Corporate Governance Research in Asian Countries: A Bibliometric and Content Analysis (2001–2021)

Abstract

1. Introduction

2. Methodology

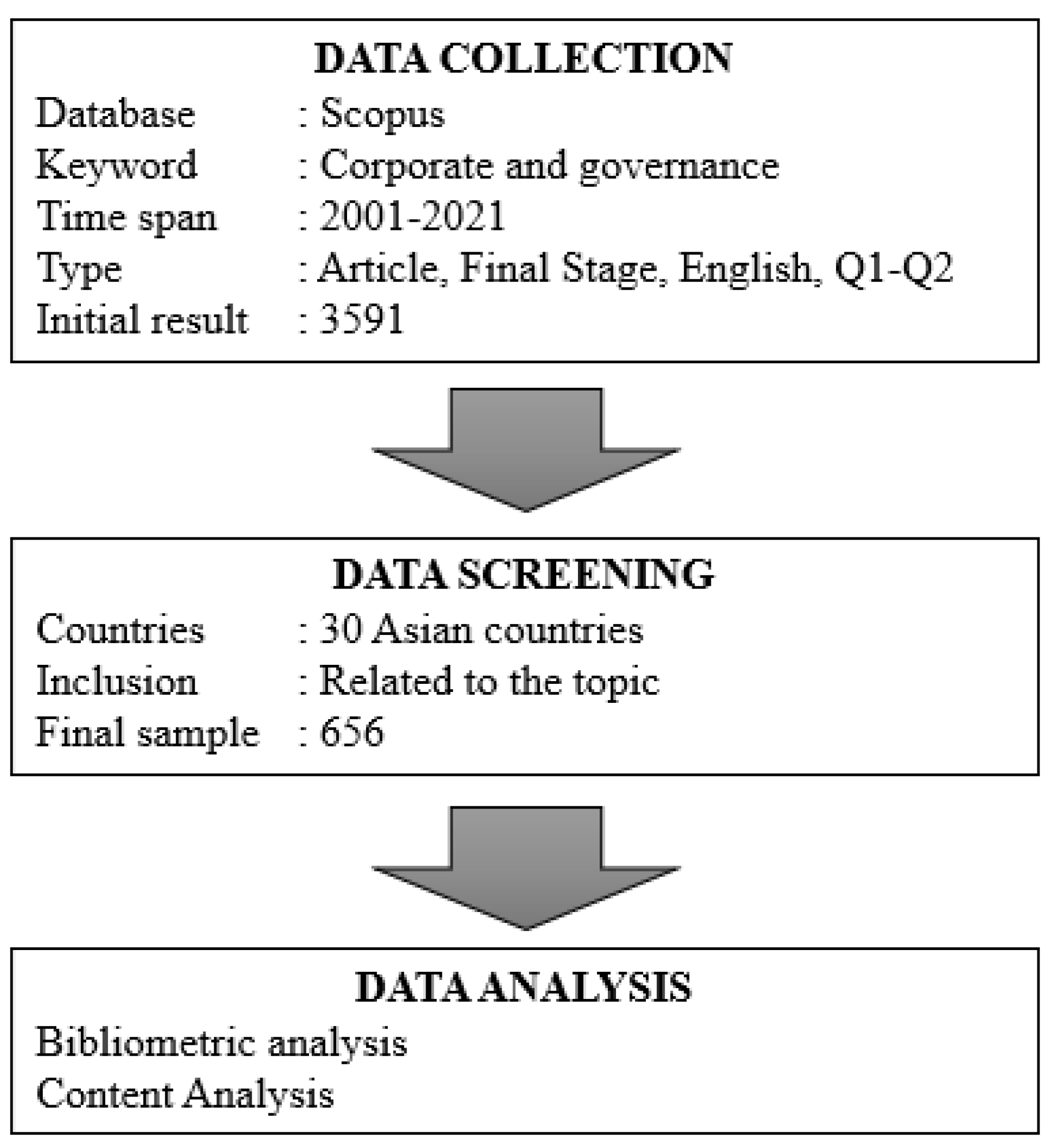

2.1. Data Collection

- First, the year filter was applied; only documents from 2001 to 2021 were used and as a result 20,800 document were selected.

- Second, the document type filter was applied: only documents of the “Article” type were selected and 20,388 article were selected.

- Third, the publication stage filter was applied; only articles in the “Final” stage were used, and as a result 19,712 articles were selected.

- Fourth, the source title type was applied: Top ten most productive journals indexed by Scopus (Q1–Q2), such as Corporate Governance an International Review (531), Journal of Business Ethics (385), Journal of Corporate Finance (369), Sustainability Switzerland (339), Corporate Governance Bingley (331), Journal of Management and Governance (218), Journal of Financial Economics (173), Corporate Governance (161), Managerial Auditing Journal (158), and Journal of Banking and Finance (153). In total, 3591 article were selected.

- Fifth, the language filter was applied; only documents written in the “English” language were chosen, and a total of 3591 articles were selected.

- Sixth, the country/territory filter was applied; 30 Asian Countries were chosen, such as China, South Korea, Taiwan, Malaysia, Hong Kong, Singapore, India, United Arab Emirates, Japan, Lebanon, Pakistan, Turkey, Indonesia, Saudi Arabia, Thailand, Viet Nam, Qatar, Kuwait, Oman, Bahrain, Jordan, Kazakhstan, Yemen, Cyprus, Bangladesh, Sri Lanka, Palestine, Syrian Arab Republic, Brunei Darussalam, and Kyrgyzstan. As a result, 995 articles were selected.

- Finally, 995 articles were reviewed by reading the titles and abstracts following the inclusion criteria, which related to this topic. A total of 656 articles were used as final sample for analysis.

