Can the Dual-Credit Policy Help China’s New Energy Vehicle Industry Achieve Corner Overtaking?

Abstract

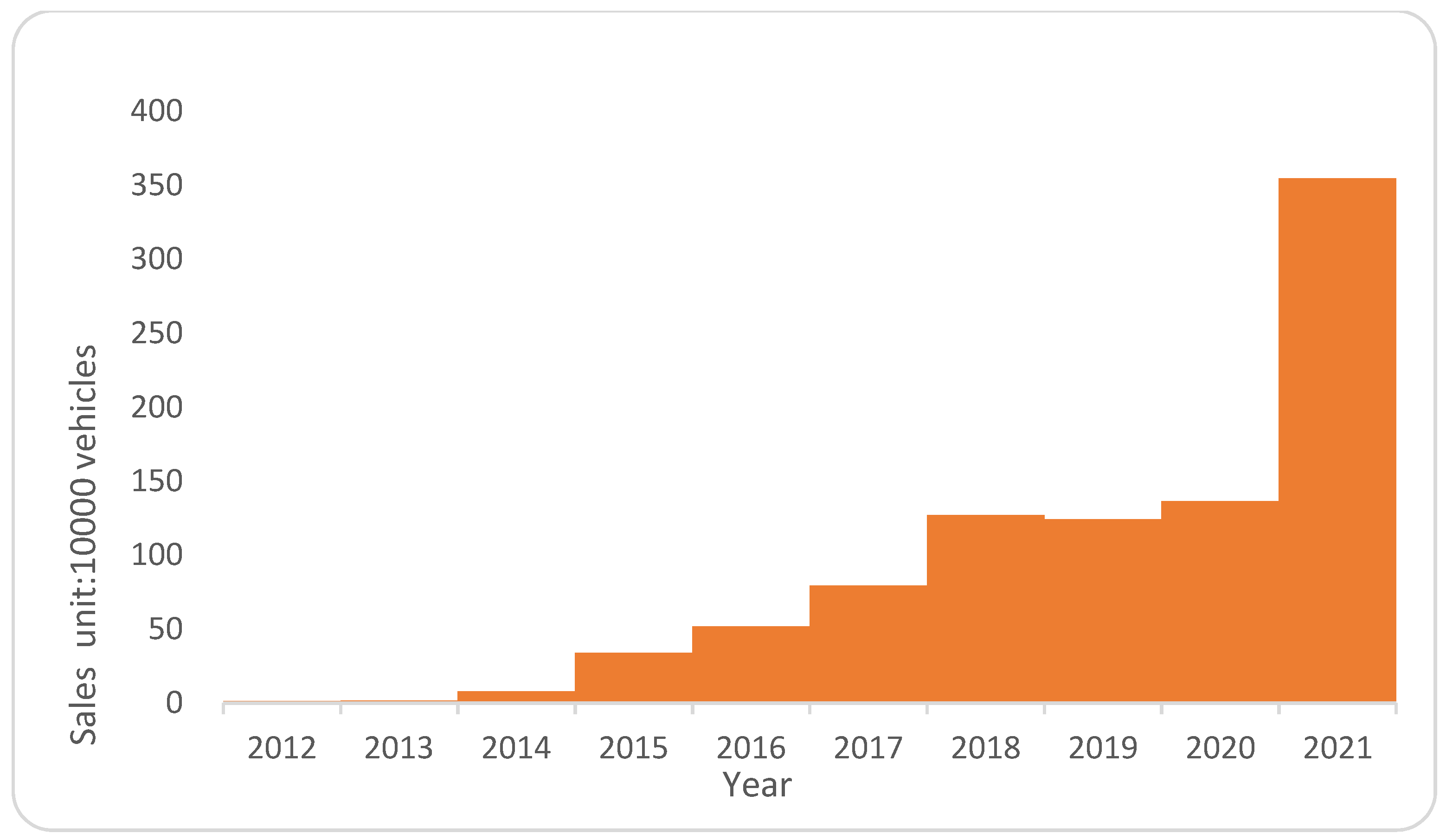

1. Introduction

2. Literature Review and Research Hypotheses

2.1. Literature Review

2.2. Research Hypotheses

3. Study Design

3.1. Sample Selection and Data Sources

3.2. Model and Variable Definitions

3.3. Descriptive Statistics

4. Results

4.1. Baseline Regression Results

4.2. Robustness Tests

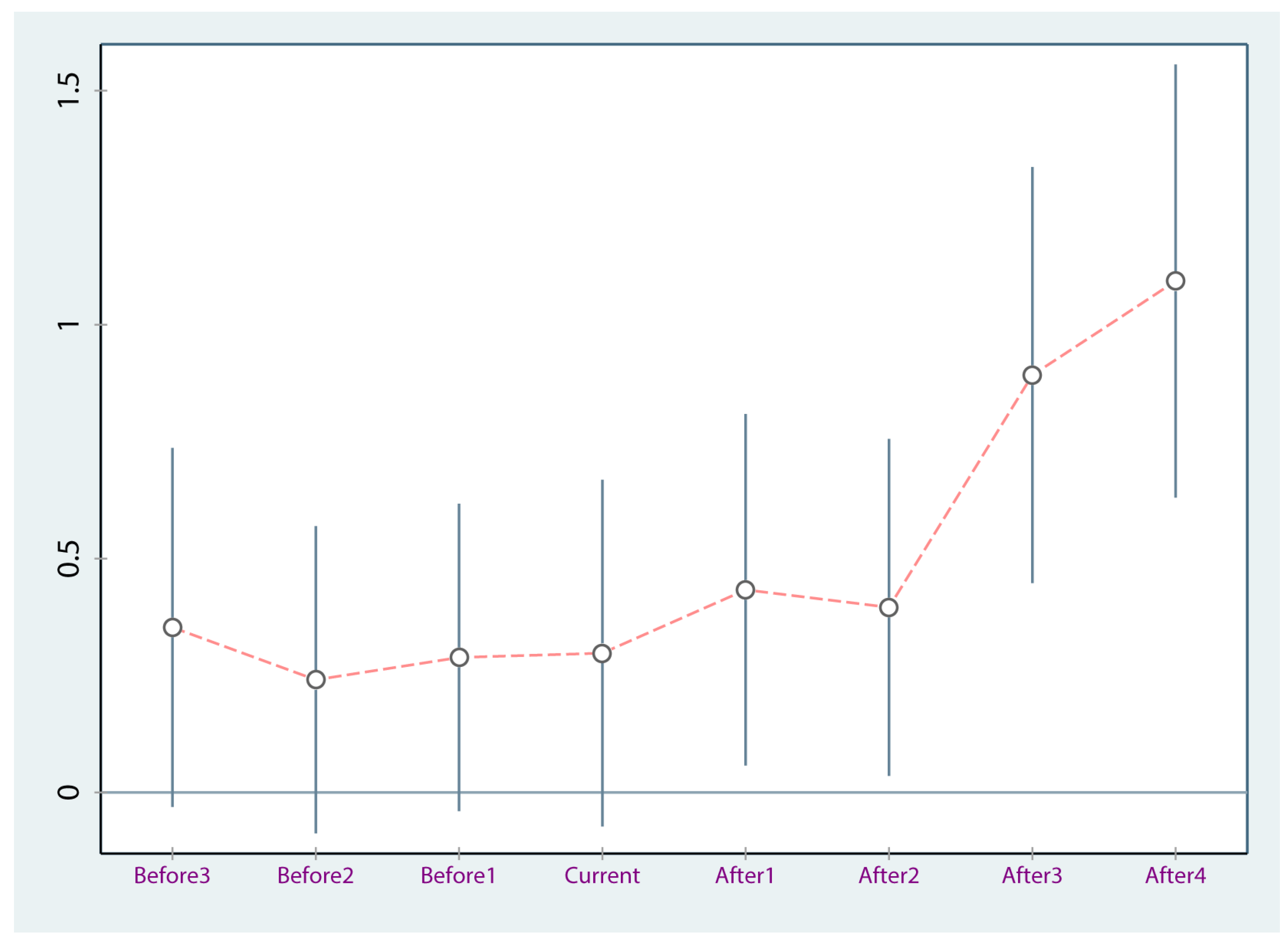

4.2.1. Parallel Trend Test

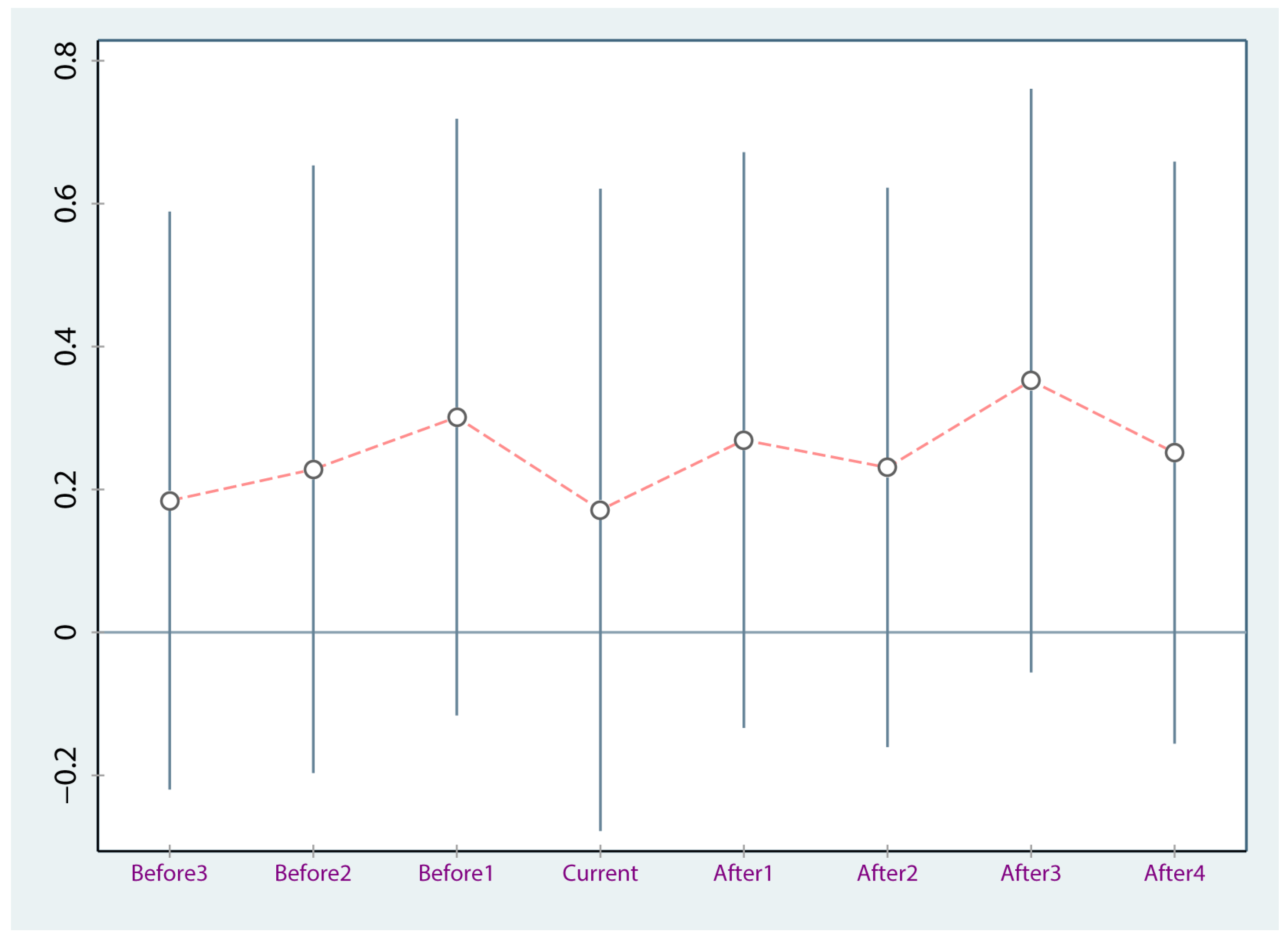

4.2.2. Placebo Test

4.3. Heterogeneity Analysis

4.3.1. Listed Companies of Domestic Automobiles

