5.1. Hypotheses Tests

Table 2 presents means, standard deviations, and correlations. To examine the hypotheses of this study, we used a firm fixed-effect hierarchical model with robust standard errors clustered by provinces. To alleviate the potential problem of multicollinearity, we created interaction terms in which all variables were mean-centered. We employed VIF (variance inflation factors) to check the problem of multicollinearity for each regression model. We further used the residual centering procedure to handle multi-collinearity problem [

76]. This method has two stages. In the first stage, we established the regression model in which the interaction term was regressed on its constituent parts and saved the residuals. In the second stage, we replaced the original interaction terms with the residuals that had been calculated from the regression model established in the first stage. The results showed that VIFs associated with each regression coefficient ranged from 1.02 to 2.18, indicating that there were no serious problems with multicollinearity for each regression model.

Table 2 presents the means, standard deviations, and Pearson correlations between the variables of this study.

Table 3 presents the regression results for the hypotheses of this study.

Hypothesis 1 proposes that CSR aimed at employees, customers, suppliers, and governments is positively related to firm sustainable growth. The empirical results examining Hypothesis 1 are summarized in

Table 3,

Table 4,

Table 5 and

Table 6. Model 2 of

Table 3 shows that CSR aimed at employees is positively related to firm sustainable growth (β = 0.15,

p < 0.01), providing empirical support for Hypothesis 1a. Model 2 of

Table 4 shows that CSR aimed at customers is positively related to firm sustainable growth (β = 0.14,

p < 0.01), providing support for Hypothesis 1b. Model 2 of

Table 5 shows that CSR aimed at suppliers is positively related to firm sustainable growth (β = 0.21,

p < 0.001), providing empirical support for Hypothesis 1c. Finally, Model 2 of

Table 6 shows that CSR aimed at governments is positively related to firm sustainable growth (β = 0.14,

p < 0.001), providing empirical support for Hypothesis 1d. On the whole, these results suggest that CSR aimed at employees, customers, suppliers, and governments are positively related to firm sustainable growth, providing empirical support for Hypothesis 1.

Hypothesis 2 proposes that dysfunctional competition positively moderates the relationship between CSR and firm performance. The empirical results for testing Hypothesis 2 are summarized in

Table 3,

Table 4,

Table 5 and

Table 6.

The results in Model 3 of

Table 3 show that the interaction term between CSR aimed at employees and dysfunctional competition is positive and significant (β = 0.11,

p < 0.01), providing empirical support for Hypothesis 2a. To facilitate interpretation of the moderating effect of dysfunctional competition on the relationship between CSR aimed at employees and firm sustainable growth, we plotted this moderating effect in

Figure 1.

Figure 1 was created by three steps. First, all samples were separated into two groups according to the median of CSR aimed at employees. Second, firm sustainable growth was regressed based on the two groups of samples, respectively. Third, two regression lines were plotted through statistic software SAS 9.4, respectively.

Figure 1 presents the moderating effect of dysfunctional competition on the relationship between CSR aimed at employees and firm sustainable growth. As shown in

Figure 1, the positive relationship between CSR aimed at employees and firm sustainable growth is stronger when the level of dysfunctional competition is high than when it is low. Using the approach suggested by Aiken and West [

77], we calculated the slopes associated with the two lines in

Figure 1. When the level of dysfunctional competition is high, the slope is 0.64, which is significant at the level of

p < 0.001. In contrast, when the level of dysfunctional competition is low, the slope is 0.06, which is not significantly different from zero, which proved further support for Hypothesis 2a.

The results in Model 3 of

Table 4 show that the interaction term between CSR aimed at customers and dysfunctional competition is positive and significant (β = 0.16,

p < 0.01), providing empirical support for Hypothesis 2b.

To facilitate the interpretation of the moderating effect of dysfunctional competition on the relationship between CSR aimed at customers and firm sustainable growth, we plotted this moderating effect in

Figure 2 the way we plotted

Figure 1.

