Abstract

This study compares how crude oil and ethanol price changes are passed through to the wholesale prices of a conventional fuel (E10), which contains 10% ethanol, and a high-blend ethanol fuel (E85), which contains 51% to 83% ethanol. Daily observations from October 2017 to June 2019 were obtained from a large market in the United States that provided wholesale fuel prices and ethanol prices. The Error Correction Model (ECM) was applied to each fuel specification using Seemingly Unrelated Regressions (SURs) in order to improve the efficiency of the estimates. Comparable to prior research, the long-run pass-through coefficient for E10 with respect to crude oil was 1.13. In contrast, the E85 long-run pass-through coefficient with respect to crude oil was 0.74. Estimates for the short-run analysis indicated asymmetry in the transmission of crude oil price changes to E10, with crude price increases passing through at greater rates compared to crude price decreases. Symmetry was found in the transmission of ethanol price changes to E85, indicating the same response to rising and falling ethanol costs. Despite the differences in ethanol requirements, the relative prices of crude oil and ethanol are still important for both fuels.

1. Introduction

The behavior of firms involved in the transmission of prices along fuel supply chains reveals important information about market efficiency, government policy outcomes, and consumer welfare. Researchers have responded by developing a robust history of studies investigating these challenges. The most common concern among these studies is whether firms treat their input cost increases and decreases the same with respect to the pass-through to final output prices or if there are asymmetric adjustments that take place. The literature on price pass-through in conventional fuel markets is vast and extends globally. However, mainly due to mandates stemming from environmental concerns, fuels with higher percentages of renewable components are more prominent now and are expected to increase in availability in the coming years. The automobile, commercial transportation, and airline industries are, therefore, expected to continue to embrace these biofuel directives with evolving technologies.

The study of price pass-through in biofuel markets is still a relatively new area of research, but the methodologies developed from investigations into conventional fuel markets can be extended to these markets as there are many similarities. The most commonly used methodology in a majority of fuel price transmission studies is the Error Correction Modeling (ECM) procedure. This methodology has also been proven flexible in applications to other concerns, including evaluating the outcomes of industrial reorganization and government investigations of market power [1,2]. However, many authors have chosen to expand the application of ECM or explore other empirical applications in the pursuit of a deeper understanding of price transmission or improvement in model inferences. These fairly recent initiatives have resulted in an exciting growth of the methodologies used to assess potential price asymmetries.

In this paper, the ECM approach was extended to a system of wholesale-level price pass-through relationships involving a conventional fuel and a high-blend ethanol-based fuel using Seemingly Unrelated Regressions (SURs) [3]. Since the equations are estimated during the same time period using volatile crude oil, ethanol, and fuel prices, it is reasonable to assume the individual equation disturbances may be correlated since economic forces affecting fuel production, transportation, and consumption would likely affect both fuels. In cases of correlated equation disturbances, the equations can be estimated with more efficiency using SURs [3]. This contribution to energy sustainability research is novel in that an SUR system using the ECM framework with daily data has never been applied to a comparison of fuel cost pass-through between a conventional fuel and a fuel with a very high percentage of renewable components. Also, while a very limited number of studies have discussed the long-run pass-through comparisons, none have developed short-run symmetry tests that can reveal original insights into the impact of cost changes with respect to a high-blend biofuel. An additional advantage of using a system of equations under SUR is that comparison hypothesis testing between the conventional fuel and high percentage biofuel model results is much more straightforward. The results of the hypothesis tests can allow inferences to be drawn with respect to price transmission comparisons between the two fuels.

The rest of this paper is organized as follows. Section 2 summarizes a review of the literature focusing on the methodological evolution of price transmission research in fuel markets. Section 3 outlines the empirical methodology used in this study. In Section 4, the results are discussed, and in Section 5, the conclusions and policy implications are presented.

