Unleashing the Moderating Influence of Firms’ Life Cycle Stages and National Income on Capital Structure Targeting Behavior: A Roadmap towards Sustainable Development

Abstract

1. Introduction

2. Theoretical Framework and Development of Hypotheses

2.1. Trade-Off Theory and Speed of Capital Adjustment

2.2. Pecking Order Theory and Speed of Capital Adjustment

2.3. Role of Moderators

2.3.1. Moderating Role of Firm’s Life Cycle

2.3.2. The Moderating Role of the Gross National Income of the Economies

2.4. Control Determinants of the Capital Structure

2.4.1. Profitability

2.4.2. Growth Opportunities

2.4.3. Tangibility

2.4.4. Size

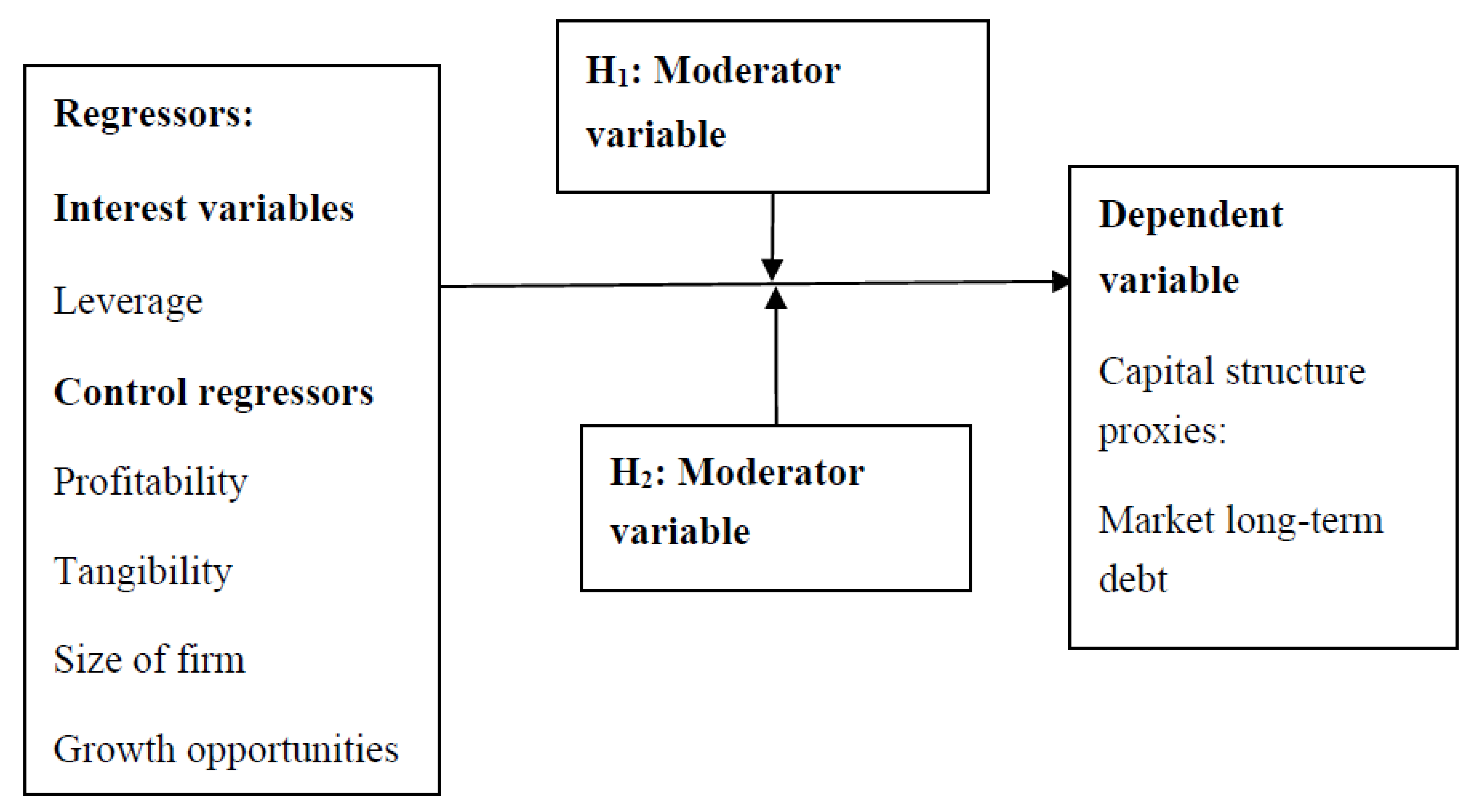

3. Theoretical and Conceptual Framework

4. Methodology and Data

5. Results and Discussion

Data Distribution and Means of Debt Ratios

6. Conclusions and Policy Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Ezeani, E.; Salem, R.; Kwabi, F.; Boutaine, K.; Bilal; Komal, B. Board Monitoring and Capital Structure Dynamics: Evidence from Bank-Based Economies. Rev. Quant. Financ. Account. 2021, 58, 473–498. [Google Scholar] [CrossRef]

- Dickinson, V. Cash Flow Patterns as a Proxy for Firm Life Cycle. Account. Rev. 2011, 86, 1969–1994. [Google Scholar] [CrossRef]

- Fama, E.F.; French, K.R. Testing Trade-off and Pecking Order Predictions about Dividends and Debt. Rev. Financ. Stud. 2002, 15, 1–33. [Google Scholar] [CrossRef]

- Kayhan, A.; Titman, S. Firms’ Histories and Their Capital Structures. J. Financ. Econ. 2007, 83, 1–32. [Google Scholar] [CrossRef]

- Wang, Y.; Zhi, Q. The Role of Green Finance in Environmental Protection: Two Aspects of Market Mechanism and Policies. Energy Procedia 2016, 104, 311–316. [Google Scholar] [CrossRef]

- Falcone, P.M. Green Investment Strategies and Bank-Firm Relationship: A Firm-Level Analysis. Econ. Bull. 2018, 38, 2225–2239. [Google Scholar]

