1. Introduction

With the boom of Smart Grid applications worldwide and the integration of different private generation units from the customer end, it has been noted that such a practice should be controlled and regularized by countries in order to ensure the reliability of the network and to have a fair market of competition between power generation companies and privately owned distributed generation units [

1]. Countries such as USA, Canada, Germany, and China have started creating their own regulations on the integration at different voltage levels of the grid with identified power quality parameters [

2].

Salman [

1] described the Smart Grid as a “Future Network”, involving massive research and development activities. The concept of a Smart Grid has been taken forward and promoted by many countries [

1] in Europe and North America, and others worldwide such as India, China, and the UAE [

3]. In this section, we will explore the definition and benefit of a Smart Grid, and the history of Smart Grids in the UAE.

The term Smart Grid has been defined by different technical bodies, which has been looked at in this literature review. The US Department of Energy defined Smart Grid as [

4]:

The digital technology that allows for two-way communication between the utility and its customers, and the sensing along the transmission lines is what makes the grid smart. Like the Internet, the Smart Grid will consist of controls, computers, automation, and new technologies and equipment working together, but in this case, these technologies will work with the electrical grid to respond digitally to our quickly changing electric demand.

The European Technology Platform for Smart Grids defined Smart Grid as [

5]:

It is an electricity network that can intelligently integrate the actions of all users connected to it—generators, consumers and those that do both—in order to efficiently deliver sustainable, economic and secure electricity supplies.

The International Electrotechnical Commission (IEC), a body for electrical equipment standards, has defined Smart Grid as [

6]:

Smart grid technologies allow the grid to become more flexible, interactive and enable it to provide real-time feedback. It incorporates technologies and services that facilitate intelligent monitoring, control, communication and self-healing technologies.

The National Institute of Standards and Technology (NIST) in the US defined the Smart Grid as [

7]:

A modernized grid that enables bi-directional flows of energy and uses two-way communication and control capabilities that will lead to an array of new functionalities and applications.

A definition by Salman in [

1], based on a selection of definitions reported in his literature:

The Smart Grid ensures the coordination of the needs and capabilities of all generating facilities, grid operators, end-users, and electricity market stakeholders so that all parts of the system operate as efficiently as possible, minimizing costs and environmental impacts while minimizing system safety, reliability, resilience, and stability.

Another definition by Borlase [

8] “the integration of electrical and communications infrastructures with advanced process automation and information technologies within the existing electrical network”.

Hence, we can obtain the optimum definition of a Smart Grid to be: An intelligent electricity network that uses two-way communication and electricity flow between a service provider and customer, with enabled data flow between its equipment and components that are digitally integrated to provide responses and actions that ensures the reliability and continuity of the power supply to the customer.

The components of Smart Grid include a classical grid with integrated customer distributed generation units, and an advanced metering infrastructure that allows the flow of electricity from and to the grid.

Figure 1., below, demonstrates a Smart Grid topology. Applications of smart Grid cover all the voltage levels, from generation up to customers. It can be connected to the grid or isolated as islanded and microgrid systems.

The benefits of Smart Grid have a significant impact on utilities, customers, and societies [

10]. Benefits can be classified into three categories which are technical, environmental, and electricity marketing [

3]. Those benefits have a huge impact on the utilities’ finances by having customers sharing the grid and participating in sharing the load of peak demand [

8].

Full utilization of Smart Grid technical benefits will lead to the improvement of energy efficiency, grid reliability, operational efficiency, security of the grid, power supply quality, connection, and access to the grid. The environmental benefit revolves around participating in carbon emission reduction as well as climate change combat benefits [

7]. Other benefits to consumers include the encouragement that they receive to adapt their lifestyle to their energy usage and manage their consumption [

8].

In view of the above benefits, it is clearly noticed that there is a win-win situation between both main stakeholders—service-provider utilities and consumers—as well as the documentation of data transactions between them which can be described as open data. This open data helps utilities predict the consumers’ demand, share the generation with privates, and minimize the impact on the environment by reducing carbon emission level.

The aim of this study is to explore the perception of prosumer-to-prosumer electricity trading within the Power Distribution Network in the United Arab Emirates. This will enhance the understanding of the energy trading market between self-generated power producers that are connected to a network grid, where the consumer will be utilizing the excess power available in the form of electricity trading, by importing and exporting power without adding any additional power plant to the grid. The objectives of the study are to develop an understanding of the Smart Grid and energy trading, and to identify the customer perceptions of the modern energy trading platforms. The study will obtain responses to the following two research questions that have been identified in the literature review: What are the challenges associated with distributed energy trading? And what is the customer perception and satisfaction level with the quality of supply with energy trading capacities integrated to the grid?

This study will contribute to building a knowledge base for the UAE electricity market and enhance its readiness to adopt Peer-to-Peer trading by reviewing the ongoing projects within the UAE and exploring peoples’ perception on the transition from having one single source from the utility towards distributed generation and trading of electricity.

The structure of this study includes six sections: introduction, literature review, method used to conduct the research, results of the interviews, discussion, and conclusion.

