Nexus between Sustainability Reporting and Firm Performance: Considering Industry Groups, Accounting, and Market Measures

Abstract

1. Introduction

2. Literature Review

3. Materials and Methods

4. Results

5. Discussion

6. Implications and Further Research

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Buallay, A.; Fadel, S.M.; Al-Ajmi, J.Y.; Saudagaran, S. Sustainability reporting and performance of MENA banks: Is there a trade-off? Meas. Bus. Excell. 2020, 24, 197–221. [Google Scholar] [CrossRef]

- Girón, A.; Kazemikhasragh, A.; Cicchiello, A.F. Sustainability Reporting and Firms’ Economic Performance: Evidence from Asia and Africa. J. Knowl. Econ. 2021, 12, 1741–1759. [Google Scholar] [CrossRef]

- Milne, M.J.; Gray, R. W(h)ither Ecology? The Triple Bottom Line, the Global Reporting Initiative, and Corporate Sustainability Reporting. J. Bus. Ethics 2013, 118, 13–29. [Google Scholar] [CrossRef]

- Orlitzky, M.; Schmidt, F.L.; Rynes, S.L. Corporate social and financial performance: A meta-analysis. Organ. Stud. 2003, 24, 403–441. [Google Scholar] [CrossRef]

- Dixon-Fowler, H.R.; Slater, D.J.; Johnson, J.L. Beyond “Does it Pay to be Green?” A Meta-Analysis of Moderators of the CEP–CFP Relationship. J Bus Ethics 2013, 112, 353–366. [Google Scholar] [CrossRef]

- Albertini, E. Does Environmental Management Improve Financial Performance? A Meta-Analytical Review. Organ. Environ. 2013, 26, 431–457. [Google Scholar] [CrossRef]

- Friede, G.; Busch, T.; Bassen, A. ESG and financial performance: Aggregated evidence from more than 2000 empirical studies. J. Sustain. Financ. Investig. 2015, 5, 210–233. [Google Scholar] [CrossRef]

- Duque-Grisales, E.; Aguilera-Caracuel, J. Environmental, Social, and Governance (ESG) Scores and Financial Performance of Multilatinas: Moderating Effects of Geographic International Diversification and Financial Slack. J. Bus. Ethics 2019, 168, 315–334. [Google Scholar] [CrossRef]

- Landi, G.; Sciarelli, M. Towards a More Ethical Market: The Impact of ESG Rating on Corporate Financial Performance. Soc. Responsib. J. 2019, 15, 11–27. [Google Scholar] [CrossRef]

- Ortas, E.; Roger, L.; José, B.; Moneva, M. Socially Responsible Investment and cleaner production in the Asia Pacific: Does it pay to be good? J. Clean. Prod. 2013, 52, 272–280. [Google Scholar] [CrossRef]

- Brooks, C.; Oikonomou, I. The effects of environmental, social and governance disclosures and performance on firm value: A review of the literature in accounting and finance. Br. Account. Rev. 2018, 50, 1–15. [Google Scholar] [CrossRef]

- Atan, R.; Alam, M.M.; Said, J.; Zamri, M. The Impacts of Environmental, Social, and Governance Factors on Firm Performance: Panel Study of Malaysian Companies. Manag. Environ. Qual. Int. J. 2018, 29, 182–194. [Google Scholar] [CrossRef]

- Aggarwal, P. Impact of Sustainability Performance of Company on its Financial Performance: A Study of Listed Indian Companies. Glob. J. Man. Bus. Res. 2013, 13, 11. [Google Scholar]

- Pojasek, R.B. A framework for business sustainability. Environ. Qual. Manag. 2007, 17, 81–88. [Google Scholar] [CrossRef]

- Margolis, J.D.; Elfenbein, H.A.; Walsh, J.P. Does It Pay to Be Good? A Meta-Analysis and Redirection of Research on the Relationship between Corporate Social and Financial Performance. Ann. Arbor. 2007, 1001, 1–68. [Google Scholar]

- Barnett, M.L. Stakeholder Influence Capacity and the Variability of Financial Returns to Corporate Social Responsibility. Acad. Manag. Rev. 2007, 32, 794–816. [Google Scholar] [CrossRef]

