The Impact of Digital Transformation on Corporate Sustainability: Evidence from Listed Companies in China

Abstract

1. Introduction

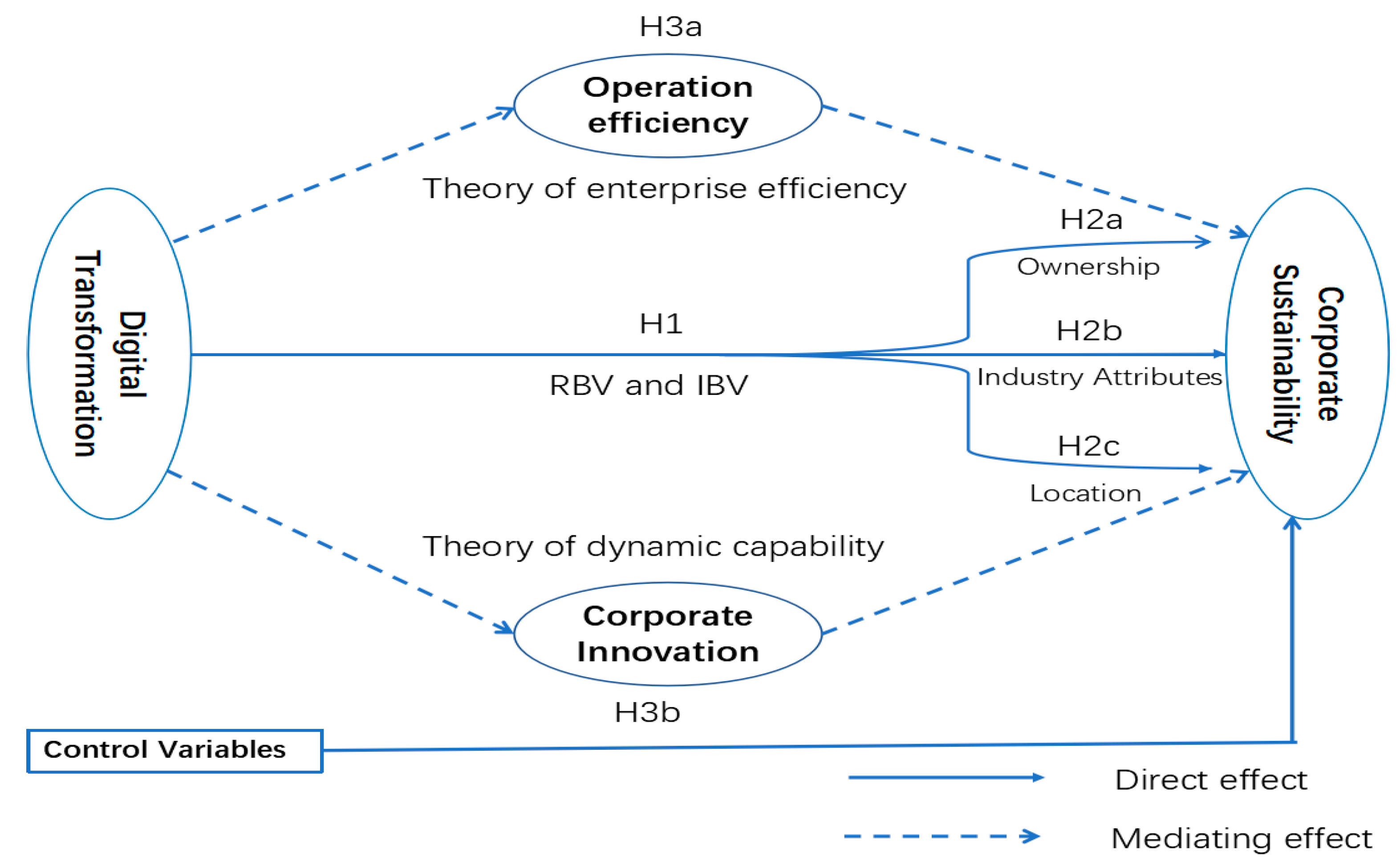

2. Literature Review and Hypothesis Development

2.1. Digital Transformation and Corporate Sustainability

2.2. The Heterogeneous Impact of Digital Transformation on Corporate Sustainability

2.3. The Mechanism of Digital Transformation Impacting Corporate Sustainability

3. Data, Variables and Models

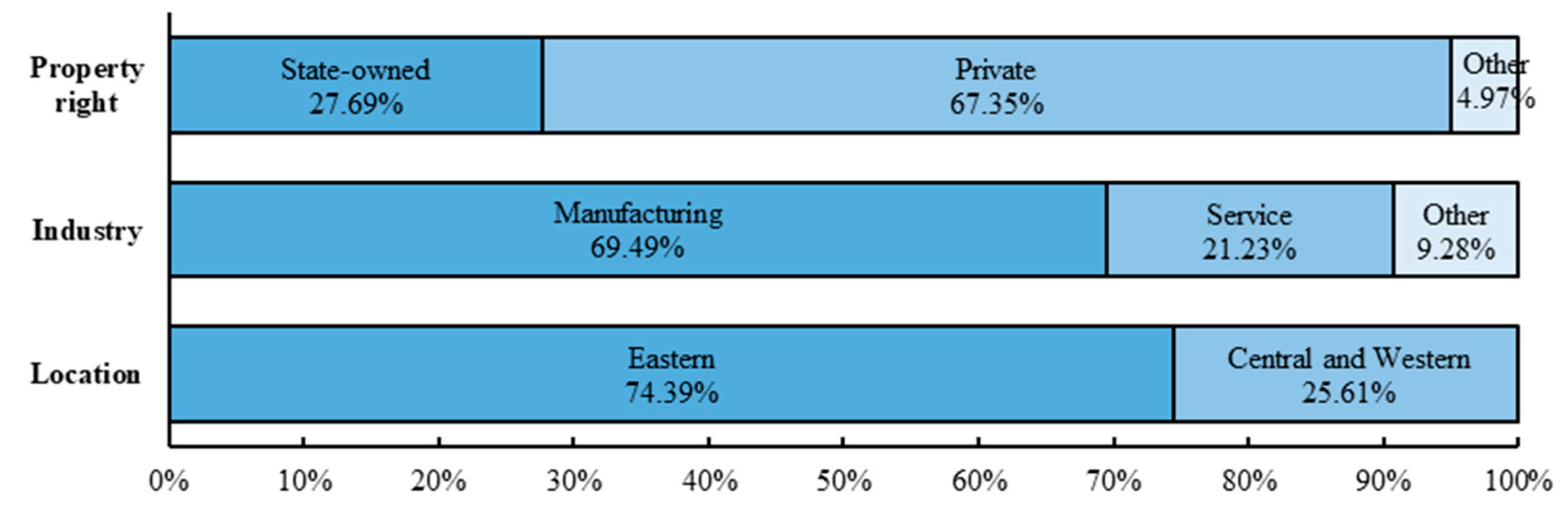

3.1. Data and Sample

3.2. Variable Description

3.2.1. Corporate Sustainability

3.2.2. Digital Transformation

3.2.3. Mediator Variable

3.2.4. Control Variables

3.3. Regression Models

4. Estimation and Analysis

4.1. Benchmark Regression Results

4.2. Robustness Test for Endogeneity

4.2.1. Robustness Test with 2SLS

4.2.2. Robustness Checks with Variable Replacement, Changing Period and Heckman Two-stage Estimation

4.3. Heterogeneity

5. Further Discussions on Mediating Effect

6. Implications and Discussion

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- ElMassah, S.; Mohieldin, M. Digital transformation and localizing the sustainable development goals (SDGs). Ecolog. Econ. 2020, 169, 106490. [Google Scholar] [CrossRef]

- Zhang, X.; Yang, T.; Wang, C.; Wan, G.H. Digital finance and household consumption: Theory and evidence from China. Manage. World 2020, 36, 48–63. [Google Scholar]

- Feliciano-Cestero, M.M.; Ameen, N.; Kotabe, M.; Paul, J.; Signoret, M. Is digital transformation threatened? A systematic literature review of the factors influencing firms’ digital transformation and internationalization. J. Bus. Res. 2023, 157, 113546. [Google Scholar] [CrossRef]

- Gaglio, C.; Kraemer-Mbula, E.; Lorenz, E. The effects of digital transformation on innovation and productivity: Firm-level evidence of South African manufacturing micro and small enterprises. Technol. Soc. Change 2022, 182, 121785. [Google Scholar] [CrossRef]

- Baumgartner, R.J.; Ebner, D. Corporate sustainability strategies: Sustainability profiles and maturity levels. Sustain. Dev. 2010, 18, 76–89. [Google Scholar] [CrossRef]

