A Bibliometric Analysis of Green Bonds and Sustainable Green Energy: Evidence from the Last Fifteen Years (2007–2022)

Abstract

1. Introduction

2. Literature Review

3. Methodology

4. Results

4.1. The Current State of Publishing

4.2. Highly Productive Regions and Nations in Green Bonds Research

4.3. Universities and Learning Institutes with the Most Significant Number of Publications

4.4. Top Journals in Terms of Productivity

4.5. The Most Prolific Authors in Green Bonds

4.6. The Most-Cited Publication

4.7. Three-Field Plot

4.8. Co-Occurrence of Authors’ Keywords

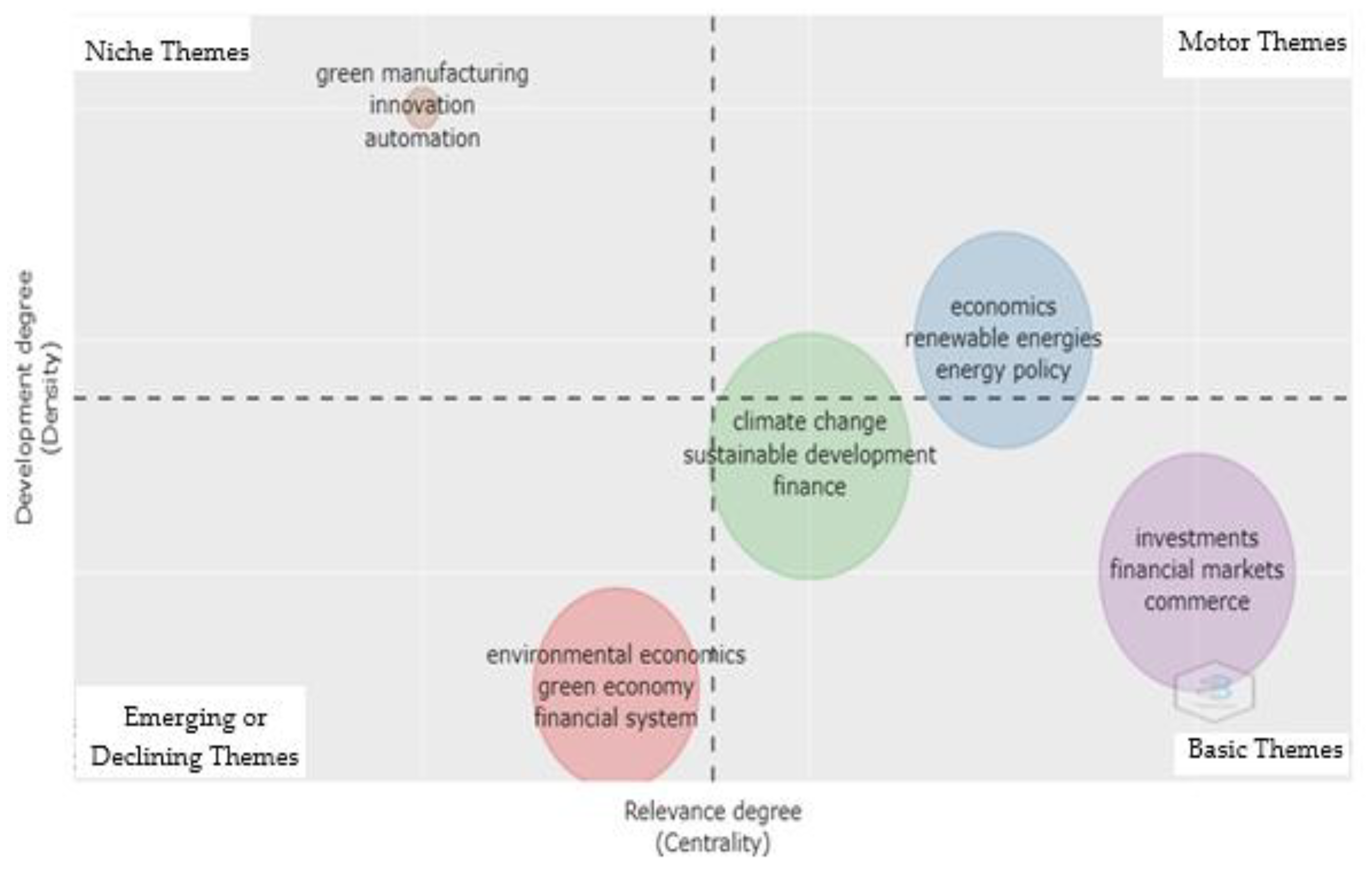

4.9. The Thematic Map: A Co-Word Analysis

4.9.1. Motor Themes

4.9.2. Niche Themes

4.9.3. Peripheral Themes

4.9.4. Transversal Themes

5. Limitations

6. Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Almaqableh, L.; Wallace, D.; Pereira, V.; Ramiah, V.; Wood, G.; Veron, J.F.; Moosa, I.; Watson, A. Is it possible to establish the link between drug busts and the cryptocurrency market? Yes, we can. Int. J. Inf. Manag. 2022, 102488. [Google Scholar] [CrossRef]

- Pham, L. Is it risky to go green? A volatility analysis of the green bond market. J. Sustain. Financ. Investig. 2016, 6, 263–291. [Google Scholar] [CrossRef]

- Al-Qudah, A.A.; Al-Okaily, M.; Alqudah, G.; Ghazlat, A. Mobile payment adoption in the time of the COVID-19 pandemic. Electron. Commer. Res. 2022, 27, 1–25. [Google Scholar] [CrossRef]

- Al-Okaily, M. Assessing the effectiveness of accounting information systems in the era of COVID-19 pandemic. VINE J. Inf. Knowl. Manag. Syst. 2021; ahead-of-print. [Google Scholar] [CrossRef]

- Alsmadi, A.A.; Alzoubi, M. Green Economy: Bibliometric Analysis Approach. Int. J. Energy Econ. Policy 2022, 12, 282–289. [Google Scholar] [CrossRef]

