Financial and Logistical Service Strategy of Third-Party Logistics Enterprises in Cross-Border E-Commerce Environment

Abstract

1. Introduction

2. Literature Review

2.1. Supply Chain Finance

2.2. Logistics-Service Level of 3PL Enterprises

3. Problem Description and Basic Assumption

3.1. Problem Description

3.2. Model Assumption and Summary of Notation

| Summary of Notation | |

| Own funds used by the cross-border e-commerce enterprise to place orders at the beginning of the period. | |

| The number of products ordered by the cross-border e-commerce enterprise using its own funds. | |

| The amount of inventory pledged by the cross-border e-commerce enterprise, 0 <<. | |

| The total supply volume of the cross-border e-commerce enterprise to offshore markets. | |

| The sales and loan cycle of the merchandise. | |

| The selling price of the pledge in local currency. | |

| Pledge rate as a decision variable, where ; the amount of loans provided by the 3PL enterprise is . | |

| The level of logistics services provided by the 3PL enterprise as a decision variable. | |

| Interest rates on inventory pledge loans; is the total revenue (principal and interest sum) of financial services for the 3PL enterprise. As the principal and interest due on the loan are not higher than the maximum value of the pledge, , then

| |

| The interest rate charged by the bank to the 3PL enterprise, . is the cost of capital for the 3PL enterprise. | |

| The market demand when the logistics services are at the lowest level for the industry, consisting of the exchange rate e and base demand . The distribution function and probability density are and , respectively. | |

| The 3PL enterprise’s capability coefficient, which is a comprehensive assessment of the indicators that make up the enterprise’s capability (i.e., a comprehensive, integrated, and high-level overview of the enterprise’s capability) [37]. A smaller denotes higher capability. | |

| The offshore market price sensitivity coefficient. | |

| The logistics sensitivity coefficient for offshore markets. | |

| The logistics cost per unit product of the 3PL enterprise. Drawing on the study by Xie et al., we denote , where is a fixed cost and is a variable cost [38]. Logistics cost and service level have the following relationships: (1) service cost increases with service level , and the marginal cost increases; (2) the stronger the capability of the 3PL enterprise, the smaller the rate of incremental marginal cost. | |

| The price of logistics services per product unit for the 3PL enterprise. As the logistics cost cannot exceed the logistics-service price, , we have

| |

| The unit product cost of the cross-border e-commerce enterprise. | |

| Default rate of the cross-border e-commerce enterprise. | |

| Exchange rate of local and foreign currencies as a random variable. | |

| Import tariff rates for target offshore markets. | |

| Cost of loans pledged by the 3PL enterprise per unit of inventory, . | |

| Loan revenue from inventory pledged by the 3PL enterprise per unit, , where . | |

