1. Introduction

Climate change mitigation has become a significant concern for both developed and developing countries. The increase in environmental degradation, greenhouse gas (GHG) emissions, and global warming is mainly a result of human activities, and the potential consequences are so dreadful that researchers, leaders, and politicians around the world have begun to prioritize efforts with regard to investigating climate change causes and designing appropriate policies to mitigate its impacts. As international cooperation and global solutions are required, world leaders from almost 200 countries met in November 2021 at the United Nations Climate Change Conference (COP26) and made enhanced commitments to accelerate actions towards the goals of the Paris Agreement, such as limiting the rise of mean global temperature to 1.5 °C.

Reaching global net-zero carbon dioxide (CO

2) emissions, phasing down coal power, halting and reversing deforestation, switching to electric vehicles, and reducing methane (CH

4) emissions are among the main commitments settled in the Glasgow Climate Pact, which resulted from COP26 [

1]. However, designing policies and actions to contribute to these global objectives represents an important challenge, especially for developing countries, because the majority of them are in desperate need of economic development to improve the life quality of their people and address the consequences of global warming that they are already facing, such as resource scarcity.

In order to appropriately design strategies and policies to meet these ambitious pledges, it is necessary to understand the specific economic and environmental situation of each country as economic development and environmental degradation are expected to be related and a balance must be achieved to reach sustainable development. Providing important new evidence on how economic activities associated with the development of countries affects climate change is essential to make policies that permit the improvement of the quality of life of citizens with sustainable commitments. This is especially true for developing countries, whose economic progress must be made in an era in which environmental restrictions require different methods of industrialization. That is the case of Latin American countries, in which there is still a strong necessity for transforming their economies while improving institutional and public services and reducing inequality [

2].

We concentrate our study in Colombia, as a country that is transitioning in Latin America, with constant rates of economic growth during the last decades. Although Colombian GHG emissions only represent 0.4% of global emissions, according to 2018 data from the World Bank, the country is not exempt from the climate change mitigation discussion [

3]. In fact, the United States National Intelligence Council has identified Colombia, along with other 10 countries from Asia, Central America, and the Caribbean, as one of the countries of great concern due to the threat of climate change as it is considered highly vulnerable to its physical effects and lacks the capacity to adapt [

4]. Because of this, the Colombian government recognized the need for actions in the country and made ambitious commitments at COP26: they declared 30% of its territory a protected area and planted 180 million trees by 2022; they will achieve a 51% reduction in GHG emissions by 2030, and reach carbon neutrality by 2050. Furthermore, Colombia joined the alliance proposed by the government of the United States of reducing methane emissions by 30% from 2020 levels by the end of the decade.

The aim of this study is to assess the nexus between economic development and environmental degradation in Colombia by testing the validity of the environmental Kuznets curve (EKC) hypothesis, including macroeconomic variables that may also affect the environment, such as urbanization; the value added by the agricultural and industrial sectors; energy consumption; and foreign direct investment. The EKC hypothesis posits that pollution emissions increase and environmental quality declines when a country or region is in the early stages of economic growth, but beyond some level of income per capita, the situation changes so that higher income levels lead to increased environmental awareness, the enforcement of environmental regulations, cleaner technologies, and higher environmental expenditures, resulting in a gradual decline in the level of pollution and environmental degradation [

5,

6,

7].

Estimating and analyzing the EKC has become the main approach in the energy and economic literature to understand development impacts on the environment and provide recommendations on public policy making accordingly. There is a wide range of literature investigating the validity of the EKC hypothesis for different countries and periods, and considering multiple environmental indicators and macroeconomic variables [

8,

9]. Nonetheless, there is a lack of research in the case of Latin American and Caribbean countries. Particularly in Colombia, the few existing studies of the relationship between economic development and environmental degradation in the country are focused on carbon dioxide emissions as an environmental indicator, failing to consider other relevant factors related to the environment.

This paper contributes to the existing literature by trying to fill the cited gap by estimating and studying the potential relations between gross domestic product (GDP) per capita and three different indicators of environmental degradation: carbon dioxide emissions, methane emissions, and the ecological footprint. First, carbon dioxide emissions are the main focus in global climate change mitigation, which makes it essential for environmental degradation analysis. From the few existing studies of the carbon dioxide emissions relationship with the economic development for the Colombian case, there are mixed results, and in most cases these are not supported by statistically validated models. Henceforth, we seek to provide new scientific evidence to better understand this nexus and contribute to the debate on carbon reduction and the design of environmental policies, for Colombia.

