Exploring the Success Factors of Smart City Adoption via Structural Equation Modeling

Abstract

:1. Introduction

2. Literature Review

2.1. Related Works on Smart City Adoption Models

2.2. Technology Adoption Models

2.3. Smart Cities

2.4. The Role of Security Factors in Smart City Adoption

- Information security

- Information privacy

- Perceived security risk

- Perceived trust

2.5. The Role of Technological Factors in Smart City Adoption

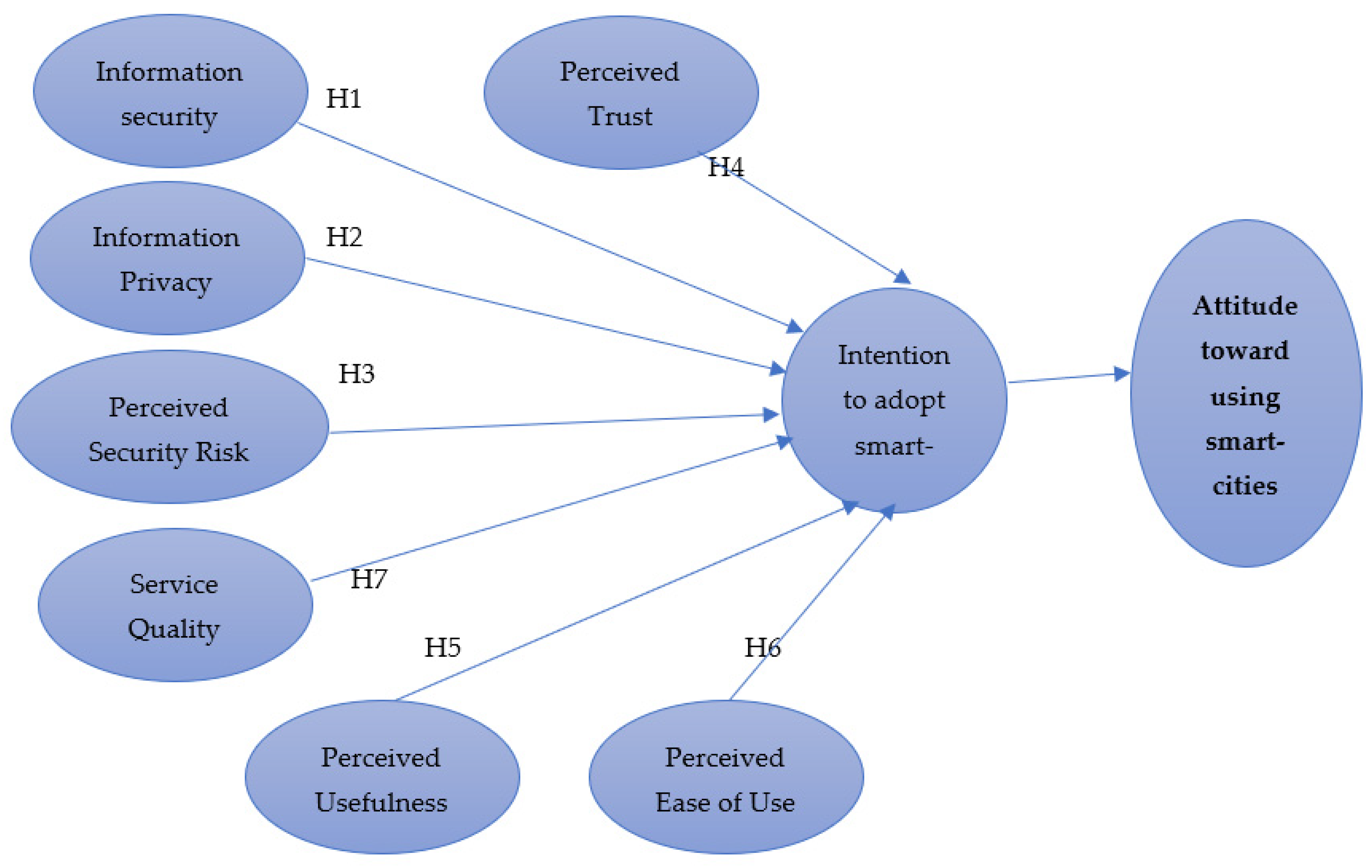

3. A Security- and Technological-Factors-Based Model for the Adoption of Smart Cities

3.1. Perceived Usefulness

3.2. Perceived Ease of Use

3.3. Service Quality

3.4. Intention to Adopt Smart City Applications

4. Methodology

4.1. Data Collection Method

4.2. Participants

4.3. Measurement Instrument

5. Results and Analysis

5.1. The Reliability and Validity of Measures

5.2. Measurement Construct Validity

5.3. Convergent Measurement Validity

5.4. Model Measurement Fit

5.5. Analysis of the Structural Model

6. Discussion

6.1. Research Implications

6.2. Limitations and Future Work

7. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| Factors | Items |

|---|---|

| Information Security | IS1: Smart-cities services have mechanisms to ensure the safe transmission of its users’ information |

| SR2: Smart-cities providers show great concern for the security of any transactions and services. | |

| SR3: When I send data via smart-cities applications, I am sure that they will not be intercepted by unauthorized third parties. | |

| Information Privacy | IP1: My information privacy by using smart-cities services is protected. |

| IP2: I think that smart-cities providers will not provide my personal information to other companies without my consent. | |

| IP3: I think smart-cities providers respect the user’s rights when obtaining personal information. | |

| Perceived Security Risk | PSR1: Providing user information through smart-cities services is safe. |

| PSR2: I think it is not risky to provide user information to smart-cities providers. | |

| PSR3: I would not hesitate to provide my user information (such as name, address, health condition, bank information, and phone number, etc.) to smart-cities providers. | |

| Perceived Trust | PT1: The services of Smart-cities are very adequate. |

| PT2: The services of Smart-cities are very appropriate. | |

| PT3: The services of Smart-cities full meet my needs. | |

| Perceived Usefulness | PEU1: Smart-cities services will be useful in my daily life. |

| PEU2: Using Smart-cities applications will increase my chances of doing tasks. | |

