Abstract

This article aims to uncover the asymmetric labor-market consequences of the long-run civil war in Afghanistan by employing a non-linear autoregressive distributed lags (NARDL) model and an asymmetric causality technique over the period from 2004Q3 to 2020Q4. The findings from the NARDL model reveal that the positive asymmetric shocks from the cost of war, GDP growth, final government expenditure, foreign direct investment, and the rule of law significantly decrease the unemployment rate, while their negative asymmetric shocks increase the unemployment rate in the short and long runs. Innovatively, the composite financial inclusion index has been incorporated into the model, which provides interesting results. It demonstrates that enhancing the outreach of financial services plays an important role in reducing the unemployment rate during wartime in Afghanistan, while its exclusion is found to increase the unemployment rate both in the short and long runs. Moreover, the results of the asymmetric causality test reveal that an asymmetric causality runs from both the positive and negative components of the cost of war, the composite financial inclusion index, GDP growth, foreign direct investment, inflation rate, population growth, and the rule of law to the unemployment rate, while no evidence is found to support a causality nexus between the unemployment rate, final government expenditure, and the secondary school enrollment rate. The results entail several policy implications that are discussed.

1. Introduction

From 1992 to 2021, Afghanistan’s longest war, which resulted in the overthrow of several political regimes and governments, had severe impacts on socioeconomic indicators. Extreme poverty, the highest unemployment rate, extreme income disparities, forced migration, loss of millions of people, physical and mental disabilities, loss of social and economic infrastructure, human capital flight, and trillions of dollars of outcome-free expenditure are the ultimate results of the civil wars in Afghanistan [1,2]. It is well documented by the existing literature (see, inter alia, refs. [3,4,5]) that civil wars destroy economic and social institutions, plunge a country into poverty, foster extremism, erode social norms, and increase unemployment rate, all of which return as a cyclical effect to war intensification. Nonetheless, there is no general agreement on the speed of a nation’s post-conflict recovery, but it is literally obvious that it takes longer than expected due to the prevalence of social exclusion, extreme poverty, and reconstruction of devasted infrastructure in war-torn societies—Afghanistan being at the top of the list of such societies, assuming that long-run civil wars have concurrent and long-term negative effects, specifically on the high unemployment rate. Thus, this study turns its focus to analyzing one of the sensitive strands of the socioeconomic predictors—that is, the labor market effects of the long-run war on the unemployment rate, which is assumed to have significant causality in intensifying the war in Afghanistan.

From an economic point of view, civil wars disrupt the balance of demand and supply of manpower in an economy, causing the supply (demand) curves to shift upward (downward), resulting in an excess of manpower supply, which significantly heightens the unemployment rate [6,7]. The short-run consequences of war-driven unemployment may simultaneously swallow per capita savings and decrease per capita real income and aggregate consumption, which can be adjusted by effective interference [8], while the long-run consequences of war-driven unemployment have far more serious social impacts on the economy, inflicting severe negativity and inconceivable human suffering [9], which will take an unexpectedly long time to recover to its pre-war state. Moreover, it is also well evident that war-driven unemployment is a significant driver of plunging nations into severe poverty and unemployment, further enhancing the propensity for prolonged civil wars. Therefore, the emerging term “war-driven unemployment” should still be used with caution because several empirical studies show an inverse trend—that is, unemployment-driven civil wars [5,10]. Such claims are plausible but are likely to provide only half an explanation. Therefore, one way or another, each war-torn society will, perhaps, require a context-specific analysis to gain a wider and deeper insight into the causes, effects, and causality direction of the civil wars with the socioeconomic indicators. The principal conclusions of recent studies have also urged empirical works to focus on context-specific questions, sophisticated empirical models, and a wide range of predictors to offer comprehensive results on the social and economic consequences of civil wars (see, inter alia, refs. [11,12]). From a sustainability viewpoint, only when output growth exceeds the economy’s aggregate productivity of human capital can it decrease the unemployment rate. As a result, growth moves closer to sustainability if the gradual economic growth promotes a rapid decline in unemployment [13]. Again, such a theoretical expectation is disrupted by the consequences of prolonged civil wars in a country.

Even though a vast body of literature exists on the legacies of civil wars and their effects on different indicators, such as mental health, human displacement, growth, poverty, and income disparities, the missing gaps in the literature can be highlighted in two key areas. First, the scarcity of empirical studies to analyze the effects of long-run civil war on the unemployment rate—that is, one of the sensitive labor-market strands and an important component of the sustainable development goals (SDGs) for developing and post-conflict economies, using sophisticated models to offer consistent, accurate, and comprehensive results. Second, the non-existence of such studies examining the effects of the longest civil war on the unemployment rate in Afghanistan, which has been a war-torn society for the last four decades, provides ample room and significant justification for the present study to fill the gaps. To that end, it is important to direct the study by formulating three key questions, among all others. First, does the long-run civil war have positive (negative) asymmetric effects that increase (decrease) the unemployment rate? Second, as aimed by the United Nations, does financial inclusion effectively intermediate to squeeze the asymmetries of civil war on the unemployment rate? Third, do the negative (positive) components of the civil war cause any negativity (positivity) in the unemployment rate?

The key objective of this study is to provide statistical evidence on the effects of the long-run civil war on the unemployment rate in Afghanistan by taking a new step in the existing literature and using non-linear autoregressive distributed lags (NARDL) and asymmetric causality techniques to uncover the effects and establish a foundational literature. Though the study focuses on Afghanistan, its outcome can be generalized to all war-torn societies that share a common nature. Thus, this paper is a novel study in the literature of war-driven unemployment analysis in Afghanistan and, therefore, its contribution can be outlined as follows: First and foremost, to the best of the authors’ knowledge, this is the first ever study in the existing literature for Afghanistan examining the effects of long-run civil war on the unemployment rate. Second, this paper builds a comprehensive composite financial inclusion index for Afghanistan, using widely accepted predictors that explain financial inclusion outreach and are incorporated into the model to explain its intermediating role in reducing unemployability during wartime. Third, unlike most recent studies, this paper employs sophisticated models that allow asymmetric characteristics of the predictors in assessing the effects of civil war on the unemployment rate, using the most recent and updated datasets from 2004Q3 to 2020Q4 to reflect new statistical evidence. Fourth, it enables a broad range of control predictors in the modeling process to provide deeper analysis by considering the intermediating effects of relevant macroeconomic indicators on the unemployment rate.

The remaining sections of the study are structured as follows. Section 2 reviews the relevant literature about the concept of civil war and its effects on various socioeconomic indicators, specifically the unemployment rate. Section 3 presents the methodology, explaining the empirical models, estimation strategy, data, and variables used in the study to test the competing hypotheses. Section 4 presents the results of the estimations and discussion about the findings. Section 5 provides the concluding remarks and some relevant policy recommendations.

2. Literature Review

There are various definitions of war in the existing literature, but all definitions give the impression of similar content. McNeill and Mueller [14] define war as a state of armed conflict within or between two or more nations seeking political, economic, and/or other beneficial hegemonies. Gersovitz and Kriger [15] define civil wars as politically organized, sustained, large-scale, and armed conflicts within or between important groups of a country’s inhabitants over the monopoly of political and economic powers. Kalyvas [16] and Farrell [17] define war as instances of organized and sustained conflicts between political parties, groups of inhabitants, two or more nations, or countries that are subject to a common authority at the onset of aggression. Although various definitions and theories have been developed to define civil war and its destructive effects on nations, it is evident that war is a great tragedy and a societal catastrophe [18], whether it is executed by one country against another or imagined to be waged by humanity as a whole [19].

