Abstract

The sustainability of mineral resources and, in particular, their abundance is a topic of growing interest. Nevertheless, the abundance of mineral raw materials is an extremely complex notion as it not only encompasses geological considerations but also environmental, technical, economic, and social constraints. In addition, to the best of our knowledge, no tools are currently available to allow a comprehensive evaluation of mineral raw material abundance. This research paper, therefore, aims to present an innovative and unique methodology to evaluate the abundance of non-energy mineral resources and determine a mineral abundance index (MAI). Based on a multicriteria analysis, MAI considers the natural abundance of a mineral raw material in the Earth’s crust and its availability on the market and integrates the influence of factors that could constrain or promote future market changes. This new index ranging from 0 (very scarce) to 100 (very abundant) aims to qualify the abundance of mineral resources in a simple and rapid manner based on published and reliable data. This new methodology could be a powerful decision-making support tool for any downstream industrials and end-users making use of mineral raw materials.

1. Introduction

Throughout history, human beings have exploited natural resources and interacted with and transformed their environment [,]. According to [] and references therein, human activities can be divided into four main subsequent phases: primitive, slavery, feudal, and capitalist, with the last one corresponding to the current period. Each of these phases involves varying degrees of interaction with the environment and use of natural resources. The impact of human activities on the environment, particularly since the capitalist phase, has been a major concern for the United Nations since June 1972, with the organisation of the first World Conference on the Environment in Stockholm, Sweden []. Concurrently, the Club of Rome published a report pointing out the risk of mineral resource depletion and environmental degradation due to human activities in a world of economic growth []. The year 1972 can, therefore, be considered a reference point for the formulation of concepts on the consumption of natural resources and economic development. Later on, this led to a definition of sustainable development by the Brundtland Report, published in 1987 by the Commission on Environment and Development of the United Nations: “Sustainable development is the development that meets the needs of the present without compromising the ability of future generations to meet their own needs” [,,].

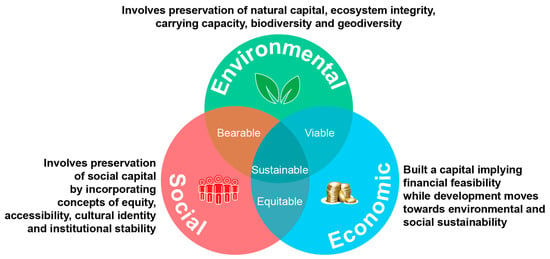

In the course of the United Nations conferences through its Department of Economic and Social Affairs (Rio de Janeiro in 1992, Johannesburg in 2002, Rio de Janeiro in 2012, and New York in 2015), sustainable development became a real paradigm aiming at respecting a balance between social, environmental, and economic aspects (Figure 1). The 2030 Agenda for Sustainable Development is now structured around 17 Sustainable Development Goals (SDGs) [,].

Figure 1.

Concept of sustainable development relying on three main pillars. Modified after [,].

In this context, many industries aim to achieve “sustainable” economic growth that is respectful of the environment and human beings [,,,]. These actions involve the “green economy”, eco-design, compliance with the SDGs, and the creation of “eco-friendly” products.

The cosmetics sector is no exception to this trend [,,,]. In 2021 in Europe, the cosmetics industry represented a value of EUR 80 billion at the retail sales price, over 255,111 direct employees, and over 1.71 million involved in the cosmetics value chain []. The European cosmetics and personal care market is, alongside that of the United States of America, the largest market for cosmetic products in the world, with 500 million users on the Old Continent.

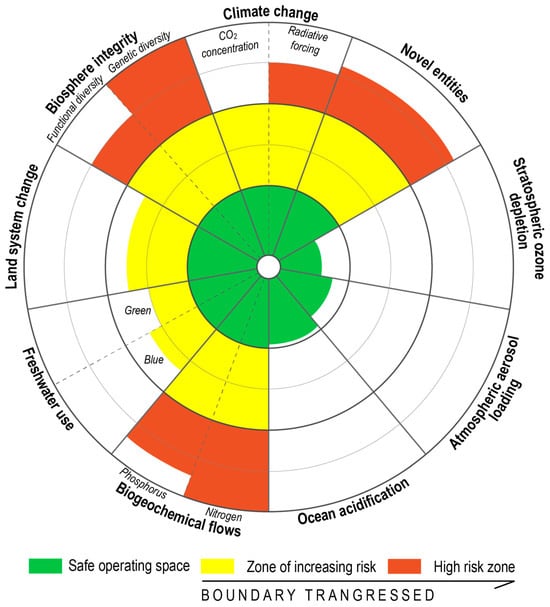

The cosmetic industry has to limit the impacts of all of its activities on the climate, water, biodiversity, and natural resources. These impacts can be also considered in terms of the planetary boundaries (Figure 2) as defined by the Stockholm Resilience Centre, a concept subsequently endorsed by the United Nations and the international scientific community [,,,,]. In order to preserve natural resources, the cosmetic industry needs to promote recycling, a circular economy, and the use of bio-based raw materials and abundant mineral resources.

Figure 2.

The nine planetary boundaries and their statuses. It is noteworthy that 6 of 9 boundaries are already transgressed in 2023 (stockholmresilience.org, accessed on 22 November 2023). Modified after [,].

Part of this challenge can be addressed through “green chemistry” and the use of “eco-friendly” and bio-based ingredients [,,].

However, inorganic raw materials are not covered or sufficiently addressed by these concepts. Among inorganic raw materials, some minerals, rocks, and metals are known as ingredients for cosmetics. The goal of this research study is first to establish a definition of “abundance” from a sustainability perspective and, second, to propose a methodology to rate abundance. However, the abundance of mineral raw materials is a complex concept, and many authors have discussed it in the past, some from a geological point of view and others from a technical–economic point of view (see Section 2). Authors distinguish physical abundance (geological availability of mineral resources within the Earth’s crust) from economic abundance (a mineral resource-based product can be rare and thus become exclusive and competitive). Indeed, these notions of abundance about raw materials’ value rely on geological data but also on environmental, technical, economic, and social considerations. A methodology as a powerful decision support tool adapted to the sustainable development challenges of downstream industries is lacking to easily assess the abundance of mineral raw materials.

Consequently, the authors of this research paper propose to develop a new and innovative methodology for easily estimating mineral resource abundance.

It is worth noting that the proposed methodology does not address the issue of sustainable sourcing and traceability. Indeed, other dedicated initiatives and methodologies take charge of such problems. For instance, the Organisation for Economic Cooperation and Development (OECD) developed a Due Diligence Guidance for Responsible Business Conduct, which is globally regarded as the leading best practice framework to minimise adverse impacts on company operations, supply chains, and other business relationships. More specifically to mineral supply chains, the OECD also published the Due Diligence Guidance for Supply Chains of Minerals from Conflict Affected and High-Risk Areas, which was specifically designed to address conflict financing and human rights violations associated with mineral production, processing, and trade.

This paper first provides some context regarding previous research on the mineral resource abundance concept (see Section 2). Then, we present a new and innovative methodology to calculate a mineral abundance index (MAI) applied to non-energy mineral resources (i.e., metals, industrial rocks, and minerals). Based on a multicriteria analysis and a rational approach, the MAI methodology is described in detail, references used for the different criteria are cited (see Section 3), and the MAI calculation is presented (see Section 4). In Section 5, the methodology is applied to assess the abundance of bentonite, one of the inorganic cosmetic ingredients. The application of this methodology for downstream industries and the MAI’s usefulness as a powerful decision support tool are finally discussed in Section 6. For the first time, downstream users will have access to efficient monitoring of the impact of the consumption of mineral resources, aiming to look for alternative solutions when a risk of depletion is highlighted. Indeed, MAI could be used as a characterisation factor in the wider framework of life cycle assessment, could accompany the efforts to promote “Green and Climate Smart Mining” (GSCM) practices, and could help to secure mineral supply for clean energy technologies.

2. Mineral Resource Abundance: Spheres of Influence and Skill

2.1. Why Do We Exploit Mineral Resources?

The notion of “mineral resources abundance” is linked to the exploitation of mineral resources, which are globally not renewable on a human scale. The formation of mineral resources is the result of the dynamics of life on the planet over billions of years of geological time.

