Renewable and Non-Renewable Energy Consumption and Its Impact on Economic Growth

Abstract

1. Introduction

2. Literature Review

3. Materials and Methods

3.1. Methods

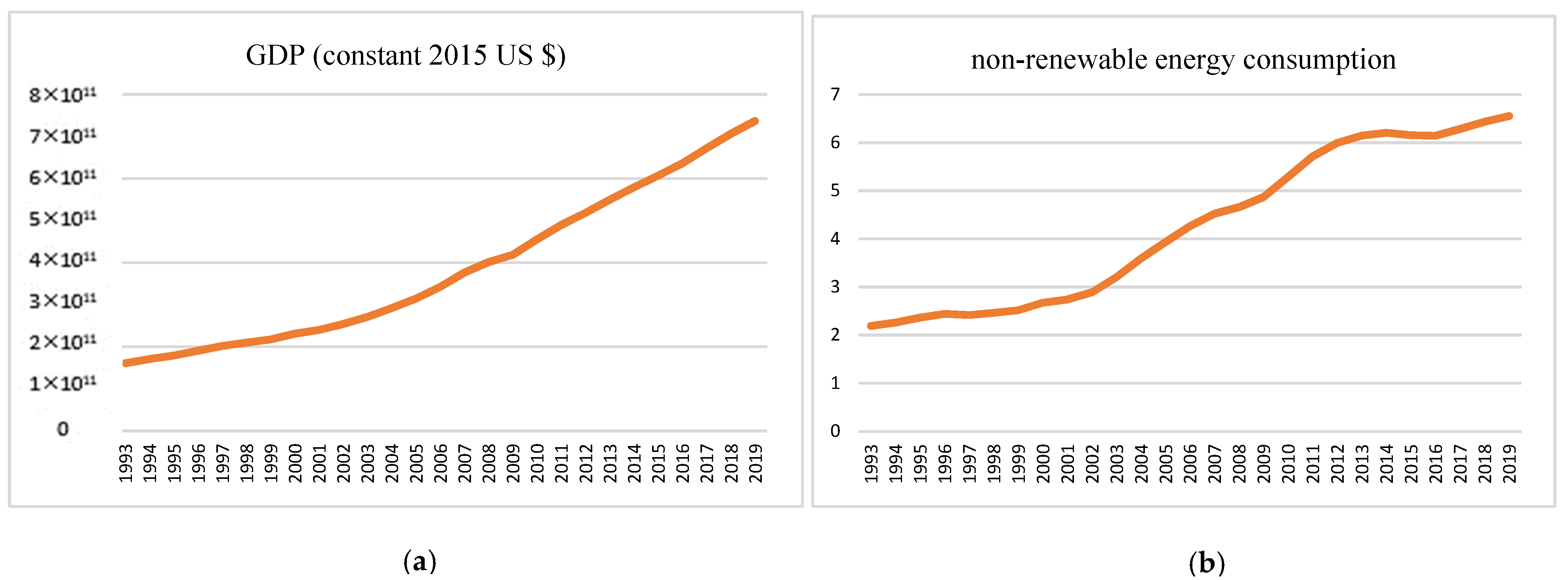

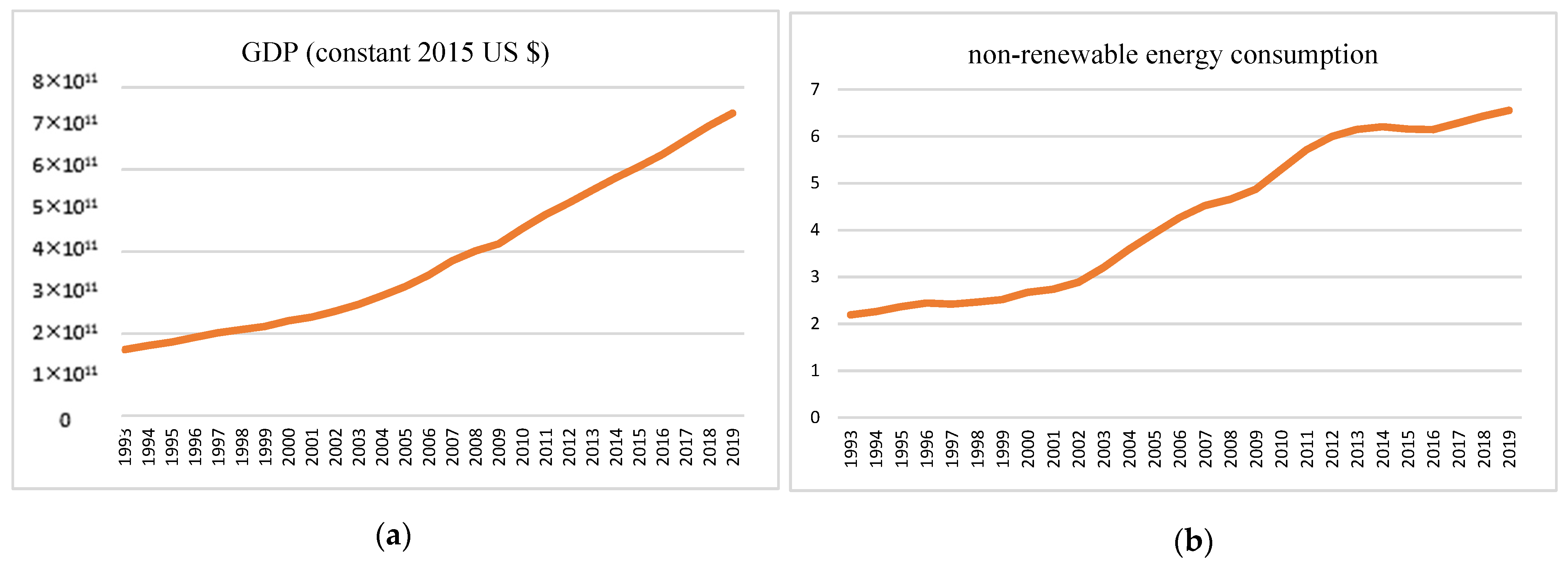

3.2. Data Description and Model Variables

4. Results and Discussions

5. Conclusions, Implications, and Limitations

5.1. Main Findings

5.2. Theoretical and Practical Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Developed Countries | |||

| Australia | Germany | Norway | United Kingdom |

| Austria | Hong Kong SAR | New Zealand | Chile |

| Argentina | Ireland | Portugal | Denmark |

| Belgium | Iceland | Spain | Italy |

| Canada | Japan | Switzerland | Russian |

| France | Korea, Rep | Sweden | Romania |

| Finland | Luxembourg | Singapore | |

| Greece | Netherlands | United States | |

| Developing Countries | |||

| Albania | Cuba | Panama | |

| Algeria | Dominican Republic | Peru | |

| Armenia | Ecuador | Sri Lanka | |

| Azerbaijan | Georgia | Thailand | |

| Belarus | Iran (Islamic Republic of) | Trinidad and Tobago | |

| Brazil | Lebanon | Tunisia | |

| Bulgaria | Malaysia | Turkey | |

| China | Mauritius | Ukraine | |

| Colombia | Mexico | Uruguay | |

| Costa Rica | Mongolia | ||

References