- Agreement, P. United Nations Framework Convention on Climate Change (UNFCCC); Climate Change Secretariat: Bonn, Germany, 2015; Volume 4, pp. 471–474. [Google Scholar]

- Al-Okaily, M.; Al-Okaily, A. An Empirical Assessment of Enterprise Information Systems Success in a Developing Country: The Jordanian Experience. TQM J. 2022; ahead-of-print. [Google Scholar] [CrossRef]

- World Bank. Green Bond Impact Report; Technical Report; World Bank Treasury Department: Washington, DC, USA, 2016; Available online: http://treasury.worldbank.org/cmd/pdf/WorldBankGreenBondImpactReport.pdf (accessed on 1 July 2016).

- Aljawarneh, N.M.; Alomari, K.A.K.; Alomari, Z.S.; Taha, O. Cyber incivility and knowledge hoarding: Does interactional justice matter? VINE J. Inf. Knowl. Manag. Systems 2022, 52, 57–70. [Google Scholar] [CrossRef]

- Abu-Salih, B.; Wongthongtham, P.; Morrison, G.; Coutinho, K.; Al-Okaily, M.; Huneiti, A. Short-term renewable energy consumption and generation forecasting: A case study of Western Australia. Heliyon 2022, 8, e09152. [Google Scholar] [CrossRef]

- Al-Okaily, A.; Al-Okaily, M.; Teoh, A.P.; Al-Debei, M. An Empirical Study on Data Warehouse Systems Effectiveness: The Case of Jordanian Banks in the Business Intelligence Era. EuroMed J. Bus. 2022; ahead-of-print. [Google Scholar] [CrossRef]

- Alawneh, R.; Jannoud, I.; Rabayah, H.; Ali, H. Developing a Novel Index for Assessing and Managing the Contribution of Sustainable Campuses to Achieve UN SDGs. Sustainability 2021, 13, 11770. [Google Scholar] [CrossRef]

- Agliardi, E.; Agliardi, R. Pricing climate-related risks in the bond market. J. Financ. Stab. 2021, 54, 100868. [Google Scholar] [CrossRef]

- Amiguet, L.; Lafuente, A.M.; Kydland, F.E.; Lindahl, J.M.M. One hundred and twenty-five years of the journal of political economy: A bibliometric overview. J. Polit. Econ. 2017, 125, 105–110. [Google Scholar]

