Abstract

Service and product innovation have been emphasized as being essential to the success of ICT firms in numerous studies. Being ongoing processes, R&D activities make it challenging to forecast the benefits to a business. Does the company obtain immediate returns on its research and development expenditures? How long will their effectiveness remain? During the development of a strategy, business managers must take all these factors into account. A major objective of this paper is to determine the relationship between a company’s R&D investment and its business performance. We collected data from 1262 small- and medium-sized enterprises in the ICT service industry in China between 2011 and 2020. The R&D investment was selected as the independent variable, while its financial performance (ROA, ROE, liquidity ratio, debt asset ratio, and interest cover ratio) and market value (Tobins’ Q) were selected as the dependent variables. Multiple linear regressions were used to determine whether there was a correlation between these variables. Firstly, R&D investment improve current profitability and there is a one-period lag in these benefits. Second, R&D is negatively correlated with short-term debt-paying ability, but positively correlated with a long-term view, and these effects will last for one period. Lastly, R&D investment has a negative impact on the current market value, but the R&D investment within the two lagged periods still has a positive impact. This study addresses a significant gap in empirical research. Recommendations for companies to consider when making R&D decisions are also included in the paper.

1. Introduction

Due to the COVID-19 pandemic that has affected the entire world since 2020, businesses across industries have been adversely affected in financial performance, mainly traditional manufacturing. Nevertheless, it is undeniable that specific industries have also gained unprecedented opportunities in this crisis. During COVID-19, many brick-and-mortar business activities were suspended and shifted to online activities, such as online offices, online education, and online stores [1,2]. As a result, the market’s demand for digital products and services has reached a new high [3]. Most businesses and social life have moved into the online realm, leading to a boom in the ICT industry [4,5]. Even today, when COVID-19 is over, changes in market demands and customer consumption habits still require enterprises to innovate continuously.

According to the recently released Science and Engineering Indicators by the National Science Foundation (NSF), global R&D performance is concentrated in several countries. The US is the best performer (27%), followed by China (22%), closely followed by Japan (7%), Germany (6%), and South Korea (4%). The US is ranked first in R&D expenditure, from a report by OECD in 2021, with USD 612.7 billion spent in 2019. Conversely, China has held the second position since it overtook the EU-27 in 2015, with USD 514.8 billion in 2019. For national R&D intensity, the US peaked at 3% for the first time, and China rose from 2.1% to 2.2%. By contrast, Israel and Korea reached their highest R&D intensities with 4.9% and 4.6%. However, the EU-27 is usually smaller at 2.1%. In most OECD nations, R&D intensity has grown from a national standpoint. Consequently, nations are investing more and more in R&D operations. As a result, government R&D funding support will encourage companies to conduct internal R&D activities [6,7]. More R&D activities will finally lead to business success [8,9,10,11]. Firstly, severe competition in the market compels businesses to produce value-added goods, processes, and services to consistently fulfill the market’s changing requirements [12,13,14,15] and accomplish the objective of sustainable corporate development. Secondly, R&D expenditures can provide a more visual representation of the innovation activities within a company, thus attracting more investors [16] and enhancing the market expectations of the company.

The sectors where R&D investment is rapidly booming differ from region to region. The automotive sector leads the way in the EU, while ICT and biotechnology-based health industries dominate the US. China is mainly developing in the software and ICT sectors. As a result, the new ICT industry in China is gradually displacing the Chinese SME as the dominating sector. The Chinese government also strongly supports the development of the ICT industry. In terms of funds, the government provides financial subsidies for new enterprises; in terms of the treatment of R&D personnel, it optimizes the guarantee of talent services and focuses on the cultivation of professional talents; it also provides support in terms of infrastructure. Because most of the business in the ICT industry relies on the network, it has optimized and upgraded the network speed, coverage, and quality. It is easy to see how much China attaches importance to developing the ICT industry. Therefore, this research takes SMEs in the Chinese ICT industry as the analysis object.

The degree to which R&D investment influences corporate growth differs by industry. Generally, R&D expenditures and their impact on growth are related to the technology intensity of the firm. If a company relies heavily on technology, the more technology-intensive it is, the more capital it needs to invest in R&D activities, which increases its impact [17]. Therefore, it is meaningful to conduct empirical research on the ICT industry. The purpose of this study is to find out if the R&D expenditure of firms is linked to their current and future performance within Chinese SMEs from the ICT service industry. It must be determined whether R&D expenditures have delayed effects on businesses and the duration of these effects. Considering the difficulty of data collection and the limitations of corporate confidentiality policies, this study relied on data disclosed in annual reports.

This paper contains the following parts: Section 2 provides an overview of the study background, previous literature, and the development of hypotheses. Section 3 includes the sources of data collection, all variables used in the regression analysis, and the test models. Section 4 contains the results of the analysis. In Section 5, the conclusion is reached. The theoretical and practical contributions, the limitations of the study, and recommendations for future research are also discussed.

2. Background and Research Hypotheses

2.1. Conceptual Framework

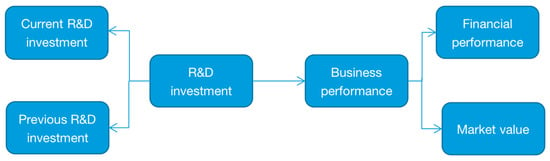

The research was conducted based on examining prior research to assess the relationship between business R&D spending and its performance. Figure 1 shows the conceptual framework of the paper. As shown in Figure 1, R&D expenditure was chosen as the independent variable, and indicators related to business performance were selected as the dependent variable to evaluate R&D expenditures and business performance over various periods. In determining whether a company’s R&D expenditures contribute to its recent performance, how long the benefits of R&D investment will last will also be tested. For competitive analysis, the financial and market performance of enterprises are examined.

Figure 1.

Conceptual framework.

