Novel COVID-19 Outbreak and Global Uncertainty in the Top-10 Affected Countries: Evidence from Wavelet Coherence Approach

Abstract

1. Introduction

2. Literature Review

2.1. COVID-19 and Stock Market

2.2. COVID-19 and Uncertainty

2.3. COVID-19 and Exchange Rate

2.4. COVID-19—OIL

2.5. COVID-19 and Gold

3. Data and Methodology

3.1. Estimation Technique (Wavelet Coherence)

3.2. Justification of Using Wavelet Coherence Approach

3.3. Data

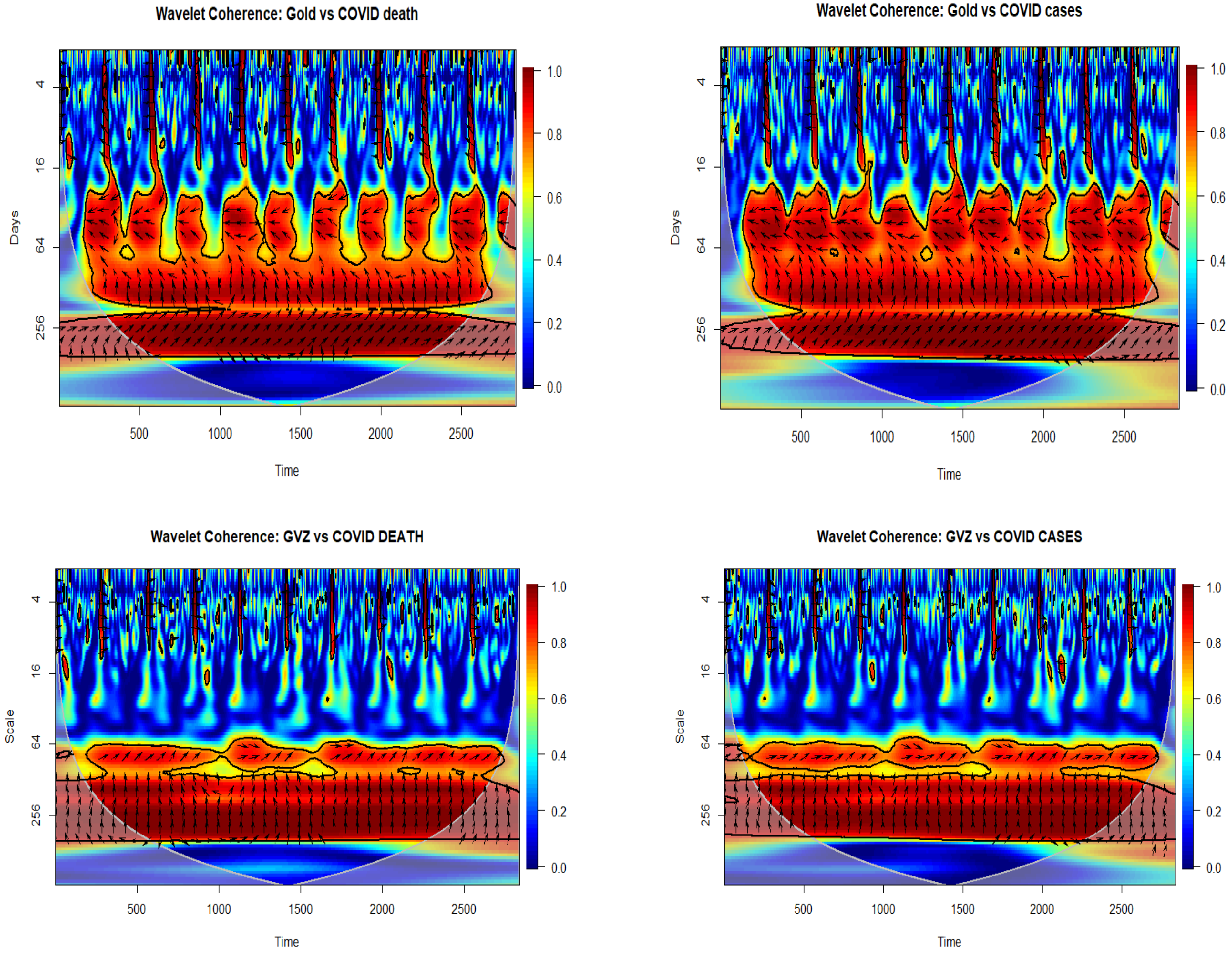

4. Results and Discussion

Highlights of the Novelty of Analysis

- This study is novel in the sense that COVID-19 has had a significant impact on the global economy, leading to an unprecedented level of uncertainty and volatility in financial markets, especially the 10 most impacted countries.