2. Literature Review

The qualitative strategy in this study explored the existing Smart Grid projects in the Distribution Network of UAE and their integration into the grid. The approach of this strategy consists of reviewing: the Smart Grid projects in the UAE, the Peer-to-Peer (P2P) electricity trading projects, and the power quality-related issues within energy trading. The review started with identifying reputable peer-reviewed papers related to the topic, where 133 papers were investigated based on the following keywords: electricity trading, P2P electricity trading, electricity trading interviews, P2P electricity trading quality, electricity trading blockchain, and electricity trading prosumers. The preliminary identified papers were further shortlisted to 66 papers and were investigated to collect the factors to be used in the semi-structured interviews. Additionally, the published reports by the utilities, their published projects and initiatives information, the progress posted to their official website and the news were also reviewed.

The electricity network in the UAE is controlled through four utilities based on the geographical regions within the UAE. In the emirates of Abu Dhabi, it is TAQA, which has different subsidiaries in transmission; Abu Dhabi Dispatch Company, TRANSCO; and two distribution companies, Abu Dhabi Distribution Company (ADDC) and Al Ain Distribution Company (AADC). The generation falls under the Independent Worldwide Production Partners (IWPP). In the emirate of Dubai, Dubai Electricity and Water Authority (DEWA) is the utility that serves the power and water network, while in the emirate of Sharjah it is served by Sharjah Electricity and Water Authority (SEWA). In the other emirates—Ajman, Umm Al Quwain, Ras Al-Khaimah and Fujairah—Etihad Water and Electricity (formerly known as the Federal Electricity and Water Authority, FEWA) is responsible for the power and water networks. The voltage level in the UAE is unified to be 400 volts in the low voltage level; 33,000 and 11,000 volts in the Medium Voltage (MV) distribution network; and 132 kV, 220 kV and 400 kV in the transmission network. The UAE utilities are being connected to the transmission level of 400 kV as part of the UAE transmission grid.

The Smart Grid journey in UAE started with the Emirate of Abu Dhabi, where its utility, ADDC, started the replacement of conventional meters with digital meters with the introduction of solar rooftop consumer integration to the grid projects [

11]. The digital meters, which are known as Advance Metering Infrastructure (AMI), were then adopted by the remaining utilities in the UAE. In 2009, DEWA started its AMI adoption, and had installed more than two million smart meters by 2021 [

12]. This action was then followed by the Etihad Water and Electricity in 2016 [

13], and by SEWA in 2017 [

14].

The initiative of solar rooftop by Abu Dhabi [

15] was followed in 2013 by a project called “Shams Dubai”, initiated by DEWA [

16]. Both projects enabled customers to generate power through roof-installed photovoltaic units. The generated power would be consumed within the premises, where the excess can be exported to the grid through a tariff meter that will log the transactions. Both initiatives were offered to customers connected to the Low Voltage (LV) side of the grid, which generated the opportunity to assess the feasibility of connecting larger installations directly to the Medium Voltage (MV) side of the grid. The standards and regulations have been set for the LV integration to the grid. Meanwhile, there is a lack of regulations for the MV integration to the grid, which shall be addressed and developed in this study with comparison to other countries who are pioneers in Smart Grid. On the other hand, Electric Vehicles (EV) charging station infrastructure has been developed dramatically in the UAE in order to fulfill the demand of EV cars. DEWA started the initiative of public EV charger installation in 2015 with 100 units, which increased in 2022 to 325 EV public chargers in Dubai that are fully managed by DEWA [

17]. SEWA introduced the first EV charging stations in 2016 [

18], followed by solar EV charging stations in 2017 [

19]. In 2017, FEWA announced the introduction of 50 EV charging stations [

20], with the first unit being commissioned at its headquarters in Ajman [

21]. As the three utilities adopted the introduction of EV charging stations, in Abu Dhabi the same is owned by private entities, with a regulated metering tariff via separate meters [

22]. Those EV stations can be considered as an input to the grid if the Vehicle-to-Grid (V2G) provision is provided [

12], and it can be a potential area of development towards utilities’ transition to Smart Grid by considering the EV charging stations as battery storage.

The UAE is considered one of the pioneers in promoting Smart Grid integration to its strategy, along with the introduction of the 2050 energy mixtures strategy where 50% of power will be produced from clean energy. The leadership support and commitment towards this strategy is evidenced by the continuous support of researchers and related projects [

23]. Microgrid concept has been established in the UAE as a pilot project, with the DEWA Smart Grid Station, located at its Green Garage in the Al-Ruwaiyah area, considered one of those pilot projects. This setup started its operation in 2016, and it combines different Smart Grid initiatives that have been adopted by DEWA such as: green chargers for EV, solar roof “Shams Dubai”, and smart meters. The setup also contains several technologies that have been installed at the premises [

24]. Another microgrid project in the UAE is the “Themar Al Emarat” farm, an agriculture firm that had a challenge with grid connection due to its location. However, it overcame this challenge by establishing a microgrid with 5.94 MW hybrid energy solution formed by a combination of PV solar and diesel generators [

25,

26]. Bio-mass generation units are also being considered in the UAE. Currently, a waste-to-energy power plant is operated by Emirates Waste to Energy Company (EWTE), which is a partnership between Masdar and Bee’ah in Sharjah, with a 30 MW capacity [

27]. Another project is under construction in Dubai under Dubai Municipality, which is expected to be in operation in 2023 with 80 Mwh initially, up to 200 Mwh after project completion in 2024 [

28]. Al Rawabi dairy farm, in Dubai, is currently running bio-mass distributed generation with a capacity of 1.3 MW [

29], and other such projects are being considered in different parts of the UAE for their feasibilities [

30]. Battery storage systems are being installed at different scales in the UAE. Abu Dhabi firm Transco has installed 108 MW Sodium Sulfur (NaS) batteries at several locations [

31], while DEWA has its own pilot project installation with both NaS and TESLA systems [

32]. DEWA also is testing a virtual power plant (VPP) based on the different technologies that are being adopted and installed [

33].

