Directions for Sustainable Development of China’s Coal Industry in the Post-Epidemic Era

Abstract

1. Introduction

- (1)

- Analyze the macroenvironment and the state of development of the coal industry in China in the post-epidemic era;

- (2)

- Identify risk factors and challenges for the SD of the coal industry in China;

- (3)

- To substantiate the directions of the SD of the coal industry in China.

- (1)

- What factors affect the SD of China’s coal industry in the current economic, environmental, and geopolitical context?

- (2)

- Which areas are promising for SD in China’s coal sector?

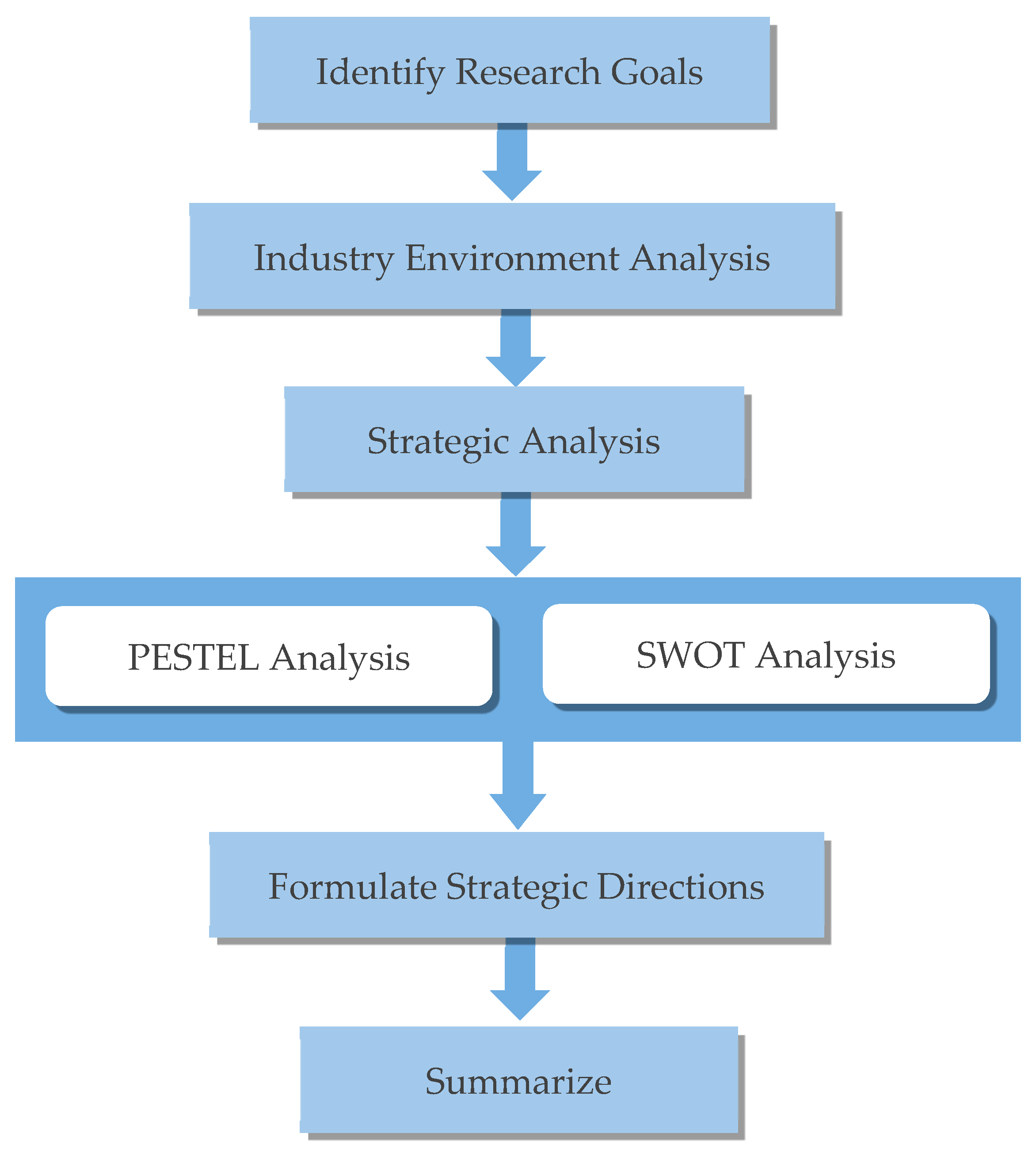

2. Materials and Methods

2.1. Literature Analysis

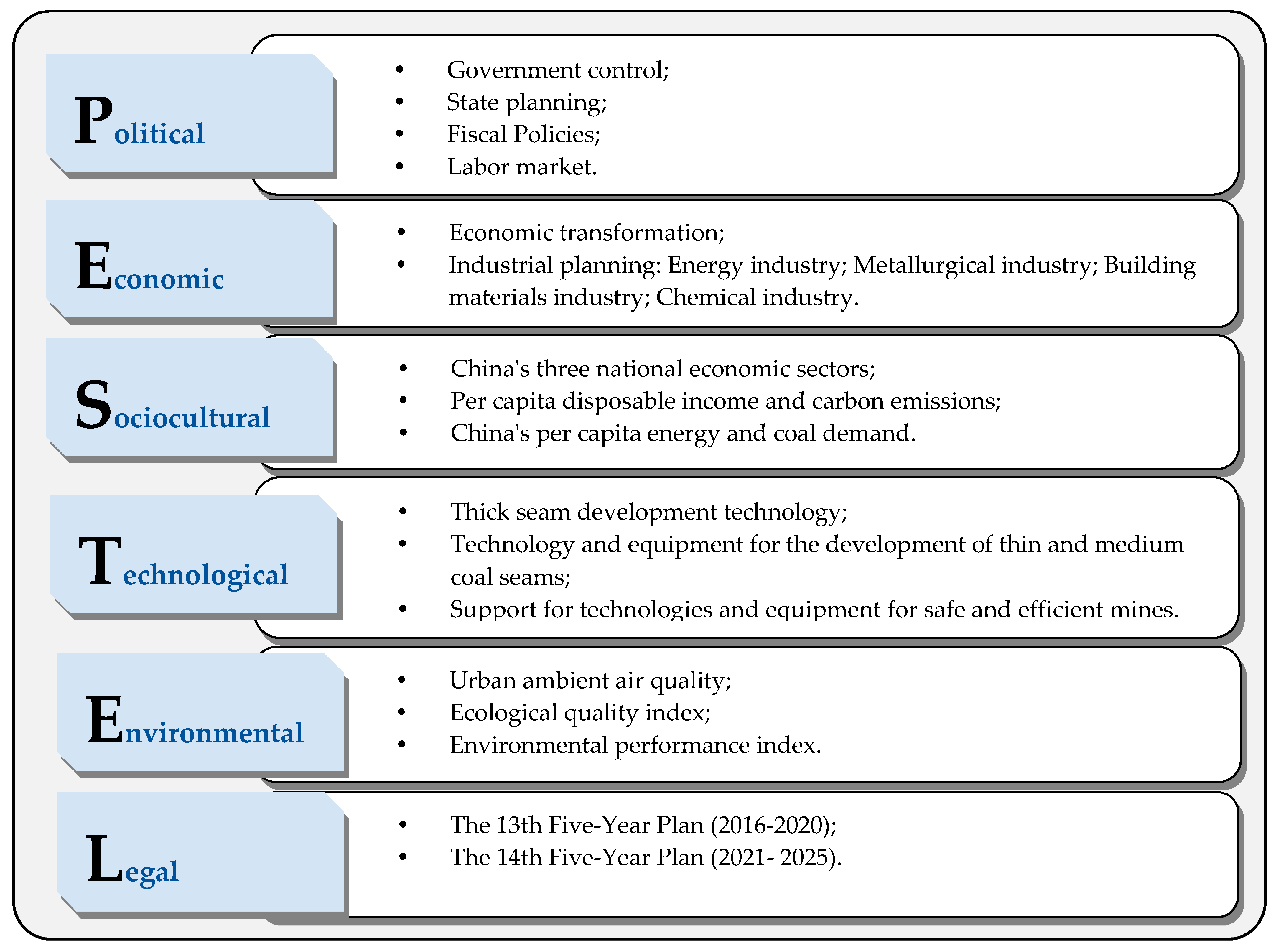

2.2. PESTEL Analysis

2.3. SWOT Analysis

3. Results

3.1. Current Development of China’s Coal Industry before and after the COVID-19 Outbreak

3.1.1. Production and Consumption

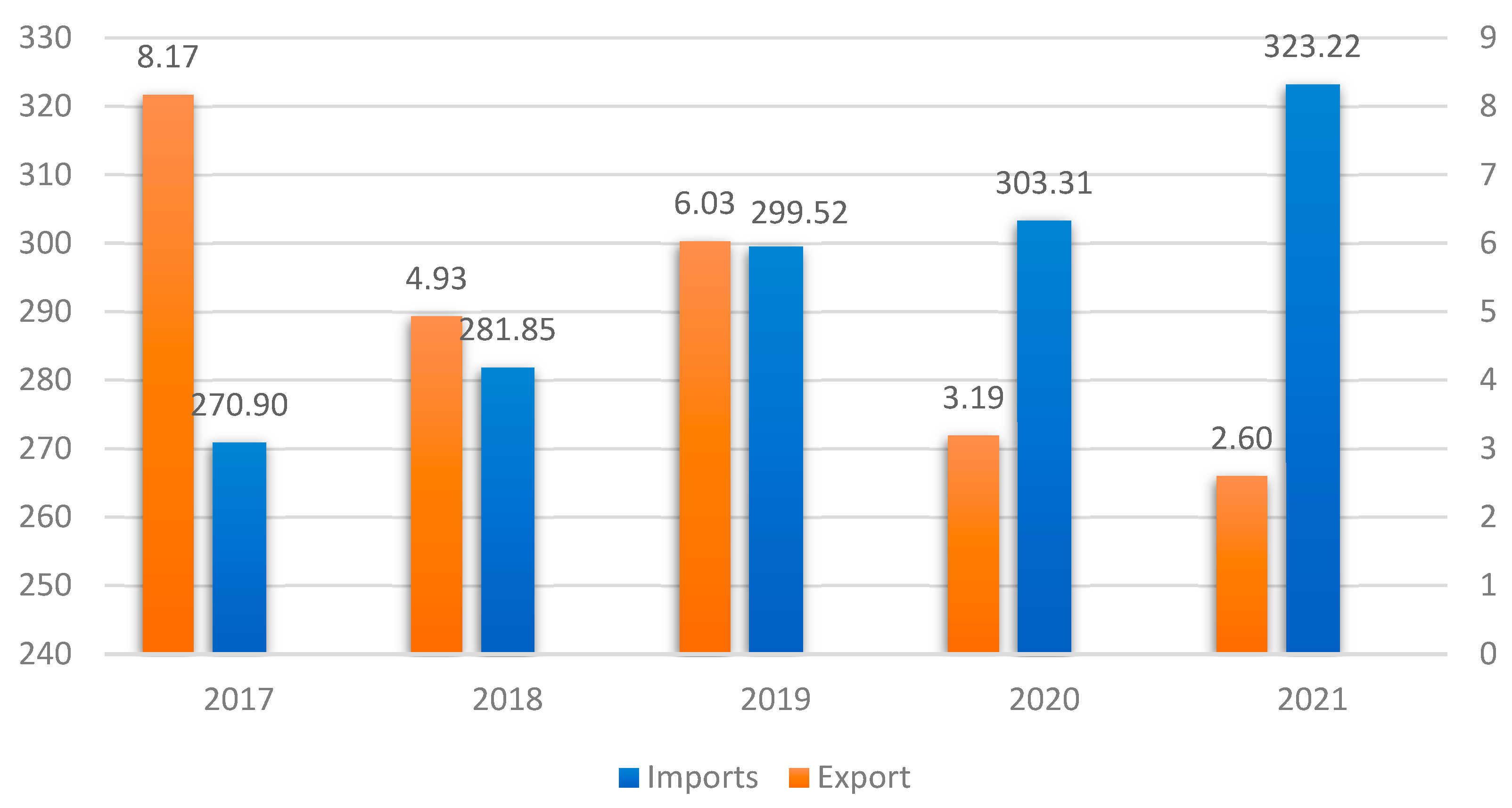

3.1.2. Import and Export

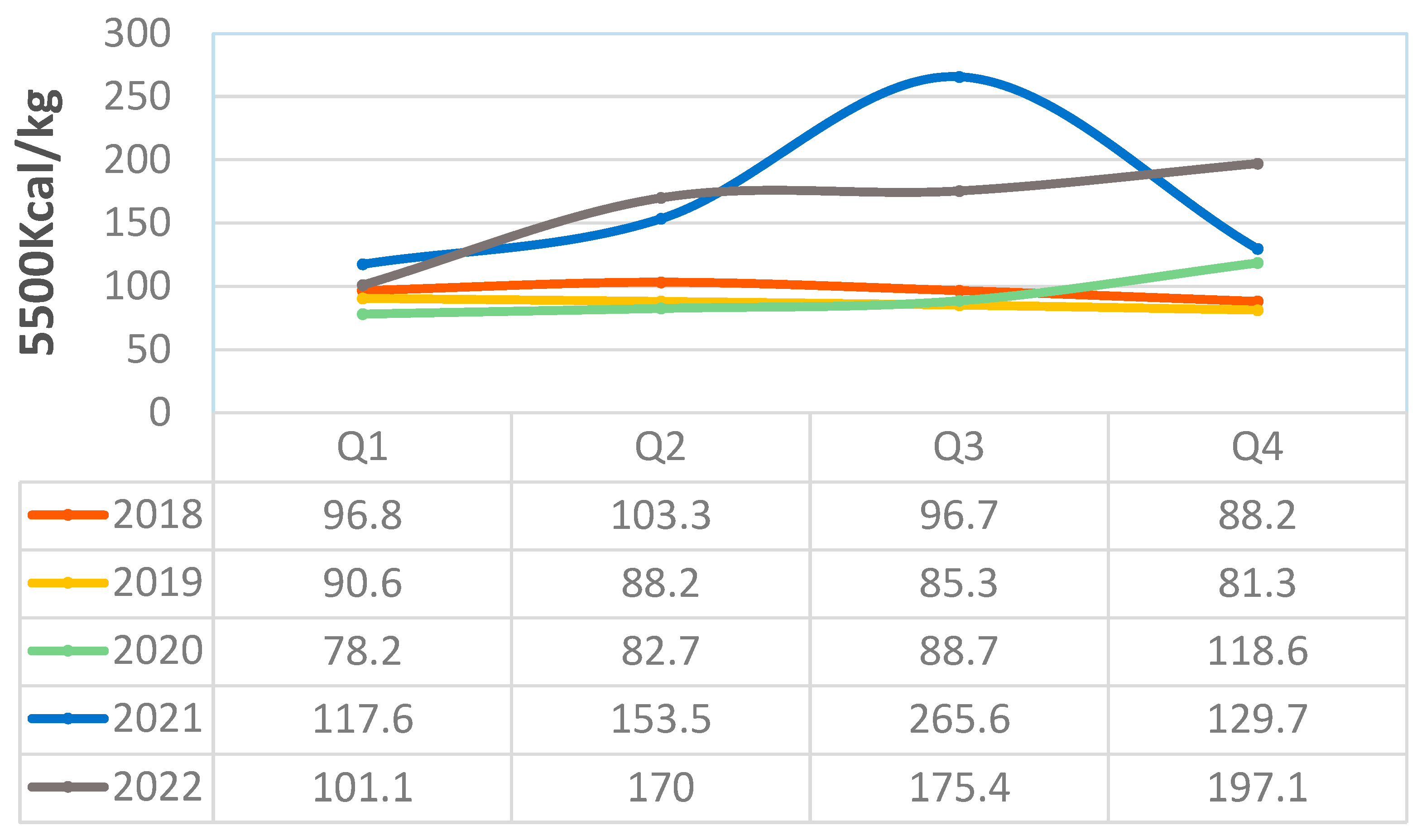

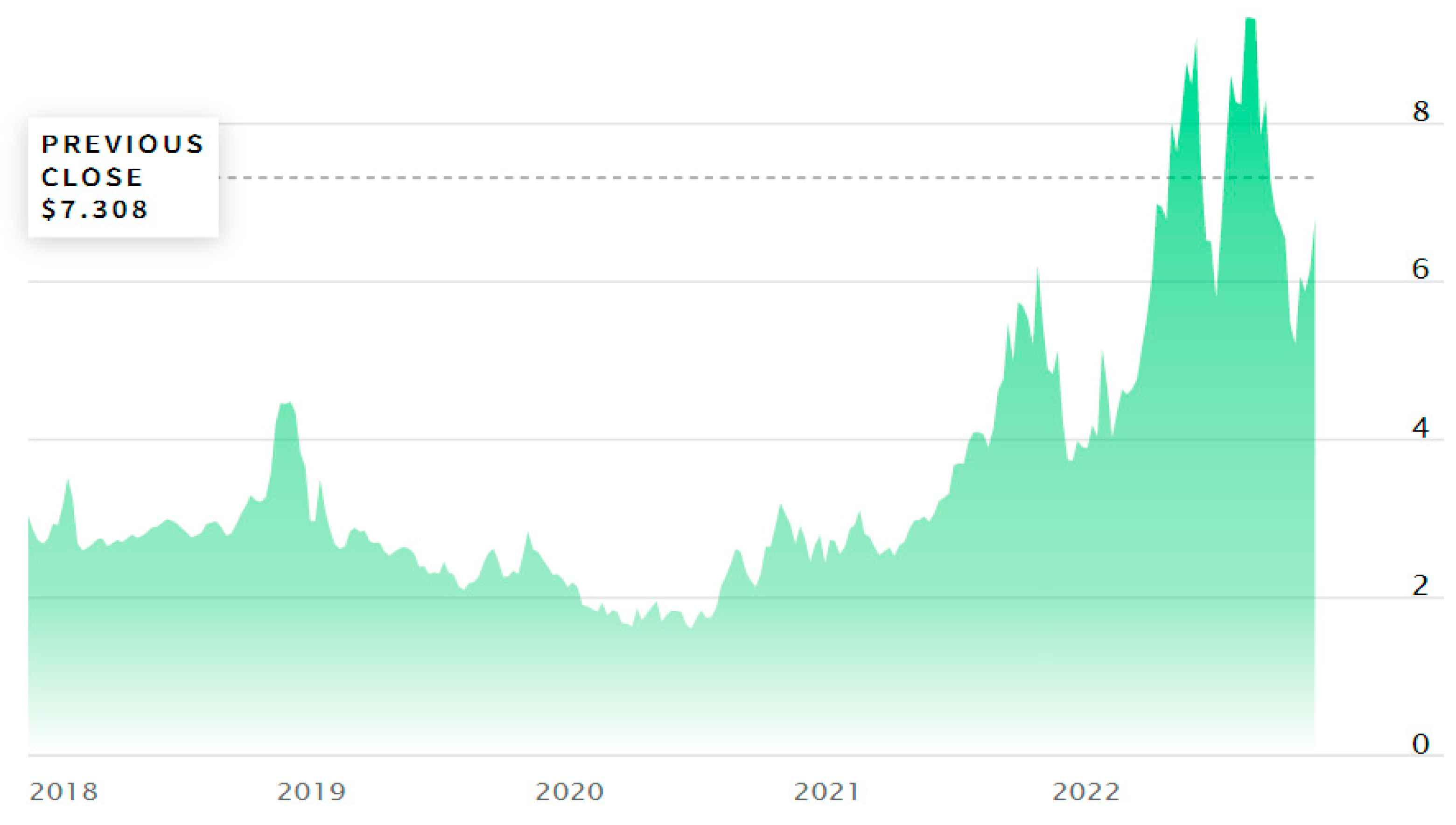

3.1.3. Coal Prices

3.2. Analysis of the Influence of the Macroenvironment

3.2.1. PESTEL Analysis

- Political

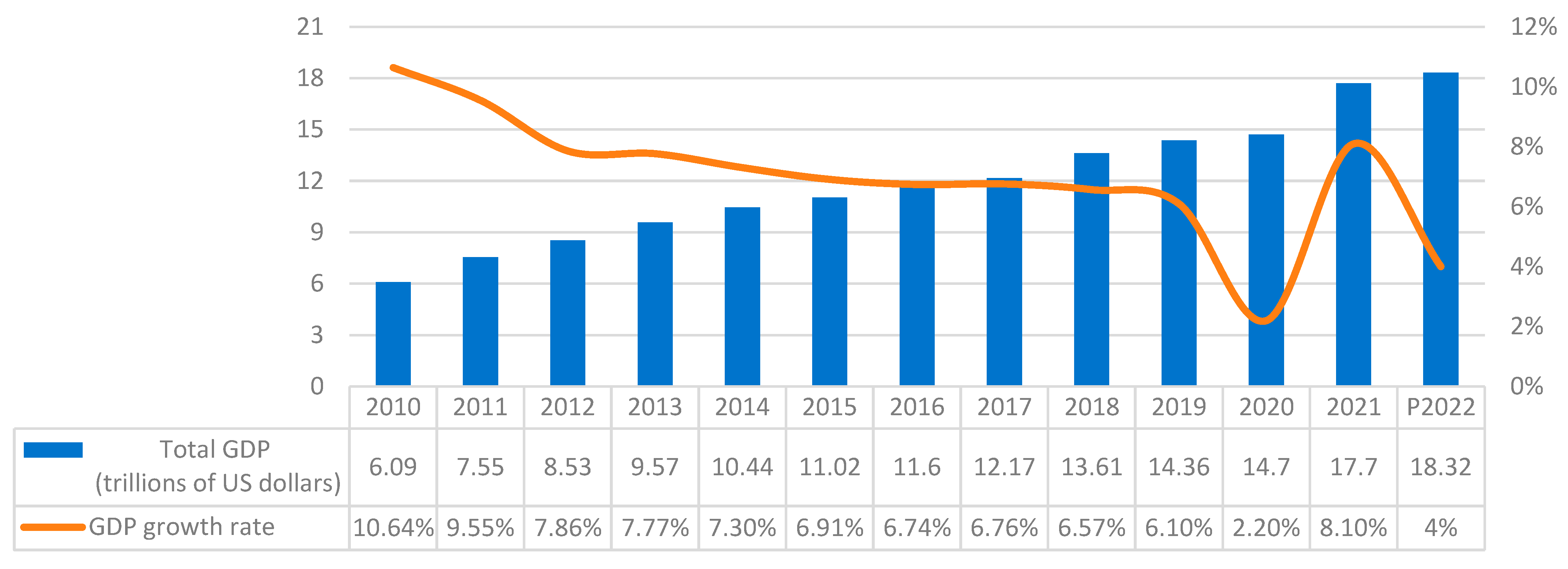

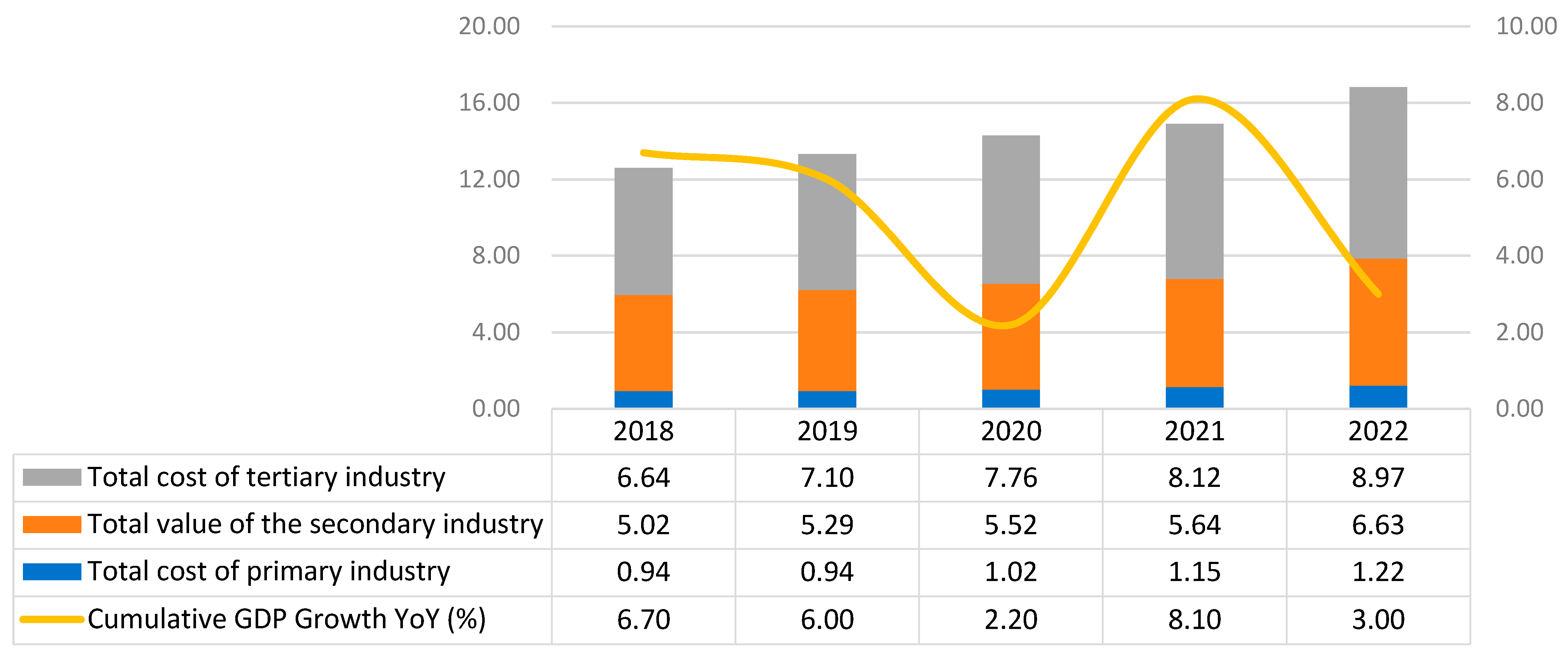

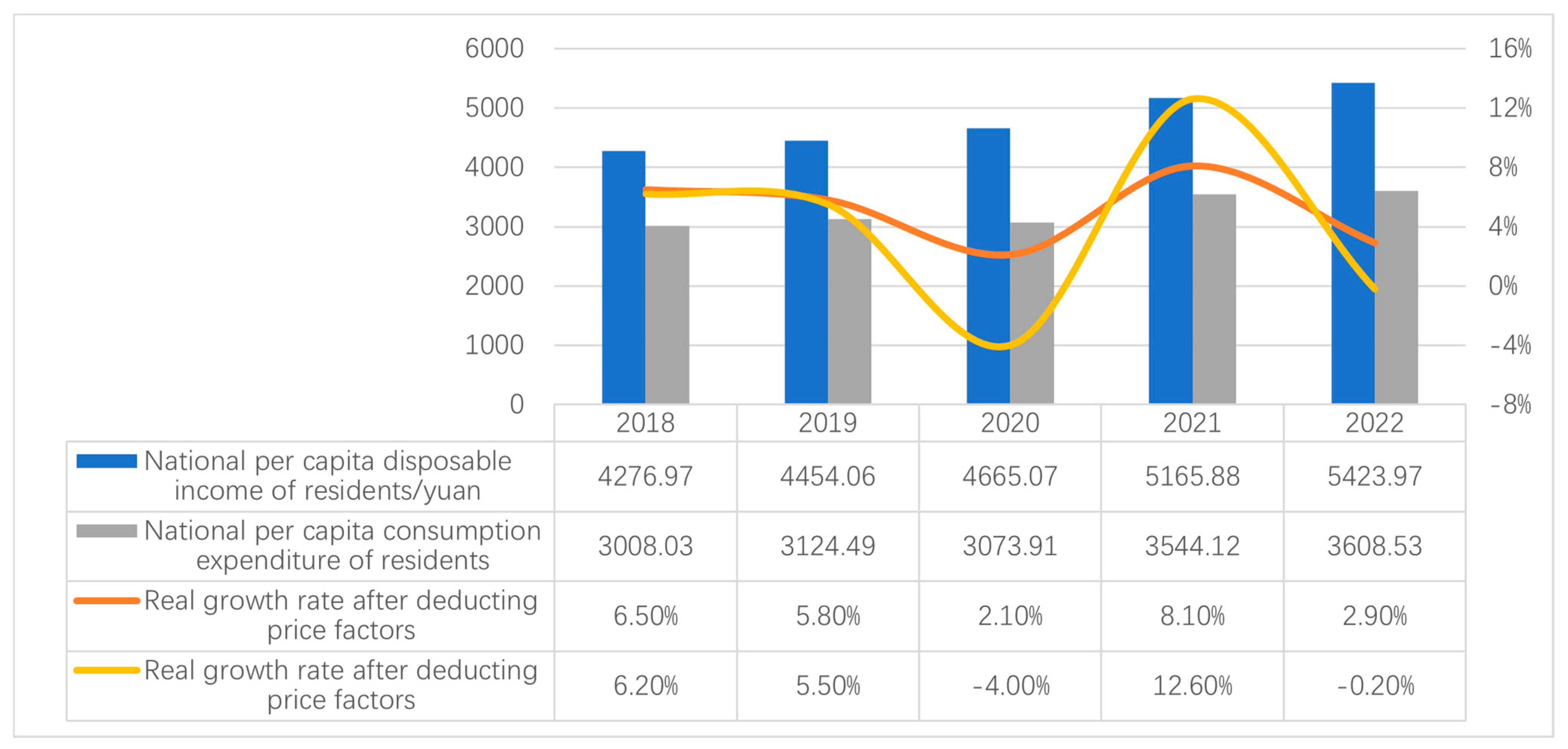

- Economic

- Sociocultural

- Technological

- Thick-seam development technology

- 2.

- Technology and equipment for the development of thin and medium coal seams

- 3.

- Support for technologies and equipment for safe and efficient mines

- Environmental

- Coastal area;

- 2.

- Inland area;

- Legal

3.2.2. SWOT Analysis

- Strengths

- Weaknesses

- Opportunities

- Threats