- Baumgartner, R.J.; Rauter, R. Strategic perspectives of corporate sustainability management to develop a sustainable organization. J. Clean Prod. 2017, 140, 81–92. [Google Scholar] [CrossRef]

- Klimek, D. Sustainable enterprise capital management. Economies 2020, 8, 12. [Google Scholar] [CrossRef]

- Cheng, G.; Long, W. Urban sustainable development capability in the Silk Road economic belt and its influencing factors—An empirical test based on the super-efficiency DEA-Panel Tobit Model. East Chin. Econ. Manag. 2017, 31, 35–43. [Google Scholar]

- Liu, J.; Zhao, Y.; Lin, T.; Xing, L.; Lin, M.; Sun, C.; Zeng, Z.; Zhang, G. Analysis of sustainability of Chinese cities based on network big data of city rankings. Ecol. Indic. 2021, 133, 108374. [Google Scholar] [CrossRef]

- Sun, Y.; Tang, X. The impact of digital inclusive finance on sustainable economic growth in China. Financ. Res. Lett. 2022, 50, 103234. [Google Scholar] [CrossRef]

- Johnson, M.P.; Schaltegger, S. Two decades of sustainability management tools for SMEs: How far have we come? J. Small Bus. Manag. 2016, 54, 481–505. [Google Scholar] [CrossRef]

- Jiang, Q.; Liu, Z.; Liu, W.; Li, T.; Cong, W.; Zhang, H.; Shi, J. A principal component analysis based three-dimensional sustainability assessment model to evaluate corporate sustainable performance. J. Clean Prod. 2018, 187, 625–637. [Google Scholar] [CrossRef]

- Pranugrahaning, A.; Donovan, J.D.; Topple, C.; Masli, E.K. Corporate sustainability assessments: A systematic literature review and conceptual framework. J. Clean Prod. 2021, 295, 126385. [Google Scholar] [CrossRef]

- Mani, V.; Jabbour, C.J.C.; Mani, K.T. Supply chain social sustainability in small and medium manufacturing enterprises and firms’ performance: Empirical evidence from an emerging Asian economy. Int. J. Product. Econ. 2020, 227, 107656. [Google Scholar] [CrossRef]

- Klimek, D.; Jędrych, E. A Model for the Sustainable Management of Enterprise Capital. Sustainability 2021, 13, 183. [Google Scholar] [CrossRef]

- Amini, M.; Bienstock, C.C. Corporate sustainability: An integrative definition and framework to evaluate corporate practice and guide academic research. J. Clean Prod. 2014, 76, 12–19. [Google Scholar] [CrossRef]

- Su, Y.; Yu, Y.Q.; Li, D. Research on the influence of enterprise innovation ability on sustainable development ability: Based on the regulatory role of government subsidies. East Chin. Econ. Manag. 2018, 32, 112–117. [Google Scholar]

- Wu, L.; Sun, L.; Chang, Q.; Zhang, D.; Qi, P. How do digitalization capabilities enable open innovation in manufacturing enterprises? A multiple case study based on resource integration perspective. Technol. Soc. Change 2022, 184, 122019. [Google Scholar] [CrossRef]

- Ludwig, P.; Sassen, R. Which internal corporate governance mechanisms drive corporate sustainability? J. Environ. Manage. 2022, 301, 113780. [Google Scholar] [CrossRef]

- Li, M.; Jia, S. Resource orchestration for innovation: The dual role of information technology. Tech. Anal. Strateg. Manage. 2018, 30, 1136–1147. [Google Scholar] [CrossRef]

- Barney, J. Firm resources and sustained competitive advantage. J. Manage. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Xie, K.; Xia, Z.; Xiao, J. The enterprise realization mechanism of big data becoming a real production factor: From the product innovation perspective. Chin. Ind. Econ. 2020, 5, 42–60. [Google Scholar]

- Wu, H. Analysis of digital capital: Structural characteristics and movement path. Economist 2021, 3, 44–51. [Google Scholar]

- Chaudhuri, A.; Subramanian, N.; Dora, M. Circular economy and digital capabilities of SMEs for providing value to customers: Combined resource-based view and ambidexterity perspective. J. Bus. Res. 2022, 142, 32–44. [Google Scholar] [CrossRef]