Although the above-mentioned projects are being borne by the government, they also motivate and drive the market for more distributed generation systems that can be constructed at different scales and integrated to the grid. This can enhance the foundation of multi-prosumer infrastructure and drive the energy trading between them at a wider scale. Many companies in the UAE are offering the support to establish own generation units, such as Al Shirawi Solar [

34] and Clean Max [

35]. They also offer a variety of different financial schemes between ownership and leasing depending on the firm area and electricity demand requirement.

Power Quality is a term of measuring the harmonics that effect the voltage and current values and is defined by IEEE as “the concept of powering and grounding sensitive equipment in a manner that is suitable to the operation of that equipment” [

36]. It also refers to the characterized voltage and current at a given time in the power system with electromagnetic phenomena, according to IEEE1159 in the following

Table 1 of terms and definitions [

37]. The first utilities to encounter the risk when integrating Smart Grids to their grids were utilities in North America and Canada according to Farhangi [

2]. He also stated the challenges during the integration to customers as the interference point was the smart meter, where the assets after the meters are owned by customers, hence utilities needed to invest and bear the cost of the replacement. Another challenge was the wide area and different custodians in North America. The power quality parameters and voltage stability are also among the challenges that should be considered prior to any integration [

2]. Another study [

38] investigated the voltage measures and introduced “coordinated-voltage control” to overcome the changing role of the devices connected to the Smart Grid, such as on-line tap changer (OLTC), diesel generated, solar-based units, and others. The research overcame the dynamic change control on OLTC based on voltage and reactive power constrains. Where in [

39], a framework had been developed in California for an electrical grid to be connected to renewable energy generation plants by “designing a supervisory Model Predictive Control (MPC) for long-term optimal operation of the integrated system, accounting for battery maintenance and time-varying electric power pricing”.

Simulations were carried out to illustrate the applicability and effectiveness of the proposed designs. Research on a case study in Spain [

40] highlighted the issue related to power quality and the occurrence of voltage dip in the network. It stated that the reactive power should be monitored and controlled in order to maintain the voltage level in the grid, and that the two-way communication infrastructure was crucial to facilitate the access and flow of data. A mathematical model was introduced in [

41] to enhance the power quality of the supply with availability of Voltage Source Controller (VSC), which connected a microgrid to a utility and a diesel generator to ensure the continuity of the supply. It also helps to maximize the use of the renewable resources and minimize the cost of diesel where frequent interruptions occurred in the grid. Setting up future Smart Grids with AC/DC Hybrid topology was studied in [

42] and developed a “stochastic dispatch model” that consists of two stages: First, scheduling the production for the next 24 h and second, determining the import/export schedule, a useful tool that can be used to predict uncertainty in the Smart Grid. A demand side management approach was proposed in [

43] with regard to the impact of power quality from photovoltaic and electric vehicles on voltage magnitude and voltage imbalance of residential grids. It proposed a DSM scheme to reschedule the EV consumption and generated power from PV to improve power quality. A strategy for harmonics mitigation in microgrid with household appliances to fulfill demand side management strategy was discussed in [

44]. Comprehensive harmonic analysis was conducted with real measurements of the nonlinear load of residential appliances. To keep the total demand distortion below the standard limits, a load-shifting strategy was applied. Load profiles were created based on the measurement of current and voltage harmonics (up to 50th order) with their phase angles; active, reactive, and apparent powers as well as power factor and frequency. The results show that the load-shifting strategy produced a promising outcome for reducing the TDD. A study [

45] examined the power quality control for a microgrid via the management of battery energy system and protection using automated demand side management (ADSM). The study recommended that power quality parameter of voltage deviation, frequency, total harmonic distortion and power factor be quantified through power quality monitoring index (PQMI) and corrective action to be taken in through ADSM for the benefit of the microgrid. Another study [

46] proposed the adoption of measured Total Harmonic Distortion (THD) during operational mode to obtain power factor correction PFC, as PFC can operate at low current THD or in conventional resistor emulator mode with contribution to THD and PF at distribution feeders. Power Quality Enhancer (PQE) is used to mitigate the household appliances’ non-linear load. Power quality issues, such as harmonics and short-duration voltage variation, associated with the integration of renewable energy, especially wind power, were presented in [

47], and simulated using a typical load profile for the city of Riyadh in Saudi Arabia. The role of reactive power and voltage regulator was demonstrated. It promotes further studies for demand side management of electricity pools to mitigate power quality issues arising from integrating renewable energy resources.

From the reviewed literature, the challenges associated with integrating distributed generation and prosumers to the grid shall be identified through interviewing the subject matter experts, system owners, and individual customers. Based on the recommendations in the visited papers, power quality and power reliability are crucial aspects of Smart Grid and should be discussed during the interviews to better identify their perception. In addition, the perception of the P2P electricity market is worth exploration and discussion in this research to build a general understating of the UAE market in accepting the electricity network revolution. The identified research opportunity will build a foundation for the utilities, developers, and individuals in the UAE to adopt P2P electricity trading.

