1. Introduction

It is widely recognised that ESG has become an influential doctrine of good business practice that helps guide investors towards companies with responsible environmental, social, and governance profiles. However, it also agreed that the ESG discourse covers a wide and heterogeneous range of issues, just as it involves numerous concepts, which are not all easily compatible such as, for example, legal regulation or voluntary corporate ethics, and strict compliance or trust in strong company culture. So far, research is scarce on the conceptual development of the ESG discourse as well as how companies articulate it in their official communication. This article uses annual reports as its principal data source. Whereas ESG matters used to be of secondary concern compared to a company’s financial performance, normally tucked away at the end of annual corporate reports, ESG today features prominently in corporate reporting.

This article is informed by Michel Foucault’s work, which offers a twofold framework of analysis that we develop for the purpose of this study. On the one hand, ‘archaeology’ is a descriptive approach for registering discourse purely as it emerges and transforms over time, and, on the other hand, ‘genealogy’ is an interpretative approach, which considers how concepts are articulated ‘tactically’ to gain legitimacy in a given domain, how concepts are re-appropriated and re-interpreted, or how actors seek to influence the rules of discourse. Highlighting this duality, Hubert Dreyfus and Paul Rabinow describe, in their seminal book on Foucault [

1], Foucault’s overall approach as rooted in both structuralism and hermeneutics, both of which he draws upon but also seeks to transcend. Broadly inspired by this duality in Foucault, this article proceeds in two steps. First, we register the growth patterns of CSR-related terms as they have been used by larger Danish companies over the last decade. Second, we carry out an interpretative analysis of how companies articulate ESG concepts for various tactical reasons and, more fundamentally, to navigate between the dispositives of law, discipline and security.

The article is organised in six main sections. The first section describes the emergence of ESG as a doctrine, emphasising how the push towards sustainability separates ESG from CSR. In the second section, we introduce Foucault’s discourse analysis, explaining how it can be fruitfully extended by corpus linguistics. The third section discusses annual reports as a research object and explains the methodology of data-mining, including our selection of ESG keywords. The fourth section reports on the results of data-mining applied to 281 annual reports, detailing the proportional growth of terms in the environmental, social and governance dimensions during the period 2016 to 2021. The fifth section explicates Foucault’s dispositive and then deploys it in analysing how Danish companies’ use ESG concepts in relation to the dispositives. Finally, the sixth section discusses how companies ‘tactically’ articulate ESG concepts, specifically in their attempt to navigate the tensions between law, discipline, and security.

2. CSR, ESG, and Sustainability

The concept of corporate social responsibility, CSR, emerged in North America in the 1950′s, denoting the businessman’s ethical responsibilities as well as the social responsibility of corporations. However, the concept only started to gain broader traction within the corporate world in the late 1980s and is a process that was intensified with the UN’s issuance of its report,

Our Common Future, in 1987 [

2]. While the concept remains unsettled, since the CSR discourse is marked by competing definitions of the concept as well as normative claims, the European Commission define CSR as ‘the responsibility of enterprises for their impact on society’ [

3]. The ESG doctrine has emerged in the recent decade partly as a response to the limitations of CSR, promising to tackle multiple issues arising from the environmental, social and governance aspects of corporations’ operations. Hence, the term ESG responds to demands for broadening corporations’ responsibility and hereby urge them to internalise various business externalities, while also providing investors with more detailed and transparent data of company activities. Breaking with the voluntary and inconsistent data disclosures associated with CSR, ESG promises to ensure consistent and representative details on companies’ ESG-related impact. Compared to CSR, the ESG doctrine is thus characterised by greater regulatory aspirations, which unfold rapidly across different regions that witness the implementation of various legal initiatives to address key ESG issues. Quintessential of such broad-ranging regulatory efforts is the need to establish effective regulation, while ensuring that other regulatory initiatives do not have contradictory effects. The regulatory efforts related to ESG are expected to become more comprehensive during the coming decade.

ESG encompasses the threefold dimensions of environmental, social, and governance, all of which define distinct areas, but ESG also addresses the interplay between them. The environmental dimension denotes the various environmental ‘externalities’ arising from a company’s operations, including issues of climate change contribution, environmental pollution, and the impact on biodiversity. The social dimension centres on the human factor, both internally and externally, involving issues of gender and diversity, responsibility to local communities, and labour conditions. Lastly, the governance dimension refers to the internal structures of corporations, such as issues of board composition, executive compensation, the relationship to stakeholders, lobbyism, and whistle-blower procedures.

The theme of sustainability is central to the development of ESG. The notion ‘sustainable development’ was defined in 1987 by the United Nations as development that ‘meets the needs of the present without compromising the ability of future generations to meet their own needs’ [

2] (p. 16). ‘Sustainable development’ gained currency in tandem with the increased public awareness of corporations’ environmental impact, particularly spurred by governmental and NGO reports on climate change and global risks that repeatedly highlight the environment’s limited ability to serve present and future needs. In the early 1990s, the academic field began giving more attention to how business practices impact the natural environment, as evidenced in a new research domain called ‘business and the natural environment’. Subsequently, in the 2000s, these research efforts expanded around the term ‘business sustainability’, as the corporate influence on the social world also came into focus [

4] (p. 1320). In 2006, a series of ESG investment and reporting criteria was compiled in the UN’s Principles for Responsible Investment report, which explicated the aspirations for furthering responsible and sustainable investments. This development meant that sustainability extended from principally environmental concerns to include a set of social concerns previously central to CSR, such as inequality, poverty, health, and food insecurity. This expansion paved the way for the emergence of the more comprehensive ESG discourse.

Rearticulating and expanding the scope of the CSR concept, the emergence of ESG is associated with three paradigmatic shifts in corporate sustainability, as argued by the World Economic Forum [

5]. First, sustainability has allegedly transitioned from signposting to substance, since sustainability is no longer primarily a marketing and branding exercise, but is increasingly considered an integral factor in core business operations with external validation through distinct metrics. Second, sustainability initiatives are supposedly no longer fragmented across organisations, but are instead integrated into a single system, where the three dimensions of ESG are fundamentally interconnected. Lastly, the definition of sustainability has transitioned from primarily implying cost savings to active value creation, insofar as ESG integration promises to generate a strategic lever, which will spur future growth avenues and performance [

5]. This latter point resonates with Helen Tregidga and Marcus Milne’s 2005 article [

6], which conducts an interpretive textual analysis on a leading company on the reporting of environmental and social impact. The authors provide a longitudinal analysis, based on company reports, of how the conception of resources transitions from management to sustainable development [

6] (p. 219). Focusing on the ESG principles, Tregidga and Milne [

6] (p. 237) highlight how the conception of the environment alters from externally imposed requirements concerned with environmental degradation to an internal source of value. The above assessments are predominantly positive regarding the gains ensuing from the shift from CSR towards the recent ESG discourse.

However, more critical studies have recently emerged regarding the role of ESG and, particularly, the concept of sustainability. Jill F. Solomon et al. center on the emergent discourse of private climate change reporting, zooming in on the one-on-one meetings between corporations and institutional investors [

7] (p. 1119). Their study finds that risk-reward oriented institutional investors have pushed a discourse within private climate change reporting, which places a greater focus on risk and risk management [

7] (p. 1138). The authors document that this discourse on risk arises in tandem with private climate change reporting, which increasingly becomes a discourse of opportunity, insofar as investors now reap financial benefits by introducing green products and technologies into the marketplace [

7] (p. 1139). Mario Abela [

8] also investigates changes in sustainability reporting with inspiration from Foucault, taking the assumption that the key concepts of reporting are neither universal nor timeless. Abela suggests that we witness a discursive shift in sustainability reporting away from impacts on people and the planet towards profit or ‘enterprise value,’ conceived as short-term positive cash flows. Highly relevant for our present study, Abela argues that paying close attention to concepts is crucial, as they carry a set of beliefs and values that often become ‘mainstream’, and hence accepted as timeless ‘facts’ [

8]. An important task in our present study of Danish companies’ embrace of the ESG discourse is indeed to trace how certain concepts proliferate over time and become ‘mainstreamed’ as natural ESG terms.

Finally, Laura Silva-Casteñada and Nathalie Trussart [

9] use Foucault’s notion of the dispositive in their analysis of sustainability standards and certification. Their focus of interest is sustainability standards and certification, which they explore in the discussions around the ‘The Roundtable of Sustainable Palm Oil’. In this case, a number of civil society organizations participate in contesting, correcting and reconstructing what is accepted knowledge of sustainable palm oil. Particularly relevant for our study is that Silva-Casteñada and Trussart use Foucault’s concept of the dispositive to highlight the disruptive as well as the stabilizing processes that ensue, as advocacy networks challenge the certified sustainability standards [

9]. Broadly similar, our study deploys the dispositive to describe how companies seek to negotiate and influence what is accepted as sustainability standards in their business sectors.

3. Analysing the ESG Discourse in Its ‘Positivity’

Our approach to ESG starts from Foucault’s playful comment that he was quite content to be called ‘a happy positivist’, if that meant approaching statements in their immediate existence [

10] (p. 125). Somewhat jokingly invoking positivism, Foucault sought to distance himself from traditions, such as ideology critique and hermeneutics. Instead, he wished to approach discourse at the level of what was actually said, while excluding the search for deep meaning, hidden intentions, or underlying ideology. By this move, Foucault sought to establish discourse as an independent object of analysis, irreducible to the meaning of subjects or to deeper structures. In

The Archaeology of Knowledge, from 1969, Foucault declared that he wanted to ‘restore to the statement the specificity of its occurrence’ [

10] (p. 28). The patterns, systematic relations, and historical development of the discourse must not be explained by something exterior (e.g., historical epochs), more fundamental (e.g., economic relations), or transcendental (e.g., consciousness). Instead, Foucault insisted, discourse itself must take centre stage, which means ‘posing the problem of its own limits, its divisions, its transformation’ [

10] (p. 117). Inspired by Foucault’s guidelines, the first part of our analysis will focus on ESG in its pure emergence and historical specificity, since we wish to offer a contextualised description of the ESG discourse in its sudden emergence without pretending exhaustiveness.