- Mikalef, P.; Pateli, A. Information technology-enabled dynamic capabilities and their indirect effect on competitive performance: Findings from PLS-SEM and fsQCA. J. Bus. Res. 2017, 70, 1–16. [Google Scholar] [CrossRef]

- Frynas, J.G.; Mol, M.J.; Mellahi, K. Management innovation made in China: Haier’s Rendanheyi. Calif. Manage. Rev. 2018, 61, 71–93. [Google Scholar] [CrossRef]

- Swaminathan, A.; Meffert, J. Digital @ Scale: The Playbook You Need to Transform Your Company; John Wiley & Sons: Hoboken, NJ, USA, 2017. [Google Scholar]

- Patnaik, S.; Munjal, S.; Varma, A.; Sinha, S. Extending the resource-based view through the lens of the institution-based view: A longitudinal case study of an Indian higher educational institution. J. Bus. Res. 2022, 147, 124–141. [Google Scholar] [CrossRef]

- Shi, Y.P.; Wang, Y.; Zhang, W.T. Digital transformation of enterprises in China: Current situation, problems and prospects. Economist 2021, 12, 90–97. [Google Scholar]

- Teece, D.J. Profiting from innovation in the digital economy: Enabling technologies, standards, and licensing models in the wireless world. Res. Pol. 2018, 47, 1367–1387. [Google Scholar] [CrossRef]

- Mourtzis, D.; Doukas, M.; Psarommatis, F.; Giannoulis, C.; Michalos, G. A web-based platform for mass customisation and personalisation. CIRP J. Manuf. Sci. Technol. 2014, 7, 112–128. [Google Scholar] [CrossRef]

- Malone, T.W.; Yates, J.; Benjamin, R.I. Electronic markets and electronic hierarchies. Commun. ACM 1987, 30, 484–497. [Google Scholar] [CrossRef]

- Matt, C.; Hess, T.; Benlian, A.J. Digital transformation strategies. Bus. Inf. Syst. Eng. 2015, 57, 339–343. [Google Scholar] [CrossRef]

- Maung, M.; Wilson, C.; Tang, X. Political connections and industrial pollution: Evidence based on state ownership and environmental levies in China. J. Bus. Ethics 2016, 138, 649–659. [Google Scholar] [CrossRef]

- Li, X.; Chan, C.G.-W. Who pollutes? Ownership type and environmental performance of Chinese firms. J. Contemp. China 2016, 25, 248–263. [Google Scholar] [CrossRef]

- Yao, Y.; Zhang, Q. An analysis of technological efficiency of Chinese industrial firm. Econ. Res. J. 2001, 10, 13–19. [Google Scholar]

- Lin, Y.F.; Liu, M.X.; Zhang, Q. Policy burdens and soft budget constraints of firms: An empirical study from China. Manage. World 2004, 8, 127–156. [Google Scholar]

- Allen, F.; Qian, J.; Qian, M. Law, finance, and economic growth in China. J. Finan. Econ. 2005, 77, 57–116. [Google Scholar] [CrossRef]

- Shen, H.; Yu, P.; Wu, L. State ownership, environment uncertainty and investment efficiency. J. Econ. Res. 2012, 7, 113–126. [Google Scholar]

- Pareliussen, J.; Mosiashvili, N. Digital Technology Adoption, Productivity Gains in Adopting Firms and Sectoral Spill-Overs: Firm-Level Evidence from Estonia; OECD Economics Department Working Papers; OECD: Paris, France, 2020. [Google Scholar]

- Ni, K.; Liu, X. Digital Transformation and Enterprise Growth: Theoretical Logic and Chinese Practice. Sci. Manage. Res. 2021, 43, 79–97. [Google Scholar]

- Ghosh, S.; Hughes, M.; Hodgkinson, I.; Hughes, P. Digital transformation of industrial businesses: A dynamic capability approach. Technovation 2022, 113, 102414. [Google Scholar] [CrossRef]

- Song, Z.; Wang, C.; Bergmann, L. China’s prefectural digital divide: Spatial analysis and multivariate determinants of ICT diffusion. Int. J. Inf. Manage. 2020, 52, 102072. [Google Scholar] [CrossRef]

- Li, X.; Shao, X.; Chang, T.; Albu, L.L. Does digital finance promote the green innovation of China’s listed companies? Energy Econ. 2022, 114, 106254. [Google Scholar] [CrossRef]

