Abstract

About 95% of current hydrogen production uses technologies involving primary fossil resources. A minor part is synthesized by low-carbon and close-to-zero-carbon-footprint methods using RESs. The significant expansion of low-carbon hydrogen energy is considered to be a part of the “green transition” policies taking over in technologically leading countries. Projects of hydrogen synthesis from natural gas with carbon capture for subsequent export to European and Asian regions poor in natural resources are considered promising by fossil-rich countries. Quality changes in natural resource use and gas grids will include (1) previously developed scientific groundwork and production facilities for hydrogen energy to stimulate the use of existing natural gas grids for hydrogen energy transport projects; (2) existing infrastructure for gas filling stations in China and Russia to allow the expansion of hydrogen-fuel-cell vehicles (HFCVs) using typical “mini-plant” projects of hydrogen synthesis using methane conversion technology; (3) feasibility testing for different hydrogen synthesis plants at medium and large scales using fossil resources (primarily natural gas), water and atomic energy. The results of this study will help focus on the primary tasks for quality changes in natural resource and gas grid use. Investments made and planned in hydrogen energy are assessed.

1. Introduction

The goal of achieving carbon neutrality, as declared by a number of large countries, including Russia, in 2020–2021, with a reasonable approach can contribute to the development of innovations within the mineral resource complex (MRC) that would allow for maintaining social and economic efficiency, including the creation of jobs and useful value. At the same time, the specific value chains of a number of enterprises and entire industries of MRCs may undergo significant changes over the next two decades due to the wider introduction of energy-saving, “energy-transitional” (“green”) technologies and renewable energy sources (RESs).

The largest share of anthropogenic carbon (CO2) emissions—40–45%, according to available estimates, on average for countries around the world—originate from the energy sector; 30–40% are from industries and services, and the remaining 15–25% of current emissions are produced by the transport industry [1,2]. One of the key ways to reduce anthropogenic CO2 emissions is through the use of hydrogen as the main energy raw material; hence, technologies for its production (acquisition, synthesis), storage and transportation are being developed, as well as technologies and conceptual proposals for the use of hydrogen in various types of metallurgical and other plants for transport.

The processes involved in the transition to renewable energy sources in the energy and industrial sectors will be of decisive importance in achieving carbon neutrality [2,3]. A relatively easy solution and, therefore, the first priority in the “green strategies” realization could be the transition of transport to carbon-neutral fuels, including hydrogen. However, even in the case of complete neutralization in processes of obtaining, storing and delivering fuel, such a transition would reduce the current level of anthropogenic CO2 emissions by an average of only 15–20%, primarily in cities [2,4,5].

Currently, the volume of hydrogen produced in the world for the needs of various industries is about 90 million tons per year, including 21% obtained as a subproduct [6]. Hydrogen is mainly used in the chemical and oil industries as an intermediate raw material. For example, out of 5 Mtons produced in Russia, the transport industry uses less than 0.3% hydrogen [7].

It should be noted that, in recent decades, especially in 2019–2023, the volume of scientific publications in the world on hydrogen energy and transport has reached new levels [8,9,10]. New knowledge on hydrogen fuel, its features and aspects of its use has been formed, including technical and economic aspects of the production of hydrogen fuel in various ways, as well as hydrogen fuel cells and energy systems [10,11,12]. A huge proportion of publications evaluate the efficiency of hydrogen-fuel-cell (HFC) engines compared to internal combustion engines (ICEs) and battery-powered vehicles (BEVs). Dedicated conferences are held annually, for example, the Hydrogen Fuel Cell 2023 Exhibition and Conference (https://www.hydrogen-fuel-cell-summit.com/) (accessed on 5 October 2023).

The projected reduction in the production cost of liquid hydrogen from the average level of USD 5.5–9.0 per 1 kg (excluding transportation and storage costs) in 2021–early 2022 to the level of USD 0.5–1.0 per 1 kg, that is, a decrease of 9–10 times, in the period of 2025–2035 was accepted as an axiom by many authors in 2010–2020. Such a reduction, provided that the forecasts are realistic, could allow hydrogen fuel to potentially compete with fossil fuels in the price conditions of 2021 if not accounting for its origin. Theoretically, taking into account the multiple price increases for natural gas and electricity in the markets of the EU and Asia-Pacific countries during the peak months of 2022, such a low “future” cost of hydrogen virtually serves as an additional incentive for the speedy transition to the widespread use of such a “feasible” resource.

In fact, there is a certain logical trap. All forecasts for reducing the cost of hydrogen production were based on the assumption that there would be some production and technological cycles that had not yet been discovered by science and that these would make it possible to produce, store and use hydrogen in huge volumes while being safe and cheap, partly due to the scale effect. Such technological optimism also includes hydrogen extraction prospects from the bowels of the Earth’s crust, ocean energy and wastes [13,14,15].

In fact, at present and during the last 15 years in leading countries, the functioning of hydrogen energy elements has been ensured by large-scale state support, since the current cost of owning and operating various engines and systems based on hydrogen fuel cells exceeds the costs of similar known systems based on internal combustion engines (ICE) and fossil fuel sources by 3 to 10 times in different cases [16,17].

Technologies for producing hydrogen for use in fuel cells are linked to the principles of “green energy”, in which hydrogen is developed as fuel to balance the volatility of electricity generation from renewable sources such as the sun and wind. Numerous hydrogen synthesis technologies are being improved. Hydrogen is produced by water electrolysis (“green”), various types of methane conversion with or without carbon capture (“turquoise”, “blue”), and coal gasification (“brown”), as well as nuclear (“yellow”), hydropower, biomass energy, natural (“gold”) and a number of promising methods, including methane pyrolysis [1,3].

For various methods of the industrial production of hydrogen, an increase in cost is accompanied by a decrease in the so-called carbon footprint, which is discussed in detail in a large number of scientific papers. The current cost of liquid hydrogen synthesis, depending on the technology used, economies of scale, and the average costs of primary resources—hydrocarbons—and electricity in various countries and regions, ranges from USD 1.6 per 1 kg (methane reforming without CO2 capture, as in Russia, Qatar, USA and other countries rich in gas) up to USD 15–18 per 1 kg or more (electrolysis of desalinated water in countries with expensive electricity, including the EU, Japan and South Korea) [3].

Countries and huge companies rich in natural resources, primarily natural gas, are more interested in using them to obtain hydrogen rather than using costly methods like water electrolysis, despite the greater carbon footprint of “fossil-use” methods. By 2030, according to McKinsey’s forecast (McKinsey & Company. The clean hydrogen opportunity for hydrocarbon-rich countries. URL: https://www.mckinsey.com/industries/oil-and-gas/our-insights/the-clean-hydrogen-opportunity-for-hydrocarbon-rich-countries (accessed on 23 September 2023)), due to economies of scale, the average cost of hydrogen for end-users in countries rich in hydrocarbons (Russia, USA, Gulf monarchies, Canada, Australia, China and former Soviet Middle East republics) may decrease by 2 times—from USD 7 to 3.5.

One of the cheapest and most attractive “energy transition” priorities is the method of obtaining hydrogen from methane through pyrolysis (turquoise hydrogen), which ensures the low level or absence of CO2 emissions during and after the synthesis procedure with a relatively low demand for electricity, unlike water electrolysis [18,19,20].

In an effort to reduce carbon emissions, countries and groups such as the EU have sought to support only methods of producing hydrogen that would have a low-carbon footprint as part of their policies. The electrolysis of water using electricity generated from renewable energy sources and the steam conversion of biogas give rise to close-to-zero emissions [21]. Other methods (Table 1) produce certain amounts of CO2 emissions, which they have tried to take into account, for example, in the EU Green Taxonomy, giving temporary permission to produce blue, yellow, orange and other types of hydrogen [22,23,24].

Table 1.

Types of hydrogen, their costs and shares of current production [3,6,8].

About 95% of current hydrogen production uses technologies involving primary fossil resources—gas, coal and oil. A minor part is synthesized by low-carbon and close-to-zero-carbon-footprint methods using different renewable energy sources (RESs). The significant expansion of low-carbon hydrogen energy is considered to be a part of the “green transition” policies taking over in technologically leading countries. However, the high costs of using low-carbon (including CCS or CCUS) and RES technologies force governments to change their ambitious green hydrogen programs to cheaper ones.