Foucault’s axiom of the positivity of discourse entails an emphasis on surface relations that we will pursue in our analysis of the ESG discourse. Instead of the ‘deep’ reading of texts, concepts, or statements in the search for hidden explanations, we will analyse such discursive elements on their surface, horizontally. This axiom entails exploring the relations that a concept (for example, the ESG concept) takes up within a field of associated texts, other concepts, propositions and counter-propositions. Foucault termed such a field a ‘discursive formation’, which is a system of interdependencies ‘on the basis of which coherent (or incoherent) propositions are built up, more or less exact descriptions developed, verifications carried out, theories deployed’ [

10] (p. 182). It follows, therefore, that although those who speak within a specific discourse must abide by certain conventions, procedures, and limitations, one must avoid the idea that a discursive formation is a purely restrictive or immobile structure of fixed rules. Instead, we wish to emphasise that a discursive formation also incites new statements that presuppose, endorse, anticipate, or contest already existing statements within the same formation. Hence, a discursive formation is in perpetual movement, since, as Foucault says, it evolves in a ‘temporal dispersion that enables it to be repeated, known, forgotten, transformed’ [

10] (p. 25). These principles of discourse analysis are merely a select subset of the ground-breaking approach to discourse, which Foucault developed in

The Archaeology of Knowledge.

For the purposes of this article, we follow Foucault’s injunction to establish horizontal relations across texts, which entails disregarding conventional units such as ‘the text’, ‘the author’, and ‘the book’, or the divisions between disciplines such as ‘economics’, ‘politics’, or ‘literature’. Accordingly, we will work across such unities, while establishing the relations that the ESG concept takes up with other concepts, which we specify as ‘keywords’ in the ESG discourse. Furthermore, we identify with Foucault’s flirtation with positivism by extending his discourse analysis with quantitative methods used in corpus linguistics. This integration of discourse analysis and corpus linguistics has already been suggested and explored empirically by Paul Baker, among others [

11,

12]. Baker argues that the adoption of corpus linguistics can strengthen the objectivity of discourse analysis, ‘resulting in a more robust and valid set of findings’ [

12] (p. 247). The justification for such an integration is that Foucault himself never expressed any issues with experimenting with his approach, declaring that he hoped his work would be approached as ‘a kind of toolbox’, which others would ‘rummage through to find a tool which they can use however they wish in their own area… I don’t write for an audience, I write for users, not readers’ [

13] (pp. 523–524). To be sure, many scholars inspired by Foucault have used qualitative methods, focusing on discourse as a historical product, often describing the socio-political context in which discourse evolves. In order to accept the use of quantitative methods in conjunction with Foucauldian analysis, we approve of Foucault’s own gesture that seems to welcome any method helpful for realising the aims of specific Foucault-inspired research.

As a method, corpus linguistics is not identified by a single methodology. Instead, it makes use of different methods, which are similar, insofar as they are executed on large collections of electronically stored texts. As Baker et al. explains: ‘Many CL methods are quantitative and/or make use of statistical tests, which are performed by computer software’ [

14] (p. 274). The idea is to place discourse analysis and corpus linguistics on an equal footing, so that they each contribute with the same weight to a methodological synergy. As such, the integration can imply, first, a quantitative identification of linguistic patterns in a body of texts, which, second, will be analysed in a qualitative fashion through close readings of individual texts [

12] (p. 248). Importantly, corpus linguistics gives us the possibility of identifying keywords, which are any word ‘found to be outstanding in its frequency in the text’ [

11] (p. 90). Baker explains that ‘keywords are important because they reveal the most significant lexical differences or features in a text or between texts. They, therefore, act as lexical signposts, revealing what producers of a text have chosen to focus on’ [

11] (p. 90). We will use this definition of keywords in our data-mining analysis below.

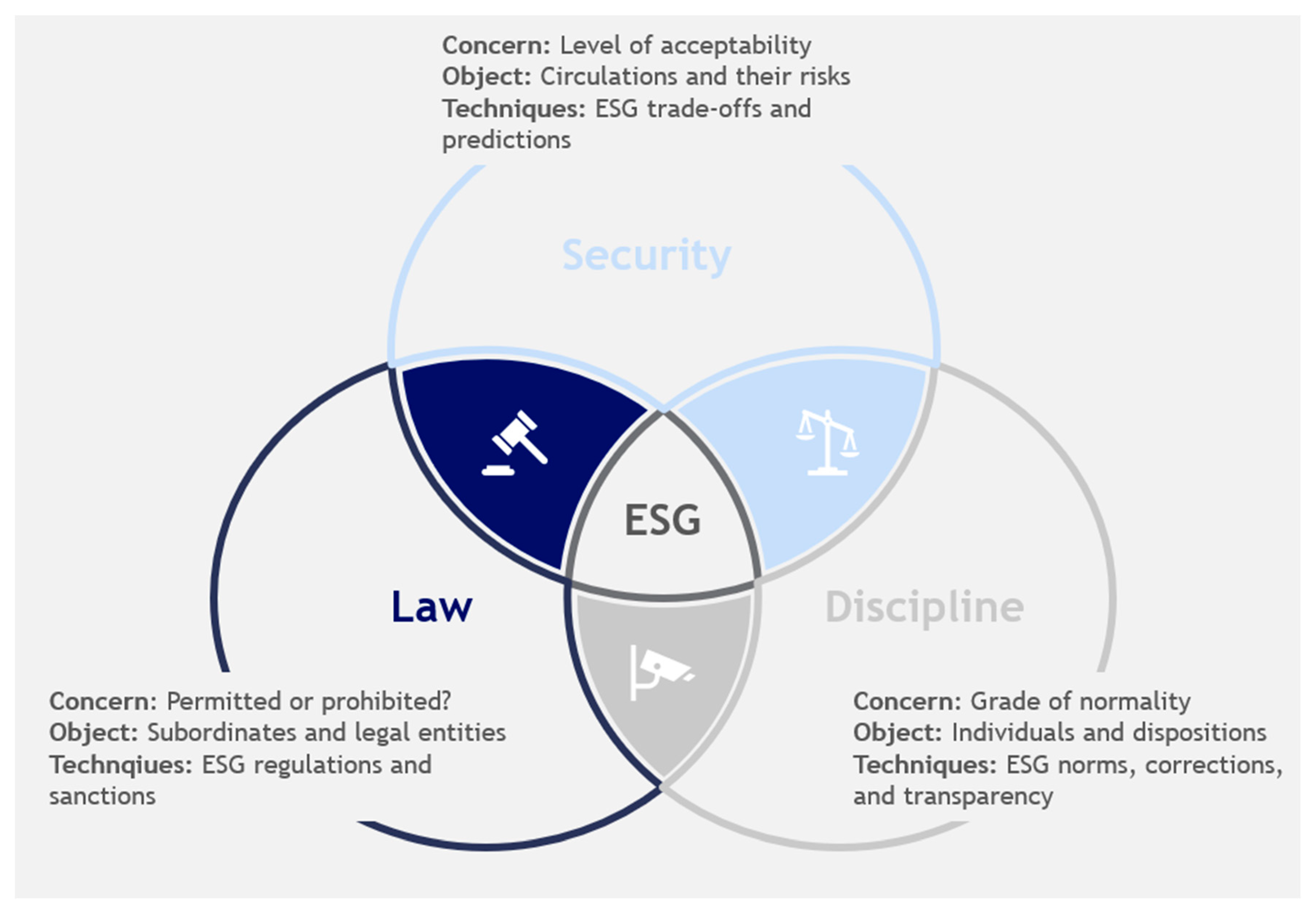

Another analytical resource we draw on from Foucault is his analyses of the complex interplay of three major systems of governance, namely law, discipline, and security, or ‘the dispositives’ of power/knowledge, to use Foucault’s specific term. One of the authors has developed this term as an analytical framework, ‘dispositional analytics’, for studying pressing governmental problems such as migration, economic crises, and pandemics [

15]. In Foucault’s work, the dispositives emerged historically as responses to urgent problems in Western Europe, including infectious diseases, famine, crime, and labour unrest. In our interpretation, the dispostives of law, discipline, and security prevail as part of the heritage of European history, constituting entrenched models for handling pressing problems that emerge in our time. Foucault emphasised that emergent problems often bring about responses that combine the dispositives or cause reconfigurations in their interrelation. For example, in the 18th century, the security dispositive brought about new strategies for minimising damages caused by infectious diseases at the population level. Foucault said that security inserts the problem of infections into a series of probable events, striving for acceptable levels of incidences against the costs of reacting to it [

16] (p. 6). Seeking to predict, manage, and mitigate the risk of epidemics, security gradually replaced and reconfigured the previous anti-infectious strategies of law and discipline (incarceration, quarantine, and partitioning of the city). For our purposes, we suggest that this framework is helpful for studying the current reactions to CSR’s shortcomings and the pressing climate crises more broadly, as it helps explore how the recent ESG doctrine combines law, discipline, and security, perhaps constituting transformations in their relational configuration.

4. The Annual Report as Data Material

This section discusses the corporate annual report as a research object, highlighting the recent evolution of the report towards higher complexity. The format of the annual report has undergone a transformative evolution over the past decades, developing into an information-rich and professional format that contains a breadth of information beyond merely that of financial figures. Ali Uyar’s [

17] longitudinal study of annual reports shows that annual reports have improved significantly in terms of content, design, and scope of information. The size of the reports, as measured in number of pages, were relatively static up until 2001, comprising an average of 40 pages, after which the page count has increased exponentially towards an average of approximately 190 pages in 2015, while subsequently stagnating a little. The annual report format has advanced from printed reports into electronic publications, alongside corporate web sites and social media pieces. Furthermore, the reports are no longer issued in simple black-and-white, but are increasingly splashed all over with corporate colours and littered with graphics, tables, figures, and pictures [

17] (p. 8). In most cases, the production of the annual report is no longer delegated to a distant accounting unit but has become a cross-departmental deliverable involving investor relations, finance, corporate communication, HR, and accounting [

17].

The evolution of the annual report, In terms of information and scope, has been pushed by a multitude of factors, including increased complexity of business operations, stricter regulatory requirements, and greater sophistication of corporate governance as a discipline. The growth of more extensive corporate reporting can also be traced to the ideal of transparency. The ideal of transparency of listed companies has been underpinned by the issuance of mandatory and voluntary guidelines and regulatory frameworks from various institutions (see, for example, the EU’s

Transparency Directive, implemented in 2004, which mandates that that transparency is ‘essential for the proper functioning of capital markets’ [

18].