Thus, human beings have always exploited mineral resources, from flint, tin, copper, iron, and gold in the Neolithic period and since antiquity to the metals that accompany the current energy transition (e.g., rare earths, cobalt, lithium, and indium). Indeed, human ingenuity and innovation have made it possible to develop new technologies using more and more mineral resources in terms of their diversity and quantity [,].

The industrial and technological revolutions over the last few centuries have been accompanied by a substantial improvement in the living environment and, at the same time, the consumption and, therefore, the exploitation of mineral resources, which are globally non-renewable on a human scale.

A specific mineral raw material should not be considered more essential than another without fully taking into account its value to humans. On the other hand, it is its function, i.e., an intrinsic property, for which it is used, that becomes essential []. However, the intrinsic property of a mineral raw material may be shared between several mineral raw materials and, therefore, reduces its scarcity. For the same intrinsic property, the use of different mineral raw materials (substitutability vs. essentiality) is very often accompanied by different technologies to exploit the intrinsic function [].

Consequently, it is indeed for an intrinsic property and a physical–chemical property(ies) that human beings will seek to exploit mineral resources with a suitable profile. This raises the question of the quantity available of various mineral resources on the planet and, therefore, indirectly, their abundance.

2.2. Mineral Resource Abundance, Scarcity, and Depletion: Optimism or Pessimism?

Historically, in 1798, Thomas Malthus predicted that a continuous increase in the world’s population would outstrip the productive capacity of agricultural land, eventually leading to famines, epidemics, and wars for access to natural resources []. This pessimistic view of access to resources with population growth was taken up by Ricardo in 1817, who first included the notion of “mineral scarcity” as a factor limiting population growth in his essay []. Conversely, in 1848, Mill considered that the capacity of human beings to innovate could compensate for exploiting more natural resources in a growing world []. It is also worth recalling the fear expressed by Jevons in 1865 of the depletion of British coal deposits, which could affect its economy if too much extraction took place []. Between the 1890s and 1920s, a political and social movement in the United States (i.e., the Conservation Movement) advocated the rational use of resources in a context of mistrust over the depletion of mineral resources linked to the strong development of the pioneer provinces in the USA []. The movement was about using more abundant non-renewable resources over less abundant ones and using resources from recycling rather than primary resources.

At the same time, at the end of the 19th century, the question of the abundance of chemical elements that make up the different envelopes of our planet (crust, mantle, and core) arose with the work of Clarke [] on the continental crust. However, this question was initially of a purely scientific nature. Knowing the chemical composition of the Earth’s crust furthers the aim of reconstructing its geological history [,,,].

After the Second World War, there were new concerns about the long-term access to and supply of mineral resources. These fears stemmed from the immense challenge of post-war reconstruction, which required significant mineral resources. Several studies and publications aimed to better understand the relationship between economic growth and the depletion of non-renewable resources, including mineral resources []. Firstly, [] argued that technological advances and innovation can overcome the scarcity of non-renewable resources in the future, which is also the position of other authors [], even recently []. Conversely, the initial postulate of [] was largely contradicted by Meadows et al. [,] (famous report, “Limits to Growth”, of the Club of Rome) and [], who argued that the increase in per capita food and industrial production would collapse due to natural resource depletion and environmental degradation.

Thus, in the literature, there are two opposing views on the scarcity of minerals and, more broadly, natural resources [,,]:

- Optimists [,,,,,,,,]: based on the opportunity cost paradigm. All authors do not deny the progressive depletion of mineral resources but consider that human beings are sufficiently ingenious to meet the challenges of such depletion. Thus, as demand outstrips supply, costs will rise in tandem with the pressure to find substitutes or alternatives to less abundant mineral resources. Recycling is also a strong theme of the so-called optimistic authors. Thus, according to them, the geological stock or geopotential [,,,] is gigantic, and it will always be possible to extract mineral resources but at a higher cost.

- Pessimists [,,,,]: the Earth is a finite natural object, and, therefore, the quantity of mineral resources is also finite. If the consumption of mineral resources is considered to be in perpetual growth, supply will no longer be able to satisfy demand at any given time.

Both sides find support among economists and lawyers. Thus, economists generally tend to be “optimistic”, in the sense that human ingenuity will always find substitutes for scarce and depleting mineral resources [,,,,], whereas lawyers are generally rather “pessimistic” and consider that the next generations have a legitimate right to fair access to even scarce mineral resources []. However, both sides agree that mineral resources are exhaustible, and the two paradigms could be reconciled. Therefore, humans will be able to solve the problems of mineral resource depletion if reasonable approaches are considered such as substituting scarce mineral resources and increasing the rate of recycling while ensuring that the present generation does not deprive future generations of geologically scarce resources [,]. Mineral resources should, therefore, ideally be exploited in a sustainable and rational manner.

2.3. Concepts of Geological Potential, Resources, and Reserves

In order to be able to exploit mineral resources in a sustainable and reasoned manner, the essential question arises as to the knowledge of the quantity available on Earth, in other words, the notions of geological potential, resources, and reserves.

This thinking began in the 1940s and 1950s with, among others, the famous work of Hubbert [] and his “peak oil” and that of Blondel and Lasky [], followed by that of McKelvey [], who defined a terminology for reserves and resources that has since been adopted and is still used by the United States Geological Survey []. It should be noted that a linear relationship between crustal concentrations of certain elements and their US reserves has been demonstrated [], which will be confirmed later [].

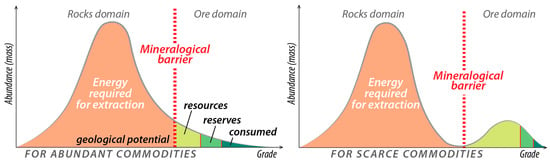

The oil shocks of the 1970s significantly raised the issue of depletion and access to mineral resources, which, by definition, have a limited initial natural stock [,], as discussed in a reference article published by Skinner [], who first defined the notion of a “mineralogical barrier” separating two distinct areas (Figure 3):

- A domain where the mineral substances of interest contained in the rocks (very low content and high abundance) are inaccessible from an economic and/or technical point of view because they require too much energy (can be assimilated pro parte to the geological potential area);

- A domain where mineral substances of interest are contained in ores (high grade and low abundance) that are economically viable to mine and constitute deposits (can be assimilated to the resource and reserve area).

Figure 3.

Graphs showing, for abundant commodities (left, >0.1 wt.%) and scarce commodities (right, <0.1 wt.%), the domain of rocks where grades are too low and abundance is high, which cannot be mined, and the domain of ores where grades are high and abundance is low, which can be mined as it requires less energy (modified from [,]).

This mineralogical barrier is mobile over time according to technological advances, geological knowledge and exploration, and the evolution of raw material prices. Finally, to simplify, the mineralogical barrier defined by Skinner [] separates the domain of geological potential from that of resources and reserves. It could be considered a barrier of (1) grade, (2) the energy needed to extract/process the useful commodity(ies), (3) the degree of geological knowledge, (4) technology (ore processing to extract useful commodity(ies) from mineral(s)), and (5) economics (prices that can lower or raise the cut-off grade).

Graphs published by Skinner [] show two forms of Gaussian curves depending on whether the elements are rare (<0.1%) or abundant (>0.1%; Figure 3).

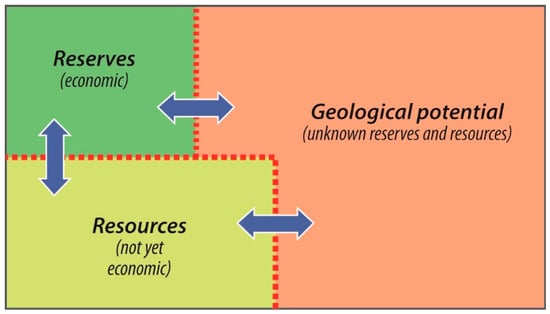

These concepts of resources, reserves, and geological potential can be visually represented in the form of a “total resource box” [] (Figure 4). The first entity represents the geopotential whose reserves and resources are unknown. This geological potential includes the part called “resources”, which is known and not yet economic but which could become so, and, finally, the part called “reserves”, which is profitable to exploit and best known. The boundaries between these areas are mobile in time.

Figure 4.

