Impact of Oil Price on Economic Growth of OECD Countries: A Dynamic Panel Data Analysis

Abstract

1. Introduction

2. Literature Review

3. Methodology

3.1. Data and Conceptual Framework

3.2. Operationalization and Empirical Model

4. Results and Discussion

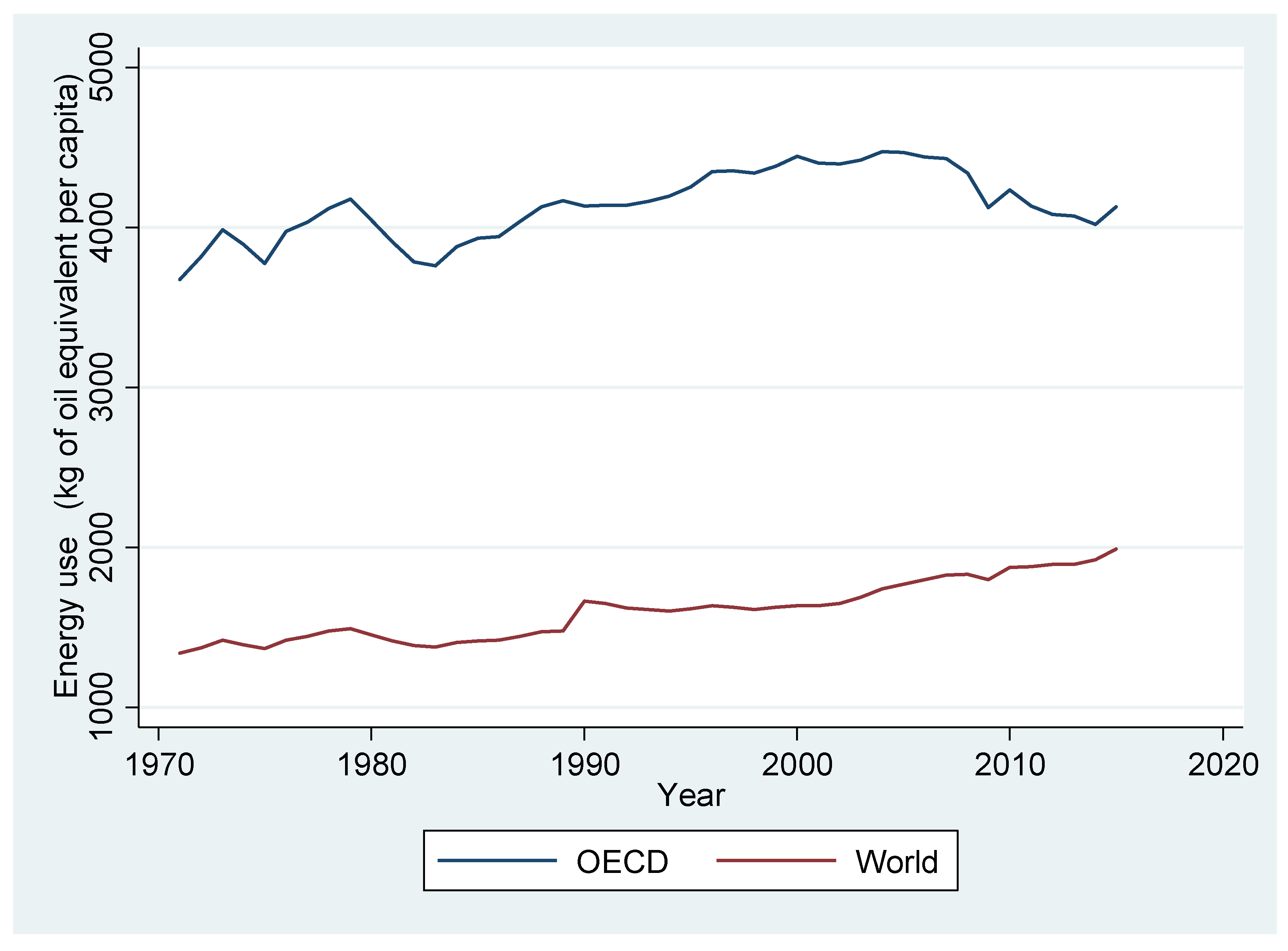

4.1. Descriptive Analysis

4.2. GMM Panel Data Results on Growth Model and Channel Variables

4.3. Estimation of the Impact of Oil Price on Economic Growth

5. Conclusions and Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Abdelsalam, M.A.M. Oil price fluctuations and economic growth: The case of MENA countries. Rev. Econ. Politi-Sci. 2020. Available online: https://www.emerald.com/insight/content/doi/10.1108/REPS-12-2019-0162/full/html (accessed on 23 May 2022).

- Dehn, J. The effects on growth of commodity price uncertainty and shocks. In Policy Research Working Paper 2455; World Bank, Development Research Group: Washington, DC, USA, 2001. [Google Scholar]

- Darby, M.R. The price of oil and world inflation and recession. Am. Econ. Rev. 1982, 72, 738–751. [Google Scholar]

- Hamilton, J.D. Oil and the Macroeconomy since World War II. J. Politi- Econ. 1983, 91, 228–248. [Google Scholar] [CrossRef]

- Koenker, R.; Bassett, G., Jr. Regression quantiles. Econometrica 1978, 46, 33–50. [Google Scholar] [CrossRef]

- Rasche, R.H.; Tatom, J.A. The Effects of the New Energy Regime on Economic Capacity, Production and Prices. Fed. Reserve Bank St. Louis Rev. 1974, 59, 3–28. [Google Scholar] [CrossRef]