However, the information disclosed in annual reports is often presented in overly positive tones, hence straddling the borderline of regulatory requirements. Sebastião Netto et al. [

19] define one of the key characteristics of greenwashing as selective disclosure, whereby companies retain negative information on environmental performance while concurrently communicate positive messages about the same subject. Much similar to greenwashing, the act of ESG washing can occur in various ways. Without a robust regulatory foundation of ESG, companies can portray themselves as ESG champions by engaging in corporate rebranding exercises, using strong communication channels, while making relatively superficial ESG commitments [

19] (p. 10).

As John Roberts [

20] puts it, transparency loses its force when it transforms into ‘a fantasy of total control’, i.e., the belief that information contained in annual reports is always valid and comprehensive enough to provide an accurate snapshot of the underlying health of businesses. Moreover, while the increasing complexity of business operations in the 21st century has facilitated a ballooning of information in corporate reports, the same complexity provides a veil for what goes on behind a company’s walls.

4.1. Data-Mining and ESG Keywords

In order to explore how Danish large-cap corporations integrate ESG in their self-presentations, we first needed to establish our research object, the ESG discourse, or, more precisely, a delineated corpus of ESG terms. The goal was to establish distinct linguistic corpuses related to each of the three key ESG components. Hence, we constructed these corpuses by applying the terms ‘environmental’, ‘social’, and ‘governance’ to the Princeton Wordnet lexical database, identifying sister terms for each of the components. This database gathers nouns, verbs, adjectives, and adverbs into synsets (a simple interface used to look up words in WordNet) that bear a close resemblance in meaning, rather than mere resemblance in word forms. Building on the identified sister terms, we applied the Related Words database to extend the search and capture terms that were not selected through the Princeton database. Finally, we added to the lists other terms deemed of relevance that were not captured by the methodological search.

The three corpuses display which keywords each ESG component is articulated around, while also allowing us to track the keyword frequencies over time. In order to further establish validity, the corpuses were cross-referenced with various ‘official’ documents on ESG matters from respected institutions. Even if the discourse in the corporate world tends to celebrate certain terms in certain years, such discursive trends is presumably tempered over time through the application of a longitudinal data series. Our use of corpus linguistics provides a relatively long-term perspective on when and to what extent corporations integrate ESG vocabulary into their corporate communication.

Table 1 provides an overview of all the keywords selected to create the ESG corpuses.

In order to describe how Danish corporations integrate the ESG corpuses into their public communication, we chose the annual reports of listed companies in the large-cap OMX C25 index as the main data source. The annual report provides an overview of the company to shareholders as well as to the public, disseminating the company’s financial and operational performance over the past year. We chose annual reports rather than quarterly reports to achieve a greater breath of information as well as a more elaborate use of ESG terms.

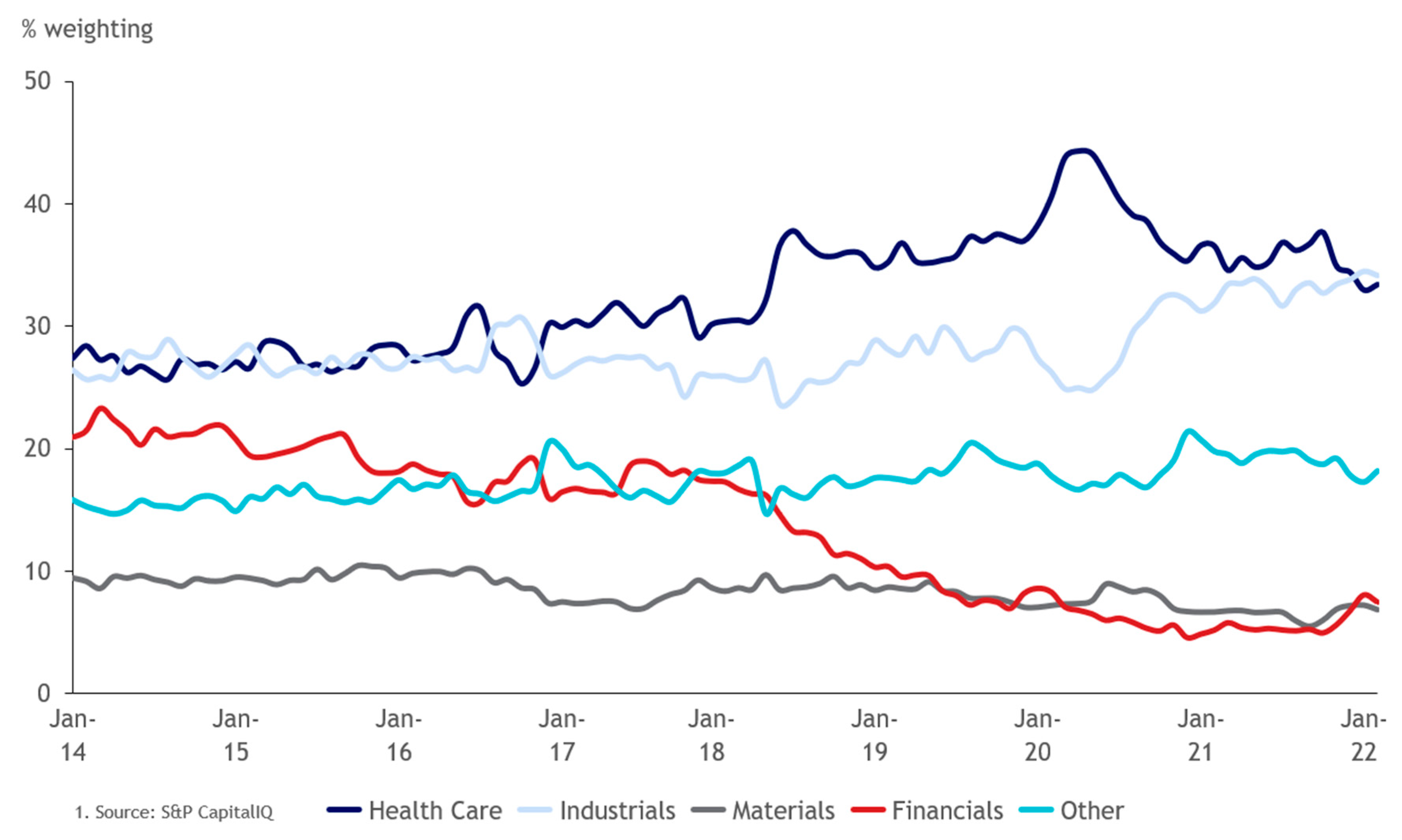

The Danish C25 Index, listed on the Nasdaq OMX Copenhagen, comprises the 25 largest public stocks in Denmark, providing quite a representative proxy for Danish equities as such. Given the continuous shuffling of the index, it is important to note that the companies included in this article’s sample size are only representative of the C25 index as of April 2022. At the time of writing (end of April 2022), the index is heavily weighted towards health care and industry, each comprising 36% and 32% of total equity holdings, which is in line with the historical equity weighting.

Figure 1 displays the sector weighting of the C25 index during the last 8 years, i.e., from 2014 to 2022.

Finally, we include a few clarifications regarding the annual reports that we use for linguistic corpus analysis. The annual reports of the C25 companies have been fetched directly from company websites in the period from 2010–2021 (all years included), constituting 12 years of observations. We chose this period in order to achieve a relatively long temporal horizon. Arguably, the standards within corporate regulation, reporting, and governance, as well as the macroeconomic backdrop, were substantially different in the years prior to 2010, which could influence comparisons across time. As some of the companies were not listed throughout the entire period, the total amount of annual reports comprised 281.

4.2. Sustainability and Remuneration Reports

In recent years, many Danish companies have developed their corporate reporting on ESG beyond what is contained in their annual reports, through the publication of sustainability or executive remuneration reports and, in some cases, both. Sustainability reports provide in-depth presentations of the company’s operations from the perspective of sustainability, while the executive remuneration reports relate to the governance dimension of ESG, providing overviews of executive compensation schemes. Remuneration reports took on a regulatory dimension with the EU’s 2017 amendment of the Shareholder Rights Directive (SDR), which outlined the mandatory publication of remuneration reports alongside its formal requirements [

21]. The SDR amendment was signed into Danish law, effective in mid-2019 [

22]. Sustainability reports are distinct from traditional CSR reports that were both broader in content and centered particularly on the social responsibility of the company.

