Financial Literacy and Credit Accessibility of Rice Farmers in Pakistan: Analysis for Central Punjab and Khyber Pakhtunkhwa Regions

Abstract

1. Introduction

1.1. Financial Literacy and Access to Capital

1.2. The Role of the Agricultural Sector in Pakistan

1.3. Challenges for the Agricultural Sector

2. Related Research Work

2.1. Subsidy

2.2. Microcredit

2.3. Agricultural Credit in Pakistan

2.4. Farmers’ Access to Credit Sources

| Source | Topic | Outcome | Type | Location |

|---|---|---|---|---|

| Wadud [36] | Impact of microcredit on agricultural farm performance and food security in Bangladesh | Bangladeshi farmers boost their revenue by 9.46%. | International | Bangladesh |

| Quach et al. [37] | Access to credit and household poverty reduction in rural Vietnam | Increased food and non-food consumption per capita, significant influence on welfare. | International | Vietnam |

| Ibrahim and Bauer [41] | Access to microcredit and its impact on farm profit among rural farmers in dryland of Sudan | Farmers’ income increased in direct proportion to the amount of credit accessed by farmers. | International | Sudan |

| Ankrah Twumasi et al. [69] | Financial literacy and its determinants: The case of rural farm households in Ghana | Respondents’ socioeconomic and demographic characteristics, such as gender, income, age, and education, significantly affect financial literacy. | International | Ghana |

| Crepon et al. [43] | Impact of microcredit in rural areas of Morocco: evidence from a randomized evaluation | Microcredit gave a rise in households’ income, expanded local businesses, mitigated poverty. | International | Morocco |

| Dewi et al. [44] | Roles of food security and energy credit in increasing rice production and profits in Kampar Regency, Riau Province | 46.98% of farms, 29.43% of consumers, and 23.57% of other enterprises adopted FSAC. | International | Indonesia |

| Farida et al. [45] | An impact estimator using propensity score matching: People’s business credit program to micro-entrepreneurs in Indonesia | FSAC had an impact on rising profit and total income, falling food expenditure share, growing labor force, and growing asset ownership. | International | Indonesia |

| Dahri et al. [46] | Determinants of the KKPE credit program repayment of cattle farmers in Central Java, Indonesia | Majority of cattle farmers utilized the FSAC for cattle farm operations, specifically to purchase feeder cattle or pregnant cattle, feed, medicine, and cage repairs. | International | Indonesia |

| Wati et al. [47] | Microcredit access and impact on production and revenue of organic rice farming in Bogor regency | Microcredit had a favorable effect on labor, input usage, and organic rice production. | International | Indonesia |

| Zakic et al. [70] | Significance of financial literacy for the agricultural holdings in Serbia | Continuous education programs through agricultural extension services are critically important for upgrading financial literacy skills among farmers. | International | Serbia |

| Ravikumar et al. [71] | Assessment of farm financial literacy among jasmine growers in Tamilnadu, India | Financial literacy in rural areas is significantly affected by such variables as age, education, experience, farm income, years of relationship with the bank, size of landholding, and frequency of bank visits. | International | India |

| Chandio and Jiang [56] | Determinants of credit constraints: Evidence from Sindh, Pakistan | Availability of agricultural credit is comparatively low due to Sindh province’s remoteness from formal credit sources, challenging lending requirements, and high-interest rates. | National | Sindh, Pakistan |

| Amanullah et al. [57] | Credit constraints and rural farmers’ welfare in an agrarian economy | Low access to credit has a detrimental impact on farmers’ well-being and income, while a lack of proper access to credit facilities renders farmers unable to obtain prospective farming earnings. | National | KP, Pakistan |

| Hussain and Thapa [64] | Smallholders’ access to agricultural credit in Pakistan | Size of landholding and the availability of agricultural finance are interrelated. Therefore, the size of the farm is a crucial consideration for classifying farmers into large, medium, and small groups. | National | Sindh & Punjab, Pakistan |

| Saqib et al. [13] | Factors influencing farmers’ adoption of agricultural credit as a risk management strategy: The case of Pakistan. | Farmers’ ages are inversely correlated with their ability to acquire official agricultural loans in Pakistan. | National | Pakistan |

| Ullah et al. [72] | Factors determining farmers’ access to and sources of credit: Evidence from the rain-fed zone of Pakistan | The results indicate a moderate positive association between farmers’ access to agricultural credit and their adoption of improved agricultural technologies. The binary logit model’s results indicate that farmers with a large-sized farm, high farm income, better access to information, and large physical asset ownership showed a positive influence on credit access. | National | KP, Pakistan |