3. Materials and Methods

The qualitative strategy in this study explored the existing Smart Grid projects in the UAE at the Distribution Network level and their integration to the grid. The approach of this study is to review the Smart Grid projects in the UAE, electricity trading Peer-to-Peer (P2P) projects, and power quality-related issues within energy trading which is then used in the semi-structured interviews.

The energy trading knowledge among different stakeholders within the electrical network was targeted for this study, including customers, subject matter experts and Distributed Generation system owners. The semi-structured interviews explored the factors provided in

Table 2.

The selection of the interviewees was based on their geographical locations in different emirates, as the four utilities in the UAE are controlling those locations independently, to ensure different views from different utility users’ perspectives, with different electrical backgrounds, and with individual electricity account holders with respect to their respective electricity service providers. The targeted number among the four utilities’ stakeholders was set at twenty, with five interviewees from each utility. The actual number of completed interviews was sixteen. The study outcome was based on the input received through the semi-structured interviews with the stakeholders and is subjective, with its value biased by the input from the stakeholders.

The study Is considered inductive in terms of stakeholders’ perceptions toward P2P energy trading, and their satisfaction level on the quality and the reliability of the power supply. It explored the challenges, opportunities, and operational issues linked to the energy trading and prosumers activities with the network. The feedback from the interviews can be considered as insight from the UAE market and the perception of people towards P2P electricity trading and the changes in the electricity network. The semi-structured interviews were conducted face-to-face and remotely, due to the COVID-19 pandemic, where interviews were conducted between the years 2021 and 2022. Each interview was scheduled in advance after obtaining initial acceptance from the interviewee, who signed the consent form as per the Institutional Review Board (IRB) at the American University of Sharjah protocols. The average length of each interview was roughly an hour. After the interview, all responses were gathered and analyzed. The following are the responses from the interviews, followed by author interpretation.

4. Results

The outcome of the interviews with respect to the examined factors are demonstrated and presented in this section.

4.1. Power Quality (PQ) Patterns

The interviewees were introduced to seven different power quality patterns and were asked to rate them with a Likert scale of 1 to 5 according to their impact on their daily operation. The majority of the responses indicated that Transients could have the most effect on the daily businesses or activities, as we have different segments of interviewees. The boxplot in

Figure 2 represents the distribution of the responses. Network unbalance, voltage variations, and flicker are considered by respondents to be most likely to have an impact on their activities and business and so they required attention.

The supply reliability was given more importance than power quality. In their response, the continuity of supply was stated to be more important for sustaining their activities and businesses. However, the power quality issues were also considered to be important, but with less priority than supply reliability as activities and businesses can be managed with many available solutions to minimize the impact on the daily activities and businesses, such as using harmonic filters and capacitor.

4.2. Type of Connection

The type of connection was addressed in the interview, as participants were asked about trading systems that consider their load requirements, run their business without interruption, minimize the cost, and increase their profit margin. Three types of connections were addressed to the interviewees in order to select the most favorable type to their activities and business which are: continuous permanent connection, regulated connection with defined scheduled time for consumption, and a sequential switching schedule for specific appliances usage and consumption.

Figure 3 represents the classification of the responses about the type of connection. Just more than half of the participants (53%) preferred to have a regulated defined on/off timing during the energy trading as they would be complying to the requirement of electricity usage during the day and fulfill their demand. The continuous connection was selected by 40% of the participants where they indicated that it would have more flexibility and freedom on their daily appliances usage and perform trading while conducting different activities during the day. The sequential switching schedule for specific appliances usage and consumption was selected by a minority group (7%) as their justification was that it would be used as a guidance to streamline their energy trading and to obtain the optimum advantage from the trading.

In response to the type of peer to trade with, the residential segment were more flexible in their choice as they considered that profit and cost reduction could be obtained from other peers regardless of their business and firm type, with preference for commercial and industrial firms as the potential of guaranteeing the trading was highlighted by the interviewees to avoid disconnection and ensure reliable supply.

As commercial peers are easier to communicate with and approve any power amount, they have a better understanding of needs, and they are more attractive for revenue. Residential peers had the advantage of helping old people, and people of determination receiving surplus power, they guaranteed the customer to sell, they have no dynamic change in terms of load or sudden change with minimum reactive power, and they have similar needs when they trade with other residentials. For industrial peers, they will have higher concerns related to power quality.

4.3. Supply and Reliability of Connection

During the interview, the supply and reliability of the connection was discussed with two different scenarios. The first scenario is with a traditional connection that has a standard supply connection from the grid towards customer and the meter is logging the consumption. The second scenario is with a Smart Grid P2P connection, where a bi-directional meter is logging both the consumption and the generated power that is fed into the grid. Both scenarios were addressed to the interviewees for their feedback.

4.3.1. Power Supply with Traditional/Classic Connection

In this type of connection, the electricity flows in one direction from the utility to the customer. From the interview responses, it is noticed that the sudden activities, which are utility power failure and the emergency breakdowns, are more likely to affect the businesses and activities by customers, while the planned activities, such as planned maintenance shutdowns and regulating consumption during the day, will have less impact. These phenomena, as per the interviewees, should be backed-up with a means of emergency supply, such as stand-by generators, in order to fulfil the critical and essential loads required for their operation. The System Average Interruption Duration Index (SAIDI) is used to measure the duration of interruption on customers over one year, and the System Average Interruption Frequency Index (SAIFI) is measuring the frequency of interruption per customer over one year. Both SAIDI and SAIFI are linked with the IEEE1366 standard [

48].

