Does Environmental Regulation Promote Corporate Green Innovation? Empirical Evidence from Chinese Carbon Capture Companies

Abstract

1. Introduction

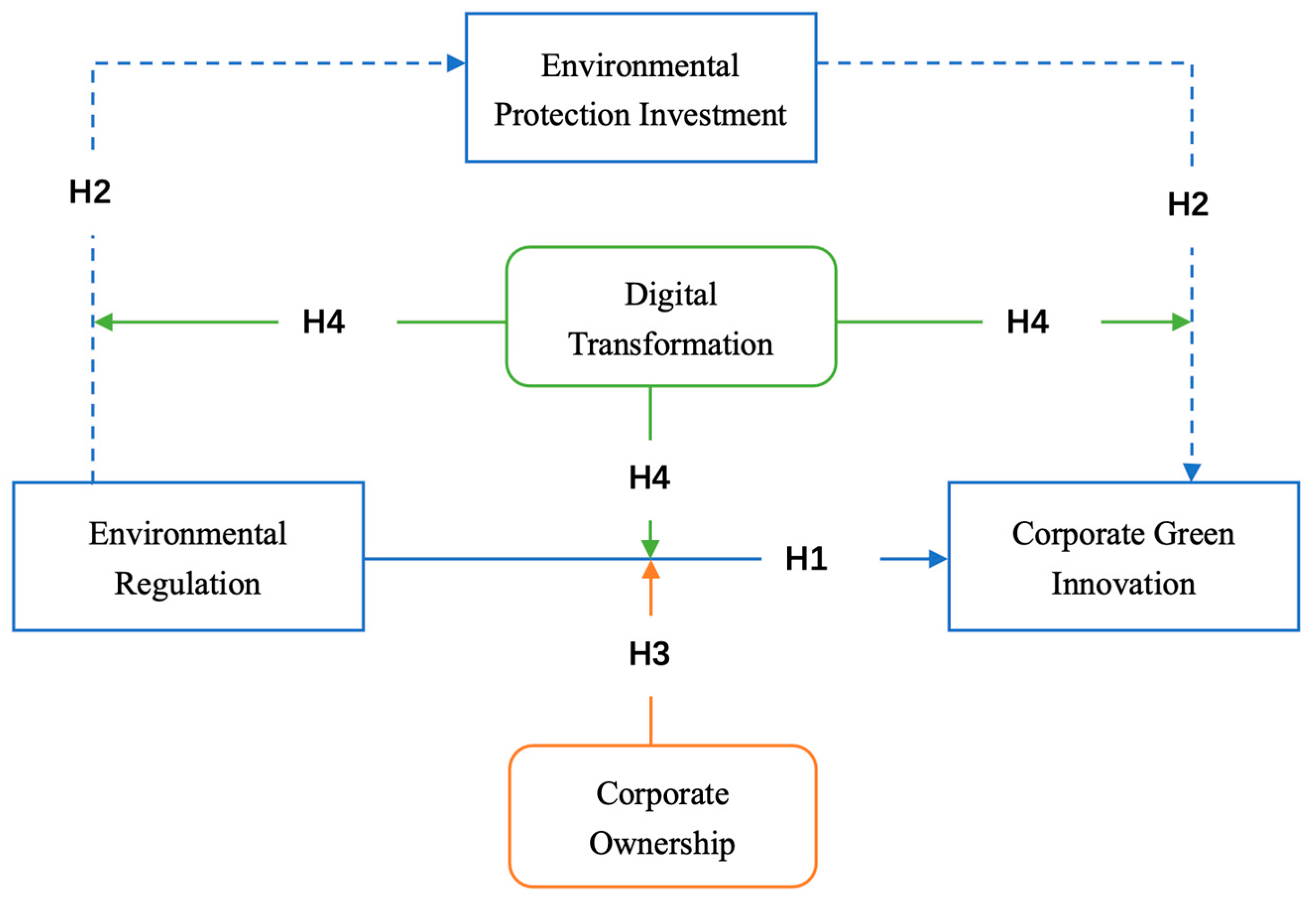

2. Hypothesis Development

2.1. Environmental Regulation and Corporate Green Innovation

2.2. The Intermediary Role of Corporate Environmental Investment

2.3. Differences in the Role of the Nature of Property Rights of Different Enterprises

2.4. Moderating Role of the Degree of Digital Transformation of Enterprises

3. Research Methodology

3.1. Sample Selection and Data Sources

3.2. Variable Definition

- (1)

- Dependent variable: corporate green innovation (GRE)

- (2)

- Independent variable: intensity of government environmental regulation (ER)

- (3)

- Mediating variable: corporate environmental protection input (INPUT)

- (4)

- Moderating variable: the degree of digital transformation of enterprises (INTE)

- (5)

- Control variables.