- Soana, M.G. The Relationship between Corporate Social Performance and Corporate Financial Performance in the Banking Sector. J. Bus. Ethics 2011, 104, 133–148. [Google Scholar] [CrossRef]

- Qiu, Y.; Shaukat, A.; Tharyan, R. Environmental and Social Disclosures: Link with Corporate Financial Performance. The Br. Account. Rev. 2016, 48, 102–116. [Google Scholar] [CrossRef]

- Haider, M.; Shannon, R.; Moschis, G.P. Sustainable Consumption Research and the Role of Marketing: A Review of the Literature (1976–2021). Sustainability 2022, 14, 3999. [Google Scholar] [CrossRef]

- Al Hawaj, A.Y.; Buallay, A.M. A Worldwide Sectorial Analysis of Sustainability Reporting and Its Impact on Firm Performance. J. Sustain. Financ. Investig. 2022, 12, 62–86. [Google Scholar] [CrossRef]

- Dinh, T.; Husmann, A.; Melloni, G. Corporate Sustainability Reporting in Europe: A Scoping Review. Account. Eur. 2023, 20, 1–29. [Google Scholar] [CrossRef]

- Thomas, C.J.; Tuyon, J.; Matahir, H.; Dixit, S. The impact of sustainability practices on firm financial performance: Evidence from Malaysia. Manag. Account. Rev. 2021, 20, 211–243. [Google Scholar]

- Buallay, A.; Al Marri, M. Sustainability disclosure and its impact on telecommunication and information technology sectors’ performance: Worldwide evidence. Int. J. Emerg. Serv. 2022, 11, 379–395. [Google Scholar] [CrossRef]

- Najjar, M.; Alsurakji, I.H.; El-Qanni, A.; Nour, A.I. The role of blockchain technology in the integration of sustainability practices across multi-tier supply networks: Implications and potential complexities. J. Sustain. Financ. Invest. 2023, 13, 744–762. [Google Scholar] [CrossRef]

- Patten, D.M. Exposure, legitimacy, and social disclosure. J. Account. Public Policy 1991, 10, 297–308. [Google Scholar] [CrossRef]

- Freeman, R.E. Divergent stakeholder theory. Acad. Manag. Rev. 1999, 24, 233–236. [Google Scholar] [CrossRef]

- McWilliams, A.; Siegel, D. Corporate social responsibility and financial performance: Correlation or misspecification? Strateg. Manag. J. 2000, 21, 603–609. [Google Scholar] [CrossRef]

- Campbell, J.L. Why would corporations behave in socially responsible ways? An institutional theory of corporate social responsibility. Acad. Manag. Rev. 2007, 32, 946–967. [Google Scholar] [CrossRef]

- Donaldson, T.; Preston, L.E. The stakeholder theory of the corporation: Concepts, evidence, and implications. Acad. Manag. Rev. 1995, 20, 65–91. [Google Scholar] [CrossRef]

- Diez-Cañamero, B.; Bishara, T.; Otegi-Olaso, J.R.; Minguez, R.; Fernández, J.M. Measurement of Corporate Social Responsibility: A Review of Corporate Sustainability Indexes, Rankings, and Ratings. Sustainability 2020, 12, 2153. [Google Scholar] [CrossRef]

- Ma, C.; Chishti, M.F.; Durrani, M.K.; Bashir, R.; Safdar, S.; Hussain, R.T. The Corporate Social Responsibility and Its Impact on Financial Performance: A Case of Developing Countries. Sustainability 2023, 15, 3724. [Google Scholar] [CrossRef]

- Buallay, A.; Al-Ajmi, J. The Role of Audit Committee Attributes in Corporate Sustainability Reporting: Evidence from Banks in the Gulf Cooperation Council. J. Appl. Account. Res. 2020, 21, 249–264. [Google Scholar] [CrossRef]

- Asa’d, I.A.A.; Nour, A.; Atout, S. The Impact of Financial Performance on Firm’s Value during Covid-19 Pandemic for Companies Listed in the Palestine Exchange (2019–2020). In EAMMIS 2022: From the Internet of Things to the Internet of Ideas: The Role of Artificial Intelligence; Musleh Al-Sartawi, A.M.A., Razzaque, A., Kamal, M.M., Eds.; Lecture Notes in Networks and Systems; Springer: Cham, Switzerland, 2023; Volume 557. [Google Scholar] [CrossRef]

