulistyo, H.; Siyamtinah, H.S. Innovation capability of SMEs through entrepreneurship, marketing capability, relational capital and empowerment. Asia Pac. Manag. Rev. 2016, 21, 196–203. [Google Scholar] [CrossRef]

- Wu, Y.; Ma, Z. The Power of Makerspaces: Heterotopia and Innovation. Sustainability 2023, 15, 629. [Google Scholar] [CrossRef]

- Fu, P.; Li, L.; Xie, X. Reconstructing makerspaces in China: Mass innovation space and the transformative creative industries. Humanit. Soc. Sci. Commun. 2022, 9, 356. [Google Scholar] [CrossRef]

- Meyer, J.W.; Rowan, B. Institutionalized Organizations: Formal Structure as Myth and Ceremony. Am. J. Sociol. 1977, 83, 340–363. [Google Scholar] [CrossRef]

- Teece, D.J.; Pisano, G.; Shuen, A. Dynamic capabilities and strategic management. Strateg. Manag. J. 1997, 18, 509–533. [Google Scholar] [CrossRef]

- Pierce, T.P.; Willy, C.; Roncace, R.; Bischoff, J. Extending The Technology Acceptance Model: Policy Acceptance Model (PAM). Am. J. Health Sci. AJHS 2014, 5, 129–144. [Google Scholar] [CrossRef]

- Li, C.; Zhang, Y.; Wang, Y. The influence of policy perception and decision preference on innovation policy response behavior. Sci. Sci. Manag. ST 2018, 39, 3–15. (In Chinese) [Google Scholar]

- Sun, Z.; Lei, Z.; Yin, Z. Innovation policy in China: Nationally promulgated but locally implemented. Appl. Econ. Lett. 2018, 25, 1481–1486. [Google Scholar] [CrossRef]

- Zubeltzu-Jaka, E.; Erauskin-Tolosa, A.; Heras-Saizarbitoria, I. Shedding light on the determinants of eco-innovation: A meta-analytic study. Bus. Strategy Environ. 2018, 27, 1093–1103. [Google Scholar] [CrossRef]

- Neyens, I.; Faems, D.; Sels, L. The impact of continuous and discontinuous alliance strategies on startup innovation performance. Int. J. Technol. Manag. 2010, 52, 392. [Google Scholar] [CrossRef]

- Pham, L.; Tran, T.T.; Thipwong, P.; Huang, W.T. Dynamic capability and organizational performance: Is social networking site a missing link? J. Organ. End User Comput. 2019, 31, 1–21. [Google Scholar] [CrossRef]

- Wang, M.; Fang, S. The moderating effect of environmental uncertainty on the relationship between network structures and the innovative performance of a new venture. J. Bus. Ind. Mark. 2012, 27, 311–323. [Google Scholar] [CrossRef]

- Gunawan, T.; Jacob, J.; Duysters, G. Network ties and entrepreneurial orientation: Innovative performance of SMEs in a developing country. Int. Entrep. Manag. J. 2015, 12, 575–599. [Google Scholar] [CrossRef]

- D’Aveni, R.; Battista, G.; Smith, K. The age of temporary advantage. Strateg. Manag. J. 2010, 31, 1371–1385. [Google Scholar] [CrossRef]

- Lindtner, S. Hacking with Chinese Characteristics: The Promises of the Maker Movement against China’s Manufacturing Culture. Sci. Technol. Hum. Values 2015, 40, 854–879. [Google Scholar] [CrossRef]

- Spigel, B.; Harrison, R. Toward a process theory of entrepreneurial ecosystems. Strat. Entrep. J. 2018, 12, 151–168. [Google Scholar] [CrossRef]

- Greenspan, S.; Granfield, J.M. Reconsidering the construct of mental retardation: Implications of a model of social competence. Am. J. Ment. Retard. 1992, 96, 442–453. [Google Scholar]