3.3. Model Design

4. Results

4.1. Descriptive Statistics

4.2. Correlation Analysis

4.3. Multicollinearity Test

4.4. Mediation Effect Test

4.5. Test for Heterogeneity of Firm Ownership

4.6. Moderating Effect Test

4.7. Robustness Test

5. Discussion

6. Conclusions

6.1. Research Finding

6.2. Policy Implications

6.3. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Longa, F.D.; Fragkos, P.; Nogueira, L.P.; van der Zwaan, B. System-level effects of increased energy efficiency in global low-carbon scenarios: A model comparison. Comput. Ind. Eng. 2022, 167, 108029. [Google Scholar] [CrossRef]

- Wang, P.; Zhao, S.; Dai, T.; Peng, K.; Zhang, Q.; Li, J.; Chen, W. Regional disparities in steel production and restrictions to progress on global decarbonization: A cross-national analysis. Renew. Sustain. Energy Rev. 2022, 161, 112367. [Google Scholar] [CrossRef]

- Sun, L.; Cui, H.; Ge, Q. Will China achieve its 2060 carbon neutral commitment from the provincal perspective. Adv. Clim. Change Res. 2022, 13, 169–178. [Google Scholar] [CrossRef]

- Zhang, L.; Liu, X.; Chen, W. Characteristic analysis of conwentional pole and consequence pole IPMSM for electric vehicle application. Energy Rep. 2022, 8, 259–269. [Google Scholar] [CrossRef]

- Zuo, Z.; Guo, H.; Cheng, J. An LSTM-STRIPAT model analysis of China’s 2030 CO2 emissiona peak. Carbon Manag. 2020, 11, 577–592. [Google Scholar] [CrossRef]

- Wei, Y.; Chen, K.; Wang, X. Policy and Management of Caibon Peaking and Carbon Neutrality: A Literature Review. Engineering 2022, 14, 52–63. [Google Scholar] [CrossRef]

- Wu, G.; Niu, D. A study of carbon peaking and carbon neutral pathways in Chinas power sector under a 1.5 °C temperature contral target. Environ. Sci. Pollut. Res. 2022, 29, 85062–85080. [Google Scholar] [CrossRef]

- Caminade, C.; Kovat, S.; Lloyd, S.J. Impact of climate change on global malaria distribution. Proc. Natl. Acad. Sci. USA 2017, 111, 3286–3291. [Google Scholar] [CrossRef]

- Ismailos, C.; Touchie, M.F. Achieving a low carbon housing sticks: An analysis of low-rise residential carbon reduction measures for new construction in Ontario. Build. Environ. 2017, 126, 176–183. [Google Scholar] [CrossRef]

- Oikonomou, V.; Becchis, F.; Russolillo, D. Energy saving and energy efficiency concepts for policy making. Energy Policy 2009, 37, 4787–4796. [Google Scholar] [CrossRef]

- Thunman, H.; Vilches, T.B.; Nguyen, H.N.T. Circular use of plastics-transformation of existing petrochemical clusters into thermochemical recycling plants with 100% plastics recovery. Sustain. Mater. Technol. 2009, 22, e00124. [Google Scholar] [CrossRef]

- Ilbahar, E.; Colak, M. A combined methodology based on z-fuzzy numbers for sustainabilitity assessmentof hydrogen energy storage systems. Int. J. Hydrogen Energy 2022, 47, 15528–15546. [Google Scholar] [CrossRef]

- Zhang, T.; Zhang, W. CO2 ingection deformation monitoring based on UAV and in SAR technology: A case study of Shizhuang, Shanxi proviance, China. Remote Sens. 2022, 14, 237. [Google Scholar] [CrossRef]

- Shao, J.; Xiao, L. Observation of Field-Emission dependence on stored energy. Phys. Rev. Lett. 2015, 115, 264802. [Google Scholar] [CrossRef] [PubMed]

- Shukla, P.R.; Dhar, S. Renewable energy and low carbon economy transition in India. J. Renew. Sustain. Energy 2010, 2, 031005. [Google Scholar] [CrossRef]

- Engel, D.; Jones, E. Development of a risk-based comparison methodology of carbon capture technologies. Greenh. Gases Sci. Technol. 2014, 4, 316–330. [Google Scholar] [CrossRef]

- Zeng, X.; Shao, R. Industrial demonstration plant for the gasification of herb residue bed two-stage process. Bioresour. Technol. 2016, 206, 93–98. [Google Scholar] [CrossRef]

- Alanne, K.; Saari, A. Estimating the environmental burdens of residential energy supply systems through material input and emission factors. Build Environ. 2008, 43, 1734–1748. [Google Scholar] [CrossRef]

- Budizianowski, W.M. Valud-added carbon management technologies for low CO2 intensive carbon-based energy vectors. Energy 2012, 41, 280–297. [Google Scholar] [CrossRef]

