1. Introduction

In the last few years, the growing debate about project economic sustainability evaluation from a life cycle perspective has been focused on Life Cycle Costing (LCC). As normed in the Standard ISO 15686-5:2008, repealed with Standard ISO 15686–5:2017 [

1], the approach is devoted, among the other aims, to evaluate alternative design options at different scales (building/system/component/material), according to an economic–financial viewpoint. Operatively, using the Global Cost calculation, model input and model output are expressed in monetary terms, as illustrated in Standard EN 15459:2007, repealed in 2017 [

2] and in the guidelines accompanying Commission Delegated Regulation (EU) No 244/2012 [

3], according to the Directive 2010/31/EU – EPBD recast [

4] updated with the EPBD-Directive 2018/844/EU [

5], and then enhanced with the Communication “A Renovation Wave for Europe—Greening our Buildings, Creating Jobs, Improving Lives” (European Commission, 2020 presented from the Commission to the European Parliament on 10 October 2020 [

6].

Despite the potentialities of the approach, some limits emerge principally due to the neoclassical nature of the economic principles on which it is founded. As authors underline [

7], LCC is frequently applied in “environmental contexts”, for example by taking into consideration the energy performance of the objects under evaluation, by promoting investments able to guarantee energy savings, and by design options that make use of technologies for renewable energy source employment or eco-design solutions. Nevertheless, assuming a holistic concept of sustainability, at the time the approach is not suitable for concretely facing the environmental dimension of evaluation issues, at least without some developments and integrations of the model. In other terms, the LCC does not include environmental costs.

The limits of LCC in dealing with environmental cost components seems, at least according to our knowledge, poorly studied by the scientific literature: this point represents the missing link which form basis for the research problem to be addressed. The necessity to fill the gap derives from the relevance of environmental issues besides the economic-financial ones in the decision-making processes related to interventions in the construction sector. Precisely, it is our belief that the problem should not only be treated in terms of monetization of environmental impacts, as a vast literature on the quantification and monetization of externalities proposes. Rather, it may be effective to identify an appropriate use of the economic–financial assessment approach, refining some calculation steps, as proposed in the present work. In other terms, the research question is focused on the exploration of the potentialities in adopting variable discount rates/discount factors in the cash-flow analysis more than trying to identify the preferable discount rate value for the specific case study. As emerges from some scientific literature contributions on the topic, which provides the platform for the study as highlighted in

Section 2 of the present work, the necessity to clarify how to include environmental cost items into the Global Cost calculation seems relevant, not only in the case of private projects but also in the case of public/PPP interventions, due to their specific issues. Even from the literature, two research addresses emerge for strengthening the capability of LCC to deal with environmental components:

(1) The first one is directed towards the integration of LCC and environmental quantitative analysis, using LCC and Life Cycle Assessment (LCA) [

8] joint application, as explored by a vast and quite recent literature [

9,

10,

11,

12,

13,

14,

15]. In the studies, the quantitative dimension prevails, given that the environmental impacts expressed in terms for example of embodied energy and embodied carbon can be internalized into the LCC model in monetary terms.

(2) The second one is directed towards the integration of the environmental dimension into the microeconomic approach, by adopting appropriate discount rates and discounting modalities. In fact, as discussed in the consolidated debate on the topic, the discount rate is a crucial component in private and public projects; specifically, in relation to the public interventions, the discount rate should be calibrated according to the long project time horizon, the intergenerational perspective over time, and, above all, the preferability of interventions coherent with environmental policies oriented towards the negative externalities reduction [

16]. This second address is selected for a deepening of the present work.

As known, the second point is particularly relevant for public projects, in which the time value of money issue becomes crucial (being in the presence of long lifespan analyses and economic objectives wider than the private ones) in terms of stakeholders involved, indirect costs and benefits, and future generations inclusion according to an intergenerational time perspective. An extensive and consolidated scientific debate on the topic has been open for decades in relation to economic-financial evaluation tools such as, above all, the cost benefit analysis and its variants. Contrarily, the literature about the use of discounting in LCC applications seems rather poor.

Thus, the purpose of this paper is to explore alternative discounting approaches for introducing environmental components into the model towards an “environmental LCC model”. Focus is posed on three discounting modalities: (1) the environmental hurdle rate technique, based on the hurdle rate principle and resolved by adopting different rates in the same model; (2) the escalation rate approach, based on the price rate principle, and resolved by adopting discount rates growing over time; and (3) the classic approach based on the financial “time preference” rate, resolved through the Net Present Value (NPV) calculation.

Summarizing the workflow of the research, after a synthetic presentation of the methodological aspects and after the presentation of a case study, a two-step simulation is implemented. The first discounting technique is precisely compared to the second one and to the third one for identifying the preferable discounting method in life cycle evaluation through the implementation of a set of simulations. A first simulation is proposed by comparing an LCC calculated for two alternative building components, considering a specific cost item by means of (1) a conventional LCC calculation by using a financial NPV discount rate, (2) an “environmental” LCC calculation by adopting three different environmental hurdle rates (in three LCC models), and (3) an “environmental” LCC calculation by using an escalation rate. A second simulation is developed by comparing an LCC calculated for both building components by means of a conventional LCC calculation with a financial NPV discount rate and an “environmental” LCC calculation by using different environmental hurdle rates (in the same LCC model), then comparing the results by using hurdle rates and financial NPV rate over relevant cost items. As a final step, the environmental hurdle rate values (in the same LCC model) are increased to obtain the thresholds beyond which the two alternatives reverse the order of preference. To support the application, a case study—object of previous studies—is assumed: two alternative technological components, i.e., a timber frame and an aluminum frame.