- Frimpong, P.B.; Antwi, A.O.; Brew, S.E.Y. Effect of Energy Prices on Economic Growth in the ECOWAS Sub-Region: Investigating the Channels Using Panel Data. J. Afr. Bus. 2017, 19, 227–243. [Google Scholar] [CrossRef]

- Okonjo-Iweala, N. Africa’s growth and resilience in a volatile world. J. Int. Aff. 2009, 62, 175–184. [Google Scholar]

- Jiménez-Rodríguez, R.; Sánchez, M. Oil price shocks and real GDP growth: Empirical evidence for some OECD countries. Appl. Econ. 2005, 37, 201–228. [Google Scholar] [CrossRef]

- Cleveland, C.J.; Costanza, R.; Hall, C.A.S.; Kaufmann, R. Energy and the U.S. Economy: A Biophysical Perspective. Science 1984, 225, 890–897. [Google Scholar] [CrossRef]

- Ayres, R.U.; Warr, B. Energy efficiency and economic growth: The ‘rebound effect’as a driver. In Energy Efficiency and Sustainable Consumption; Palgrave Macmillan: London, UK, 2009; pp. 119–135. [Google Scholar]

- Akpan, E.O. Oil price shocks and Nigeria’s macro economy. Presented at the Annual Conference of CSAE Conference, Economic Development in Africa, Toronto, ON, Canada, 25–29 November 2009; pp. 22–24. [Google Scholar]

- Dabachi, U.M.; Mahmood, S.; Ahmad, A.U.; Ismail, S.; Farouq, I.S.; Jakada, A.H.; Kabiru, K. Energy consumption, energy price, energy intensity environmental degradation, and economic growth nexus in African OPEC countries: Evidence from simultaneous equations models. J. Environ. Treat. Tech. 2020, 8, 403–409. [Google Scholar]

- Jahangir, S.M.R.; Dural, B.Y. Crude oil, natural gas, and economic growth: Impact and causality analysis in Caspian Sea region. Int. J. Manag. Econ. 2018, 54, 169–184. [Google Scholar] [CrossRef]