4. The Model

4.1. Cross-Border E-Commerce Enterprise’s Supply Volume Model

4.2. Decision-Making Model for the 3PL Enterprise When the Cross-Border E-Commerce Enterprise Is Undercapitalized

4.2.1. Revenue Function of the Supply Chain Enterprise’s Financial Services

4.2.2. Decision Model of the Pledge Rate and Logistics-Service Level of the 3PL Enterprise

5. Model Analysis

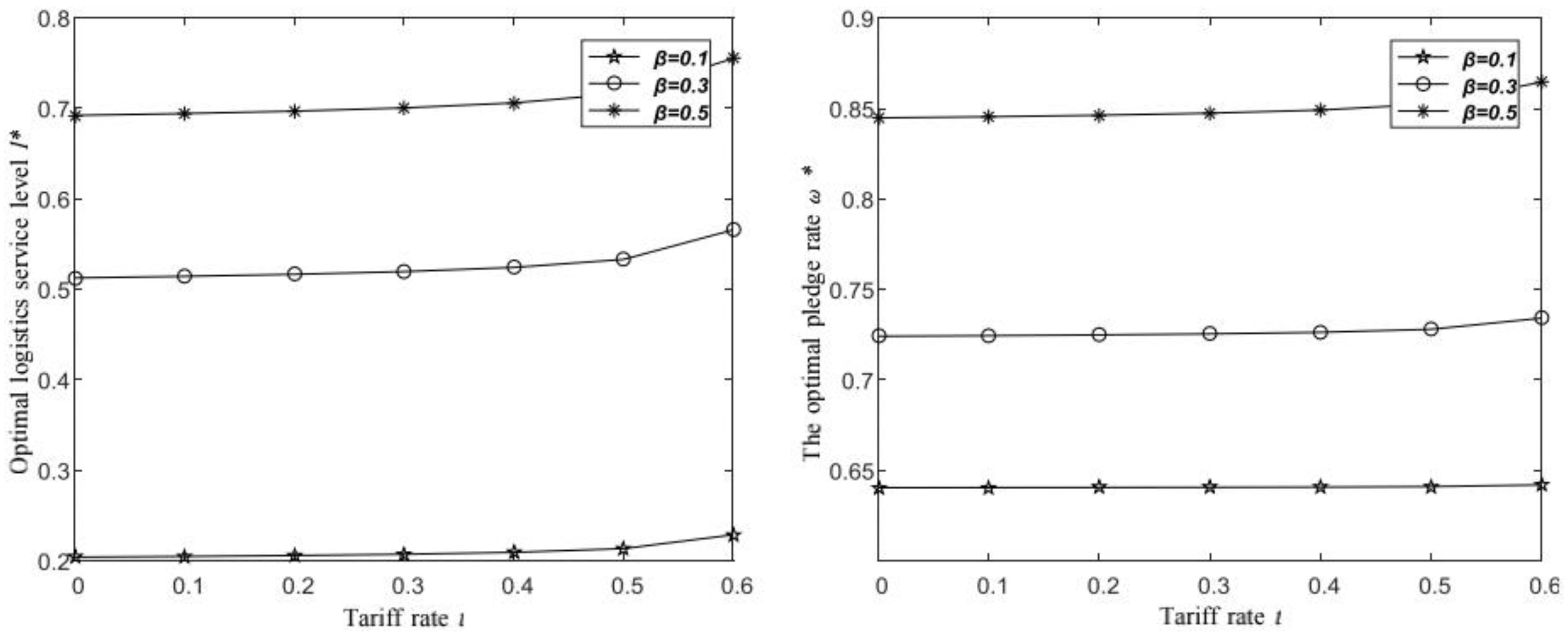

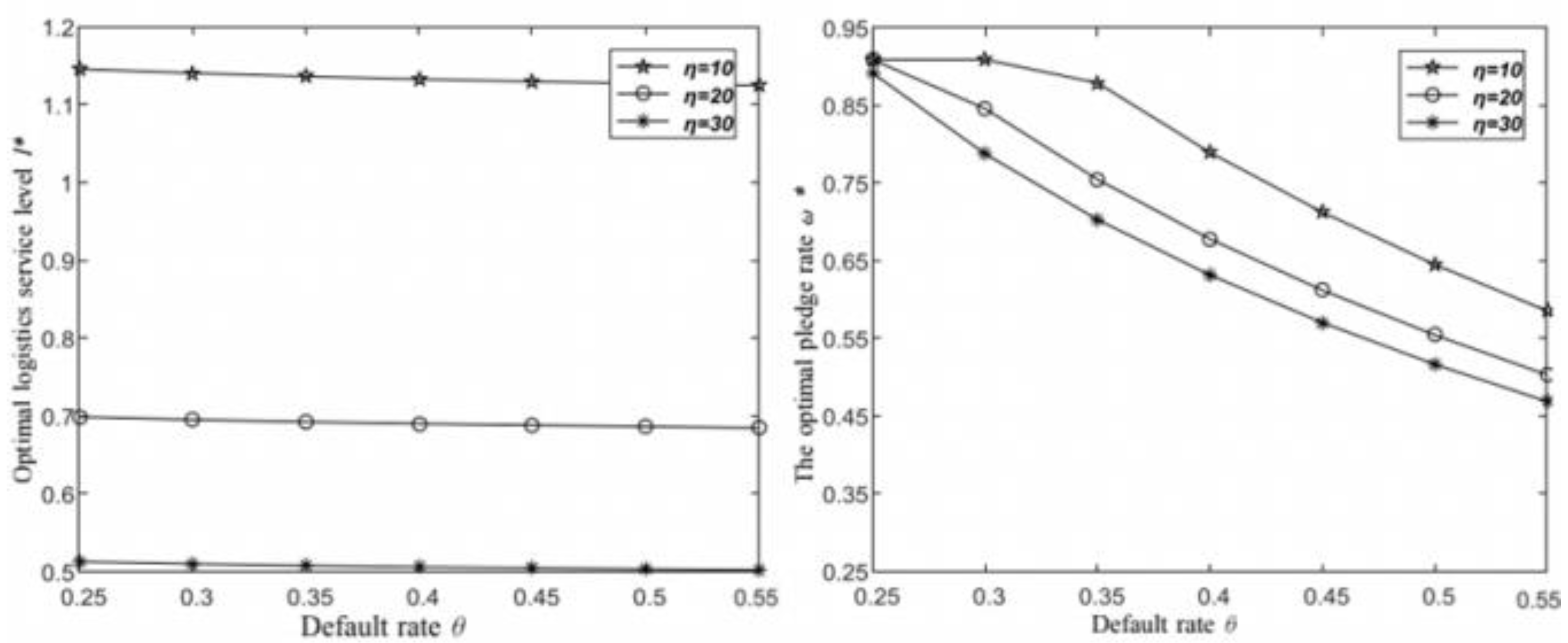

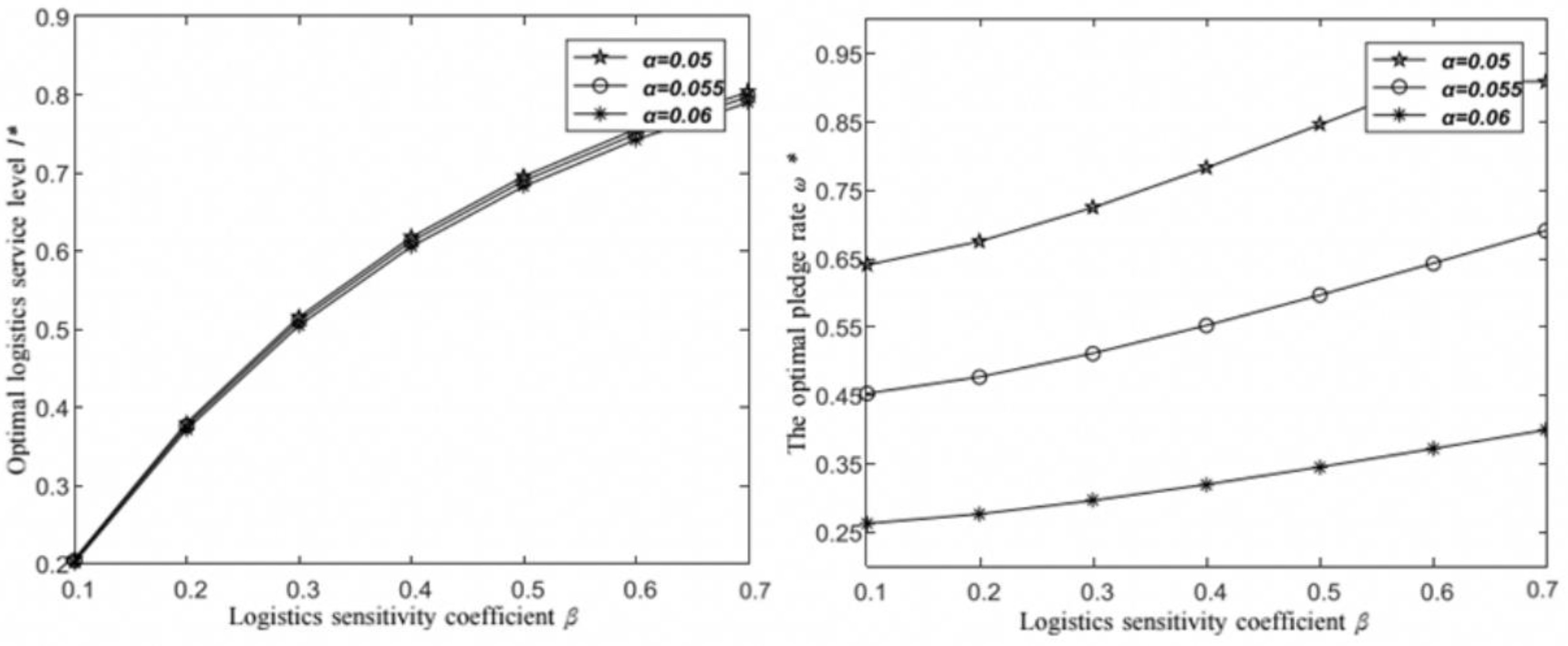

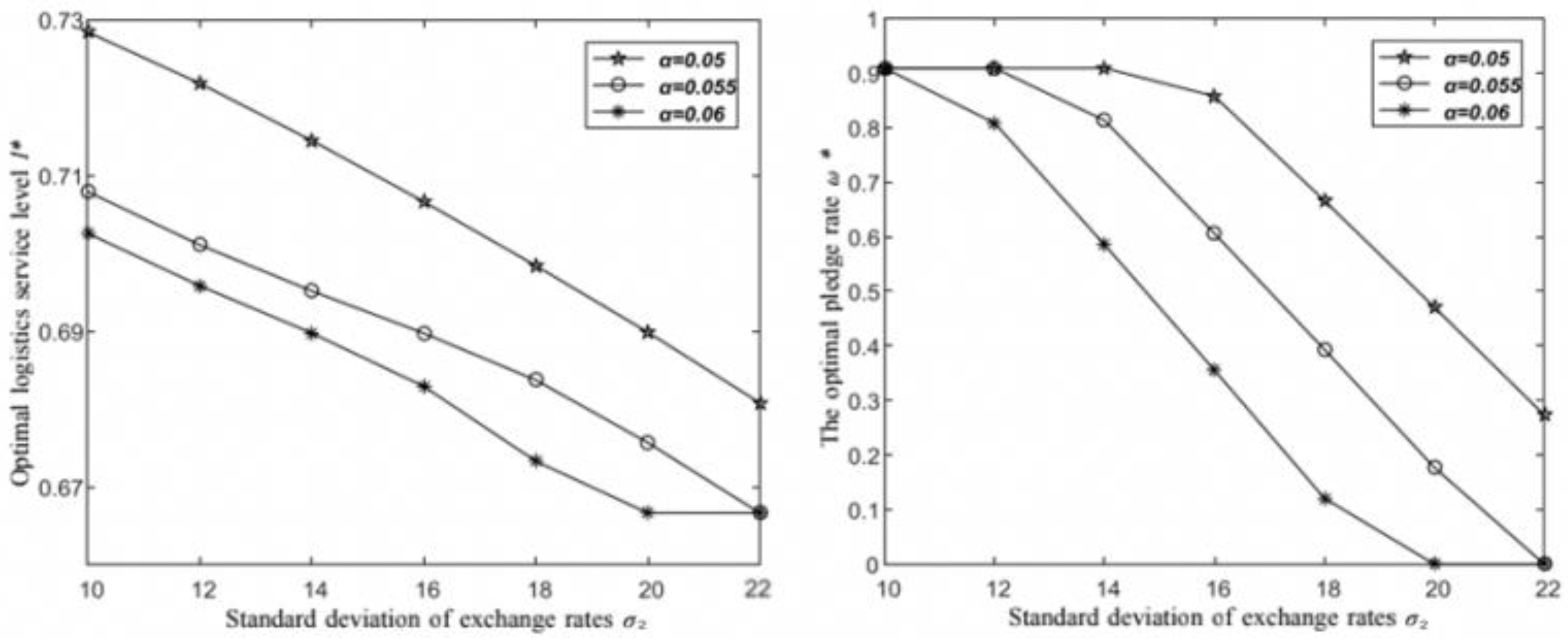

