1. Introduction

State-owned Enterprises (SOEs) have been dominating the Chinese market for decades, where firms are sponsored or administered by state agencies at the various levels of the government [

1,

2]. However, several reforms opened the Chinese market for both private and foreign investors in the past few decades, when China first introduced State-owned Enterprises to replace government ministries [

3,

4]. Hence, China launched Shanghai and Shenzhen stock exchanges in the early 1990s to allow private and institutional investors to enter the financial market, creating non-state-owned enterprises to exist on a split-share structure basis. The SSSR in 2005 came to empower the free market control over listed firms and to restructure SOEs to finalise China’s open market policy [

5,

6]. After the SSSR was executed in 2009, China moved to develop the domestic accounting profession by issuing “Document 56”, which included empirical steps to accelerate the development of the domestic accounting industry [

7,

8] to create capable accounting firms that can provide audit services comparable with the well-known Big 4 audit firms [

7,

9] along with a set of medium and small audit firms that can provide audit services to firms of different sizes in China.

This study examines the role of the SSSR in sustaining auditor independence in China. In more developed markets (e.g., in the UK and the USA), the propensity that an auditor will issue a qualified auditor opinion (e.g., to report any material misstatements in the financial statements when they are detected) is used as a surrogate for auditor independence sustainability. Hence, the research design for these studies designs a qualitative response model that estimates the propensity to issue an MAO relative to a standard unqualified auditor opinion to indicate higher auditor independence sustainability. In particular, our study explores the structural reforms in the Chinese financial market during the study period, which created a unique institutional environment.

Different from more capitalist economies (i.e., the UK and the USA), the ownership in the Chinese stock market is not diffused. In contrast, the state in China exerts some type of control over most listed firms [

1,

2], where many of the Chinese listed firms are either sponsored or administered by state agencies at various levels of the government. Several studies highlight how this market structure affects the accounting profession in China [

4,

10,

11]. In particular, they argue that State-owned Enterprises (SOEs) can affect small audit firms’ reports to their benefit (i.e., a collusion between the state agencies and small audit firms). This ownership structure dominated by the state, however, has been changing since China started its third wave of privatisation through the SSSR in 2005.

To investigate the conjectures, we use the propensity to issue an MAO to act as a surrogate for auditor independence sustainability. Although firms can dodge MAOs using the flexibility of the accounting standards [

4,

12,

13], doing so might affect how investors, creditors and, regulators look at the company’s profile. Hence, initially, we run Binary Logistic Regression (BLR) capturing the determinants of MAOs, with one group representing MAOs (i.e., unqualified auditor opinion with an emphasis of matter paragraph, qualified auditor opinion, adverse opinion, or a disclaimer of opinion), and the other being a standard unqualified auditor opinion. The higher propensity to issue an MAO, when appropriate, indicates higher auditor independence sustainability. We also investigate whether an MAO is translated by an auditor qualification or by attaching an emphasis of matter paragraph to a clean audit report, unlike in previous literature that used a binary outcome for auditor report [

14,

15,

16,

17]. To investigate this issue, we run a multinomial logistic regression model (MLR) that allows a comparison between three types of auditor opinion (i.e., standard unqualified auditor opinion, unqualified auditor opinion with an emphasis of matter paragraph and any other type of MAOs). The distinction between these three types of auditor opinion is important to show if ownership type (i.e., LSOE or NSOE) affects the type of MAO given to the firm (i.e., emphasis of matter paragraph, qualified opinion, an adverse opinion, or a disclaimer of opinion).

The empirical results show that the auditors of LSOEs exhibit lower auditor independence sustainability compared with the auditors of NSOEs. Big 10 auditor choice (both the international Big 4 and the domestic Big 6) does not seem to affect the relative probability that NSOEs will receive an MAO. However, it moderates the influence of LSOEs on auditor independence sustainability. We also notice an increase in MAOs in the period after the SSSR. This improvement in auditor independence sustainability is only translated by a higher likelihood of issuing an unqualified auditor opinion with an emphasis of matter paragraph instead of an audit qualification.

This study contributes to auditor independence sustainability literature in two ways. First, it helps in understanding how the institutional environment of the firm affects the independence of its auditor. Also, it helps regulators evaluate how the new rules and regulations (i.e., the SSSR) help sustain auditor independence. The remainder of the paper proceeds as follows.