Moreover, we extend the analysis by studying methane and the ecological footprint. According to data retrieved from the climate analysis indicators tool (CAIT) [

10], the level of methane emissions in Colombia is almost the same as carbon dioxide emissions and has been increasing over the years, with the agricultural sector being mainly responsible. Assessing the economic development impact on methane emissions is therefore especially relevant for Colombia considering that this gas has a 100-year warming potential 28 times larger than CO

2 [

11]. Lastly, the ecological footprint is appropriate for measuring environmental degradation as it converts the impact sources (electricity, food, water, materials) and waste generation (such as carbon dioxide emissions) into the equivalent biologically productive land required to produce or absorb these impacts [

12]. Ecological footprint results have been used as an indicator of environmental degradation to investigate the EKC hypothesis by some empirical studies [

9,

13,

14]. However, to the best of our knowledge, there are no reports of EKC estimation for the ecological footprint in Colombia, although they may be a powerful indicator to understand environmental impact and sustainable resource use in the country rather than only focusing on air pollutant accumulation.

To estimate a model for each environmental degradation indicator, we use the autoregressive distributed lag (ARDL) bound testing procedure by Pesaran, Shin, and Smith [

15]. This methodology allows us to test if cointegration exists, has strong small sample properties, and provides unbiased estimates of the long-run model and valid t-statistics even in the presence of endogeneity [

15,

16]. Furthermore, we use stochastic simulations to easily and properly interpret the causal relationships between the variables and make substantive statistical inference from our ARDL models, contributing to better understanding the impact of related variables.

The study is structured as follows:

Section 2 presents the literature addressing the EKC hypothesis, the Colombian environmental context, and the contribution of our study;

Section 3 focuses on data description and the econometric methodology;

Section 4 reports the empirical results and discussion; and

Section 5 concludes the study.

2. Literature Review

The Kuznets curve hypothesis has its origin in the work of Simon Kuznets in 1955, who found an inverted-U shaped relationship between per capita income and income inequality, implying that the initial stage of income growth is characterized by unequal income distribution; however, there is a turning point in economic growth where income distribution starts moving towards equality [

17]. This initial contribution was extended to the environmental field when [

5] investigated the North American Free Trade Agreement (NAFTA) and also found an inverted-U shaped relationship between air pollutants (sulfur dioxide and smoke) and income per capita. Then, with the work of [

6], where the hypothesis was validated by the World Bank, it became a controversial topic in the scientific community as it was stated that the view that greater economic activity inevitably hurts the environment is mistakenly based on static assumptions about technology, tastes, and environmental investments [

18].

The expression

‘environmental Kuznets curve hypothesis’ appeared for the first time in the literature in 1993 when Panayotou studied the economic growth effect on air and land [

7]. This position has been expounded even more forcefully by authors such as Beckerman [

19], who stated that the best and probably only way for a country to attain a decent environment is to become rich, whereas others such as Van Alstine and Neumayer [

20] clarify that economic growth by itself will most likely not be the solution to environmental degradation as some developing countries will not reach the turning point for decades to come.

From those first contributions in the 1990s, the EKC has become the main framework in the energy economic literature to study the relationship between environmental degradation, economic development, and other variables, such as energy consumption. Due to the assertiveness of the policies that emanate from EKC estimation and analysis, there is a vast number of studies in economic literature that have focused on the empirical and theoretical investigation of its validity providing a varied mixture of results as they depend on the econometric models, the variables included, the environmental degradation indicators employed, and the sample of countries and periods chosen to examine the relationship [

8,

9].

Some authors focus their studies on individual countries, for example, Kenya [

21], USA [

22], Pakistan [

16], South Africa [

23], and China [

24], whereas others investigate the EKC for a group of countries from a specific region or with similar characteristics, such as Sub-Saharan African countries [

25], the top five emitters of greenhouse gas emissions from fuel combustion in developing countries [

26], 15 Middle East and North African (MENA) countries [

9], 36 high-income countries [

27], and 16 European Union countries [

28]. Depending on the latter, econometric techniques employed vary from vector autoregression (VAR) models, Johansen cointegration approaches, ARDL bounds technique, and Granger causality tests, in the case of individual countries, to the panel cointegration approach, dynamic ordinary least squares regression (DOLS), fully modified ordinary least squares regression (FMOLS), and the panel-vector error-correction model (VECM), among others, for studies considering a group of countries.