- Lynch, P.D.; Eisenberger, R.; Armeli, S. Perceived Organizational Support: Inferior versus Superior Performance by Wary Employees. J. Appl. Psychol. 1999, 84, 467–483. [Google Scholar] [CrossRef]

- Mahoney, J.L.; Bergman, L.R. Conceptual and methodological considerations in a developmental approach to the study of positive adaptation. J. Appl. Dev. Psychol. 2002, 23, 195–217. [Google Scholar] [CrossRef]

- Zhu, J.; Shi, X. A study on the cluster networks innovation performance based on the internal and external adjustment effect. Sci. Res. Manag. 2016, 37, 121–128. [Google Scholar] [CrossRef]

- Sok, P.; O’Cass, A. Understanding service firms brand value creation: A multilevel perspective including the overarching role of service brand marketing capability. J. Serv. Mark. 2011, 25, 528–539. [Google Scholar] [CrossRef]

- Chien, C.-C.; Lin, H.-C.; Lien, B.Y.-H. Capability contingent: The impact of organisational learning styles on innovation performance. Total. Qual. Manag. Bus. Excel. 2015, 26, 14–28. [Google Scholar] [CrossRef]

- Hetcher, L.; Stepanski, E.J.A. A Step-by Step Approach to Using the SAS System for Univariate and Multivariate Statistics; SAS Institue: Cary, NC, USA, 1994. [Google Scholar]

- Hair, J.F.; Black, W.C.; Bab, B.J.; Anderson, R.E.; Tatham, R.L. Multivariate Data Analysis, 6th ed.; Engle Wood Cliffs: Pretice Hall, NJ, USA, 2006. [Google Scholar]

- Fornell, C.; Larcker, D.F. Structural equation models with unobservable variables and measurement error: Algebra and statistics. J. Mark. Res. 1981, 18, 382–388. [Google Scholar] [CrossRef]

- Edward, J.R.; Lambert, L.S. Methods for integrating moderation and mediation: A general analytical framework using moderated path analysis. Psychol. Methods 2007, 12, 1–22. [Google Scholar] [CrossRef]

- Grillitsch, M.; Hansen, T.; Coenen, L.; Miörner, J.; Moodysson, J. Innovation policy for system-wide transformation: The case of strategic innovation programmes (SIPs) in Sweden. Res. Policy 2019, 48, 1048–1061. [Google Scholar] [CrossRef]

- Jia, N.; Luo, X.; Fang, Z.; Liao, C. When and How Artificial Intelligence Augments Employee Creativity. Acad. Manag. J. 2023; in press. [Google Scholar] [CrossRef]

| No. | Variables | Definition |

|---|---|---|

| 1 | Age | The age of interviewee |

| 2 | Gender | Gender of interviewee, woman = 1, man = 2 |

| 3 | Education | Highest degree of the interviewee, ranging from 1 to 3 |

| 4 | Job content | Interviewee’s responsibility in the startup |

| 5 | Firm size (ln) | Number of employees in the startup |

| 6 | Firm age | Number of months since the startup was founded |

| 7 | Ownership | Nature of ownership of the startup: private, public, or mixed ownership |

| 8 | NFM | Total number of firms in the makerspace |

| 9 | Makerspace rating | Level of makerspace recognized by the government: district, city, provincial, or national makerspace |

| 10 | Supporting institutions | Type of organization to rely on: state-owned enterprise, private-owned enterprise, government, or research institution |

