2.1. Theoretical Review

The achievement of local governments’ publicly stated pollution reduction and energy consumption targets ultimately relies on the implementation by micro-level enterprises within their jurisdiction, with heavily polluting enterprises playing a pivotal role in meeting environmentally binding performance assessments. Following the “compliance cost hypothesis”, under the stringent environmental regulatory pressure imposed by the government, businesses are compelled to undertake pollution control measures. Particularly for pollution-intensive industries, the costs associated with environmental stewardship are relatively higher, inevitably squeezing out productive investments within the enterprise [

13,

14]. This implies that compliance with environmental targets by heavily polluting enterprises entails additional expenses, such as procuring environmental equipment, staff training, and equipment maintenance, resulting in a rapid escalation of the enterprise’s short-term production costs. Furthermore, decisionmakers within these enterprises may need to engage in clean technology research and development to enhance their production processes and reduce emissions to achieve the environmental objectives. Given the enterprises’ existing resource constraints in the short term, any decision in this regard would lead to changes in the enterprises’ current assets, thereby affecting their performance [

15]. Particularly for pollution-intensive industries, the high costs associated with environmental stewardship further burden their production and operating expenses [

16]. In the short term, the pressure of clean production and pollution control costs brought about by government environmental regulations severely narrows the profit margins of enterprises [

17].

Based on the long-term perspective, actively fulfilling environmental responsibilities can enhance the reputation of heavily polluting enterprises, attracting investors and consumers and contributing to the long-term sustainable development of the enterprise. Actively adhering to government environmental governance decisions also benefits the enhancement of the market value of enterprises [

18]. Furthermore, in some regions, compliance with environmental requirements is becoming a prerequisite for enterprises to enter the market. Under the influence of environmental constraints, heavily polluting enterprises may expand their consumer market by implementing energy-saving and emission reduction measures. The “Porter Hypothesis” suggests that reasonable environmental regulations can incentivize businesses to engage in technological innovation and transformation, offsetting the costs through innovative compensation effects and enhancing their competitiveness [

19]. Ref. [

20] based on the “Porter Hypothesis”, examined the connection between government environmental regulations and the innovation capabilities of listed companies and found that in regions with well-designed environmental policies, the innovation capabilities of companies in competitive industries were significantly improved. Under the environmental pressure of meeting environmental objectives, enterprises are stimulated to actively innovate, increasing investment in the development of clean technologies and services [

21], thereby achieving a competitive advantage and high-quality development [

22,

23]. Innovation activities triggered by government environmental regulations typically have a lagged positive impact on economic benefits. Therefore, most of the cutting-edge literature suggests that government environmental governance decisions and the long-term performance of enterprises often exhibit a positive relationship [

24,

25,

26,

27]. Based on the above analysis, this paper proposes the following research hypothesis:

Hypothesis 1a: LGETCs inhibit the short-term performance of HPEs.

Hypothesis 1b: LGETCs promote the long-term performance of HPEs.

In the context of environmental protection, financial institutions are increasingly focusing on social and environmental responsibilities, leaning towards supporting enterprises that comply with sustainable development and environmental standards. Faced with local environmental targets leading to stricter pollution regulations, non-compliant businesses face substantial fines and legal liabilities, thereby increasing the investment risk for heavily polluting enterprises’ external stakeholders. When investment risks are higher, investors tend to charge a higher risk premium to the company. Financial institutions typically also focus on the financial health of the enterprises; environmental regulations can negatively impact a company’s financial situation, and environmental risks may lead to financial instability, thereby reducing the confidence financial institutions have in these companies. Companies subject to stringent environmental regulations, seeking bank loans, also need to pay higher interest rates [

28]. Additionally, heavily polluting companies, aiming to achieve government environmental objectives, need to invest significant funds to upgrade technology and improve operations. These costs can impede a company’s cash flow, reducing short-term investment efficiency and subsequently affecting their own financing capabilities. The existence of financing constraints restrains a company’s growth, investment, and external economic activities, ultimately leading to a decline in the company’s performance [

29]. Based on the above analysis, this paper puts forth the following research hypothesis:

Hypothesis 2: LGETCs further inhibit the short-term performance of HPEs by increasing corporate financing constraints.