| PEU3: Using Smart-cities applications will help me to accomplish tasks more quickly. | |

| Perceived Ease of Use | PES1: Smart-cities applications easy to use. |

| PES2: My interaction with Smart-cities applications is clear and understandable. | |

| PES3: Learning how to use Smart-cities applications is easy for me. | |

| Service Quality | SQ1: The service provider of smart-cities provide attention when I face problems with the use smart-cities applications. |

| SQ2: The service provider of smart-cities provide services related to me at the promised time. | |

| SEQ3: The service provider of smart-cities have sufficient knowledge to answer my questions regarding the smart-cities applications. | |

| Intention to Adopt | INA1: I intend to use smart-cities services to accomplish my tasks in the future. |

| INA2: I will always try to use smart-cities services in my daily life. | |

| INA3: I plan to use smart-cities services in the future. |

References

- Ali, A.; Hameed, A.; Moin, M.F.; Khan, N.A. Exploring factors affecting mobile-banking app adoption: A perspective from adaptive structuration theory. Aslib J. Inf. Manag. 2022, 75, 773–795. [Google Scholar] [CrossRef]

- Ali, M.; Amir, H.; Ahmed, M. The role of university switching costs, perceived service quality, perceived university image and student satisfaction in shaping student loyalty. J. Mark. High. Educ. 2021, 20, 1–22. [Google Scholar] [CrossRef]

- Alshurideh, M.T.; Al Kurdi, B.; Salloum, S.A. The moderation effect of gender on accepting electronic payment technology: A study on United Arab Emirates consumers. Rev. Int. Bus. Strategy 2021, 31, 375–396. [Google Scholar] [CrossRef]

- Zhou, Q.; Lim, F.J.; Yu, H.; Xu, G.; Ren, X.; Liu, D.; Wang, X.; Mai, X.; Xu, H. A study on factors affecting service quality and loyalty intention in smart-cities. J. Retail. Consum. Serv. 2021, 60, 102424. [Google Scholar] [CrossRef]

- Zhu, Q.; Lyu, Z.; Long, Y.; Wachenheim, C.J. Adoption of smart-citiesin rural China: Impact of information dissemination channel. Socio-Econ. Plan. Sci. 2021, 101011. [Google Scholar]

- Ariansyah, K. Minat masyarakat terhadap layanan Near Field Communication (NFC) komersial di Indonesia. Bul. Pos Dan Telekomun. 2012, 10, 125–136. [Google Scholar] [CrossRef]

- Achsan, W.; Achsani, N.A.; Bandono, B. The Demographic and Behavior Determinant of Credit Card Default in Indonesia. Signifikan J. Ilmu Ekon. 2022, 11, 43–56. [Google Scholar] [CrossRef]

- Afandi, A.; Fadhillah, A.; Sari, D.P. Pengaruh Persepsi Kegunaan, Persepsi Kemudahan dan Persepsi Kepercayaan Terhadap Niat Menggunakan E-Wallet Dengan Sikap Sebagai Variabel Intervening. Innov. J. Soc. Sci. Res. 2021, 1, 568–577. [Google Scholar]

- Ahmed, W.; Rasool, A.; Javed, A.R.; Kumar, N.; Gadekallu, T.R.; Jalil, Z.; Kryvinska, N. Security in next generation mobile payment systems: A comprehensive survey. IEEE Access 2021, 9, 115932–115950. [Google Scholar] [CrossRef]

- Ajzen, I. The theory of planned behavior. Organ. Behav. Hum. Decis. Process. 1991, 50, 179–211. [Google Scholar] [CrossRef]

- Alam, M.Z.; Alam, M.M.D.; Uddin, M.A.; Mohd Noor, N.A. Do mobile health (mHealth) services ensure the quality of health life? An integrated approach from a developing country context. J. Mark. Commun. 2022, 28, 152–182. [Google Scholar] [CrossRef]

- Alamoudi, H. Examining Retailing Sustainability in the QR Code-Enabled Mobile Payments Context During the COVID-19 Pandemic. Int. J. Cust. Relatsh. Mark. Manag. (IJCRMM) 2022, 13, 1–22. [Google Scholar] [CrossRef]

- Asravor, R.K.; Boakye, A.N.; Essuman, J. Adoption and intensity of use of mobile money among smallholder farmers in rural Ghana. Inf. Dev. 2021, 38, 204–217. [Google Scholar] [CrossRef]

- Baabdullah, A.M.; Alalwan, A.A.; Rana, N.P.; Kizgin, H.; Patil, P. Consumer use of smart-cities(M-Banking) in Saudi Arabia: Towards an integrated model. Int. J. Inf. Manag. 2019, 44, 38–52. [Google Scholar] [CrossRef]

- Zaib, U.; Al-Turjman, F.; Mostarda, L.; Gagliardi, R. Applications of artificial intelligence and machine learning in smart cities. Comput. Commun. 2020, 154, 313–323. [Google Scholar]

- Bagozzi, R.P.; Yi, Y. On the evaluation of structural equation models. J. Acad. Mark. Sci. 1988, 16, 74–94. [Google Scholar] [CrossRef]

- Balakrishnan, V.; Shuib, N.L.M. Drivers and inhibitors for digital payment adoption using the Cashless Society Readiness-Adoption model in Malaysia. Technol. Soc. 2021, 65, 101554. [Google Scholar] [CrossRef]

- Shishakly, R.; Almaiah, M.; Lutfi, A.; Alrawad, M. The influence of using smart technologies for sustainable development in higher education institutions. Int. J. Data Netw. Sci. 2023, 8, 77–90. [Google Scholar] [CrossRef]

- Beke, F.T.; Eggers, F.; Verhoef, P.C.; Wieringa, J.E. Consumers’ privacy calculus: The PRICAL index development and validation. Int. J. Res. Mark. 2022, 39, 20–41. [Google Scholar] [CrossRef]

- Belanche, D.; Casaló, L.V.; Flavián, M.; Ibáñez-Sánchez, S. Understanding influencer marketing: The role of congruence between influencers, products and consumers. J. Bus. Res. 2021, 132, 186–195. [Google Scholar] [CrossRef]

