How to Leverage Big Data Analytic Capabilities for Innovation Ambidexterity: A Mediated Moderation Model

Abstract

1. Introduction

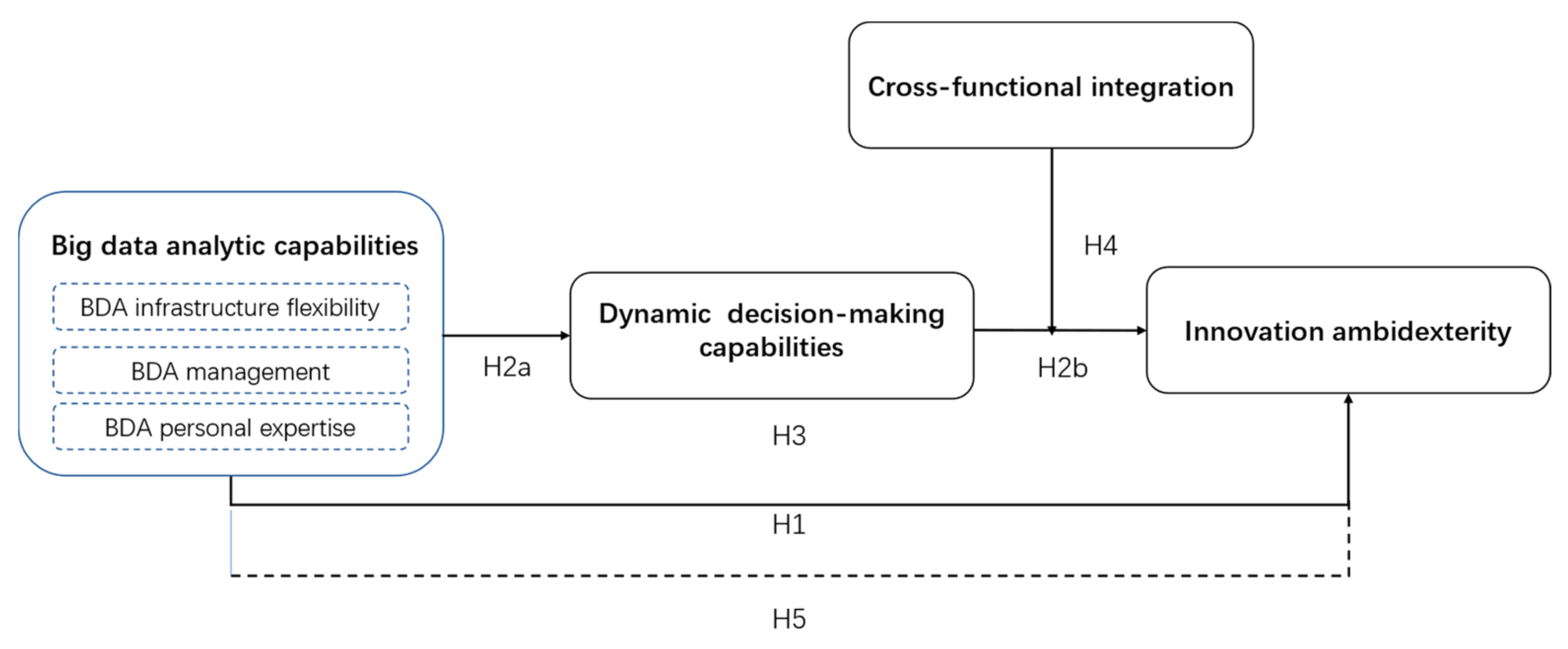

2. Theoretical Foundation and Hypothesis Development

2.1. Knowledge-Based Dynamic Capability View

2.2. Big Data Analytic Capabilities

2.3. BDACs and Innovation Ambidexterity

2.4. Mediating Role of Dynamic-Decision Making

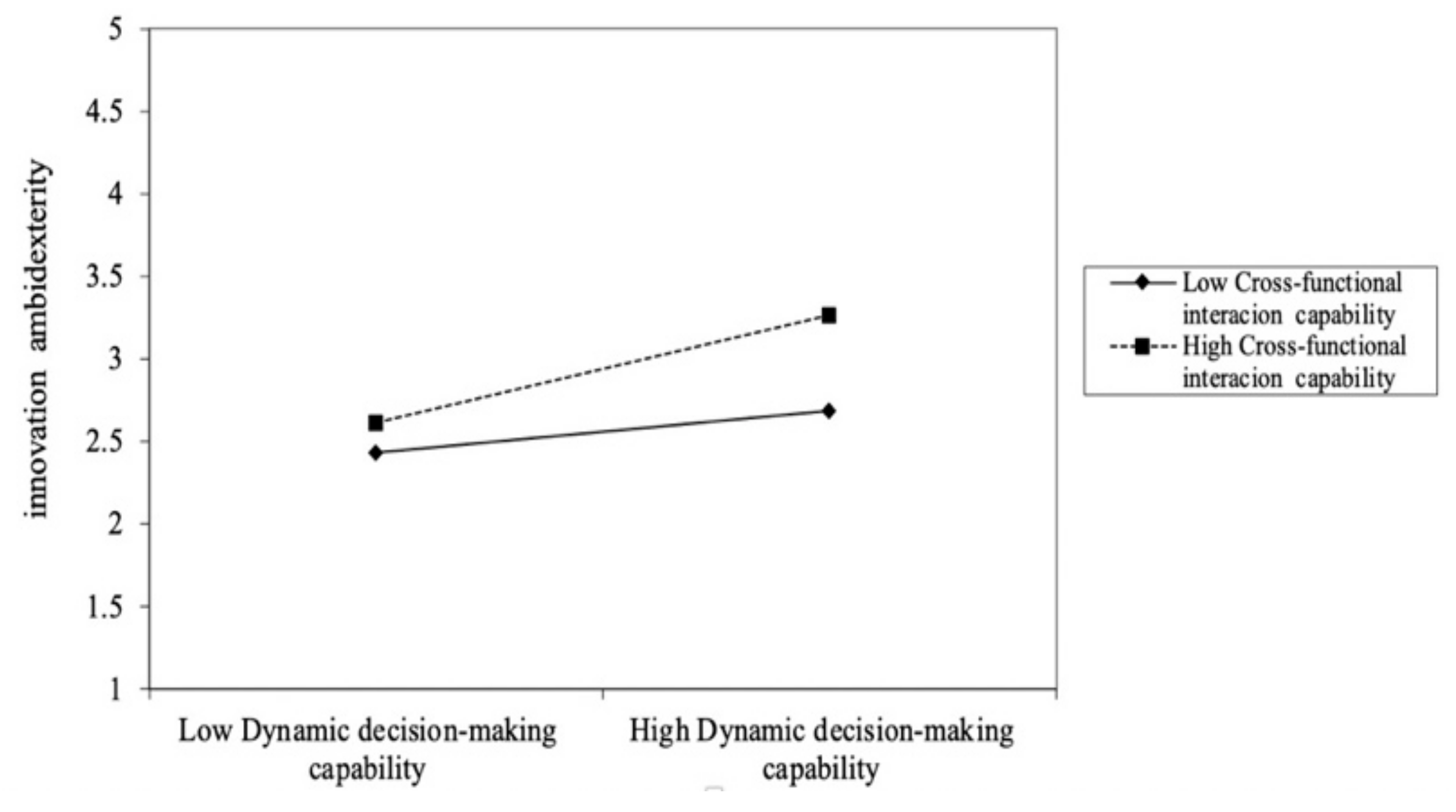

2.5. Moderating Role of Cross-Functional Integration

3. Methodology

3.1. Sample and Data Collection

3.2. Measures and Validation of Constructs

3.3. The Construct Reliability and Validation

4. Analyses and Results

4.1. Descriptive Analysis

4.2. Hypotheses Testing

5. Discussion and Contribution

5.1. Theoretical Implications

5.2. Managerial Implications

6. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Measurement Scales as Used in Survey

| Construct and Their Measures | Loading | AVE | CR | α |

| Big data analytics capabilities | ||||

| BDA Infrastructure Flexibility | 0.537 | 0.874 | 0.803 | |

| Compared to rivals within our industry, our organization has the foremost available analytics systems. | 0.656 | |||

| Our organization utilizes open systems network mechanisms to boost analytics connectivity. | 0.726 | |||

| Software applications can be easily used across multiple analytics platforms. | 0.785 | |||

| Our user interfaces provide transparent access to all platforms. | 0.731 | |||

| Reusable software modules are widely used in new system development. | 0.779 | |||

| The legacy system within our organization restricts the development of new applications. | 0.713 | |||

| BDA Management Capabilities | 0.565 | 0.912 | 0.857 | |

| We continuously examine innovative opportunities for the strategic use of business analytics. | 0.766 | |||

