An Investigation of Saudi Arabia’s Ambitious Reform Programme with Vision 2030 to Incentivise Investment in the Country’s Non-Oil Industries

Abstract

1. Introduction

1.1. Problem Statement

1.2. Significance of the Study

1.3. Research Aims and Objectives

1.4. Objectives

2. Literature Review

2.1. Saudi Arabia’s Ambitious Reform Programme with Vision 2030

2.2. Advancement in Investment in the Country’s Non-Oil Industries

2.3. Saudi Arabia’s Ambitious Reform Programme in Improving Non-Oil Industries

3. Research Gap

4. Research Methodology

4.1. Population and Sample Process

4.2. Sampling Technique

4.3. Filtering Strategy

4.4. Data Collection Procedures

4.5. Process of Findings

4.6. Measurement of Variables

5. Results

5.1. Demographic Details

5.2. Hypothesis 1

5.2.1. Descriptive Test

5.2.2. Regression Test

5.2.3. Chi-Square Test

5.3. Hypothesis 2

5.3.1. Descriptive Test

5.3.2. Regression Test

5.3.3. Chi-Square Test

5.4. Hypothesis 3

5.4.1. Descriptive Test

5.4.2. Regression Test

5.4.3. Chi-Square Test

6. Discussion and Conclusions

6.1. Discussion

6.2. Theoretical Contribution of the Study

6.3. Implication of the Study

6.4. Conclusions

6.5. Research Limitation

6.6. Future Scope

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Survey Question

| Demographic 1. What is your age? 18–20 years 20–25 years More than 30 years 2. What is your gender? Male Female 3. What is your highest education? Higher Secondary Graduation Post-graduation Dependent Variable 4. Is this reform program will help oil-independent industry growth? Strongly agree Agree Neutral Disagree Strongly disagree 5. Does the financial support is important for success of the reform program? Strongly agree Agree Neutral Disagree Strongly disagree Independent Variables 6. Does government have enough role in improving incentivised investment? Strongly agree Agree Neutral Disagree Strongly disagree 7. Is the incentivised investment is important for the betterment of the Vision-2030? Strongly agree Agree Neutral Disagree Strongly disagree 8. Does the innovation in incentivised investment is important for financial aspect? Strongly agree Agree Neutral Disagree Strongly disagree 9. Does Vision-2030 can help in improving economic growth? Strongly agree Agree Neutral Disagree Strongly disagree 10. Does the strategic planning is important for economic growth of Saudi Arabia? Strongly agree Agree Neutral Disagree Strongly disagree 11. Does the support from stakeholders helps in maintaining economic growth? Strongly agree Agree Neutral Disagree Strongly disagree 12. Is economic growth is beneficial for the reduction in non-oil dependency of the country? Strongly agree Agree Neutral Disagree Strongly disagree 13. Does availability of capital is important for success of Vision-2030? Strongly agree Agree Neutral Disagree Strongly disagree 14. Does stakeholders are important for capital management? Strongly agree Agree Neutral Disagree Strongly disagree 15. Does the capital management require proper planning by the government? Strongly agree Agree Neutral Disagree Strongly disagree |

References

- Abu-Bader, S.H. Using Statistical Methods in Social Science Research: With a Complete SPSS Guide; Oxford University Press: Oxford, MO, USA, 2021; Available online: https://books.google.co.in/books/about/Using_Statistical_Methods_in_Social_Scie.html?id=A-t0DgAAQBAJ&redir_esc=y (accessed on 7 January 2023).

- Aguinis, H.; Hill, N.S.; Bailey, J.R. Best practices in data collection and preparation: Recommendations for reviewers, editors, and authors. Organ. Res. Methods 2021, 24, 678–693. [Google Scholar] [CrossRef]

- Al Naimi, S.M. Economic diversification trends in the Gulf: The case of Saudi Arabia. Circ. Econ. Sustain. 2022, 2, 221–230. [Google Scholar] [CrossRef]

- Albadry, A.S.; Oraibi, F.M. Foundations and Dimensions of Sustainable Development in Saudi Arabia for 2030. Balt. J. Law Politics 2022, 15, 1195–1207. [Google Scholar]

- Alwakid, W.; Aparicio, S.; Urbano, D. The influence of green entrepreneurship on sustainable development in Saudi Arabia: The role of formal institutions. Int. J. Environ. Res. Public Health 2021, 18, 5433. [Google Scholar] [CrossRef]

- Alzahrani, J.S. A Contingency Approach towards Strategic Planning at National Level: Saudi Arabia’s Vision 2030 Perspective. 2019. Available online: https://www.researchgate.net/profile/Joman-Alzahrani/publication/346261351_A_Contingency_Approach_Towards_Strategic_Planning_at_National_Level_Saudi_Arabia’s_Vision_2030_Perspective/links/5fbd2fe0a6fdcc6cc66335cc/A-Contingency-Approach-Towards-Strategic-Planning-at-National-Level-Saudi-Arabias-Vision-2030-Perspective.pdf (accessed on 7 January 2023).