The results obtained confirm the relevance of the discount rate potential effect on the global cost calculation and confirm how sensible the model output can be even in presence of slight variations in the rate values. Moreover, the discount rate allows modelling some of the potential impacts of building/building components on the environment, for example, assuming the expectations of technological development over time, and their relative impact on model output. In this article, special attention is devoted to the environmental hurdle rate approach, due to the capacity to model into the LCC not only today’s knowledge—as with the classic financial rate—but also the expectations of future knowledge, for example, on the development of technology. Notice that by applying the environmental hurdle rate, the results can even change the final preferability ranking obtained using a financial discounting, maintaining the same assumptions.

Summing up, the work can represent a potential contribution to growing the debate on the topic and supporting environmentally responsible investment decisions in the building construction sector, both in the case of new builds and in the case of retrofitting interventions of existing assets, in private/public/PPP operational contexts. Precisely, the work can be a potential contribution to furtherly clarify the inclusion of environmental components in LCC applications by strengthening its capability to handle environmental impacts.

The article is articulated as follows. In

Section 2 the literature background is illustrated.

Section 3 presents the methodology. In

Section 4 the case study is presented. In

Section 5 the results of the simulations are illustrated, and

Section 6 discusses and concludes the work.

2. Literature Background

The main theoretical premise of this article is the recent debate about the limits of the LCC approach as a tool for supporting environmental decision making.

The attention devoted to the LCCs is witnessed by the growing literature of the last few years. In this section, the fundamental references on LCC approach assumed for this research are presented. Despite the growing literature, as anticipated in

Section 1, the limits of LCC, specifically in dealing with environmental cost components seem poorly studied. Thus, this gap in the literature represents the research problem to address the research domain of the present work, starting from the fundamental literature on the topic. Precisely, this literature background focuses on the most recent scientific contributions towards the development of the standard LCC approach, generally based on suggested integrations towards the inclusion of environmental and social components in the model, besides the economic–financial ones. Furthermore, the literature background focuses on the contributions oriented to suggest operative modalities to internalize the environmental impacts in LCC analysis, specifically by means of discounting methods. Notice that this second research address is rather difficult, considering the poorness of the contributions on discounting approaches associated with LCC, and considering the absence of recent contributions from the methodological viewpoint. Right away, a synthesis of the literature background is presented.