2.2. Data Extraction

2.3. Data Analysis

2.3.1. Bibliometric Analysis

2.3.2. Content Analysis

3. Result and Discussion

3.1. Publication Statistics and Finding Popular Keywords in the Last 20 Years

3.2. Identification of Corporate Governance Publication Journals and the Most Prolific Authors

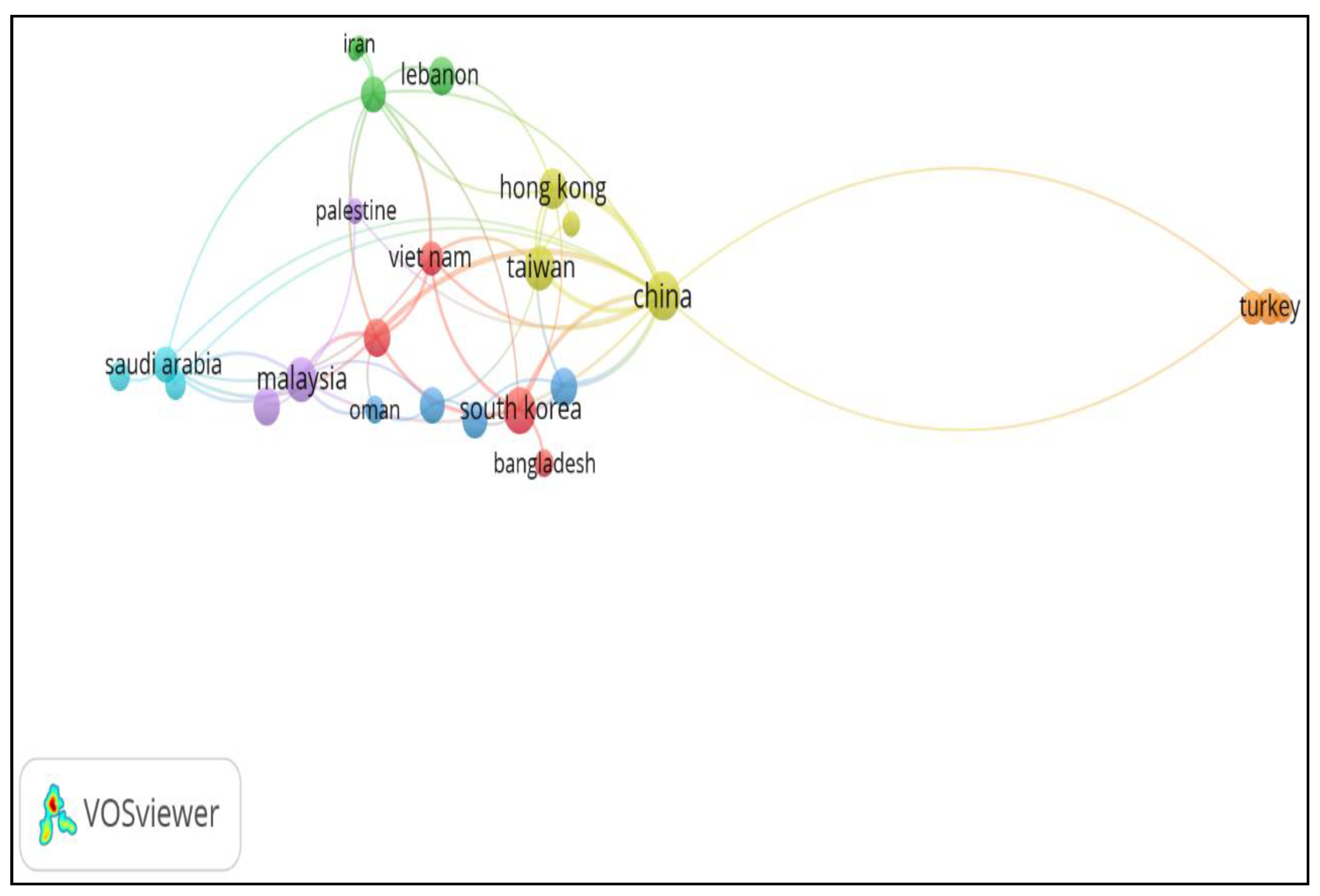

3.3. Participations by Institutions and Countries

3.4. Research Trends on Corporate Governance

3.5. In-Depth Content Analysis of the 10 Most Influential Articles

4. Conclusions

4.1. Implications of the Study

4.2. Future Research Direction

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Aras, G.; Crowther, D. Governance and Sustainability: An Investigation into the Relationship between Corporate Governance and Corporate Sustainability. Manag. Decis. 2008, 46, 433–448. [Google Scholar] [CrossRef]

- Wilkin, C.L.; Couchman, P.K.; Sohal, A.; Zutshi, A. Exploring differences between smaller and large organizations’ corporate governance of information technology. Int. J. Account. Inf. Syst. 2016, 22, 6–25. [Google Scholar] [CrossRef]

- Nasrallah, N.; El Khoury, R. Is corporate governance a good predictor of SMEs financial performance? Evidence from developing countries (the case of Lebanon). J. Sustain. Financ. Invest. 2022, 12, 13–43. [Google Scholar] [CrossRef]

- Tunger, D.; Eulerich, M. Bibliometric analysis of corporate governance research in German-speaking countries: Applying bibliometrics to business research using a custom-made database. Scientometrics 2018, 117, 2041–2059. [Google Scholar] [CrossRef]

- Zheng, C.; Kouwenberg, R. A Bibliometric Review of Global Research on Corporate Governance and Board Attributes. Sustainability 2019, 11, 3428. [Google Scholar] [CrossRef]

- Du Plessis, J.J.; Hargovan, A.; Harris, J. Principles of Contemporary Corporate Governance; Cambridge University Press: Cambridge, UK, 2018. [Google Scholar]

- Scherer, A.G.; Rasche, A.; Palazzo, G.; Spicer, A. Managing for Political Corporate Social Responsibility: New Challenges and Directions for PCSR 2.0. J. Manag. Stud. 2016, 53, 273–298. [Google Scholar] [CrossRef]