2.2. Literature Review and Hypotheses

R&D Investment and Business Performance

According to Apergis and Sorros [18], R&D expenditures and corporate success are directly related. Also, for the empirical analysis of American companies, Pourkairmi et al. [19] found that R&D investment positively impact business performance. He proposed that one dollar of R&D spending increases the company’s revenue by 22%. In the research on the European Union’s enterprises, the positive impact of R&D investment on corporate performance is also significant [20,21,22,23,24]. Kılıç [25] also found a significant positive correlation between them in a study of IT companies in Istanbul. Similar conclusions were also obtained in the study of Vietnam [26,27] and Korea [28].

The contrary viewpoint, however, cannot be ignored or disregarded. In 2021, Groza, Zmich, and Rajabi [29] argued that in businesses with a poor level of creative ability, innovation can harm the company’s sales growth. When Vithessonthi and Racela [30] examined non-financial businesses, they found a negative correlation between R&D spending and business performance. A negative relationship was also found in a study of Turkish firms [31]. Busru and Shanmugasundaram [32] reported similar findings in a survey of Indian companies. Turning to China, studies of small and micro-enterprises in Taiwan also found that business investment in research and development negatively impacts business performance [33,34]. This phenomenon is widespread in Chinese manufacturing [35,36,37].

To better measure the financial business performance, this study chooses to conduct research mainly on the profitability and debt-paying ability of enterprises. First, to test the relationship between R&D investment and profitability, Hypothesis 1 is proposed.

H1.

R&D investment can affect profitability positively.

Next, to measure the relationship between R&D investment and debt-paying ability from short-term and long-term perspectives, Hypothesis 2 and Hypothesis 3 are proposed as following:

H2.

R&D investment can affect short-term debt-paying ability positively.

H3.

R&D investment can affect long-term debt-paying ability positively.

2.3. R&D Investment and Market Value

Several scholars believe that R&D elasticity contributes significantly to the added value of the market [38]. Research conducted by Bae and Kim [39] shows that by analyzing firms in the United States, Germany, and Japan, they can conclude that R&D spending leads to a significant increase in market value. In addition, Davcik et al. [40] analyzed US IT companies and found that R&D investment led to success in the market. When researching ICT companies in the United States, Pourkarimi et al. [19] also concluded that R&D investment increased the company’s market share. The same conclusion is also drawn based on the studies on Chinese firms by Xu and Sim [40] and Leung and Sharma [16]. They pointed out that R&D investment can increase an organization’s market value, thereby improving its profitability in the long run.

However, the voices of naysayers deserve serious consideration. Asthana and Zhang [41] found that the present value of firms is negatively affected by their analysis of non-financial institutions. In addition, some scholars believe that a company’s R&D investment has nothing to do with its market value. Lin, Lee, and Hung [42] surveyed 258 technology companies in the United States and found the opposite result. Their study found no evidence to support the claim that increased spending on R&D activities increases market value.

Thus, H4 is proposed to test the relationship between enterprise R&D investment and enterprise market value.

H4.

R&D investment can affect market value positively.

2.4. The Lagged Effect of R&D Investment

In addition to discussing the current benefits that companies can gain from R&D activities, some scholars have also suggested that the company’s investment in R&D can bring continuous revenue and growth in the future, which will benefit the market value and financial performance. Several global empirical studies have confirmed this statement, including China [16,34,36,37,43,44,45], Taiwan, China [33,43,46,47], EU [8,31], USA [19,31,42,48,49], Japan [44], Korea [28,36,50], Slovenia [51], Turkey [52,53], Bangladesh [54], and India [32].

How long will it last? As previous studies have pointed out, the lag time for R&D investment is largely region dependent. According to Amir et al. [48], the lag time for US R&D spending is between three and seven years. In contrast, data for other regions were relatively stable. The lagged time for Japanese firms is one year [44], the shortest in the world. In addition, China, Taiwan, South Korea, and European countries usually last two to three years. Of course, lag times also vary by industry.

Previously, scholars have concentrated their efforts on empirical studies of the industrial sector. However, given the rapid development of network technology, research in ICT enterprises is urgent. So, to make up for the lack of research in this area, this study will focus on SMEs in China’s ICT industry. To test whether there is a lagging effect on enterprise investment, Hypothesis 5 is put forward.

H5.

R&D investment have a delayed effect both on financial performance and market value.

3. Research Design

3.1. Data Collection

According to OECD (Organization for Economic Cooperation and Development), the ICT (Information and Communication Technology) industry is defined as a collection of manufacturing and service industries that use electronic technology to acquire, disseminate, and demonstrate data information, including ICT manufacturing and ICT services. This paper researches SMEs related to China’s ICT service industry. Their main business activities focus on telecommunications and other information transmission, software, and technology services. The samples of this empirical study all come from the New Third Board (NEEQ). This research used ten-year panel data from 2011 to 2020. After excluding any missing or incomplete data samples, 1262 firms were collected.

3.2. Study Variables

3.2.1. Independent Variables

A review of the relevant literature reveals two common approaches to calculating R&D costs for the independent variable. One is R&D intensity. Experts generally agree that R&D intensity is usually calculated by comparing the total investment in R&D with the total revenue of the firm [32,55,56,57]. The other is R&D expenditures, or their logarithms immediately applied to research [30,32,44,46,53]. This study uses the logarithm of R&D expenditure as the dependent variable. Compared with R&D intensity, it is more intuitive and more straightforward.

3.2.2. Dependent Variables

Firstly, this research divides business financial performance into two parts: profitability and debt-paying ability:

- (1)

- Based on the summary of previous studies, return on asset (ROA) and return on equity (ROE) are chosen as dependent variables to represent the firm’s profitability. In the previous literature, ROA and ROE are the two most widely used indicators representing the profitability of enterprises [18,21,30,51,58,59,60]. ROA and ROE can make horizontal comparisons between different lines and enterprises. Compared with other indicators, such as return on investment (ROI), they can be used to evaluate the overall financial performance rather than the performance of a specific project.