- Biswas, A.; Jaiswal, D.; Kant, R. Augmenting bank service quality dimensions: Moderation of perceived trust and perceived risk. Int. J. Product. Perform. Manag. 2021, 72, 469–490. [Google Scholar] [CrossRef]

- Bojjagani, S.; Sastry, V.N.; Chen, C.M.; Kumari, S.; Khan, M.K. Systematic survey of mobile payments, protocols, and security infrastructure. J. Ambient. Intell. Humaniz. Comput. 2021, 14, 609–654. [Google Scholar] [CrossRef]

- Bulutoding, L.; Bidin, C.R.K.; Syariati, A.; Qarina, Q. Antecedents and Consequence of Murabaha Funding in Islamic Banks of Indonesia. J. Asian Financ. Econ. Bus. (JAFEB) 2021, 8, 487–495. [Google Scholar]

- Caldeira, T.A.; Ferreira, J.B.; Freitas, A.; Falcão, R.P.D.Q. Adoption of Mobile Payments in Brazil: Technology Readiness, Trust and Perceived Quality. BBR Braz. Bus. Rev. 2021, 18, 415–432. [Google Scholar]

- Cao, T. The study of factors on the small and medium enterprises’ adoption of mobile payment: Implications for the COVID-19 Era. Front. Public Health 2021, 9, 646592. [Google Scholar] [CrossRef] [PubMed]

- Cao, X.; Yu, L.; Liu, Z.; Gong, M.; Adeel, L. Understanding mobile payment users’ continuance intention: A trust transfer perspective. Internet Res. 2018, 28, 456–476. [Google Scholar] [CrossRef]

- Merino, C.; Guillermo, R. Diseño e Implementación de un Sistema de Inventario Usando la Tecnología NFC para la Unidad Educativa Particular Virgen del Cisne en la Ciudad de Machala Mediante una Aplicación con Sistema Operativo IOS 2021. Master’s Thesis, Universidad Católica de Santiago de Guayaquil, Guayaquil, Ecuador, 2021. [Google Scholar]

- Coskun, E.; Ferman, M. Factors Encouraging and Hindering a Wider Acceptance and More Frequent Utilization of Mobile Payment Systems: An Empirical Study among Mobile Phone Subscribers in Turkey. J. Manag. Mark. Logist. 2021, 8, 164–183. [Google Scholar] [CrossRef]

- Davis, F.D. Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Q. 1989, 319–340. [Google Scholar] [CrossRef]

- Dirsehan, T.; Cankat, E. Role of mobile food-ordering applications in developing restaurants’ brand satisfaction and loyalty in the pandemic period. J. Retail. Consum. Serv. 2021, 62, 102608. [Google Scholar] [CrossRef]

- Alshuwaikhat, H.M.; Aina, Y.A.; Binsaedan, L. Analysis of the implementation of urban computing in smart cities: A framework for the transformation of Saudi cities. Heliyon 2022, 8, e11138. [Google Scholar] [CrossRef]

- Dospinescu, O.; Anastasiei, B.; Dospinescu, N. Key factors determining the expected benefit of customers when using bank cards: An analysis on millennials and generation Z in Romania. Symmetry 2019, 11, 1449. [Google Scholar] [CrossRef]

- Duggal, E.; Verma, H.V. Offline to online shopping: Shift in volition or escape from violation. J. Indian Bus. Res. 2022, 14, 339–357. [Google Scholar] [CrossRef]

- El-Chaarani, H.; El-Abiad, Z. The Impact of Technological Innovation on Bank Performance. J. Internet Bank. Commer. 2018, 23. [Google Scholar]

- Fan, L.; Zhang, X.; Rai, L.; Du, Y. Mobile payment: The next frontier of payment systems?-an empirical study based on push-pull-mooring framework. J. Theor. Appl. Electron. Commer. Res. 2021, 16, 155–169. [Google Scholar] [CrossRef]

- Alwahaishi, S. Student Use of Smart-cities During the Coronavirus Pandemic: An Extension of UTAUT to Trust and Perceived Risk. Int. J. Distance Educ. Technol. (IJDET) 2021, 19, 1–19. [Google Scholar]

- Farhadi, M.; Fooladi, M. Performance of Islamic E-Banking: Case of Iran. Iran. J. Account. Audit. Financ. 2021, 5, 31–39. [Google Scholar]

- Gbongli, K.; Xu, Y.; Amedjonekou, K.M. Extended technology acceptance model to predict mobile-based money acceptance and sustainability: A multi-analytical structural equation modeling and neural network approach. Sustainability 2019, 11, 3639. [Google Scholar] [CrossRef]

- Geebren, A.; Jabbar, A.; Luo, M. Examining the role of consumer satisfaction within mobile eco-systems: Evidence from smart-citiesservices. Comput. Hum. Behav. 2021, 114, 106584. [Google Scholar] [CrossRef]

- Girish, V.G.; Kim, M.Y.; Sharma, I.; Lee, C.K. Examining the structural relationships among smart-cities interactivity, uncertainty avoidance, and perceived risks of COVID-19: Applying extended technology acceptance model. Int. J. Hum.–Comput. Interact. 2022, 38, 742–752. [Google Scholar] [CrossRef]

- Ashwin, K. The challenges of IoT addressing security, ethics, privacy, and laws. Internet Things 2021, 15, 100420. [Google Scholar] [CrossRef]

- Castiblanco Jimenez, I.A.; Cepeda García, L.C.; Violante, M.G.; Marcolin, F.; Vezzetti, E. Commonly used external TAM variables in smart-cities, agriculture and virtual reality applications. Future Internet 2020, 13, 7. [Google Scholar] [CrossRef]

- Weerathunga, P.R.; Samarathunga, W.H.M.S.; Rathnayake, H.N.; Agampodi, S.B.; Nurunnabi, M.; Madhunimasha, M.M.S.C. The COVID-19 pandemic and the acceptance of Smart-cities among university Users: The Role of Precipitating Events. Educ. Sci. 2021, 11, 436. [Google Scholar] [CrossRef]

- Gerbing, D.W.; Anderson, J.C. Monte Carlo evaluations of goodness of fit indices for structural equation models. Sociol. Methods Res. 1992, 21, 132–160. [Google Scholar] [CrossRef]