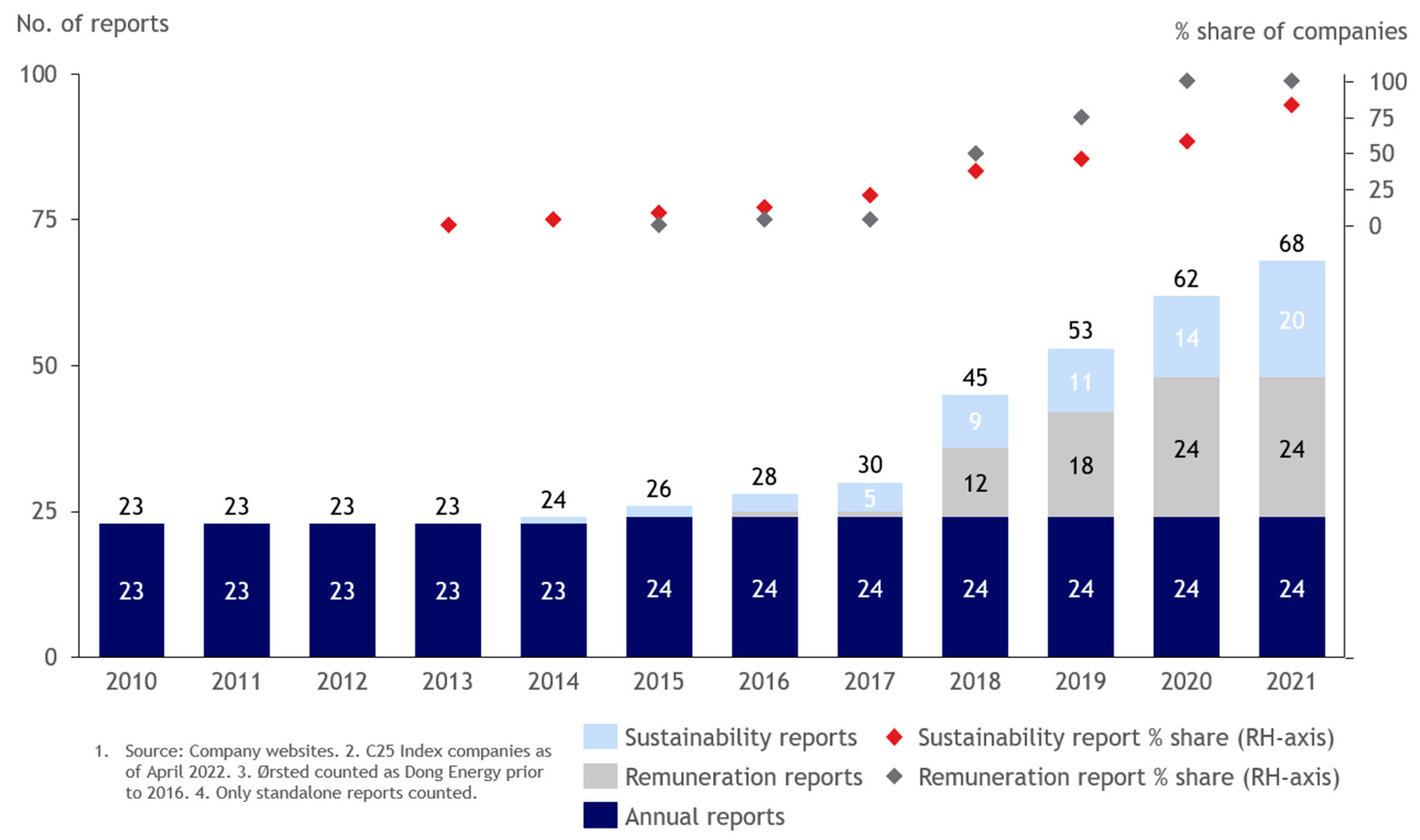

Figure 2 highlights the growth of sustainability and remuneration reports from C25 companies in recent years, displaying a very fast-growing and sudden trend, partly fuelled by regulatory requirements. In 2015, 8% of the companies in the C25 index published sustainability reports, while zero percent of them published specific remuneration reports. Moving to 2021, corporate reporting has evolved significantly from 2015, since 83% of the companies now publish dedicated sustainability reports, while all of the C25 companies publish remuneration reports.

4.3. Data-Mining Procedure

We applied rStudio to create a code for the efficient mining of the required data within the same interval from all annual reports at once. First, we inserted all the 281 annual reports as values into the program. Next, we created a long vector to contain one of the ESG corpuses. In order to facilitate data-processing from the annual reports, several loops were applied to the data, transforming all text into lowercase, while also replacing all tabs, line breaks, digits, and punctuations. This looping method morphed the annual reports into homogenous blocks of text, to which the different corpus vectors could be applied to each line of text and search for the relevant terms. Ultimately, this resulted in a data frame containing mined data across search terms, companies, and time. We repeated this procedure for each of the three ESG corpuses.

The mined data in each of the corpuses allowed us to construct a time series with an annual frequency during the sample period from 2010 to 2021. These time series of ESG corpuses represent a quantification of qualitative data, which can be decomposed by year, company, corpus, and term.

5. Findings Derived from Data-Mining

We applied the data-mining methodology, as described above, to the 281 annual reports across the ESG corpuses, which yielded interesting data on the temporal evolution of these.

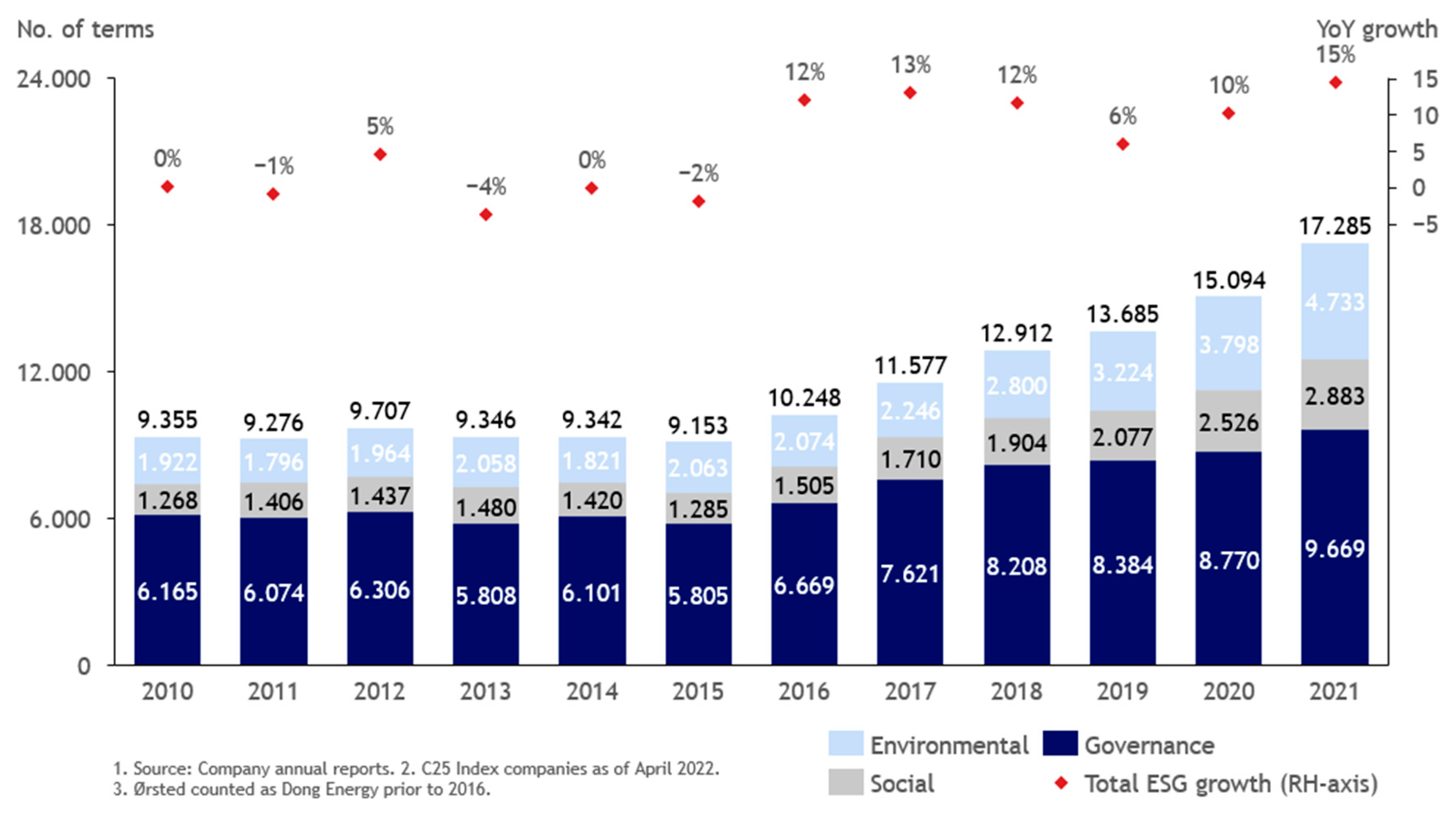

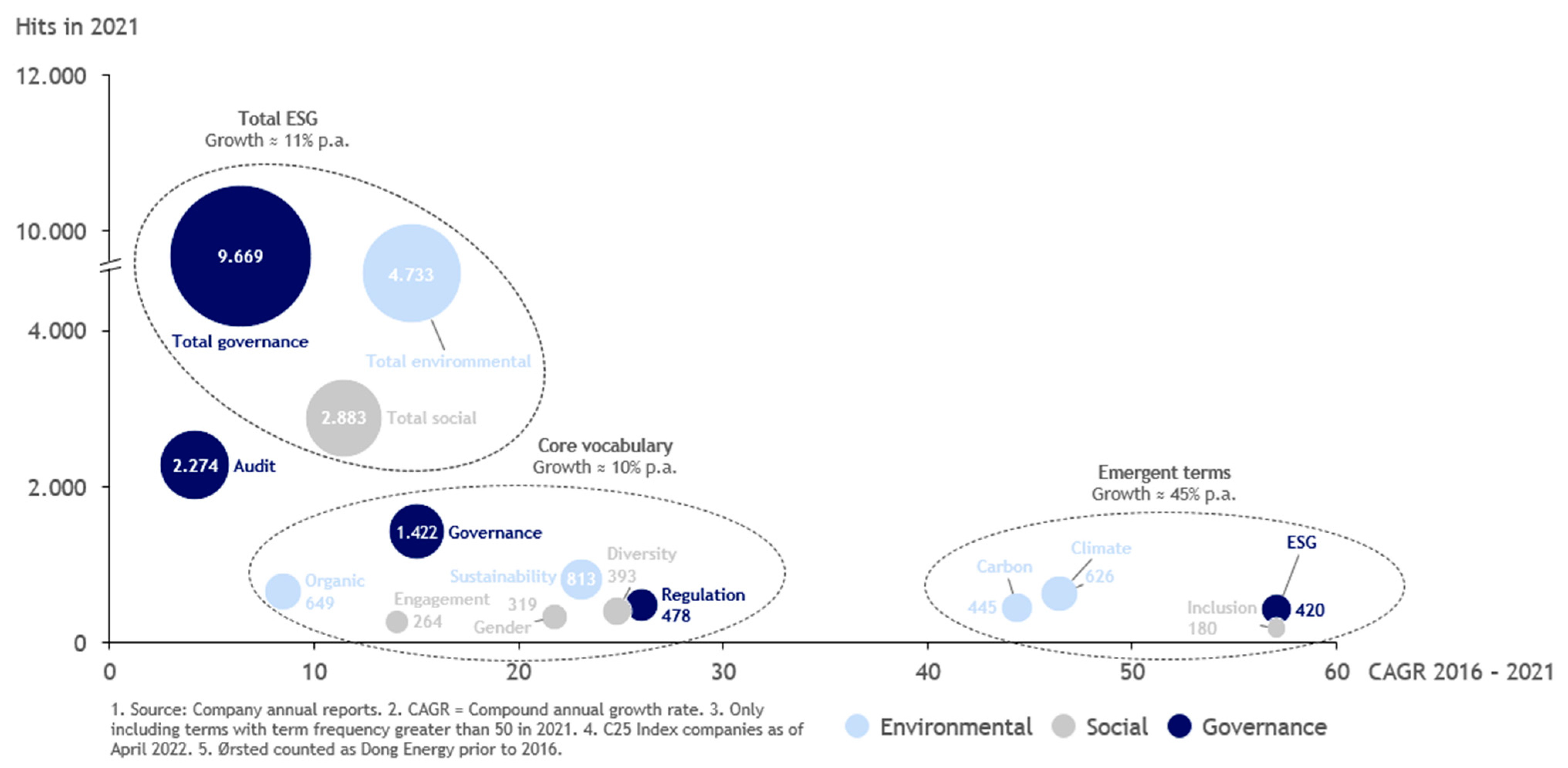

A key observation is that the total term frequency of ESG has increased drastically over time, growing from 9355 hits in 2010 to 17,285 in 2021, which equals a compounded annual growth rate (CAGR) of 5.7%. However, the total development remained somewhat flat from 2010 until 2016, oscillating in the range of 9355 to 9153 hits, after which the term frequency once again picks up dramatically. Specifically, the annual growth rate of total ESG from 2016 to 2021 was 11% in this period, underscoring that ESG term frequency picked up steam during this period. When adjusting for sample size, which changes from 23 to 24 in 2017 (with the inclusion of the IT consultancy company, Netcompany), the growth pattern is the same.