3. Materials and Methods

3.1. Area and Time

3.2. Data

3.3. Sampling Method

3.4. Data Analysis Method

4. Results and Discussion

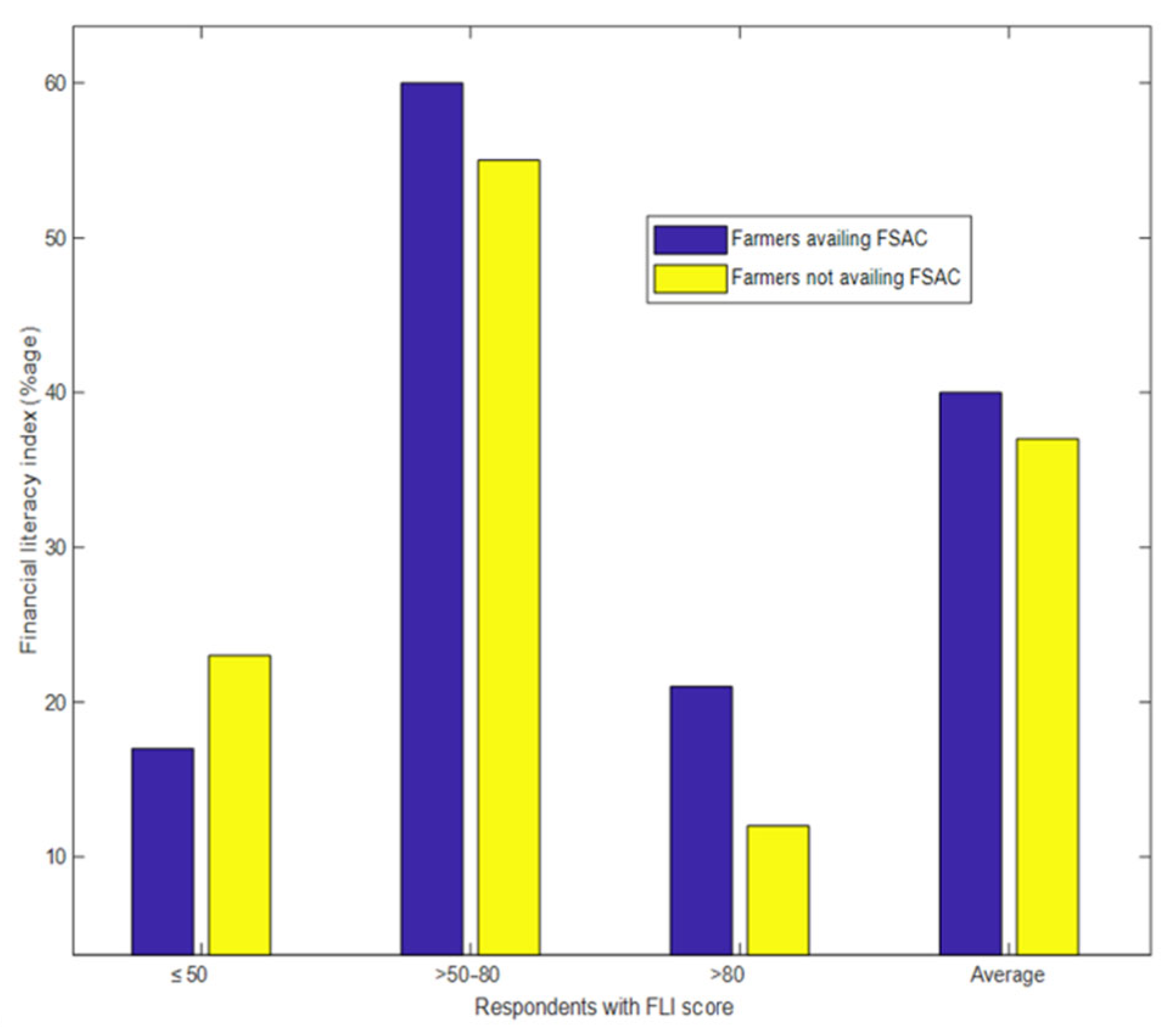

4.1. Financial Literacy Analysis

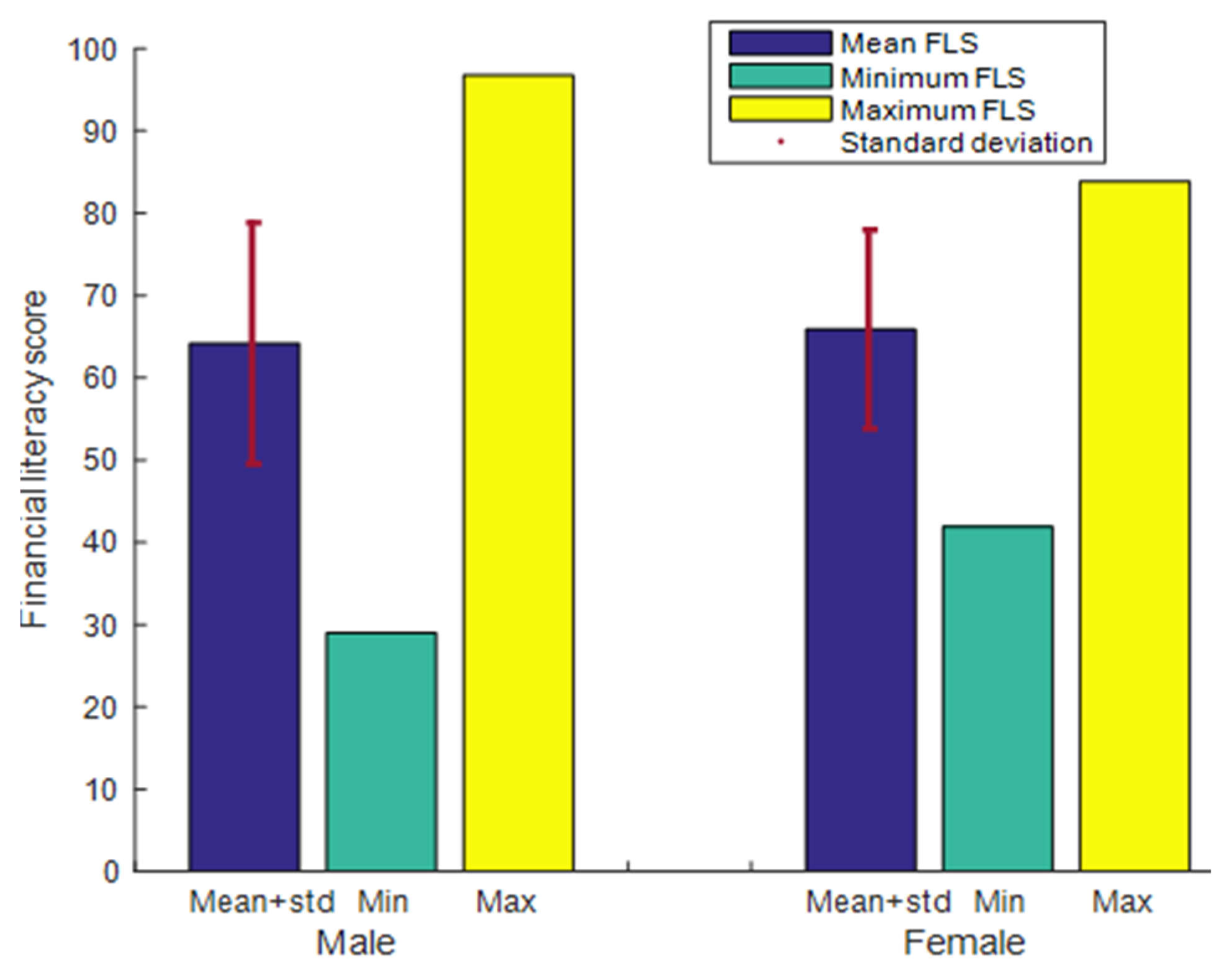

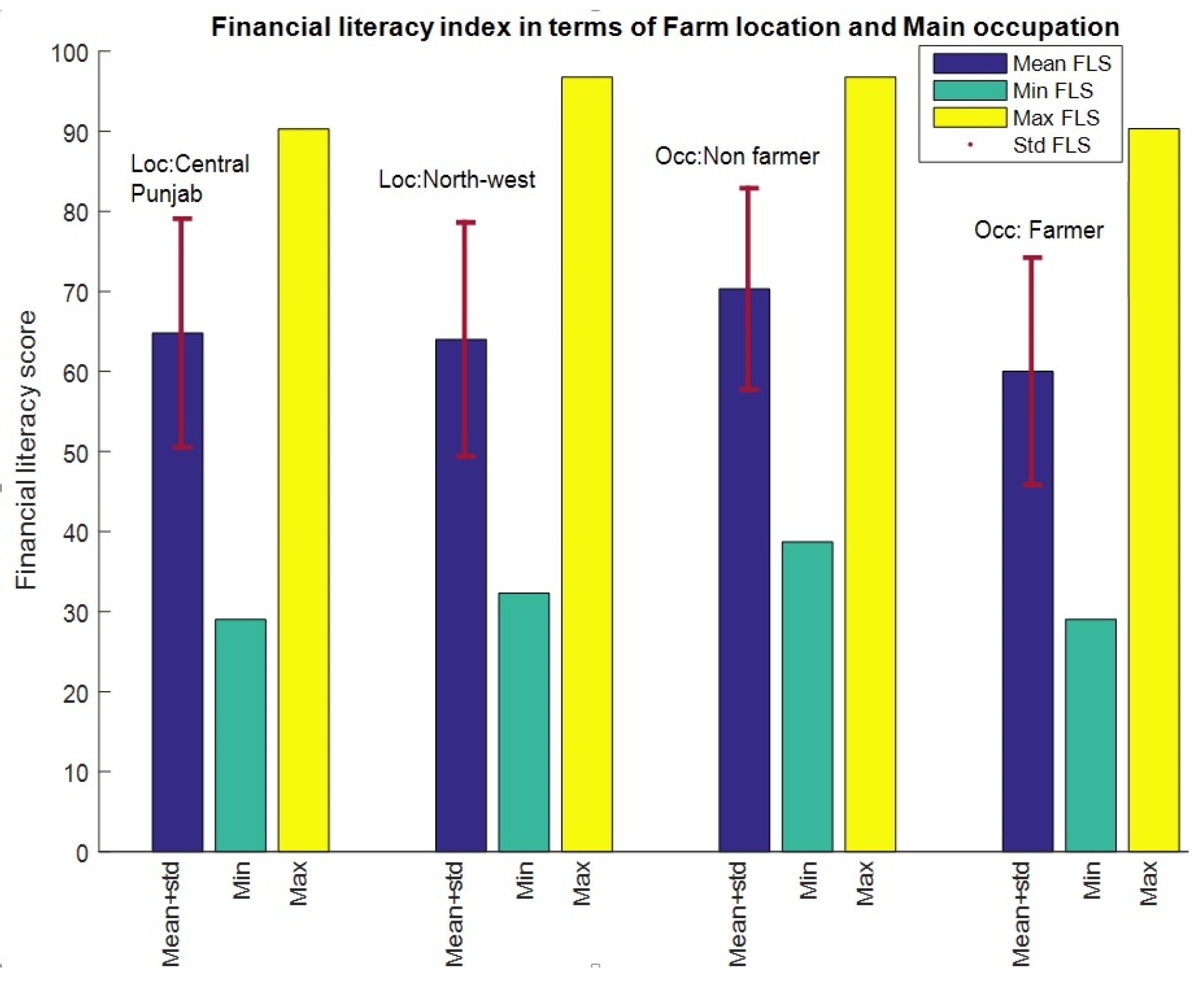

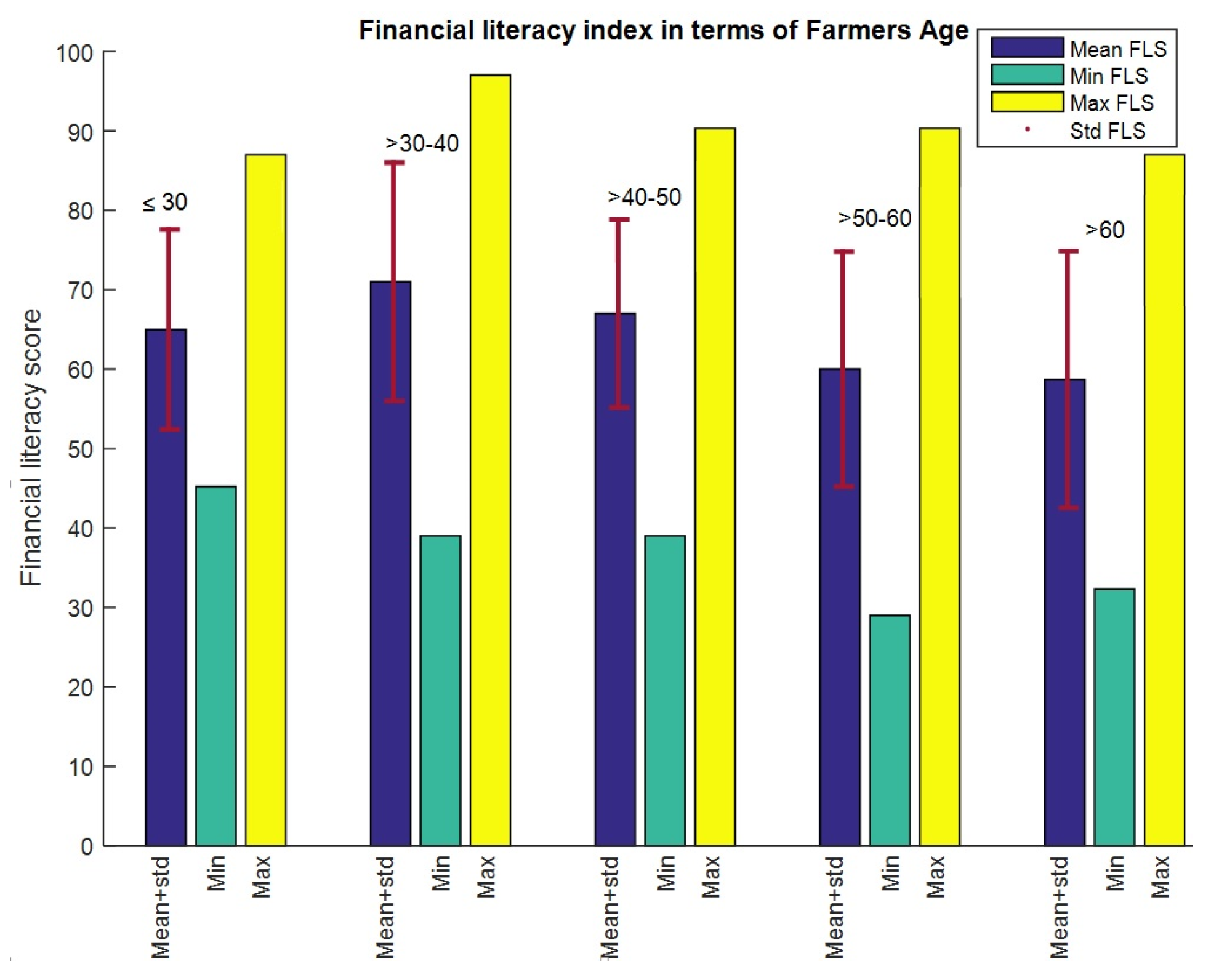

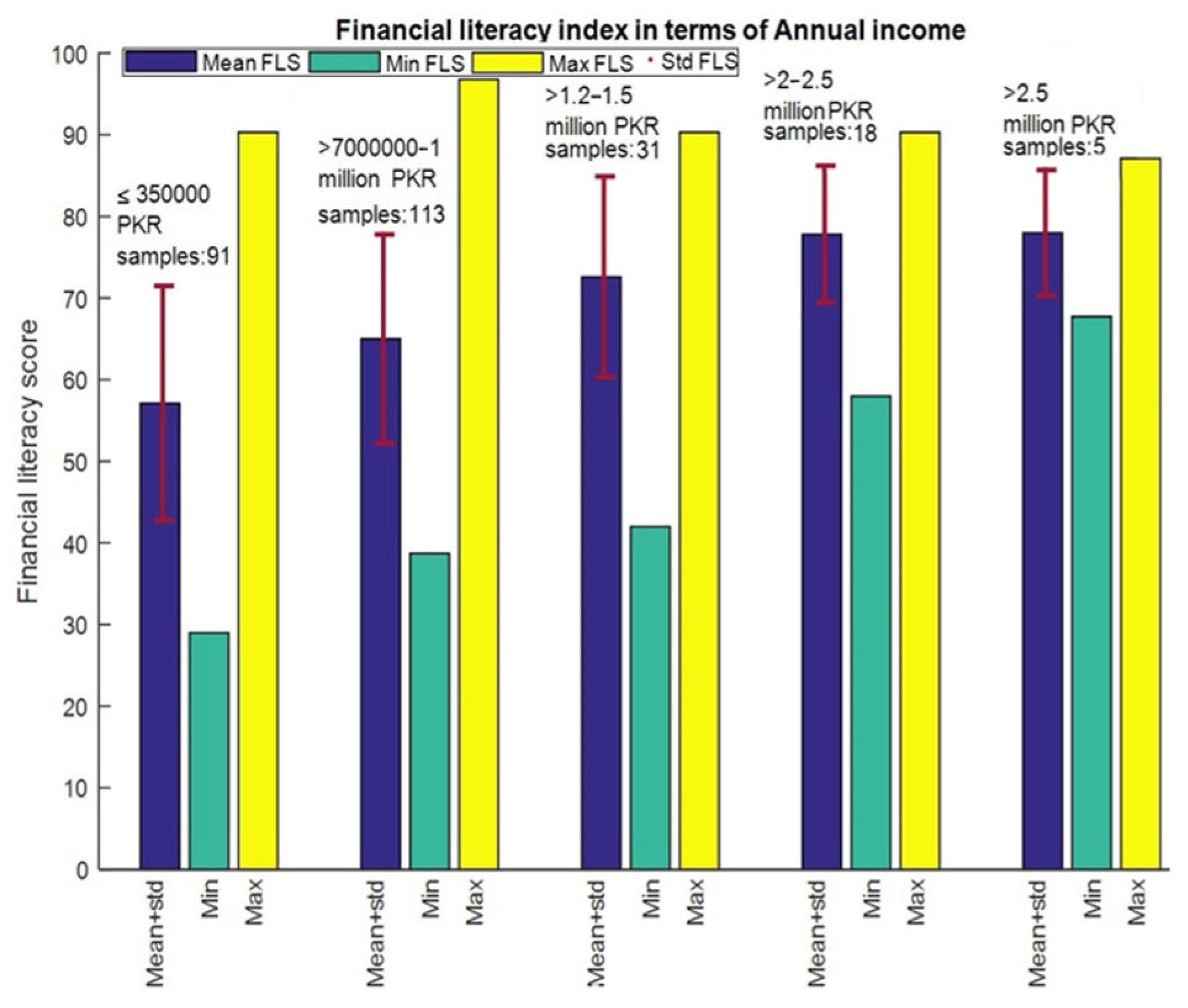

4.2. Financial Literacy Characteristics of Respondents

4.3. Variables Affecting Financial Literacy

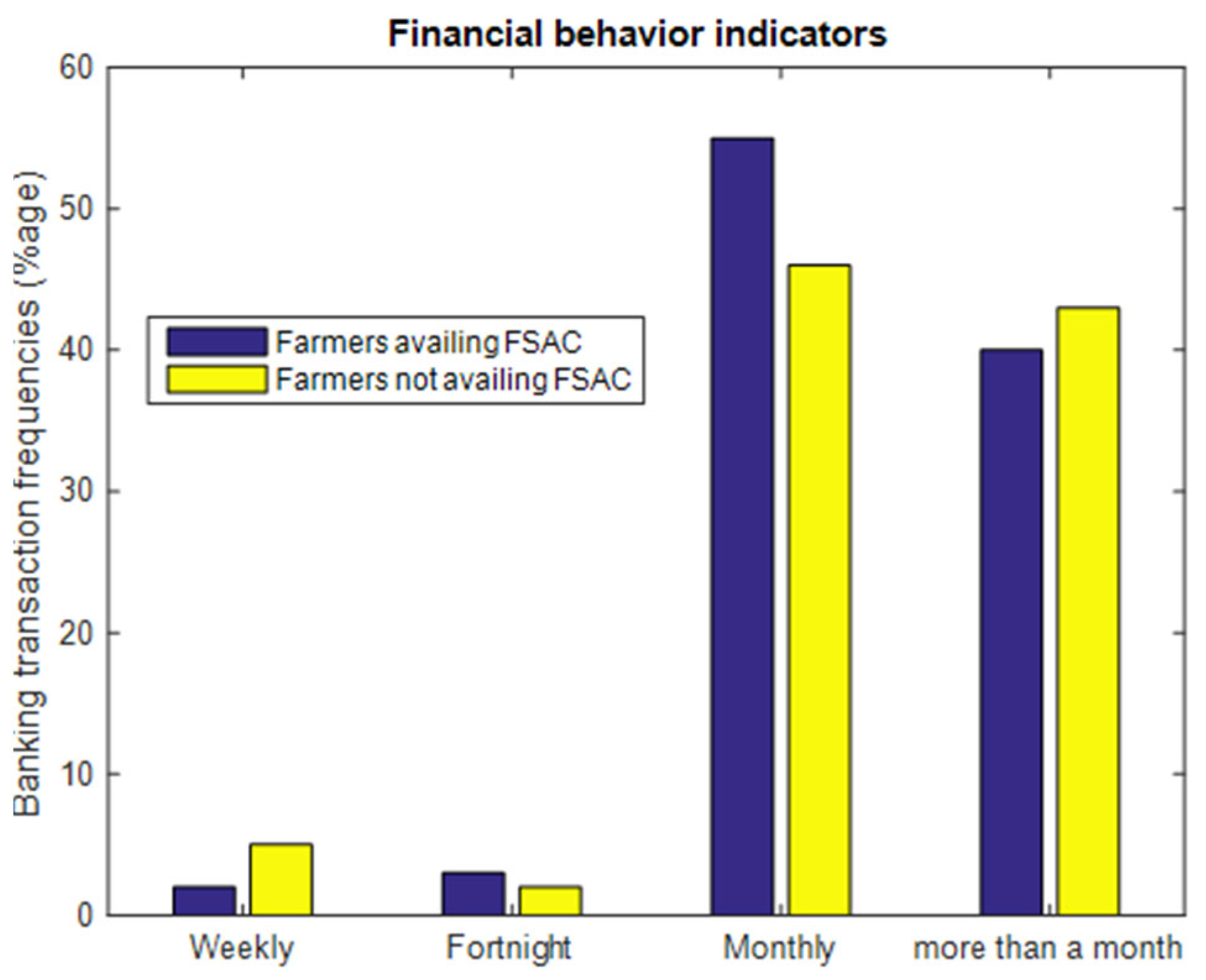

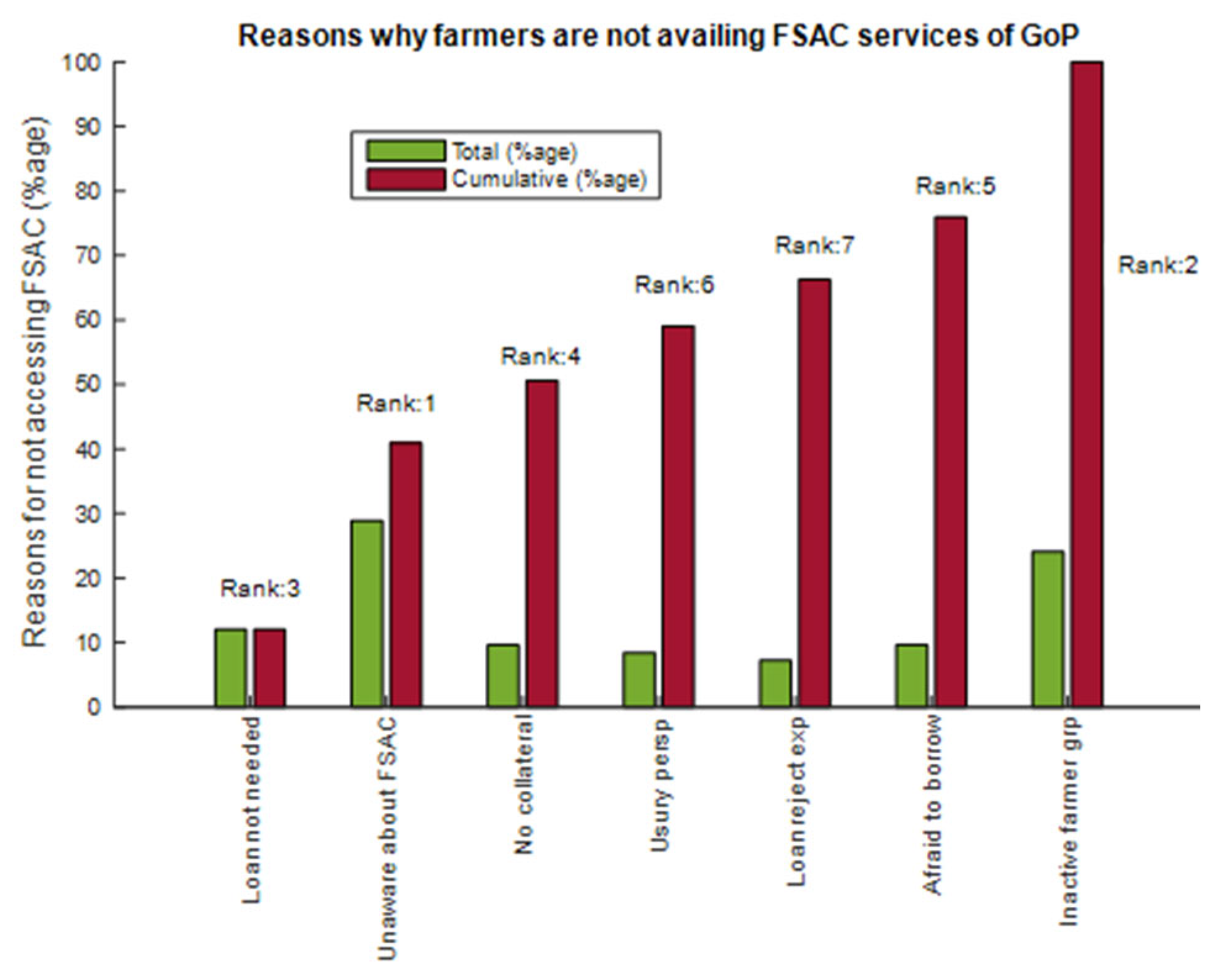

4.4. FSAC Accessibility

4.5. Loan Application

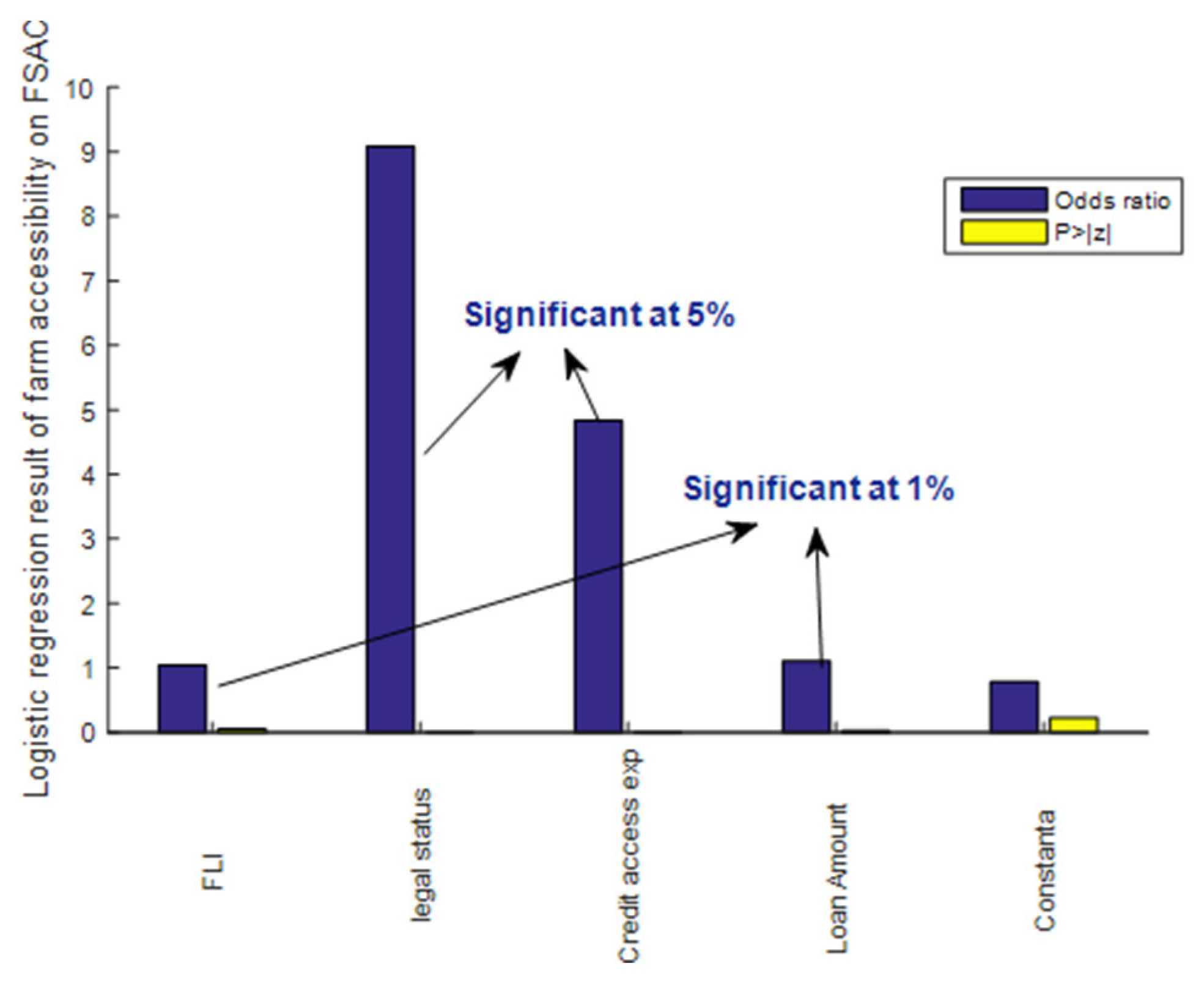

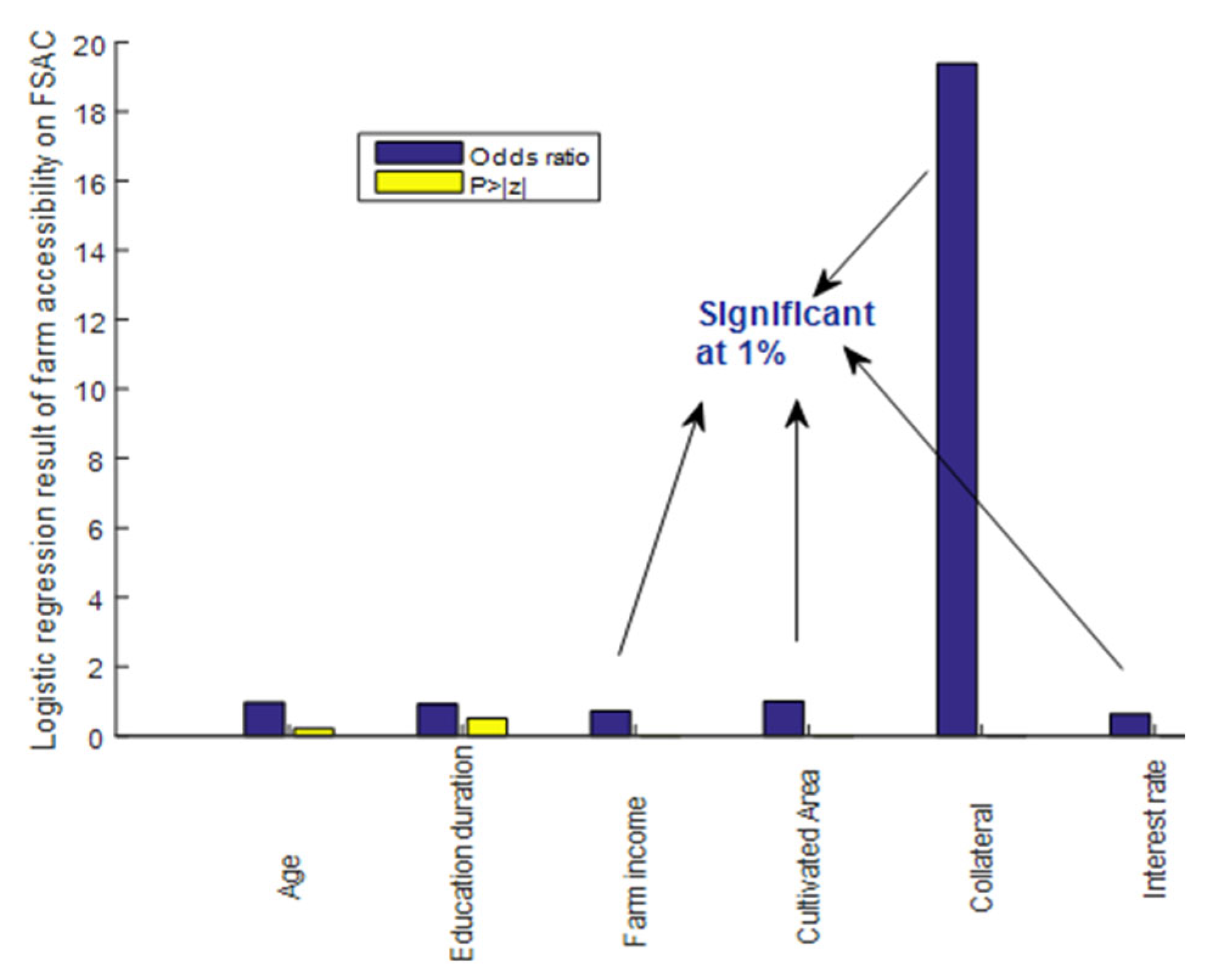

4.6. The Impact Variables of FSAC Accessibility

5. Recommendations

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Siregar, H. Micro-Based Macroeconomic Policy; IPB Press: Bogor, Indonesia, 2009. [Google Scholar]

- Erokhin, V.; Gao, T.; Chivu, L.; Andrei, J.V. Food security in a food self-sufficient economy: A review of China’s ongoing transition to a zero hunger state. Agricu. Econ. Czech 2022, 68, 476–487. [Google Scholar] [CrossRef]