- Falcone, P.; Sica, E. Assessing the Opportunities and Challenges of Green Finance in Italy: An Analysis of the Biomass Production Sector. Sustainability 2019, 11, 517. [Google Scholar] [CrossRef]

- Mazzucato, M.; Semieniuk, G. Financing Renewable Energy: Who Is Financing What and Why It Matters. Technol. Forecast. Soc. Change 2018, 127, 8–22. [Google Scholar] [CrossRef]

- Antoniou, A.; Guney, Y.; Paudyal, K. The Determinants of Capital Structure: Capital Market-Oriented versus Bank-Oriented Institutions. J. Financ. Quant. Anal. 2008, 43, 59. [Google Scholar] [CrossRef]

- Huang, R.; Ritter, J.R. Testing Theories of Capital Structure and Estimating the Speed of Adjustment. J. Financ. Quant. Anal. 2009, 44, 237–271. [Google Scholar] [CrossRef]

- Booth, L.; Aivazian, V.; Demirguc-Kunt, A.; Maksimovic, V. Capital Structures in Developing Countries. J. Financ. 2001, 56, 87–130. [Google Scholar] [CrossRef]

- Mansour, M.; Al Amosh, H.; Alodat, A.Y.; Khatib, S.F.A.; Saleh, M.W.A. The Relationship between Corporate Governance Quality and Firm Performance: The Moderating Role of Capital Structure. Sustainability 2022, 14, 10525. [Google Scholar] [CrossRef]

- Mathur, N.; Tiwari, S.C.; Ramaiah, T.S.; Mathur, H. Capital structure, competitive intensity and firm performance: An analysis of Indian pharmaceutical companies. Manag. Financ. 2021, 47, 1357–1382. [Google Scholar] [CrossRef]

- Mubeen, R.; Han, D.; Abbas, J.; Raza, S.; Bodian, W. Examining the Relationship between Product Market Competition and Chinese Firms Performance: The Mediating Impact of Capital Structure and Moderating Influence of Firm Size. Front. Psychol. 2022, 12, 709678. [Google Scholar] [CrossRef]

- Choi, S.-J.; Jia, N.; Lu, J. The Structure of Political Institutions and Effectiveness of Corporate Political Lobbying. Organ. Sci. 2014, 26, 158–179. [Google Scholar] [CrossRef]

- Khan, I.; Hou, F.; Irfan, M.; Zakari, A.; Le, H.P. Does Energy Trilemma a Driver of Economic Growth? The Roles of Energy Use, Population Growth, and Financial Development. Renew. Sust. Energy Rev. 2021, 146, 111157. [Google Scholar] [CrossRef]

- Demirgüç-Kunt, A.; Levine, R. Bank-Based and Market-Based Financial Systems: Cross-Country Comparisons; World Bank Publications: Washington, DC, USA, 1999. [Google Scholar]

- Arya, A.; Glover, J.C.; Sunder, S. Are Unmanaged Earnings Always Better for Shareholders? SSRN Electron. J. 2002, 17, 111–116. [Google Scholar] [CrossRef]

- Drobetz, W.; Wanzenried, G. What Determines the Speed of Adjustment to the Target Capital Structure? Appl. Financ. Econ. 2006, 16, 941–958. [Google Scholar] [CrossRef]

- Porter, M.E. Competitive Advantage of Nations: Creating and Sustaining Superior Performance; Simon and Schuster: New York, NY, USA, 2011. [Google Scholar]

- Miller, D.; Friesen, P.H. A Longitudinal Study of the Corporate Life Cycle. Manag. Sci. 1984, 30, 1161–1183. [Google Scholar] [CrossRef]

- Modigliani, F.; Miller, M.H. The Cost of Capital, Corporation Finance and the Theory of Investment. Am. Econ. Rev. 1958, 48, 261–297. [Google Scholar]

- Modigliani, F.; Miller, M.H. Corporate Income Taxes and the Cost of Capital: A Correction. Am. Econ. Rev. 1963, 53, 433–443. [Google Scholar]

- Hirshleifer, J. Investment Decision under Uncertainty: Applications of the State-Preference Approach. Q. J. Econ. 1966, 80, 252–277. [Google Scholar] [CrossRef]

- Kraus, A.; Litzenberger, R.H. A State-Preference Model of Optimal Financial Leverage. J. Financ. 1973, 28, 911–922. [Google Scholar] [CrossRef]

- Amin, M.S.; Khan, H.; Jaddon, I.A.; Tahir, M. Capital Structure Theories and Speed of Capital Adjustment towards Target Capital Structure along Life Cycle Stages of Asian Manufacturing Firms. JAFEE 2020, 6, 53–62. [Google Scholar] [CrossRef]

- Miller, M.H. Debt and Taxes. J. Financ. 1977, 32, 261–275. [Google Scholar] [CrossRef]

- Lloyd-Davies, P.R. Optimal Financial Policy in Imperfect Markets. J. Financ. Quant. Anal. 1975, 10, 457–481. [Google Scholar] [CrossRef]

- Myers, S.C. Capital Structure Puzzle. Available online: https://www.nber.org/papers/w1393 (accessed on 25 June 2021).

- Jensen, M.C.; Meckling, W.H. Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure. J. Financ. Econ. 1976, 3, 305–360. [Google Scholar] [CrossRef]

- Fischer, E.O.; Heinkel, R.; Zechner, J. Dynamic Capital Structure Choice: Theory and Tests. J. Financ. 1989, 44, 19–40. [Google Scholar] [CrossRef]

- Goldstein, R.; Ju, N.; Leland, H. An EBIT-Based Model of Dynamic Capital Structure. J. Bus. 2001, 74, 483–512. [Google Scholar] [CrossRef]

- Hennessy, C.A.; Whited, T.M. Debt Dynamics. J. Financ. 2005, 60, 1129–1165. [Google Scholar] [CrossRef]

- Leary, M.T.; Roberts, M.R. Do Firms Rebalance Their Capital Structures? J. Financ. 2005, 60, 2575–2619. [Google Scholar] [CrossRef]