- Lin, Q.S.; Li, S. The theory of enterprise efficiency and the efficiency of Chinese enterprises. Econ. Res. J. 1996, 7, 73–80. [Google Scholar]

- Gölzer, P.; Fritzsche, A. Data-driven operations management: Organisational implications of the digital transformation in industrial practice. Prod. Plan Control. 2017, 28, 1332–1343. [Google Scholar] [CrossRef]

- Fernandez, Z.; Nieto, M.J. The internet: Competitive strategy and boundaries of the firm. Int. J. Technol. Manage. 2006, 35, 182–195. [Google Scholar] [CrossRef]

- Vial, G. Understanding digital transformation: A review and a research agenda. In Managing Digital Transformation: Understanding the Strategic Process, 1st ed.; Hinterhuber, A., Vescovi, T., Checchinato, F., Eds.; Routledge: London, UK, 2021; pp. 13–66. [Google Scholar]

- Westerman, G.; Bonnet, D.; McAfee, A. The nine elements of digital transformation. MIT Sloan Manag. Rev. 2014, 55, 1–6. [Google Scholar]

- Ferreira, J.J.; Fernandes, C.I.; Ferreira, F.A. To be or not to be digital, that is the question: Firm innovation and performance. J. Bus. Res. 2019, 101, 583–590. [Google Scholar] [CrossRef]

- Cheng, L. A study on innovation mechanism of enterprise value network from the perspective of the internet economy. Chin. Ind. Econ. 2013, 9, 82–94. [Google Scholar]

- Cockburn, I.M.; Henderson, R.; Stern, S. The Impact of Artificial Intelligence on Innovation: An Exploratory Analysis. In The Economics of Artificial Intelligence; University of Chicago Press: Chicago, IL, USA, 2019; pp. 115–148. [Google Scholar]

- Holmstrom, B. Agency costs and innovation. J. Econ. Behav. Organ. 1989, 12, 305–327. [Google Scholar] [CrossRef]

- Brynjolfsson, E.; Mitchell, T. What can machine learning do? Workforce implications. Science 2017, 358, 1530–1534. [Google Scholar] [CrossRef]

- Griliches, Z. Hybrid corn: An exploration in the economics of technological change. Econom. J. Econom. Soc. 1957, 25, 501–522. [Google Scholar] [CrossRef]

- Liu, S.; Yan, J.; Zhang, S.; Lin, H. Can corporate digital transformation promote input-output efficiency? Manage. World 2021, 37, 170–190. [Google Scholar]

- Wu, F.; Hu, H.; Lin, H.; Ren, X. Enterprise digital transformation and capital market performance: Empirical evidence from stock liquidity. Manage. World 2021, 37, 130–144. [Google Scholar]

- Lei, H.; Liang, Q.; Li, J. Does the Firm’s Political Governance Affect Its Operational Performance—A Non-parametric Test Based on Chinese Listed Companies. Chin. Ind. Econ. 2012, 9, 109–121. [Google Scholar]

- Hong, J.; Jiang, M.; Zhang, C. Digital Transformation, Innovation and the Improvement of Enterprises’ Export Quality. J. Int. Trade 2022, 48, 1–15. [Google Scholar]

- Wen, Z.; Chang, L.; Hau, K.-T.; Liu, H. Testing and application of the mediating effects. Acta Psychol. Sin. 2004, 36, 614–620. [Google Scholar]

- Wang, L.; Kang, Y.K.; Xue, F.; Huang, W. Comprehensive framework of environmental policy effects: Empirical evidence from 16 pilot policies. Finan. Trade Econ. 2022, 4, 98–112. [Google Scholar]

- Yang, D.M.; Liu, Y.W. Why can internet plus increase performance. Chin. Ind. Econ. 2018, 5, 80–98. [Google Scholar]