3.3. Planning for the Sustainable Development of China’s Coal Sector in the Post-Epidemic Era

3.3.1. Guaranteeing the Security of the National Energy Storage Facility

3.3.2. Energy Development Planning for Different Regions

3.3.3. Develop Clean Coal Technology

3.3.4. Enhancing International Cooperation

4. Discussion

5. Conclusions

- The analysis showed that China’s coal production and consumption have been steadily increasing, including the period 2018–2021. Total consumption in the four major coal-consuming industries, including electricity, metallurgy, chemicals, and construction materials, has also increased.

- China’s coal imports tend to increase, while exports tend to decrease significantly. The structure of imports in 2022 has changed. The volume of supplies from Russia, Indonesia, and Mongolia has increased quite significantly; at the same time, the volume from Canada, the United States, and Australia has decreased significantly.

- There are two main coal-pricing mechanisms in China: a price determined by market supply and demand, and a price formed by government intervention. In 2022, prices tended to increase, with the overall price level lower than in the pandemic year of 2021.

- Detailed PESTEL analysis of China’s coal industry showed that the coal enterprises are state-owned. The government is developing large-scale programs of decarbonization, the sustainable development of the coal industry, COVID-19 mitigation programs on energy and the economy, and others. The growth rate of the Chinese economy is gradually slowing down. Demand for thermal coal in China depends largely on macroeconomic conditions and the development of related downstream industries and tends to be