- Fatemi, A.; Fooladi, I.; Tehranian, H. Valuation Effects of Corporate Social Responsibility. J. Bank. Financ. 2015, 59, 182–192. [Google Scholar] [CrossRef]

- Malik, M.S.; Ali, H.; Ishfaq, A. Corporate Social Responsibility and Organizational Performance: Empirical Evidence from Banking Sector. Pak. J. Commer. Soc. Sci. 2015, 9, 241–247. [Google Scholar]

- Lyon, T.; Lu, Y.; Shi, X.; Yin, Q. How Do Shareholders Respond to Sustainability Awards? Evidence from China. Ecol. Econ. 2013, 94, 1–8. [Google Scholar] [CrossRef]

- Horváthová, E. Does Environmental Performance Affect Financial Performance? A Meta-Analysis. Ecol. Econ. 2010, 70, 52–59. [Google Scholar] [CrossRef]

- Renneboog, L.; Ter Horst, J.; Zhang, C. The price of ethics and stakeholder governance: The performance of socially responsible mutual funds. J. Corp. Financ. 2008, 14, 302–322. [Google Scholar] [CrossRef]

- Yu, E.P.; Guo, C.Q.; Luu, B.V. Environmental, social and governance transparency, and firm value. Bus. Strategy Environ. 2018, 27, 987–1004. [Google Scholar] [CrossRef]

- Friske, W.; Hoelscher, S.A.; Nik, A. The impact of voluntary sustainability reporting on firm value: Insights from signaling theory. J. Acad. Mark. Sci. 2022, 50, 372–392. [Google Scholar] [CrossRef]

- Bose, S.; Shams, S.; Ali, M.J.; Mihret, D. COVID-19 impact, sustainability performance, and firm value: International evidence. Account. Financ. 2022, 62, 597–643. [Google Scholar] [CrossRef]

- Nour, A.; Bouqalieh, B.; Okour, S. The impact of institutional governance mechanisms on the dimensions of the efficiency of intellectual capital and the role of the size of the company in the Jordanian Shareholding industrial companies. An-Najah Univ. J. Res. B 2022, 36, 2181–2212. [Google Scholar]

- Mattera, M.; Alba Ruiz-Morales, C.; Gava, L.; Soto, F. Sustainable business models to create sustainable competitive advantages: Strategic approach to overcoming COVID-19 crisis and improve financial performance. Compet. Rev. 2022, 32, 455–474. [Google Scholar] [CrossRef]

- Oware, K.M.; Valacherry, A.K.; Mallikarjunappa, T. Do third-party assurance and mandatory reporting matter to philanthropic and financial performance nexus? Evidence from India. Soc. Responsib. J. 2022, 18, 897–917. [Google Scholar] [CrossRef]

- Buallay, A.; El Khoury, R.; Hamdan, A. Sustainability reporting in smart cities: A multidimensional performance measures. Cities 2021, 119, 103397. [Google Scholar] [CrossRef]

- Pham, D.C.; Do, T.N.A.; Doan, T.N.; Nguyen, T.X.H.; Pham, T.K.Y.; Tan, A.W.K. The impact of sustainability practices on financial performance: Empirical evidence from Sweden. Cogent Bus. Manag. 2021, 8, 1912526. [Google Scholar] [CrossRef]

- Buallay, A. Sustainability Reporting and Agriculture Industries’ Performance: Worldwide Evidence. J. Agribus. Dev. Emerg. Econ. 2021, 12, 769–790. [Google Scholar] [CrossRef]

- Buallay, A. Sustainability Reporting and Firm’s Performance: Comparative Study between Manufacturing and Banking Sectors. Int. J. Product. Perform. Manag. 2019, 69, 431–445. [Google Scholar] [CrossRef]

- Graves, S.B.; Waddock, S.A. Institutional owners and corporate social performance. Acad. Manag. J. 1994, 37, 1034–1046. [Google Scholar] [CrossRef]