- Lou, R.; Zhou, N.; Li, Z. Spatial-Temporal Evolution and Sustainable Type Division of Fishery Science and Technology Innovation Efficiency in China. Sustainability 2022, 14, 7277. [Google Scholar] [CrossRef]

- Xiao, W.; Kong, H. The impact of innovation-driven strategy on high-quality economic development: Evidence from China. Sustainabality 2022, 14, 4212. [Google Scholar] [CrossRef]

- Li, G.; Wang, X. How green technological innovation ability influences enterprise competitiveness. Technol. Soc. 2019, 59, 101136. [Google Scholar] [CrossRef]

- Ye, F.; Quan, Y.; He, Y.; Lin, X. The impact of government preferences and environmental regulations on green development of China’s marine economy. Environ. Impact Assess. Rev. 2021, 87, 106522. [Google Scholar] [CrossRef]

- Li, J.; Tharakan, P.; Liang, X. Technological, economic and financial prospects of carbon dioxide capture in the cement industry. Energy Policy 2013, 61, 1377–1387. [Google Scholar] [CrossRef]

- Leonzio, G.; Fennell, P.S.; Shah, N. Analysis of technologies for carbon dioxide capture from the air. Appl. Sci. 2022, 12, 8321. [Google Scholar] [CrossRef]

- Guo, M.; Wang, H.; Kuai, Y. Environmental regulation and green innovation: Evidence from heavily polluting firms in China. Finance Res. Lett. 2022, 103624, in press. [Google Scholar] [CrossRef]

- Ouyang, Y.; Ye, F.; Tan, K. The effect of strategic synergy between local and neighborhood environmental regulations on green innovation efficiency: The perspective of industrial transfer. J. Clean. Prod. 2022, 380, 134933. [Google Scholar] [CrossRef]

- Yu, H.; Wang, J.; Hou, J.; Yu, B.; Pan, Y. The effect of economic growth pressure on green technology innovation: Do environmental regulation, government support, and financial development matter? J. Environ. Manag. 2023, 330, 117172. [Google Scholar] [CrossRef]

- Li, X.; Du, K.; Ouyang X; Liu, L. Does more stringent environmental regulation induce firms’ innovation? Evidence from the 11th Five-year plan in China. Energy Econ. 2022, 112, 106110. [Google Scholar] [CrossRef]

- Liu, M.; Li, Y. Environmental regulation and green innovation: Evidence from China’s carbon emissions trading policy. Finance Res. Lett. 2022, 48, 103051. [Google Scholar] [CrossRef]

- Song, W.; Han, X. Heterogeneous two-sided effects of different types of environmental regulations on carbon productivity in China. Sci. Total Environ. 2022, 841, 156769. [Google Scholar] [CrossRef] [PubMed]

- Sun, J.; Zhai, N.; Miao, J.; Mu, H.; Li, W. How do heterogeneous environmental regulations affect the sustainable development of marine green economy? Empirical evidence from China’s coastal areas. Ocean Coast. Manag. 2023, 232, 106448. [Google Scholar] [CrossRef]

- Du, W.; Li, M.; Wang, Z. The impact of environmental regulation on firms’ energy-environment efficiency: Concurrent discussion of policy tool heterogeneity. Ecol. Indic. 2022, 143, 109327. [Google Scholar] [CrossRef]

- Tian, Y.; Feng, C. The internal-structural effects of different types of environmental regulations on China’s green total-factor productivity. Energy Econ. 2022, 113, 106246. [Google Scholar] [CrossRef]

- Li, M.; Gao, X. Implementation of enterprises’ green technology innovation under market-based environmental regulation: An evolutionary game approach. J. Environ. Manag. 2022, 308, 114570. [Google Scholar] [CrossRef]

- Bhuiyan, M.B.U.; Huang, H.J.; Villiers, C. Determinants of environmental investment: Evidence from Europe. J. Clean. Prod. 2021, 292, 125990. [Google Scholar] [CrossRef]

- Huang, J.; Zhao, J.; Cao, J. Environmental regulation and corporate R&D investment—Evidence from a quasi-natural experiment. Int. Rev. Econ. Financ. 2021, 72, 154–174. [Google Scholar] [CrossRef]

- Ahmed, Z.; Ahmad, M.; Murshed, M.; Shah, M.I.; Mahmood, H.; Abbas, S. How do green energy technology investments, technological innovation, and trade globalization enhance green energy supply and stimulate environmental sustainability in the G7 countries? Gondwana Res. 2022, 112, 105–115. [Google Scholar] [CrossRef]

- Guo, J.; Zhou, Y.; Ali, S.; Shahzad, U.; Cui, L. Exploring the role of green innovation and investment in energy for environmental quality: An empirical appraisal from provincial data of China. J. Environ. Manag. 2021, 292, 112779. [Google Scholar] [CrossRef]