a demand-driven market. Much attention is being paid to the transition from raw, low-tech production to high-tech production with higher added value, and many others. China is actively developing new technologies for coal mining, shutting down nonecological mines, not funding foreign coal projects, and developing innovative technologies for environmentally friendly coal consumption. By 2060, China plans to be carbon neutral. To date, China’s environmental indicators are at insufficient levels, which requires intensive work on them. Therefore, China’s current energy planning aims to ensure energy sustainability while respecting environmental constraints.

- SWOT analysis of China’s coal industry showed that the strengths are innovative technologies for the development of powerful coal seams and the weaknesses are the rising prices of imported coal, the volume of consumption of which is 8%. The opportunities provide the expansion of coal imports from Russia and infrastructure development, and the threat is the potential outbreak of a new coronavirus infection, which is currently considered to be overcome.

- The main risks for China’s coal industry development and challenge factors are the high energy consumption and energy intensity of China’s GDP; the need for enormous coal production as well as imports; the difficulty in solving the problem of renewable energy sources with the necessary volumes of coal use; the need to reduce the environmental burden and transition to carbon neutrality by 2060; and the need for the intensive development and implementation of clean coal technologies.

- As part of the “dual carbon” goal, China’s energy restructuring must consider the relationship between the short- and long-term outlook. Under the dire situation of the new epidemic, and increased risks and uncertainties, fossil energy sources will play an important role in supporting China’s economy to maintain sustainable progress. Deepening the energy revolution, the basic national conditions of the coal energy structure should be respected. In the face of sudden public safety risks, the government needs to develop effective policies to prevent and control epidemics. Companies need to improve their emergency planning systems and supplement emergency provisions accordingly, establish emergency stockpiles in accordance with the risk assessment of mobilization hazards.

- An improvement in energy storage security in China can be a mechanism to reduce and release coal-mining capacity. When hydropower, wind power, solar power, and other energy sources are in the stage of normal power generation, coal mines will reduce capacity and control output; when normal power generation is not possible or capacity is insufficient, coal will play a role in guaranteeing the result.

- Increase the development of clean, efficient, and low-carbon coal use and research and development, and include key technology projects such as carbon capture, carbon storage, and carbon recycling as key energy innovations. Focus on areas that consume large amounts of coal and increase industrial and financial policy support. Then, vigorously promote the high-quality development of the modern coal industry, promote coal gasification, coal liquefaction, conversion of coal to natural gas and coal to olefins, expand the coal chemical industry chain, and promote technological advances in new coal-based materials.

