The Impact of Property Rights Structure on High-Quality Development of Enterprises Based on Integrated Machine Learning—A Case Study of State-Owned Enterprises in China

Abstract

:1. Introduction

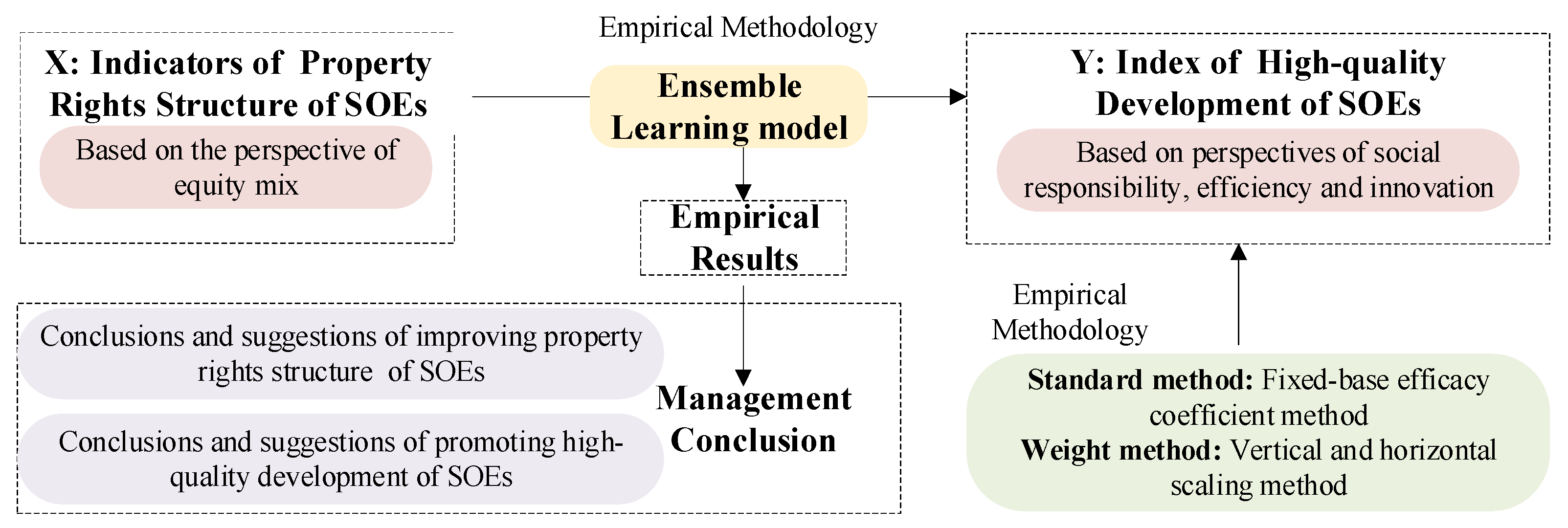

2. Research Methodology

2.1. Integrated Learning Model

2.2. Base-Effectiveness Coefficient Method

2.3. Longitudinal Pull-Out Method

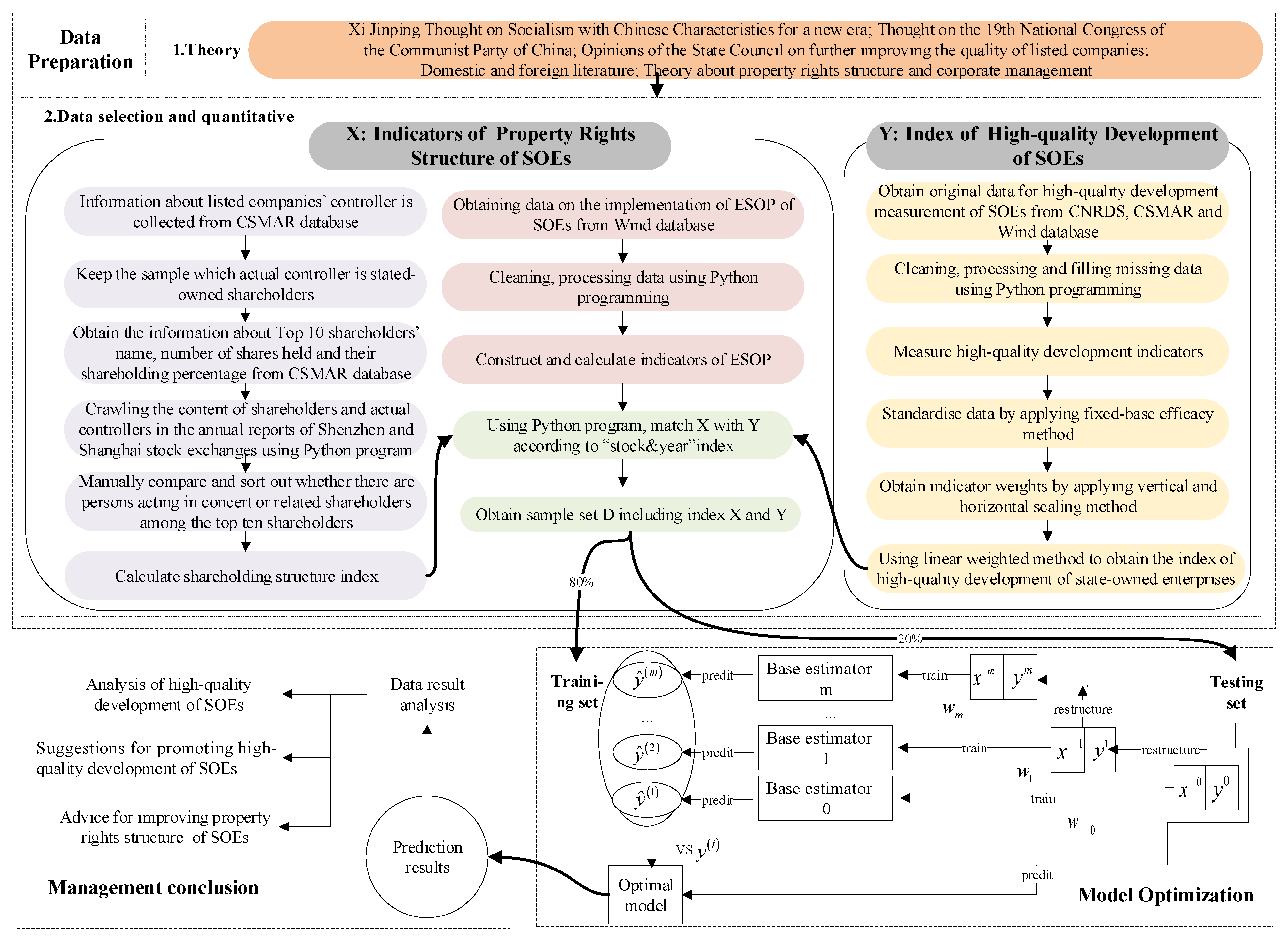

3. Research Progress Design

4. Data Screening and Indicator Construction

4.1. Theoretical Compendium

- (1)

