Pricing Decision Models of Manufacturer-Led Dual-Channel Supply Chain with Free-Rider Problem

Abstract

1. Introduction

2. Literature Review

3. Model Establishment and Solution

3.1. Model Assumptions and Notation Description

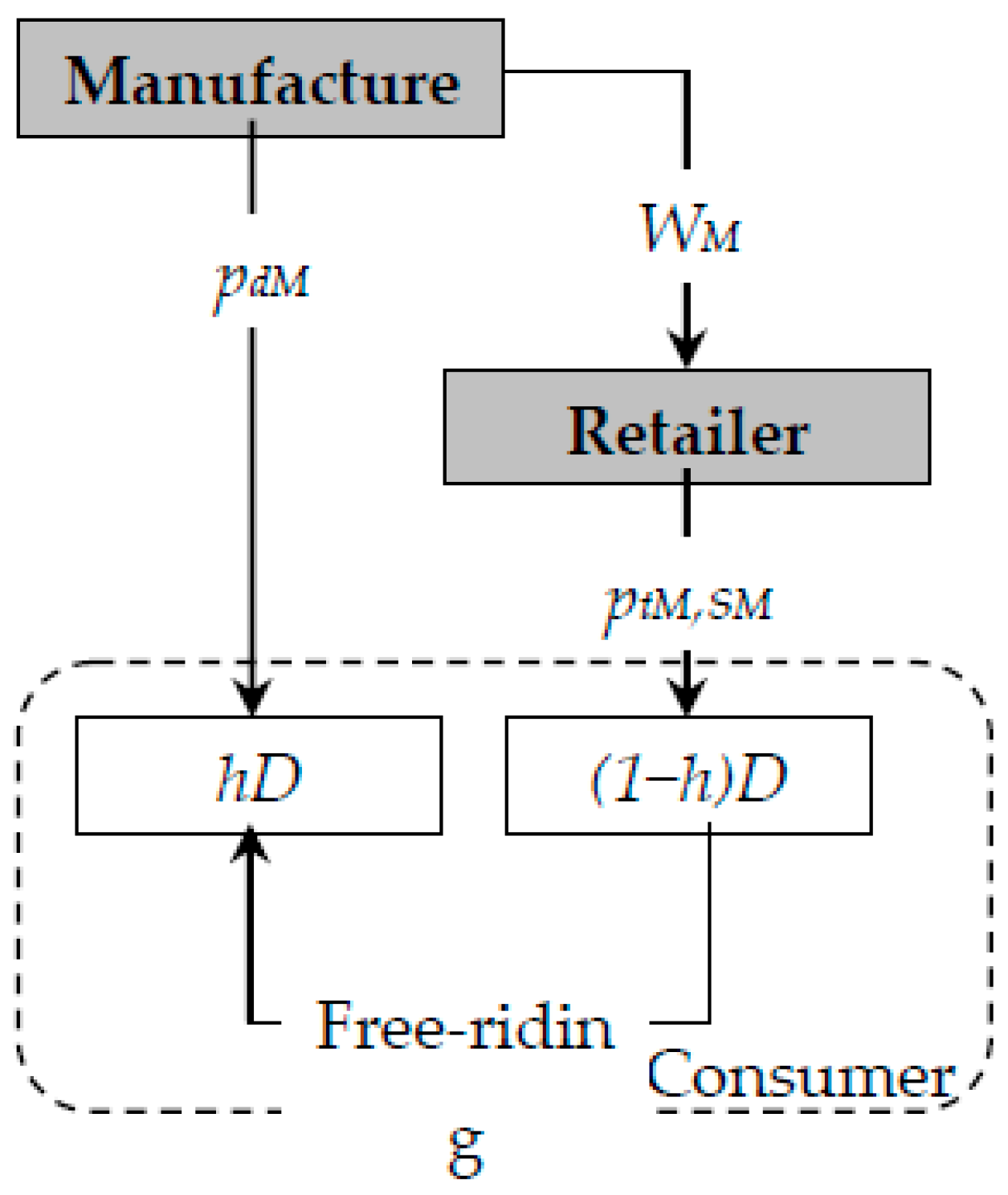

3.2. Decision Model of Retailer Dual-Channel Supply Chain Considering Free-Riding Coefficient

3.2.1. Retailer Dual-Channel Demand Function

3.2.2. Retailer Dual-Channel Profit Function

3.2.3. Optimal Pricing when Service Level Is Determined

3.2.4. Solve for Optimal Service Level

3.3. A Dual-Channel Supply Chain Decision Model for Manufacturers Considering the Free-Riding Factor

3.3.1. Optimal Pricing When Service Levels Are Determined

3.3.2. Solving for the Optimal Service Level

4. Numerical Calculation and Analysis of Results

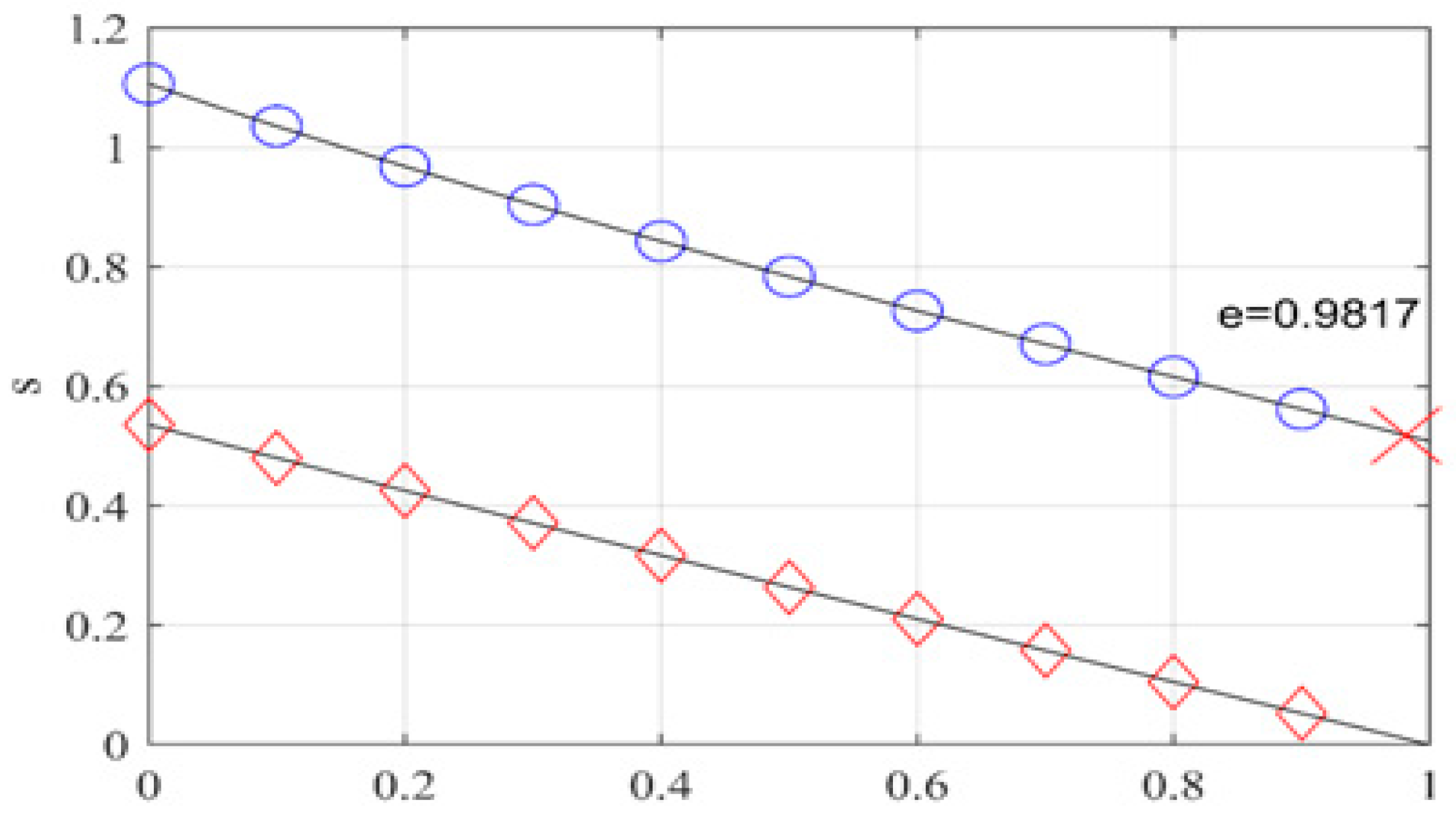