- Promote the sustainable development and transformation of the industry and develop a closed-loop economy. Strengthen strategic research on international coal cooperation, and establish economic and trade cooperation, industrial investment, financial cooperation, etc., with countries along the One Belt, One Road; develop overseas mining bases and establish industrial parks where capital, mining, engineering, operation, and foreign trade are coordinated; open resource supply areas for countries along the Belt and Road, reducing transportation risks, and jointly building high-quality coal development.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- De La Peña, L.; Guo, R.; Cao, X.; Ni, X.; Zhang, W. Accelerating the energy transition to achieve carbon neutrality. Resour. Conserv. Recycl. 2022, 177, 105957. [Google Scholar] [CrossRef]

- Siksnelyte-Butkiene, I. Impact of the COVID-19 Pandemic to the Sustainability of the Energy Sector. Sustainability 2021, 13, 12973. [Google Scholar] [CrossRef]

- Pata, U.K.; Kumar, A. The influence of hydropower and coal consumption on greenhouse gas emissions: A comparison between China and India. Water 2021, 13, 1387. [Google Scholar] [CrossRef]

- Ukaogo, P.O.; Ewuzie, U.; Onwuka, C.V. Environmental pollution: Causes, effects, and the remedies. In Microorganisms for sustainable environment and health. Microorg. Sustain. Environ. Health 2020, 419–429. [Google Scholar] [CrossRef]

- Zhang, F.; Deng, X.; Phillips, F.; Fang, C.; Wang, C. Impacts of industrial structure and technical progress on carbon emission intensity: Evidence from 281 cities in China. Technol. Forecast. Soc. 2020, 154, 119949. [Google Scholar] [CrossRef]

- Li, L.; Lei, Y.; Wu, S.; He, C.; Chen, J.; Yan, D. Impacts of city size change and industrial structure change on CO2 emissions in Chinese cities. J. Clean. Prod. 2018, 195, 831–838. [Google Scholar] [CrossRef]

- Wang, Z.; Li, C.; Liu, Q.; Niu, B.; Peng, S.; Deng, L.; Kang, P.; Zhang, X. Pollution haven hypothesis of domestic trade in China: A perspective of SO2 emissions. Sci. Total Environ. 2019, 663, 198–205. [Google Scholar] [CrossRef]

- Xu, G.; Schwarz, P.; Yang, H. Adjusting energy consumption structure to achieve China’s CO2 emissions peak. Renew. Sustain. Energy Rev. 2020, 122, 109737. [Google Scholar] [CrossRef]

- Tian, X.; Bai, F.; Jia, J.; Liu, Y.; Shi, F. Realizing low-carbon development in a developing and industrializing region: Impacts of industrial structure change on CO2 emissions in southwest China. J. Environ. Manag. 2019, 233, 728–738. [Google Scholar] [CrossRef]

- Zheng, H.; Zhang, Z.; Wei, W.; Song, M.; Dietzenbacher, E.; Wang, X.; Meng, J.; Shan, Y.; Ou, J.; Guan, D. Regional determinants of China’s consumption-based emissions in the economic transition. Environ. Res. Lett. 2020, 15, 074001. [Google Scholar] [CrossRef]

- Leach, F.; Kalghatgi, G.; Stone, R.; Miles, P. The scope for improving the efficiency and environmental impact of internal combustion engines. Transp. Eng. 2020, 1, 100005. [Google Scholar] [CrossRef]

- Liu, Z.; Deng, Z.; Davis, S.J.; Giron, C.; Ciais, P. Monitoring global carbon emissions in 2021. Nat. Rev. Earth Environ. 2022, 3, 217–219. [Google Scholar] [CrossRef] [PubMed]

- BP Statistical Review of World Energy 2022. Available online: https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/statistical-review/bp-stats-review-2022-full-report.pdf (accessed on 3 March 2023).

- Yurak, V.V.; Dushin, A.V.; Mochalova, L.A. Vs sustainable development: Scenarios for the future. J. Min. Inst. 2020, 242, 242–247. [Google Scholar] [CrossRef]

- Gyamfi, B.A.; Adedoyin, F.F.; Bein, M.A.; Bekun, F.V.; Agozie, D.Q. The anthropogenic consequences of energy consumption in E7 economies: Juxtaposing roles of renewable, coal, nuclear, oil and gas energy: Evidence from panel quantile method. J. Clean. Prod. 2021, 295, 126373. [Google Scholar] [CrossRef]

- China Mineral Resources. 2022. Available online: http://ccera.com.cn/upload/coal/file/20220921/1663743339124064.pdf (accessed on 3 September 2022).

- Li, S.; Zhao, Y.; Xiao, W.; Yue, W.; Wu, T. Optimizing ecological security pattern in the coal resource-based city: A case study in Shuozhou City, China. Ecol. Indic. 2021, 130, 108026. [Google Scholar] [CrossRef]

- Qi, H. Structural Analysis of China’s Coal Supply and Demand and Research on Energy Conservation Issues. China Collect. Econ. 2022, 13, 138–140. [Google Scholar]

- Wang, S.; Li, C.; Zhou, H. Impact of China’s economic growth and energy consumption structure on atmospheric pollutants: Based on a panel threshold model. J. Clean. Prod. 2019, 236, 117694. [Google Scholar] [CrossRef]

- Liu, X.; Guo, P.; Nie, L. Applying emergy and decoupling analysis to assess the sustainability of China’s coal mining area. J. Clean. Prod. 2020, 243, 118577. [Google Scholar] [CrossRef]

- Wu, P.; Zhao, G.; Li, Y. Green Mining Strategy Selection via an Integrated SWOT-PEST Analysis and Fuzzy AHP-MARCOS Approach. Sustainability 2022, 14, 7577. [Google Scholar] [CrossRef]

- Metzler, B. Leveling up your research and research operations: Strategies for scale. Ethnogr. Prax. Ind. Conf. Proc. 2020, 2020, 203–217. [Google Scholar] [CrossRef]

- Samusenko, A.S.; Plaskova, N.S.; Prodanova, N.A. The analysis of the external environment to determine the practical focus of applied research and development in the framework of innovation. Complex Syst. Innov. Sustain. Digit. Age 2020, 1, 245–255. [Google Scholar] [CrossRef]

- Azimi, R.; Yazdani-Chamzini, A.; Fouladgar, M.M.; Zavadskas, E.K.; Basiri, M.H. Ranking the strategies of mining sector through ANP and TOPSIS in a SWOT framework. J. Bus. Econ. Manag. 2011, 12, 670–689. [Google Scholar] [CrossRef]

- Ghicajanu, M.I.H.A.E.L.A. Application of SWOT technique in business management. Ann. Univ. Petroşani Econ. 2021, 21, 161–168. [Google Scholar]

- Omer, S.K. SWOT analysis implementation’s significance on strategy planning. J. Process Manag. New Technol. 2019, 7, 56–62. [Google Scholar] [CrossRef]

- Piercy, N.; Giles, W. Making SWOT analysis work. Mark. Intell. Plan. 1989, 7, 5–7. [Google Scholar] [CrossRef]

- China Energy Media Research Institute. 2022. Available online: https://news.bjx.com.cn/html/20220719/1242318.shtml (accessed on 19 July 2022).

- China Energy Media Research Institute. 2021. Available online: https://coal.in-en.com/html/coal-2595995.shtml (accessed on 16 June 2021).

- China New Energy Network. Available online: http://www.china-nengyuan.com/baike/5869.html (accessed on 19 March 2020).

- Ma, J.; Zhang, R.; Li, L.; Liu, Z.; Sun, J.; Kong, L.; Liu, X. Analysis of the Dust-Concentration Distribution Law in an Open-Pit Mine and Its Influencing Factors. ACS Omega 2022, 7, 43609–43620. [Google Scholar] [CrossRef] [PubMed]

- Meng, F.; Zhang, T. Analysis of the impact of the “Belt and Road” initiative on China’s coal import and export. Sino-Foreign Energy 2022, 27, 8–14. [Google Scholar]

- National Bureau of Statistics of China. Available online: http://www.stats.gov.cn/ (accessed on 6 December 2022).

- Interim Measures for Commercial Coal Quality Management. Available online: http://www.customs.gov.cn/urumqi_customs/jyjy123/1713512/2100898/index.html (accessed on 18 November 2018).

- Feng, Y.; Feng, H. The development history and prospect of China’s coal price index. China Coal 2019, 45, 10–14. [Google Scholar] [CrossRef]

- Wang, X.; Liu, C.; Chen, S.; Chen, L.; Li, K.; Liu, N. Impact of coal sector’s de-capacity policy on coal price. Appl. Energy 2020, 265, 114802. [Google Scholar] [CrossRef]

- China Thermal Coal (5500Kcal/kg) Price. Available online: https://yte1.com/datas/donglimei-pri?end=2022 (accessed on 3 December 2022).

- Ofori, P.; Hodgkinson, J.; Khanal, M.; Hapugoda, P.; Yin, J. Potential resources from coal mining and combustion waste: Australian perspective. Environ. Dev. Sustain. 2022, 1–18. [Google Scholar] [CrossRef]

- General Administration of Customs of China. Available online: http://www.zhijinsteel.com/tongji/jktj/index.html (accessed on 12 December 2022).