Section 2 introduces relevant literature and develops the research hypotheses.

Section 3 introduces the research methodology, while data details are presented in

Section 4. The results are discussed in

Section 5, and

Section 6 concludes the study.

2. Literature Review and Hypotheses Development

The demand for external audit services is a consequence of the agency problem arising between the owners of a firm and its management due to the separation between management and ownership [

18,

19]. Auditors play an external oversight role in ensuring that the financial statements are prepared per the accounting standards. To do so, they are required to issue an auditor opinion to assert that, based on the acquired evidence, the financial statements are reliable, and the firm will be able to achieve the going concern accounting convention [

20,

21,

22]. Hence, the auditor of the firm should become familiar with the client’s business, assess its management decisions, check internal control procedures, and obtain evidence that the client’s financial statements are being under the accounting standards [

23].

As a result, auditors can provide one of the three types of auditor opinions: an unqualified opinion to confirm that their investigation does not identify any material misstatement in the financial statements provided. Alternatively, in some cases, the auditor can issue an emphasis of matter statement to highlight some concerns related to the firm’s ability to accomplish the going concern convention (i.e., pending lawsuits). Or, in more severe scenarios, the auditor can issue an audit qualification, adverse opinion or disclaimer of opinion. Consistent with a higher audit quality be defined as “greater assurance that the financial statements faithfully reflect the firm’s underlying economics, conditioned on its financial reporting system and innate characteristics” [

24]. The propensity to issue an MAO, when appropriate, indicates the sustainability of the independence part of audit quality (i.e., the audit firm will report any material misstatement if detected) [

18,

19].

In the US context, Francis [

25] argues that MAOs only matter when the auditor is providing a high-quality audit. As a result, an audit qualification report would not necessarily cause a bad reaction from investors compared to an MAO issued by a high-quality audit firm. Audit opinion research can be summarised into studies that investigate how audit-specific variables (i.e., audit firm size, audit report lag and audit tenure) and client-specific variables (i.e., client size, client profitability and client risk) affect MAOs [

23]. For instance, DeFond et al. [

26] used auditor propensity to issue an MAO as a surrogate for auditor independence sustainability and studied how audit-specific variables, in particular, total audit fees and non-audit fees, affected auditor independence for 1158 financially distressed US listed firms. In their study, they argued that market-based institutional incentives (i.e., litigation risk and loss of reputation) outweigh the benefits of compromising audit independence by charging higher audit fees, and they found no association between audit fees or non-audit fees with the propensity to issue an MAO.

Lai [

27] examined how regulations limiting non-audit services can help sustain auditor independence using the propensity to issue an MAO as a proxy for sustaining auditor independence. In his study, he investigated the association between the passing of the Sarbanes-Oxley Act in July 2002 and auditors’ propensity to issue MAOs. Using a sample of 12,115 firm-year observations in the period 2000 to 2002, he finds an increase in the likelihood of issuing an MAO after the passing of the Act. The results are also robust to the use of discretionary accruals as an alternative proxy for audit quality, confirming that auditors became more conservative after the passing of the Act. Hence, the Sarbanes-Oxley Act has improved auditor independence sustainability by limiting the scope of non-audit fee services.

Among the early studies that examined auditor independence sustainability and market deregulation in China, Gul et al. [

16] investigated the Auditor Disaffiliation Programme that was executed between 1997 and 1998 to eliminate the subscription of audit firms to the local governments. The disaffiliation programme aimed to sustain auditor independence in China. By studying a sample of 1248 Chinese listed firms through the period 1995 to 2000, they found that, after the completion of the disaffiliation programme, the likelihood of receiving MAOs increased substantially. They also report that this effect was more pronounced amongst small audit firms rather than big reputable audit firms (i.e., the Big 10 audit firms).

With regards to regulations that aim to limit management opportunistic behaviours and sustain auditor independence in China, Chi et al. [

28] studied the effect of two rules in 2004 issued by China’s State-owned Assets Supervision and Administration Commission (SASAC). First, the SASAC is responsible for assigning the auditor for CSOEs, and secondly, these firms should retain the assigned auditor for a minimum of two years and a maximum of five years. The new rules, affecting only CSOEs, allow them to study the impact of these regulations on audit quality. They found that the new rules enhance audit quality for CSOEs compared to other firms, using abnormal accruals and the propensity to receive MAOs as proxies for a higher-quality audit.