4.3.2. Jointly Listed Automotive Companies

4.3.3. Comparative Analysis of Domestic Automobile Companies and Joint Venture Automobile Companies

4.3.4. Parallel Trend Test

5. Mechanism Testing

5.1. Enterprise Market Expectation Mechanism

5.2. Market Competition Mechanism

6. Conclusions and Recommendations

6.1. Conclusions

6.2. Recommendations

6.2.1. Build a Dual Market Mechanism Based on the Trading of New Energy Vehicle Products and Regulated by the Double Credit Virtual Trading Market

6.2.2. Strengthening the Protection of the Domestic Automobile Industry

6.2.3. The Government Coordinates Scientific and Technological Resources to Provide Technical Support for the Development of New Energy Vehicles

6.2.4. Introduction of Wholly Foreign-Owned Enterprises

6.2.5. Incorporating a Wider Range of Vehicle Types into the Dual-Credit Policy System

6.2.6. Exploring Different New Energy Technology Points Assignment Methods

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Imran, M.; Jian, Z.; Haque, A.; Urbański, M.; Nair, S. Determinants of Firm’s Export Performance in China’s Automobile Industry. Sustainability 2018, 10, 4078. [Google Scholar] [CrossRef]

- Chen, Y.; Lin Lawell, C.Y.C.; Wang, Y. The Chinese automobile industry and government policy. Res. Transp. Econ. 2020, 84, 100849. [Google Scholar] [CrossRef]