- Bhatt, P.R.; Bhatt, R.R. Corporate Governance and Firm Performance in Malaysia. Corp. Gov. Int. J. Bus. Soc. 2017, 17, 896–912. [Google Scholar] [CrossRef]

- Neifar, S.; Jarboui, A. Corporate governance and operational risk voluntary disclosure: Evidence from Islamic banks. Res. Int. Bus. Financ. 2018, 46, 43–54. [Google Scholar] [CrossRef]

- Basterretxea, I.; Cornforth, C.; Heras-Saizarbitoria, I. Corporate Governance as a Key Aspect in the Failure of Worker Cooperatives. Econ. Ind. Democr. 2022, 43, 362–387. [Google Scholar] [CrossRef]

- Cornett, M.M.; Marcus, A.J.; Tehranian, H. Corporate governance and pay-for-performance: The impact of earnings management. J. Financ. Econ. 2008, 87, 357–373. [Google Scholar] [CrossRef]

- AAyuso, S.; Rodríguez, M.A.; García-Castro, R.; Ariño, M.A. Maximizing Stakeholders’ Interests: An Empirical Analysis of the Stakeholder Approach to Corporate Governance. Bus. Soc. 2014, 53, 414–439. [Google Scholar] [CrossRef]

- Liu, X.; Zhang, C. Corporate Governance, Social Responsibility Information Disclosure, and Enterprise Value in China. J. Clean. Prod. 2017, 142, 1075–1084. [Google Scholar] [CrossRef]

- Armstrong, C.S.; Ittner, C.D.; Larcker, D.F. Corporate Governance, Compensation Consultants, and Ceo Pay Levels. Rev. Account. Stud. 2012, 17, 322–351. [Google Scholar] [CrossRef]

- Al Amosh, H.; Khatib, S.F. Ownership Structure and Environmental, Social and Governance Performance Disclosure: The Moderating Role of the Board Independence. J. Bus. Socio-Econ. Dev. 2021, 2, 49–66. [Google Scholar] [CrossRef]

- Hazaea, S.A.; Tabash, M.I.; Zhu, J.; Khatib, S.F.A.; Farhan, N.H.S. Internal audit and financial performance of Yemeni commercial banks: Empirical evidence. Banks Bank Syst. 2021, 16, 137–147. [Google Scholar] [CrossRef]

- Alnabsha, A.; Abdou, H.A.; Ntim, C.G.; Elamer, A.A. Corporate Boards, Ownership Structures and Corporate Disclosures: Evidence from a Developing Country. J. Appl. Account. Res. 2018, 19, 20–41. [Google Scholar] [CrossRef]

- Elamer, A.A.; Ntim, C.G.; Abdou, H.A.; Owusu, A.; Elmagrhi, M.; Ibrahim, A.E.A. Are bank risk disclosures informative? Evidence from debt markets. Int. J. Financ. Econ. 2021, 26, 1270–1298. [Google Scholar] [CrossRef]

- Chopra, M.; Chhavi, M. Is the COVID-19 Pandemic More Contagious for the Asian Stock Markets? A Comparison with the Asian Financial, the Us Subprime and the Eurozone Debt Crisis. J. Asian Econ. 2022, 79, 101450. [Google Scholar] [CrossRef]

- Zattoni, A.; Pugliese, A. Corporate Governance Research in the Wake of a Systemic Crisis: Lessons and Opportunities from the COVID-19 Pandemic. J. Manag. Stud. 2021, 58, 1405–1410. [Google Scholar] [CrossRef]

- Cabeza, L.F.; Frazzica, A.; Chàfer, M.; Vérez, D.; Palomba, V. Research Trends and Perspectives of Thermal Management of Electric Batteries: Bibliometric Analysis. J. Energy Storage 2020, 32, 101976. [Google Scholar] [CrossRef]

- Sadraei, R.; Biancone, P.; Lanzalonga, F.; Jafari-Sadeghi, V.; Chmet, F. How to increase sustainable production in the food sector? Mapping industrial and business strategies and providing future research agenda. Bus. Strat. Environ. 2022. [Google Scholar] [CrossRef]

- Pizzi, S.; Caputo, A.; Corvino, A.; Venturelli, A. Management research and the UN sustainable development goals (SDGs): A bibliometric investigation and systematic review. J. Clean. Prod. 2020, 276, 124033. [Google Scholar] [CrossRef]

- Biancone, P.P.; Saiti, B.; Petricean, D.; Chmet, F. The Bibliometric Analysis of Islamic Banking and Finance. J. Islam. Account. Bus. Res. 2020, 11, 2069–2086. [Google Scholar] [CrossRef]

- Secinaro, S.; Calandra, D.; Petricean, D.; Chmet, F. Social Finance and Banking Research as a Driver for Sustainable Development: A Bibliometric Analysis. Sustainability 2020, 13, 330. [Google Scholar] [CrossRef]

- Mumu, J.R.; Saona, P.; Haque, S.; Azad, A.K. Gender diversity in corporate governance: A bibliometric analysis and research agenda. Gend. Manag. Int. J. 2021, 37, 328–343. [Google Scholar] [CrossRef]

- Jan, A.A.; Lai, F.-W.; Tahir, M. Developing an Islamic Corporate Governance framework to examine sustainability performance in Islamic Banks and Financial Institutions. J. Clean. Prod. 2021, 315, 128099. [Google Scholar] [CrossRef]

- Khatib, S.F.; Abdullah, D.F.; Elamer, A.; Hazaea, S.A. The development of corporate governance literature in Malaysia: A systematic literature review and research agenda. Corp. Gov. Int. J. Bus. Soc. 2022, 22, 1026–1053. [Google Scholar] [CrossRef]

- Jan, A.A.; Lai, F.-W.; Siddique, J.; Zahid, M.; Ali, S.E.A. A walk of corporate sustainability towards sustainable development: A bibliometric analysis of literature from 2005 to 2021. Environ. Sci. Pollut. Res. 2022, 19, 1–12. [Google Scholar] [CrossRef]