- Bachelet, M.J.; Becchetti, L.; Manfredonia, S. The green bonds premium puzzles the role of issuer characteristics and third-party verification. Sustainability 2019, 11, 1098. [Google Scholar] [CrossRef]

- Bancel, F.; Glavas, D. The role of state ownership as a determinant of green bond issuance. SSRN Electron. J. 2021, 11, 191–211. [Google Scholar] [CrossRef]

- Baraibar-diez, E.; Luna, M.; Odriozola, D.; Llorente, I. Mapping social impact: A bibliometric analysis. Sustainability 2020, 12, 9389. [Google Scholar] [CrossRef]

- Al-Okaily, A.; Al-Okaily, M.; Teoh, A.P. Evaluating ERP systems success: Evidence from Jordanian firms in the age of the digital business. VINE J. Inf. Knowl. Manag. Syst. 2021; ahead-of-print. [Google Scholar] [CrossRef]

- Al-Okaily, M.; Natour, A.R.A.; Shishan, F.; Al-Dmour, A.; Alghazzawi, R.; Alsharairi, M. Sustainable FinTech Innovation Orientation: A Moderated Model. Sustainability 2021, 13, 13591. [Google Scholar] [CrossRef]

- Barua, S.; Chiesa, M. Sustainable financing practices through green bonds: What affects the funding size? Bus. Strategy Environ. 2019, 28, 1131–1147. [Google Scholar] [CrossRef]

- Caldecott, B. Introduction to Special Issue: Stranded Assets and the Environment. J. Sustain. Financ. Investig. 2017, 7, 1–13. [Google Scholar] [CrossRef]

- Carney, M. Resolving the Climate Paradox. Speech Given by Mark Carney, Governor of the Bank of England, Chair of the Financial Stability Board. Arthur Burns Memorial Lecture, Berlin. Available online: https://www.bankofengland.co.uk/speech/2016/resolving-theclimate-paradox (accessed on 22 September 2016).

- Derwall, J.; Koedijk, K. Socially responsible fixed-income funds. J. Bus. Financ. Account. 2009, 36, 210–229. [Google Scholar] [CrossRef]

- Chatziantoniou, I.; Abakah, E.J.A.; Gabauer, D.; Tiwari, A.K. Quantile time–frequency price connectedness between green bond, green equity, sustainable investments and clean energy markets. J. Clean. Prod. 2022, 361, 132088. [Google Scholar] [CrossRef]

- Chava, S. Environmental externalities and cost of capital. Manag. Sci. 2014, 60, 2223–2247. [Google Scholar] [CrossRef]

- Chiesa, M.; Barua, S. The surge of impact borrowing: The magnitude and determinants of green bond supply and its heterogeneity across markets. J. Sustain. Financ. Investig. 2019, 9, 138–161. [Google Scholar] [CrossRef]

- Zhou, X.; Cui, Y. Green bonds, corporate performance, and corporate social responsibility. Sustainability 2019, 11, 6881. [Google Scholar] [CrossRef]

- Damutz, T. Financing Sustainable and Innovative Initiatives. In Sparkling Sustainability and Innovation Conference Paper; North Carolina State University: Raleigh, NC, USA, 2016. [Google Scholar]

- Deng, Z.; Yongjun Tang, D.; Zhang, Y. The Journal of Alternative Investments is “greenness” priced in the market? Evidence from green bond issuance in China. J. Altern. Investig. 2020, 23, 57–71. [Google Scholar] [CrossRef]

- Dorfleitner, G.; Utz, S.; Zhang, R. The pricing of green bonds: External reviews and the shades of green. Rev. Manag. Sci. 2022, 16, 797–834. [Google Scholar] [CrossRef]

- Dou, X.; Qi, S. The choice of green bond financing instruments. Cogent Bus. Manag. 2019, 6, 1652227. [Google Scholar] [CrossRef]

- Alsmadi, A.A.; Shuhaiber, A.; Alhawamdeh, L.N.; Alghazzawi, R.; Al-Okaily, M. Twenty Years of Mobile Banking Services Development and Sustainability: A Bibliometric Analysis Overview (2000–2020). Sustainability 2022, 14, 10630. [Google Scholar] [CrossRef]

