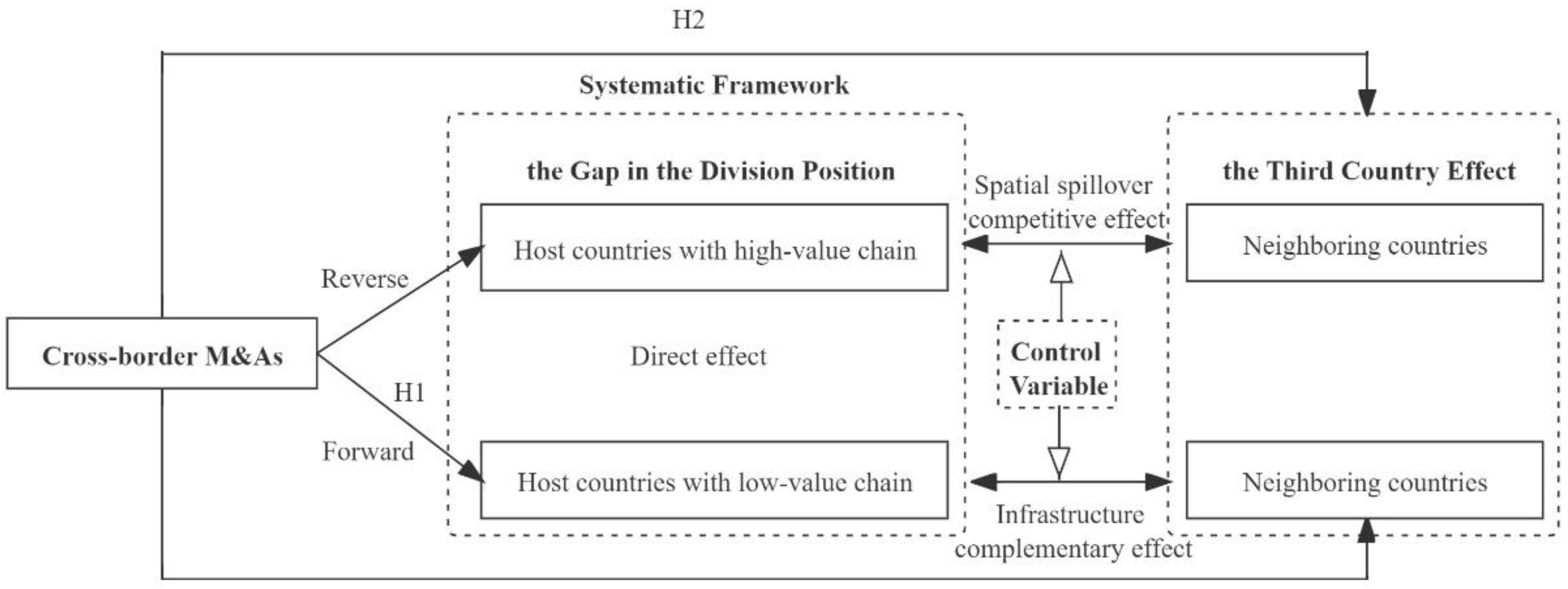

The Impact of Reverse Cross-Border Mergers and Acquisitions in Emerging Countries on the Division Position in the Global Value Chain: A Systematic Framework of the Third Country Effect