- Peng, M.W.; Jiang, Y. Institutions Behind Family Ownership and Control in Large Firms. J. Manag. Stud. 2010, 47, 253–273. [Google Scholar] [CrossRef]

- Dinh, T.Q.; Calabrò, A. Asian Family Firms through Corporate Governance and Institutions: A Systematic Review of the Literature and Agenda for Future Research. Int. J. Manag. Rev. 2019, 21, 50–75. [Google Scholar] [CrossRef]

- Dias, C.S.; Rodrigues, R.G.; Ferreira, J.J. What’s New in the Research on Agricultural Entrepreneurship? J. Rural Stud. 2019, 65, 99–115. [Google Scholar] [CrossRef]

- Vieira, E.; Gomes, J. A Comparison of Scopus and Web of Science for a Typical University. Scientometrics 2009, 81, 587–600. [Google Scholar] [CrossRef]

- Mongeon, P.; Paul-Hus, A. The journal coverage of Web of Science and Scopus: A comparative analysis. Scientometrics 2016, 106, 213–228. [Google Scholar] [CrossRef]

- Ghani, N.A.; Teo, P.-C.; Ho, T.C.; Choo, L.S.; Kelana, B.W.Y.; Adam, S.; Ramliy, M.K. Bibliometric Analysis of Global Research Trends on Higher Education Internationalization Using Scopus Database: Towards Sustainability of Higher Education Institutions. Sustainability 2022, 14, 8810. [Google Scholar] [CrossRef]

- Ranjbari, M.; Esfandabadi, Z.S.; Zanetti, M.C.; Scagnelli, S.D.; Siebers, P.-O.; Aghbashlo, M.; Peng, W.; Quatraro, F.; Tabatabaei, M. Three pillars of sustainability in the wake of COVID-19: A systematic review and future research agenda for sustainable development. J. Clean. Prod. 2021, 297, 126660. [Google Scholar] [CrossRef]

- Wali, S.; Hannan, M.; Ker, P.J.; Rahman, A.; Mansor, M.; Muttaqi, K.; Mahlia, T.; Begum, R. Grid-connected lithium-ion battery energy storage system: A bibliometric analysis for emerging future directions. J. Clean. Prod. 2022, 334, 130272. [Google Scholar] [CrossRef]

- Xu, P.; Zhu, X.; Tian, H.; Zhao, G.; Chi, Y.; Jia, B.; Zhang, J. The broad application and mechanism of humic acids for treating environmental pollutants: Insights from bibliometric analysis. J. Clean. Prod. 2022, 337, 130510. [Google Scholar] [CrossRef]

- Van Eck, N.J.; Waltman, L. Vosviewer Manual; Univeristeit Leiden: Leiden, The Netherlands, 2013; Volume 1, pp. 1–53. [Google Scholar]

- Bhatt, Y.; Ghuman, K.; Dhir, A. Sustainable Manufacturing. Bibliometrics and Content Analysis. J. Clean. Prod. 2020, 260, 120988. [Google Scholar] [CrossRef]

- Bidari, G.; Djajadikerta, H.G. Factors influencing corporate social responsibility disclosures in Nepalese banks. Asian J. Account. Res. 2020, 5, 209–224. [Google Scholar] [CrossRef]

- Piwowar-Sulej, K.; Krzywonos, M.; Kwil, I. Environmental entrepreneurship—Bibliometric and content analysis of the subject literature based on H-Core. J. Clean. Prod. 2021, 295, 126277. [Google Scholar] [CrossRef]

- Reimann, F.; Rauer, J.; Kaufmann, L. Mne Subsidiaries’ Strategic Commitment to Csr in Emerging Economies: The Role of Administrative Distance, Subsidiary Size, and Experience in the Host Country. J. Bus. Ethics 2015, 132, 845–857. [Google Scholar] [CrossRef]

- Gereffi, G.; Lee, J. Economic and Social Upgrading in Global Value Chains and Industrial Clusters: Why Governance Matters. J. Bus. Ethics 2016, 133, 25–38. [Google Scholar] [CrossRef]

- Chen, G.; Firth, M.; Gao, D.N.; Rui, O.M. Ownership Structure, Corporate Governance, and Fraud: Evidence from China. J. Corp. Financ. 2006, 12, 424–448. [Google Scholar] [CrossRef]

- Chahine, S. Activity-based diversification, corporate governance, and the market valuation of commercial banks in the Gulf Commercial Council. J. Manag. Gov. 2007, 11, 353–382. [Google Scholar] [CrossRef]

- Jamali, D.; Safieddine, A.; Daouk, M. Corporate governance and women: An empirical study of top and middle women managers in the Lebanese banking sector. Corp. Gov. Int. J. Bus. Soc. 2007, 7, 574–585. [Google Scholar] [CrossRef]

- Chung, C.Y.; Kim, I.; Rabarison, M.K.; To, T.Y.; Wu, E. Shareholder litigation rights and corporate acquisitions. J. Corp. Financ. 2020, 62, 101599. [Google Scholar] [CrossRef]

- Baek, J.-S.; Kang, J.-K.; Park, K.S. Corporate governance and firm value: Evidence from the Korean financial crisis. J. Financ. Econ. 2004, 71, 265–313. [Google Scholar] [CrossRef]

- Cho, D.S.; Kim, J. Outside Directors, Ownership Structure and Firm Profitability in Korea. Corp. Gov. Int. Rev. 2007, 15, 239–250. [Google Scholar] [CrossRef]

- Agyei-Mensah, B.K. Internal control information disclosure and corporate governance: Evidence from an emerging market. Corp. Gov. Int. J. Bus. Soc. 2016, 16, 79–95. [Google Scholar] [CrossRef]