4.3.2. Power Supply with Peer-2-Peer P2P Connection

In this type of connection, the electricity flow is bi-directional between peers and bi-directional meters are installed to measure both generated and consumed power. It is noticed that the emergency breakdowns are likely to affect the businesses and activities between the peers as other sources could exist, while the utility power failure and planned activities, such as planned maintenance shutdowns and regulating consumption during the day, will have a lesser and more manageable impact.

4.4. Integration of the System

The integration mode to the energy trading system was discussed during the interview. Five different options were provided, and the participants were asked to select the option they prefer to have their energy traded through. The five options were: self-system owned by customer, third party trading platform, communities with readymade infrastructures, summation and aggregation of surplus power with other customers, and following Virtual Power Plant (VPP) concept to be treated as a source of power where required.

Figure 4 provides the classification proportion on the provided 5 options. Based on the interview, 47% of the participants preferred to have their self-system directly connected, and 27% preferred a third-party platform. Ready-made communities and aggregation of the produced power had a preference of 13% each, and the VPP concept was not been selected by the interviewees. From this we can observe that more people are willing to start their energy trading system with the help of other providers for more profit generation and less operating costs.

4.5. Timing of Trading

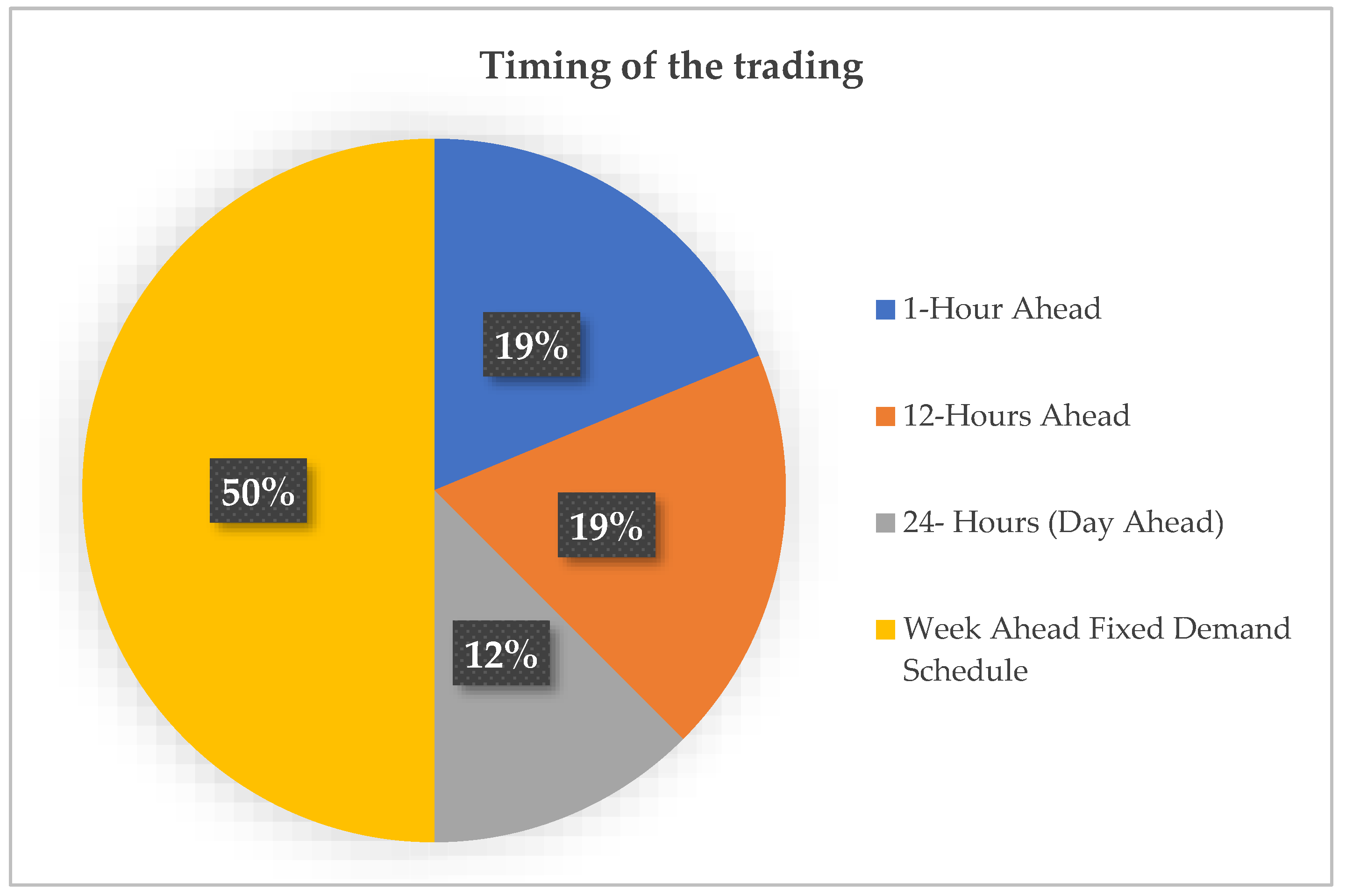

From the visited literature, four different timing options were discussed during the interview. The four options are: trading with one hour ahead, 12 h ahead, 24 h ahead, and week ahead fixed demand scheduled trading. The response from the participants is illustrated in

