1. Introduction

Global warming has become one of the issues that governments around the world must address, as a low-carbon transition must be completed for sustainable and innovative economic development, and thus countries have announced their various carbon neutrality goals. Against this background, this paper is dedicated to exploring the optimal policies to achieve a low-carbon transition under the combination of government and market. This will not only expand the research field of carbon reduction policies and provide a new theoretical basis for countries to realize low-carbon transitions, but also find a new practical way through the contradictions of various types of current climate policies. Academics have never stopped exploring the ways to achieve a low-carbon transition, and the externality problem caused by climate change and pollution emissions is an enduring object of research in the field of new institutional economics. Climate policies have moved from theory to practice, attracting many scholars to invest in related research [

1,

2,

3,

4]. In addition, many factors affecting the low-carbon transition have been studied and have gradually developed into a broad trend [

5,

6,

7,

8].

However, the effectiveness of these strategies has been hampered by reality and challenged by theory in developing countries such as China, even though China has announced and acted on its carbon reduction goals. On the one hand, traditional climate policies have mainly aimed at reducing carbon emissions and have failed to proactively guide and support firms in their low-carbon transition. Under China’s past development methodology, which relied on high resource and energy consumption, the industrial sector grew rapidly and accounted for a large share of the total, creating phenomena such as overcapacity [

9,

10] and zombie firms [

11,

12]. As a result, the low-carbon transition of firms has remained on the surface. On the other hand, in the background of the global economic downturn and the coming post-epidemic era, China’s economic growth rate has been continuously declining, and the latest Chinese government report shows that the real GDP growth rate was only 3% in 2022. Under such circumstances, it is obvious that the continued implementation of climate policies aimed at reducing carbon emissions is not in line with reality, and it is an urgent requirement to explore the optimal solution for the low-carbon development of firms.

Green finance innovatively connects environmental governance and financial sector development [

13]. In 2016, Chinese government issued the

Guidance on the Construction of a Green Finance System, which indicated China’s definition of green finance. Besides this, this document indicated that establishing a green finance system in China is primarily about attracting and motivating greater social funds into green industry, while more powerfully discouraging environmentally harmful investing. Therefore, China is developing green finance primarily to ensure a green and low-carbon transition of its economy. In 2017, China’s State Council decided to build green financial reform and innovation experimental zones (hereinafter referred to as the green finance pilot policy, GFPP), and subsequently issued documents to provide policy guidance for the building. Pilot zones include the five provinces of Zhejiang, Jiangxi, Guangdong, Guizhou, and Xinjiang, while non-pilot zones include the remaining twenty-five provinces and cities.

The GFPP can be considered as a quasi-natural experiment because the central government selected the experimental provinces in 2016, rather than after a long inspection, which also means that the policy is exogenous. Therefore, with the help of this exogenous shock and a difference-in-differences (DID) method, we can study the treatment effect of the GFPP on the low-carbon transition of China’s industrial sector. Compared to green finance in developed countries without strong central government policy guidance, China’s implementation of the GFPP have several unique advantages in dealing with climate change issues. We have sorted and summarized the content of policy documents and literature to elaborate on this advantage. First, under a government-led green finance system, regions implementing the GFPP can play a more effective role in green finance. Second, the GFPP implemented in China includes more green financial instruments and products, and the government has tightened supervision over financial institutions. Finally, the regions where the GFPP is implemented can gather more resources and technologies, create an agglomeration effect, and accelerate carbon reduction.

Currently, relevant studies have focused on the impact of green finance on green productivity [

14], environmental quality [

15], carbon emissions [

16,

17,

18,

19,

20], and carbon efficiency [

21], leaving two research directions that could be further expanded. The first is to select an appropriate indicator to measure China’s industrial low-carbon transition. We reviewed a range of literature and selected carbon intensity as a proxy variable, which is a powerful and authoritative measure of the low-carbon transition. Carbon intensity can be decomposed into the product of two ratios, one being the ratio of carbon emissions to energy consumption and the other being the ratio of energy consumption to GDP. On the one hand, the ratio of carbon emissions to energy consumption corresponds to emission-reduction technologies, also known as end-of-pipe technologies, which can facilitate the decoupling of fossil energy consumption from carbon emissions. On the other hand, the ratio of energy consumption to GDP corresponds to energy-saving technologies, which can facilitate the decoupling of fossil energy consumption from economic growth. The second is to further discover the low-carbon implications of the GFPP. The literature that explores the effect of the GFPP on indicators related to carbon emissions largely does not use causal inference methods, so the estimates are likely to be biased. Besides this, they mainly use a part of green finance such as green bonds or a comprehensive green finance index as a proxy variable for green finance, which does not allow for an accurate assessment of the impact of green finance. We employ a DID strategy to accurately estimate the treatment effect of the GFPP, so that we can derive precise values for the policy effect and compare them to climate policies.

A number of diverse strategies are then carried out to identify the treatment effect of the GFPP. First, a detailed set of time-varying controls are controlled, including urbanization level, economic level, R&D investment, energy consumption, and industry level. These controls filter out uncertain impacts as much as possible. Second, we regard the GFPP as an exogenous shock and use a DID strategy to eliminate endogeneity and accurately estimate the treatment effect of the GFPP. Third, we conduct several robustness checks to confirm the reliability of benchmark estimation, such as an event study analysis of the parallel trend. Fourth, we investigate the heterogeneity of treatment effects through grouped regressions and the long- and short-term effects by decomposing the carbon intensity.