- Kini, J. Multidimensional Food Security Index: A Comprehensive Approach. Asian J. Agric. Ext. Econ. Sociol. 2022, 40, 317–331. [Google Scholar] [CrossRef]

- Cook, P.; Nixson, F. Finance and Small and Medium-Sized Enterprise Development; Institute for Development Policy and Management: Manchester, UK, 2000. [Google Scholar]

- Lader, P. The public/private partnership. Springs Spring 1996, 35, 41–44. [Google Scholar]

- Tobias, R. A Closer Look at EU Agricultural Subsidies: Developing Modification Criteria; Germanwatch: Berlin, Germany, 2006. [Google Scholar]

- Etonihu, K.I.; Rahman, S.A.; Usman, S. Determinants of access to agricultural credit among crop farmers in a farming community of Nasarawa State, Nigeria. J. Dev. Agric. Econ. 2013, 5, 192–196. [Google Scholar] [CrossRef]

- Gao, T.; Ivolga, A.; Erokhin, V. Sustainable rural development in Northern China: Caught in a vice between poverty, urban attractions, and migration. Sustainability 2018, 10, 1467. [Google Scholar] [CrossRef]

- Sikandar, F.; Erokhin, V.; Xin, L.; Sidorova, M.; Ivolga, A.; Bobryshev, A. Sustainable agriculture and rural poverty eradication in Pakistan: The role of foreign aid and government policies. Sustainability 2022, 14, 14751. [Google Scholar] [CrossRef]

- Akram, W.; Hussain, Z.; Sial, M.H.; Hussain, I. Agricultural credit constraints and borrowing behavior of farmers in rural Punjab. Eur. J. Sci. Res. 2008, 23, 294–304. [Google Scholar]

- Constantin, M.; Radulescu, I.D.; Andrei, J.V.; Chivu, L.; Erokhin, V.; Gao, T. A perspective on agricultural labor productivity and greenhouse gas emissions in context of the common agricultural policy exigencies. Econ. Agric. 2021, 68, 53–67. [Google Scholar] [CrossRef]

- Panait, M.; Erokhin, V.; Andrei, J.V.; Gao, T. Implication of TNCs in agri-food sector—Challenges, constraints and limits—Profit or CSR? Strateg. Manag. 2020, 20, 33–43. [Google Scholar] [CrossRef]

- Saqib, S.; Ahmad, M.M.; Panezai, S.; Ali, U. Factors influencing farmers’ adoption of agricultural credit as a risk management strategy: The case of Pakistan. Int. J. Disaster Risk Reduct. 2016, 17, 67–76. [Google Scholar] [CrossRef]