The basic concept of war is not uncommon to the nations; it is stated that, if not all, almost a large proportion of all nations have witnessed either intense or trifling conflicts. In the common sense, an armed conflict between political groups is linked by aggressions of extensive duration and magnitude [20]. Though advances in technology have changed the mechanics of war from those of 1945, the concept has remained unchanged. On the one hand, the empirical literature widely documents the effects of long-term war on socioeconomic indicators, reporting the customary measurement of war effects in terms of money, cost of war, effects of war on the economy, lost productivity, psychological effects of war, and the number of people killed, wounded, and displaced; while on the other hand, it does not report a standard measurement method to ascertain the scale and magnitude of the effects of war on specific socioeconomic indicators. Moreover, the trend of global war has been gradually declining in the past two centuries, but the trend of civil war shows a rapid upward shift in the last four decades [21]. It shows that civil war is most likely to impact the working population; therefore, the human capital and their active engagement in an affected economy [22]. In a general theoretical sense, using plausible assumptions, unemployment is based on the excessive supply of manpower viz-a-viz demand for labor in an economy. A supply that is higher than the numbers demanded or does not match the skills, knowledge, and technicalities is likely to influence the rate of unemployment [23]. However, these assumptions become invalid in an economy bearing the brunt of massive destruction due to prolonged civil wars, where war is assumed to be the main cause of the unemployment onset and unemployment is the outset cause of the intensified civil wars. Though the existing literature mainly documents the civil wars that are outright linked to unemployment, this study proceeds to review the available ones.

For instance, Raphael and Winter-Ebmer [24] investigated the empirical relationship between the unemployment rate and the level of crime, using datasets for US states. The authors employed a wide range of control variables for state-level demographic and economic factors, prime defense contracts, state-effects, time-trend, and year-effects in their estimations. They found that there was a significant link between the decline in crime and the unemployment rate during the 1990s, implying that the decline in the unemployment rate was associated with a reduction in the crime rate. This requires testing the following hypothesis in the context of the long-term war in Afghanistan:

H1.

There is an asymmetric relationship between civil war and unemployment in Afghanistan.

Rabiile [25] examined the effects of civil wars on the unemployment rate in Mogadishu, Somalia, aiming to test the effectiveness of the Somalian government’s policies to increase job creation in an affected war economy. The author used a self-administered questionnaire and collected primary data from 171 out of 300 respondents and employed descriptive statistics and correlation analysis. The author concluded that there was a significant link between civil war and unemployment, emphasizing the importance of policy changes to encourage foreign investment and sound international projects to reduce unemployment in Mogadishu, Somalia. Hamilton [26] examined the impact of unemployment on civil conflict in 184 countries based on the North Ireland case. The author used both social and economic factors, with a specific focus on civil conflict in ethnically heterogeneous nations. Using logit regression models, the author found that rising unemployment rates are linked with the onset of civil wars.

Miguel and Roland [27] investigated the impact of US bombing on the persistence of local poverty and unemployability in Vietnam, using a set of unique data relevant to the US military, comprising bombing intensity at district levels, which bears a massive humanitarian cost. The estimation was based on comparative analysis of the districts bombed with other districts, while the authors controlled for demographic and geographic characteristics. The authors conclude that there were no significant effects of bombing on the outcome variables, though it has been the most intensified bombing in the history of Vietnam (see, also, ref. [28]).

Berman et al. [29] argued for the notion of the opportunity cost, relevant to government spending to bring social and political order, assuming that gainful employment of young men reduces their propensity to participate in armed conflicts. The authors used their assumptions in Afghanistan, Iran, and the Philippines, employing a set of survey data comprising unemployment, attacks against governments and their allied forces, and civilian deaths. The estimation results of their study conclude that there is no significantly positive link between the predictors. Specifically, no evidence was found to support the relationship between unemployment and the number of attacks killing civilians in all three countries. Furthermore, the authors found potential explanations, presenting the notion that insurgent meticulousness to arbitrate between the potentials of predation on one hand and security measures and information costs on the other would be the negative association between the unemployment rate and civil wars.

Kecmanovic [30] evaluated the effects of war in Croatia on unemployment, education, and earnings lines of men born in 1971, using the Croatian and Slovenian Labor Force Survey datasets and the Difference in Difference (DiD) method to analyze their data in comparison with Slovenia, a neighboring country that experienced no war. The authors found that the war is negatively associated with education and positively associated with the unemployment rate and earning outcomes of men born in 1971. The author argues that Croatia’s victory explains the observed preferential treatment of draftees in the labor market. Moreover, Galdo [12] investigated the effects of armed conflicts on the labor market in Peru, using datasets spanning from 1980 to 1995. The author discovered that the first 36 months of life are the most vulnerable period of early life exposure to civil war, and that one standard deviation increase in war causes a 5% decrease in adult monthly earnings, a significant decrease in the recruitment of female job seekers, and a 6% decrease in the possibility of men working in large companies. Thus, the author emphasizes the positive association of unemployment with the civil war in Peru. This leads this study to develop the following hypothesis:

H2.

Civil war has non-monotonic negative effects on the rapidly rising unemployment rate in both the short and long runs.

Shemyakina [31] explored the effects of armed conflicts on the outcomes of the labor market in Tajikistan, focusing on school-age cohorts during wartime, from 1992 to 1998. The author controlled for district-level exposures to civil war and employed regression analysis. The author found that younger women who lived in war-effected regions were more affected by conflict than men and were 10% more likely to be employed compared to older women from less affected districts. These results show a changing pattern in the employment of women induced by civil war.

Vincent de Paul et al. [32] evaluated the long-run effects of conflict exposure throughout various stages of life on the outcomes of the labor market in Sierra Leone using datasets from the Sierra Leone Integrated Household Survey (2011) and other sources on human-rights violations and loss of assets during war. The authors found negative effects of conflict exposures throughout primary schooling time and long-run labor market involvement and employment, implying that long-run effects of war reduce labor market participation, e.g., employment, by 3% in Sierra Leone.

Mansoor [33], which is a leading study of the war-unemployment rate nexus in Afghanistan, attempted to explain the principal reasons for unemployment in Afghanistan. The author employed secondary datasets collected from a nationally representative household survey and augmented the variables of his study with age, gender, marital status, the level of education, educational attainment, sector-wise employment, and insecurity perception. The author employed logit regression models to test the effects of the war and the youth protuberance on total labor market failure in Afghanistan and found that the high unemployment rate is not statistically significant enough to impact the war and the insecurity in Afghanistan and concluded that the rapidly rising unemployment rate is not necessarily the cause of the prolonged war in the country, while age, gender, education, marital status, geographical constraints, and sector-wise employment are statistically significant enough to impact the unemployment in Afghanistan. Assuming the feedback effects, it is important to develop and test the following two competing hypotheses:

H3.

In a country-specific context—for example, in Afghanistan—asymmetric causality runs from civil war to unemployment rate with no feedback response.

H4.

The current study assumes that the expansion of financial inclusion outreach intertwines with the civil war and reduces the direct effects of the civil war on the unemployment rate.

Although the existing literature is limited in reporting empirical studies focusing on testing the effects of civil wars on unemployment rate or using sophisticated models to provide accurate and consistent results, the literature reports no study analyzing the effects of long-term civil wars on the unemployment rate in Afghanistan, a country where most of the population lives below the poverty line with an extremely high unemployment rate. Thus, it encourages the present study to overcome these empirical shortcomings.

3. Methodology

Based on the developed hypotheses and the overarching objectives of the study, this section specifies the econometric methods used to examine the effects of the civil war on the unemployment rate in Afghanistan—a country that has been a war-torn society for more than four decades. It then explains key measurements, data collection from various reliable sources, and the variables employed in the study. Recognizing the importance of the SDGs (Sustainable Development Goals) of the United Nations, this paper innovatively employs the composite financial inclusion index as a comprehensive proxy to capture the effects of emerging financial services on the unemployment rate during wartime. The study also describes the methodology used to construct the composite financial inclusion index.