- Bhat, K.U.; Chen, Y.; Jebran, K.; Memon, Z.A. Board Diversity and Corporate Risk: Evidence from China. Corp. Gov. Int. J. Bus. Soc. 2019, 20, 280–293. [Google Scholar] [CrossRef]

- Chintrakarn, P.; Jiraporn, P.; Tong, S.; Chatjuthamard, P. Exploring the Effect of Religious Piety on Corporate Governance: Evidence from Anti-takeover Defenses and Historical Religious Identification. J. Bus. Ethics 2017, 141, 469–476. [Google Scholar] [CrossRef]

- Xie, L.; Chen, Z.; Wang, H.; Zheng, C.; Jiang, J. Bibliometric and Visualized Analysis of Scientific Publications on Atlantoaxial Spine Surgery Based on Web of Science and VOSviewer. World Neurosurg. 2020, 137, 435–442.e4. [Google Scholar] [CrossRef]

- Huang, Y.-J.; Cheng, S.; Yang, F.-Q.; Chen, C. Analysis and Visualization of Research on Resilient Cities and Communities Based on VOSviewer. Int. J. Environ. Res. Public Health 2022, 19, 7068. [Google Scholar] [CrossRef]

- Tanjung, M. A cross-firm analysis of corporate governance compliance and performance in Indonesia. Manag. Audit. J. 2020, 35, 621–643. [Google Scholar] [CrossRef]

- Shahrier, N.A.; Ho, J.S.Y.; Gaur, S.S. Ownership concentration, board characteristics and firm performance among Shariah-compliant companies. J. Manag. Gov. 2020, 24, 365–388. [Google Scholar] [CrossRef]

- Huang, X.; Kang, J.K. Geographic Concentration of Institutions, Corporate Governance, and Firm Value. J. Corp. Financ. 2017, 47, 191–218. [Google Scholar] [CrossRef]

- Ni, X.; Yin, S. The unintended real effects of short selling in an emerging market. J. Corp. Financ. 2020, 64, 101659. [Google Scholar] [CrossRef]

- Khan, M.; Lee, H.Y.; Bae, J.H. The Role of Transparency in Humanitarian Logistics. Sustainability 2019, 11, 2078. [Google Scholar] [CrossRef]

- Usman, O.; Yakubu, U.A. An investigation of the post-privatization firms’ financial performance in Nigeria: The role of corporate governance practices. Corp. Gov. Int. J. Bus. Soc. 2019, 19, 404–418. [Google Scholar] [CrossRef]

- Ali, R.; Sial, M.S.; Brugni, T.V.; Hwang, J.; Khuong, N.V.; Khanh, T.H.T. Does CSR Moderate the Relationship between Corporate Governance and Chinese Firm’s Financial Performance? Evidence from the Shanghai Stock Exchange (SSE) Firms. Sustainability 2019, 12, 149. [Google Scholar] [CrossRef]

- Cherian, J.; Umar, M.; Thu, P.A.; Nguyen-Trang, T.; Sial, M.S.; Khuong, N.V. Does Corporate Social Responsibility Affect the Financial Performance of the Manufacturing Sector? Evidence from an Emerging Economy. Sustainability 2019, 11, 1182. [Google Scholar] [CrossRef]

- Tahir, H.; Masri, R.; Rahman, M. Impact of board attributes on the firm dividend payout policy: Evidence from Malaysia. Corp. Gov. Int. J. Bus. Soc. 2020, 20, 919–937. [Google Scholar] [CrossRef]

- Khan, M.K.; Zahid, R.M.A.; Saleem, A.; Sági, J. Board Composition and Social & Environmental Accountability: A Dynamic Model Analysis of Chinese Firms. Sustainability 2021, 13, 10662. [Google Scholar] [CrossRef]

- Li, P.; Zhou, R.; Xiong, Y. Can ESG Performance Affect Bond Default Rate? Evidence from China. Sustainability 2020, 12, 2954. [Google Scholar] [CrossRef]

- Saeed, A.; Noreen, U.; Azam, A.; Tahir, M. Does CSR Governance Improve Social Sustainability and Reduce the Carbon Footprint: International Evidence from the Energy Sector. Sustainability 2021, 13, 3596. [Google Scholar] [CrossRef]

- Tulcanaza-Prieto, A.B.; Shin, H.; Lee, Y.; Lee, C.W. Relationship among CSR Initiatives and Financial and Non-Financial Corporate Performance in the Ecuadorian Banking Environment. Sustainability 2020, 12, 1621. [Google Scholar] [CrossRef]

- Wang, K.; Xue, K.-K.; Xu, J.-H.; Chu, C.-C.; Tsai, S.-B.; Fan, H.-J.; Wang, Z.-Y.; Wang, J. How Does a Staggered Board Provision Affect Corporate Strategic Change?—Evidence from China’s Listed Companies. Sustainability 2018, 10, 1412. [Google Scholar] [CrossRef]

- Ruan, L.; Liu, H. Environmental, Social, Governance Activities and Firm Performance: Evidence from China. Sustainability 2021, 13, 767. [Google Scholar] [CrossRef]

- Ma, T.; Jiang, M.; Yuan, X. Pay Me Later is Not Always Positively Associated with Bank Risk Reduction—From the Perspective of Long-Term Compensation and Black Box Effect. Sustainability 2019, 12, 35. [Google Scholar] [CrossRef]

- Wang, H.; Luo, T.; Tian, G.G.; Yan, H. How does bank ownership affect firm investment? Evidence from China. J. Bank. Financ. 2020, 113, 105741. [Google Scholar] [CrossRef]

- Sencal, H.; Asutay, M. Ethical Disclosure in the Shari’ah Annual Reports of Islamic Banks: Discourse on Shari’ah Governance, Quantitative Empirics and Qualitative Analysis. Corp. Gov. Int. J. Bus. Soc. 2020, 21, 175–211. [Google Scholar] [CrossRef]

- Utama, C.A.; Utama, S.; Amarullah, F. Corporate Governance and Ownership Structure: Indonesia Evidence. Corp. Gov. Int. J. Bus. Soc. 2017, 17, 165–191. [Google Scholar] [CrossRef]