| Variables | Item | CAID | Cronbach’s α |

|---|---|---|---|

| Policy perception | PP1 | 0.867 | 0.893 |

| PP2 | 0.845 | ||

| PP3 | 0.861 | ||

| PP4 | 0.877 | ||

| Policy adaptation | PA1 | 0.851 | 0.899 |

| PA2 | 0.856 | ||

| PA3 | 0.861 | ||

| Makerspaces support | PMS1 | 0.933 | 0.939 |

| PMS2 | 0.921 | ||

| PMS3 | 0.925 | ||

| PMS4 | 0.924 | ||

| PMS5 | 0.923 | ||

| Innovative activities | IB1 | 0.495 | 0.599 |

| IB2 | 0.480 | ||

| IB3 | 0.494 | ||

| IB4 | 0.833 | ||

| IB5 | 0.548 | ||

| Dynamic capabilities | DC1 | 0.865 | 0.881 |

| DC2 | 0.856 | ||

| DC3 | 0.861 | ||

| DC4 | 0.858 | ||

| DC5 | 0.857 | ||

| DC6 | 0.870 | ||

| Innovative performance | IP1 | 0.808 | 0.865 |

| IP2 | 0.811 | ||

| IP3 | 0.804 |

| No. | Variables | KMO Coefficient | Chi Square | p Value of Sphericity Test |

|---|---|---|---|---|

| 1 | Policy perception | 0.824 | 367.582 | 0.000 |

| 2 | Policy adaptation | 0.753 | 303.249 | 0.000 |

| 3 | Makerspaces support | 0.902 | 384.753 | 0.000 |

| 4 | Innovative activities | 0.809 | 327.847 | 0.000 |

| 5 | Dynamic capabilities | 0.884 | 313.687 | 0.000 |

| 6 | Innovative performance | 0.739 | 526.593 | 0.000 |

| Variables | Item | Loadings | CR | AVE |

|---|---|---|---|---|

| Policy perception | PP1 | 0.847 | 0.902 | 0.732 |

| PP2 | 0.865 | |||

| PP3 | 0.904 | |||

| PP4 | 0.921 | |||

| Policy adaptation | PA1 | 0.913 | 0.895 | 0.621 |

| PA2 | 0.827 | |||

| PA3 | 0.863 | |||

| Makerspaces support | PMS1 | 0.922 | 0.937 | 0.809 |

| PMS2 | 0.942 | |||

| PMS3 | 0.919 | |||

| PMS4 | 0.908 | |||

| PMS5 | 0.939 | |||

| Innovative activities | IB1 | 0.525 | 0.698 | 0.532 |

| IB2 | 0.553 | |||

| IB3 | 0.667 | |||

| IB4 | 0.823 | |||

| IB5 | 0.728 | |||

| Dynamic capabilities | DC1 | 0.865 | 0.881 | 0.728 |

| DC2 | 0.856 | |||

| DC3 | 0.861 | |||

| DC4 | 0.858 | |||

| DC5 | 0.857 | |||

| DC6 | 0.870 | |||

| Innovative performance | IP1 | 0.808 | 0.865 | 0.734 |

| IP2 | 0.811 | |||

| IP3 | 0.804 |

| No. | Variables | Mean | S.D. | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Age | 2.03 | 0.73 | |||||||||||||||

| 2 | Gender | 1.52 | 0.50 | −0.088 | ||||||||||||||

| 3 | Education | 2.14 | 0.43 | 0.225 ** | −0.128 | |||||||||||||

| 4 | Job content | 1.55 | 1.11 | −0.085 | 0.172 ** | −0.086 | ||||||||||||

| 5 | Firm size (ln) | 2.80 | 1.26 | −0.092 | −0.087 | 0.022 | 0.014 | |||||||||||

| 6 | Firm age | 22.42 | 8.94 | −0.098 | −0.040 | 0.038 | −0.019 | −0.007 | ||||||||||

| 7 | Ownership | 2.87 | 0.49 | 0.018 | −0.129 * | −0.035 | −0.025 | 0.021 | 0.030 | |||||||||

| 8 | NFM | 1.77 | 0.90 | 0.148 ** | −0.001 | 0.027 | 0.001 | −0.069 | 0.005 | 0.058 | ||||||||

| 9 | Makerspace rating | 2.88 | 1.80 | −0.085 | −0.047 | 0.088 | −0.023 | −0.006 | 0.001 | 0.192 ** | 0.038 | |||||||