4.1. Impact of Consumer Free-Riding Coefficient on Service Level

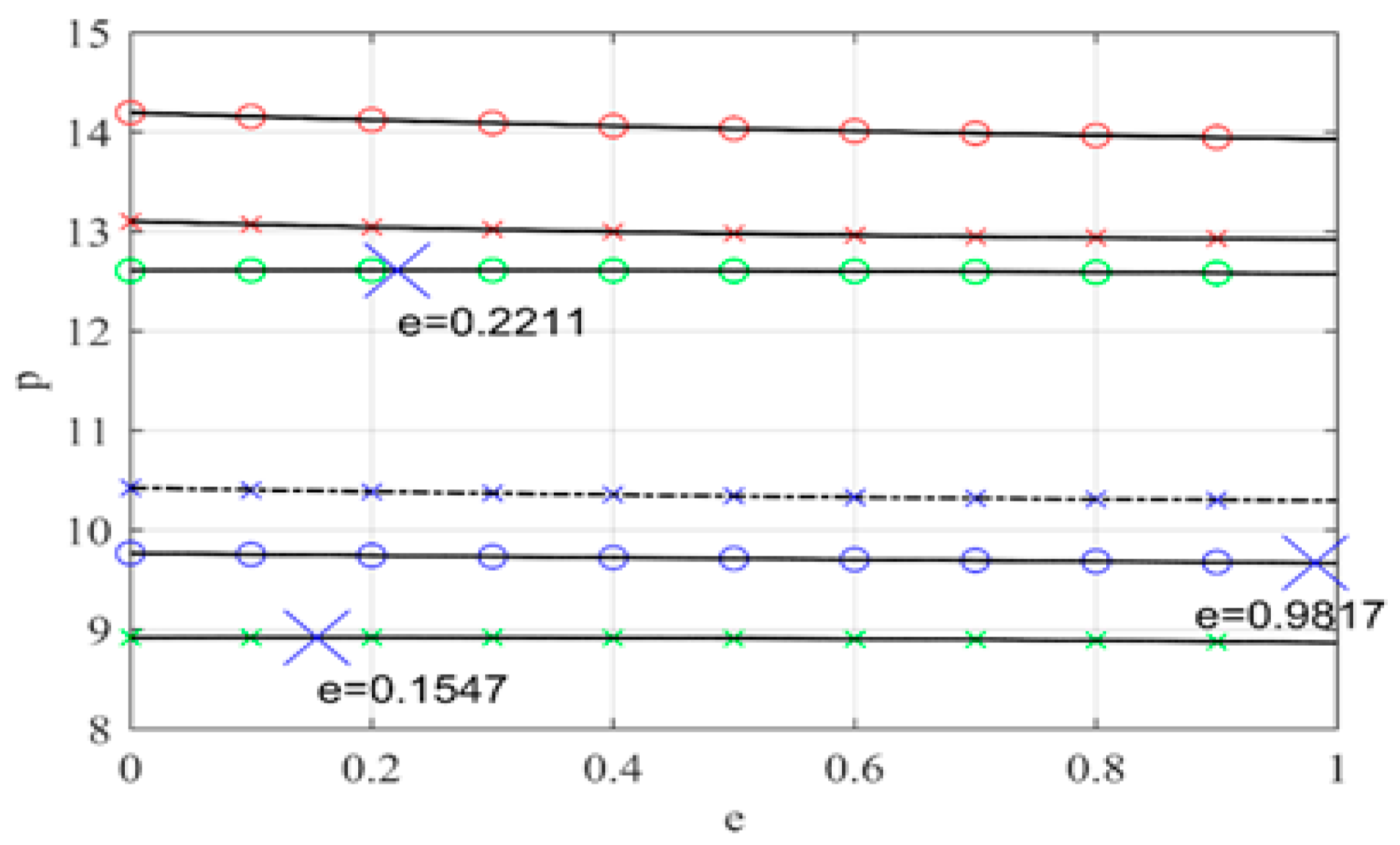

4.2. Impact of Consumer Free-Riding Coefficient on Price Level

4.3. Impact of Consumer Free-Riding Coefficient on Demand

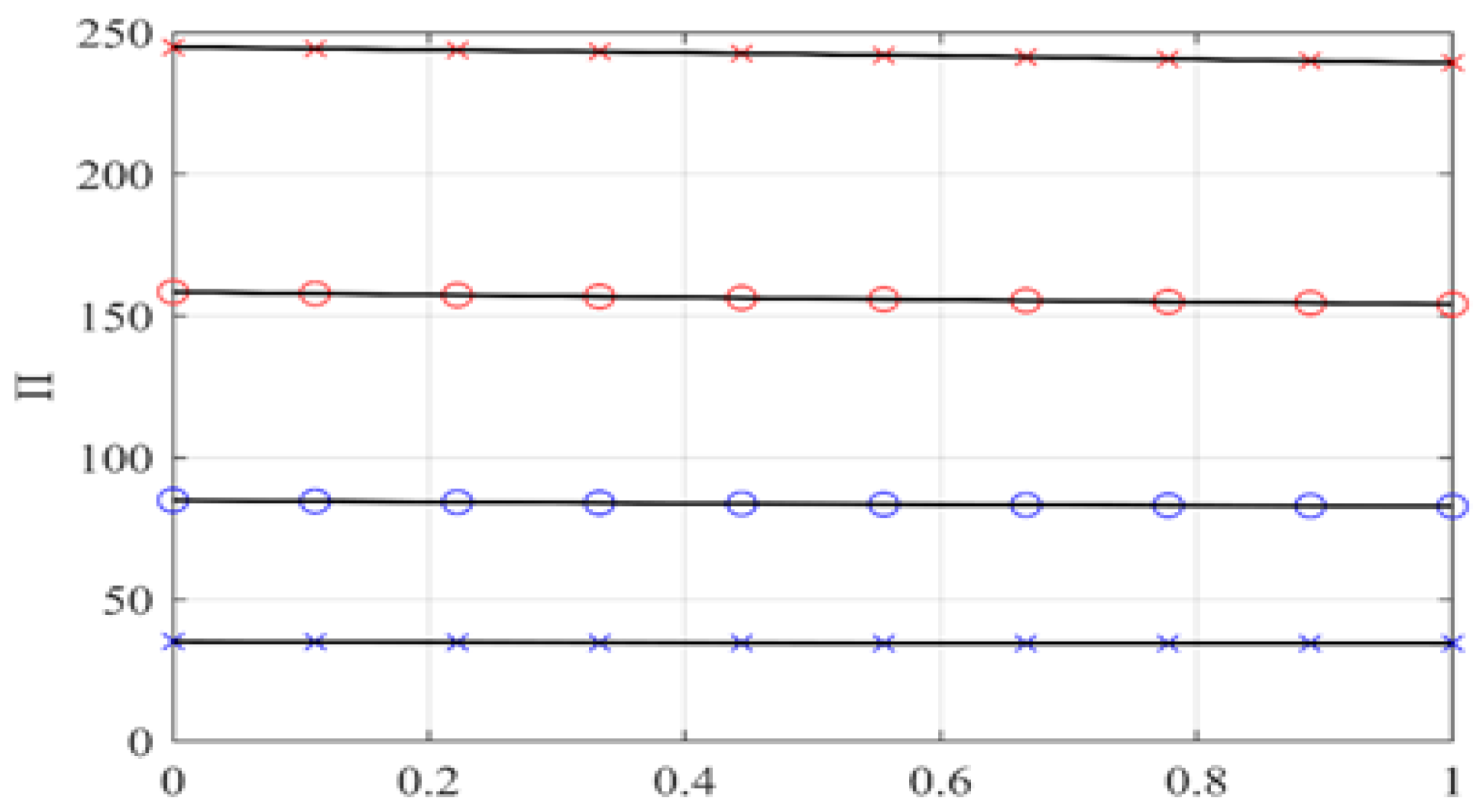

4.4. Impact of Consumer Free-Riding Coefficient on Profit Level

5. Discussion and Managerial Insights

6. Conclusions

- In a manufacturer-led retailer dual-channel supply chain, after consumers enjoy offline services in traditional channels, the motivation of retailers to provide good multisensory experience services such as visual, auditory, and tactile will be inhibited to a certain extent as the degree of their subsequent free-riding behavior deepens. When the free-riding coefficient is large enough, it stimulates retailers to offer better buying services instead, due to a sharp decrease in demand from traditional channels. The