We match and constructed a panel sample covering 30 Chinese provinces from 2011 to 2020, based on which we conducted an empirical study and derived the following findings. First, the GFPP has decreased the industrial carbon intensity of pilot zones by 4.09% and this result still holds after some robustness checks. Second, this negative effect of the GFPP varies by geographic location and population size. Third, the GFPP mainly promotes the low-carbon transition of industrial enterprises in the pilot zones by promoting energy transition rather than developing short-term emission reduction technologies such as end-of-pipe treatment.

We contribute to the following four facets of the existing literature. First, we identify the treatment effect of the GFPP based on the causal inference method, which can overcome the endogeneity problem. Second, current literature mainly uses a part of green finance such as green bonds or a green finance index as a proxy variable for green finance, which does not allow for an accurate assessment of the impact of green finance. We investigate this impact based on a DID method, which can reduce the problems associated with this inconsistency in measurement scales and thus accurately assess the impact of green finance. Third, our DID strategy allows us to examine the differences in policy effects between policy-implementing and non-policy-implementing regions, and therefore enables comparison with other climate policies. Fourth, we further explore the pathways for GFPP to achieve a low-carbon transition for enterprises and find that promoting a long-term energy transition is the main way to do so.

2. Literature Review

Following the elevation of climate change from a diplomatic governance issue to a development issue, China has taken a strong stance on climate issues, but the results have been unsatisfactory. According to the

China Statistical Yearbook, China’s carbon emissions increased from 9037 million tons in 2010 to 12,219 million tons in 2019. Despite a slight decline in 2016, the overall trend is still on the rise. Many scholars believe that this is related to the complex relationship between climate policy, career incentive structure, and the business performance of enterprises [

22,

23,

24]. In the industrial sector in particular, a range of factors, such as overcapacity [

9,

10], zombie firms [

11,

12], and industrial monopolies [

25], have made it difficult for China to achieve its industrial low-carbon transition. As a result, much of the literature suggests that a low-carbon transition through a green finance policy that addresses corporate financing is a better option. We mainly review the literature from the following two aspects.

2.1. Measuring the Low-Carbon Transition in China

The Chinese central government has been using carbon emissions per unit of GDP as the official indicator (i.e., carbon intensity) when establishing the milestones for the comprehensive green and low-carbon transition of the economy. Carbon intensity can be decomposed into the product of two ratios, one being the ratio of carbon emissions to energy consumption and the other being the ratio of energy consumption to GDP [

26,

27,

28]. An understanding from this perspective provides a good illustration of how the low-carbon transition can be achieved. On the one hand, the ratio of carbon emissions to energy consumption corresponds to emission-reduction technologies, also known as end-of-pipe technologies, which can facilitate the decoupling of fossil energy consumption from carbon emissions [

29,

30,

31,

32]. On the other hand, the ratio of energy consumption to GDP corresponds to energy-saving technologies, which can facilitate the decoupling of fossil energy consumption from economic growth [

33,

34,

35,

36]. Therefore, carbon intensity is widely recognized by government and academia as a powerful authoritative measure of the low-carbon transition. For China’s industrial sector in particular, recent literature suggests that nearly 80% of China’s carbon emissions come from the power and industrial sectors [

37]. Besides this, China’s investment and financing needs for a low-carbon transition in the industrial sector could reach trillions of dollars annually in the future, with a significant financing gap. Hence, as a developing country that relies on industrial development to drive economic growth, it is appropriate to use carbon intensity to measure the industrial low-carbon transition.

2.2. Green Finance and Its Low-Carbon Implications

Green finance innovatively connects environmental governance and financial sector development [

13] and was first of interest in developed countries, giving rise to relevant practical and theoretical concepts. There are broad and narrow approaches to exploring the concept of green finance. In a narrow sense, the green finance measure is to determine the green percentage of financial assets, for example, identifying in advance industry standards for priority green industries to support, such as renewable energy, recycling, waste management, and environmental protection. Broadly speaking, green finance metrics are those that define the green goals of the financial system in terms of sustainability and suggest ways to measure their effectiveness [

38]. The direction of academic research on it has then evolved from the concept to the system [

39], regional gap [

39], mechanisms [

40], importance [

41], and determinants and potential benefits [

42]. During this period, developed countries such as Europe and the United States, where green finance has emerged, have only carried out some green industry development activities based on green finance. Because their green development and low-carbon development goals were not as urgent as China’s, they did not implement specific policies. In China, by contrast, the central government is paying more attention to green finance and has implemented many government-led policies. As a result, many empirical studies with China as a sample have been born. In terms of purpose and empirical evidence, much of the recent literature has explored the influence of green finance on green productivity [

14], environmental quality [

15], carbon emissions [

16,

17,

18,

19,

20], and carbon efficiency [

21] in China. Besides this, there is more consensus in this literature that green finance is an effective measure to promote the synergistic achievement of industrial structural upgrading and industrial decarbonization [

16,

17,

18,

19,

20,

21]. Therefore, studies on the relationship between green finance and low-carbon indicators suggest the carbon reduction effects of green finance in practice. However, the literature in this area still has more room for expansion. On the one hand, most of their findings are not based on causal inference methods, so the estimates are likely to be biased. On the other hand, they mainly use a part of green finance or a comprehensive green finance index as a proxy variable for green finance, which does not allow for an accurate assessment of the impact of green finance. This sets the stage for further research in this paper with the help of the exogenous shock from policy as well as the DID method.