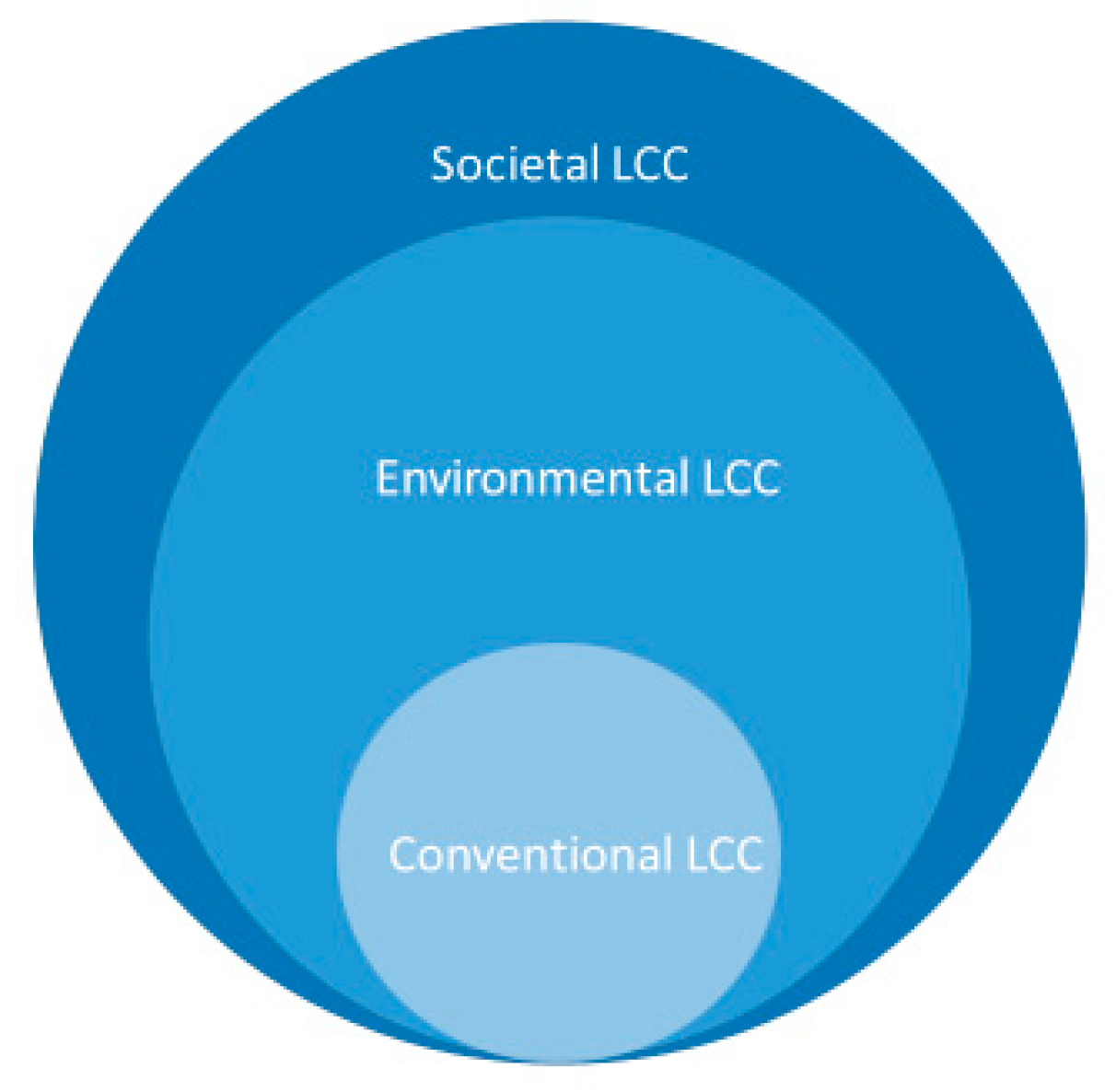

First of all, as Thiebat illustrates [

17], the work by the international scientific society SETAC (Society of Environmental Toxicology and Chemistry on the Global Cost) is fundamental in addressing the problem of sustainable development by integrating its three pillars: environmental, economic, and social. Precisely, the SETAC defines three LCC typologies: conventional LCC, environmental LCC, and societal LCC, as synthesized in

Figure 1 [

18,

19,

20]. According to this perspective, the Conventional LCC considers the costs directly sustained by the producer/user without considering externalities and environmental impacts, according to a market economy perspective. Contrarily, the ELCC is a project evaluation approach that considers all the costs associated with the life cycle of a product, directly sustained by one or more subjects involved in the whole life cycle, i.e., in the entire life cycle. The analysis includes externalities that are foreseen within decision-making processes, i.e., that are expected to be included in future decision-making processes [

21]. All stages of the life cycle and related costs must therefore be introduced in the ELCC, including environmental costs (calculated with LCA), in terms of whole life cost. Finally, societal LCC assumes the widest perspective and includes the ELCC, the externalities monetized in terms of willingness-to-pay, and the environmental impacts through LCA. As mentioned by Thiebat, societal LCC is directed to assess all the costs in the product life cycle sustained by any subject in the society as a whole, also in a long-term perspective. Thus, through this last assessment approach, LCC is capable of including societal costs. To some extent, societal LCC corresponds to the Social Life Cycle Assessment (SLCA) approach.

Gluck and Baumann [

7] highlight that LCC presents limitations mainly due to the theoretical origins of LCC, as a tool not originally developed in an environmental context. The traditional LCC approach is defined by the Authors as an analysis adopted to rank different investment alternatives by presenting the studies of [

22,

23]. From a theoretical viewpoint, LCC is based on the normative neoclassical economic theory, which implies economic rationality in decision-making behaviours; thus, the LCC limits can be brought back to the neoclassical nature of the economic principles upon which the approach is founded. LCC is weak in considering costs for future generations, adopting a life cycle perspective referring to the project, but not to a concrete intergenerational vision. Furthermore, LCC is weak in making rational decisions under uncertainty; then, LCC tends to oversimplify the environmental components by reducing them to the one-dimensional monetary unit. LCC-based accounting tools are available aiming at incorporating environmental costs into the calculation, but a contradiction exists between LCC theoretical assumptions and environmental ones. As is known, the market economy principles are not valid when in presence of environmental decision-making, usually in contexts characterized by complexity and uncertainty mainly due to the long-term time horizons of the analyses. This last point is strictly correlated to the time value of money issue, frequently solved through the use of discounting procedures. Assuming that the time value of money can be expressed through the discount rate, and assuming that it depends on different components (inflation, cost of capital, opportunity cost, demand preferences, etc.), Gluch and Baumann highlight three alternative discounting modalities:

The “classic” approach, through the NPV calculation with nominal costs and real/nominal discount rate, based on the “time preference” principle, as illustrated in ISO 15686-5:2006/2017, based on the TG4 Report, 2003 [

24]. On this same basis, the ASTM (American Society for Testing and Materials) approach is developed, by making a distinction between relevant cost items and energy costs, and by adopting two different rates.

Environmental hurdle rate technique, which is founded on the use of different rates (“green”, “yellow”, and “red”), given the certain degree of the negative contribution on the environment produced by a certain input variable and related cost item (hurdle rate principle) [

25,

26,

27].

Escalation rate approach, based on the use of discount rates incrementally over time, given the expectation that a certain cost item will increase more than other items (price rate principle) [

25,

26,

27].

Additionally, other recent studies exploring the potentialities of the environmental LCC application in the building construction and retrofit interventions direct attention towards the influence of the discount rate in model output calculation [

28,

29,

30]. Further literature concentrates on the modalities for integrating economic and environmental impacts in buildings, since the design stages, and in relation to different uses [

31,

32,

33,

34].

Finally, the present research starts from the results of previous works—conducted by assuming the same case study considered in this research—which demonstrate that in the applications of LCC analysis also with environmental components, the discount rate is among the variables towards which the results show greater sensitivity, albeit in the presence of minimal variations [

35,

36,

37].

3. Methodology

As known, LCC aims at quantifying costs and benefits according to a whole life cycle perspective [

38,

39,

40,

41]. Standard ISO 15686–5:2008, repealed with Standard ISO 15686–5:2017—Buildings and constructed assets—Service-life planning, Part 5: Life Cycle Costing, is the methodological foundation of the approach [

1]. LCC is implied in decision-making processes for supporting the selection among optional design solutions at different scales: component, material, building, and system. Based on efficiency criteria, it is an approach for the economic evaluation that can be implied in the new build projects or retrofitting of the existing buildings, both in private and in public contexts and PPP interventions. Considering relevant immediate and/or long-term costs and benefits in the calculation, problems arise related to the intertemporal comparison of amounts of money, particularly in the case of public projects for which long time horizons are set for the analysis. The approach can be applied for different purposes—for example, the selection of the preferability of technological scenarios—when in presence of input data on costs, and financial input data. The output is expressed through quantitative indicators (net present value, net present cost, net savings, savings to investment ratio, discounted pay back period, adjusted internal rate of revenue, etc.).