| 10 | Supporting institutions | 3.65 | 1.54 | −0.098 | −0.033 | −0.095 | −0.055 | 0.156 ** | 0.088 | −0.087 | 0.004 | 0.000 | ||||||

| 11 | Innovative activities | 3.53 | 0.92 | −0.065 | 0.035 | 0.013 | 0.005 | 0.031 | 0.029 | −0.022 | 0.008 | 0.049 | 0.039 | |||||

| 12 | Innovative performance | 3.45 | 0.79 | −0.045 | 0.038 | 0.046 | −0.031 | 0.012 | 0.023 | 0.028 | 0.050 | 0.086 | 0.026 | 0.547 ** | ||||

| 13 | Dynamic capabilities | 3.71 | 0.68 | −0.044 | 0.026 | 0.001 | −0.027 | −0.017 | 0.004 | −0.026 | 0.002 | 0.023 | 0.015 | 0.556 ** | 0.489 ** | |||

| 14 | Policy perception | 3.75 | 0.72 | −0.085 | 0.083 | −0.013 | −0.068 | −0.006 | 0.020 | 0.017 | 0.018 | 0.097 | 0.006 | 0.425 ** | 0.483 ** | 0.543 ** | ||

| 15 | Policy adaptation | 3.69 | 0.77 | −0.057 | 0.037 | 0.040 | −0.032 | −0.025 | 0.002 | 0.051 | 0.016 | 0.036 | 0.011 | 0.424 ** | 0.508 ** | 0.521 ** | 0.480 ** | |

| 16 | Makerspace support | 3.85 | 0.79 | −0.071 | 0.023 | 0.014 | −0.047 | −0.042 | 0.018 | 0.040 | 0.080 | 0.080 | 0.041 | 0.432 ** | 0.446 ** | 0.526 ** | 0.432 ** | 0.524 ** |

| Innovative Activities (Y1) | Dynamic Capabilities (Y2) | Innovative Performance (Y3) | Policy Adaptation (M) | ||||

|---|---|---|---|---|---|---|---|

| Control Variables | M1 | M2 | M4 | M5 | M6 | M7 | M8 |

| Age | 0.546 | −0.033 | −0.008 | −0.005 | −0.019 | −0.015 | −0.013 |

| Gender | −0.037 | −0.006 | −0.043 | −0.037 | 0.016 | 0.024 | −0.024 |

| Education | −0.013 | 0.008 | 0.011 | −0.015 | 0.089 | 0.054 | 0.103 |

| Job content | 0.039 | 0.020 | 0.007 | 0.003 | 0.002 | −0.004 | 0.016 |

| Firm size | 0.025 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| Firm age | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| Ownership | 0.000 | −0.080 | −0.069 | −0.084 | 0.041 | 0.021 | 0.059 |

| NFM | −0.062 | 0.009 | 0.012 | 0.014 | 0.051 | 0.053 | −0.005 |

| Makerspace rating | 0.008 | 0.000 | −0.003 | −0.002 | 0.003 | 0.003 | −0.002 |

| Supporting institutions | −0.000 | −0.000 | 0.000 | −0.000 | −0.000 | −0.000 | 0.000 |

| Independent variables | |||||||

| Policy perception | 0.546 *** | 0.323 *** | 0.524 *** | 0.339 *** | 0.529 *** | 0.276 *** | 0.736 *** |

| Mediating variables | |||||||

| Policy adaptation | 0.302 *** | 0.251 *** | 0.343 *** | ||||

| R | 0.434 | 0.472 | 0.548 | 0.586 | 0.494 | 0.551 | 0.685 |

| R2 | 0.189 | 0.223 | 0.300 | 0.343 | 0.244 | 0.303 | 0.469 |

| MSE | 0.704 | 0.676 | 0.336 | 0.316 | 0.490 | 0.453 | 0.327 |

| F | 8.013 | 9.048 | 14.758 | 16.431 | 11.090 | 13.695 | 30.401 |

| Innovative Activities | Dynamic Capabilities | Innovative Performance | Policy Adaptation | |