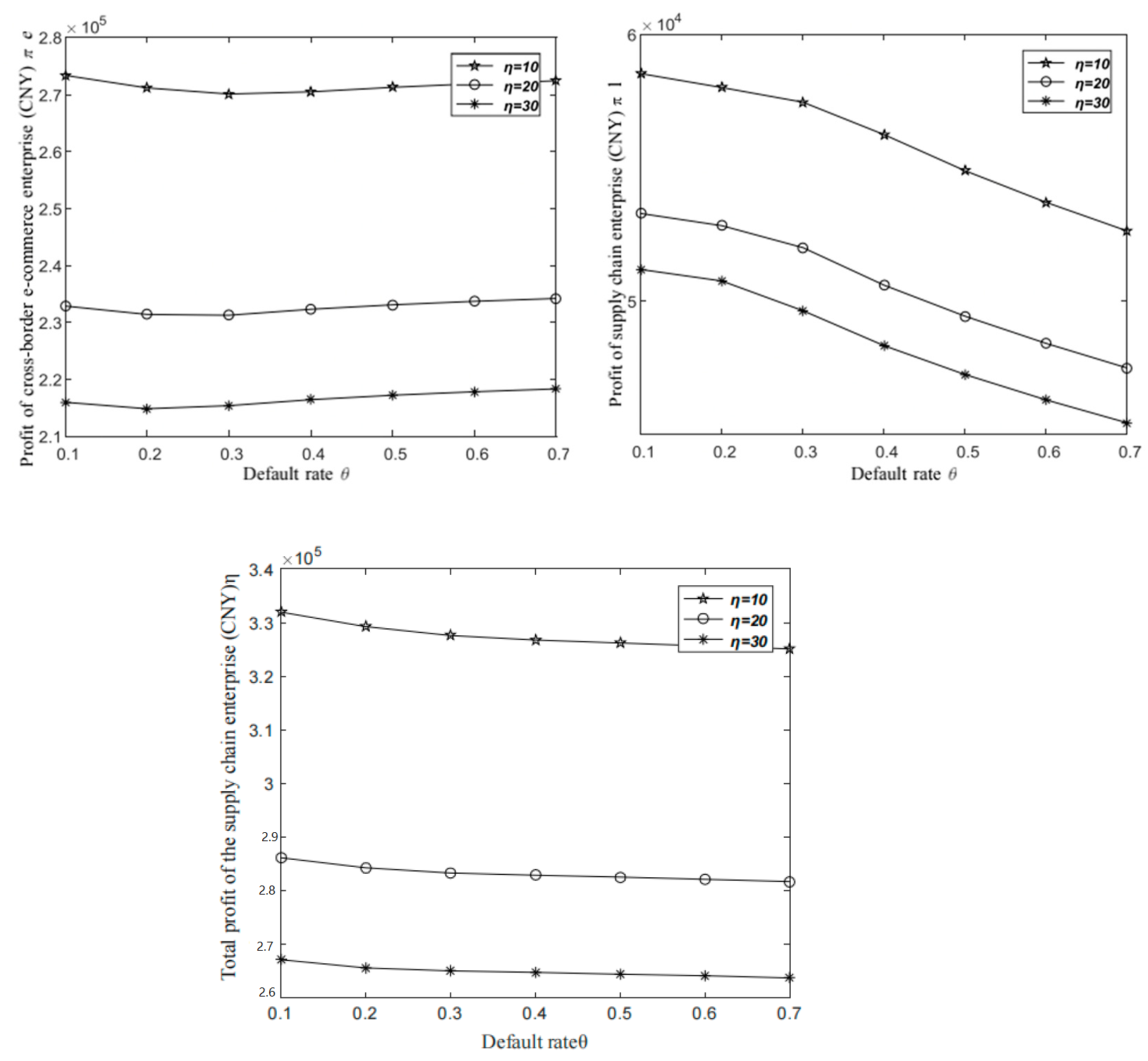

6. Numerical Analysis and Discussion

7. Conclusions, Limitations, and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| One-Sample Kolmogorov–Smirnov Test | ||