- Astivia, O.L.O.; Zumbo, B.D. Heteroskedasticity in Multiple Regression Analysis: What it is, How to Detect it and How to Solve it with Applications in R and SPSS. Pract. Assess. Res. Eval. 2019, 24, 1. [Google Scholar] [CrossRef]

- Bibri, S.E.; Krogstie, J.; Kärrholm, M. Compact city planning and development: Emerging practices and strategies for achieving the goals of sustainability. Dev. Built Environ. 2020, 4, 100021. [Google Scholar] [CrossRef]

- Bradshaw, M.; Van de Graaf, T.; Connolly, R. Preparing for the new oil order? Saudi Arabia and Russia. Energy Strategy Rev. 2019, 26, 100374. [Google Scholar] [CrossRef]

- Chen, D.; Han, W. Deepening Cooperation between Saudi Arabia and China; King Abdullah Petroleum Studies and Research Center: Riyadh, Saudi Arabia, 2019; p. 24. Available online: https://www.kapsarc.org/wp-content/uploads/2019/03/Deepening-Cooperation-Between-Saudi-Arabia-and-China.pdf (accessed on 11 January 2023).

- Yusuf, N.; Abdulmohsen, D. Saudi Arabia’s NEOM Project as a Testing Ground for Economically Feasible Planned Cities: Case Study. Sustainability 2022, 15, 608. [Google Scholar] [CrossRef]

- McPherson-Smith, O. Diversification, Khashoggi, and Saudi Arabia’s public investment fund. Glob. Policy 2021, 12, 190–203. [Google Scholar] [CrossRef]

- Christodoulou, A.; Dalaklis, D.; Ölcer, A.; Ballini, F. Can market-based measures stimulate investments in green technologies for the abatement of ghg emissions from shipping? A review of proposed market-based measures. Trans. Marit. Sci. 2021, 10, 208–215. [Google Scholar] [CrossRef]

- Chugunov, I.; Makohon, V. Fiscal strategy as an instrument of economic growth. Balt. J. Econ. Stud. 2019, 5, 213–217. [Google Scholar] [CrossRef]

- Ding, D.; Han, Q.L.; Wang, Z.; Ge, X. A survey on model-based distributed control and filtering for industrial cyber-physical systems. IEEE Trans. Ind. Inform. 2019, 15, 2483–2499. [Google Scholar] [CrossRef]

- Faudot, A. Saudi Arabia and the rentier regime trap: A critical assessment of the plan Vision 2030. Resour. Policy 2019, 62, 94–101. [Google Scholar] [CrossRef]

- Flick, U. Introducing Research Methodology: Thinking Your Way through Your Research Project; Sage: Thousand Oaks, CA, USA, 2020; Available online: https://www.torrossa.com/gs/resourceProxy?an=5018146&publisher=FZ7200 (accessed on 11 January 2023).

- Fobbe, L.; Hilletofth, P. The role of stakeholder interaction in sustainable business models. A systematic literature review. J. Clean. Prod. 2021, 327, 129510. [Google Scholar] [CrossRef]

- Franche, R.L.; Baril, R.; Shaw, W.; Nicholas, M.; Loisel, P. Workplace-based return-to-work interventions: Optimizing the role of stakeholders in implementation and research. J. Occup. Rehabil. 2020, 15, 525–542. [Google Scholar] [CrossRef]

- Fu, J.; Zhang, Y.; Liu, J.; Lian, X.; Tang, J.; Zhu, F. Pharmacometabonomics: Data processing and statistical analysis. Brief. Bioinform. 2021, 22, bbab138. [Google Scholar] [CrossRef]

- Grand, S.; Wolff, K. Assessing Saudi Vision 2030: A 2020 Review; Atlantic Council: Washington, DC, USA, 2020; p. 17. Available online: https://d8-engineering.kku.edu.sa/sites/d8-engineering.kku.edu.sa/files/2021-06/Assessing-Saudi-Vision-2030-A-2020-review.pdf (accessed on 18 January 2023).