Figure 2 presents the moderating effect of dysfunctional competition on the relationship between CSR aimed at customers and firm sustainable growth. As shown in

Figure 2, the positive relationship between CSR aimed at customers and firm sustainable growth is stronger when the level of dysfunctional competition is high than when it is low. Using the approach suggested by Aiken and West [

77], we calculated the slopes associated with the two lines in

Figure 2. When the level of dysfunctional competition is high, the slope is 0.58, which is significant at the level of

p < 0.001. In contrast, when the level of dysfunctional competition is low, the slope is 0.15, which is significant at the level of

p < 0.05, which proved further support for Hypothesis 2b.

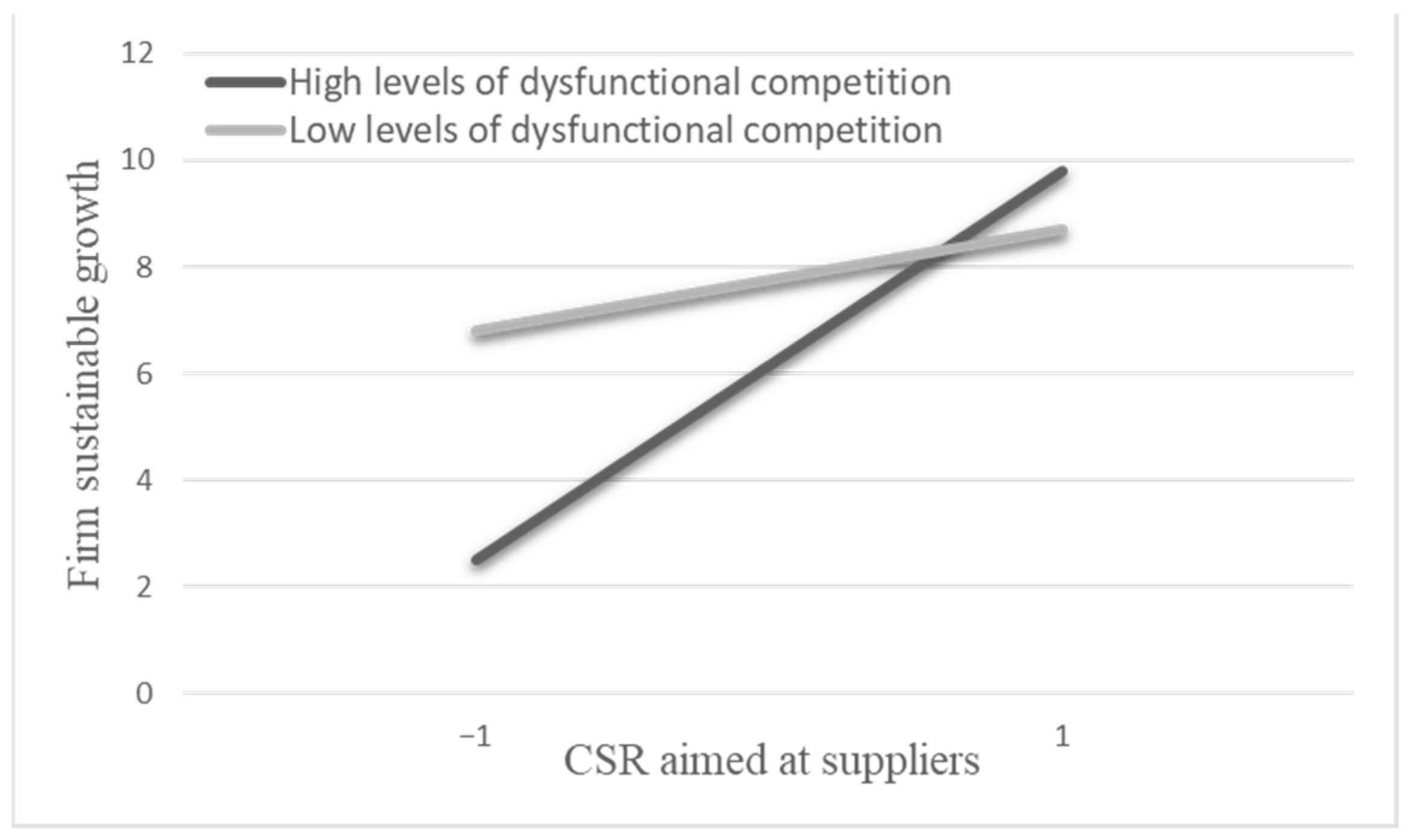

The results in Model 3 of

Table 5 show that the interaction term between CSR aimed at suppliers and dysfunctional competition is positive and significant (β = 0.09,

p < 0.05). providing empirical support for Hypothesis 2c.