2. Literature

Due to properties typically found in fuel price data, the ECM methodology has become the most popular technique for the evaluation of fuel price transmission pass-through. An important early contribution using this procedure was Borenstein et al.’s work [4]. The authors analyzed data from the United States and found asymmetrical pricing behavior in both the crude-to-wholesale and wholesale-to-retail stages. Bachmeier and Griffin [5] contributed to the ECM methodology by improving the asymmetric pricing evaluation process. Using daily data from the United States, they found no evidence of asymmetry in the crude-to-wholesale gasoline price transmission process. After these crucial methodological contributions, many authors have used the ECM methodology to appraise the presence of price asymmetry in fuel markets across the world.

Galeotti et al. [6] used an ECM to assess potential price asymmetries extending from crude oil to retail gasoline across five dominant European markets. The authors revealed the majority of evidence pointed to the presence of price asymmetry. Bettendorf et al. [7] applied the ECM methodology on separate data sets constructed for each day of the week in the Dutch gasoline market. The results regarding asymmetric pricing were mixed, leading to the inference that the day of the week when prices are observed is important. Kaufmann and Laskowski [8] also used an ECM specification to assess price asymmetries in American crude and refined petroleum markets. The authors concluded there was a lack of asymmetry in their study, which they attributed to adding fuel utilization and stock rates to their model. Remer [9] used daily data and found asymmetries in the price transmission between wholesale and retail markets. Remer also found support for consumer search theories as determinants of price asymmetry by comparing the findings of regular and premium gasoline. Chesnes [10] used an ECM model along with daily data from the United States and elaborated that the differing conclusions often found in price transmission studies are related to data aggregation techniques and using prices from different levels of the fuel supply chain. The author found support for asymmetry in this study. Cha and Le [11] used weekly data to assess price transmission asymmetry at several levels of the gasoline distribution system in South Korea. The results from this study indicated the presence of pricing asymmetry and that consumer search costs are the likely causes of this outcome.

Some studies have used the ECM to evaluate how regulatory initiatives have affected the dynamics of fuel systems. Contín-Pilart et al. [1] applied a multivariate ECM to the Spanish oil industry in order to assess the outcomes of restructuring attempts by the Spanish government. The results of this study indicated retail gasoline prices responded symmetrically to spot prices during and after the regulation. Raeder et al. [12] evaluated a new fuel pricing strategy in the Brazilian fuel sector and found little changes with respect to pricing asymmetries before and after the new strategy. However, the welfare impact on consumers was more desirable after the changes. Cui et al. [13] investigated the impact of a regulatory price cap on retail gasoline markets in China. Using daily data, the authors found that retail prices responded asymmetrically to changes in the price cap but had insignificant responses to crude oil price changes. This result led to the inference that this particular form of regulation may serve as a point of collusion for gas stations.

Farkas and Yontcheva [2] used an ECM specification to model the wholesale gasoline market in Hungary in order to help determine if a government inquiry regarding the pricing strategies of a dominant firm changed the firm’s behavior. Asymmetry with respect to the price transmission process between crude oil and wholesale gasoline was observed prior to the inquiry, but afterward, the price responses became much more symmetric. While the breadth of the application of the ECM methodology is impressive, there are variations on the basic ECM that have also garnered interest.

Grasso and Minera [14] provided a comprehensive review up through that point in time with a focus on how the differences in ECM application might affect the observed results. The authors focused on the results generated from the basic (asymmetric) ECM and ECM applications based on autoregressive threshold and threshold cointegration generalizations. They found the results to be sensitive across the different model specifications depending on the specific price transmission stages and individual market fundamentals.

In more recent years, some researchers have chosen to pursue methodologies outside of the traditional ECM framework. Bagnai and Ospina [15] used a nonlinear cointegration methodology and monthly data to assess more than three decades of the crude oil to gasoline price pass-through relationship in the United States. Some advantages of this approach mentioned by the authors include the ability to assess asymmetry effects with respect to the presence of data outliers and the detection of structural breaks in the pricing relationships when the timing is not previously known. Bakhat et al. [16] recognized that most empirical studies of price pass-through in fuel markets only consider the magnitudes of responses with little inference provided on the speed of adjustments to cost shocks. The authors applied a non-linear autoregressive distributed lag to weekly data from European countries and the United States and found differing levels of asymmetric responses from both diesel and gasoline as well as from across the different countries.