- Jiang, T. Mediating Effect and Moderating Effect in Empirical Research on Causal Inference. Chin. Ind. Econ. 2022, 5, 100–120. [Google Scholar]

| Type | Variable | Definition | Measurement |

|---|---|---|---|

| Explained variable | Sustainability | Ability to generate sustainable development | Shown in Formula (1) |

| Core explanatory variable | Digital | Digital transformation | Natural logarithm of the frequency of the key terms “artificial intelligence technology”, “cloud computing”, “blockchain technology”, “big data” and “digital technology applications” in corporate annual reports |

| Mediator variable | Efficiency | Operation efficiency | The ratio of operating cost to average inventory balance |

| Innovation | Research and development | R&D inputs on operating revenues ratio as a percentage | |

| Control variable | Size | Enterprise size | Natural logarithm of total assets |

| Leverage | Debt to assets ratio | Ratio of total liabilities to total assets | |

| Risk | Degree of total leverage | Change in earnings per common share on change in production and sales | |

| ROA | Profitability | Ratio of net income to total assets as a percentage | |

| Growth | Growth rate | The ratio of the increase in the current year’s operating income to the total operating income of the previous year | |

| ListedAge | Listed age | The number of years the company has been listed | |

| SBS | The size of board of supervisors | The number of members on the board of supervisors | |

| SHR | Ownership concentration of shareholders | The percentage ownership of the largest shareholder | |

| IDR | The proportion of independent directors | The ratio of the number of independent directors to board size as a percentage | |

| Dual | The duality of CEO and chairperson | If a firm’s CEO and chairperson is the same individual, the value is 1 and 0 otherwise |

| Variables | N | Mean | SD | Min | Max |

|---|---|---|---|---|---|

| Sustainability | 11,294 | 7.0349 | 6.1277 | −2.6126 | 35.0790 |

| Digital | 11,294 | 16.1880 | 26.5136 | 1 | 153 |

| Efficiency | 11,294 | 14.3913 | 56.4143 | 0.0000 | 480.4879 |

| Innovation | 11,294 | 5.1322 | 5.3516 | 0 | 76.3497 |

| Size | 11,294 | 1.7765 | 8.7268 | 0.0074 | 243.2558 |

| Leverage | 11,294 | 0.3923 | 0.1883 | 0.0604 | 0.8405 |

| Risk | 11,294 | 2.0966 | 2.0445 | 0.9098 | 14.7495 |

| ROA | 11,294 | 0.0541 | 0.0405 | 0.0020 | 0.2052 |

| Growth | 11,294 | 0.1983 | 0.3848 | −0.3953 | 2.4993 |

| ListedAge | 11,294 | 9.4759 | 7.3777 | 0.0822 | 26.4575 |

| SBS | 11,294 | 3.4123 | 0.9015 | 3 | 7 |

| SHR | 11,294 | 33.8659 | 14.5133 | 8.4300 | 73.8200 |

| IDR | 11,294 | 37.8795 | 5.3883 | 33.3300 | 57.1400 |

| Dual | 11,294 | 0.3288 | 0.4698 | 0 | 1 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Digital | 0.269 *** | 0.263 *** | 0.167 *** | 0.175 *** |

| (4.27) | (4.13) | (5.07) | (5.23) | |

| Size | −0.143 ** | −0.130 ** | ||

| (−2.17) | (−1.97) | |||

| Leverage | 15.147 *** | 15.157 *** | ||

| (30.44) | (30.41) | |||

| Risk | −0.255 *** | −0.257 *** | ||

| (−10.44) | (−10.50) | |||

| ROA | 125.119 *** | 125.231 *** | ||

| (42.40) | (42.22) | |||

| Growth | 1.422 *** | 1.408 *** | ||

| (11.31) | (10.95) | |||

| ListedAge | 0.040 *** | 0.040 *** | ||

| (4.11) | (4.15) | |||

| SBS | −0.188 *** | −0.195 *** | ||

| (−3.27) | (−3.38) | |||

| SHR | −0.025 *** | −0.026 *** | ||

| (−6.36) | (−6.45) | |||

| IDR | 0.010 | 0.011 | ||

| (0.98) | (1.02) | |||

| Dual | 0.115 | 0.125 | ||

| (1.13) | (1.23) | |||

| Constant | 6.537 *** | 6.643 *** | −1.874 | −1.688 |

| (47.50) | (30.50) | (−1.40) | (−1.26) | |

| Year FE | No | YES | No | YES |

| N | 11,294 | 11,294 | 11,294 | 11,294 |

| R2 | 0.004 | 0.004 | 0.671 | 0.672 |

| Variables | (1) | (2) | (3) | |||

|---|---|---|---|---|---|---|

| IV1: One-Period Lagged Digital | IV2: Average Digital Level of Peer Enterprises | IV3: (1) Focal City’s Internet Development Level; (2) The Spherical Distance to Hangzhou | ||||

| First Stage | Second Stage | First Stage | Second Stage | First Stage | Second Stage | |

