Risk Analysis under a Circular Economy Context Using a Systems Thinking Approach

Abstract

1. Introduction

2. Literature Review

2.1. On Circular Economy

2.2. Risk Assessment

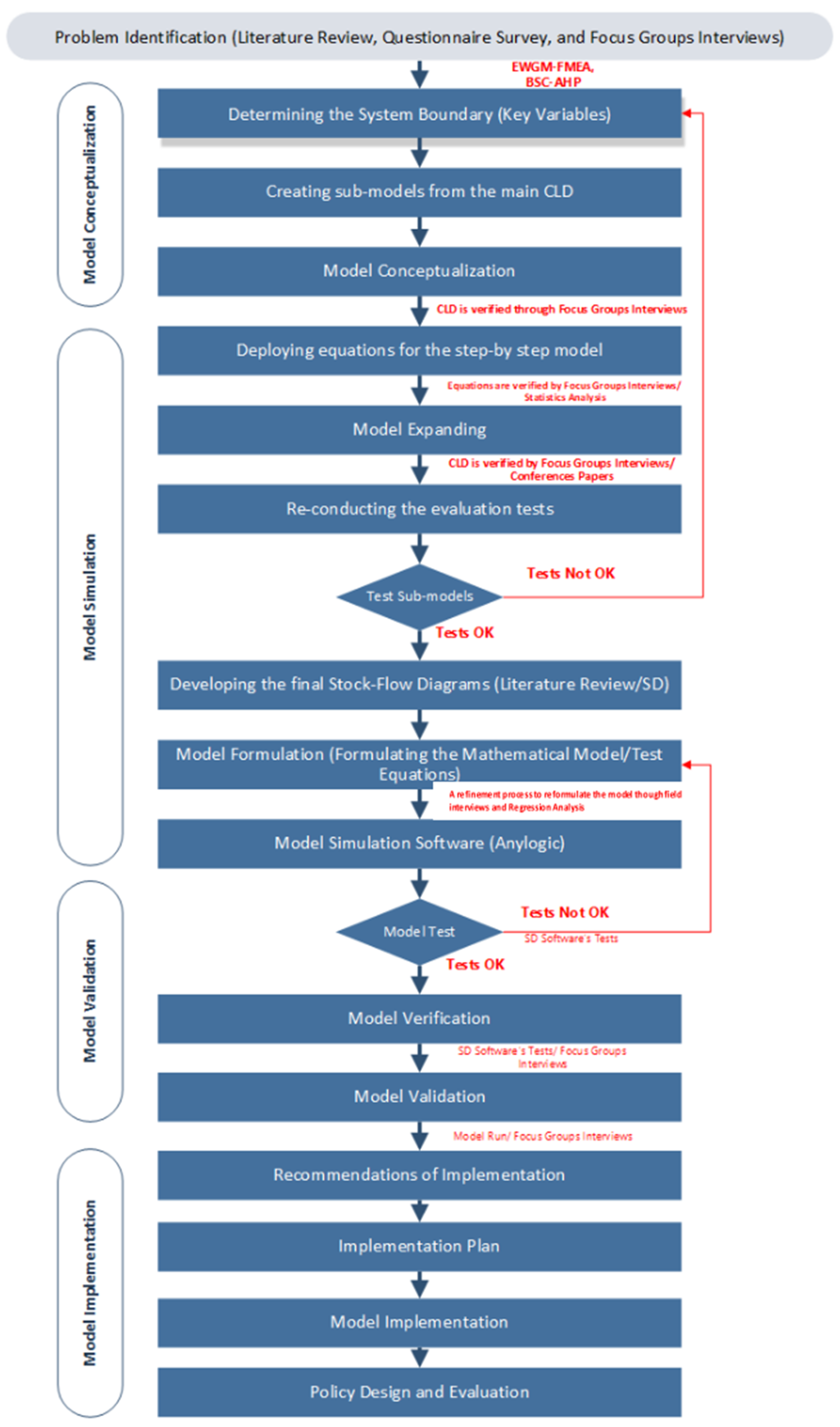

3. Research Methodology

3.1. Data Collection

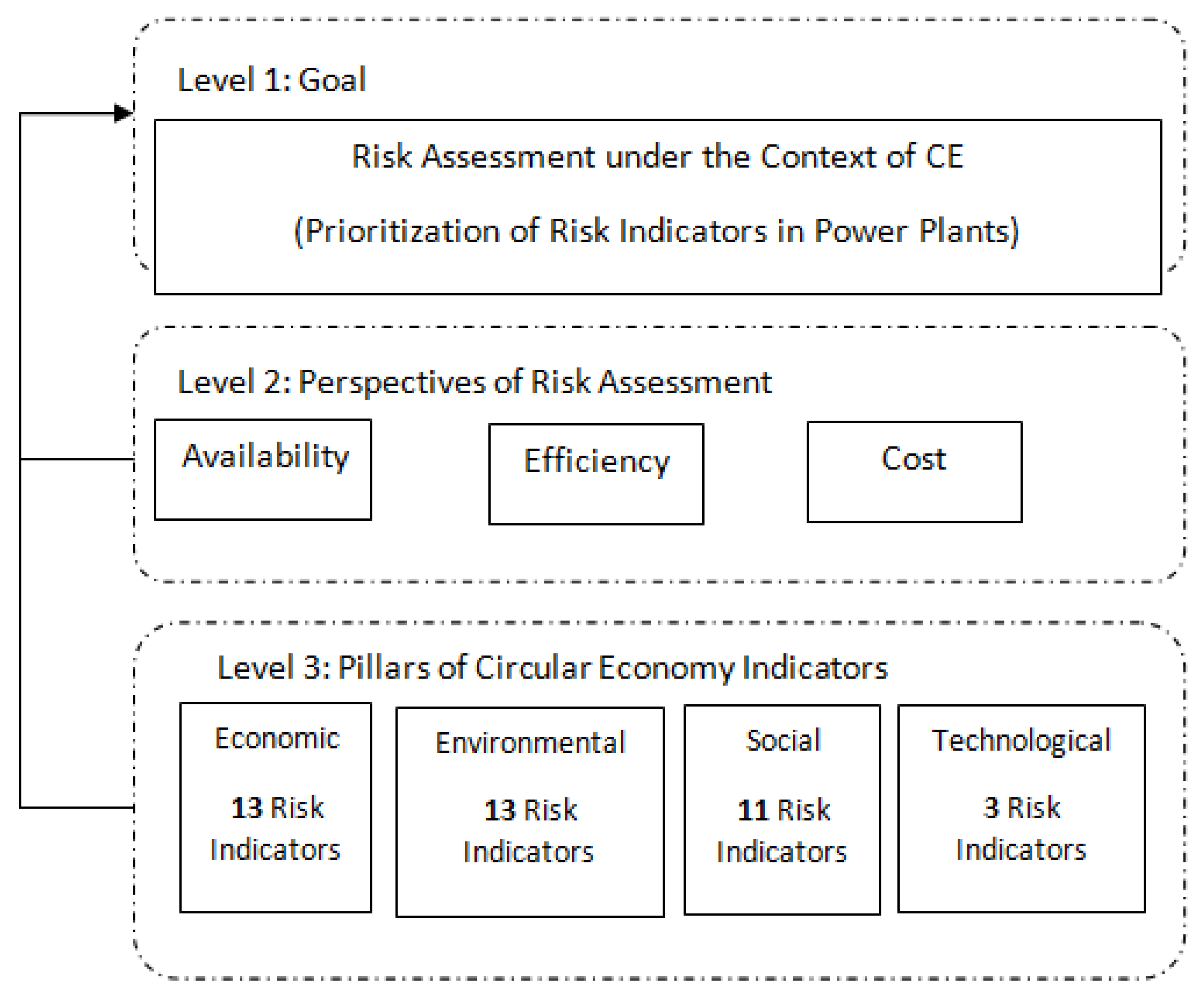

3.2. Taxonomy of CE Risks

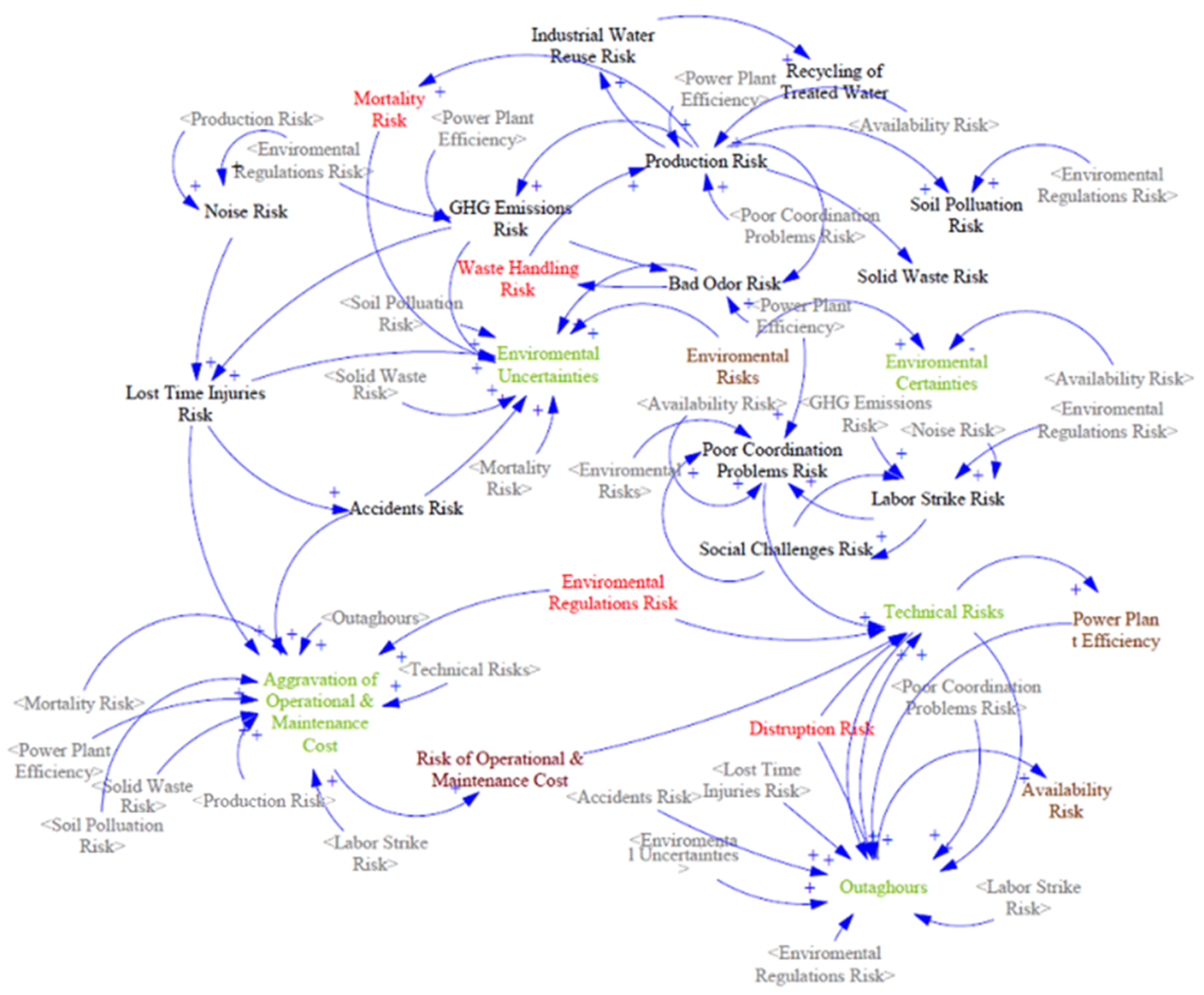

3.3. Causal Loop Diagram (CLD) Development

4. Conclusion, Recommendation, and Limitation

5. Implications of the Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Anthony, B.S.D.; Viguerie, S.P.; Waldeck, A. Corporate Longevity: Turbulence Ahead for Large Organizations. Strategy Innov. 2016, 14, 1–9. [Google Scholar]

- Abdelmeguid, A.; Afy-Shararah, M.; Salonitis, K. Investigating the challenges of applying the principles of the circular economy in the fashion industry: A systematic review. Sustain. Prod. Consum. 2022, 32, 505–518. [Google Scholar] [CrossRef]

- Dantas, T.E.T.; de-Souza, E.D.; Destro, I.R.; Hammes, G.; Rodriguez, C.M.T.; Soares, S.R. How the combination of Circular Economy and Industry 4.0 can contribute towards achieving the Sustainable Development Goals. Sustain. Prod. Consum. 2021, 26, 213–227. [Google Scholar] [CrossRef]

- Lin, S.; Shen, B.; Yong, S.; Angelo, M.; Promentilla, B.; Yatim, P. Prioritization of sustainability indicators for promoting the circular economy : The case of developing countries. Renew. Sustain. Energy Rev. 2019, 111, 314–331. [Google Scholar] [CrossRef]