|---|---|---|

| VAR00001 | ||

| N | 728 | |

| Normal Parameters a,b | Mean | 394.6535 |

| Std. Deviation | 16.09476 | |

| Most Extreme Differences | Absolute | 0.206 |

| Positive | 0.206 | |

| Negative | −0.088 | |

| Test Statistic | 0.206 | |

| Asymp. Sig. (2-tailed) | 0.000 c | |

| Date | Exchange Rates | Rise or Fall% | Trial Calculation in 1 RMB |

|---|---|---|---|

| 1 December 2020 | 0.002322 | 0.10% | 430.6632214 |

| 1 November 2020 | 0.002365 | -- | 422.832981 |

| 1 October 2020 | 0.002395 | −0.38% | 417.5365344 |

| 1 September 2020 | 0.002388 | −0.15% | 418.760469 |

| 1 August 2020 | 0.002472 | -- | 404.5307443 |

| 1 July 2020 | 0.002512 | −0.23% | 398.089172 |

| 1 June 2020 | 0.002544 | −0.66% | 393.081761 |

| 1 May 2020 | 0.002538 | −0.55% | 394.0110323 |

| 1 April 2020 | 0.002562 | −0.03% | 390.3200625 |

| 1 March 2020 | 0.002551 | -- | 392.003136 |

| 1 February 2020 | 0.002558 | -- | 390.9304144 |

| 1 January 2020 | 0.002562 | −0.34% | 390.3200625 |

| 1 December 2019 | 0.002623 | -- | 381.2428517 |

| 1 November 2019 | 0.00264 | −0.63% | 378.7878788 |

| 1 October 2019 | 0.002689 | 0.13% | 371.8854593 |

| 1 September 2019 | 0.002675 | -- | 373.8317757 |

| 1 August 2019 | 0.002585 | 0.18% | 386.8471954 |

| 1 July 2019 | 0.002585 | −0.23% | 386.8471954 |

| 1 June 2019 | 0.002623 | -- | 381.2428517 |

| 1 May 2019 | 0.002565 | 0.33% | 389.8635478 |

| 1 April 2019 | 0.002564 | −0.41% | 390.0156006 |

| 1 March 2019 | 0.002554 | 0.21% | 391.5426782 |

| 1 February 2019 | 0.002573 | 0.49% | 388.6513797 |

| 1 January 2019 | 0.002613 | -- | 382.7018752 |

| One-Sample Kolmogorov–Smirnov Test | ||

|---|---|---|

| VAR00001 | ||

| N | 12 | |

| Normal Parameters a,b | Mean | 1747.0894 |

| Std. Deviation | 284.36303 | |

| Most Extreme Differences | Absolute | 0.187 |

| Positive | 0.157 | |

| Negative | −0.187 | |

| Test Statistic | 0.187 | |

| Asymp. Sig. (2-tailed) | 0.200 c,d | |

| Date | Actual Import Value | Example Data (1/5 Million) |

|---|---|---|

| February 2020 | 53,685.904 | 1073.72 |

| March 2020 | 89,429.515 | 1788.59 |

| April 2020 | 93,850.224 | 1877.00 |

| May 2020 | 85,107.218 | 1702.14 |

| June 2020 | 106,678.892 | 2133.58 |

| July 2020 | 92,437.095 | 1848.74 |

| August 2020 | 86,049.474 | 1720.99 |

| September 2020 | 92,804.893 | 1856.10 |

| October 2020 | 107,175.092 | 2143.50 |

| November 2020 | 73,914.857 | 1478.30 |

| December 2020 | 81,880.65 | 1637.61 |

| January 2021 | 85,239.85 | 1704.80 |

References

- Liu, C.; Wu, J.; Lakshika Jayetileke, H. Overseas Warehouse Deployment for Cross-Border E-Commerce in the Context of the Belt and Road Initiative. Sustainability 2022, 14, 9642. [Google Scholar] [CrossRef]

- Bhaskaran, K.; Chang, R.N.; Dey, P.; Sanz, J.L. Financial Services Industry Challenges and Innovation Opportunities R&D to shape the digital future of financial services. In Proceedings of the IEEE World Congress on Services (IEEE Services 2019), Milan, Italy, 8–13 July 2019; pp. 224–227. [Google Scholar] [CrossRef]

- Opasanon, S.; Kitthamkesorn, S. Border Crossing Design in Light of the ASEAN Economic Community: Simulation based approach. Transp. Policy 2016, 48, 1–12. [Google Scholar] [CrossRef]

- Vandenberg, P. Adapting to the Financial Landscape: Evidence from Small Firms in Nairobi. World Dev. 2003, 31, 1829–1843. [Google Scholar]

- Li, J.M.; Li, X.R.; Zhang, K.Y.; Guo, M. Research on the Financing Equilibrium and Coordination Strategy of Online Retailers under the New Eetail Model. Chin. J. Manag. Sci. 2021, 29, 57–69. [Google Scholar] [CrossRef]

- Qin, X.S. Research on Cross-Border E-Commerce Supply Chain Financing Model under the Condition of Overseas Warehouse. Commer. Account. 2020, 6, 63–66. [Google Scholar]

- Huang, S.; Fan, Z.P.; Wang, X. The Impact of Transportation Fee on the Performance of Capital-Constrained Supply Chain under 3PL Financing Service. Comput. Ind. Eng. 2019, 130, 358–369. [Google Scholar]

- Wang, F.; Yang, X.; Zhuo, X.; Xiong, M. Joint Logistics and Financial Services by a 3PL Firm: Effects of Risk Preference and Demand Volatility. Transp. Res. Part E Logist. Transp. Rev. 2019, 130, 312–328. [Google Scholar] [CrossRef]