- Castelnovo, P. Innovation in private and state-owned enterprises: A cross-industry analysis of patenting activity. Struct. Change Econ. Dyn. 2022, 62, 98–113. [Google Scholar] [CrossRef]

- Yang, Z.; Shao, S.; Yang, L. Unintended consequences of carbon regulation on the performance of SOEs in China: The role of technical efficiency. Energy Econ. 2021, 94, 105072. [Google Scholar] [CrossRef]

- Niu, Y.; Wen, W.; Wang, S.; Li, S. Breaking barriers to innovation: The power of digital transformation. Financ. Res. Lett. 2023, 51, 103457. [Google Scholar] [CrossRef]

- Zhang, Z.; Jin, J.; Li, S.; Zhang, Y. Digital transformation of incumbent firms from the perspective of portfolios of innovation. Technol. Soc. 2023, 72, 102149. [Google Scholar] [CrossRef]

- Feliciano-Cestero, M.M.; Ameen, N.; Kotabe, M.; Paul, J.; Signoret, M. Is digital transformation threatened? A systematic literature review of the factors influencing firms’ digital transformation and internationalization. J. Bus. Res. 2023, 157, 113546. [Google Scholar] [CrossRef]

- Malodia, S.; Mishra, M.; Fait, M.; Papa, A.; Dezi, L. To digit or to head? Designing digital transformation journey of SMEs among digital self-efficacy and professional leadership. J. Bus. Res. 2023, 157, 113547. [Google Scholar] [CrossRef]

- Du, K.; Cheng, Y.; Yao, X. Environmental regulation, green technology innovation, and industrial structure upgrading: The road to the green transformation of Chinese cities. Energy Econ. 2021, 98, 105247. [Google Scholar] [CrossRef]

- Tian, H.; Li, Y.; Zhang, Y. Digital and intelligent empowerment: Can big data capability drive green process innovation of manufacturing enterprises? J. Clean. Prod. 2022, 377, 134261. [Google Scholar] [CrossRef]

- Lin, B.; Zhang, A. Can government environmental regulation promote low-carbon development in heavy polluting industries? Evidence from China’s new environmental protection law. Environ. Impact Assess. Rev. 2023, 99, 106991. [Google Scholar] [CrossRef]

- Feng, C.; Zhu, R.; Wei, G.; Dong, K.; Dong, J. Typical case of carbon capture and utilization in Chinese iron and steel enterprises: CO2 emission analysis. J. Clean. Prod. 2022, 363, 132528. [Google Scholar] [CrossRef]

- Song, Y.; Zhang, K.; Li, X. A novel multi-objective mutation flower pollination algorithm for the optimization of industrial enterprise R&D investment allocation. Appl. Soft Comput. 2021, 109, 107530. [Google Scholar] [CrossRef]

- Du, Y.; Huang, R. Research on the core competitiveness of pharmaceutical listed companies based on fuzzy comprehensive evaluation. J. Intell. Fuzzy Syst. 2020, 38, 6971–6978. [Google Scholar] [CrossRef]

- Capponi, G.; Martinelli, A.; Nuvolari, A. Breakthrough innovation and where to find them. Res. Policy 2021, 51, 104376. [Google Scholar] [CrossRef]

- Wang, L.; Chen, F.; Knell, M. Pattern of technology upgrading—The case of biotechnology in China. Asian J. Technol. Innov. 2019, 27, 152–171. [Google Scholar] [CrossRef]

- Lee, P.C. Investgating the knowledge spillover and externality of technology standards based on patent dada. IEEE Trans. Eng. Manag. 2021, 68, 1027–1041. [Google Scholar] [CrossRef]

- Ball, C.; Kittler, M. Removing environmental market failure through support mechanisms: Insight from green star-ups in the British, French and German energy sectors. Small Bus. Econ. 2019, 52, 831–844. [Google Scholar] [CrossRef]

- Zhu, Q.; Geng, Y.; Lai, K. Barriers to promoting Eco-industrial parks development in China: Perspectives from senior officials at national industrial parks. J. Ind. Ecol. 2015, 19, 457–467. [Google Scholar] [CrossRef]

- Huang, Z.; Liao, G.; Li, Z. Loaning scale and government subsidy for promoting green innovation. Technol. Forecast. Soc. Change 2019, 144, 148–156. [Google Scholar] [CrossRef]

- Yu, F.; Wang, L.; Li, X. The effects of government subsidies on new energy vehicle enterprises: The moderating role of intelligent transformation. Energy Policy 2020, 141, 111463. [Google Scholar] [CrossRef]

- Xin, C.; Hao, X.; Cheng, L. Do environmental administrative penalties affect audit fees? Result from multiple econometric models. Sustainability 2022, 14, 4268. [Google Scholar] [CrossRef]

- Wang, X.; Ge, J.; Han, A. Market impacts of environmental regulation on the production of rare earths: A computable general equilibrium analysis for Chain. J. Clean. Prod. 2017, 154, 614–620. [Google Scholar] [CrossRef]