- The pandemic has affected commodity prices and stock markets differently, highlighting the need for a comprehensive analysis of the relationship between COVID-19 and financial assets.

- Focusing on the top ten corona-affected countries provides valuable insight into the impact of COVID-19 on the world’s largest economies and how they are coping with the pandemic’s economic fallout.

- This analysis can also provide a useful reference for policymakers, investors, and business leaders to understand the ongoing effects of COVID-19 on the global economy and financial markets.

- The study of the relationship between COVID-19 and financial assets can also help identify patterns and trends that can inform future policy decisions and risk management strategies.

- The integration of multiple variables, such as global uncertainty, commodity prices, and stock markets, provides a comprehensive and holistic understanding of the impact of COVID-19 on the global economy.

- The novelty of this analysis lies in its focus on the latest developments and the most recent data, ensuring that the findings are up-to-date and relevant in the current context.

5. Conclusions and Policy Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Abbas, S.; Rehman, F.U.; Khan, S.; Rehman, M.Z.; Alonazi, W.B.; Noman, A.A. Crowding-Out Effect of Natural Resources on Domestic Investment: The Importance of Information Communication and Technology (ICT) and Control of Corruption in the Middle East and Central Asia. Sustainability 2022, 14, 13392. [Google Scholar] [CrossRef]

- Aggarwal, S.; Nawn, S.; Dugar, A. What caused global stock market meltdown during the COVID pandemic–Lockdown stringency or investor panic? Financ. Res. Lett. 2021, 38, 101827. [Google Scholar] [CrossRef] [PubMed]

- Aguiar-Conraria, L.; Soares, M.J. Oil and the macroeconomy: Using wavelets to analyze old issues. Empir. Econ. 2011, 40, 645–655. [Google Scholar] [CrossRef]

- Akhtaruzzaman, M.; Boubaker, S.; Sensoy, A. Financial contagion during COVID-19 crisis. Financ. Res. Lett. 2021, 38, 101604. [Google Scholar] [CrossRef]

- Akhtaruzzaman, M.; Boubaker, S.; Chiah, M.; Zhong, A. COVID-19 and oil price risk exposure. Financ. Res. Lett. 2020, 42, 101882. [Google Scholar] [CrossRef]

- Ali, M.; Khattak, M.A.; Khan, S.; Khan, N. COVID-19 and the ASEAN stock market: A wavelet analysis of conventional and Islamic equity indices. Stud. Econ. Financ. 2022, ahead-of-print. [Google Scholar] [CrossRef]

- Ali, M.; Alam, N.; Rizvi, S.A.R. Coronavirus (COVID-19)—An epidemic or pandemic for financial markets. J. Behav. Exp. Financ. 2020, 27, 100341. [Google Scholar] [CrossRef]

- Altig, D.; Baker, S.; Barrero, J.M.; Bloom, N.; Bunn, P.; Chen, S.; Davis, S.J.; Leather, J.; Meyer, B.; Mihaylov, E.; et al. Economic uncertainty before and during the COVID-19 pandemic. J. Public Econ. 2020, 191, 104274. [Google Scholar] [CrossRef]

- Ben Amar, A.; Belaid, F.; Ben Youssef, A.; Chiao, B.; Guesmi, K. The unprecedented reaction of equity and commodity markets to COVID-19. Financ. Res. Lett. 2021, 38, 101853. [Google Scholar] [CrossRef]

- Ashraf, B.N. Stock markets’ reaction to COVID-19: Cases or fatalities? Res. Int. Bus. Financ. 2020, 54, 101249. [Google Scholar] [CrossRef]

- Aslam, F.; Aziz, S.; Nguyen, D.K.; Mughal, K.S.; Khan, M. On the efficiency of foreign exchange markets in times of the COVID-19 pandemic. Technol. Forecast. Soc. Change 2020, 161, 120261. [Google Scholar] [CrossRef]

- Aslam, F.; Mohmand, Y.T.; Ferreira, P.; Memon, B.A.; Khan, M.; Khan, M. Network analysis of global stock markets at the beginning of the coronavirus disease (COVID-19) outbreak. Borsa Istanb. Rev. 2020, 20, S49–S61. [Google Scholar] [CrossRef]