- Mabula, J.B.; Ping, H.D. Financial Literacy of SME Managers’ on Access to Finance and Performance: The Mediating Role of Financial Service Utilization. Int. J. Adv. Comput. Sci. Appl. 2018, 9, 32–41. [Google Scholar]

- Wang, Y.; Shen, J.; Pan, J.; Chen, T. A Credit Risk Contagion Intensity Model of Supply Chain Enterprises under Different Credit Modes. Sustainability 2022, 14, 13518. [Google Scholar] [CrossRef]

- Chen, X.F.; Cai, G.S. Join Logistics and Financial Services by a 3PL Firm. Eur. J. Oper. Res. 2011, 214, 579–587. [Google Scholar] [CrossRef]

- Yi, X.J.; Sheng, K.; Yu, T.; Wang, Y.Y.; Wang, S.H. R&D Investment and Financing Efficiency in Chinese Environmental Protection Enterprises: Perspectives of COVID-19 and Supply Chain Financial Regulation. Int. J. Logist. Res. Appl. 2022, 25, 569–590. [Google Scholar] [CrossRef]

- Li, J.; Wang, Y.; Feng, G.; Wang, S.; Yuguang, S. Supply Chain Finance Review: Current Situation and Future Trend. Syst. Eng.-Theory Pract. 2020, 40, 1977–1995. [Google Scholar]

- Wang, Z.; Wang, Q.; Lai, Y.; Liang, C. Drivers and Outcomes of Supply Chain Finance Adoption: An Empirical Investigation in China. Int. J. Prod. Econ. 2020, 220, 107453. [Google Scholar] [CrossRef]

- Frye, J.; Ashley, L.; Bliss, R. Collateral Damage: A Source of Systematic Credit Risk. Risk 2000, 13, 91–94. [Google Scholar]

- Cossin, D.; Huang, Z.J.; Aunon-Nerin, D. A Framework Collateral Risk Control for Determination. Eur. Cent. Bank Work. Pap. Ser. 2003, 209, 1–42. [Google Scholar]

- Zhang, X.X. Research on Inventory Pledge Financing Pledge Decision under Internet of Things Technology. J. Financ. Res. 2020, 4, 80–86. [Google Scholar]

- Chen, X.F.; Cai, G.; Song, J.S. The Cash Flow Advantages of 3PLs as Supply Chain Orchestrators. Manuf. Serv. Oper. Manag. 2019, 21, 435–451. [Google Scholar]

- Ma, Z.H.; Xu, X.Q. Third Party Logistics Financing and Logistics Service Decisions under Supplier Competition. Appl. Res. Comput. 2019, 36, 404–410. [Google Scholar]

- Wang, X.J.; Gu, C.L.; Zhao, J.H.; He, Q.L. Stochastic Game Model for Moran Process under Selection Differences and its Application. Syst. Eng. Theory Pract. 2020, 40, 1193–1209. [Google Scholar]

- Liu, X.H.; Zhou, L.G. Logistics Financial Services in the Supply Chain Environment-Analysis of the Role of “Orchestrator” Based on 3PL. J. Cent. Univ. Financ. Econ. 2015, 7, 74–79+90. [Google Scholar]

- Yi, Y. Prospects for the Development of Chinese Cross-border Logistics Finance Based on Blockchain Technology—Taking Pay As You Go as an Example. Pract. Foreign Econ. Relat. Trade 2020, 4, 77–80. [Google Scholar]

- Li, S.; Chen, X.F. The Role of Supply Chain Finance in Third-party Logistics Industry: A Case Study from China. Int. J. Logist. Res. Appl. 2018, 22, 154–171. [Google Scholar] [CrossRef]

- Cao, G.M.; Wang, Y.S.; Gao, H.H.; Liu, H.; Liu, H.B.; Song, Z.G.; Fan, Y.Q. Coordination Decision-Making for Intelligent Transformation of Logistics Services under Capital Constraint. Sustainability 2023, 15, 5421. [Google Scholar] [CrossRef]

- Gefen, D.; Straub, D.W. Consumer Trust in B2C E-Commerce and the Importance of Social Presense: Experiments in E-Products and E-Services. Omega 2004, 32, 407–424. [Google Scholar] [CrossRef]