increase in the number of free ridings caused price competition between traditional and online channels, with decreasing sales prices in the traditional channels, and when the free-riding coefficient increased to a certain range, the level of service provided began to increase, costs rose, and so did the wholesale prices.

- In the manufacturer-led manufacturer dual-channel supply chain, as the free-riding coefficient increases, the less motivated the retailers are to provide services; the demand decreases, and the service level decreases, which also has an impact on the pricing decisions of each member of the supply chain. The manufacturer’s wholesale price and the retailer’s traditional channel sales price decrease, and the manufacturer’s network channel has an incremental increase in demand and a rising and then decreasing sales price trend. Consumer free-riding behavior adversely affects the development of each player in the supply chain and the whole, resulting in a downward trend in the profits earned by each player. Due to the increase in the number of free ridings and the incremental demand in the online channel, the manufacturer first raised the price in the online channel to maximize revenue, but as retailers also started to compete for the market, the manufacturer lowered the selling price to increase customer stickiness. The consumers’ free-riding behavior has led to channel conflict, resulting in reduced revenue for both upstream and downstream companies in the supply chain, as well as for the supply chain as a whole.

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Esmaeili, M.; Aryanezhad, M.B.; Zeephongsekul, P. A game theory approach in seller-buyer supply chain. Eur. J. Oper. Res. 2009, 195, 442–448. [Google Scholar] [CrossRef]

- Park, S.Y.; Keh, H.T. Modelling hybrid distribution channels: A game-theoretic analysis. J. Retail. Consum. Serv. 2003, 10, 155–167. [Google Scholar] [CrossRef]

- Cachon, G.P.; Kök, A.G. Competing manufacturers in a retail supply chain: On contractual form and coordination. Manag. Sci. 2010, 56, 571–589. [Google Scholar] [CrossRef]

- Shin, J. How does free riding on customer service affect competition. Mark. Sci. 2007, 26, 488–503. [Google Scholar] [CrossRef]

- Wu, D.; Ray, G.; Geng, X.; Whinston, A. Implications of reduced search cost and free riding in E-commerce. Mark. Sci. 2004, 23, 255–262. [Google Scholar] [CrossRef]

- Meng, Q.; Li, M.; Liu, W.; Li, Z.; Zhang, J. Pricing policies of dual-channel green supply chain: Considering government subsidies and consumers’ dual preferences. Sustain. Prod. Consum. 2021, 26, 1021–1030. [Google Scholar] [CrossRef]