- Al-Okaily, M. Toward an integrated model for the antecedents and consequences of AIS usage at the organizational level. EuroMed J. Bus. 2022; ahead-of-print. [Google Scholar] [CrossRef]

- Fatica, A.S.; Panzica, R. Green bonds as a tool against climate change? Bus. Strategy Environ. 2020, 30, 2688–2701. [Google Scholar] [CrossRef]

- Garrigos-Simon, F.J.; Botella-Carrubi, M.D.; Gonzalez-Cruz, T.F. Social capital, human capital, and sustainability: A bibliometric and visualization analysis. Sustainability 2018, 10, 4751. [Google Scholar] [CrossRef]

- Gatti, S.; Florio, A. Issue spread determinants in the green bond market: The role of second party reviews and of the green bond principles. In Research Handbook of Finance and Sustainability; Edward Elgar Publishing: Cheltenham, UK, 2018; pp. 206–224. [Google Scholar] [CrossRef]

- German Development Institute. Green Bonds: Taking Off the Rose-Coloured Glasses. Briefing Paper n° 2. 2016. Available online: https://www.die-gdi.de/uploads/media/BP24.2016.korr_01.pdf (accessed on 12 February 2016).

- Gianfrate, G.; Peri, M. The green advantage: Exploring the convenience of issuing green bonds. J. Clean. Prod. 2019, 219, 127–135. [Google Scholar] [CrossRef]

- Glomsrød, S.; Wei, T. Business as unusual: The implications of fossil divestment and green bonds for financial flows, economic growth and energy market. Energy Sustain. Dev. 2018, 44, 1–10. [Google Scholar] [CrossRef]

- Goss, A.; Roberts, G. The impact of corporate social responsibility on the cost of bank loans. J. Bank. Financ. 2011, 35, 1794–1810. [Google Scholar] [CrossRef]

- Hacıömeroğlu, H.A.; Danışoğlu, S.; Güner, Z.N. For the love of the environment: An analysis of green versus brown bonds during the COVID-19 pandemic. Financ. Res. Lett. 2022, 47, 2021. [Google Scholar] [CrossRef]

- Al-Okaily, A.; Ai Ping, T.; Al-Okaily, M. Towards business intelligence success measurement in an organization: A conceptual study. J. Syst. Manag. Sci. 2021, 11, 155–170. [Google Scholar] [CrossRef]

- Hamdan, M.A.; Yamin, J.; Hafez, E.M.A. Passive cooling roof design under Jordanian climate. Sustain. Cities Soc. 2022, 5, 26–29. [Google Scholar] [CrossRef]

- Huynh, T.L.D. When ‘green’ challenges ‘prime’: Empirical evidence from government bond markets. J. Sustain. Financ. Investig. 2022, 12, 375–388. [Google Scholar] [CrossRef]

- Huynh, T.L.D.; Hille, E.; Nasir, M.A. Diversification in the age of the 4th industrial revolution: The role of artificial intelligence, green bonds and cryptocurrencies. Technol. Forecast. Soc. Change 2020, 159, 120188. [Google Scholar] [CrossRef]

- Huynh, T.L.D.; Ridder, N.; Wang, M. Beyond the shades: The impact of credit rating and greenness on the green bond premium. SSRN Electron. J. 2022, 11, 93–117. [Google Scholar] [CrossRef]

- Hyun, S.; Park, D.; Tian, S. The price of going green: The role of greenness in green bond markets. Account. Financ. 2020, 60, 73–95. [Google Scholar] [CrossRef]

- ICMA International Capital Markets Association. Green Bond Principles, 2016. Voluntary Process Guidelines for Issuing Green Bonds; GBP Resource Centre: Brooklyn, NY, USA, 2016; Volume 3, pp. 1–7. [Google Scholar]

- Al-Okaily, A.; Abd Rahman, M.S.; Al-Okaily, M.; Ismail, W.N.S.W.; Ali, A. Measuring success of accounting information system: Applying the DeLone and McLean model at the organizational level. J. Theor. Appl. Inf. Technol. 2020, 98, 2697–2706. [Google Scholar]