In the face of uncertain external business environments, companies often incur higher non-productive expenses and tax burdens. The adverse effects of policy uncertainty on a company’s production and operations tend to be more pronounced [

30]. According to the principal–agent theory, environmental uncertainty exacerbates the agency conflicts existing between shareholders and management [

31]. Heavily polluting enterprises facing constraints from local government energy-saving and emission reduction targets present worrisome prospects. The information asymmetry in the principal–agent process facilitates management’s “self-dealing” behavior. Furthermore, management typically exhibits self-interest and short-sightedness, leading to behavior aimed at maximizing personal benefits through premature consumption when confronted with operational risks [

32]. This behavior results in increased agency costs for the company. The rise in agency costs reflects inefficiencies in the internal principal–agent mechanism of the company. Shareholders fail to provide effective oversight of corporate executives, leading to a lack of motivation on the part of managers to maximize the company’s interests, which is detrimental to the company’s sound operation. Additionally, excessively high non-productive expenses, regarded as agency costs, can squeeze the share of productive investments within the company, potentially leading to a situation where the company faces “reduced investment levels and diminished operational efficiency”. Therefore, the elevated agency costs within a company do not bode well for achieving stable improvement in financial performance, making it challenging to realize the maximization of corporate value [

33,

34]. Based on the above analysis, this paper proposes the following research hypothesis:

Hypothesis 3: LGETCs raise the agency costs of HPEs and increase their operational burden, which is not conducive to the performance improvement of HPEs.

After facing significant pressure from the government’s energy-saving and emission reduction targets, heavily polluting companies are left with two options. In the short term, they can choose to drastically reduce their emissions to ensure their own survival. However, for long-term sustainability and growth, they can opt to develop clean technologies, upgrade their processes, and enhance resource utilization to address environmental governance pressures [

23,

35,

36]. Reasonable environmental constraints imposed by the government can stimulate companies to invest in research and development, leading them to prefer low-energy, low-pollution, green, clean technologies during their production processes [

36,

37]. This, in turn, contributes to enhancing their technological innovation capabilities, particularly in the realm of green technology innovation. Leading scholars commonly assert that technological innovation has a substantial positive impact on a company’s performance. It can compensate for the various costs incurred by businesses due to compliance with environmental regulations, a phenomenon referred to as the “innovation compensation effect” [

20,

38]. Green technology innovation, in particular, serves as an effective means to simultaneously achieve pollution control, emission reduction, and economic benefits, facilitating companies in exploring a path of innovation-driven green sustainable development. Based on the above analysis, this paper proposes the following research hypothesis:

Hypothesis 4: The LGETCs are conducive to the improvement of the innovation level of the HPEs, which can mitigate the negative impact on the performance of the HPEs, and there is an innovation compensation effect.