From an operative viewpoint, the centrality of the approach is posed in the Global Cost calculation, described in Standard EN 15459:2007 repealed in Standard EN 15459:20017 [

2] and in the Guidelines accompanying Commission Delegated Regulation (EU) No 244/2012 [

3], according to the Directive 2010/31/EU—EPBD recast [

4]. The global cost method, illustrated in Standard 15459:2007, is found in the sum of the initial investment costs, and the sum of annual and disposal costs, minus the eventual residual value of the components, as illustrated in Equation (1):

where: C

G(τ) stands for the global cost (referred to as starting year τ

0); C

I stands for initial investment costs; C

a,i (j) stands for the annual cost during the year i of component j, which includes annual running costs (energy costs, operational costs, maintenance costs) and periodic replacement costs; R

d(i) stands for the discount rate during the year i; V

f,τ(j) stands for the residual value of the component j at the end of the calculation period, referred to the starting year.

In Standard EN 15459:2007, the discount factor is expressed through the following formula:

where: t stands for the number of years starting from the initial time; r stands for the real discount rate.

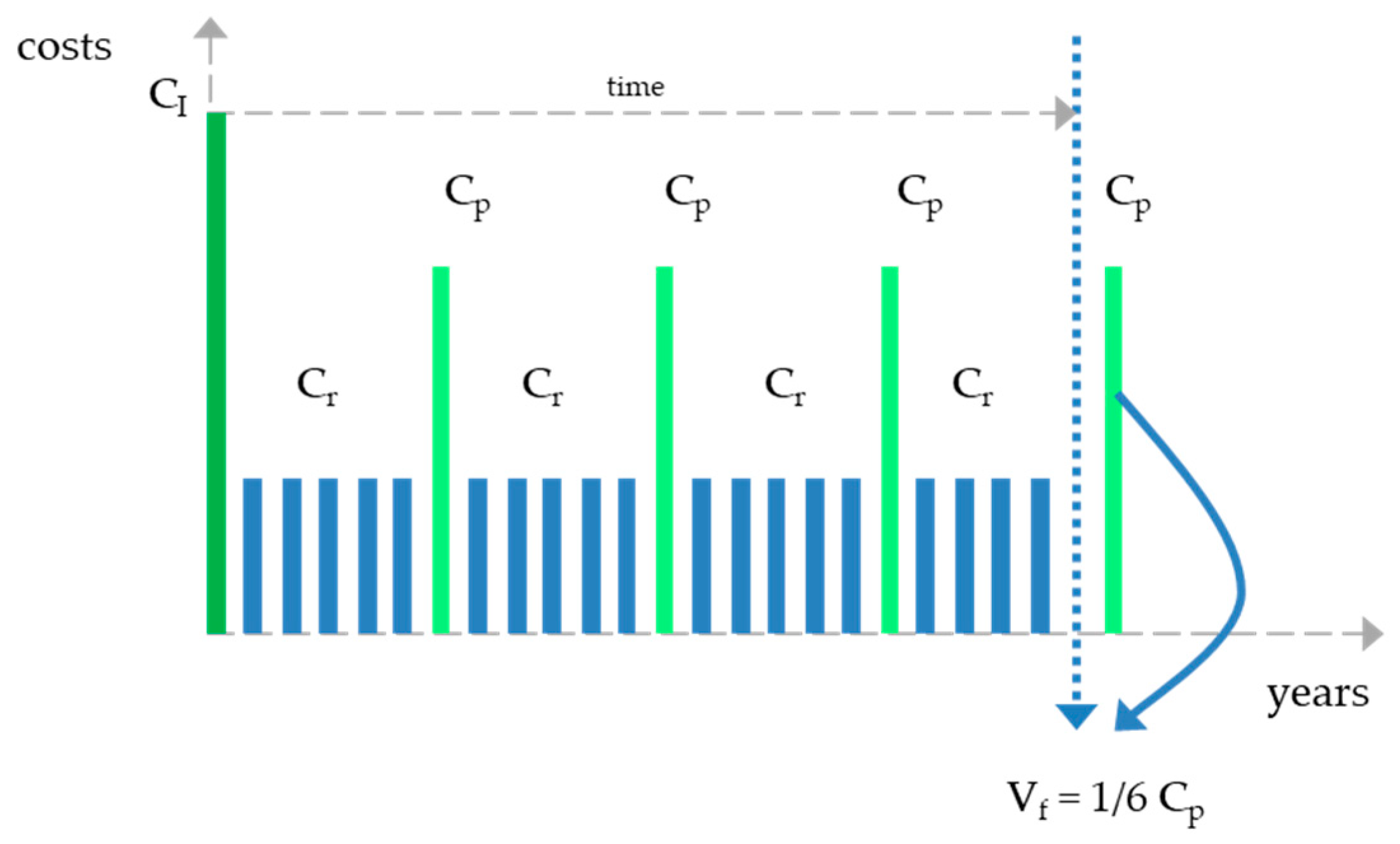

In

Figure 2, a schematic example of the discounting process is illustrated by referring to some specific components such as initial investment costs (C

I) not discounted, running costs (C

r), and replacement costs (C

p), discounted:

In

Figure 3, a schematic example of the final residual value calculation is illustrated, following the methodological addresses formalized in Standard EN 15459:2007:

Assuming the LCC methodology and introducing an element of environmental evaluation in the project life cycle cost analysis, an insight into the discounting methodologies is proposed. As anticipated in the Introduction, and as deepened in the scientific background section, three alternative modalities to resolve the discounting are identified through the literature review. In the next sub-section, an insight into the three operative modalities is proposed.