DeFond et al. [

14] also studied China’s structural reforms to the audit profession in the 1990s, when the Ministry of Finance (MOF) started to establish legal penalties for standards violations and, second, it issued new disclosure rules and regulations regarding the format of the annual reports and accounting consolidations that limit managers’ use of discretions. Using a sample of 1286 firm-year observations for the period 1993 to 1996, they find that the new regulations enhanced auditor independence sustainability using MAOs as a proxy for higher auditor independence sustainability. Although the propensity to issue a qualified audit opinion, when appropriate, was found to be associated with higher audit independence, DeFond et al. [

14] reported a “flight from quality” behaviour by Chinese firms after the adoption of new regulations, where firms will tend to avoid higher quality audit firms in the periods of IPO.

Chen et al. [

12] further investigated the effects of profitability regulations on management opportunistic behaviour and the role of audit quality, measured by the propensity to issue an MAO, to study whether firms tend to manipulate financial reports to meet stock de-listing targets, or in cases of IPO. Using a sample of 1521 firm-year observations during the period 1995 to 1997, they find that firms engaging in earnings management activities are more likely to receive MAOs. Chen et al. [

3] also examined the impact of legal and regulatory changes that increase litigation and sanction risks by auditors on audit quality. The regulations they studied state that auditors are required to sign audit reports according to China’s Independent Auditing Standard (CIAS) and that two Certified Public Accountants (CPAs) must sign the audit report and specify those responsible for the audit performed and, hence, responsible for regulatory sanctions related to audit failure.

They found that audit quality, measured by the propensity to issue MAOs, has increased because of these legal and regulatory changes, using a sample of 8917 firm-year observations for the period from 1995 to 2004. Firth et al. [

29] also investigated the effect of regulations that affect auditor tenure on audit quality. In particular, they investigated how the different forms of auditor rotation (i.e., mandatory auditor rotation and voluntary auditor rotation) affected audit quality in China. Their initial sample included 9761 firm-year observations over the period 1997 to 2005, and they found that auditor independence for mandatory auditor rotation firms is higher compared with no-rotation firms.

Despite the rich literature on auditor independence in China, a common characteristic of previous studies is that they focus on the overall effect of new regulations on enhancing auditor independence sustainability in China. Nevertheless, they do not consider the setting of the Chinese financial market and its reforms. Previous literature on audit regulations that aim to limit opportunistic management behaviours [

3,

12,

29] does not include variables that control for state ownership in their estimation models. Another characteristic of previous literature on auditor independence sustainability in China is that it does not generally distinguish between big and small audit firms, and if it does so, it does not distinguish between big international and domestic audit firms. Finally, other than [

29], regulations affecting auditor independence in China are considered to have the same effect across China’s different regions.

This study, however, considers China’s state capitalism and how its reforms (i.e., the SSSR) impact auditor independence sustainability. Considering the potential influence of the state over auditors’ reports in the case of LSOEs through political connections [

4,

10,

30], the Hypothesis 1 can be formed as follows:

Hypothesis 1. Ceteris paribus, the auditors of LSOEs exhibit lower auditor independence compared with auditors of NSOEs in China.

We then conjecture that auditor independence sustainability in China will improve subsequent to the SSSR. Also, LSOEs who maintained control after the completion of the reform will also sustain auditor independence. This is due to the change in share nature after the agreement on the SSSR for each firm; in particular, the state shares will become tradable when the SSSR is considered completed, which will be followed by the actual sale of shares depending upon the signed agreement between the major tradable shareholders of each firm and the state. Doing so will, presumably, push the state to act more as NSOEs; therefore, the need for high-quality external assurance that the financial statements of the firm are fairly presented might apply to both LSOEs and NSOEs equally. Hence, the Hypothesis 2 can be formed in two parts:

Hypothesis 2. Ceteris paribus, auditor independence improves after the completion of the SSSR.