- Salvador, R.; Barros, M.V.; Donner, M.; Brito, P.; Halog, A.; De Francisco, A.C. How to advance regional circular bioeconomy systems? Identifying barriers, challenges, drivers, and opportunities. Sustain. Prod. Consum. 2022, 32, 248–269. [Google Scholar] [CrossRef]

- Velenturf, A.P.M.; Purnell, P. Principles for a sustainable circular economy. Sustain. Prod. Consum. 2021, 27, 1437–1457. [Google Scholar] [CrossRef]

- Kazancoglu, Y.; Deniz, Y.; Ozen, O.; Kumar, S.; Mangey, M. Risk assessment for sustainability in e-waste recycling in circular economy. Clean Technol. Environ. Policy 2022, 24, 1145–1157. [Google Scholar] [CrossRef]

- Ozkan-Ozen, Y.D.; Kazancoglu, Y.; Mangla, S.K. Resources, Conservation & Recycling Synchronized Barriers for Circular Supply Chains in Industry 3.5/Industry 4.0 Transition for Sustainable. Resour. Conserv. Recycl. 2020, 161, 104986. [Google Scholar] [CrossRef]

- Liu, Y.; Wood, L.C.; Venkatesh, V.G.; Zhang, A.; Farooque, M. Barriers to sustainable food consumption and production in China: A fuzzy DEMATEL analysis from a circular economy perspective. Sustain. Prod. Consum. 2021, 28, 1114–1129. [Google Scholar] [CrossRef]

- Franco, M.A. A system dynamics approach to product design and business model strategies for the circular economy. J. Clean. Prod. 2019, 241, 118327. [Google Scholar] [CrossRef]

- Deloitte. Circular Economy in the Energy Industry; Deloitte: Berlin, Germany, 2018. [Google Scholar]

- Kun, H.; Jian, Z. Circular Economy Strategies of oil and Gas exploitation in China. Energy Procedia 2011, 5, 2189–2194. [Google Scholar] [CrossRef]

- IRENA. Renewables Readiness Assessment; IRENA: Abu Dhabi, United Arab Emirates, 2021. [Google Scholar]

- Kiviranta, K.; Thomasson, T.; Hirvonen, J.; Matti, T. Connecting circular economy and energy industry : A techno-economic study for the Å land Islands. Appl. Energy 2020, 279, 115883. [Google Scholar] [CrossRef]

- Gonzalez, J. Modelling and Controlling Risk in Energy Systems; University of Manchester: Singapore, 2015; Available online: http://eprints.maths.manchester.ac.uk/2406/1/PhDthesis_Jhonny_Gonzalez.pdf (accessed on 13 February 2021).

- Ramkumar, S.; Kraanen, F.; Plomp, R.; Edgerton, B. Linear Risks; WBCSD: Geneva, Switzerland, 2018. [Google Scholar]

- Wu, D.D.; Olson, D.L. Introduction to the Special Section on “Optimizing Risk Management: Methods and Tools”. Hum. Ecol. Risk Assess. 2009, 15, 220–226. [Google Scholar] [CrossRef]

- EASAC. Indicators for a Circular Economy; EASAC: Halle, Germany, 2016. [Google Scholar]

- Esposito, M.; Tse, T.; Soufani, K. Introducing a Circular Economy : New Thinking with New Managerial and Policy Implications. Calif. Manag. Rev. 2018, 60, 5–19. [Google Scholar] [CrossRef]

- Guzzo, D.; Pigosso, D.C.A.; Videira, N.; Mascarenhas, J. A system dynamics-based framework for examining Circular Economy transitions. J. Clean. Prod. 2022, 333, 129933. [Google Scholar] [CrossRef]

- Saidani, M.; Yannou, B.; Leroy, Y.; Kendall, A.; Industriel, L.G. A taxonomy of circular economy indicators. J. Clean. Prod. 2019, 207, 542–559. [Google Scholar] [CrossRef]

- Lenssen, J.J.; Dentchev, N.A.; Roger, L. Sustainability, Risk management and governance: Towards an integrative approach. Corp. Gov. 2014, 14, 670–684. [Google Scholar] [CrossRef]

- Wijethilake, C.; Lama, T. Sustainability core values and sustainability risk management: Moderating effects of top management commitment and stakeholder pressure. Bus. Strategy Environ. 2018, 28, 143–154. [Google Scholar] [CrossRef]