3. Empirical Methodology

3.1. Testing for Price Pass-Through Symmetry Using the Error Correction Model

In order to proceed with the ECM methodology, the long-run relationship must be considered between the wholesale fuel prices and input costs. The conventional fuel price is defined as E10, which is a ten percent blend of ethanol with the remaining ninety percent refined from crude oil. The high-blend ethanol-based fuel is defined as E85, which comprises up to nearly eighty-five percent ethanol, with the remaining mix refined from crude oil. The long-run relationships are established using the following equation:

where WPt is wholesale price in dollars per gallon (either E10 or E85) in period t, Ct is the crude oil price in dollars per gallon in period t, and Et is the ethanol price in dollars per gallon in period t. To account for the potential effects of price inflation in fuel markets, a trend variable has been added as advised by Borenstein et al. [4] as well as several other authors [2,11].

The next steps are to determine if the data underlying Equation (1) are cointegrated which will allow the ECM methodology to proceed and proper inferences to be made about the long-run relationships between the variables. Table 1 contains the results of the unit root and cointegration tests. The results indicate that the individual prices are integrated into the first order and that the residuals estimated from Equation (1) are cointegrated in first differences. After confirming the suitability of the ECM for this study, the remaining steps for this methodology can be undertaken.

Table 1.

Unit root and cointegration tests.

As suggested in the literature, the error term from Equation (1) is used to estimate how quickly the long-run relationship returns to equilibrium:

Equation (2) forms the basis of the ECM, as its lagged value will be used in model estimation. Engle and Granger [17] provided the necessary foundation for the ECM methodology which Bachmeier and Griffin [5] later used to establish a more flexible and intuitive asymmetry evaluation process. Based on these contributions, Equation (1) can be modified to allow a separate evaluation of rising and falling input costs with respect to fuel prices:

where ∆ represents the change from the previous period, and n and m are the lag lengths of rising and falling Ct and Et, respectively. With this model specification, both short-run and long-run inferences can be made with respect to input cost changes. Clearly, this straightforward model simplifies the many factors that might influence wholesale prices of E10 and E85, such as supply chain disruptions and other domestic or global events affecting energy prices. However, the use of daily data in this study provides an advantage as market prices should quickly reflect these changes. An additional benefit proposed in this study, as discussed earlier, is that Equation (3) will be estimated for both fuels via a SUR system of equations. Assuming these factors simultaneously affect both fuels, the SUR specification will provide the most efficient estimates [18]. The remaining steps needed to implement the ECM in this study include establishing the causal relationships for both fuels with respect to the input costs and determining the appropriate lag lengths needed to estimate Equation (3).

3.2. Granger Causality

Granger [19] proposed a method that can be used to determine the direction of causality between variables that are likely related. Causality tests were conducted between the fuel prices and input costs to ensure the relationships depicted in Equation (1) are correctly specified. These results are contained in Table 2. Results from the causality tests confirm there is greater evidence that market price signals are passed from upstream levels of the fuel system to downstream levels and that Equation (1) is the correct empirical representation for this price transmission study.

Table 2.

Granger causality tests.

3.3. Lag Order Analysis

Price shocks often take a period of time before their effect can be fully realized in a fuel system, which requires the use of lagged information. This information is also required in order to implement Equation (3) and to eventually present a robust comparison of the effects that rising and falling input costs have on both fuel prices. For this study, I used the Schwarz Bayesian information criterion (SBC) to help determine the appropriate lag lengths for ∆Ct and ∆Et. By minimizing the SBC, I found eight-day lags for the rising and falling crude and ethanol prices to be optimal for both the E10 and E85 models. From the literature, there are no restrictions that lag lengths chosen for both rising and falling input cost changes fit a certain pattern. However, it is often convenient that the lag lengths are the same for ease of implementation and comparison [20]. Furthermore, as discussed in Borenstein et al. [4], varying lengths of lag structure should have little effect on the overall results.