- Faulkender, M.; Flannery, M.J.; Hankins, K.W.; Smith, J.M. Cash Flows and Leverage Adjustments. J. Financ. Econ. 2012, 103, 632–646. [Google Scholar] [CrossRef]

- Byoun, S. How and When Do Firms Adjust Their Capital Structures toward Targets? J. Financ. 2008, 63, 3069–3096. [Google Scholar] [CrossRef]

- Donaldson, G. Corporate Debt Capacity: A Study of Corporate Debt Policy and the Determination of Corporate Debt Capacity; Beard Books: Fairless Hills, PA, USA, 2000. [Google Scholar]

- Kim, J.; Jung, S.; Ha, M. Consolidated Financial Reporting and the Effect of Mandatory IFRS Adoption on the Information Content of Earnings Announcements: Evidence from Korea. Asia-Pac. J. Account. Econ. 2021, 28, 674–695. [Google Scholar] [CrossRef]

- Connelly, B.L.; Certo, S.T.; Ireland, R.D.; Reutzel, C.R. Signaling Theory: A Review and Assessment. J. Manag. 2011, 37, 39–67. [Google Scholar] [CrossRef]

- Sharma, S.; Durand, R.M.; Gur-Arie, O. Identification and Analysis of Moderator Variables. J. Mark. Res. 1981, 18, 291–300. [Google Scholar] [CrossRef]

- Boulding, E. Family Adjustments to War Separation and Reunion. Ann. Am. Acad. Pol. Soc. Sci. 1950, 272, 59–67. [Google Scholar] [CrossRef]

- Anthony, J.H.; Ramesh, K. Association between Accounting Performance Measures and Stock Prices. J. Account. Econ. 1992, 15, 203–227. [Google Scholar] [CrossRef]

- Kieschnick, R.; Moussawi, R. Firm Age, Corporate Governance, and Capital Structure Choices. J. Corp. Financ. 2018, 48, 597–614. [Google Scholar] [CrossRef]

- Seifert, B.; Gonenc, H. Issuing and Repurchasing: The Influence of Mispricing, Corporate Life Cycle and Financing Waves. J. Multinatl. Financ. Manag. 2012, 22, 66–81. [Google Scholar] [CrossRef]

- Bulan, L.; Yan, Z. Firm Maturity and the Pecking Order Theory. J. Bus. Econ. 2010, 9, 179–200. [Google Scholar] [CrossRef]

- Faff, R.; Kwok, W.C.; Podolski, E.J.; Wong, G. Do Corporate Policies Follow a Life-Cycle? J. Bank. Financ. 2016, 69, 95–107. [Google Scholar] [CrossRef]

- Berger, N.; Udell, G.F. The Economics of Small Business Finance: The Roles of Private Equity and Debt Markets in the Financial Growth Cycle. J. Bank. Financ. 1998, 22, 613–673. [Google Scholar] [CrossRef]

- Cohen, P.; Cohen, J.; Aiken, L.S.; West, S.G. The Problem of Units and the Circumstance for POMP. Multivar. Behav. Res. 1999, 34, 315–346. [Google Scholar] [CrossRef]

- Clark, B.J.; Francis, B.B.; Hasan, I. Do Firms Adjust Toward Target Capital Structures? Some International Evidence. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1286383 (accessed on 1 September 2021).

- Li, Y.; Yang, X.; Ran, Q.; Wu, H.; Irfan, M.; Ahmad, M. Energy Structure, Digital Economy, and Carbon Emissions: Evidence from China. Environ. Sci. Pollut. Res. 2021, 28, 64606–64629. [Google Scholar] [CrossRef]

- Razzaq, A.; Ajaz, T.; Li, J.C.; Irfan, M.; Suksatan, W. Investigating the Asymmetric Linkages between Infrastructure Development, Green Innovation, and Consumption-Based Material Footprint: Novel Empirical Estimations from Highly Resource-Consuming Economies. Resour. Policy 2021, 74, 102302. [Google Scholar] [CrossRef]

- Irfan, M.; Chen, Z.; Adebayo, T.S.; Al-Faryan, M.A.S. Socio-Economic and Technological Drivers of Sustainability and Resources Management: Demonstrating the Role of Information and Communications Technology and Financial Development Using Advanced Wavelet Coherence Approach. Resour. Policy 2022, 79, 103038. [Google Scholar] [CrossRef]

- Yan, P.; Choi, Y.; Choi, S.; Jung, S. Agency Theory Approach for the Performance of Returnee Entrepreneurs. J. Appl. Bus. Res. JABR 2018, 34, 447–454. [Google Scholar] [CrossRef]

- Jovanovic, B. Selection and the Evolution of Industry. Econometrica 1982, 50, 649–670. [Google Scholar] [CrossRef]

- Flannery, M.J.; Rangan, K.P. Partial Adjustment toward Target Capital Structures. J. Financ. Econ. 2006, 79, 469–506. [Google Scholar] [CrossRef]

- Vasiliou, D.; Eriotis, N.; Daskalakis, N. Testing the Pecking Order Theory: The Importance of Methodology. Qual. Res. Financ. Mark. 2009, 1, 85–96. [Google Scholar] [CrossRef]

- Matemilola, B.T.; Bany-Ariffin, A.N.; Azman-Saini, W.N.W.; Nassir, A.M. Does Top Managers’ Experience Affect Firms’ Capital Structure? Res. Int. Bus. Financ. 2018, 45, 488–498. [Google Scholar] [CrossRef]

- Frielinghaus, A.; Mostert, B.; Firer, C. Capital Structure and the Firm’s Life Stage. S. Afr. J. Bus. Manag. 2005, 36, 9–18. [Google Scholar] [CrossRef]

- Pfaffermayr, M.; Stöckl, M.; Winner, H. Capital Structure, Corporate Taxation and Firm Age. Fisc. Stud. 2013, 34, 109–135. [Google Scholar] [CrossRef]

- Mahajan, A.; Tartaroglu, S. Equity Market Timing and Capital Structure: International Evidence. J. Bank. Financ. 2008, 32, 754–766. [Google Scholar] [CrossRef]