However, the inevitable practical consequence of expanding the use of hydrogen in the energy sector and the mass roll-out of hydrogen station infrastructure in transport in the future decades may be a significant change in the conditions and features of the operation of MRC enterprises that supply primary resources for hydrogen production. In this regard, the purpose of this article is to identify and systematize promising areas, projects and technologies that are the most feasible prospects in the field of hydrogen energy from techno-economic and ecological points of view. The main hypothesis of this paper implies that the quality changes in natural resource and gas grid use will follow as the prospective hydrogen technology expansion becomes more clear, including that in Russia.

When writing this article, the methods of system analysis, synthesis and generalizations were used. This is a combination of systematic and critical review research, focusing on technological, ecological and socio-technical aspects of hydrogen energy. Similar methodologies have been adopted by many other authors.

2. Obstacles to Producing Hydrogen

Today, the search for ways to reduce the cost of hydrogen synthesis while minimizing the carbon footprint requires the development of various methods and technological solutions, including the most costly ones, based on future economies of scale. So, to test the hypothesis made by Prof. V. N. Larin in 1968 about the hydride structure of the Earth, deputies of the State Duma of the Russian Federation, in the fall of 2021, sent a request to the Federal Agency for Subsoil Use (Rosnedra). According to the hypothesis, at a depth between the lithosphere and the core, there is a “metal sphere” that contains significant reserves of hydrogen [25]. In 2020, an agreement was also made between Helios Aragon and the American fund Ascend Funds Management for a geological project to search for hydrogen and helium with a consultant professor from the University of Durham (England), John Glias. However, even if hydrogen is found in the bowels of the Earth’s crust, its production from a depth of 200 km or more at the current level of technological development will not be able to be cost-effective in the foreseeable future. Since 2020, they have used Glias’ term “gold hydrogen” to signify this natural acquisition method.

In order for hydrogen energy technologies to be widely used, it is necessary to overcome a number of existing scientific, practical and legal problems (obstacles):

- Organize production using a method of hydrogen production that would be cost-effective, allow the production of fuel on an industrial scale and not have a significant carbon footprint [2].

- Significantly reduce the cost of manufacturing engines and systems based on hydrogen fuel cells and increase their motor life period and integrated efficiency factor or coefficient of operational productivity (IEF/COP).

- Ensure safety throughout the entire chain from the production to consumption of hydrogen, including storage and transport systems, with gradual improvements in their kinematic and thermodynamic characteristics, and reduce the content of special metal per kg of hydrogen transport fittings of hydrogen pipelines and storage facilities for its safe storage [26].

- Improve the efficiency of hydrogen transportation and (or) reduce the distance from the places of production to the places of consumption.

- Overcome the lack of feasible technologies for capturing and storing carbon dioxide in countries striving to become significant producers of “low-carbon” hydrogen.

- Find a way to overcome the freshwater deficit in a number of countries planning large-scale hydrogen production by electrolysis by building expensive desalination plants.

- Develop an international system of standards and regulations in the field of hydrogen energy based on optimal technological solutions.

The system of standards and regulations in the field of hydrogen energy is already functioning in a number of countries [27]. In Russia, the development of new required standards and the improvement of regulatory documentation are provided by the 2022 Roadmap for the Development of Hydrogen Energy and are planned to finish at the end of 2024.

Notably, there are still different expert opinions about which method for storage and transportation of hydrogen is the most cost-efficient today and in the future—compressed hydrogen solutions or liquid hydrogen.

For small volumes in the storage and transportation of hydrogen (car), containers for compressed gas with nominal operating pressures of 35 and 70 MPa for types III and IV (composite cylinder with a metal shell and a plastic liner, UN regulation SAE J2579 hydrogen system standard) are considered optimal for the near future. The main advantage of using compressed hydrogen is the ability to quickly refuel vehicles in approximately 3–5 min with a volume of 5–20 kg and the cost-effectiveness [28,29,30].

For large-scale hydrogen storage, the optimal solution is to inject it into underground gas storage facilities, the most efficient of which are salt caverns, as previously recognized. Thus, at this stage, effective large-scale hydrogen storage can only be achieved in regions with favorable geological conditions for this, which implies the active development of technologies for transporting hydrogen from its production sites to direct consumers [31,32,33].

Cryo-compressed hydrogen (CcH) and liquid hydrogen (LH2) storage are alternative mature approaches in which hydrogen is liquefied at −253 °C and compressed into vessels that can reach pressures of 250–350 atm. But the process of turning gas into liquid is extremely expensive, consuming approximately 25–40% of the energy contained in stored hydrogen compared to the 10% energy loss when compressing hydrogen.

An alternative approach to hydrogen storage has also been developed—a cryogenic high-pressure vessel—in which an attempt was made to combine liquefaction and compression technologies. Its use in small volumes required for motor transport will be limited in the coming years by the lack of infrastructure, since gas stations in all countries are created using compressed hydrogen technology [34,35,36]. International standards, including those being finished in Russia, imply the use of compressed hydrogen solutions for road and railway transport.

Besides the comparatively high cost of hydrogen fuel synthesis in both methods, its use in the energy sector and transport is hampered by the high cost of the main equipment—fuel systems and cells, as well as tanks for the corrosion-free and safe storage and transportation of hydrogen.

Also contributing to the high cost is the low level of integrated efficiency that originates from several transformations and operations of transportation and storage, starting with gas production and other primary resource systems for converting chemical energy into electrical or mechanical energy. Thus, the final efficiency of HFCVs is claimed to be at a level of only 25–35%, while that of BEVs, in comparison, can reach 70–90% [37].

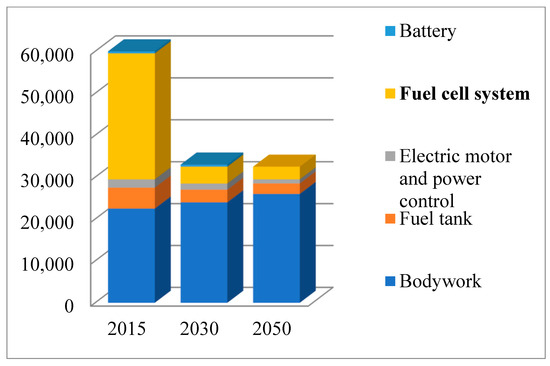

According to the 2015 forecast of the International Energy Agency (IEA), a significant reduction in the cost of hydrogen fuel cells for vehicles should occur by about 2030 (Figure 1) and should be based on technologies that have not been developed so far.

Figure 1.

Forecast of the component costs for HFCVs in USD by IEA (2015) [38]. Figure 1 was created by authors using the information from public domain of IEA.

Thus, the 2015 forecast assumed an almost 8-fold reduction in the cost of a hydrogen-fuel-cell system by 2030 from about USD 30 thousand to USD 3.5–4 thousand, which would bring the average cost of an HFCV (hydrogen car) to the average cost of a car with an internal combustion engine (ICE). As a reason for the cost reduction, the forecast assumed that a then-unknown, more economical method of manufacturing HFCV engines would be developed and then scaled up.

However, in their 2020–2021 forecasts, the IEA claimed that only by 2050–2070 would the cost of fuel cells for MFTs and HFTs (MFTs = medium-freight trucks; HFTs = heavy-freight trucks) and hydrogen storage tanks decline as economies of scale are achieved in the LDV sub-sector [39] (pp. 262–263), [40]. It can hence be stated that earlier forecasts by the IEA contained excessively optimistic views, while the average cost of an HFCV engine for a passenger car, at least for the period 2015–2022, has not dramatically decreased [41,42,43].

3. Brief Information about the Development of Hydrogen Energy in Leading Countries

Most economically developed countries have adopted long-term hydrogen strategies (Figure 2), programs and road maps as part of their strategic planning.

Figure 2.

Countries that have approved hydrogen development strategies before 2021 (blue) and in 2021 (green), according to IEA [6,40,44], WEC [45], and USDOE [46].

Some huge projects have been claimed to be realized in African and Asian countries that have not adopted hydrogen strategies yet, but these are underway.

3.1. Europe

The EU countries consider the use of hydrogen technologies to be one of the foundations of energy security in the context of achieving carbon neutrality. In the early 2000s, 25 EU countries began joint work within the framework of the European Research Area (ERA) project, one of the goals of which was to create a platform for research and development in the field of hydrogen technologies and fuel cells [47].