3.4. Data

The fuel and ethanol data used in this study comprise daily observations from a large market in the southern United States and cover the time period from 9 October 2017 to 11 June 2019. This market resides in an area that, based on the number of energy firms present, employment in energy-related fields, and volume of energy products flowing in and out of the region, is considered the largest energy market in the United States and, therefore, a strong representative sample for this study. These prices were sourced from the Oil Price Information Service (OPIS) wholesale rack for that city. The OPIS wholesale rack prices are not available on Sunday, so any price changes estimated on a Monday would reference the previous Saturday’s price. Daily crude oil prices expressed as the spot price of West Texas Intermediate crude (WTI) were matched by date to the OPIS data and were obtained from the U.S. Energy Information Administration (EIA). The WTI crude prices are the benchmark in the United States and the leading global crude oil value indicator [21].

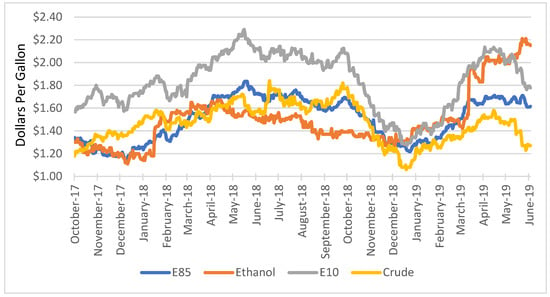

Figure 1 illustrates time trends with respect to the data used in this study. As expected, there is a close relationship between crude oil and E10, and some patterns of lagged reaction of E10 to crude price changes are visible. The relationship between E85 and ethanol is not as close and predictable as that of E10 and crude oil. The market for E85 is still maturing relative to E10 for many reasons, which will be discussed later in this paper.

Figure 1.

Time trends in wholesale prices and input costs.

There are some connections between the commodities, as illustrated by the events beginning in October 2018 when strong declines in crude oil seemed to lead the other prices down as well. Nevertheless, the volatility of all the price series displayed in the figure as well as several rising and falling trends in the cost variables provides additional evidence that make this data suitable for both the ECM and SUR specified earlier.

Table 3 contains the descriptive statistics for the data used in this study. The coefficient of variation results indicate that E85 is less variable than E10 despite the fact that ethanol is the most variable of all the price series. Over this analysis period, the spot price of crude oil was the least variable series, but this stability was not passed on to the E10 price even though it makes up a significant majority of the E10 blend. The difference in variability between E10 and E85 is one of the main drivers of policy initiatives that pursue renewable energy.

Table 3.

Variable descriptive statistics.

The use of daily data offers several advantages as other authors have noted [9,10]. The aggregation of important price signals into time periods not truly reflective of fuel and crude oil market conditions could mask critical reactions in the price pass-through relationships. Fuel and oil markets can be volatile and subject to global economic forces on a daily basis. Therefore, the use of daily data will offer the best opportunity for capturing the effects of these changes.

4. Results

4.1. Econometric Models

Table 4 contains the long-run estimates for both E10 and E85, as specified in Equation (1). Compared to more recent previous studies, ethanol’s contribution to both the short and long-run fuel pricing relationship has rarely, if ever, been mentioned even though ethanol has been mandated to be used in the United States fuel supply for more than fifteen years. The estimates in both models are also strongly significant.

Table 4.

Long-run fuel price and cost relationships.

The estimate of for the crude oil cost to fuel price transmission is an important step in forming inferences regarding the long-run relationship. As often discussed in the literature, a value of one indicates crude price changes are completely transmitted to wholesale E10. With an estimate of 1.129, when crude prices increase one dollar per gallon, the transmitted crude price change to E10 is slightly more than one dollar. To confirm this outcome, a hypothesis test was conducted with the null that = 1 and was consequently rejected at the 1% level (T-Statistic, 5.71). There could be several reasons for this outcome, including market power or competitive landscape. However, there have been other studies confirming pass-through values from upstream to downstream levels of more than one.

