Innovation and E-Commerce Models, the Technology Catalysts for Sustainable Development: The Emirate of Dubai Case Study

Abstract

1. Introduction

1.1. Research Aims and Questions

- RQ1. How do innovation and e-commerce models jointly influence sustainable development?

- RQ2. Are organic or inorganic growth strategies more effective for innovating e-commerce models?

- RQ3. Which ESG metrics, mapped with Sustainable Development Goals, can be adequate for E-Commerce innovating models?

- RQ4. Is it possible to provide a meaningful research framework application in the Emirate of Dubai case study?

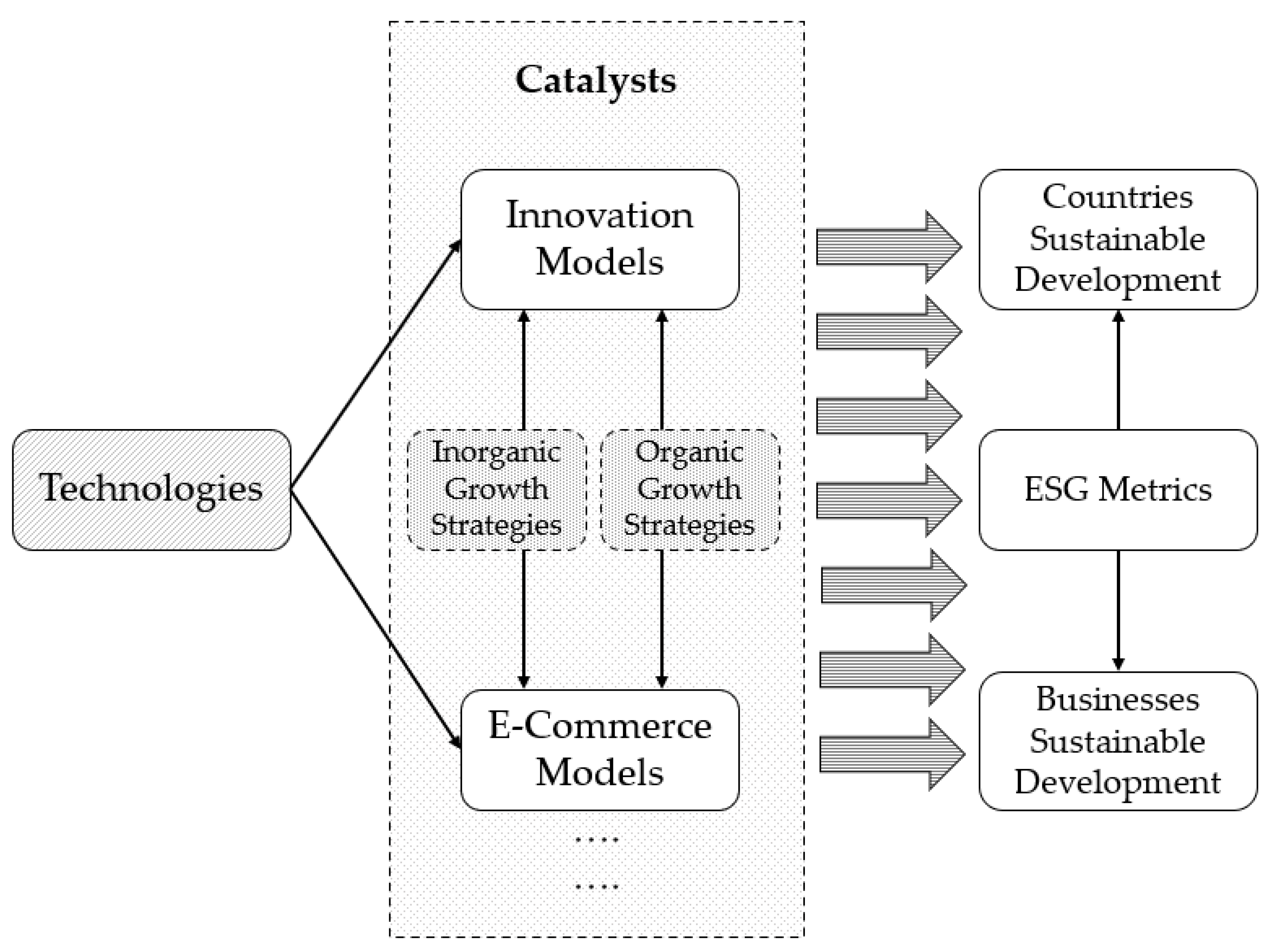

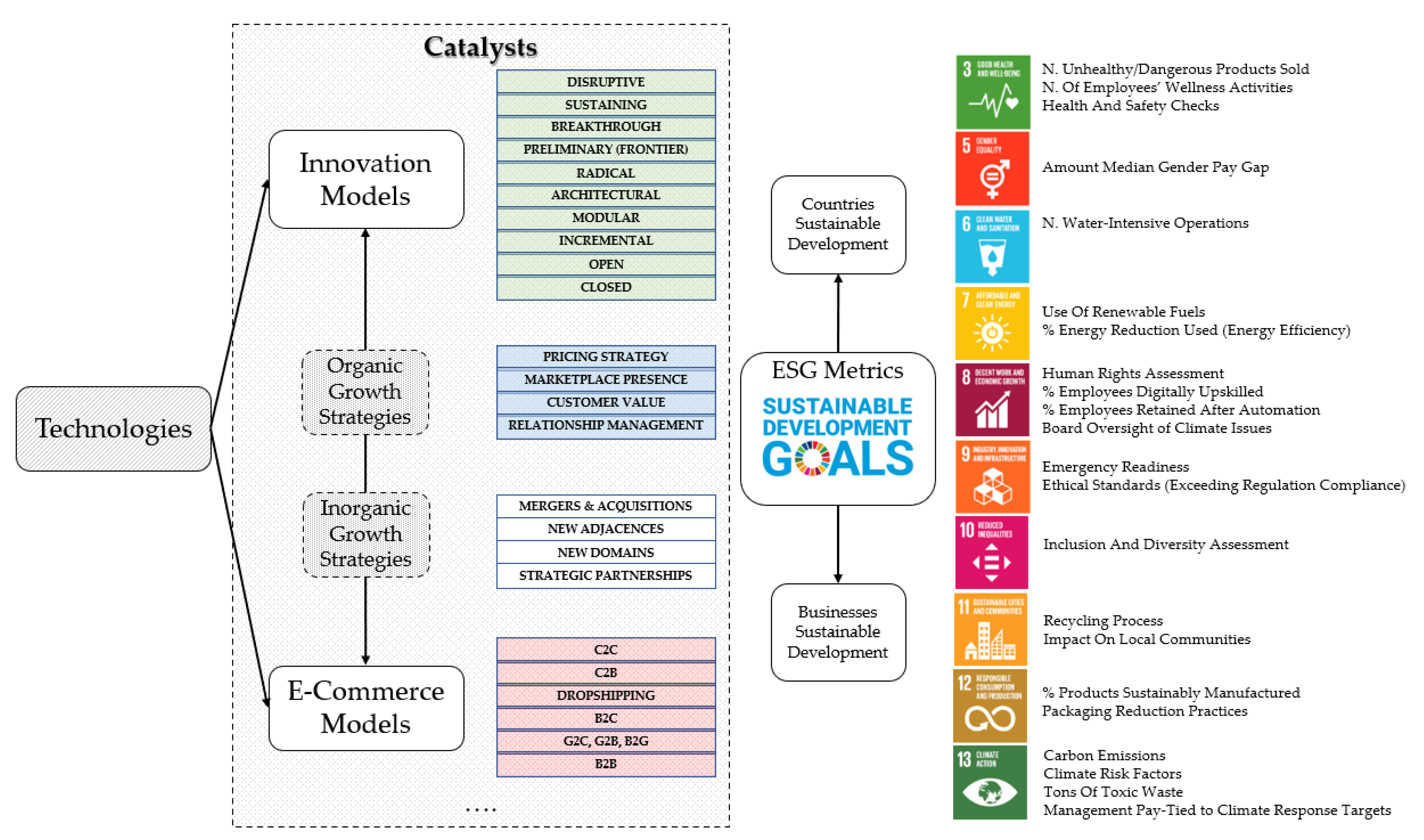

1.2. Research Framework

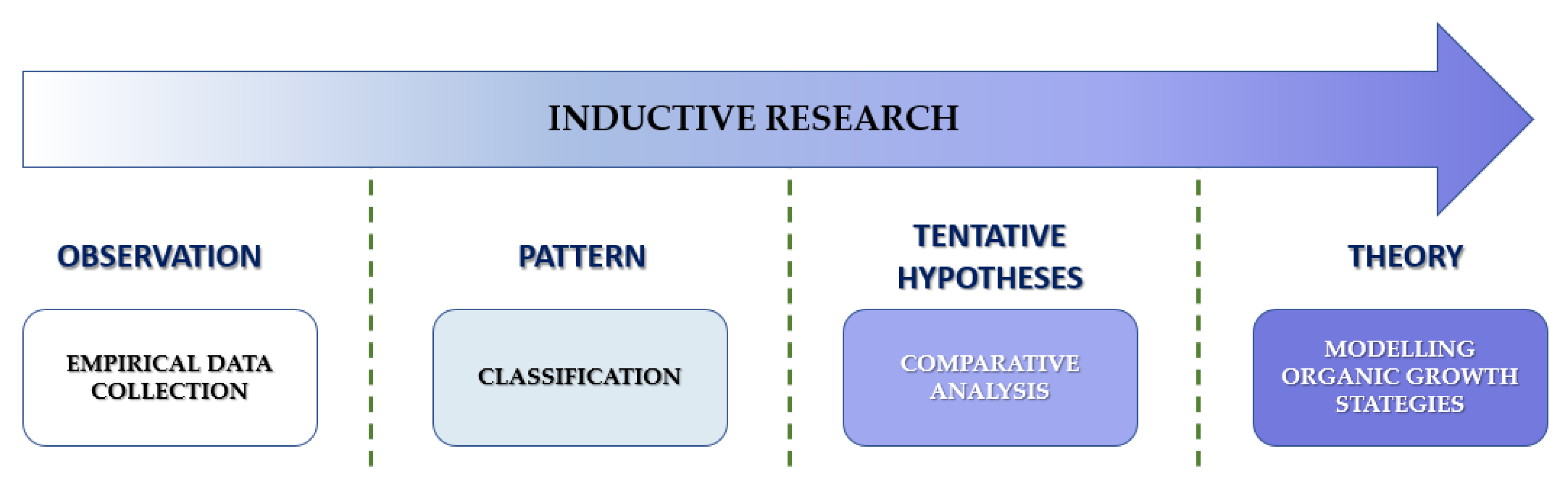

2. Methodology

- -

- A relevant literature review investigates the influence determined by the joint effect of innovation and e-commerce models (addressing RQ1—research question 1)

- -

- A model framework is designed to examine the strategic options derived by the combination of relevant variables such as inorganic/organic growth strategies (adopted for innovating e-commerce models) and effective ESG goals to be achieved (addressing RQ2 and RQ3).

- -

- The model framework is applied through a relevant case study focusing on the Emirates of Dubai (addressing RQ4).

- (a)

- Systematic research on Scopus (and then integrated with Google and Google Scholar) of essential keywords (with alternative and combined use of operators AND/OR) “e-commerce”, “electronic commerce”, “online”, “m-commerce”, “mobile commerce”, “ESG”, “sustainable development”, “sustainability”, “innovation”, “innovative”, “growth”, “organic growth”, “Dubai” or “United Arab Emirates” or “UAE” or “U.A.E.”;

- (b)

- classification of strategies and cases under the types of e-commerce and/or innovation models identified in the literature;

- (c)