Discounting Approaches

Summarizing the literature on the topic, the following three discounting approaches emerge:

(1) Net Present Value approach. Fix the basic assumptions (the lifespan of the object under evaluation, and the discount rate value), based on the time preference principle, the net present value is calculated by discounting the costs as expressed in Equation (1) through the discount factor expressed in Equation (2). In other terms, adopting the nomenclature illustrated in [

7]:

The limit of the approach—according to an environmental viewpoint—consists of the potential increase in relevant costs items (i.e., the demolitions and waste disposal costs), which highly impact the environment and are highly affected by uncertainty.

(2) Environmental Hurdle rate approach. The environmental hurdle rate approach is founded on the application of differentiated discount rates (hurdle rates), given the weight of the potential impact of a building construction sector activity on the environment. This last is expressed through the relative cost amount. For example, according to the hurdle rate principle environmental cost due to a relevant cost item being discounted with a red discount rate, i.e., r = 0%, a less relevant cost item is discounted with a yellow discount rate, i.e., r = 4%, and for a cost item which is expected to decrease and vanish, the relevance in future periods is discounted through a green discount rate, i.e., r = 8%.

Formally, the hurdle rate can be expressed as in the following Equation (4):

where: P stands for payment; r stands for “red” rate; y stands for “yellow” rate; g stands for “green” rate; t stands for time.

Notice that the environmental hurdle rate is applicable in the case where an investment is financially economical but not environmentally favorable (NIST—National Institute of Standards and Technology, U.S. Department of Commerce, 2021).

According to an environmental viewpoint, the advantage of this approach consists, for example, of the capability to internalize into the model, for example, the expected development trends in technology, the different weights attributed to each specific relevant cost item, etc.

(3) Escalation rate approach. This third approach founds on the “escalation rate principle”, or, simply, on the assumption that the relative price for the most relevant cost items is weighted to increase in time and, thus, it can be estimated to increase more than the other cost items (for example, a relative price change of 3%, thus e = 0.03). Formally, the escalation rate can be expressed through the following Equation (5):

where: P stands for payment; i stands for interest rate; e stands for escalation rate; and t stands for time. As for the previous case, according to an environmental viewpoint, the advantage of this last approach consists of the capability to introduce more flexibility and variability in the expected growth/degrowth of prices.

The three discounting approaches are summarized in

Figure 4 below.

Based on these three approaches for the discounting calculation, a set of comparative simulations is implemented by assuming a case study, as illustrated in the following sections, and as summarized in the workflow below (

Figure 5).

4. Case Study

For implementing a set of simulations through the before-mentioned approaches concerning a reference context, the case study adopted in previous applications is adopted in this research [

35,

36,

37]. Precisely, in these applications, the outcome of a design experience is considered (S. Pattono, Master’s degree in Sustainable Architecture, Politecnico di Torino, Academic Year 2015–2016), as mentioned in [

35].

Two technological components—a timber frame window and an aluminum frame window—are selected as an alternative to be used in a hypothetical construction project concerning a multifunctional multi-story building. This last is composed by a shopping mall in the lower floors, and office spaces in the upper floors, with a gross internal floor area of about 4100 m

2, a total glazing area of about 1400 m

2, and a glazing ratio of the external walls of 90%. This last is characterized by a particular shading device for reducing the solar incidence in the summer and for optimizing the solar gain in winter (see

Figure 6a).

For the glass façade, two alternative technological solutions are considered: a timber frame window and an aluminum frame window (see

Figure 6b,c). Both of them have double selected low-emission glazing filled with argon. Notice that the two technological solutions present the same window transmittance value.

The input data set for the global cost calculation consists of the relevant costs for both options: the initial investment costs (including installation costs), the annual running, and replacement costs (including inspection), the disposal costs, maintenance costs, replacement costs, and the total embodied emissions. Then, the eventual residual value, the discount rate, lifespan, and period of analysis are fixed, as summarized in

Table 1 below.

As for the input data, the following assumptions are considered:

The initial investment costs and annual running and replacement costs, which include inspection, maintenance and periodic replacement of the technical components, calculated as a percentage on the investment costs with specific frequency, are defined using price lists and indications by manufacturers companies.

The dismantling and disposal costs, which include possible incomes from recycled materials (glass, timber and aluminum), calculated using price lists of disposal companies (in this case, aluminum frames are considered partially recyclable, thus reducing the respective disposal costs).

The residual value of the technological components is calculated by applying to the replacement costs the residual technical life to total technical life ratio.

The total embodied emissions, or Embodied Carbon (EC), represents the CO2-related costs calculated in terms of embedded emissions.

The financial data—including the lifespan (which corresponds to the economic life of the technological components), and the discount rate, set as a function of the specific investment risk and the loan costs—are calculated considering the costs for a planning horizon of 25 years, with a discount rate of 5%. The discount rate value is hypothesised assuming that the application is not strictly finalized to evaluate the financial profitability of the investment; thus, the market risk component is assumed low.

Implicitly, economic objectives in a long term decision-making process are assumed.

5. Simulations and Results

Assuming the methodology illustrated in

Section 3, and assuming the case study illustrated in

Section 4, in this section, the results of the comparative simulations are presented.