- Li, Y.S.; Kong, X.X.; Zhang, M. Industrial upgrading in global production networks: The case of the Chinese automotive industry. Asia Pac. Bus. Rev. 2014, 22, 21–37. [Google Scholar] [CrossRef]

- Tian, G.; Chu, J.; Hu, H.; Li, H. Technology innovation system and its integrated structure for automotive components remanufacturing industry development in China. J. Clean. Prod. 2014, 85, 419–432. [Google Scholar] [CrossRef]

- Techakanjanakit, S.; Huang, M. The Strategic Transformation of Automobile Industry in China. Int. J. Financ. Res. 2012, 3, 8–16. [Google Scholar] [CrossRef]

- Yuan, X.; Liu, X.; Zuo, J. The development of new energy vehicles for a sustainable future: A review. Renew. Sustain. Energy Rev. 2015, 42, 298–305. [Google Scholar] [CrossRef]

- Ren, J. New energy vehicle in China for sustainable development: Analysis of success factors and strategic implications. Transp. Res. Part D Transp. Environ. 2018, 59, 268–288. [Google Scholar] [CrossRef]

- Manioudis, M.; Meramveliotakis, G. Broad strokes towards a grand theory in the analysis of sustainable development: A return to the classical political economy. New Political Econ. 2022, 27, 866–878. [Google Scholar] [CrossRef]

- Klarin, T. The Concept of Sustainable Development: From its Beginning to the Contemporary Issues. Zagreb Int. Rev. Econ. Bus. 2018, 21, 67–94. [Google Scholar] [CrossRef]

- Holland, S.P.; Mansur, E.T.; Yates, A.J. The electric vehicle transition and the economics of banning gasoline vehicles. Am. Econ. J. Econ. Policy 2021, 13, 316–344. [Google Scholar] [CrossRef]

- Wu, Q.; Sun, S. Energy and Environmental Impact of the Promotion of Battery Electric Vehicles in the Context of Banning Gasoline Vehicle Sales. Energies 2022, 15, 8388. [Google Scholar] [CrossRef]

- Gong, H.; Wang, M.Q.; Wang, H. New energy vehicles in China: Policies, demonstration, and progress. Mitig. Adapt. Strateg. Glob. Chang. 2012, 18, 207–228. [Google Scholar] [CrossRef]

- Zhang, X.; Bai, X. Incentive policies from 2006 to 2016 and new energy vehicle adoption in 2010–2020 in China. Renew. Sustain. Energy Rev. 2017, 70, 24–43. [Google Scholar] [CrossRef]

- Enderwick, P.; Buckley, P.J. The role of springboarding in economic catch-up: A theoretical perspective. J. Int. Manag. 2021, 27, 100832. [Google Scholar] [CrossRef]

- Lee, K.; Gao, X.; Li, X. Industrial catch-up in China: A sectoral systems of innovation perspective. Camb. J. Reg. Econ. Soc. 2016, 10, 59–76. [Google Scholar] [CrossRef]

- Malerba, F.; Lee, K. An evolutionary perspective on economic catch-up by latecomers. Ind. Corp. Chang. 2021, 30, 986–1010. [Google Scholar] [CrossRef]

- Asongu, S.A. Knowledge Economy Gaps, Policy Syndromes, and Catch-Up Strategies: Fresh South Korean Lessons to Africa. J. Knowl. Econ. 2015, 8, 211–253. [Google Scholar] [CrossRef]

- Lee, K.; Malerba, F. Catch-up cycles and changes in industrial leadership:Windows of opportunity and responses of firms and countries in the evolution of sectoral systems. Res. Policy 2017, 46, 338–351. [Google Scholar] [CrossRef]

- Li, D.; Capone, G.; Malerba, F. The long march to catch-up: A history-friendly model of China’s mobile communications industry. Res. Policy 2019, 48, 649–664. [Google Scholar] [CrossRef]

- Yu, F.; Wang, L.; Li, X. The effects of government subsidies on new energy vehicle enterprises: The moderating role of intelligent transformation. Energy Policy 2020, 141, 111463. [Google Scholar] [CrossRef]

- Liu, W.; Yi, H. What affects the diffusion of new energy vehicles financial subsidy policy? Evidence from Chinese cities. Int. J. Environ. Res. Public Health 2020, 17, 726. [Google Scholar] [CrossRef]

- Yu, Y.; Zhou, D.; Zha, D.; Wang, Q.; Zhu, Q. Optimal production and pricing strategies in auto supply chain when dual credit policy is substituted for subsidy policy. Energy 2021, 226, 120369. [Google Scholar] [CrossRef]