- Atkeson, A. What Will Be the Economic Impact of COVID-19 in the US? Rough Estimates of Disease Scenarios; No. w26867; National Bureau of Economic Research: Cambridge, MA, USA, 2020. [Google Scholar] [CrossRef]

- Aye, G.C.; Carcel, H.; Gil-Alana, L.A.; Gupta, R. Does gold act as a hedge against inflation in the UK? Evidence from a fractional cointegration approach over 1257 to 2016. Resour. Policy 2017, 54, 53–57. [Google Scholar] [CrossRef]

- Baek, S.; Mohanty, S.K.; Glambosky, M. COVID-19 and stock market volatility: An industry level analysis. Financ. Res. Lett. 2020, 37, 101748. [Google Scholar] [CrossRef]

- Bai, Y. Cross-border sentiment: An empirical analysis on EU stock markets. Appl. Financ. Econ. 2014, 24, 259–290. [Google Scholar] [CrossRef]

- Baig, A.S.; Butt, H.A.; Haroon, O.; Rizvi, S.A.R. Deaths, panic, lockdowns and US equity markets: The case of COVID-19 pandemic. Financ. Res. Lett. 2021, 38, 101701. [Google Scholar] [CrossRef] [PubMed]

- Baker, S.; Bloom, N.; Davis, S.; Terry, S. COVID-Induced Economic Uncertainty; No. w26983; National Bureau of Economic Research: Cambridge, MA, USA, 2020. [Google Scholar] [CrossRef]

- Baruník, J.; Kočenda, E.; Vácha, L. Gold, oil, and stocks: Dynamic correlations. Int. Rev. Econ. Financ. 2016, 42, 186–201. [Google Scholar] [CrossRef]

- Baur, D.G.; Lucey, B.M. Is Gold a Hedge or a Safe Haven? An Analysis of Stocks, Bonds and Gold. Financ. Rev. 2010, 45, 217–229. [Google Scholar] [CrossRef]

- Baur, D.G.; McDermott, T.K. Is gold a safe haven? International evidence. J. Bank. Financ. 2010, 34, 1886–1898. [Google Scholar] [CrossRef]

- Benedetto, F.; Mastroeni, L.; Quaresima, G.; Vellucci, P. Does OVX affect WTI and Brent oil spot variance? Evidence from an entropy analysis. Energy Econ. 2020, 89, 104815. [Google Scholar] [CrossRef]

- Bhutto, N.A.; Khan, S.; Khan, U.A.; Matlani, A. The impact of COVID-19 on conventional and Islamic stocks: Empirical evidence from Pakistan. J. Econ. Adm. Sci. 2022, ahead-of-print. [Google Scholar] [CrossRef]

- Bis.org. COVID-19 Statistical Resources. 2021. Available online: https://www.bis.org/ifc/COVID19.htm (accessed on 27 March 2021).

- Bodart, V.; Candelon, B. Evidence of interdependence and contagion using a frequency domain framework. Emerg. Mark. Rev. 2009, 10, 140–150. [Google Scholar] [CrossRef]

- Bouri, E.; Cepni, O.; Gabauer, D.; Gupta, R. Return connectedness across asset classes around the COVID-19 outbreak. Int. Rev. Financ. Anal. 2021, 73, 101646. [Google Scholar] [CrossRef]

- Bouri, E.; Demirer, R.; Gupta, R.; Pierdzioch, C. Infectious Diseases, Market Uncertainty and Oil Market Volatility. Energies 2020, 13, 4090. [Google Scholar] [CrossRef]

- Bouri, E.; Gupta, R.; Tiwari, A.K.; Roubaud, D. Does Bitcoin hedge global uncertainty? Evidence from wavelet-based quantile-in-quantile regressions. Financ. Res. Lett. 2017, 23, 87–95. [Google Scholar] [CrossRef]

- Chen, C.D.; Chen, C.C.; Tang, W.W.; Huang, B.Y. The positive and negative impacts of the SARS outbreak: A case of the Taiwan industries. J. Dev. Areas 2009, 43, 281–293. [Google Scholar] [CrossRef]

- Chen, M.-H.; Jang, S.S.; Kim, W.G. The impact of the SARS outbreak on Taiwanese hotel stock performance: An event-study approach. Int. J. Hosp. Manag. 2007, 26, 200–212. [Google Scholar] [CrossRef]

- Choi, S.Y. Industry volatility and economic uncertainty due to the COVID-19 pandemic: Evidence from wavelet coherence analysis. Financ. Res. Lett. 2020, 37, 101783. [Google Scholar] [CrossRef]