Abstract

1. Introduction

2. Review and Research Hypothesis

2.1. The Direct Impact of Cross-Border M&As in Emerging Countries on the Division Position in Global Value Chains

2.2. Third Country Effect of Cross-Border M&As on the Division Position in the Global Value Chain

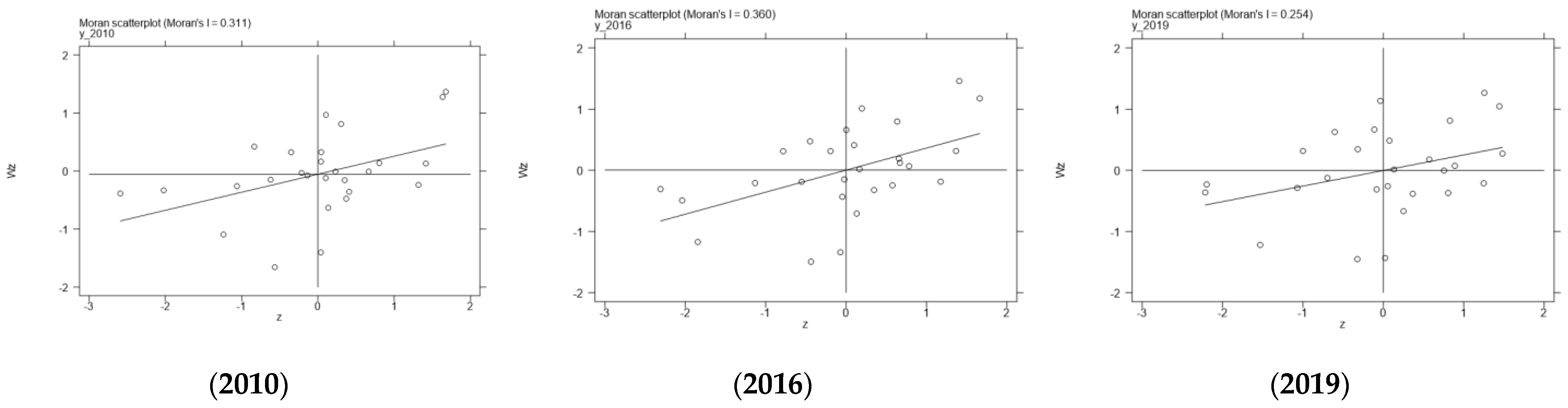

3. Exploratory Spatial Correlation Analysis of the Division Position in the Global Value Chain

3.1. Evolution Characteristics of the Global Spatial Correlation Pattern

3.2. Evolution Characteristics of the Local Spatial Correlation Pattern

4. Discussion

4.1. Identification and Selection for Spatial Metrological Models

4.2. Data Sources

4.3. Variable Measurement

4.4. Descriptive Statistics

4.5. Correlation Analysis

5. Analysis of Empirical Results

5.1. Model Estimation and Empirical Analysis

5.2. Robustness Test Based on Weight Matrix of Economic Distance

6. Spatial and Temporal Heterogeneity Analysis

7. Conclusions and Implication

7.1. Conclusions

7.2. Implications

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | |

|---|---|---|---|---|---|---|---|---|---|

| Explanatory Variable | Gvc_po | Gvc_po_h | Gvc_po_l | ||||||

| Direct Effect | Indirect Effect | Total Effect | Direct Effect | Indirect Effect | Total Effect | Direct Effect | Indirect Effect | Total Effect | |

| lnmerge | −0.001 | −0.013 ** | −0.015 ** | −0.004 | −0.014 ** | −0.017 ** | −0.014 ** | −0.009 | −0.023 ** |

| (−0.31) | (−2.11) | (−2.03) | (−0.66) | (−2.04) | (−2.34) | (−2.27) | (−1.34) | (−2.46) | |

| Tec | 0.084 * | −0.018 | 0.066 | 0.284 *** | 0.057 | 0.341 *** | −0.023 | −0.057 | −0.079 |

| (1.92) | (−0.27) | (0.82) | (4.75) | (0.64) | (3.04) | (−0.48) | (−1.00) | (−0.90) | |

| Gdp_ra | 0.015 ** | 0.001 | 0.016 | 0.012 | 0.008 | 0.020 ** | 0.026 *** | −0.001 | 0.025 ** |

| (2.37) | (0.12) | (1.58) | (1.61) | (0.74) | (1.78) | (2.99) | (−0.12) | (1.88) | |

| Res | 0.010 | 0.017 | 0.028 ** | −0.021 * | 0.018 | −0.002 | 0.033 *** | 0.003 | 0.036 *** |

| (1.31) | (1.28) | (2.08) | (−1.87) | (1.12) | (−0.14) | (3.99) | (0.323) | (2.53) | |

| Open | 0.613 *** | −0.177 | 0.436 *** | 0.306 *** | −0.093 | 0.213 | 0.35 | 0.671 | 1.021 ** |

| (5.10) | (−1.07) | (2.28) | (2.59) | (−0.64) | (1.25) | (0.97) | (1.59) | (2.21) | |

| lnTele | 0.187 | 0.501 *** | 0.688 *** | −0.136 | 0.427 *** | 0.291 | 0.769 *** | 0.269 | −1.039 ** |