- Chu, M.K.; Ho, Y.K.; Yeap, L.H. Tracking the development of audit committees in Singapore listed companies. Manag. Audit. J. 2021, 36, 770–784. [Google Scholar] [CrossRef]

- Katmon, N.; Al Farooque, O. Exploring the Impact of Internal Corporate Governance on the Relation between Disclosure Quality and Earnings Management in the UK Listed Companies. J. Bus. Ethics 2017, 142, 345–367. [Google Scholar] [CrossRef]

- Alsaadi, A. Can Inclusion in Religious Index Membership Mitigate Earnings Management? J. Bus. Ethics 2021, 169, 333–354. [Google Scholar] [CrossRef]

- Wang, T.; Jiao, H.; Xu, Z.; Yang, X. Entrepreneurial finance meets government investment at initial public offering: The role of minority state ownership. Corp. Gov. Int. Rev. 2018, 26, 97–117. [Google Scholar] [CrossRef]

- Mahmood, Z.; Kouser, R.; Ali, W.; Ahmad, Z.; Salman, T. Does Corporate Governance Affect Sustainability Disclosure? A Mixed Methods Study. Sustainability 2018, 10, 207. [Google Scholar] [CrossRef]

- Ikram, M.; Zhang, Q.; Sroufe, R.; Ferasso, M. The Social Dimensions of Corporate Sustainability: An Integrative Framework Including COVID-19 Insights. Sustainability 2020, 12, 8747. [Google Scholar] [CrossRef]

- Huang, J.-Y.; Shen, K.-Y.; Shieh, J.C.; Tzeng, G.-H. Strengthen Financial Holding Companies’ Business Sustainability by Using a Hybrid Corporate Governance Evaluation Model. Sustainability 2019, 11, 582. [Google Scholar] [CrossRef]

- Moshirian, F.; Tian, X.; Zhang, B.; Zhang, W. Stock Market Liberalization and Innovation. J. Financ. Econ. 2021, 139, 985–1014. [Google Scholar] [CrossRef]

- Jia, L.; Nam, E.; Chun, D. Impact of Chinese Government Subsidies on Enterprise Innovation: Based on a Three-Dimensional Perspective. Sustainability 2021, 13, 1288. [Google Scholar] [CrossRef]

- Lee, S.C.; Rhee, M.; Yoon, J. Foreign Monitoring and Audit Quality: Evidence from Korea. Sustainability 2018, 10, 3151. [Google Scholar] [CrossRef]

- Jiraporn, P.; Uyar, A.; Kuzey, C.; Kilic, M. What drives board committee structure? Evidence from an emerging market. Manag. Audit. J. 2019, 35, 373–397. [Google Scholar] [CrossRef]

- Xu, P.; Bai, G. Board Governance, Sustainable Innovation Capability and Corporate Expansion: Empirical Data from Private Listed Companies in China. Sustainability 2019, 11, 3529. [Google Scholar] [CrossRef]

- Lois, P.; Drogalas, G.; Nerantzidis, M.; Georgiou, I.; Gkampeta, E. Risk-Based Internal Audit: Factors Related to Its Implementation. Corp. Gov. Int. J. Bus. Soc. 2021, 21, 645–662. [Google Scholar] [CrossRef]

- Nasih, M.; Harymawan, I.; Paramitasari, Y.I.; Handayani, A. Carbon Emissions, Firm Size, and Corporate Governance Structure: Evidence from the Mining and Agricultural Industries in Indonesia. Sustainability 2019, 11, 2483. [Google Scholar] [CrossRef]

- Sakawa, H.; Watanabel, N. Institutional Ownership and Firm Performance under Stakeholder-Oriented Corporate Governance. Sustainability 2020, 12, 1021. [Google Scholar] [CrossRef]

- Ahsan, T.; Mirza, S.S.; Al-Gamrh, B.; Bin-Feng, C.; Rao, Z.-U. How to deal with policy uncertainty to attain sustainable growth: The role of corporate governance. Corp. Gov. Int. J. Bus. Soc. 2020, 21, 78–91. [Google Scholar] [CrossRef]

- Chen, I.-J.; Hasan, I.; Lin, C.-Y.; Nguyen, T.N.V. Do Banks Value Borrowers’ Environmental Record? Evidence from Financial Contracts. J. Bus. Ethics 2021, 174, 687–713. [Google Scholar] [CrossRef]

- Joh, S.W. Corporate governance and firm profitability: Evidence from Korea before the economic crisis. J. Financ. Econ. 2003, 68, 287–322. [Google Scholar] [CrossRef]

- Kim, J.B.; Li, Y.; Zhang, L. Cfos Versus Ceos: Equity Incentives and Crashes. J. Financ. Econ. 2011, 101, 713–730. [Google Scholar] [CrossRef]

- Liu, Q.; Lu, Z. Corporate governance and earnings management in the Chinese listed companies: A tunneling perspective. J. Corp. Financ. 2007, 13, 881–906. [Google Scholar] [CrossRef]

- Rahman, R.A.; Ali, F.H.M. Board, audit committee, culture and earnings management: Malaysian evidence. Manag. Audit. J. 2006, 21, 783–804. [Google Scholar] [CrossRef]

- Jizi, M.I.; Salama, A.; Dixon, R.; Stratling, R. Corporate governance and corporate social responsibility disclosure: Evidence from the US banking sector. J. Bus. Ethics 2014, 125, 601–615. [Google Scholar] [CrossRef]

- Chen, K.C.; Chen, Z.; Wei, K.J. Legal Protection of Investors, Corporate Governance, and the Cost of Equity Capital. J. Corp. Financ. 2009, 15, 273–289. [Google Scholar] [CrossRef]