- Li, Y.; Zhang, Q.; Li, H.; Tang, Y.; Liu, B. The impact of dual-credit scheme on the development of the new energy vehicle industry. Energy Procedia 2019, 158, 4311–4317. [Google Scholar] [CrossRef]

- Liu, C.; Liu, Y.; Zhang, D.; Xie, C. The capital market responses to new energy vehicle (NEV) subsidies: An event study on China. Energy Econ. 2022, 105, 105677. [Google Scholar] [CrossRef]

- Wang, X.; Li, Z.; Shaikh, R.; Ranjha, A.R.; Batala, L.K. Do government subsidies promote financial performance? Fresh evidence from China’s new energy vehicle industry. Sustain. Prod. Consum. 2021, 28, 142–153. [Google Scholar] [CrossRef]

- Li, J.; Ku, Y.; Li, L.; Liu, C.; Deng, X. Optimal channel strategy for obtaining new energy vehicle credits under dual credit policy: Purchase, self-produce, or both? J. Clean. Prod. 2022, 342, 130852. [Google Scholar] [CrossRef]

- Yu, L.; Jiang, X.; He, Y.; Jiao, Y. Promoting the Diffusion of New Energy Vehicles under Dual Credit Policy: Asymmetric Competition and Cooperation in Complex Network. Energies 2022, 15, 5361. [Google Scholar] [CrossRef]

- Wang, Z.; Zhao, C.; Yin, J.; Zhang, B. Purchasing intentions of Chinese citizens on new energy vehicles: How should one respond to current preferential policy? J. Clean. Prod. 2017, 161, 1000–1010. [Google Scholar] [CrossRef]

- Zhao, D.; Ji, S.; Wang, H.; Jiang, L. How do government subsidies promote new energy vehicle diffusion in the complex network context? A three-stage evolutionary game model. Energy 2021, 230, 120899. [Google Scholar] [CrossRef]

- Li, J.; Zhou, Y.; Yu, D.; Liu, C. Consumers’ Purchase Intention of New Energy Vehicles: Do Product-Life-Cycle Policy Portfolios Matter? Sustainability 2020, 12, 1711. [Google Scholar] [CrossRef]

- Yao, X.; Ma, S.; Bai, Y.; Jia, N. When are new energy vehicle incentives effective? Empirical evidence from 88 pilot cities in China. Transp. Res. Part A Policy Pract. 2022, 165, 207–224. [Google Scholar] [CrossRef]

- Yu, P.; Zhang, J.; Yang, D.; Lin, X.; Xu, T. The evolution of China’s new energy vehicle industry from the perspective of a technology–market–policy framework. Sustainability 2019, 11, 1711. [Google Scholar] [CrossRef]

- Jiang, C.; Zhang, Y.; Bu, M.; Liu, W. The effectiveness of government subsidies on manufacturing innovation: Evidence from the new energy vehicle industry in China. Sustainability 2018, 10, 1692. [Google Scholar] [CrossRef]

- Qin, S.; Xiong, Y. Differential impact of subsidised and nonsubsidized policies on the innovation of new energy vehicle enterprises: Evidence from China. Asian J. Technol. Innov. 2022, 1–24. [Google Scholar] [CrossRef]

- Dong, F.; Zheng, L. The impact of market-incentive environmental regulation on the development of the new energy vehicle industry: A quasi-natural experiment based on China’s dual-credit policy. Env. Sci. Pollut. Res. Int. 2022, 29, 5863–5880. [Google Scholar] [CrossRef]

- Li, J.; Ku, Y.; Yu, Y.; Liu, C.; Zhou, Y. Optimizing production of new energy vehicles with across-chain cooperation under China’s dual credit policy. Energy 2020, 194, 116832. [Google Scholar] [CrossRef]

- Wu, Y.A.; Ng, A.W.; Yu, Z.; Huang, J.; Meng, K.; Dong, Z.Y. A review of evolutionary policy incentives for sustainable development of electric vehicles in China: Strategic implications. Energy Policy 2021, 148, 111983. [Google Scholar] [CrossRef]

- Van Tuijl, E.; Carvalho, L.; Dittrich, K. Beyond the joint-venture: Knowledge sourcing in Chinese automotive events. Ind. Innov. 2018, 25, 389–407. [Google Scholar] [CrossRef]

- Peng, L.; Li, Y.; Yu, H. Effects of Dual Credit Policy and Consumer Preferences on Production Decisions in Automobile Supply Chain. Sustainability 2021, 13, 5821. [Google Scholar] [CrossRef]