| (1.57) | (2.88) | (3.21) | (−1.07) | (2.47) | (1.4) | (4.02) | (1.31) | (2.92) | |

| N | 270 | 270 | 270 | 190 | 190 | 190 | 80 | 80 | 80 |

| Host Country | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|---|---|---|---|---|

| France | −0.1402 | −0.1356 | −0.1139 | −0.0906 | −0.0985 | −0.0952 | −0.1015 | −0.1222 | −0.163 | −0.155 |

| Britain | −0.0213 | −0.0167 | 0.005 | 0.0283 | 0.0204 | 0.0237 | 0.0174 | −0.0033 | −0.046 | −0.038 |

| Netherlands | −0.0189 | −0.0143 | 0.0074 | 0.0307 | 0.0228 | 0.0261 | 0.0198 | −0.0009 | −0.022 | −0.015 |

| Spain | −0.0682 | −0.0636 | −0.0419 | −0.0185 | −0.0264 | −0.0231 | −0.0295 | −0.0502 | −0.007 | −0.008 |

| Portugal | −0.0395 | −0.0349 | −0.0132 | 0.0102 | 0.0022 | 0.0055 | −0.0008 | −0.0215 | −0.024 | −0.017 |

| Japan | −0.0372 | −0.0326 | −0.0109 | 0.0125 | 0.0045 | 0.0078 | 0.0015 | −0.0192 | −0.051 | −0.044 |

| Canada | −0.0534 | −0.0488 | −0.0271 | −0.0037 | −0.0116 | −0.0083 | −0.0147 | −0.0354 | −0.064 | −0.056 |

| Singapore | −0.0297 | −0.025 | −0.0034 | 0.02 | 0.0121 | 0.0154 | 0.009 | −0.0117 | −0.064 | −0.056 |

| Vietnam | −0.051 | −0.0463 | −0.0247 | −0.0013 | −0.0092 | −0.0059 | −0.0123 | −0.033 | 0.010 | 0.008 |

| India | −0.0495 | −0.0449 | −0.0232 | 0.0001 | −0.0078 | −0.0045 | −0.0108 | −0.0315 | −0.047 | −0.04 |

| America | −0.0466 | −0.042 | −0.0203 | 0.0031 | −0.0049 | −0.0016 | −0.0079 | −0.0286 | 0.015 | 0.022 |

| Indonesia | −0.0458 | −0.0411 | −0.0195 | 0.0039 | −0.004 | −0.0007 | −0.0071 | −0.0278 | −0.043 | −0.036 |

| Sweden | −0.0431 | −0.0384 | −0.0168 | 0.0066 | −0.0013 | 0.002 | −0.0044 | −0.0251 | −0.067 | −0.059 |

| Australia | −0.0356 | −0.031 | −0.0093 | 0.014 | 0.0061 | 0.0094 | 0.0031 | −0.0176 | −0.054 | −0.047 |

| Brazil | −0.0321 | −0.0274 | −0.0058 | 0.0176 | 0.0097 | 0.013 | 0.0066 | −0.0141 | −0.014 | −0.007 |

| Belgium | −0.032 | −0.0274 | −0.0057 | 0.0176 | 0.0097 | 0.013 | 0.0067 | −0.014 | −0.034 | −0.027 |

| Mexico | −0.0308 | −0.0262 | −0.0045 | 0.0189 | 0.0109 | 0.0142 | 0.0079 | −0.0128 | −0.058 | −0.051 |

| Italy | −0.0182 | −0.0136 | 0.0081 | 0.0315 | 0.0236 | 0.0269 | 0.0205 | −0.0002 | −0.042 | −0.035 |

| Switzerland | −0.0083 | −0.0037 | 0.018 | 0.0414 | 0.0335 | 0.0368 | 0.0304 | 0.0097 | −0.055 | −0.048 |

| Germany | −0.0081 | −0.0035 | 0.0182 | 0.0416 | 0.0337 | 0.037 | 0.0306 | 0.0099 | −0.043 | −0.036 |

| Korea | 0.0062 | 0.0108 | 0.0325 | 0.0559 | 0.048 | 0.0513 | −0.0449 | −0.0242 | −0.001 | −0.008 |

| Finland | 0.0136 | 0.0182 | 0.0399 | 0.0633 | 0.0553 | 0.0587 | 0.0523 | 0.0316 | −0.029 | −0.023 |