- Foudeh, M. The long run effects of oil prices on economic growth: The case of Saudi Arabia. Int. J. Energy Econ. Policy 2017, 7, 171. [Google Scholar]

- Arouri, M.E.H.; Nguyen, D.K. Oil prices, stock markets and portfolio investment: Evidence from sector analysis in Europe over the last decade. Energy Policy 2010, 38, 4528–4539. [Google Scholar] [CrossRef]

- Filis, G.; Degiannakis, S.; Floros, C. Dynamic correlation between stock market and oil prices: The case of oil-importing and oil-exporting countries. Int. Rev. Financial Anal. 2011, 20, 152–164. [Google Scholar] [CrossRef]

- Rahman, M.H.; Majumder, S.C. Nexus between energy consumptions and CO2 emissions in selected industrialized countries. Int. J. Entrep. Res. 2020, 3, 13–19. [Google Scholar] [CrossRef]

- Bjørnland, H.C. The dynamic effects of aggregate demand, supply and oil price shocks—a comparative study. Manch. Sch. 2000, 68, 578–607. [Google Scholar] [CrossRef]

- Cavalcanti, T.V.D.V.; Mohaddes, K.; Raissi, M. Commodity price volatility and the sources of growth. J. Appl. Econom. 2015, 30, 857–873. [Google Scholar] [CrossRef]

- Mgbame, C.O.; Donwa, P.A.; Ogbaisi, S.A. Oil price movements and Nigeria’s economic indicators. Asian J. Empir. Res. 2015, 5, 59–63. [Google Scholar]

- Lee, K.; Ni, S. On the dynamic effects of oil price shocks: A study using industry level data. J. Monetary Econ. 2002, 49, 823–852. [Google Scholar] [CrossRef]

- Kilian, L. Exogenous Oil Supply Shocks: How Big Are They and How Much Do They Matter for the U.S. Economy? Rev. Econ. Stat. 2008, 90, 216–240. [Google Scholar] [CrossRef]

- Kilian, L.; Park, C. The Impact of Oil Price Shocks on the U.S. Stock Market. Int. Econ. Rev. 2009, 50, 1267–1287. [Google Scholar] [CrossRef]

- Hamilton, J.D. Causes and Consequences of the Oil Shock of 2007-08; No. w15002; National Bureau of Economic Research: Cambridge, MA, USA, 2009. [Google Scholar]

- Akinlo, T.; Apanisile, O.T. The Impact of Volatility of Oil Price on the Economic Growth in Sub-Saharan Africa. Br. J. Econ. Manag. Trade 2015, 5, 338–349. [Google Scholar] [CrossRef] [PubMed]

- van Eyden, R.; Difeto, M.; Gupta, R.; Wohar, M.E. Oil price volatility and economic growth: Evidence from advanced economies using more than a century’s data. Appl. Energy 2018, 233–234, 612–621. [Google Scholar] [CrossRef]

- Okonju, C. Oil price fluctuations and its effects on growth. J. Hist. Econ. 2009, 2, 15–18. [Google Scholar]

- El-Anshasy, A.; Mohaddes, K.; Nugent, J.B. Working Paper No. 310-Oil, Volatility and Institutions: Cross-Country Evidence from Major Oil Producers-Dallas Fed; Federal Reserve Bank of Dallas: Dallas, TX, USA, 2017. [Google Scholar]

- Jarrett, U.; Mohaddes, K.; Mohtadi, H. Oil price volatility, financial institutions and economic growth. Energy Policy 2018, 126, 131–144. [Google Scholar] [CrossRef]

- Kilian, L.; Lewis, L.T. Does the Fed Respond to Oil Price Shocks? Econ. J. 2011, 121, 1047–1072. [Google Scholar] [CrossRef]

- Nordhaus, W.D. Who’s afraid of a big bad oil shock? Brook. Pap. Econ. Act. 2007, 2007, 219–238. [Google Scholar] [CrossRef]