| We enforce adequate plans for the utilization of business analytics. | 0.689 | |||

| When we make business analytics investment decisions, we estimate the effect they will have on the productivity of the employees’ work. | 0.705 | |||

| When we make business analytics investment decisions, we project how much these options will help end users make quicker decisions. | 0.778 | |||

| In our organization, business analysts and line people coordinate their efforts harmoniously. | 0.780 | |||

| In our organization, business analysts and line people from various departments regularly attend cross-functional meetings. | 0.801 | |||

| In our organization, the responsibility for analytics development is clear. | 0.763 | |||

| We are confident that analytics project proposals are properly appraised. | 0.726 | |||

| BDA Personnel Expertise | 0.524 | 0.898 | 0.853 | |

| Our analytics personnel are very capable in terms of programming skills (e.g., structured programming, web-based application, etc.). | 0.737 | |||

| Our analytics personnel are very capable in decision support systems (e.g., expert systems, artificial intelligence, data warehousing, mining, marts, etc.). | 0.751 | |||

| Our analytics personnel show superior understanding of technological trends. | 0.733 | |||

| Our analytics personnel show superior ability to learn new technologies. | 0.718 | |||

| Our analytics personnel are very knowledgeable about the critical factors for the success of our organization. | 0.691 | |||

| Our analytics personnel are very capable in interpreting business problems and developing appropriate solutions. | 0.759 | |||

| Our analytics personnel work closely with customers and maintain productive user/client relationships. | 0.711 | |||

| Our analytics personnel are very capable in terms of executing work in a collective environment. | 0.687 | |||