3.1. Model Specification

To obtain a specification, the present study draws on linear methods used by recent studies (see, inter alia, refs. [33,34,35]) and argues that the linearity assumption does not fully uncover the effects of civil war and the control predictors on the dependent variables used in this paper—thereby, the effects of civil war on the unemployment rate. Except for the cost of war, which is used as a key variable of interest and the composite financial inclusion index, the choice of other explanatory variables augmented in the subsequent models follow recent studies in the literature (see, for instance, [36,37,38,39,40]). To that end, assuming that all the predictors are either I(0), I(1), or a combination of both, without any higher degree of integration, this study begins the specification with the long-run non-linear model of Shin et al. [41] as follows:

Here, the unemployment rate, cost of war, composite financial index, gross domestic product growth rate, population growth rate, final government expenditure, inflation rate, secondary school enrollment rate, the rule of law, and foreign direct investment rate. Moreover, are the long-run positive (negative) partial sum changes in the variables [41]. The positive and negative partial sum changes of the explanatory variables use and functions to be integrated in the model (1). The linear I(0) combination, that is, of Equation (1) and its asymmetric partial sum of squares, can be expressed as:

where all the variables are explained before, the conditioned [I(0; stationarity at the level)] property of the series can be achieved in Equation (2) if is significant to reject the null hypothesis of non-stationarity at the level. Moreover, the cointegration between the predictors can be established if is significant to reject the null of no cointegration between the predictors at either of 10%, 5%, or 1% significant levels. It is very probable that Equation (2) may exhibit endogeneity and multicollinearity problems that needs to be adjusted before empirical estimation [42]. Thus, we adjust the endogeneity and multicollinearity issues by incorporating the autoregressive (AR) and parameter and the dynamic form into Equation (2) as:

where is the AR parameter, presents the coefficient that brings in the dynamic adjustment in the equation [43], and for simplicity purposes, presents the positive (negative) partial sum of all the other control variables. Now the present study specifies the non-linear autoregressive distributed lags model of Shin et al. [41] as follows:

where the change sign Δ is the difference operator, are the long-run positive (negative) partial sum changes, and are the short-run positive (negative) asymmetric coefficients augmented in the model. All other specifications are similar to Equation (1). The use of the non-linear ARDL model has several distinctive advantages over other common estimation methods, such as linear ARDL, ordinary least squares, vector autoregressive, and vector error-correction. First, its superiority is clear in decomposing the positive and negative partial sum of the predictors in both the short- and long-run to capture the asymmetric effects of the explanatory variables on the outcome variable. Second, it incorporates the cointegration bound test into the long-run and instantaneously estimates it with the short-run coefficients while it conserves the data-generation processes, yielding robust and consistent estimates (see, for instance, [41]). Third, the coefficients of the asymmetric ARDL model are robust in the presence of any structural break in the series [44].

Consistent with the asymmetric assumption and in-line with the above specification, the present study investigates causality relationships between the variables using an asymmetric approach. The need for an asymmetric causality model comes from the reality that macroeconomic predictors respond more to negative shocks than positive ones. Therefore, this study employs the proposed asymmetric causality model of Hatemi-J [45] to examine the asymmetric causality nexus between the unemployment rate and the described explanatory variables , defining each of them as a random walk process as:

where and are the stochastic error terms and are defined as:

Equations (6) and (7) represent the sum of the positive and negative shocks [46]. Therefore, the positive and negative shocks of the dependent and independent variables can be . The non-linear causality of negative shocks is estimated using the following vector autoregressive (VAR) model:

where , , , and present the vector of variables being tested, the constant, the matrix of lagged variables as such , and the error terms, respectively. Testing the null hypothesis of no granger causality of positive and negative shocks between the variables, the following Wald test is used:

where C presents the matrix of ones for restricted and zeros for all other parameters, presents the column of stacking operators. the variance covariance of the VAR model. Optimal lag length is selected via the HJC (Hatemi-J Information Criterion), while the critical values are derived using bootstrap iterations [46]. The null hypothesis of no asymmetric causality nexus between the positive and negative components of the predictors is rejected if the Wald statistics are greater than the critical values at a desired significant level.

3.2. Measurement and Data Sources

This paper uses a set of time-series data containing annual observations spanning from 2004 to 2020 for Afghanistan, which is the context of interest for the analysis of the effects of civil war on the unemployment rate. Following Shahbaz et al. [47], Hameed et al. [48], and Azimi and Shafiq [49], the study transformed the annual observations into quarterly series, using the linear interpolation methodology proposed by Asogu [50]. This method is rational because it accurately transforms the data into a higher number of observations without affecting the stationarity properties or trends of the variables. Moreover, it increases the sample size (N = 17 to N = 66) and offers more observations, helping to obtain consistent results. Thus, the dataset presents quarterly observations from the third quarter of 2004 to the fourth quarter of 2020. As defined before, the variables include unemployment rate; cost of war to Afghanistan’s GDP (%); GDP growth rate; secondary school enrollment rate; the rule of law; final government expenditure to GDP (%); composite financial inclusion index; inflation rate; population growth rate; and foreign direct investment to GDP (%). The data comes from the World Development Indicators (WDI), Worldwide Governance Indicators (WGI), the International Monetary Fund’s Financial Access Survey (FAS-IMF), and the United States Department of Defense Budget. Table 1 provides complete information about the description, symbols, measurements, and sources of the data obtained for the variables.

Table 1.

Variables’ description and data sources.

Unemployment rate is employed as the dependent variable. It reflects the percentage change in the unemployment rate during the civil war in Afghanistan. General theory postulates that civil wars and unemployment rate strongly covariate during wartime and aftermath, affecting the overall social inclusion and economic well-being of a nation [52,53]. The cost of war measures the amount of money the United States spent in Afghanistan from 2004 to 2020. Due to a lack of availability of the data, the cost of war presents aggregate data for Afghanistan and is not disaggregated by provinces, although the war intensity has been higher in some provinces than in others during the period of this study. Furthermore, this proxy has two more features than the proxies used in recent studies. First, it allows more accurate estimations than the number of people killed and injured. Second, it provides actual data on the amount of money spent on operating pure military operations—thus reflecting the real economic cost of war. The secondary school enrollment rate is used as an explanatory variable to measure the gross enrollment in secondary schools and to reflect the variability of the fundamental attempts at advancing skills and knowledge to reduce the unemployment rate. Furthermore, the rule of law is employed to capture the effects of institutional quality on reducing unemployment rate. It is widely documented that the rule of law is an appropriate proxy for institutional quality when analyzing the effects of civil war on the mentioned outcome variables (see, inter alia, refs.[54,55]). Studies by Bala and Bala [56], Janifar et al. [57], Mubarak [58], and Hjazeen et al. [59] suggest the incorporation of population growth, GDP growth, foreign direct investment, and the inflation rate when investigating the effects of other socioeconomic predictors on unemployment rate in developing economies. Finally, recognizing the importance of financial inclusion in combating unemployment, this paper innovatively constructs and employs the composite financial inclusion index as a control variable to ascertain its impact on the unemployment rate during wartime.

3.3. Construction of (cfi)

The cfi comprises three key dimensions, such as banking penetration, availability, and usage of financial services by the bankable adults. The construction is based on the methodology proposed by Sarma [51] and begins with the specification of key indicators for each dimension. Table 2 describes the indicators and weights.

Table 2.

The cfi indicators.

Then, the construction continues to determine an appropriate index for each of the dimensions by observing the minimum and maximum integers using the following equation:

Here, are the normalized value of the particular dimension, weight of the dimension, actual value, lower limit, and upper limit of the dimension i, respectively [60]. It is worth mentioning that the lower limit is fixed by assigning 0 value, while the upper limit is fixed by the 90th percentile rank. Next, the composite financial inclusion index is estimated employing Equations (9)–(11), using the notions of distance (d) achievements of points from being the worst and from being the ideal situation:

where Equation (11) estimates the normalized Euclidian distance between the achievement point and worst position on the nth space, Equation (12) estimates the normalized inverse distance between and ideal position on the nth space, and Equation (13) computes the composite financial inclusion index by taking the average of Equations (11) and (12). This method of construction is widely accepted as a standardized predictor of composite financial inclusion index (see, inter alia, refs. [39,40,61]). Having described the methodology, dependent and independent variables, and the data collection sources used in the study, the next section explains the results and discusses on the findings.