- comparative analysis of the results to identify patterns, trends, and best practices.

- -

- Section 3 focuses on the literature review results, presenting a systematic perspective of technologies, innovation types, strategies, and ESG metrics mapped with the SDGs.

- -

- Section 4 presents the designed model for the analyses of the e-commerce ecosystem.

- -

- Section 5 applies the analyses to the Emirate of Dubai case study.

3. Findings: Literature Review

3.1. Technology Catalysts

3.2. Organic vs. Inorganic Growth Strategies in Innovation and E-Commerce

3.3. E-Commerce Models

- The spread of “small brands”—The market is evolving towards a P2C model (from producer to consumer) where the producer relates directly to end customers. Each manufacturer is virtually a brand; there are no obstacles or large barriers to entry.

- “Influencer” retailers—The role of the small retailer will increasingly be focused on creating a relationship with its customers, a real community to be involved and nurtured with information and added value.

- The sustainability challenge—The pressure to achieve environmental sustainability enshrined in the recent climate agreements will push companies to find ecological and sustainable solutions to avoid ever more stringent sanctions or constraints, which will be transparently certified and demonstrated to the final consumer.

- The “physical” purchase of products must become an “experience”—The increasingly intense rhythms of life have oriented customers to e-commerce solutions. Travel time and parking time is “wasted”.

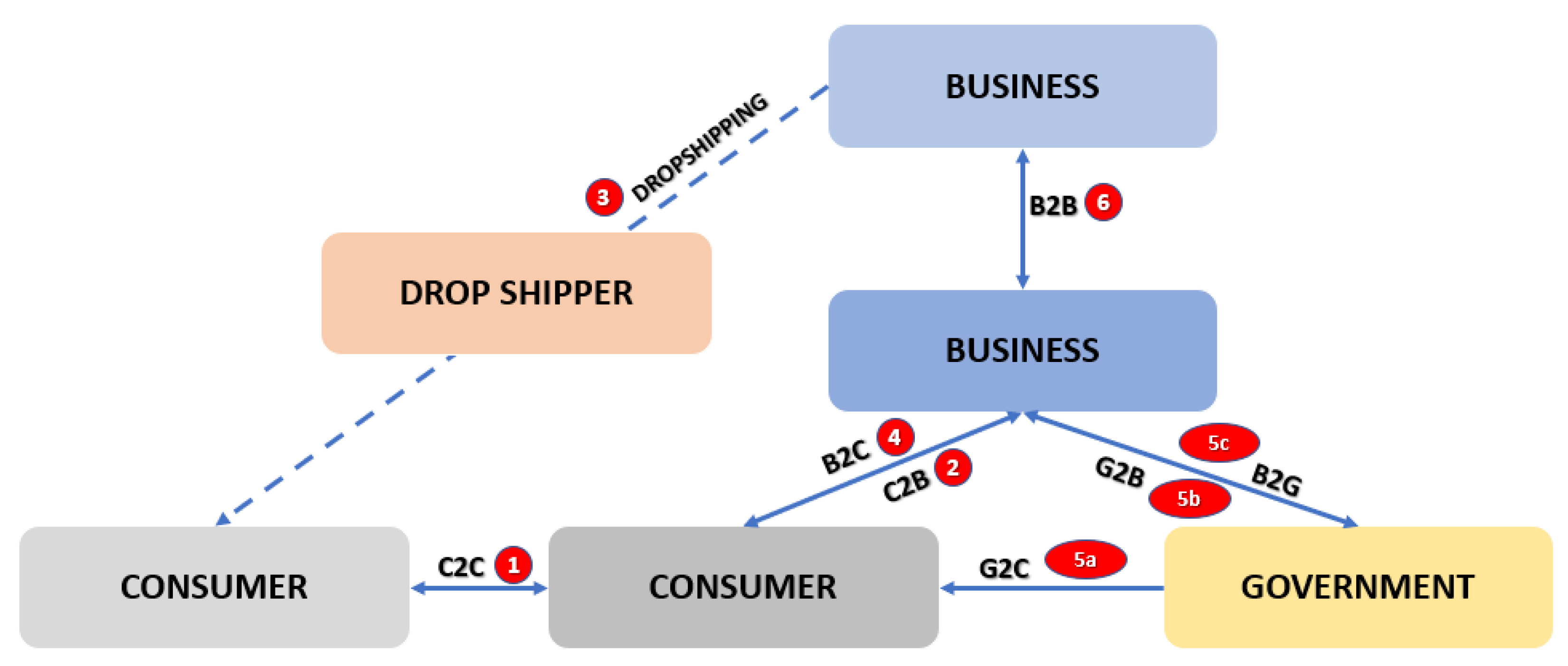

3.3.1. Consumer to Consumer (C2C)

3.3.2. Consumer to Business (C2B)

3.3.3. Drop Shipping (DS)

3.3.4. Business to Consumer (B2C)

3.3.5. E-Commerce with Government (G2C, G2B, B2G)

- (a)

- The first G2C model is aimed at the citizen and consists of websites registering documents or auctions to sell certain products [30].