Established in 2008, the Fuel Cells and Hydrogen Joint Undertaking (FCHJU) public–private partnership, which brings together more than 100 participants—European territories and cities—has published the European Hydrogen Roadmap, which describes activities planned up to 2030 and up to 2050 with budgets of tens and hundreds of billions of euros. On 30 November 2021, FCHJU transferred its business to its successor—Clean Hydrogen JU [48].

On 8 July 2020, the European Commission presented two documents: “Ensuring a climate-neutral economy: an EU strategy for the integration of energy systems” and a “Hydrogen strategy for a climate-neutral Europe”. The “Hydrogen Strategy…” notes that the use of hydrogen is preferable for land transport, including trains on sections of railway tracks where electrification is impossible or economically unprofitable, where hydrogen can replace the diesel locomotives used today [49].

In the Sustainable and Smart Mobility Strategy [50], published at the end of 2020, one of the key goals is to deploy 30 million vehicles with zero emissions by 2030 (about 10% of the vehicle fleet), with more than 95% of the vehicle fleet meeting this goal by 2050. The main focus in reducing CO2 emissions in the EU is on battery electric vehicles—BEVs.

Until the early 2020s, Germany was the driving force behind the introduction of hydrogen technologies among European countries; then, France began to catch up with it. In 2006, the “National Innovation Program for Hydrogen and Fuel Cell Technologies” (NIP) was introduced in Germany and extended to 2025 (NIP 2) with a budget of 2 billion euros. In June 2020, the German government adopted the National Hydrogen Strategy, according to which another 9.5 billion euros should be allocated by the end of 2023 in order to restore the economy from the consequences of restrictions due to the coronavirus [51]. In Germany, the state provided a subsidy of up to 50% of the costs for the construction of hydrogen filling stations [52]. As a result, at the end of 2022, almost half of the 250 hydrogen filling stations in Europe were operating in this country, and the hydrogen train Coradia iLint has functioned since 2022.

Variants of the Hydrogen Strategy were considered, with serious disagreements among supporters of the use of “blue/turquoise” versus “green” hydrogen. The document allows the use of “turquoise” hydrogen produced with the release of CO2 in the medium term, as it is several times cheaper for the economy than “carbon-neutral” green methods of producing hydrogen. The strategy left representatives of the Federal Association of German Industry dissatisfied, as they felt that the government had missed the opportunity to use the potential of aviation and maritime transport for the introduction of hydrogen [53]. A number of public organizations, on the contrary, declared the need to limit the use of hydrogen, arguing that there are alternative energy sources with higher levels of efficiency and safety [53].

It should be noted that In parallel with the strategy at the federal level, the regional authorities of the German states also approved hydrogen strategies or road maps (for example, the hydrogen strategy of the German Northern Lands [54]) based on the possibilities given by regional budgets. As part of these regional initiatives, for example, in Saxony, a local hydrogen-fuel-cell train manufactured by Alstom (France) was launched, the cost of which is currently three times higher than the cost of a diesel counterpart [55].

Considering Germany’s leading role in the EU, researchers concluded that German practices have been “transmitted” to other European countries to a significant extent, primarily in France in recent years. In the development of light road transport in the EU, priority is given to battery electric technologies. Transport using hydrogen fuel cells will be implemented as a priority in the cargo sector of public transport, including railways, as well as taxis [52,53,55].

3.2. USA

All types of transport in the United States account for about 30% of carbon dioxide emissions. To achieve the approved indicators of carbon neutrality by 2030, the development of hydrogen energy in such priority areas as cargo, sea and air transport is envisaged. In July 2020, the US Department of Energy published the Hydrogen Strategy [56] aimed at accelerating R&D in the field of hydrogen energy.

In 2021, the US Department of Energy launched the Hydrogen Shot–Earthshot project, aimed at reducing the cost of hydrogen to USD 1/kg over a decade and reducing CO2 emissions by 16%. Studies by the Massachusetts Institute of Technology (MIT), confirmed by scientists from other countries, prove the possibility of reducing the cost of hydrogen production to USD 2.5/kg by 2030 using solar energy electrolysis in the southern states of the United States [57], while it is still recognized that methane pyrolysis is the cheapest low-carbon alternative in the foreseeable future [58,59,60].

Back in 2017, nine US states developed an action plan to accelerate the introduction of zero-emission vehicles, including the use of hydrogen fuel cells [61]. However, BEVs are much more popular in the US, and some “opinion leaders”—such as I. Musk—are skeptical about the prospects for hydrogen vehicles. Startup companies—specialized manufacturers of hydrogen vehicles—are gradually developing (Hyzon Motors and so on), but they have not achieved a significant increase in sales like Tesla. Leading American automakers (GM, Ford, Chrysler), unlike their huge Japanese, Korean and Chinese competitors, have not yet brought their “hydrogen models” to the market.

3.3. Japan

Japan has been developing hydrogen tech for more than 40 years [62], and in 1974, it became one of the founding countries of the International Hydrogen Energy Association. Interest in hydrogen technologies has grown, especially since the accident at the Fukushima-1 nuclear power plant in 2011. The 2019 Strategic Roadmap for Hydrogen and Fuel Cells document sets a target of 800,000 hydrogen-fuel-cell vehicles (about 2.5% of the vehicle fleet) and 900 hydrogen filling stations by 2030 [6] (p. 49).

In 2017, the car manufacturers Toyota, Honda, Nissan, Tokyo Gas and Iwatani Corp., in order to accelerate the process of practically testing the technologies being created in the automotive industry, founded Japan H2 Mobility. The cost of building one hydrogen filling station in Japan in the 2010s was estimated at an average of USD 4 million. However, according to Japan H2 Mobility experts, by 2025, the cost of construction (reconstruction) and operation of hydrogen filling stations will be reduced by a factor of three compared to 2016 [63,64].

In the Basic Hydrogen Strategy of Japan, adopted in 2017, an ambitious goal was proclaimed—to build a “hydrogen society” by 2035–2040. One of the important indicators of the document’s implementation is the number of passenger HFCVs in operation. In 2020, 40,000 hydrogen-powered vehicles were planned, but in reality, about 7500 (Toyota Mirai) were produced and sold by this date, some of them for export. At the beginning of 2023, there were about 10 thousand HFCVs in the country, which is about 7 times behind the ambitious plans approved in 2017. To intensify sales, Toyota claims it will release next-generation fuel cells by 2026 that will be 50% cheaper than current ones (from 2013) but will provide a 20% increase in range (https://carbuzz.com/news/toyota-says-next-gen-fuel-cell-will-be-50-percent-cheaper-by-2026 (accessed on 17 June 2023)).

Measures to support the development of hydrogen transport in Japan over the past period included [65,66] subsidizing the purchase of cars; subsidizing (by the administrations of large cities, for example, Tokyo) the cost of renting hydrogen cars and carsharing; and subsidizing the construction of hydrogen filling stations. However, studies by Japanese scientists have shown that the owners of hydrogen cars are mainly wealthy buyers over 50 years old, for whom subsidies and benefits from the government associated with buying a car are not as important as the ease of use and prospects [67]. This stratum of buyers is quite prudent and does not yet believe in the imminent implementation of the concept of the “Hydrogen Society” in Japan, despite the country’s high provision of hydrogen filling stations [68].

As a result, in June 2023, Japan approved a new Basic Hydrogen Strategy, in which many priorities were revised, and the concept of the rapid construction of the “Hydrogen Society” by the 2030s was actually recognized as a fantasy [69,70].

3.4. South Korea

In 2003, the government established the Coordinating Committee for the Development and Demonstration of Hydrogen and Fuel Technologies, and by 2007, the authorities set one of the tasks: by 2040, replace 50% of automotive fuel with hydrogen, for which the research and development of fuel cells is actively underway. The Hyundai Tucson IX and Kia Mohave, powered by hydrogen fuel cells, were used to transport guests of the Expo 2012 exhibition in Yeosu. In the same year, 2012, the operation of Hyundai buses with a cruising range of 500 km, equipped with cylinders with a capacity of 40 kg of hydrogen, was launched at the Seoul airport.

The prospects for the transition to a “hydrogen economy” were announced in the Renewable Energy Act in 2012 [71]. According to Korean researchers, the implementation of the provisions of the program made it possible to stimulate the production of energy from renewable sources in a number of industries [72].