- Baker, M.; Wurgler, J. Market Timing and Capital Structure. J. Financ. 2002, 57, 1–32. [Google Scholar] [CrossRef]

- Hovakimian, A.; Opler, T.; Titman, S. The Debt-Equity Choice. J. Financ. Quant. Anal. 2001, 36, 1–24. [Google Scholar] [CrossRef]

- Hasan, M.M.; Cheung, A. Organization Capital and Firm Life Cycle. J. Corp. Financ. 2018, 48, 556–578. [Google Scholar] [CrossRef]

- Rajan, R.G.; Zingales, L. What Do We Know about Capital Structure? Some Evidence from International Data. J. Financ. 1995, 50, 1421–1460. [Google Scholar] [CrossRef]

- Fan, J.P.H.; Titman, S.; Twite, G. An International Comparison of Capital Structure and Debt Maturity Choices. J. Financ. Quant. Anal. 2011, 47, 23–56. [Google Scholar] [CrossRef]

- Pérez, S.E.; Llopis, A.S.; Llopis, J.A.S. The Determinants of Survival of Spanish Manufacturing Firms. Rev. Ind. Organ. 2004, 25, 251–273. [Google Scholar] [CrossRef]

- Marsh, P. The Choice between Equity and Debt: An Empirical Study. J. Financ. 1982, 37, 121–144. [Google Scholar] [CrossRef]

- Alves, P.F.P.; Ferreira, M.A. Capital Structure and Law around the World. J. Multinatl. Financ. Manag. 2011, 21, 119–150. [Google Scholar] [CrossRef]

- Anthony, J.H.; Petroni, K.R. Accounting Estimation Disclosures and Firm Valuation in the Property-Casualty Insurance Industry. J. Account. Audit. Financ. 1997, 12, 257–281. [Google Scholar] [CrossRef]

- Bartolacci, F.; Paolini, A.; Quaranta, A.G.; Soverchia, M. Assessing Factors That Influence Waste Management Financial Sustainability. Waste Manag. 2018, 79, 571–579. [Google Scholar] [CrossRef]

- Choi, J.-D.; Park, J.-H. The Performance Effect of Two Different Dimensions of Absorptive Capacity and Moderating Role of Holding-Cash. Technol. Anal. Strateg. Manag. 2016, 29, 1033–1047. [Google Scholar] [CrossRef]

- Xu, J. Profitability and Capital Structure: Evidence from Import Penetration. J. Financ. Econ. 2012, 106, 427–446. [Google Scholar] [CrossRef]

- Tang, C.; Irfan, M.; Razzaq, A.; Dagar, V. Natural Resources and Financial Development: Role of Business Regulations in Testing the Resource-Curse Hypothesis in ASEAN Countries. Resour. Policy 2022, 76, 102612. [Google Scholar] [CrossRef]

- Wooldridge, J.M. Inverse Probability Weighted M-Estimators for Sample Selection, Attrition, and Stratification. Port. Econ. J. 2002, 1, 117–139. [Google Scholar] [CrossRef]

- Bevan, A.A.; Danbolt, J. Testing for Inconsistencies in the Estimation of UK Capital Structure Determinants. Appl. Financ. Econ. 2004, 14, 55–66. [Google Scholar] [CrossRef]

- Petersen, M.A. Estimating Standard Errors in Finance Panel Data Sets: Comparing Approaches. Rev. Financ. Stud. 2009, 22, 435–480. [Google Scholar] [CrossRef]

- Baum, C.F.; Schaffer, M.E.; Stillman, S. Instrumental Variables and GMM: Estimation and Testing. Stata J. 2003, 3, 1–31. [Google Scholar] [CrossRef]

- Holtz-Eakin, D.; Newey, W.; Rosen, H.S. Estimating Vector Autoregressions with Panel Data. Econometrica 1988, 56, 1371–1395. [Google Scholar] [CrossRef]

- Arellano, M.; Bond, S. Some Tests of Specification for Panel Data: Monte Carlo Evidence and an Application to Employment Equations. Rev. Econ. Stud. 1991, 58, 277–297. [Google Scholar] [CrossRef]

- Arellano, M.; Bover, O. Another Look at the Instrumental Variable Estimation of Error-Components Models. J. Econom. 1995, 68, 29–51. [Google Scholar] [CrossRef]

- Blundell, R.; Bond, S. Initial Conditions and Moment Restrictions in Dynamic Panel Data Models. J. Econom. 1998, 87, 115–143. [Google Scholar] [CrossRef]

- Cohen, P. Applied Multiple Regression/Correlation Analysis for the Behavioral Sciences; Psychology Press: London, UK, 2014. [Google Scholar] [CrossRef]

- Tascón, M.T.; Castro, P.; Ferreras, A. How Does a Firm’s Life Cycle Influence the Relationship between Carbon Performance and Financial Debt? Bus. Strategy Environ. 2021, 30, 1879–1897. [Google Scholar] [CrossRef]

- Castro, P.; Tascón Fernández, M.T.; Amor-Tapia, B.; de Miguel, A. Target Leverage and Speed of Adjustment along the Life Cycle of European Listed Firms. BRQ Bus. Res. Q. 2016, 19, 188–205. [Google Scholar] [CrossRef]

- Imbierowicz, B.; Wahrenburg, M. Wealth Transfer Effects between Stockholders and Bondholders. Q. Rev. Econ. 2013, 53, 23–43. [Google Scholar] [CrossRef]

- Cetorelli, N.; Strahan, P.E. Finance as a Barrier to Entry: Bank Competition and Industry Structure in Local U.S. Markets. J. Financ. 2006, 61, 437–461. [Google Scholar] [CrossRef]

- Huang, W.; Yin, H.; Choi, S.; Muhammad, M. Micro- and Small-Sized Enterprises’ Sustainability-Oriented Innovation for COVID-19. Sustainability 2022, 14, 7521. [Google Scholar] [CrossRef]