- (b)

- The second G2B model establishes business contacts and manages purchases/sales through auctions [31].

- (c)

- The third B2G model is based on selling and purchasing information with commercial services [32].

3.3.6. Business to Business (B2B)

3.4. Innovation Models

3.4.1. Disruptive Innovation

- -

- Online marketplaces: The creation of online marketplaces such as Amazon and Alibaba have disrupted traditional brick-and-mortar retailers by providing customers with a wider variety of goods and services at lower prices and more convenience through home delivery.

- -

- On-demand delivery: Companies such as Uber Eats, GrubHub, and Postmates have disrupted traditional food delivery services by offering on-demand delivery and a wider variety of restaurants to choose from.

- -

- Subscription-based models: Subscription-based models such as Birchbox and Dollar Shave Club have disrupted traditional retail models by offering customers the convenience of regularly delivered, personalised products at a lower cost.

- -

- Mobile commerce: The development of mobile commerce has disrupted traditional brick-and-mortar retailers by allowing customers to shop anytime, anywhere, using their smartphones or tablets.

- -

- Chatbots and virtual assistants: The integration of chatbots and virtual assistants in e-commerce has disrupted traditional customer service by providing customers with 24/7 assistance, instant responses, and personalised recommendations.

3.4.2. Sustaining Innovation

3.4.3. Breakthrough Innovation

- -

- E-commerce platforms: The creation of e-commerce platforms such as Amazon, Alibaba, and eBay have fundamentally changed how customers shop online by providing a centralised marketplace for various goods and services.

- -

- Online marketplaces for niche products: The creation of online marketplaces for niche products such as Etsy, handmade goods, and Zulily, daily deals on clothing and accessories, has fundamentally changed how customers discover and purchase niche products.

- -

- Digital wallets and payment systems: The development of digital wallets and payment systems such as PayPal, Venmo, and Apple Pay has fundamentally changed how customers make online and in-store payments.

- -

- Subscription-based models for streaming content: The creation of subscription-based models such as Netflix, Hulu, and Spotify have fundamentally changed how customers consume and pay for video and music content.

- -

- Virtual reality shopping mall: Integrating virtual reality technology in e-commerce can fundamentally change how customers shop online by providing an immersive and interactive shopping experience that simulates a physical shopping mall.

3.4.4. Preliminary (Frontier) Innovation

- -

- 5G-enabled e-commerce: The integration of 5G technology in e-commerce can enable new opportunities for faster and more reliable online shopping, real-time customer service, and immersive virtual and augmented reality shopping experiences.

- -

- Internet of Things (IoT) enabled e-commerce: Integrating IoT technology in e-commerce can enable new opportunities for automated replenishment, smart product recommendations, and more personalised and seamless shopping experiences.

- -

- AI-enabled e-commerce: Integrating AI technology in e-commerce can enable new opportunities for personalised product recommendations, automated customer service, and more efficient supply chain management.

- -

- Autonomous delivery: Integrating autonomous vehicles and drones in e-commerce can enable new opportunities for same-day and even same-hour delivery and provide more efficient and cost-effective logistics.

- -

- Quantum computing in e-commerce: Integrating quantum computing technology in e-commerce can enable new opportunities for enhanced security and encryption, improved optimisation and decision-making, and more advanced artificial intelligence applications.

3.4.5. Radical Innovation

- -

- Mobile commerce: The development of mobile commerce has fundamentally changed how customers shop online, allowing them to shop anytime, anywhere, using their smartphones or tablets.

- -

- Social commerce: Integrating social media into e-commerce has fundamentally changed how customers discover and purchase products by allowing them to share products and reviews with their friends and followers on social media platforms.

- -

- Subscription-based models: Subscription-based models have fundamentally changed how customers purchase products by allowing them to subscribe to regular deliveries of products, such as groceries, clothing, or beauty products.

- -

- Virtual reality and augmented reality: Integrating virtual reality and augmented reality technologies in e-commerce can fundamentally change how customers interact with products and shop online by providing an immersive and interactive shopping experience.

- -

- Blockchain-based e-commerce: The integration of blockchain technology in e-commerce can fundamentally change how customers make payments by providing a secure, decentralised, and transparent payment service.

3.4.6. Architectural Innovation

- -

- Cloud-based architecture: E-commerce companies can adopt the cloud-based architecture, such as Amazon Web Services or Microsoft Azure, to improve the scalability, flexibility, and cost-effectiveness of their e-commerce systems.

- -

- Microservice architecture: E-commerce companies can adopt a microservice architecture, which allows them to break down their systems into small, independent services that can be developed, tested, and improved separately.

- -

- Serverless architecture: E-commerce companies can adopt a serverless architecture, which allows them to run their applications and services without provisioning or managing servers. It can improve scalability and cost-efficiency.

- -

- Edge computing: E-commerce companies can adopt edge computing, which allows them to process data closer to the source of data. It can improve performance and reduce latency.

- -

- Containerisation: E-commerce companies can adopt containerisation, which allows them to package their applications and dependencies together in a container, improving the scalability and portability of their systems.

- -

- AI-based architecture: E-commerce companies can adopt AI-based architecture, which allows them to use machine learning and deep learning algorithms to improve the overall performance and user experience of their e-commerce systems.

3.4.7. Modular Innovation

- -

- Platform-based e-commerce: E-commerce companies can build their online store on a modular platform, such as Shopify or Magento, which allows them to add new features and capabilities incrementally without rebuilding the entire system.

- -

- Microservice architecture: E-commerce companies can adopt a microservice architecture, which allows them to break down their systems into small, independent services that can be developed, tested, and improved separately.

- -

- API-based integration: E-commerce companies can use application programming interfaces (APIs) to integrate their systems with external services and platforms, such as payment providers, logistics providers, and marketing platforms, which allows them to add new features and capabilities incrementally.

- -

- Modular product design: E-commerce companies can adopt a modular product design approach, which allows them to break down complex products into smaller, independent modules that can be developed, tested, and improved separately.

- -

- Component-based development: E-commerce companies can adopt a component-based development approach, which allows them to break down their systems into small, reusable components that can be developed, tested, and improved separately.

3.4.8. Incremental Innovation

- -

- Product improvements: E-commerce companies can make small improvements to existing products, such as adding new features, improving the design, or reducing costs.

- -

- Process improvements: E-commerce companies can make small improvements to existing processes, such as streamlining logistics, improving customer service, or increasing website speed.

- -

- Marketing improvements: E-commerce companies can make small improvements to their marketing efforts, such as refining their targeting strategy, improving the customer experience, or creating more engaging content.

- -

- Cost optimisation: E-commerce companies can optimise their costs by reducing the costs of goods sold, logistics, marketing, and other expenses.

- -

- Service improvements: E-commerce companies can make small improvements to their customer service, such as adding new support channels, providing more detailed product information, or providing more personalised recommendations.