- Turban, D.B.; Greening, D.W. Corporate social performance and organizational attractiveness to prospective employees. Acad. Manag. J. 1997, 40, 658–672. [Google Scholar]

- Mattingly, J.E.; Berman, S.L. Measurement of Corporate Social Action: Discovering Taxonomy in the Kinder Lydenburg Domini Ratings Data. Buss. Soc. 2006, 45, 20–46. [Google Scholar] [CrossRef]

- Godfrey, P.C.; Merrill, C.B.; Hansen, J.M. The relationship between corporate social responsibility and shareholder value: An empirical test of the risk management hypothesis. Strat. Manag. J. 2009, 30, 425–445. [Google Scholar] [CrossRef]

- Eccles, R.G.; Ioannis, I.; Serafeim, G. The Impact of Corporate Sustainability on Organizational Processes and Performance. Manag. Sci. 2014, 60, 2835–2857. [Google Scholar] [CrossRef]

- Kang, K.H.; Lee, S.; Huh, C. Impacts of positive and negative corporate social responsibility activities on company performance in the tourism industry. Int. J. Hosp. Manag. 2010, 29, 72–82. [Google Scholar] [CrossRef]

- Gentry, R.J.; Chen, W. The relationship between accounting and market measures of firm financial performance: How strong is it? J. Manag. Issues 2010, 17, 514–530. [Google Scholar]

- Inoue, Y.; Lee, S. Effects of different dimensions of corporate social responsibility on corporate financial performance in tourism-related industries. Tour. Manag. 2011, 32, 790–804. [Google Scholar] [CrossRef]

- Khatib, S.F.A.; Nour, A.-N.I. The Impact of Corporate Governance on Firm Performance during The COVID-19 Pandemic: Evidence from Malaysia. J. Asian Financ. Econ. Bus. 2021, 8, 943–952. [Google Scholar]

- Nour, A.; Alia, M.A.; Balout, M. The Impact of Corporate Social Responsibility Disclosure on the Financial Performance of Banks Listed on the PEX and the ASE. In ICGER 2021: Artificial Intelligence for Sustainable Finance and Sustainable Technology; Musleh Al-Sartawi, A.M.A., Ed.; Lecture Notes in Networks and Systems; Springer: Cham, Switzerland, 2022; Volume 423. [Google Scholar] [CrossRef]

- Callan, S.J.; Thomas, J.M. Corporate financial performance and corporate social performance: An update and reinvestigation. Corp. Soc. Responsib. Environ. Manag. 2009, 16, 61–78. [Google Scholar] [CrossRef]

- Qoyum, A.; Sakti, M.R.P.; Thaker, H.M.T.; Alhashfi, R.U. Does the Islamic label indicate good environmental, social, governance (ESG) performance? Evidence from sharia-compliant firms in Indonesia and Malaysia. Borsa Istanb. Rev. 2022, 22, 306–320. [Google Scholar] [CrossRef]

- Bansal, M.; Samad, T.A.; Bashir, H.A. The sustainability reporting-firm performance nexus: Evidence from a threshold model. J. Glob. Responsib. 2021, 12, 491–512. [Google Scholar] [CrossRef]

- Velte, P. Does ESG Performance Have an Impact on Financial Performance? Evidence from Germany. J. Glob. Responsib. 2017, 8, 169–178. [Google Scholar] [CrossRef]

- Sharfman, M.P.; Fernando, C.S. Environmental risk management and the cost of capital. Strat. Manag. J. 2008, 29, 569–592. [Google Scholar] [CrossRef]

- Aouadi, A.; Marsat, S. Do ESG Controversies Matter for Firm Value? Evidence from International Data. J. Bus. Ethics 2018, 151, 1027–1047. [Google Scholar] [CrossRef]