- (2)

- The dependent variables are liquidity, debt asset ratio, and interest rate coverage ratio. This research evaluates enterprises’ debt-paying ability from two perspectives: short-term strength and long-term. First, the liquidity ratio determines a company’s ability to pay its short-term obligations. This metric helps determine whether a company can use its current assets to pay its current liabilities. Therefore, the liquidity ratio is selected as an independent variable to measure the short-term solvency of the enterprise [33,51,59,61]. Second, the debt asset ratio reflects the creditor’s risk of providing credit funds to the enterprise and the ability to operate with debt. It is generally positively correlated with the long-term debt-paying ability of the enterprise. Therefore, from the perspective of asset size, the debt asset ratio is selected to represent the long-term debt repayment ability of the enterprise [51,59,60]. Last, the interest coverage ratio also can reflect the ability of debt paying [52]. It refers to the ratio of the profit before interest and taxes that can be used to pay interest to the interest expense payable in the current period during the loan repayment period of the project. It is widely used to measure whether the pre-tax profit generated by the enterprise can pay the current interest. Therefore, when analyzing long-term debt-paying ability from the profitability perspective, the interest coverage ratio is chosen as the dependent indicator.

Second, the market value of a company can be determined with the help of Tobin’s Q, which has been employed in various empirical investigations [16,56,62]. Tobin’s Q measures firm performance and management quality by comparing market value to the replacement cost of capital [63]. One of its benefits is that it can be used to evaluate past results and forecast future outcomes.

3.2.3. Control Variables

Consistent with earlier studies, this study also selects firm size and firm age as control variables. In reading previous research, we found that the methods used to determine firm size were variable. The logarithm of total assets, the logarithm of total sales, and the logarithm of unqualified personnel are commonly used. Classification requirements for Chinese SMEs lead to more nuances in asset size, which may affect the findings. Therefore, the size of an organization is measured by the logarithm of the total number of employees. To determine the age of firms, we continued with the approach recommended by most researchers. This study calculates companies’ age based on the years they have existed until 2020. In reading previous research, we found that many methods used to determine firm size were variable, including logarithms of total assets, logarithms of total sales, and logarithms of employees [64,65,66]. How China classifies SMEs leads to significant differences in asset size, which may affect the research results. Therefore, the size of an organization is measured by the logarithm of the total number of employees. In addition, we also control total asset turnover [34,67,68].

The variables mentioned above that were used in this analysis are summarized in Table 1, and each variable is assigned a code that will represent each variable in multiple regression tests. The calculation formula of each variable is also displayed in the table.

Table 1.

Study variables.

3.3. Research Model

In general, multiple regression models can be used to test the relationship between one dependent variable and multiple independent variables. Thus, multiple regression is applied to determine the relationship between firm R&D investment and performance in this research. After reading the previous literature [24], the most basic multiple regression model is:

In Equation (1), is the dependent variable, is the constant term, and and are the coefficients of the independent variables. and are the independent variables, and is the error term.

Based on the analytical model established in the study of [51], referring to the hysteresis model to test lagged effect established by [33], the research model of this study was developed and designed:

Model 1:

Model 2:

Model 3:

Model 4:

Model 5:

Model 6:

In the above equations, i represents the number of enterprises (i = 1, 2, 3, …), t represents the year (t = 2011, 2012, …, 2020), and m represents the lagged period (m = 0, 1, 2). Then represents the R&D investment of the i enterprise in the t year, and represents the R&D investment of the i enterprise in the t-m year. These are used to test the impact of R&D investment on the business performance in the current period, lagged one and two periods.

4. Analysis and Result

Through the correlation test of panel data, after the corresponding processing of the data, descriptive statistics were carried out to understand the basic situation of the variable data studied, and STATA software was used for correlation analysis. We can initially see the variables on the right side of the model and the affected variables. The correlation between variables can also aid in studying whether there is a high degree of correlation between the explanatory variables to understand whether there may be a high degree of multicollinearity in the data. Then, we performed multiple regression estimation of the model to study the independent variables on the dependent variables.

4.1. Descriptive Statistics

Descriptive statistics were performed on each variable’s sample data to understand the data’s basic situation. The maximum value, minimum value, standard deviation, and other data indicators were obtained. We were aware of maximum and minimum value gaps and data fluctuations. Due to many enterprises and the extensive data sample size, some outliers will inevitably appear, resulting in biased results. Therefore, the upper and lower 1% indentation was used to reduce the values of less than one percentile and higher than the 99th percentile to the 1st and 99th percentile, respectively, thereby achieving data reduction in a more reasonable range and reducing the impact of too small or too large a value. Descriptive statistics are shown in Table 2.

Table 2.

Descriptive statistics.

Due to the lack of original ICR data, the remaining observable data amount to 4999 samples. All other data samples amount to 8831. Since the standard deviation is the dispersion coefficient compared to the upper mean, the higher the dispersion coefficient is, the more dispersed the value is. If it is greater than 1, the data fluctuation is relatively large. According to Table 1, it can be found that the standard deviations of ROA, ROE, TQ, and TAT are relatively large. It shows that the company’s ROA, ROE, TQ, and TAT fluctuated relatively largely between 2011 and 2020 and are much more stable than other numerical fluctuations.

4.2. Correlation Analysis

We then carry out correlation analysis on the data. The absolute value of the correlation coefficient represents the magnitude of the correlation, and the positive and negative indicate the direction of the correlation. The correlation does not represent the final regression result, and we hope that the variables on the right side of the equation have no high correlation; otherwise, there may be multicollinearity that will have a destructive impact on the model results. The results of the preliminary correlation analysis are presented in Table 3.

Table 3.

Correlation analysis.