- Xin, Y.; Chang, X.; Zhu, J. How does the digital economy affect energy efficiency? Empirical research on Chinese cities. Energy Environ. 2022, 1, 0958305X221143411. [Google Scholar] [CrossRef]

- Xin, Y.; Li, H.; Adebayo, T.S.; Awosusi, A.A. Asymmetric linkage between biomass energy consumption and ecological footprints in top ten biomass-consuming nations. Econ. Res.-Ekon. Istraživanja 2022, 1–26. [Google Scholar] [CrossRef]

| Variables | Measurement | Empirical Studies |

|---|---|---|

| Size | Market Capitalization’s Natural Logarithm | [2,26,63] |

| Tangibility | Net Plants, Equipment & Property/Total Assets | [11,26,57,64,68] |

| Growth opportunities | Market Value of Share/Book Value of Share MB | [3,12,13,26,57,68,69] |

| Profitability | EBIT/Total Assets | [12,13,26,57,59,70,71,72] |

| Stages of Life Cycle | Introduction | Growth | Mature | Shake-Out | Decline |

|---|---|---|---|---|---|

| Net Operating cash flow | Negative | Positive | Positive | Positive, Negative, Positive | Negative, Negative |

| Net Investing cash flow | Negative | Negative | Negative | Positive, Negative, Positive | Positive, Positive |

| Net Financing cash flow | Positive | Positive | Negative | Positive, Negative, Negative | Positive, Negative |

| Economy | Panel of Economy | No. of Firms | Introduction | Growth | Mature | Shakeout | Decline | Numbers of Year-Observations |

|---|---|---|---|---|---|---|---|---|

| Panel “A” | ||||||||

| Japan | HI | 1210 | 390 | 1944 | 7205 | 1096 | 255 | 10,890 |

| India | LMI | 724 | 588 | 1346 | 3415 | 767 | 400 | 6516 |

| Indonesia | LMI | 98 | 117 | 206 | 475 | 53 | 31 | 882 |

| South Korea | HI | 87 | 85 | 235 | 328 | 92 | 43 | 783 |

| Malaysia | UMI | 232 | 180 | 338 | 1118 | 336 | 116 | 2088 |

| Pakistan | LMI | 75 | 95 | 129 | 364 | 72 | 15 | 675 |

| Philippine | LMI | 16 | 14 | 34 | 79 | 11 | 6 | 144 |

| Singapore | HI | 133 | 140 | 201 | 559 | 198 | 99 | 1197 |

| Sri Lanka | LMI | 36 | 38 | 78 | 152 | 40 | 16 | 324 |

| Thai Land | UMI | 149 | 127 | 193 | 829 | 143 | 49 | 1341 |

| Turkey | UMI | 75 | 92 | 176 | 289 | 88 | 30 | 675 |

| Total | 2835 | 1866 | 488 | 14,813 | 2896 | 1060 | 25,515 | |

| Panel “B” | ||||||||

| HI | 1430 | 615 | 2380 | 8092 | 1386 | 397 | 12,870 | |

| UMI | 456 | 399 | 707 | 2236 | 567 | 195 | 4104 | |

| LMI | 949 | 852 | 1793 | 4485 | 943 | 468 | 8541 | |

| Country/Panel | Total Book Debt Ratio (%) | Long-Term Book Debt Ratio (%) | Total Market Debt Ratio (%) | Long-Term Market Debt Ratio (%) |

|---|---|---|---|---|

| Panel “A” | ||||

| Japan | 25.52 | 15.03 | 27.99 | 16.70 |

| India | 40.80 | 26.12 | 40.51 | 27.13 |

| Indonesia | 32.18 | 17.10 | 33.00 | 18.80 |

| Korea | 33.64 | 14.99 | 36.52 | 20.18 |

| Malaysia | 23.22 | 10.15 | 28.73 | 13.33 |

| Pakistan | 37.19 | 16.95 | 40.01 | 21.30 |

| Philippine | 24.20 | 11.40 | 25.04 | 12.31 |

| Singapore | 22.98 | 9.37 | 28.10 | 11.57 |

| Sri Lanka | 26.23 | 8.77 | 27.97 | 10.75 |

| Thai land | 25.46 | 10.00 | 23.79 | 9.21 |

| Turkey | 29.97 | 16.24 | 23.92 | 12.19 |

| Total/pooled | 30.02 | 16.98 | 31.66 | 18.54 |

| Panel “B” | ||||

| HI Economies | 25.78 | 14.50 | 28.52 | 16.44 |

| LMI Economies | 38.79 | 23.56 | 38.96 | 24.94 |

| UMI Economies | 25.06 | 11.10 | 26.32 | 11.80 |

| Total/pooled | 30.02 | 16.98 | 31.66 | 18.54 |

| Stages/Means | Introduction | Growth | Mature | Shakeout | Decline | Pooled | |

|---|---|---|---|---|---|---|---|

| HI | Total market debt ratio | 0.4189 | 0.3827 | 0.2519 | 0.2560 | 0.2730 | 0.2852 |

| Market long-term debt ratio | 0.2162 | 0.2434 | 0.1448 | 0.1303 | 0.1281 | 0.1644 | |

| Long-term book debt ratio | 0.2007 | 0.2093 | 0.1286 | 0.1139 | 0.1162 | 0.1450 | |

| Total book debt ratio | 0.4016 | 0.3446 | 0.2265 | 0.2276 | 0.2572 | 0.2578 | |

| LMI | Total market debt ratio | 0.5458 | 0.4379 | 0.3388 | 0.3739 | 0.4377 | 0.3896 |

| Market long-term debt ratio | 0.3335 | 0.2997 | 0.2165 | 0.2259 | 0.2663 | 0.2494 | |

| Long-term book debt ratio | 0.3050 | 0.2999 | 0.2076 | 0.1928 | 0.2169 | 0.2356 | |

| Total book debt ratio | 0.5251 | 0.4512 | 0.3445 | 0.3411 | 0.4064 | 0.3879 | |

| UMI | Total market debt ratio | 0.38095 | 0.34207 | 0.22459 | 0.22706 | 0.28496 | 0.26324 |