- Sun, X.; Zheng, Y.; Wang, B. The effect of Chinas pilot low-carbon city initiative on enterprise labor structure. Front. Energy Res. 2021, 9, 821677. [Google Scholar] [CrossRef]

- Kainiemi, L.; Eloneva, S.; Toikka, A.; Levänen, J.; Järvinen, M. Opportunities and obstacles for CO2 mineralization: CO2 mineralization specific frames in the interviews of Finnish carbon capture and storage (CCS) experts. J. Clean. Prod. 2015, 94, 352–358. [Google Scholar] [CrossRef]

- Shen, Y.; Ruan, S. Accounting Conservatism, R&D Manipulation, and Corporate Innovation: Evidence from China. Sustainability 2022, 14, 9048. [Google Scholar] [CrossRef]

- Pan, X.; Pan, X.; Wu, X.; Jiang, L.; Guo, S.; Feng, X. Research on the heterogeneous impact of carbon emission reduction policy on R&D investment intensity: From the perspective of enterprise’s ownership structure. J. Clean. Prod. 2021, 328, 129532. [Google Scholar] [CrossRef]

- Yang, L.; Qin, H.; Xia, W.; Gan, Q.; Li, L.; Su, J.; Yu, X. Resource slack, environmental management maturity and enterprise environmental protection investment: An enterprise life cycle adjustment perspective. J. Clean. Prod. 2021, 309, 127339. [Google Scholar] [CrossRef]

- Wu, W.; Liu, Q.; Wu, C.; Tsai, S. An empirical study on government direct environmental regulation and heterogeneous innovation investment. J. Clean. Prod. 2020, 254, 120079. [Google Scholar] [CrossRef]

- Zhang, J.; Chen, Z.; Altuntaş, M. Tracing volatility in natural resources, green finance and investment in energy resources: Fresh evidence from China. Resour. Policy 2022, 79, 102946. [Google Scholar] [CrossRef]

- Huang, S.; Lin, H.; Zhu, N. The influence of the policy of replacing environmental protection fees with taxes on enterprise green innovation-evidence from China’s heavily polluting industries. Sustainability 2022, 14, 6850. [Google Scholar] [CrossRef]

- Xu, X.; Chen, X.; Xu, Y.; Wang, T.; Zhang, Y. Improving the Innovative Performance of Renewable Energy Enterprises in China: Effects of Subsidy Policy and Intellectual Property Legislation. Sustainability 2022, 14, 8169. [Google Scholar] [CrossRef]

- Chen, C.; Gu, J.; Luo, R. Corporate innovation and R&D expenditure disclosures. Technol. Forecast. Soc. Change 2022, 174, 121230. [Google Scholar] [CrossRef]

- Li, Y.; Zhu, D. Share pledging and corporate environmental investment. Financ. Res. Lett. 2022, 50, 103348. [Google Scholar] [CrossRef]

- Wei, F.; Zhou, L. Multiple large shareholders and corporate environmental protection investment: Evidence from the Chinese listed companies. China J. Account. Res. 2020, 13, 387–404. [Google Scholar] [CrossRef]

- Long, F.; Lin, F.; Ge, C. Impact of China’s environmental protection tax on corporate performance: Empirical data from heavily polluting industries. Environ. Impact Assess. Rev. 2022, 97, 106892. [Google Scholar] [CrossRef]

- He, M.; Zhu, X.; Li, H. How does carbon emissions trading scheme affect steel enterprises’ pollution control performance? A quasi natural experiment from China. Sci. Total Environ. 2023, 858, 159871. [Google Scholar] [CrossRef]

- Cheng, Y.; Zhang, Y.; Wang, J.; Jiang, J. The impact of the urban digital economy on China’s carbon intensity: Spatial spillover and mediating effect. Resour. Conserv. Recycl. 2023, 189, 106762. [Google Scholar] [CrossRef]

- Hepburn, C.; Qi, Y.; Stern, N.; Ward, B.; Xie, C.; Zenghelis, D. Towards carbon neutrality and China’s 14th Five-Year Plan: Clean energy transition, sustainable urban development, and investment priorities. Environ. Sci. Ecotechnology 2021, 8, 100130. [Google Scholar] [CrossRef] [PubMed]

- Lin, B.; Ma, R. How does digital finance influence green technology innovation in China? Evidence from the financing constraints perspective. J. Environ. Manag. 2022, 320, 115833. [Google Scholar] [CrossRef]

- Feng, S.; Chong, Y.; Yu, H.; Ye, X.; Li, G. Digital financial development and ecological footprint: Evidence from green-biased technology innovation and environmental inclusion. J. Clean. Prod. 2022, 380, 135069. [Google Scholar] [CrossRef]