4. Results and Discussions

4.1. Stationarity Result

We start our analysis with a correlation analysis among the variables to detect any multicollinearity between them. The results of the correlation analysis are presented in Table 3. They indicate, however, that the cost of war is negatively associated with school enrollment ratio and positively associated with final government expenditures; they are significant at a 10% level, implying no extreme collinearity. Other variables are discovered to have a negligible correlation with one another. Thus, the results support the specification and estimation of the NARDL model to determine the effects of cost of war on the unemployment rate. Moreover, we test the unit root of the variables, which is important in time-series estimations to ascertain their integrating orders to avoid any misspecifications. To that end, this study employs the Augmented Dickey and Fuller (ADF) [62] and Phillips and Perron (PP) [63] methods. For estimation purposes, the study has selected the optimal lag length via the AIC, SIC, and HIC frameworks in the standard vector autoregressive environment with a maximum five-lag order. The results are reported in Table 4, and all three methods suggest using two lags. Thus, the study employs two lags and maintains them throughout the subsequent estimations.

Table 3.

Correlation matrix.

Table 4.

Optimal lag length.

Both the ADF and PP tests are widely used in the literature and provide consistent results in testing the null of non-stationarity, unless the data exhibit structural breaks. To account for any structural breaks in the data, the Zivot and Andrew (ZA) [64] method is also deployed with one structural break to test the null of non-stationarity in the presence of structural break. The results of the ADF and PP tests that include intercept and trend regressors are reported in Table 5, while the results of the ZA are presented in Table 3. For the rejected null of non-stationarity at the level, the ADF and PP results indicate that the unemployment rate and inflation rate are significant at 5% and 1% levels, while they indicate that composite financial inclusion index, school enrollment ratio, the rule of law, final government expenditure, foreign direct investment, cost of war, and population growth rate are insignificant to reject the null at the level, but they become significant at 1% level to reject the null after taking their first difference. The results demonstrate that the variables follow mixed integration of I(0) and I(1) without any higher degree of integration.

Table 5.

Unit root test results.

Moreover, the study computed the ZA test to capture any break in the data, allowing breaks both in the intercept and trend. The results indicate that the unemployment rate, GDP growth, inflation rate, the rule of law, and final government expenditure are significant for the rejected null of non-stationarity in the presence of break at 1% level. Though the results are consistent with those of the ADF and PP shown in Table 5, ZA provides more insights into the data trend. The results reflect the fact that due to several major events in Afghanistan, such as the US troop withdrawal inception in 2014 and their retainment as Afghan military supporting units, a sharp downward shift in government expenditure [65], aggregate consumption, aggregate demand and supply, the rise and fall in on-the-budget contributions of the US and its alliance to support military operations, a sudden shift in employment and placements, and the higher intensity of civil war from 2014 onward, various macroeconomic strands have witnessed significant shifts and caused breaks. Considering the results obtained from ADF, PP, and ZA tests, the study concludes that the variables follow mixed integrating orders of I(0) and I(1), while there is no evidence to support any higher degree of integration. Therefore, based on the specifications, the study proceeds to estimate and interpret the long-run nexus, e.g., cointegration between the variables.

4.2. Cointegration Analysis

The study confirms the mixed integrating order of the predictors and the presence of breaks in the data, as shown in Table 5 and Table 6. Next, the study computes the symmetric ARDL bound test for the cointegration augmented with a dummy variable for break date [1 = break, 0 = no break] and optimal lag length automatically selected via the AIC, SIC, and HQIC methods. The results are reported in Table 7 and demonstrate that the test statistics (F = 39.196 > 3.97, t = −10.651 > −5.54) are greater than the critical values at a 1% significant level and support the rejection of the null hypothesis of no cointegration between the variables. This implies that the variables are cointegrated and move together in the long run.

Table 6.

Zivot and Andrew unit root test results.

Table 7.

Bound test cointegration results.

Recalling the assumption of the non-linear combination of the predictors, the present study continues to test the asymmetric cointegration between them. Though establishing non-linear cointegration among the variables of mixed integrating orders is relatively complicated, it provides deeper insights into the long-run nexus among them [66]. To that end, the asymmetric ARDL bound test is computed and the results are reported in the upper part of Table 7. It shows that for the rejected null hypothesis of no asymmetric cointegration between the variables, both F-statistics and t-statistics are significant at a 1% level; that is, they are greater than the upper bound I(1) critical values at 1%, confirming the long-run asymmetric bound between variables. This simply shows that the variables incorporated in the model asymmetrically move together in the long run, and the results are linked to both the theoretical concept and real-life example of the effects of civil war on socio-economic indicators—that is, civil wars bring in serious shifts in employment in the host country, heighten poverty, and increase government expenditure through intense economic fragility, forced population displacement, and loss of economic infrastructure. Furthermore, the Wald test is applied to examine the null of short- and long-run symmetries using and , respectively. The results of the Wald test that are presented in the rear part of Table 8 are statistically significant to reject the null of short-run and long-run symmetries and support the notion of non-linearity among the predictors both in the short and long runs. From these results, several important findings can be noted. First, it implies that the cost of war, which is the key variable of interest, and other control variables together significantly impact the unemployment rate in the short and long run. Second, the rejected null of symmetries indicates that the cost of war and the control variables differently affect the unemployment rate both in the short and long run—thereby, supporting the non-monotonic effects of war and the control variables on the dependent one. Third, the results direct the study to investigate and determine the size and magnitude of the short and long-run asymmetric effects of war and the control variables on the unemployment rate. To that end, the study estimates the non-linear ARDL model.

Table 8.

Asymmetric cointegration and Wald test results.

4.3. Non-Linear ARDL Results

Next, the study computes the non-linear ARDL model to investigate the effects of the cost of war and the relevant control variables on the unemployment rate in Afghanistan, using Equation (4). The estimation is conducted by selecting the optimal lag length via the AIC, SIC, and HIC frameworks using the “varsoc” command, e.g., in the unrestricted vector autoregressive environment (Table 3). First and foremost, Table 9 reports the results of the NARDL estimates for model 1—that is, the nonlinear effects of civil war on the unemployment rate. The results are very clear-cut and reflect the real-life example of a war-torn community like Afghanistan. They demonstrate that the cost of war to GDP (%), as a proxy for civil war, has a significant impact on the unemployment rate in both the short and long run. The results indicate that a positive change in the cost of war increases the unemployment rate by 0.218% and 0.405% in the short and long runs, respectively. A negative partial sum change in the cost of war has a negative effect on the unemployment rate, demonstrating that a negative change in the cost of war—thus, a decrease in the intensity of war—causes the unemployment rate to fall by 0.221% and 0.387% in the short and long runs, respectively, providing a relaxation to higher job opportunities and higher employment in different sectors of the economy. The results are somehow consistent with the findings of Humphreys and Weinstein [67], who found weak effects of civil wars on employability. Comparatively, Justino and Verwimp [68] did not find sufficient evidence to link the consequences of civil wars with employability, poverty, and economy in Rwanda. In a flip-side effect analysis, though it might be confounded for all developing countries irrespective of homogeneity issues, Cramer [37] argued that there is a meaningful nexus between civil wars and unemployability, showing that unemployed youth are the key cause of civil wars in developing economies. The findings of this study indicate that, considering the homogeneous property of Afghanistan’s case, civil armed conflicts have significant effects on the rising unemployment rate in the short and long runs.

Table 9.

Results of non-linear ARDL estimates.

Moreover, this study innovatively measures the impact of financial inclusion on the unemployment rate during wartime in Afghanistan. Coincidentally, the topic of financial inclusion emerged in the 2001s, as Afghanistan entered a new political era and new civil wars erupted. Therefore, the composite financial inclusion has been added into the model to control for the effects of financial inclusion, which is assumed to be an effective tool for reducing unemployability. The results indicate that a positive shock from the composite financial inclusion reduces the unemployment rate by 0.17% and 0.049% in the short and long runs, respectively. A negative shock from the composite financial inclusion increases the unemployment rate by 0.066% and 0.057% in the short and long runs, respectively. This implies that even though the civil armed conflicts in Afghanistan reduced the employability from one side, while on the other, the emergence of banking system, outreach of financial inclusion to potentially bankable population have raised the employability in Afghanistan. The results are consistent with those of Kim et al. [69], Mehry et al. [70], Azimi [42], Akanbi et al. [71], and Alshyab et al. [72], who also found that financial inclusion significantly reduces the unemployment rate, while there is a large proportion of the world population that is still financially excluded.