- Hasanov, F.; Bulut, C.; Suleymanov, E. Review of energy-growth nexus: Panel analysis for ten Eurasian oil exporting countries. Renew. Sustain. Energy Rev. 2017, 73, 369–386. [Google Scholar] [CrossRef]

- Ahmed, M.; Azam, M. Causal nexus between energy consumption and economic growth for high-, middle- and low-income countries using frequency domain analysis. Renew. Sustain. Energy Rev. 2016, 60, 653–678. [Google Scholar] [CrossRef]

- Mulugetta, Y.; Ben Hagan, E.; Kammen, D. Energy access for sustainable development. Env. Res. Lett. 2019, 14, 020201. [Google Scholar] [CrossRef]

- Ellabban, O.; Abu-Rub, H.; Blaabjerg, F. Renewable energy resources: Current status, future prospects and their enabling technology. Renew. Sustain. Energy Rev. 2014, 39, 748–764. [Google Scholar] [CrossRef]

- Aslan, A.; Apergis, N.; Yildirim, S. Causality between energy consumption and GDP in the US: Evidence from wavelet analysis. Front. Energy 2014, 8, 1–8. [Google Scholar] [CrossRef]

- Marques, A.C.; Fuinhas, J.A. Is renewable energy effective in promoting growth? Energy Policy 2012, 46, 434–442. [Google Scholar] [CrossRef]

- Sadorsky, P. Renewable energy consumption and income in emerging economies. Energy Policy 2009, 37, 4021–4028. [Google Scholar] [CrossRef]

- Energy Information Administration, EIA. Available online: http://www.eia.gov/todayinenergy/detail.cfm?Id=3270 (accessed on 12 December 2017).