- Xu, X.; He, C. The Effects of Network Structure Attributes on Growth Performance of Logistics Service Integrators in Logistics Service Supply Chain: Empirical Evidence. Sustainability 2022, 14, 16788. [Google Scholar] [CrossRef]

- Perçin, S.; Min, H. A Hybrid Quality Function Deployment and Fuzzy Decision-Making Methodology for the Optimal Selection of Third-Party Logistics Service Providers. Int. J. Logist. Res. Appl. 2013, 16, 380–397. [Google Scholar] [CrossRef]

- Van, D.J.M.; Rutten, W.G.M.M. Logistics Service Management: Opportunities for Differentiation. Int. J. Logist. Manag. 1998, 9, 91–98. [Google Scholar]

- Gunasekaran, A.; Ngai, E. Information Systems in Supply Chain Integration and Management. Eur. J. Oper. Res. 2004, 159, 269–295. [Google Scholar]

- Zhang, X.M.; Zhao, Q.L.; Zhang, J.J.; Yue, X.P. Logistics Service Supply Chain Vertical Integration Decision under Service Efficiency Competition. Sustainability 2023, 15, 3915. [Google Scholar] [CrossRef]

- Ding, F.; Chen, J.; Chen, C.; Huo, J.Z. Research on the Competitive Strategy of Cross-Border E-Commerce based on Differentiation Strategy. Oper. Res. Manag. Sci. 2019, 28, 33–40. [Google Scholar]

- Mills, E.S. Uncertainty and Price Theory. Q. J. Econ. 1959, 73, 116–130. [Google Scholar] [CrossRef]

- Coppes, R.C. Are Exchange Rate Changes Normally Distributed? Econ. Lett. 1995, 47, 117–121. [Google Scholar] [CrossRef]

- Dong, J.; Zhang, D.; Nagurney, A. A Supply Chain Network Equilibrium Model with Random Demands. Eur. J. Oper. Res. 2004, 40, 2648–2657. [Google Scholar]

- Feng, Y.; Zhang, Y.Z. Evaluation of TPL-Intervened Production Transportation and Marketing Supply Chain Alliance Decisions and Operational Efficiency. Oper. Res. Manag. Sci. 2019, 28, 67–77. [Google Scholar]

- Zhu, Y.M.; Wang, X.M.; Zhang, S.C. Study on the Impact of Cross-Border E-Commerce Logistics Dervice Quality on Consumers’ Willingness to Repurchase. Price Theory Pract. 2020, 5, 113–116. [Google Scholar]

- Wu, Z.G.; Han, Y.Q.; Zhou, Y.Z. Research on Enterprise Capability Index Measurement Model. Oper. Res. Manag. Sci. 2004, 13, 145–149. [Google Scholar]

- Xie, T.S.; Li, J. Third-Party Logistics Service Pricing Game Analysis. J. Syst. Eng. 2008, 23, 751–758. [Google Scholar]

| Parameters | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Value | 300,000 | 300 | 60 | 10% | 600 | 30% | 20 | 20 | 0.05 | 0.5 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ji, J.; Zheng, H.; Qi, J.; Ji, M.; Kong, L.; Ji, S. Financial and Logistical Service Strategy of Third-Party Logistics Enterprises in Cross-Border E-Commerce Environment. Sustainability 2023, 15, 6874. https://doi.org/10.3390/su15086874

Ji J, Zheng H, Qi J, Ji M, Kong L, Ji S. Financial and Logistical Service Strategy of Third-Party Logistics Enterprises in Cross-Border E-Commerce Environment. Sustainability. 2023; 15(8):6874. https://doi.org/10.3390/su15086874

Chicago/Turabian StyleJi, Jialu, Hongxing Zheng, Jia Qi, Mingjun Ji, Lingrui Kong, and Shengzhong Ji. 2023. "Financial and Logistical Service Strategy of Third-Party Logistics Enterprises in Cross-Border E-Commerce Environment" Sustainability 15, no. 8: 6874. https://doi.org/10.3390/su15086874

APA StyleJi, J., Zheng, H., Qi, J., Ji, M., Kong, L., & Ji, S. (2023). Financial and Logistical Service Strategy of Third-Party Logistics Enterprises in Cross-Border E-Commerce Environment. Sustainability, 15(8), 6874. https://doi.org/10.3390/su15086874