- Guendouz, A.A.; Ouassaf, S.M. The economic diversification in Saudi Arabia under the strategic vision 2030. Acad. Account. Financ. Stud. J. 2020, 24, 1–23. Available online: https://www.researchgate.net/profile/Abdelkrim-Guendouz/publication/346080275_The_Economic_Diversification_in_Saudi_Arabia_under_the_Strategic_Vision_2030/links/5fba382a299bf104cf6af618/The-Economic-Diversification-in-Saudi-Arabia-under-the-Strategic-Vision-2030.pdf (accessed on 18 January 2023).

- Habibi, N. Implementing saudi arabia’s vision 2030: An interim balance sheet. Middle East Brief 2019, 127, 1–9. [Google Scholar]

- Hysa, E.; Kruja, A.; Rehman, N.U.; Laurenti, R. Circular economy innovation and environmental sustainability impact on economic growth: An integrated model for sustainable development. Sustainability 2020, 12, 4831. [Google Scholar] [CrossRef]

- Kumar, R. Research Methodology: A Step-By-Step Guide for Beginners; Sage: Thousand Oaks, CA, USA, 2018; Available online: http://www.sociology.kpi.ua/wp-content/uploads/2014/06/Ranjit_Kumar-Research_Methodology_A_Step-by-Step_G.pdf (accessed on 24 January 2023).

- König, M.; Ungerer, C.; Baltes, G.; Terzidis, O. Different patterns in the evolution of digital and non-digital ventures’ business models. Technol. Forecast. Soc. Chang. 2019, 146, 844–852. [Google Scholar] [CrossRef]

- Kothari, C. Research Methodology Methods and Techniques by CR Kothari; New Age International (P) Ltd.: Kathmandu, Nepal, 2017; Volume 91, Available online: https://pdfcookie.com/documents/research-methodology-methods-and-techniques-by-cr-kothari-7rv3wzk460ld (accessed on 18 January 2023).

- Lieberknecht, K. Community-centered climate planning: Using local knowledge and communication frames to catalyze climate planning in Texas. J. Am. Plan. Assoc. 2022, 88, 97–112. [Google Scholar] [CrossRef]

- Lee, S.C.; Pollitt, H.; Fujikawa, K. (Eds.) Energy, Environmental and Economic Sustainability in East Asia: Policies and Institutional Reforms; Routledge: Oxford, UK, 2019; Available online: https://www.google.com/aclk?sa=l&ai=DChcSEwjyh9Tm5dr9AhVRBCsKHfeAAPIYABAAGgJzZg&sig=AOD64_0jknf3CSEvBEYBPRSiLUesMs5LqA&q&adurl&ved=2ahUKEwil5MXm5dr9AhVQxjgGHTmeCWsQ0Qx6BAgEEAE (accessed on 24 January 2023).

- Leonidou, E.; Christofi, M.; Vrontis, D.; Thrassou, A. An integrative framework of stakeholder engagement for innovation management and entrepreneurship development. J. Bus. Res. 2020, 119, 245–258. [Google Scholar] [CrossRef]

- Liu, Z.; Pontius, R.G., Jr. The total operating characteristic from stratified random sampling with an application to flood mapping. Remote Sens. 2021, 13, 3922. [Google Scholar] [CrossRef]

- Maffini, G.; Xing, J.; Devereux, M.P. The impact of investment incentives: Evidence from UK corporation tax returns. Am. Econ. J. Econ. Policy 2019, 11, 361–389. [Google Scholar] [CrossRef]

- Martins, F.S.; da Cunha, J.A.C.; Serra, F.A.R. Secondary data in research–uses and opportunities. PODIUM Sport Leis. Tour. Rev. 2018, 7–9. [Google Scholar] [CrossRef]

- Medhioub, I.; Makni, M. Oil price and stock market returns uncertainties and private investment in Saudi Arabia. Econ. J. Emerg. Mark. 2020, 12, 208–219. [Google Scholar] [CrossRef]

- Mishra, P.; Pandey, C.M.; Singh, U.; Gupta, A.; Sahu, C.; Keshri, A. Descriptive statistics and normality tests for statistical data. Ann. Card. Anaesth. 2019, 22, 67. [Google Scholar] [CrossRef]

- Phan, D.H.B.; Iyke, B.N.; Sharma, S.S.; Affandi, Y. Economic policy uncertainty and financial stability–Is there a relation? Econ. Model. 2021, 94, 1018–1029. [Google Scholar] [CrossRef]

- Qadir, M.I.; Rehman, M.S.; Gardezi, S.G. Growing winds of change in Saudi Arabia through vision 2030. J. Contemp. Stud. 2020, 9, 34–47. Available online: https://jcs.ndu.edu.pk/site/article/download/22/8 (accessed on 24 January 2023).