3. Methodology

The definitions of variables used in this study are presented in

Table 1. We estimate a qualitative response model, which models the determinants of auditor independence following previous literature [

3,

12,

23,

26,

29,

31] to test the hypotheses regarding auditor independence. We classify firms as LSOE if the state meets one of the following. (i) the one with the maximum shareholding in the shareholder list of listed companies unless opposite evidence exists; (ii) the one who can execute and control superior voting rights than the shareholder with the maximum shareholding of a listed company; (iii) the one who holds and controls 30 percent or above of shares and voting rights unless opposite evidence exists; (iv) the one who can decide the election of over half of members of the board of directors of a listed company by executing voting rights; or (v) the one who is under other circumstances as the stipulations of CSRC (CSMAR, China Listed Firm’s Shareholders Research Database user guide. We also include control variables related to firm characteristics that impact the propensity that a firm will receive an MAO [

4,

9,

10,

12], as illustrated in

Table 1. All continuous variables are winsorised at the top and bottom 1% to limit extreme values.

We add industry dummies to control for industry-fixed effects and the differences across regions. Then, we run BLRs to investigate the factors impacting auditor independence in China, using the propensity to receive an MAO as a surrogate for sustaining auditor independence. In the estimation response model, we compare between standard unqualified auditor opinions and all other types of MAOs where the likelihood of receiving an MAO, when appropriate, will indicate higher auditor independence. Where in China, an auditor can issue an unqualified auditor opinion with emphasis of matter paragraph to indicate any significant events (i.e., pending lawsuits) that might affect the firm [

17]. Hence, we include unqualified auditor opinion with emphasis of matter paragraph in the class of MAOs and in a separate class in our analyses.

We then introduce some interaction terms between the experimental variables to test the research hypotheses. We also allow a more detailed comparison between auditor opinions (i.e., standard unqualified, unqualified with an emphasis of matter paragraph and other types of MAOs) to investigate whether auditor independence sustainability is translated through audit qualification or by only attaching an emphasis of matter paragraph to an unqualified auditor opinion. To do this, we rerun the estimation models using an MLR model that allows for the three-group comparison we need. Therefore, we start with running a simple regression that does not incorporate the impact of the SSSR.

Equation (2) introduces the effects of the SSSR on auditor independence sustainability without distinguishing between unqualified audit opinion with emphasis of matter paragraph and other qualified audit opinions. This provides a benchmark of the overall effect of the SSSR on audit independence.

We then run multinomial logit regressions (MLRs) to analyse three possible outcomes of the auditor report (i.e., standard unqualified, unqualified with emphasis of matter paragraph and other qualified auditor opinions) via which we can investigate whether audit firms would rather issue an unqualified audit opinion with an emphasis of matter paragraph instead of an audit qualification.

The main source of data is China Stock Market and Accounting Research (CSMAR) database. We covered 13,549 firm-year observations in the analysis during the SSSR period.

Table 2 summarises the sample selection process where to maintain a homogeneous sample, it is restricted to non-financial firms with no B-shares or H-shares. The SASAC issued two rules in 2004 regarding CSOEs’ auditor choice, and hence, CSOEs were excluded from the study sample.

Table 3 shows that, on average, 95% of audit opinions are standard unqualified auditor opinions, which is a common characteristic of the Chinese audit market. The table also shows a jump in the number of MAOs in the years after the structural reforms. On average, LSOEs receive fewer MAOs compared with NSOEs. This might be due to better accounting quality for LSOEs, in that they have less pressure to engage in earnings management behaviours to achieve IPO goals or to avoid de-listing regulations through their use of political connections [

4,

10,

11,

12].

Table 4 shows the descriptive statistics where we provide summary statistics for the study sample in

Appendix A for the variables we use in the analysis. It summarises the mean value for each variable in each year to show the changes over time. It also distinguishes between LSOEs and NSOEs. On average, NSOEs receive more MAOs compared with SOEs, especially in the period before the SSSR. This suggests lower auditor independence sustainability for LSOEs, or it reflects the lower earnings management incentives for LSOEs [

12].