- Kahia, M.; Aïssa, M.S.B.; Lanouar, C. Renewable and non-renewable energy use-economic growth nexus: The case of MENA Net Oil Importing Countries. Renew. Sustain. Energy Rev. 2017, 71, 127–140. [Google Scholar] [CrossRef]

- Apergis, N.; Payne, J.E. Renewable, and non-renewable energy consumption-growth nexus: Evidence from a panel error correction model. Energy Econ. 2012, 34, 733–738. [Google Scholar] [CrossRef]

- Koçak, E.; Şarkgüneşi, A. The renewable energy and economic growth nexus in Black Sea and Balkan countries. Energy Policy 2017, 100, 51–57. [Google Scholar] [CrossRef]

- Owusu Appiah, M. Investigating the multivariate Granger causality between energy consumption, economic growth and CO2 emissions in Ghana. Energy Policy 2018, 112, 198–208. [Google Scholar] [CrossRef]

- Mutascu, M. A bootstrap panel Granger causality analysis of energy consumption and economic growth in the G7 countries. Renew. Sustain. Energy Rev. 2016, 63, 166–171. [Google Scholar] [CrossRef]

- Salim, R.A.; Rafiq, S. Why do some emerging economies proactively accelerate the adoption of renewable energy? Energy Econ. 2012, 34, 1051–1057. [Google Scholar] [CrossRef]

- Tang, C.F.; Tan, E.C. Exploring the nexus of electricity consumption, economic growth, energy prices and technology innovation in Malaysia. Appl. Energy 2013, 104, 297–305. [Google Scholar] [CrossRef]

- Espoir, D.K.; Sunge, R.; Bannor, F. Economic growth, renewable and nonrenewable electricity consumption: Fresh evidence from a panel sample of African countries. Energy Nexus 2023, 9, 100165. [Google Scholar] [CrossRef]

- Bhattacharya, M.; Paramati, S.R.; Ozturk, I.; Bhattacharya, S. The effect of renewable energy consumption on economic growth: Evidence from top 38 countries. Appl. Energy 2016, 162, 733–741. [Google Scholar] [CrossRef]

- Bilgili, F. Business cycle co-movements between renewables consumption and industrial production: A continuous wavelet coherence approach. Renew. Sustain. Energy Rev. 2015, 52, 325–332. [Google Scholar] [CrossRef]

- Adams, S.; Klobodu, E.K.M.; Opoku, E.E.O. Energy consumption, political regime, and economic growth in sub-Saharan Africa. Energy Policy 2016, 96, 36–44. [Google Scholar] [CrossRef]

- Rafindadi, A.A.; Ozturk, I. Impacts of renewable energy consumption on the German economic growth: Evidence from combined cointegration test. Renew. Sustain. Energy Rev. 2017, 75, 1130–1141. [Google Scholar] [CrossRef]

- Atems, B.; Hotaling, C. The effect of renewable and nonrenewable electricity generation on economic growth. Energy Policy 2018, 112, 111–118. [Google Scholar] [CrossRef]

- Pinzon, K. Dynamics between energy consumption and economic growth in Ecuador: A granger causality analysis. Econ. Anal. Policy 2018, 57, 88–101. [Google Scholar] [CrossRef]

- AlKhars, M.; Miah, F.; Qudrat-Ullah, H.; Kayal, A. A Systematic Review of the Relationship between Energy Consumption and Economic Growth in GCC Countries. Sustainability 2020, 12, 3845. [Google Scholar] [CrossRef]

- Guler, H.; Haykır, O.; Oz, S. Does the electricity consumption and economic growth nexus alter during COVID-19 pandemic? Evidence from European countries. Electr. J. 2021, 35, 107144. [Google Scholar] [CrossRef]

- Azam, M.; Rafiq, M.; Shafique, H.; Zhang, M.; Ateeq, J. Analyzing the relationship between economic growth and electricity consumption from renewable and non-renewable sources: Fresh evidence from newly industrialized countries. Sustain. Energy Technol. 2020, 44, 100991. [Google Scholar] [CrossRef]