| Market long-term debt ratio | 0.15283 | 0.16904 | 0.09826 | 0.10453 | 0.12630 | 0.11796 | |

| Long-term book debt ratio | 0.14698 | 0.17256 | 0.09135 | 0.08669 | 0.11058 | 0.11102 | |

| Total book debt ratio | 0.36529 | 0.34455 | 0.21242 | 0.20018 | 0.26061 | 0.25064 |

| High Income | Lower-Income | Upper Income | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stages | Profitability | Tangibility | Size | Growth Opportunities | Profitability | Tangibility | Size | Growth Opportunities | Profitability | Tangibility | Size | Growth Opportunities | |

| Introduction | Mean | 0.0026 | 0.2644 | 11.39 | 1.3511 | 0.0467 | 0.3405 | 10.25 | 1.4364 | 0.0161 | 0.3285 | 10.76 | 1.5981 |

| Median | 0.0156 | 0.2443 | 11.28 | 0.8180 | 0.0527 | 0.3316 | 10.01 | 0.8680 | 0.0222 | 0.3065 | 10.61 | 1.0640 | |

| Standard deviation | 0.0623 | 0.1606 | 1.58 | 1.9029 | 0.0703 | 0.1757 | 1.78 | 2.0672 | 0.0704 | 0.1771 | 1.38 | 1.9563 | |

| Growth | Mean | 0.0393 | 0.3220 | 12.38 | 1.0943 | 0.0871 | 0.4332 | 11.22 | 1.7331 | 0.0571 | 0.3786 | 11.45 | 1.5913 |

| Median | 0.0381 | 0.3198 | 12.15 | 0.8240 | 0.0819 | 0.4339 | 11.01 | 1.1410 | 0.0576 | 0.3858 | 11.24 | 1.0770 | |

| Standard deviation | 0.0439 | 0.1398 | 1.79 | 1.1419 | 0.0625 | 0.1733 | 2.06 | 1.8783 | 0.0537 | 0.1739 | 1.66 | 1.8924 | |

| Mature | Mean | 0.0555 | 0.2963 | 12.55 | 1.1017 | 0.1091 | 0.3924 | 11.18 | 2.2662 | 0.0811 | 0.3761 | 11.22 | 1.5585 |

| Median | 0.0501 | 0.2873 | 12.31 | 0.8370 | 0.0989 | 0.3879 | 10.92 | 1.2690 | 0.0750 | 0.3717 | 11.07 | 1.0350 | |

| Standard deviation | 0.0465 | 0.1308 | 1.79 | 1.1788 | 0.0837 | 0.1745 | 2.12 | 2.8103 | 0.0775 | 0.1669 | 1.66 | 1.9734 | |

| Shakeout | Mean | 0.0281 | 0.2403 | 11.64 | 1.1607 | 0.0717 | 0.3091 | 10.61 | 2.0901 | 0.0458 | 0.3019 | 10.79 | 1.4101 |

| Median | 0.0295 | 0.2221 | 11.37 | 0.7930 | 0.0612 | 0.2763 | 10.14 | 1.0070 | 0.0364 | 0.2749 | 10.60 | 0.9200 | |

| Standard deviation | 0.0567 | 0.1431 | 1.72 | 1.5464 | 0.0941 | 0.1935 | 2.07 | 3.0636 | 0.0856 | 0.1839 | 1.62 | 1.9181 | |

| Decline | Mean | −0.0158 | 0.2199 | 10.92 | 1.5829 | 0.0072 | 0.2601 | 10.22 | 1.4627 | −0.0137 | 0.2887 | 10.27 | 1.4480 |

| Median | −0.0035 | 0.1962 | 10.76 | 0.7980 | 0.0141 | 0.2199 | 9.86 | 0.7920 | −0.0002 | 0.2481 | 9.97 | 0.9260 | |

| Standard deviation | 0.0817 | 0.1590 | 1.39 | 2.5268 | 0.0779 | 0.1830 | 1.85 | 2.6303 | 0.0808 | 0.2136 | 1.45 | 2.2194 | |

| Pooled | Mean | 0.0449 | 0.2911 | 12.31 | 1.1316 | 0.0886 | 0.3794 | 10.98 | 2.0082 | 0.0613 | 0.3575 | 11.11 | 1.5423 |

| Median | 0.0432 | 0.2826 | 12.07 | 0.8290 | 0.0818 | 0.3728 | 10.69 | 1.1300 | 0.0582 | 0.3515 | 10.92 | 1.0140 | |

| Standard deviation | 0.0525 | 0.1387 | 1.82 | 1.3163 | 0.0842 | 0.1830 | 2.09 | 2.6130 | 0.0793 | 0.1767 | 1.64 | 1.9629 | |

| GMM (Main Results) | OLS | Within Group | ||||

|---|---|---|---|---|---|---|

| Coefficient | z-Statistics | Coefficient | t-Statistics | Coefficient | t-Statistics | |

| Leverage (t−1) | 0.7508 *** | (36.83) | 0.8257 *** | (203.49) | 0.4241 *** | (67.75) |

| Introduction | 0.0280 *** | (5.09) | 0.0414 *** | (12.50) | 0.0380 *** | (11.39) |

| Growth | 0.0282 *** | (7.02) | 0.0411 *** | (18.19) | 0.0382 *** | (16.98) |

| Shake out | −0.0140 *** | (−3.81) | −0.0024 | (−0.97) | −0.0031 | (−1.27) |

| Decline | −0.0133 ** | (−2.35) | −0.0001 | (−0. 98) | 0.004345 | (1.07) |

| Leverage (t−1) × (introduction) | 0.0907 *** | (3.91) | 0.0227 ** | (2.25) | 0.0338 *** | (3.38) |

| Leverage (t−1) × (growth) | 0.0947 *** | (4.87) | 0.0279 *** | (3.76) | 0.0156 ** | (2.15) |

| Leverage (t−1) × (shake out) | 0.040 ** | (1.75) | −0.024 *** | (−2.99) | −0.0363 *** | (−4.41) |