| Dynamic Decision-making Capability | 0.614 | 0.888 | 0.788 | |

| When we formulate an decision it is usually planned in detail. | 0.726 | |||

| We make our decisions based on a systematic analysis of our business environment. | 0.795 | |||

| We usually make decisions spontaneously. | 0.788 | |||

| We often produce new ideas during the process of decision-making. | 0.816 | |||

| We are very good at finding new solutions to address problems. | 0.789 | |||

| Cross-functional integration | 0.508 | 0.838 | 0.754 | |

| Functional departments within our company have a common prioritization of innovative tasks. | 0.728 | |||

| Our company’s strategic decisions are based on plans agreed upon by all functional departments. | 0.694 | |||

| We freely communicate information about our successful and unsuccessful experiences across all functional areas. | 0.719 | |||

| All of our functional departments are tightly integrated in serving the needs of our target markets. | 0.700 | |||

| All functional departments work hard to jointly solve problems of innovative tasks. | 0.722 | |||

| Exploitation innovation | 0.560 | 0.883 | 0.797 | |

| Our unit accepts demands that go beyond existing products and services. | 0.721 | |||

| We improve our provision’s efficiency of products and services. | 0.718 | |||

| Our unit expands services for existing clients. | 0.755 | |||

| We regularly implement small adaptations to existing products and services. | 0.699 | |||

| We introduce improved, but existing products and services for our local market. | 0.779 | |||

| Lowering costs of internal processes is an important objective. | 0.810 | |||

| Exploration innovation | 0.583 | 0.893 | 0.785 | |

| We commercialize products and services that are completely new to our unit. | 0.780 | |||

| We frequently refine the provision of existing products and services. | 0.738 | |||

| Our unit regularly uses new distribution channels. | 0.754 | |||

| We regularly search for and approach new clients in new markets. | 0.801 | |||

| We experiment with new products and services in our local market. | 0.698 | |||

| We invent new products and services. | 0.805 |

References

- Ciampi, F.; Demi, S.; Magrini, A.; Marzi, G.; Papa, A. Exploring the impact of big data analytics capabilities on business model innovation: The mediating role of entrepreneurial orientation. J. Bus. Res. 2020, 123, 1–13. [Google Scholar] [CrossRef]

- Xie, Z.; Wang, J.; Miao, L. Big data and emerging market firms’ innovation in an open economy: The diversification strategy perspective. Technol. Forecast. Soc. Chang. 2021, 173, 121091. [Google Scholar] [CrossRef]

- Mikalef, P.; Boura, M.; Lekakos, G.; Krogstie, J. Big data analytics capabilities and innovation: The mediating role of dynamic capabilities and moderating effect of the environment. Br. J. Manag. 2018, 30, 272–298. [Google Scholar] [CrossRef]

- Kwon, O.; Lee, N.; Shin, B. Data quality management, data usage experience and acquisition intention of big data analytics. Int. J. Inf. Manag. 2014, 34, 387–394. [Google Scholar] [CrossRef]

- Wolfert, S.; Ge, L.; Verdouw, C.; Bogaardt, M.-J. Big data in smart farming–a review. Agric. Syst. 2017, 153, 69–80. [Google Scholar] [CrossRef]

- Tan, K.H.; Zhan, Y.; Ji, G.; Ye, F.; Chang, C. Harvesting big data to enhance supply chain innovation capabilities: An analytic infrastructure based on deduction graph. Int. J. Prod. Econ. 2015, 165, 223–233. [Google Scholar] [CrossRef]

- Wang, Y.; Kung, L.; Wang, W.Y.C.; Cegielski, C.G. An integrated big data analytics-enabled transformation model: Application to health care. Inf. Manag. 2018, 55, 64–79. [Google Scholar] [CrossRef]

- Mikalef, P.; Krogstie, J.; Pappas, I.O.; Pavlou, P. Exploring the relationship between big data analytics capability and competitive performance: The mediating roles of dynamic and operational capabilities. Inf. Manag. 2020, 57, 103169. [Google Scholar] [CrossRef]

- Akter, S.; Wamba, S.F.; Gunasekaran, A.; Dubey, R.; Childe, S.J. How to improve firm performance using big data analytics capability and business strategy alignment? Int. J. Prod. Econ. 2016, 182, 113–131. [Google Scholar] [CrossRef]

- Zhong, R.Y.; Newman, S.T.; Huang, G.Q.; Lan, S. Big Data for supply chain management in the service and manufacturing sectors: Challenges, opportunities, and future perspectives. Comput. Ind. Eng. 2016, 101, 572–591. [Google Scholar] [CrossRef]

- Raisch, S.; Birkinshaw, J. Organizational ambidexterity: Antecedents, outcomes, and moderators. J. Manag. 2008, 34, 375–409. (In English) [Google Scholar] [CrossRef]

- Benner, M.J.; Tushman, M.L. Exploitation, exploration, and process management: The productivity dilemma revisited. Acad Manag. Rev. 2003, 28, 238–256. (In English) [Google Scholar] [CrossRef]

- Wamba, S.F.; Dubey, R.; Gunasekaran, A.; Akter, S. The performance effects of big data analytics and supply chain ambidexterity: The moderating effect of environmental dynamism. Int. J. Prod. Econ. 2020, 222, 107498. [Google Scholar] [CrossRef]