- Robb, C.A.; James, R.N. Associations between individual characteristics and financial knowledge among college students. J. Pers. Financ. 2009, 8, 170–184. [Google Scholar]

- Klapper, L.; Lusardi, A.; Panos, G. Financial Literacy and the Financial Crisis; National Bureau of Economic Research: Cambridge, MA, USA, 2012. [Google Scholar]

- Ullah, A.; Arshad, M.; Kächele, H.; Zeb, A.; Mahmood, N.; Müller, K. Socio-economic analysis of farmers facing asymmetric information in inputs markets: Evidence from the rainfed zone of Pakistan. Technol. Soc. 2020, 63, 101405. [Google Scholar] [CrossRef]

- Elahi, E.; Abid, M.; Zhang, L.; ul Haq, S.; Sahito, J.G.M. Agricultural advisory and financial services; farm level access, outreach and impact in a mixed cropping district of Punjab, Pakistan. Land Use Policy 2018, 71, 249–260. [Google Scholar] [CrossRef]

- Ullah, A.; Arshad, M.; Kachele, H.; Khan, A.; Mahmood, N.; Müller, K. Information asymmetry, input markets, adoption of innovations and agricultural land use in Khyber Pakhtunkhwa, Pakistan. Land Use Policy 2020, 90, 104261. [Google Scholar] [CrossRef]

- Zada, M.; Shah, S.J.; Yukun, C.; Rauf, T.; Khan, N.; Shah, S.A.A. Impact of small-to-medium size forest enterprises on rural livelihood: Evidence from Khyber Pakhtunkhwa, Pakistan. Sustainability 2019, 11, 2989. [Google Scholar] [CrossRef]

- Zada, M.; Yukun, C.; Zada, S. Effect of financial management practices on the development of small-to medium size forest enterprises: Insight from Pakistan. GeoJournal 2021, 86, 1073–1088. [Google Scholar] [CrossRef]

- Government of Pakistan. Pakistan Economic Survey 2016–2017. Available online: https://www.finance.gov.pk/survey_1617.html (accessed on 21 December 2022).

- Government of Pakistan. Agriculture. Pakistan Economic Survey 2019–2020. Available online: https://finance.gov.pk/survey/chapters_18/02-Agriculture.pdf (accessed on 21 December 2022).

- World Bank. World Development Indicators. Available online: http://data.worldbank.org/ (accessed on 21 December 2022).

- Government of Pakistan. Pakistan Economic Survey 2015–2016. Available online: http://www.finance.gov.pk (accessed on 15 December 2022).