- Gupta, B.B.; Narayan, S. A survey on contactless smart cards and payment system: Technologies, policies, attacks and countermeasures. J. Glob. Inf. Manag. (JGIM) 2020, 28, 135–159. [Google Scholar] [CrossRef]

- Gupta, S.; Dhingra, S. Modeling the key factors influencing the adoption of mobile financial services: An interpretive structural modeling approach. J. Financ. Serv. Mark. 2021, 27, 96–110. [Google Scholar] [CrossRef]

- Hair, J.F., Jr.; Howard, M.C.; Nitzl, C. Assessing measurement model quality in PLS-SEM using confirmatory composite analysis. J. Bus. Res. 2020, 109, 101–110. [Google Scholar] [CrossRef]

- Hidayat-ur-Rehman, I.; Alzahrani, S.; Rehman, M.Z.; Akhter, F. Determining the factors of m-wallets adoption. A Twofold SEM-ANN Approach. PLoS ONE 2022, 17, e0262954. [Google Scholar] [CrossRef] [PubMed]

- Ho, J.C.; Wu, C.G.; Lee, C.S.; Pham, T.T.T. Factors affecting the behavioral intention to adopt smart-cities: An international comparison. Technol. Soc. 2020, 63, 101360. [Google Scholar] [CrossRef]

- Hoang, V.H.; Nguyen, P.M.; Luu, T.M.N.; Vu, T.M.H. Determinants of Intention to Borrow Consumer Credit in Vietnam: Application and Extension of Technology Acceptance Model. J. Asian Financ. Econ. Bus. 2021, 8, 885–895. [Google Scholar]

- Hossain, M.A. Security perception in the adoption of mobile payment and the moderating effect of gender. PSU Res. Rev. 2019, 3, 179–190. [Google Scholar] [CrossRef]

- Idrees, A.; Lodhi, R.N.; Rabbani, S.; Ahmad, S. Exploring Stimuli Affecting Behavioral Intention and Actual Credit Card Usage: Application of Updated Technology Acceptance Model. KASBIT Bus. J. 2021, 14, 155–175. [Google Scholar]

- Jadil, Y.; Rana, N.P.; Dwivedi, Y.K. A meta-analysis of the UTAUT model in the smart-citiesliterature: The moderating role of sample size and culture. J. Bus. Res. 2021, 132, 354–372. [Google Scholar] [CrossRef]

- Kamdjoug, J.R.K.; Wamba-Taguimdje, S.L.; Wamba, S.F.; Kake, I.B.E. Determining factors and impacts of the intention to adopt smart-citiesapp in Cameroon: Case of SARA by afriland First Bank. J. Retail. Consum. Serv. 2021, 61, 102509. [Google Scholar] [CrossRef]

- Kar, A.K. What affects usage satisfaction in mobile payments? Modelling user generated content to develop the “digital service usage satisfaction model”. Inf. Syst. Front. 2021, 23, 1341–1361. [Google Scholar] [CrossRef] [PubMed]

- Kasemsap, K. Investigating the roles of mobile commerce and mobile payment in global business. In Securing Transactions and Payment Systems for m-Commerce; IGI Global: Hershey, PA, USA, 2016; pp. 1–23. [Google Scholar]

- Khanra, S.; Dhir, A.; Kaur, P.; Joseph, R.P. Factors influencing the adoption postponement of mobile payment services in the hospitality sector during a pandemic. J. Hosp. Tour. Manag. 2021, 46, 26–39. [Google Scholar] [CrossRef]

- Khedmatgozar, H.R. The impact of perceived risks on internet banking adoption in Iran: A longitudinal survey. Electron. Commer. Res. 2021, 21, 147–167. [Google Scholar] [CrossRef]

- Kimiagari, S.; Baei, F. Promoting e-banking actual usage: Mix of technology acceptance model and technology-organisation-environment framework. Enterp. Inf. Syst. 2021, 16, 1894356. [Google Scholar] [CrossRef]

- Kimiagari, S.; Malafe, N.S.A. The role of cognitive and affective responses in the relationship between internal and external stimuli on online impulse buying behavior. J. Retail. Consum. Serv. 2021, 61, 102567. [Google Scholar] [CrossRef]

- Kratschmann, M.; Dütschke, E. Selling the sun: A critical review of the sustainability of solar energy marketing and advertising in Germany. Energy Res. Soc. Sci. 2021, 73, 101919. [Google Scholar] [CrossRef]

- Lathiya, P.; Wang, J. Near-Field Communications (NFC) for Wireless Power Transfer (WPT): An Overview. In Wireless Power Transfer–Recent Development, Applications and New Perspectives; Books on Demand: Norderstedt, Germany, 2021. [Google Scholar]

- Lew, S.; Tan, G.W.H.; Loh, X.M.; Hew, J.J.; Ooi, K.B. The disruptive mobile wallet in the hospitality industry: An extended mobile technology acceptance model. Technol. Soc. 2020, 63, 101430. [Google Scholar] [CrossRef]

- Liébana-Cabanillas, F.; Molinillo, S.; Japutra, A. Exploring the determinants of intention to use P2P mobile payment in Spain. Inf. Syst. Manag. 2021, 38, 165–180. [Google Scholar] [CrossRef]

- Liébana-Cabanillas, F.; Singh, N.; Kalinic, Z.; Carvajal-Trujillo, E. Examining the determinants of continuance intention to use and the moderating effect of the gender and age of users of NFC mobile payments: A multi-analytical approach. Inf. Technol. Manag. 2021, 22, 133–161. [Google Scholar] [CrossRef]

- Luna, I.R.D.; Montoro-Ríos, F.; Liébana-Cabanillas, F.; Luna, J.G.D. NFC technology acceptance for mobile payments: A Brazilian Perspective. Rev. Bras. Gestão Negócios 2017, 19, 82–103. [Google Scholar]

- Malaquias, R.F.; Hwang, Y. Smart-citiesuse: A comparative study with Brazilian and US participants. Int. J. Inf. Manag. 2019, 44, 132–140. [Google Scholar] [CrossRef]