- Rifkin, J. The Green New Deal: Why the Fossil Fuel Civilization Will Collapse by 2028, and the Bold Economic Plan to Save Life on Earth; St. Martin’s Press: New York, NY, USA, 2019; Available online: https://us.macmillan.com/books/9781250253217/thegreennewdeal (accessed on 24 January 2023).

- Rosati, F.; Faria, L.G. Addressing the SDGs in sustainability reports: The relationship with institutional factors. J. Clean. Prod. 2019, 215, 1312–1326. [Google Scholar] [CrossRef]

- Saudiembassy.Vision 2030. 2023. Available online: https://www.saudiembassy.net/vision-2030 (accessed on 21 January 2023).

- Schindler, S.; Kanai, J.M. Getting the territory right: Infrastructure-led development and the re-emergence of spatial planning strategies. In Planning Regional Futures; Routledge: Oxford, UK, 2021; pp. 75–98. Available online: https://rsa.tandfonline.com/doi/pdf/10.1080/00343404.2019.1661984\ (accessed on 24 January 2023).

- Statista. Digital Investment—Saudi Arabia. 2023. Available online: https://www.statista.com/outlook/dmo/fintech/digital-investment/saudi-arabia#transaction-value (accessed on 20 January 2023).

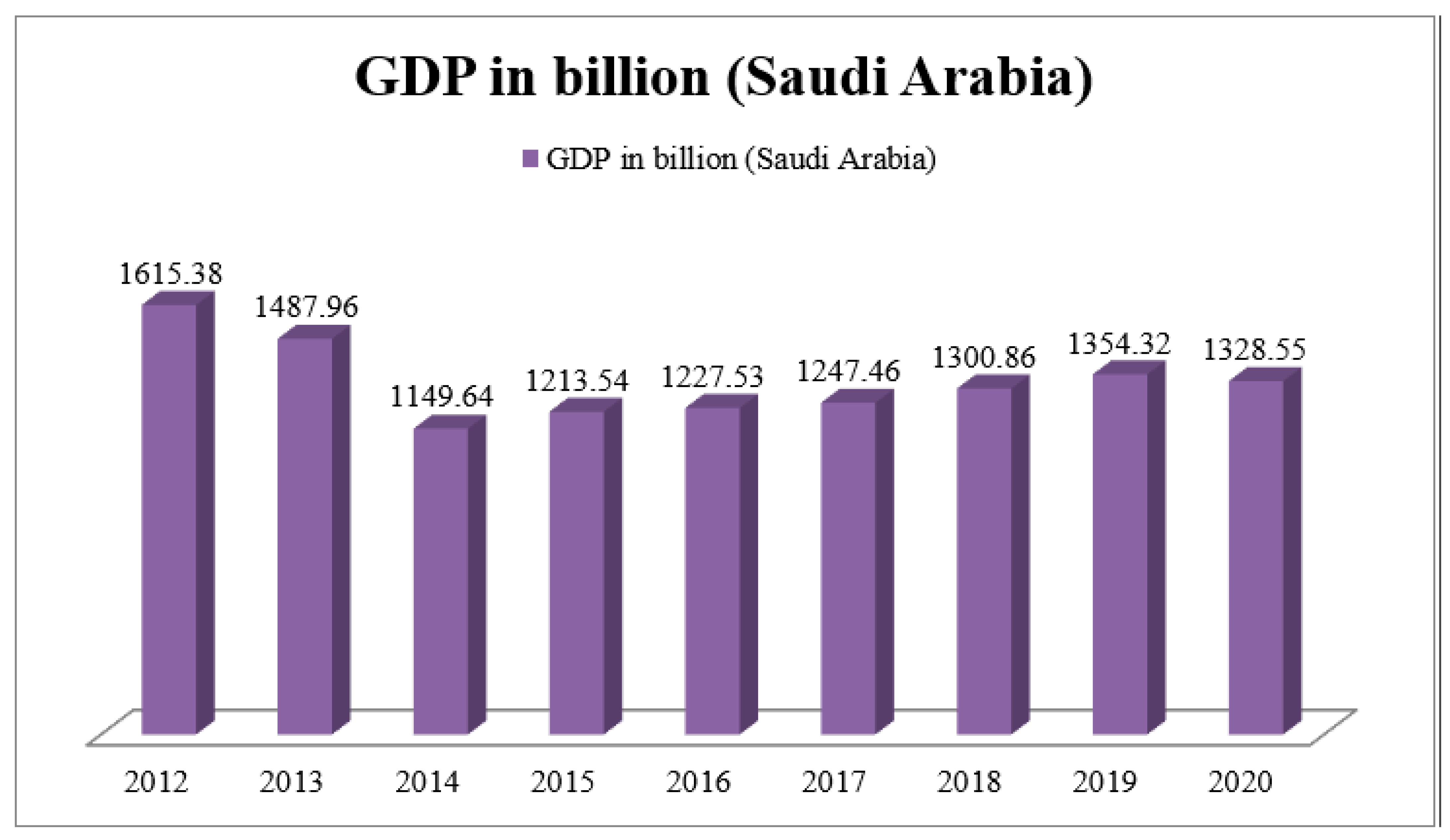

- Statista. Gross Domestic Product of the Non-Oil Private Sector in Saudi Arabia from 2012 to 2020. 2023. Available online: https://www.statista.com/statistics/626071/saudi-arabia-non-oil-private-sector-gdp/#:~:text=The%20total%20estimated%20GDP%20for,about%202.62%20trillion%20Saudi%20riyals (accessed on 20 January 2023).