- Shamim, S.; Zeng, J.; Choksy, U.S.; Shariq, S.M. Connecting big data management capabilities with employee ambidexterity in Chinese multinational enterprises through the mediation of big data value creation at the employee level. Int. Bus. Rev. 2020, 29, 101604. [Google Scholar] [CrossRef]

- Shamim, S.; Zeng, J.; Khan, Z.; Zia, N.U. Big data analytics capability and decision making performance in emerging market firms: The role of contractual and relational governance mechanisms. Technol. Forecast. Soc. Chang. 2020, 161, 120315. [Google Scholar] [CrossRef]

- Hughes, P.; Souchon, A.; Nemkova, E.; Hodgkinson, I.; Oliveira, J.; Boso, N.; Hultman, M.; Yeboah-Banin, A.; Sychangco, J. Quadratic effects of dynamic decision-making capability on innovation orientation and performance: Evidence from Chinese exporters. Ind. Market Manag. 2019, 83, 59–69. [Google Scholar] [CrossRef]

- Yli-Renko, H.; Autio, E.; Sapienza, H.J. Social capital, knowledge acquisition, and knowledge exploitation in young technology-based firms. Strat. Manag. J. 2001, 22, 587–613. [Google Scholar] [CrossRef]

- Troy, L.C.; Hirunyawipada, T.; Paswan, A.K. Cross-functional integration and new product success: An empirical investigation of the findings. J. Mark. 2008, 72, 132–146. [Google Scholar] [CrossRef]

- Carayannopoulos, S.; Auster, E.R. External knowledge sourcing in biotechnology through acquisition versus alliance: A KBV approach. Res. Policy 2010, 39, 254–267. [Google Scholar] [CrossRef]

- Grant, R.M. Toward a knowledge-based theory of the firm. Strat. Manag. J. 1996, 17, 109–122. [Google Scholar] [CrossRef]

- Verona, G. A resource-based view of product development. Acad. Manag. Rev. 1999, 24, 132–142. [Google Scholar] [CrossRef]

- Teece, D.J.; Pisano, G.; Shuen, A. Dynamic capabilities and strategic management. Strateg. Manag. J. 1997, 18, 509–533. [Google Scholar] [CrossRef]

- Zheng, S.; Zhang, W.; Du, J. Knowledge-based dynamic capabilities and innovation in networked environments. J. Knowl. Manag. 2011, 15, 1035–1051. [Google Scholar] [CrossRef]

- Easterby-Smith, M.; Prieto, I.M. Dynamic capabilities and knowledge management: An integrative role for learning? Br. J. Manag. 2008, 19, 235–249. [Google Scholar] [CrossRef]

- Oliva, F.L.; Couto, M.H.G.; Santos, R.F.; Bresciani, S. The integration between knowledge management and dynamic capabilities in agile organizations. Manag. Decis. 2018, 57, 1960–1979. [Google Scholar] [CrossRef]

- Teece, D.J. Explicating dynamic capabilities: The nature and microfoundations of (sustainable) enterprise performance. Strat. Manag. J. 2007, 28, 1319–1350. [Google Scholar] [CrossRef]

- Liu, H.; Ke, W.; Wei, K.K.; Hua, Z. The impact of IT capabilities on firm performance: The mediating roles of absorptive capacity and supply chain agility. Decis. Support Syst. 2013, 54, 1452–1462. [Google Scholar] [CrossRef]

- Winter, S.G. Understanding dynamic capabilities. Strateg. Manag. J. 2003, 24, 991–995. [Google Scholar] [CrossRef]

- Kaur, V. Knowledge-Based Dynamic Capabilities and Competitive Advantage–Data Analysis and Interpretations. In Knowledge-Based Dynamic Capabilities: The Road Ahead in Gaining Organizational Competitiveness; Springer: Cham, Switzerland, 2019; pp. 145–208. [Google Scholar]

- Kaur, V. Knowledge-based dynamic capabilities: A scientometric analysis of marriage between knowledge management and dynamic capabilities. J. Knowl. Manag. 2022. [Google Scholar] [CrossRef]

- Bharadwaj, A.S. A resource-based perspective on information technology capability and firm performance: An empirical investigation. MIS Q. 2000, 24, 169–196. [Google Scholar] [CrossRef]

- Bhatt, G.D.; Grover, V. Types of information technology capabilities and their role in competitive advantage: An empirical study. J. Manag. Inf. Syst. 2005, 22, 253–277. [Google Scholar] [CrossRef]

- Rialti, R.; Zollo, L.; Ferraris, A.; Alon, I. Big data analytics capabilities and performance: Evidence from a moderated multi-mediation model. Technol. Forecast. Soc. Chang. 2019, 149, 119781. [Google Scholar] [CrossRef]

- Gupta, M.; George, J.F. Toward the development of a big data analytics capability. Inf. Manag. 2016, 53, 1049–1064. [Google Scholar] [CrossRef]

- Rialti, R.; Marzi, G.; Silic, M.; Ciappei, C. Ambidextrous organization and agility in big data era: The role of business process management systems. Bus. Process Manag. J. 2018, 24, 1091–1109. [Google Scholar] [CrossRef]