- Theoretical combing of high-quality development of state-owned enterprises

- (2)

- Theoretical arrangement of property rights structure of state-owned enterprises

4.2. Indicator Selection

- (1)

- Selection of indicators for high-quality development of SOEs

- (2)

- Selection of indicators of SOEs’ ownership structure

4.3. Indicator Quantification

- (1)

- Data source

- (2)

- Index calculation

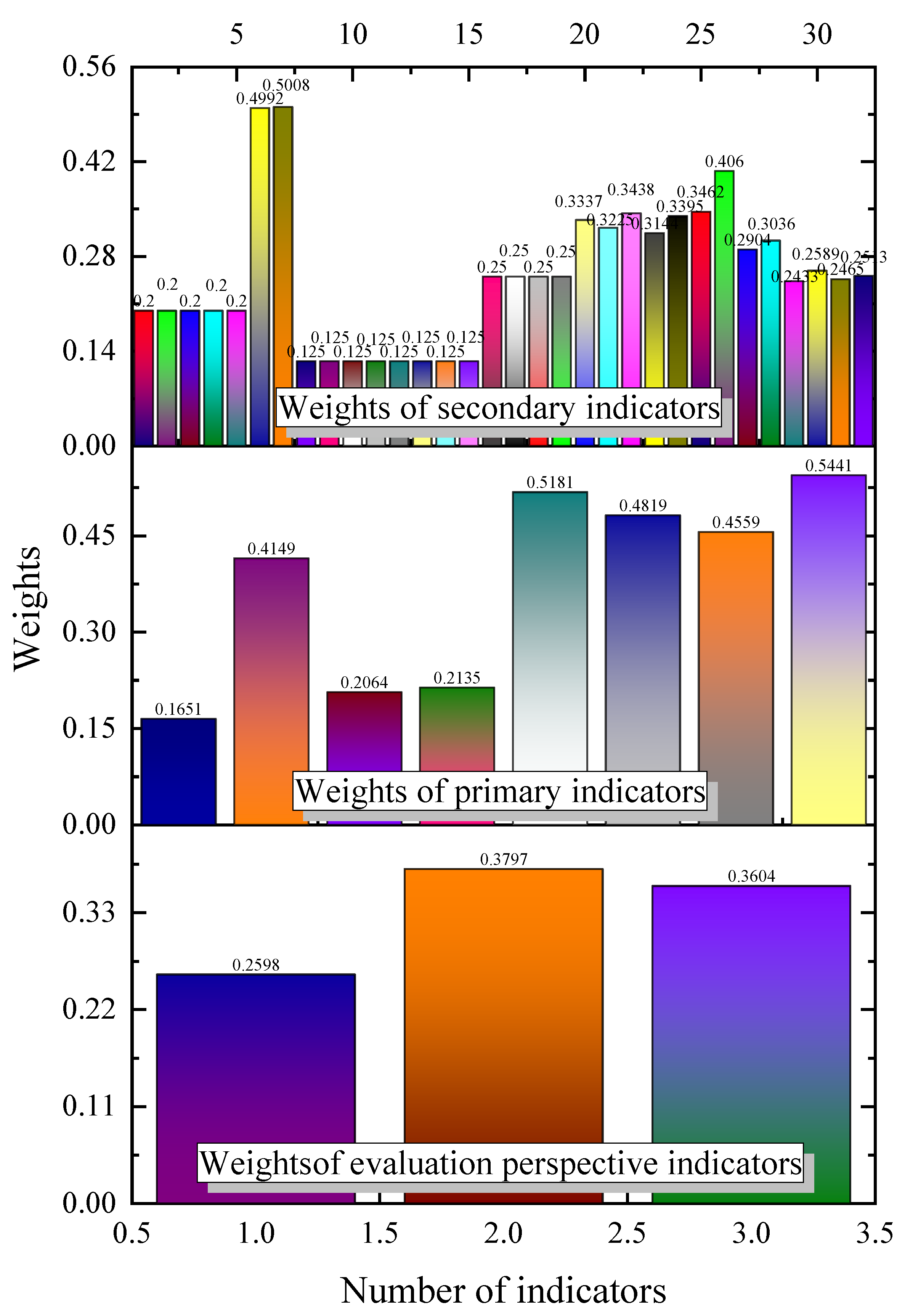

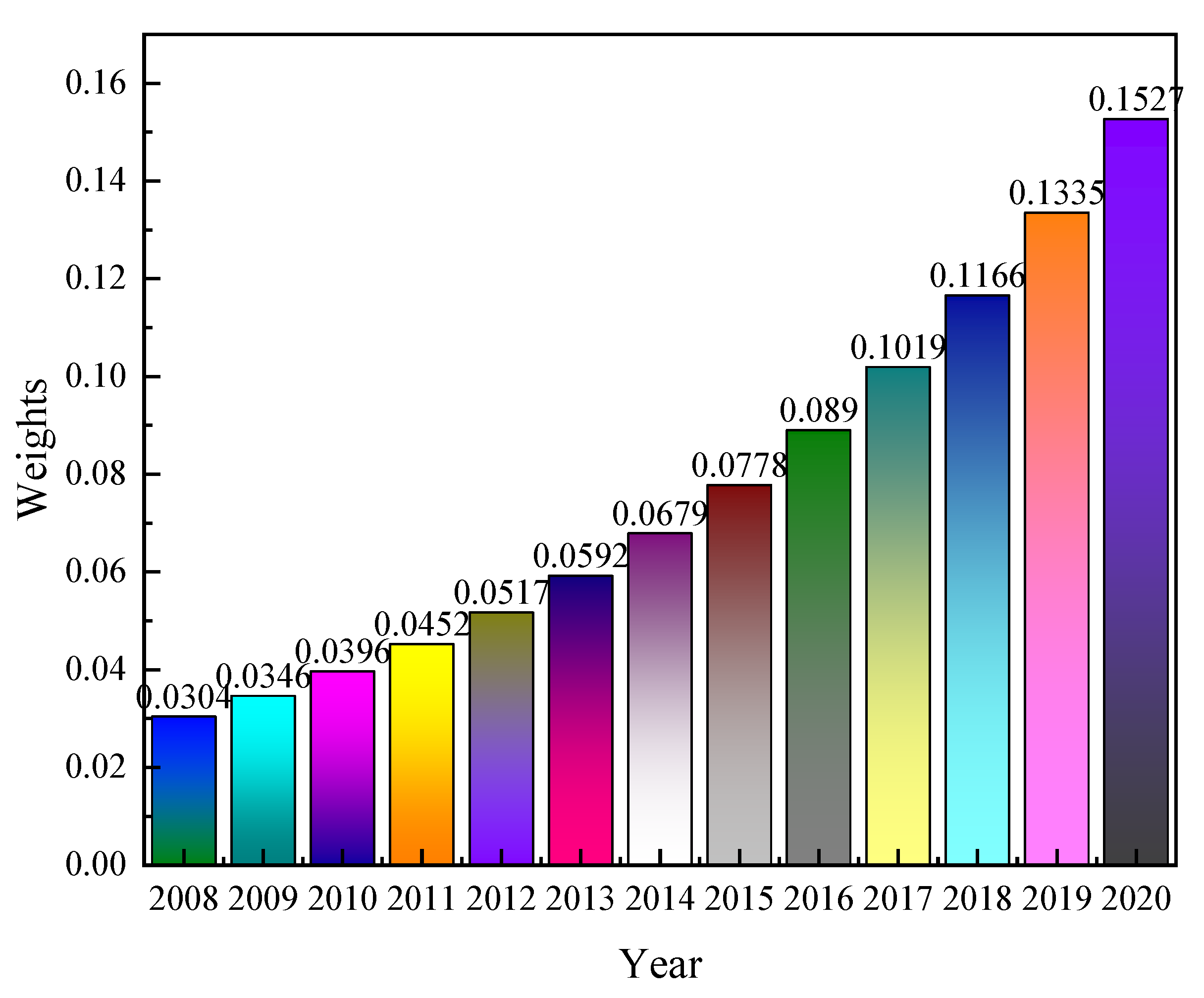

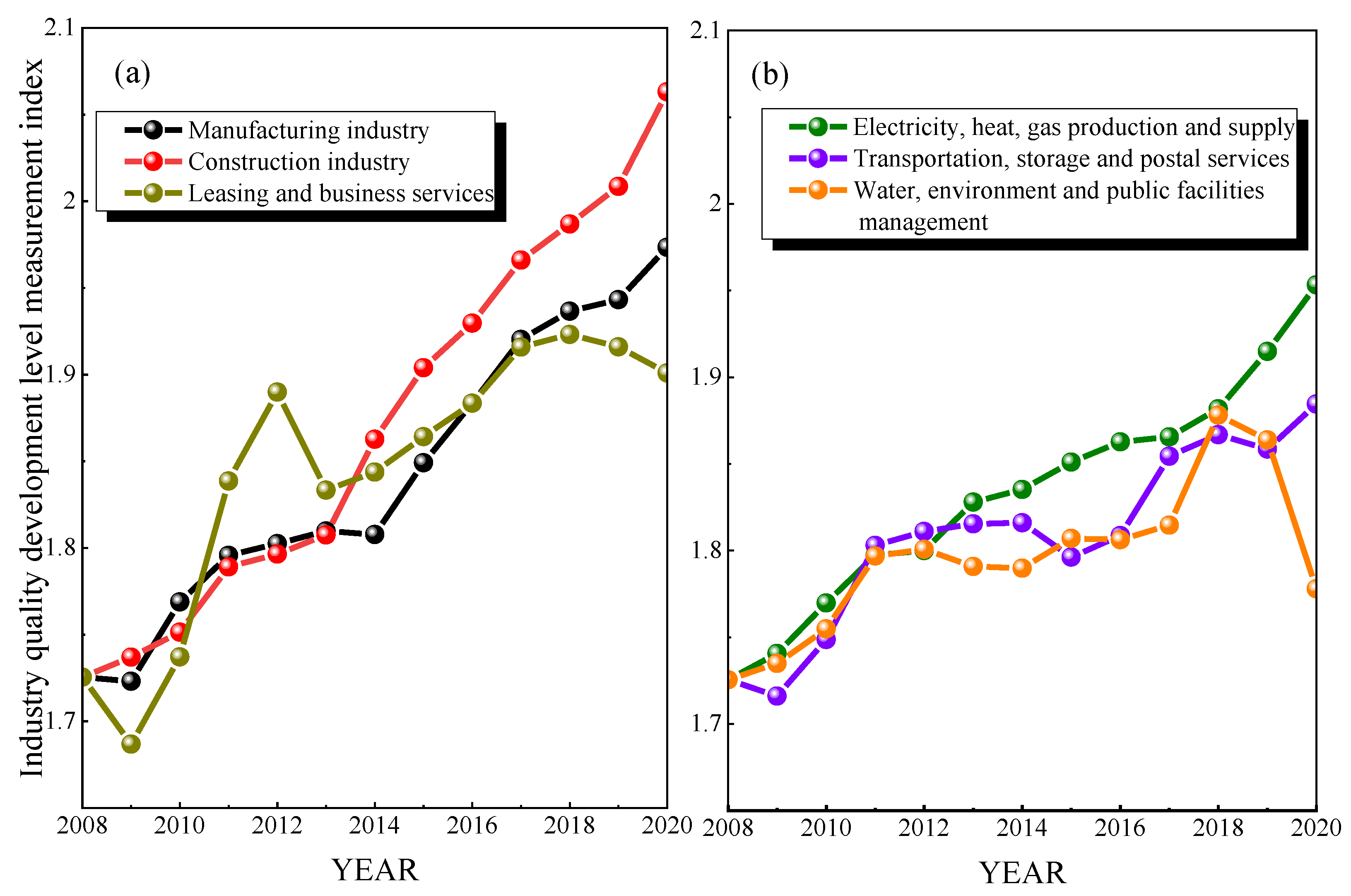

5. Results of Measuring the Level of High-Quality Development of SOEs