To facilitate interpretation of the moderating effect of dysfunctional competition on the relationship between CSR aimed at suppliers and firm sustainable growth, we plotted this moderating effect in

Figure 3 the way we plotted

Figure 1.

Figure 3 presents the moderating effect of dysfunctional competition on the relationship between CSR aimed at suppliers and firm sustainable growth. As shown in

Figure 3, the positive relationship between CSR aimed at suppliers and firm sustainable growth is stronger when the level of dysfunctional competition is high than when it is low. Using the approach suggested by Aiken and West [

77], we calculated the slopes associated with the two lines in

Figure 3. When the level of dysfunctional competition is high, the slope is 0.36, which is significant at the level of

p < 0.001. In contrast, when the level of dysfunctional competition is low, the slope is 0.13, which is significant at the level of

p < 0.05, which proved further support for Hypothesis 2c.

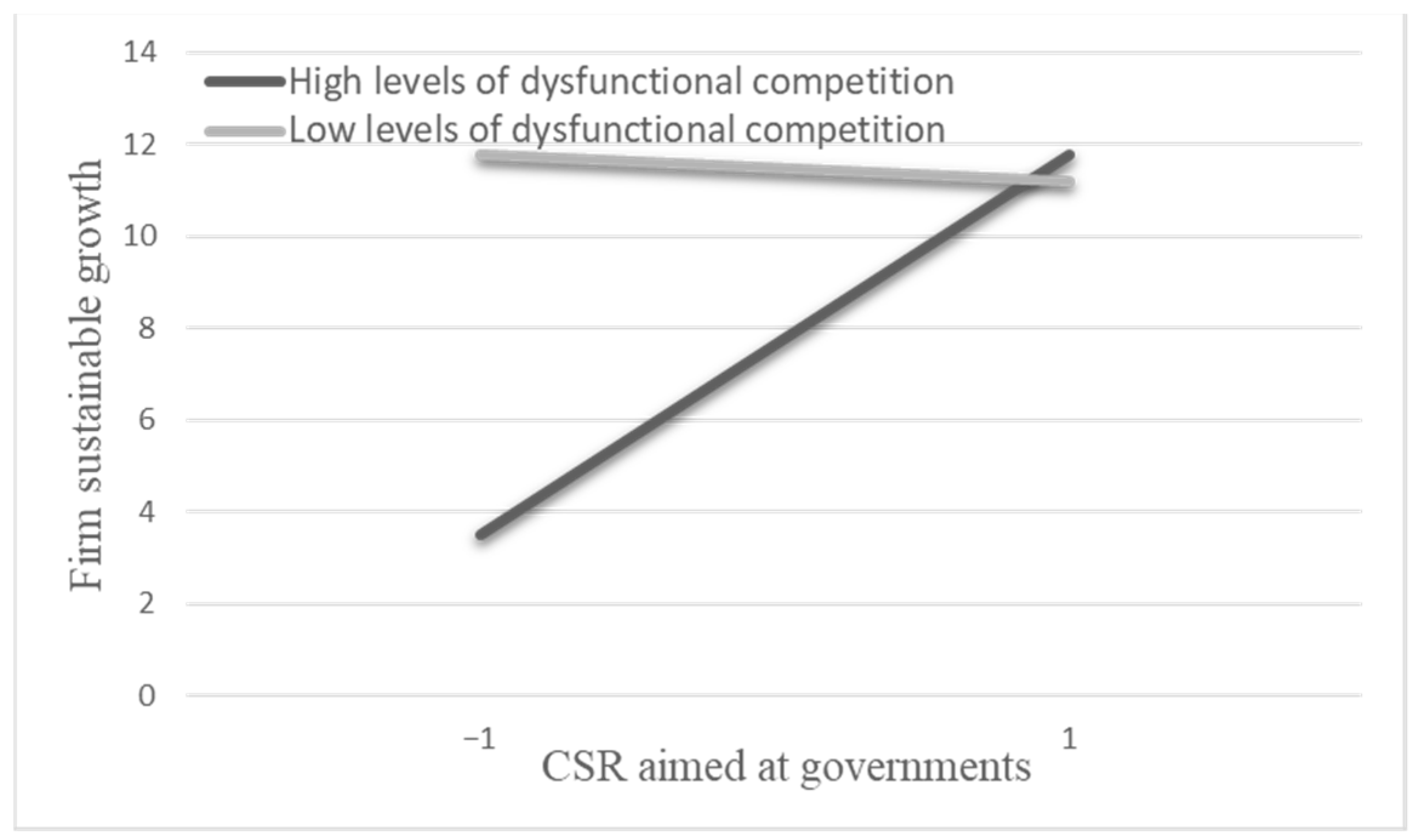

The results in Model 3 of

Table 6 show that the interaction term between CSR aimed at governments and dysfunctional competition is positive and significant (β = 0.22,

p < 0.001), providing empirical support for Hypothesis 2d.To facilitate interpretation of the moderating effect of dysfunctional competition on the relationship between CSR aimed at governments and firm sustainable growth, we plotted this moderating effect in

Figure 4 the way we plotted

Figure 1.

Figure 4 presents the moderating effect of dysfunctional competition on the relationship between CSR aimed at governments and firm sustainable growth. As shown in

Figure 4, the positive relationship between CSR aimed at governments and firm sustainable growth is stronger when the level of dysfunctional competition is high than when it is low. Using the approach suggested by Aiken and West [

77], we calculated the slopes associated with the two lines in

Figure 4. When the level of dysfunctional competition is high, the slope is 0.45, which is significant at the level of

p < 0.001. In contrast, when the level of dysfunctional competition is low, the slope is −0.09, which is not significantly different from zero, providing further support for Hypothesis 2d.