- Saleh, A.; Enaizan, O.; Eneizan, B.; Al-Mu’ani, L.A.; Al-Radaideh, A.T.; Hanandeh, F. A Hybrid SEM and Neural Network Approach to Understand and Predict the Determinants of Consumers’ Acceptance and Usage of Mobile-Commerce Application. Int. J. Interact. Mob. Technol. 2022, 16, 125–152. [Google Scholar] [CrossRef]

- Jiang, D.; Jia, F. Extreme spillover between green bonds and clean energy markets. Sustainability 2022, 14, 6338. [Google Scholar] [CrossRef]

- Jin, J.; Han, L.; Wu, L.; Zeng, H. International review of financial analysis the hedging effect of green bonds on carbon market risk. Int. Rev. Financ. Anal. 2020, 71, 101509. [Google Scholar] [CrossRef]

- Kanamura, T. Are green bonds environmentally friendly and good performing assets? Energy Econ. 2020, 88, 104767. [Google Scholar] [CrossRef]

- Karim, S.; Naeem, M.A. Do global factors drive the interconnectedness among green, Islamic and conventional financial markets? Int. J. Manag. Financ. 2022, 18, 639–660. [Google Scholar] [CrossRef]

- Kochetygova, J.; Arora, V.; Jauhari, A. The S&P Green Project Bond Index: Capturing a Deeper Shade of Green; Technical Report; McGraw-Hill Financial: New York, NY, USA, 2014; Available online: http://us.spindices.com/documents/research/research-the-sp-green-project-bond-index-capturing-adeeper-shade-of-green.pdf (accessed on 1 July 2016).

- Krimphoff, J.; Charmann, S.; Clucas, N.; Emfel, M.; Favier, A.; Godinot, S. Green Bonds Must Keep the Green Promise! A Call for Collective Action towards Effective and Credible Standards for the Green Bond Market; WWF: Paris, France, 2016. [Google Scholar]

- Laborda, J.; Sánchez-Guerra, Á. Green bond finance in Europe and the stock market reaction. Estud. Econ. Apl. 2021, 39, 5. [Google Scholar] [CrossRef]

- Laengle, S.; Merigó, J.M.; Miranda, J.; Słowinski, R.; Bomze, I.; Borgonovo, E.; Dyson, R.G.; Oliveira, J.F.; Teunter, R. Forty years of the European journal of operational research: A bibliometric overview. Eur. J. Oper. Res. 2017, 262, 803–816. [Google Scholar] [CrossRef]

- Larcker, D.F.; Watts, E.M. Where’s the greenium? J. Account. Econ. 2020, 69, 101312. [Google Scholar] [CrossRef]

- Lau, P.; Sze, A.; Wan, W.; Wong, A. The economics of the greenium: How much is the world willing to pay to save the earth? Environ. Resour. Econ. 2022, 81, 379–408. [Google Scholar] [CrossRef]

- Alomari, Z. Does human capital moderate the relationship between strategic thinking and strategic human resource management? Manag. Sci. Lett. 2020, 10, 565–574. [Google Scholar] [CrossRef]

- Al-Radaideh, A.T. Factors affecting acceptance and adoption of mobile health application (MHA). Int. J. Psychosoc. Rehabil. 2020, 24, 1218–1229. [Google Scholar] [CrossRef]

- Lenzi, D. The risk of environmental damage: A corporate governance perspective. Int. J. Green Econ. 2018, 12, 2. [Google Scholar] [CrossRef]

- Löffler, K.U.; Petreski, A.; Stephan, A. Drivers of green bond issuance and new evidence on the greenium. Eurasian Econ. Rev. 2021, 11, 1–24. [Google Scholar] [CrossRef]

- Cobo, M.J.; López-Herrera, A.G.; Herrera-Viedma, E.; Herrera, F. An approach for detecting, quantifying, and visualizing the evolution of a research field: A practical application to the Fuzzy Sets Theory field. J. Informetr. 2011, 5, 146–166. [Google Scholar] [CrossRef]