“Total resource box” showing geological potential, resources, and reserves with moving boundaries (modified from [,]).

2.4. Defining Scarcity/Abundance: Spheres of Influence and Skill

Mineral resource scarcity, which can be contrasted with abundance, can have several definitions. On a purely physical basis, an element is geochemically scarce if its average abundance in the Earth’s crust (Clarke index) is less than 0.1% by weight or 1000 ppm [,,,,]. This definition remains objective, as it is independent of the intended function of the substance and the needs of society, but it is inappropriate for the economic use of chemical elements.

Thus, physical scarcity (or geological availability = natural, within the Earth’s crust) is quite different from economic scarcity (a product can be rare and thus become exclusive and competitive). This notion of scarcity is, therefore, relative depending on the point of view and the field of knowledge. Scarcity in the economy is sometimes seen as a driver for innovation [], itself driven by price incentives and curiosity about the unknown, both of which lead humans to develop new methods, technologies, and processes.

From the early 2000s onwards, mineral commodity prices began to rise, prompting industry, politicians, and governments to react to the fragility of supply chains and to commission studies aimed at estimating the criticality of raw materials [,,,,,].

Criticality is the risk of supply disruption that could jeopardise the operation of a strategic or essential product, technology, infrastructure, or other development bases. Supply risks can result from geopolitical and/or economic instability in producing and trading countries, while substitution and recycling may mitigate these risks.

Thus, the concept of criticality has been defined along two dimensions: the geological availability and accessibility of raw materials, and the economic impacts or vulnerability to supply chain interruption [,,]. Until recently, criticality has been used for the raw materials governance policy of states or economic communities. In recent years, criticality has been studied by academia to understand the meaning, develop assessment methodologies, and propose risk mitigation measures to decision-makers [,,,,,,,,,,,].

3. A Mineral Resource Abundance Definition Adapted to the Sustainable Development Challenges of Downstream Industries

3.1. Literal Definition

Alongside the development of the methodology for assessing the abundance of a mineral raw material (metal as an individual chemical element or mineral as an assemblage of chemical elements) used in downstream industries, this study proposes a literal definition as follows: “an abundant mineral raw material (metal or mineral) is an inorganic species, naturally widespread in the Earth’s crust, largely mined, readily available on economic markets, while being more or less substitutable and retaining the desired function”.

To qualify the abundance of a mineral raw material used in downstream industries, this study aims to define a “Mineral Abundance Index”. The mineral abundance index (MAI) assesses “the available quantity of a mineral raw material ingredient (metal or mineral) used in downstream industries and resulting from the transformation of a mineral raw material extracted from the Earth’s crust and available on the markets, as well as its essentiality”.

Consequently, the abundance of a mineral raw material has two meanings, one natural and intrinsic and the other anthropogenic and extrinsic, based on three related pillars—geology, economy, and technology—and, finally, the capacity for innovation for better ecotechnological efficiency in a sustainable development approach.

3.2. Defining Spheres of Criteria for Assessing the Mineral Abundance Index

As seen above, it is clear that the notion of mineral raw material abundance/scarcity can be approached from two main perspectives:

- Geological (physical scarcity) related to the resources of the geosphere;

- Economic (economic scarcity) related to the resources of the technical–economic sphere.

In addition to these two spheres, there is the paradigm to be considered regarding mineral scarcity: optimistic (“opportunity and cost”) or pessimistic (“fixed stock”).

Human beings will be able, under supply/demand and, therefore, price pressure, to solve the problems of mineral resource depletion and reconcile the two paradigms. Indeed, for instance, it could be by substituting scarce mineral resources and/or increasing the rate of recycling while ensuring that the present generation does not deprive future generations of geologically scarce resources [,].

This capacity for innovation specific to human beings thus contributes to the development of new resources that can be integrated into the socio-epistemic sphere [,].

Therefore, the definition of the multicriteria “Mineral Abundance Index (MAI)” that will be applied to the mineral resources used by the industry is organised around several criteria divided into the three main mineral resource spheres (Table 1):

- Geosphere: physical (natural) mineral raw material abundance defined according to criteria independent of technical–economic aspects;

- Technical–economic sphere: economic mineral raw material abundance defined according to technical and economic criteria related to the available techniques used to extract the useful commodities, as well as the associated economic, accessibility, and environmental constraints;

- Socio-epistemic sphere: mineral raw material abundance defined according to prospective criteria, which constrains/motivates innovation for substitution and recycling development.

Table 1.

Three spheres define the mineral abundance index (MAI) with different criteria. Percentages represent the weighting coefficient for each sphere and for each criterion within each sphere.

Table 1.

Three spheres define the mineral abundance index (MAI) with different criteria. Percentages represent the weighting coefficient for each sphere and for each criterion within each sphere.

| Sphere | Criterion | ||

|---|---|---|---|

| Geosphere G (30 %) | Physical (natural) mineral abundance defined by criteria independent of technical and economic aspects | Crustal scarcity potential (CSP) 30% | Expresses the average concentration of a chemical element in the Earth’s crust compared to the average concentration of silicon (the most abundant element in the crust). |

| Energy required for extraction, treatment and separation of element (E) 50% | Expresses the energy value required to produce 1 kg of an element through its extraction, processing and separation and based mainly on the strength of chemical bonds within ore. | ||

| Enrichment factor (FE) 20% | Expresses the factor to be applied to the average crustal concentration of an element to sufficiently enrich a portion of the crust to form a deposit. | ||

| Technical-economic sphere TE (40 %) | Economic mineral abundance defined by technical-economic criteria linked to the techniques used and available to extract the useful commodities, as well as the associated economic, accessibility and environmental constraints | Years of known reserves (TR) 30% | Expresses the number of years remaining in the exploitation of a commodity for a given annual global production. |

| Surplus ore potential (SOP) 20% | Expresses the increased quantity of ore to be extracted in order to compensate for the drop in the ore grade mined over time. | ||

| Resources accessibility per country (AR) 25% With 5 sub-criteria (AR1 to AR5) | Expresses the degree of accessibility to mineral resources by producing countries, which contribute at least 80% of the world production of a commodity. | ||

| Environmental impact (ENV) 25% With 2 sub-criteria (ENV1 and ENV2) | Qualifies the environmental impact of the mineral processing used to extract a commodity, as well as the environmental performance of countries that contribute at least 80% of the global production of this commodity. | ||

| Socio-epistemic sphere SE (30 %) | Mineral abundance defined by forward-looking criteria linked to the commodity markets, which will constrain/motivate innovation for purposes of substitution and development of recycling | Price volatility over last decade (V) 20% | Qualifies the degree of price stability over the last decade. |

| Concentration index for the production (PR) 30% | Qualifies the risks of monopoly/dependence on the production of a given commodity. | ||

| Maturity of recycling loops (REC) 25% | Qualifies the maturity of recycling loops for a given commodity. | ||

| Substitutability (SUB) 25% | Qualifies the degree of substitution of a commodity for given applications. | ||

The mineral abundance index is calculated based on a multicriteria analysis. Table 1 lists the different criteria chosen in the methodology and subsequently described and detailed in this study.

3.3. Geosphere

3.3.1. Crustal Scarcity Potential (CSP)

It has been shown that a linear relationship exists overall between the average concentration of an element in the Earth’s crust (the Clarke index) and the content of that element in the ores mined [,,].

More specifically, a linear relationship exists between crustal concentration (Clarke) and global reserves (the share of the resources of a commodity that can be economically exploited at the time of a reserve estimate) [,]. Ref. [], another broadly linear relationship was demonstrated between crustal concentration (Clarke) and base reserve (the portion of the overall reserves that meets the criteria for mining: grade, quality, and depth). More recently, there also appeared to be a relationship between crustal concentration (Clarke) and cumulative reserves and consumption [,].

Furthermore, Skinner [] and Henckens et al. [] assume that the size of the initial stock of an element considered to be lowly abundant (<0.1%) is related to its average crustal concentration. In other words, the more concentrated an element is on average in the crust, the larger the initial stock to be mined, and vice versa.

The average crustal concentration of an element is natural and does not depend on technical–economic parameters, which are strongly governed by the temporal aspect. Thus, the value of the average crustal concentration is independent of time and is particularly appropriate for estimating the impact of the mineral resource characterisation factor in long-term life cycle assessments (LCAs) [] as well as for estimating the physical (geological) scarcity of a commodity.