Figure 5. For the discussed four options, 50% of the participants selected a week ahead fixed demand schedule as the justification they provided is it would help them being prepared in advance for trading and calculating the requirement for purchasing and selling electricity along with their business schedule. This timing option is also linked with the previous factor, type of connection, and confirms that people tend to follow a guided process schedule in order to fulfill their trading needs. The remaining three options which are 1-h, 12-h, and 24-h timing had similar selection proportions. The type of the peer and the connection type might have an effect on the timing selection, which can be explored and investigated further.

4.6. Financial Terms

In order to construct and operate an electricity trading infrastructure, investment is required from the customer in order to fulfil the system requirements and trade the electricity without any hassle. Government support and loans will drive the market of self-generation and electricity trading as per participants. Having the system on a leasing program was an option provided through respondents in order to avoid the operation expense burden on the customer, in particular the residential sectors. Others stated that owning the system could be more cost-beneficial to the industrial and commercial firms due to the potential opportunity of more system capacity. However, it is advised to conduct a feasibility study on any proposed system.

From the responses of the interviewees, it was highlighted that having regulation on the surplus of generated power will not support the market of electricity trading initiative and might lower the participation rate. It was recommended to have a battery storage system to overcome this challenge and avoid charges on surplus in power. Also, aggregation of the power producers could have a minor impact on the surplus and legal terms could be shared by more participants.

4.7. Trading Platform Issues

In order to evaluate customers understanding on electricity trading, and their perceptions on the electricity trading platform, a set of questions were asked during the interview, with responses on a Likert scale from 1 to 5, in order to obtain feedback on the topics based on findings from the literature review that was conducted during this study. In this section, the responses from the interviewees to the related questions are addressed, followed with the interpretation of each question.

In the first question, the participants provided their thoughts on having a central agent or broker during the trading process. Most of the participants believe that the trading should be independent from a third party, and would most likely increase the profit margin during trading. The participants highlighted that the cost to establish and run the system would be reimbursed by the profits that are gained from the trading process, while having a central agent or broker would incur additional cost that could be saved and reflected in a higher profit margin.

Independency from utility connection was discussed with the interviewees for their feedback on the reducing consumption bill. Half of the participants believed that being independent from the utility will not have an impact on bill reduction due to other cost incurred from having a trading system. The participants’ feedback indicated that some preferred the cost for securing power supply to their premises be preserved and reflected on the energy bills, while the others believed that being independent from the grid will somehow reduce the consumption bills.

The operation cost related to the installed system and trading platform was discussed with the interviewees. Most of the interviewees accepted that there should be an operation cost associated with the energy trading activities on both the physical assets and the infrastructure required. Therefore, the operation costs seem to have minimum effect on the profit margin.

Blockchain was explained and addressed to the interviewees in terms of its structure, data privacy, and security. The majority of the participants believe that blockchain will help facilitate fair and transparent trading due to the availability of data and history. This drives the process of P2P trading to be compatible with blockchain and support the necessity of the historical and transparent data for fair energy trading. Although data privacy is considered a threat to the trading system, participants feel their data will be secure during the trading.

In terms of setting the telecommunication infrastructure that will facilitate data capture, sensing and transmitting, and live communication, most of the participants overseeing telecom infrastructure might bias the decision of establishing and participating in an energy trading platform due to its high initial investment due to their capital cost. Interviewees highlighted that support and incentives can be provided from the UAE government as a support towards energy mix strategy, by having different support schemes that will encourage more people towards participating in self-generation power and energy trading.

To understand the feedback on having controlled switching schedule and sequence on the customers’ appliances, this issue was addressed during the interview. The responses from the interviewees tended to be concerned about losing their right to use their own appliances, and is considered inconvenient as there is a lack of flexibility for the consumers to use their appliances/equipment whenever they want.

Another concern related to the surplus in the generated power. The interviewees were asked to provide their feedback on regulation if extra charges were to be enforced on the amount generated exceeding the agreed level of production. The response from the participants was that being charged on extra produced power will demotivate them from continuing trading, where they believe that they should be able to trade all the produced surpluses regardless of an upper limit. In authors’ opinion, regulation must be in place to avoid any disturbance to the system due to overproduced power with un-matched power demand, that could result in network failure. The time required for trading was discussed during the interview in

Section 4.5, where, in terms of Likert scale response, participants stated that it is important to them to have a defined time for trading rather than having sudden trading requests. This will enable them to define their power demand and manage their required power demand during the day. Also, it will allow them to optimize the required energy trading among peers with the maximum profit and lowest cost.

The power quality issues were addressed with the interviewees to view their feedback on its impact to adopting energy trading. Most participants linked the resistance of people not entering the energy trading to the power quality issues. Obtaining the correct voltage and frequency level within the agreed tolerance limits is important to the participants. Also, participants support the thought that classic connection from the grid is more secured. Few people considered this point as neutral as they believe that some risk can be accepted in order to support the energy trading market and support the diversity in electricity production. In terms of having extra charges and high bills to be paid to the utility in favor of engaging in trading system, most of the participants disagree with this concept as, in their opinion, this point does not support the concept of adopting energy trading.