3. Policy Background

China is the pioneer country worldwide in embracing a green finance system, with the backing of the central government. The Chinese government issued the Guidance on the Construction of a Green Finance System in 2016, which pointed out China’s definition of green finance. Green finance refers to the economic activities that support environmental improvement, combat climate change, and conserve and efficiently use resources. Besides this, this document indicated that establishing a green finance system in China is primarily about attracting and motivating greater social funds into green industry, while more powerfully discouraging environmentally harmful investing. Therefore, China is developing green finance primarily to ensure a green transition of its economy. In 2017, the GFPP was officially proposed and built in five provinces, namely Zhejiang, Jiangxi, Guangdong, Guizhou, and Xinjiang, each with its own characteristics. Subsequently, the People’s Bank of China and seven other ministries and commissions issued the Master Plan for the Construction of Green Financial Reform and Innovation Experimental Zones, providing policy guidance and top-level design for the construction. This implies an exogenous shock of green finance policy (as mentioned above, we refer to it as the GFPP).

Following the introduction of the GFPP, China’s green finance has grown dramatically, and green financial products and instruments have become more abundant and diversified. First, green credit: by the close of 2021, domestic and foreign denominated green loans totaled RMB 15.9 trillion, which was an increase of 33% compared with the previous year. Second, green bonds: the volume of green bonds issued in China is expanding rapidly, with the stock size reaching RMB 1.16 trillion by the end of 2021. The scale of new green bonds (excluding green local government bonds) is about RMB 607.24 billion, accounting for 0.98% of the national bond issuance scale. Third, green funds: according to Wind data, the number of green-investment-related theme funds issued in 2021 exceeded 50, and the scale of green funds was close to RMB 800 billion, reaching the highest peak in years.

Compared to green finance in developed countries without strong central government policy guidance, China’s implementation of the GFPP has several unique advantages in dealing with climate change issues. We have sorted and summarized the content of policy documents and literature to elaborate on this advantage.

First, under a government-led green finance system, regions implementing the GFPP can play a more effective role in green finance. China’s green finance system is neither an independently developed system nor a market-based system, but a collaboration of financial institutions, enterprises, markets, and the government [

43]. The establishment of this multi-party cooperation is favorable to the rise of the proportion of green financing and the industrial low-carbon transition [

39]. For example, traditional industrial policy is merely a government effort to increase production, investment, research and development, modernization, and industrial restructuring in one industry while discouraging similar activities in other industries. The GFPP, in contrast, can promote the green upgrading of industries by internalizing the costs of innovation and environmental externalities through government, financial institutions, and green products. Most importantly, in regions where GFPP is implemented, under the joint guidance of local governments and financial institutions, green capital in the financial market can flow to the most needed enterprises or enterprises with the greatest carbon reduction potential, forming the optimal allocation of resources [

40]. This effectively solves the information asymmetry problem in the traditional financial market. Due to various factors, such as a short survival time and more flexible operation methods, the financing needs of small, medium, and micro enterprises in the traditional financial market are characterized by being small scale, high frequency, and urgent in time. The structured financial information that these enterprises can provide is relatively limited in terms of time length, the breadth of indicators, and content validity, making it difficult to accurately evaluate and monitor their credit risk level, development prospects, and capital utilization efficiency with traditional risk-management tools. This leads to a high degree of adverse selection and moral hazard, which further drives up financing costs.

Second, the GFPP implemented in China includes more green financial instruments and products, and the government has tightened supervision over financial institutions. For instance, clean coal is considered a green product in China and can be financed through green bonds, while this is not the case in Europe. The reason for this is that developed countries and developing countries such as China consider different priority goals in formulating green finance standards. Additionally, the carbon emission problem in China is more critical than that in developed countries, with the time to achieve the carbon peak goal is shorter [

42]. Such difficulties are mainly reflected in China’s need for a substantially growing economy, the high energy consumption of its predominantly industrial industries, its coal-rich resources and high-carbon energy consumption structure, and the slow progress of energy market reform due to consumers’ weak ability to pay. These major contradictions and difficulties are both supply-side and demand-side related. Therefore, more needs to be undertaken in the short term in terms of developing more effective and efficient green finance. As for the supervision of financial institutions, the Chinese government requires state-owned and commercial banks to disclose the specifics and content of their green credit policies starting in 2007 [

42], which has become a main part of the GFPP, to ensure that green capital is used for green low-carbon projects. If companies emit more pollution, especially major polluters, they will face higher financing thresholds and higher financing costs.