- Meghisan-Toma, G.M.; Puiu, S.; Florea, N.M.; Meghisan, F.; Doran, D. Generation Z’young adults and M-commerce use in Romania. J. Theor. Appl. Electron. Commer. Res. 2021, 16, 1458–1471. [Google Scholar] [CrossRef]

- Migliore, G.; Wagner, R.; Cechella, F.S.; Liébana-Cabanillas, F. Antecedents to the Adoption of Mobile Payment in China and Italy: An Integration of UTAUT2 and Innovation Resistance Theory. Inf. Syst. Front. 2022, 24, 2099–2122. [Google Scholar] [CrossRef]

- Mills, D.; Pudney, S.; Pevcin, P.; Dvorak, J. Evidence-based public policy decision-making in smart cities: Does extant theory support achievement of city sustainability objectives? Sustainability 2021, 14, 3. [Google Scholar] [CrossRef]

- Alqudah, H.; Amran, N.A.; Hassan, H.; Lutfi, A.; Alessa, N.; Almaiah, M.A. Examining the critical factors of internal audit effectiveness from internal auditors’ perspective: Moderating role of extrinsic rewards. Heliyon 2023. [Google Scholar] [CrossRef] [PubMed]

- Mohd Thas Thaker, H.; Mohd Thas Thaker, M.A.; Khaliq, A.; Allah Pitchay, A.; Iqbal Hussain, H. Behavioural intention and adoption of internet banking among clients’ of Islamic banks in Malaysia: An analysis using UTAUT2. J. Islam. Mark. 2021, 13, 1171–1197. [Google Scholar] [CrossRef]

- Mombeuil, C.; Uhde, H. Relative convenience, relative advantage, perceived security, perceived privacy, and continuous use intention of China’s WeChat Pay: A mixed-method two-phase design study. J. Retail. Consum. Serv. 2021, 59, 102384. [Google Scholar] [CrossRef]

- Alrawad, M.; Lutfi, A.; Almaiah, M.A.; Alsyouf, A.; Al-Khasawneh, A.L.; Arafa, H.M.; Ahmed, N.A.; AboAlkhair, A.M.; Tork, M. Managers’ perception and attitude toward financial risks associated with SMEs: Analytic hierarchy process approach. J. Risk Financ. Manag. 2023, 16, 86. [Google Scholar] [CrossRef]

- Moore, G.C.; Benbasat, I. Development of an instrument to measure the perceptions of adopting an information technology innovation. Inf. Syst. Res. 1991, 2, 192–222. [Google Scholar] [CrossRef]

- Museli, A.; Navimipour, N.J. A model for examining the factors impacting the near field communication technology adoption in the organizations. Kybernetes 2018, 47, 1378–1400. [Google Scholar] [CrossRef]

- Nam, T.H.; Quan, V.D.H. Multi-dimensional analysis of perceived risk on credit card adoption. In International Econometric Conference of Vietnam; Springer: Cham, Switzerland, 2019; pp. 606–620. [Google Scholar]

- Omar, S.; Mohsen, K.; Tsimonis, G.; Oozeerally, A.; Hsu, J.H. M-commerce: The nexus between mobile shopping service quality and loyalty. J. Retail. Consum. Serv. 2021, 60, 102468. [Google Scholar] [CrossRef]

- Ou, C.X.; Zhang, X.; Angelopoulos, S.; Davison, R.M.; Janse, N. Security breaches and organization response strategy: Exploring consumers’ threat and coping appraisals. Int. J. Inf. Manag. 2022, 65, 102498. [Google Scholar] [CrossRef]

- Pal, A.; Herath, T.; De’, R.; Rao, H.R. Contextual facilitators and barriers influencing the continued use of mobile payment services in a developing country: Insights from adopters in India. Inf. Technol. Dev. 2020, 26, 394–420. [Google Scholar] [CrossRef]

- Palos-Sanchez, P.; Saura, J.R.; Velicia-Martin, F.; Cepeda-Carrion, G. A business model adoption based on tourism innovation: Applying a gratification theory to mobile applications. Eur. Res. Manag. Bus. Econ. 2021, 27, 100149. [Google Scholar] [CrossRef]

- Patil, P.; Tamilmani, K.; Rana, N.P.; Raghavan, V. Understanding consumer adoption of mobile payment in India: Extending Meta-UTAUT model with personal innovativeness, anxiety, trust, and grievance redressal. Int. J. Inf. Manag. 2020, 54, 102144. [Google Scholar] [CrossRef]

- Pelaez, A.; Chen, C.W.; Chen, Y.X. Effects of perceived risk on intention to purchase: A meta-analysis. J. Comput. Inf. Syst. 2019, 59, 73–84. [Google Scholar] [CrossRef]

- Purwanto, A.; Juliana, J. The effect of supplier performance and transformational supply chain leadership style on supply chain performance in manufacturing companies. Uncertain Supply Chain Manag. 2021, 10, 511–516. [Google Scholar] [CrossRef]

- Purwanto, A.; Asbari, M.; Santoso, T.I.; Paramarta, V.; Sunarsi, D. Social and Management Research Quantitative Analysis for Medium Sample: Comparing of Lisrel, Tetrad, GSCA, Amos, SmartPLS, WarpPLS, and SPSS. J. Ilm. Ilmu Adm. Publik 2020, 10, 518–532. [Google Scholar]

- Qureshi, J.A.; Rehman, S.; Qureshi, M.A. Consumers’ attitude towards usage of debit and credit cards: Evidences from the digital economy of Pakistan. Int. J. Econ. Financ. Issues 2018, 8, 220–228. [Google Scholar]

- Rabaa’i, A.A.; AlMaati, S. Exploring the determinants of users’ continuance intention to use smart-citiesservices in Kuwait: Extending the expectation-confirmation model. Asia Pac. J. Inf. Syst. 2021, 31, 141–184. [Google Scholar]

- Ramos-de-Luna, I.; Montoro-Ríos, F.; Liébana-Cabanillas, F. Determinants of the intention to use NFC technology as a payment system: An acceptance model approach. Inf. Syst. E-Bus. Manag. 2016, 14, 293–314. [Google Scholar] [CrossRef]