The estimate for in the E85 specification is lower and statistically different at the 1% level (T-Statistic, −6.70) from the estimate in the E10 model. These results indicate that increases in crude and ethanol costs are less than fully passed through to the wholesale price of E85 and are also lower in magnitude compared to estimates from the E10 specification. Previous research has also concluded less than full pass-through of upstream prices for an E85 fuel blend compared to E10 [22]. It may seem counterintuitive that the crude oil price coefficient in the E85 model carries a larger and statistically different coefficient at the 1% level for pass-through compared to the coefficient for ethanol (T-Statistic, −9.63). This result is likely due to the complex nature of the demand for E85 in fuel markets. The flex-fuel vehicles designed to use E85 can also use E10 and comprise a much smaller overall percentage of the American automobile fleet. Therefore, the relative prices of crude and ethanol would still be an important factor to consider for consumers in this market.

While the estimates provided in Table 4 reveal important insights into the differences between the two markets in the long run, the short-run estimates of price transmission presented in Table 5 and Table 6 also present some compelling observations. Estimating Equation (3) for both the E10 and E85 fuel models using the SUR approach is relatively straightforward.

Table 5.

SUR results for E10 cost pass-through.

Table 6.

SUR results for E85 cost pass-through.

The E10 results are illustrated in Table 5. The pass-through of crude oil price changes are nearly identical between rising and falling in the immediate (same day) comparison. Starting with the one-day lag, cost decreases in crude gain momentum in pass-through but start to wain after the second lagged day. Cost increases in crude pass-through build slowly and continue at a relatively consistent pace throughout the lag structure, indicating a significant impact that lingers in the market for several days. Only one of the estimated coefficients for rising crude costs is statistically insignificant, whereas four of the falling crude cost coefficients are not significant. The pass-through of ethanol price changes are in general smaller in magnitude, which is not surprising given the lower percentage of ethanol in this fuel. However, there are several significant estimates for both rising and falling coefficients. Both of the estimates for the error correction terms, and , have the expected negative signs consistent with long-run equilibrium convergence. However, the error correction term for cost increases is not significant.

Table 6 contains the SUR results for the E85 blend. The crude oil pass-through coefficients are very similar in magnitude to the ethanol pass-through coefficients. An immediate (same day) comparison cannot be made for the crude oil coefficients as the falling estimate is not significant. However, both of the ethanol immediate impact coefficients are significant. The crude oil rising and falling estimates fluctuated up and down over the lag periods, with equal numbers of significant coefficient estimates. The significant falling ethanol estimates were larger in magnitude compared to the significant rising ethanol estimates, although there were only three significant falling estimates compared to seven significant rising estimates. Both coefficients for the error correction terms were negative and also significant.

Applying the SUR approach resulted in several advantages. Since some mild correlation was found between the error terms in the two models, the SUR approach was appropriate for this study as the standard errors in both models were slightly lower on average compared to estimating the models separately. This result ensured the most efficient estimators and most accurate statistical inferences regarding the price transmission comparisons. As an additional advantage, cross-model hypothesis testing for variables of interest is conveniently carried out with restrictions estimated within the most efficient framework. These hypothesis tests are discussed in the next section in addition to the intra-model hypothesis tests.

4.2. Symmetry Analysis

Comparing short-run estimates by focusing on individual coefficient comparisons may yield some interesting observations, but in order to rigorously evaluate whether there are asymmetric adjustments in cost changes for the respective fuels, hypothesis tests on the statistically significant coefficients need to be evaluated. This step is especially critical given the variation in magnitude and significance of the respective lag structures. Table 7 outlines the hypothesis testing procedure to evaluate symmetry in this study. The null hypothesis for these tests implies symmetry in the price pass-through relationship.

Table 7.

Symmetry testing framework.

Table 8 contains the results of the symmetry tests for both the E10 and E85 specifications. The speed that fuel prices change in addition to the total magnitude of an input cost change distributed throughout the lag structure is an important metric for gauging market performance. As consumers of fuel products are well aware, fuel costs can change daily in response to a variety of economic forces often with immediate (same day) price impact. In order to examine this immediate impact, several hypothesis tests were evaluated both within each specification and cross-model comparisons.

Table 8.

Results of symmetry tests.

