Decision-Making of Cross-Border E-Commerce Platform Supply Chains Considering Information Sharing and Free Shipping

Abstract

:1. Introduction

- (1)

- Considering the impact of free shipping on consumers’ willingness to buy, under what circumstances would retailers choose to offer free shipping services?

- (2)

- Is the retailer with information willing to share it? Is the new entrant willing to obtain information? Is the platform willing to enable information sharing?

- (3)

- Which is an equilibrium strategy for competing retailers’ decisions on information sharing, free shipping, and quantity?

- (4)

- How should the CBEC platform develop business strategies to achieve a win–win–win situation in the marketplace mode?

2. Model Description and Notations

2.1. Demand Function

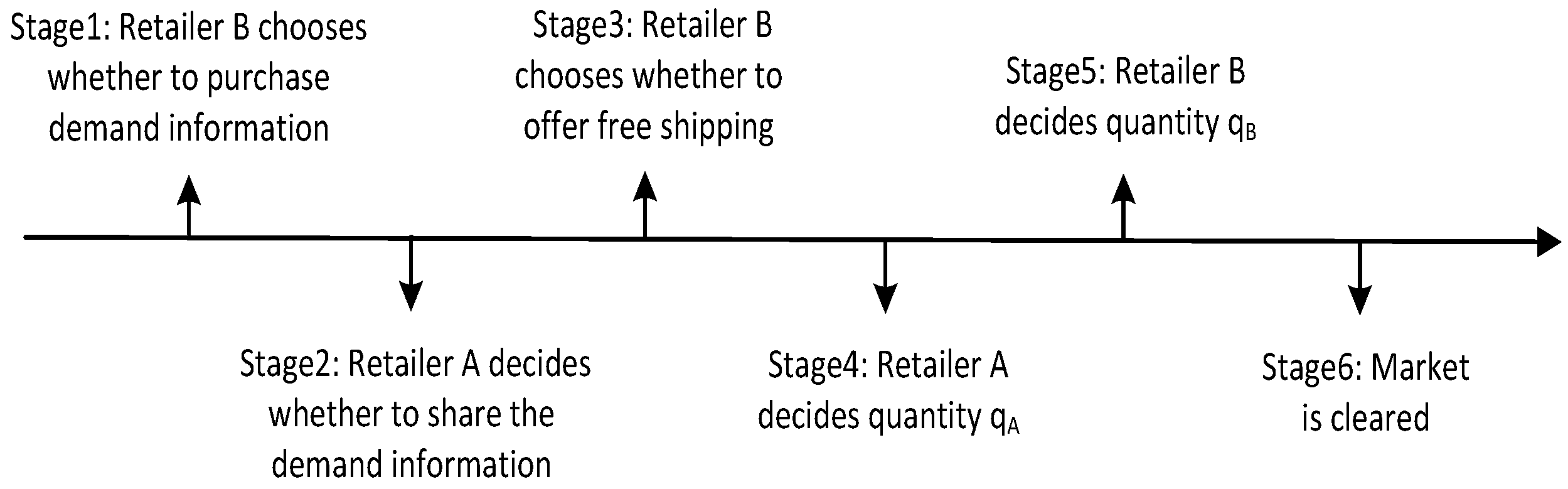

2.2. Events and Profit Functions

3. Theoretical Analysis of the Model

- (a)

- : , ;

- (b)

- : , , , .

- where , , .