- Ghaseminejad Raeeni, A.A.; Hosseini, S.; Moghaddasi, R. How energy consumption is related to agricultural growth and export: An econometric analysis on Iranian data. Energy Rep. 2019, 5, 50–53. [Google Scholar] [CrossRef]

- Zhang, L.; Pang, J.; Chen, X.; Lu, Z. Carbon emissions, energy consumption and economic growth: Evidence from the agricultural sector of China’s main grain-producing areas. Sci. Total Environ. 2019, 665, 1017–1025. [Google Scholar] [CrossRef] [PubMed]

- Shahbaz, M.; Zeshan, M.; Afza, T. Is energy consumption effective to spur economic growth in Pakistan? New evidence from bounds test to level relationships and Granger causality tests. Econ. Model. 2012, 29, 2310–2319. [Google Scholar] [CrossRef]

- Dumitrescu, E.I.; Hurlin, C. Testing for Granger non-causality in heterogeneous panels. Econ. Model. 2012, 29, 1450–1460. [Google Scholar] [CrossRef]

- Pesaran, M.H. A simple panel unit root test in the presence of cross-section dependence. J. Appl. Econom. 2007, 22, 265–312. [Google Scholar] [CrossRef]

- Magazzino, C.; Mutascu, M.; Mele, M.; Asumadu Sarkodie, S. Energy consumption and economic growth in Italy: A wavelet analysis. Energy Rep. 2021, 7, 1520–1528. [Google Scholar] [CrossRef]

- Amri, F. The relationship amongst energy consumption (renewable and nonrenewable), and GDP in Algeria. Renew. Sustain. Energy Rev. 2017, 76, 62–71. [Google Scholar] [CrossRef]

| Variable | Description | Unit | Source |

|---|---|---|---|

| GDP | Gross Domestic Product | Constant 2015 US Dollars | World Bank |

| K | Gross fixed capital formation | Constant 2015 US Dollars | World Bank |

| L | Total population aged 15 and older who supply labor for the production of goods and services | - | World Bank |