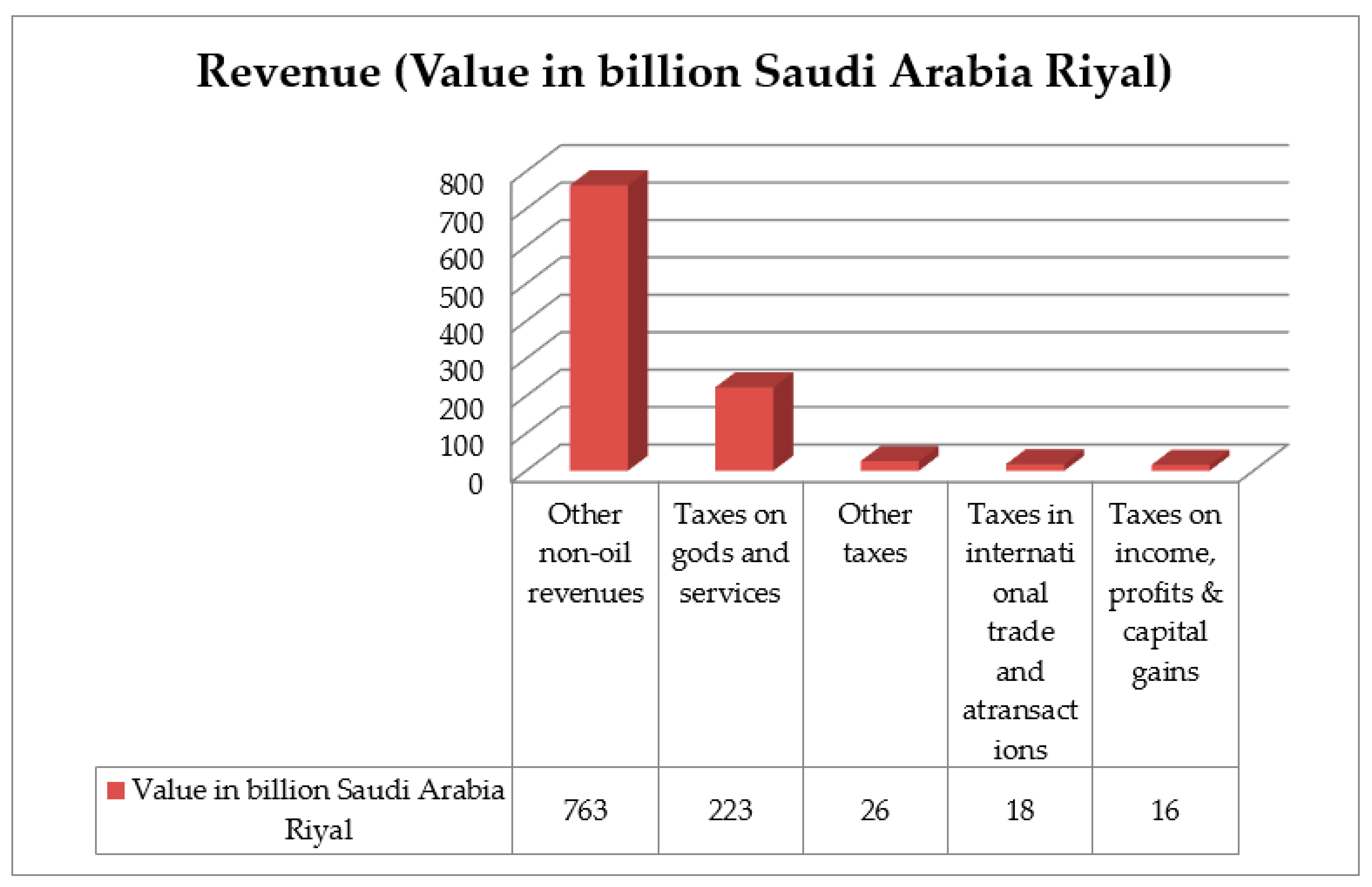

- Statista. Projected Value of the Saudi Arabian Government’s Non-Oil Revenue of in 2022, by Type. 2023. Available online: https://www.statista.com/statistics/1026112/saudi-arabia-value-of-governmental-non-oil-revenue-by-type/#:~:text=The%20government%20of%20Saudi%20Arabia,from%20other%20non-oil%20revenues (accessed on 24 January 2023).

- Sunny, S.A.; Shu, C. Investments, incentives, and innovation: Geographical clustering dynamics as drivers of sustainable entrepreneurship. Small Bus. Econ. 2019, 52, 905–927. [Google Scholar] [CrossRef]

- Vision2030.gov.sa.Vision 2030 Overview. 2023. Available online: https://www.vision2030.gov.sa/v2030/overview/ (accessed on 21 January 2023).

- Derakhshan, R.; Turner, R.; Mancini, M. Project governance and stakeholders: A literature review. Int. J. Proj. Manag. 2019, 37, 98–116. [Google Scholar] [CrossRef]

| Variables | Main Findings | References |

|---|---|---|

| Independent Industry Growth | Independent industry growth refers to the growth of the economy besides its average rate | [1] |

| Betterment of the Vision | Vision refers to the aim or objectives toward which any country or the reform within the country works | [8] |

| Incentivised Investment | Incentivised investment is the establishment of government policy that works on encouraging businesses to expand or grow | [12] |

| Strategic Planning | Strategic planning can refer to the strategies of the leaders within any country for defining the future aim | [19] |

| Financial Support | Financial support is the monetary support that helps any organization or any economy to continue | [24] |