Finally, the regions where the GFPP is implemented can gather more resources and technologies, create an agglomeration effect, and accelerate carbon reduction. The most essential role of the GFPP is to promote the utilization and allocation efficiency of green capital and direct green low-carbon resources. Following this, industrial upgrading, energy structure optimization, and low-carbon development can be accomplished collaboratively [

14]. The empirical results of a series of studies in the literature prove this interpretation, whether from the perspective of the macro-system [

44,

45,

46] or micro-enterprise [

47,

48]. In traditional financial activities, due to the lack of appropriate regulatory mechanisms, enterprises also face a relatively low cost of capital and thus tend to invest their capital in less environmentally efficient production activities rather than choosing green investments with lower production capacity. With the further implementation of the GFPP, the reduction in capital availability for polluting enterprises and the improvement of the regulatory capacity of financial institutions can reduce the likelihood of enterprises investing in polluting production activities. In this case, enterprises can reduce their own capital demand by improving the efficiency of capital allocation.

4. Empirical Strategy and Data

4.1. Econometric Strategy

A DID method is used to precisely estimate the effect of GFPP on industrial carbon intensity, and its specific settings are as follows:

where outcome

is the industrial carbon intensity of province

in year

, denoting the decoupling of carbon emissions and economic development in industry; treatment variable

is the interaction of the dummy variable

, which equals one if province

was in the GFPP treatment group and zero otherwise, and the dummy variable

, which equals one if GFPP was implemented in and after year

and zero otherwise;

is a vector of time-varying province-level controls that may affect industrial carbon intensity (to be discussed later);

is a province fixed-effects term capturing time-invariant province characteristics, such as geographical locations and provincial scales;

is a year fixed-effects term capturing macro shocks and environmental regulation, such as carbon emissions constraints in the Five-Year Plan (since 2011, China has issued classified and guided carbon emission intensity constraint indicators to all provinces in the Five-Year Plan);

is a stochastic error term.

The coefficient of

in Equation (1) is our focus. The unbiased estimation of

in the DID framework depends on the parallel trend assumption that the outcome between the treatment group and the control group should have no development difference before the implementation of GFPP, that is, the development trends are parallel. We conduct an event study of the GFPP combining the DID method to prove a parallel pre-trend, and its specific settings are as follows:

where

is a set of dummies indicating a ten-year window around the implementation year of the GFPP, that is, the six years before the implementation year and the three years after the implementation year.

denotes the year that the GFPP was implemented, and

. Other settings are the same as Equation (1). In regression, we set the year

as the benchmark year to prevent perfect multicollinearity.

4.2. Data

The dataset used in our study comes from the China Statistical Yearbook, China Energy Statistical Yearbook, and China Science and Technology Statistical Yearbook. We matched these and constructed a panel sample covering 30 Chinese provinces from 2011 to 2020 (due to the unavailability of data, our sample does not include the Tibet, Hong Kong, Macao, and Taiwan regions). All the original data related to prices are adjusted based on 2011, and the specific variables are selected as follows.

4.2.1. Dependent Variable

We calculate carbon intensity as the ratio of industrial carbon emissions to the value of industrial output value. The existing literature provides different methods for calculating carbon emissions, which can produce different values. Therefore, we use the authoritative method provided by the Intergovernmental Panel on Climate Change (IPCC) to calculate:

where

is the carbon emissions;

is the energy consumption of energy

;

is the average low calorific value (i.e., net calorific value) of energy

provided in

China Energy Statistics Yearbook;

. is the carbon emission coefficient of energy

n provided by IPCC;

is the carbon oxidation factor, equaling to one according to the IPCC;

is the molecular weight ratio of carbon dioxide to carbon.

According to the Equation (3), we calculate the total industrial carbon emissions of eight energy sources: raw coal, coke, crude oil, gasoline, kerosene, diesel, fuel oil, and natural gas. Following this, the data of carbon intensity can be obtained by dividing the industrial carbon emissions by the industrial output value.

4.2.2. Treatment Variable

is the interaction of the dummy variable and , which have been defined above. The treatment group include five provinces: Zhejiang, Jiangxi, Guangdong, Guizhou, and Xinjiang, and the treatment year is 2017.

4.2.3. Controls

In terms of the selection of controls, according to the STIRPAT (stochastic impacts by regression on population, affluence, and technology) model [

49], the impacts of a region on the environment and ecosystem depend on population, affluence, and technology. Therefore, we select the urbanization level, measured by the proportion of urban population in the total population; economic level, measured by the per capita GDP; and R&D investment, measured by the internal expenditure of research and development funds, to represent them, respectively. In addition, we refer to related literature and add two other controls to the model. One is energy consumption, measured by the industrial energy consumption and calculated by the same method in Equation (3), the other is industry level, measured by the proportion of industrial output value in GDP.

4.2.4. Summary Statistics

Table 1 presents the summary statistics of main variables. We see that the minimum value of carbon intensity is 0.93, which means that the industrial carbon emissions and economic growth of some provinces are almost decoupled. However, the average value of carbon intensity is 13.73, and even the maximum value is only 50.36, which means that most provinces have not yet achieved an industrial low-carbon transition. In addition, from the data of the controls, most of them are at normal levels, and it is more obvious that industrial energy consumption is very large and the contribution of industrial output to GDP is a large percentage, so it is challenging to accomplish industrial development and industrial carbon reduction in China at the same time.