- Rodrick, S.S.; Islam, H.; Sarker, S.A.; Tisha, F.F. Prospects and Challenges of using Credit Card Services: A Study on the users in Dhaka City. AIUB J. Bus. Econ. 2021, 18, 161–186. [Google Scholar]

- Sahi, A.M.; Khalid, H.; Abbas, A.F.; Khatib, S.F. The Evolving Research of Customer Adoption of Digital Payment: Learning from Content and Statistical Analysis of the Literature. J. Open Innov. Technol. Mark. Complex. 2021, 7, 230. [Google Scholar] [CrossRef]

- Saprikis, V.; Avlogiaris, G.; Katarachia, A. A Comparative Study of Users versus Non-Users’ Behavioral Intention towards M-Banking Apps’ Adoption. Information 2022, 13, 30. [Google Scholar] [CrossRef]

- Mohammed Amin, A.; Hajjej, F.; Shishakly, R.; Lutfi, A.; Amin, A.; Bani Awad, A. The role of quality measurements in enhancing the usability of mobile learning applications during COVID-19. Electronics 2022, 11, 1951. [Google Scholar]

- Hair, J.F.; Risher, J.J.; Sarstedt, M.; Ringle, C.M. When to use and how to report the results of PLS-SEM. Eur. Bus. Rev. 2019, 31, 2–24. [Google Scholar] [CrossRef]

- Shin, S.; Lee, W.J. Factors affecting user acceptance for NFC mobile wallets in the US and Korea. Innov. Manag. Rev. 2021, 18, 417–433. [Google Scholar] [CrossRef]

- Singh, N.; Sinha, N.; Liébana-Cabanillas, F.J. Determining factors in the adoption and recommendation of mobile wallet services in India: Analysis of the effect of innovativeness, stress to use and social influence. Int. J. Inf. Manag. 2020, 50, 191–205. [Google Scholar] [CrossRef]

- Sreelakshmi, C.C.; Prathap, S.K. Continuance adoption of mobile-based payments in COVID-19 context: An integrated framework of health belief model and expectation confirmation model. Int. J. Pervasive Comput. Commun. 2020, 16, 351–369. [Google Scholar]

- Sulaiman, S.N.A.; Almunawar, M.N. The adoption of biometric point-of-sale terminal for payments. J. Sci. Technol. Policy Manag. 2021, 13, 585–609. [Google Scholar] [CrossRef]

- Sun, S.; Law, R.; Schuckert, M.; Hyun, S.S. Impacts of mobile payment-related attributes on consumers’ repurchase intention. Int. J. Tour. Res. 2022, 24, 44–57. [Google Scholar] [CrossRef]

- Taylor, S.; Todd, P.A. Understanding information technology usage: A test of competing models. Inf. Syst. Res. 1995, 6, 144–176. [Google Scholar] [CrossRef]

- Teng, S.; Khong, K.W. Examining actual consumer usage of E-wallet: A case study of big data analytics. Comput. Hum. Behav. 2021, 121, 106778. [Google Scholar] [CrossRef]

- Tew, H.T.; Tan, G.W.H.; Loh, X.M.; Lee, V.H.; Lim, W.L.; Ooi, K.B. Tapping the next purchase: Embracing the wave of mobile payment. J. Comput. Inf. Syst. 2021, 62, 527–535. [Google Scholar] [CrossRef]

- Trinh, H.N.; Tran, H.H.; Vuong, D.H.Q. Determinants of consumers’ intention to use credit card: A perspective of multifaceted perceived risk. Asian J. Econ. Bank. 2020, 4, 105–120. [Google Scholar] [CrossRef]

- Trinh, N.H.; Tran, H.H.; Vuong, Q.D.H. Perceived risk and intention to use credit cards: A case study in Vietnam. J. Asian Financ. Econ. Bus. 2021, 8, 949–958. [Google Scholar]

- Usman, H.; Projo, N.W.K.; Chairy, C.; Haque, M.G. The exploration role of Sharia compliance in technology acceptance model for e-banking (case: Islamic bank in Indonesia). J. Islam. Mark. 2021, 13, 1089–1110. [Google Scholar] [CrossRef]

- Venkatesh, V.; Bala, H. Technology acceptance model 3 and a research agenda on interventions. Decis. Sci. 2008, 39, 273–315. [Google Scholar] [CrossRef]

- Venkatesh, V.; Morris, M.G.; Davis, G.B.; Davis, F.D. User acceptance of information technology: Toward a unified view. MIS Q. 2003, 425–478. [Google Scholar] [CrossRef]

- Vladimirovich Platov, A.; Kazbekovich Tarchokov, S.; Sobirovna Zikirova, S.; Igorevna Litvinova, O.; Eduardovich Udalov, D. NFC Technology Acceptance Factors in Tourism. In Proceedings of the IV International Scientific and Practical Conference, Tokyo, Japan, 12–15 October 2021; pp. 1–7. [Google Scholar]

- Wamba, S.F.; Queiroz, M.M.; Blome, C.; Sivarajah, U. Fostering financial inclusion in a developing country: Predicting user acceptance of mobile wallets in Cameroon. J. Glob. Inf. Manag. (JGIM) 2021, 29, 195–220. [Google Scholar] [CrossRef]

- Wang, E.S.T. Influences of Innovation Attributes on Value Perceptions and Usage Intentions of Mobile Payment. J. Electron. Commer. Res. 2022, 23, 45–58. [Google Scholar]

- Wei, M.F.; Luh, Y.H.; Huang, Y.H.; Chang, Y.C. Young generation’s mobile payment adoption behavior: Analysis based on an extended UTAUT model. J. Theor. Appl. Electron. Commer. Res. 2021, 16, 618–637. [Google Scholar] [CrossRef]

- Widagdo, B.; Roz, K. Hedonic shopping motivation and impulse buying: The effect of website quality on customer satisfaction. J. Asian Financ. Econ. Bus. 2021, 8, 395–405. [Google Scholar]

- Widyanto, H.A.; Kusumawardani, K.A.; Yohanes, H. Safety first: Extending UTAUT to better predict mobile payment adoption by incorporating perceived security, perceived risk and trust. J. Sci. Technol. Policy Manag. 2021, 13, 952–973. [Google Scholar] [CrossRef]