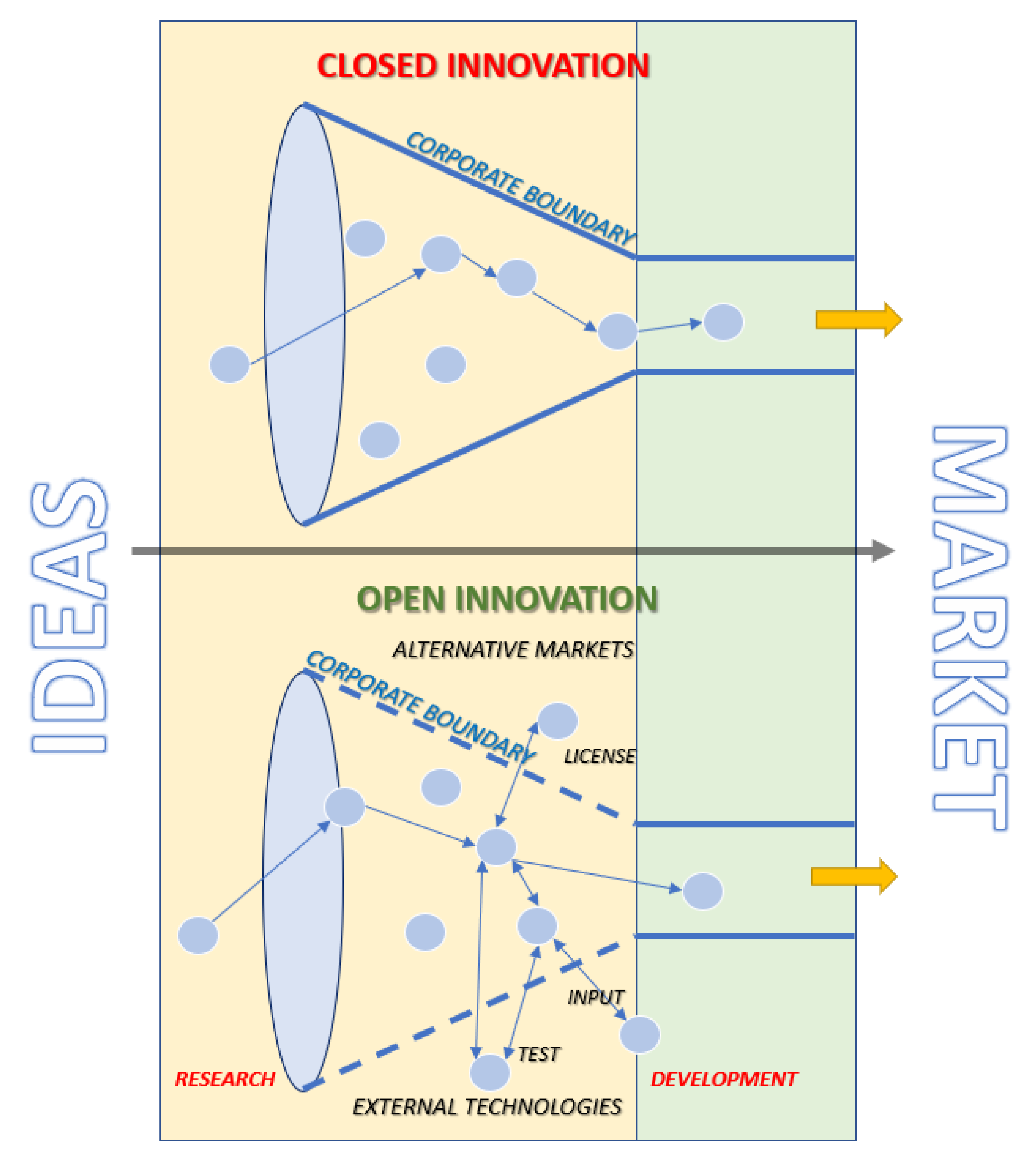

3.4.9. Open Innovation

- -

- Crowdsourcing: E-commerce companies can use crowdsourcing platforms to solicit ideas and feedback from customers and other stakeholders. It can help generate new ideas and improve existing products and services.

- -

- Incubators and accelerators: E-commerce companies can partner with incubators and accelerators to identify and support promising start-ups that can provide new technologies and business models.

- -

- Open innovation challenges: E-commerce companies can launch open innovation challenges to solicit new ideas and solutions from a wide range of external partners.

- -

- Hackathons: E-commerce companies can host hackathons to encourage developers, designers, and entrepreneurs to generate new ideas and solutions for the e-commerce industry.

- -

- Open source: E-commerce companies can use open-source software, platforms, and tools to reduce development costs and speed up the time-to-market of new products and services.

- -

- Partnerships and collaborations: E-commerce companies can form partnerships and collaborations with other companies, universities, and research organisations to share resources and expertise and generate new ideas and solutions.

3.4.10. Closed Innovation

- -

- In-house R&D: E-commerce companies can invest in in-house research and development teams to generate new ideas, products, and services.

- -

- Patent protection: E-commerce companies can file for patents to protect their intellectual property and prevent competitors from copying their innovations.

- -

- Proprietary technology: E-commerce companies can develop proprietary technology to give them a competitive advantage and prevent competitors from accessing their technology.

- -

- Internal collaboration: E-commerce companies can encourage internal collaboration among departments and teams to generate new ideas, products, and services.

- -

- Closed innovation challenges: E-commerce companies can launch closed innovation challenges to encourage employees to generate new ideas and solutions internally.

3.5. E-Commerce and Technology Innovation

3.6. E-Commerce, ESG Goals, Sustainable Development

- -

- Reducing carbon emissions: E-commerce can reduce the need for transportation and logistics, which can help lower carbon emissions. Online marketplaces and platforms can also help match buyers and sellers, reducing the need for long-distance transportation.

- -

- Improving resource efficiency: E-commerce can also help improve resource efficiency by allowing for more efficient supply chain and logistics processes. It can lead to reduced waste and lower environmental impact.

- -

- Promoting fair labour practices: E-commerce platforms can also promote fair labour practices by providing transparency and traceability in supply chains, enabling consumers to make informed choices about the products they purchase.

- -

- Increasing access to goods and services: E-commerce can also increase access to goods and services for under-served communities, including those in rural areas and developing countries, which can contribute to social and economic development.

- -

- Good corporate governance: E-commerce platforms can also promote good corporate governance by providing transparency and accountability in their operations and supply chains. It can help ensure that companies adhere to ethical and sustainable practices.

4. Findings: Model Framework

5. Findings: Case Study, the Emirate of Dubai

5.1. The Emirate of Dubai Ecosystem

- -

- Online marketplaces: Dubai has several large online marketplaces that are instrumental in driving e-commerce growth in the city.

- -

- Mobile commerce: Dubai has a high penetration of smartphones and mobile internet, which has helped to drive the growth of mobile commerce in the city. Many e-commerce companies in Dubai have developed mobile apps to make it easier for customers to shop online.

- -

- Cashless payments: Dubai has been actively promoting using cashless payments and has implemented various initiatives to encourage digital payments. It has helped to make it easier for customers to shop online and has helped to drive the growth of e-commerce in the city.

- -

- Logistics and delivery: Dubai has a well-developed logistics infrastructure, which has helped to make it easier for e-commerce companies to deliver goods to customers. Many e-commerce companies in Dubai are also experimenting with new delivery options, such as same-day and drone delivery, to improve the customer experience.

- -

- Virtual and augmented reality: Some E-commerce companies in Dubai have started experimenting with virtual and augmented reality technology to provide customers with a more immersive shopping experience. This technology allows customers to virtually try on clothes and jewellery, explore a product in 3D, and obtain a better sense of the product’s size and features.

- -

- AI and machine learning: Some Dubai companies have started implementing AI and machine learning to improve their e-commerce operations. It includes personalisation, customer service automation, product recommendations, and inventory management.

5.1.1. EXPO Dubai 2020

5.1.2. E-Commerce Free Trade Zone

5.2. Dubai E-Commerce Innovation Models

- -

- Growing mobile commerce: With the high penetration of smartphones and mobile internet in the UAE, mobile commerce is becoming increasingly popular. Many e-commerce platforms in the UAE are now investing in mobile-optimised websites and apps to improve the mobile shopping experience for customers.

- -

- Increase in social media commerce: Social media platforms have become an important channel for e-commerce players in the UAE to reach customers. Many retailers are now using social media to promote their products, with some even allowing customers to make purchases directly through social media platforms.

- -

- Cross-border e-commerce: The UAE is a hub for cross-border e-commerce, with many international retailers setting up operations in the country to take advantage of the growing market.

- -

- Growth of online marketplaces: Online marketplaces are becoming increasingly popular in the UAE, as they offer customers a wide range of products and services from different sellers in one place.

- -

- Emphasis on Convenience and speed: Many e-commerce companies in the UAE focus on providing convenient and fast delivery options to their customers, such as same-day or next-day delivery.

5.2.1. Dubai CommerCity Free Trade Zone (FTZ)

5.2.2. Smart Dubai 2021

- -

- “Seamless—providing integrated daily life services;

- -

- Efficient—optimising the use of city resources;

- -

- Safe—anticipating risks and protecting people and information;

- -

- Personalised—enriching life and business experiences for all” [81].

- -

- “customer happiness—achieving happiness for residents and visitors in their daily urban lives;

- -

- economic growth—achieving financial savings;

- -

- resource and infrastructure resilience—ensuring clean and sustainable resources and enhanced infrastructures.” [82].

5.2.3. Dubai E-Commerce Strategy

- “cement Dubai as the global logistics hub for the region where e-commerce is set to contribute AED12 billion to the local GDP by 2023;

- attract more foreign direct investments in the e-commerce sector;

- increase the market share of Dubai-based firms in terms of local and regional distribution to reach AED24 billion by 2022 by slashing the business cost of e-commerce activities by 20 percent; business cost includes the cost of storage, customs fees, VAT and transportation, among others;

- reduce the paperwork required for customs clearance and reduce fees imposed on goods passing through the free zones” [81].