- Park, Y.W.; Shin, H.-H. Board composition and earnings management in Canada. J. Corp. Financ. 2004, 10, 431–457. [Google Scholar] [CrossRef]

| Year | No. of Articles | No. of Countries Contributing | No. of Citations | Popular Keywords |

|---|---|---|---|---|

| 2012 | 23 | 18 | 539 | Corporate governance; audit committee; board structure; forward-looking information; director |

| 2013 | 30 | 21 | 588 | Corporate governance; board of director; emerging markets; disclosure; economic development |

| 2014 | 45 | 28 | 681 | Corporate governance; governance approach; corporate social responsibility; sustainability; corporate strategy |

| 2015 | 50 | 28 | 531 | Corporate governance; governance approach; board of director; corporate strategy; firm performance |

| 2016 | 50 | 25 | 381 | Corporate governance; governance approach; board of director; corporate social responsibility; sustainability |

| 2017 | 33 | 22 | 186 | Corporate governance; governance approach; corporate social responsibility; corporate strategy; sustainability |

| 2018 | 40 | 29 | 171 | Corporate governance; governance approach; corporate strategy; sustainability; corporate social responsibility |

| 2019 | 58 | 28 | 164 | Corporate governance; corporate strategy; governance approach; Corporate social responsibility; innovation |

| 2020 | 93 | 24 | 108 | Corporate governance; governance approach; sustainability; corporate strategy; firm size |

| 2021 | 59 | 24 | - | Corporate governance; financial crisis; board of director; earnings management; firm performance |

| No. | Journal Name | No. of Articles | % | First Article Published | Cited by | H-Index | SJR |

|---|---|---|---|---|---|---|---|

| 1. | Corporate Ownership & Control | 130 | 19.82% | 2008 | 382 | 21 | N/A |

| 2. | Corporate Governance (Bingley) | 130 | 19.82% | 2005 | 1.879 | 64 | 0.85 (Q1) |

| 3. | Sustainability (Switzerland) | 119 | 18.14% | 2007 | 913 | 109 | 0.66 (Q1) |

| 4. | Corporate Governance: An International Review | 79 | 12.04% | 2005 | 2.718 | 91 | 1.18 (Q1) |

| 5. | Journal of Corporate Finance | 59 | 8.99% | 2001 | 3.375 | 109 | 2.1 (Q1) |

| 6. | Journal of Business Ethics | 46 | 7.01% | 2003 | 1.879 | 208 | 2.44 (Q1) |

| 7. | Managerial Auditing Journal | 40 | 6.10% | 2003 | 1.486 | 61 | 0.45 (Q2) |

| 8. | Journal of Banking and Finance | 27 | 4.12% | 2005 | 1.030 | 172 | 1.47 (Q1) |

| 9. | Journal of Management & Governance | 16 | 2.44% | 2003 | 183 | 53 | 0.58 (Q2) |

| 10. | Journal of Financial Economics | 10 | 1.52% | 2001 | 2013 | 27 | 10.42 (Q1) |

| Rank | Author | H-Index | No. of Published Articles | First Article Published | Most Cited Article Title (Number of Citations) |

|---|---|---|---|---|---|

| 1 | Lee J. | 7 | 8 | 2004 | Economic and Social Upgrading in Global Value Chains and Industrial Clusters: Why Governance Matters [44] (247) |

| 2 | Chahine S. | 18 | 7 | 2007 | Activity-based diversification, corporate governance, and the market valuation of commercial banks in the Gulf Commercial Council [46] (16) |

| 3 | Safieddine A. | 15 | 6 | 2007 | Corporate governance and women: An empirical study of top and middle women managers in the Lebanese banking sector [47] (38) |

| 4 | Chung C. Y. | 12 | 6 | 2017 | Shareholder litigation rights and corporate acquisitions [48] (6) |

| 5 | Kang J.-K. | 30 | 5 | 2002 | Corporate governance and firm value: Evidence from the South Korean financial crisis [49] (414) |

| 6 | Kim J. | 2 | 5 | 2006 | Outside director, ownership structure and firm profitability in South Korea [50] (90) |

| 7 | Agyei-Mensah B. K. | 7 | 5 | 2010 | Internal control information disclosure and corporate governance: evidence from an emerging market [51] (30) |

| 8 | Chen Y. | 6 | 5 | 2013 | Board diversity and corporate risk: evidence from China [52] (19) |

| 9 | Jiraporn P. | 25 | 5 | 2014 | Exploring the Effect of Religious Piety on Corporate Governance: Evidence from Anti-takeover Defenses and Historical Religious Identification [53] (15) |

| 10 | Firth M. | 49 | 4 | 2001 | Ownership structure, corporate governance, and fraud: Evidence from China [45] (461) |

| Rank | Institutions | Location | No. of Articles | No. of Citations | First Publication |

|---|---|---|---|---|---|

| 1 | Olayan School of Business, American University of Beirut | Lebanon | 5 | 59 | 2009 |

| 2. | School of Accounting, Dongbei University of Finance and Economics | China | 4 | 69 | 2013 |

| 3. | Department of Finance and Accounting, Solbridge International School of Business | South Korea | 4 | 46 | 2012 |

| 4. | School of Management, Harbin Institute of Technology | China | 4 | 26 | 2015 |

| 5. | College of Business Administration, Kookmin University | South Korea | 4 | 14 | 2017 |

| 6. | School of Business Administration, College of Business and Economics, Chung-Ang University | South Korea | 4 | 14 | 2017 |

| 7. | National Taiwan University | Taiwan | 3 | 112 | 2007 |

| 8. | Lee Kong Chian School of Business, Singapore Management University | Singapore | 3 | 110 | 2008 |

| 9. | Department of Accounting, National Dong Hwa University | China | 3 | 68 | 2013 |

| 10. | Bang College of Business, Kimep University | Kazakhstan | 3 | 66 | 2009 |

| Rank | Country | No. of Article | % Out of 656 | No. of Citations | First Publication |