The results for the effects of GDP growth on the unemployment rate indicate that a positive partial sum change in growth causes the unemployment rate to reduce by 0.290% and 0.019% in the short and long runs, respectively. This is linked to the general theory that growth in GDP accelerates labor productivity, enhances the labor force cycle, and increases employment. On the other hand, the results demonstrate that a negative partial sum shock from GDP growth increases the unemployment rate by 0.110% and 0.020% in the short and long runs, respectively. This implies that the short-run negative effects are higher than the long run, giving rise to the rapid growth in the labor force than the economic growth causes the unemployment rate to increase in the short run, while it slows down by 0.020% in the long run. Studies by Banda et al. [73], Soylu et al. [74], Chand et al. [75], Shaaibith et al. [76], and Hjazeen et al. [59] also found a significantly negative impact of economic growth on the unemployment rate in different economic contexts, while Tenzin [77] and Chuttoo [78] found no significance to link the unemployment rate with economic growth. In sum, these results correspond with Okun’s law, assuming that a rise in GDP is associated with a rise in employment—thus, GDP growth reduces the unemployment rate.

For the effects of government expenditure on the unemployment rate, the results report significant short and long run coefficients both for positive and negative changes. It shows that a positive shock reduces unemployment by 0.016% while a negative shock increases unemployment by 0.007% in the short run. A positive change in government expenditure decreases unemployment by 0.013%, whereas its negative shock increases unemployment by 0.097% in the long run. Furthermore, foreign direct investment is also found to have a significant impact on the unemployment rate in Afghanistan. The results indicate that positive (negative) partial sum changes decrease (increase) the unemployment rate by 0.108% (0.267%) in the short run, while in the long run, positive (negative) partial sum changes in foreign direct investment decrease (increase) unemployment by 0.063% (0.024%). The inflation rate is also tested against the unemployment rate. The results indicate that a positive partial sum shock from the inflation rate decreases the unemployment rate, while a negative partial sum shock increases the unemployment rate in the short and long runs. The results correspond with the Phillips-curve concept, implying that a percentage rise in the inflation rate causes the unemployment rate to reduce proportionately. These are also consistent with the findings of Attia et al. [79] but are in contrast with those of Azimi [80], who found that the inflation rate increases the unemployment rate in transitional economies.

Notwithstanding, the secondary school enrollment rate has been employed in the model to test its effects viz-a-viz the unemployment rate during wartime in Afghanistan. It reveals that positive (negative) changes in the secondary school enrollment rate significantly increase (decrease) the unemployment rate both in the short and long runs by 0.117% (0.055%) and 0.021% (0.133%), respectively. Though in a theoretical sense, it is commonly assumed that increased human capital knowledge and skills increase creativity and job creation, the findings of this study suggest otherwise in a war-torn economy, therefore, Afghanistan. This might be due to three key reasons. First, the results are linked to the fact that during the war, the number of ghost schools in rural areas and students increased, while in reality it did not contribute to reduce the unemployment rate but rather showed an incremental effect. Second, the Afghan economy did not grow simultaneously with the growth in the labor force, causing graduates and human capital to remain unemployed. Third, the higher proportion of employment is sourced from the agriculture sector. War has seriously shifted the agricultural lands to be used as battle grounds—so it may have caused the unemployment rate to increase in Afghanistan. In an empirical sense, our results are in contrast with the findings of Erdem and Tugcu [81], Aden [82], and Hindun [83], who found that education, thereby, school enrollment, is negatively associated with the unemployment rate. Furthermore, the results reveal that the population growth rate is significant enough to explain the unemployment rate in Afghanistan during wartime. It shows that a positive partial sum change in the population growth rate causes the unemployment rate to increase by 0.098% and 0.047% in the short and long runs, respectively. It also indicates that a negative shock from the population growth rate decreases the unemployment rate by 0.346% and 0.140% in the short and long runs, respectively. Yelwa et al. [84], Gideon [85], and Manuhuttu and Kimirop [86] also found that population growth is positively associated with the unemployment rate, implying that an increase in the population rate causes unemployment to increase. Finally, the asymmetric effects of the rule of law, which is used as a proxy for institutional quality, are tested on the unemployment rate. The results demonstrate that a positive shock from institutional quality reduces the unemployment rate by 0.283% and 0.146% in the short and long runs, respectively, whereas a negative shock from institutional quality increases the unemployment rate in the short and long runs. The results are consistent with the findings of Ragmoun [87], who also found that institutional quality negatively impacts the unemployment rate.

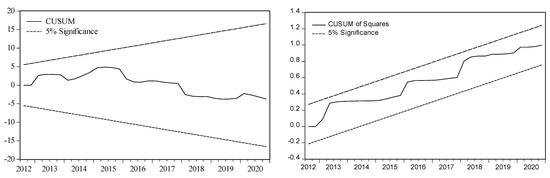

The results of the non-linear ARDL model are robust and consistent. The rear part of Table 6 provides the relevant diagnostic checks. They indicate that the model is highly fit and that all the explanatory variables jointly affect the unemployment rate at a 1% level. Moreover, the residuals of the estimated model are homoscedastic, normally distributed, and do not suffer from serial correlation. For parameter stability, the study computed the CUSUM (cumulative sum) and CUSUMSQ (cumulative sum of squares) tests (see Figure 1), and they indicate that the parameters are significantly stable.

Figure 1.

CUSUM and CUSUMSQ results. Note: CUSUM = Cumulative sum, CUSUMSQ = Cumulative sum of squares.

4.4. Non-Linear Causality Analysis

Table 10 reports the results of the asymmetric causality test of Hatemi-J [45]. The optimal lag length is based on the HJC (Hatemi-J Information Criterion) framework, and the critical values for 1%, 5%, and 10% are generated using the bootstrap iteration method. The results are interesting and indicate that the null hypothesis of both positive and negative shocks of the cost of war causing unemployment is rejected at a 1% level. It also indicates that the test statistics of both positive and negative shocks of the composite financial inclusion index to cause positive and negative unemployment rates are rejected at a 1% level. The positive shock of GDP growth to positive unemployment rates is only significant at a 10% level, while its negative null is rejected at a 5% level. Furthermore, unless no evidence is found to reject the null hypothesis of both positive and negative shocks to final government expenditure and school enrollment rate causing positive and negative unemployment rates, all other predictors were found to be statistically significant to reject the null hypothesis. The results are consistent with the findings of Kenny [88], Sahoo and Sahoo [89], Mehry et al. [70], and Purwiyanta and Rini [90], who also found statistically significant causality relationships between unemployment rate, economic growth, and financial inclusion.

Table 10.

Asymmetric causality test of Hatemi-J.