According to Table 3, the correlation coefficient between RD and ROA is 0.0993, which is significant at the significance level of 0.01. Therefore, there is a relatively apparent positive correlation between RD and ROA. The correlation coefficient between ROE and RD is 0.0814, which is significant at the significance level of 0.01. The correlation coefficient between RD and TQ is 0.0752. In addition, the correlation coefficients between RD and ICR, DAR, and LIQ were −0.0381, 0.0531, −0.0420, and −0.0545, respectively, all of which had significant correlations. However, since the correlation is only the correlation between two variables, no other control variables are added to control it. Therefore, it cannot be used as the final regression result, and the specific hypothesis verification needs to be verified through subsequent regression analysis. The absolute value of the correlation coefficient between explanatory variables or control variables in different models is less than 0.8. Therefore, no high degree of multicollinearity will adversely affect the model results.

4.3. Multiple Regression Analysis

After that, we use multiple regression analysis to find out how the variables in the model are connected to one another.

Table 4 shows the results of multiple regression analysis of model 1, showing that the adjusted R square of the model is 0.0649, the goodness of fit is 6.49%, the F test value is 154.0926, and there is a probability of more than 99% that the entire model passes the test. The impact coefficient of RD is 0.0192, indicating that the current RD has a significant positive impact on ROA. The impact coefficient of RD with a lag of one period is 0.0043, which is significant at the 5% significance level. There is a significant negative impact on R&D investment with a lag of two periods, and the impact coefficient is −0.0174, which is significant at the 1% significance level.

Table 4.

Multiple regression analysis (Model 1).

The results of multiple regression analysis of model 2 (Table 5) show that the adjusted R square of the model is 0.0778, the goodness of fit is 7.78%, the F test value is 187.1712, and there is a probability of more than 99% that the entire model passes the test. Among them, the impact coefficient of RD is 0.0339, indicating that the current RD has a significant positive impact on ROE. However, the impact coefficient of RD with a lag of one period on ROE is 0.0095, indicating that the positive impact of RD with a lag of one period on ROE still exists. Interestingly, the impact coefficient of RD with a lag of two periods is −0.0277, indicating that R&D investment with a lag of two periods has a significant negative impact on ROE.

Table 5.

Multiple regression analysis (Model 2).

Table 6 shows the results of multiple regression analysis of model 3. It shows that, in the current model, RD has a significant negative impact on LIQ, RD with a lag of one period has a significant negative impact on LIQ, and RD with a lag of two periods has no significant correlation.

Table 6.

Multiple regression analysis (Model 3).

The results of the multiple regression analysis of model 4 are illustrated in Table 7, showingthat, in the current model, RD has no significant impact on DAR. RD lagged by one period had a significant positive effect on the presence of DAR. However, the impact of RD lagged by two periods on DTA was not significant.

Table 7.

Multiple regression analysis (Model 4).

In Table 8, the results of the multiple regression analysis of model 5 show that, in the current model, RD has a significant positive impact on ICR. RD with a lag of one period has a significant positive effect on ICR, while RD with a lag of two periods has no significant effect on ICR.

Table 8.

Multiple regression analysis (Model 5).

The results of multiple regression analysis of model 6 (Table 9) show that the impact coefficients of RD in the current period are −0.0473, which has a significant negative impact on TQ. The RD coefficients with one and two lags are 0.0566 and 0.2337, respectively, and there is a significant positive impact on TQ, and the RD coefficient with two lags is the highest.

Table 9.

Multiple regression analysis (Model 6).

5. Conclusions

5.1. Discussion

According to the analysis results of model 1 and model 2, Hypothesis 1 holds. Therefore, for China’s ICT service SMEs, increasing R&D investment can effectively improve the profitability of enterprises. According to Table 4 and Table 5, both ROA and ROE significantly positively impact the current corporate profitability. Hypothesis H1a is thus supported. This conclusion has also been confirmed in previous studies on Western countries. The same is for the research on the ICT industry. In 2022, Pourkarimi and Kam [19] also found a positive correlation between R&D investment and corporate profitability when researching American companies. Turning to EU countries, Nunes [31] and Tilică [23] also confirm the existence of this positive link. When analyzing Turkish companies, Ergun [24] also affirmed the role of R&D investment in promoting corporate profitability. However, the conclusion is refuted by other studies on Chinese SMEs. The main reason is that the samples selected for the study come from different industries. Most previous studies focused on the manufacturing industry, while this study focused on ICT service firms. It indicates that companies from the ICT service industry can obtain a faster return from R&D activities than the manufacturing industry.

Through the test of model 3, the negative impact of the enterprise’s liquidity ratio and R&D investment is noticeable, so Hypothesis 2 does not hold. This negative impact is primarily because increasing R&D investment will also increase the pressure on corporate cash flow, thereby affecting the short-term solvency of the company. According to Table 7 and Table 8, R&D investment has no positive impact on the debt asset ratio but has a significant positive impact on the interest coverage ratio. From the perspective of assets, R&D expenditures cannot improve the debt-paying ability of enterprises. However, from the profit perspective, the promotion effect of R&D investment is unquestionable. Therefore, Hypothesis 3 holds.

According to the analysis results in Table 9, there is a significant negative impact on R&D investment and Tobin’s Q in the same period. Therefore, Hypothesis 4 does not hold. It is different from previous research conclusions on Western countries. The study of the United States [19,40] and European Union countries [19,39] found that R&D investment positively impacts the current market value. It indicated that Chinese SMEs need more time to convert R&D investment into market value growth than Western developed countries. Meanwhile, Chinese SMEs face more uncertainties and risks when developing products or services.

