The Effects of Operational Efficiency and Environmental Risk on the Adoption of Environmental Management Practices

Abstract

:1. Introduction

2. Literature Review

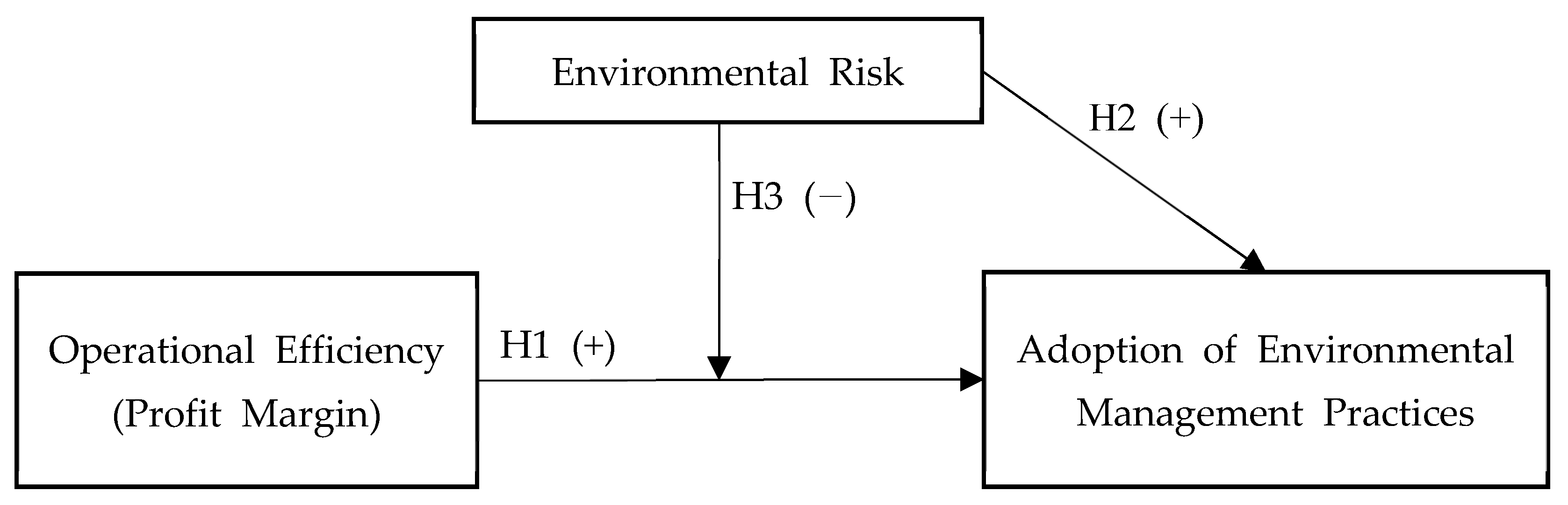

3. Hypotheses Development

3.1. Effect of Operational Efficiency

3.2. Effect of Environmental Risk

3.3. Joint Effect of Operational Efficiency and Environmental Risk

4. Method

4.1. Data and Sample

4.2. Variables

4.2.1. Dependent Variable

4.2.2. Independent Variables

4.2.3. Control Variables

4.3. Empirical Models Variables

5. Results

Robustness Test

6. Discussion and Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Riley, T. Just 100 companies responsible for 71% of global emissions, study says. The Guardian, 10 July 2017. [Google Scholar]

- Jowit, J. World’s top firms cause $2.2tn of environmental damage, report estimates. The Guardian, 18 February 2010. [Google Scholar]

- Hojnik, J.; Ruzzier, M. What drives eco-innovation? A review of an emerging literature. Environ. Innov. Soc. Transit. 2016, 19, 31–41. [Google Scholar] [CrossRef]

- Tseng, M.L.; Islam, M.S.; Karia, N.; Fauzi, F.A.; Afrin, S. A literature review on green supply chain management: Trends and future challenges. Resour. Conserv. Recycl. 2019, 141, 145–162. [Google Scholar] [CrossRef]

- Camilleri, M.A. The rationale for ISO 14001 certification: A systematic review and a cost–benefit analysis. Corp. Soc. Responsib. Environ. Manag. 2022, 29, 1067–1083. [Google Scholar] [CrossRef]

- Hardcopf, R.; Shah, R.; Mukherjee, U. Explaining heterogeneity in environmental management practice adoption across firms. Prod. Oper. Manag. 2019, 28, 2898–2918. [Google Scholar] [CrossRef]