5. Conclusions

It is assumed that civil war not only destroys a country’s infrastructure but also has serious negative effects on the socioeconomic indicators of an economy, both during wartime and as residual effects afterward. The results of the empirical analysis using an asymmetric approach to test the effects of civil war and relevant control predictors on the unemployment rate in Afghanistan suggest that both the positive and negative asymmetric shocks from civil war, which is the key variable of interest in this study, significantly increase and decrease the unemployment rate in the short and long runs, respectively. The results clearly reflect that an increase in the cost of war causes the unemployment rate to increase, while a percentage decrease in the cost of war causes the unemployment rate to decrease in the runs. This implies that the occurrence of war allocates specific employments for the military sector, while it causes a massive unemployability in Afghanistan. Innovatively, this article incorporated the composite financial inclusion index into the model. The results demonstrate that enhancing the outreach of financial services intermediately reduces the unemployment rate during wartime in Afghanistan, while the exclusion of financial services increases the unemployment rate both in the short and long runs. Consistent with Okun’s law, the findings support that an asymmetric positive change in the GDP growth rate increases employability, whereas its negative asymmetric change reduces employability in the short and long runs. Moreover, the findings provide significant evidence that positive (negative) partial changes in government expenditure, foreign direct investment, and the rule of law decrease (increase) the unemployment rate in the short and long runs. The findings show that an asymmetric positive change in the inflation rate reduces the unemployment rate, while a negative partial sum change in the inflation rate reduces the unemployment rate. The population growth rate is also found to have significantly asymmetric effects on the unemployment rate both in the short and long runs, implying that positive (negative) changes in the population growth rate increase (decrease) the unemployment rate in Afghanistan. Finally, as the results suggested, the study examined the asymmetric causality relationship between the unemployment rate, the cost of war, and the control variables. The results indicate that except for the final government expenditure and the secondary school enrollment rate, asymmetric causality runs from both the positive and negative asymmetric components of the cost of war, the composite financial inclusion index, GDP growth, foreign direct investment, inflation rate, population growth, and the rule of law to the unemployment rate.

These results highlight several important policy implications. First, the government needs to bring in significant orders in the relevant policies concerning the labor market to adjust to the excessive supply of unskilled and deficient labor that has emerged as a direct and indirect consequence of the long-running war in Afghanistan. Second, improving regional and provincial occupational mobility would be an effective policy tool to reduce the unemployment rate, with a specific focus on the regions most affected by war. Third, as an act of post-war economic recovery, though it takes longer, the government needs to support the engagement of private sector actors to generate jobs. Fourth, improvement of policies that attract innovative and technological projects to create new job opportunities. Fifth, it is found that financial inclusion is an effective tool to reduce the long-run effects of war on unemployability. As a result, assisting financial institutions in extending the outreach of financial inclusion would engage newly banked people in the creation of new job opportunities.

Limitations of the Study

The present study suffers from one major limitation, which is the unavailability of datasets for the cost of war in Afghanistan for a longer period. Since there has been war in Afghanistan for more than four decades, the datasets are only available from 2004 to 2020. Upon availability, future studies may augment higher-frequency datasets to explore additional insights into the effects of war on the unemployment rate in Afghanistan.

Author Contributions

M.A.H.: major writing, data collection and analysis, methodology selection and regression analysis; M.M.R.: conceptualization, variable and methodology selection, minor writing, supervision, and editing; R.K.: minor writing, editing, and supervision. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The datasets are retrieved from the World Development Indicators (WDI) available at (https://databank.worldbank.org/source/world-development-indicators), Worldwide Governance Indicators (WGI) available at (http://info.worldbank.org/governance/WGI/), the International Monetary Fund’s Financial Access Survey (FAS-IMF), available at (https://data.imf.org/?sk=E5DCAB7E-A5CA-4892-A6EA-598B5463A34C), and are available for reuse by future scholars.

Conflicts of Interest

The authors declare no conflict of interest.

Abbreviations

| AIC | Akaike information criterion |

| ARDL | autoregressive distributed lags |

| CUSUM | cumulative sum |

| CUSUMSQ | cumulative sum of squares |

| CV | critical values |

| cow | cost of war, |

| cfi | composite financial inclusion index |

| gdpg | GDP growth |

| FAS | Financial Access Survey |

| fge | final government expenditure |

| fdi | foreign direct investment |

| HQIC | Hannan–Quinn information criterion |

| IMF | International Monetary Fund |

| inf | inflation ration |

| Port. | Portmanteau test |

| SC | serial correlation |

| SIC | Schwarz information criterion |

| BP | Breusch–Pegan |

| JB | Jarque–Bera |

| ser | secondary school enrollment rate |

| pgr | population growth |

| rol | rule of law |

| uer | unemployment rate |

| WDI | World Development Indicators |

| WGI | Worldwide Governance Indicators |

References

- Bellal, A.; Giacca, G.; Casey-Maslen, S. International law and armed non-state actors in Afghanistan. Int. Rev. Red Cross 2011, 93, 47–79. [Google Scholar] [CrossRef]

- Van Bijlert, M. Afghanistan’s post-liberal peace: Between external intervention and local efforts. In Post-Liberal Peace Transitition between Peace Fortmation and State Formation; Edinburgh University Press: Edinburgh, UK, 2022; Chapter 6; pp. 126–142. [Google Scholar]

- Nguema, J.-N.B.B. Political and Economic Causes of Civil Wars in African Countries Based on Econometric Findings. J. Power Polit. Gov. 2016, 4, 27–35. [Google Scholar] [CrossRef]

- Anyanwu, C.J. Economic and Political Causes of Civil Wars in Africa: Some Econometric Results. 2002. Available online: https://www.afdb.org/fileadmin/uploads/afdb/Documents/Publications/00157680-FR-ERP-73.PDF (accessed on 23 January 2023).

- Collier, P.; Hoeffler, A.; Söderbom, M. On the duration of civil war. J. Peace Res. 2004, 41, 253–273. [Google Scholar] [CrossRef]

- Iden, G. Human Resource Cost of the War. J. Peace Res. 1971, 8, 293–298. [Google Scholar] [CrossRef]

- Serttaş, F.Ö.; Uluöz, D. The Impact of Syrian Migration on Unemployment: Evidence from Turkey. ADAM Akad. Sos. Bilim. Derg. 2021, 11, 1–30. [Google Scholar] [CrossRef]

- Chamarbagwala, R.; Morán, H.E. The human capital consequences of civil war: Evidence from Guatemala. J. Dev. Econ. 2011, 94, 41–61. [Google Scholar] [CrossRef]

- Obinger, H.; Schmitt, C. Total war and the emergence of unemployment insurance in western countries. J. Eur. Public Policy 2020, 27, 1879–1901. [Google Scholar] [CrossRef]

- Coghlan, B.; Ngoy, P.; Mulumba, F.; Hardy, C.; Bemo, V.N.; Stewart, T.; Brennan, R. Mortality in the Democratic Republic of Congo: An Ongoing Crisis. International Rescue Committee. 2007. Available online: https://www.rescue.org/report/mortality-democratic-republic-congo-ongoing-crisis (accessed on 11 December 2022).

- Blattman, C.; Edward, M. “Civil War”, 1050 Massachusetts Avenue, Cambridge, MA 02138, 14810, 2009. Available online: https://www.nber.org/system/files/working_papers/w14801/w14801.pdf (accessed on 11 December 2022).

- Galdo, J. The long-run labor-market consequences of civil war: Evidence from the shining path in peru. Econ. Dev. Cult. Chang. 2013, 61, 789–823. [Google Scholar] [CrossRef]

- Siddikee, M.N.; Zahid, J.; Sanjida, A.; Oshchepkova, P. Sustainable economic growth and unemployment nexus of SDG 2030: Bangladesh in Asia. SN Bus. Econ. 2022, 2, 12. [Google Scholar] [CrossRef] [PubMed]

- McNeill, W.H.; Mueller, J. Retreat from Doomsday: The Obsolescence of Major War. Technol. Cult. 1990, 21, 321–328. [Google Scholar] [CrossRef]

- Gersovitz, M.; Kriger, N. What is a civil war? A critical review of its definition and (econometric)consequences. World Bank Res. Obs. 2013, 28, 159–190. [Google Scholar] [CrossRef]

- Kalyvas, S.N. The Logic of Violence in Civil War; Cambridge University Press: Cambridge, UK, 2012; pp. xix–xx. [Google Scholar]

- Farrell, K.W. The Arc of War: Origins, Escalation, and Transformation by Jack, S. Levy and William, R. Thompson. J. World Hist. 2013, 24, 179–181. [Google Scholar] [CrossRef]

- Thompson, W.R. The Consequences of War. Int. Interact. Empir. Theor. Res. Int. Relat. 1993, 19, 125–147. [Google Scholar] [CrossRef]

- Moosa, I.A. The Economics of War: Profiteering, Militarism and Imperialism; Edward Elgar Publishing Ltd.: Cheltenham, UK, 2019. [Google Scholar]