Figure 3 below displays the total evolution of ESG term frequency, broken down at each subcomponent.

As

Figure 3 shows, the governance component has the highest proportional frequency in absolute numbers of ESG hits over time, presumably because this component is considered so essential to the operations of companies in the contemporary business environment. Similar to the total trend of ESG terms, the governance variable had negative growth from 2010 to 2015, and it subsequently grew from 2016 and onwards at a rate of 7.7%. When looking at the entire sample period, the governance frequency rose from 6165 hits in 2010 to 9669 in 2021, with a CAGR of 4.1%.

Yet, as one might perhaps expect, the environmental variable exhibits the proportionally highest growth throughout the sample period with a staggering 8.5% per year in absolute terms. Decomposed at the sample size, the annual reports contained 84 environmentally related keywords in 2010, but this number subsequently more than doubled to include 197 keywords in 2021. The increased concern for environmental matters in recent years is reflected in our data, insofar as much of the growth of the environmental component occurred in the years from 2016 to 2021, growing at 17.9% annually. This striking annual growth pick-up in the environmental corpus within the sample period also manifests the shift from CSR to ESG, as we discussed earlier.

The social component makes up the smallest fraction of ESG terms within our sample, at 15.26% of the total data points, although, parallel to the environmental component, it also exhibits growth throughout the sample period. The social component grows at 7.7% throughout the period, of which the highest growth rate occurs in the period between 2016 to 2021. In relative terms, this component also undergoes approximately a doubling in hits, growing from 55 per report in 2010 to 120 per report in 2021.

5.1. The Environmental Component

The high growth of the environmental component is largely due to a few key words, which are central in the current discourse of climate change and sustainable development. Keywords such as ‘climate’, ’organic’, ’emissions’, and ‘sustainability’ are all top performers within the environmental corpus, both in terms of share of corpus and in terms of annual growth rates, where all keywords exhibit a growth of more than 5% annually throughout the sample period. Bases on these results, the C25 companies’ efforts within the environmental realm are closely articulated in relation to the mitigation of climate change, a problem that is likely to become increasingly regulated within the coming years. In light of this finding, we would suggest that companies’ environmental initiatives are communicated, at least partly, with reference to their expressed needs for hedging regulatory risk with respect to climate change.

A somewhat peculiar data-point is the term of ‘taxonomy’, which has risen from zero occurrences in 2019 to 142 in 2020 and 308 in 2021. Moreover, almost corresponding to how carbon emission has become a key performance indicator in sustainability debates, so has carbon’s frequency increased markedly throughout the sample period, growing 15% annually. Such a rapid uptake in relatively uncommon words underscores the pace at which the ESG discourse is developing.

5.2. The Social Component

Reflecting the overall growth trend of the social variable, it is evident that almost all of the keywords of the social component exhibit frequency growth throughout the sample period. High occurrence keywords refer primarily to the internal operations of the company, such as ‘diversity’, ‘gender’, and ‘culture’. Additionally, we find top-performing social keywords related to the external operations of the company, including ‘consumer’, ‘ethical’, and ‘social’, although this finding is less significant. This focus on the internal operations of the company indicates that the discourse within the social realm is currently being articulated around topics, such as diversity, equity, and inclusion (DEI).

Certain keywords exhibit extraordinary growth throughout the sample period, even when we account for the relatively small numbers that these keywords constitute. Keywords such as ‘inclusion’, ‘gender’, and ‘diversity’ all exhibit extraordinary annual growth rates around approximately 20%. These keywords are central to the articulation of the social component within the current business environment and the significant growth in keyword intensity during the last 12 years documents that this discursive component has only emerged within the recent decades.

5.3. The Governance Component

ESG governance principles stipulate that companies use accurate and transparent accounting methods, ensure integrity and diversity in board and leadership appointments, and are accountable to shareholders. In brief, the governance component centres on how corporations police themselves. Good corporate governance entails that companies perform due diligence in their choice of board members and executives, ensure transparency in executive remuneration, and that they neither use donations or political lobbying to obtain preferential treatment, nor engage in corruption, bribery and tax evasion.

The top-performing keywords in the governance corpus, the largest corpus by far, are closely linked to traditional concepts of good corporate governance. Some of these keywords refer to the administrative organisation of corporate governance structures, including the keywords ‘board of directors’, ‘audit’, and ‘controlling’. Additionally, we established an adjacent category consisting of terms more related to the outcomes and characteristics of governance, such as ‘responsibility’, ‘compliance’, and ‘ownership’. Control and oversight are common denominators across all the keywords of significance, which signal a corporate commitment to ensuring transparency, or what Roberts terms ‘a fantasy of total control’ [

23] (p. 968).

Corresponding to the overall growth trajectory of the governance component, the growth patterns of the keywords constituting the governance corpus do not parallel the other linguistic corpuses. Nevertheless, some terms do exhibit notable growth trajectories, such as ‘regulation’, which grew at a 12% rate annually, reflecting the widely held perception that the regulatory pressure on corporations has become more comprehensive and complex. Moreover, the term of ‘ESG’ itself grew from virtually zero hits in 2010 to 420 in 2021. By comparison, the ‘CSR’ term has effectively moved inversely to the emerging ESG discourse, declining from 210 hits in 2010 to 48 hits in 2021. On the face of it, CSR has faded to the background, while ESG has increasingly surged to take a central position in today’s corporate communication. The inverse relation of the CSR and ESG frequency in combination with the total growth trajectory of ESG-related keywords makes evident that the shift from CSR to ESG primarily took place in the sample period from 2010 to 2021, and particularly around 2016.

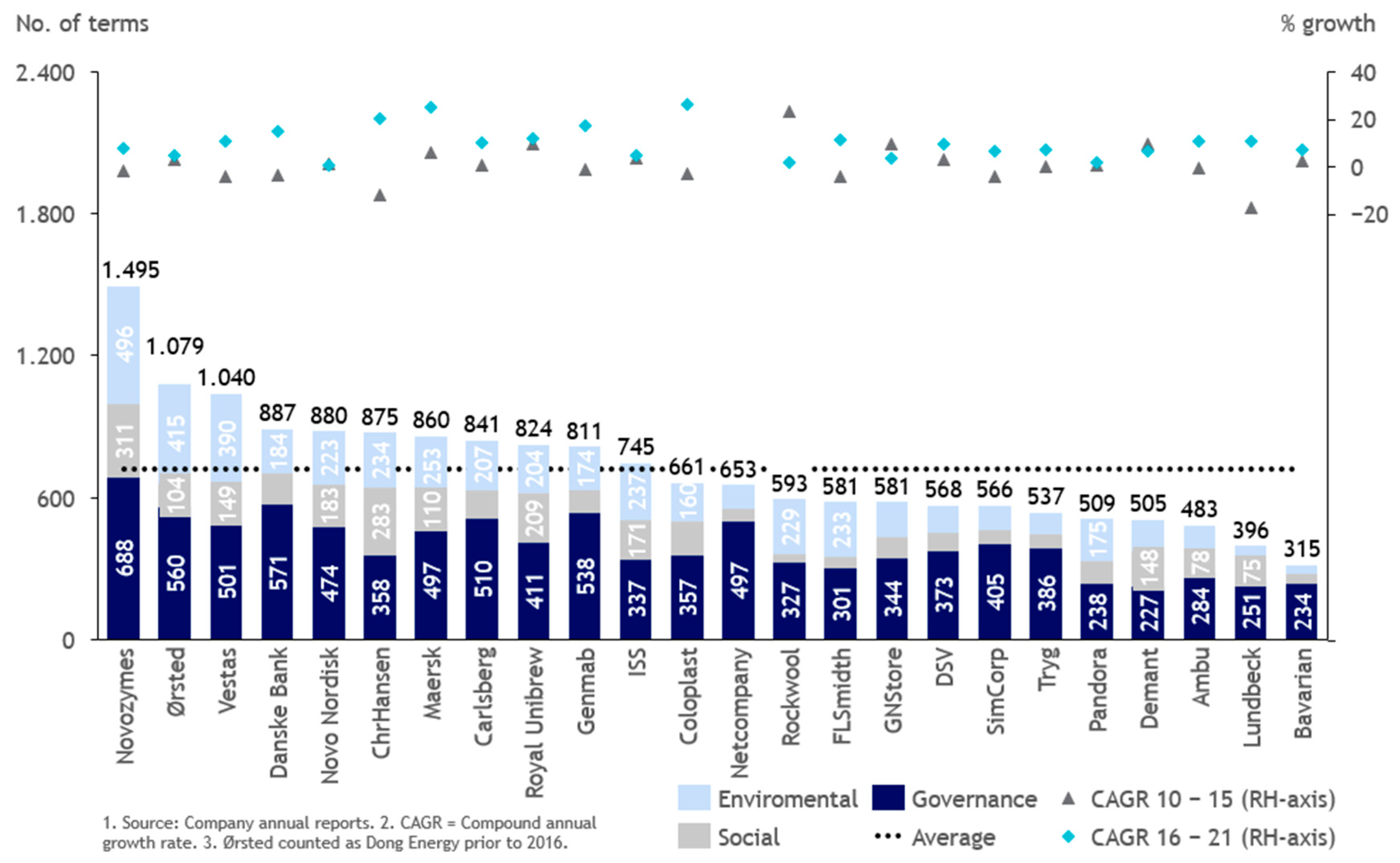

Figure 4 shows a breakdown of ESG vocabularies, as they are used by Danish large-cap companies.