4. Numerical Analysis

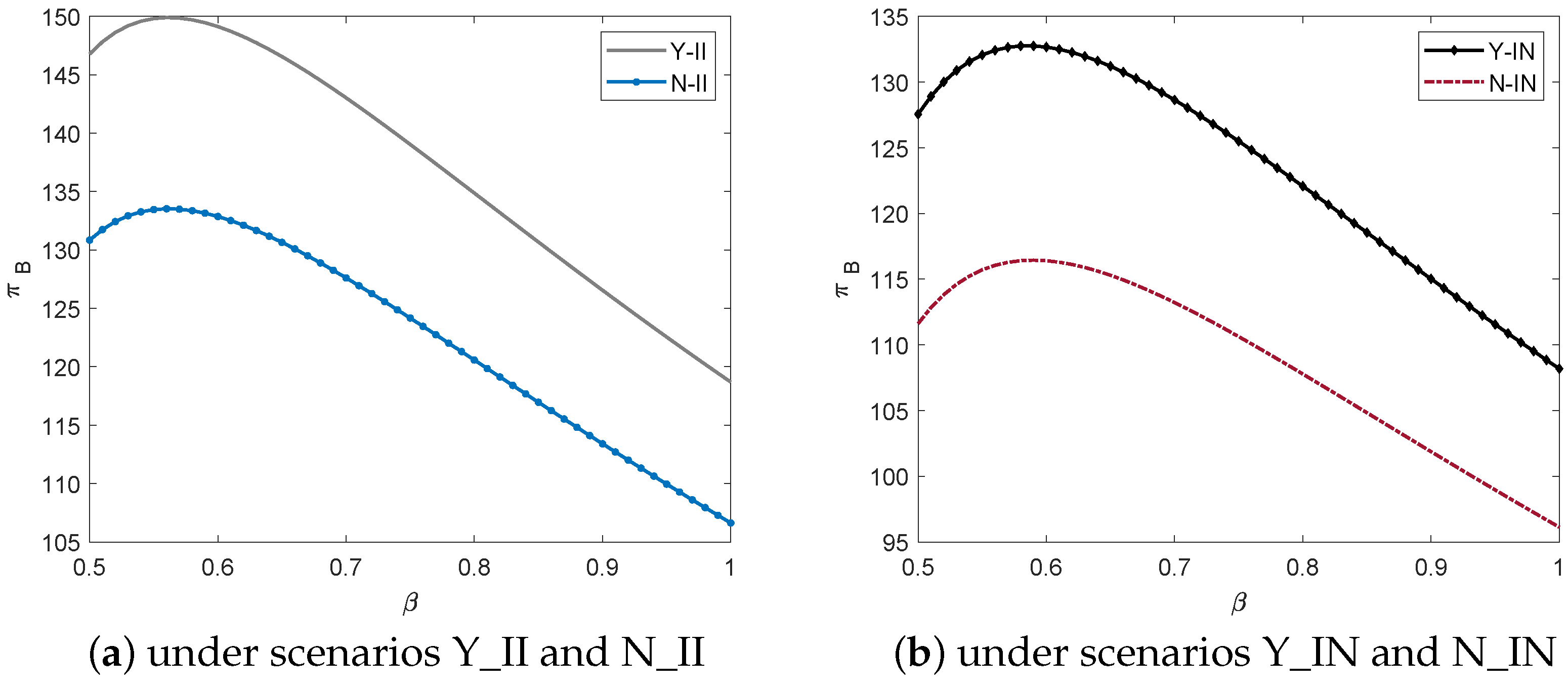

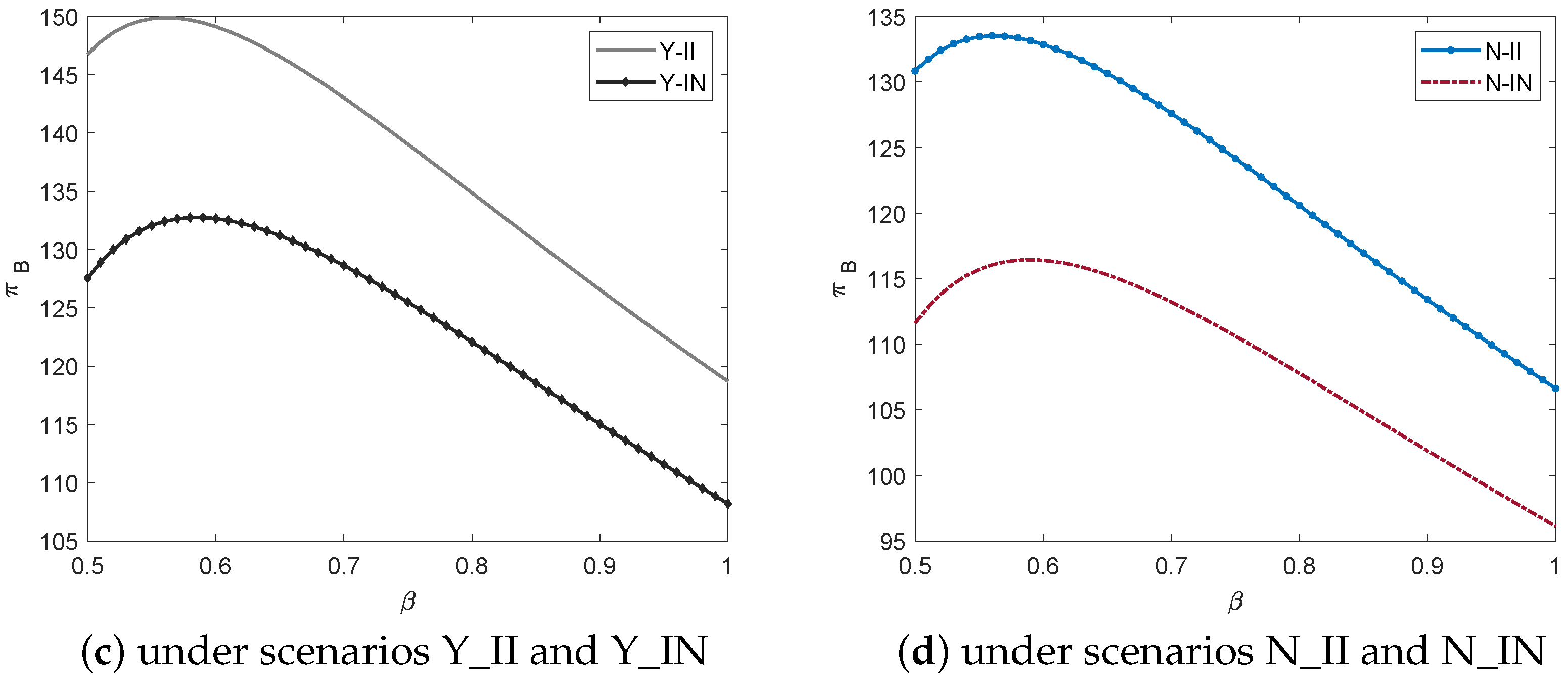

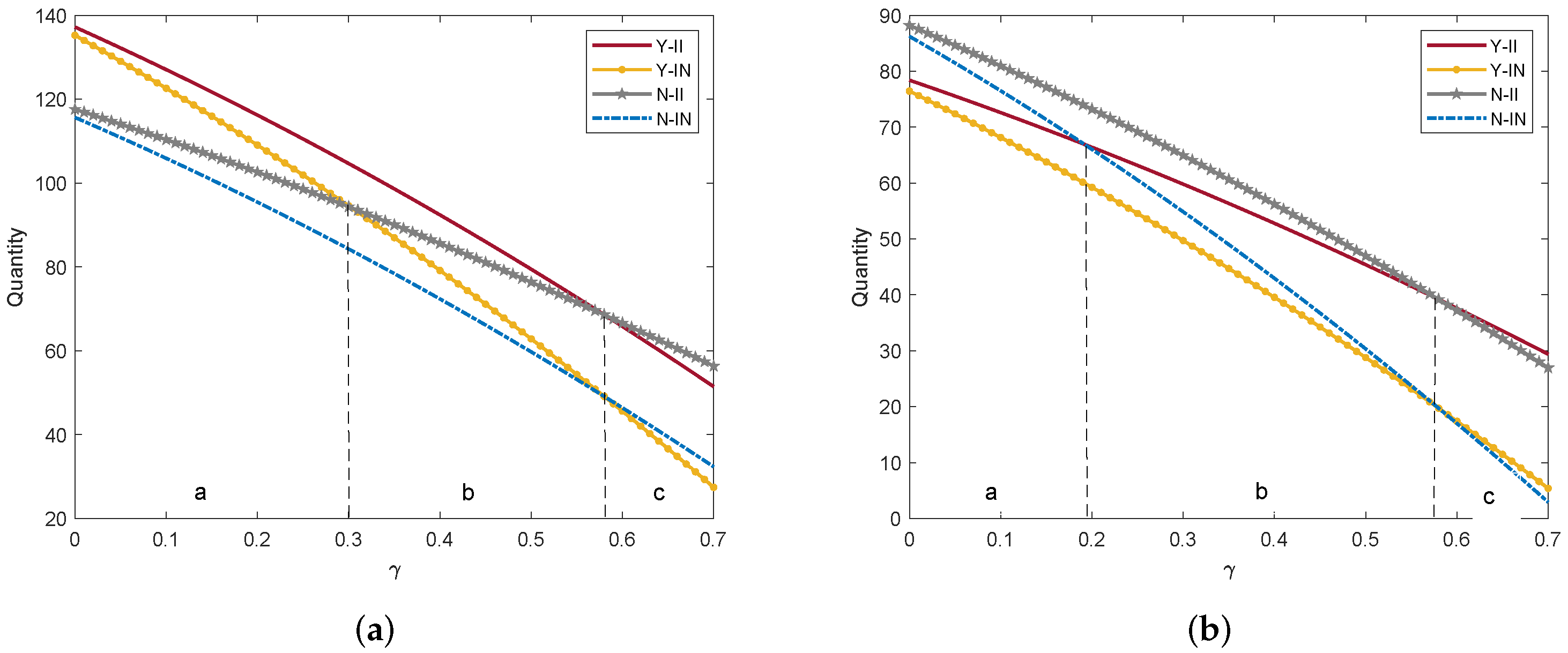

4.1. Profit Analysis for Retailers

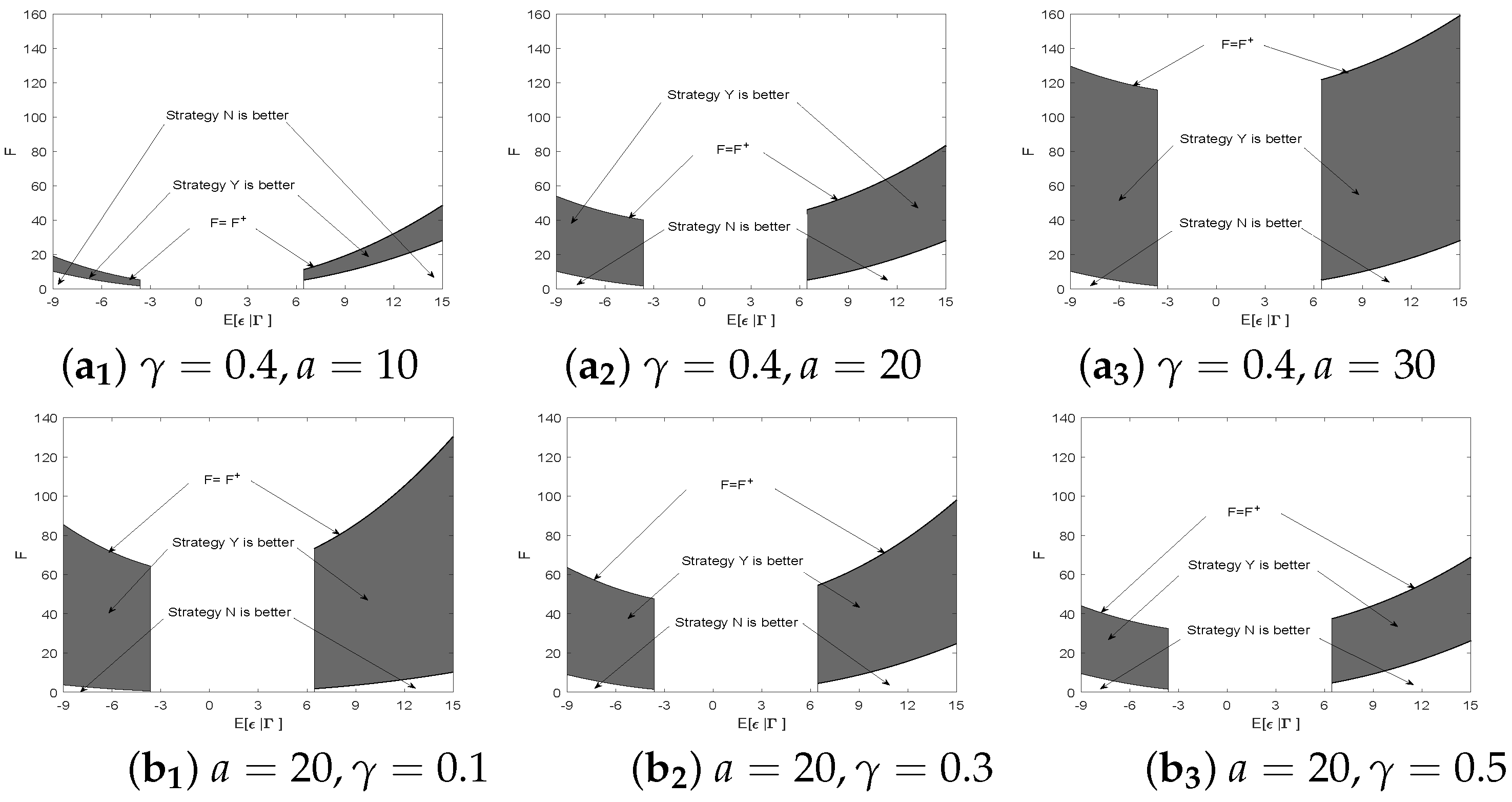

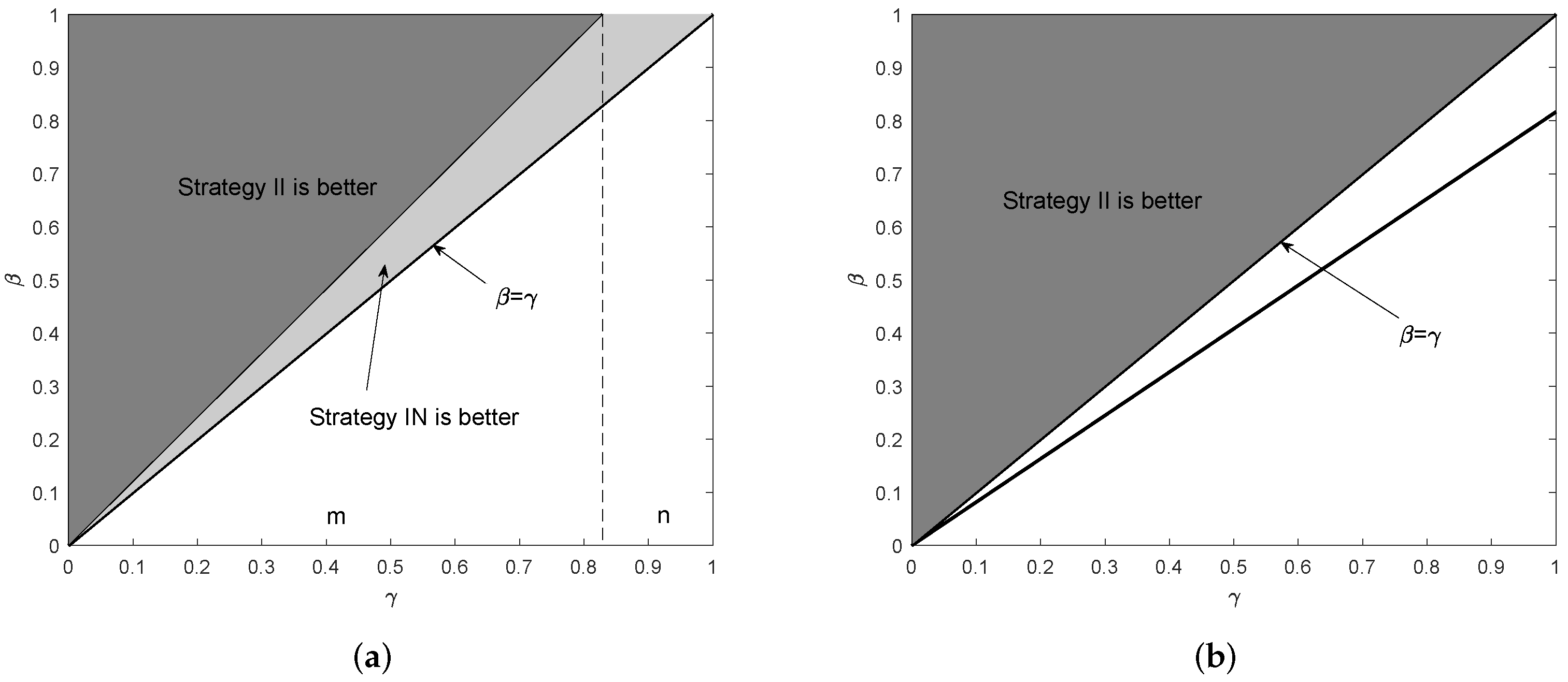

4.2. Strategic Choices for Retailers

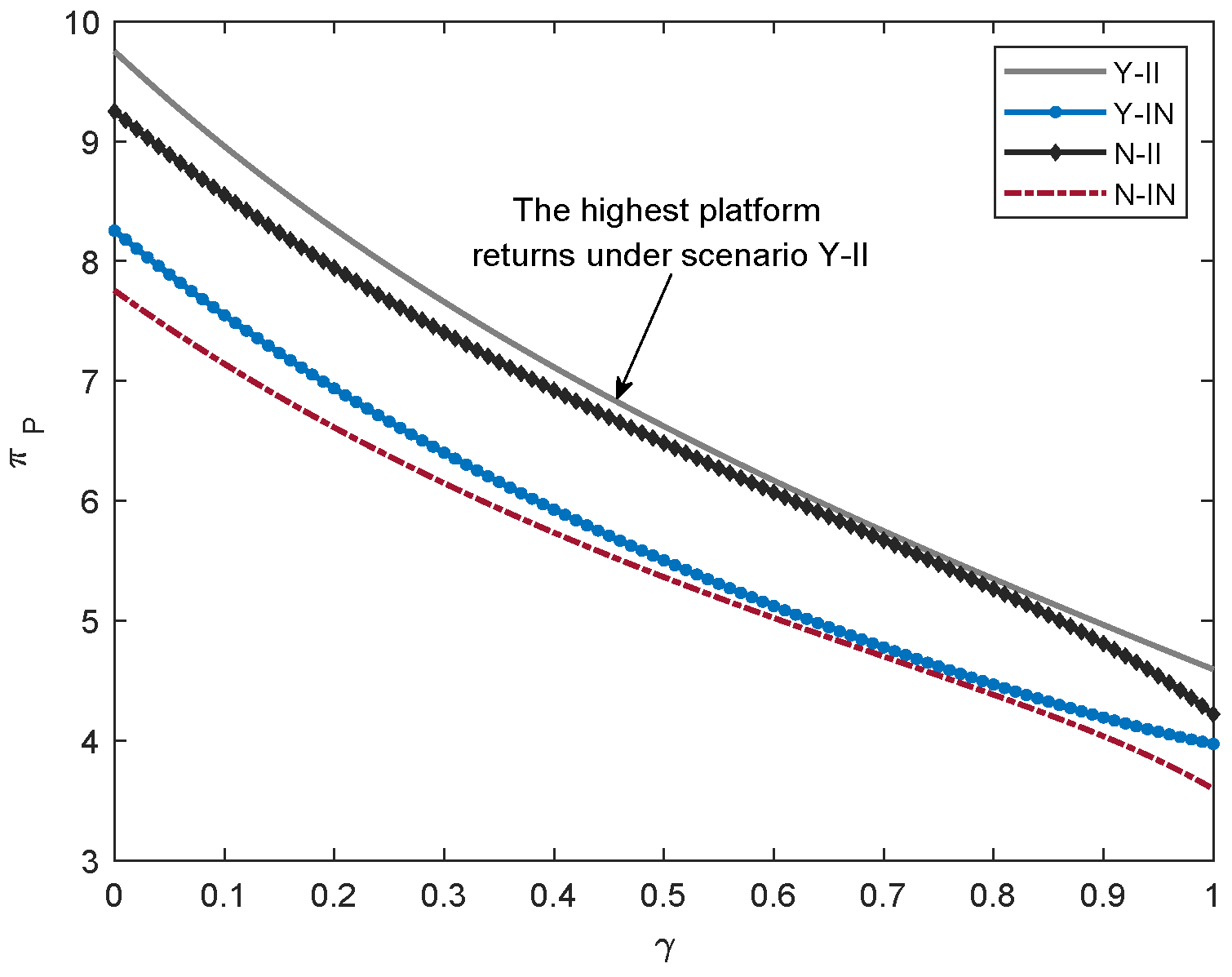

4.3. Platform Numerical Analysis

5. Discussion and Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| CBEC | Cross-border E-commerce |

Appendix A. The Derivation of Equilibriums

| Y_II | |

| Y_IN | |

| N_II | |

| N_IN | |

| Retailer A | |

| Retailer B | |