- Bowen, A.; Kuralbayeva, K.; Tipoe, E.L. Characterising green employment: The impacts of ‘greening’ on workforce composition. Energy Econ. 2018, 72, 263–275. [Google Scholar] [CrossRef]

- Du, J.; Dabuo, F.T.; Madzikanda, B.; Boamah, K.B.; Coulibaly, P.T.; Anfom, K. Influence of environmental regulation and resource utilization on research and development towards sustainability: A perspective of China’s coal mining industry. In Proceedings of the 2nd International Conference on Green Energy, Environment and Sustainable Development (GEESD2021b); IOS Press: Amsterdam, The Netherlands, 2021. [Google Scholar] [CrossRef]

- Wang, Q.; Yang, X.; Li, R. The impact of the COVID-19 pandemic on the energy market–A comparative relationship between oil and coal. Energy Strategy Rev. 2022, 39, 100761. [Google Scholar] [CrossRef]

- Qian, X.; Wang, D.; Wang, J.; Chen, S. Resource curse, environmental regulation and transformation of coal-mining cities in China. Resour. Policy 2021, 74, 101447. [Google Scholar] [CrossRef]

- Hwang, J.; Song, M.; Cho, S. Institutional Arrangement and Policy Context Underlying Sustainability Actions in the US: Lessons for Asian Regions. J. Contemp. East. Asia 2020, 19, 59–83. [Google Scholar] [CrossRef]

- Hanna, R.; Xu, Y.; Victor, D.G. After COVID-19, green investment must deliver jobs to get political traction. Nature 2020, 582, 178–180. [Google Scholar] [CrossRef]

- Wang, G.; Liao, Q.; Li, Z.; Zhang, H.; Liang, Y.; Wei, X. How does soaring natural gas prices impact renewable energy: A case study in China. Energy 2022, 252, 123940. [Google Scholar] [CrossRef]

- Natural Gas Price Trends. Available online: https://tradingeconomics.com/commodity/natural-gas (accessed on 5 December 2022).

- Liu, Y.; Zhou, Y. Territory spatial planning and national governance system in China. Land Use Policy 2021, 102, 105288. [Google Scholar] [CrossRef]

- Zhu, B.; Zhang, T. The impact of cross-region industrial structure optimization on economy, carbon emissions and energy consumption: A case of the Yangtze River Delta. Sci. Total Environ. 2021, 778, 146089. [Google Scholar] [CrossRef]

- Jia, Z.; Lin, B. How to achieve the first step of the carbon-neutrality 2060 target in China: The coal substitution perspective. Energy 2021, 233, 121179. [Google Scholar] [CrossRef]

- Clean Coal Technologies in Japan. Available online: https://www.jcoal.or.jp/eng/cctinjapan/ (accessed on 17 December 2022).

- Szima, S.; del Pozo, C.A.; Cloete, S.; Fogarasi, S.; Álvaro, J.; Cormos, A.-M.; Cormos, C.-C.; Amini, S. Techno-economic assessment of IGCC power plants using gas switching technology to minimize the energy penalty of CO2 capture. Clean Technol. 2021, 3, 594–617. [Google Scholar] [CrossRef]

- Tang, J.; Chu, M.S.; Li, F.; Feng, C.; Liu, Z.G.; Zhou, Y.S. Development and progress on hydrogen metallurgy. Int. J. Miner. Metall. Mater. 2020, 27, 713–723. [Google Scholar] [CrossRef]

- Classification of National Economic Industries in 2017 (GB/T 4754-2017). Available online: http://www.stats.gov.cn/tjsj/tjbz/hyflbz/201710/t20171012_1541679.html (accessed on 29 September 2017).

- Regulations on the Division of Three Industries. Available online: http://www.stats.gov.cn/tjsj/tjbz/201301/t20130114_8675.html (accessed on 18 November 2022).

- Change Trend of China’s Gross National Product from 2018 to 2022. Available online: http://www.gov.cn/shuju/hgjjyxqk/detail.html?q=0 (accessed on 12 December 2022).

- Huo, C.; Chen, L. The Impact of the Income Gap on Carbon Emissions: Evidence from China. Energies 2022, 15, 3771. [Google Scholar] [CrossRef]

- Income and Consumption Expenditure of Chinese Residents. Available online: http://www.gov.cn/index.htm (accessed on 12 December 2022).

- Yang, S.; Jiang, Q.; Sánchez-Barricarte, J.J. China’s fertility change: An analysis with multiple measures. Popul. Health Metr. 2022, 20, 1–14. [Google Scholar] [CrossRef]

- Guo, J. Review and Prospect of Underground Coal Mining Technology and Equipment in China. China Coal 2021, 47, 24–30. [Google Scholar] [CrossRef]

- Wang, G. Technical innovation and development of complete equipment for high-efficiency mining face in coal mines. Coal Sci. Technol. 2010, 38, 63–68+106. [Google Scholar] [CrossRef]

- Hu, B.; Zhang, P.; Zhang, F. Safe and efficient production practice and development countermeasures of coal mines in China. Coal Econ. Res. 2019, 39, 4–9. [Google Scholar] [CrossRef]

- Guo, J.; Tan, J. Meticulous design and continuous innovation to build a world-class modern mine. Well Constr. Technol. 2020, 41, 20–23. [Google Scholar] [CrossRef]

- Liu, R.; Xiao, P.; Zhong, L.; Jiang, J.; Xu, Z. Research status of 700 °C ultra-supercritical coal-fired power generation technology. Therm. Power Gener. 2017, 46, 1–7+23. [Google Scholar]

- Wang, G.; Li, S.; Zhang, J.; Pang, Y.; Chen, P.; Chen, G.; Du, Y. Consolidating the safety of the coal industry and laying the cornerstone of energy security. China Coal 2022, 48, 1–9. [Google Scholar] [CrossRef]

- Guo, H.; Lyu, X.; Meng, E.; Xu, Y.; Zhang, M.; Fu, H.; Zhang, Y.; Song, K. CCUS in China: Challenges and Opportunities. In Proceedings of the SPE Improved Oil Recovery Conference, Virtual, 25–29 April 2022. [Google Scholar] [CrossRef]

- China: Decoupling GDP Growth from Rising Emissions. Available online: https://energypost.eu/china-decoupling-gdp-growth-from-rising-emissions/ (accessed on 12 April 2021).

- Sun, W.; Ren, S.; Liu, K.; Zan, C. Decoupling China’s mining carbon emissions from economic development: Analysis of influencing factors. Front. Environ. Sci. 2022, 10, 944708. [Google Scholar] [CrossRef]

- Wu, Z.; Huang, X.; Chen, R.; Mao, X.; Qi, X. The United States and China on the paths and policies to carbon neutrality. J. Environ. Manag. 2022, 320, 115785. [Google Scholar] [CrossRef]

- Ministry of Ecology and Environment: “Thirteenth Five-Year Plan” China’s Work on Climate Change Has Achieved Remarkable Results. Available online: http://news.cctv.com/2020/10/21/ARTIDkN02hTRiTyzLm8E65nE201021.shtml (accessed on 21 October 2020).

- 2021 Bulletin on the State of China’s Ecological Environment. Available online: http://www.gov.cn/xinwen/2022-05/28/5692799/files/349e930e68794f3287888d8dbe9b3ced.pdf (accessed on 26 May 2022).

- Regional Ecological Quality Evaluation Measures. Available online: https://www.mee.gov.cn/xxgk2018/xxgk/xxgk03/202111/W020211124377111066485.pdf (accessed on 17 October 2021).

- Regional Distribution of Coal in China. Available online: https://www.osgeo.cn/map/m01c8 (accessed on 17 February 2020).

- Wolf, M.J.; Emerson, J.W.; Esty, D.C.; de Sherbinin, A.; Wendling, Z.A. Environmental Performance Index; Yale Center for Environmental Law & Policy: New Haven, CT, USA, 2022. [Google Scholar]

- 2022 EPI Report. Available online: https://epi.yale.edu/downloads/epi2022report06062022.pdf (accessed on 6 June 2022).

- Wendling, Z.A.; Jacob, M.; Esty, D.C.; Emerson, J.W. Explaining environmental performance: Insights for progress on sustainability. Environ. Dev. 2022, 44, 100741. [Google Scholar] [CrossRef]

- Zhuang, G. China is Capable of Leading Global Climate Governance. In Beautiful China: 70 Years Since 1949 and 70 People’s Views on Eco-Civilization Construction; Springer: Singapore, 2021; pp. 717–725. [Google Scholar] [CrossRef]

- Shi, T. The Spatiotemporal Evolutionary Trend and Driving Factors of the Coupling Coordinated Development between Regional Green Finance and Ecological Environment. Int. J. Environ. Res. Public Health 2022, 19, 6211. [Google Scholar] [CrossRef] [PubMed]

- China Government Network. Available online: https://www.gov.cn/ (accessed on 3 December 2022).