- Jin, J.; Jia, S.; Wang, J.; Li, Y. Development Strategy of New Energy Business for Traditional Car Manufacturers under the Dual-Credit Policy. Technol. Invest. 2022, 13, 121–143. [Google Scholar] [CrossRef]

- Wang, Z.; Li, X. Demand Subsidy versus Production Regulation: Development of New Energy Vehicles in a Competitive Environment. Mathematics 2021, 9, 1280. [Google Scholar] [CrossRef]

- Ye, R.-K.; Gao, Z.-F.; Fang, K.; Liu, K.-L.; Chen, J.-W. Moving from subsidy stimulation to endogenous development: A system dynamics analysis of China’s NEVs in the post-subsidy era. Technol. Forecast. Soc. Chang. 2021, 168, 120757. [Google Scholar] [CrossRef]

| Experimental Group of Car Companies (Stock Code) | Control Group Car Companies (Stock Code) |

|---|---|

| Jianghua Automobile (600418) BYD (002594) Haima Automobile (000572) Great Wall Motor (601633) Lifan Technology (601777) Dongfeng Automobile (600006) SAIC (600104) GAC (601238) Changan Automobile (000625) Jiangling Automobile (000550) | Jinlong Motor (600686) Yutong Bus (600066) Ankai Bus (000868) Yaxing Bus (600213) Zhongtong Bus (000957) Shuguang Stock (600303) Foton Motor (600166) |

| Type | Indicator | Specific Indicator | Definition |

|---|---|---|---|

| Explained variables | Corporate Performance | CP | Tobin’s Q |

| Explanatory variables | Policy Variables | DID | Time × Treated |

| Control variables | Firm Age | Age | Take logarithm of business registration time for enterprises |

| Enterprise Size | Size | Logarithmic value of total assets | |

| Capital Structure | Lev | Balance sheet ratio | |

| Profitability | Roe | Corporate Return on Net Assets | |

| Government Subsidies | Subsidies | Government grants/Operating income | |

| Tax Preference | Tax preference | (Various taxes and fees paid by enterprises—Tax refunds)/Business income |

| VARIABLE | N | Mean | Sd | Min | Max |

|---|---|---|---|---|---|

| CP | 204 | 1.372 | 0.465 | 0.747 | 5.548 |

| Age | 204 | 2.946 | 0.248 | 2.197 | 3.611 |

| Size | 204 | 14.75 | 1.364 | 11.28 | 18.34 |

| Lev | 204 | 0.625 | 0.147 | 0.301 | 0.975 |

| Roe | 204 | 0.0634 | 0.235 | −1.658 | 0.638 |

| Subsidies | 204 | 0.0113 | 0.0157 | 0 | 0.161 |

| Tax preference | 204 | 0.0297 | 0.0341 | −0.0522 | 0.115 |

| VARIABLE | CP | |||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| DID | 0.325 *** | 0.370 *** | ||

| (0.104) | (0.112) | |||

| DID2018 | 0.222 | 0.247 * | ||

| (0.138) | (0.134) | |||

| DID2019 | 0.184 | 0.210 | ||

| (0.134) | (0.135) | |||

| DID2020 | 0.493 *** | 0.653 *** | ||

| (0.157) | (0.196) | |||

| DID2021 | 0.543 *** | 0.666 *** | ||

| (0.195) | (0.188) | |||

| Age | 0.227 | 0.118 | ||

| (1.272) | (1.285) | |||

| Size | −0.283 ** | −0.342 *** | ||

| (0.123) | (0.121) | |||

| Lev | −0.022 | −0.009 | ||

| (0.505) | (0.512) | |||

| Roe | −0.033 | −0.108 | ||

| (0.168) | (0.147) | |||

| Subsidies | −2.778 ** | −1.805 | ||

| (1.400) | (1.268) | |||

| Tax preference | 3.766 ** | 4.845 ** | ||

| (1.879) | (1.932) | |||

| _cons | 2.004 *** | 4.934 | 1.995 *** | 5.906 |

| (0.220) | (4.769) | (0.217) | (4.737) | |

| Enterprise fixed | YES | YES | YES | YES |

| Year fixed | YES | YES | YES | YES |

| N | 204 | 204 | 204 | 204 |

| R2 | 0.499 | 0.543 | 0.512 | 0.566 |

| VARIABLE | Sales | |||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| DID | 4.790 *** | 4.680 *** | ||