6. Analysis of the Results of the Impact of Changes in the Ownership Structure of SOEs on High-Quality Development

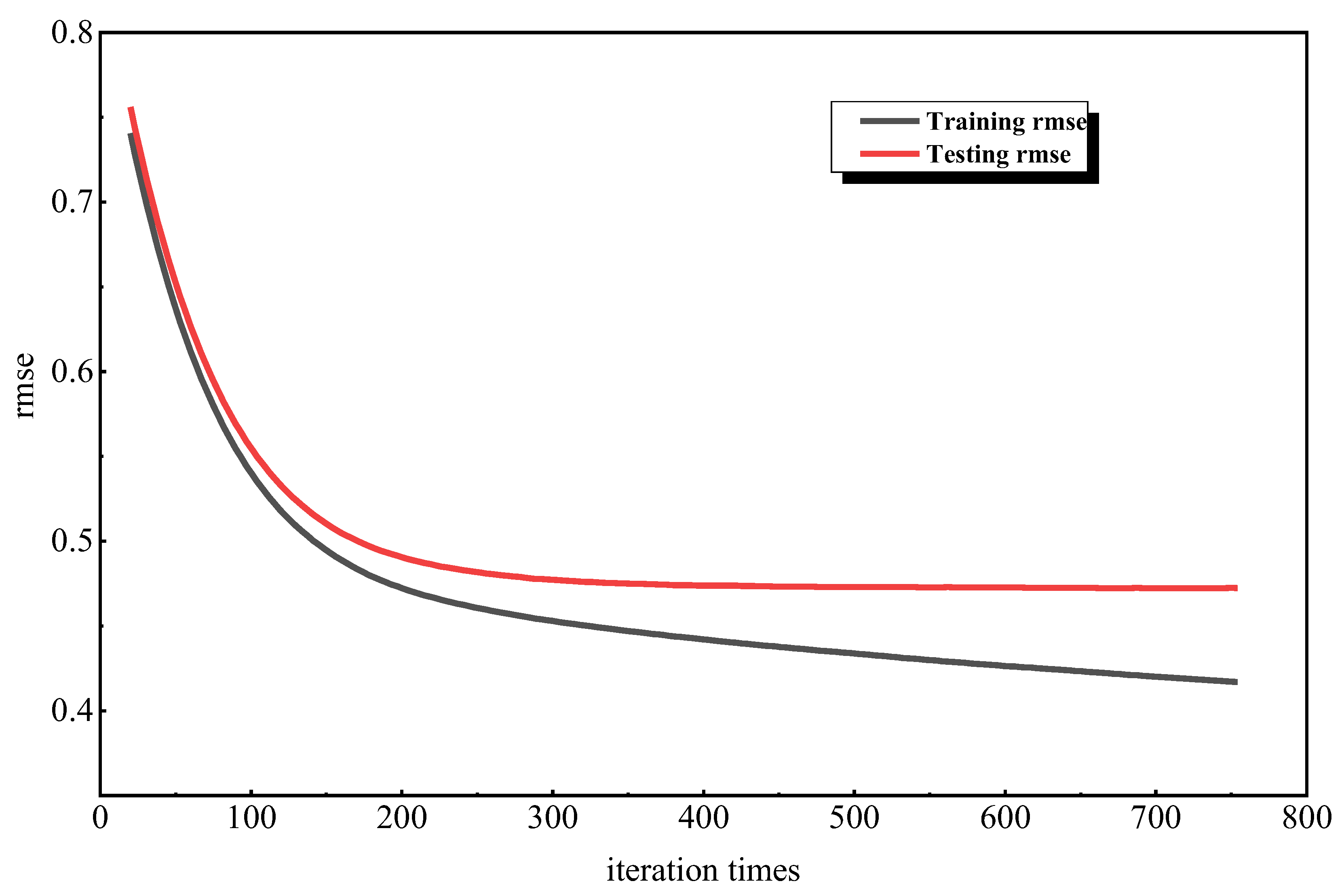

6.1. Integrated Model Training and Testing Results

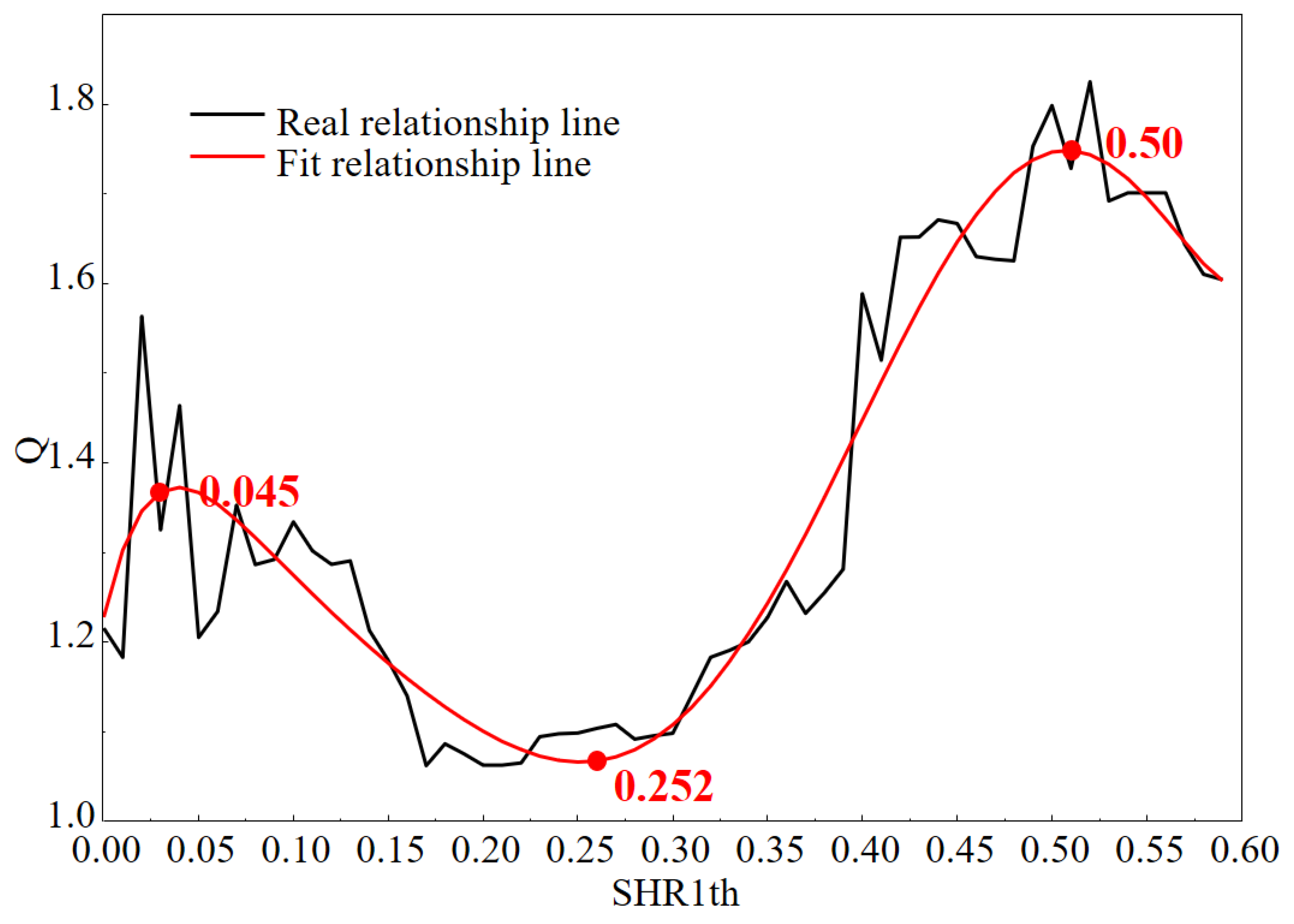

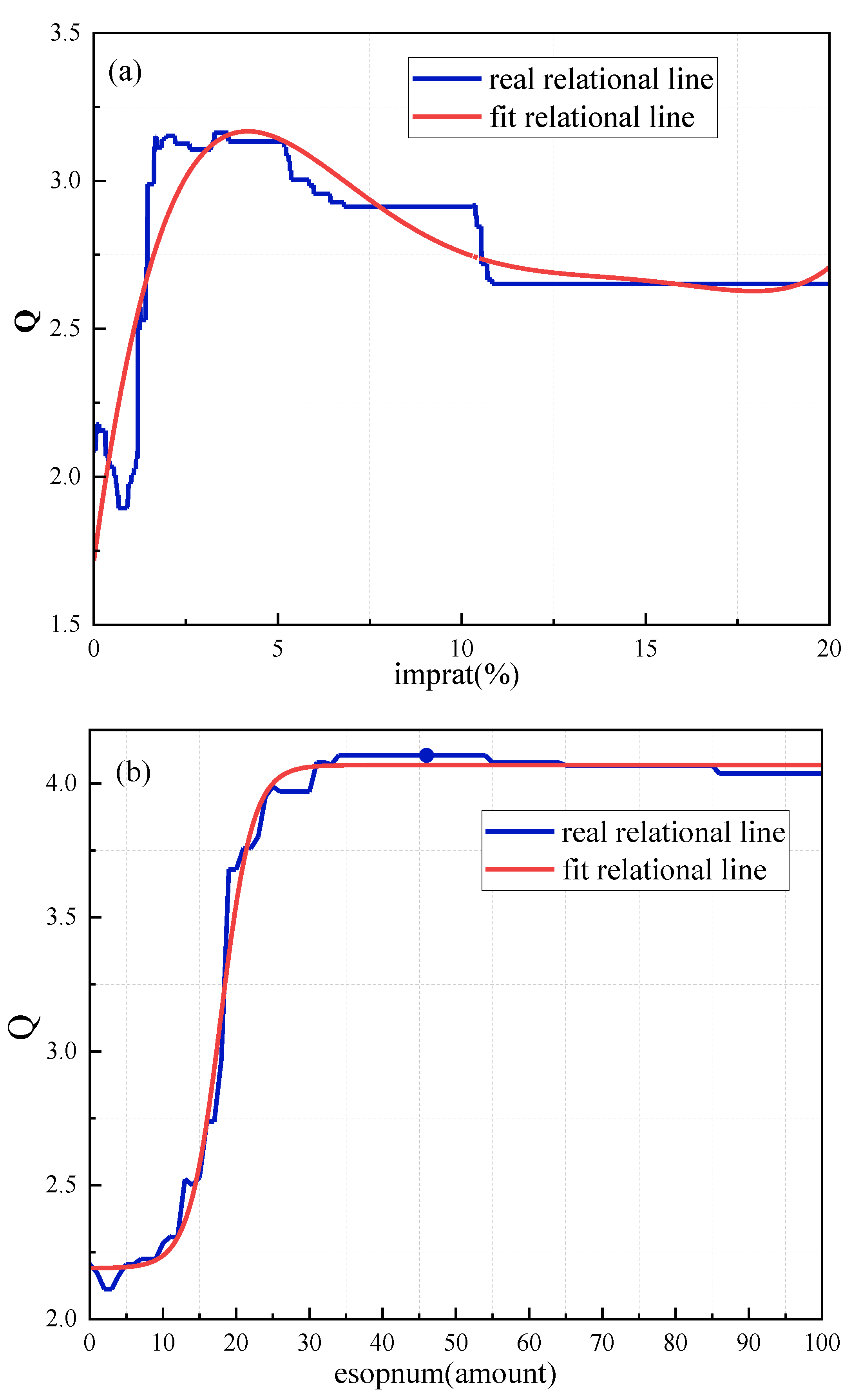

6.2. Analysis of Empirical Results

7. Conclusions

- (1)

- Since 2008, the level of quality development of Chinese SOEs has shown an overall upward trend, and the performance of competitive SOEs is generally better than that of public welfare SOEs. In particular, the value of the quality development index of the construction industry is at the forefront of all SOEs, and the value tends to increase significantly every year. The development quality of SOEs in the public welfare category water conservancy industry needs to be improved; especially after the subprime crisis in 2018, the measurement index showed a downward change trend, and further reform solutions need to be sought to improve the corporate property rights system and enhance governance efficiency and profitability in order to further improve the development quality.

- (2)

- Equity mixed reform encourages SOEs to introduce non-public capital to improve the property rights structure, and there is a sine function relationship between the shareholding ratio of the first non-state shareholder introduced by SOEs and the level of high-quality development of SOEs. The shareholding ratio is maintained in the range of 25.2–50%. The change in property rights structure leads to positive changes in the development quality of SOEs. In order to ensure the positive effect of the change in ownership structure on the development quality of SOEs, SOEs should maintain the same nature of state-owned property rights.