The first criterion of the geosphere is the one defined by [] and named crustal scarcity potential (CSP). The CSP criterion corresponds to the ratio between the crustal concentration of silicon (CSi), one of the most abundant elements in the Earth’s crust, and the crustal concentration of an element x (Cx) (Equation (1)) in [].

- CSPx: crustal scarcity potential of element x (in kg eq Si·kg−1);

- Cx: average crustal concentration of element x (in µg·g−1 or ppm);

- CSi: average crustal concentration of the element Si (in µg·g−1 or ppm);

- CSPx expresses how much lower the average concentration of element x is than the average concentration of silicon in the Earth’s crust (in number of times).

CSP values were calculated for 76 elements by [] based on the mean crustal concentrations reported by [], except for carbon, tellurium, and rhodium, which were derived from []. The higher the value, the less abundant the element. Thus, the least abundant element is iridium, and the most abundant is silicon.

This criterion is very important for characterising the natural abundance of elements, which constitute the minerals and rocks exploited by humans. The CSP criterion, therefore, appears to be important in the calculation of the geosphere index (G) and is given a weighting coefficient of 30%.

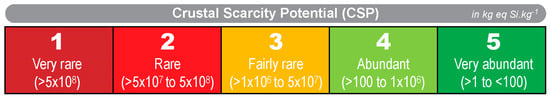

For the CSP criterion, values range from 1 to 7.6 × 109 kg Si·eq·kg−1 []. To normalise the CSP values, five classes were defined as shown in Figure 5.

Figure 5.

Details of the five normalised classes defining the “Crustal Scarcity Potential” (CSP) criterion, which is involved in the calculation of the geosphere index (G). CSP [] is in kg eq Si·kg−1 and corresponds to the ratio between the crustal concentration of silicon (CSi) and the crustal concentration of an element x (Cx).

3.3.2. Energy Required for Extraction, Treatment, and Separation of Element (E)

In [], the energy required to exploit a mineral resource is a key factor in defining the “mineralogical barrier”. Indeed, it is the amount of energy required to extract a useful commodity that, among other things, determines the boundary between the domain of rocks and minerals. A rock or ore is composed of minerals, which are themselves made up of atoms of different chemical elements. It is important to note that the chemical bonds between atoms constituting minerals and, therefore, rocks and ores have a greater or lesser strength depending on the crystal structure. Thus, depending on the elements and, therefore, the minerals, rocks, and ores, more or less energy will be needed to extract the useful commodity. At the same time, the higher the content of a useful commodity in a matrix, the less energy needed to extract it. For example, it takes a lot of energy to extract a commodity from a rock (low grade) compared to an ore (high grade), and, therefore, from an economic point of view, the lower the grade, the higher the energy requirement, and, thus, the less profitable the extraction.

In [], it was mentioned that one of the biggest constraints on the availability of raw materials in the longer term is the increasing amount of energy required to produce ever more complex materials resulting from innovation (e.g., graphene, composites, etc.). This argument also applies to primary minerals with decreasing grades and quality []. In other words, the more the ores become depleted (lower grades) over time, the more energy will be needed to extract, process, and separate useful commodities from these ores.

It is noteworthy that [] showed that there is a relationship between the crustal abundance of elements, the energy required to extract these elements from the ore, and mineral prices. Indeed, the energy required influenced price variations by about 43% and the average crustal abundance by about 21% for 22 chemical elements over the period of 1970–2013.

The other aspect of energy is the environmental impact that the extraction, processing, and separation of an element can have. Indeed, the higher the energy demand for extraction, the greater the environmental impacts of extracting an element from an ore. It is this principle of cumulative energy demand that is incorporated into life cycle assessments [,] or criticality [] and is based on the strength of chemical bonds between elements.

Thus, the amount of energy required to produce 1 kg of an element through its extraction, processing, and separation (up to the factory gate) is based primarily on the strength of the chemical bonds within an ore [,]. The strength of chemical bonds is, therefore, an intrinsic and physical (natural) parameter found in the geosphere. It is noteworthy that among other energy consumption methods, mineral exploration is negligible.

The values (in MJ·kg−1) for the criterion “Energy required for extraction, treatment and separation of element (E)” are taken from []. The limitation of this criterion is that values are not available for all chemical elements. In addition, the values for this criterion for industrial minerals are taken from [], an environmental criticality study applied to the commodities identified by the European Union, in which the energy requirement is present.

Since the energy required to exploit a mineral resource is a key factor in defining the “mineralogical barrier” [], criterion E is, therefore, the most important criterion in the calculation of the geosphere index (G) and is given a weighting coefficient of 50%.

For the E criterion, values range from 0 to 683,000 MJ·kg−1 [,]. To normalise the E values, five classes were defined as shown in Figure 6.

Figure 6.

Details of the five normalised classes defining the “Energy required” (E) criterion (in MJ·kg−1) and part of the calculation of the geosphere index (G). E represents the amount of energy required to produce 1 kg of an element through its extraction, processing, and separation [,].

3.3.3. Enrichment Factor (FE)

A mineral occurrence is an anomalous concentration of useful commodities (metals, minerals, and rocks) that are accessible and can eventually be exploited if economic, environmental, and social conditions allow, and the occurrence becomes a mineral deposit. To obtain from an average crustal concentration (Clarke) an anomalous mineral concentration (mineral occurrence), a process of enrichment must take place, linked to the concomitance of geological events at a given place (geography and geodynamic setting) and time (temporal and geological time scale).

Thus, the more abundant a substance is on average in the earth’s crust, the lower the concentration of the substance needed to form a mineral deposit [,,]. For example, to form an iron ore deposit, the metal will need to be concentrated nine times higher than its average natural concentration in the crust. To form a gold-bearing mineral deposit, the precious metal will need to be concentrated up to 7000 times more than its average natural concentration in the crust. In other words, based on the enrichment factor, gold is less abundant than iron.

The enrichment factor (FE) is calculated (Equation (2)) as the ratio of the anomalous concentration of a useful commodity (average grade of a known mineral deposit) to its crustal average concentration (Clarke). FE is often presented in the form of a range, as grades can change depending on the nature of the deposits (there are naturally high-grade deposits and others with lower grades) but also more broadly over time due in particular to fluctuations in raw material prices and/or technological barriers. Thus, when prices rise, the value of the cut-off grade falls, and vice versa. For example, the average grade of a gold deposit mined in the 1980s–1990s was in the order of several grams per tonne of gold (g·t−1 Au), whereas, today, many mined deposits have grades of around 1 g·t−1 Au or less. It can thus be considered that the estimated value of the enrichment factor is valid and consistent for about 30 years. Indeed, mining companies build up their feasibility studies over a maximum of 30 years.

- = enrichment factor for commodity x (without unit);

- = average content of a deposit of commodity x (in % or g·t−1);

- = average crustal concentration (Clarke) of an element x (in ppm = 0.0001% = g·t−1 = µg·g−1).

This third criterion FE is part of the geosphere as it depends on natural values (Clarke) independent of technical–economic issues. However, on the other hand, it can partly integrate the technical–economic sphere, as it also depends on values related to technical–economic issues (average content). The choice to include this criterion in the geosphere is based on several studies [,,,,,,,,]. The authors mention that the grade of a mineral deposit is considered to be intrinsic and, therefore, a physical (natural) criterion independent of technical and economic issues.

It is noteworthy that for metal and industrial mineral-derived ingredients, it is the scarcest element that is considered for the Clarke value, according to []. For the average ore grades, a literature review will be carried out in order to estimate the average grade of a deposit of a commodity.

This criterion is linked to the grade of the ores. In the literature, this notion is often considered an intrinsic criterion specific to the geosphere, even if it is the economics that allow the average grade of an ore to be characterised (interesting from an economic point of view for exploitation). Thus, the FE criterion is less decisive in characterising the natural mineral resource abundance linked to the geosphere index (G) and is given a weighting coefficient equal to 20%.

For the FE criterion, the values range from 0 to >10,000. To normalise the FE values, five classes were defined as shown in Figure 7.

Figure 7.