- Kilian, L. Oil Price Shocks: Causes and Consequences. Annu. Rev. Resour. Econ. 2014, 6, 133–154. [Google Scholar] [CrossRef]

- Bernanke, B.S.; Gertler, M.; Watson, M.; Sims, C.A.; Friedman, B.M. Systematic Monetary Policy and the Effects of Oil Price Shocks. Brook. Pap. Econ. Act. 1997, 28, 91–157. [Google Scholar] [CrossRef]

- Hamilton, J.D.; Herrera, A.M. Comment: Ail shocks and aggregate macroeconomic behavior: The role of monetary policy. J. Money Credit. Bank. 2004, 36, 265–286. [Google Scholar] [CrossRef]

- Mo, B.; Chen, C.; Nie, H.; Jiang, Y. Visiting effects of crude oil price on economic growth in BRICS countries: Fresh evidence from wavelet-based quantile-on-quantile tests. Energy 2019, 178, 234–251. [Google Scholar] [CrossRef]

- Liaqat, M.; Ashraf, A.; Nisar, S.; Khursheed, A. The Impact of Oil Price Inflation on Economic Growth of Oil Importing Economies: Empirical Evidence from Pakistan. J. Asian Financ. Econ. Bus. 2022, 9, 167–176. [Google Scholar]

- Akinsola, M.O.; Odhiambo, N.M. Asymmetric effect of oil price on economic growth: Panel analysis of low-income oil-importing countries. Energy Rep. 2020, 6, 1057–1066. [Google Scholar] [CrossRef]

- Işık, C.; Ongan, S.; Bulut, U.; Karakaya, S.; Irfan, M.; Alvarado, R.; Ahmad, M.; Rehman, A. Reinvestigating the Environmental Kuznets Curve (EKC) hypothesis by a composite model constructed on the Armey curve hypothesis with government spending for the US States. Environ. Sci. Pollut. Res. 2021, 29, 16472–16483. [Google Scholar] [CrossRef] [PubMed]

- Chang, Y.; Wong, J.F. Oil price fluctuations and Singapore economy. Energy Policy 2003, 31, 1151–1165. [Google Scholar] [CrossRef]

- Olomola, P.A.; Adejumo, A.V. Oil price shock and macroeconomic activities in Nigeria. Int. Res. J. Financ. Econ. 2006, 3, 28–34. [Google Scholar]

- Oriakhi, D.E.; Osaze, I.D. Oil price volatility and its consequences on the growth of the Nigerian economy: An examination (1970–2010). Asian Econ. Financ. Rev. 2013, 3, 683–702. [Google Scholar]

- Hamilton, J.D. What is an oil shock? J. Econom. 2003, 113, 363–398. [Google Scholar] [CrossRef]

- Maalel, N.F.; Mahmood, H. Oil-abundance and macroeconomic performance in the GCC countries. Int. J. Energy Econ. Policy 2018, 8, 182–187. [Google Scholar]

- Odhiambo, N. Oil price and economic growth of oil-importing countries: A review of international literature. Appl. Econ. Int. Dev. 2020, 20, 129–151. [Google Scholar]

- Mehrara, M.; Oskoui, K.N. The sources of macroeconomic fluctuations in oil exporting countries: A comparative study. Econ. Model. 2007, 24, 365–379. [Google Scholar] [CrossRef]

- Adjaye, J.A. The relationship between energy consumption, energy prices, and economic growth: Time series evidence from Asian developing countries. Energy Econ. 1999, 22, 615–625. [Google Scholar] [CrossRef]

- Faisal, F.T. The relationship between energy consumption and economic growth: Evidence from non-Granger causality test. Procedia Comput. Sci. 2017, 120, 671–675. [Google Scholar] [CrossRef]

- Osigwe, A.C. Exchange rate fluctuations, oil prices and economic performance: Empirical evidence from Nigeria. Int. J. Energy Econ. Policy 2015, 5, 502–506. [Google Scholar]