In March 2016, the Korean government announced the start of the transition of 26,000 buses from liquefied natural gas to hydrogen, with the conversion of about 200 gas stations. The first hydrogen bus entered the streets of Ulsan in October 2018, and by 2030, it is planned to reach the goal of 40% of public transport on hydrogen [73]. If about 200 fuel-cell buses are operating in Korea as of June 2023, then by 2040, it is planned to reach the goal of 40 thousand units. Also, by 2040, 80,000 taxis and 30,000 hydrogen-powered trucks will be used in the country, and the cost of hydrogen will decrease from the current KRW 8000 (RUB 510 or USD 6.5) per kilogram to KRW 3000 (RUB 190 or USD 2.5) [74].

In accordance with the roadmap adopted in 2019, Korea is going to produce 6.2 million hydrogen cars by 2040, of which 2.9 will be used domestically, and 3.3 million will be exported. The plans of the Korean government are aimed at making the country the largest producer of hydrogen cars and fuel cells in the world by 2030, relying on some of its own unique developments and economies of scale [75,76,77].

For a number of positions, these plans were fulfilled; however, for example, there is a lag in the number of hydrogen filling stations. Instead of 310 filling stations by the end of 2022, only about 180 filling stations were put into operation. By 2040, it is planned to build 1200 filling stations, which seems to be a fairly realistic goal for a country with a population of 50 million.

In the spring of 2020, in order to improve the socio-economic situation and overcome the consequences of COVID-19, the Green New Deal program was launched in Korea, aimed at recycling diesel-powered vehicles and switching to cars with zero CO2 emissions (90% by 2030 according to the plan). Critics of the Green New Deal accuse the authorities of unfair funding: 30.7% of the funds are allocated to the development and creation of cars with zero environmental pollution, while only 21.5% are allocated to the development of the necessary infrastructure. At the same time, this program allocated additional funds to support HFCV producers [78].

Hyundai is the world leader in hydrogen technology in the automotive industry. In 2000, the company introduced the first fuel-cell electric vehicle, the Santa Fe FCEV. In 2013, the world’s first mass-produced electric vehicle of this type, the ix35, was introduced. It was followed in 2018 by the second-generation NEXO model. The Hyundai Motor Group is currently implementing the Fuel Cell Vision 2030 strategy, according to which the company plans to increase the production of fuel-cell systems to up to 700 thousand units per year by 2030 for various sectors of the economy [79].

In June 2023, South Korea opened what it claims is the world’s first hydrogen power generation bidding market, with several countries participating, including Azerbaijan, France, Japan and Oman. Seoul is focusing on hydrogen production as it shifts away from nuclear power [80].

3.5. China

In China, along with Japan and South Korea, the development of hydrogen energy is considered one of the key development tasks; the goal is to create the world’s leading hydrogen economy in the future, including first self-sufficiency, than the export of products and services [81,82,83]. In 2015, the PRC adopted the “Made in China 2025” program, which contains one of the main goals—the accelerated development of hydrogen transport. According to the forecast of the China Hydrogen Association performed in that period, by 2025, there will be 50 thousand fuel-cell vehicles and 200 filling stations in operation, and by 2035, there will be 15 million vehicles and 1.5 thousand filling stations [84].

It should be noted that China is currently the only country that has “over-fulfilled” its strategic plans for the development of hydrogen energy: the “bar” of 200 filling stations in China was surpassed in April 2022 instead of 2025. In particular, a network of hydrogen filling stations along the Beijing–Zhangjiakou highway was set up on an accelerated basis for the 2022 Winter Olympics. In parallel, in the summer of 2023, a plant for the production of green H2 with a capacity of 20 Mt per year was commissioned in China. Synthesis is powered by a 4 GW solar power plant with a storage system (https://chinahydrogen.substack.com/p/4gw-off-grid-solar-power-to-green (accessed on 21 June 2023)). The construction of a plant with a capacity of 200 Mt of hydrogen per year has begun with a commissioning date of 2026 and an investment volume of USD 5 billion. This plant will be located in the city of Jiuquan and will feature 800 MW/1600 MWh of energy storage. It will use 8638 electrolyzers and occupy a total area of 67 km (https://www.pv-magazine.com/2023/06/29/china-halts-tender-for-4-gw-offgrid-solar-hydrogen-project (accessed on 29 June 2023)).

By the end of 2023, it will be the second-largest green H2 project in the world, while the largest will be the NEOM Green Hydrogen Company project in Saudi Arabia, with a capacity of 1200 Mt of carbon-free hydrogen in the form of green ammonia and a total investment value of USD 8.4 billion, by the end of 2026 (https://www.offshore-energy.biz/development-of-worlds-largest-carbon-free-green-hydrogen-plant-in-full-swing (accessed on 22 May 2023)).

During the period from 2011 to 2020, the PRC provided subsidies for manufacturers of zero-carbon vehicles (mainly BEVs), but at the end of 2020, subsidies were discontinued. According to the PRC Ministry of Finance, automakers have become overly reliant on support measures, which has reduced their competitiveness with BEV companies abroad, and the hydrogen-fuel-cell industry has not undergone qualitative development [85,86]. The reasons given are the insufficiency (or lack) of standards, the imperfection of management policies and the high cost of production [87,88,89].

By the beginning of 2021, the PRC had allocated from USD 0.3 to 1 billion for the development of hydrogen technologies, according to various estimates. However, over the next four decades until 2060, according to the forecasts of China International Capital Corp and China Hydrogen Alliance, the country’s hydrogen energy and transport will receive investments of about USD 470 billion (CNY 3 trillion), that is, an average of more than 4 billion per year.

In September 2020, the declared priority in the development of hydrogen energy was the use of fuel cells in freight traffic, public transport and taxis [90]. The test operation of buses running on hydrogen fuel cells in Foshan showed that this type of transport would soon be more efficient than electric buses due to the greater range and relatively low cost of operation with a comparable production volume [90]. This result differs from the conclusions obtained by IEA and Russian experts, according to which the operation of transport using hydrogen fuel cells in terms of integrated environmental and economic efficiency will be inferior to transport using natural gas until at least 2030 [6,7,44].

The above-named freight traffic priority was realized in China, which accounted for over 95% of fuel-cell truck sales globally, driven largely by a more than fivefold increase in heavy-duty fuel-cell trucks from the end of 2021 to June 2023 thanks to favorable policies and supporting infrastructure [6,91]. Cars powered by hydrogen fuel cells will be in demand in the northwestern part of the country, where distances between populated areas are long and the prevalence of electric vehicles is low.

According to conclusions made by Chinese economists on freight traffic and public transport, their comparisons of the economic efficiency of using different types of modern fuels generally correspond to the same conclusions of experts from some other countries [92,93,94].

3.6. India

India shows very high rates of “connection” to world projects in the field of hydrogen energy. Although, so far, there has been almost no investment in this area, while by 2030, according to Indian leaders, up to USD 100 billion will be invested in hydrogen technologies.

In August 2021, Indian Prime Minister Narendra Modi announced the launch of the National Hydrogen Mission. Green hydrogen is what will allow India to make a qualitative leap, becoming a global center for its production and export (this quote is fully consistent with similar statements in the Russian Concept for the Development of Hydrogen Energy, also adopted in 2021). The mission aims to produce 5 million tons of green hydrogen by 2030 for domestic consumption and 10 Mtons for exports. The Indian government allocated USD 11.4 billion to support hydrogen projects until 2030 [95].

Besides that, in January 2023, the Indian government announced USD 2 billion for the “National green hydrogen mission” (Green Hydrogen/Green Ammonia Policy of 17 February 2022). In total, implementing the National Green Hydrogen Mission is expected to attract up to USD 100 billion in investments by 2030, primarily in private funds.

In recent studies by the Indian Institute of Petroleum Technology and other Indian profiled organizations’ experts, the green hydrogen value chain of India was analyzed [96,97,98]. Hydrogen plays an important role in India’s economy, with about 6 million tons of H2 consumed annually (which is about the same as in Russia), mainly for ammonia and methanol production and for use in refineries.

However, virtually all of the hydrogen consumed in India today is produced from fossil fuels. Its production releases approximately 9 tons of CO2 per ton of hydrogen. Thus, ensuring cost-effective domestic production of green hydrogen using renewable electricity is critical for India to achieve its previously announced targets for reducing carbon emissions (target of reaching Net Zero emissions by 2070).