- Ma, D.; Zhu, Q. Innovation in emerging economies: Research on the digital economy driving high-quality green development. J. Bus. Res. 2022, 145, 801–813. [Google Scholar] [CrossRef]

- Liu, S.; Wang, Y. Green innovation effect of pilot zones for green finance reform: Evidence of quasi natural experiment. Technol. Forecast. Soc. Change 2023, 186, 122079. [Google Scholar] [CrossRef]

- Cui, S.; Wang, Y.; Zhu, Z.; Zhu, Z.; Yu, C. The impact of heterogeneous environmental regulation on the energy eco-efficiency of China’s energy-mineral cities. J. Clean. Prod. 2022, 350, 131553. [Google Scholar] [CrossRef]

- Liao, Z. Is environmental innovation conductive to corporate financing? The moderating role of advertising expenditures. Bus. Strategy Environ. 2020, 29, 954–961. [Google Scholar] [CrossRef]

- Feng, G.; Niu, P.; Wang, J.; Liu, J. Capital market liberalization and green innovation for sustainability: Evidence from China. Econ. Anal. Policy 2022, 75, 610–623. [Google Scholar] [CrossRef]

- Zor, S. Conservation or revolution? The sustainable transition of textile and apparel firms under the environmental regulation: Evidence from China. J. Clean. Prod. 2023, 382, 135339. [Google Scholar] [CrossRef]

- Li, F.; Wang, Z.; Huang, L. Economic growth target and environmental regulation intensity: Evidence from 284 cities in China. Environ. Sci. Pollut. Res. 2022, 29, 10235–10249. [Google Scholar] [CrossRef]

- Lodhia, S.; Jacobs, K.; Park, Y.J. Driving Public Sector Environmental Reporting. Public Manag. Rev. 2012, 14, 631–647. [Google Scholar] [CrossRef]

- Zhang, S.; Qin, G.; Wang, L.; Cheng, B.; Tian, Y. Evolutionary game research between the government environmental regulation intensities and the pollution emissions of papermaking enterprises. Discrete Dynam Nat. Soc. 2021, 2021, 7337290. [Google Scholar] [CrossRef]

- Huang, L.; Lei, Z. How environmental regulation affect corporate green investment: Evidence from China. J. Clean. Prod. 2021, 279, 123560. [Google Scholar] [CrossRef]

- Wang, L.; Chen, C.; Zhu, B. Earnings pressure, external supervision, and corporate environmental protection investment: Comparison between heavy-polluting and non-heavy-polluting industries. J. Clean. Prod. 2023, 385, 135648. [Google Scholar] [CrossRef]

- Li, G.; Jin, Y.; Gao, X. Digital transformation and pollution emission of enterprises: Evidence from China’s micro-enterprises. Energy Rep. 2023, 9, 552–567. [Google Scholar] [CrossRef]

- Zhang, Y.; Yang, G.; Zhang, D.; Wang, T. Investigation on recognition method of acoustic emission signal of the compressor valve based on the deep learning method. Energy Rep. 2021, 7, 62–71. [Google Scholar] [CrossRef]

- Wang, T.; Wen, C.Y.; Seng, J.L. The association between the mandatory adoption of XBRL and the performance of listed state-owned enterprises and non-state-owned enterprises in China. Inf. Manag. 2014, 51, 336–346. [Google Scholar] [CrossRef]

- Lu, C.; Niu, Y. Do companies compare employees’ salaries? Evidence from stated-owned enterprise group. China J. Account. Res. 2022, 15, 100252. [Google Scholar] [CrossRef]

- Xing, J.; Zhang, Y.; Xiong, X. Social capital, independent director connectedness, and stock price crash risk. Int. Rev. Econ. Financ. 2023, 83, 786–804. [Google Scholar] [CrossRef]

- Du, L.; Lin, W.; Du, J.; Jin, M.; Fan, M. Can vertical environmental regulation induce enterprise green innovation? A new perspective from automatic air quality monitoring station in China. J. Environ. Manag. 2022, 317, 115349. [Google Scholar] [CrossRef] [PubMed]

- Du, Z.; Xu, C.; Lin, B. Does the Emission Trading Scheme achieve the dual dividend of reducing pollution and improving energy efficiency? Micro evidence from China. J. Environ. Manag. 2022, 323, 116202. [Google Scholar] [CrossRef] [PubMed]

- Li, Y.; Zhao, K.; Zhang, F. Identification of key influencing factors to Chinese coal power enterprises transition in the context of carbon neutrality: A modified fuzzy Dematel approach. Energy 2023, 263, 125427. [Google Scholar] [CrossRef]

- Li, J.; Dong, K.; Wang, K.; Dong, X. How does natural resource dependence influence carbon emissions? The role of environmental regulation. Resour. Policy 2023, 80, 103268. [Google Scholar] [CrossRef]