- Trade Development Authority of Pakistan. Statistics for 2015–2016. Available online: http://www.tdap.gov.pk/tdap-statistics.php (accessed on 21 December 2022).

- Pakistan Bureau of Statistics. Agricultural Census. Available online: http://www.pbs.gov.pk/ (accessed on 10 December 2022).

- Government of Pakistan. Multidimensional Poverty in Pakistan. Available online: https://www.undp.org/pakistan/publications/multidimensional-poverty-pakistan (accessed on 10 December 2022).

- Food and Agriculture Organization of the United Nations. Women in Agriculture in Pakistan. Available online: http://www.fao.org (accessed on 15 November 2022).

- Food and Agriculture Organization of the United Nations. Available online: http://www.fao.org/faostat/en (accessed on 15 November 2022).

- Qamer, F.M.; Shehzad, K.; Abbas, S.; Murthy, M.; Xi, C.; Gilani, H.; Bajracharya, B. Mapping deforestation and forest degradation patterns in Western Himalaya, Pakistan. Remote Sens. 2016, 8, 385. [Google Scholar] [CrossRef]

- United Nations Development Program. Climate Public Expenditure and Institutional Review. Available online: http://www.pk.undp.org (accessed on 15 November 2022).

- Qamar-uz-Zaman, C.; Mahmood, A.; Rasul, G.; Afzaal, M. Climate Change Indicators of Pakistan; Pakistan Metrological Department: Islamabad, Pakistan, 2009. [Google Scholar]

- Hussain, S.S.; Mudasser, M. Prospects for wheat production under changing climate in mountain areas of Pakistan: An econometric analysis. Agric. Syst. 2007, 94, 494–501. [Google Scholar] [CrossRef]

- Todaro, M.P.; Stephen, C.S. Economic Development; Addison Wesley: Harlow, UK, 2009. [Google Scholar]

- Milton, H.S.; Orley, M.A., Jr. Contemporary Economics; Worth Publishers: New York, NY, USA, 1993. [Google Scholar]

- Wadud, M.A. Impact of Microcredit on Agricultural Farm Performance and Food Security in Bangladesh; Institute for Inclusive Finance and Development: Dhaka, Bangladesh, 2013. [Google Scholar]

- Quach, M.H.; Mullineux, A.W.; Murinde, V. Access to Credit and Household Poverty Reduction in Rural Vietnam; The University of Birmingham: Birmingham, UK, 2005. [Google Scholar]

- Montgomery, H. Serving the Poorest of the Poor: The Poverty Impact of the Khushhali Banks Microfinance Lending in Pakistan; Asian Development Bank Institute: Tokyo, Japan, 2005. [Google Scholar]

- Karlan, D.; Goldberg, N. The Impact of Microfinance: A Review of Methodological Issues; NYU Wagner Graduate School: New York, NY, USA, 2006. [Google Scholar]

- Aghion, B.A.; Morduch, J. The Economics of Microfinance; MIT Press: Cambridge, MA, USA, 2005. [Google Scholar]

- Ibrahim, A.H.; Bauer, S. Access to microcredit and its impact on farm profit among rural farmers in dryland of Sudan. Glob. Adv. Res. J. Agric. Sci. 2013, 2, 88–102. [Google Scholar]

- Angioloni, S.; Kudabaev, Z.; Ames, G.C.W.; Wetzstein, M. Micro-credit impact in Kyrgyzstan: A study case. In Proceedings of the 2013 Annual Meeting of the Southern Agricultural Economics Association, Orlando, FL, USA, 2–5 February 2013. [Google Scholar]

- Crepon, B.; Devoto, D.; Duflo, E.; Pariente, W. Impact of Microcredit in Rural Areas of Morocco: Evidence from Randomizes Evaluation; Agence Francaise de Developpement: Paris, France, 2011. [Google Scholar]

- Dewi, I.S.; Dwi, R.; Netti, T. Roles of food security and energy credit in increasing rice production and profits in Kampar Regency, Riau Province. J. Din. Pertanian 2015, 30, 163–170. [Google Scholar] [CrossRef]

- Farida, F.; Siregar, H.; Nuryartono, N.; Intan, E.K.P. An impact estimator using propensity score matching: People’s business credit program to micro-entrepreneurs in Indonesia. Iran. Econ. Rev. 2016, 20, 599–615. [Google Scholar] [CrossRef]

- Dahri, T.; Hutagaol, P.; Siregar, H.; Simatupang, P. Determinants of the KKPE Credit Program Repayment of Cattle Farmers in Central Java, Indonesia. Glob. J. Commer. Manag. Perspect. 2015, 4, 17–22. [Google Scholar]

- Wati, D.R.; Nuryartono, N.; Anggraeni, L. Microcredit access and impact on production and revenue of organic rice farming in Bogor regency. J. Econ. Dev. Policy 2014, 3, 75–94. [Google Scholar]

- Arief, B.; Rosmiati, M. Impact of Credit Access on Rice Farmers Household Welfare; IKOPIN Press: Jatinangor, Indonesia, 2013. [Google Scholar]

- Pakistan Bureau of Statistics. 6th Population and Housing Census 2017. Available online: https://www.pbs.gov.pk/content/populationcensus (accessed on 15 December 2022).

- Abdullah, D.Z.; Khan, S.A.; Jebran, K.; Ali, A. Agricultural credit in Pakistan: Past trends and future prospects. J. Appl. Environ. Biol. Sci. 2015, 5, 178–188. [Google Scholar]

- Pakistan Bureau of Statistics. Agriculture Statistics 2019. Available online: https://www.pbs.gov.pk/content/agriculture-statistics (accessed on 20 December 2022).

- Baqir, R. SBP Sets Agri Loan Target at Rs. 1.35 tr. Available online: https://www.dawn.com/news/1517680 (accessed on 28 November 2022).

- Business Recorder. Govt in Budget 2019–20 Announces Special Measures for Agriculture Development. Available online: https://www.brecorder.com/2019/06/12/502133/govt-inbudget-2019-20-announces-special-measures-foragriculture-development (accessed on 18 August 2022).

- Bashir, M.K.; Mehmood, Y.; Hassan, S. Impact of agricultural credit on productivity of wheat crop: Evidence from Lahore, Punjab, Pakistan. Pak. J. Agric. Sci. 2010, 47, 405–409. [Google Scholar]

- Chandio, A.A.; Jiang, Y.; Rehman, A. Credit margin of investment in the agricultural sector and credit fungibility: The case of smallholders of district Shikarpur, Sindh, Pakistan. Finan. Innov. 2018, 4, 27. [Google Scholar] [CrossRef]

- Chandio, A.A.; Jiang, Y. Determinants of credit constraints: Evidence from Sindh, Pakistan. Emerg. Mark. Finan. Trade 2018, 54, 3401–3410. [Google Scholar] [CrossRef]

- Amanullah; Lakhan, G.R.; Channa, S.A.; Magsi, H.; Koondher, M.A.; Wang, J.; Channa, N.A. Credit constraints and rural farmers’ welfare in an agrarian economy. Heliyon 2020, 6, e05252. [Google Scholar] [CrossRef]

- Chandio, A.A.; Jiang, Y.; Wei, F.; Rehman, A.; Liu, D. Famers’ access to credit: Does collateral matter or cash flow matter? Evidence from Sindh, Pakistan. Cogent Econ. Finan. 2017, 5, 1369383. [Google Scholar] [CrossRef]