5.1. Simulation 1

The first simulation is implemented by comparing the LCC calculated both for aluminum and timber frames, based on the following assumptions:

LCC calculation by adopting a uniform financial NPV discount rate (rate value 5%), and by resolving Equation (3):

where P

dd stands for dismantling and disposal costs; t stands for time.

“Environmental” LCC calculations by adopting different hurdle rates alternatively (red rate value 0%, yellow rate value 4%, green rate value 6%), and by resolving the following Equations:

where P

dd stands for dismantling and disposal costs; r stands for “red” rate; y stands for “yellow” rate; g stands for “green” rate; t stands for time.

“Environmental” LCC calculation by adopting an escalation rate (rate value 3%), and by resolving Equation (5):

The application is implemented for one specific cost item, for instance, dismantling and disposal cost, considering traditional dismantling methods and transport to waste disposal. Notice that in the case of timber, the waste disposal represents a cost, whilst in the case of aluminum, the disposal represents a potential income, due to recycling potentialities. Furthermore, notice that the CO

2 (total embodied emissions) indicated in

Table 1 is not monetized and included in the simulation, with the aim to “isolate” the efficacy of the different discount rates solely on the financial cost items. In other terms, the simulation aims at verify the effect of the alternative discounting modalities in relation to the cost items capable to produce higher or lower effects on the environment. Furthermore, the simulation assumes that CO

2 emissions have by nature a clear negative impact on the environment, thus influencing equally all the scenarios.

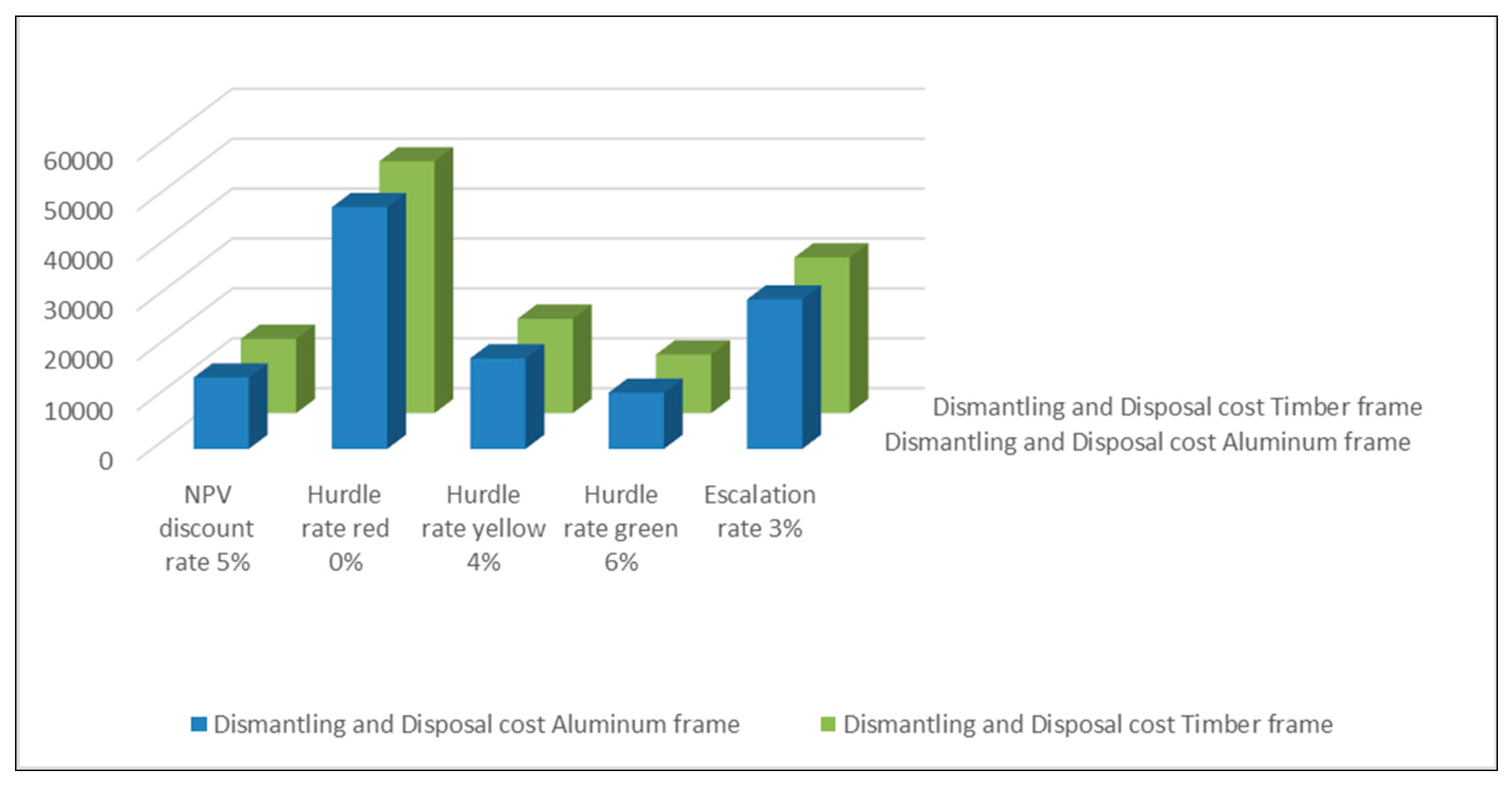

The results are summarized in

Table 2 below.

Concerning the discount rate values selected for the application, the following logics is followed:

The rate value used in the NPV calculation (5%) is fixed indicatively with reference to the market rates trends.