| Leverage (t−1) × (decline) | 0.0687 ** | (2.39) | 0.0064 | (0.05) | −0.0309 ** | (−2.53) |

| Profitability | −0.1967 *** | (−12.71) | −0.1720 *** | (−17.13) | −0.1212 *** | (−8.77) |

| Size | 0.00001 | (0.03) | 0.00052 | (1.48) | −0.0664 *** | (−43.35) |

| Tangibility | 0.06982 *** | (9.03) | 0.0504 *** | (11.69) | 0.1262 *** | (12.72) |

| Growth opportunities | −0.0032 *** | (−7.09) | −0.0026 *** | (−7.92) | 0.0034 *** | (5.53) |

| Constant | 0.0329 ** | (4.21) | 0.0192 *** | (3.53) | 0.8321 *** | (46.47) |

| Economy effect | Yes | Yes | No | |||

| Industry effect | Yes | Yes | No | |||

| Year effect | Yes | Yes | Yes | |||

| Number of groups | 2835 | |||||

| Number of instruments | 41 | p-value | ||||

| AR (1) p-value | 0.00 | (−17.00) | p-value | |||

| AR (2) p-value | 0.502 | (0.67) | ||||

| Hansen p-value | 0.585 | (1.07) | ||||

| Wald and F p-value | 0.00 | (76,166.01) | 0.00 | (2749.06) | 0.00 | (724.63) |

| Wooldridge p-value | 0.00 | (910.403) | ||||

| Wu-Hausman p-value | 0.00 | (22.828) | ||||

| White/Koenker p-value | 0.00 | (1866.777) | ||||

| GMM (Main Results) | OLS | Within Group | ||||

|---|---|---|---|---|---|---|

| Coefficient | z-Statistics | Coefficient | t-Statistics | Coefficient | t-Statistics | |

| Leverage (t−1) | 0.830 *** | (17.94) | 0.8410 *** | (172.98) | 0.4474 *** | (67.75) |

| il2 | 0.0087 | (1.17) | 0.0240 *** | (11.24) | ||

| il3 | 0.00415 | (0.47) | 0.0186 *** | (7.82) | ||

| mltlevxil2 | −0.0107 | (−0.25) | −0.032 *** | (−5.34) | 0.0198 | (1.62) |

| mltlevxil3 | −0.0564 | (−1.12) | −0.0866 *** | (−8.22) | −0.0487 | (−2.75) |

| Profitability | −0.2163 *** | (−12.74) | −0.2289 *** | (−22.87) | −0.3125 *** | (−22.85) |

| Size | 0.0011 ** | (2.55) | 0.0080 *** | (19.46) | 0.00274 *** | (27.03) |

| Tangibility | 0.0634 *** | (6.70) | 0.0624 *** | (14.45) | 0.1501 *** | (14.54) |

| Growth opportunities | −0.0027 *** | (−6.64) | −0.0028 *** | (−8.75) | −0.0095 *** | (−16.94) |

| Constant | 0.025 ** | (2.29) | −0.073 *** | (−11.49) | −0.867 *** | (−25.11) |

| Economy effect | Yes | Yes | No | |||

| Industry effect | Yes | Yes | No | |||

| Year effect | Yes | Yes | Yes | |||

| Number of groups | 2835 | |||||

| Number of instruments | 38 | p-value | ||||

| AR (1) p-value | 0.00 | (−16.06) | p-value | |||

| AR (2) p-value | 0.724 | (0.35) | ||||

| Hansen p-value | 0.766 | (1.14) | ||||

| Wald and F p-value | 0.00 | (76,166.01) | 0.00 | (2949.93) | 0.00 | (813.41) |

| Wooldridge p-value | 0.00 | (1064.697) | ||||

| Wu-Hausman p-value | 0.00 | (18.960) | ||||

| White/Koenker p-value | 0.00 | (1588.413) | ||||

| GMM (Main Results) | OLS | Within Group | ||||

|---|---|---|---|---|---|---|

| Coefficient | z-Statistics | Coefficient | t-Statistics | Coefficient | t-Statistics | |

| Leverage (t−1) | 0.6853 *** | (15.09) | 0.8428 *** | (124.98) | 0.4578 *** | (46.46) |

| Introduction | 0.0286 *** | (5.32) | 0.0406 *** | (9.86) | 0.0379 *** | (11.37) |

| Growth | 0.0261 *** | (23.50) | 0.041 *** | (19.18) | 0.0385 *** | (17.14) |

| Shake out | −0.0156 *** | (−3.82) | −0.0029 | (−1.44) | −0.0031 | (−1.23) |

| Decline | −0.0145 ** | (−2.46) | −0.00094 | (−0.22) | 0.0042 | (1.04) |

| Leverage (t−1) × (introduction) | 0.0877 *** | (3.94) | 0.0277 * | (1.81) | 0.036 *** | (3.60) |

| Leverage (t−1) × (growth) | 0.11 *** | (4.49) | 0.0273 ** | (2.93) | 0.0151 ** | (2.08) |

| Leverage (t−1) × (shake out) | 0.0493 ** | (2.01) | −0.0209 | (−1.4) | −0.0374 *** | (−4.54) |

| Leverage (t−1) × (decline) | 0.072 ** | (2.47) | 0.0064 | (0.28) | −0.0307 ** | (−2.51) |

| Profitability | −0.2081 *** | (2.26) | −0.1778 *** | (−13.06) | −0.1171 *** | (−8.46) |

| Size | 0.00017 | (0.35) | 0.00059 | (1.52) | −0.0669 *** | (−43.54) |

| Tangibility | 0.0732 *** | (8.53) | 0.0513 *** | (9.66) | 0.126 *** | (12.70) |

| Growth opportunities | −0.003 *** | (−6.43) | −0.0028 *** | (−6.31) | 0.0033 *** | (5.45) |