- (3)

- The impact of the share capital of employee stock ownership plans on the level of quality development of SOEs tends to increase, then decrease, and then stabilize. The marginal incentive effect of employees is the greatest when the share capital is maintained at about 5%, and the effect of relying on their own hard work to improve the quality of development of SOEs is the most significant.

- (4)

- The number of employee stock ownership plans implemented positively affects the level of high-quality development of SOEs. In order to maximize employee motivation and improve the quality of SOE development, SOEs should implement employee stock ownership plans more than twice a year.

- (1)

- Based on the guiding ideas of China’s 19th National Congress Report and Opinions, quantifiable measurement indexes were selected, and the fixed-base efficacy coefficient method and the longitudinal and horizontal pull-out gearing method were used to measure the level of high-quality development of SOEs, ensuring that the indexes have comparability in time and dynamic changes, which enriches the research methods and literature related to high-quality development of enterprises.

- (2)

- Based on the integrated learning model, we investigated the impact of changes in the ownership structure of SOEs on the level of high-quality development, which can provide reference implications for SOEs to further improve the ownership structure and enhance the level of development while demonstrating the effect of equity mixing, and help achieve the goal of high-quality macroeconomy.

- (3)

- Using Chinese enterprises as a sample, the findings can be used as a reference for emerging markets and developing countries to cross the middle-income trap and formulate SOE reform strategies.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Ohashi-Kaneko, K.; Takase, M.; Kon, N.; Fujiwara, K.; Kurata, K. Effect of light quality on growth and vegetable quality in leaf lettuce, spinach and komatsuna. Environ. Control. Biol. 2007, 45, 189–198. [Google Scholar] [CrossRef]

- Chakamera, C.; Alagidede, P. The nexus between infrastructure (quantity and quality) and economic growth in Sub Saharan Africa. Int. Rev. Appl. Econ. 2018, 32, 641–672. [Google Scholar] [CrossRef]

- Mlachila, M.; Tapsoba, R.; Tapsoba, S.J. A quality of growth index for developing countries: A proposal. Soc. Indic. Res. 2017, 134, 675–710. [Google Scholar] [CrossRef]

- Wei, M.; Li, S. A study on measuring the level of quality development of China’s economy in the new era. Res. Quant. Econ. Tech. Econ. 2018, 35, 3–20. [Google Scholar]

- Ren, B. Judgment Criteria, Determinants and Ways to Achieve High-Quality Economic Development in China in the New Era. China Post 2018, 10, 5–16. [Google Scholar]

- Huang, S.J.; Xiao, H.J.; Wang, X. On the high-quality development of state-owned enterprises. China Ind. Econ. 2018, 10, 19–41. [Google Scholar]

- Xiao, H. High-quality development of state-owned enterprises for the 14th Five-Year Plan. Econ. Syst. Reform. 2020, 5, 22–29. [Google Scholar]

- Huang, Q. Industrial development and industrialization in China in the 40 years of reform and opening up. China Soc. Sci. Dig. 2019, 9, 5–23. [Google Scholar]

- Jin, B. An economic study on "high-quality development". China Ind. Econ. 2018, 4, 5–18. [Google Scholar]

- Wang, Y. A century of change, high-quality development and building a new development pattern. Manag. World 2020, 36, 1–13. [Google Scholar]

- Zhang, T. Research on the theoretical interpretation and measurement method of high-quality development. Res. Quant. Econ. Tech. Econ. 2020, 37, 23–43. [Google Scholar]

- Gao, P.; Yuan, F.; Hu, H.; Liu, X. Dynamics, mechanisms and governance of high-quality development. Econ. Syst. Res. 2020, 55, 4–19. [Google Scholar]

- Zhang, J.K.; Hou, Y.Z.; Liu, P.E.L.; He, J.W.; Zhuo, X. Target requirements and strategic path of high-quality development. Manag. World 2019, 35, 1–7. [Google Scholar]

- Zhao, T.; Zhang, Z.; Liang, S.K. Digital economy, entrepreneurial activity and high-quality development Empirical evidence from Chinese cities. Manag. World 2020, 36, 65–76. [Google Scholar]

- Xu, X.; Li, S.; Wang, X.; Bi, Q. The choice of China’s economic growth target: Ending the “collapse theory” with high-quality development. World Econ. 2018, 41, 3–25. [Google Scholar]

- Liu, Z.B.; Ling, Y.H. Structural transformation, total factor productivity and high-quality development. Manag. World 2020, 36, 15–29. [Google Scholar]

- Liu, S.; Zhang, S.J.; Zhu, H.D. Research on the measurement of national innovation drive and its effect on high quality economic development. Res. Quant. Econ. Tech. Econ. 2019, 36, 3–23. [Google Scholar]

- Yu, Y.; Yang, X.; Zhang, S. A study on the spatial and temporal transition characteristics of China’s economy from high growth to high quality development. Res. Quant. Econ. Tech. Econ. 2019, 36, 3–21. [Google Scholar]

- Chen, S.; Chen, D. Haze pollution, government governance and economic quality development. Econ. Res. 2018, 53, 20–34. [Google Scholar]

- Xiao, Z.Y. Analysis of the dynamics of high-quality development in China—Based on economic and social development perspectives. Soft Sci. 2019, 33, 1–5. [Google Scholar]

- Qi, J. Fiscal expenditure incentives, spatial correlation and quality of economic growth: Evidence from a Chinese province. Int. J. Bus. Sci. Appl. Manag. 2016, 11, 191–201. [Google Scholar] [CrossRef]

- Chen, Z.; Liu, Y.M. Government subsidies, firm innovation and high-quality development of manufacturing firms. Reform 2019, 08, 140–151. [Google Scholar]

- Cao, X.; Ren, B. Analysis of time series changes and regional differences in the quality of economic growth in China. Econ. Res. 2011, 46, 26–40. [Google Scholar]

- Xiao, Z.; Wang, Y. Notes on “Structural entropy weighting method for determining the weights of evaluation indicators”. Oper. Res. Manag. 2020, 29, 145–149. [Google Scholar]

- Wang, X.P.; Yu, X.L.; Wang, T.T. Air pollution impact prediction in chemical parks based on integrated learning strategy. Oper. Res. Manag. 2021, 30, 127–134. [Google Scholar]