For the E10 model, the null hypothesis for the immediate impact of a crude oil price change is symmetric is accepted (T-Statistic, 0.08), indicating cost increases and decreases of crude oil are passed through equally to the wholesale price of E10 on the day they occur. A comparison of the immediate impact of the ethanol price changes could not be made, as the immediate rising ethanol coefficient was not statistically significant. The immediate impact of a crude oil price change was not comparable in the E85 model, as the immediate rising crude coefficient was not significant. The hypothesis that immediate price changes in ethanol are passed through equally to the wholesale price of E85 was rejected (T-Statistic, −2.43), leading to the inference that a decrease in ethanol price is passed through at a higher percentage than an increase in ethanol price on the day they occur.

The immediate impact of a price change per gallon of input cost can be compared across models as well. It may be of interest to measure how the primary components of E10 (crude oil) and E85 (ethanol) relate to each other with respect to the pass-through of cost increases and decreases as we continue to progress into the future where more emphasis is likely to be placed on higher blends of ethanol in the fuel supply. The null hypothesis is accepted: the immediate shock of crude oil price increases on the E10 price is symmetrical to the immediate shock of ethanol price increases on the E85 price (T-Statistic, 1.08). This result indicates there is no immediate time period difference in how crude oil price increases are passed through to E10 compared to ethanol price increases pass-through to E85. The null that the immediate impact on E10 and E85 is the same for falling crude and ethanol prices is, however, rejected (T-Statistic, −2.14). The implication of this result is that falling ethanol prices are passed on to E85 at a higher percentage in the immediate time period compared to the crude oil falling price percentage.

While examining the brunt of immediate price shocks in fuel markets can be compelling, the total magnitude of an input cost change distributed throughout the lag structure must be evaluated before a full assessment of symmetrical pricing behavior can be determined. Table 8 also illustrates the results of the full symmetry tests both within models and across models. In the E10 specification, the null hypothesis that increases and decreases in crude oil costs passed through symmetrically is rejected (T-Statistic, 2.63), indicating price increases are passed through at greater magnitudes compared to price decreases. This outcome is very familiar in the literature and illustrates the asymmetrical pricing behavior so commonly found in conventional gasoline markets. The null hypothesis for evaluating symmetry in ethanol price pass-through is also rejected (T-Statistic, −2.11). This result implies asymmetry in the pass-through of ethanol changes, with decreases getting passed through at higher rates compared to increases.

For the E85 model, the null hypothesis for symmetry in crude oil cost change pass-through was rejected (T-Statistic, −2.54), indicating falling crude costs are passed through in greater percentages compared to rising crude costs. The null hypothesis for symmetry in ethanol pass-through was not rejected (T-Statistic, 0.22), indicating E85 prices respond the same to rising and falling ethanol costs. This is an important result, and it contrasts the asymmetry results of E10 with respect to crude oil price pass-through. Building on the comparison between the E10 and E85 fuels, two cross-model hypotheses of interest can be evaluated.

The first hypothesis evaluated whether cost increases in the primary components of each fuel evaluated across their respective lag structures were symmetrical. This hypothesis was rejected (T-Statistic, 6.26), leading to the inference that cost increases in crude oil were passed along to the E10 price in much higher percentages compared to the pass-through of cost increases in ethanol to E85. Likewise, the price decreases in the primary components across the eight-day lag structures were compared with respect to the pass-through to final prices, and the hypothesis of symmetry was also rejected (T-Statistic, 4.44), indicating crude oil price decreases were passed along in higher percentages to E10 compared to ethanol price decreases to the final E85 price.

Finally, symmetry can be evaluated between the long-run error correction terms. This hypothesis was not evaluated for the E10 model. For the E85 model, the hypothesis of long-run symmetry in the adjustment process to equilibrium was not rejected (T-Statistic, −1.15), leading to the conclusion that increasing and decreasing cost changes passed through to E85 are symmetric in their adjustment back to long-run equilibrium.

5. Conclusions

This study used daily data to compare a conventional fuel (E10) and a high-blend corn-based ethanol fuel (E85) with respect to the pass-through of cost changes to final wholesale prices. Using daily data from October 2017 to June 2019, the ECM methodology was applied within a SUR system in order to improve the efficiency of the estimates and allow for relatively seamless hypothesis testing. The estimates were then used to evaluate symmetry hypotheses both within models and across models.