- Cole, M.A.; Elliott, R.J.; Shimamoto, K. Globalization, firm-level characteristics and environmental management: A study of Japan. Ecol. Econ. 2006, 59, 312–323. [Google Scholar] [CrossRef]

- Zhang, B.; Bi, J.; Yuan, Z.; Ge, J.; Liu, B.; Bu, M. Why do firms engage in environmental management? An empirical study in China. J. Clean. Prod. 2008, 16, 1036–1045. [Google Scholar] [CrossRef]

- Nissim, D.; Penman, S.H. Ratio analysis and equity valuation: From research to practice. Rev. Account. Stud. 2001, 6, 109–154. [Google Scholar] [CrossRef]

- Fairfield, P.M.; Yohn, T.L. Using asset turnover and profit margin to forecast changes in profitability. Rev. Account. Stud. 2001, 6, 371–385. [Google Scholar] [CrossRef]

- Soliman, M.T. The use of DuPont analysis by market participants. Account. Rev. 2008, 83, 823–853. [Google Scholar] [CrossRef]

- Amir, E.; Kama, I.; Livnat, J. Conditional versus unconditional persistence of RNOA components: Implications for valuation. Rev. Account. Stud. 2011, 16, 302–327. [Google Scholar] [CrossRef]

- Bird, R.D.; Hall, A.; Momentè, F.; Reggiani, F. What corporate social responsibility activities are valued by the market? J. Bus. Ethics 2007, 76, 189–206. [Google Scholar] [CrossRef]

- King, A.A.; Lenox, M.J.; Terlaak, A. The strategic use of decentralized institutions: Exploring certification with the ISO 14001 management standard. Acad. Manag. J. 2005, 48, 1091–1106. [Google Scholar] [CrossRef]

- Horbach, J. Determinants of environmental innovation—New evidence from German panel data sources. Res. Policy 2008, 37, 163–173. [Google Scholar] [CrossRef]

- Zhou, X.; Du, J. Does environmental regulation induce improved financial development for green technological innovation in China? J. Environ. Manag. 2021, 300, 113685. [Google Scholar] [CrossRef] [PubMed]

- López-Gamero, M.D.; Molina-Azorín, J.F.; Claver-Cortés, E. The potential of environmental regulation to change managerial perception, environmental management, competitiveness and financial performance. J. Clean. Prod. 2010, 18, 963–974. [Google Scholar] [CrossRef]

- Huang, Y.C.; Chen, C.T. Exploring institutional pressures, firm green slack, green product innovation and green new product success: Evidence from Taiwan’s high-tech industries. Technol. Forecast. Soc. Chang. 2022, 174, 121196. [Google Scholar] [CrossRef]

- Sarkis, J.; Gonzalez-Torre, P.; Adenso-Diaz, B. Stakeholder pressure and the adoption of environmental practices: The mediating effect of training. J. Oper. Manag. 2010, 28, 163–176. [Google Scholar] [CrossRef]

- Wu, H.; Hao, Y.; Ren, S. How do environmental regulation and environmental decentralization affect green total factor energy efficiency: Evidence from China. Energy Econ. 2020, 91, 104880. [Google Scholar] [CrossRef]

- Nejati, M.; Amran, A.; Hazlina Ahmad, N. Examining stakeholders’ influence on environmental responsibility of micro, small and medium-sized enterprises and its outcomes. Manag. Decis. 2014, 52, 2021–2043. [Google Scholar] [CrossRef]

- Hofer, C.; Cantor, D.E.; Dai, J. The competitive determinants of a firm’s environmental management activities: Evidence from US manufacturing industries. J. Oper. Manag. 2012, 30, 69–84. [Google Scholar] [CrossRef]

- Pagell, M.; Yang, C.L.; Krumwiede, D.W.; Sheu, C. Does the competitive environment influence the efficacy of investments in environmental management? J. Supply Chain Manag. 2004, 40, 30–39. [Google Scholar] [CrossRef]

- Garcés-Ayerbe, C.; Rivera-Torres, P.; Murillo-Luna, J.L. Stakeholder pressure and environmental proactivity: Moderating effect of competitive advantage expectations. Manag. Decis. 2012, 50, 189–206. [Google Scholar] [CrossRef]