- Guo, F.; Wang, J.; Song, Y. How to promote sustainable development of construction and demolition waste recycling systems : Production subsidies or consumption subsidies ? Sustain. Prod. Consum. 2022, 32, 407–423. [Google Scholar] [CrossRef]

- Kalmykova, Y.; Sadagopan, M.; Rosado, L. Circular economy—From review of theories and practices to development of implementation tools. Resour. Conserv. Recycl. 2018, 135, 190–201. [Google Scholar] [CrossRef]

- Geissdoerfer, M.; Savaget, P.; Bocken, N.M.P.; Jan, E. The Circular Economy—A new sustainability paradigm ? J. Clean. Prod. 2017, 143, 757–768. [Google Scholar] [CrossRef]

- Saidani, M.; Yannou, B.; Leroy, Y.; Cluzel, F. How to Assess Product Performance in the Circular Economy ? Proposed Requirements for the Design of a Circularity Measurement Framework. Recycling 2017, 2, 6. [Google Scholar] [CrossRef]

- Henry, M.; Schraven, D.; Bocken, N.; Frenken, K.; Hekkert, M.; Kirchherr, J. The battle of the buzzwords: A comparative review of the circular economy and the sharing economy concepts. Environ. Innov. Soc. Transit. 2021, 38, 1–21. [Google Scholar] [CrossRef]

- Huang, Y.; Garrido, S.; Lin, T.; Cheng, C.; Lin, C. Exploring the decisive barriers to achieve circular economy : Strategies for the textile innovation in Taiwan. Sustain. Prod. Consum. 2021, 27, 1406–1423. [Google Scholar] [CrossRef]

- Kirchherr, J.; Reike, D.; Hekkert, M. Resources, Conservation & Recycling Conceptualizing the circular economy: An analysis of 114 de fi nitions. Resour. Conserv. Recycl. 2017, 127, 221–232. [Google Scholar] [CrossRef]

- Bressanelli, G.; Perona, M.; Saccani, N. Assessing the impacts of Circular Economy : A framework and an application A application to the washing machine industry. Int. J. Manag. Decis. Mak. 2019, 18, 282–308. [Google Scholar] [CrossRef]

- Elia, V.; Gnoni, M.G.; Tornese, F. Measuring circular economy strategies through index methods: A critical analysis. J. Clean. Prod. 2017, 142, 2741–2751. [Google Scholar] [CrossRef]

- Urbinati, A.; Chiaroni, D.; Chiesa, V. Towards a new taxonomy of circular economy business models. J. Clean. Prod. 2017, 168, 487–498. [Google Scholar] [CrossRef]

- Howard, M.; Hopkinson, P.; Miemczyk, J. The regenerative supply chain: A framework for developing circular economy indicators. Int. J. Prod. Res. 2018, 57, 7300–7318. [Google Scholar] [CrossRef]

- Ellen MacArthur Foundation. Circular Indicators—An Approach to Measuring Circularity; Ellen MacArthur Foundation: Isle of Wight, UK, 2015; Volume 23. [Google Scholar] [CrossRef]

- Waas, T.; Verbruggen, A.; Wright, T. University research for sustainable development: Definition and characteristics explored. J. Clean. Prod. 2010, 18, 629–636. [Google Scholar] [CrossRef]

- Uqaili, M.A.; Harijan, K. Energy, Environment and Sustainable Development; Springer: Vienna, Austria, 2012; Volume 12, pp. 1–349. [Google Scholar] [CrossRef]

- Abrahams, G. Constructing definitions of sustainable development. Smart Sustain. Built Environ. 2017, 6, 34–47. [Google Scholar] [CrossRef]

- Holden, E.; Linnerud, K.; Banister, D. Sustainable development: Our Common Future revisited. Glob. Environ. Chang. 2014, 26, 130–139. [Google Scholar] [CrossRef]

- Korhonen, J.; Nuur, C.; Feldmann, A.; Eshetu, S. Circular economy as an essentially contested concept. J. Clean. Prod. 2018, 175, 544–552. [Google Scholar] [CrossRef]

- Kaur, P.J.; Yadav, P.; Gupta, M.; Khandegar, V.; Jain, A. Bamboo as a Source for Value Added Products: Paving Way to Global Circular Economy. BioResources 2022, 17, 1–27. [Google Scholar] [CrossRef]