- MacAskill, S.; Roca, E.; Liu, B.; Stewart, R.A.; Sahin, O. Is there a green premium in the green bond market? Systematic literature review revealing premium determinants. J. Clean. Prod. 2021, 280, 124491. [Google Scholar] [CrossRef]

- Al-Okaily, M.; Alqudah, H.; Al-Qudah, A.A.; Alkhwaldi, A.F. Examining the Critical Factors of Computer-Assisted Audit Tools and Techniques Adoption in the Post-COVID-19 Period: Internal Auditors Perspective. VINE J. Inf. Knowl. Manag. Syst. 2022; ahead-of-print. [Google Scholar] [CrossRef]

- Nanayakkara, M.; Colombage, S. Do investors in green bond market pay a premium ? Global evidence. Appl. Econ. 2019, 51, 4425–4437. [Google Scholar] [CrossRef]

- Oguntuase, O.J.; Windapo, A. Green bonds and green buildings: New options for achieving sustainable development in Nigeria. In Advances in 21st Century Human Settlements; Springer: Singapore, 2022; pp. 193–218. [Google Scholar] [CrossRef]

- Oikonomou, I.; Brooks, C.; Pavelin, S. The effects of corporate social performance on the cost of corporate debt and credit ratings. Financ. Rev. 2014, 49, 49–75. [Google Scholar] [CrossRef]

- Nissi, E. The volatility of the “Green” option-adjusted spread: Evidence before and during the pandemic period. Risks 2022, 10, 45. [Google Scholar] [CrossRef]

- Russo, A.; Mariani, M.; Caragnano, A. Exploring the determinants of green bond issuance: Going beyond the long-lasting debate on performance consequences. Bus. Strategy Environ. 2021, 30, 38–59. [Google Scholar] [CrossRef]

- Almaqableh, L.; Reddy, K.; Pereira, V.; Ramiah, V.; Wallace, D.; Veron, J.F. An investigative study of links between terrorist attacks and cryptocurrency markets. J. Bus. Res. 2022, 147, 177–188. [Google Scholar] [CrossRef]

- Secretary-General, U.N. Trends in Private Sector Climate Finance. Report Prepared by the Climate Change Support Team of the United Nations Secretary-General on the Progress Made Since the 2014 Climate Summit. New York. Available online: http://www.un.org/climatechange/wp-content/uploads/2015/10/SG-TRENDS-PRIVATE-SECTOR-CLIMATE-FINANCE-AW-HI-RES-WEB1.pdf (accessed on 12 May 2014).

- Shankleman, J. Green Investments at $694 Billion Are Much Bigger Than You Think. Available online: http://www.bloomberg.com/news/articles/2016-07-01/green-investmentsat-694-billion-are-much-bigger-than-you-think (accessed on 1 July 2016).

- Shishlov, I.; Morel, R.; Cochran, I. Beyond Transparency: Unlocking the Full Potential of Green Bonds. Paris: Institute for Climate Economics. Available online: https://www.i4ce.org/wp-core/wp-content/ploads/2016/06/I4CE_Green_Bonds.pdf (accessed on 18 July 2016).

- Small, H. Co-citation in the scientific literature: A new measure of the relationship between two documents. J. Am. Soc. Inf. Sci. 1973, 24, 265–269. [Google Scholar] [CrossRef]

- Sohag, K.; Hammoudeh, S.; Elsayed, A.H.; Mariev, O.; Safonova, Y. Do geopolitical events transmit opportunity or threat to green markets? Decomposed measures of geopolitical risks. Energy Econ. 2022, 111, 106068. [Google Scholar] [CrossRef]

- Taghizadeh-Hesary, F.; Mortha, A.; Yoshino, N.; Phoumin, H. Utilising green finance for sustainability: Empirical analysis of the characteristics of green bond markets. In Energy Sustainability and Climate Change in ASEAN; Springer: Singapore, 2021; pp. 169–194. [Google Scholar] [CrossRef]

- Tang, D.Y.; Zhang, Y. Do shareholders benefit from green bonds? J. Corp. Financ. 2020, 61, 101427. [Google Scholar] [CrossRef]