| Economic Growth | Economic growth defines the increment in the quality or the number of economic goods | [5] |

| Statistics | ||||

|---|---|---|---|---|

| Age | Gender | Highest Education | ||

| N | Valid | 225 | 225 | 225 |

| Missing | 0 | 0 | 0 | |

| Mean | 1.66 | 1.41 | 2.08 | |

| Median | 2.00 | 1.00 | 2.00 | |

| Mode | 2 | 1 | 3 | |

| Std. Deviation | 0.621 | 0.493 | 0.865 | |

| Variance | 0.385 | 0.243 | 0.749 | |

| Skewness | 0.379 | 0.373 | −0.147 | |

| Std. Error of Skewness | 0.162 | 0.162 | 0.162 | |

| Kurtosis | −0.657 | −1.878 | −1.653 | |

| Std. Error of Kurtosis | 0.323 | 0.323 | 0.323 | |

| Range | 2 | 1 | 2 | |

| Minimum | 1 | 1 | 1 | |

| Maximum | 3 | 2 | 3 | |

| Sum | 374 | 317 | 467 | |

| Statistics | ||||

|---|---|---|---|---|

| Independent_Industry_Growth | Incentivised_Investment | Betterment_of_the_Vision | ||

| N | Valid | 225 | 225 | 225 |

| Missing | 0 | 0 | 0 | |

| Mean | 1.75 | 1.82 | 1.42 | |

| Median | 2.00 | 2.00 | 1.00 | |

| Mode | 2 | 2 | 1 | |

| Std. Deviation | 0.436 | 0.793 | 0.494 | |

| Variance | 0.190 | 0.629 | 0.244 | |

| Skewness | −1.142 | 1.304 | 0.336 | |

| Std. Error of Skewness | 0.162 | 0.162 | 0.162 | |

| Kurtosis | −0.702 | 2.057 | −1.904 | |

| Std. Error of Kurtosis | 0.323 | 0.323 | 0.323 | |

| Range | 1 | 3 | 1 | |

| Minimum | 1 | 1 | 1 | |

| Maximum | 2 | 4 | 2 | |

| Sum | 393 | 410 | 319 | |

| Model Summary b | ||||||||||||||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate | Change Statistics | |||||||||||

| R Square Change | F Change | df1 | df2 | Sig. F Change | ||||||||||||

| 1 | 0.362 a | 0.131 | 0.123 | 0.408 | 0.131 | 16.768 | 2 | 222 | 0.000 | |||||||