Hypothesis 5 is also supported. R&D spending has a significant lagged impact on a firm’s financial performance and market value. It can be observed from Table 4 and Table 5 that the R&D investment of the lagging period has a continuously positive impact on the ROA and ROE of the enterprise. However, the positive impact of R&D investment lagging two periods on ROA and ROE has turned into a negative impact. Therefore, the profitability of R&D investment on corporate profitability can last two years, but the positive impact can only last for one year. Referring to Table 6, Table 7 and Table 8, there is still a significant impact on the solvency of R&D investment lagging one period, but R&D investment lagging two periods has no significant impact. Among them, even the one-period R&D investment still hurts short-term solvency. Nevertheless, R&D investment with a lag of one period shows a positive trend for long-term solvency. Therefore, no matter from the long-term or short-term perspective, the impact of R&D investment on debt repayment ability lasts for at most one year. Finally, for the market value, R&D investment with a lag of one period and a period of two lags both show a positive impact. Therefore, the positive impact of R&D investment on market prices can last for two years.

How do they maintain their competitive edge in a rapidly evolving technology-based marketplace? It is important to emphasize that product innovation could give a business a competitive advantage. R&D investment within an organization could improve financial performance and market value. Therefore, R&D activities must meet enterprises’ long-term goals and sustainable development rather than only focusing on short-term benefits. In other words, the R&D strategy within enterprises is the top priority to ensure survival and long-term growth. As corporations develop their future strategies, they must carefully consider how R&D operations affect their financial performance and market value. They need to analyze R&D expenditure more competitively. Simultaneously, a high market value and profit margins may maintain R&D expenditure levels, particularly when combined with a long-term R&D strategy. Advanced technology is the only way to maintain its fundamental competitiveness and achieve sustainable profitability for the ICT sector.

As mentioned earlier, R&D spending is critical to the operational performance of Chinese SME ICT firms. In the longer term, R&D spending improves current and next-year profitability and solvency, and the positive impact on market values can last up to two years. According to earlier researchers, a lower lag time means less risk and uncertainty for a business. Compared with studies in other countries, we believe that the shorter lag period of SMEs in China’s ICT service industry indicates that the market has higher requirements for enterprises to update their technologies or services continuously. It can also be found that Chinese SMEs should extend the gain time brought by R&D projects.

5.2. Theoretical Contribution

An increasing number of Chinese SMEs are realizing that they must invest in corporate R&D and product regeneration to keep up with science and technology advancements and changes in market demand for their survival and growth. However, much research on Chinese companies has concentrated on the manufacturing industry. Research into the ICT industry is very restricted. This study aims to investigate whether R&D expenditures impact the performance of firms positively or negatively. It is necessary to write this in response to the need for more empirical studies on the performance of SMEs in the ICT sector. However, this correlation has also been studied in many previous works, where the idea of lagging R&D investment has also been proposed. However, there is limited empirical evidence to support the findings concerning SMEs in the ICT industry in China. There is no doubt, based on the results of the study, that the expenditure on R&D will improve the business performance over the current period and the following period. Furthermore, R&D expenditures do not affect the market value of the current period, but their impact begins to appear in the second year and lasts for two years.

5.3. Managerial Contribution

This paper also contains suggestions for businesses. There is a need for managers to consider the investment in R&D in the development of new products when making business strategies. Increasing a company’s expenditures on research and development will not immediately increase that company’s market value. To lower the risk in the capital chain, managers should consider this in advance when planning R&D investments. Secondly, the results of this empirical study indicate that R&D investments in information and communication technology can only benefit businesses for up to two years. In this way, the availability of new products or technologies to the organization is also limited by time, requiring firms to continually update their products to keep their innovative vitality and profitability to remain relevant in their market. Before investing in R&D, companies should determine whether they can generate sufficient profits for the duration of a new product’s growth-promoting impact.

On the other hand, it also demonstrates that the benefits to an enterprise of each R&D activity are limited. Therefore, when undertaking R&D activities, companies should give more attention to developing their R&D results on the market. Before engaging in R&D activities, companies should first develop R&D strategies that are more scientific and market-oriented. These strategies should benefit the organizations in terms of achieving their long-term objectives.

5.4. Limitations and Suggestions

The limitations of the research should be addressed. It should be noted that this research has some caveats. The first is a more detailed division of the sample. The samples of small- and medium-sized enterprises selected in this article come from China’s ICT service industry. Still, there is no more specific division of whether they are innovative companies. In addition, owing to the sample size, it is hard to conduct in-depth research on the purpose and reasons for corporate innovation investment, which may have biased the study results. As Passaro et al. [69] mentioned, SMEs must promote ecological innovation to realize the transformation from a brown economy to a green economy, especially in China. They also mention many factors that can facilitate this innovation, such as customer needs [70,71], managers’ decisions [72], financial funds [73], etc. In future research, we can study the eco-innovation activities of SMEs for sustainable development.

Secondly, the influence of the external environment cannot be ignored. Liu et al. [74] found that a corrupt environment reduces the role of internal research and development in their study of Chinese firms in 2020. Mani, Ashnai, and Wang [75] discussed the corporate–political tie, another external aspect worthy of consideration for future research. Therefore, including potential influences from the outside world in the research analysis conducted for an external study might be one way to produce more convincing results.

Author Contributions

Conceptualization, M.H. and R.P.E.; methodology, M.H. and R.P.E.; software, R.P.E.; validation, M.H. and R.P.E.; formal analysis, M.H. and R.P.E.; investigation, M.H.; resources, M.H.; data curation, M.H.; writing—original draft preparation, M.H.; writing—review and editing, R.P.E.; visualization, M.H. and R.P.E.; supervision, R.P.E.; project administration, R.P.E. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The experimental data used to support the findings of this study are available from the author upon request.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Bivona, E.; Cruz, M. Can business model innovation help SMEs in the food and beverage industry to respond to crises? Findings from a Swiss brewery during COVID-19. Br. Food J. 2021, 123, 3638–3660. [Google Scholar] [CrossRef]

- Gavrila Gavrila, S.; de Lucas Ancillo, A. COVID-19 as an entrepreneurship, innovation, digitization and digitalization accelerator: Spanish Internet domains registration analysis. Br. Food J. 2021, 123, 3358–3390. [Google Scholar] [CrossRef]