| Malaysia | 0.0131 | 0.0178 | 0.0394 | 0.0628 | 0.0549 | 0.0582 | 0.0518 | 0.0311 | −0.045 | −0.038 |

| Thailand | −0.0672 | −0.0626 | −0.0409 | −0.0176 | −0.0255 | −0.0222 | −0.0285 | −0.0492 | −0.054 | −0.046 |

| Pakistan | 0.0734 | 0.0688 | 0.0471 | 0.0237 | 0.0316 | 0.0283 | 0.0347 | 0.0554 | 0.116 | 0.109 |

| Kazakhstan | 0.0544 | 0.059 | 0.0807 | 0.1041 | 0.0961 | 0.0995 | 0.0931 | 0.0724 | −0.0322 | −0.025 |

| Russia | 0.0581 | 0.0627 | 0.0844 | 0.1078 | 0.0999 | 0.1032 | 0.0968 | 0.0761 | −0.0695 | −0.062 |

References

- Duan, Y.; Deng, Z.; Liu, H.; Yang, M.; Liu, M.; Wang, X. Exploring the mediating effect of managerial ability on knowledge diversity and innovation performance in reverse cross-border M & As: Evidence from Chinese manufacturing corporations. Int. J. Prod. Econ. 2022, 247, 108434. [Google Scholar]

- Sun, Z. Chinese reverse M&A: The Wu Wei paradigm of post-M & A integration process. Chin. Manag. Stud. 2018, 12, 774–794. [Google Scholar]

- Su, Y.; Guo, W.; Yang, Z. Reverse Knowledge Transfer in Cross-Border Mergers and Acquisitions in the Chinese High-Tech Industry under Government Intervention. Complexity 2021, 4, 8881989. [Google Scholar] [CrossRef]

- Rui, H.; Yip, G.S. Foreign acquisitions by Chinese firms: A strategic intent perspective. J. World Bus. 2008, 43, 213–226. [Google Scholar] [CrossRef]

- Jiang, W.; Yang, Y. Bridging the Identity Gap: Organizational Identity Asymmetry and Strategic Choices for Integration. Manag. World 2018, 34, 140–156. [Google Scholar]

- Huang, M.; Zhang, M.; Pi, S.; Lu, S. Research on the relationship between the integration configuration of reverse cross-border M&A and the performance of M&A integration of Chinese enterprises. J. Manag. 2019, 16, 656–664. [Google Scholar]

- Luo, Y.; Tung, R.L. International Expansion of Emerging Market Enterprises: A Springboard Perspective. J. Int. Bus. Stud. 2007, 38, 481–498. [Google Scholar] [CrossRef]

- Wu, X.M.; Su, Z.W. Using cross-border mergers and acquisitions as a lever for technological catch-up: A dynamic capability perspective. Manag. Word 2014, 4, 146–164. [Google Scholar]

- Dai, X.; Song, J. The Construction Effect of China’s OFDI Global Value Chain and Its Spatial Spillover. Financ. Res. 2020, 46, 125–139. [Google Scholar]

- Nadeem, M.; Jun, Y.; Niazi, M.; Tian, Y.; Subhan, S. Paths of economic development: A global evidence for the mediating role of institutions for participation in global value chains. Econ. Res.-Ekon. Istraživanja 2021, 34, 687–708. [Google Scholar] [CrossRef]

- Blonigen, B.A. A Review of the Empirical Literature on FDI Determinants. Atl. Econ. J. 2005, 33, 11299. [Google Scholar] [CrossRef]

- Baltagi, B.H.; Egger, P.; Pfaffermayr, M. Estimating Models of Complex FDI: Are There Third-Country Effects? Mimeo 2007, 140, 260–281. [Google Scholar] [CrossRef]

- Ekholm, K.; Rikard, F.; James, R.M. Export-Platform Foreign Direct Investment. J. Eur. Econ. Assoc. 2007, 5, 776–795. [Google Scholar] [CrossRef]

- Martijn, R.; Elhorst, J.P. The spatial econometrics of FDI and third country effects. Lett. Spat. Resour. Sci. 2015, 8, 1–13. [Google Scholar]