- Haniffa, R.; Hudaib, M. Corporate governance structure and performance of Malaysian listed companies. J. Bus. Financ. Account. 2006, 33, 1034–1062. [Google Scholar] [CrossRef]

| Article | Subject | Focus | Model Used | Results |

|---|---|---|---|---|

| Mattera et al., 2022 [43] | Implementation of sustainable business models and its effect on firm’s performance | FTSEMIB Index Companies’ financial performance during COVID-19 in the year 2020 | Chi-square and correlation analyses of the share price | Positive association between sustainable strategies and firm’s financial performance |

| Oware, K.M., Mallikarjunappa, T. 2022 [44] | Examination of the moderating effect of mandatory CSR reporting on financial performance of listed firms in India | Indian stock market companies for 800 firm-year observations from 2010 to 2019 | Hierarchical regression and panel regression with fixed effect assumptions | Positive relation between financial performance (ROA and Tobin’s Q) and CSR expenditure |

| Thomas, C.J., et al., 2021 [22] | Empirical analysis of sustainability practices on firm performance using ESG data | Malaysia stock market companies for 36 public listed firms reporting ESG scores from 2015 to 2019 | Static panel regression | Positive relation between ESG and financial performance, ROA, ROE, and Tobin’s Q, but only significant for ROE |

| Buallay, A. et.al., 2021 [45] | Research on the relationship between the level of sustainability reporting and firm’s performance | 20 different smart city companies for 3536 observations from 2008 to 2017 | Multiple regression model | Positive significant association between ESG and ROA, ROE; negative significant association between ESG and Tobin’s Q |

| Pham, D. C. et al. (2021) [46] | Sustainability practices on the financial performance | Swedish companies for 116 listed firms in the year 2019 | Multivariate regression model | Positive relationship between corporate sustainability and performance |

| Buallay, A., et al., 2021 [47] | Research on the relationship between ESG and a bank’s performance (Tobin’s Q) | Stock exchanges of MENA countries for 59 listed banks from 2008 to 2017 | Fixed-effect regression model and IV-GMM (generalized model of moments) | Positive impact of ESG on performance; social performance plays a negative role in determining a bank’s profitability and value |

| Buallay, A. 2019 [48] | Research on sustainability reporting’s effect on performance with a comparison between manufacturing and banking sectors | Companies in 80 countries (932 manufacturers and 530 banks) for 11,705 observations from 2008 to 2017 | Pooled data regression Model | Positive impact of ESG on performance in the manufacturing sector, besides negative effects in the banking sector |