5.4. Pros and Cons of Data-Mining

The quantitative analysis of ESG corpuses had the advantage that it allowed us to quantify the ESG discourse, providing measurable data-points beyond the general perception of this discourse’s growing importance in the contemporary corporate landscape.

Figure 5, inserted below, provides an overview of top ESG terms identified in our data-mining. However, one could object that such data is merely an indication of how the prevailing discourse has transformed over time and is not necessarily a reflection of companies’ actual strategic priorities. While we acknowledge the possibility of such a discrepancy between discourse and corporate strategy, this article assumes that the evolving discourse and the emergence of certain technical terms do in fact give an indication of where companies are placing their strategic focus. Fundamentally, the issuance of an annual report is a discursive event that sets a condition for what can subsequently be communicated—both externally to the public and internally in the company.

Henrik Nielsen [

23] applied the data from the ESG corpuses to test whether such data have any power in predicting excess returns of the Danish C25 companies within the period from 2010 to 2021, and he found no predictive materiality. Based on these findings, and considering the recent shift in discourse from CSR to ESG, one could hypothesise that it is only in the most recent years that ESG has reached sufficient maturity to be effectively adopted by Danish corporations.

Related to this point of ESG maturity, one could also imagine a multitude of long-term gains associated with adopting ESG principles that have not yet transpired. From the perspective of neo-institutional theory, it is evident how ESG could enhance companies’ legitimacy in various arenas, such as the labour and product markets. A concrete benefit of such increased legitimacy is that a strong ESG profile helps to attract and retain high-quality human capital [

24] (p. 6). Moreover, adopting the lens of neo-institutional theory [

25] would make evident that not all activities within a business fall under the motive of mere profit-maximisation, and that ‘decoupling’ between a company’s technical core and legitimising structures can occur.

6. Dispositional Analytics

We now shift from the quantitative analysis of the corpus linguistic approach to a qualitative analysis developed from Foucault’s notion of the dispositive. Although informative, the above analysis of the occurrence of ESG keywords does not elucidate the rationalities or the broader societal context that induce companies to adopt ESG principles. The following sections introduce the framework to be applied in the qualitative analyses of annual reports, namely dispositional analytics, which scholars have reconstructed on the basis of Foucault’s work from the late 1970s [

26,

27].

In his 1978 lectures, Foucault [

16] (pp. 5–24) presented the dispositives of law, discipline, and security, which constitute distinct models for tackling problems of city governance in the 18th century, such as crime, epidemics, or famine. From the perspective of law, discipline, and security, such problems appear as very different, insofar as, for example, the problem of prohibiting certain acts is distinct from disciplining the criminal, which is again distinct from securitizing crime. Giving a ‘childish example’, Foucault explains that

the law sets up a binary distinction between what is permitted and what is prohibited, coupling violations to specific sanctions: ‘Take a completely simple penal law in the form of a prohibition like, say, “you must not kill, you must not steal”, along with its punishment, hanging, or banishment, or a fine’ [

16] (p. 4). The law is anchored in a sovereign, the King, or, in modern times, the political government. Currently, we witness the development of a plethora of regulatory frameworks related to ESG, including sustainable financing, corporate governance structures, ESG taxonomies, reporting transparency regulation, and data harmonisation [

28] (p. 6).

Discipline, by contrast, focuses on deviant persons or actions, of which the criminal is emblematic, seeking to establish which deviance he manifests and how he can be normalised in order to prevent future violations. As Foucault says, from the perspective of discipline ‘everything is framed by, on the one hand, a series of supervisions, checks, inspections, and varied controls that, even before the thief has stolen, make it possible to identify whether or not he is going to steal, and so on’. He continues, ‘On the other hand, punishment will not just be the spectacular, definitive moment of the hanging, fine, or banishment, but a practice like incarceration with a series of exercises and a work of transformation on the guilty person’ [

19] (p. 4). Conventional tools of discipline include confinement, mandatory labour, corrective training, surveillance, and examination. Today, disciplinary normalisation is not restricted to ‘abnormal’ individuals but can also be found in the corporate world in terms of compliance principles, accountancy, best practices, and transparency procedures.

Finally,

security works by predicting possible events and planning for tolerable rates of crime, infections, or market fluctuations, using modern statistical sciences to take empirical reality into account. Hence, says Foucault, from the perspective of security, one asks: ‘What is the average rate of criminality for this [type]? How can we predict statistically the number of thefts at a given moment, in a given society, in a given town, in the town or in the country, in a given social stratum, and so on?’ [

19] (p. 4). Given that security deploys a cost/benefit analysis focused on achieving the greatest effect for the least expense, the question is: ‘What, therefore, is the comparative cost of the theft and of its repression’ [

19] (pp. 4–5). Moreover, from the perspective of security, the potential criminal is supposedly someone who also makes cost/benefit calculations. He/she, explains Foucault, will consider the ‘possible gains and losses, which means that penal action must act on the interplay of gains and losses’ [

29] (p. 259). Security deals with the reality ‘as it is’, seeking to identify a healthy equilibrium by maximising what is desirable and minimising risks. Examples of contemporary security techniques include statistical prediction, risk calculation, and machine-learning. In brief, these are the main characteristics of the dispositives of law, discipline, and security.

As a tool of analysis, how can the dispositive be defined? In a famous interview from 1977, Foucault says that the dispositive describes a network that connects diverse elements, including practices, techniques, procedures, scientific doctrines, legal principles, architecture, and more [

30] (p. 194). To take the most illustrative example, the disciplinary dispositive connects a set of practices for surveying, comparing, and correcting human bodies with particular forms of knowledge about humans’ capacity and deviance, especially psychology and psychiatry [

31]. These practices and knowledge forms were pushed forward by a strategy of ‘normalisation’; that is, a strategy for preventing unwanted behaviour and moulding individuals to comply with certain norms in prisons, military barracks, schools, factories, and hospitals. When a dispositive emerges in history, objects (in discipline: actions, bodies, and mental capacities) will appear in a particular normative light that produces them (in discipline, as objects of correction and optimization). In brief, the dispositive arises at a distinct historical juncture, and it connects power and knowledge in making the social world visible and actionable in a specific way.

In some of Foucault’s works, he describes the historical emergence of one, single dispositive, most famously the disciplinary dispositive in his book

Discipline and Punish [

31]. At other moments, however, he analyses the interplay between several dispositives, such as the major dispositives of law, discipline, and security [

19]. Sometimes, this interplay entails convergence, mutual support and reinforcement of the dispositives, whereas, at other times, the dispositives compete, challenge and create problems for each other. This is so, because dispositives do not follow each other in historical sequence, whereby the emergence of ‘new’ dispositives replaces the existing ones (‘from law to discipline to security’). It is rather the case that dispositives arise ‘alongside’ each other in history, dynamically evolving together, sometimes even infiltrating each other. To avoid the sequential view, Foucault says: ‘In reality you have a series of complex edifices [….] the system of correlation between juridico-legal mechanisms, disciplinary mechanisms, and mechanisms of security’ [

16] (p. 7). Foucault’s description of the interplay of law, discipline, and security is highly suggestive for the analysis of pressing, contemporary problems such as how to ensure transparency in corporate governance, how to monitor companies’ actual sustainability, or, overall, how to bring about effective compliance with ESG principles. Often, as we suggest later, such problems indeed oscillate between the dispositives of law, discipline and security.

To fully benefit from dispositional analytics, then, one must explore the dynamic interplay between the dispositives in a specific process, such as ESG adoption among large companies. As noted by Kaspar Villadsen [

27], modern organisations are complex and often contradictory, insofar as they can be invested by several dispositives at once. He offers the example of workplace absenteeism to illustrate how the disciplinary dispositive would turn absenteeism into an object of knowledge and intervention [

27] (p. 480). From the perspective of discipline, it is not so much the act of absenteeism itself that is of interest but rather the absentee as an individual who possesses particular dispositions, habits and, most likely, abnormalities to be normalised through counselling. The dispositive makes absenteeism visible in a particular normative light, which reveals the absentee’s ‘abnormalities’ by drawing on psychological and medical knowledge.

Expanding Villadsen’s example, we suggest that law would inevitably come into play, when the employee’s absenteeism violates a threshold defined by the employment contract. The contract might also specify which sanctions the employer can apply, in case absenteeism is not justifiable by illness or other excusable events. Typically, the employment contract is part of an overall, national or international regulatory framework, which stipulates rights and obligations of employee as well as employer. From the perspective of law, absenteeism is an act, which falls on either side of the permitted/prohibited divide and must be coupled with certain sanctions.

Finally, in the optics of security, workplace absenteeism is a statistically recurring event that will inevitably take place in all organisations. Its frequency and fluctuations can be measured, and the costs it inflicts on workplaces and society can be calculated. Hence, security tackles absenteeism as a statistical problem. From this predictive rationality, a phenomenon, such as absenteeism, is naturally occurring and cannot be entirely eradicated. Instead, like crime [

16] (p. 21), what can be aimed for is to reach acceptable levels, while weighing the costs of intervening against the consequences of letting absenteeism occur.

In real-life politics and organisational contexts, several dispositives will often be at play in responses to a problem like workplace absenteeism. For example, an employee could be legally obliged to seek medical assistance or psychological counselling (law and discipline), or management might calculate the costs of implementing stricter regulations against absenteeism (security and law). As mentioned, the dispositives can both support and contradict each other in their interplay around pressing problems, creating transient objects as a result: is absenteeism essentially a legal, disciplinary or security problem? The below analysis returns to the annual reports by means of qualitative analysis, seeking to flesh out such interplay of dispositives in Danish large-cap organisations’ articulations of the ESG discourse.

The following sections set out to apply dispositional analytics in analysing the annual reports of C25 companies, seeking to offer a more granular perspective on how the ESG discourse manifests itself within the annual reports. The examples in the following section will be qualitative in nature but supported by observations and quotes derived from the quantitative data. First, we explore how each of the dispositives of law, discipline, and security can serve to analyse companies’ embrace of ESG, and next, we focus briefly on the interplay between the dispositives. Towards the end of the analysis, we describe how ESG concepts may be launched strategically at the intersection between the dispositives of law, discipline, and security. By ‘strategically’, we mean that the ESG concepts can serve to integrate, arbitrate, or overcome contradictions arising from the dispositives and their interplay. This analysis will primarily focus on high-performing ESG front-running companies within their respective industries, namely Pandora, Ørsted, Maersk, Novozymes, Danske Bank, and Novo Nordisk.