- Kersnovski, A.A. The Philosophy of War. In Strategiya; Oxford University Press: Oxford, UK, 2021; pp. 137–198. [Google Scholar]

- Yum, Y.O.; Schenck-Hamlin, W. Reactions to 9/11 as a function of terror management and perspective taking. J. Soc. Psychol. 2005, 145, 265–286. [Google Scholar] [CrossRef] [PubMed]

- Gleditsch, K.S. A revised list of wars between and within independent states, 1816–2002. Int. Interact. 2004, 30, 231–262. [Google Scholar] [CrossRef]

- Hall, R.E. A theory of the natural unemployment rate and the duration of employment. J. Monet. Econ. 1979, 5, 153–169. [Google Scholar] [CrossRef]

- Raphael, S.; Winter-Ebmer, R. Identifying the effect of unemployment on crime. J. Law Econ. 2001, 44, 259–283. [Google Scholar] [CrossRef]

- Rabiile, M.F. Civil War and Unemployment in Mogadishu Somalia; Kampala International University: Kampala, Uganda, 2010. [Google Scholar]

- Hamilton, R.D. Opportunity to Rebel: The Effects of Unemployment Coupled with Ethnic Divided on the Onset of Civil Conflict; Georgia State University: Atlanta, GA, USA, 2010. [Google Scholar]

- Miguel, E.; Roland, G. The long-run impact of bombing Vietnam. J. Dev. Econ. 2011, 96, 1–15. [Google Scholar] [CrossRef]

- Barceló, J. The long-term effects of war exposure on civic engagement. Proc. Natl. Acad. Sci. USA 2021, 118, e2015539118. [Google Scholar] [CrossRef] [PubMed]

- Berman, E.; Callen, M.; Felter, J.H.; Shapiro, J.N. Do working men rebel? insurgency and unemployment in Afghanistan, Iraq, and the Philippines. J. Confl. Resolut. 2011, 55, 496–528. [Google Scholar] [CrossRef]

- Kecmanovic, M. The Short-run Effects of the Croatian War on Education, Employment, and Earnings. J. Confl. Resolut. 2013, 57, 991–1010. [Google Scholar] [CrossRef]

- Shemyakina, O. Exploring the Impact of Conflict Exposure during Formative Years on Labour Market Outcomes in Tajikistan. J. Dev. Stud. 2015, 51, 422–446. [Google Scholar] [CrossRef]

- De Paul, M.V.; Dávalos, J.; Sandy, J.F.; Mahoi, I.; Chetachi, J.K. Civil War and Labor-Market Outcomes in Sierra Leone. 2020. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3631407 (accessed on 11 December 2022).

- Mansoor, A.A. The Main Determinants of Unemployment in Afghanistan, and Exploring the Effects of Insecurity and Youth Bulge in Exacer-Bating the Unemployment Scenario; International Institute of Social Studies: The Hague, The Netherlands, 2021. [Google Scholar]

- Urdal, H. The Devil in the Demographics: The Effect of Youth Bulges on Domestic Armed Conflict, 1950–2000. Soc. Dev. Pap. 2004, 14, 1–25. [Google Scholar]

- DeFina, R.H. The impacts of unemployment on alternative poverty rates. Rev. Income Wealth 2004, 50, 69–85. [Google Scholar] [CrossRef]

- Azeng, T.F.; Yogo, T.U. Youth Unemployment, Education and Political Instability: Evidence from Selected Developing Countries 1991–2009; HiCN Households in Conflict Network; HiCN Working Paper 200; University of Sussex: Brighton, UK, 2015. [Google Scholar]

- Cramer, C. Unemployment and Participation in Violence. World Dev. Rep. 2010, 2011, 1–37. [Google Scholar]

- Jabir, M.I.; Mensah, L.; Gyeke-Dako, A. Financial inclusion and poverty reduction in sub-Saharan Africa. Afr. Financ. J. 2017, 19, 1–22. [Google Scholar]

- Honohan, P. Cross-country variation in household access to financial services. J. Bank. Financ. 2008, 32, 2493–2500. [Google Scholar] [CrossRef]

- Park, C.; Mercado, R. Financial Inclusion, Poverty, and Income Inequality in Developing Asia; ADB Economics Working Pepers Series; ADB: Manila, Philippines, 2015. [Google Scholar]

- Shin, Y.; Yu, B.; Greenwood-Nimmo, M. Modelling asymmetric cointegration and dynamic multipliers in a nonlinear ARDL framework. In Festschrift in Honor of Peter Schmidt: Econometric Methods and Applications 2014; Horrace, W.C., Sickles, R.C., Eds.; Springer: Berlin/Heidelberg, Germany, 2014; pp. 281–314. [Google Scholar] [CrossRef]

- Azimi, M.N. Assessing the asymmetric effects of capital and money markets on economic growth in China. Heliyon 2022, 8, e08794. [Google Scholar] [CrossRef]

- Chen, H.; Hongo, D.O.; Ssali, M.W.; Nyaranga, M.S.; Nderitu, C.W. The Asymmetric Influence of Financial Development on Economic Growth in Kenya: Evidence From NARDL. SAGE Open 2020, 10, 2158244019894071. [Google Scholar] [CrossRef]

- Shrestha, M.B.; Bhatta, G.R. Selecting appropriate methodological framework for time series data analysis. J. Financ. Data Sci. 2018, 4, 71–89. [Google Scholar] [CrossRef]

- Hatemi, J.-A. Asymmetric causality tests with an application. Empir. Econ. 2012, 43, 447–456. [Google Scholar] [CrossRef]

- Ajmi, A.; Gupta, R.; Babalos, V.; Hefer, R. Oil price and consumer price nexus in South Africa revisited: A novel asymmetric causality approach. Energy Explor. Exploit. 2015, 33, 63–74. [Google Scholar] [CrossRef]

- Shahbaz, M.; Nasir, M.A.; Lahiani, A. Role of financial development in economic growth in the light of asymmetric effects and financial efficiency. Int. J. Financ. Econ. 2022, 27, 361–383. [Google Scholar] [CrossRef]

- Hameed, R.; Rahman, M.; Khanam, R. Assessing the asymmetric war-growth nexus: A case of Afghanistan. PLoS ONE 2022, 17, e0272670. [Google Scholar] [CrossRef]

- Azimi, M.N.; Shafiq, M.M. Hypothesizing directional causality between the governance indicators and economic growth: The case of Afghanistan. Futur. Bus. J. 2020, 6, 1–14. [Google Scholar] [CrossRef]

- Asogu, J.O. Quarterly Interpolation of Annual Statistical Series Using Robust Non-parametric Methods. CBN Econ. Financ. Rev. 1997, 35, 154–170. [Google Scholar]

- Sarma, M. Index of Financial Inclusion—A Measure of Financial Sector Inclusiveness; Berlin Working Papers on Money, Finance, Trade and Development; Working Paper No. 07/2012; Jawaharlal Nehru University: Delhi, India, 2012; Volume 24, pp. 472–476. Available online: https://finance-and-trade.htw-berlin.de/fileadmin/HTW/Forschung/Money_Finance_Trade_Development/working_paper_series/wp_07_2012_Sarma_Index-of-Financial-Inclusion.pdf (accessed on 12 June 2022).