| RE | Renewable energy consumption | quadrillion Btu | EIA |

| NRE | Non-renewable energy consumption | quadrillion Btu | EIA |

| Developed Countries | |||||

|---|---|---|---|---|---|

| Descriptive Statistics | LnL | LnK | LnGDP | LnNRE | LnRE |

| Mean | 15.836 | 30.002 | 26.905 | 0.823 | −1.368 |

| Median | 15.527 | 29.812 | 26.711 | 0.497 | −1.306 |

| Maximum | 18.929 | 33.668 | 30.623 | 4.547 | 2.439 |

| Minimum | 11.904 | 25.681 | 22.775 | −3.477 | −5.357 |

| Std. Dev. | 1.500 | 1.416 | 1.403 | 1.596 | 1.537 |

| Observations | 810 | 810 | 810 | 810 | 810 |

| LnGDP | 1 | ||||

| LnK | 1 | 0.991 | |||

| LnL | 1 | 0.899 | 0.911 | ||

| LnRE | 0.661 | 0.642 | 0.667 | 1 | |

| LnNRE | 0.955 | 0.926 | 0.932 | 1 | 0.594 |

| Developing Countries | |||||

| Mean | 15.627 | 28.064 | 24.943 | −3.195 | −0.438 |

| Median | 15.383 | 27.720 | 24.683 | −2.987 | −0.733 |

| Maximum | 20.500 | 34.048 | 30.291 | 2.873 | 4.898 |

| Minimum | 13.055 | 23.241 | 21.730 | −10.176 | −3.875 |

| Std. Dev. | 1.603 | 1.755 | 1.673 | 2.240 | 1.733 |

| Observations | 783 | 783 | 783 | 783 | 783 |

| LnGDP | 1 | ||||

| LnK | 1 | 0.981 | |||

| LnL | 1 | 0.916 | 0.925 | ||

| LnRE | 0.890 | 0.881 | 0.882 | 1 | |

| LnNRE | 0.769 | 0.718 | 0.732 | 1 | 0.539 |

| Developed Countries | ||

| Test | Statistic | Probability |

| Pesaran (CD) | 103.427 *** | 0.0000 |

| Friedman | 730.086 *** | 0.0000 |

| Frees | 26.720 *** | Critical values from Frees’ Q distribution |

| alpha = 0.10: 0.1035 alpha = 0.05: 0.1350 alpha = 0.01: 0.1947 | ||

| Developing Countries | ||

| Test | Statistic | Probability |

| Pesaran (CD) | 45.893 *** | 0.0000 |

| Friedman | 320.158 *** | 0.0000 |

| Frees | 10.479 | Critical values from Frees’ Q distribution |

| alpha = 0.10: 0.1124 alpha = 0.05: 0.1470 alpha = 0.01: 0.2129 | ||

| Developed Countries | ||||

| Variable | Statistic | CIPS | ||

| Critical Values | ||||

| 10% | 5% | 1% | ||

| LGDP | −1.829 | −2.07 | −2.15 | −2.3 |

| LRE | −2.809 *** | |||

| LNRE | −1.454 | |||

| LK | −1.515 | |||

| LL | −1.768 | |||

| ∆LGDP | −3.382 *** | |||

| ∆LRE | −5.381 *** | |||

| ∆LNRE | −5.295 *** | |||

| ∆LK | −3.514 *** | |||

| ∆LL | −3.808 *** | |||

| Developing Countries | ||||

| Variable | Statistic | CIPS | ||

| Critical Values | ||||

| 10% | 5% | 1% | ||

| LGDP | −2.437 *** | −2.07 | −2.15 | −2.3 |

| LRE | −1.513 | |||

| LNRE | −2.144 *** | |||

| LK | −2.359 *** | |||

| LL | −1.110 | |||

| ∆LGDP | −3.713 *** | |||

| ∆LRE | −4.547 *** | |||

| ∆LNRE | −4.653 *** | |||

| ∆LK | −4.257 *** | |||

| ∆LL | −3.487 *** | |||

| Developed Countries | |||||

|---|---|---|---|---|---|

| Within-Dimension | Between-Dimension | ||||

| Statistic | Prob | Statistic | Prob. | ||

| Panel v-Statistic | 6.290 *** | 0.0000 | |||

| Panel rho-Statistic | 2.011 | 0.9779 | 3.597 | 0.999 | Group rho-Statistic |

| Panel PP-Statistic | −2.888 *** | 0.0019 | −2.581 *** | 0.0049 | Group PP-Statistic |

| Panel ADF-Statistic | −1.017 | 0.1545 | −0.740 | 0.229 | Group ADF-Statistic |

| Developing Countries | |||||

| Panel v-Statistic | 5.196 *** | 0.0000 | |||

| Panel rho-Statistic | −0.809 | 0.209 | 3.784 | 0.999 | Group rho-Statistic |

| Panel PP-Statistic | −8.267 *** | 0.0000 | −1.694 *** | 0.045 | Group PP-Statistic |

| Panel ADF-Statistic | −3.971 *** | 0.0000 | 1.950 *** | 0.974 | Group ADF-Statistic |