The results show that despite the unchanged market share of the international Big 4 audit firms, the domestic Big 6 audit firms’ market share has increased significantly after the structural reforms. The percentage of LSOEs, however, shows a continuous drop throughout the sample period, reaching 35% of total firms after the SSSR, while it was almost 70% of all firms before the SSSR was introduced and executed. The other control variables for firm characteristics that are thought to act as determinants of the likelihood of MAOs being issued in the prior literature and theory show no particular trends over time. We can note that, on average, LSOEs have bigger firm size, higher sales growth, profitability and leverage, and lower audit risk, relative to NSOEs.

Table 5 reports the Pearson Correlation Matrix, which shows the relationships between the independent variables we are using in the analysis. We calculated the variance inflation factor (VIF), and it shows no problematic correlations between the variables used as all values lie below 10 [

9,

30]. Hence, this suggests no multicollinearity problems in the regression analyses discussed later in this section.

4. Results

The BLR results are presented in

Table 6. The dependent variable is MAOs (i.e., unqualified auditor opinion with an emphasis of matter paragraph, a qualified auditor opinion, an adverse opinion or a disclaimer) as a surrogate for auditor independence sustainability. The estimates for the BLR in Model 1 summarise the determinants of MAOs in China ignoring the structural reforms. The results show that LSOEs are less likely to receive an MAO compared with NSOEs. Although the results fail to show an influence of Big 10 auditor choice (both the international Big 4 and the domestic Big 6) on auditor independence sustainability, it moderates the negative impact of LSOEs on MAO issuance.

These findings support the argument that LSOEs appoint small audit firms over which they can exert political power to affect their audit opinion [

4,

10,

11]. The results fail to report an impact of MDI on auditor independence sustainability, as the coefficients are not statistically significant. This implies that the prediction that market development improves auditor independence sustainability is unfounded. Hence, Wong’s [

1] claim that China’s legal environment (i.e., application of courts) is weak persists.

Regarding the other variables that control for firm characteristics that affect the propensity to receive an MAO, consistent with previous literature, we find a negative association between MAOs and a firm’s size, profitability (ROA) and liquidity (Current Ratio). Moreover, a positive association between MAOs and reporting losses and leverage [

12,

28] also exists. For receivables and inventories to total assets, however, we find a negative association with MAO, which might be explained by the lower tendency of Chinese firms to use inventories to manipulate accounting data following [

12]. This means that higher receivables and inventories do not imply higher risk (i.e., does not accurately measure operational complexity), which might lead auditors to issue an MAO.

To test how the structural reforms affect auditor independence sustainability in China, Models 2 and 3 provide estimates that include the individual effect of each event on auditor independence and how they moderate the LSOEs’ effect on auditor independence, respectively. This allows comparing auditor independence sustainability in China in three periods, before SSSR, after SSSR and before Document 56, and lastly, after the structural reforms. Model 2 reports a decrease in the likelihood of receiving an MAO in the period after the SSSR but before Document 56. In that period, most of the Chinese firms were in the process of completing the SSSR. To explain this tendency, we argue that Chinese firms, during the SSSR period, do not seem to have the incentive to manipulate financial data. This is because, during this transition period, the sale of the non-tradable shares owned by the state is based on a consensus price between tradable- and non-tradable-shares shareholders and not based on market value.

After the structural reforms, we notice an increase in the number of MAO, implying that, in the period after 2009, when Document 56 was issued, the incentives to manipulate accounting data might be the same for both LSOEs and NSOEs, which is reflected in a general increase in the likelihood to issue an MAO. Model 3 investigates whether the structural reforms moderate the effect of LSOEs on auditor independence. There seems to be no incremental effect of state influence on MAOs in the periods after the structural reforms.

In

Table 7, we compare three types of audit opinions. The standard unqualified auditor opinion is the base outcome, and we compare it with unqualified auditor opinion with an emphasis of matter paragraph and other types of MAO (i.e., qualified auditor opinion, adverse opinion, and a disclaimer of opinion). By doing so, we test whether the BLRs’ higher auditor independence sustainability results are translated through audit qualifications or by merely adding an explanatory note to an unqualified audit opinion. Model 1 shows that auditors of LSOEs are less likely to issue either a qualified auditor opinion, adverse opinion, or disclaimer of opinion compared with auditors of NSOEs. This result is not observed for the likelihood of issuing an unqualified auditor opinion with an emphasis of matter paragraph relative to standard unqualified audit opinion.