4.8. SWOT Analysis

Strengths, Weakness, Opportunities and Threats (SWOT) analysis was conducted through brainstorming the microgrid topology and P2P energy trading in order to provide a better picture of the perception in the UAE of this transition in the market. Following are the details on the obtained feedback from the participants.

4.8.1. Strengths

During the interviews, the participants were asked to highlight their point of view on the strengths of having microgrid topology and P2P energy trading in the UAE. Reducing the pressure on the utility in terms of sharing the generation among the community through their installed technologies was addressed by most of the interviewees. This will lead to better utilization of the electrical network assets. The same has been linked in the response from participants to the UAE government’s 2050 strategy on the energy mixture. Another strength of having Smart Grid topology with P2P trading, is it will enhance the UAE’s people culturally on the importance of renewable energy by adopting different technologies in self-generation as well as storage of excess power using different battery storage systems, with higher independence level in energy production and consumption and the flexibility of controlling their demand. Participants also believed that this market transition in the energy sector will boost the UAE economy and will lead to more negotiable prices instead of a fixed tariff.

4.8.2. Weaknesses

Participants identified some of the weaknesses related to P2P energy trading. In their view, it might increase the duration of failures in the system and affect the availability of power. This will lead to shortage in the power supply and might affect businesses and activities due to demand not being fulfilled. The availability of power generated from renewable energy might vary significantly during the day—due to different reasons, such as weather or the malfunctioning of the system. There is also a concern related to the area required for installations as such self-generated systems and renewable energy sources require large areas for installation. The limit on the produced load is considered a weakness as the output and the surplus from the self-generation is mainly being consumed within the firm, leaving limited amounts to be traded. This can be overcome by implementing demand side management and energy conservation for better power utilization during the day. The cost of operation and maintenance was highlighted by participants, which might lead to demotivating firms from sustaining their trading process, as well as deterring new firms from entering P2P trading. This financial impact can be addressed during the design of any self-generation system to predict the required return on investment. The shortage in setting up trading regulation and the market fairness can also impact the expansion of the electricity trading market. Participants recommended that roles and responsibilities should be defined at different levels of the system along with the related regulation. Respondents were skeptical about quality issues that might affect the electricity trading stability and reliability of supply, which should be controlled and regulated among the trading peers. The lack of experience in customer interaction and price negotiation should be enhanced through different awareness campaigns and seminars that can be conducted by the electricity regulator. The functionality of the system’s components and the installation of new components should be controlled to guarantee the reliability of the supply during trading. The participants referred to having a historical data of supply interruption and availability where the international indices SAIFI and SAIDI can be monitored in the P2P trading. Other aspects were identified by the participants, including data privacy, loss and leakage, as the system is believed to be capable of protecting peers’ information and data while offering data transparency to ensure the trading fairness. The trading time between the peers has been considered as a weakness by participants, which also has been highlighted during the interview process. The sudden demand of load could have an impact on the daily operation, whereas in-advance scheduling is preferred as it allow users to plan the load utilization during the day. The highlighted weaknesses can be transformed to opportunities by further analyzing the challenges associated with each point.

4.8.3. Opportunities

The opportunities that are associated with the microgrid topology and P2P energy trading were explored with the interviewees as they pointed to potential areas that can be tackled. The energy trading topology is believed to open new markets for electricity production, enhancing the employment rate by engaging more human resources in different areas, such as operation, maintenance, and data analysis, as well as helping promote new technologies and energy consumption habits among people. It will also contribute to cost reduction on utilities, especially to supplying remote areas, and will provide more flexibility to consumers in terms of managing their power demand during different times of the day. Another opportunity is having data of customers with their consumption profile that can be analyzed and processed further to build different models that will predict load and demand. Energy trading and microgrids support Sustainable Development Goals (SDG) by providing power to a larger segment of the community and enhance economic growth. Additionally, it drives technological development for better user interaction among peers and utilities.

4.8.4. Threats

Each process can be associated with some threats that can be carefully tackled and turned into opportunities. During the interviews, participants were requested to highlight threats that can be identified during trading. The threat of power security was discussed, as participants believed that reliability of power supply can be affected by using different fueling types in different sources of generation. Physical damage to the system might cause serious impact to the energy trading and could result in high downtime cost. Also, data breaches and cyber-attack issues can be considered as there are many user interactions in the trading platform. Power storge and reserve efficiency might not fulfil the demand of other peers while trading. Another threat is the lack of investors in such a trading environment, and the fear of having a bad impact on peoples’ daily lifestyle. This can be tackled by having several awareness initiatives directed to people about the system and its contribution towards the economy, society, and the environment. Moreover, technology de-risk projects can help utilities and customers test the trading system and remove any resistance based on the vagueness of the technology and its application.

5. Discussion

The semi-structured interview outcomes from the participants provided in-depth information about the UAE people in different segments, including customers, subject matter experts, and business owners in terms of the perception of energy trading and its associated issues, including the power quality and supply reliability. Many concerns were highlighted during the interviews. Some of the highlighted factors related to power stability, power quality, reliability and supply continuity, maintaining voltage and frequency within limits, ways to deal with excesses power, price, and costs.