- Corbet, S.; Larkin, C.; Lucey, B. The contagion effects of the COVID-19 pandemic: Evidence from gold and cryptocurrencies. Financ. Res. Lett. 2020, 35, 101554. [Google Scholar] [CrossRef]

- Dahir, A.M.; Mahat, F.; Amin Noordin, B.A.; Hisyam Ab Razak, N. Dynamic connectedness between Bitcoin and equity market information across BRICS countries: Evidence from TVP-VAR connectedness approach. Int. J. Manag. Financ. 2020, 16, 357–371. [Google Scholar] [CrossRef]

- Danielsson, J.; Valenzuela, M.; Zer, I. Learning from history: Volatility and financial crises. Rev. Financ. Stud. 2018, 31, 2774–2805. [Google Scholar] [CrossRef]

- Del Giudice, A.; Paltrinieri, A. The impact of the Arab Spring and the Ebola outbreak on African equity mutual fund investor decisions. Res. Int. Bus. Financ. 2017, 41, 600–612. [Google Scholar] [CrossRef]

- Dutta, A.; Das, D.; Jana, R.K.; Vo, X.V. COVID-19 and oil market crash: Revisiting the safe haven property of gold and Bitcoin. Resour. Policy 2020, 69, 101816. [Google Scholar] [CrossRef] [PubMed]

- Economic Analysis; Policy Division|Dept of Economic; Social Affairs|United Nations. Global Economic Recovery Remains Precarious—The Projected Rebound of 4.7 Percent Will Barely Offset 2020 Losses. 2021. Available online: https://www.un.org/development/desa/dpad/publication/world-economic-situation-and-prospects-february-2021-briefing-no-146/ (accessed on 27 March 2021).

- Eichenbaum, M.S.; Rebelo, S.; Trabandt, M. The Macroeconomics of Epidemics; No. w26882; National Bureau of Economic Research: Cambridge, MA, USA, 2020. [Google Scholar]

- Farhi, E.; Gabaix, X. Rare disasters and exchange rates. Q. J. Econ. 2016, 131, 52. [Google Scholar] [CrossRef]

- Feng, G.-F.; Yang, H.-C.; Gong, Q.; Chang, C.-P. What is the exchange rate volatility response to COVID-19 and government interventions? Econ. Anal. Policy 2021, 69, 705–719. [Google Scholar] [CrossRef]

- Gil-Alana, L.A.; Monge, M. Crude Oil Prices and COVID-19: Persistence of the Shock. Energy Res. Lett. 2020, 1, 13200. [Google Scholar] [CrossRef]

- Grinsted, A.; Moore, J.C.; Jevrejeva, S. Application of the cross wavelet transformand wavelet coherence to geophysical time series. Nonlinear Process. Geophys. 2004, 11, 561–566. [Google Scholar] [CrossRef]

- Guan, L.; Zhang, W.-W.; Ahmad, F.; Naqvi, B. The volatility of natural resource prices and its impact on the economic growth for natural resource-dependent economies: A comparison of oil and gold dependent economies. Resour. Policy 2021, 72, 102125. [Google Scholar] [CrossRef]

- Gunay, S. Comparing COVID-19 with the GFC: A shockwave analysis of currency markets. Res. Int. Bus. Financ. 2021, 56, 101377. [Google Scholar] [CrossRef]

- Harjoto, M.A.; Rossi, F.; Lee, R.; Sergi, B.S. How do equity markets react to COVID-19? Evidence from emerging and developed countries. J. Econ. Bus. 2020, 115, 105966. [Google Scholar] [CrossRef]

- He, X.; Gokmenoglu, K.K.; Kirikkaleli, D.; Rizvi, S.K.A. Co-movement of foreign exchange rate returns and stock market returns in an emerging market: Evidence from the wavelet coherence approach. Int. J. Financ. Econ. 2021, 1–12. [Google Scholar] [CrossRef]

- Hkiri, B.; Hammoudeh, S.; Aloui, C.; Yarovaya, L. Are Islamic indexes a safe haven for investors? An analysis of total, directional and net volatility spillovers between conventional and Islamic indexes and importance of crisis periods. Pac.-Basin Financ. J. 2017, 43, 124–150. [Google Scholar] [CrossRef]

- 2020. Available online: https://www.npr.org/2020/03/08/813439501/saudi-arabia-stuns-world-with-massive-discount-in-oil-sold-to-asia-europe-and-u-.(n.d.) (accessed on 20 March 2021).