- Onea, I.A. Exploring the COVID-19 pandemic impact on innovation and entrepreneurship—Review and evidence from Global Innovation Index. In Proceedings of the International Conference on Business Excellence 2022, Bucharest, Romania, 24–26 March 2022; Volume 16, pp. 527–544. [Google Scholar] [CrossRef]

- Khlystova, O.; Kalyuzhnova, Y.; Belitski, M. The impact of the COVID-19 pandemic on the creative industries: A literature review and future research agenda. J. Bus. Res. 2022, 139, 1192–1210. [Google Scholar] [CrossRef]

- Liñán, F.; Jaén, I. The Covid-19 pandemic and entrepreneurship: Some reflections. Int. J. Emerg. Mark. 2022, 17, 1165–1174. [Google Scholar] [CrossRef]

- Tong, X.; Wang, Z.; Li, X. The influence of government subsidy on enterprise innovation: Based on Chinese high-tech enterprises. Econ. Res.-Ekon. Istraživanja 2021, 35, 1481–1499. [Google Scholar] [CrossRef]

- Wu, W.-S.; Zhao, K. Government R&D subsidies and enterprise R&D activities: Theory and evidence. Econ. Res.-Ekon. Istraživanja 2021, 35, 391–408. [Google Scholar] [CrossRef]

- Çiftçioğlu, S. Can increasing the R&D intensity lower unemployment rate?: Case of five selected European countries. Ekon. Časopis 2020, 68, 188–207. [Google Scholar]

- Blanco, F.A.; Delgado, F.J.; Presno, M.J. R&D expenditure in the EU: Convergence or divergence? Econ. Res.-Ekon. Istraživanja 2020, 33, 1685–1710. [Google Scholar] [CrossRef]

- Kučera, J.; Fiľa, M. R&D expenditure, innovation performance and economic development of the EU countries. Entrep. Sustain. Issues 2022, 9, 227–241. [Google Scholar] [CrossRef]

- Amankwah-Amoah, J. COVID-19 pandemic and innovation activities in the global airline industry: A review. Environ. Int. 2021, 156, 106719. [Google Scholar] [CrossRef]

- Hu, J.; Huang, Q.; Chen, X. Environmental regulation, innovation quality and firms’ competitivity―Quasi-natural experiment based on China’s carbon emissions trading pilot. Econ. Res.-Ekon. Istraživanja 2020, 33, 3307–3333. [Google Scholar] [CrossRef]

- Johennesse, L.-A.C.; Budidarma, I.G.A.M.B. Corporate Governance and R&D Strategic Decision Making. East Asian J. Multidiscip. Res. 2022, 1, 238–260. [Google Scholar]

- Lee, J.W. Lagged Effects of R&D Investment on Corporate Market Value: Evidence from Manufacturing Firms Listed in Chinese Stock Markets. J. Asian Financ. Econ. Bus. 2020, 7, 69–76. [Google Scholar] [CrossRef]

- Moretti, F.; Biancardi, D. Inbound open innovation and firm performance. J. Innov. Knowl. 2020, 5, 1–19. [Google Scholar] [CrossRef]

- Leung, T.Y.; Sharma, P. Differences in the impact of R&D intensity and R&D internationalization on firm performance—Mediating role of innovation performance. J. Bus. Res. 2021, 131, 81–91. [Google Scholar] [CrossRef]

- Trachuk, A.; Linder, N. Innovation and Performance: An Empirical Study of Russian Industrial Companies. Int. J. Innov. Technol. Manag. 2018, 15, 1850027. [Google Scholar] [CrossRef]

- Apergis, N.; Sorros, J. The Role of R&D Expenses for Profitability: Evidence from U.S. Fossil and Renewable Energy Firms. Int. J. Econ. Financ. 2014, 6, 8–15. [Google Scholar] [CrossRef]

- Pourkarimi, P.; Kam, E. The Impact of R&D and Advertising on Firm Performance in High-Tech Industries—Evidence from the U.S. Information and Communications Technology Industry. J. Quant. Econ. 2022, 20, 723–753. [Google Scholar] [CrossRef]

- Nunes, S.; Lopes, R.; Fuller-Love, N. Networking, Innovation, and Firms’ Performance: Portugal as Illustration. J. Knowl. Econ. 2017, 10, 899–920. [Google Scholar] [CrossRef]

- Jaisinghani, D. Impact of R&D on profitability in the pharma sector: An empirical study from India. J. Asia Bus. Stud. 2016, 10, 194–210. [Google Scholar] [CrossRef]

- Nunes, P.M.; Viveiros, A.; Serrasqueiro, Z. Are the determinants of young SME profitability different? Empirical evidence using dynamic estimators. J. Bus. Econ. Manag. 2012, 13, 443–470. [Google Scholar] [CrossRef]

- Țilică, E.V. R&D and Human Capital Policies as Determinant Factors for a Company’s Performance and Profitability. Int. J. Bus. Econ. Sci. Appl. Res. 2021, 14, 22–39. [Google Scholar] [CrossRef]

- Ergün, T. Reflection of R&D Spending on Financial Performance: Case of Aviation Sector. Anadolu Üniversitesi İktisadi Ve İdari Bilim. Fakültesi Derg. 2022, 23, 443–463. [Google Scholar] [CrossRef]

- Kiliç, M. BIST bilişim sektöründeki firmaların Ar-Ge harcamalarının finansal performans üzerindeki etkisi. Erciyes Üniversitesi Sos. Bilim. Enstitüsü Derg. 2020, 49, 219–234. [Google Scholar]

- Pham, M.T.; Nguyen, H.D.; Hoang, Q.T. Role of Research and Development on Profitability: An Empirical Research on Textile Listed Firms in Vietnam. Econ. Insights Trends Chall. 2021, X, 1–9. [Google Scholar] [CrossRef]