- Zamparutti, T.; Mcneill, A.; Moora, H.; Jõe, M.; Piirsalu, E. Circular Economy with Focus on Waste, Renewable Energy and Sustainable Bioenergy in Estonia; Policy Department for Economic, Scientific and Quality of Life Policies: Luxembourg, 2017. [Google Scholar] [CrossRef]

- Xu, J.; Li, X.; Wu, D.D. Optimizing circular economy planning and risk analysis using system dynamics. Hum. Ecol. Risk Assess. 2009, 15, 316–331. [Google Scholar] [CrossRef]

- Wojcik, A. Risk Sharing in the Circular Economy. Sci. Sustain. J. 2017, 1, 26–38. [Google Scholar] [CrossRef]

- Zeng, S.-L.; Hu, H.; Wang, W. Circular economy assessment for coal-fired power plants based on supperefficiency DEA model. In Proceedings of the 2009 International Conference on Energy and Environment Technology ICEET 2009, Washington, DC, USA, 16–18 October 2009; Volume 1, pp. 50–54. [Google Scholar] [CrossRef]

- Pieroni, M.P.P.; McAloone, T.C.; Borgianni, Y.; Maccioni, L.; Pigosso, D.C.A. An expert system for circular economy business modelling: Advising manufacturing companies in decoupling value creation from resource consumption. Sustain. Prod. Consum. 2021, 27, 534–550. [Google Scholar] [CrossRef]

- Ranjbari, M.; Morales-Alonso, G.; Esfandabadi, Z.S.; Carrasco-Gallego, R. Sustainability and the sharing economy: Modelling the interconnections. Dir. Organ. 2019, 68, 33–40. [Google Scholar] [CrossRef]

- Ranjbari, M.; Esfandabadi, Z.S. Sharing Economy Risks: Opportunities or Threats for Insurance Companies? A Case Study on the Iranian Insurance Industry. In The Future of Risk Management, Volume II: Perspectives on Financial and Corporate Strategies; Palgrave Macmillan: London, UK, 2019. [Google Scholar] [CrossRef]

- Bodar, C.; Spijker, J.; Lijzen, J.; Der Loop, S.W.; Luit, R.; Heugens, E.; Janssen, M.; Wassenaar, P.; Traas, T. Risk management of hazardous substances in a circular economy. J. Environ. Manag. 2018, 212, 108–114. [Google Scholar] [CrossRef]

- Greyson, J. An economic instrument for zero waste, economic growth and sustainability. J. Clean. Prod. 2007, 15, 1382–1390. [Google Scholar] [CrossRef]

- Su, B.; Heshmati, A.; Geng, Y.; Yu, X. A review of the circular economy in China: Moving from rhetoric to implementation. J. Clean. Prod. 2013, 42, 215–227. [Google Scholar] [CrossRef]

- WEF. Building Resilience in Supply Chain; WEF: Geneva, Switzerlnd, 2013; Available online: http://www3.weforum.org/docs/WEF_RRN_MO_BuildingResilienceSupplyChains_ExecutiveSummary_2013.pdf (accessed on 13 February 2021).

- Sterman, J.D. Systems Thinking and Modeling for a Complex World; McGraw-Hill: New York, NY, USA, 2000; Volume 6, ISBN 007238915X. [Google Scholar]

- Aslani, A.; Helo, P.; Naaranoja, M. Role of renewable energy policies in energy dependency in Finland: System dynamics approach. Appl. Energy 2014, 113, 758–765. [Google Scholar] [CrossRef]

- Forrester, J.W. Industrial Dynamics-after the First Decade. Manag. Sci. 1968, 14, 398–415. [Google Scholar] [CrossRef]

- Rowitz, L. Public Health Leadership; Jones & Bartlett Publishers: Burlington, MA, USA, 2013; ISBN 1449645216. [Google Scholar]

- Di Nardo, M.; Gallo, M.; Murino, T.; Santillo, L.C. System dynamics simulation for fire and explosion risk analysis in home environment. Int. Rev. Model. Simul. 2017, 10, 43–54. [Google Scholar] [CrossRef]

- Anand, S.; Vrat, P.; Dahiya, R.P. Application of a system dynamics approach for assessment and mitigation of CO2 emissions from the cement industry. J. Environ. Manag. 2006, 79, 383–398. [Google Scholar] [CrossRef] [PubMed]

- Qudrat-Ullah, H. The Physics of Stocks and Flows of Energy Systems; Springer: Berlin/Heidelberg, Germany, 2016; ISBN 978-3-319-24827-1. [Google Scholar]