- 2021. Available online: https://www.imf.org/external/pubs/ft/ar/2020/eng/spotlight/COVID-19/ (accessed on 27 March 2021).

- Hung, N.T. Volatility spillovers and time-frequency correlations between Chinese and African stock markets. Reg. Stat. 2020, 10, 63–82. [Google Scholar] [CrossRef]

- Ichev, R.; Marinč, M. Stock prices and geographic proximity of information: Evidence from the Ebola outbreak. Int. Rev. Financ. Anal. 2018, 56, 153–166. [Google Scholar] [CrossRef]

- International Energy Agency. Global Energy Review 2020; OECD Publishing: Paris, France, 2020; Available online: https://www.iea.org/reports/global-energy-review-2020/global-energy-and-co2-emissions-in-2020 (accessed on 10 February 2020).

- Iyke, B.N.; Ho, S.-Y. Exchange rate exposure in the South African stock market before and during the COVID-19 pandemic. Financ. Res. Lett. 2021, 43, 102000. [Google Scholar] [CrossRef]

- Izzeldin, M.; Muradoğlu, Y.G.; Pappas, V.; Sivaprasad, S. The impact of COVID-19 on G7 stock markets volatility: Evidence from a ST-HAR model. Int. Rev. Financ. Anal. 2021, 74, 101671. [Google Scholar] [CrossRef]

- James, N.; Menzies, M. Association between COVID-19 cases and international equity indices. Phys. D Nonlinear Phenom. 2021, 417, 132809. [Google Scholar] [CrossRef]

- Ji, Q.; Zhang, D.; Zhao, Y. Searching for safe-haven assets during the COVID-19 pandemic. Int. Rev. Financ. Anal. 2020, 71, 101526. [Google Scholar] [CrossRef]

- Kamaludin, K.; Sundarasen, S.; Ibrahim, I. COVID-19, Dow Jones and equity market movement in ASEAN-5 countries: Evidence from wavelet analyses. Heliyon 2021, 7, e05851. [Google Scholar] [CrossRef]

- Kang, S.H.; Uddin, G.S.; Troster, V.; Yoon, S.-M. Directional spillover effects between ASEAN and world stock markets. J. Multinatl. Financ. Manag. 2019, 52, 100592. [Google Scholar] [CrossRef]

- Karim, S.; Khan, S.; Mirza, N.; Alawi, S.M.; Taghizadeh-Hesary, F. Climate finance in the wake of COVID-19: Connectedness of clean energy with conventional energy and regional stock markets. Clim. Chang. Econ. 2022, 13, 2240008. [Google Scholar] [CrossRef]

- Karamti, C.; Belhassine, O. COVID-19 pandemic waves and global financial markets: Evidence from wavelet coherence analysis. Financ. Res. Lett. 2022, 45, 102136. [Google Scholar] [CrossRef]

- Khalfaoui, R.; Solarin, S.A.; Al-Qadasi, A.; Ben Jabeur, S. Dynamic causality interplay from COVID-19 pandemic to oil price, stock market, and economic policy uncertainty: Evidence from oil-importing and oil-exporting countries. Ann. Oper. Res. 2022, 313, 105–143. [Google Scholar] [CrossRef]

- Khan, S.; Ullah, M.; Shahzad, M.R.; Khan, U.A.; Khan, U.; Eldin, S.M.; Alotaibi, A.M. Spillover Connectedness among Global Uncertainties and Sectorial Indices of Pakistan: Evidence from Quantile Connectedness Approach. Sustainability 2022, 14, 15908. [Google Scholar] [CrossRef]

- Khan, S.; Bhutto, N.A.; Khan, U.A.; Rehman, M.Z.; Alonazi, W.B.; Ludeen, A. Ṣukūk or Bond, Which Is More Sustainable during COVID-19? Global Evidence from the Wavelet Coherence Model. Sustainability 2022, 14, 10541. [Google Scholar] [CrossRef]

- Khan, S.; Aslan, H.; Khan, U.A.; Bhatti, M. Are Islamic and conventional banks decoupled? Empirical evidence from Turkey. Int. J. Emerg. Mark. 2022, ahead-of-print. [Google Scholar] [CrossRef]

- Kinateder, H.; Campbell, R.; Choudhury, T. Safe haven in GFC versus COVID-19: 100 turbulent days in the financial markets. Financ. Res. Lett. 2021, 43, 101951. [Google Scholar] [CrossRef]