In addition to the sample of countries and the estimation method employed, the turning point in income levels varies depending on the selected indicator of environmental degradation. As reviewed by Sarkodie and Ozturk [

8], the majority of studies are based on carbon dioxide emissions due to its signifcant impact on GHG emissions (carbon dioxide, nitrous oxide, methane, perfluorocarbons, sulfur hexafluoride, and hydrofluorocarbons), while other atmospheric indicators such as sulfur dioxide or air pollutants (PM

10, PM

2.5) concentration are less considered [

29]. Land indicators, such as fertilizer consumption [

30] or deforestation [

31]; freshwater indicators, such as biological oxygen demand (BOD) [

32] or water pollution [

33]; and biodiversity indicators [

34] have also been used as environmental degradation proxies for estimating the EKC.

The variables included in the estimated equation also affect the results. Bias from omitted variables, integrated variables, spurious regression, and the identification of time effects are the main econometric problems when estimating the EKC [

18]. Some authors have tested the basic equation, only including income per capita and its squared form in the model, but others have augmented this equation by including the cubic form of income per capita and other variables that may affect the environmental indicator, such as urbanization, financial development, foreign direct investments, and energy consumption. Due to the differences exposed, results from studies vary from the validation of the EKC hypothesis to finding a linear or N-shaped relationship. As results cannot be generalized, it is necessary to study the specific Colombian case in order to reach our goal of understanding the economic and environmental nexus in the country to provide recommendations for policy design.

As mentioned before, despite the wide range of literature investigating the EKC hypothesis, there is a lack of research in the case of Colombia and, in general, Latin American and Caribbean countries. There are few authors that have estimated EKC model using panel data from a group of countries of the region, including Colombia [

35,

36]. Meanwhile, only six studies were identified that address relationships from the EKC hypothesis specifically in Colombia, and these did not contain conclusive evidence as mixed results were obtained. Firstly, Vásquez and Garcia (2003) used solid waste, GDP per capita, and a technologically advanced indicator for the Aburrá Valley Metropolitan Area using OLS, resulting in a model with adjusted R-squared of 90% but not conclusive results about EKC [

37]. Then, Correa, Vasco, and Pérez (2005) considered carbon dioxide emissions, sulfure dioxide emissions, biological oxygen demand, GDP per capita, the GINI index, political freedom, and the literacy rate using OLS, and the results showed that Colombia is on the upward slope of the EKC, meaning that economic growth is worsening environmental quality [

38]. Afterwards, Ruiz-Agudelo et al. (2019) utilized the endangered species total number, GDP per capita, the GINI index, the environmental performance index, and the literacy rate using OLS, and the results showed that the EKC hypothesis is not met for Colombia [

34]. Additionally, Sosa and Navarro (2020) utilized carbon dioxide emissions, GDP per capita, energy consumption, urbanization, and economic complexity using the ANFIS model, FMOLS, and DOLS and did not find conclusive results for the EKC hypothesis [

39]. Finally, Laverde-Rojas et al. (2021) considered carbon dioxide emissions, GDP per capita, electric power consumption, foreign direct investment, urban population, exports and imports, and economic complexity index using VECM and found that the EKC hypothesis is not valid for Colombia and there is no evidence that improvements in economic complexity have positive effects on reducing pollution levels [

40].

Given this inconclusiveness and the fact that some of these results came from not statistically validated models, we aim to contribute to the literature and provide reliable results for policy making by implementing statistically validated ARDL models to test the EKC hypothesis for Colombia not only considering carbon dioxide emissions as environmental indicator but also methane emissions and the ecological footprint.