References

- Awiagah, R.; Kang, J.; Lim, J.I. Factors affecting e-commerce adoption among SMEs in Ghana. Inf. Dev. 2016, 32, 815–836. [Google Scholar] [CrossRef]

- Alzahrani, J. The impact of e-commerce adoption on business strategy in Saudi Arabian small and medium enterprises (SMEs). Rev. Econ. Polit. Sci. 2019, 4, 73–88. [Google Scholar] [CrossRef]

- Wang, J. Opportunities and challenges of international e-commerce in the pilot areas of China. Int. J. Mark. Stud. 2014, 6, 141. [Google Scholar] [CrossRef]

- Baek, E.; Lee, H.K.; Choo, H.J. Cross-border online shopping experiences of Chinese shoppers. Asia Pac. J. Mark. Logist. 2019, 32, 366–385. [Google Scholar] [CrossRef]

- Hadasik, B.; Kubiczek, J. E-commerce market environment formed by the COVID-19 pandemic—A strategic analysis. Forum Sci. Oecon. 2022, 10, 25–52. [Google Scholar]

- Adam, I.O.; Alhassan, M.D.; Afriyie, Y. What drives global B2C E-commerce? An analysis of the effect of ICT access, human resource development and regulatory environment. Technol. Anal. Strateg. Manag. 2020, 32, 835–850. [Google Scholar] [CrossRef]

- Hua, G.; Wang, S.; Cheng, T. Optimal order lot sizing and pricing with free shipping. Eur. J. Oper. Res. 2012, 218, 435–441. [Google Scholar] [CrossRef]