Details of the five normalised classes defining the “Enrichment Factor” (FE) criterion and part of the calculation of the geosphere index (G). F is the ratio of the anomalous concentration of a useful commodity (average grade of a known mineral deposit) to its crustal average concentration (Clarke).

3.4. Technical–Economic Sphere

3.4.1. Years of Known Reserves (TR)

The “Years of Known Reserves (TR)” criterion is the theoretical ratio of reserves (unit mass) to the annual world production (unit mass per year) for a commodity x (Equation (3)) (see [,,]).

The values of reserves and annual world production were obtained from the databases associated with the economic surveys conducted by certain national geological surveys, such as the USGS (United States), the BGS (Great Britain), the BRGM (France), or the BGR (Germany). Thus, this criterion gives the number of years of operation remaining for a given substance and must be updated every year.

It should be remembered that reserves are data that make it possible to calculate the quantity of a useful substance in deposits that are known (discovered) and economically profitable to exploit in accordance with the prices and technologies available. In other words, the notion of “reserves” constitutes the highest degree of geological knowledge and economic confidence for a deposit, which is the subject of international standards in the field of mineral exploration ([,,], CRIRSCO, NI43-101, and JORC). Reserves are a part of the resources in a deposit. The deposit is an anomalous concentration of a useful and economically viable substance to be exploited at a given time. In addition, there is the notion of geological potential and the total reserves, the resources of which are not known, as the boundaries between reserves, resources, and geological potential are mobile over time (Figure 4) [].

Reserve and resource values may evolve considering the following points:

- Technological developments: unconventional deposits may become exploitable thanks to new techniques that make it possible to extract, process, and separate the useful commodity;

- Economic conditions: the price of a useful commodity varies over time and may lead to the profitability of previously unknown deposits or motivate the continuation/initiation of exploration surveys;

- Geological knowledge acquired during mining exploration may lead to the discovery of new deposits (“green field”) or extensions to known deposits (“brown field”) and thus help to increase resources, reserves, and, consequently, mineral resource abundance;

- The recycling rate: secondary raw materials (“urban mine”) may, in the future, make a greater contribution to increasing the reserves and resources of a given commodity and, hence, its abundance.

This criterion is the subject of debate among scholars regarding the estimation of mineral scarcity or long-term resource depletion. It is another example of the “fixed stock” and “opportunity and cost” paradigms pitting pessimists and optimists of mineral resource depletion against each other. In any case, years of known reserves are regularly used as a criterion for assessing the criticality of raw materials, as for the World Materials Forum [].

The TR criterion is quite decisive in characterising the mineral resource abundance linked to the index of the technical–economic sphere (TE) and is given a weighting coefficient equal to 30%.

For the criterion TR, the values range from 0 to >100 years. To normalise the TR values, five classes were defined as shown in Figure 8.

Figure 8.

Details of the five normalised classes defining the “Years of Known Reserves” (TR) criterion and part of the calculation of the technical–economic index (TE). TR (in years) corresponds to the theoretical ratio of reserves (unit mass) to annual world production (unit mass per year) for a commodity x.

3.4.2. Surplus Ore Potential (SOP)

In [], the importance of grade in positioning the “mineralogical barrier” between the domains of (low-grade) non-exploitable rocks and (high-grade) ores that are economically viable to mine was demonstrated. Humans will, therefore, exploit the richest ores first, i.e., those with the highest grade.

In life cycle assessment (LCA), mineral content is found to be a value used to qualify/quantify mineral scarcity for characterisation factors [,,]. Indeed, the assumption is that as a result of the increasing extraction of mineral resources, the grade of the deposits decreases over the years [,]. In order to obtain the same amount of a useful commodity from less rich ores, more ore will have to be extracted, and, therefore, more waste rock and other mining wastes will have to be disposed of at the same time.

Thus, Vieira et al. (2016) [] defined a criterion entitled “Surplus Ore Potential (SOP)” as an indicator to be considered within the methodologies for conducting LCA studies. This criterion is also used in the LCA methodology of the European ReCiPe project [] and the LC-IMPACT project [,,] and is recommended by [].

The “Surplus Ore Potential (SOP)” criterion used for the definition of the mineral abundance index is in kg ore·kg−1 of a commodity. It represents the average increase in the amount of ore that needs to be mined per kilogram of material extracted. In other words, it characterises the increased amount of ore that must be extracted to produce the same amount of a commodity from less and less rich ores. SOP values, available for metals and industrial minerals, are taken from [,]. The higher the SOP value, the lower the abundance of the commodity.

This criterion incorporates the paradigm of decreasing average ore grade over time. This decrease is nevertheless compensated for by a larger tonnage mined, which guarantees a relatively constant abundance. The SOP criterion is less decisive in characterising the mineral resource abundance linked to the techno-economic sphere index (TE) and is given a weighting coefficient of 20%.

The SOP values range from 4.14 × 10−2 kg ore·kg−1 (gypsum) to 1.73 × 105 kg ore·kg−1 (caesium). To normalise the SOP values, five classes were defined as shown in Figure 9.

Figure 9.

Details of the five normalised classes defining the “Surplus Ore Potential” (SOP) criterion and part of the calculation of the technical–economic index (TE). SOP (in kg ore·kg−1) corresponds to the average increase in the amount of ore that needs to be mined per kilogram of material extracted.

3.4.3. Resource Accessibility per Country (AR)

Mineral resources have no borders since the formation of deposits exploited by humans is the result of geological, and, therefore, natural, phenomena over time and in given locations (current or past favourable geodynamic settings such as subduction zones, orogens, volcanic arcs, or oceanic ridges).

It is, therefore, easy to imagine the challenges in terms of supply (e.g., political stability, infrastructures, etc.). This raises the question of the accessibility of mineral resources according to the location of extraction sites and known reserves.

Beyond simple access through infrastructure (roads, railways, airports, mineral ports, processing plants, refineries, smelters, etc.), it is also a question of the ease of access for investors (taxation, mining code, etc.), access to the rule of law ensuring political, administrative, and legislative continuity (corruption, political regime), or internal security (terrorism, crime, etc.).

For many years, the World Bank and the OECD (Organisation for Economic Co-operation and Development) have developed methodologies for calculating country-specific indexes on these accessibility issues. The World Bank publishes annual governance indicators for more than 200 countries around the world, known as the Worldwide Governance Indicators (WGI) [,]. The same applies to the OECD, which publishes the values of an index measuring the attractiveness of a country for foreign investment, the “FDI (Foreign Direct Investment) Restrictiveness Index” [,].

So as to address a worldwide overview, the methodology uses information dealing with the main countries producing the commodities involved in the manufacture of industrial products (comprising at least 80% of the global production). This kind of information is mainly taken in the USGS Minerals Yearbooks.

The criterion “Resources accessibility per country (AR)” is divided into five subcriteria that reflect the different dimensions given to the term “accessibility”:

- Subcriterion “Political stability and Absence of violence/terrorism (AR1)”;

- Subcriterion “Regulatory restrictiveness index for mining/quarrying (AR2)”;

- Subcriterion “Government effectiveness (AR3)”;

- Subcriterion “Control of corruption (AR4)”;

- Subcriterion “Logistics performance (AR5)”.

Indeed, these subcriteria condition the ease of access given to mining companies in each country, among others, to explore and/or exploit mineral resources. Thus, the easier the access, the more positive the impact on mineral resource abundance. In other words, the easier the accessibility to mineral resources, the higher the criterion AR value, favouring, at the same time, the mineral resource abundance.

Political Stability and Absence of Violence/Terrorism (AR1)

This first subcriterion is based on the criteria developed by the World Bank through its Worldwide Governance Indicators (WGIs) [,]. AR1 corresponds to the “PV (Political Stability and Absence of Violence/Terrorism)” criterion defined by the World Bank.

This subcriterion aims to capture perceptions of the likelihood that the government will be destabilised or overthrown by unconstitutional or violent means, including politically motivated violence and terrorism [].

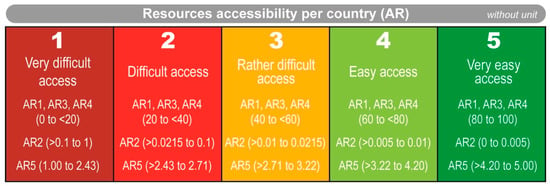

For AR1, values range from 0 (unstable) to 100 (stable). To normalise the AR1 values, five classes were defined as shown in Figure 10.