| a Predictors: (Constant), Betterment_of_the_Vision, Incentivised_Investment | ||||||||||||||||

| b Dependent Variable: Independent_Industry_Growth | ||||||||||||||||

| ANOVA a | ||||||||||||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | |||||||||||

| 1 | Regression | 5.585 | 2 | 2.793 | 16.768 | 0.000 b | ||||||||||

| Residual | 36.975 | 222 | 0.167 | |||||||||||||

| Total | 42.560 | 224 | ||||||||||||||

| a Dependent Variable: Independent_Industry_Growth | ||||||||||||||||

| b Predictors: (Constant), Betterment_of_the_Vision, Incentivised_Investment | ||||||||||||||||

| Coefficients a | ||||||||||||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | ||||||||||||

| B | Std. Error | Beta | ||||||||||||||

| 1 | (Constant) | 1.425 | 0.090 | 15.831 | 0.000 | |||||||||||

| Incentivised_Investment | 0.207 | 0.037 | 0.377 | 5.567 | 0.000 | |||||||||||

| Betterment_of_the_Vision | −0.040 | 0.060 | −0.045 | −0.665 | 0.507 | |||||||||||

| a Dependent Variable: Independent_Industry_Growth | ||||||||||||||||

| Chi-Square Tests | |||

|---|---|---|---|

| Value | df | Asymp. Sig. (2-Sided) | |

| Pearson Chi-Square | 38.676 a | 2 | 0.000 |

| Likelihood Ratio | 40.858 | 2 | 0.000 |

| Linear-by-Linear Association | 29.009 | 1 | 0.000 |

| N of Valid Cases | 225 | ||

| Statistics | ||||

|---|---|---|---|---|

| Financial_Support | Economic_Growth | Strategic_Planning | ||

| N | Valid | 225 | 225 | 225 |

| Missing | 0 | 0 | 0 | |

| Mean | 1.34 | 1.91 | 1.59 | |

| Median | 1.00 | 2.00 | 2.00 | |

| Mode | 1 | 2 | 2 | |

| Std. Deviation | 0.474 | 0.858 | 0.494 | |

| Variance | 0.225 | 0.737 | 0.244 | |

| Skewness | 0.691 | 0.950 | −0.354 | |

| Std. Error of Skewness | 0.162 | 0.162 | 0.162 | |

| Kurtosis | −1.537 | 0.542 | −1.891 | |

| Std. Error of Kurtosis | 0.323 | 0.323 | 0.323 | |

| Range | 1 | 3 | 1 | |

| Minimum | 1 | 1 | 1 | |

| Maximum | 2 | 4 | 2 | |

| Sum | 301 | 429 | 357 | |

| Model Summary b | |||||||||||||||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate | Change Statistics | ||||||||||||

| R Square Change | F Change | df1 | df2 | Sig. F Change | |||||||||||||

| 1 | 0.326 a | 0.106 | 0.098 | 0.450 | 0.106 | 13.206 | 2 | 222 | 0.000 | ||||||||

| a Predictors: (Constant), Strategic_Planning, Economic_Growth. | |||||||||||||||||

| b Dependent Variable: Financial_Support. | |||||||||||||||||

| ANOVA a | |||||||||||||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | ||||||||||||

| 1 | Regression | 5.351 | 2 | 2.676 | 13.206 | 0.000 b | |||||||||||

| Residual | 44.978 | 222 | 0.203 | ||||||||||||||

| Total | 50.329 | 224 | |||||||||||||||

| a Dependent Variable: Financial_Support. | |||||||||||||||||

| b Predictors: (Constant), Strategic_Planning, Economic_Growth. | |||||||||||||||||

| Coefficients a | |||||||||||||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | |||||||||||||

| B | Std. Error | Beta | |||||||||||||||

| 1 | (Constant) | 0.840 | 0.108 | 7.744 | 0.000 | ||||||||||||

| Economic_Growth | 0.130 | 0.037 | 0.236 | 3.532 | 0.001 | ||||||||||||

| Strategic_Planning | 0.158 | 0.064 | 0.164 | 2.460 | 0.015 | ||||||||||||

| a Dependent Variable: Financial_Support. | |||||||||||||||||

| Chi-Square Tests | |||

|---|---|---|---|

| Value | df | Asymp. Sig. (2-Sided) | |

| Pearson Chi-Square | 99.863 a | 3 | 0.000 |

| Likelihood Ratio | 132.568 | 3 | 0.000 |

| Linear-by-Linear Association | 18.361 | 1 | 0.000 |

| N of Valid Cases | 225 | ||

| Statistics | ||||

|---|---|---|---|---|

| Independent_Industry_Growth | Stakeholders_Importance | Proper_Planning_of_Government | ||