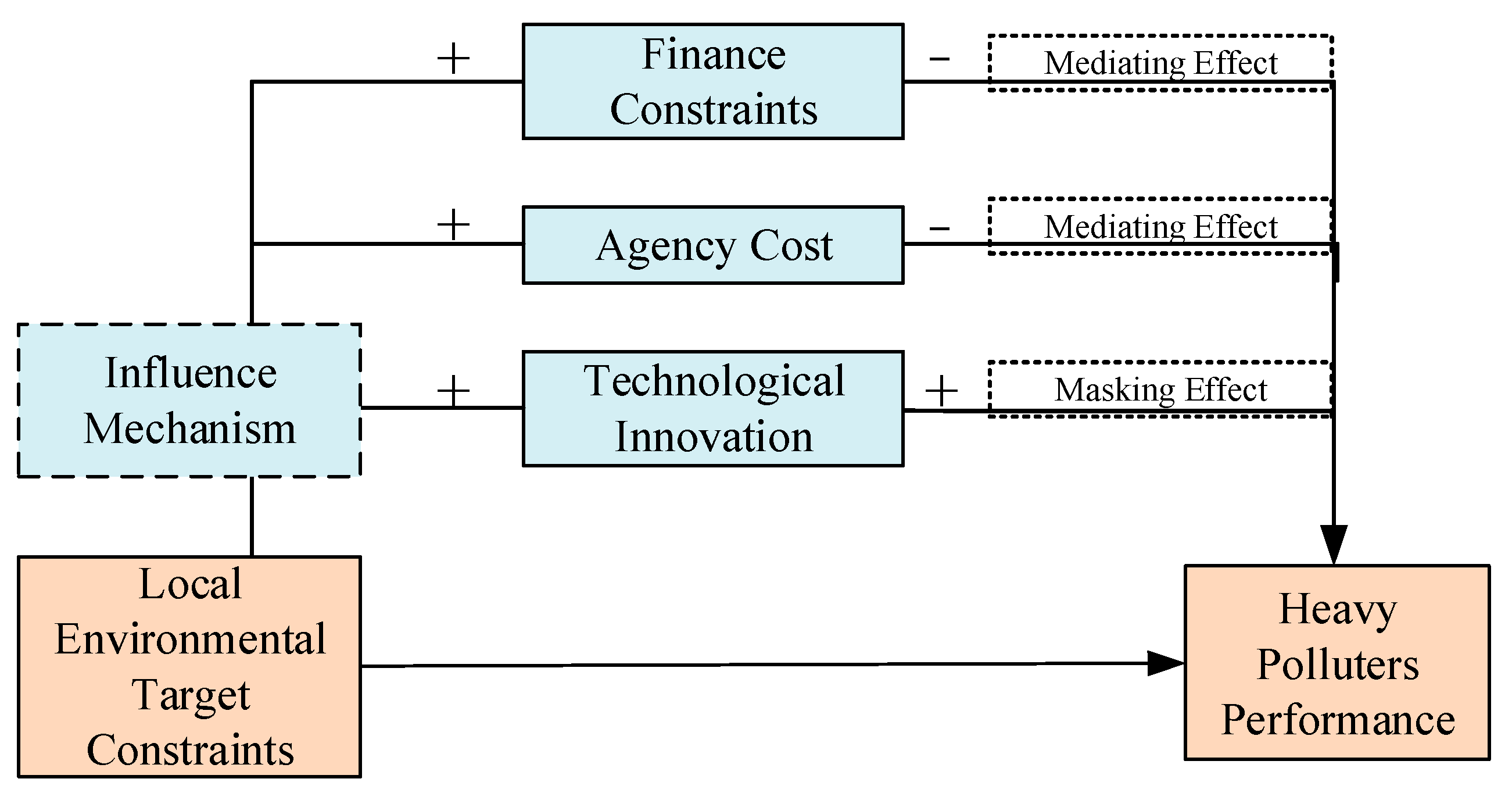

In summary, the hypotheses of this paper on the effect of LGETCs on the performance of HPEs and the mechanism of the effect are shown in

Figure 1.

2.2. Review of Empirical Studies

The relevant literature in this regard can be categorized into two aspects. The first aspect examines the substantive impact of environmental targets on pollutant emissions, focusing on the changes in emissions of pollutants like sulfur dioxide at the macro-level, such as prefecture-level cities and counties. Ref. [

39] analyzed government work reports from 230 Chinese cities for the years 2004–2013, and their findings suggest that environmental target constraints have a positive effect on local economic development, but this effect is influenced by officials’ proactiveness. Ref. [

40] examined the influence of local governments’ environmental concerns on local atmospheric pollution by measuring economic growth constraints and environmental target constraints. They found that in regions without economic pressure, local governments can effectively achieve environmental target constraints, leading to a significant reduction in atmospheric pollution. Local governments tend to balance their governance efforts between economic and environmental aspects, and in the presence of economic growth pressure, environmental governance may be overlooked. Ref. [

23] based on the economic growth goals of 257 prefecture-level cities in China, found that moderate goals effectively improve carbon emission performance, but overly ambitious goals may backfire. However, ref. [

21] discovered that the negative impact of economic growth pressure on environmental pollution can be mitigated through the intensity of environmental regulations.

The second aspect of the literature focuses on the impact of external environmental regulatory pressure on a firm’s production and strategic decisions from the perspective of corporate decision-making behavior. Ref. [

36] treat China’s environmental target constraints as an exogenous policy shock and examine their effects at the firm level. They find that, in the short term, environmental target constraint policies can effectively reduce emissions of atmospheric pollutants by firms but do not show effectiveness in promoting long-term emission reduction measures like green technology innovation. However, there are differing views on the impact of environmental regulation on firm innovation effects. Ref. [

10] based on central vertical environmental monitoring policies, found that real-time environmental monitoring stations can promote green technology innovation by firms. Micro-level firms, as the primary contributors to societal production, are crucial for pollution control efforts, and the focus of environmental regulation on pollution control largely centers around encouraging firms to engage in the development of clean and green technologies. However, technological innovation comes with high costs, uncertainties, and associated risks, all of which have a direct connection to firm performance. Therefore, studying the impact of environmental target constraints on firm performance is of significant importance.