- Delmas, M.A.; Toffel, M.W. Organizational responses to environmental demands: Opening the black box. Strateg. Manag. J. 2008, 29, 1027–1055. [Google Scholar] [CrossRef]

- Klassen, R.D. Plant-level environmental management orientation: The influence of management views and plant characteristics. Prod. Oper. Manag. 2001, 10, 257–275. [Google Scholar] [CrossRef]

- Shan, Y.G.; Tang, Q.; Zhang, J. The impact of managerial ownership on carbon transparency: Australian evidence. J. Clean. Prod. 2021, 317, 128480. [Google Scholar] [CrossRef]

- Tung, A.; Baird, K.; Schoch, H. The relationship between organizational factors and the effectiveness of environmental management. J. Environ. Manag. 2014, 144, 186–196. [Google Scholar] [CrossRef] [PubMed]

- Frondel, M.; Horbach, J.; Rennings, K. What triggers environmental management and innovation? Empirical evidence for Germany. Ecol. Econ. 2008, 66, 153–160. [Google Scholar] [CrossRef]

- Hardcopf, R.; Shah, R.; Dhanorkar, S. The impact of a spill or pollution accident on firm environmental activity: An empirical investigation. Prod. Oper. Manag. 2021, 30, 2467–2491. [Google Scholar] [CrossRef]

- Christmann, P.; Taylor, G. Globalization and the environment: Determinants of firm self-regulation in China. J. Int. Bus. Stud. 2001, 32, 439–458. [Google Scholar] [CrossRef]

- Chiou, T.Y.; Chan, H.K.; Lettice, F.; Chung, S.H. The influence of greening the suppliers and green innovation on environmental performance and competitive advantage in Taiwan. Transp. Res. Part E Logist. Transp. Rev. 2011, 47, 822–836. [Google Scholar] [CrossRef]

- Prado-Lorenzo, J.M.; Rodríguez-Domínguez, L.; Gallego-Álvarez, I.; García-Sánchez, I.M. Factors influencing the disclosure of greenhouse gas emissions in companies world-wide. Manag. Decis. 2009, 47, 1133–1157. [Google Scholar] [CrossRef]

- Fernandes, S.M.; Bornia, A.C.; Nakamura, L.R. The influence of boards of directors on environmental disclosure. Manag. Decis. 2018, 57, 2358–2382. [Google Scholar] [CrossRef]

- Peters, G.F.; Romi, A.M. Does the voluntary adoption of corporate governance mechanisms improve environmental risk disclosures? Evidence from greenhouse gas emission accounting. J. Bus. Ethics 2014, 125, 637–666. [Google Scholar] [CrossRef]

- Fiorini, P.D.C.; Jabbour, C.J.C.; de Sousa Jabbour, A.B.L.; Stefanelli, N.O.; Fernando, Y. Interplay between information systems and environmental management in ISO 14001-certified companies. Manag. Decis. 2019, 57, 1883–1901. [Google Scholar] [CrossRef]

- Chen, Y.; Zhu, X.; Xiong, X.; Zhang, C.; Huang, J. Who discloses carbon information? The joint role of ownership and factor market distortion. Manag. Decis. 2023, 61, 2391–2412. [Google Scholar] [CrossRef]

- Farooq, U.; Subhani, B.H.; Shafiq, M.N.; Gillani, S. Assessing the environmental impacts of environmental tax rate and corporate statutory tax rate: Empirical evidence from industry-intensive economies. Energy Rep. 2023, 9, 6241–6250. [Google Scholar] [CrossRef]

- Johnstone, N.; Labonne, J. Why do manufacturing facilities introduce environmental management systems? Improving and/or signaling performance. Ecol. Econ. 2009, 68, 719–730. [Google Scholar] [CrossRef]

- Zhu, Q.; Cordeiro, J.; Sarkis, J. Institutional pressures, dynamic capabilities and environmental management systems: Investigating the ISO 9000–Environmental management system implementation linkage. J. Environ. Manag. 2013, 114, 232–242. [Google Scholar] [CrossRef]

- Hajmohammad, S.; Vachon, S.; Klassen, R.D.; Gavronski, I. Lean management and supply management: Their role in green practices and performance. J. Clean. Prod. 2013, 39, 312–320. [Google Scholar] [CrossRef]

- Barcos, L.; Barroso, A.; Surroca, J.; Tribó, J.A. Corporate social responsibility and inventory policy. Int. J. Prod. Econ. 2013, 143, 580–588. [Google Scholar] [CrossRef]