| N | Valid | 225 | 225 | 225 |

| Missing | 0 | 0 | 0 | |

| Mean | 1.75 | 1.74 | 1.99 | |

| Median | 2.00 | 2.00 | 2.00 | |

| Mode | 2 | 2 | 1 a | |

| Std. Deviation | 0.436 | 0.822 | 1.217 | |

| Variance | 0.190 | 0.676 | 1.482 | |

| Skewness | −1.142 | 1.395 | 1.380 | |

| Std. Error of Skewness | 0.162 | 0.162 | 0.162 | |

| Kurtosis | −0.702 | 1.971 | 0.875 | |

| Std. Error of Kurtosis | 0.323 | 0.323 | 0.323 | |

| Range | 1 | 3 | 4 | |

| Minimum | 1 | 1 | 1 | |

| Maximum | 2 | 4 | 5 | |

| Sum | 393 | 391 | 448 | |

| Model Summary b | ||||||||||||||||||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate | Change Statistics | |||||||||||||||

| R Square Change | F Change | df1 | df2 | Sig. F Change | ||||||||||||||||

| 1 | 0.554 a | 0.307 | 0.300 | 0.365 | 0.307 | 49.059 | 2 | 222 | 0.000 | |||||||||||

| a Predictors: (Constant), Proper_Planning_of_Government, Stakeholders_Importance | ||||||||||||||||||||

| b Dependent Variable: Independent_Industry_Growth | ||||||||||||||||||||

| ANOVA a | ||||||||||||||||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | |||||||||||||||

| 1 | Regression | 13.045 | 2 | 6.522 | 49.059 | 0.000 b | ||||||||||||||

| Residual | 29.515 | 222 | 0.133 | |||||||||||||||||

| Total | 42.560 | 224 | ||||||||||||||||||

| a Dependent Variable: Independent_Industry_Growth | ||||||||||||||||||||

| b Predictors: (Constant), Proper_Planning_of_Government, Stakeholders_Importance | ||||||||||||||||||||

| Coefficients a | ||||||||||||||||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | ||||||||||||||||

| B | Std. Error | Beta | ||||||||||||||||||

| 1 | (Constant) | 1.148 | 0.069 | 16.563 | 0.000 | |||||||||||||||

| Stakeholders_Importance | 0.150 | 0.030 | 0.284 | 5.080 | 0.000 | |||||||||||||||

| Proper_Planning_of_Government | 0.170 | 0.020 | 0.473 | 8.470 | 0.000 | |||||||||||||||

| a Dependent Variable: Independent_Industry_Growth | ||||||||||||||||||||

| Chi-Square Tests | |||

|---|---|---|---|

| Value | df | Asymp. Sig. (2-Sided) | |

| Pearson Chi-Square | 21.058 a | 2 | 0.000 |

| Likelihood Ratio | 24.822 | 2 | 0.000 |

| Linear-by-Linear Association | 18.459 | 1 | 0.000 |

| N of Valid Cases | 225 | ||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Alam, F.; Alam, S.; Asif, M.; Hani, U.; Khan, M.N. An Investigation of Saudi Arabia’s Ambitious Reform Programme with Vision 2030 to Incentivise Investment in the Country’s Non-Oil Industries. Sustainability 2023, 15, 5357. https://doi.org/10.3390/su15065357

Alam F, Alam S, Asif M, Hani U, Khan MN. An Investigation of Saudi Arabia’s Ambitious Reform Programme with Vision 2030 to Incentivise Investment in the Country’s Non-Oil Industries. Sustainability. 2023; 15(6):5357. https://doi.org/10.3390/su15065357

Chicago/Turabian StyleAlam, Firoz, Shahid Alam, Mohammad Asif, Umme Hani, and Mohd Naved Khan. 2023. "An Investigation of Saudi Arabia’s Ambitious Reform Programme with Vision 2030 to Incentivise Investment in the Country’s Non-Oil Industries" Sustainability 15, no. 6: 5357. https://doi.org/10.3390/su15065357

APA StyleAlam, F., Alam, S., Asif, M., Hani, U., & Khan, M. N. (2023). An Investigation of Saudi Arabia’s Ambitious Reform Programme with Vision 2030 to Incentivise Investment in the Country’s Non-Oil Industries. Sustainability, 15(6), 5357. https://doi.org/10.3390/su15065357