| L.Digital | 0.850 *** | |||||

| (138.37) | ||||||

| DTbar | 0.050 *** | |||||

| (40.40) | ||||||

| HZdistance | 0.074 * | |||||

| (1.77) | ||||||

| CityInternet | 0.597 *** | |||||

| (12.26) | ||||||

| Digital | 0.192 *** | 0.338 *** | 0.463 *** | |||

| (4.11) | (5.71) | (2.60) | ||||

| Size | 0.002 | −0.088 | 0.142 *** | −0.142 ** | 0.088 *** | −0.159 ** |

| (0.30) | (−1.23) | (7.63) | (−2.14) | (3.88) | (−2.28) | |

| Leverage | −0.076 | 15.377 *** | −0.185 | 15.210 *** | −0.470 *** | 15.285 *** |

| (−1.31) | (28.83) | (−1.50) | (30.47) | (−3.22) | (30.12) | |

| Risk | −0.018 *** | −0.275 *** | −0.030 *** | −0.248 *** | −0.045 *** | −0.240 *** |

| (−3.27) | (−9.61) | (−3.91) | (−10.03) | (−5.18) | (−9.17) | |

| ROA | −0.247 | 126.298 *** | −0.358 | 125.327 *** | −0.928 * | 125.567 *** |

| (−1.10) | (37.63) | (−0.73) | (42.35) | (−1.71) | (42.68) | |

| Growth | 0.103 *** | 1.358 *** | 0.120 *** | 1.398 *** | 0.172 *** | 1.360 *** |

| (3.25) | (8.68) | (3.54) | (10.85) | (4.60) | (10.35) | |

| ListedAge | −0.003 ** | 0.025 ** | −0.003 | 0.042 *** | −0.009 ** | 0.044 *** |

| (−2.56) | (2.24) | (−0.89) | (4.27) | (−2.55) | (4.40) | |

| SBS | −0.006 | −0.172 ** | −0.087 *** | −0.176 *** | −0.093 *** | −0.164 *** |

| (−0.66) | (−2.51) | (−4.23) | (−3.02) | (−3.54) | (−2.69) | |

| SHR | −0.002 *** | −0.030 *** | −0.005 *** | −0.024 *** | −0.012 *** | −0.022 *** |

| (−3.45) | (−6.11) | (−3.55) | (−5.80) | (−7.60) | (−5.00) | |

| IDR | −0.000 | 0.015 | −0.001 | 0.009 | 0.001 | 0.009 |

| (−0.06) | (1.18) | (−0.19) | (0.88) | (0.34) | (0.86) | |

| Dual | 0.053 *** | 0.146 | 0.090 ** | 0.105 | 0.090* | 0.090 |

| (3.04) | (1.16) | (2.26) | (1.02) | (1.89) | (0.84) | |

| Constant | 0.635 *** | −3.328 ** | −1.516 *** | −1.823 | 0.375 | −1.802 |

| (3.74) | (−2.18) | (−3.88) | (−1.36) | (0.79) | (−1.34) | |

| Year FE | YES | YES | YES | YES | YES | YES |

| N | 7,350 | 7,350 | 11,236 | 11,236 | 11,294 | 11,294 |

| R2 | 0.738 | 0.691 | 0.316 | 0.670 | 0.099 | 0.668 |

| Wald F test | 19146.5 | 1632.18 | 75.186 | |||

| Hansen J test | 0.007 [0.933] | |||||

| Variables | Variable Replacement | Sample Period Change | Regression Method | |||

|---|---|---|---|---|---|---|

| (1) Digital Dimension | (2) Digital Degree | (3) Sustainable Growth Rate | (4) 5-Year | (5) 10-Year | (6) Heckman | |

| Digital | 0.374 *** | 0.174 *** | 0.182 *** | 0.162 *** | 0.178 *** | 0.178 *** |

| (3.87) | (5.20) | (5.02) | (5.14) | (5.33) | (5.33) | |

| IMR | 2.383 *** | 2.383 *** | ||||

| (3.57) | (3.57) | |||||

| Controls | YES | YES | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES | YES | YES |