5. Empirical Results and Robustness Check

5.1. Empirical Results

To identify the treatment effect of the GFPP on carbon intensity more accurately and explain the coefficient economically, the natural logarithm of dependent variables (carbon intensity) and non-percentage controls (economic level, R&D investment, and energy consumption) are taken in regression to reduce the influence of extreme values in data on regression results and avoid the collinearity.

Table 2 presents the estimation results of Equation (1). Columns (1) through (3) all denote carbon intensity and are gradually added province fixed effects and year fixed effects.

We mainly focus on the estimation coefficients of the treatment variable . In Column (1), the coefficient of is −0.2447 and statistically significant at 1% level, which means that the GFPP has decreased the industrial carbon intensity of the pilot zones by 24.47%. However, this result is biased because we did not add fixed effects. We can see then that the coefficients of in Columns (2) and (3) are all negative and statistically significant at the 5% level in the process of continuously adding fixed effects. The coefficient of in Column (3) is −0.0409, which reveals that the GFPP has decreased the industrial carbon intensity of pilot zones by 4.09%. This coefficient is relatively reasonable in numerical value compared to related literature.

First, recent studies show that China’s industrial carbon emissions are still very large and industrial carbon efficiency is still at a moderate level [

50,

51,

52]. Second, some literature on China’s carbon-trading policy suggests that the carbon reduction effect of carbon-trading policy is at a value of about 10% [

2,

3,

4]. Considering that China’s carbon-trading pilot started to be implemented much earlier than green finance, in 2013, the maturity and completeness of the construction is therefore much higher. Moreover, the GFPP focuses on corporate green financing, and the direct carbon reduction effect is inevitably smaller than that of the carbon-trading policy. Third, the results of other literature that does not use exogenous shocks to study this are either based on spatial econometric models, where the estimated coefficients do not intuitively reflect the size of the carbon reduction effect of green finance policies [

19,

42], or they are biased by only employing OLS estimates with a carbon reduction effect of about 2% [

20].

Some problems in the building of China’s green financial system also justify the values of our estimated coefficients. On the one hand, green enterprises lack unified identification standards, and the qualifications of investment target enterprises vary. State-owned banks’ green credit investment objects are concentrated in central enterprises and state-owned enterprises, and less investment is made in private enterprises. On the other hand, it is difficult to identify green products, and there is the phenomenon of high awareness but low practice, which is decoupled from design, circulation and consumption, and no green standard system of the whole lifecycle has been formed.

The event-study results of Equation (2) are shown in

Figure 1, in which the dotted line is the 95% confidence interval, and the connecting line of each year is the estimated coefficient. If the confidence interval does not contain zero, it means that the treatment effect of the GFPP in that year is statistically significant. Our expected result is that before the enforcement of the GFPP, the estimated coefficients should all be close to zero, which indicates that the development trends of the treatment group and control group are parallel, and after the enforcement of the GFPP, the estimated coefficients should all be far away from zero, which indicates that the GFPP is effective.

Findings in

Figure 1 confirm that we cannot reject the null hypothesis with the evidence that the negative treatment effect of the GFPP on carbon intensity is increasing and statistically significant after the implementation of the GFPP. Although this treatment effect of the GFPP was not statistically significant until two years later, it is reasonable to a large extent considering China’s previous low level of green finance and the difficulty of developing green finance in the pilot zones [

39]. The current cost of issuing green bonds in China is still high, and there is a lack of special incentives for low- and zero-carbon transitions for green projects. Small- and medium-sized enterprises, as an important market force for green transformation, lack targeted preferential policies. The comprehensive green finance evaluation system of banking institutions takes the aggregate business, such as the share of green finance business, the share of green finance business, the year-on-year growth rate of total green finance business, and the share of total green finance business risk, as the evaluation index, and has not yet included the carbon assets, carbon footprint, and project income of green projects and products, and so on. The evaluation targets remain at a shallow level, of weight but not quality, which easily causes incentive distortion, resource mismatch, and other problems.

5.2. Robustness Check

We conducted several robustness checks to further confirm the credibility of the benchmark results.