The empirical evidence from the symmetry hypothesis tests revealed several interesting points. In the E85 model, an immediate decrease in ethanol prices was passed through at a greater rate compared to immediate ethanol price increases. This result is likely explained by theories related to search costs for downstream users of E85 given its limited market relative to E10, as well as the strong relationship between E85 prices and crude oil prices. While evaluating price changes across entire lag structures, asymmetry was found in the E10 market in that crude oil price increases were passed through at greater rates compared to decreases. In the E85 market, symmetry in the pass-through of ethanol cost changes was confirmed. These results for the E85 market are compelling and offer a stark contrast between the “rockets and feathers” [23] frequently observed in conventional fuel cost transmission studies. A likely explanation for this important result is that the E85 market has yet to achieve the overall demand relative to E10, which may be a necessary condition for market power arguments.

Cross-model comparisons revealed that a significant difference was found with respect to how immediate price decreases are passed through with falling ethanol prices transmitting to E85 at greater rates compared to falling crude oil price pass-through to E10. With respect to the entire lag structures of both fuels, both cost increases and decreases in crude oil were passed along to the E10 price in much higher percentages compared to the pass-through of cost increases and decreases in ethanol to E85. A liquidity argument may explain this phenomenon since the market for E10 contains more buyers and sellers relative to the market for E85, thus exerting more force on moving volume through the market-clearing mechanisms.

Based on the symmetry hypothesis test results, the evidence presented in this study supports the notion that, overall, the E85 market is more equitable in the treatment of rising and falling input costs compared to the conventional E10 market. A natural extension of this result is that downstream users of E85 may have the opportunity to experience more positive welfare effects compared to downstream users of E10. This implication could be important to the future of the global fuel industry, as higher blend biofuels can be promoted not only through their positive environmental impacts but also through their more equitable treatment with respect to downstream users. Major biofuel adoption policies such as the Higher Blends Infrastructure Incentive Program (HBIIP) promoted by the United States Department of Agriculture (USDA) and the European Union’s Renewable Energy Directive could benefit from this outcome through increased awareness and acceptance.

Since the methods used in this paper are well established in the literature, it should be relatively straightforward to generalize this study to other markets and time periods. The only limiting factor may be the availability of daily wholesale data for high-blend biofuels relative to conventional fuel data. For future research related to these findings, the concepts of consumer search costs and possible differences in short-term stock availability between the two fuels may be interesting extensions. Although the data may be difficult to acquire, daily retail prices of E85 would allow researchers the ability to add another level of the fuel supply and demand chain for comparison purposes to the already well-established E10 market.

By using methodologies with proven foundations in economic inquiry applied to a comparison of energy products that resulted in inferences strengthening arguments for the adoption of a more environmentally friendly fuel choice, this research creates a link across these fields to reach important cross-disciplinary conclusions. There is still much to be learned regarding the relationships between conventional fuels and high-blend biofuels as more knowledge is discovered in the advancement toward cleaner fuel adoption.

Funding

This work was financially supported in part by the Gilbert Parker Chair of Excellence and the Tom E. Hendrix Chair of Excellence in Free Enterprise at the University of Tennessee at Martin, respectively.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available upon request to the corresponding author.

Conflicts of Interest

The author declares no conflict of interest.

References

- Contín-Pilart, I.; Correljé, A.F.; Palacios, M.B. Competition, regulation, and pricing behaviour in the Spanish retail gasoline market. Energy Policy 2009, 37, 219–228. [Google Scholar] [CrossRef]

- Farkas, R.; Yontcheva, B. Price transmission in the presence of a vertically integrated dominant firm: Evidence from the gasoline market. Energy Policy 2019, 126, 223–237. [Google Scholar] [CrossRef]

- Zellner, A. An Efficient Method of Estimating Seemingly Unrelated Regressions and Tests for Aggregation Bias. J. Am. Stat. Assoc. 1962, 57, 348–368. [Google Scholar] [CrossRef]

- Borenstein, S.; Cameron, A.C.; Gilbert, R. Do gasoline prices respond asymmetrically to crude oil price changes? Q. J. Econ. 1997, 112, 305–339. [Google Scholar] [CrossRef]