- Cao, K.; He, P.; Liu, Z. Production and pricing decisions in a dual-channel supply chain under remanufacturing subsidy policy and carbon tax policy. J. Oper. Res. Soc. 2020, 71, 1199–1215. [Google Scholar] [CrossRef]

- Lou, Z.; Lou, X.; Dai, X. Game-Theoretic Models of Green Products in a Two-Echelon Dual-Channel Supply Chain under Government Subsidies. Math. Probl. Eng. 2020, 2020, 2425401. [Google Scholar] [CrossRef]

- Zhang, C.; Wang, Y.; Zhang, L. Risk-averse preferences in a dual-channel supply chain with trade credit and demand uncertainty. RAIRO—Oper. Res. 2021, 55, S2879–S2903. [Google Scholar] [CrossRef]

- Giri, B.C.; Kumar, M.; Kripasindhu, C. Coordination mechanisms of a three-layer supply chain under demand and supply risk uncertainties. RAIRO—Oper. Res. 2021, 55, S2593–S2617. [Google Scholar] [CrossRef]

- Yan, B.; Chen, Z.; Liu, Y.; Chen, X.X. Pricing decision and coordination mechanism of dual-channel supply chain dominated by a risk-aversion retailer under demand disruption. RAIRO—Oper. Res. 2021, 55, 433–456. [Google Scholar] [CrossRef]

- Zhang, C.; Liu, Y.; Han, G. Two-stage pricing strategies of a dual-channel supply chain considering public green preference. Comput. Ind. Eng. 2020, 151, 106988. [Google Scholar] [CrossRef]

- Du, X.; Zhao, W.; Fateh, M. Managing a Dual-Channel Supply Chain with Fairness and Channel Preference. Math. Probl. Eng. 2021, 2021, 6614692. [Google Scholar] [CrossRef]

- Hu, Y.; Lin, J.; Su, X.L. Channel Selection Decision in a Dual-Channel Supply Chain: A Consumer-Driven Perspective. IEEE Access 2020, 8, 145634–145648. [Google Scholar] [CrossRef]

- Gao, J.; Xiao, Z.; Wei, H. Competition and coordination in a dual-channel green supply chain with an eco-label policy. Comput. Ind. Eng. 2021, 153, 107057. [Google Scholar] [CrossRef]

- Subrata, S.; Izabela, N. Strategic Integration Decision under Supply Chain Competition in the Presence of Online Channel. Symmetry 2020, 13, 58. [Google Scholar]

- Wang, Y.; Fan, R.; Shen, L.; Jin, M. Decisions and coordination of green e-commerce supply chain considering green manufacturer’s fairness concerns. Int. J. Prod. Res. 2020, 58, 7471–7489. [Google Scholar] [CrossRef]

- Xu, J.; Zhou, X.; Zhang, J.; Long, Z.D. The optimal channel structure with retail costs in a dual-channel supply chain. Int. J. Prod. Res. 2021, 59, 47–75. [Google Scholar] [CrossRef]

- Das, R.; Barman, A.; Roy, B.; De, P. Integration of pricing and inventory decisions of deteriorating item in a decentralized supply chain: A Stackelberg-game approach. Int. J. Syst. Assur. Eng. Manag. 2022, 13, 479–493. [Google Scholar] [CrossRef]

- Shao, X. Omnichannel retail move in a dual-channel supply chain. Eur. J. Oper. Res. 2021, 294, 936–950. [Google Scholar] [CrossRef]

- Li, Z.; Yang, W.; Liu, X.; Si, Y. Coupon promotion and its two-stage price intervention on dual-channel supply chain. Comput. Ind. Eng. 2020, 145, 106543. [Google Scholar] [CrossRef]

- Wang, L.; Song, Q. Pricing policies for dual-channel supply chain with green investment and sales effort under uncertain demand. Math. Comput. Simul. 2020, 171, 79–93. [Google Scholar] [CrossRef]