6.1. Law

To begin, we observe that the annual reports are deeply invested with the legal dispositive, since many of the subjects therein are bound by financial disclosure regulation. Some content is simply mandatory to include in corporate reporting, and the law establishes the minimum level of compliance in terms of standardised information disclosure across the corporate landscape. Corporate law stipulates what kind of information can be communicated to the public and when, and companies can be held liable in cases of non-compliant information disclosures. In the context of the annual report, the legal dispositive thus establishes, to a large degree, what can be said and what cannot, and what is permitted or prohibited. Not only does the law clearly stipulate legal sanctions, but such sanctions will typically be accompanied by substantial reputational damage and adverse economic effects.

An example of the law’s binary distinction between permitted and prohibited can be found in the risk management section of Maersk’s 2021 annual report, which asserts that data privacy and ethics should be managed effectively in order to ‘safeguard the company from legal, business, and reputational risks’ [

32] (p. 30). This example highlights that within some business matters, the chief concern is to maintain legal compliance, since incidences of non-compliance are viewed as risks of significant harm to the company. The law does not only hold implications for the risk management practices of companies, but can also sway the market in a given direction, thus influencing which products companies bring to the marketplace. In Danske Bank’s 2021 annual report, the company declares that it has ‘launched competitive responsible investment offerings in line with the EU’s Sustainable Finance Disclosure Regulation (SFDR)’ [

33] (p. 18), followed by a success story of the capital invested in their ESG funds. Evidently, the law and its stipulations condition exchanges on the market, effectively setting up divisions between wanted and unwanted circulations. Legal authorities can exert control over companies, i.e., the supply-side, in order to influence the end-consumers, i.e., the demand-side.

Many topics associated with good corporate governance are closely tied to jurisprudence. In the Danish business context, the legal dispositive propels a large part of corporate governance initiatives, insofar as the law, for example, mandates companies to ensure oversight and thus establish a board of directors in public companies. All of the annual C25 reports prominently feature corporate governance and chairman sections, often in the shape of a chairman’s letter, which typically highlights the use of risk management and compliance with regulatory principles. Thus, the corporate governance sections vividly illustrate how legal regulatory principles are articulated by corporations, these sections being replete with accounts of how the company ensures compliance in terms of financial reporting, remuneration, and shareholder protection. The link between governance and jurisprudence implies that corporate management is well aware of potential sanctions if non-compliant practices should surface. As many of the issues related to corporate governance are governed by law and thus mandatory, it is perhaps unsurprising that the data-mined governance corpus showed a significantly higher proportional frequency than that of the environmental and social corpuses.

However, legal regulation is not confined strictly to companies’ corporate governance but also evolves rapidly in relation to the environmental dimension. As mentioned in the section on the evolution of the ESG discourse, legal demarcation lines are still being drawn up in response to environmental issues. Danish companies generally embrace this additional legal complexity, in part to ensure legal compliance, but probably also to convey their role as ESG frontrunners. Hence, both Maersk [

32] and Ørsted [

34] highlight their efforts in complying with the EU Taxonomy, linking these efforts to their core business. To some extent, we suggest the push for environmental regulation started with NGOs, the press, and market participants, who pushed the environmental agenda to the forefront of public debate; however, it was also soon adopted by policymakers to reassure the public of their genuine efforts to reduce CO

2 emissions, shift to organic farming, and promote electric vehicles.

We previously defined the legal dispositive as instituting a set of rigid distinctions between permitted and prohibited, and as such, ESG has yet to be fully instituted legally in the governance of the Danish corporate sector. As noted earlier, many ESG initiatives are still operating on a purely voluntary basis. For example, Novo Nordisk’s annual report from 2021 outlines their compliance with, amongst others, legal requirements and standards [

35] (p. 23), of which none of the legal ones directly concern ESG. Generally, ESG is still largely defined by ‘best practice’, industry standards, and recommendations, indicating that the doctrine mainly exerts its influence through other means than the law. One such means is disciplinary concepts and techniques.

6.2. Discipline

While the legal dispositive brings to the annual reports a set of strict binary divisions, discipline imbues the reports with a series of norms that companies promise to monitor and uphold. With the disciplinary dispositive, there are no longer simply binary divisions between permitted and prohibited; instead, what comes into view is a range of non-acceptable, ‘abnormal’ phenomena that management seeks to prevent, monitor, and eliminate. The organisation itself becomes a target of optimization, and the annual report becomes the vehicle through which the company can communicate to external stakeholders that it is abiding by the norms. In broad terms, discipline invests organisations with continuous and infinite processes towards optimization. Tools of discipline in the corporate sector include benchmarking, time-optimization, performance measurement, internal sanctioning, psychological employee profiling, and transparency measures.

One could view the voluntary disclosures of information in annual reports, beyond the basic requirements of financial reporting, as a disciplinary transparency measure. This demand for transparency was emphasised in the UN’s PRI (Principles for Responsible Investment), which is a UN-supported investor network working to promote sustainable investments. Among its key principles is that investors should “seek appropriate disclosure on ESG issues by the entities in which we invest” [

36]. Generally, when a company voluntarily discloses its corporate efforts regarding an area such as ESG, it provides external overseers with company information, hereby inviting public scrutiny. Yet, Roberts [

20] emphasises that problems may arise if stakeholders, internal or external, believe that the transparency provided by the annual report is complete. Such a belief neglects the self-idealizing nature of the annual report, which allows companies to favourably spin controversial subjects. Companies will describe their transformative objectives and goals for specific business units in detail, defining related KPIs (key performance indicators) and OKRs (Objectives and Key Results), that underpin processes of continuous monitoring and reporting. Moreover, annual reports will typically feature milestones, achievements, and ‘victory stories’ for various business units, thereby setting norms for other parts of the company to pursue. Such external communication of performance norms can simultaneously serve as self-disciplinary internal communication, which is supposed to spur continuous optimization among employees and units.

The annual reports indicate that it is particularly in relation to the environmental agenda that companies are put under pressure from external parties. Ørsted, for example, details how the UN’s IPCC (Intergovernmental Panel on Climate Change) projections of climate change will affect the world as we know it; however, at the same time, Ørsted asserts its own role in preventing such scenarios [

34]. Yet, companies themselves can also exert disciplinary pressure in their own corporate ecosystem. Danske Bank states how they are ‘introducing short and medium-term carbon emission reduction targets […] across [their] financing and investment portfolios’ [

33] (p.18), thus subjecting their financial counterparts to emission targets that they themselves participated in defining. Should a financial counterpart deviate from such emission targets, the bank might levy disciplinary and financial reactions to guide the counterpart in the desired direction. This effect of adding disciplinary pressure onto ecosystems and supply chains stands out as a recurring theme in the selected annual reports across the represented industries that range from financial institutions to industrial goods.

Asserting the genuineness of their ESG commitments, some companies emphasise their capital structures by linking their debt finance with sustainability-linked interest rates. For example, Pandora’s annual report for 2021 proudly announces that establishing green financing ‘connects [their] capital structure to the sustainability agenda’ [

37] (p. 9). Directly linking the interest rates of its financing to sustainability goals, Pandora submits to norms linked to the sustainability agenda and connects their environmental commitments closer to their business operation. Such green financial arrangements provide investors with a credible image that companies are truly, as it were, ‘putting their money where their mouth is’, even if this genuineness might be a somewhat idealised image.

The governance structures of companies also display disciplinary characteristics, even if some of the most important structures, such as the board of directors and internal audits, are principally rooted in the legal dispositive. For example, the notions of oversight and compliance presuppose that organisational processes can effectively be aligned with certain norms, which means that governance structures, such as a board of directors, are expected to monitor, perform oversight, and ensure that processes are optimised to comply with such norms. However, in corporate governance, not only monitoring and compliance mechanisms can be understood as disciplinary, since, at times, the business operations themselves can become submitted to disciplinary control. An example is that of Maersk, which highlights their compliance efforts with respect to corruption: ‘systems are in place to enforce export controls and sanctions, and transaction spot checks are carried out on an ongoing basis’ [

32] (p. 30). As evident by the example above, control is not only achieved through surveillance from the executive level, but also through the implementation of disciplinary surveillance systems that detect non-compliance and impose sanctions.

Companies that strive towards the ideal of transparency and perfect oversight will often voluntarily subject themselves to disciplinary mechanisms and various optimisation techniques. A case in point is Novo Nordisk, who explains how their voluntary compliance with ESG reporting standards stems from their aspiration to ‘demonstrate commitment to being transparent and accountable for how we operate’ [

35] (p. 22). In this context, ESG is tied to transparency by the assumption that companies must not only comply with relevant ESG norms and standards, but that they must also broadcast their compliance in a transparent manner. We would suggest that a key condition of possibility for the interlinking of ESG and transparency is the lack of harmonisation and credibility across diverse ESG principles and codifications. ESG compliance is indeed often accompanied by the promise of transparency, which entails that stakeholders would be able to see through the veil and gauge ‘the true nature’ of corporate compliance. However, inspired by Roberts [

20], one can debate the attainability of such a promise, which refers to compliance as if it were a distinct object or ‘thing’ to be uncovered.

6.3. Security

While the legal and disciplinary dispositives underpin corporate governance and their environmental dimensions, the social dimension centres on other issues. To begin, employment conditions fall under the social dimension, which are broadly regulated by international and national frameworks, such as those set out by the International Labour Organisation (ILO). However, these frameworks merely establish a minimum level of acceptable working conditions. Where the social dimension appears in the annual reports, focus is primarily on employee performance and the development of human resources. Today, the latter is also referred to as ‘human capital’, which is managed in ways that typically involve little legal regulation.

In addition to human capital, the corporate efforts in relation to ESG’s social dimension are typically centred around diversity, equity, and inclusion at the workplace as well as corporations’ involvement in local communities, for example, through the funding of projects or institutions that serve poor and underprivileged communities. Pertinent questions regarding the social dimension include whether companies offer workplace conditions that give high priority to employees’ well-being, health, and safety. More specifically, social questions related to the workplace focus on whether companies take unethical advantage of its employees, or, conversely, practice an ethically conscious management that works for inclusion, diversity and work/life balance as well as fights against racial, gender, and sexual discrimination. Several of these concerns were formulated as part of ‘The Ten Principles of the UN Global Compact’ [

36]. As part of the ESG doctrine, ‘socially responsible investing’ defines an investment strategy concerned with these facets of the employment relation, and it directs investors towards companies adhering to such corporate ethics.