- Arellano, M.; Bond, S. Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev. Econ. Stud. 1991, 58, 277–297. [Google Scholar] [CrossRef]

- Arellano, M.; Bover, O. Another look at the instrumental variable estimation of error-components models. J. Econ. 1995, 68, 29–51. [Google Scholar] [CrossRef]

- Yüncü, İ. Essays on Financial Development and Economic Growth. Doctoral Dissertation, Bilkent Universitesi, Ankara, Turkey, 2007. [Google Scholar]

- Levine, R. More on finance and growth: More finance, more growth? Rev. -Fed. Reserve Bank St. Louis 2003, 85, 31–46. [Google Scholar] [CrossRef]

- Bond, D. Governing Disaster: The Political Life of the Environment during the BP Oil Spill. Cult. Anthr. 2013, 28, 694–715. [Google Scholar] [CrossRef]

- Bleaney, M.; Gemmell, N.; Kneller, R. Testing the endogenous growth model: Public expenditure, taxation, and growth over the long run. Can. J. Econ. Rev. Can. D’économique 2001, 34, 36–57. [Google Scholar] [CrossRef]

- Barro, R.J. A cross-country study of growth, saving, and government. In National Saving and Economic Performance; University of Chicago Press: Chicago, IL, USA, 1991. [Google Scholar]

- Barro, R.; Sala-i-Martin, X. Economic Growth, 2nd ed.; The MIT Press: Cambridge, MA, USA; London, UK, 2004. [Google Scholar]

- Anaman, K.A. Determinants of economic growth in Brunei Darussalam. J. Asian Econ. 2004, 15, 777–796. [Google Scholar] [CrossRef]

- Asheghian, P. Determinants of Economic Growth in Japan: The Role of Foreign Direct Investment. Glob. Econ. J. 2009, 9, 1850171. [Google Scholar] [CrossRef]

- Arshad, A.; Zakaria, M.; Junyang, X. Energy prices and economic growth in Pakistan: A macro-econometric analysis. Renew. Sustain. Energy Rev. 2016, 55, 25–33. [Google Scholar] [CrossRef]

- Bhattacharya, K.; Bhattacharyya, I. Impact of increase in oil prices on inflation and output in India. Econ. Political Wkly. 2001, 36, 4735–4741. [Google Scholar]

- Hsing, Y. Impacts of higher crude oil prices and changing macroeconomic conditions on output growth in Germany. Int. Res. J. Financ. Econ. 2007, 11, 135–140. [Google Scholar]

- Bouzid, A. The relationship of oil prices and economic growth in Tunisia: A vector error correction model analysis. Rom. Econ. J. 2012, 43, 3–22. [Google Scholar]

| Variable Name | Description | Source |

|---|---|---|

| Log of RGDP | Logarithm of Real Gross Domestic Production | World Development Indicators |

| Log Oil Price | Logarithm of Annual Average Oil Price | Organization for Economic Co-operation and Development Petroleum database (https://data.oecd.org/energy/crude-oil-import-prices.htm, accessed on 3 July 2022) |

| Log Real Interest Rate | Logarithm of Real Interest Rate | World Development Indicators |

| Log Gov. Expenditure | Logarithm of Government Expenditure | World Development Indicators |

| Log Exchange Rate | Logarithm of Exchange Rate (USD) | World Development Indicators |

| Log Investment | Logarithm of Total (Private & Public Investment) | World Development Indicators |

| Log Inflation | Logarithm of Consumer Price Index | World Development Indicators |