The Green Hydrogen/Green Ammonia Policy specifically provides for the following:

- Measures are adopted to allow sales (distribution) companies to supply electricity to producers of green hydrogen and ammonia at reduced tariffs.

- Producers of green hydrogen and ammonia are exempted from paying tariffs for the transmission of electricity between states for 25 years if the project is commissioned before 30 June 2025.

- Green hydrogen/ammonia producers and renewable energy production facilities should be provided with a connection to the electricity grid in a prioritized (accelerated) manner.

Currently, India lacks its own capacity to produce and process hydrogen. An attempt to negotiate with Germany regarding the possibility of purchasing hydrogen in July 2023 was unsuccessful, since, according to the terms of the tender, the distance between the hydrogen production plant and the processing enterprises should not exceed 500 km. Even the most advanced existing technologies, including the German flagship Linde, do not yet allow hydrogen to be transported over long distances without significant losses—especially in liquefied form—and, accordingly, without discrepancies in the volume of supplies. However, Indian investors like Larsen & Toubro (L&T) take part in hydrogen projects abroad, like the mega green hydrogen plant in Saudi Arabia (https://www.offshore-energy.biz/neom-green-hydrogen-project-wraps-up-2022-with-important-milestone (accessed on 28 December 2022)).

To end this chapter, we should state that the key conclusions of experts from the Asia-Pacific countries and Europe on the measures, methods and rates of introduction of the economic and environmental efficiency of hydrogen energy were taken into account in recent analytical works and scientific suggestions dedicated to the effectiveness of resource management of the mineral resource complex of Russia and its interaction with hydrogen energy development demands [99,100,101].

4. Results

4.1. The Growing Number of HFCVs and Hydrogen Filling Stations Worldwide as a Visible Consumer Achievement in the Field of Hydrogen Energy

Despite a significant number of existing problems and not fully realized issues of the interaction of hydrogen and metals under conditions of ultralow temperatures (−253 °C), which are necessary for storing hydrogen in a liquefied state [102,103], in the mid-2010s, the companies H2 Mobility, Linde and some others created standard commercial projects of hydrogen filling stations, which began to be supplied to the markets of Asia-Pacific countries, Europe and the USA. The average cost of a typical hydrogen filling station is about 3 million euros [102,103].

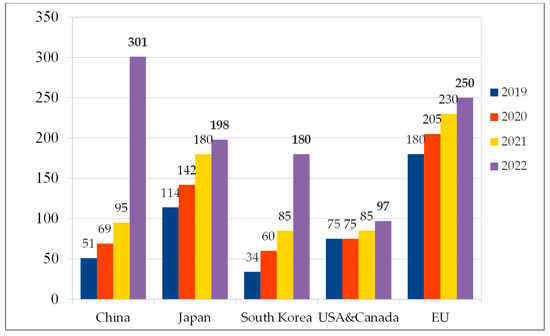

From Figure 3, we can conclude that the growth in the number of hydrogen filling stations for vehicles in recent years is significant, but the growth rates vary by country and region. The growth in the number of hydrogen refueling stations in 2021–2022 in China can be considered “Explosive”. The United States and Canada, in 2019–2022, observed mostly moderate growth. Hydrogen passenger cars are so far used only in certain regions of large countries: in particular, in the USA—mainly in the state of California—and in China—in Inner Mongolia (North-West) and in the coastal province of Guangdong. In Russia, it is planned to test the operation of vehicles and energy systems using hydrogen fuel cells on Sakhalin Island.

Figure 3.

The number of hydrogen filling stations in 2019–2022 in leading countries and the EU in units (compiled by the authors according to the H2 Station map portal [104], Internet sources https://www.greencarcongress.com/2023/01/20230115-h2.html (accessed on 5 October 2023); https://www.statista.com/statistics/1026719/number-of-hydrogen-fuel-stations-by-country (accessed on 5 October 2023)). Figure 3 was created by authors using the information from public domains.

The number of hydrogen cars worldwide at the beginning of 2023 almost reached 70 thousand units (Figure 4, Table 2), of which about 80% were passenger cars, 11% were buses, and 9% were trucks.

Figure 4.

Number of vehicles with hydrogen fuel cells (HFCVs) by type (thousand units) according to IEA [6,105]. Figure 4 was created by authors using the information from IEA.

Table 2.

Number of vehicles with hydrogen fuel cells in leading countries and regions in 2017–2022, thousand units.

The cost of a passenger car with an engine is about twice that of a car with an internal combustion engine and about 1.5 times that of a battery electric vehicle (BEV), so they are in demand among a relatively small part of the eco-friendly and affluent segment of consumers, often described as “innovators” [63,64,83]. Substantial government subsidies and incentives nowadays support the purchase of both private cars and public transport (buses, trucks) with HFC engines in all countries where they are in use.

Hydrogen use in road transport increased by around 45% in 2022, albeit from a low baseline, driven mainly by increased use in heavy-duty vehicles. Notoriously, fewer than 20% of the total number of Chinese heavy-duty HFC trucks consume more than half of the hydrogen used in road transport [6].

The United States was the leader in the number of hydrogen-fuel-cell vehicles in use until 2019, followed by South Korea. Then, they changed places. The annual global increase in the number of cars in 2018–2022 ranged from 10 to 18 thousand units per year and was provided mainly by two mass manufacturers—Hyundai (cars, trucks and buses) and Toyota (passenger segment and buses). In 2022, Chinese Wuhan (Grove Hydrogen) and Great Wall (Lemon) were added to the number of mass car producers. Chinese Foton sold more than 400 HFC buses over 2021–2022, and Skywell sold about the same number of heavy trucks [91].

4.2. Development of Hydrogen Energy in Russia

The unique experience in the development of hydrogen engines, as well as hydrogen storage and transportation technologies in the USSR and Russia, has been available since the 1960s, from the beginning of work on the creation of the H1 rocket and space system. This experience in the design of hydrogen systems was successfully applied at the Energia-Buran program in the 1980s. Currently, the development of oxygen–hydrogen engines and upper stages, carried out by the Design Bureau of Himavtomatika JSC (KBKhA), is used in the Russian and Indian space programs.

The leading domestic manufacturer of hydrogen storage systems is Cryogenmash PJSC. The company has developed tanks for storing hydrogen in a liquid state (at a temperature of −253 °C) with daily losses of 0.033–0.130%, which are successfully used, in particular, by the Rosatom company [106]. From 2000 to 2021, Cryogenmash exported 15 unique liquid hydrogen storage and transportation systems to Europe and Asia. At the same time, PJSC Cryogenmash produced, for Linde Engineering, small storage systems used for refueling hydrogen vehicles (more than 200 hydrogen refueling stations were delivered to the markets of Europe and the Asia-Pacific region).

In response to the strategies adopted by the EU and Asia-Pacific countries for the decarbonization of energy, industry and transport and their announced plans to expand the use of hydrogen, the largest Russian suppliers of energy resources in 2019–2022 began to actively develop projects for the export of hydrogen in liquid and compressed states (Rosatom [107]), as part of a mixture (Gazprom) and in the bound state in the form of ammonia (Novatek). Options were considered for natural gas supplies to Germany for the subsequent production of hydrogen at the point of consumption with CO2 capture, as well as supplies in bound (ammonia, gas mixtures) and liquid states. Options for ensuring carbon-neutral hydrogen synthesis and the corresponding issues of locating facilities for the production and storage of this fuel were the subject of discussions between potential consumers and manufacturers in the country [108].

In October 2020, the action plan “Development of Hydrogen Energy in the Russian Federation until 2024” (hereinafter referred to as the “Plan”), focused on the export of hydrogen, was approved. As a follow-up to the Plan, at the beginning of 2021, the Concept for the Development of Hydrogen Energy in the Russian Federation (hereinafter referred to as the “Concept”) was approved, which detailed goals, objectives and measures for the development of hydrogen energy for the periods up to 2024 (medium term) and up to 2035 (long term), and also contained a forecast of the hydrogen energy industry by 2050. According to the authors of the Concept, relatively low costs for the production of low-carbon hydrogen in Russia would make it possible to master its large-scale production in Russia and export it as a secondary resource. The prerequisites for export were comparative proximity to the main potential consumers (EU countries and Asia-Pacific countries such as Japan and South Korea); the availability of resources necessary for hydrogen production (natural gas, free electrical capacities); and experience in the implementation of scientific and technical know-how in the hydrogen energy area.