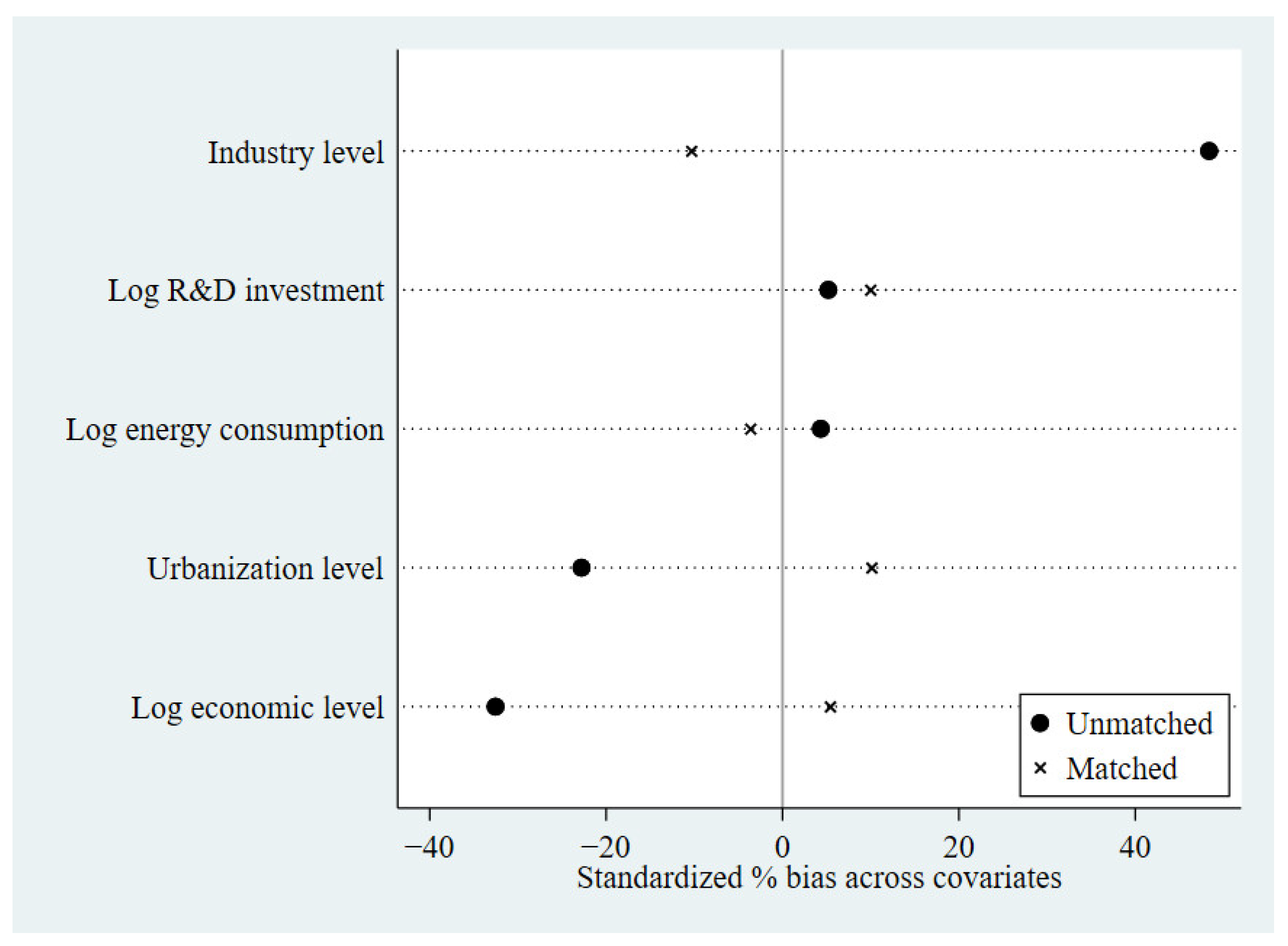

First, combining propensity score-matching (PSM) with DID estimator, we tend to match each treatment group sample to a specific control group sample. On the one hand, the GFPP is selected by the central government for implementation in pilot regions, and this selection is inherently biased. On the other hand, the inherent reason for selection may be factors such as the level of economic development and financial sophistication of each region; the better the place, the more likely it is to be selected as a pilot. In this potential scenario, we may obtain estimation results that overestimate the policy effects, due to the fact that the pilot regions themselves could have better implemented the GFPP. Therefore, we randomize the treatment group assignment for the GFPP and account for any potential self-selection bias. A radius-matching method is thus employed, and details are presented in

Table 3 and

Figure 2.

The findings in

Table 3 suggest that after matching the treatment group sample with control group sample, the estimated coefficient of treatment variable is still negative and statistically significant at the 5% level. Besides this,

Figure 2 shows that before matching, the bias of industry level, urbanization level, and log economic level is very large, ranging from 20% to 40% and after matching, the total bias of controls is less than 10%. These findings indicate that our PSM-DID estimates are credible and there is no potential self-selection bias.

Second, we include an interaction term in the regression to consider another mainstream policy affecting carbon intensity. In Equation (1), we use the year fixed effects to control the provincial carbon intensity constraint, while another mainstream climate policy in China is the carbon-trading pilot policy. Since 2013, China has started to set up a carbon-trading pilot policy in seven provinces and cities, which were all completed in 2014. We generate dummy variables according to these pilot provinces and years and have them interact with Equation (1). The estimates results are reported in

Table 4, which conveys that the treatment effect of the GFPP remains credible in controlling for the carbon-trading pilot policy.