- Wu, R.Z.; Lee, J.H.; Tian, X.F. Determinants of the intention to use cross-border mobile payments in Korea among Chinese tourists: An integrated perspective of UTAUT2 with TTF and ITM. J. Theor. Appl. Electron. Commer. Res. 2021, 16, 1537–1556. [Google Scholar] [CrossRef]

- Yuan, T.; Honglei, Z.; Xiao, X.; Ge, W.; Xianting, C. Measuring perceived risk in sharing economy: A classical test theory and item response theory approach. Int. J. Hosp. Manag. 2021, 96, 102980. [Google Scholar] [CrossRef]

- Yuen, T.W. Factors influencing foreign consumers to adopt mobile payment extensions offered by multinational mobile messaging applications. Int. J. Multinatl. Corp. Strategy 2020, 3, 130–152. [Google Scholar] [CrossRef]

- Zhang, B.; Peng, G.; Xing, F.; Chen, S. Mobile Applications in China’s Smart Cities: State-of-the-Art and Lessons Learned. J. Glob. Inf. Manag. (JGIM) 2021, 29, 1–18. [Google Scholar] [CrossRef]

- Zhang, R.; Zhang, Y.; Xia, J. Impact of mobile payment on physical health: Evidence from the 2017 China household finance survey. Front. Public Health 2022, 10, 963234. [Google Scholar] [CrossRef]

- Zhao, H.; Anong, S.T.; Zhang, L. Understanding the impact of financial incentives on NFC mobile payment adoption: An experimental analysis. Int. J. Bank Mark. 2019, 37, 1296–1312. [Google Scholar] [CrossRef]

- Zhao, Y.; Bacao, F. How does the pandemic facilitate mobile payment? An investigation on users’ perspective under the COVID-19 pandemic. Int. J. Environ. Res. Public Health 2021, 18, 1016. [Google Scholar] [CrossRef]

- Zhong, Y.; Oh, S.; Moon, H.C. Service transformation under industry 4.0: Investigating acceptance of facial recognition payment through an extended technology acceptance model. Technol. Soc. 2021, 64, 101515. [Google Scholar] [CrossRef]

- Lopez-Carreiro, I.; Monzon, A.; Lopez, E. MaaS Implications in the Smart City: A Multi-Stakeholder Approach. Sustainability 2023, 15, 10832. [Google Scholar] [CrossRef]

- Beck, D. Stakeholder Theory for Sustainable Cities and Society: A Humanist and Environmental approach for integrating People, Institutions, and Environmental Ecosystems. Stud. Ecol. Bioethicae 2023, 21, 59–67. [Google Scholar] [CrossRef]

- Hamamurad, Q.H.; Jusoh, N.M.; Ujang, U. Factors Affecting Stakeholder Acceptance of a Malaysian Smart City. Smart Cities 2022, 5, 1508–1535. [Google Scholar] [CrossRef]

| No | Factors | Code | Pilot Test | Final Test |

|---|---|---|---|---|

| 1 | Information Security | IS | 0.881 | 0.841 |

| 2 | Information Privacy | IP | 0.807 | 0.835 |

| 3 | Perceived Security Risk | PSR | 0.874 | 0.821 |

| 4 | Service Quality | SQ | 0.792 | 0.828 |

| 5 | Perceived Trust | PT | 0.921 | 0.911 |

| 6 | Perceived Usefulness | PEU | 0.824 | 0.843 |

| 7 | Perceived Ease of Use | PES | 0.777 | 0.792 |

| 8 | Intention to Adopt | INA | 0.890 | 0.881 |

| Factors | Items | Factor Loadings | Composite Reliability | Cronbach’s Alpha | AVE | R-Squared |

|---|---|---|---|---|---|---|

| Intention to Adopt | INA1 | 0.881 | 0.892 | 0.822 | 0.751 | 0.652 |

| INA2 | 0.922 | |||||

| INA3 | 0.795 | |||||

| Information Security | IS1 | 0.894 | 0.915 | 0.849 | 0.779 | 0.661 |

| IS2 | 0.879 | |||||

| IS3 | 0.871 | |||||

| Information Privacy | IP1 | 0.889 | 0.920 | 0.869 | 0.790 | 0.480 |

| IP 2 | 0.881 | |||||

| IP 3 | 0.900 | |||||

| Perceived Security Risk | PSR1 | 0.909 | 0.931 | 0.890 | 0.811 | 0.510 |

| PSR2 | 0.894 | |||||

| PSR3 | 0.895 | |||||

| Perceived Ease of Use | PES1 | 0.850 | 0.881 | 0.891 | 0.707 | 0.521 |

| PES2 | 0.872 | |||||

| PES3 | 0.801 | |||||

| Perceived Usefulness | PEU1 | 0.872 | 0.886 | 0.809 | 0.725 | 0.594 |

| PEU2 | 0.911 | |||||

| PEU3 | 0.781 | |||||

| Perceived Trust | PT1 | 0.865 | 0.870 | 0.871 | 0.680 | 0.741 |

| PT2 | 0.798 | |||||

| PT3 | 0.822 | |||||

| Service quality | SQ1 | 0.942 | 0.960 | 0.933 | 0.879 | 0.770 |

| SQ2 | 0.940 | |||||

| SQ3 | 0.932 |

| Factors | Items | INA | IS | IP | PSR | PES | PEU | PT | SQ |

|---|---|---|---|---|---|---|---|---|---|

| Intention to Adopt | INA1 | 0.871 | 0.560 | 0.620 | 0.525 | 0.544 | 0.631 | 0.719 | 0.659 |

| INA2 | 0.921 | 0.615 | 0.604 | 0.539 | 0.609 | 0.561 | 0.699 | 0.691 | |

| INA3 | 0.761 | 0.451 | 0.510 | 0.375 | 0.440 | 0.370 | 0.551 | 0.589 | |

| Information Security | IS1 | 0.590 | 0.889 | 0.652 | 0.560 | 0.600 | 0.619 | 0.580 | 0.522 |