- Teti, E.; Baraglia, I.; Dallocchio, M.; Mariani, G. The green bonds: Empirical evidence and implications for sustainability. J. Clean. Prod. 2022, 366, 132784. [Google Scholar] [CrossRef]

- Tolliver, C.; Keeley, A.R.; Managi, S. Drivers of green bond market growth: The importance of nationally determined contributions to the Paris agreement and implications for sustainability. J. Clean. Prod. 2019, 244, 118643. [Google Scholar] [CrossRef]

- Uddin, G.S.; Jayasekera, R.; Park, D.; Luo, T.; Tian, S. Go green or stay black: Bond market dynamics in Asia. Int. Rev. Financ. Anal. 2022, 81, 102114. [Google Scholar] [CrossRef]

- Aboushi, A.; Hamdan, M.; Abdelhafez, E.; Turk, E.A.; Ibbini, J.; Abu Shaban, N. Water disinfection by solar energy. Energy Sources Part A Recovery Util. Environ. Eff. 2021, 43, 2088–2098. [Google Scholar] [CrossRef]

- Wang, J.; Chen, X.; Li, X.; Yu, J.; Zhong, R. The market reaction to green bond issuance: Evidence from China. Pac. Basin Financ. J. 2020, 60, 101294. [Google Scholar] [CrossRef]

- Wharton. Making the Transition to a Low-Carbon Economy. Technical Report. Initiative for Global Environmental Leadership. 2015. Available online: http://knowledge.wharton.upenn.edu/special-report/making-the-transition-to-a-low-carbon-economy/ (accessed on 23 April 2015).

- Wu, Y.; Farrukh, M.; Raza, A.; Meng, F.; Alam, I. Framing the evolution of the corporate social responsibility and environmental management journal. Corp. Soc. Responsib. Environ. Manag. 2021, 28, 1397–1411. [Google Scholar] [CrossRef]

- Wulandari, F.; Sch, D.; Stephan, A.; Sun, C. Impact of liquidity risk on yield spread of green bond. Financ. Res. Lett. 2018, 27, 53–59. [Google Scholar] [CrossRef]

- Cobo, M.J.; López-Herrera, A.G.; Herrera-Viedma, E.; Herrera, F. SciMAT: A new science mapping analysis software tool. J. Am. Soc. Inf. Sci. Technol. 2012, 63, 1609–1630. [Google Scholar] [CrossRef]