- Shehu, E.; Papies, D.; Neslin, S.A. Free shipping promotions and product returns. J. Mark. Res. 2020, 57, 640–658. [Google Scholar] [CrossRef]

- Niu, B.; Xu, H.; Xie, F. Free shipping in cross-border supply chains considering tax disparity and carrier’s pricing decisions. Transp. Res. Part. Logist. Transp. Rev. 2021, 152, 102369. [Google Scholar] [CrossRef]

- Song, Y.; Liu, J.; Zhang, W.; Li, J. Blockchains role in e-commerce sellers decision-making on information disclosure under competition. Ann. Oper. Res. 2022, 1–40. [Google Scholar] [CrossRef]

- Qu, S.; Xu, L.; Mangla, S.K.; Chan, F.T.; Zhu, J.; Arisian, S. Matchmaking in reward-based crowdfunding platforms: A hybrid machine learning approach. Int. J. Prod. Res. 2022, 60, 7551–7571. [Google Scholar] [CrossRef]

- Qu, S.; Li, Y.; Ji, Y. The mixed integer robust maximum expert consensus models for large-scale GDM under uncertainty circumstances. Appl. Soft Comput. 2021, 107, 107369. [Google Scholar] [CrossRef]

- Dominguez, R.; Cannella, S.; Barbosa-Póvoa, A.P.; Framinan, J.M. OVAP: A strategy to implement partial information sharing among supply chain retailers. Transp. Res. Part. Logist. Transp. Rev. 2018, 110, 122–136. [Google Scholar] [CrossRef]