The hurdle rate values are set by considering the market rate value (the 5% rate used in the NPV calculation) and simulating according to a range of likely deviations, with all the limits of the simulation in object. Precisely, the red rate value adopted (0%) reflects the worst condition, giving a full value (not discounted) for the most relevant cost items (in terms of their potential environmental impact); the yellow rate value (4%) and the green rate value (6%) are set, indicatively, slightly below and slightly above the market rate value (5%), in order to give a growing weight to the cost items selected as average impacting and positively impacting on the environment, respectively.

The escalation rate value (3%) is hypothesized indicatively with reference to the possible expectations of an increase in costs over time.

Notice that the application focuses on the methodology testing rather than defining, through the calculation, the rate values in relation to the specific case study. The same logic is assumed for the second simulation. Thus, the values must be considered as indicative ones, and as commented in

Section 6, with all the limitations that this approximation implies.

The dismantling and disposal cost item for timber/aluminum frame, discounted with different discounting approaches, shows high variability, due to the different rates applied. By adopting a green hurdle rate, the LCC results are lower than the base case (LCC with NPV discount rate): the green hurdle rate could be favourable to the evaluation because it rewards the fact that the cost item “improves” over time, for example, by implying advanced or more performant technologies, it is able to diminish its environmental impact. Then, notice that by adopting a red hurdle rate—which refers to high environmental impact items—the LCC is significantly increased compared to the base case, showing the considerable weight of environmental costs. The results with yellow hurdle rates are intermediate, as expected. These considerations are confirmed in both frames.

In

Figure 7, the same results are graphically represented.

As concerns the escalation rate approach, the results obtained are rather weak in terms of the capability to impact the final LCC values. In this specific case, the escalation rate calculation results, dealing with cost items whose impact is growing over time (as for example, the maintenance costs), are not significantly different from the results obtained with the exponential discount rate (growing over time) implied in the NPV calculation (see Equation (3)). Thus, this approach is omitted in the following simulations.

This first simulation seems to demonstrate the capability of the discount rate to internalize into the analysis the potential impacts of alternative building components on the environment, and the capability to model the expectations of (eventual) technological development over time, and their impact on the output of the analysis. On this basis, the use of different discounting modalities represents support to the decision-making processes, when comparing alternatives with different behavior over time, not only in terms of durability but also in environmental terms [

42].

For deepening the analysis, a simulation is implemented by extending the number of relevant cost items subject to the discounting calculation, as illustrated in the next sub-section.

5.2. Simulation 2 and 2bis

5.2.1. Simulation 2

The second simulation is based on the following assumptions:

LCC calculation by adopting a uniform financial NPV discount rate (rate value 5%), and by resolving Equation (3):

where P

n stands for the cost amount related to each cost items considered in the LCC calculation; t stands for time.

“Environmental” LCC calculation by adopting different hurdle rates about different cost items, and by resolving Equation (4):

where P

n stands for the cost amount related to each cost item considered in the LCC calculation; r stands for “red” rate; y stands for “yellow” rate; g stands for “green” rate; t stands for time.

Comparison among the results by adopting green/yellow/red hurdle rates—specific for each technological option—and financial NPV rate, over initial investment costs, maintenance costs, and dismantling and disposal costs.

Percentage variance calculation between the results of the LCC by adopting hurdle rates and LCC by adopting a conventional time preference discount rate.

Table 3 summarises the whole LCC with different hurdle rates, applied to the different cost items, and differentiated for each specific technological component, and compared with the LCC calculated by adopting the conventional financial rate.

This second simulation confirms that the effects of the discount rate are significant on the final results. Precisely, by comparing the LCC obtained with the financial rate and the hurdle rates, the global cost increases sensibly for aluminum (+26.58%) and decreases in the case of timber (−1.96%). The increase in the global cost is less favourable for an aluminum frame, due to the presence of higher “red” cost items than in the case of a timber frame. Furthermore, the LCC related to the timber frame, with hurdle rates, yields slightly better results than the LCC with the financial rate due to the presence of “green” and “yellow” cost items. Nevertheless, the results are highly in favour of aluminum. By introducing the hurdle rates, the results are still in favor of aluminum, but the preference is highly reduced.

These results seem to confirm that by adopting hurdle rates, the results can evidence the effects on the environment better than by using uniform financial rates, both in a positive and negative sense. Considering all these aspects, a further step of the analysis is encouraged, as illustrated in the next sub-section.

5.2.2. Simulation 2bis

Given that the relevance of the rates can come to distort the order of priorities, in simulation 2bis, the hurdle rate values are increased to obtain the thresholds beyond which the two alternatives reverse the order of preference, as reported in

Table 4. The second-bis simulation is based on the following assumptions:

LCC calculation by adopting a uniform financial NPV discount rate (rate value 5%), and by resolving Equation (3):

where P

n stands for the cost amount related to each cost item considered in the LCC calculation; t stands for time.

“Environmental” LCC calculation by adopting different “threshold” hurdle rates about different cost items, and by resolving Equation (4):

where P

n stands for the cost amount related to each cost items considered in the LCC calculation; r stands for “red” rate; y stands for “yellow” rate; g stands for “green” rate; t stands for time.

Comparison among the results by adopting green/yellow/red hurdle rates specific for each technological option and a financial NPV rate over initial investment costs, maintenance costs, dismantling and disposal costs.

Percentage variance calculation between the results of the LCC by adopting hurdle rates and LCC by adopting a conventional time preference discount rate.

Unexpectedly, the threshold hurdle rate values are not extremely high, but they can be considered in the range of acceptability in relation to the context of the analysis. In this third simulation, the rate values are able to bring the two alternatives closer together, and the alternative priorities are reversed. The timber frame is slightly preferable, contrary to the previous simulation.