| (0.419) | (0.417) | |||

| DID2018 | 4.486 *** | 4.482 *** | ||

| (0.573) | (0.586) | |||

| DID2019 | 4.186 *** | 4.054 *** | ||

| (0.606) | (0.641) | |||

| DID2020 | 4.284 *** | 3.944 *** | ||

| (0.709) | (0.687) | |||

| DID2021 | 4.961 *** | 4.846 *** | ||

| (0.730) | (0.709) | |||

| Age | −4.664 | −4.325 | ||

| (4.794) | (5.091) | |||

| Size | 0.542 | 0.364 | ||

| (0.425) | (0.448) | |||

| Lev | 3.449 ** | 3.329 * | ||

| (1.650) | (1.726) | |||

| Roe | 0.365 | 0.159 | ||

| (0.388) | (0.402) | |||

| Subsidies | −1.630 | 1.662 | ||

| (6.902) | (7.709) | |||

| Tax preference | −13.058 | −12.642 | ||

| (9.598) | (10.404) | |||

| _cons | 3.949 *** | 6.782 | 3.653 *** | 7.879 |

| (0.486) | (13.502) | (0.568) | (13.978) | |

| Enterprise fixed | YES | YES | YES | YES |

| Year fixed | YES | YES | YES | YES |

| N | 204 | 204 | 204 | 204 |

| R2 | 0.829 | 0.838 | 0.811 | 0.819 |

| VARIABLE | CP | |||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| DID | 0.496 *** | 0.566 *** | ||

| (0.116) | (0.157) | |||

| DID2018 | 0.286 * | 0.353 ** | ||

| (0.147) | (0.175) | |||

| DID2019 | 0.248 * | 0.235 | ||

| (0.137) | (0.160) | |||

| DID2020 | 0.745 *** | 0.941 *** | ||

| (0.188) | (0.262) | |||

| DID2021 | 0.946 *** | 1.103 *** | ||

| (0.199) | (0.200) | |||

| Age | −0.032 | −0.170 | ||

| (2.348) | (2.146) | |||

| Size | −0.266 ** | −0.339 *** | ||

| (0.116) | (0.103) | |||

| Lev | 0.206 | 0.389 | ||

| (0.563) | (0.569) | |||

| Roe | −0.033 | −0.130 | ||

| (0.184) | (0.168) | |||

| Subsidies | −3.226 ** | −2.419 * | ||

| (1.613) | (1.396) | |||

| Tax preference | 3.829 | 5.289 * | ||

| (2.838) | (2.735) | |||

| _cons | 2.083 *** | 5.275 | 2.074 *** | 6.363 |

| (0.284) | (6.918) | (0.284) | (6.403) | |

| Enterprise fixed | YES | YES | YES | YES |

| Year fixed | YES | YES | YES | YES |

| N | 144 | 144 | 144 | 144 |

| R2 | 0.542 | 0.576 | 0.578 | 0.627 |

| CP | ||||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| DID | 0.153 | 0.187 * | ||

| (0.111) | (0.104) | |||

| DID2018 | 0.159 | 0.118 | ||

| (0.159) | (0.120) | |||

| DID2019 | 0.120 | 0.180 | ||

| (0.152) | (0.152) | |||

| DID2020 | 0.242 | 0.452 ** | ||

| (0.163) | (0.204) | |||

| DID2021 | 0.141 | 0.313 * | ||

| (0.162) | (0.170) | |||

| Age | −2.534 | −2.597 | ||

| (1.584) | (1.632) | |||

| Size | −0.478 *** | −0.517 *** | ||

| (0.153) | (0.164) | |||

| Lev | −0.046 | −0.097 | ||

| (0.681) | (0.693) | |||

| Roe | −0.108 | −0.144 | ||

| (0.165) | (0.150) | |||

| Subsidies | −2.192 * | −1.597 | ||

| (1.267) | (1.259) | |||

| Tax preference | 6.659 *** | 7.476 *** | ||

| (2.342) | (2.514) | |||

| _cons | 2.120 *** | 14.571 ** | 2.117 *** | 15.237 ** |

| (0.285) | (6.251) | (0.286) | (6.503) | |

| Enterprise fixed | YES | YES | YES | YES |

| Year fixed | YES | YES | YES | YES |

| N | 144 | 144 | 144 | 144 |

| R2 | 0.527 | 0.629 | 0.528 | 0.639 |

| Full Sample | Domestic Automobile Company | Joint Venture Automobile Company | ||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| DID | 0.079 | 0.164 | 0.261 ** | 0.333 * | 0.041 | 0.237 * |

| (0.094) | (0.114) | (0.131) | (0.200) | (0.117) | (0.124) | |

| DID_Expectation | 1.390 *** | 1.218 *** | 1.091 *** | 0.987 *** | 0.418 | −0.731 |