| Sector | Number | Percentage |

|---|---|---|

| Industrials | 12 | 27 |

| Consumer Staples | 7 | 15 |

| Health Care | 1 | 2 |

| Consumer Discretionary | 11 | 24 |

| Materials | 7 | 15 |

| Energy | 2 | 4 |

| Utilities | 3 | 7 |

| Information Technology | 1 | 2 |

| Communication Services | 2 | 4 |

| Total | 46 | 100 |

| Industry Group | Number | Percentage |

|---|---|---|

| Capital Goods | 10 | 22 |

| Food and Staples Retailing | 2 | 4 |

| Pharmaceuticals, Biotechnology, and Life Sciences | 1 | 2 |

| Automobiles and Components | 6 | 13 |

| Household and Personal Products | 1 | 2 |

| Materials | 7 | 16 |

| Energy | 2 | 4 |

| Consumer Services | 1 | 2 |

| Utilities | 3 | 7 |

| Food, Beverage, and Tobacco | 4 | 9 |

| Consumer Durables and Apparel | 3 | 7 |

| Retailing | 1 | 2 |

| Technology Hardware and Equipment | 1 | 2 |

| Transportation | 2 | 4 |

| Telecommunication Services | 2 | 4 |

| Total | 46 | 100 |

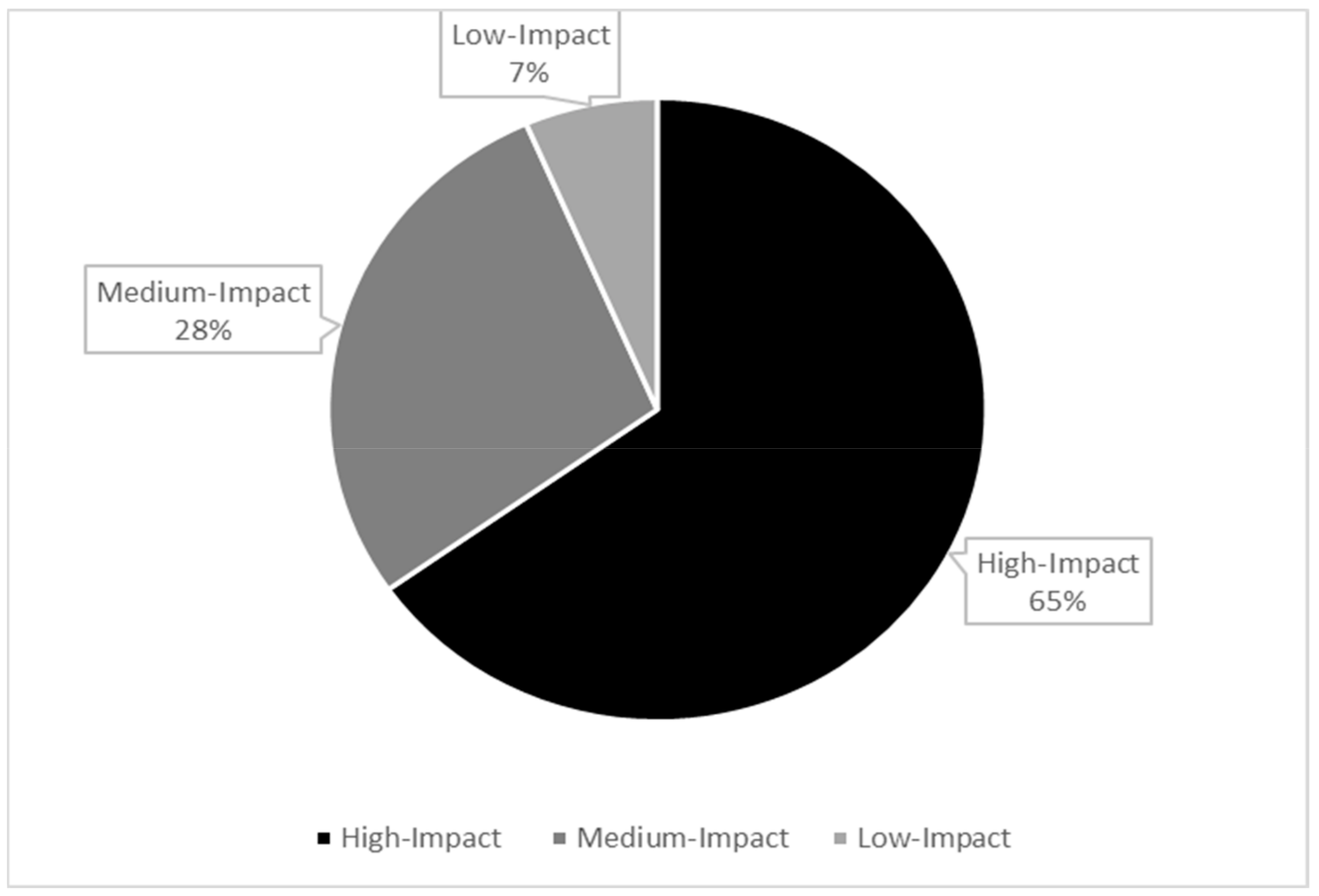

| High Impact Sectors | Medium Impact Sectors | Low Impact Sectors |

|---|---|---|

| Agriculture Airports Building Materials (includes Quarrying) Chemicals and Pharmaceuticals Construction Major Systems Engineering Fast Food Chains Food, Beverages, and Tobacco Forestry and Paper Mining and Metals Oil and Gas Power Generation Road Distribution and Shipping Supermarkets Vehicle Manufacture Waste Water Pest Control | DIY and Building Supplies Electronic and Electrical equipment Energy and Fuel Distribution Engineering and Machinery Financials not elsewhere classified (see right) Hotels, Catering, and Facilities Management Manufacturers not elsewhere classified Ports Printing and Newspaper Publishing Property Developers Retailers not elsewhere classified Vehicle Hire Public Transport | Information Technology Media Consumer/Mortgage Finance Property Investors Research and Development Leisure not elsewhere classified (Gyms and Gaming) Support Services Telecoms Wholesale Distribution |