- Wang, T.; Wang, Z.; He, P. Impact of Information Sharing Modes on the Dual-Channel Closed Loop Supply Chains Under Different Power Structures. Asia-Pac. J. Oper. Res. 2021, 38, 2050051. [Google Scholar] [CrossRef]

- Das, R.; Barman, A.; Roy, B.; De, P.K. Pricing and greening strategies in a dual-channel supply chain with cost and profit sharing contracts. Environ. Dev. Sustain. 2022, 1–34. [Google Scholar] [CrossRef]

- Barman, A.; De, P.K.; Chakraborty, A.K.; Lim, C.P.; Das, R. Optimal pricing policy in a three-layer dual-channel supply chain under government subsidy in green manufacturing. Math. Comput. Simul. 2023, 204, 401–429. [Google Scholar] [CrossRef]

- Ma, D.; Hu, J.; Wang, W. Differential game of product-service supply chain considering consumers’ reference effect and supply chain members’ reciprocity altruism in the online-to-offline mode. Ann. Oper. Res. 2021, 304, 263–297. [Google Scholar] [CrossRef]

- Mu, Z.; Liu, X.; Li, K. Optimizing Operating Parameters of a Dual E-Commerce-Retail Sales Channel in a Closed-Loop Supply Chain. IEEE Access 2020, 8, 180352–180369. [Google Scholar] [CrossRef]

- Zhou, Y.; Guo, J.; Zhou, W. Pricing/service strategies for a dual-channel supply chain with free riding and service-cost sharing. Int. J. Prod. Econ. 2018, 196, 198–210. [Google Scholar] [CrossRef]

- Li, G.; Li, L.; Sun, J. Pricing and service effort strategy in a dual-channel supply chain with showrooming effect. Transp. Res. Part E Logist. Transp. Rev. 2019, 126, 32–48. [Google Scholar] [CrossRef]

- Ma, J.; Li, Y.; Wang, Z. Analysis of Pricing and Service Effort in Dual-Channel Supply Chains with Showrooming Effect. Int. J. Bifurc. Chaos Appl. Sci. Eng. 2020, 30, 2050241. [Google Scholar] [CrossRef]

- Wu, Y.; Wang, J.; Chen, L. Optimization and Decision of Supply Chain Considering Negative Spillover Effect and Service Competition. Sustainability 2021, 13, 2320. [Google Scholar] [CrossRef]

- Jiang, Y.; Liu, L.; Lim, A. Optimal pricing decisions for an omni-channel supply chain with retail service. Int. Trans. Oper. Res. 2020, 27, 2927–2948. [Google Scholar] [CrossRef]

- Kang, Y.; Chen, J.; Wu, D. Research on Pricing and Service Level Strategies of Dual Channel Reverse Supply Chain Considering Consumer Preference in Multi-Regional Situations. Int. J. Environ. Res. Public Health 2020, 17, 9143. [Google Scholar] [CrossRef] [PubMed]

- Yang, W.; Si, Y.; Zhang, J.; Liu, S.; Appolloni, A. Coordination Mechanism of Dual-Channel Supply Chains Considering Retailer Innovation Inputs. Sustainability 2021, 13, 813. [Google Scholar] [CrossRef]

- Li, Q.; Li, M.; Huang, Y. Dynamic Investigation in Green Supply Chain considering Channel Service. Complexity 2020, 2020, 1640724. [Google Scholar] [CrossRef]

- Yi, S.; Yu, L.; Zhang, Z. Research on Pricing Strategy of Dual-Channel Supply Chain Based on Customer Value and Value-Added Service. Mathematics 2020, 9, 11. [Google Scholar] [CrossRef]

- Zhang, J.; Zhu, C. Research on the Dynamic Pricing and Service Decisions in the Reverse Supply Chain considering Consumers’ Service Sensitivity. Sustainability 2020, 12, 9348. [Google Scholar] [CrossRef]