| (0.398) | (0.313) | (0.408) | (0.332) | (0.914) | (0.841) | |

| Expectation | −0.785 ** | −0.470 * | −0.774 ** | −0.484 | −0.746 ** | 0.062 |

| (0.371) | (0.273) | (0.364) | (0.315) | (0.376) | (0.230) | |

| Age | 0.367 | 0.365 | −2.522 | |||

| (1.272) | (2.618) | (1.611) | ||||

| Size | −0.219 * | −0.228 ** | −0.497 *** | |||

| (0.119) | (0.106) | (0.169) | ||||

| Lev | 0.213 | 0.397 | −0.050 | |||

| (0.511) | (0.599) | (0.693) | ||||

| Roe | −0.016 | −0.010 | −0.109 | |||

| (0.172) | (0.185) | (0.167) | ||||

| Subsidies | −2.375 * | −2.676 * | −2.316 * | |||

| (1.285) | (1.528) | (1.339) | ||||

| Tax preference | 4.766 ** | 4.529 | 6.430 *** | |||

| (1.885) | (2.744) | (2.406) | ||||

| _cons | 2.115 *** | 3.645 | 2.178 *** | 3.682 | 2.215 *** | 14.776 ** |

| (0.255) | (4.787) | (0.312) | (7.555) | (0.315) | (6.490) | |

| Enterprise fixed | YES | YES | YES | YES | YES | YES |

| Year fixed | YES | YES | YES | YES | YES | YES |

| N | 204 | 204 | 144 | 144 | 144 | 144 |

| R2 | 0.533 | 0.567 | 0.565 | 0.589 | 0.545 | 0.629 |

| Full Sample | Domestic Automobile Company | Joint Venture Automobile Company | ||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| DID | 0.307 *** | 0.260 ** | 0.410 *** | 0.372 ** | 0.172 | 0.276 |

| (0.114) | (0.131) | (0.124) | (0.167) | (0.136) | (0.177) | |

| DID_Market | 0.987 | 2.557 *** | 1.446 | 2.946 ** | 1.046 | −0.703 |

| (0.785) | (0.909) | (0.991) | (1.225) | (1.057) | (1.751) | |

| Market | −0.604 | −0.457 | 0.503 | 0.571 | −0.962 | −0.789 |

| (0.472) | (0.585) | (0.534) | (0.529) | (0.847) | (0.878) | |

| Age | 1.149 | 1.033 | −3.392 | |||

| (1.530) | (2.363) | (2.538) | ||||

| Size | −0.352 *** | −0.363 *** | −0.470 *** | |||

| (0.115) | (0.117) | (0.150) | ||||

| Lev | −0.018 | 0.233 | −0.010 | |||

| (0.501) | (0.565) | (0.646) | ||||

| Roe | −0.037 | −0.041 | −0.111 | |||

| (0.166) | (0.186) | (0.162) | ||||

| Subsidies | −2.887 ** | −3.311 * | −1.980 | |||

| (1.403) | (1.685) | (1.236) | ||||

| Tax preference | 3.322 * | 2.979 | 7.002 *** | |||

| (1.962) | (2.828) | (2.572) | ||||

| _cons | 2.015 *** | 3.430 | 2.075 *** | 3.722 | 2.137 *** | 16.659 * |

| (0.223) | (5.257) | (0.288) | (6.916) | (0.291) | (8.590) | |

| Enterprise fixed | YES | YES | YES | YES | YES | YES |

| Year fixed | YES | YES | YES | YES | YES | YES |

| N | 204 | 204 | 144 | 144 | 144 | 144 |

| R2 | 0.501 | 0.553 | 0.547 | 0.588 | 0.529 | 0.631 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, Y.; Zhang, L.; Liu, J.; Qiao, X. Can the Dual-Credit Policy Help China’s New Energy Vehicle Industry Achieve Corner Overtaking? Sustainability 2023, 15, 2406. https://doi.org/10.3390/su15032406

Li Y, Zhang L, Liu J, Qiao X. Can the Dual-Credit Policy Help China’s New Energy Vehicle Industry Achieve Corner Overtaking? Sustainability. 2023; 15(3):2406. https://doi.org/10.3390/su15032406

Chicago/Turabian StyleLi, Yuchao, Lijie Zhang, Jiamin Liu, and Xinpei Qiao. 2023. "Can the Dual-Credit Policy Help China’s New Energy Vehicle Industry Achieve Corner Overtaking?" Sustainability 15, no. 3: 2406. https://doi.org/10.3390/su15032406

APA StyleLi, Y., Zhang, L., Liu, J., & Qiao, X. (2023). Can the Dual-Credit Policy Help China’s New Energy Vehicle Industry Achieve Corner Overtaking? Sustainability, 15(3), 2406. https://doi.org/10.3390/su15032406