| Developed Countries | ||

| t-Statistic | Prob. | |

| ADF | −4.6844 *** | 0.0000 |

| Residual variance | 0.000627 | |

| HAC variance | 0.000716 | |

| Developing Countries | ||

| t-Statistic | Prob. | |

| ADF | −5.219 *** | 0.0000 |

| Residual variance | 0.002 | |

| HAC variance | 0.002 | |

| Developed Countries | |||

|---|---|---|---|

| Variable | Coefficient | t-Statistic | Prob |

| LnRE | 0.121 *** | 8.789 | 0.0000 |

| LnNRE | 0.201 *** | 4.726 | 0.0000 |

| LnK | 0.477 *** | 22.660 | 0.0000 |

| LnL | 0.540 *** | 7.550 | 0.0000 |

| Developing Countries | |||

| LnRE | 0.042 *** | 10.592 | 0.0001 |

| LnNRE | 0.235 *** | 56.293 | 0.0000 |

| LnK | 0.195 *** | 8.814 | 0.0000 |

| LnL | 0.283 ** | −23.521 | 0.0230 |

| Long-Run Analysis | ||||

|---|---|---|---|---|

| Variable | Coefficient. | Standard Error | T-Statistic | p-Values |

| LnRE | 0.187 *** | 0.009 | 20.588 | 0.0000 |

| LnNRE | 0.456 *** | 0.041 | 10.927 | 0.0000 |

| LnK | 0.254 *** | 0.014 | 17.602 | 0.0000 |

| LnL | 0.166 ** | 0.087 | 1.909 | 0.0567 |

| Short-Run Analysis | ||||

| Constant | 1.771 *** | 0.532 | 3.323 | 0.0010 |

| ∆ LnRE | 0.010 | 0.008 | 1.175 | 0.240 |

| ∆ LnRE(−1) | −0.015 | 0.013 | −1.214 | 0.224 |

| ∆ LnNRE | 0.078 ** | 0.031 | 2.528 | 0.011 |

| ∆ LnNRE(−1) | 0.047 ** | 0.023 | 2.065 | 0.039 |

| ∆ LnK | 0.230 *** | 0.025 | 9.200 | 0.0000 |

| ∆ LnK(−1) | −0.014 | 0.011 | −1.267 | 0.205 |

| ∆ LnL | 0.088 | 0.104 | 0.850 | 0.395 |

| ∆ LnL(−1) | −0.019 | 0.097 | −0.199 | 0.842 |

| ECT(−1) | −0.105 *** | 0.031 | −3.305 | 0.0010 |

| Long-Run Analysis | ||||

|---|---|---|---|---|

| Variable | Coefficient. | Standard Error | T-Statistic | p-Values |

| LnRE | 0.015 | 0.010 | 1.527 | 0.1273 |

| LnNRE | 0.169 *** | 0.021 | 8.022 | 0.0000 |

| LnK | 0.267 *** | 0.009 | 27.871 | 0.0000 |

| LnL | 0.296 *** | 0.041 | 7.228 | 0.0000 |

| Short-Run Analysis | ||||

| Constant | 3.063 *** | 0.602 | 5.085 | 0.0000 |

| ∆ LnRE | 0.012 ** | 0.006 | 1.901 | 0.057 |

| ∆ LnNRE | 0.042 ** | 0.020 | 2.050 | 0.040 |

| ∆ LnK | 0.101 *** | 0.019 | 5.347 | 0.0000 |

| ∆ LnL | −0.222 | 0.281 | −0.790 | 0.429 |

| trend | 0.005 *** | 0.001 | 3.521 | 0.0005 |

| ECT(−1) | −0.240 *** | 0.047 | −5.010 | 0.0000 |

| Developed Countries | Developing Countries | |||||

|---|---|---|---|---|---|---|

| Wald-Stat | Prob. | Wald-Stat | Prob. | |||

| LnK→LnGDP | 3.995 *** | 0.0000 | LnK→LnGDP | 3.713 *** | 0.0000 | |

| LnGDP→LnK | 8.123 *** | 0.0000 | LnGDP→LnK | 2.837 *** | 0.0000 | |

| LnL→LnGDP | 2.716 | 0.275 | LnL→LnGDP | 4.249 *** | 0.0000 | |

| LnGDP→LnL | 7.578 *** | 0.0000 | LnGDP→LnL | 2.679 *** | 0.0000 | |

| LnRE→LnGDP | 2.572 | 0.439 | LnRE→LnGDP | 2.061 *** | 0.0000 | |

| LnGDP→LnRE | 4.523 *** | 0.0000 | LnGDP→LnRE | 4.931 *** | 0.0000 | |

| LnNRE→LnGDP | 3.188 ** | 0.033 | LnNRE→LnGDP | 3.558 *** | 0.0018 | |

| LnGDP→LnNRE | 6.517 *** | 0.0000 | LnGDP→LnNRE | 4.102 *** | 0.0000 | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mohammadi, H.; Saghaian, S.; Zandi Dareh Gharibi, B. Renewable and Non-Renewable Energy Consumption and Its Impact on Economic Growth. Sustainability 2023, 15, 3822. https://doi.org/10.3390/su15043822

Mohammadi H, Saghaian S, Zandi Dareh Gharibi B. Renewable and Non-Renewable Energy Consumption and Its Impact on Economic Growth. Sustainability. 2023; 15(4):3822. https://doi.org/10.3390/su15043822

Chicago/Turabian StyleMohammadi, Hosein, Sayed Saghaian, and Bahareh Zandi Dareh Gharibi. 2023. "Renewable and Non-Renewable Energy Consumption and Its Impact on Economic Growth" Sustainability 15, no. 4: 3822. https://doi.org/10.3390/su15043822

APA StyleMohammadi, H., Saghaian, S., & Zandi Dareh Gharibi, B. (2023). Renewable and Non-Renewable Energy Consumption and Its Impact on Economic Growth. Sustainability, 15(4), 3822. https://doi.org/10.3390/su15043822