- Kočenda, E.; Moravcová, M. Exchange rate comovements, hedging and volatility spillovers on new EU forex markets. J. Int. Financ. Mark. Inst. Money 2019, 58, 42–64. [Google Scholar] [CrossRef]

- Lai, Y.; Hu, Y. A study of systemic risk of global stock markets under COVID-19 based on complex financial networks. Phys. A Stat. Mech. Its Appl. 2021, 566, 125613. [Google Scholar] [CrossRef]

- Lee, C.C.; Lee, C.C.; Lien, D. Do country risk and financial uncertainty matter for energy commodity futures? J. Futur. Mark. 2019, 39, 366–383. [Google Scholar] [CrossRef]

- Li, S.; Lucey, B.M. Reassessing the role of precious metals as safe havens–What colour is your haven and why? J. Commod. Mark. 2017, 7, 1–14. [Google Scholar] [CrossRef]

- Lin, B.; Su, T. Does COVID-19 open a Pandora’s box of changing the connectedness in energy commodities? Res. Int. Bus. Financ. 2021, 56, 101360. [Google Scholar] [CrossRef] [PubMed]

- Liu, H.; Manzoor, A.; Wang, C.; Zhang, L.; Manzoor, Z. The COVID-19 outbreak and affected countries stock markets response. Int. J. Environ. Res. Public Health 2020, 17, 2800. [Google Scholar] [CrossRef]

- Ma, C.; Rogers, J.H.; Zhou, S. Global Economic and Financial Effects of 21st Century Pandemics and Epidemics. 2020. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3565646 (accessed on 8 October 2022).

- Ma, Y.R.; Ji, Q.; Pan, J. Oil financialization and volatility forecast: Evidence from multidimensional predictors. J. Forecast. 2019, 38, 564–581. [Google Scholar]

- Manela, A.; Moreira, A. News implied volatility and disaster concerns. J. Financ. Econ. 2017, 123, 137–162. [Google Scholar] [CrossRef]

- Mensi, W.; Sensoy, A.; Vo, X.V.; Kang, S.H. Impact of COVID-19 outbreak on asymmetric multifractality of gold and oil prices. Resour. Policy 2020, 69, 101829. [Google Scholar] [CrossRef]

- Narayan, P.K. Has COVID-19 Changed Exchange Rate Resistance to Shocks? Asian Econ. Lett. 2020, 1, 17389. [Google Scholar] [CrossRef]

- Iyke, B.N. The Disease Outbreak Channel of Exchange Rate Return Predictability: Evidence from COVID-19. Emerg. Mark. Financ. Trade 2020, 56, 2277–2297. [Google Scholar] [CrossRef]

- Noy, I.; Vu, T.B. The economics of natural disasters in a developing country: The case of Vietnam. J. Asian Econ. 2010, 21, 345–354. [Google Scholar] [CrossRef]

- Okorie, D.I.; Lin, B. Stock markets and the COVID-19 fractal contagion effects. Financ. Res. Lett. 2021, 38, 101640. [Google Scholar] [CrossRef]

- Papadamou, S.; Fassas, A.; Kenourgios, D.; Dimitriou, D. Direct and Indirect Effects of COVID-19 Pandemic on Implied Stock Market Volatility: Evidence from Panel Data Analysis; University Library of Munich: Munich, Germany, 2020. [Google Scholar]

- Reboredo, J.C. Is gold a hedge or safe haven against oil price movements? Resour. Policy 2013, 38, 130–137. [Google Scholar] [CrossRef]

- Reboredo, J.C.; Rivera-Castro, M.A. A wavelet decomposition approach to crude oil price and exchange rate dependence. Econ. Model. 2013, 32, 42–57. [Google Scholar] [CrossRef]

- Rehman, M.Z.; Khan, S.; Ali, M.; Rehman, F.U.; Alonazi, W.B.; Aljuaid, M. Advance Dynamic Panel Second-Generation Two-Step System Generalized Method of Movement Modeling: Applications in Economic Stability-Shadow Economy Nexus with a Special Case of Kingdom of Saudi Arabia. Mathematics 2022, 11, 85. [Google Scholar] [CrossRef]

- Salisu, A.A.; Adediran, I. Gold as a hedge against oil shocks: Evidence from new datasets for oil shocks. Resour. Policy 2020, 66, 101606. [Google Scholar] [CrossRef]

- Salisu, A.A.; Akanni, L.; Raheem, I. The COVID-19 global fear index and the predictability of commodity price returns. J. Behav. Exp. Financ. 2020, 27, 100383. [Google Scholar] [CrossRef]