5.2.4. eSupply—Dubai E-Procurement Portal

5.2.5. AliDropship—Alibaba DS Service in the UAE

5.2.6. Amazon.ae

5.2.7. Namshi.com

5.2.8. Noon.com

5.3. Dubai E-Commerce Sustainable Models

- -

- Evakind is an e-commerce platform for eco-friendly products founded by a young entrepreneur, Sladjana Franovic. This green Dubai start-up is on a mission to champion small, independent local and international brands with ethical, sustainable, and environment-friendly values. The online shopping platform offers a range of eco-friendly homeware, cleaning, personal care, and beauty products. It is partially owned by Casinetto, a UAE-based food distribution company founded in 2010, whose warehouses and strong supply chains enable Evakind to import and store products from around the world [97].

- -

- Ethikal is “an e-commerce platform that offers sustainable fashion right here in the UAE! Dedicated to curating a platform that offers only ethical wear from the likes of Doodlage, The Summer House, Mati, Rias Jaipur and more, the e-store features stunning artisanal pieces” [98];

- -

- Goshopia aims to let its customer discover “the best slow, sustainable, & ethical fashion designers & brands” [99];

- -

- The Green Ecostore is an “online store for Eco-friendly products that are Sustainable, reusable, recycled & save energy. Brands include Swell, KeepCup, Loqi, Preserve & more” [100];

- Reduction of the number of delivery attempts. One of the most effective and obvious ways to limit CO2 emissions is to reduce the number of product delivery attempts. The fewer trips a van travels to deliver a package, the fewer emissions it produces. By allowing consumers to choose where and when to receive a package (with a reduced time frame), e-retailers can, thus, increase the chances of a package being delivered on the first try.

- Offer an ecological delivery option. Noon is renewing its company fleet to reduce polluting emissions by choosing a green fleet. It also partnered with a Berlin-based micro-mobility provider, Tier, to improve mobility [101].

- Choice of recyclable packaging material. Consumers are not only critical of the use of packaging material but also of its reuse. All the above companies converged to use completely recyclable packaging.

- Reduction of the number of returns. Reducing the number of returns helps to limit the CO2 emissions of each order. Each return shipment causes extra transport, extra vans, extra fuel, and, therefore, extra CO2. Providing clear product descriptions and high-resolution photos so that consumers have a clear and precise idea of what they are buying reduces the likelihood of returns and benefits the environment.

- ○

- “Raise awareness, build capacity, promote and support the development and implementation of CSR and sustainability best practices;

- ○

- Discuss and build a strategy on various CSR, sustainability, and good governance topics and issues;

- ○

- Develop collaborations with peer companies to lead on specific CSR, sustainability, and good governance issues and build learning resources;

- ○

- Provide feedback to the CRB on the value, effectiveness, and efficiency of a company’s services and products;

- ○

- Encourage CSR reporting among members” [102].

6. Conclusions

- -

- Environmental benefits: E-commerce can reduce the environmental impact of transportation and logistics by reducing the need for physical stores and distribution centres and reducing transportation’s carbon footprint.

- -

- Economic benefits: E-commerce can promote economic growth and job creation by enabling businesses to expand their customer base and increase sales.

- -

- Social benefits: E-commerce can improve access to goods and services for people in remote areas and promote social inclusion by making it easier for people with disabilities to shop online.

- -

- Innovation: E-commerce allows companies to experiment with new business models, technologies, and delivery options, which can drive innovation and improve the overall customer experience.

- -

- Environmental impact: E-commerce can increase the environmental impact of packaging and transportation and contribute to the growth of urban sprawl and the loss of green spaces.

- -

- Economic impact: E-commerce can lead to the closure of physical stores and the loss of jobs in the retail sector, as well as increase income inequality by favouring large e-commerce companies over small businesses.

- -

- Social impact: E-commerce can contribute to social isolation and make it more difficult for people with limited internet access to access goods and services.

- -

- Cybersecurity: The increased reliance on e-commerce can also create new cybersecurity risks and vulnerabilities, leading to data breaches and other security incidents.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Pasanen, M. SME Growth Strategies: Organic or Non-Organic? J. Enterprising Cult. 2007, 15, 317–338. [Google Scholar] [CrossRef]

- Hess, E.D.; Kazanjian, R.K. The Search for Organic Growth; Cambridge University Press: Cambridge, UK, 2006. [Google Scholar]

- Bahadir, S.C.; Bharadwaj, S.; Parzen, M. A meta-analysis of the determinants of organic sales growth. Int. J. Res. Mark. 2009, 26, 263–275. [Google Scholar] [CrossRef]

- Rottig, D. A marriage metaphor model for socio-cultural integration in international mergers and acquisitions. Thunderbird Int. Bus. Rev. 2013, 55, 439–451. [Google Scholar] [CrossRef]

- Di Guardo, M.C.; Harrigan, K.R.; Marku, E. M&A and diversification strategies: What effect on quality of inventive activity? J. Manag. Gov. 2019, 23, 669–692. [Google Scholar]

- Schmid, A.S.; Sánchez, C.M.; Goldberg, S.R. M&A today: Great challenges, but great opportunities. J. Corp. Account. Financ. 2012, 23, 3–8. [Google Scholar]

- Perry, J.S.; Herd, T.J. Reducing M&A risk through improved due diligence. Strat. Leadersh. 2004, 32, 12–19. [Google Scholar] [CrossRef]

- Warter, I.; Warter, L. Cultural Due Diligence in M&A. Importance of Soft Risks Factors. Ann. Spiru Haret Univ. Econ. Ser. 2017, 17, 38–62. [Google Scholar] [CrossRef]

- Graebner, M.E.; Eisenhardt, K.M.; Roundy, P.T. Success and failure in technology acquisitions: Lessons for buyers and sellers. Acad. Manag. Perspect. 2010, 24, 73–92. [Google Scholar]

- Tiwari, R.; Anjum, B.; Chand, K.; Pathak, R. Sustainability of Inorganic Growth in Online Retail by Snapdeal: A Case Study. Int. J. Manag. Stud. 2019, VI, 12. [Google Scholar] [CrossRef]

- Herndon, M.; Bender, J. What M&A Looks Like During the Pandemic. Harvard Business Review. Available online: https://hbr.org/2020/06/what-ma-looks-like-during-the-pandemic (accessed on 1 November 2021).

- Weber, C.L.; Koomey, J.G.; Matthews, H.S. The Energy and Climate Change Implications of Different Music Delivery Methods. J. Ind. Ecol. 2010, 14, 754–769. [Google Scholar] [CrossRef]

- Pagitsas, C. Chief Sustainability Officers at Work; Apress: Berkeley, CA, USA, 2022; pp. 103–117. [Google Scholar]

- Saidani, M.; Kim, H.; Ayadhi, N.; Yannou, B. Can Online Customer Reviews Help Design More Sustainable Products? A Preliminary Study on Amazon Climate Pledge Friendly Products. In Proceedings of the ASME 2021 International Design Engineering Technical Conferences and Computers and Information in Engineering Conference, Online, 17–19 August 2021. [Google Scholar] [CrossRef]

- Briken, K.; Taylor, P. Fulfilling the ‘British way’: Beyond constrained choice—Amazon workers’ lived experiences of workfare. Ind. Relat. J. 2018, 49, 438–458. [Google Scholar] [CrossRef]

- Codagnone, C.; Abadie, F.; Biagi, F. The Future of Work in the ‘Sharing Economy’. Market Efficiency and Equitable Opportunities or Unfair Precarisation? Institute for Prospective Technological Studies, Seville, Spain, Science for Policy report by the Joint Research Centre: Seville, Spain, 2016. [Google Scholar]

- Dablanc, L.; Morganti, E.; Arvidsson, N.; Woxenius, J.; Browne, M.; Saidi, N. The rise of on-demand ‘Instant Deliveries’ in European cities. Supply Chain. Forum Int. J. 2017, 18, 203–217. [Google Scholar] [CrossRef]

- Liu, S.; Chen, H.; Hu, Z. Research on Logistics Time Management Decision Based on Supply Chain. IOP Conf. Series Mater. Sci. Eng. 2018, 394, 032088. [Google Scholar] [CrossRef]

- Kalhan, A. Impact of malls on small shops and hawkers. Econ. Political Wkly. 2007, 42, 2063–2066. [Google Scholar]