- Zhang, F.; Wang, C. Dynamic pricing strategy and coordination in a dual-channel supply chain considering service value. Appl. Math. Model. 2018, 54, 722–742. [Google Scholar] [CrossRef]

- Ke, H.; Jiang, Y. Equilibrium analysis of marketing strategies in supply chain with marketing efforts induced demand considering free riding. Soft Comput. 2020, 25, 2103–2114. [Google Scholar] [CrossRef]

- Yan, N.; Zhang, Y.; Xu, X.; Gao, Y. Online finance with dual channels and bidirectional free-riding effect. Int. J. Prod. Econ. 2021, 231, 107834. [Google Scholar] [CrossRef]

- Iyer, G. Coordinating Channels under Price and Nonprice Competition. Mark. Sci. 1998, 17, 338–355. [Google Scholar] [CrossRef]

| Study Background Assumptions | |

|---|---|

| 1 | Upstream and downstream members of the supply chain are perfectly rational, with manufacturers and retailers being rational people seeking to maximize their own interests |

| 2 | In the dual-channel supply chain, the attitude of the manufacturer and retailer towards risk is neutral |

| 3 | For the convenience of calculation and analysis, it is assumed that the cost per unit product produced by the manufacturer is zero |

| 4 | The production capacity of the manufacturer can meet the market demand, and the products of the network channel and the traditional channel are homogeneous |

| 5 | The retail price of the commodity is always greater than the wholesale price, and the cost of sales in online and offline channels is not considered |

| 6 | The level of service provided by retailers in traditional channels is independent of channel model |

| 7 | The companies studied in this research mainly produce electronic and clothing products |

| Symbols | Definition |

|---|---|

| D | The market demand for products |

| h | The preference coefficient of consumers to offline channels in dual-channel supply chains |

| Pt, Pd | The sales prices of offline channel and online channel products are represented, respectively, |

| M, R | M and R represent the manufacturer dual-channel model and the retailer dual-channel model, respectively |

| Dt | Market demand of offline channel products in dual-channel supply chain |

| Dd | Market demand of online channel products in dual-channel supply chain |

| a’, a | Demand price elasticity coefficient—the degree to which the demand function is affected by the price level of the channel |

| f | When there are both online and offline channels in the dual-channel supply chain, the channel demand is not only affected by the price of the product in the channel but also by the sales price of the product in the competitive channel, which is called cross-price elasticity coefficient, |

| The service cost coefficient, | |

| w | The price per unit product wholesaled by the manufacturer to the retailer |

| c | Production cost per unit of product |

| s | The service level provided by traditional channels |

| r | Demand elasticity coefficient of service, that is, the degree of influence of service level on demand function, |

| e | Consumer free-riding coefficient, |

| ∏m,∏r,∏ | They are, respectively, manufacturer profit, retailer profit, and total supply chain profit |

| The optimal pricing decision |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, X.; Xu, Y.; Chen, X.; Liang, J. Pricing Decision Models of Manufacturer-Led Dual-Channel Supply Chain with Free-Rider Problem. Sustainability 2023, 15, 4087. https://doi.org/10.3390/su15054087

Zhang X, Xu Y, Chen X, Liang J. Pricing Decision Models of Manufacturer-Led Dual-Channel Supply Chain with Free-Rider Problem. Sustainability. 2023; 15(5):4087. https://doi.org/10.3390/su15054087

Chicago/Turabian StyleZhang, Xuelong, Yuxin Xu, Xiaofan Chen, and Jiuying Liang. 2023. "Pricing Decision Models of Manufacturer-Led Dual-Channel Supply Chain with Free-Rider Problem" Sustainability 15, no. 5: 4087. https://doi.org/10.3390/su15054087

APA StyleZhang, X., Xu, Y., Chen, X., & Liang, J. (2023). Pricing Decision Models of Manufacturer-Led Dual-Channel Supply Chain with Free-Rider Problem. Sustainability, 15(5), 4087. https://doi.org/10.3390/su15054087