Figure 10.

Details of the five normalised classes defining the “Resources accessibility per country” (AR) criterion and part of the calculation of the technical–economic index (TE). It is noteworthy that this criterion encompasses five subcriteria, AR1 to AR5 (see text for details).

Regulatory Restrictiveness Index for Mining/Quarrying (AR2)

This second subcriterion is an index that has been developed by the OECD since 2003: the FDI (foreign direct investment) regulatory restrictiveness index [,]. This international index measures statutory restrictions on foreign direct investment in 22 economic sectors, including mining and quarrying. Thus, the value of the FDI index for the “mining and quarrying” sector will be considered as the value of AR2, as it is the most appropriate to address the issue of mineral resource abundance. This OECD index assesses the restrictiveness of country-specific rules governing foreign direct investment by looking at four main types of restrictions: (1) limitations on foreign ownership, (2) discriminatory screening or approval mechanisms, (3) restrictions on the employment of foreigners as key personnel, and (4) other operational restrictions.

The values of the mining and quarrying criterion are calculated for 84 countries worldwide and range from 0 (open to investment) to 1 (closed to investment). The data are updated annually and are available on the OECD website (stats.oecd.org). To normalise the AR2 values, five classes were defined as shown in Figure 10.

Government Effectiveness (AR3)

This third subcriterion is the one developed by the World Bank through its WGI (Kaufmann et al., 2010 []; World Bank, 2021 []). AR3 corresponds to the “GE (Government Effectiveness)” criteria defined by the World Bank.

GE criteria aim to capture perceptions of the quality of public services, the quality of the civil service and its degree of independence from political pressures, the quality of policy formulation and implementation, and the credibility of government commitment to such policies [].

For AR3, values range from 0 (unstable and inefficient) to 100 (stable and efficient). To normalise the AR3 values, five classes were defined as shown in Figure 10.

Control of Corruption (AR4)

This fourth subcriterion is the one developed by the World Bank through its WGI [,]. AR4 corresponds to “CC (Control of Corruption)” defined by the World Bank. AR4 aims to capture perceptions of the extent to which public power is exercised for private ends, including forms of petty and grand corruption as well as the “capture” of the state by private elites and interests [].

For AR4, values range from 0 (corruption) to 100 (no corruption). To normalise the AR4 values, five classes were defined as shown in Figure 10.

Logistics Performance (AR5)

This fifth and last subcriterion is a unique index that has been developed by the World Bank since 2007 to characterise the logistics performance of 160 countries []. The AR5 subcriterion of this study corresponds to the logistics performance index (LPI) published by the World Bank.

This subcriterion is available for 160 countries worldwide. It is an interactive benchmarking tool created to help countries identify the challenges and opportunities they face in their trade logistics performance and what they can do to improve their performance in the future. The index is based on a global survey of operators in the field (global freight forwarders and carriers), providing feedback on the logistics “friendliness” of the countries in which they operate and with which they trade. The feedback from operators is complemented by quantitative data on the performance of key elements of the supply chain in the country under consideration. The index developed by the World Bank is, therefore, composed of both qualitative and quantitative measures and helps to build logistics friendliness profiles for 160 countries. Since 2010, the data have been updated every two years by the World Bank, with the latest in 2018 [] (lpi.worldbank.org).

For AR5, values range from 1 (low performance) to 5 (high performance). To normalise the AR5 values, five classes were defined as shown in Figure 10.

3.4.4. Environmental Impact (ENV)

The objective of the responsible sourcing of mineral ingredients implies the integration of the environmental impacts of the use of mineral resources by the downstream industries. The mining industry, like any other industrial activity, generates impacts on the environment, on people, and on the economy—in other words, on the three pillars that define the concept of sustainable development: economic, environmental, and social.

The exploitation and/or exploration of mineral resources takes place within a legislative framework specific to each country where the explored and/or exploited deposits are located. Around the world, the mining code and/or the equivalent of the environmental code govern extractive activity and increasingly incorporate the environmental constraints with which mining companies and industrialists in the sector must comply. Beyond these mining laws, the final environmental impacts of mineral exploitation/exploration are also influenced by a country’s environmental protection policy. In other words, countries do not have the same consideration for environmental protection and thus limit or favour exploration/exploitation. Eventually, this impacts mineral resource abundance. The stage of the extractive cycle causing the most environmental impacts is the ore-processing stage (mineral processing and extractive metallurgy) because the use of chemicals, the energy consumption, and the discharge of residues are significant. Depending on the ore processing, the environmental impacts may vary. The legal framework of a country imposes weaker or stronger constraints on the industry but also the industry’s capacity to adopt good practices (beyond legal constraints). Moreover, “green chemistry” is now very important to consider, outlining a framework for making more environmentally friendly chemicals, processes, and products in the industry [,,,,].

Thus, in order to integrate these notions, the “Environmental Impact (ENV)” criterion will be based on two subcriteria:

- Ore processing (ENV1), where ores containing useful commodities are employed by downstream industries;

- The environmental performance of countries (ENV2), where the mineral resources, employed by downstream industries, are mined.

Ore Processing Environmental Impact (ENV1)

As seen above, a mineral resource is exploited for its useful function in human activities (e.g., thermal/electrical conduction, absorbency, colouring, fireproofing, ductility, etc.). Thus, a commodity is extracted from the underground when it has this desired function. In order to obtain this function, the commodity that has become useful must be mined and then undergo a treatment that will allow the commodity to be isolated from the extracted material.

It is during ore processing that the environmental impacts can be the most significant if the company does not respect the rules in force or does not observe good practices (beyond the regulatory framework). It should also be remembered that the techniques applied will depend on the useful commodity and, therefore, on the nature of the ore and the type of deposit exploited.

Regarding mineral resource abundance, it is above all the environmental dimension that influences the impacts generated by the process used. Indeed, the international dynamic aiming to respect the pillars of the concept of sustainable development influences the use of certain treatment processes that are not very respectful of the environment. These less respectful processes may then be abandoned by industrialists for environmental and/or ethical/image reasons or to comply with new rules imposed by countries. At the same time, this will lead to the drop out of certain types of ore and, therefore, of deposits, thus affecting the mineral resource abundance of a useful commodity.

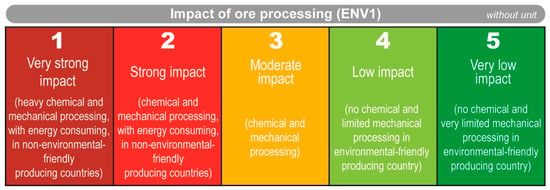

There is no formally established index in the literature that could allow measuring the environmental impact of a treatment process applied to a given commodity. Thus, the criterion “Treatment process (ENV1)” will be qualified at best by a detailed study applied to a given commodity.

The specificity of subcriterion ENV1 is that it is based on data from each country producing a mineral commodity. As it is almost impossible to list all countries producing a commodity, the choice was made to consider the main countries that together account for 80% of the world production for a given commodity. A ratio was then calculated to figure out the distribution between these main producing countries. This ratio was applied to the values of the subcriterion to better reflect the impact of each country in proportion to their production. The ENV1 accounted for 12.5% of the total weight for the technical–economic sphere index (TE). To normalise the ENV1 values, five classes were defined as shown in Figure 11.

Figure 11.

Details of the five normalised classes defining the “Impact of ore processing” (ENV1) criterion and part of the calculation of the technical–economic index (TE).

Environmental Performance Index (ENV2)

Since 2006, Yale University has developed an index that measures the environmental performance of countries [] and whose data are published every two years in a report covering 180 countries worldwide.

This environmental performance index (EPI) is calculated on the basis of 32 indicators divided into 11 issue categories and addressing two policy objectives: ecosystem vitality and environmental health. Each indicator is selected according to six criteria: relevance, performance orientation, methodology established to ensure comparability, third-party verification of the data, degree of geographical coverage, degree of temporal continuity, reliability of the data, and data dissemination rights.