- Miguel, E.; Satyanath, S.; Sergenti, E. Economic shocks and civil conflict: An instrumental variables approach. J. Polit. Econ. 2004, 112, 725–753. [Google Scholar] [CrossRef]

- Ciccone, A. Estimating the Effect of Transitory Economic Shocks on Civil Conflict. Rev. Econ. Inst. 2013, 4, 1–14. [Google Scholar] [CrossRef]

- Marelli, E.; Choudhry, M.T.; Signorelli, M. Youth and total unemployment rate: The impact of policies and institutions. Riv. Internazionale Sci. Soc. 2013, 63–86. [Google Scholar]

- Kokotovi, Ć.F. An empirical study of factors influencing total unemployment rate in comparison to youth unemployment rate in selected EU member-states. Theor. Appl. Econ. 2016, 23, 79–92. [Google Scholar]

- Bala, U.; Ibrahim, A.; Hadith, N.B. Impact of Population Growth, Poverty and Unemployment on Economic Growth. Asian Bus. Res. J. 2020, 5, 48–54. [Google Scholar] [CrossRef]

- Alam, J.; Nur Alam, Q.; Hoque, M. Impact of GDP, Inflation, Population Growth and FDI on Unemployment: A study on Bangladesh Economy. Afr. J. Econ. Sustain. Dev. 2020, 3, 67–79. [Google Scholar] [CrossRef]

- Mubarak, M.S.; Nugroho, S.B.M. The Impact of Population, Labor, Unemployment, and Poverty on Economic Growth Regencies/Municipality in Sulawesi Tengah Province. J. Ekon. Pembang. 2020, 18, 62–79. [Google Scholar] [CrossRef]

- Hjazeen, H.; Seraj, M.; Ozdeser, H. The nexus between the economic growth and unemployment in Jordan. Futur. Bus. J. 2021, 7, 42. [Google Scholar] [CrossRef]

- Omar, M.A.; Inaba, K. Does financial inclusion reduce poverty and income inequality in developing countries? A panel data analysis. J. Econ. Struct. 2020, 9, 37. [Google Scholar] [CrossRef]

- Rojas-Suarez, L.; Amado, M.A. Understanding Latin America’s Financial Inclusion Gap; Working Paper 367; Center for Global Development: Washington, DC, USA, 2014; Available online: https://www.cgdev.org/sites/default/files/latin-american-financial-inclusion-gap.pdf (accessed on 12 June 2022).

- Dickey, D.A.; Fuller, W.A. Distribution of the estimators for autoregressive time series with a unit root. J. Am. Stat. Assoc. 1979, 74, 427–431. [Google Scholar] [CrossRef]

- Phillips, P.C.; Perron, P. Testing for a unit root in time series regression. Biometrika 1988, 75, 335–346. [Google Scholar] [CrossRef]

- Zivot, E.; Andrews, D.W.K. Further evidence on the great crash, the oil-price shock, and the unit-root hypothesis. J. Bus. Econ. Stat. 1992, 10, 251–270. [Google Scholar] [CrossRef]

- Griff, W. Afghanistan War: 2001–2014. Britannica, 2014. Available online: https://www.britannica.com/event/Afghanistan-War (accessed on 25 June 2021).

- Tjøstheim, D. Some notes on nonlinear cointegration: A partial review with some novel perspectives. Econom. Rev. 2020, 39, 655–673. [Google Scholar] [CrossRef]

- Humphreys, M.; Weinstein, J.M. Demobilization and reintegration. J. Conflict Resolut. 2007, 51, 531–567. [Google Scholar] [CrossRef]

- Justino, P.; Verwimp, P. Poverty Dynamics, Violent Conflict, and Convergence in Rwanda. Rev. Income Wealth 2013, 59, 66–90. [Google Scholar] [CrossRef]

- Kim, D.H.; Chen, T.C.; Lin, S.C. Finance and unemployment: New panel evidence. J. Econ. Policy Reform. 2019, 22, 307–324. [Google Scholar] [CrossRef]

- Mehry, E.-B.; Ashraf, S.; Marwa, E. The impact of financial inclusion on unemployment rate in developing countries. Int. J. Econ. Financ. Issues 2021, 11, 79–93. [Google Scholar] [CrossRef]

- Akanbi, S.B.; Dauda, R.O.; Yusuf, H.A.; Abdulrahman, A.I. Financial Inclusion and Monetary Policy in West Africa. J. Emerg. Econ. Islam. Res. 2020, 8, 88–99. [Google Scholar] [CrossRef]

- Alshyab, N.; Sandri, S.; Daradkah, D. The effect of financial inclusion on unemployment reduction—Evidence from non-oil producing Arab countries. Int. J. Bus. Perform. Manag. 2021, 22, 100–116. [Google Scholar] [CrossRef]

- Banda, H.; Ngirande, H.; Hogwe, F. The impact of economic growth on unemployment in South Africa: 1994–2012. Invest. Manag. Financ. Innov. 2016, 13, 246–255. [Google Scholar] [CrossRef]

- Soylu, Ö.B.; Çakmak, İ.; Okur, F. Economic growth and unemployment issue: Panel data analysis in Eastern European Countries. J. Int. Stud. 2018, 11, 93–107. [Google Scholar] [CrossRef]

- Chand, K.; Tiwari, R.; Phuyal, M. Economic Growth and Unemployment Rate: An Empirical Study of Indian Economy. PRAGATI J. Indian Econ. 2017, 4, 130–137. [Google Scholar] [CrossRef]

- Shaaibith, S.J.; Daly, S.S.; Neama, M.M. Test of economic growth and unemployment using vector auto regression in Iraq. Opcion 2020, 36, 762–779. [Google Scholar]

- Tenzin, U. The Nexus Among Economic Growth, Inflation and Unemployment in Bhutan. South Asia Econ. J. 2019, 20, 94–105. [Google Scholar] [CrossRef]

- Chuttoo, U.D. Effect of Economic Growth on Unemployment and Validity of Okun’s Law in Mauritius. Glob. J. Emerg. Mark. Econ. 2020, 12, 231–250. [Google Scholar] [CrossRef]

- Shahzad, M.; Abdel-Aty, A.H.; Attia, R.A.; Khoshnaw, S.H.; Aldila, D.; Ali, M.; Sultan, F. Dynamics models for identifying the key transmission parameters of the COVID-19 disease. Alex. Eng. J. 2021, 60, 757–765. [Google Scholar] [CrossRef]

- Azimi, M.N. Drawing on Phillips curve: Does the inverse relation between inflation and unemployment persist in transitional economies. Int. J. Econ. Account. 2016, 7, 89–100. [Google Scholar] [CrossRef]

- Erdem, E.; Tugcu, C.T. Higher Education and Unemployment: A cointegration and causality analysis of the case of Turkey. Eur. J. Educ. 2012, 47, 299–309. [Google Scholar] [CrossRef]

- Aden, I. Impact of Education on Unemployment Evidence from Canada. Major Paper Presented to the Department of Economics of the University of Ottawa. 2017. Available online: http://hdl.handle.net/10393/36134 (accessed on 11 August 2022).

- Hindun. Impact of Education Level on Unemployment Rate in Indonesia. Int. J. Educ. Res. Rev. 2019, 4, 321–324. [Google Scholar] [CrossRef]

- Yelwa, M.; David, O.O.; Awe, E.O. Analysis of the Relationship between Inflation, Unemployment and Economic Growth in Nigeria: 1987–2012. Appl. Econ. Financ. 2015, 2, 102–109. [Google Scholar] [CrossRef]

- Gideon, H.E. Impact of Population Growth on Unemployment in Nigeria. Am. Univ. Niger. Dep. Econ. Sr. Res. Proj. 2017, 1–48. [Google Scholar]

- Manuhuttu, F.Y.; Kimirop, O. Determination of population growth against level of unemployment in Merauke district. Int. J. Civ. Eng. Technol. 2019, 10, 10–20. [Google Scholar]

- Ragmoun, W. Institutional quality, unemployment, economic growth and entrepreneurial activity in developed countries: A dynamic and sustainable approach. Rev. Int. Bus. Strateg. 2022; ahead of print. [Google Scholar]

- Kenny, V. A causal relationship between unemployment and economic growth. Munich Pers. RePEc Arch. 2019, 93133, 1–11. [Google Scholar]

- Adil, M.H.; Hatekar, N.; Sahoo, P. The Impact of Financial Innovation on the Money Demand Function: An Empirical Verification in India. Margin 2020, 14, 28–61. [Google Scholar] [CrossRef]

- Purwiyanta, D.A.; Purwiyanta, A.; Astuti, R.D. The Causality of Financial Inclusion and Economic Growth in Indonesia. J. Ekon. Dan Bisnis 2022, 20, 18–30. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).