- Garbolino, E.; Chery, J.-P.; Guarnieri, F. A Simplified Approach to Risk Assessment Based on System Dynamics: An Industrial Case Study. Risk Anal. 2016, 36, 16–29. [Google Scholar] [CrossRef] [PubMed]

- Ostrom, L.T.; Wilhelmsen, C.A. Risk Assessment, Tools, Techniques, and Their Applications; Wiley & Sons: Toronto, ON, Canada, 2012; ISBN 9780470892039. [Google Scholar]

- Ayyub, B.M. Risk Analysis in Engineering and Economics; CRC Press: Boca Raton, FL, USA, 2014; ISBN 1466518251. [Google Scholar]

- Kouvelis, P.; Dong, L.; Boyabatli, O.; Li, R. Handbook of Integrated Risk Management in Global Supply Chains; Wiley: Hoboken, NJ, USA, 2012; ISBN 9780470535127. [Google Scholar]

- Radivojević, G.; Gajović, V. Supply chain risk modeling by AHP and Fuzzy AHP methods. J. Risk Res. 2014, 17, 337–352. [Google Scholar] [CrossRef]

- Haimes, Y.Y. Risk Modeling, Assessment, and Management, 3rd ed.; Wiley & Sons: Hoboken, NJ, USA, 2009; ISBN 9780470282373. [Google Scholar]

- Mashaqbeh, S.M.A.; Munive-Hernandez, J.E.; Khan, M.K.; Khazaleh, A.A. A System Dynamics Simulation Model for Environmental Risk Assessment at Strategic level in Power Plants. Int. J. Reliab. Saf. 2020, 14, 58–84. [Google Scholar] [CrossRef]

- Pan, I.; Korre, A.; Durucan, S. A systems based approach for financial risk modelling and optimisation of the mineral processing and metal production industry. Comput. Chem. Eng. 2016, 89, 84–105. [Google Scholar] [CrossRef]

- Yazdani, M.; Gonzalez, E.D.R.S.; Chatterjee, P. A multi-criteria decision-making framework for agriculture supply chain risk management under a circular economy context. Manag. Decis. 2021, 59, 1801–1826. [Google Scholar] [CrossRef]

- Ghisellini, P.; Cialani, C.; Ulgiati, S. A review on circular economy: The expected transition to a balanced interplay of environmental and economic systems. J. Clean. Prod. 2016, 114, 11–32. [Google Scholar] [CrossRef]

- Jamshidi, A.; Ait-kadi, D.; Ruiz, A.; Rebaiaia, M.L. Dynamic risk assessment of complex systems using FCM. Int. J. Prod. Res. 2018, 56, 1070–1088. [Google Scholar] [CrossRef]

- Al Mashaqbeh, S.M.; Munive-Hernandez, J.E.; Khan, M.K.; Al Khazaleh, A. Developing a systematic methodology to build a systems dynamics model for assessment of non-technical risks in power plants. Int. J. Syst. Syst. Eng. 2020, 10, 39–71. [Google Scholar] [CrossRef]

- Georgiadis, P.; Vlachos, D.; Tagaras, G. The Impact of Product Lifecycle on Capacity Planning of Closed-Loop Supply Chains with Remanufacturing. Prod. Oper. Manag. 2006, 15, 514–527. [Google Scholar] [CrossRef]

- Georgiadis, P.; Besiou, M. Sustainability in electrical and electronic equipment closed-loop supply chains: A System Dynamics approach. J. Clean. Prod. 2008, 16, 1665–1678. [Google Scholar] [CrossRef]

- Kazancoglu, Y.; Ekinci, E.; Mangla, S.K.; Sezer, M.D.; Kayikci, Y. Performance evaluation of reverse logistics in food supply chains in a circular economy using system dynamics. Bus. Strategy Environ. 2021, 30, 71–91. [Google Scholar] [CrossRef]

- Wang, Y.; Chang, X.; Chen, Z.; Zhong, Y.; Fan, T. Impact of subsidy policies on recycling and remanufacturing using system dynamics methodology: A case of auto parts in China. J. Clean. Prod. 2014, 74, 161–171. [Google Scholar] [CrossRef]

- Forrester, J.W. System Dynamics and the Lessons of 35 Years by. In A Systems-Based Approach to Policymaking; De Greene, K.B., Ed.; Springer: New York, NY, USA, 1991; pp. 190–240. ISBN 978-1-4613-6417-7/978-1-4615-3226-2. [Google Scholar]