The first publication of the index [] was analysed in 2008 by the Institute for International and European Environmental Policy on behalf of the German Federal Environment Agency []. Although the first publication of this index suffers from methodological weaknesses and sometimes poor data quality, the German analysis praised the availability of a global index that aims to encourage countries to develop a policy for environmental protection, which was ultimately challenged by the publication of the Yale University index.

The latest environmental performance index values, published in [], have been audited by the European Commission via the JRC (Joint Research Centre) to qualify the transparency of the methodology and the reliability of the results []. In concluding this recent analysis, [] states that the Yale University index “meets the quality standards for statistical soundness and acknowledges the EPI as a reliable composite indicator to measure environmental performance worldwide. By looking beyond the overall index scores, the EPI allows to provide insights on its underlying categories where the real essence of a composite indicator lies. The EPI has been the result of 20 years of research and constant refinements, bringing a first-of-its-kind composite measure to the global environmental policy arena”.

As a result of this scientific recognition, the Yale University Environmental Performance Index (EPI) is included as the “Country Environmental Performance (ENV2)” sub-criterion in the calculation of the “Environmental Impact (ENV)” criterion for determining the mineral abundance index (MAI).

The specificity of subcriterion ENV2 is that it is based on data from each country producing a mineral commodity. As it is almost impossible to list all countries producing a commodity, the choice was made to consider the main countries that together account for 80% of the world production of a given commodity. A ratio was then calculated to see the distribution between these main producing countries. This ratio was applied to the values of the subcriterion in order to best reflect the impact of each country in proportion to their production.

The environmental performance index developed by [] is graded from 0 to 100. The ENV1 accounts for 12.5% of the total weight for the technical–economic sphere index (TE). To standardise the values, five classes were defined as shown in Figure 12.

Figure 12.

Details of the five normalised classes defining the “Environmental performance of producing countries” (ENV2) criterion and part of the calculation of the technical–economic index (TE). ENV2 is based on the environmental performance index (EPI) developed by Yale University since 2006.

3.5. Socio-Epistemic Sphere

As seen above, physical (or should we say geological, i.e., within the Earth’s crust) scarcity is quite different from economic scarcity (a product can be scarce and thus become exclusive and competitive). This notion of scarcity is, therefore, relative depending on the point of view and the field of knowledge. Scarcity in the economic domain is sometimes seen as a driver of innovation [], which in turn is driven by price incentives and curiosity about the unknown, both of which lead humans to develop new methods, technologies, and processes.

The criteria defined in the socio-epistemic sphere aim to explore these notions in order to provide a long-term strategic vision on the use of the commodities considered in the downstream industries. The objective of the criteria defined in this sphere is thus to complete the notions seen previously, which aimed to characterise the abundance of commodities in their “natural” and “technical-economic” situations. The aim here is to take one step further by studying the influence of markets on the risks of scarcity of these commodities and the factors that can increase the relative abundance for the end-user.

3.5.1. Price Volatility over Last Decade (V)

There are several reasons for using the price factor in the definition and characterisation of the mineral abundance index. For a company, the use of a given mineral material is intimately conditioned by a trade-off between the cost of acquiring the substance on the market and the performance gain obtained by using it [,,]. In other words, for a given performance, a substance will be considered more abundant if it is accessible at a stable price over time, thus “complementing” its natural abundance.

The price is a “signal” to assess the importance and potential abundance on the markets of possible by-products/co-products at a given time. In [], it is pointed out that a number of so-called “minor” metals are often mined in conjunction with major or “host” metals, as the former are less concentrated in the Earth’s crust (<0.1%) and are less likely to form deposits on their own. In addition, there is the economic definition based on the participation of the metal “miner” in the overall revenue of the mining operation. A by-product makes a smaller financial contribution to the total operating income than the host metal. The co-product has a created economic value of the same order of magnitude as the host metal, irrespective of the quantities extracted []. In [], these interdependencies were defined in a so-called “metals wheel” representation. The role of price developments in extraction dynamics is intimately linked to this interdependent relationship.

The evolution of mineral resource prices plays a key role in the dynamics of extraction and thus greatly conditions their abundance on the markets. In order to integrate this parameter, it was decided to define a criterion relating to the volatility of prices for a given substance over a 10-year period. This time horizon allows for a more detailed consideration of the phenomena of commodity market cycles. In finance, the measure of the variability of prices over time is called volatility. The volatility of a price characterises the amplitude with which it can vary, up or down in relation to an average price, over a given period [].

It is, therefore, natural that the calculation of volatility should include the standard deviation, which, in statistics, expresses the dispersion of values around a mean. Several studies use historical price volatility as an indicator of commodity supply risk [,]. In the present methodology, the choice is to consider the relative standard deviation (Equation (4)) for the calculation of the price volatility criterion (V) in order to obtain values in percentages for a time interval of 10 years, taking into account the phenomena of commodity market cycles.

In terms of data sources, it should be remembered that only ten or so metals are listed daily, in particular, in London (London Metal Exchange—LME). The other metals or substances are traded under over-the-counter contracts between producers and buyers, which may be trading houses. Transaction prices are not made public. Specialised information sources, available only by subscription, provide ranges of transaction prices for a wide range of mineral commodities. These prices may represent only a small part of the actual market, but they are the only indicators of the market trend for these mineral commodities. Thus, the reference values chosen for the study of a commodity will have several sources depending on the commodity under consideration and the availability of prices for a given grade of the commodity. The US Geological Survey, in its Minerals Commodity Summaries reports, can provide some of these values with a 10-year history. In other cases, the price may also be estimated through reference to customs trade data (e.g., UN ComTrade—International Trade Statistics Database) on the same reference (price per tonne).

This criterion characterises the relative abundance (i.e., on the markets) of a given substance. It also measures the trade-off for an end-user between the performance gain obtained by using the substance and its cost or even the potential difficulties of its supply. Criterion V, therefore, appears to be predominant in the calculation of the socio-epistemic sphere index (SE) and is given a weighting coefficient of 20%.

For criterion V, the values range from 0 to >200%. To standardise the V values, five classes were defined as shown in Figure 13.

Figure 13.

Details of the five normalised classes defining the “Volatility of prices over last decade” (V) criterion and part of the socio-epistemic index (SE). V (in %) characterises the relative abundance (i.e., on the markets) of a given commodity.

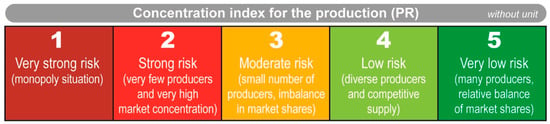

3.5.2. Concentration Index for the Production (PR)

The definition of the criterion “Concentration index for the production (PR)” is based on the principle that the relative abundance of a mineral ingredient for a given user depends on the ease of obtaining it on the market. Thus, the more diverse the producers of a given grade of the ingredient, the higher the abundance.

However, it should be noted that this criterion measures more so the risk that a too-strong concentration of the market (monopoly) may impose on the user rather than on the abundance itself.

The definition of the “PR” criterion is based on the concept of a benchmark economic index for measuring market concentration (the Herfindahl–Hirschman index—HHI) while proposing an adaptation of the latter to the field of study selected.

The HHI is conventionally used to measure market concentration. Named after the work of economists Orris C. Herfindahl and Albert O. Hirschman, who proposed and developed this index in parallel [,], it has been taken up over the years by biologists, ecologists, linguists, sociologists, and demographers. In 1982, the US Department of Justice adopted it to assess the competitive effects of corporate mergers [,]. The HHI thus represents the extent to which a small number of firms account for a large share of output. The higher the HHI in a given market, the more output that is concentrated among a small number of firms.

The HHI varies between a theoretical value of 0 (infinity of actors with zero output) and 1 (a single producer in a monopoly situation). In economics, a level of concentration equal to 0.4 or higher is considered a warning signal, inviting a more in-depth analysis of the possible risks that concentration may pose to economic actors [].

This criterion is very important for characterising the relative abundance (i.e., on the markets) of a given commodity. It plays a major role in the medium-term supply strategy of a player in the industrial sector. Indeed, the more diversified the producers of a given quality ingredient, the higher the abundance. The PR criterion, therefore, appears to be preponderant in the calculation of the index of the socio-epistemic sphere index (SE) and is given the highest weighting, equal to 30%. To standardise the PR values, five classes were defined as shown in Figure 14.

Figure 14.