On the whole, these results suggest that the relationships between CSR aimed at employees, customers, suppliers, governments and firm sustainable growth are positively moderated by dysfunctional competition, providing support for Hypothesis 2.

5.2. Robustness Tests

We conducted several important robustness tests to ensure the robustness of our results.

Concerns associated with overall CSR aimed at all groups of stakeholders. In our main study, we found that CSR aimed at four chosen groups of stakeholders (e.g., CSR aimed at employees, customers, suppliers, and governments) is positively related to firm sustainable growth and that dysfunctional market competition positively moderated these relationships. However, there remains a concern regarding how overall CSR aimed at all groups of stakeholders (e.g., local societies, firm competitors, and communities) affects firm sustainable growth, when one considers that overall CSR aimed at all groups of stakeholders is different from CSR aimed at the four chosen groups of stakeholders. We do not think that, at this stage, we can provide sufficient empirical evidence or strong logic to predict how overall CSR that is aimed at all groups of stakeholders may affect firm sustainable growth. Therefore, it should be noted that we cannot propose a formal hypothesis to predict how overall CSR aimed at all groups of stakeholders affects firm sustainable growth; instead, we explored this question by adopting overall CSR aimed at the four chosen groups of stakeholders. We regressed firm sustainable growth on overall CSR, which was measured by a weighted average of scores for the CSR aimed at the four chosen groups of stakeholders. The results are reported in

Table 7.

The results of Model 2 in

Table 7 show that overall CSR is positively related to firm sustainable growth (β = 0.15,

p < 0.01), providing further support for Hypothesis 1. Furthermore, the results in Model 3 of

Table 7 show that the interaction term between overall CSR and dysfunctional competition is positive and significant (β = 0.14,

p < 0.01), providing further support for Hypothesis 2. The plot and slope analyses of the moderating effect of dysfunctional competition on the relationship between overall CSR and firm sustainable growth is fundamentally consistent with those discussed above (the result is available from the authors upon request).