- Chen, Z.; Li, H.; Ren, H.; Xu, Q.; Hong, J. A total environmental risk assessment model for international hub airports. Int. J. Proj. Manag. 2011, 29, 856–866. [Google Scholar] [CrossRef]

- Dastkhan, H.; Owlia, M.S. What are the right policies for electricity supply in Middle East? A regional dynamic integrated electricity model for the province of Yazd in Iran. Renew. Sustain. Energy Rev. 2014, 33, 254–267. [Google Scholar] [CrossRef]

- Elsawah, S.; Pierce, S.A.; Hamilton, S.H.; van Delden, H.; Haase, D.; Elmahdi, A.; Jakeman, A.J. An overview of the system dynamics process for integrated modelling of socio-ecological systems: Lessons on good modelling practice from five case studies. Environ. Model. Softw. 2017, 93, 127–145. [Google Scholar] [CrossRef]

- Vera, I.A.; Langlois, L.M.; Rogner, H.H.; Jalal, A.I.; Toth, F.L. Indicators for sustainable energy development: An initiative by the International Atomic Energy Agency. Nat. Resour. Forum 2005, 29, 274–283. [Google Scholar] [CrossRef]

- Cimren, E.; Bassi, A.; Fiksel, J. T21-Ohio, a System Dynamics Approach to Policy Assessment for Sustainable Development: A Waste to Profit Case Study. Sustainability 2010, 2, 2814–2832. [Google Scholar] [CrossRef]

- Foley, A.M.; Gallachóir, B.P.Ó.; Hur, J.; Baldick, R.; Mckeogh, E.J. A strategic review of electricity systems models. Energy 2010, 35, 4522–4530. [Google Scholar] [CrossRef]

| Economic Risks |

| Competition risk |

| Interest rate risk |

| Exchange rate risk |

| Supplier price risk |

| Price of electricity risk |

| Credit risk |

| Investment risk |

| Debt collection risk |

| Operating revenue and expense risk |

| Procurement cost risk |

| Global economic recession risk |

| Asset depreciation risk |

| Market liquidity risk |

| Environmental Risks |

| GHG emissions (NOx, CO2 and SO2) risk |

| Environmental regulations |

| Industrial water reuse ratio risk |

| Recycling of treated water risk |

| Solid waste risk in thermal power plants |

| Waste handling risk |

| Lost time due to injuries risk |

| Accident fatalities per energy produced risk (Severe accidents risks) |

| Human toxicity potential expresses risk (ex. Polychlorinated Biphenyls (PCBs |

| Noise impact caused by energy system risk |

| Bad odors risk |

| Risk of mortality due to normal operation (reduced life expectancy in years of life lost/GWh) |

| Soil pollution risk |

| Social Risks |

| Lack of motivation for staff risk |

| Lack of innovation risk |

| Lack of organizational learning capability risk |

| Poor relationship between parties risk |

| Labor strikes risk |

| Social challenges risk (Poverty, substantial levels of inequalities, health challenge) |

| Behavioral aspect of employee’s risk |

| Union/labor relations risk |

| Reputation risk (Negative Media Coverage) |

| Changing behavior risk (Change in human behavior) |

| Local community impacts risk |

| Technological Risks |

| Obsolescence risk |

| Improved combustion efficiency risk |

| Sustainable technology innovation risk |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

AlMashaqbeh, S.; Munive-Hernandez, J.E. Risk Analysis under a Circular Economy Context Using a Systems Thinking Approach. Sustainability 2023, 15, 4141. https://doi.org/10.3390/su15054141

AlMashaqbeh S, Munive-Hernandez JE. Risk Analysis under a Circular Economy Context Using a Systems Thinking Approach. Sustainability. 2023; 15(5):4141. https://doi.org/10.3390/su15054141

Chicago/Turabian StyleAlMashaqbeh, Sahar, and Jose Eduardo Munive-Hernandez. 2023. "Risk Analysis under a Circular Economy Context Using a Systems Thinking Approach" Sustainability 15, no. 5: 4141. https://doi.org/10.3390/su15054141

APA StyleAlMashaqbeh, S., & Munive-Hernandez, J. E. (2023). Risk Analysis under a Circular Economy Context Using a Systems Thinking Approach. Sustainability, 15(5), 4141. https://doi.org/10.3390/su15054141