- Bachmeier, L.J.; Griffin, J.M. New evidence on asymmetric gasoline price responses. Rev. Econ. Stat. 2003, 85, 772–776. [Google Scholar] [CrossRef]

- Galeotti, M.; Lanza, A.; Manera, M. Rockets and Feathers Revisited: An International Comparison on European Gasoline Markets. Energy Econ. 2003, 25, 175–190. [Google Scholar] [CrossRef]

- Bettendorf, L.; van der Geest, S.A.; Varkevisser, M. Price asymmetries in the Dutch retail gasoline market. Energy Econ. 2003, 25, 669–689. [Google Scholar] [CrossRef]

- Kaufmann, R.K.; Laskowski, C. Causes for an asymmetric relation between the price of crude oil and refined petroleum products. Energy Policy 2005, 33, 1587–1596. [Google Scholar] [CrossRef]

- Remer, M. An empirical investigation of the determinants of asymmetric pricing. Int. J. Ind. Organ. 2015, 42, 46–56. [Google Scholar] [CrossRef]

- Chesnes, M. Asymmetric pass-through in US gasoline prices. Energy J. 2016, 37, 153–180. [Google Scholar] [CrossRef]

- Cha, K.; Lee, C.-Y. Rockets and Feathers in the Gasoline Market: Evidence from South Korea. Sustainability 2023, 15, 3815. [Google Scholar] [CrossRef]

- Raeder, F.T.; Rodrigues, N.; Losekann, L.D. Asymmetry in Gasoline Price Transmission: How do Fuel Pricing Strategy and the Ethanol Addition Mandate Affect Consumers? Int. J. Energy Econ. Policy 2022, 12, 517–527. [Google Scholar] [CrossRef]

- Cui, J.; Yang, H.; Wang, Y.; Yang, C. Dynamics of the gas retail market under China’s price cap regulation. Energy Policy 2023, 174, 113424. [Google Scholar] [CrossRef]

- Grasso, M.; Manera, M. Asymmetric error correction models for the oil-gasoline price relationship. Energy Policy 2007, 35, 156–177. [Google Scholar] [CrossRef]

- Bagnai, A.; Ospina, C.A.M. Asymmetries, outliers and structural stability in the US gasoline market. Energy Econ. 2018, 69, 250–260. [Google Scholar] [CrossRef]

- Bakhat, M.; Rosselló, J.; Sansó, A. Price transmission between oil and gasoline and diesel: A new measure for evaluating time asymmetries. Energy Econ. 2022, 106, 105766. [Google Scholar] [CrossRef]

- Engle, R.; Granger, C.W.J. Co-Integration and error correction: Representation, estimation, and testing. Econometrica 1987, 55, 251–276. [Google Scholar] [CrossRef]

- Blair, B.F.; Campbell, R.C.; Mixon, P.A. Price pass-through in US gasoline markets. Energy Econ. 2017, 65, 42–49. [Google Scholar] [CrossRef]

- Granger, C.W.J. Investigating causal relations by econometric models and crossspectral methods. Econometrica 1969, 37, 424–438. [Google Scholar] [CrossRef]

- Radchenko, S. Oil price volatility and the asymmetric response of gasoline prices to oil price increases and decreases. Energy Econ. 2005, 27, 708–730. [Google Scholar] [CrossRef]

- Yang, Y.-T.; Yang, T.-Y.; Chen, S.-H.; Tong, C.-V. Exploring the non-linearity of West Texas Intermediate crude oil price from exchange rate of US dollar and West Texas Intermediate crude oil production. Energy Strategy Rev. 2022, 41, 100854. [Google Scholar] [CrossRef]

- Li, J.; Stock, J.H. Cost pass-through to higher ethanol blends at the pump: Evidence from Minnesota gas station data. J. Environ. Econ. Mangement 2019, 93, 1–19. [Google Scholar] [CrossRef]

- Bacon, R. Rockets and feathers: The asymmetric speed of adjustment of UK retail gasoline prices to cost changes. Energy Econ. 1991, 13, 211–218. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).