|---|---|---|---|---|---|

| 1 | China | 147 | 22.41% | 4108 | 2001 |

| 2 | South Korea | 92 | 14.02% | 3126 | 2001 |

| 3 | Malaysia | 75 | 11.43% | 1660 | 2003 |

| 4 | Taiwan | 69 | 10.52% | 1429 | 2006 |

| 5 | Hong Kong | 49 | 7.47% | 3251 | 2001 |

| 6 | India | 32 | 4.88% | 561 | 2005 |

| 7 | Singapore | 30 | 4.57% | 852 | 2005 |

| 8 | Lebanon | 30 | 4.57% | 605 | 2003 |

| 9 | Pakistan | 27 | 4.12% | 393 | 2007 |

| 10 | United Arab Emirates | 26 | 3.96% | 470 | 2004 |

| Cluster No. | Main Theme | Articles | Keywords |

|---|---|---|---|

| 1 | Corporate Governance | [8,56,57,58,59,60,61] | Board characteristic, CEO turnover, compliance, corporate governance, corporate governance index, emerging market, executive compensation, family firm, firm performance, government ownership, independent director institutional investor, investor protection, ownership concentration, ownership structure, privatization, state-owned enterprise, transparency, voluntary disclosure |

| 2 | Corporate Social Responsibility and Financial Performance | [52,62,63,64,65,66,67,68] | Board composition, board diversity, board gender diversity, board independence, board size, CEO duality, corporate social performance, corporate social responsibility, environmental economics, financial performance, firm value, numerical model, organizational performance, performance assessment, regression analysis, risk assessment |

| 3 | Corporate Strategy and Performance | [69,70,71,72,73] | Banking, business development, capital market, corporate performance, corporate strategy, equity, ethic, industrial enterprise, industrial performance, industrial policy, investment, market condition, perception, research work |

| 4 | Agency Theory | [74,75,76,77,78] | Agency theory, audit committee, board of director, CEO, corporate ownership, disclosure, earnings management, financial reporting, governance, initial public offering, intellectual capital, ownership, performance, shareholder |

| 5 | Corporate Sustainability | [71,79,80,81,82,83] | Corporate sustainability, COVID-19, decision making, empirical analysis, financial system, governance approach, innovation, management practice, market system, stock market, strategic approach, sustainability, sustainable development |

| 6 | Audit and Agency Problem | [48,84,85,86,87] | Agency problem, audit fee, audit quality, board structure, emerging economy, family ownership, financial crisis, incentive, internal audit, risk management |

| 7 | Firm Size | [88,89,90] | Family control, firm size, panel data, policy making, spatiotemporal analysis, stakeholder |

| 8 | Business Ethic | [91] | Business ethic |

| No | Reference/Citation/Journal | Aim of the Study |

|---|---|---|

| 1 | Chen, Firth [45]/461/Journal of Corporate Finance | To examine and obtain information on whether ownership structure and governance mechanisms (boardroom characteristics, ownership, and audit) influence company fraud in China. |

| 2 | Joh [92]/453/Journal of Financial Economics | To find out if a company’s ownership structure has affected pre-crisis performance. |

| 3 | Baek, Kang [49]/414/Journal of Financial Economics | To explore the importance of company governance measures in confirm the worth of the corporate throughout a crisis. |

| 4 | Kim, Li [93]/379/Journal of Financial Economics | To investigate whether the equity preferences of the CEO and the CFO are related to the risk of a particular company’s stock market crash. |

| 5 | Liu and Lu [94]/341/Journal of Corporate Finance | To explore the correlation between profit management and corporate governance in listed companies in China by introducing the tunnel perspective. |

| 6 | Rahman and Ali [95]/326/Managerial Auditing Journal | To investigate the relationship between revenue management and corporate governance characteristics, 97 board and audit committee characteristics on the main board of the Malaysian Stock Exchange from 2002 to 2003 were listed. |

| 7 | Jizi, Salama [96]/313/Journal of Business Ethics | To study the impact of corporate governance, particularly regarding the role of the board of directors, on the quality of CSR disclosure in the annual reports of listed banks in the United States after the lending crisis. Subprime mortgages in the United States. |

| 8 | Chen, Chen [97]/288/Journal of Corporate Finance | To examine the impact of corporate-level governance on the cost of equity in emerging markets and how affected by legal protections from investors at the national level. |

| 9 | Park and Shin [98]/272/Journal of Corporate Finance | To examine the impact of board composition on the management of Canadian revenue practices. |

| 10 | Gereffi and Lee [44]/247/Journal of Business Ethics | To understand how CSR relates to industry clusters and document GVCs by highlighting the following:

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wahyuningrum, I.F.S.; Chegenizadeh, A.; Humaira, N.G.; Budihardjo, M.A.; Nikraz, H. Corporate Governance Research in Asian Countries: A Bibliometric and Content Analysis (2001–2021). Sustainability 2023, 15, 6381. https://doi.org/10.3390/su15086381

Wahyuningrum IFS, Chegenizadeh A, Humaira NG, Budihardjo MA, Nikraz H. Corporate Governance Research in Asian Countries: A Bibliometric and Content Analysis (2001–2021). Sustainability. 2023; 15(8):6381. https://doi.org/10.3390/su15086381

Chicago/Turabian StyleWahyuningrum, Indah Fajarini Sri, Amin Chegenizadeh, Natasya Ghinna Humaira, Mochamad Arief Budihardjo, and Hamid Nikraz. 2023. "Corporate Governance Research in Asian Countries: A Bibliometric and Content Analysis (2001–2021)" Sustainability 15, no. 8: 6381. https://doi.org/10.3390/su15086381

APA StyleWahyuningrum, I. F. S., Chegenizadeh, A., Humaira, N. G., Budihardjo, M. A., & Nikraz, H. (2023). Corporate Governance Research in Asian Countries: A Bibliometric and Content Analysis (2001–2021). Sustainability, 15(8), 6381. https://doi.org/10.3390/su15086381