- Dartnell, L.R.; Kish, K. Do responses to the COVID-19 pandemic anticipate a long-lasting shift towards peer-to-peer production or degrowth? Sustain. Prod. Consum. 2021, 27, 2165–2177. [Google Scholar] [CrossRef]

- Sashi, C.M. Customer engagement, buyer-seller relationships, and social media. Manag. Decis. 2012, 50, 253–272. [Google Scholar] [CrossRef]

- Settey, T.; Gnap, J.; Beňová, D.; Pavličko, M.; Blažeková, O. The Growth of E-Commerce Due to COVID-19 and the Need for Urban Logistics Centers Using Electric Vehicles: Bratislava Case Study. Sustainability 2021, 13, 5357. [Google Scholar] [CrossRef]

- Khalifa, M.; Liu, V. Online consumer retention: Contingent effects of online shopping habit and online shopping experience. Eur. J. Inf. Syst. 2007, 16, 780–792. [Google Scholar] [CrossRef]

- Gumzej, R. E-Commerce. In Intelligent Logistics Systems for Smart Cities and Communities; Springer: Cham, Switzerland, 2021; pp. 53–58. [Google Scholar]

- Gonzalez, A.G. eBay Law: The legal implications of the C2C electronic commerce model. Comput. Law Secur. Rev. 2003, 19, 468–473. [Google Scholar] [CrossRef]

- Chen, D.-N.; Jeng, B.; Lee, W.-P.; Chuang, C.-H. An agent-based model for consumer-to-business electronic commerce. Expert Syst. Appl. 2008, 34, 469–481. [Google Scholar] [CrossRef]

- Singh, G.; Kaur, H.; Singh, A. Dropshipping in e-commerce: A perspective. In Proceedings of the 2018 9th International Conference on E-business, Management and Economics, Waterloo, ON, Canada, 2–4 August 2018; pp. 7–14. [Google Scholar]

- Kumar, V.; Raheja, E.G. Business to business (b2b) and business to consumer (b2c) management. Int. J. Comput. Technol. 2012, 3, 447–451. [Google Scholar]

- Altrad, A.; Pathmanathan, P.R.; Al Moaiad, Y.; Endara, Y.M.; Aseh, K.; El-Ebiary, Y.A.B.; Farea, M.M.; Latiff, N.A.A.; Saany, S.I.A. Amazon in Business to Customers and Overcoming Obstacles. In Proceedings of the 2nd International Conference on Smart Computing and Electronic Enterprise (ICSCEE), Cameron Highlands, Malaysia, 15–17 June 2021; pp. 175–179. [Google Scholar]

- Haque, A.U.; Yamoah, F.A.; Sroka, W. Willingness to Reduce Food Choice in Favour of Sustainable Alternatives: The Role of Government and Consumer Behaviour. In Perspectives on Consumer Behaviour; Springer: Berlin/Heidelberg, Germany, 2020; pp. 31–51. [Google Scholar] [CrossRef]

- Panayiotou, N.A.; Stavrou, V.P. Government to business e-services—A systematic literature review. Gov. Inf. Q. 2021, 38, 101576. [Google Scholar] [CrossRef]

- Finkenstadt, D.J. Essays on perceived service quality and perceived value in business-to-government knowledge-based services. Ph.D. Thesis, The University of North Carolina at Chapel Hill, Chapel Hill, NC, USA, 2020. [Google Scholar]

- Lucking-Reiley, D.; Spulber, D.F. Business-to-Business Electronic Commerce. J. Econ. Perspect. 2001, 15, 55–68. [Google Scholar] [CrossRef]

- Gregor, S.; Hevner, A.R. The Knowledge Innovation Matrix (KIM): A Clarifying Lens for Innovation. Informing Sci. Int. J. Emerg. Transdiscipl. 2014, 17, 217–239. [Google Scholar] [CrossRef]

- Kleysen, R.F.; Street, C.T. Toward a multi-dimensional measure of individual innovative behavior. J. Intellect. Cap. 2001, 2, 284–296. [Google Scholar] [CrossRef]

- Kyffin, S.; Gardien, P. Navigating the innovation matrix: An approach to design-led innovation. Int. J. Des. 2009, 3, 57–69. [Google Scholar]

- Herbig, P.A.; McCarty, C. The innovation matrix. J. Glob. Mark. 1993, 6, 69–90. [Google Scholar] [CrossRef]

- Kahn, K.B. Understanding innovation. Bus. Horiz. 2018, 61, 453–460. [Google Scholar] [CrossRef]

- Christensen, C.; Raynor, M.E.; McDonald, R. Disruptive Innovation; Harvard Business Review: Brighton, MA, USA, 2013. [Google Scholar]

- MacGregor, S.P.; Carleton, T. Sustaining Innovation: Collaboration Models for a Complex World; Springer Science & Business Media: Berlin/Heidelberg, Germany, 2011. [Google Scholar]

- Cheng, C.C.; Chen, J. Breakthrough innovation: The roles of dynamic innovation capabilities and open innovation activities. J. Bus. Ind. Mark. 2013, 28, 444–454. [Google Scholar] [CrossRef]

- Wang, Z.-H. Preliminary innovation and exploration in teaching of entomology culture. Wuyi Sci. J. 2015, 2015. [Google Scholar]

- Leifer, R.; McDermott, C.M.; O’connor, G.C.; Peters, L.S.; Rice, M.P.; Veryzer, R.W., Jr. Radical Innovation: How Mature Companies Can Outsmart Upstarts; Harvard Business Press: Brighton, MA, USA, 2000. [Google Scholar]

- Henderson, R.M.; Clark, K.B. Architectural Innovation: The Reconfiguration of Existing Product Technologies and the Failure of Established Firms. Adm. Sci. Q. 1990, 35, 9–30. [Google Scholar] [CrossRef]

- Magnusson, T.; Lindström, G.; Berggren, C. Architectural or modular innovation? Managing discontinuous product development in response to challenging environmental performance targets. Int. J. Innov. Manag. 2003, 7, 1–26. [Google Scholar] [CrossRef]

- Ettlie, J.E.; Bridges, W.P.; O’keefe, R.D. Organisation strategy and structural differences for radical versus incremental innovation. Manag. Sci. 1984, 30, 682–695. [Google Scholar] [CrossRef]

- Chesbrough, H.W. Open Innovation: The New Imperative for Creating and Profiting from Technology; Harvard Business Press: Brighton, MA, USA, 2003. [Google Scholar]

- Mosteanu, N.; Faccia, A. Fintech Frontiers in Quantum Computing, Fractals, and Blockchain Distributed Ledger: Paradigm Shifts and Open Innovation. J. Open Innov. Technol. Mark. Complex. 2021, 7, 19. [Google Scholar] [CrossRef]

- Almirall, E.; Casadesus-Masanell, R. Open versus closed innovation: A model of discovery and divergence. Acad. Manag. Rev. 2010, 35, 27–47. [Google Scholar]

- Srai, J.S.; Lorentz, H. Developing design principles for the hatalization of purchasing and supply management. J. Purch. Supply Manag. 2018, 25, 78–98. [Google Scholar] [CrossRef]

- Eduardsen, J. Chapter 7 Internationalisation through Digitalisation: The Impact of E-commerce Usage on Internationalisation in Small- and Medium-sized Firms. In International Business in the Information and Digital Age; Emerald Group Publishing Limited: Bingley, UK, 2018; pp. 159–186. [Google Scholar] [CrossRef]

- Jara, M.; Vyt, D.; Mevel, O.; Morvan, T.; Morvan, N. Measuring customers benefits of click and collect. J. Serv. Mark. 2018, 32, 430–442. [Google Scholar] [CrossRef]

- Bullock, M. Panic, pandemic and payment preferences. In Proceedings of the Morgan Stanley Disruption Evolved Webcast, Online, 3 June 2020. [Google Scholar]

- Tzavlopoulos, Ι.; Gotzamani, K.; Andronikidis, A.; Vassiliadis, C. Determining the impact of e-commerce quality on customers’ perceived risk, satisfaction, value and loyalty. Int. J. Qual. Serv. Sci. 2019, 11, 4. [Google Scholar] [CrossRef]

- Petratos, P.N.; Ljepava, N.; Salman, A. Blockchain Technology, Sustainability and Business: A Literature Review and the Case of Dubai and UAE. In Sustainable Development and Social Responsibility; Springer: Berlin/Heidelberg, Germany, 2020; Volume 1, pp. 87–93. [Google Scholar] [CrossRef]