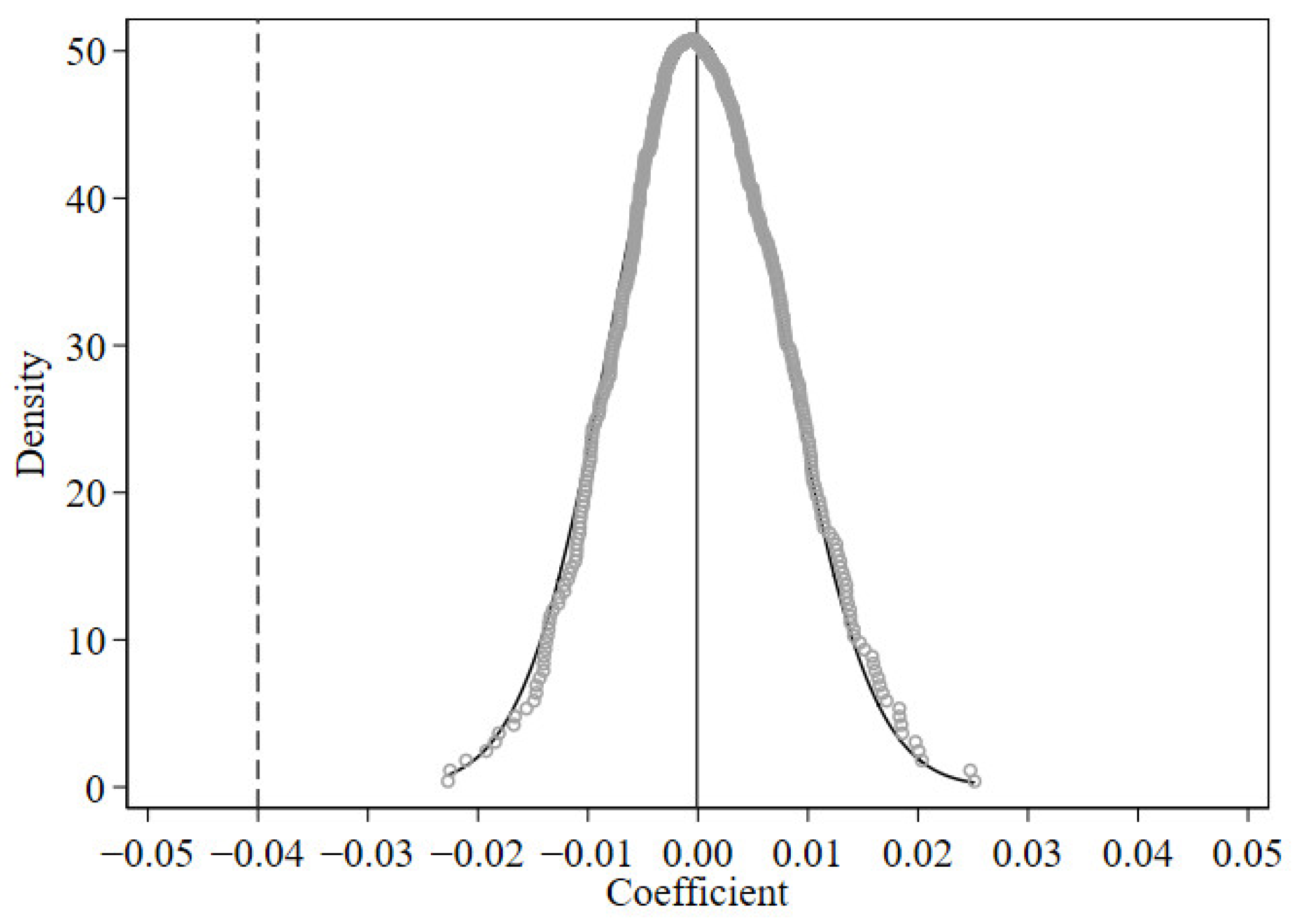

Third, we employ a placebo test to consider random factors or unobserved variables that may affect carbon intensity. The design of this test is to invent the treatment group or to estimate the policy time. If the fictitious regression result is far from the original regression result, the original estimation can be considered credible. Specifically, we conducted a placebo test by randomly constructing the treatment group, that is, disrupting provinces that have implemented the GFPP.

Figure 3 shows the placebo test results of 500-interation Monte Carlo simulations, in which the vertical solid line represents the average value of simulation coefficients, and the vertical dotted line represents the real value of benchmark estimated coefficients.

The results reveal that the simulated values of the estimated coefficients of the GFPP are mostly distributed around zero, which is significantly different from the benchmark estimation results. This finding proves that our benchmark estimation of the GFPP on carbon intensity is not affected by some random factors.

6. Further Discussion

6.1. Heterogeneity in Treatment Effect

From the official documents, we know that the implementation zones of the GFPP are divided into three echelons; the first echelon includes Zhejiang and Guangdong provinces, the second echelon includes Guizhou and Jiangxi provinces, and the third echelon is Xinjiang. These three echelons have their unique features, such as development level, resource agglomeration level, industrial structure, and financial development level. They can reflect the diversity of the pilot zones. From the perspective of geographical location and population size, it can properly reflect the characteristic differences of pilot zones.

Therefore, on the one hand, we divide the samples according to the east, central, and west regions. From the east to the west, the development level and financial level gradually decrease. On the other hand, we divide the samples according to the median of average population. The more populous the provinces, the richer the resources.

Table 5 reports the test results of heterogeneity in treatment effect.

From

Table 5, we know that the coefficients of

in Columns (2) and (3) are not statistically significant, indicating that the GFPP has no impact on carbon intensity in the central and west regions, while the coefficient of

in Column (1) is statistically significant, indicating that the GFPP decreases carbon intensity in the eastern region. Besides this, the coefficient of

is statistically significant in Column (4) but not significant in Column (5), indicating that the GFPP decreases carbon intensity in the high population group but not in the low population group. These findings reveal that the more developed the economy, the more abundant the resources, the better the implementation effect of GFPP in the provinces [

53].