- Zhang, B.; Wang, S.; Wang, D.; Wang, Q.; Yang, X.; Tong, R. Air quality changes in China 2013–2020: Effectiveness of clean coal technology policies. J. Clean. Prod. 2022, 366, 132961. [Google Scholar] [CrossRef]

- Qi, R.; Liu, T.; Jia, Q.; Sun, L.; Liu, J. Simulating the sustainable effect of green mining construction policies on coal mining industry of China. J. Clean. Prod. 2019, 226, 392–406. [Google Scholar] [CrossRef]

- Import and Export Tariff of the People’s Republic of China. 2021. Available online: http://jsz.mof.gov.cn/zhengcefagui/202111/t20211125_3768943.htm (accessed on 25 November 2021).

- Wang, G.; Xu, Y.; Ren, H. Intelligent and ecological coal mining as well as clean utilization technology in China: Review and prospects. Int. J. Min. Sci. Technol. 2019, 29, 161–169. [Google Scholar] [CrossRef]

- Wang, J.; Pan, W.; Zhang, G.; Yang, S.; Yang, K.; Li, L. Principle and application of image recognition intelligent coal discharge technology. J. Coal Sci. 2022, 47, 87–101. [Google Scholar] [CrossRef]

- Eguchi, S.; Takayabu, H.; Lin, C. Sources of inefficient power generation by coal-fired thermal power plants in China: A metafrontier DEA decomposition approach. Renew. Sustain. Energy Rev. 2021, 138, 110562. [Google Scholar] [CrossRef]

- Shi, D. Steady Industrial Growth: International Experience, Practical Challenges and Policy Orientation. China Ind. Econ. 2022, 2, 5–26. [Google Scholar] [CrossRef]

- Sino-Russian Energy Cooperation Projects. Available online: https://baijiahao.baidu.com/s?id=1717964072618761322&wfr=spider&for=pc (accessed on 2 December 2021).

- Zakeri, B.; Paulavets, K.; Barreto-Gomez, L.; Echeverri, L.G.; Pachauri, S.; Boza-Kiss, B.; Zimm, C.; Rogelj, J.; Creutzig, F.; Ürge-Vorsatz, D.; et al. Pandemic, War, and Global Energy Transitions. Energies 2022, 15, 6114. [Google Scholar] [CrossRef]

- Chu, W.; Vicidomini, M.; Calise, F.; Duić, N.; Østergaard, P.A.; Wang, Q.; da Graça Carvalho, M. Recent Advances in Low-Carbon and Sustainable, Efficient Technology: Strategies and Applications. Energies 2022, 15, 2954. [Google Scholar] [CrossRef]

- Mohammad, N.; Mohamad Ishak, W.W.; Mustapa, S.I.; Ayodele, B.V. Natural gas as a key alternative energy source in sustainable renewable energy transition: A mini review. Front. Energy Res. 2021, 9, 625023. [Google Scholar] [CrossRef]

- Yang, F.; Xu, H. Analysis of the development path of ecological environmental protection and comprehensive utilization of resources in the coal industry in the 14th Five-Year Plan. China Coal 2021, 47, 73–82. [Google Scholar] [CrossRef]

- Wang, Y.; Fu, G.; Lyu, Q.; Wu, Y.; Jia, Q.; Yang, X.; Li, X. Reform and development of coal mine safety in China: An analysis from government supervision, technical equipment, and miner education. Resour. Policy 2022, 77, 102777. [Google Scholar] [CrossRef]

- Romasheva, N.; Dmitrieva, D. Energy resources exploitation in the Russian arctic: Challenges and prospects for the sustainable development of the ecosystem. Energies 2021, 14, 8300. [Google Scholar] [CrossRef]

- “14th Five-Year Plan” Modern Energy System Planning. Available online: https://www.ndrc.gov.cn/xxgk/zcfb/ghwb/202203/P020220322582066837126.pdf (accessed on 22 March 2022).

- Proposing good strategies for promoting coal and seeking development plans—The representatives and members of the coal industry in the two sessions actively offer advice and suggestions to seek common industry reform and development. China Coal Ind. 2022, 4, 8–14.

- Huang, L.; Zhao, W. The impact of green trade and green growth on natural resources. Resour. Policy 2022, 77, 102749. [Google Scholar] [CrossRef]

- Ilinova, A.A.; Romasheva, N.V.; Stroykov, G.A. Prospects and social effects of carbon dioxide sequestration and utilization projects. J. Min. Inst. 2020, 244, 493–502. [Google Scholar] [CrossRef]

- Cherepovitsyn, A.; Rutenko, E.; Solovyova, V. Sustainable development of oil and gas resources: A system of environmental, socio-economic, and innovation indicators. J. Mar. Sci. Eng. 2021, 9, 1307. [Google Scholar] [CrossRef]

- Qiushu, W.; Song, C.; Li, W.; Han, J. Analysis on the development process and current situation of China’s mining international cooperation. Geol. Explor. 2022, 58, 229–238. [Google Scholar]

- Bertram, C.; Luderer, G.; Creutzig, F.; Bauer, N.; Ueckerdt, F.; Malik, A.; Edenhofer, O. COVID-19-induced low power demand and market forces starkly reduce CO2 emissions. Nat. Clim. Chang. 2021, 11, 193–196. [Google Scholar] [CrossRef]

- Santiago, I.; Moreno-Munoz, A.; Quintero-Jiménez, P.; Garcia-Torres, F.; Gonzalez-Redondo, M.J. Electricity demand during pandemic times: The case of the COVID-19 in Spain. Energy Policy 2021, 148, 111964. [Google Scholar] [CrossRef] [PubMed]

- Abbasi, K.R.; Shahbaz, M.; Zhang, J.; Irfan, M.; Alvarado, R. Analyze the environmental sustainability factors of China: The role of fossil fuel energy and renewable energy. Renew. Energy 2022, 187, 390–402. [Google Scholar] [CrossRef]

- Mastoi, M.S.; Munir, H.M.; Zhuang, S.; Hassan, M.; Usman, M.; Alahmadi, A.; Alamri, B. A comprehensive analysis of the power demand–supply situation, electricity usage patterns, and the recent development of renewable energy in China. Sustainability 2022, 14, 3391. [Google Scholar] [CrossRef]

- Kumar, A.; Yang, T.; Sharma, M.P. Greenhouse gas measurement from Chinese freshwater bodies: A review. J. Clean. Prod. 2019, 233, 368–378. [Google Scholar] [CrossRef]

- China National Energy Administration. Available online: http://www.nea.gov.cn/2022-01/28/c_1310445390.htm (accessed on 28 January 2022).

- Sun, L.; Niu, D.; Wang, K.; Xu, X. Sustainable development pathways of hydropower in China: Interdisciplinary qualitative analysis and scenario-based system dynamics quantitative modeling. J. Clean. Prod. 2021, 287, 125528. [Google Scholar] [CrossRef]

- Development of China Renewable Energy in 2022. Available online: https://www.ndrc.gov.cn/fggz/hjyzy/jnhnx/202302/t20230215_1348799_ext.html (accessed on 15 February 2023).

- “Fourteen Five -Year Plan” Modern Energy System Plan. Available online: http://www.gov.cn/zhengce/zhengceku/2022-03/23/content_5680759.htm (accessed on 29 January 2022).

- Best, R.; Burke, P.J. Energy mix persistence and the effect of carbon pricing. Aust. J. Agric. Resour. Econ. 2020, 64, 555–574. [Google Scholar] [CrossRef]

- Zhdaneev, O.V. Technological sovereignty of the Russian Federation fuel and energy complex. J. Min. Inst. 2022, 258, 1049–1066. [Google Scholar] [CrossRef]

- Kretschmann, J.; Plien, M.; Nguyen, T.H.N.; Rudakov, M. Effective capacity building by empowerment teaching in the field of occupational safety and health management in mining. J. Min. Inst. 2020, 242, 248–256. [Google Scholar] [CrossRef]

- Ilyinova, A.A.; Solovieva, V.M. Strategic planning and forecasting: Changing the essence and role in the conditions of instability of the energy sector. N. Mark. Form. Econ. Order 2021, 2, 56–68. [Google Scholar] [CrossRef]

- Zhang, L.; Ponomarenko, T.V.; Xu, H. Transformation of Chinese coal companies in accordance with the concept of ESG-requirements for sustainable development. Econ. Cent. Asia 2022, 6, 243–254. [Google Scholar] [CrossRef]

- Marinina, O.; Kirsanova, N.; Nevskaya, M. Circular Economy Models in Industry: Developing a Conceptual Framework. Energies 2022, 15, 9376. [Google Scholar] [CrossRef]

- Marinina, O.; Tsvetkova, A.; Vasilev, Y.; Komendantova, N.; Parfenova, A. Evaluating the Downstream Development Strategy of Oil Companies: The Case of Rosneft. Resources 2022, 11, 4. [Google Scholar] [CrossRef]