- Sheng, M.L.; Saide, S. Supply chain survivability in crisis times through a viable system perspective: Big data, knowledge ambidexterity, and the mediating role of virtual enterprise. J. Bus. Res. 2021, 137, 567–578. [Google Scholar] [CrossRef]

- Kim, G.; Shin, B.; Kim, K.K.; Lee, H.G. IT capabilities, process-oriented dynamic capabilities, and firm financial performance. J. Assoc. Inf. Syst. 2011, 12, 1. [Google Scholar] [CrossRef]

- Wamba, S.F.; Gunasekaran, A.; Akter, S.; Ren, S.J.-F.; Dubey, R.; Childe, S.J. Big data analytics and firm performance: Effects of dynamic capabilities. J. Bus. Res. 2017, 70, 356–365. [Google Scholar] [CrossRef]

- Cabeza-Pullés, D.; Fernández-Pérez, V.; Roldán-Bravo, M.I. Internal networking and innovation ambidexterity: The mediating role of knowledge management processes in university research. Eur. Manag. J. 2020, 38, 450–461. [Google Scholar] [CrossRef]

- March, J.G. Exploration and exploitation in organizational learning. Organ. Sci. 1991, 2, 71–87. [Google Scholar] [CrossRef]

- Gupta, A.K.; Smith, K.G.; Shalley, C.E. The interplay between exploration and exploitation. Acad. Manag. J. 2006, 49, 693–706. [Google Scholar] [CrossRef]

- Tushman, M.L.; Iii O’Reilly, C.A. Ambidextrous organizations: Managing evolutionary and revolutionary change. Califor. Manag. Rev. 1996, 1996 38, 8–29. [Google Scholar] [CrossRef]

- Sinha, S. Managing an ambidextrous organization: Balancing innovation and efficiency. Strat. Dir. 2016, 32, 35–37. [Google Scholar] [CrossRef]

- Simsek, Z.; Heavey, C.; Veiga, J.F.; Souder, D. A typology for aligning organizational ambidexterity’s conceptualizations, antecedents, and outcomes. J. Manag. Stud. 2009, 46, 864–894. [Google Scholar] [CrossRef]

- Dezi, L.; Santoro, G.; Gabteni, H.; Pellicelli, A.C. The role of big data in shaping ambidextrous business process management: Case studies from the service industry. Bus. Process Manag. J. 2018, 24, 1163–1175. [Google Scholar] [CrossRef]

- Božič, K.; Dimovski, V. Business intelligence and analytics use, innovation ambidexterity, and firm performance: A dynamic capabilities perspective. J. Strateg. Inf. Syst. 2019, 28, 101578. [Google Scholar] [CrossRef]

- Panda, S.; Rath, S.K. Information technology capability, knowledge management capability, and organizational agility: The role of environmental factors. J. Manag. Organ. 2018, 27, 148–174. [Google Scholar] [CrossRef]

- Yu, W.; Zhao, G.; Liu, Q.; Song, Y. Role of big data analytics capability in developing integrated hospital supply chains and operational flexibility: An organizational information processing theory perspective. Technol. Forecast. Soc. Chang. 2021, 163, 120417. [Google Scholar] [CrossRef]

- Mihalache, O.R.; Jansen, J.J.P.; Van den Bosch, F.A.J.; Volberda, H.W. Top management team shared leadership and organizational ambidexterity: A moderated mediation framework. Strat. Entrep. J. 2014, 8, 128–148. [Google Scholar] [CrossRef]

- Goksoy, S. Analysis of the Relationship between Shared Leadership and Distributed Leadership. Eur. J. Educ. Res. 2016, 16, 1–35. [Google Scholar] [CrossRef]

- Soto-Acosta, P.; Popa, S.; Martinez-Conesa, I. Information technology, knowledge management and environmental dynamism as drivers of innovation ambidexterity: A study in SMEs. J. Knowl. Manag. 2018, 22, 822–849. [Google Scholar] [CrossRef]

- Craig, J.B.; Dibrell, C.; Garrett, R. Examining relationships among family influence, family culture, flexible planning systems, innovativeness and firm performance. J. Fam. Bus. Strat. 2014, 5, 229–238. [Google Scholar] [CrossRef]

- Nemkova, E. The impact of agility on the market performance of born-global firms: An exploratory study of the ‘Tech City’innovation cluster. J. Bus. Res. 2017, 80, 257–265. [Google Scholar] [CrossRef]

- Souchon, A.L.; Hughes, P.; Farrell, A.M.; Nemkova, E.; Oliveira, J.S. Spontaneity and international marketing performance. Int. Mark. Rev. 2016, 33, 671–690. [Google Scholar] [CrossRef]

- Teece, D.J. A dynamic capabilities-based entrepreneurial theory of the multinational enterprise. J. Int. Bus. Stud. 2014, 45, 8–37. [Google Scholar] [CrossRef]

- AL-Khatib, A.; Shuhaiber, A. Green intellectual capital and green supply chain performance: Does big data analytics capabilities matter? Sustainability 2022, 14, 10054. [Google Scholar] [CrossRef]