Issues associated with the sample. Because in our sample, over a fifth of the observations have not reported any dysfunctional competition, there remains a concern about whether our empirical findings are biased. To address this potential problem, we re-estimated the regression models listed in

Table 3,

Table 4,

Table 5,

Table 6 and

Table 7 by employing the two-stage model suggested by Heckman [

78]. The two-stage model, as Heckman put it, generates consistent and asymptotically efficient estimates [

78]. In the first stage, we estimated the regression model:

In this equation,

i indexes firms,

t indicates observation years, α

i represents firm-specific fixed effects, and ɛ

i,t is the error term. Dysfunctional competition

i,t is a dummy variable, coded 1 if it is greater than zero, and 0 if it is zero. Based on the regression results, we calculated the value for the inverse Mill’s ratio (γ

1). In the second stage, the inverse Mill’s ratio (γ

i,t) was included as a regressor in the regression models listed in

Table 3,

Table 4,

Table 5,

Table 6 and

Table 7. The results are consistent with the results of our main analysis (these analyses are available from authors upon request). Moreover, we dropped the observations which have not reported any dysfunctional competition from the sample and re-estimated the regression models listed in

Table 3,

Table 4,

Table 5,

Table 6 and

Table 7. The results are consistent with our main findings (the detailed results are available from the authors upon request).

Alternative measure of firm sustainable growth. In the main analysis, we estimate models of sustainable growth in terms of a firm’s annual sales revenues. Yet, there remains a concern that annual sales revenues alone cannot effectively and validly capture a firm’s sustainable growth, especially when one considers that the measurement of firm sustainable growth might be biased because of the lack of strict market regulation in China. We employed (1) return on assets, (2) market share growth, (3) cash flow from market operations, (4) profit growth, (5) sales growth to further analyses how CSR affects firm sustainable growth. For example, when market share growth is employed, the model is as follows:

In this equation, i indexes firms, t indicates observation years, α is an adjustment parameter that reflects how firm sustainable growth rates depend on market share growth, and ɛi,t + 1 is the error term. β is a vector of parameters characterizing the effects of covariates (Xit). The regression results using the alternative measure of firm sustainable growth are consistent with our main findings (the detailed results are available from the authors upon request).

Model overfitting. Considering that our regressions contain a large set of variables, model overfitting might be a potential problem. In order to address this potential issue, we employed two methods. In the first method, we dropped all control variables, and reran all regression models. The results were statistically the same as the main analyses. In the second method, we only included firm size as a control variable in the regressions, because firm size is the only control variable that is significant in the main analyses. The results again were essentially consistent with our main findings (these results are available from the authors upon request).

Furthermore, we conducted several additional robustness tests. For example, in order to make sure that our results were not affected by outliers, we reran all regressions by winsorizing all continuous variables (e.g., CSR aimed at customers, CSR aimed at suppliers, CSR aimed at governments, CSR aimed at employees, overall CSR, and dysfunctional competition) at the 1% and 99% present levels. The results were consistent with the regressions using nonwinsorized measures (the detailed results are available from the authors upon request). In addition, prior studies have shown that institutional support and environmental turbulence affected the effectiveness of firm investments, such as CSR, on firm sustainable growth [

28,

79]. In supplementary analyses, we controlled for institutional support and environmental turbulence, and reran all regression models. The findings suggested that both institutional support and environmental turbulence did not significantly affect firm sustainable growth. The findings were fully consistent with the main findings of this study. In addition, it is likely that CSR stability and CSR discrimination affect the effectiveness of CSR on firm sustainable growth. We calculate CSR stability and CSR discrimination as follows:

where

i indicates firms,

k indexes stakeholders, and

t indicates observation years.

In our supplementary analyses, we controlled for CSR stability and CSR discrimination, and reran all regression models. The findings suggested that both CSR stability and CSR discrimination did not significantly affect firm sustainable growth.