- Li, G.; Li, N.; Sethi, S.P. Does CSR reduce idiosyncratic risk? Roles of operational efficiency and AI innovation. Prod. Oper. Manag. 2021, 30, 2027–2045. [Google Scholar] [CrossRef]

- Bellamy, M.A.; Dhanorkar, S.; Subramanian, R. Administrative environmental innovations, supply network structure, and environmental disclosure. J. Oper. Manag. 2020, 66, 895–932. [Google Scholar] [CrossRef]

| Variable | Measurement | Data Source |

|---|---|---|

| 1 EMP | Ratio of the number of the EMPs adopted by a firm to the total number of EMPs adopted by any firm in the same industry. | Thomson Reuters’ ASSET4 |

| 2 Profit Margin | Ratio of net income to revenue. | Compustat |

| 3 ROA | Ratio of net income to total assets. | Compustat |

| 4 ROE | Ratio of net income to shareholder equity. | Compustat |

| 5 Asset Turnover | Ratio of revenue to total assets. | Compustat |

| 6 Environmental Risk | An ordinal variable assessed based on the severity of potential issues related to factors like energy use, water use, emissions, waste, pollution, and disasters. The levels of risk are categorized as low (0), medium (1), and high (2). | First for Sustainability |

| 7 Size | Natural log of total assets. | Compustat |

| 8 EMS | A dummy variable identifying whether or not the firm adopts a certified environmental management system. | Thomson Reuters’ ASSET4 |

| 9 Market Leadership | A dummy variable identifying whether or not the firm has highest market share. | Compustat |

| Variable | Mean | SD | Min | Max | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 EMP | 0.313 | 0.313 | 0 | 1 | 1 | ||||||||

| 2 Profit Margin | 0.212 | 0.178 | −4.063 | 0.956 | −0.050 ** | 1 | |||||||

| 3 ROA | 0.054 | 0.093 | −1.971 | 0.769 | 0.026 ** | 0.377 ** | 1 | ||||||

| 4 ROE | 0.086 | 5.672 | −28.383 | 445.010 | 0.005 | −0.006 | 0.123 ** | 1 | |||||

| 5 Asset Turnover | 0.885 | 0.697 | 0.014 | 4.928 | 0.082 ** | −0.395 ** | 0.183 ** | −0.002 | 1 | ||||

| 6 Environmental Risk | 1.094 | 0.870 | 0 | 2 | 0.145 ** | 0.012 | −0.059 ** | 0.013 | −0.126 ** | 1 | |||

| 7 Size | 22.716 | 1.462 | 16.914 | 28.751 | 0.283 ** | 0.131 ** | −0.094 ** | 0.029 ** | −0.229 ** | −0.098 ** | 1 | ||

| 8 EMS | 0.272 | 0.445 | 0 | 1 | 0.449 ** | −0.068 ** | 0.016 | −0.009 | 0.024 * | 0.308 ** | 0.108 ** | 1 | |

| 9 Market Leadership | 0.199 | 0.399 | 0 | 1 | 0.273 ** | −0.137 ** | 0.044 ** | −0.004 | 0.249 ** | 0.022 * | 0.183 ** | 0.149 ** | 1 |

| Model 1 | Model 2 | Model 3 | Model 4 | |

|---|---|---|---|---|

| Return on Asset | 0.018 (0.026) | |||

| Return on Equity | −0.000 (0.000) | |||

| Asset Turnover | −0.000 (0.012) | |||

| Profit Margin | 0.042 (0.017) ** | |||

| Firm Size | −0.002 (0.006) | −0.002 (0.006) | −0.003 (0.007) | −0.003 (0.006) |

| EMS Adoption | 0.146 (0.008) *** | 0.146 (0.008) *** | 0.146 (0.008) *** | 0.146 (0.008) *** |

| Market Leadership | 0.021 (0.011) * | 0.021 (0.011) * | 0.021 (0.011) * | 0.021 (0.011) * |

| Intercept | 0.265 (0.155) * | 0.267 (0.154) * | 0.270 (0.166) | 0.309 (0.156) ** |