| Year | Number of Articles |

|---|---|

| 2007 | 1 |

| 2010 | 1 |

| 2011 | 1 |

| 2012 | 3 |

| 2014 | 4 |

| 2015 | 1 |

| 2016 | 9 |

| 2017 | 12 |

| 2018 | 32 |

| 2019 | 38 |

| 2020 | 77 |

| 2021 | 133 |

| 2022 | 7 |

| No | Country | Number of Paper |

|---|---|---|

| 1 | China | 111 |

| 2 | USA | 84 |

| 3 | UK | 49 |

| 4 | Australia | 40 |

| 5 | India | 29 |

| 6 | Italy | 29 |

| 7 | France | 28 |

| 8 | Spain | 23 |

| 9 | Japan | 22 |

| 10 | Germany | 19 |

| Affiliations | Articles |

|---|---|

| University of Bologna | 13 |

| Griffith University Queensland | 10 |

| Financial University Under the Government of The Russian Federation | 8 |

| Kyushu University | 8 |

| University of Economics Ho Chi Minh City | 8 |

| University of Science and Technology Beijing | 8 |

| Peking University Shenzhen Graduate School | 7 |

| Universities Indonesia | 7 |

| Federation University Australia | 6 |

| Jinan University | 6 |

| London School of Economics and Political Science | 6 |

| Southwestern University of Finance and Economics | 6 |

| University College London | 6 |

| China University of Mining and Technology | 5 |

| Esch-Sur-Alzette | 5 |

| Massey University | 5 |

| National University of Singapore | 5 |

| Stockholm Environment Institute | 5 |

| University of Auckland | 5 |

| No | Sources | Articles |

|---|---|---|

| 1 | Journal of Sustainable Finance and Investment | 16 |

| 2 | Finance Research Letters | 12 |

| 3 | Journal of Cleaner Production | 12 |

| 4 | Sustainability (Switzerland) | 12 |

| 5 | Ion Conference Series: Earth and Environmental Science | 11 |

| 6 | Energy Economics | 8 |

| 7 | E3s Web of Conferences | 7 |

| 8 | Energy Policy | 7 |

| 9 | World Economy and International Relations | 6 |

| 10 | Business Strategy and The Environment | 4 |

| No | Author | Documents | Citations |

|---|---|---|---|

| 1 | Naeem M.A. | 6 | 43 |

| 2 | Agliardi E. | 5 | 27 |

| 3 | Managi S. | 5 | 93 |

| 4 | Pham l. | 5 | 78 |

| 5 | Siswantoro D. | 5 | 7 |

| 6 | Agliardi R. | 4 | 27 |

| 7 | Fu j. | 4 | 3 |

| 8 | Keeley A.R. | 4 | 92 |

| 9 | Ng A.W. | 4 | 47 |

| 10 | Shahzad S.J.H. | 4 | 24 |

| Authors | Title | Year | Source Title | Total Citations |

|---|---|---|---|---|

| Zerbib Od | The effect of pro-environmental preferences on bond prices: Evidence from green bonds | 2017 | Journal of Banking and Finance | 118 |

| Reboredo Jc | Green Bond and Financial Markets: Co-Movement, Diversification and Price Spillover Effects | 2017 | Energy economics | 81 |

| Tang Dy | Do shareholders benefit from green bonds? | 2018 | Journal of Corporate Finance | 65 |

| Hachenberg B | Are green bonds priced differently from conventional bonds? | 2018 | Journal of Asset Management | 61 |

| Gianfrate G | The green advantage: Exploring the convenience of issuing green bonds | 2019 | Journal of Cleaner Production | 59 |

| Febi W | The impact of liquidity risk on the yield spread of green bonds | 2018 | Finance Research Letters | 57 |

| Hanif I | Carbon emissions across the spectrum of renewable and nonrenewable energy use in developing economies of Asia | 2019 | Renewable Energy | 56 |

| Bachelet Mj | The Green Bonds Premium Puzzle: The Role of Issuer Characteristics and Third-Party Verification | 2019 | Sustainability | 54 |

| Pham L | Is it risky to go green? A volatility analysis of the green bond market | 2016 | Journal of Sustainable Finance & Investment | 50 |

| Ng Th | Bond financing for renewable energy in Asia | 2016 | Energy Policy | 49 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Alsmadi, A.A.; Al-Okaily, M.; Alrawashdeh, N.; Al-Gasaymeh, A.; Moh’d Al-hazimeh, A.; Zakari, A. A Bibliometric Analysis of Green Bonds and Sustainable Green Energy: Evidence from the Last Fifteen Years (2007–2022). Sustainability 2023, 15, 5778. https://doi.org/10.3390/su15075778

Alsmadi AA, Al-Okaily M, Alrawashdeh N, Al-Gasaymeh A, Moh’d Al-hazimeh A, Zakari A. A Bibliometric Analysis of Green Bonds and Sustainable Green Energy: Evidence from the Last Fifteen Years (2007–2022). Sustainability. 2023; 15(7):5778. https://doi.org/10.3390/su15075778

Chicago/Turabian StyleAlsmadi, Ayman Abdalmajeed, Manaf Al-Okaily, Najed Alrawashdeh, Anwar Al-Gasaymeh, Amer Moh’d Al-hazimeh, and Abdulrasheed Zakari. 2023. "A Bibliometric Analysis of Green Bonds and Sustainable Green Energy: Evidence from the Last Fifteen Years (2007–2022)" Sustainability 15, no. 7: 5778. https://doi.org/10.3390/su15075778

APA StyleAlsmadi, A. A., Al-Okaily, M., Alrawashdeh, N., Al-Gasaymeh, A., Moh’d Al-hazimeh, A., & Zakari, A. (2023). A Bibliometric Analysis of Green Bonds and Sustainable Green Energy: Evidence from the Last Fifteen Years (2007–2022). Sustainability, 15(7), 5778. https://doi.org/10.3390/su15075778