The total volume of the hydrogen supply for export was assumed to be as much as 2 million tons by 2035 and, according to different scenarios, from 7.9 to 33.4 million tons by 2050. The Concept declared the creation of three hydrogen clusters: Northwestern (export to the EU and a reduction in the carbon footprint based on improved gas pyrolysis technologies); Vostochny (export to Asian countries and the development of hydrogen infrastructure in transport and energy); and Arctic (the creation of low-carbon energy supply systems for the Arctic territories [109,110,111] and the export of hydrogen based on nuclear, tidal and other renewable energy technologies). The possibility of creating a Southern Cluster focused on the use of renewable energy sources such as solar and wind in the production of hydrogen was also admitted.

After the introduction of anti-Russian sanctions and the enforcement of political regulations in Western countries, which will be obstacles to mutually effective (“win-win”) cooperation with Russian companies in the coming years, the focus of the development of hydrogen technologies in the country in 2022–2023 was shifted to internal developments and possible interrelation with Asian countries in the hydrogen sphere.

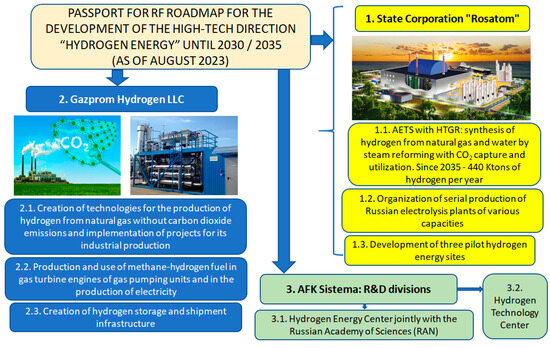

From December 2022 to January 2023, a new strategic document, the Roadmap for the Development of Hydrogen Technologies until 2030/2035 (also called Roadmap for the development of the high-tech direction “Hydrogen energy” until 2030/2035; Roadmap), including 20 main activities, was prepared by an interdepartmental working group (IWG), drawn up on the basis of agreements with PJSC Gazprom and State Corporation Rosatom. The Roadmap was then adopted to replace the Concept and is focused on organizing a network of hydrogen filling stations (PJSC Gazprom) and organizing test sites for the development of promising hydrogen technologies based on electrolysis (SC Rosatom) by 2030. In August 2023, the AFK Systema was added to the pool of Roadmap agreements with its two research and development departments (R&D). (Figure 5). Subsidiaries of Rosatom (Polikom) and of AFK Systema (Sitronics group) presented some results of their work in the fall 2023.

Figure 5.

The scheme of the basic contributors to the Roadmap of the Russian Federation for the development of the high-tech direction of “Hydrogen energy” until 2030/2035 (as of August 2023).

The amount of funding for 2023–2024 is set at RUB 9.3 billion, and for the period 2023–2030, it is set at RUB 18.5 billion (which is much less than was initially suggested in February 2022). The target number of hydrogen filling stations of at least 1000 (one thousand) units by 2030 was approved in earlier documents—the Concept for the Development of Electric Vehicles in Russia (August 2021, Direction No. 7) and the Transport Strategy of Russia until 2035 (November 2021). These documents claim to allocate RUB 180.3 billion (USD 1.8 bln) from the state budget for the development of electric and hydrogen transport until 2030, and the greater part is devoted to electric transport. The automobile section of the Transport Strategy also sets the establishment of restrictions on the use of passenger vehicles with obsolete “non-environmental” engines by 2030.

Buses and freight vehicles were identified in all mentioned documents as priority areas for investments in hydrogen transport during the decade until 2030 (whereas passenger vehicles are unlikely to receive a significant impetus until there is a radical decrease in the cost of hydrogen-fuel-cell engines). In order to start to implement the Roadmap goals in 2025, Russian manufacturers will need to master a set of technologies to build hydrogen filling stations, including hydrogen compression. Otherwise, at least part of the necessary equipment will have to be ordered from abroad, particularly from China [112,113].

Prototypes of road and rail hydrogen transport are being developed by domestic manufacturers. The creation of vehicles using HFC is carried out by the automobile plants KamAZ, GAZ, BelAZ (Belorussia), the alliance of FSUE “NAMI” and Sollers Yelabuga (Cortege/Aurus). JSC Russian Railways (RZD) is developing projects for electric passenger trains, shunting locomotives, and repair and tunnel trains with hydrogen fuel cells. SC Rosatom and OJSC Transmashholding have developed a project for the organization of railway communication using rail buses (mini-trains) with HFC RA-3 Orlan on Sakhalin Island. An experimental fuel-cell tram was created at the Central Research Institute of Marine Electrical Engineering in St. Petersburg (a test run took place in 2019). The Central Institute of Aviation Motors (CIAM), together with the Institute of Problems of Chemical Physics of the Russian Academy of Sciences and InEnergy, have developed a small-sized manned aircraft with fuel cells. In September 2023, Sitronics group successfully tested a vessel (a catamaran for 20 passengers) with an electrochemical generator that generates energy from hydrogen, developed by the Hydrogen Technology Center of AFK Sistema. There exist some other Russian projects that are using hydrogen energy at various stages of implementation and development [114,115,116].

According to the Roadmap, budget investments and support measures until 2030 are mainly planned to be directed to the creation of prototypes and the testing of passenger and freight hydrogen transport, while large Russian companies are investing in research on a number of fundamental technological processes based on hydrogen technologies. It should be noted that the implementation of any large-scale projects will require system modeling of the economic and environmental aspects of the full cycle of production (synthesis) of hydrogen from primary resources, along with its subsequent storage and delivery to the end user. In the case of implementing joint projects with foreign partners (China, India, South Korea, Japan and other countries), it is necessary to take into account the long-term interests of Russian suppliers of primary resources, hydrogen, as well as equipment manufacturers and technology developers in the processes of international cooperation.

Finalizing this chapter on the current achievements of Russian science and production in the field of hydrogen energy, we should add that its general trend coincides with the relevant experience, prospective goals and developed systems of standards and regulations in the hydrogen energy fields of the leading countries.

4.3. Estimation of Investments in the Development of Hydrogen Energy and Hydrogen Transport

The scale of investments in technologies related to renewable energy sources and “energy transition” increased every year during the period 2010–2020 [2], despite the fact that the fundamental environmental and economic efficiency of such investments was often questioned by authors from different countries [5,57,117]. At the same time, the high current price of energy transition technologies and their relatively low economic efficiency are often interpreted as investments in leadership positions in the future carbon-free world energy [118,119].

To neutralize the economic consequences of antiviral restrictions during the pandemic from 2020 to early 2022, long-term programs to support national producers were adopted in countries with the largest gross domestic product (GDP) around the world. A feature of the programs adopted in such countries as Germany, South Korea, Japan and China is that they include large-scale investments in the fields of hydrogen energy and transport worth tens of billions of dollars/euros. Never before has such an amount of funds been allocated for the development of hydrogen technologies. In particular, investments in technologies related to hydrogen transport accounted for 4.9–7.5% of all investments in “energy transition” technologies in 2013–2020 [120,121], while the main share of funds allocated during this period for the purpose of de-carbonization accounted for the development of electric transport.

National hydrogen strategies, concepts, roadmaps and some other strategic documents contain the constantly changing figures of planning investments in the development of hydrogen energy, an overview of which the authors have tried to compile as of August 2023 (Table 3, Figure 6).

Table 3.

Estimation of investments in the development of hydrogen energy in billion euros: actual and forecast data.

Figure 6.

The share of main countries’ investors in the development of hydrogen energy.

According to the data systematized by the authors, South Korea, Germany, the USA and Japan should be considered leaders in investments in hydrogen energy and hydrogen transport as of the end of 2022. According to public statements by the country’s leaders, the largest volume of investments in the field of hydrogen energy is planned to be made in 2024–2030 in India, where they are going to sharply intensify the transition from the use of coal in favor of hydrogen.

It should be noted that an estimation method for volumes of investments in hydrogen energy and transport is under consideration right now. Today, we can declare the existence of direct and indirect connections between investments in the field of hydrogen energy from the state and private companies. Some of such investments are hard to split. For example, if one builds a hydrogen refilling station, should the cost of common building works (foundation, walls, roof and so on) be counted as an appropriate figure, or should only the cost of hydrogen compressing equipment be counted? If we consider the participation of different parties in a “hydrogen” project, should the bank interest or possible PPP organization payments be counted as “hydrogen investments” or a bank/investor profit and state services cost, respectively?

