6.1. Conclusions

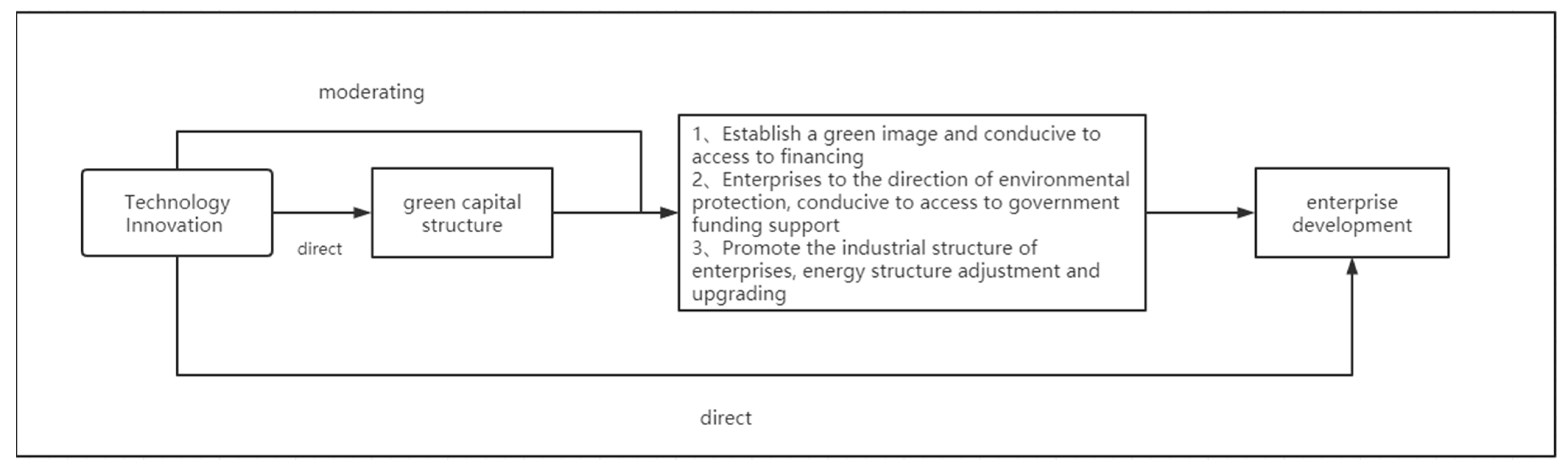

Based on the background of green economy and green finance, it has become imperative for enterprises to transform and upgrade. A reasonable capital structure plays a key role in the transformation, and a green capital structure is conducive to achieving the dual carbon target, developing enterprises in a green direction, and improving their competitiveness [

35]. Technological innovation also plays a moderating role in the impact of green capital structure on corporate development. A more in-depth discussion of the impact of ownership nature, net cash flow from operating activities, and equity concentration on green capital structure on firm development would also make the study more in-depth and comprehensive. Therefore, this paper integrates green capital structure, technological innovation, and firm development into the same framework and constructs regression models to test the rationality of the hypotheses through a series of empirical analyses. The main results are as follows.

Firstly, green capital structure helps to promote enterprise development. By raising funds related to environmental protection, enterprises establish a corporate image of green and healthy development, which is in line with national policies and positively responds to the call of the state, and is conducive to attracting funds, gaining access to relevant capital support policies of the state, and making it easier to obtain loans. The green capital structure of the company helps to gain public trust and attract more investment, which further promotes the development of the company.

Second, technological innovation capacity has a moderating effect on green capital structure and enterprise development. An increase in funding for R&D investment may, to some extent, weaken the role of green capital structure in promoting enterprise development. Technological innovation is a long-term and continuous process with risks and lags, which requires a large amount of capital investment and needs to raise a large amount of funds, which may affect the financing concept of the green direction of enterprises, which will change the capital structure of enterprises and ultimately affect the progress of enterprise development. Therefore, the increase in funding for R&D investment will, to a certain extent, weaken the role of green capital structure in promoting the development of enterprises.

Third, the higher the cash flow from operating activities, the more important the role of green capital structure in promoting enterprise development. Operating cash flow is the first element of an enterprise’s production and operation activities, which can reflect the enterprise’s profitability and solvency, and further reflect the enterprise’s market value. The higher the cash flow from operating activities, the higher the value of the enterprise and the better its profitability, which is conducive to stabilizing the share price, increasing investors’ willingness to invest, and better for attracting investment, so the green capital structure plays a more important role in promoting enterprise development.