- Blonigen, B.A.; Davies, R.B.; Waddell, G.R.; Naughton, H.T. FDI in space: Spatial autoregressive relationships in foreign direct investment. Eur. Econ. Rev. 2006, 51, 1303–1325. [Google Scholar] [CrossRef]

- Harry, G.; Jolanda, P. FDI and the Relevance of Spatial Linkages: Do Third-Country Effects Matter for Dutch FDI? Rev. World Econ./Weltwirtschaftliches Arch. 2009, 145, 319–338. [Google Scholar]

- Nwaogu, U.G.; Ryan, M. Spatial Interdependence in US Outward FDI into Africa, Latin America and the Caribbean. World Econ. 2014, 37, 1267–1289. [Google Scholar] [CrossRef]

- Ma, S.; Liu, M. Research on the third country effect of China’s OFDI in countries along the “the Belt and Road”: Based on the spatial measurement method. Int. Trade Issues 2016, 7, 72–83. [Google Scholar]

- Yang, Q.; Wu, M. The crowding out effect of China’s OFDI on developed countries’ OFDI in the third-party market: Inno-vative Development of Emerging Economies and the Construction of China’s Pilot Free Trade Zone. In Proceedings of the 2015 Annual Conference of China Emerging Economies Research Association and the 2015 Emerging Economies Forum (Interna-tional Academic Conference) (Part 2), Guangzhou, China, 4–6 December 2015; pp. 212–239. [Google Scholar]

- Tran, T.T.; Nguyen, C.D.; Dang, V.Q.; Hoai, D.T.; Vu TM, H.; Phuong, T.T.; Yen, H.T.H.; Thi, T.H.T.; Tuan, P.V. Regional Inter-dependence and Vietnam-Korea Economic Relationship. KIEP Res. Pap. Stud. Compr. Reg. Strateg. 2016, 12, 257. [Google Scholar] [CrossRef]

- Chou, K.H.; Chen, C.H.; Mai, C.C. The impact of third-country effects and economic integration on China’s outward FDI. Econ. Model. 2011, 28, 5. [Google Scholar] [CrossRef]

- Driffield, N. On the search for spillovers from foreign direct investment (FDI) with spatial dependency. Reg. Stud. 2006, 40, 107–119. [Google Scholar] [CrossRef]

- Cai, Y.; Qian, X.; Nadeem, M.; Wang, Z.; Lian, T.; Haq, S.U. Tracing carbon emissions convergence along the way to participate in global value chains: A spatial econometric approach for emerging market countries. Front. Environ. Sci. 2022, 10, 2211. [Google Scholar] [CrossRef]

- Guo, W.; Wang, Z. Research on the path of cross-border mergers and acquisitions of private enterprises based on the reconstruction of global value chain. Econ. Syst. Reform 2017, 5, 96–100. [Google Scholar]

- Mathews, J.A. Dragon multinational: New players in 21th century globalization. Asia Pac. J. Manag. 2006, 23, 5–27. [Google Scholar] [CrossRef]

- Luo, Y.; Rui, H. An ambidexterity perspective toward multinational enterprises from emerging economies. Acad. Manag. Perspect. 2009, 23, 49. [Google Scholar] [CrossRef]

- Li, J.; Rugman, A.M. Real options and the theory of foreign direct investment. Int. Bus. Rev. 2007, 16, 687–712. [Google Scholar] [CrossRef]

- Cao, M.; Alon, I. Overcoming the liability of foreignness—A new perspective on Chinese MNCs. J. Bus. Res. 2020, 128, 611–626. [Google Scholar] [CrossRef]

- Wang, C.; Hu, M.; Zhou, W. Research on the Evolution of the Role of Corporate Headquarters in Technology-Seeking Cross-border M & A—A Longitudinal Case Study Based on Times Electric. Sci. Sci. Manag. Sci. Technol. 2017, 38, 56–69. [Google Scholar]

- Jing, G.; Sheng, B. Cross-border mergers and acquisitions, exchange rate changes and the status of global value chain. J. Int. Financ. 2021, 3, 37–46. [Google Scholar]

- Ao, X.; Zhou, M. An empirical study on the impact of OFDI on the status of the global value chain of home countrie. Wuhan Financ. 2020, 7, 3–10. [Google Scholar]

- Gupta, O.; Roos, G. Mergers and acquisitions through an intellectual capital perspective. J. Intellect. Cap. 2001, 2, 297–309. [Google Scholar] [CrossRef]