- Salisu, A.A.; Raheem, I.D.; Vo, X.V. Assessing the safe haven property of the gold market during COVID-19 pandemic. Int. Rev. Financ. Anal. 2021, 74, 101666. [Google Scholar] [CrossRef]

- Salisu, A.A.; Sikiru, A.A.; Vo, X.V. Pandemics and the emerging stock markets. Borsa Istanb. Rev. 2020, 20, S40–S48. [Google Scholar] [CrossRef]

- Salisu, A.A.; Vo, X.V.; Lawal, A. Hedging oil price risk with gold during COVID-19 pandemic. Resour. Policy 2020, 70, 101897. [Google Scholar] [CrossRef] [PubMed]

- Sergi, B.S.; Harjoto, M.A.; Rossi, F.; Lee, R. Do stock markets love misery? Evidence from the COVID-19. Financ. Res. Lett. 2021, 42, 101923. [Google Scholar] [CrossRef]

- Shahzad, S.J.H.; Bouri, E.; Roubaud, D.; Kristoufek, L. Safe haven, hedge and diversification for G7 stock markets: Gold versus bitcoin. Econ. Model. 2020, 87, 212–224. [Google Scholar] [CrossRef]

- Shaikh, I. Impact of COVID-19 pandemic on the energy markets. Econ. Chang. Restruct. 2021, 55, 433–484. [Google Scholar] [CrossRef]

- Sharif, A.; Aloui, C.; Yarovaya, L. COVID-19 pandemic, oil prices, stock market, geopolitical risk and policy uncertainty nexus in the US economy: Fresh evidence from the wavelet-based approach. Int. Rev. Financ. Anal. 2020, 70, 101496. [Google Scholar] [CrossRef]

- Sharma, G.D.; Tiwari, A.K.; Talan, G.; Jain, M. Revisiting the sustainable versus conventional investment dilemma in COVID-19 times. Energy Policy 2021, 156, 112467. [Google Scholar] [CrossRef]

- Sharma, G.D.; Tiwari, A.K.; Jain, M.; Yadav, A.; Erkut, B. Unconditional and conditional analysis between COVID-19 cases, temperature, exchange rate and stock markets using wavelet coherence and wavelet partial coherence approaches. Heliyon 2021, 7, e06181. [Google Scholar] [CrossRef] [PubMed]

- Shehzad, K.; Xiaoxing, L.; Kazouz, H. COVID-19′s disasters are perilous than Global Financial Crisis: A rumor or fact? Financ. Res. Lett. 2020, 36, 101669. [Google Scholar] [CrossRef]

- Sui, L.; Sun, L. Spillover effects between exchange rates and stock prices: Evidence from BRICS around the recent global financial crisis. Res. Int. Bus. Financ. 2016, 36, 459–471. [Google Scholar] [CrossRef]

- Szczygielski, J.J.; Bwanya, P.R.; Charteris, A.; Brzeszczyński, J. The only certainty is uncertainty: An analysis of the impact of COVID-19 uncertainty on regional stock markets. Financ. Res. Lett. 2021, 43, 101945. [Google Scholar] [CrossRef] [PubMed]

- Torrence, C.; Compo, G.P. A practical guide to wavelet analysis. Bull. Am. Meteorol. Soc. 1998, 79, 61–78. [Google Scholar] [CrossRef]

- Torrence, C.; Webster, P.J. Interdecadal changes in the ENSO–monsoon system. J. Clim. 1999, 12, 2679–2690. [Google Scholar] [CrossRef]

- Uddin, M.; Chowdhury, A.; Anderson, K.; Chaudhuri, K. The effect of COVID–19 pandemic on global stock market volatility: Can economic strength help to manage the uncertainty? J. Bus. Res. 2021, 128, 31–44. [Google Scholar] [CrossRef]

- Vácha, L.; Barunik, J. Co-movement of energy commodities revisited: Evidence from wavelet coherence analysis. Energy Econ. 2012, 34, 241–247. [Google Scholar] [CrossRef]

- Wang, Y.; Wei, Y.; Wu, C. Analysis of the efficiency and multifractality of gold markets based on multifractal detrended fluctuation analysis. Phys. A Stat. Mech. Its Appl. 2011, 390, 817–827. [Google Scholar] [CrossRef]

- Wasiuzzaman, S.; Rahman, H.S.W.H.A. Performance of gold-backed cryptocurrencies during the COVID-19 crisis. Financ. Res. Lett. 2021, 43, 101958. [Google Scholar] [CrossRef] [PubMed]