|---|---|---|---|---|

| Control Variables | M9 | M10 | M11 | M12 |

| Age | −0.302 | −0.005 | −0.015 | −0.005 |

| Gender | −0.006 | −0.369 | 0.024 | −0.022 |

| Education | 0.008 | −0.015 | 0.054 | 0.090 |

| Job content | 0.020 | 0.003 | −0.001 | 0.015 |

| Firm size | 0.000 | 0.000 | 0.000 | 0.000 |

| Firm age | 0.000 | 0.000 | 0.000 | 0.000 |

| Ownership | −0.080 | −0.084 | 0.021 | 0.044 |

| NFM | 0.009 | 0.014 | 0.053 | −0.019 |

| Makerspace rating | 0.001 | −0.002 | 0.003 | −0.028 |

| Supporting institutions | −0.000 | −0.000 | −0.000 | 0.000 |

| Independent variable | ||||

| Policy perception | 0.323 *** | 0.339 *** | 0.276 *** | 0.236 |

| Mediating variable | ||||

| Policy adaptation | 0.302 *** | 0.251 *** | 0.343 *** | |

| Moderating variable | ||||

| Makerspace support | −0.222 | |||

| Interaction | ||||

| Policy perception * Makerspace support | 0.104 ** | |||

| R | 0.472 | 0.586 | 0.551 | 0.703 |

| R2 | 0.223 | 0.343 | 0.303 | 0.494 |

| MSE | 0.676 | 0.316 | 0.453 | 0.314 |

| F | 9.048 | 16.431 | 13.695 | 28.264 |

| Innovative Performance | Dynamic Capabilities | ||

|---|---|---|---|

| Model 13 | Model 14 | Model 15 | |

| Age | −0.021 | −0.013 | −0.016 |

| Gender | 0.066 | 0.058 | 0.006 |

| Education | 0.081 | 0.075 | −0.003 |

| Job content | −0.011 | −0.013 | −0.020 |

| Firm size | 0.000 | 0.000 | 0.000 |

| Firm age | 0.000 | 0.000 | −0.000 |

| Ownership | 0.104 | 0.104 | −0.022 |

| NFM | 0.040 | 0.041 | 0.006 |

| Makerspace rating | 0.005 | 0.005 | −0.001 |

| Supporting institutions | 0.000 | 0.000 | 0.000 |

| Innovative activities | 0.469 *** | 0.200 *** | 0.414 ** |

| Dynamic capabilities | 0.649 *** | ||

| R | 0.558 | 0.726 | 0.559 |

| R2 | 0.312 | 0.526 | 0.312 |

| MSE | 0.446 | 0.308 | 0.330 |

| F | 15.586 | 34.999 | 15.630 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, Y.; Li, Y.; Qiu, S. Analysis on the Effectiveness and Mechanisms of Public Policies to Promote Innovation of High-Tech Startups in Makerspaces. Sustainability 2023, 15, 7027. https://doi.org/10.3390/su15097027

Li Y, Li Y, Qiu S. Analysis on the Effectiveness and Mechanisms of Public Policies to Promote Innovation of High-Tech Startups in Makerspaces. Sustainability. 2023; 15(9):7027. https://doi.org/10.3390/su15097027

Chicago/Turabian StyleLi, Youjia, Yi Li, and Shunli Qiu. 2023. "Analysis on the Effectiveness and Mechanisms of Public Policies to Promote Innovation of High-Tech Startups in Makerspaces" Sustainability 15, no. 9: 7027. https://doi.org/10.3390/su15097027

APA StyleLi, Y., Li, Y., & Qiu, S. (2023). Analysis on the Effectiveness and Mechanisms of Public Policies to Promote Innovation of High-Tech Startups in Makerspaces. Sustainability, 15(9), 7027. https://doi.org/10.3390/su15097027