- Ghasemaghaei, M.; Calic, G. Does big data enhance firm innovation competency? The mediating role of data-driven insights. J. Bus. Res. 2019, 104, 69–84. [Google Scholar] [CrossRef]

- Helfat, C.E.; Winter, S.G. Untangling dynamic and operational capabilities: Strategy for the (N) ever-changing world. Strat. Manag. J. 2011, 32, 1243–1250. [Google Scholar] [CrossRef]

- Salomo, S.; Weise, J.; Gemünden, H.G. NPD planning activities and innovation performance: The mediating role of process management and the moderating effect of product innovativeness. J. Prod. Innov. Manag. 2007, 24, 285–302. [Google Scholar] [CrossRef]

- Dew, N.; Read, S.; Sarasvathy, S.D.; Wiltbank, R. Effectual versus predictive logics in entrepreneurial decision-making: Differences between experts and novices. J. Bus. Ventur. 2009, 24, 287–309. [Google Scholar] [CrossRef]

- Song, X.M.; Montoya-Weiss, M.M.; Schmidt, J.B. Antecedents and consequences of cross-functional cooperation: A comparison of R&D, manufacturing, and marketing perspectives. J. Prod. Innov. Manag. Int. Publ. Prod. Dev. Manag. Assoc. 1997, 14, 35–47. [Google Scholar]

- Pellathy, D.A.; Mollenkopf, D.A.; Stank, T.P.; Autry, C.W. Cross-functional integration: Concept clarification and scale development. J. Bus. Logist. 2019, 40, 81–104. [Google Scholar] [CrossRef]

- Sethi, R. New product quality and product development teams. J. Mark. 2000, 64, 1–14. [Google Scholar] [CrossRef]

- Cheng, C.C.; Yang, C.; Sheu, C. Effects of open innovation and knowledge-based dynamic capabilities on radical innovation: An empirical study. J. Eng. Technol. Manag. 2016, 41, 79–91. [Google Scholar] [CrossRef]

- Hirunyawipada, T.; Beyerlein, M.; Blankson, C. Cross-functional integration as a knowledge transformation mechanism: Implications for new product development. Ind. Mark. Manag. 2009, 39, 650–660. [Google Scholar] [CrossRef]

- Yang, S.-Y.; Tsai, K.-H. Lifting the veil on the link between absorptive capacity and innovation: The roles of cross-functional integration and customer orientation. Ind. Mark. Manag. 2019, 82, 117–130. [Google Scholar] [CrossRef]

- Gardner, H.K.; Gino, F.; Staats, B.R. Dynamically integrating knowledge in teams: Transforming resources into performance. Acad. Manag. J. 2012, 55, 998–1022. [Google Scholar] [CrossRef]

- Adler, P.; Heckscher, C.; Prusak, L. Cómo construir una empresa colaborativa: Cuatro claves para crear una cultura de confianza y trabajo en equipo. Harv. Bus. Rev. 2011, 89, 44–52. [Google Scholar]

- Kaur, V.; Mehta, V. Knowledge-based dynamic capabilities: A new perspective for achieving global competitiveness in IT sector. Pac. Bus. Rev. Int. 2016, 1, 95–106. [Google Scholar]

- Shamim, S.; Zeng, J.; Shariq, S.M.; Khan, Z. Role of big data management in enhancing big data decision-making capability and quality among Chinese firms: A dynamic capabilities view. Inf. Manag. 2018, 56, 103135. [Google Scholar] [CrossRef]

- DeVellis, R.F. Scale Development: Theory and Applications; Sage Publications: Saunders Oaks, CA, USA, 2016. [Google Scholar]

- Armstrong, J.S.; Overton, T.S. Estimating nonresponse bias in mail surveys. J. Mark. Res. 1977, 14, 396–402. [Google Scholar] [CrossRef]

- Jansen; Van Den Bosch, F. A.J. Exploratory innovation, exploitative innovation, and performance: Effects of organizational antecedents and environmental moderators. Manag. Sci. 2006, 52, 1661–1674. [Google Scholar]

- Swink, M.; Schoenherr, T. The effects of cross-functional integration on profitability, process efficiency, and asset productivity. J. Bus. Logist. 2015, 36, 69–87. [Google Scholar] [CrossRef]

- Hmieleski, K.M.; Corbett, A.C. Proclivity for improvisation as a predictor of entrepreneurial intentions. J. Small Bus. Manag. 2006, 44, 45–63. [Google Scholar] [CrossRef]

- Perreault, W.D.; Leigh, L.E. Reliability of nominal data based on qualitative judgments. J. Mark. Res. 1989, 26, 135. [Google Scholar] [CrossRef]

- Anderson, J.C.; Gerbing, D.W. Structural equation modeling in practice: A review and recommended two-step approach. Psychol. Bull. 1988, 103, 411. [Google Scholar] [CrossRef]

- Moss, S.; Prosser, H.; Costello, H.; Simpson, N.; Patel, P.; Rowe, S.; Turner, S.; Hatton, C. Reliability and validity of the PAS-ADD Checklist for detecting psychiatric disorders in adults with intellectual disability. J. Intellect. Disabil. Res. 1998, 42, 173–183. [Google Scholar] [CrossRef]