- Wei, Z.; Luo, Y.; Huang, Z.; Guo, K. Spillover effects of RMB exchange rate among B&R countries: Before and during COVID-19 event. Financ. Res. Lett. 2020, 37, 101782. [Google Scholar] [CrossRef] [PubMed]

- World Health Organization. WHO Director-General’s Opening Remarks at the Media Briefing on COVID-19; WHO: Geneva, Switzerland, 2020. [Google Scholar]

- Youssef, M.; Mokni, K.; Ajmi, A.N. Dynamic connectedness between stock markets in the presence of the COVID-19 pandemic: Does economic policy uncertainty matter? Financ. Innov. 2021, 7, 13. [Google Scholar] [CrossRef] [PubMed]

- Zhang, D.; Hu, M.; Ji, Q. Financial markets under the global pandemic of COVID-19. Financ. Res. Lett. 2020, 36, 101528. [Google Scholar] [CrossRef]

| Affected Countries | COV Cases | COV Deaths | |

|---|---|---|---|

| 1. | United States | 25,885,662 | 434,934 |

| 2. | India | 10,767,208 | 154,522 |

| 3. | Brazil | 9,229,322 | 225,099 |

| 4. | Russia | 3,868,087 | 179,046 |

| 5. | United Kingdom | 3,835,783 | 106,564 |

| 6. | France | 3,201,461 | 76,512 |

| 7. | Spain | 2,822,805 | 59,081 |

| 8. | Italy | 2,560,957 | 88,845 |

| 9. | Turkey | 2,485,182 | 26,117 |

| 10 | Germany | 2,224,898 | 57,454 |

| STATS | N | Mean | SD | Min | Max | Skewness | Kurtosis |

|---|---|---|---|---|---|---|---|

| COVDTH | 2840 | 53,720.46 | 74,986.54 | 0.00 | 499,209.00 | 2.57 | 11.54 |

| COVCAS | 2840 | 2,032,767.00 | 3,896,737.00 | 0.00 | 27,900,000.00 | 3.72 | 20.10 |

| VIX | 2840 | 28.50 | 11.72 | 12.10 | 82.69 | 1.93 | 7.87 |

| WTI | 2840 | 41.53 | 12.06 | −37.63 | 63.57 | −1.28 | 8.76 |

| OVX | 2840 | 60.90 | 42.67 | 27.66 | 325.15 | 2.54 | 10.32 |

| EVZ | 2840 | 7.64 | 2.15 | 4.13 | 19.31 | 2.02 | 10.34 |

| GVZ | 2840 | 21.25 | 6.01 | 10.91 | 48.98 | 1.24 | 6.20 |

| SMI | 2840 | 19,770.46 | 29,366.91 | 1014.10 | 125,076.60 | 2.23 | 6.91 |

| ER | 2840 | 16.01 | 28.28 | 0.71 | 80.93 | 1.54 | 3.41 |

| USEPU | 2840 | 269.95 | 143.02 | 22.25 | 807.66 | 0.88 | 3.52 |

| Gold | 2636 | 1780.09 | 139.14 | 1471.24 | 2063.54 | −0.30 | 1.94 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rehman, M.Z.; Khan, S.; Abbas, G.; Alhashim, M. Novel COVID-19 Outbreak and Global Uncertainty in the Top-10 Affected Countries: Evidence from Wavelet Coherence Approach. Sustainability 2023, 15, 5556. https://doi.org/10.3390/su15065556

Rehman MZ, Khan S, Abbas G, Alhashim M. Novel COVID-19 Outbreak and Global Uncertainty in the Top-10 Affected Countries: Evidence from Wavelet Coherence Approach. Sustainability. 2023; 15(6):5556. https://doi.org/10.3390/su15065556

Chicago/Turabian StyleRehman, Mohd Ziaur, Shabeer Khan, Ghulam Abbas, and Mohammed Alhashim. 2023. "Novel COVID-19 Outbreak and Global Uncertainty in the Top-10 Affected Countries: Evidence from Wavelet Coherence Approach" Sustainability 15, no. 6: 5556. https://doi.org/10.3390/su15065556

APA StyleRehman, M. Z., Khan, S., Abbas, G., & Alhashim, M. (2023). Novel COVID-19 Outbreak and Global Uncertainty in the Top-10 Affected Countries: Evidence from Wavelet Coherence Approach. Sustainability, 15(6), 5556. https://doi.org/10.3390/su15065556