- Lv, Q. Supply chain decision-making of cross-border E-commerce platforms. Adv. Ind. Eng. Manag. 2018, 7, 1–5. [Google Scholar]

- Lu, Y.H.; Yeh, C.C.; Liau, T.W. Exploring the key factors affecting the usage intention for cross-border e-commerce platforms based on DEMATEL and EDAS method. Electron. Commer. Res. 2022, 1–23. [Google Scholar] [CrossRef]

- Zha, X.; Zhang, X.; Liu, Y.; Dan, B. Bonded-warehouse or direct-mail? Logistics mode choice in a cross-border e-commerce supply chain with platform information sharing. Electron. Commer. Res. Appl. 2022, 54, 101181. [Google Scholar] [CrossRef]

- Qi, X.; Chan, J.H.; Hu, J.; Li, Y. Motivations for selecting cross-border e-commerce as a foreign market entry mode. Ind. Mark. Manag. 2020, 89, 50–60. [Google Scholar] [CrossRef]

- Cao, K.; Xu, Y.; Cao, J.; Xu, B.; Wang, J. Whether a retailer should enter an e-commerce platform taking into account consumer returns. Int. Trans. Oper. Res. 2020, 27, 2878–2898. [Google Scholar] [CrossRef]

- Jiang, B.; Jerath, K.; Srinivasan, K. Firm strategies in the mid tail of platform-based retailing. Mark. Sci. 2011, 30, 757–775. [Google Scholar] [CrossRef]

- Li, C.; Chu, M.; Zhou, C.; Xie, W. Is it always advantageous to add-on item recommendation service with a contingent free shipping policy in platform retailing? Electron. Commer. Res. Appl. 2019, 37, 100883. [Google Scholar] [CrossRef]

- Wang, Y.Y.; Li, J. Research on pricing, service and logistic decision-making of E-supply chain with Free Shipping strategy. J. Control Decis. 2018, 5, 319–337. [Google Scholar] [CrossRef]

- Han, S.; Chen, S.; Yang, K.; Li, H.; Yang, F.; Luo, Z. Free shipping policy for imported cross-border e-commerce platforms. Ann. Oper. Res. 2022, 1–30. [Google Scholar] [CrossRef]

- Etumnu, C.E. Free shipping. Appl. Econ. Lett. 2022, 1–4. [Google Scholar] [CrossRef]

- Leng, M.; Becerril-Arreola, R. Joint pricing and contingent free-shipping decisions in B2C transactions. Prod. Oper. Manag. 2010, 19, 390–405. [Google Scholar] [CrossRef]

- Rui, G.; XiaXia, M.; TianXing, S. Research on the Impact of Consumers—Time Sensitivity on E-commerce Free Shipping Strategy. In Proceedings of the 2020 Chinese Control And Decision Conference (CCDC), Hefei, China, 22–24 August 2020; pp. 4204–4209. [Google Scholar]

- Li, L.; Zhang, H. Confidentiality and information sharing in supply chain coordination. Manag. Sci. 2008, 54, 1467–1481. [Google Scholar] [CrossRef]

- Jain, A.; Seshadri, S.; Sohoni, M. Differential pricing for information sharing under competition. Prod. Oper. Manag. 2011, 20, 235–252. [Google Scholar] [CrossRef]

- Ha, A.Y.; Tong, S.; Zhang, H. Sharing demand information in competing supply chains with production diseconomies. Manag. Sci. 2011, 57, 566–581. [Google Scholar] [CrossRef]

- Shang, W.; Ha, A.Y.; Tong, S. Information sharing in a supply chain with a common retailer. Manag. Sci. 2016, 62, 245–263. [Google Scholar] [CrossRef]

- Huang, S.; Guan, X.; Chen, Y.J. Retailer information sharing with supplier encroachment. Prod. Oper. Manag. 2018, 27, 1133–1147. [Google Scholar] [CrossRef]

- Min, Z.; Mikai, X.; Debao, D. Research on game strategy of information sharing in cross-border e-commerce supply chain between manufacturers and retailers. In Proceedings of the Advances in Intelligent Systems and Interactive Applications, Proceedings of the 4th International Conference on Intelligent, Interactive Systems and Applications (IISA2019), Bangkok, Thailand, 28–30 June 2019; Springer: Berlin/Heidelberg, Germany, 2020; pp. 399–406. [Google Scholar]

- Kirby, A.J. Trade associations as information exchange mechanisms. Rand J. Econ. 1988, 19, 138–146. [Google Scholar] [CrossRef]

- Niu, B.; Dai, Z.; Chen, L. Information leakage in a cross-border logistics supply chain considering demand uncertainty and signal inference. Ann. Oper. Res. 2022, 309, 785–816. [Google Scholar] [CrossRef]