- Cohen, J.; Cohen, P. Applied Multiple Regression/Correlation Analysis for the Behavioral Sciences, 3rd ed.; L. Erlbaum Associates: Mahwah, NJ, USA, 2003. [Google Scholar]

- Greene, W.H. Econometric Analysis; Prentice Hall International Inc: Hoboken, NJ, USA, 2000. [Google Scholar]

- Preacher, K.J.; Rucker, D.D.; Hayes, A.F. Addressing moderated mediation hypotheses: Theory, methods, and prescriptions. Multivar. Behav. Res. 2007, 42, 185–227. [Google Scholar] [CrossRef]

- Zhao, X.; Lynch, J.G., Jr.; Chen, Q. Reconsidering Baron and Kenny: Myths and truths about mediation analysis. J. Consum. Res. 2010, 37, 197–206. [Google Scholar] [CrossRef]

- Mikalef, P.; Krogstie, J. Examining the interplay between big data analytics and contextual factors in driving process innovation capabilities. Eur. J. Inf. Syst. 2020, 29, 260–287. [Google Scholar] [CrossRef]

- Olabode, O.E.; Boso, N.; Hultman, M.; Leonidou, C.N. Big data analytics capability and market performance: The roles of disruptive business models and competitive intensity. J. Bus. Res. 2021, 139, 1218–1230. [Google Scholar] [CrossRef]

- Li, L.; Lin, J.; Ouyang, Y.; Luo, X.R. Evaluating the impact of big data analytics usage on the decision-making quality of organizations. Technol. Forecast. Soc. Chang. 2021, 175, 121355. [Google Scholar] [CrossRef]

- Ghasemaghaei, M.; Ebrahimi, S.; Hassanein, K. Data analytics competency for improving firm decision making performance. J. Strateg. Inf. Syst. 2018, 27, 101–113. [Google Scholar] [CrossRef]

- Strese, S.; Meuer, M.W.; Flatten, T.C.; Brettel, M. Examining cross-functional coopetition as a driver of organizational ambidexterity. Ind. Mark. Manag. 2016, 57, 40–52. [Google Scholar] [CrossRef]

- Amankwah-Amoah, J.; Adomako, S. The effects of knowledge integration and contextual ambidexterity on innovation in entrepreneurial ventures. J. Bus. Res. 2021, 127, 312–321. [Google Scholar] [CrossRef]

- Behl, A.; Gaur, J.; Pereira, V.; Yadav, R.; Laker, B. Role of big data analytics capabilities to improve sustainable competitive advantage of MSME service firms during COVID-19—A multi-theoretical approach. J. Bus. Res. 2022, 148, 378–389. [Google Scholar] [CrossRef]

| Model | χ2/df | RMSEA | CFI | TLI | SRMR | |

|---|---|---|---|---|---|---|

| Baseline model | Four factors | 1.75 | 0.053 | 0.923 | 0.921 | 0.057 |

| Model 1 | Three factors | 2.14 | 0.069 | 0.892 | 0.849 | 0.085 |

| Model 2 | Two factors | 2.36 | 0.084 | 0.813 | 0.773 | 0.089 |

| Model 3 | One factor model | 3.51 | 0.099 | 0.754 | 0.712 | 0.094 |

| Firm Characteristics | Frequency | Percentage (%) |

|---|---|---|

| Firm size (of employees) | ||

| <50 | 11 | 5.5 |

| 51–100 | 32 | 16.1 |

| 101–200 | 31 | 15.6 |

| 201–500 | 63 | 31.7 |

| 501–1000 | 33 | 16.6 |

| >1000 | 29 | 14.5 |

| Firm age (years) | ||

| <3 | 7 | 3.5 |

| 3–10 | 79 | 39.7 |

| 10–20 | 85 | 42.7 |

| >20 | 28 | 14.1 |

| Respondent’s Position | ||

| Vice President of above | 45 | 22.6 |

| Middle manager | 120 | 60.3 |

| Senior Technical | 30 | 15.1 |

| Directors | 4 | 2.0 |

| Mean | SD. | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1. Firm Size | 3.65 | 1.437 | |||||||||||||

| 2. Firm age | 3.71 | 0.854 | 0.515 | ||||||||||||

| 3. IC1 | 0.172 | 0.217 | −0.079 | 0.124 | |||||||||||

| 4. IC2 | 0.153 | 0.287 | −0.098 | 0.178 * | −0.121 | ||||||||||

| 5. IC3 | 0.089 | 0.315 | 0.016 | 0.091 | −0.087 | −0.081 | |||||||||

| 6. IC4 | 0.212 | 0.159 | 0.031 | 0.212 | −0.067 | −0.023 | −0.021 | ||||||||

| 7. ET | 3.870 | 0.653 | 0.078 * | 0.045 | −0.064 | −0.120 | −0.033 | −0.125 | |||||||

| 8. BDAI | 3.929 | 0.646 | 0.168 * | 0.102 | −0.175 | −0.184 | −0.126 | 0.133 | 0.326 * | ||||||

| 9. BDAM | 3.988 | 0.586 | 0.171 | 0.139 | −0.019 | −0.174 | −0.147 | −0.119 | 0.188 | 0.622 ** | |||||

| 10. BDAP | 4.089 | 0.592 | 0.133 | 0.113 | −0.062 * | −0.207 | −0.211 | −0.088 | 0.396 * | 0.619 ** | 0.599 ** | ||||

| 11. DMC | 4.193 | 0.613 | −0.017 | −0.119 | −0.045 | −0.126 | 0.011 | −0.146 | 0.533 ** | 0.511 ** | 0.502 ** | 0.436 ** | |||