Details of the five normalised classes defining the “Concentration index for the production” (PR) criterion and part of the socio-epistemic index (SE). Based on the Herfindahl–Hirschman index (HHI) [,], this criterion plays a major role in the medium-term supply strategy of a player in the industrial sector.

3.5.3. Maturity of Recycling Loops (REC)

Recycling is one of the pillars of the circular economy concept, which aims to change the paradigm of the so-called linear economy (extract, produce, consume, and throw away), the model of our societies since the Industrial Revolution. The aim is to limit the waste of resources and the environmental impact by increasing efficiency at all stages of the product economy (goods and services). Thus, recycling will potentially have a positive influence on mineral resource abundance. The use of mineral ingredients of recycled origin (secondary mineral resources) should in theory limit the pressure on the primary mineral resources (extracted in mines and quarries) from which they are derived.

However, there is only one limitation to this notion: if demand increases, improved recycling can only contribute to a limited extent to reducing the pressure on primary extraction. Indeed, since only the quantities initially produced can be recycled, the deficit created by an increase in demand will necessarily be filled by “virgin” resources extracted from mines/quarries [].

The first definition of the recycling rate is that it can be equated, under certain conditions, to the ratio between the quantities recycled and the quantities placed on the market or consumed in the same year []. This is relevant for waste resulting from short-lived products, for products with simple compositions, and insofar as the data are accessible. However, these three conditions are very rarely met for products containing mineral ingredients (with complex compositions) and even more so in certain industrial sectors with long production chains.

The recycling rate can also refer to the ratio between the quantities of raw materials from recycling integrated into production and the quantities produced, which is a different measure. This can lead to confusion. Furthermore, this figure can be very different from the actual recycling rate for a given material and territory, depending on the industrial and consumption structure [].

In 2011, the publication of the report “Recycling Rates of Metals” by the United Nations [] brought some clarification, proposing a conceptual scheme of the life cycle of metals in the economy and a definition of each stage, as well as a reflection on indicators for measuring metal recycling. Although this study is a reference and appears, to date, to be the most exhaustive in terms of data and methodology, its main limitation is the lack of updates over time.

In [], the authors conducted an assessment of criticality at the European Union level and used the UNEP (United Nations Environment Programme) methodology to measure the contribution of the “recycling rate” indicator to the reduction in supply risks. To carry this out, they introduced an attempt to quantify the various flows precisely. The main limitation of this method is its lack of applicability due to the difficulties in obtaining the values needed for the assessment because of the lack of transparency of the production channels, making the assessment unsuitable.

Finally, another type of approach, more focused on assessing the maturity of recycling circuits, is used to evaluate the criticality of raw materials, notably by the World Materials Forum []. This approach avoids the measurement of flows, which can be delicate, and uses the principle of a qualitative assessment, justified via the consultation of experts and stakeholders in the field to establish whether the technologies and recycling circuits for a particular substance are progressing over time.

This study will retain this approach (REC criterion) and will be based on the commodity chain analyses of the mineral ingredients considered, making it possible to fine-tune the characterisation of a recycling rate with the share that can be integrated into the production circuit of a particular product.

The REC criterion appears to be the most important one in the calculation of the socio-epistemic sphere index (SE), as it characterises the capacity of a company to reduce the pressure on primary geological resources. It is given a weighting of 25%. To standardise the REC values, five classes were defined as shown in Figure 15.

Figure 15.

Details of the five normalised classes defining the “Maturity of recycling loops” (REC) criterion and part of the socio-epistemic index (SE). REC aims to identify the need for a company to reduce the pressure on primary geological resources.

3.5.4. Substitutability (SUB)

The availability of a substitute material reduces the strain on the original material. In this sense, it has a more or less long-term effect on both the natural (geological) and economic abundance of a given commodity. Substitution is generally seen as a means of reducing the economic consequences in the event of a potential supply shortage of a commodity.

This substitution will be interesting if and only if such an operation has an action on the price and does not modify the performance of the substituted commodity or the finished product incorporating it.

“Substitution” and “substitutability”, and the associated methodologies, are addressed in several studies [,,]. Several studies on the criticality of raw materials use substitutability as an indicator of supply risk. A literature review on this subject was conducted by []. The authors conclude that three studies in particular use substitutability as a measure of supply risk reduction: the European Commission [], the Cologne Institute for Economic Research [], and the General Electric company [].

The qualitative approach is chosen in this study, mainly because the objectives are similar to those defined in an industrial setting []. It is an assessment of the company’s ability to replace an unavailable component with an alternative material. If no immediate substitute is available, it also assesses the potential difficulty and development time of a possible substitute.

Particular attention will be paid to the price and performance criteria of the substitute, which are the only ways to effectively qualify the substitutability of one element for another in a given industry. On the other hand, there is the possibility that the possible substitute material may also experience supply or scarcity problems, which would have the effect of reducing mineral resource abundance.

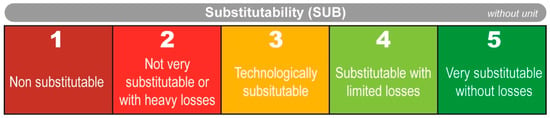

The SUB criterion appears to be predominant in the calculation of the socio-epistemic sphere index (SE), as it characterises the capacity of a company to replace an unavailable commodity with an alternative material in the event of a decrease in the market abundance of the latter. It is given a weighting of 25%. To standardise the SUB values, five classes were defined as shown in Figure 16.

Figure 16.

Details of the five normalised classes defining the “Substitutability” (SUB) criterion and part of the socio-epistemic index (SE). SUB characterises the capacity to replace an unavailable commodity with an alternative material.

4. Methodology for Assessing Mineral Resource Abundance of Commodities Used in Downstream Industries

The objective of this part of the study is to evaluate the value of the mineral abundance index (MAI) from the different criteria distributed in the three mineral resource spheres. Since the criteria are inhomogeneous (they are not expressed in the same unit), it is necessary to use multicriteria analysis theorised by [].

4.1. Calculation of the Geosphere Index

The geosphere index (G) is calculated, according to Equation (5), as the weighted average of the three selected criteria (i.e., CSP, E, and FE), each weighted according to their importance (see Section 3.3). This index varies from 1 to 5.

- G: geosphere index value;

- P: weighting coefficient;

- V: criterion value;

- x: mineral commodity;

- i: criterion i (CSP value, E value, and FE value).

The geosphere index (G) reflects the intrinsic character (independent of technical and economic factors) of the criteria used for its calculation and thus allows the natural abundance of a mineral commodity to be qualified. Although the geosphere is the basis for qualifying mineral resource abundance s.l., the downstream industries use a small proportion of the quantity of mineral resources in this sphere. Thus, although this index remains essential for the qualification of mineral resource abundance, its importance is less decisive for the downstream industries than the other two indices of the technical–economic and socio-epistemic spheres. G is, therefore, weighted with a coefficient of 30% for the cosmetics industry but can be adapted according to different downstream industries (e.g., automotive, aerospace, defence, etc.).

Finally, the value calculated on the basis of the three criteria for the geosphere was derived from reliable and easily accessible bibliographic data, as they are published.

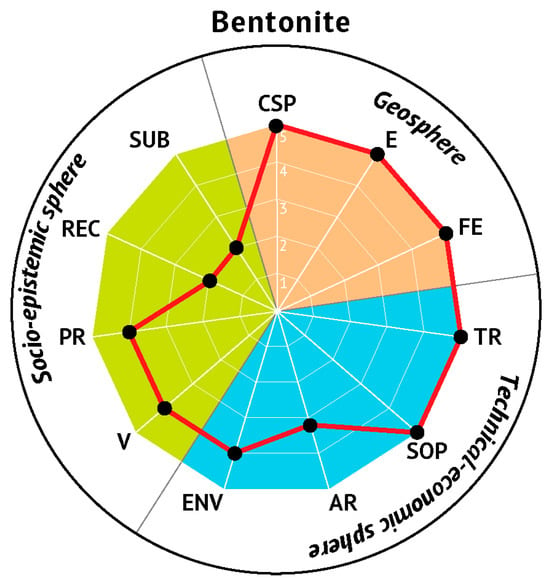

4.2. Calculation of the Technical–Economic Sphere Index