Some businesses include certain “traditional” uses of hydrogen and some innovations. For example, The Russian Hydrogen company at SPIEF 2023 signed an agreement on cooperation with the government of the Irkutsk Region and En+ regarding the implementation of a project of the Federal Center of Chemistry.

The key projects of the company in Usolye-Sibirsky will be the organization of membrane electrolysis for the production of caustic soda and chlorine, while they are also planning to “launch the production of epichlorohydrin, epoxy resin, phosphorus and its derivatives and other types of products demanded by consumers” (https://www.interfax.ru/business/906531 (accessed on 15 June 2023): “Russian Hydrogen” will invest RUB 830 billion in the creation of the federal center of chemistry). The investment volume is declared to be RUB 830 billion in 2023–2033, which is equivalent to 8 billion euros at the current exchange rate. That would be really hard to split into prospective hydrogen energy investment and “current” production investment in a well-known technology.

This is why, in this paper, we preferred to use official state documents (countries’ hydrogen strategies, anti-crisis strategies) or conceptual documents like roadmaps issued by national production associations or state facilities to try to estimate the volume of investments in the development of hydrogen energy in different countries and regions. We should admit that this is a very rough estimation, taking into account the vulnerability of declared figures during implementation in a 10-year period or so and the inevitable inaccuracies associated with the unproposed ownership of certain investments, which was described above.

The estimated volume of investments in the development of hydrogen energy and transport in Russia until 2030 in Table 2 accounted for the forecast figures given by the IWG when discussing the draft comprehensive program for the development of the low-carbon hydrogen energy industry and the Technological Strategy for the Development of the Hydrogen Industry of the Russian Federation until 2035 in the Ministry of Energy of the Russian Federation 17–18 February 2022 [116] (p. 29). Adopting the curtailment of projects focused on hydrogen exports in current conditions, it is assumed that the value of investments in 2024–2030 will decrease by at least 2.5–3 times compared to the declared value (thus, in Table 2, instead of the investment volume of RUB 3 trillion by 2030 proposed by the IWG for Russia, it is reduced to RUB 1 trillion and calculated at an exchange rate of 100 RUB/EUR).

Also, there arises an accounting problem of which country to assign investments to in the case of joint projects if contributors do not disclose the information.

Keeping in mind the uncertainties caused by the above-mentioned issues, one could conclude that, according to the data recently obtained, the largest investments in the development of hydrogen energy and transport until 2030 are planned to be made by India, South Korea, China and the leading EU countries—Germany and France. It should be noted that in the early 2010s, the USA held a leading investment position in hydrogen technologies, but for the period 2020–2030, it fell behind other countries. However, McKinsey supports some controversial information on the USA’s planned leading investing role until the 2030s, probably taking into account currently delayed plans from before 2021 (Hydrogen Insights May 2023 Hydrogen Council, McKinsey & Company. P. 6. https://hydrogencouncil.com/wp-content/uploads/2023/05/hydrogen-insights-2023.pdf (accessed on 5 October 2023)). Comparatively active investment in hydrogen projects is expected to be maintained in Japan from 2024 to 2030. In China, the most significant investments in hydrogen technologies are planned to be made in the period after 2030; however, the investment volume will likely surpass that made by the United States in the coming years, which is supported by current reports.

Private and currently unplanned investments in hydrogen technologies in countries with available funds in the stock market can also play a significant role in the future. Today, in the HFCV sector, unlike the battery electric vehicle (BEV) sector, there are no large specialized manufacturing companies or independent brands. Numerous “independent manufacturers” collect only prototypes and piece copies of hydrogen cars. The most mass production of hydrogen-fuel-cell vehicles was carried out in 2013–2023 by Hyundai and Toyota. However, through that period, both manufacturers annually faced a 50–70% lag behind their own previous production plans. Looking at the multiple increases in the stock value from 2018 to 2022 of such BEV manufacturers as Tesla, Rivian, Nikkola, Lucid, NIO and others, one could assume that with an expected significant reduction in the cost of the HFC engine system and feedstock by 2030, successful HFCV manufacturers also have a chance to receive significant stock market financial support. In turn, the volume of investments in hydrogen technologies in countries associated with these producers can increase significantly, and HFCV producers will be able to compensate for the actual gap with BEV.

5. Major Technological Solutions for Hydrogen Energy in Russia until 2030

According to the available forecast data, in February 2022, Russia, along with such countries as India, South Korea, France, Germany, Japan, China and the United States, was ready to invest significant funds in the development of hydrogen technologies until 2030. Today, the most obvious of the investment directions is the creation of a network of hydrogen filling stations by 2030 that will be able to meet the needs of road and rail transport (the development plan for the latter is on Sakhalin Island). So, the creation of the infrastructure of hydrogen filling stations in Russia is a visible and comparatively highly forecasted element in the development of hydrogen energy technologies in the coming years.

Two general options (alternative ways to create a hydrogen filling station network) are considered as follows:

- Hydrogen production in a plant at the “regional level”, with subsequent delivery of fuel to filling stations in a liquefied or compressed state;

- Hydrogen synthesis at the places of consumption in volumes close to the needs of serviced transport—trucks, buses, cars and railroad trains [122,123].

A number of scientists have proposed a promising technology for creating mini-plants for the production of hydrogen in volumes of up to 5000 m3 per hour (which is equivalent to about 420.5 kg at normal pressure and provides for the full refueling of about 60–70 vehicles such as Toyota Mirai or Hyundai Nexo or 10 heavy-weight trucks) based on methane reforming with complete CO2 capture [26,59,124]. Taking into account the operational and technical characteristics of this development, which has passed full-scale tests, it is possible to use it to produce hydrogen directly at vehicle-refueling sites that have access to the required volume of the methane mixture, particularly when connected to the main gas pipeline. At present, existing specialized gas filling stations with pipeline connections can be convenient facilities for installing mini-plants for the production of hydrogen.

Thus, the addition of the established infrastructure of specialized gas filling stations with these mini-factories is one of the ways to create a network of hydrogen filling stations in the country. If implemented, the costs of storing and transporting hydrogen fuel to filling stations will be minimized [125,126]. At the same time, technological solutions will be required for the utilization of CO2 captured by mini-factories, which can be produced and further transported in a liquid state [26,124].

Another way to create a hydrogen refueling infrastructure for motor vehicles is the method of delivering hydrogen fuel by specialized tankers to gas stations from the places of its production and storage, which is currently widespread in the countries of the Asia-Pacific region, Europe and the United States. Taking into account the economies of scale, the production of hydrogen using electrolysis and a number of other methods is economically feasible on medium (10–50 thousand tons per year) and large scales (more than 50 thousand tons per year) [127,128].

It should be noted that projects for the large-scale production of hydrogen fuel for its subsequent export to the emerging markets in Europe and the Asia-Pacific region were actively developed by a number of large Russian energy companies, particularly Rosatom, Gazprom and RusHydro, in 2020–2022. In these projects, technologies for the storage and transportation of liquid hydrogen, already mastered by Russian enterprises, as well as a number of promising technologies for its synthesis, were called upon to find applications. In the case of the implementation of these projects in a “truncated form”, the products may initially be sent to the domestic market, and the technologies and equipment for the production, storage and transportation of hydrogen fuel to filling stations can be subsequently exported.

The largest hydrogen synthesis project in the country is being developed based on the process of adiabatic methane conversion, together with a high-temperature gas-cooled reactor based on a nuclear power plant (AETS). The creation of AETS with a total thermal capacity of 2400 MW will make it possible to produce from 440 to 800 thousand tons of hydrogen per year without emitting CO2 into the atmosphere [127,129].

Since January 2023, an electrolysis plant manufactured by the Russian company Policom has been operating at the Kola NPP of the State Corporation “Rosatom”—A prototype with a capacity of 50 Nm3/h (50 normal cubic meters per hour) of hydrogen with a service life of 10 years set by the customer (Rosatom has developed electrolyzers for the production of hydrogen (URL: https://strana-rosatom.ru/2022/02/17/rosatom-razrabotal-elektroliznyh/?ysclid=lhow3prfgd351572324 (accessed on 15 June 2023) (in Russian)). On this basis, in 2025, it is planned to create a large-scale bench and test complex for the production of hydrogen and then promote technologies and sell Rusatom Overseas–Polikom electrolysis plants abroad. Initially, the Rosatom project at the Kola NPP was designed to export products to European consumers, but in the near future, countries in Asia, Africa or South America could become the most likely consumers of such technologies. At the same time, in the future, the delivery of hydrogen in a liquefied or compressed state to the Scandinavian countries closest to the Kola NPP striving for “carbon neutrality” would be the most expedient from an economic point of view.