- Cherepovitsyn, A.; Rutenko, E. Strategic Planning of Oil and Gas Companies: The Decarbonization Transition. Energies 2022, 15, 6163. [Google Scholar] [CrossRef]

| Indicators | Unit | Lignite Coal | Other Coal | ||

|---|---|---|---|---|---|

| Basic Requirements (Transportation Distance * ≤ 600 KM) | Long-Distance Transportation (Transportation Distance > 600 KM) | Basic Requirements (Transportation Distance ≤ 600 KM) | Long-Distance Transportation (Transportation Distance > 600 KM) | ||

| Ash (Ad) | % | ≤30 | ≤20 | ≤40 | ≤30 |

| Sulfur fraction (St,d) | % | ≤1.5 | ≤1 | ≤3 | ≤2 |

| Heat generation (Qnet,ar) | MJ/kg | ≥16.5 | ≥18 | ||

| Mercury (Hgd) | μg/g | ≤0.6 | |||

| Arsenic (Asd) | μg/g | ≤80 | |||

| Phosphorus (Pd) | % | ≤0.15 | |||

| Chlorine (Cld) | % | ≤0.3 | |||

| Fluorine (Fd) | μg/g | ≤200 | |||

| Year | Options | Russia | Indonesia | Mongolia | Canada | U.S. | Australia |

|---|---|---|---|---|---|---|---|

| 2020 | Import (billions of dollars) | 2.42 | 3.12 | 2.00 | 0.68 | 0.11 | 7.90 |

| Quantity (million tonnes) | 33.67 | 56.12 | 28.45 | 5.50 | 0.95 | 78.08 | |

| 2021 | Import (billions of dollars) | 7.00 | 9.71 | 2.00 | 28.28 | 2.70 | 1.01 |

| Quantity (million tonnes) | 54.77 | 87.94 | 16.03 | 10.43 | 10.60 | 11.71 | |

| 2022 (until November) | Import (billions of dollars) | 10.78 | 16.96 | 4.23 | 3.06 | 1.76 | 0.31 |

| Quantity (million tonnes) | 61.17 | 115.12 | 18.58 | 6.88 | 3.94 | 2.86 |

| Category | Index | Content |

|---|---|---|

| I | EQI ≥ 70 | The natural ecosystem has a high proportion of coverage, low intensity of human interference, rich biodiversity, complete ecological structure, stable systems, and perfect ecological functions. |

| II | 55 ≤ EQI < 70 | The natural ecosystem has a higher coverage ratio, lower intensity of human interference, richer biodiversity, more complete ecological structure, more stable systems, and better ecological functions. |

| III | 40 ≤ EQI < 55 | The proportion of natural ecosystem coverage is average, subject to a certain degree of human activities, biodiversity richness is average, ecological structure integrity and stability is average, and ecological functions are basically perfect. |

| IV | 30 ≤ EQI < 40 | Natural ecological background conditions are poor or the intensity of human interference is high, the natural ecosystem is more fragile, and the ecological function is low. |

| V | EQI < 30 | Poor natural ecological background conditions or high intensity of human interference, fragile natural ecosystems, and low ecological functions. |

| Countries | EPI | 10-Year Change | Ecosystem Vitality | Environmental Health | Climate Policy |

|---|---|---|---|---|---|

| China | 28.4 | 11.40 | 24.5 | 32.8 | 30.4 |

| Russia | 37.5 | 1.6 | 39 | 50.6 | 29.1 |

| U.S. | 51.1 | 3.3 | 51.4 | 76.8 | 37.2 |

| U.K. | 77.7 | 23 | 62.3 | 83.9 | 91.5 |

| India | 18.9 | −0.6 | 19.3 | 12.5 | 21.7 |

| Plans | Years of the Planned Period | Politics | The Key Content of the Five-Year Plan |

|---|---|---|---|

| The 13th Five-Year Plan (2016–2020) | 2016 | Thirteenth Five-Year Plan for the development of the coal industry |

|

| 2017 | The 13th Five-Year Coal Mine Safety Plan | ||

| 2018 | A guide to working with energy in 2018 | ||

| 2019 | Notice of work to eliminate overcapacity in key areas in 2019 | ||

| 2020 | Notice of issues related to the recommendation of the first batch of intelligent coal construction demonstration | ||

| The 14th Five-Year Plan (2021–2025) | 2021 | The 2030 Peak Carbon Action Program |

|

| Guidelines for the qualitative development of the coal industry in the 14th Five-Year Plan | |||

| The Smart Coal Mine Construction Handbook (2021 edition) | |||

| 2022 | The 14th Five-Year Mine Safety Plan | ||

| Science and technology to support the Carbon Peak Program (2022–2030) |

| Project Areas | Cooperating Companies | Contents |

|---|---|---|

| Oil and gas development | China National Petroleum Corporation (CNPC) and Public Joint Stock Company Rosneft Oil Company (Rosneft) | CNPC and Rosneft signed a license agreement for the use of RN-GRID software—a technology for hydraulic fracturing modeling and design of oil reservoirs. Rosneft will contribute to improving the efficiency of the development of Chinese oil and gas fields. |

| Production facilities | China National Chemical Engineering Co., Ltd. (CNCEC), Sinohydro Group Ltd., China Energy Engineering Group Co., Ltd. (CEEC) and Rosneft | CNCEC and Rosneft signed an agreement on cooperation in the procurement of participation in the construction of production facilities, which provides for long-term cooperation in the construction of new production facilities in Russia for oil and gas production, transportation, and processing according to the list of capital projects, considering the possibility of participation in competitive procurement for the period 2022–2027. Sinohydro Group Ltd. and Rosneft signed “Cooperation Agreement on Participation in Procurement in the Field of Construction of Production Equipment”. Sinohydro Group Ltd.will actively participate in public tenders organized by Rosneft and its subsidiaries, covering areas including but not limited to new construction, modernization, reconstruction, and equipment rehabilitation of oil extraction, hydrocarbon production, and oil-refining equipment. CEEC China Gezhouba Group Co., Ltd. signed a cooperation agreement with Rosneft, aiming to promote long-term cooperation in the fields of oil and gas production, transportation, and processing in Russia, and to conduct specific negotiations on competitive procurement for planned projects of Rosneft between 2022 and 2027. |

| Energy, power grid | China Energy Engineering Group Co., Ltd. (CEEC) and Russia Merentiev Institute of Energy Systems, Russian PAO Rosseti | CEEC China Electric Power Planning & Engineering Institute and Russia Merentiev Institute of Energy Systems signed a memorandum of understanding on a partnership agreement, which aims to promote cooperation between the two sides in the fields of energy planning and design, energy project-related research, etc. In the future, both parties will promote energy and power cooperation between Russia and China in the fields of energy and power-related cooperative research, organization of seminars and working groups, organization of international conferences and forums, energy and power-related knowledge sharing, organization of exchange visits of researchers/experts, etc. CEEC negotiated with Russian PAO Rosset on cooperation opportunities for the upgrading and renovation of power grid systems and new construction projects in Russia and third countries, and reached a preliminary cooperation intention. |

| Green energy | China Harbin Electric Corporation (CHEC) and Rosneft; China Dongfang Electric Corporation (CDEC) and Russian Orient Petroleum (ROP) | CHEC signed a cooperation agreement with Rosneft for a 25 MW project in Krasnoyarsk region. The 25 MW project in Krasnoyarsk region is the first wind power project ever planned by Rosneft. The project belongs to Rosneft’s subsidiary OOCL and is located in the Krasnoyarsk oil exploration area. CDEC and ROP signed a cooperation agreement. The two sides agreed to set up a working group to prepare for the launch of a study on the wind power potential of the wind farm of the OOCL project and further deepen the details of the cooperation. The wind power project in Ulyanovsk, Russia, previously supplied and constructed by Dongfang Electric, with a total installed capacity of 35 MW, is the first wind power project developed on a large scale in Russia, and is also the first demonstration project of Chinese wind power equipment entering the Russian wind power market. |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, L.; Ponomarenko, T. Directions for Sustainable Development of China’s Coal Industry in the Post-Epidemic Era. Sustainability 2023, 15, 6518. https://doi.org/10.3390/su15086518

Zhang L, Ponomarenko T. Directions for Sustainable Development of China’s Coal Industry in the Post-Epidemic Era. Sustainability. 2023; 15(8):6518. https://doi.org/10.3390/su15086518

Chicago/Turabian StyleZhang, Lijuan, and Tatyana Ponomarenko. 2023. "Directions for Sustainable Development of China’s Coal Industry in the Post-Epidemic Era" Sustainability 15, no. 8: 6518. https://doi.org/10.3390/su15086518

APA StyleZhang, L., & Ponomarenko, T. (2023). Directions for Sustainable Development of China’s Coal Industry in the Post-Epidemic Era. Sustainability, 15(8), 6518. https://doi.org/10.3390/su15086518