The ESG focus on ensuring employees’ well-being can be linked to the aforementioned concept of human capital and the idea that human capital serves as the key competitive advantage for a company. In Foucault’s analysis of human capital theory, he emphasises how protagonists of this theory criticise the classical analysis of labour in terms of abstract labour power and the time in which it is used. Human capital replaces the focus on quantitative labour (number of workers and number of working hours) with a recognition of labour in its qualitative nature [

29] (pp. 224–225). A basic premise in human capital theory is that employees, like all human actors, are endowed with a capacity to make self-enhancing investments, calculate their interests, and make trade-offs that maximise their future income.

Through these rational choices, people invest in their own human capital, individual-specific skills and competences that they carry with them, which therefore circulate in and out of companies [

38]. From the perspective of human capital theory, motivation of employees, recruitment and retention are essential tasks of profit-maximising business management. Insofar as the human capital concept lends itself to the ESG discourse in its social dimension, it means that taking good care of the company’s human capital and maximising its profitability is mutually supportive.

This profit-enhancing link between good human capital management and company performance is signalled in several of the annual reports of C25 companies. For example, Pandora’s company values were launched in 2021 under the slogan: ‘We Dream, We Dare, We Care, We Deliver’ [

37] (p. 25). As the slogan signals, the effective management of the company’s human capital links delivery targets with the self-actualization of the employees (understood as allegedly self-interested carriers of human capital). Put otherwise, implicit is the assumption that facilitating the self-realisation of human capital spurs business development and profit-maximisation.

Often, in line with the corporate slogan above, a ‘strong company culture’ is communicated as part of a strategy to attract and retain human capital, namely a company culture based on a common strive for certain higher ideals and values, the fulfilment of human potential, and the promise that employees will be part of a greater journey towards a better future. Hence, Ørsted’s 2021 annual report emphasises how the board has prioritised the development of ‘a company culture based on high ethical standards and clear values that permeate across our entire business’ [

34] (p. 60). The importance of ‘strong company culture’ and corporate ethics as decisive for attracting employees, the key asset for bolstering company value, is also signalled in this quote from Ørsted’s annual report: ‘We see this commitment as an important and tangible step to create a fully inclusive culture. Our success relies more than anything on our employees’ [

34] (p. 8). This quote aligns seamlessly with the assumption that human capital is an invaluable asset that drives companies’ competitive advantage.

The assumed positive link between ensuring employees’ well-being and securing company profit is again encapsulated in Maersk’s annual report, which describes the company’s efforts on the social dimension: ‘We will ensure that our people thrive at work by providing a safe and inspiring workplace’ [

32] (p. 27). The quote echoes ESG governance concepts about ensuring safe and stimulating working conditions. One also detects a resonance with human capital dictums regarding the labour force’s mobility and capacity to make self-optimising trade-offs regarding which workplace they chose for themselves. Using the annual report as a vehicle to communicate company efforts in employee development and workplace culture, companies can bolster their brand in an attempt to motivate their workforce and attract new talents.

Central to Foucault’s concept of security is the problem of how to effectively deal with inevitable risks in today’s management discourse, referred to as ‘risk management’. This task is highly pertinent to business logistics, of which Maersk is a leading player world-wide. Maersk must not only ensure that their global circulation of commercial goods happens in the most efficient and economically optimal way; this circulation also needs to be secured against a series of risks, including illegal border-crossers, unregulated capital, counterfeits, and drugs [

39]. Other central concerns of risk management relate to the environmental dimension, which can be helpfully understood as a matter of securitization.

C25 companies’ attempts to weigh the upsides and downsides of their efforts in relation to the environmental dimension broadly resonate with Foucault’s notion of securitization. If companies can successfully brand themselves as more sustainable than their competitors, they can better preserve a product market, hard to access for these competitors. An example is Maersk’s ocean freight, ‘ECO Delivery’, which provides the customer with carbon-neutral ocean transportation [

32] (p. 28). However, such shipping service is neither cheap to establish nor to sustain, given the price gap between traditional fuels and sustainable fuels. From a security perspective, however, this service is worth the extra expenses, as the revenue upside, including both direct sales and cross-selling opportunities, probably outweighs the high cost. More importantly, carbon-neutral shipping serves as risk management in a world that is still becoming more focused on the green transition. In line with Solomon et al. [

7], this example highlights that ESG is sometimes understood as a discourse of both risk and opportunity.

As the environmental agenda accelerates, companies are now facing a risk of obsolescence, if they do not make successful efforts to articulate this emergent agenda. The following quote highlights how Ørsted seeks to securitize their environmental risks: ‘We take climate-related risks and opportunities into account when we prepare business cases for investment in new assets or activities. […] we seek to avoid ending up with stranded assets’ [

34] (p. 34). To be sure, many investments are no longer evaluated from traditional investment criteria, but are supplemented with an adjustment for climate risks, which, from the investor perspective, can be predicted and deployed as a kind of risk management. Moreover, the notion of ‘stranded assets’, brought about by new regulation or market movements related to the environmental agenda, defines the economic risks companies may incur, if they fail to effectively display climate-impact considerations. In sum, integration of the environmental dimension may not only ensure higher returns generated from green products, but it can also decrease companies’ exposure to climate risk, thereby improving the risk-return ratio. This last calculation can be understood as a strategy of ‘securitization’ in the face of the new business conditions set by the climate agenda.

Figure 6 illustrates how ESG can be conceived through the lens of dispositional analytics, showing that ESG-issues are often calculated and targeted by both law, discipline and security.

7. The ‘Tactical’ Use of ESG Concepts

It is a valuable theoretical reminder to recall that the dispositives evolve in dynamic interplay, and that this interplay can unfold as relations of mutual reinforcement or contradiction. The dynamic interrelationship between the three major dispositives, as described by Foucault, is suggestive of how the ESG doctrine has emerged at the intersection of law, discipline, and security. Most often, those urgent problems that ESG addresses, such as how to stop environmental degradation, ensure transparency towards shareholders, and establish inclusive workplaces, are not considered as purely legal, disciplinary or security matters. Instead, as we have seen, these issues spur reactions that oscillate between jurisprudence, disciplinary reasoning, and security calculations, or even begin to establish new constellations of the dispositives. Noticeably, on this background, many of the emerging key ESG concepts work as ‘hybrids’ that straddle, or integrate law, discipline, and security, as would seem to be the case with concepts, such as ‘compliance’, ‘audit’, ‘diversity’, ‘transparency’, ‘good governance’, and ‘risk management’.

We now suggest that companies’ articulation of such hybrid concepts can be understood as tactical responses to the increasingly unavoidable ESG doctrine. One of Foucault’s famous pronouncements is that ‘power is reversible’ [

40], which means, among others, that ‘liberating’ or ‘progressive’ notions can always begin to serve new regimes of domination. This fundamental point reached a more analytical formulation when Foucault spoke of the ‘tactical polyvalence’ of discourse, which implies that a statement’s tactical function arises from the statement’s specific relationship to other statements. Emphasising this fundamental instability of statements, whereby it can be put to a very different use in a different context, Foucault said that discourse is constituted by ‘a series of discontinuous segments whose tactical function is neither uniform nor stable’ [

40] (p. 100). Accordingly, a statement does not carry any inherent, stable value, since its value ensues from the system of statements, the discursive formation, within which the statement is articulated, and which authorises certain values and assumptions.

Adopting these assumptions in an analysis of ESG concepts opens up explorations of the discursive struggles around how ‘compliance’, ‘audit’, ‘diversity’, ‘transparency’, ‘good governance’, and ‘risk management’ should be defined and, specifically, whether they should imply legal, disciplinary or security interventions. For our purposes, Foucault’s notion of a statement’s ‘tactical polyvalence’ offers a focal point from which to explore how ESG concepts become rearticulated by companies in their ‘tactical’ efforts to remain legitimate in their industry, accommodate investors and consumers, or convince law-makers that legal intervention is unnecessary.

The above qualitative analysis displayed how some companies explicitly adopted ESG principles in their communication, such as in Danske Bank’s promotion of ‘responsible investment’ [

33], in Pandora’s promotion of ‘green financing’ [

37], in Novo Nordisk’s commitment to ‘transparency’ [

35], and in Ørsted’s promise to ensure an ‘inclusive culture’ [

34]. Using the term ‘tactical’ to describe the companies’ appropriations of such ESG concepts in their annual reporting is not to claim that this communication is merely a ‘ceremony’, which is ‘decoupled’ from companies’ actual productive activities (a key point in neo-institutional theory, see: Meyer and Rowan [

25]). Companies may rearticulate such ESG concepts for a number of reasons, such as seeking to influence the prevailing standards in their industry or striving to position themselves as ‘business leaders’.

Companies that successfully present themselves as ESG protagonists in their respective industries can achieve a competitive advantage. Industry competitors may appear as less responsible, progressive, and competitive in comparison with the alleged market leaders. A relevant example is the shipping company Maersk, which, in its 2021 annual report, declares that decarbonization has become ‘a licence to operate’ within container shipping [

32] (p. 35). If Maersk succeeds in projecting itself as a protagonist of the growing consensus that decarbonization is a ‘must’ in container shipping, it can position itself advantageously to its less articulate competitors in regard to decarbonization efforts. Once a comparison from this criterion is adopted by investors and other stakeholders, competitors will be forced to move closer to the norm of decarbonization. We recall that Foucault [

31] described how discipline sets up norms that allow for comparison across a hierarchical scale and apply sanctions on those who deviate from the norm. A tactical use of ESG concepts can serve the purpose of seeking to institute such industry-specific norms.

Companies’ articulation of their environmental responsibility often entails declarations that business growth and sustainable production are fully compatible. As the longstanding CSR dictum says: companies can do

well by doing good. Novozymes has clearly re-appropriated this slogan in asserting that they recognize ‘the potential to grow [their] business while innovating transformative solutions for the climate’ [

41] (p. 25). The ‘business-to-consumer’ company Pandora forges a link between market demand and sustainability efforts in their self-presentation. The following quote shows how the jewellery company has allegedly adopted sustainability as a response to consumer preferences: ‘Consumers are increasingly willing to change their purchasing habits to reduce environmental impact […] Pandora has taken an industry lead by demonstrating how sustainability can be integrated across all activities’ [