In conclusion, the results under the economic–environmental viewpoint are preferable for timber frame, whilst according to the solely economic viewpoint, the results are in favour of aluminum frame. By introducing the environmental component, the results for aluminum are noticeably worsened. Thus, according to the environmental viewpoint, and in presence of verified data, the results are more closed and the timber option—clearly less preferable from a financial viewpoint—comes back into consideration for the final preferability ranking.

6. Discussion and Conclusions

This paper aims to explore the application of alternative discounting approaches for the economic–environmental sustainability evaluation according to a life cycle perspective. The methodology addresses the literature on the topic, and precisely, recent contributions in the scientific debate on the use of LCC and its variants, such as the ELCC. It focuses on the capability of three alternative discounting approaches to support decision-making processes, and precisely the selection of alternative components in the building sector, in presence of environmental impact restriction policies (and related regulations) and the presence of limited economic resources. Furthermore, centrality is posed in the case of long lifespan, as in the case of components highly impacting on buildings’ energy performance, and is thus crucial for design decisions since the early stages.

This last aspect is crucial in the case of public projects and/or sustainable public procurement processes, where the time–value money issue is highly impacting on the design decisions.

After a literature review on the topic, a set of simulations is implemented. Firstly, a simulation is implemented by comparing an LCC calculated for aluminum and timber frames, developing a conventional LCC calculation by adopting a uniform financial NPV discount rate. Then, an “environmental” LCC calculation is conducted by adopting different environmental hurdle rates, and an “environmental” LCC calculation is conducted by adopting an escalation rate. This first application assumes one specific cost item (dismantling and disposal cost). Secondly, a simulation is implemented by comparing an LCC calculated for both frames, this time by developing a conventional LCC calculation by adopting a uniform financial NPV discount rate, and an “environmental” LCC calculation by adopting different environmental hurdle rates (in the same model) about each different technological option, then comparing the results by adopting green/yellow/red hurdle rates and financial NPV rate, over initial investment costs, maintenance costs, dismantling and disposal costs, also through the percentage variance calculation between the results of the LCC by adopting hurdle rates and LCC by adopting a conventional discount rate. In this second case, the escalation rate approach is omitted. Lastly, maintaining the previous assumptions, the environmental hurdle rate values are increased to obtain the thresholds beyond which the two alternatives reverse the order of preference.

The results demonstrate that the discount rate allows us to internalize into the analysis the potential impacts of building/building components on the environment, to model the expectations of technological development over time, and to chart their relative impact on model output. Thus, the results suggest that the use of different discounting modalities represents support to the decision-making processes in the building and construction sector design activities. Precisely, by adopting the environmental hurdle rate the results can evidence the effects on the environment better than financial rates: according to the environmental viewpoint the results about aluminum and timber frames, respectively, are more close to each other than by using a financial discounting, and it can even change the final preferability ranking as in our case (or, at least, reduce the preferability degree).

The present research represents a potential contribution to decision-making processes, both in private, public, and PPP contexts. The joint application of economic and environmental sustainability evaluation is a fundamental advancement in the ecological transition from a Circular Economy perspective. Introducing a more robust discounting into the life cycle evaluation models can represent a step forward in environmentally responsible decision-making processes, by incorporating the environmental impacts on manufacturing. Additionally, in some cases, it can reveal the alternatives able to produce even positive effects on the environment. Furthermore, the research tries to overcome the limits of the conventional LCC, founded on the neoclassic economic theory.

Despite the potentialities of the methodology, limits emerge from the research, due essentially to the availability of data. In relation to the research domain, the study represents a first step that is certainly not exhaustive, considering the complexity of the subject. Further developments are necessary, both as regards the theoretical aspects and as regards the operational ones.

Under the theoretical viewpoint, strictly linked to the research domain, the study investigates the contributions produced in relation to the use of discounting methods in the LCC approach; however, the research should be extended to the literature which for some decades has dealt, in a broader sense, with the crucial issue of the choice of the discount rate in public projects or interventions with significant environmental effects. It must be traced back to economic–environmental studies but also to studies on financial tools for the treatment of the weighted discount rate.

Under the operative viewpoint, the main limits are summarized in the following bullet point:

Firstly, the application is implemented using simulated discount rates, and simulated technological development trends. The results obtained for aluminum and timber, respectively, are not comparable, being different from the assumptions (input data and starting conditions). Nevertheless, the work is useful to demonstrate that by using different discounting modalities, different results are obtainable.

Secondly, the simulation is applied to a solely technological component, and it must be implemented on a wider range of alternatives, covering different scales (building/component/system/material, etc.).

Thirdly, despite a certain simplicity in the calculation of quantitative results by means of the presented discounted modalities, it is worth mentioning the difficulty to identify the discount rate values, specifically in environmental contexts. This is mainly due to the poor availability of comparable cases at the time being and to the difficulty in generalizing the specific contexts in which the analysis must be developed.

Lastly, in order to provide, on the basis of this case study, practical indications for extending the methodology to other potential applicability contexts and scales: building, components, systems, and materials, the main limit consists of the effective availability of reliable data on the relevant costs and discount rates, selected case by case. The concrete applicability of the results of the present analysis to other cases is limited by the need to preliminarily verify the values relating to the rates adopted for the simulations.

Starting from the results of this work, and considering the limitations evidenced above, future research developments can be addressed. First of all, an application with verified input data and assumptions is necessary for supporting the interpretations and conclusions presented; then, an application on a case study at the building scale, in a private/public/PPP intervention context can potentially avail the effective applicability of the methodology.