A highly promising project was presented on Sakhalin Island by JSC Rusatom Overseas in initial cooperation with the French manufacturer of industrial gases Air Liquide. The capacity of the complex for the production of low-carbon hydrogen by the steam reforming of methane with CO2 capture was planned to be from 30 to 100 thousand tons per year, most of which was planned to be exported to Japan and South Korea. In February 2022, a feasibility study was completed for the said turquoise hydrogen production project with greenhouse gas capture. After Air Liquide left the project in September 2022, a memorandum of understanding was signed with China Energy Engineering Group Co., Ltd. (CEEC), Beijing, China.

In 2021, scientists from St. Petersburg Mining University completed a feasibility study for a medium-sized project for the production of hydrogen at the Ust-Srednekanskaya HPP in the Magadan Region by electrolysis in volumes of up to 18 thousand tons of hydrogen per year [59]. The project provides that the produced “green” hydrogen using special containers is first delivered by road to the port and then by sea to the ports of Japan. The payback of the project investment, according to calculations, is about 20 years, which indicates its relatively low profitability. This negative result is also significant, as it demonstrates the following. Even the use of cheap electricity resources (provided by a surplus hydropower plant), the costs of transporting liquid hydrogen over long distances in the absence of a sufficient production scale make a project barely profitable at the current scientific and technological level.

It should be noted that the hydrogen production projects listed above In Russia, despite their radically different capacities (up to 800, 100 and 18 thousand tons per year, respectively), were primarily focused on exports to consumers in Europe or the Asia-Pacific region. When focusing on the domestic market, it is necessary to take into account both the technological and economic limitations of available technologies, their scales, the specific needs for hydrogen energy and transport in different regions of the country and their features. Focused support is expected for promising industries’ “points of growth” in the field of hydrogen technologies, where there already exists significant groundwork. The focus of research and development of technologies and equipment in key areas is aimed at leadership in a number of promising markets and the ability to build mechanisms for adapting and exchanging know-how with foreign players [130].

The cost of hydrogen depends on the method used for its production and the scale of production. Water electrolysis remains the most expensive method, in which, taking into account economies of scale, the minimum cost currently reaches USD 7.5 per kg, and the average cost is USD 10–12 per kg [131,132,133]. Obtaining “green”, “yellow” and “turquoise” hydrogen involves the creation of large- and medium-scale production facilities with the subsequent liquefaction or compression (compression), storage and transportation of products to the place of sale or consumption.

One way to minimize storage and transportation costs is to use synthesis cycles at points of consumption, such as refilling stations. According to some publications [58,59,132], the creation of mini-plants for the synthesis of hydrogen from natural gas (methane) has been sufficiently developed. According to the information provided on the specific cost per 1 kg of liquid hydrogen for various components of the cycles of its synthesis, storage and transportation, mini-plants make it possible to achieve a relatively low cost of the final product, including a CO2 utilization process in the technological cycle (Figure 7).

Figure 7.

Estimated cost of the known hydrogen supply cycle components for transport needs in Russia for plants of different sizes [26,31,58,59,100,107,122,133].

In order to provide a certain region with a network of mini-plants for the synthesis of hydrogen at filling stations, in the future, it will be most expedient to use the infrastructure of existing gas filling stations. At the beginning of 2023, there were more than 900 gas filling stations in Russia in use connected to main gas pipelines, and by 2030, their number should reach 2696 units (https://1prime.ru/transport/20230420/840426895.html?ysclid=limxazcjlx730271222 (accessed on 20 April 2023) (in Russian)).

A hydrogen filling station with a mini methane fuel synthesis plant implementing this project was opened for the first time in the world in January 2023 by Sinopec in China. The company’s press release notes that the installation with a capacity of 1000 kg of “clean fuel” per day (allows for filling up to 200 passenger cars) will become a standard solution in China for the further development of a hydrogen refueling network. Note that the “turquoise” cycle of hydrogen synthesis from methane has logical limitations in terms of the final efficiency, which is estimated to be from 10% to 30% [3,70,134], and issues related to greenhouse gas emissions. The utilization of CO2 produced by different types of methane conversion requires additional costs, estimated at USD 0.9–1.6 per 1 kg of produced hydrogen [58,59,135].

While developing technological solutions that allow the use of side CO2, the cost of hydrogen synthesis from methane using mini-plants can be reduced. When methane is used as a primary feedstock for hydrogen production, methane pyrolysis is considered the most promising from the point of view of minimizing greenhouse gas emissions. This method is most efficient for capturing and then using CO2. The reaction of methane and hydrogen gives solid carbon, which, in turn, can be used in the production of nanostructured materials—fullerenes and carbon nanotubes [1,136,137]. Depending on the type of catalysts used, the “input” cost of natural gas, the possibility of selling solid carbon and the by-product carbon black (C), a fairly wide range of final costs of the product is observed–from USD 2.5 to 7 per kg (Figure 8).

Figure 8.

Scheme of the main elements of hydrogen production by methane pyrolysis, taking into account their estimated costs [26,58,59,100,116,122,135].

The wide range of costs of hydrogen production by methane pyrolysis is explained, as indicated above, by a large number of influencing factors and the lack of experimental facilities of sufficient scale. The most significant limitation of all methods for the synthesis of hydrogen from methane is actually the mere size of its complex efficiency (operational productivity) or integrated efficiency factor (IEF/COP)—from 10% to 30%.

Keeping this in mind, we can assume the creation of certain zones (regions) where CO2 emissions can be minimized due to hydrogen fuel—primarily around big cities and resorts. At the same time, we should recognize that the level of use of the energy value of natural raw materials extracted for the production of hydrogen will be far from optimal.

The implementation of the goal of 1000 hydrogen filling stations created by 2030 seems to be possible due to the technologies available to Russian manufacturers and the developments currently being carried out:

- Technological solutions for the storage and transportation of hydrogen fuel;

- Samples of trucks and buses powered by hydrogen fuel cells submitted by Kamaz PJSC, GAZ Group and other minor car manufacturers;

- Implemented pilot projects using methane conversion and pyrolysis methods with the possibility of capturing CO2 for plants for the synthesis of “turquoise” hydrogen (from natural gas) at small and medium scales.

At the beginning of 2023, Russian companies had not fully mastered the production of high-pressure hydrogen compression systems (standards 35 MPa; 70 MPa). Quantum, Linde and H2 Mobility are leaders in the market for these products, although in 2021–2022, analogs from Chinese manufacturers did appear. The first Russian filling station 35 MPa by Polikom company was presented in September 2023. Hydrogen cylinders for 35 and 70 MPa were certified in the mid-2010s in accordance with ISO 11439 [138].

Challenges for possible quality changes in natural resource and gas grid use in the prospective hydrogen technology roll-out in Russia until 2030 include (Figure 9):

Figure 9.

Primary tasks for quality changes in natural resource and gas grid use in prospective hydrogen technology roll-out in Russia until 2030.

- The launch of the serial production of models of passenger and freight vehicles, including railroad ones, using compressed hydrogen as fuel (it is advisable to use the current standards of 35 and 70 MPa). Notably, according to the conclusions of the IWG, in the car and truck sectors, as well as railway transport, hydrogen transport will not reach economic parity with current technologies until 2030 [116].

- The adaptation of technological solutions for equipment for the storage and transportation of hydrogen from large- and medium-scale production sites.

- The creation of a network of “turquoise” hydrogen mini-factories based on the existing gas filling infrastructure and medium-scale plants based on methane conversion and pyrolysis methods, including those that capture or neutralize CO2 emissions.

- The creation of domestic analogs or the purchase of Chinese equipment for filling stations.

The most resource-intensive of these tasks is the task of creating hydrogen fusion plants of various sizes. With the expansion of the use of hydrogen in transport and energy, natural fossil resources can become primary resources for the production of hydrogen in certain regions, which can be recognized as a priority in terms of minimizing CO2 emissions or emissions of harmful substances.