- Savin, I.; Egbetokun, A. Emergence of Innovation Networks from R&D Cooperation with Endogenous Absorptive Capacity. J. Econ. Dyn. Control. 2016, 64, 82–103. [Google Scholar]

- Qiao, L.; Zhao, G.; Wu, J. Does distance create beauty or barrier? Meta-analysis of distance between countries and cross-border M&A performance. Foreign Econ. Manag. 2020, 42, 119–133. [Google Scholar]

- Yi, J.; Meng, S.; Cai, F. External R & D, technical distance, market distance and enterprise innovation performance. China Soft Sci. 2017, 4, 141–151. [Google Scholar]

- Behrens, K.; Duraanton, G. Productive Cities: Sorting, Selection, and Agglomeration. J. Political Econ. 2014, 122, 507–553. [Google Scholar] [CrossRef]

- Syverson, C. Product Substitutability and Productivity Dispersion. Rev. Econ. Stat. 2003, 86, 534–550. [Google Scholar] [CrossRef]

- Desbordes, R.; Franssen, L. Foreign Direct Investment and Productivity: A Cross-Country, Multisector Analysis. Asian Dev. Rev. 2019, 36, 54–79. [Google Scholar] [CrossRef]

- Yu, M.; Gao, K. Imported Intermediate Inputs and Outward Direct Investment Probability: Evidence from Chinese Firms. China Econ. Q. 2021, 4, 1369–1390. [Google Scholar]

- Krugman, R.P. The Spatial Economy; MIT Press: Cambridge, MA, USA, 1999. [Google Scholar]

- Yeaple, S.R. The complex integration strategies of multinationals and cross-country dependencies in the structure of foreign direct investment. J. Int. Econ. 2003, 60, 293–314. [Google Scholar] [CrossRef]

- Baltagi, B.H. Worldwide econometrics rankings: 1989–2005. Econom. Theory 2007, 23, 952–1012. [Google Scholar] [CrossRef]

- Coughlin, C.C.; Segev, E. Foreign Direct Investment in China: A Spatial Econometric Study. World Econ. 2000, 23, 1–23. [Google Scholar] [CrossRef]

- Baldwin, J.; Yan, B. Globalization, Productivity Performance, and the Transformation of the Production Process. Scand. J. Econ. 2016, 123, 1088–1115. [Google Scholar] [CrossRef]

- Xie, J.; Liu, R. Influencing Factors of China’s Outward Direct Investment and It’s Trade Effects: A Spatial Econometric Perspective. J. Int. Trade 2011, 6, 66–74. [Google Scholar]

- Wang, F.; Yang, Z. Firm Heterogeneity and the Third-Party Effect of China’s OFDI: An Analysis Based on Corporate Micro-data. Int. Econ. Trade Res. 2013, 2, 103–116. [Google Scholar]

- Fan, Y.; Hu, Z.; Xiong, B. Economic Policy Uncertainty, Proximity Effects and the Correlation between China and Asia-Pacific Countries’ Value Chains. World Econ. Stud. 2021, 8, 77–90. [Google Scholar]

- Lesage, J.; Pace, R.K. Introduction to Spatial Econometrics; CRC Press: Boca Raton, FL, USA, 2009. [Google Scholar]

- Beer, C.; Riedl, A. Modelling spatial externalities in panel data: The Spatial Durbin model revisited. Pap. Reg. Sci. 2012, 91, 299–318. [Google Scholar] [CrossRef]

- Elhorst, J.P. Dynamic panels with endogenous interaction effects when T is small. Reg. Sci. Urban Econ. 2010, 40, 272–282. [Google Scholar] [CrossRef]

- Koopman, R.; Wang, Z.; Wei, S.J. Estimating domestic content in exports when processing trade is pervasive. J. Dev. Econ. 2012, 99, 178–189. [Google Scholar] [CrossRef]

- Elhorst, J.P. Dynamic Models in Space and Time. Geogr. Anal. 2001, 33, 119–140. [Google Scholar] [CrossRef]

- Wang, Z.; Wei, S.J.; Yu, X.; Zhu, K. Characterizing Global Value Chains: Production Length and Upstreamness; National Bureau of Economic Research: Cambridge, MA, USA, 2017.