- Nie, C.; Jian, X. Measurement of high-quality development in China and analysis and comparison of the status quo between provinces. J. Quant. Tech. Econ. 2020, 37, 26–47. [Google Scholar]

- Gong, Y.; Choi, S.U. State Ownership and Accounting Quality: Evidence from State-Owned Enterprises in China. Sustainability 2021, 13, 8659. [Google Scholar] [CrossRef]

- Megginson, W.L.; Ullah, B.; Wei, Z. State ownership, soft-budget constraints, and cash holdings: Evidence from China’s privatized firms. J. Bank Financ. 2014, 48, 276–291. [Google Scholar] [CrossRef]

- Dragomir, V.D.; Dumitru, M.; Feleagă, L. Political interventions in state-owned enterprises: The corporate governance failures of a European airline. J. Account. Public Policy 2021, 40, 106855. [Google Scholar] [CrossRef]

- Minor, P.; Walmsley, T.; Strutt, A. State-owned enterprise reform in Vietnam: A dynamic CGE analysis. J. Asian Econ. 2018, 55, 42–57. [Google Scholar] [CrossRef]

- Zhou, T.; Li, J. Does mixed ownership improve the financial quality of Chinese listed companies? A case study of SXNBM’s privatization process. Nankai Bus. Rev. Int. 2017, 8, 367–388. [Google Scholar] [CrossRef]

- Du, Y.; Wang, R. Impact of corporate governance ability on capital gains in mixed ownership enterprises. Transform. Bus. Econ. 2020, 19, 92–113. [Google Scholar]

- Ruan, L.; Liu, H. The impact of institutional innovation on internal control: Evidence from Chinese state-owned enterprises. Int J. Technol. Manag. 2021, 85, 255–273. [Google Scholar] [CrossRef]

- Lu, X.; Lian, Y.J. Total factor productivity estimation of Chinese industrial firms: 1999–2007. China Econ. 2012, 11, 541–558. [Google Scholar]

- Kong, Y.; Famba, T.; Chituku-Dzimiro, G.; Sun, H.; Kurauone, O. Corporate Governance Mechanisms, Ownership and Firm Value: Evidence from Listed Chinese Firms. Int. J. Financ. Stud. 2020, 8, 20. [Google Scholar] [CrossRef]

| System | … | |||

|---|---|---|---|---|

| … | ||||

| … | ||||

| … | ||||

| … | … | … | … | … |

| … |

| Target Layer | Perspective Layer | Criteria Layer | Indicator Layer | Indicator Description | Indicator Attributes |

|---|---|---|---|---|---|

| The Index of high-quality development of SOEs (Q) | Social responsibility | Product service | Quality assurance system | The value is 1 if there is a quality assurance system; otherwise, it is 0 | Positive |

| Quality certification | The value of the quality certification is 1; otherwise, it is 0 | Positive | |||

| Product disputes | The value is 1 if there is a product dispute; otherwise, it is 0 | Negative | |||

| After-sales service | The value is 1 if there is after-sales service; otherwise, it is 0 | Positive | |||

| Customer satisfaction surveys | If there is a customer satisfaction survey, the value is 1; otherwise, it is 0 | Positive | |||

| Donation and taxation | Donation | Annual social donation amount of enterprises | Positive | ||

| Taxation | The ratio of income tax paid by SOEs to total profits | Positive | |||

| Environmental protection | Environmental investment | Annual environmental investment amount of enterprises | Positive | ||

| Environmental penalty | If there is an environmental penalty, the value is 1; otherwise, it is 0 | Negative | |||

| Pollutant emission | If there is a pollutant emission behavior, the value is 1; otherwise, it is 0 | Negative | |||

| Green office | If the green office policy has been implemented, the value is 1; otherwise, it is 0 | Positive | |||

| Environmental certification | If there is an environmental certification, the value is 1; otherwise, it is 0 | Positive | |||

| Environmental recognition | If there is an environmental recognition, the value is 1; otherwise, it is 0 | Positive | |||

| Energy saving | The value is 1 if there is an energy-saving behavior; otherwise, it is 0 | Positive | |||

| Measures to reduce the three wastes | If there are measures to reduce the three wastes, the value is 1; otherwise, it is 0 | Positive | |||

| CSR report | Comprehensiveness of report | If the content covers 6 aspects of responsibility, the value is 1; otherwise, it is 0 | Positive | ||

| Number of pages of report | Total number of pages of CSR report | Positive | |||

| CSR column | If there is a CSR column in the annual report, the value is 1; otherwise, it is 0 | Positive | |||

| CSR reliability guarantee | If there is a CSR reliability guarantee, the value of 1; otherwise, it is 0 | Positive | |||

| Profit and operation | Profitability | Total factor productivity (TFP) | Calculated by OP method | Positive | |

| Economic value added (EVA) | Net operating profit after tax—total capital × weighted average cost of capital | Positive | |||

| Labour productivity | The ratio of the total output of the enterprise to the total number of employees | Positive | |||

| Operating efficiency | Total asset turnover | The ratio of the total sales revenue of the enterprise to the average total assets | Negative | ||

| Inventory turnover | The ratio of the prime operating cost of the enterprise to the average inventory balance | Negative | |||

| Fixed asset turnover | The ratio of the total sales revenue of the enterprise to the average net fixed asset value | Negative | |||

| Innovation | Innovation input | R&D investment intensity | The ratio of R&D expenditure to operating income of enterprises | Positive | |

| Proportion of R&D staff | The ratio of the number of R&D personnel to the total number of employees | Positive | |||

| Ratio of staff with a higher degree | The ratio of the number of employees who earned master’s or doctoral degrees to the total number of employees | Positive | |||

| Innovation output | Number of citations of patents | The number of citations of the company’s authorized patents | Positive | ||

| Number of granted patents | The number of company patents granted | Positive | |||

| Proportion of invention patents | The proportion of invention patents in the patent application of enterprises | Positive | |||

| Degree of digital transformation | The sum of the frequency of keywords related to “artificial intelligence technology”, “blockchain technology”, “cloud computing technology”, “big data technology”, and “digital technology application” disclosed in annual report | Positive |

| Symbol | Definition |

|---|---|

| Shareholding ratio of the largest non-state-owned shareholder | |

| Shareholding ratio of all non-state-owned shareholders among the top ten shareholders | |