The results also show that if a Big 10 audit firm is appointed, this will, if only slightly, increase the likelihood that an unqualified auditor opinion with an emphasis of matter paragraph will be issued. Model 2 tests the impact of structural reforms on auditor independence sustainability using the three types of audit opinions. The results report a decrease in the propensity to issue a qualified auditor opinion, adverse opinion, or disclaimer of opinion compared with unqualified auditor opinions in the period after the SSSR. The results, however, show an increase in all types of MAOs in the period after the structural reforms reflecting an improved auditor independence sustainability.

Finally, in Model 3, we add interaction terms between the structural reforms and state influence (LSOE). The results fail to show that LSOEs’ impact on auditor independence has changed after these structural reforms. This suggests that auditor independence in China remains under sustainable development. The efforts through the structural reforms that aim to boost free market strategy in the country might still need more legal enforcement to take effect for all listed firms (i.e., LSOEs and NSOEs) to the level that auditors will independently issue an audit qualification to any type of firms when appropriate.

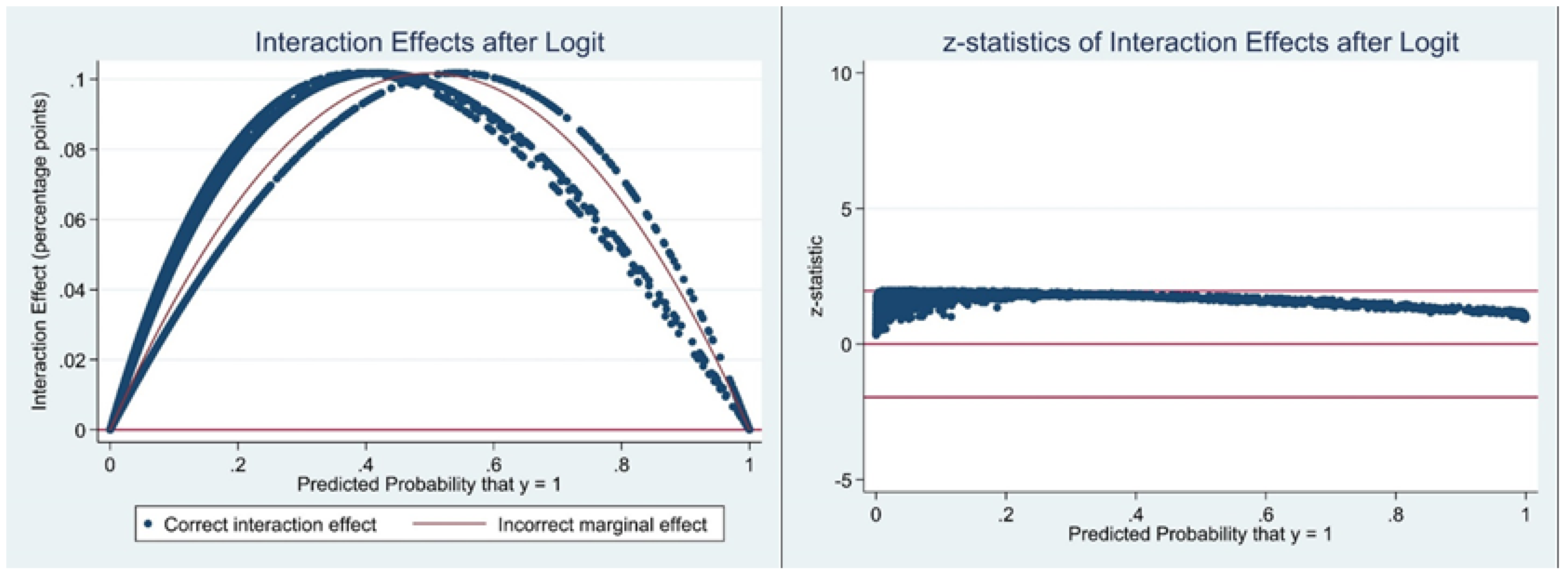

As a robustness test, this study employs dynamic models to investigate the interaction effects following [

32,

33]. To do so, the STATA command ‘inteff’ is used. This command considers the nonlinear nature of the logit regression and derives the standard errors for the interaction effect by applying the Delta method proposed by [

32]. In particular, this command allows the interaction effects to vary for each observation based on the predicted probability that the dependent variable equals one. Hence, we present the results of the magnitude and the significance of the interaction effects in graphs for each of the interaction terms that were used in the analysis.