Fourth, the higher the concentration of equity, the greater the contribution of the green capital structure to the development of the company. The higher the equity concentration, the more unified the views on key issues, and the more the management has a green philosophy, the more it influences the attitudes of employees and the way they work, which in turn has a significant impact on the direction of corporate finance. This further affects business development.

Fifth, the green capital structure of non-state-owned enterprises plays a more important role in promoting enterprise development. Non-state enterprises have more sources for financing and are more flexible. The presence of foreign capital in non-state-owned enterprises will lead to a different culture within the enterprise, which will make timely adjustments in accordance with national development policies and directions and adhere to the concept of green development, thus further influencing the investment and financing decisions of the enterprise, which is more conducive to the development of green capital structure.

6.3. Research Limitations

First, the article chooses Chinese enterprises as the research object. The universality of research results is not sufficient, there are certain gaps in the social background and economic policies of different countries, so future research can cover a broader area and scope, furthering more in-depth research on the impact of green capital structure on enterprise development [

37].

Secondly, limitations of the R&D input variables. The main elements of R&D innovation are people, capital, and technology, etc. The article ignores human and patented technology, etc. Since there is a serious lack of information on R&D personnel and patented technology in listed companies, only R&D capital is considered in the research process. With the improvement of data and information in the future, a more comprehensive study can be conducted [

38].

Thirdly, the article mainly focuses on listed companies and does not include unlisted companies in the study, so the results may not be suitable for unlisted companies.

6.4. Research Recommendations

First, at the company level, optimize the green capital structure and employ managers who value green development. Different types of enterprises are at different stages of their own development, and enterprises should attach great importance to the arrangement and planning of their green capital structure. They should have a detailed plan drawn up after detailed analysis and examination by a specialist, keeping in mind the objectives and understanding information in many ways during the planning process to avoid information asymmetry [

39,

40]. Once the plan has been drawn up, it should be implemented in accordance with the plan so that the funds raised are used to maximum effect. The role and conditions of managers in the capital restructuring process should be taken into account. The will of management is very important in choosing the direction of the company’s development, so when appointing and training management personnel, the company should focus on developing and assessing management’s environmental awareness, choosing a management team that focuses on the long-term interests of the company and has a strategic vision for development, and focusing on the supervisory role of the supervisory board. Environmental performance can be included in the performance evaluation criteria for managers, so that management can really focus on the sustainable development of the company.

Second, at the government level, it actively plays a role in improving the financing environment. It is important to have a good capital environment for corporate financing, and although China’s capital market has made great progress, it still needs to be further improved [

41,

42,

43]. The government should play a role by, for example, establishing a reasonable and effective financing system based on relevant research and studies and vigorously developing the bond market, all of which will facilitate further financing and development of enterprises [

44]. The government should effectively regulate the market. China’s current financing channels are still relatively single, can actively innovate to develop a diversified new channel, as far as possible to enable enterprises to lower the cost of financing, to further meet the environmental protection class capital needs, both to improve the development of enterprises, but also to protect the environment.

Third, at the public level, vigorously promote environmental protection, starting with the smallest things in life. Green education should start at an early age and cultivate children’s awareness of environmental protection. Encourage the public to engage in green consumption and cultivate public awareness of green investment, thus gradually promoting the development of a green economy.

6.5. Prospects for the Future

In the context of the development of the green economy, future research deserves further attention in the following areas.

(1) To examine the impact of green capital structure on corporate development and macroeconomics in the post-epidemic era.

The impact of the Corona Virus Disease 2019 has been significant and has affected many companies, affecting their production and business models and values, and therefore their capital structure. The impact of the Corona Virus Disease 2019 has been felt by everyone, from the smallest to the largest, in the national and global economy, and at the same time has had a huge impact on the global ecological environment, further influencing changes in environmental laws and policies. Therefore, it is necessary to study the impact of green capital structure on corporate development and macroeconomics in the post-epidemic era future.

(2) Introduction of other variables to examine the relationship between green capital structure and corporate development.

The article examines the relationship between technological innovation and the impact of green capital structure on firm development [

45]. There are many factors that influence green capital structure and enterprise development, and future research can be further expanded, such as: environmental regulation, the impact of government macro-regulation, etc., which will help to make the theoretical study of green capital structure on enterprise development more complete.