| IS2 | 0.539 | 0.881 | 0.550 | 0.504 | 0.528 | 0.529 | 0.519 | 0.551 | |

| IS3 | 0.620 | 0.901 | 0.679 | 0.528 | 0.619 | 0.539 | 0.600 | 0.590 | |

| Information Privacy | IP1 | 0.635 | 0.670 | 0.907 | 0.540 | 0.611 | 0.630 | 0.769 | 0.655 |

| IP 2 | 0.571 | 0.625 | 0.899 | 0.542 | 0.590 | 0.600 | 0.712 | 0.670 | |

| IP 3 | 0.615 | 0.630 | 0.898 | 0.522 | 0.560 | 0.575 | 0.669 | 0.589 | |

| Perceived Security Risk | PSR1 | 0.411 | 0.520 | 0.437 | 0.865 | 0.513 | 0.474 | 0.441 | 0.409 |

| PSR2 | 0.517 | 0.540 | 0.541 | 0.874 | 0.613 | 0.641 | 0.627 | 0.525 | |

| PSR3 | 0.489 | 0.460 | 0.511 | 0.874 | 0.651 | 0.439 | 0.498 | 0.437 | |

| Perceived Ease of Use | PES1 | 0.509 | 0.502 | 0.533 | 0.519 | 0.602 | 0.870 | 0.660 | 0.480 |

| PES2 | 0.597 | 0.611 | 0.580 | 0.577 | 0.620 | 0.905 | 0.669 | 0.505 | |

| PES3 | 0.474 | 0.495 | 0.559 | 0.474 | 0.599 | 0.770 | 0.563 | 0.390 | |

| Perceived Usefulness | PEU1 | 0.822 | 0.628 | 0.704 | 0.511 | 0.576 | 0.854 | 0.857 | 0.824 |

| PEU2 | 0.513 | 0.482 | 0.609 | 0.492 | 0.565 | 0.821 | 0.792 | 0.464 | |

| PEU3 | 0.490 | 0.440 | 0.632 | 0.550 | 0.483 | 0.836 | 0.816 | 0.529 | |

| Perceived Trust | PT1 | 0.696 | 0.605 | 0.633 | 0.484 | 0.548 | 0.494 | 0.799 | 0.939 |

| PT2 | 0.730 | 0.580 | 0.702 | 0.566 | 0.608 | 0.523 | 0.792 | 0.938 | |

| PT3 | 0.680 | 0.576 | 0.645 | 0.467 | 0.581 | 0.503 | 0.796 | 0.924 | |

| Service quality | SQ1 | 0.649 | 0.545 | 0.555 | 0.374 | 0.472 | 0.426 | 0.699 | 0.855 |

| SQ2 | 0.697 | 0.611 | 0.564 | 0.527 | 0.569 | 0.503 | 0.741 | 0.849 | |

| SQ3 | 0.681 | 0.543 | 0.638 | 0.596 | 0.658 | 0.580 | 0.744 | 0.852 |

| No | Factors | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

|---|---|---|---|---|---|---|---|---|---|

| 1 | Intention to Adopt | 1.000 | |||||||

| 2 | Information Security | 0.694 | 1.000 | ||||||

| 3 | Information Privacy | 0.764 | 0.633 | 1.000 | |||||

| 4 | Perceived Security Risk | 0.571 | 0.595 | 0.539 | 1.000 | ||||

| 5 | Perceived Ease of Use | 0.679 | 0.715 | 0.717 | 0.592 | 1.000 | |||

| 6 | Perceived Usefulness | 0.766 | 0.644 | 0.775 | 0.640 | 0.796 | 1.000 | ||

| 7 | Perceived Trust | 0.762 | 0.644 | 0.851 | 0.570 | 0.665 | 0.744 | 1.000 | |

| 8 | Service Quality | 0.633 | 0.641 | 0.545 | 0.622 | 0.662 | 0.750 | 0.571 | 1.000 |

| No | Hypotheses Links | Path Coefficient | Mean | S.D | S.E | T-Values | Results |

|---|---|---|---|---|---|---|---|

| 1 | IS → INA | 0.221 | 0.084 | 0.091 | 0.091 | 0.682 | Accepted |

| 2 | IP → INA | 0.201 | 0.180 | 0.120 | 0.120 | 1.655 | Accepted |

| 3 | PSR → INA | 0.229 | 0.341 | 0.102 | 0.102 | 2.988 | Accepted |

| 4 | PT → INA | 0.320 | 0.085 | 0.119 | 0.119 | 0.598 | Accepted |

| 5 | PES → INA | 0.291 | 0.090 | 0.109 | 0.109 | 0.665 | Accepted |

| 6 | PEU → INA | 0.310 | 0.088 | 0.110 | 0.110 | 0.441 | Accepted |

| 7 | SQ → INA | 0.109 | 0.084 | 0.101 | 0.101 | 4.170 | Accepted |

| 8 | INA → ATU | 0.365 | 0.075 | 0.110 | 0.110 | 0.662 | Accepted |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Alkdour, T.; Almaiah, M.A.; Shishakly, R.; Lutfi, A.; Alrawad, M. Exploring the Success Factors of Smart City Adoption via Structural Equation Modeling. Sustainability 2023, 15, 15915. https://doi.org/10.3390/su152215915

Alkdour T, Almaiah MA, Shishakly R, Lutfi A, Alrawad M. Exploring the Success Factors of Smart City Adoption via Structural Equation Modeling. Sustainability. 2023; 15(22):15915. https://doi.org/10.3390/su152215915

Chicago/Turabian StyleAlkdour, Tayseer, Mohammed Amin Almaiah, Rima Shishakly, Abdalwali Lutfi, and Mahmoud Alrawad. 2023. "Exploring the Success Factors of Smart City Adoption via Structural Equation Modeling" Sustainability 15, no. 22: 15915. https://doi.org/10.3390/su152215915

APA StyleAlkdour, T., Almaiah, M. A., Shishakly, R., Lutfi, A., & Alrawad, M. (2023). Exploring the Success Factors of Smart City Adoption via Structural Equation Modeling. Sustainability, 15(22), 15915. https://doi.org/10.3390/su152215915