- Li, J.; Tan, Q.; Bai, J. Spatial Econometric Analysis of Regional Innovation Production in China: An Empirical Study Based on Static and Dynamic Space Panel Models. J. Manag. World 2010, 7, 43–65. [Google Scholar]

| Year | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|---|---|---|---|---|

| Moran’s I | 0.31 * | 0.32 * | 0.34 ** | 0.32 * | 0.32 * | 0.36 ** | 0.36 ** | 0.34 ** | 0.27 * | 0.25 * |

| Geary’s C | 0.68 ** | 0.67 ** | 0.65 ** | 0.67 ** | 0.67 ** | 0.63 ** | 0.64 ** | 0.67 * | 0.75 * | 0.77 * |

| Variable | Variable Meaning | Variable Description | Data Sources |

|---|---|---|---|

| Gvc_po | China’s division position gap to the host country | Based on the difference of the value chain division position index of the bilateral relationship between countries | ADB-MRIO database in UIBE GVC |

| lnMerge | Investment level of cross-border M&A | China’s cross-border M&A flow to the host country | Zephyr Database |

| Tec | Technology R&D level of the host country | Ratio of R&D investment in the host country to GDP | World Bank Database |

| Gdp_ra | Market development potential of host country | Ratio of market growth scale of host country to GDP | World Bank Database |

| lnRes | Abundance of natural resources in the host country | Ratio of natural resource rent to GDP in host country | World Bank Database |

| Open | Market openness of the host country | Ratio of exports and imports of host countries to GDP | World Bank Database |

| lnTele | Infrastructure level of host country | Ratio of mobile phones per 100 people in the host country to GDP | World Bank Database |

| Variables | Mean | Standard Deviation | Minimum | Maximum | Observation |

|---|---|---|---|---|---|

| Gvc_po | 0.297 | 1.022 | −2.298 | 2.076 | 270 |

| Gvc_po_h | 0.821 | 0.575 | −0.022 | 2.076 | 190 |

| Gvc_po_l | −0.947 | 0.732 | −2.298 | 0.001 | 80 |

| lnMerge | 6.386 | 3.021 | 0 | 12.99 | 270 |

| Tec | 1.680 | 1.139 | −1.077 | 4.553 | 270 |

| Gdp_ra | 2.783 | 2.325 | −4.057 | 14.53 | 270 |

| lnRes | 2.837 | 4.650 | 0.0017 | 27.19 | 270 |

| Open | 0.878 | 0.656 | 0.228 | 3.791 | 270 |

| lnTele | 4.763 | 0.226 | 4.012 | 5.227 | 270 |

| Gvc_po | lnMerge | Tec | Gdp_ratio | Res | Open | lnTele | |

|---|---|---|---|---|---|---|---|

| Gvc_po | 1 | ||||||

| lnMerge | 0.188 *** | 1 | |||||

| Tec | 0.416 *** | 0.178 *** | 1 | ||||

| Gdp_ra | 0.053 | −0.209 *** | −0.352 *** | 1 | |||

| lnRes | −0.133 ** | −0.194 *** | −0.490 *** | 0.343 *** | 1 | ||

| Open | 0.110 * | −0.137 ** | 0.0930 | 0.248 *** | −0.106 * | 1 | |

| lnTele | 0.112 * | 0.0510 | 0.192 *** | −0.103 * | 0.232 *** | 0.340 *** | 1 |

| (1) | (2) | (3) | |

|---|---|---|---|

| Independent Variable | Total Sample | Host Country with High Division of Labor Status | Host Country with Low Division of Labor Status |