| N | 11,294 | 11,294 | 9,295 | 12,879 | 11,294 | 11,294 |

| R2 | 0.671 | 0.672 | 0.665 | 0.675 | 0.672 | 0.672 |

| Panel A | State-Owned | Private | ||||||

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) |

| FE | IV1 | IV2 | IV3 | FE | IV1 | IV2 | IV3 | |

| Digital | 0.000 | 0.027 | 0.044 | −0.009 | 0.204 *** | 0.239 *** | 0.384 *** | 0.531 *** |

| (0.01) | (0.33) | (0.43) | (−0.02) | (5.09) | (4.21) | (5.41) | (2.98) | |

| Controls | YES | YES | YES | YES | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES | YES | YES | YES | YES |

| N | 3127 | 1979 | 3046 | 3127 | 7606 | 4935 | 7534 | 7606 |

| R2 | 0.699 | 0.702 | 0.699 | 0.699 | 0.687 | 0.710 | 0.689 | 0.682 |

| Panel B | Manufacturing Industry | Tertiary Industry | ||||||

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) |

| FE | IV1 | IV2 | IV3 | FE | IV1 | IV2 | IV3 | |

| Digital | 0.137 *** | 0.149 ** | 0.217 * | 0.601 ** | 0.068 | 0.088 | 0.032 | −0.717 |

| (3.00) | (2.19) | (1.68) | (2.15) | (1.14) | (1.13) | (0.27) | (−1.06) | |

| Controls | YES | YES | YES | YES | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES | YES | YES | YES | YES |

| N | 7848 | 5021 | 7843 | 7848 | 2398 | 1606 | 2367 | 2398 |

| R2 | 0.659 | 0.666 | 0.659 | 0.651 | 0.722 | 0.780 | 0.723 | 0.697 |

| Panel C | Eastern regions | Central and Western Regions | ||||||

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) |

| FE | IV1 | IV2 | IV3 | FE | IV1 | IV2 | IV3 | |

| Digital | 0.181 *** | 0.209 *** | 0.344 *** | 0.379 * | 0.106 | 0.072 | 0.243 ** | 1.072 |

| (4.71) | (3.91) | (4.93) | (1.88) | (1.60) | (0.73) | (2.24) | (1.43) | |

| Controls | YES | YES | YES | YES | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES | YES | YES | YES | YES |

| N | 8402 | 5544 | 8342 | 8402 | 2892 | 1799 | 2804 | 2892 |

| R2 | 0.683 | 0.700 | 0.682 | 0.681 | 0.631 | 0.653 | 0.628 | 0.595 |

| Variables | Benchmark | Operation Efficiency | Corporate Innovation | ||

|---|---|---|---|---|---|

| (1) Sustainability | (2) Efficiency | (3) Sustainability | (4) Innovation | (5) Sustainability | |

| Digital | 0.175 *** | 4.575 *** | 0.158 *** | 0.996 *** | 0.142 *** |

| (5.23) | (5.22) | (4.73) | (12.85) | (4.03) | |

| Efficiency | 0.004 *** | ||||

| (3.56) | |||||

| Innovation | 0.033 *** | ||||

| (3.26) | |||||

| Controls | YES | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES | YES |

| N | 11,294 | 11,294 | 11,294 | 11,294 | 11,294 |

| R2 | 0.672 | 0.020 | 0.673 | 0.233 | 0.672 |

| Mechanism Variables | Sustainability | |

|---|---|---|

| R2 | Contribution | |

| Efficiency | 0.183 | 48.20% |

| Innovation | 0.197 | 51.80% |

| Total | 0.380 | 100.00% |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ji, Z.; Zhou, T.; Zhang, Q. The Impact of Digital Transformation on Corporate Sustainability: Evidence from Listed Companies in China. Sustainability 2023, 15, 2117. https://doi.org/10.3390/su15032117

Ji Z, Zhou T, Zhang Q. The Impact of Digital Transformation on Corporate Sustainability: Evidence from Listed Companies in China. Sustainability. 2023; 15(3):2117. https://doi.org/10.3390/su15032117

Chicago/Turabian StyleJi, Zhiying, Tingyu Zhou, and Qian Zhang. 2023. "The Impact of Digital Transformation on Corporate Sustainability: Evidence from Listed Companies in China" Sustainability 15, no. 3: 2117. https://doi.org/10.3390/su15032117

APA StyleJi, Z., Zhou, T., & Zhang, Q. (2023). The Impact of Digital Transformation on Corporate Sustainability: Evidence from Listed Companies in China. Sustainability, 15(3), 2117. https://doi.org/10.3390/su15032117