- Sabri, S. Smart Dubai IoT strategy: Aspiring to the promotion of happiness for residents and visitors through a con-tinuous commitment to innovation. In Smart Cities for Technological and Social Innovation; Academic Press: Cambridge, MA, USA, 2021; pp. 181–193. [Google Scholar]

- Joghee, S.; Alzoubi, H.; Dubey, A. Decisions effectiveness of FDI investment biases at real estate industry: Empirical evidence from Dubai smart city projects. Int. J. Sci. Technol. Res. 2020, 9, 1245–1258. [Google Scholar]

- Yadav, A.K.; Szpytko, J. How to Connect Hyperloop Technology with the Smart City Transportation Concept. In Electric Mobility in Public Transport—Driving Towards Cleaner Air; Springer: Berlin/Heidelberg, Germany, 2021; pp. 201–216. [Google Scholar] [CrossRef]

- Hafiz, D.; Zohdy, I. The City Adaptation to the Autonomous Vehicles Implementation: Reimagining the Dubai City of Tomorrow. In Towards Connected and Autonomous Vehicle Highways; Springer: Berlin/Heidelberg, Germany, 2021; pp. 27–41. [Google Scholar] [CrossRef]

- Zilgalvis, P. The Political Economy of the Blockchain. In Disintermediation Economics; Springer: Berlin/Heidelberg, Germany, 2021; pp. 249–266. [Google Scholar] [CrossRef]

- Blockchain in the UAE Government. Available online: https://u.ae/en/about-the-uae/digital-uae/blockchain-in-the-uae-government#:~:text=The%20Dubai%20Blockchain%20Strategy%20will,industry%20creation%2C%20and%20international%20leadership (accessed on 8 February 2023).

- Available online: https://smartdubai.ae (accessed on 8 February 2023).

- Available online: https://www.digitaldubai.ae (accessed on 8 February 2023).

- Available online: https://eng-archive.aawsat.com/asharq-al-awsat-english/business/dubai-governments-smart-services-spare-1-2-billion-dollars-12-years (accessed on 8 February 2023).

- Available online: https://www.dubaifuture.ae (accessed on 8 February 2023).

- Available online: https://www.dubaifuture.ae/initiatives/future-design-and-acceleration/dubai-future-labs (accessed on 8 February 2023).

- Available online: https://dubaifutureaccelerators.com (accessed on 8 February 2023).

- Available online: https://c4ir.ae (accessed on 8 February 2023).

- Ahmed, W.K.; Alhamad, I.M. 3D printing innovations in UAE: Case study: Abu Dhabi summer challenge 2017. In Proceedings of the 2018 Advances in Science and Engineering Technology International Conferences (ASET), Dubai, Sharjah, Abu Dhabi, United Arab Emirates, 6 February–5 April 2018; pp. 1–5. [Google Scholar]

- Available online: https://www.wipo.int/edocs/pubdocs/en/wipo_pub_gii_2021.pdf (accessed on 8 February 2023).

- Schilirò, D. Fintech in Dubai: Development and Ecosystem. Int. Bus. Res. 2021, 14, p61. [Google Scholar] [CrossRef]

- Available online: https://www.khaleejtimes.com/news/uae-to-create-a-new-task-force-for-digital-economy (accessed on 1 November 2021).

- Available online: https://www.expo2020dubai.com (accessed on 8 February 2023).

- Haneef, S.K.; Ansari, Z. Marketing strategies of Expo 2020 Dubai: A comprehensive study. Worldw. Hosp. Tour. Themes 2019, 11, 287–297. [Google Scholar] [CrossRef]

- Available online: https://gitex.com (accessed on 8 February 2023).

- Available online: https://www.dwtc.com/en/events/seamless-2021 (accessed on 8 February 2023).

- Available online: https://www.dubaicommercity.ae/#:~:text=Dubai%20CommerCity%20is%20the%20first,outpacing%20the%20global%20growth%20average (accessed on 8 February 2023).

- Available online: https://www.dubaicommercity.ae (accessed on 8 February 2023).

- Mogielnicki, R. The Fraught Future of Free Zones in Gulf Arab States. In A Political Economy of Free Zones in Gulf Arab States; Palgrave Macmillan: Cham, Switzerland, 2021; pp. 227–242. [Google Scholar]

- Mogielnicki, R. Free Zones in Dubai: Accelerators for Artificial Intelligence in the Gulf. In Artificial Intelligence in the Gulf; Springer: Berlin/Heidelberg, Germany, 2021; pp. 141–159. [Google Scholar] [CrossRef]

- Available online: https://u.ae/en/about-the-uae/strategies-initiatives-and-awards/local-governments-strategies-and-plans/smart-dubai-2021-strategy (accessed on 8 February 2023).

- Available online: https://u.ae/en/about-the-uae/strategies-initiatives-and-awards/local-governments-strategies-and-plans/dubai-e-commerce-strategy (accessed on 8 February 2023).

- Available online: https://esupply.dubai.gov.ae/esupply/web/index.html (accessed on 8 February 2023).

- Available online: https://alidropship.com/dropshipping-in-the-uae (accessed on 8 February 2023).

- Available online: https://www.amazon.ae (accessed on 8 February 2023).

- Vakhariya, S. A Study of Online Shopping Experience and Swaying Brand Preference Between Noon and Amazon in UAE. South Asian J. Manag. 2020, 27, 84–112. [Google Scholar]

- Ahmad, O.; Rajawat, A.; Alkandri, L.; Al Enezi, F. A Case Study on Souq. Com. Int. J. Account. Financ. Asia Pac. 2019, 2. [Google Scholar]

- Hasan, L.; Morris, A. Usability Problem Areas on Key International and Key Arab E-commerce Websites. J. Internet Commer. 2016, 16, 1–24. [Google Scholar] [CrossRef]

- Hasan, L. Key Design Characteristics for Developing Usable E-Commerce Websites in the Arab World. Informing Sci. Int. J. Emerg. Transdiscipl. 2016, 19, 253–275. [Google Scholar] [CrossRef]

- Alshamari, M. Accessibility evaluation of Arabic e-commerce websites using automated tools. J. Softw. Eng. Appl. 2016, 9, 439–451. [Google Scholar] [CrossRef]

- Available online: https://en-ae.namshi.com/?utm_source=google&utm_medium=cpc&utm_content=namshi&utm_campaign=ae_search_cb-010001_namshi_en_desktop-tab&gclid=Cj0KCQjww4OMBhCUARIsAILndv6lCVrwJxIVAUt5Qr2ch_G8tPJEYNtxgyZzQonV_KHORRKbIEiPRwYaAlb5EALw_wcB (accessed on 8 February 2023).

- Available online: https://www.thenationalnews.com/business/markets/2022/08/25/emaar-signs-deal-with-noon-to-sell-namshi-for-335m/#:~:text=Dubai’s%20largest%20listed%20developer%20Emaar,23%20billion%20(%24335.2%20million) (accessed on 8 February 2023).

- Moşteanu, N.R.; Faccia, A. Digital systems and new challenges of financial management–FinTech, XBRL, blockchain and cryptocurrencies. Qual.-Access Success J. 2020, 21, 159–166. [Google Scholar]

- Al-Omari, S.; Bishnoi, M.; Jakhiya, M. Souq-Amazon and Careem-Uber Acquisition Deals: An Analytical Study of the Two Merging Giants in the UAE. In Proceedings of the ICBMIS 2020: International Conference on Business Management, Innovation, and Sustainability, Dubai, United Arab Emirates, 15–16 June 2020. [Google Scholar]

- Available online: https://www.noon.com/uae-en (accessed on 8 February 2023).

- Available online: https://sentineldubai.com/blog/2022/1/11/dubai-eco-friendly-businesses-supporting-the-green-economy-initiative (accessed on 8 February 2023).

- Available online: https://evakind.com (accessed on 8 February 2023).

- Available online: https://www.harpersbazaararabia.com/fashion/featured-news/meet-one-of-the-uaes-leading-sustainable-fashion-e-commerce-platform (accessed on 8 February 2023).

- Available online: https://www.goshopia.com (accessed on 8 February 2023).

- Available online: https://thegreenecostore.com (accessed on 8 February 2023).

- Available online: https://www.khaleejtimes.com/local-business/tier-partners-with-noon-com-to-promote-sustainable-mobility (accessed on 8 February 2023).