- Nouman, M.; Siddiqi, M.; Asim, S.; Hussain, Z. Impact of socio-economic characteristics of farmers on access to agricultural credit. Sarhad J. Agric. 2013, 29, 469–476. [Google Scholar]

- Rasheed, R.; Xia, L.C.; Ishaq, M.N.; Mukhtar, M.; Waseem, M. Determinants influencing the demand of microfinance in agriculture production and estimation of constraint factors: A case from south Region of Punjab Province, Pakistan. Int. J. Agric. Ext. Rural Dev. Stud. 2016, 3, 45–58. [Google Scholar]

- Karaivanov, A.; Kessler, A. (Dis)advantages of informal loans—Theory and evidence. Eur. Econ. Rev. 2018, 102, 100–128. [Google Scholar] [CrossRef]

- Saleem, M.A.; Jan, F.A. The impact of agricultural credit on agricultural productivity in Dera Ismail Khan (District) Khyber Pakhtonkhawa Pakistan. Eur. J. Bus. Manag. 2011, 3, 38–44. [Google Scholar]

- Rehman, A.; Chandio, A.A.; Hussain, I.; Jingdong, L. Is credit the devil in the agriculture? The role of credit in Pakistan’s agricultural sector. J. Finan. Data Sci. 2017, 3, 38–44. [Google Scholar] [CrossRef]

- Hussain, A.; Thapa, G.B. Smallholders’ access to agricultural credit in Pakistan. Food Secur. 2012, 4, 73–85. [Google Scholar] [CrossRef]

- Amjad, S.; Hasnu, S. Smallholders’ access to rural credit: Evidence from Pakistan. Lahore J. Econ. 2007, 12, 1–25. [Google Scholar] [CrossRef]

- Dzadze, P.; Osei, M.; Aidoo, R.; Nurah, G. Factors determining access to formal credit in Ghana: A case study of smallholder farmers in the Abura-Asebu Kwamankese district of central region of Ghana. J. Dev. Agric. Econ. 2012, 4, 416–423. [Google Scholar] [CrossRef]

- Winter-Nelson, A.; Temu, A. Liquidity constraints, access to credit and pro-poor growth in rural Tanzania. J. Int. Dev. 2005, 17, 867–882. [Google Scholar] [CrossRef]

- World Bank. World Development Report 2008: Agriculture for Development; World Bank: Washington, DC, USA, 2008. [Google Scholar]

- Ankrah Twumasi, M.; Jiang, Y.; Adhikari, S.; Adu Gyamfi, C.; Asare, I. Financial literacy and its determinants: The case of rural farm households in Ghana. Agric. Finan. Rev. 2022, 82, 641–656. [Google Scholar] [CrossRef]

- Zakic, V.; Kovacevic, V.; Damnjanovic, J. Significance of financial literacy for the agricultural holdings in Serbia. Ekon. Poljopr. 2017, 64, 1687–1702. [Google Scholar] [CrossRef]

- Ravikumar, R.; Sivakumar, S.D.; Jawaharlal, M.; Venkatesa Palanichamy, N.; Sureshkumar, D. Assessment of farm financial literacy among jasmine growers in Tamilnadu, India. Dev. Ctry. Stud. 2013, 13, 67–75. [Google Scholar]

- Ullah, A.; Mahmood, N.; Zeb, A.; Kächele, H. Factors determining farmers’ access to and sources of credit: Evidence from the rain-fed zone of Pakistan. Agriculture 2020, 10, 586. [Google Scholar] [CrossRef]

- Yamane, T. Statistics: An Introductory Analysis; Harper and Row: New York, NY, USA, 1967. [Google Scholar]

- Lusardi, A. Household Saving Behavior: The Role of Financial Literacy, Information, and Financial Education Programs; National Bureau of Economic Research: Cambridge, MA, USA, 2008. [Google Scholar]

- Garman, E.T.; Leech, I.E.; Grable, J.E. The negative impact of employee poor personal financial behaviors on employers. Finan. Counsel. Plann. 1996, 7, 157–168. [Google Scholar]

- Servon, L.; Kaestner, R. Consumers financial literacy and the impact of online banking on the financial behavior of lower income bank customers. J. Consum. Aff. 2008, 42, 271–305. [Google Scholar] [CrossRef]

- Usera, J.J. Personal Financial Literacy: A National Needs Assessment; Institute for Educational Leadership and Evaluation: Rapid City, SD, USA, 2002. [Google Scholar]

- Chen, H.; Volpe, R.P. An analysis of personal financial literacy among college student. Finan. Serv. Rev. 1998, 7, 107–128. [Google Scholar] [CrossRef]

- Wagner, J.F. An Analysis of the Effects of Financial Education on Financial Literacy and Financial Behaviors. Ph.D. Thesis, College of Business, University of Nebraska-Lincoln, Lincoln, NE, USA, May 2015. [Google Scholar]

- Zeller, M.; Meyer, R.L. Improving the Performance of Microfinance: Financial Sustainability, Outreach, and Impact; International Food Policy Research Institute: Washington, DC, USA, 2002. [Google Scholar]

- Zhao, H.; Wu, W.; Chen, X. What Factors Affect Small and Medium Sized Enterprise’s Ability to Borrow from Bank: Evidence from Chengdu City, Capital of South-Western China’s Sichuan Province; Business Institute Berlin: Berlin, Germany, 2006. [Google Scholar]

- Nguyen, N.; Luu, N. Determinants of financing pattern and access to formal-informal credit: The case of small and medium sized enterprises in Vietnam. J. Manag. Res. 2013, 5, 240–259. [Google Scholar] [CrossRef]

- Pandula, G. An Empirical Investigation of Small and Medium Enterprise’s Access to Bank Finance. In Proceedings of the ASBBS Annual Conference, Las Vegas, NV, USA, 22–27 February 2011. [Google Scholar]

| Parameter | Farmer Group | Individual |

|---|---|---|

| Cost of loan | Group responsibility | Individual responsibility |

| Timing credit | Longer | Shorter |

| Loan amount | Smaller | Bigger |

| Risk default | Joint responsibility | Sole responsibility |

| Collateral | Joint responsibility | Sole responsibility |

| Credit approval possibility | Higher | Lower |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Raza, A.; Tong, G.; Sikandar, F.; Erokhin, V.; Tong, Z. Financial Literacy and Credit Accessibility of Rice Farmers in Pakistan: Analysis for Central Punjab and Khyber Pakhtunkhwa Regions. Sustainability 2023, 15, 2963. https://doi.org/10.3390/su15042963

Raza A, Tong G, Sikandar F, Erokhin V, Tong Z. Financial Literacy and Credit Accessibility of Rice Farmers in Pakistan: Analysis for Central Punjab and Khyber Pakhtunkhwa Regions. Sustainability. 2023; 15(4):2963. https://doi.org/10.3390/su15042963

Chicago/Turabian StyleRaza, Ali, Guangji Tong, Furqan Sikandar, Vasilii Erokhin, and Zhang Tong. 2023. "Financial Literacy and Credit Accessibility of Rice Farmers in Pakistan: Analysis for Central Punjab and Khyber Pakhtunkhwa Regions" Sustainability 15, no. 4: 2963. https://doi.org/10.3390/su15042963

APA StyleRaza, A., Tong, G., Sikandar, F., Erokhin, V., & Tong, Z. (2023). Financial Literacy and Credit Accessibility of Rice Farmers in Pakistan: Analysis for Central Punjab and Khyber Pakhtunkhwa Regions. Sustainability, 15(4), 2963. https://doi.org/10.3390/su15042963