| Variable | Definition |

|---|---|

| Tobin’s Q * | Total market value of the stock/total asset value of firm-measure of long-term financial performance, market-oriented |

| ROA | Return on Asset—net income/total asset—measure of short-term financial performance, accounting-oriented |

| Leverage | Total liabilities/total assets |

| Risk | Natural logarithm of (total debt/total asset) |

| Size | Natural logarithm of total assets |

| Current Ratio | Current asset/current liabilities |

| Growth | Natural logarithm of yearly sales growth |

| SR | Sustainability reporting |

| High Impact | Companies classified in sectors that have a high impact on the environment |

| Medium Impact | Companies classified in sectors that have a medium impact on the environment |

| Low Impact | Companies classified in sectors that have a low impact on the environment |

| Variable | Obs | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| Tobin’s Q | 920 | 1.34 | 0.407 | 0.895 | 2.18 |

| Risk | 920 | 2.978 | 1.199 | 0 | 4.042 |

| Leverage | 920 | 0.578 | 0.208 | 0.188 | 0.841 |

| Size | 920 | 15.822 | 1.158 | 13.971 | 17.625 |

| Current Ratio | 920 | 1.646 | 0.841 | 0.753 | 3.465 |

| Growth | 920 | 2.091 | 2.224 | −2.511 | 4.128 |

| ROA | 920 | 0.057 | 0.055 | −0.021 | 0.15 |

| Variable | VIF | 1/VIF |

|---|---|---|

| Risk | 2.680 | 0.373 |

| Leverage | 4.520 | 0.221 |

| Size | 1.510 | 0.660 |

| Current Ratio | 3.620 | 0.276 |

| Growth | 1.010 | 0.987 |

| High Impact | 4.040 | 0.248 |

| Medium Impact | 3.900 | 0.257 |

| SR | 2.240 | 0.447 |

| Mean VIF | 2.940 |

| (Model 1) | (Model 2) | |

|---|---|---|

| VARIABLES | Tobin’s Q | ROA |

| Risk | −0.0914 *** | −0.0141 *** |

| (0.0189) | (0.00238) | |

| Leverage | 1.219 *** | 0.0160 |

| (0.119) | (0.0147) | |

| Size | −0.117 *** | −0.00411 *** |

| (0.0121) | (0.00152) | |

| Current Ratio | 0.169 *** | 0.0187 *** |

| (0.0287) | (0.00335) | |

| Growth | 0.0190 *** | 0.00353 *** |

| (0.00497) | (0.000698) | |

| High Impact | 0.0850* | 0.0236 *** |

| (0.0435) | (0.00621) | |

| Medium Impact | −0.145 *** | 0.00643 |

| (0.0426) | (0.00633) | |

| SR | 0.0610 | 0.0281 *** |

| (0.0407) | (0.00509) | |

| Constant | 2.379 *** | 0.0804 *** |

| (0.237) | (0.0282) | |

| Observations | 920 | 920 |

| F-test | 60.330 | 46.853 |

| Sig. | 0.000 | 0.000 |

| R-squared | 0.272 | 0.270 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dincer, B.; Keskin, A.İ.; Dincer, C. Nexus between Sustainability Reporting and Firm Performance: Considering Industry Groups, Accounting, and Market Measures. Sustainability 2023, 15, 5849. https://doi.org/10.3390/su15075849

Dincer B, Keskin Aİ, Dincer C. Nexus between Sustainability Reporting and Firm Performance: Considering Industry Groups, Accounting, and Market Measures. Sustainability. 2023; 15(7):5849. https://doi.org/10.3390/su15075849

Chicago/Turabian StyleDincer, Banu, Ayşe İrem Keskin, and Caner Dincer. 2023. "Nexus between Sustainability Reporting and Firm Performance: Considering Industry Groups, Accounting, and Market Measures" Sustainability 15, no. 7: 5849. https://doi.org/10.3390/su15075849

APA StyleDincer, B., Keskin, A. İ., & Dincer, C. (2023). Nexus between Sustainability Reporting and Firm Performance: Considering Industry Groups, Accounting, and Market Measures. Sustainability, 15(7), 5849. https://doi.org/10.3390/su15075849