- Available online: https://www.dubaichamber.com/crb/dubai-chamber-sustainability-network (accessed on 8 February 2023).

- Momin, S. E-Commerce Acceptance and Implementation Among Consumers in the UAE: An Opportunity to Build Human Capital for Future Jobs in Technology and Marketing. In Human Capital in the Middle East; Springer: Berlin/Heidelberg, Germany, 2020; pp. 253–272. [Google Scholar] [CrossRef]

- Soundararajan, G. Impact of E-commerce on Global Business Environment: A Conceptual Study Focus on Middle East. Eurasian J. Anal. Chem. 2018, 13, 96–98. [Google Scholar]

- Geetha, G. Exploring the Influential Factors of Online Consumer Shopping Habits and Intention in GCC. Int. J. Innov. Sci. Res. Technol. 2020, 5. [Google Scholar]

- Almonte, R.G. Determinants of E-Commerce Websites’ User Interface: A Cross-Cultural Investigation Between Saudi Arabia and Philippines. In Proceedings of the 10th International Conference, CCD 2018, Las Vegas, NV, USA, 15–20 July 2018; pp. 300–313. [Google Scholar] [CrossRef]

- Baskaran, K.; Rajavelu, S. Digital Innovation in Industry 4.0 Era–Rebooting UAE’s Retail. In Proceedings of the 2020 International Conference on Communication and Signal Processing (ICCSP), Chennai, India, 28–30 July 2020; pp. 1614–1618. [Google Scholar]

- Davidsson, P.; Delmar, F.; Wiklund, J. Entrepreneurship as Growth: Growth as Entrepreneurship. In Strategic Entrepreneurship: Creating a New Mindset; Blackwell Publishing Ltd: Oxford, UK, 2017; pp. 328–342. [Google Scholar] [CrossRef]

- Al Mashalah, H.; Hassini, E.; Gunasekaran, A.; Mishra, D.B. The impact of digital transformation on supply chains through e-commerce: Literature review and a conceptual framework. Transp. Res. Part E Logist. Transp. Rev. 2022, 165, 102837. [Google Scholar] [CrossRef]

- Al-Khateeb, F.B. The adoption and diffusion of E-Commerce in businesses in United Arab Emirates, Innovation and Sustainable Competitive Advantage: From Regional Development to World Economies. In Proceedings of the 18th International Business Information Management Association Conference, Istanbul, Turkey, 9–10 May 2012. [Google Scholar]

- Abdallah, S.; Jaleel, B. Online shopping in the United Arab Emirates: User web experience. Int. J. Web Portals 2014, 6, 1–20. [Google Scholar] [CrossRef]

- Rao, P.; Vihari, N.S.; Jabeen, S.S. E-commerce and Fashion Retail Industry: An Empirical Investigation on the Online Retail Sector in the Gulf Cooperation Council (GCC) Countries. ICEB 2020 Proc. 2020. [Google Scholar]

- Al Alawi, A.; Kuzic, J. EB Challenges and how to overcome them in Dubai. Commun. IBIMA 2008, 4, 127–134. [Google Scholar]

- Al-Alawi, A.A.; Kuzic, J.; Chadhar, M.A. Impediments of e-business-a Dubai experience. In Proceedings of the 5th International Business Information Management Conference on Internet and Information Technology in Modern Organizations: Challenges & Answers, Cairo, Egypt, 13–15 December 2005; pp. 611–616. [Google Scholar]

- Faccia, A.; Mosteanu, N.R.; Fahed, M.; Capitanio, F. Accounting information systems and ERP in the UAE: An assessment of the current and future challenges to handle big data. In Proceedings of the 2019 3rd International Conference on Cloud and Big Data Computing, Oxford, UK, 28–30 August 2019; 2019; pp. 90–94. [Google Scholar]

- Al-Alawi, A.A.; Kuzic, J. Achieving EB benefits in Middle East-Dubai perspective. In Proceedings of the 7th International Business Information Management Association Conference, Brescia, Italy, 14–16 December 2006; pp. 183–190. [Google Scholar]

| Organic Growth | Inorganic Growth |

|---|---|

| Pricing Strategy | Mergers and Acquisition |

| Marketplace Presence | New Domains |

| Customer Value | New Adjacencies |

| Relationship Management | Strategic Partnerships |

| Drivers | Metrics | SDGs 1 |

|---|---|---|

| Environmental | Carbon Emissions Use Of Renewable Fuels Climate Risk Factors Recycling Process Emergency Readiness N. Water-Intensive Operations % Energy Reduction Used (Energy Efficiency) % Products Sustainably Manufactured Packaging Reduction Practices Tons Of Toxic Waste N. Unhealthy/Dangerous Products Sold | 13. Climate Action 7. Affordable and Clean Energy 13. Climate Action 11. Sustainable Cities and Communities 9. Industry Innovation and Infrastructure 6. Clean Water and Sanitation 7. Affordable and Clean Energy 12. Responsible Consumption and Production 12. Responsible Consumption and Production 13. Climate Action 3. Good Health and Well-Being |

| Social | N. Of Employees’ Wellness Activities Amount Median Gender Pay Gap Human Rights Assessment Health And Safety Checks Inclusion And Diversity Assessment Impact On Local Communities % Employees Digitally Upskilled % Employees Retained After Automation (Reskilled) | 3. Good Health and Well-Being 5. Gender Equality 8. Decent Work and Economic Growth 3. Good Health and Well-Being 10. Reduced Inequalities 11. Sustainable Cities and Communities 8. Decent Work and Economic Growth 8. Decent Work and Economic Growth |

| Governance | Management Pay-Tied to Climate Response Targets Board Oversight of Climate Issues Ethical Standards (Exceeding Regulation Compliance) | 13. Climate Action 8. Decent Work and Economic Growth 9. Industry Innovation and Infrastructure |

| Empirical Observation | E-Commerce Models Adopted/ Encouraged | Innovation Model Adopted/Encouraged | Organic/ Inorganic Growth | ESG Metrics and SDGs |

|---|---|---|---|---|

| B2B, B2C, B2G, DS | Open Innovation Sustaining Innovation Radical Innovation | Supporting preferably Organic Growth | |

| All Models encouraged | All Models encouraged | Supporting preferably Organic Growth | |

| All Models encouraged | All Models encouraged | Supporting Organic and Inorganic Growth | |

Dubai e-procurement Portal | G2B, G2C, B2G | Open Innovation Disruptive Innovation Radical Innovation | Supporting Organic and Inorganic Growth | |

Alibaba DS service in the UAE | DS | Open Innovation Architectural Innovation Modular Innovation Incremental Innovation Radical Innovation Disruptive Innovation Sustaining Innovation | Organic Growth | |

uae.souq.com the UAE Amazon platforms | B2C, B2B, DS | Open Innovation Closed Innovation Sustaining Innovation Disruptive Innovation | Souq.com organic growth initially, then acquired by Amazon | |

Fashion e-retailer | B2C, B2B, DS | Open Innovation Closed Innovation Sustaining Innovation Disruptive Innovation | Organic Initially, then acquired by Noon | |

Middle East’s homegrown online marketplace | B2C, B2B, DS | Open Innovation Closed Innovation Sustaining Innovation Disruptive Innovation | Organic Growth |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Faccia, A.; Le Roux, C.L.; Pandey, V. Innovation and E-Commerce Models, the Technology Catalysts for Sustainable Development: The Emirate of Dubai Case Study. Sustainability 2023, 15, 3419. https://doi.org/10.3390/su15043419

Faccia A, Le Roux CL, Pandey V. Innovation and E-Commerce Models, the Technology Catalysts for Sustainable Development: The Emirate of Dubai Case Study. Sustainability. 2023; 15(4):3419. https://doi.org/10.3390/su15043419

Chicago/Turabian StyleFaccia, Alessio, Corlise Liesl Le Roux, and Vishal Pandey. 2023. "Innovation and E-Commerce Models, the Technology Catalysts for Sustainable Development: The Emirate of Dubai Case Study" Sustainability 15, no. 4: 3419. https://doi.org/10.3390/su15043419

APA StyleFaccia, A., Le Roux, C. L., & Pandey, V. (2023). Innovation and E-Commerce Models, the Technology Catalysts for Sustainable Development: The Emirate of Dubai Case Study. Sustainability, 15(4), 3419. https://doi.org/10.3390/su15043419