- Zeng, J.; Chen, X.; Liu, Y.; Cui, R.; Zhao, P. How does the enterprise green innovation ecosystem collaborative evolve? Evidence from China. J. Clean. Prod. 2022, 375, 134181. [Google Scholar] [CrossRef]

- Liu, M.; Shan, Y.; Li, Y. Study on the effect of carbon trading regulation on green innovation and heterogeneity analysis from China. Energy Policy 2022, 171, 113290. [Google Scholar] [CrossRef]

- Yu, Z.; Shen, Y.; Jiang, S. The effects of corporate governance uncertainty on state-owned enterprises’ green innovation in China: Perspective from the participation of non-state-owned shareholders. Energy Econ. 2022, 115, 106402. [Google Scholar] [CrossRef]

- Wei, N.; Liu, S.; Jiao, Z.; Li, X. A possible contribution of carbon capture, geological utilization, and storage in the Chinese crude steel industry for carbon neutrality. J. Clean. Prod. 2022, 374, 133793. [Google Scholar] [CrossRef]

- Wang, L.; Dilanchiev, A.; Haseeb, M. The environmental regulation and policy assessment effect on the road to green recovery transformation. Econ. Anal. Policy 2022, 76, 914–929. [Google Scholar] [CrossRef]

- Pang, C.; Zhou, J.; Ji, X. The Effects of Chinese Consumers’ Brand Green Stereotypes on Purchasing Intention toward Upcycled Clothing. Sustainability 2022, 14, 16826. [Google Scholar] [CrossRef]

- Xu, X.; Zhang, W.; Wang, T.; Xi, Y.; Du, H. Impact of subsidies on innovations of environmental protection and circular economy in China. J. Environ. Manag. 2021, 289, 112385. [Google Scholar] [CrossRef] [PubMed]

- Lin, C.P.; Tsai, Y.H.; Chiu, C.K.; Liu, C.P. Forecasting the purchase intention of IT product: Key roles of trust and environmental consciousness for IT firms. Technol. Forecast. Soc. Change 2015, 99, 148–155. [Google Scholar] [CrossRef]

- Cheng, P.; Wang, X.; Choi, B.; Huan, X. Green Finance, International Technology Spillover and Green Technology Innovation: A New Perspective of Regional Innovation Capability. Sustainability 2023, 15, 1112. [Google Scholar] [CrossRef]

- Xu, X.; Cui, X.; Chen, X.; Zhou, Y. Impact of government subsidies on the innovation performance of the photovoltaic industry: Based on the moderating effect of carbon trading prices. Energy Policy 2022, 170, 113216. [Google Scholar] [CrossRef]

- Chen, Y.; Han, X.; Lv, S.; Song, B.; Zhang, X.; Li, H. The Influencing Factors of Pro-Environmental Behaviors of Farmer Households Participating in Understory Economy: Evidence from China. Sustainability 2023, 15, 688. [Google Scholar] [CrossRef]

- Wang, L.; Long, Y.; Li, C. Research on the impact mechanism of heterogeneous environmental regulation on enterprise green technology innovation. J. Environ. Manag. 2022, 322, 116127. [Google Scholar] [CrossRef]

- Cao, H.; Zhang, L.; Qi, Y.; Yang, Z.; Li, X. Government auditing and environmental governance: Evidence from China’s auditing system reform. Environ. Impact Assess. Rev. 2022, 93, 106705. [Google Scholar] [CrossRef]

- Sun, Y.; Sun, H. Green Innovation Strategy and Ambidextrous Green Innovation: The Mediating Effects of Green Supply Chain Integration. Sustainability 2021, 13, 4876. [Google Scholar] [CrossRef]

| Type | Symbol | Name | Definition |

|---|---|---|---|

| Dependent variable | GRE | Corporate Green Innovation | Annual green patent applications for enterprises |

| Independent variable | ER | Government environmental regulation intensity | The ratio of the frequency of environmental words to the frequency of words in the work reports of prefecture level municipal governments |

| Intermediate variables | INPUT | Enterprise environmental protection investment | Screen the keywords related to environmental protection investment in the notes to the financial statements of listed companies for construction in progress, other payables, and administrative expenses, obtain the relevant environmental protection investment data and take the logarithm |

| Adjustment variables | INTE | The degree of digital transformation of enterprises | Proportion of the portion of the year-end intangible asset line items disclosed in the notes to the company’s financial report relating to digital technology to total intangible assets |

| Control variables | STATE | Nature of business ownership | SOEs are assigned a value of 0; non-SOEs enterprises are assigned a value of 1 |

| SALA | Employee payroll payable | Various forms of compensation and other related expenses are given by the enterprise to obtain the services provided by employees | |

| DIRE | Percentage of independent directors | Number of independent directors as a percentage of board members | |

| RATE | Operating income growth rate | Ratio of the increase in the enterprise’s operating income for the current year to the total operating income for the previous year | |