Based on the responses received from the interviewees, the continuity of supply to sustain the activities and businesses will be most important, followed by the power quality-related issues that they considered to be manageable with the availability of new technologies.

Many other factors in energy trading were identified to play a vital rule in adopting this concept. The type of integration and timing of trading can be considered as the main factors towards the success of adopting energy trading. Moving from classical grid towards Smart Grid and energy trading would have a significant change on the way people use/produce electricity. Prosumers will tend to produce/conserve electricity in a way that generates revenue in return. The development of technology accelerates the users’ interaction with Smart Grid and enhances the spread of the energy trading culture.

The issues associated with adopting energy trading platform as discussed during the interviews resulted in dividing people into two group; the first group supports the transition in the electricity market, and the other group still believes that the classic connection is more rigid and fits their needs. The uncertainty associated with cost and return on investment was the main drive to the second group’s views as it directed them to avoid the risky process of having conflict with other peers and entering price negotiations that they avoid in the classic electrical network. More awareness and use cases can be demonstrated to the public for a better understanding of the concept to overcome the fear of trading with many peers.

The feedback from the SWOT analysis provides in-depth understanding of the areas that should be considered while designing and promoting any microgrid and P2P energy trading platforms in the UAE. The culture of sustainability pillars and the contribution of Smart Grid to the quality of life of people should be promoted through different means to target different people segments. Although benefits were highlighted, such as boosting the economy and opening new markets for trading, the clarity of the full picture should be explained to the public along with the expected benefits. It is extremely recommended that the high initial investment cost be borne or subsidized by the government, with incentives to early-bird registered peers to drive the culture change and provide different system installation examples.

The perception of the people in the UAE towards energy trading and the Smart Grid is promising. The terms related to data privacy, which is an essential component for trading, are well appreciated by people. Despite their acceptance of energy market transition, people look to support from the government to drive the culture of energy trading and to facilitate the infrastructure in reasonable and affordable way.

6. Conclusions

With the introduction of local generator units owned by customers and the bi-directional flow of data and power between the customers and utilities, the industry has faced a dramatic change in the structure of the network thanks to renewable energy and energy mixtures. Now, customers can generate their own power to meet their energy requirements, with a privilege to sell the excess power to the grid. Additionally, they can sell it to their neighborhood with an infrastructure of microgrid and P2P energy trading, where the produced power is consumed within the same area, and can be injected to the grid and transmitted to other areas. This has an advantage in reducing the number of new generation units, minimizing the operation cost of utilities, reducing emissions, and raising profit for utilities and customers. However, the issues related to controlling the network in terms of supply continuity, power quality and expected power requirement have been considered a challenge.

Distributed generation has been touted as a potential solution for reducing the burden on natural resources and the carbon footprint. It also became an alternate source of power supply to the utilities with huge cost savings specially in the developed countries. In UAE, the transition towards the targeted UAE energy mixture and the UN sustainable development goals has encouraged utilities to allow the integration of customer-owned generation into the grid at both medium and low voltage levels. Such integration shall be controlled and regulated through a set of standards and procedures that should be developed and enforced by the regulatory bodies in the UAE.

Power supply reliability shall not be compromised in any type of connection. Customers expect to receive electricity from a continuous and reliable supply at acceptable cost. It is recommended that the voltage and current parameters have to follow the regulation which defined as the Power Quality (PQ) standards.

This study introduced details about the electricity system in UAE and different operation and regulatory bodies. This information would be useful for researchers or companies interested in studying the opportunities for energy trading in the Gulf area. UAE electrical sector structure is unique and has its own distinct characteristics that should be considered when introducing energy trading or Smart Grid concepts. The outcomes of this study present the insight of people in the UAE towards P2P electricity trading and Smart Grids. The importance of trading parameters in terms of power quality, supply reliability, type of connection, type of peers, and the time window for trading are among the highest factors that shall be considered during the design of any P2P trading platform in the UAE. This paper recommended the necessity of people awareness and active engagement throughout the transition in the electricity market in order to address any misunderstanding and overcome the reluctance to new technologies. The interruption indices are highly recommended to be included in the trading model to promote supply reliability and continuity in electricity trading. The findings of the paper contribute to the base knowledge as it presents the UAE insight information and people perception towards energy trading where there is a lack of studies in this area, and the recommendations can be used to enhance energy trading between peers.

In this research, we have fulfilled the objectives of reviewing the energy market in the UAE in terms of the distributed generation projects and people’s perception towards the transition in the energy market from being the buyer into seller. There are some limitations to this study as it covers only the distribution network level within UAE, and it concentrates on the customer side including different segments of system owners along with subject-matter experts. For future research studies, the interviews should include the Original Equipment Manufacturers (OEM) of the self-generation systems, and a wider geographical area such as Gulf Council Countries (GCC), where similar utility structure exists and the energy market is seen to have strong potential. Also, the impact of shifting the electricity trading towards two-direction at the utilities level can be explored as most of the utilities within the GCC are monopolies in the electricity market and inter-utility trading can create some sort of competition that will benefit the market and development. Another tool that can be used in future study is utilizing structured surveys on larger community members to test their response to each identified factor in this study. The outcomes of the study can be integrated as trading factors while designing new UAE-specific P2P energy trading platforms.