5. Conclusions

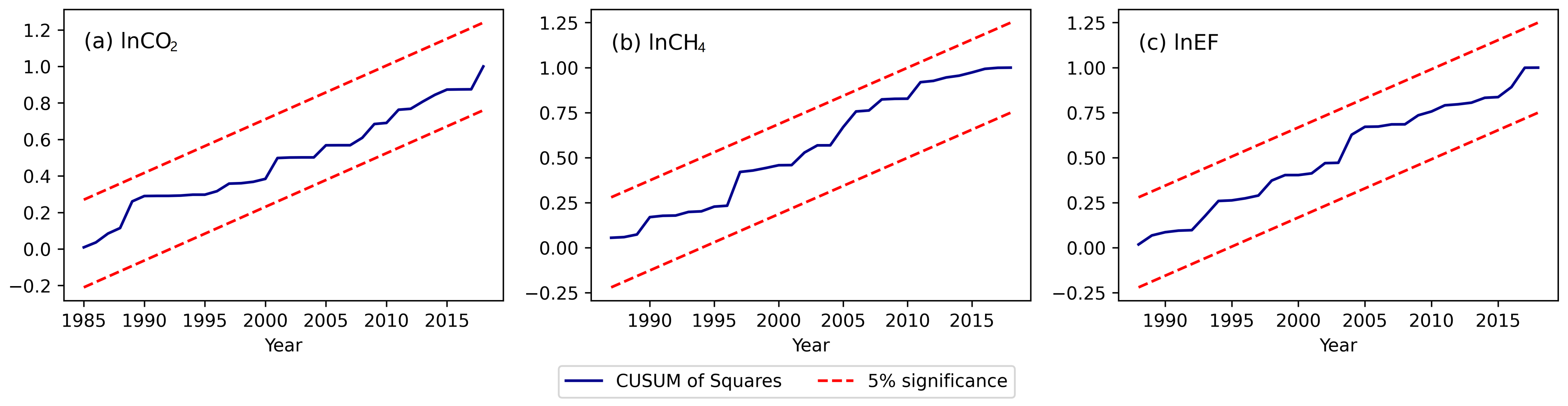

This study examined the impact of GDP per capita growth on carbon dioxide emissions, methane emissions, and the ecological footprint for a Colombian-specific case, for which there is not much research available in the literature. For this purpose, we estimated an ARDL model for each environmental degradation indicator and, in order to establish robust conclusions from it, we carried out statistical validation tests for residual normality, heteroskedasticity, serial correlation, misspecification, and structural change. After estimating each ARDL model using time series data for the period between 1970 and 2018, we found that there is a long-run robust relationship among variables, but results regarding the validity of the EKC hypothesis vary depending on the environmental degradation indicator considered. Our first model indicates that there is no evidence to validate the existence of an inverse U-shaped relationship between CO

2 emissions and GDP per capita. These results are in line with empirical findings made by [

40,

73] in similar studies. Despite this, our results suggest that industrialization could help to reduce CO

2 emissions in the long run, as long as it does not mean an increase in the use of energy from non-renewable sources.

To the best of our knowledge, methane emissions and the ecological footprint have not been previously studied in the EKC framework for Colombia. We find from our models that there is statistical evidence to validate the EKC hypothesis for these environmental degradation indicators. The turning point estimated from the CH4 model is 4113.34 constant 2015 US$ per capita, whereas the EF model indicates that the slope sign changes near to 4307.11 US$. For this last case, we find a confidence interval wider than the actual range of GDP in the sample period, but we still can conclude that economic growth can lead to an improvement in environmental quality, at least in regard to methane emissions and the ecological footprint. Moreover, the EF model results suggest that this economic growth should leverage the use of cleaner technologies and better agricultural practices as the increase in the value added of agricultural sectors will raise EF.

The effects of urbanization and foreign direct investments vary depending on the environmental indicator, and therefore it is not possible to draw general conclusions. Nevertheless, our results suggest that foreign direct investment does not have a great impact on the environment in the Colombian case as long-run elasticities are considerably low for both CO2 and CH4 models, and the variable is not significant for EF.

Although we cannot draw consistent conclusions as the results are mixed, the relationships studied and analyzed in this paper provide a better comprehension of the economic and environmental situation in Colombia and are relevant for climate policy design. In general, our empirical findings reinforce the necessity of shifting to renewable energy sources to achieve economic growth without harming the environment. In fact, there is evidence that economic growth could lead to reduced methane emissions and a reduced ecological footprint. For example, in

Figure 7a, the dynamic simulations carried out in this study demonstrate the importance of implementing agricultural practices that involve cleaner technologies due to the contribution of this sector to GHG emissions in Colombia. Hence, investment in research, innovation, and cleaner technologies for agricultural and industrial sectors could play a key role in this process. To promote this required change from fossil fuels to cleaner energy sources, carbon taxes or incentives for companies using or investing in renewable energy could be considered. Notwithstanding, the design of these or other policies should be accompanied by broader legal, socioeconomic, and institutional assessment.

Finally, this study could be extended to include new macroeconomic variables to obtain more relevant information regarding the impact of economic development on the environment. Moreover, the econometric methodology used could be implemented to make a similar investigation focusing on regions as it may be appropriate to design region-specific policies considering differences in development, main economic activities, available natural resources, etc. However, the limited access to public and precise information is an important obstacle. Regrettably, there is not much available economic and environmental data in official Colombian sources. Instead, we used global databases, such as World Development Indicators by the World Bank [

3], that can offer misleading or imprecise data for some variables. For instance, deforestation may be a relevant variable to study in Colombia as there are considerably high rates due to agriculture and cattle ranching; the creation of human settlements and roads; and illicit activities, such as illegal crops, mining, and logging, especially after the peace agreement settled in 2016 with the Revolutionary Armed Forces of Colombia (FARC) [

74,

75,

76,

77,

78]. Nevertheless, information is not available annually but completed with linear interpolation, which limits the possibility to obtain useful results. Evidently, efforts should be made to improve the estimation and distribution of environmental data on public and official sources.