Figure 1 shows the interaction effect for ‘LSOE. SSSR’ is positive. Nonetheless, the interaction effect is only slightly significant when the propensity to issue an MAO is relatively low. This implies that the SSSR increases the probability that LSOEs will receive an MAO when the predicted probability for MAOs is small.

Figure 2, similarly, shows the interaction effect for ‘LSOE. Document 56 is positive. However, the interaction effect becomes slightly significant when the propensity to issue an MAO is relatively high. Hence, the Document 56 announcement increased the probability that LSOEs will receive an MAO in cases when the predicted probability for MAOs is already very high.

The use of graphs to present interaction effects, both the magnitude and the significance level, produces more accurate estimates compared with testing the coefficient of the interaction term [

32,

33]. Therefore, the estimates in this section, accompanied by the results presented early in this paper, provide an important comparison and investigation of the main interaction terms used in this study.

5. Discussion and Implications

Financial scandals and audit failures in the past few decades put increased pressure on governments to monitor and oversight businesses. This study examined the role of privatisation in sustaining auditor independence in China. Two key reforms were analysed. The first reform related to the transformation of state-owned shares to publicly traded private shares. This change removes the affiliation of SOEs with the government, creating an environment that opposes state capitalism and supports a more capitalist economy such as that of the UK and the US, where ownership in the stock market is more diffuse. The second reform analysed in this paper was a state national policy to create 10 domestic audit firms capable of competing with the international “Big 4” audit firms known as Document 56. This five-year national policy strategy employed practical steps in developing the domestic accounting profession in the country. Hence, the study investigated the role of such transformation in sustaining external auditor independence, which was influenced by state control before the SSSR. Moreover, it investigated whether the application of this policy empirically improved auditor independence sustainability.

5.1. Theoretical Implications

Along with China’s efforts to create a more market-oriented economy, China also worked on the convergence of its national accounting standards with the IFRS. By doing so, China aimed to develop a financial market which is closer to that of more well-developed capitalist economies. A multivariate regression analysis was used in this study to examine how China’s recent structural reforms have improved external auditor independence sustainability. Where auditor independence sustainability is pronounced through the propensity of audit firms to issue modified audit opinions or, at least, attach an emphasis of matter paragraph to an unqualified auditor opinion when necessary. The study also examined the role of auditor choice in improving auditor independence sustainability and employed robustness tests using dynamic models to ensure the accuracy of the analysis, where it was found that auditor independence sustainability was less pronounced in LSOEs compared to NSOEs, which has improved significantly in consequence to the SSSR.

The study analysis also distinguished between China’s 31, assuming that more developed regions will react more strongly to the structural reforms than less-developed regions. Nonetheless, the results fail to confirm that auditor independence sustainability changed differently across China’s different regions.

5.2. Managerial Implications

The study findings do not show a direct impact of the SSSR on auditor independence sustainability. Nonetheless, reduced auditor independence was present in the period after the completion of the SSSR was found. The results, however, report an improvement in auditor independence after the announcement of Document 56. This is assumed to be due to the fact that, during the transition period, firms transformed ownership based on the reform proposal and agreed on compensations to the holders of tradable shares instead of selling their shares directly in the financial markets.

A detailed investigation of the increase in the likelihood of issuing an MAO after the completion of the SSSR and the announcement of Document 56 showed the following. The improved auditor independence was translated through a higher likelihood of the issuance of unqualified auditor options with an emphasis of matter paragraph, not other types of MAOs (i.e., qualified auditor opinion, adverse opinion, and a disclaimer of opinion). This indicates that, in the Chinese context, treating the outcome of the audit opinion process as binary leads to inaccurate conclusions about auditor independence. Moreover, we did not observe a change in the impact of LSOEs on the likelihood of the issuance of MAOs in the period after the structural reforms.

Hence, we propose that auditor independence in China remains under development, and the state influence over listed firms remains, even after these structural reforms, consistent with the views of [

1]. Also, the results failed to show a significant impact of market development on auditor independence, which further supports Wong’s [

1] arguments on China’s weak legal environment and the application of courts.