- Tung, L.T.; Binh, Q.M.Q. The impact of R&D expenditure on firm performance in emerging markets: Evidence from the Vietnamese listed companies. Asian J. Technol. Innov. 2022, 30, 447–465. [Google Scholar]

- Seo, H.S.; Kim, Y. Intangible Assets Investment and Firms’ Performance: Evidence from Small and Medium-Sized Enterprises in Korea. J. Bus. Econ. Manag. 2020, 21, 421–445. [Google Scholar] [CrossRef]

- Groza, M.D.; Zmich, L.J.; Rajabi, R. Organizational innovativeness and firm performance: Does sales management matter? Ind. Mark. Manag. 2021, 97, 10–20. [Google Scholar] [CrossRef]

- Vithessonthi, C.; Racela, O.C. Short- and long-run effects of internationalization and R&D intensity on firm performance. J. Multinatl. Financ. Manag. 2016, 34, 28–45. [Google Scholar] [CrossRef]

- Özkan, N. R&D Spending and Financial Performance: An Investigation in an Emerging Market. Int. J. Manag. Econ. Bus. 2021, 18, 38–58. [Google Scholar] [CrossRef]

- Busru, S.A.; Shanmugasundaram, G. Effects of Innovation Investment on Profitability and Moderating Role of Corporate Governance: Empirical Study of Indian Listed Firms. Indian J. Corp. Gov. 2017, 10, 97–117. [Google Scholar] [CrossRef]

- Chen, T.-C.; Guo, D.-Q.; Chen, H.-M.; Wei, T.-T. Effects of R&D intensity on firm performance in Taiwan’s semiconductor industry. Econ. Res.-Ekon. Istraživanja 2019, 32, 2377–2392. [Google Scholar] [CrossRef]

- Wang, M.-C.; Chen, Z. The relationship among environmental performance, R&D expenditure and corporate performance: Using simultaneous equations model. Qual. Quant. 2021, 56, 2675–2689. [Google Scholar] [CrossRef]

- Guo, C.; Sarkar, S.; Zhu, J.; Wang, Y.J. R&D investment, business performance, and moderating role of Guanxi: Evidence from China. Ind. Mark. Manag. 2020, 91, 55–63. [Google Scholar] [CrossRef]

- Xu, J.; Sim, J.-W. Characteristics of Corporate R&D Investment in Emerging Markets: Evidence from Manufacturing Industry in China and South Korea. Sustainability 2018, 10, 3002. [Google Scholar] [CrossRef]

- Zhao, X.; Yu, Z. Research on the impact of R&D investment on the performance of equipment manufacturing enterprises. Proc. J. Phys. Conf. Ser. 2021, 1955, 012013. [Google Scholar]

- Coluccia, D.; Dabić, M.; Del Giudice, M.; Fontana, S.; Solimene, S. R&D innovation indicator and its effects on the market. An empirical assessment from a financial perspective. J. Bus. Res. 2020, 119, 259–271. [Google Scholar] [CrossRef]

- Bae, S.C.; Kim, D. The effect of R&D investments on market value of firms: Evidence from the US, Germany, and Japan. Multinatl. Bus. Rev. 2003, 11, 51–76. [Google Scholar]

- Davcik, N.S.; Cardinali, S.; Sharma, P.; Cedrola, E. Exploring the role of international R&D activities in the impact of technological and marketing capabilities on SMEs’ performance. J. Bus. Res. 2021, 128, 650–660. [Google Scholar] [CrossRef]

- Asthana, S.C.; Zhang, Y. Effect of R&D investments on persistence of abnormal earnings. Rev. Account. Financ. 2006, 5, 124–139. [Google Scholar] [CrossRef]

- Lin, B.-W.; Lee, Y.; Hung, S.-C. R&D intensity and commercialization orientation effects on financial performance. J. Bus. Res. 2006, 59, 679–685. [Google Scholar] [CrossRef]

- Luan, C.-J.; Tien, C. Should the smiling curve frown during an economic downturn to enhance firm performance? J. Manag. Organ. 2015, 21, 573–593. [Google Scholar] [CrossRef]

- Rao, J.; Yu, Y.; Cao, Y. The effect that R&D has on company performance: Comparative analysis based on listed companies of technique intensive industry in China and Japan. Int. J. Educ. Res. 2013, 1, 1–8. [Google Scholar]

- Zang, Z.; Zhu, Q.; Mogorrón-Guerrero, H. How Does R&D Investment Affect the Financial Performance of Cultural and Creative Enterprises? The Moderating Effect of Actual Controller. Sustainability 2019, 11, 297. [Google Scholar] [CrossRef]

- Hsu, F.-J.; Chen, M.-Y.; Chen, Y.-C.; Wang, W.-C. An empirical study on the relationship between R&D and financial performance. J. Appl. Financ. Bank. 2013, 3, 107. [Google Scholar]

- Su, C.; Kong, L.; Ciabuschi, F.; Holm, U. Demand and willingness for knowledge transfer in springboard subsidiaries of Chinese multinationals. J. Bus. Res. 2020, 109, 297–309. [Google Scholar] [CrossRef]

- Amir, E.; Guan, Y.; Livne, G. The Association of R&D and Capital Expenditures with Subsequent Earnings Variability. J. Bus. Financ. Account. 2007, 34, 222–246. [Google Scholar] [CrossRef]

- Krishnan, H.A.; Tadepalli, R.; Park, D. R&D intensity, marketing intensity, and organizational performance. J. Manag. Issues 2009, 21, 232–244. [Google Scholar]

- Kim, S.; Park, K.C. Government funded R&D collaboration and it’s impact on SME’s business performance. J. Informetr. 2021, 15, 101197. [Google Scholar] [CrossRef]