| ρ | 0.128 * (1.91) | 0.017 (0.20) | 0.331 *** (4.24) |

| lnMerge | −0.008 (−0.19) | −0.004 (−0.68) | −0.011 * (−1.90) |

| lnTec | 0.087 ** (2.01) | 0.287 *** (4.85) | −0.006 (−0.130) |

| lnGdp_ra | 0.016 ** (2.443) | 0.012 * (1.71) | 0.027 *** (3.05) |

| lnRes | 0.009 (1.21) | −0.021 ** (−1.98) | 0.032 *** (4.23) |

| lnOpen | 0.617 *** (5.24) | 0.303 *** (2.66) | 0.163 (0.41) |

| lnTele | 0.161 (1.39) | −0.142 (−1.15) | 0.691 *** (4.36) |

| W × lnMerge | −0.012 ** (−2.09) | −0.014 ** (−2.08) | −0.004 (−0.59) |

| W × lnTec | −0.029 | 0.050 | −0.047 |

| (−0.48) | (0.56) | (−1.01) | |

| W × lnGdp_ra | −0.001 | 0.007 | −0.01 |

| (−0.15) | (−0.15) | (−1.10) | |

| W × lnRes | 0.015 | 0.019 | −0.008 |

| (1.18) | (1.24) | (−0.92) | |

| W × lnOpen | −0.243 | −0.10 | 0.508 |

| (−1.56) | (−0.69) | (1.16) | |

| W × lnTele | 0.441 *** | 0.432 ** | 0.001 |

| (2.64) | (2.39) | (0.01) | |

| sigma2_e | 0.019 *** (10.98) | 0.018 *** (8.89) | 0.0090 *** (5.60) |

| N | 270 | 190 | 80 |

| R2 | 0.033 | 0.467 | 0.189 |

| (1) | (2) | (3) | |

|---|---|---|---|

| Total Sample | Host Country with High Division of Labor Status | Host Country with Low Division of Labor Status | |

| ρ | 0.113 * (1.73) | −0.064 (−0.74) | 0.332 *** (4.28) |

| lnMerge | 0.001 (0.04) | −0.002 (−0.47) | −0.011 * (−2.22) |

| lnTec | 0.080 * (1.87) | 0.284 *** (4.80) | −0.005 (−0.13) |

| lnGdp_ra | 0.013 ** (2.08) | 0.012 (1.58) | 0.027 *** (3.09) |

| lnRes | 0.004 (0.43) | −0.025 * (−2.35) | 0.032 *** (4.22) |

| lnOpen | 0.625 *** (5.44) | 0.347 *** (2.93) | 0.21 (0.54) |

| lnTele | 0.219 ** (1.97) | −0.103 (−0.85) | 0.685 *** (4.32) |

| W × lnMerge | −0.013 * (−2.39) | −0.013 ** (−1.96) | −0.004 (−0.60) |

| W × lnTec | −0.036 | 0.071 | −0.042 |

| (−0.56) | (0.71) | (−0.94) | |

| W × lnGdp_ra | 0.009 | −0.004 | −0.01 |

| (1.02) | (−0.33) | (−1.02) | |

| W × lnRes | 0.019 | 0.013 | −0.008 |

| (1.61) | (0.84) | (−0.96) | |

| W × lnOpen | −0.25 | −0.106 | 0.498 |

| (−1.62) | (−0.55) | (1.17) | |

| W × lnTele | 0.491 *** | 0.117 | −0.005 |

| (2.98) | (0.62) | (−0.03) | |

| sigma2_e | 0.019 *** (10.98) | 0.018 *** (8.84) | 0.009 *** (5.61) |

| N | 270 | 190 | 80 |

| R2 | 0.02 | 0.479 | 0.224 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, X.; Sun, H.; Liu, W.; Fang, J. The Impact of Reverse Cross-Border Mergers and Acquisitions in Emerging Countries on the Division Position in the Global Value Chain: A Systematic Framework of the Third Country Effect. Sustainability 2023, 15, 4776. https://doi.org/10.3390/su15064776

Liu X, Sun H, Liu W, Fang J. The Impact of Reverse Cross-Border Mergers and Acquisitions in Emerging Countries on the Division Position in the Global Value Chain: A Systematic Framework of the Third Country Effect. Sustainability. 2023; 15(6):4776. https://doi.org/10.3390/su15064776

Chicago/Turabian StyleLiu, Xia, Hanwen Sun, Wei Liu, and Jiaqi Fang. 2023. "The Impact of Reverse Cross-Border Mergers and Acquisitions in Emerging Countries on the Division Position in the Global Value Chain: A Systematic Framework of the Third Country Effect" Sustainability 15, no. 6: 4776. https://doi.org/10.3390/su15064776

APA StyleLiu, X., Sun, H., Liu, W., & Fang, J. (2023). The Impact of Reverse Cross-Border Mergers and Acquisitions in Emerging Countries on the Division Position in the Global Value Chain: A Systematic Framework of the Third Country Effect. Sustainability, 15(6), 4776. https://doi.org/10.3390/su15064776