| Log Openness | Logarithm of Total Trade | World Development Indicators |

| Variables | Mean | Standard Deviation | Minimum | Maximum |

|---|---|---|---|---|

| Log Oil Price | 4.02 | 0.38 | 3.12 | 5.23 |

| Log Interest Rate | 1.92 | 0.32 | 1.65 | 2.34 |

| Log Gov. Expenditure | 32.45 | 4.12 | 27.32 | 39.21 |

| Log Exchange Rate | 7.23 | 0.67 | −0.32 | 9.62 |

| Log Investment | 37.21 | 2.01 | 28.64 | 41.92 |

| Log Inflation | 4.21 | 0.52 | 2.05 | 8.75 |

| Log Openness | 5.75 | 0.37 | 4.23 | 8.27 |

| Log Growth | 3.53 | 0.72 | 1.23 | 5.73 |

| Channel Variables | |||||

|---|---|---|---|---|---|

| Growth | Real Interest Rate | Exchange Rate | Gov. Expenditure | Investment | |

| Growth (−1) | 0.6564 *** (4.5901) | ||||

| Log Oil Price | −0.0322 ** (−2.5320) | 0.0231 ** (2.3402) | 0.2781 *** (4.2510) | −0.0061 * (−2.0021) | |

| Log Real Interest Rate | −0.0434 ** (−2.5786) | −0.0043 ** (−2.2101) | −0.0352 ** (−2.4012) | ||

| Log Gov. Expenditure | −0.0062 * (−2.0238) | ||||

| Log Exchange Rate | −0.0023 *** (−3.2101) | 0.0012 (0.9878) | |||

| Log Investment | 0.0322 ** (2.3021) | −0.0021 (−0.2788) | −0.0076 * (−1.9897) | 0.0028 * (2.0087) | |

| Log Inflation | 0.0023 * (2.0352) | −0.0032 ** (−2.2872) | 0.0023 (1.0023) | ||

| Log Openness | 0.0067 ** (2.5630) | 0.0045 * (2.0183) | |||

| Observations | 760 | 760 | 760 | 760 | 760 |

| Sargan Test 1 (p-Value) | 0.3245 | 0.4524 | 0.3082 | 0.4962 | 0.2878 |

| Serial Correlation 2 (p-Value) | 0.4615 | 0.6328 | 0.5282 | 0.6296 | 0.4212 |

| Channel Variables | Effect of Oil Prices on the Channel Variables | Effect of Channel Variables on Economic Growth | Effect of Energy Prices on Economic Growth |

|---|---|---|---|

| Interest Rate | −0.0322 | −0.0434 | 0.00139 |

| Exchange Rate | 0.0231 | −0.0023 | −0.000053 |

| Govt. Expenditure | 0.2781 | −0.0062 | −0.001724 |

| Investment | −0.0061 | 0.0322 | −0.000196 |

| Total Negative Effect | −0.001973 | ||

| Total Positive Effect | 0.00139 | ||

| Total Net Effect | −0.000583 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Deyshappriya, N.P.R.; Rukshan, I.A.D.D.W.; Padmakanthi, N.P.D. Impact of Oil Price on Economic Growth of OECD Countries: A Dynamic Panel Data Analysis. Sustainability 2023, 15, 4888. https://doi.org/10.3390/su15064888

Deyshappriya NPR, Rukshan IADDW, Padmakanthi NPD. Impact of Oil Price on Economic Growth of OECD Countries: A Dynamic Panel Data Analysis. Sustainability. 2023; 15(6):4888. https://doi.org/10.3390/su15064888

Chicago/Turabian StyleDeyshappriya, N. P. Ravindra, I. A. D. D. W. Rukshan, and N. P. Dammika Padmakanthi. 2023. "Impact of Oil Price on Economic Growth of OECD Countries: A Dynamic Panel Data Analysis" Sustainability 15, no. 6: 4888. https://doi.org/10.3390/su15064888

APA StyleDeyshappriya, N. P. R., Rukshan, I. A. D. D. W., & Padmakanthi, N. P. D. (2023). Impact of Oil Price on Economic Growth of OECD Countries: A Dynamic Panel Data Analysis. Sustainability, 15(6), 4888. https://doi.org/10.3390/su15064888