| Observations | 6224 | 6224 | 6224 | 6224 |

| Year Dummies | Yes | Yes | Yes | Yes |

| Firm FE | Yes | Yes | Yes | Yes |

| Adjusted | 0.8107 | 0.8108 | 0.8108 | 0.8110 |

| Model 1 | Model 2 | Model 3 | |

|---|---|---|---|

| Profit Margin | 0.042 (0.017) ** | 0.042 (0.017) ** | 0.131 (0.031) *** |

| Environmental Risk | 0.657 (0.147) *** | 0.607 (0.147) *** | |

| Profit Margin × Environmental Risk | −0.075 (0.022) *** | ||

| Firm Size | −0.002 (0.006) | −0.003 (0.006) | −0.004 (0.006) |

| EMS Adoption | 0.146 (0.008) *** | 0.146 (0.008) *** | 0.145 (0.008) *** |

| Market Leadership | 0.021 (0.011) * | 0.021 (0.011) * | |

| Intercept | 0.275 (0.154) * | −0.348 (0.180) * | −0.273 (0.181) * |

| Observations | 6224 | 6224 | 6224 |

| Year Dummies | Yes | Yes | Yes |

| Firm FE | Yes | Yes | Yes |

| Adjusted | 0.8109 | 0.8110 | 0.8113 |

| Model 1 | Model 2 | Model 3 | |

|---|---|---|---|

| Low Environmental Risk | Medium Environmental Risk | High Environmental Risk | |

| Profit Margin | 0.083 (0.035) ** | 0.131 (0.034) *** | −0.035 (0.025) |

| Firm Size | −0.028 (0.011) | 0.004 (0.015) | −0.015 (0.008) * |

| EMS Adoption | 0.139 (0.017) *** | 0.156 (0.017) *** | 0.138 (0.010) *** |

| Market Leadership | 0.069 (0.024) *** | −0.018 (0.021) | 0.031 (0.016) * |

| Intercept | 1.001 (0.308) *** | 0.124 (0.369) | −0.251 (0.194) |

| Observations | 2092 | 1454 | 2678 |

| Year Dummies | Yes | Yes | Yes |

| Firm FE | Yes | Yes | Yes |

| Adjusted | 0.7968 | 0.8037 | 0.8238 |

| Model 1 | Model 2 | Model 3 | Model 4 | |

|---|---|---|---|---|

| Profit Margin | 0.045 (0.018) ** | 0.131 (0.031) *** | 0.051 (0.020) ** | 0.156 (0.038) *** |

| Environmental Risk | 0.649 (0.147) *** | 0.599 (0.147) *** | 0.680 (0.148) *** | 0.616 (0.149) *** |

| Profit Margin × Environmental Risk | −0.075 (0.022) *** | −0.091 (0.028) *** | ||

| Firm Size | −0.002 (0.006) | −0.002 (0.006) | −0.006 (0.007) | −0.007 (0.007) |

| EMS Adoption | 0.147 (0.008) *** | 0.146 (0.008) *** | 0.142 (0.008) *** | 0.141 (0.008) *** |

| Market Leadership | 0.021 (0.011) * | 0.021 (0.011) * | 0.022 (0.012) * | 0.022 (0.012) * |

| Intercept | −0.377 (0.180) * | −0.304 (0.181) * | −0.288 (0.185) | −0.209 (0.187) |

| Observations | 6175 | 6175 | 6036 | 6036 |

| Year Dummies | Yes | Yes | Yes | Yes |

| Firm FE | Yes | Yes | Yes | Yes |

| Adjusted | 0.8117 | 0.8121 | 0.8115 | 0.8118 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lee, J.; Chung, H.; Cho, N.-E. The Effects of Operational Efficiency and Environmental Risk on the Adoption of Environmental Management Practices. Sustainability 2023, 15, 15869. https://doi.org/10.3390/su152215869

Lee J, Chung H, Cho N-E. The Effects of Operational Efficiency and Environmental Risk on the Adoption of Environmental Management Practices. Sustainability. 2023; 15(22):15869. https://doi.org/10.3390/su152215869

Chicago/Turabian StyleLee, Jiung, Hakjin Chung, and Na-Eun Cho. 2023. "The Effects of Operational Efficiency and Environmental Risk on the Adoption of Environmental Management Practices" Sustainability 15, no. 22: 15869. https://doi.org/10.3390/su152215869

APA StyleLee, J., Chung, H., & Cho, N.-E. (2023). The Effects of Operational Efficiency and Environmental Risk on the Adoption of Environmental Management Practices. Sustainability, 15(22), 15869. https://doi.org/10.3390/su152215869