| LMI economies | −0.0125 ** | (−2.13) | 0.0067 *** | (3.15) | ||

| UMI economies | −0.0162 ** | (−2.29) | 0.0051 ** | (1.99) | ||

| Leverage (t−1) × LMI economies) | 0.0842 ** | (2.48) | −0.0267 *** | (−2.84) | −0.0544 *** | (−4.65) |

| Leverage (t−1) × (UMI economies) | 0.0393 | (0.92) | −0.0746 *** | (−3.55) | −0.0321 ** | (−1.90) |

| Constant | 0.0433 ** | (3.85) | 0.0156 *** | (2.61) | 0.8367 *** | |

| Economy effect | Yes | Yes | No | |||

| Industry effect | Yes | Yes | No | |||

| Year effect | Yes | Yes | Yes | |||

| Number of groups | 2835 | |||||

| Number of instruments | 45 | p-value | ||||

| AR (1) p-value | 0.00 | (−16.74) | p-value | |||

| AR (2) p-value | 0.499 | (0.68) | ||||

| Hansen p-value | 0.718 | (0.66) | ||||

| Wald p-value | 0.00 | (32,744.12) | ||||

| Wooldridge p-value | 0.00 | (1051.395) | ||||

| Wu-Hausman p-value | 0.00 | (21.28) | ||||

| White/Koenker p-value | 0.00 | (2012.665) | ||||

| GMM (Main Results) | OLS | Within Group | ||||

|---|---|---|---|---|---|---|

| Coefficients | z-Statistics | Coefficients | t-Statistics | Coefficients | t-Statistics | |

| Leverage (t−1) | 0.7239 *** | (20.68) | 0.8863 *** | (214.32) | 0.5137 *** | (65.09) |

| Introduction | 0.0771 *** | (9.40) | 0.1018 *** | (16.69) | 0.0926 *** | (23.42) |

| Growth | 0.0385 *** | (5.88) | 0.0655 *** | (25.16) | 0.0595 *** | (24.10) |

| Shake out | −0.0338 *** | (−5.99) | −0.0091 *** | (−4.07) | −0.0068 | (−2.59) |

| Decline | −0.0312 *** | (−3.94) | −0.004 | (−0.79) | 0.0033 | (0.75) |

| Leverage (t−1) × (introduction) | 0.016 | (0.81) | −0.0565 *** | (−4.52) | −0.056 *** | (−6.95) |

| Leverage (t−1) × (growth) | 0.0717 *** | (3.50) | −0.0178 *** | (−2.68) | −0.0232 *** | (−4.11) |

| Leverage (t−1) × (shake out) | 0.0759 *** | (4.21) | −0.0031 | (−0.43) | −0.0064 *** | (−1.06) |

| Leverage (t−1) × (decline) | 0.0977 *** | (4.52) | 0.023 * | (1.71) | −0.0128 | (−1.38) |

| Profitability | −0.2770 *** | (−14.61) | −0.2287 *** | (−15.33) | −0.2265 *** | (−18.38) |

| Size | −0.0040 *** | (−5.60) | −0.0018 *** | (−4.42) | −0.0998 *** | (−69.71) |

| Tangibility | 0.0523 *** | (6.53) | 0.0267 *** | (5.26) | 0.0845 *** | (9.59) |

| Growth opportunities | −0.0046 *** | (−7.43) | −0.0044 *** | (−7.66) | 0.0024 *** | (4.39) |

| LMI economies | −0.0098 | (−1.27) | 0.0229 *** | (8.77) | ||

| UMI economies | −0.0280 *** | (−3.28) | 0.0093 *** | (3.33) | ||

| Leverage (t−1) × (LMI economies) | 0.0894 *** | (3.75) | −0.0158 *** | (−2.59) | −0.1083 *** | (−11.05) |

| Leverage (t−1) × (UMI economies) | 0.0714 *** | (2.66) | −0.0421 *** | (−4.20) | −0.0345 *** | (−2.71) |

| Constant | 0.1253 *** | (7.13) | 0.0669 *** | (10.41) | 1.314 *** | (76.73) |

| Income level effect | Yes | Yes | No | |||

| Industry effect | Yes | Yes | No | |||

| Year effect | Yes | Yes | Yes | |||

| Number of groups | 2835 | |||||

| Number of instruments | 45 | |||||

| AR (1) p-value | 0.00 | (−20.69) | ||||

| AR (2) p-value | 0.127 | (1.52) | ||||

| Hansen p-value | 0.968 | (0.07) | ||||

| Wald p-value | 0.00 | (20,8775.27) | ||||

| Wooldridge p-value | 0.00 | (1158.802) | ||||

| Wu-Hausman p-value | 0.00 | (51.8595 | ||||

| White/Koenker p-value | 0.00 | (1147.144) | ||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xin, Y.; Amin, M.S.; Khan, H.; Zheng, J.; Quddoos, M.U. Unleashing the Moderating Influence of Firms’ Life Cycle Stages and National Income on Capital Structure Targeting Behavior: A Roadmap towards Sustainable Development. Sustainability 2023, 15, 2945. https://doi.org/10.3390/su15042945

Xin Y, Amin MS, Khan H, Zheng J, Quddoos MU. Unleashing the Moderating Influence of Firms’ Life Cycle Stages and National Income on Capital Structure Targeting Behavior: A Roadmap towards Sustainable Development. Sustainability. 2023; 15(4):2945. https://doi.org/10.3390/su15042945

Chicago/Turabian StyleXin, Yongrong, Muhammad Sajid Amin, Hashim Khan, Jiyuan Zheng, and Muhammad Umer Quddoos. 2023. "Unleashing the Moderating Influence of Firms’ Life Cycle Stages and National Income on Capital Structure Targeting Behavior: A Roadmap towards Sustainable Development" Sustainability 15, no. 4: 2945. https://doi.org/10.3390/su15042945

APA StyleXin, Y., Amin, M. S., Khan, H., Zheng, J., & Quddoos, M. U. (2023). Unleashing the Moderating Influence of Firms’ Life Cycle Stages and National Income on Capital Structure Targeting Behavior: A Roadmap towards Sustainable Development. Sustainability, 15(4), 2945. https://doi.org/10.3390/su15042945