| Whether the largest non-state-owned shareholder is a controlling shareholder dummy variable. If yes, the value is 1; otherwise, it is 0 | |

| Shareholding types among the top ten shareholders | |

| Ownership balances (shareholding ratio of non-state-owned shareholders among the top ten shareholders/shareholding ratio of state-owned shareholders) | |

| ESOP implementation dummy variable. If implemented, it is 1; otherwise, it is 0 | |

| The share capital of the ESOP as a percentage of the company’s total share capital | |

| The number of implementations of the ESOP of a listed company in one year |

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 000008 | 1.7255 | 1.7488 | 1.8044 | 1.8880 | 1.7985 | 1.7593 | 1.7743 | 1.9728 | 2.1566 | 2.1550 | 2.1618 | 2.1304 | 2.0601 |

| 000011 | 1.7255 | 1.7389 | 1.7635 | 1.8020 | 1.8473 | 1.7905 | 1.8350 | 1.7934 | 1.8925 | 1.9010 | 1.8873 | 1.9196 | 1.8479 |

| 000014 | 1.7255 | 1.8203 | 1.8565 | 1.8217 | 1.8032 | 1.8469 | 1.8406 | 1.7835 | 1.8066 | 1.8199 | 1.8157 | 1.8190 | 1.7664 |

| 000016 | 1.7255 | 1.7429 | 1.8159 | 1.8194 | 1.8489 | 1.8375 | 1.8257 | 1.9137 | 1.9026 | 2.0624 | 2.0933 | 2.1180 | 2.1444 |

| 000025 | 1.7255 | 1.6917 | 1.6982 | 1.7397 | 1.7588 | 1.7597 | 1.7706 | 1.7939 | 1.7334 | 1.8784 | 1.9056 | 2.0192 | 1.9115 |

| 000029 | 1.7255 | 1.7492 | 1.7412 | 1.7321 | 1.7417 | 1.8748 | 1.8548 | 1.9079 | 1.9339 | 1.8416 | 1.9643 | 2.0052 | 1.9484 |

| 000030 | 1.7255 | 1.7217 | 1.8601 | 1.9471 | 1.7537 | 1.9805 | 1.9886 | 2.0114 | 2.0158 | 2.0579 | 2.0538 | 2.0661 | 2.1022 |

| … | … | … | … | … | … | … | … | … | … | … | … | … | … |

| 600877 | 1.7255 | 1.7358 | 1.7170 | 1.6583 | 1.6170 | 1.6038 | 1.5920 | 1.6394 | 1.6135 | 1.6421 | 1.5009 | 1.7669 | 1.9158 |

| 600890 | 1.7255 | 1.8578 | 1.7329 | 1.8770 | 1.8273 | 1.9373 | 1.8428 | 1.8227 | 1.7493 | 1.8730 | 1.7252 | 2.0088 | 1.7537 |

| 600897 | 1.7255 | 1.7313 | 1.7527 | 1.7997 | 1.8957 | 1.8657 | 1.8830 | 1.8479 | 1.8388 | 1.8654 | 1.8957 | 1.8549 | 1.6976 |

| 600960 | 1.7255 | 1.7082 | 1.7820 | 1.8238 | 1.7860 | 1.7592 | 1.7269 | 1.7755 | 1.8132 | 1.9144 | 1.8244 | 1.8187 | 1.8928 |

| 600961 | 1.7255 | 1.8110 | 1.8344 | 1.7901 | 1.8151 | 1.8688 | 1.9085 | 1.9119 | 1.9352 | 1.8375 | 1.8792 | 1.9540 | 2.0182 |

| 600963 | 1.7255 | 1.6962 | 1.7963 | 1.8041 | 1.7732 | 1.7260 | 1.7435 | 1.6800 | 1.7671 | 1.8459 | 1.9087 | 1.8937 | 1.9456 |

| 600971 | 1.7255 | 1.7738 | 1.7640 | 1.7782 | 1.8680 | 1.8772 | 1.7937 | 1.6178 | 1.7155 | 1.8969 | 1.9631 | 1.9484 | 1.8857 |

| 600975 | 1.7255 | 1.6030 | 1.6746 | 1.7344 | 1.8137 | 1.7151 | 1.7952 | 1.8176 | 1.9152 | 1.7938 | 1.8389 | 1.9092 | 1.9691 |

| 600984 | 1.7255 | 1.7381 | 1.7906 | 1.8548 | 1.8266 | 1.7887 | 1.7417 | 1.7965 | 1.8195 | 1.8391 | 1.8981 | 2.0160 | 1.9913 |

| 601001 | 1.7255 | 1.7190 | 1.7376 | 1.7935 | 1.8062 | 1.6063 | 1.6199 | 1.6847 | 1.6428 | 1.7131 | 1.7293 | 1.8649 | 1.8656 |

| 601872 | 1.7255 | 1.6455 | 1.6715 | 1.6542 | 1.6669 | 1.6145 | 1.6600 | 1.7798 | 1.6328 | 1.6056 | 1.6191 | 1.6291 | 1.8191 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bai, Y.; Zhai, D.; Zhao, X.; Wu, D. The Impact of Property Rights Structure on High-Quality Development of Enterprises Based on Integrated Machine Learning—A Case Study of State-Owned Enterprises in China. Sustainability 2023, 15, 3016. https://doi.org/10.3390/su15043016

Bai Y, Zhai D, Zhao X, Wu D. The Impact of Property Rights Structure on High-Quality Development of Enterprises Based on Integrated Machine Learning—A Case Study of State-Owned Enterprises in China. Sustainability. 2023; 15(4):3016. https://doi.org/10.3390/su15043016

Chicago/Turabian StyleBai, Yanfei, Dongxue Zhai, Xuefeng Zhao, and Delin Wu. 2023. "The Impact of Property Rights Structure on High-Quality Development of Enterprises Based on Integrated Machine Learning—A Case Study of State-Owned Enterprises in China" Sustainability 15, no. 4: 3016. https://doi.org/10.3390/su15043016

APA StyleBai, Y., Zhai, D., Zhao, X., & Wu, D. (2023). The Impact of Property Rights Structure on High-Quality Development of Enterprises Based on Integrated Machine Learning—A Case Study of State-Owned Enterprises in China. Sustainability, 15(4), 3016. https://doi.org/10.3390/su15043016