- Ravšelj, D.; Aristovnik, A. The Impact of R&D Expenditures on Corporate Performance: Evidence from Slovenian and World R&D Companies. Sustainability 2020, 12, 1943. [Google Scholar] [CrossRef]

- Ayaydin, H.; Karaaslan, İ. The effect of research and development investment on firms’financial performance: Evidence from manufacturing firms in turkey. Bilgi Ekon. Yönetimi Derg. 2014, 9, 23–39. [Google Scholar]

- Kiraci, M.; Celikay, F.; Celikay, D. The effects of firms’ R&D expenditures on profitability: An analysis with panel error correction model for Turkey. Int. J. Bus. Soc. Sci. 2016, 7, 233–240. [Google Scholar]

- Rahman, M.M.; Howlader, M.S. The impact of research and development expenditure on firm performance and firm value: Evidence from a South Asian emerging economy. J. Appl. Account. Res. 2022, 23, 825–845. [Google Scholar] [CrossRef]

- Wang, C.-H. Clarifying the Effects of R&D on Performance: Evidence from the High Technology Industries. Asia Pac. Manag. Rev. 2011, 16, 51–64. [Google Scholar]

- Xu, J.; Jin, Z. Research on the Impact of R&D Investment on Firm Performance in China’s Internet of Things Industry. J. Adv. Manag. Sci. 2016, 4, 112–116. [Google Scholar] [CrossRef]

- Czarnitzki, D.; Delanote, J. R&D policies for young SMEs: Input and output effects. Small Bus. Econ. 2015, 45, 465–485. [Google Scholar] [CrossRef]

- Haris, M.; Yao, H.; Tariq, G.; Malik, A.; Javaid, H. Intellectual Capital Performance and Profitability of Banks: Evidence from Pakistan. J. Risk Financ. Manag. 2019, 12, 56. [Google Scholar] [CrossRef]

- Hejazi, R.; Ghanbari, M.; Alipour, M. Intellectual, Human and Structural Capital Effects on Firm Performance as Measured by Tobin’s Q. Knowl. Process Manag. 2016, 23, 259–273. [Google Scholar] [CrossRef]

- Killins, R.N. Firm-specific, industry-specific and macroeconomic factors of life insurers’ profitability: Evidence from Canada. North Am. J. Econ. Financ. 2020, 51, 101068. [Google Scholar] [CrossRef]

- Alipour, M.; Mohammadi, M.F.S.; Derakhshan, H. Determinants of capital structure: An empirical study of firms in Iran. Int. J. Law Manag. 2015, 57, 53–83. [Google Scholar] [CrossRef]

- Du, D.; Osmonbekov, T. Direct effect of advertising spending on firm value: Moderating role of financial analyst coverage. Int. J. Res. Mark. 2020, 37, 196–212. [Google Scholar] [CrossRef]

- Tobin, J. A general equilibrium approach to monetary theory. J. Money Credit Bank. 1969, 1, 15–29. [Google Scholar] [CrossRef]

- Farooq, R.; Vij, S.; Kaur, J. Innovation orientation and its relationship with business performance: Moderating role of firm size. Meas. Bus. Excell. 2021, 25, 328–345. [Google Scholar] [CrossRef]

- Jogaratnam, G. The effect of market orientation, entrepreneurial orientation and human capital on positional advantage: Evidence from the restaurant industry. Int. J. Hosp. Manag. 2017, 60, 104–113. [Google Scholar] [CrossRef]

- Sadalia, I.; Marlina, L. Brand Value, Intellectual, and Financial Performance in Indonesia Stock Exchange. KnE Soc. Sci. 2018, 3, 835–844. [Google Scholar] [CrossRef]

- Scafarto, V.; Ricci, F.; Scafarto, F. Intellectual capital and firm performance in the global agribusiness industry. J. Intellect. Cap. 2016, 17, 530–552. [Google Scholar] [CrossRef]

- Zéghal, D.; Maaloul, A. Analysing value added as an indicator of intellectual capital and its consequences on company performance. J. Intellect. Cap. 2010, 11, 39–60. [Google Scholar] [CrossRef]

- Passaro, R.; Quinto, I.; Scandurra, G.; Thomas, A. The drivers of eco-innovations in small and medium-sized enterprises: A systematic literature review and research directions. Bus. Strategy Environ. 2022. [Google Scholar] [CrossRef]

- Ceptureanu, S.I.; Ceptureanu, E.G.; Popescu, D.; Anca Orzan, O. Eco-innovation capability and sustainability driven innovation practices in Romanian SMEs. Sustainability 2020, 12, 7106. [Google Scholar] [CrossRef]

- Afshar Jahanshahi, A.; Al-Gamrh, B.; Gharleghi, B. Sustainable development in Iran post-sanction: Embracing green innovation by small and medium-sized enterprises. Sustain. Dev. 2020, 28, 781–790. [Google Scholar] [CrossRef]

- Carfora, A.; Scandurra, G.; Thomas, A. Determinants of environmental innovations supporting small- and medium-sized enterprises sustainable development. Bus. Strategy Environ. 2021, 30, 2621–2636. [Google Scholar] [CrossRef]

- Musaad, O.A.S.; Zhuo, Z.; Musaad, O.A.O.; Ali Siyal, Z.; Hashmi, H.; Shah, S.A.A. A fuzzy multi-criteria analysis of barriers and policy strategies for small and medium enterprises to adopt green innovation. Symmetry 2020, 12, 116. [Google Scholar] [CrossRef]

- Liu, J.; Sheng, S.; Shu, C.; Zhao, M. R&D, networking expenses, and firm performance: An integration of the inside-out and outside-in perspectives. Ind. Mark. Manag. 2021, 92, 111–121. [Google Scholar] [CrossRef]

- Mani, S.; Ashnai, B.; Wang, J.J. Alliance portfolios and joint R&D project performance. Ind. Mark. Manag. 2022, 107, 238–252. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).