- Liu, Z.; Zhang, D.J.; Zhang, F. Information sharing on retail platforms. Manuf. Serv. Oper. Manag. 2021, 23, 606–619. [Google Scholar] [CrossRef]

- Mukhopadhyay, S.K.; Yue, X.; Zhu, X. A Stackelberg model of pricing of complementary goods under information asymmetry. Int. J. Prod. Econ. 2011, 134, 424–433. [Google Scholar] [CrossRef]

- Xu, X.; Chen, Y.; He, P.; Yu, Y.; Bi, G. The selection of marketplace mode and reselling mode with demand disruptions under cap-and-trade regulation. Int. J. Prod. Res. 2021, 1–20. [Google Scholar] [CrossRef]

- Simon, D.; Fischbach, K.; Schoder, D. Enterprise architecture management and its role in corporate strategic management. Inf. Syst. Bus. Manag. 2014, 12, 5–42. [Google Scholar] [CrossRef]

- Qu, S.; Shu, L.; Yao, J. Optimal pricing and service level in supply chain considering misreport behavior and fairness concern. Comput. Ind. Eng. 2022, 174, 108759. [Google Scholar] [CrossRef]

- Bai, Q.; Xu, J.; Gong, Y.; Chauhan, S.S. Robust decisions for regulated sustainable manufacturing with partial demand information: Mandatory emission capacity versus emission tax. Eur. J. Oper. Res. 2022, 298, 874–893. [Google Scholar] [CrossRef]

- Niu, B.; Dai, Z.; Zhuo, X. Co-opetition effect of promised-delivery-time sensitive demand on air cargo carriers—Big data investment and demand signal sharing decisions. Transp. Res. Part. Logist. Transp. Rev. 2019, 123, 29–44. [Google Scholar] [CrossRef]

- Xing, W.; Li, Q.; Zhao, X.; Li, J. Information sale and contract selection under downstream competition. Transp. Res. Part. Logist. Transp. Rev. 2020, 136, 101870. [Google Scholar] [CrossRef]

- Singh, N.; Vives, X. Price and quantity competition in a differentiated duopoly. Rand J. Econ. 1984, 15, 546–554. [Google Scholar] [CrossRef]

- Roy, R.A. Market Information and Firm Performance. Manag. Sci. 2000, 46, 1075–1084. [Google Scholar]

- Bai, Q.; Xu, J.; Chauhan, S.S. Effects of sustainability investment and risk aversion on a two-stage supply chain coordination under a carbon tax policy. Comput. Ind. Eng. 2020, 142, 106324. [Google Scholar] [CrossRef]

| E-Commerce | E-Commerce Platform | Free Shipping | Information Sharing | Competition | |

|---|---|---|---|---|---|

| Li and Zhang [26] | √ | √ | √ | ||

| Mukhopadhyay et al. [35] | √ | √ | √ | ||

| Liu et al. [34] | √ | √ | √ | ||

| Wang and Li [21] | √ | √ | √ | ||

| Rui et al. [25] | √ | √ | √ | ||

| Niu et al. [9] | √ | √ | √ | ||

| Cao et al. [18] | √ | √ | √ | √ | |

| Zha et al. [16] | √ | √ | √ | √ | |

| Our paper | √ | √ | √ | √ | √ |

| Parameters | Meaning |

|---|---|

| a | Initial market potential |

| Demand uncertainty | |

| Price sensitivity to its own quantity | |

| Price sensitivity to its rivals’ quantity | |

| Platform’s commission rate with marketplace mode | |

| F | Information purchase fee |

| The profit of i, where | |

| Sales quantity of retailers, where | |

| Unit product price, where | |

| Unit shipping fee charged to retailers by the carrier | |

| Unit shipping fee charged to overseas customers by the carrier |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Guo, L.; Shang, Y. Decision-Making of Cross-Border E-Commerce Platform Supply Chains Considering Information Sharing and Free Shipping. Sustainability 2023, 15, 3350. https://doi.org/10.3390/su15043350

Guo L, Shang Y. Decision-Making of Cross-Border E-Commerce Platform Supply Chains Considering Information Sharing and Free Shipping. Sustainability. 2023; 15(4):3350. https://doi.org/10.3390/su15043350

Chicago/Turabian StyleGuo, Libin, and Yuxiao Shang. 2023. "Decision-Making of Cross-Border E-Commerce Platform Supply Chains Considering Information Sharing and Free Shipping" Sustainability 15, no. 4: 3350. https://doi.org/10.3390/su15043350

APA StyleGuo, L., & Shang, Y. (2023). Decision-Making of Cross-Border E-Commerce Platform Supply Chains Considering Information Sharing and Free Shipping. Sustainability, 15(4), 3350. https://doi.org/10.3390/su15043350