| 12. CFC | 4.084 | 0.578 | 0.127 * | −0.118 | −0.121 | −0.154 | −0.168 | −0.173 | 0.419 ** | 0.486 ** | 0.443 ** | 0.423 ** | 0.390 ** | ||

| 13. ERI | 4.019 | 0.434 | −0.041 | 0.196 | −0.023 | −0.116 | −0.203 | −0.202 | 0.488 ** | 0.472 ** | 0.416 ** | 0.372 ** | 0.406 *** | 0.487 *** | |

| 14. EII | 3.986 | 0.598 | −0.057 | 0.213 | 0.018 | −0.134 | −0.165 | −0.191 | 0.476 ** | 0.455 ** | 0.439 ** | 0.381 ** | 0.412 *** | 0.510 *** | 0.647 *** |

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | Model 8 | |

|---|---|---|---|---|---|---|---|---|

| Dynamic Decision- Making Capability | Innovation Ambidexterity | |||||||

| Control variable | ||||||||

| Firm Size | 0.113 (0.219) | 0.076 (0.256) | 0.077 (0.037) | 0.069 (0.577) | 0.070 (0.978) | 0.062 (0.747) | 0.059 (0.229) | 0.055 (0.331) |

| Firm Age | 0.069 (0.764) | 0.057 (0.669) | 0.094 (1.259) | 0.081 (1.233) | 0.077 (1.369) | 0.091 (1.225) | 0.083 (1.617) | 0.079 (1.585) |

| IC1 | −0.035 (−1.891) | −0.055 (1.071) | −0.024 (−0.354) | −0.017 (−0.722) | −0.021 (−1.214) | −0.027 (−0.539) | −0.020 (−0.878) | −0.022 (−0.819) |

| IC2 | −0.061 (−1.263) | −0.055 (1.071) | −0.033 (−0.817) | −0.026 (−0.157) | −0.031 (−1.552) | −0.029 (−0.337) | −0.019 (−0.518) | −0.016 (−0.421) |

| IC3 | −0.125 * (−2.376) | −0.055 (1.071) | −0.151 (−1.055) | −0.075 (−0.418) | −0.067 (−0.689) | −0.069 (−0.782) | −0.062 (−0.653) | −0.066 (−0.562) |

| IC4 | −0.098 (−1.891) | −0.073 (1.139) | −0.089 (−0.257) | −0.077 (−0.775) | −0.081 (−1.306) | −0.079 (−0.504) | −0.068 (−0.512) | −0.066 (−0.489) |

| ET | 0.316 * (2.322) | 0.227 (6.345) | 0.313 * (2.424) | 0.265 (1.387) | 0.215 (1.214) | 0.101 (1.087) | 0.108 (1.452) | 0.099 (1.365) |

| Independent variable | ||||||||

| BDACS | 0.379 *** (4.409) | 0.365 *** (5.216) | 0.298 *** (4.746) | 0.302 *** (5.172) | 0.267 *** (4.032) | 0.216 *** (4.442) | ||

| Mediator | ||||||||

| DMC | 0.265 ** (3.187) | 0.261 ** (3.837) | 0.193 * (2.721) | |||||

| Moderator | ||||||||

| CFC | 0.231 (1.556) | 0.211 (1.032) | 0.176 (4.442) | |||||

| DMC × CFC | 0.109 * (2.480) | |||||||

| R2 | 0.255 | 0.463 | 0.287 | 0.378 | 0.395 | 0.336 | 0.401 | 0.412 |

| Adjust R2 | 0.248 | 0.442 | 0.265 | 0.346 | 0.361 | 0.317 | 0.388 | 0.391 |

| F | 25.178 *** | 46.128 *** | 17.196 *** | 19.345 *** | 18.176 *** | 28.134 *** | 26.358 *** | 27.675 *** |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liao, S.; Hu, Q.; Wei, J. How to Leverage Big Data Analytic Capabilities for Innovation Ambidexterity: A Mediated Moderation Model. Sustainability 2023, 15, 3948. https://doi.org/10.3390/su15053948

Liao S, Hu Q, Wei J. How to Leverage Big Data Analytic Capabilities for Innovation Ambidexterity: A Mediated Moderation Model. Sustainability. 2023; 15(5):3948. https://doi.org/10.3390/su15053948

Chicago/Turabian StyleLiao, Suqin, Qianying Hu, and Jingjing Wei. 2023. "How to Leverage Big Data Analytic Capabilities for Innovation Ambidexterity: A Mediated Moderation Model" Sustainability 15, no. 5: 3948. https://doi.org/10.3390/su15053948

APA StyleLiao, S., Hu, Q., & Wei, J. (2023). How to Leverage Big Data Analytic Capabilities for Innovation Ambidexterity: A Mediated Moderation Model. Sustainability, 15(5), 3948. https://doi.org/10.3390/su15053948