6.2. Developing Emission Reduction Technology or Pursuing Energy Transition

Some literature shows that China’s climate policy may result in short-term carbon reductions for firms, with little long-term effect [

54,

55].

The role of green finance is fundamentally different from that of environmental regulation. The GFPP provides green financing for enterprises to have more initiative in low-carbon transition and development and prioritize it to ensure economic benefits. According to this idea, we believe that if an enterprise’s carbon emission is reduced under the same energy consumption, the enterprise is developing short-term emission reduction technology; if the enterprise’s energy consumption is reduced under the same output value, the enterprise is pursuing long-term energy transition.

Table 6 reports the test results.

It is noted that the coefficients of in Columns (1) and (2) are quite different. The former is numerically close to 0 and statistically insignificant, while the latter is negative and statistically significant at the 5% level. This indicates that the GFPP mainly promotes the low-carbon transition of industrial enterprises in the pilot zones by promoting energy transition rather than developing short-term emission reduction technologies such as end-of-pipe treatment. This is mainly because the GFPP influences the environmental behavior of firms through market forces, so that the economic interests of firms are secured, and they therefore do not pursue short-term carbon reduction measures. This green financing as a channel can change the costs and benefits associated with corporate environmental behavior and incentivize a long-term energy transition.

More specifically, the GFPP can incentivize enterprises to enhance their total factor productivity by innovating with clean energy technologies and creating excess returns by covering the various costs incurred by firms for complying with environmental regulations. On the one hand, such gains come from the active flow of financial resources to firms’ clean energy technology projects. On the other hand, this gain comes from an augmentation of the funding constraints on polluting enterprises, resulting in a reduction in the quantity of polluting enterprises and an augmentation of the proportion of clean enterprises in the market.

7. Conclusions and Policy Implication

Climate change has become one of the issues that governments around the world must address, as well as a mainstream research subject in academia. In China, due to the high-energy-consuming mode of development in the past, the industrial sector accounts for a huge proportion of GDP, leading to the creation of overcapacity, zombie firms and industrial monopolies. The implementation of climate policy has therefore not been very effective. Based on this background, we use the DID method to explore the impact of the GFPP on the industrial low-carbon transition. The findings of this study are as follows.

First, the GFPP has decreased the industrial carbon intensity of pilot zones by 4.09%, which is relatively reasonable in numerical value compared to related literature. Second, this result still holds after robustness checks such as an event study analysis of the parallel trend, a PSM-DID test, a test to exclude the effect of the carbon-trading policy, and a placebo test. Third, this negative effect of the GFPP varies by geographic location (east, central, and west regions) and population size (high- and low-population groups). Fourth, the GFPP mainly promotes the low-carbon transition of industrial enterprises in the pilot zones by promoting energy transition rather than developing short-term emission reduction technologies such as end-of-pipe treatment.

Our findings have substantial policy implications.

First, the government should deeply promote the implementation of the GFPP, gradually increase the proportion of green financing in social financing, and expand the scope of financing enterprises and the scope of pilot regions. According to our estimation results, the GFPP can significantly reduce the carbon intensity of industrial enterprises and provide financial support for their low-carbon transition. Therefore, the government needs to strengthen its commitment to the GFPP and shape the experience of the implementation effect in the pilot regions to promote it to suitable industries or regions. With the essential feature of the policy being to alleviate financing constraints, enterprises can be encouraged to achieve the low-carbon upgrading of production value through low-carbon technology innovation or energy structure optimization. At the same time, due to the negative characteristics of financial policy, the regulator should introduce relevant laws and policy guidelines, improve the sharing mechanism and tracking mechanism of financing information between the government and enterprises, prevent the flow of capital to non-low-carbon projects, and avoid the development of enterprises from de-realization to deficiency.

Second, the role of green finance in energy structure transition should be emphasized to support the industrial sector to deeply transform the development path and achieve long-term low-carbon development. Our estimation results show that the GFPP promotes the low-carbon transition of industrial enterprises in the pilot zones mainly by promoting energy transition, rather than developing short-term emission reduction technologies. Therefore, local governments should pay attention to this path, focus on enterprises with excessive energy consumption, and expand long-term financing channels and scale for them. At the same time, they should continue to use the reputation and achievements of enterprises with a high-quality transition to encourage other enterprises to make a low-carbon transition, so that more enterprises will pay attention to green financial policies and actively participate in the green financial system. This interactive relationship between the government and enterprises can provide more high-quality green financing services for enterprises and feed the low-carbon transition of enterprises, forming a positive cycle.

Third, the government should fully consider the heterogeneity among regions and cities and design different GFPPs for different targets. Our estimation results show that the negative effect of GFPP on industrial carbon intensity displays heterogeneity. Therefore, on the one hand, the government should make scientific decisions based on regional characteristics when implementing green finance policies and implement differentiated policies. For example, different green funds should be issued based on the ownership and scale characteristics of enterprises. On the other hand, the government must provide green financial products and tools to compress the living space of poor enterprises, force these enterprises to make a low-carbon transition, and guide them with strict regulatory measures to prevent these enterprises from making a strategic short-term transition.