| TDR | Gearing ratio | Ratio of total enterprise liabilities to total assets | |

| YEAR | Year fixed effects | ||

| Variable | Obs | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| GRE | 102 | 23.48 | 37.223 | 0 | 170 |

| ER | 104 | 0.369 | 0.121 | 0.136 | 0.715 |

| INPUT | 104 | 10.978 | 8.719 | 0 | 22.122 |

| SALA | 102 | 17.459 | 1.327 | 13.487 | 19.272 |

| DIRE | 102 | 0.349 | 0.032 | 0.273 | 0.429 |

| RATE | 102 | 0.101 | 0.295 | −0.505 | 0.94 |

| TDR | 102 | 0.49 | 0.152 | 0.191 | 0.791 |

| INTE | 83 | 0.098 | 0.144 | 0.001 | 0.701 |

| STATE | 104 | 0.462 | 0.501 | 0 | 1 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) |

|---|---|---|---|---|---|---|---|---|

| (1) GRE | 1.000 | |||||||

| (2) ER | 0.206 | 1.000 | ||||||

| 0.038 | ||||||||

| (3) INPUT | 0.394 | 0.111 | 1.000 | |||||

| 0.000 | 0.261 | |||||||

| (4) SALA | 0.342 | −0.023 | 0.106 | 1.000 | ||||

| 0.000 | 0.821 | 0.289 | ||||||

| (5) DIRE | −0.014 | −0.032 | 0.174 | −0.091 | 1.000 | |||

| 0.887 | 0.753 | 0.080 | 0.365 | |||||

| (6) RATE | −0.039 | −0.094 | −0.116 | −0.062 | 0.201 | 1.000 | ||

| 0.695 | 0.348 | 0.245 | 0.538 | 0.043 | ||||

| (7) TDR | 0.520 | 0.091 | 0.277 | 0.554 | 0.136 | −0.094 | 1.000 | |

| 0.000 | 0.364 | 0.005 | 0.000 | 0.172 | 0.346 | |||

| (8) INTE | −0.151 | 0.172 | −0.226 | 0.007 | −0.167 | −0.111 | −0.318 | 1.000 |

| 0.172 | 0.120 | 0.040 | 0.951 | 0.130 | 0.319 | 0.003 |

| Variable | VIF | 1/VIF |

|---|---|---|

| INPUT | 1.33 | 0.74946 |

| ER | 1.47 | 0.682341 |

| SALA | 1.68 | 0.594215 |

| DIRE | 1.22 | 0.820458 |

| RATE | 1.38 | 0.724707 |

| TDR | 1.73 | 0.577725 |

| YEAR | ||

| 2014 | 1.82 | 0.549793 |

| 2015 | 1.95 | 0.514134 |

| 2016 | 1.87 | 0.533637 |

| 2017 | 2.11 | 0.473973 |

| 2018 | 2.14 | 0.467566 |

| 2019 | 2.07 | 0.484013 |

| 2020 | 2.39 | 0.418564 |

| Mean VIF | 1.78 |

| GRE | INPUT | GRE | |

|---|---|---|---|

| Variables | Model 1 | Model 2 | Model 3 |

| INPUT | 1.095 *** | ||

| (2.74) | |||

| ER | 84.460 *** | 18.866 ** | 63.802 ** |

| (2.81) | (2.45) | (2.13) | |

| SALA | 0.760 | −0.832 | 1.671 |

| (0.25) | (−1.08) | (0.57) | |

| DIRE | −59.458 | 54.551 ** | −119.189 |

| (−0.57) | (2.03) | (−1.15) | |

| RATE | −0.875 | −5.078 | 4.685 |

| (−0.07) | (−1.63) | (0.39) | |

| TDR | 122.981 *** | 17.264 ** | 104.078 *** |

| (4.76) | (2.61) | (4.02) | |

| YEAR | Omission | ||

| Constant | −76.615 | −12.918 | −62.470 |

| (−1.17) | (−0.77) | (−0.99) | |

| Observations | 102 | 102 | 102 |

| R-squared | 0.380 | 0.251 | 0.429 |

| GRE | INPUT | GRE | |

|---|---|---|---|

| Variables | Model 4 | Model 5 | Model 6 |

| INPUT | 2.090 *** | ||

| (4.34) | |||

| ER | 119.293 *** | 7.734 | 71.037 ** |

| (3.44) | (0.84) | (2.49) | |

| INPUT*STATE | −2.586 *** | ||

| (−3.74) | |||

| STATE | −14.844 ** | −3.101 * | −9.629 |

| (−2.26) | (−1.79) | (−1.53) | |

| SALA | −0.878 | −1.482 * | 1.799 |

| (−0.29) | (−1.82) | (0.60) | |

| DIRE | −46.668 | 43.330 | −121.051 |

| (−0.46) | (1.62) | (−1.26) | |

| RATE | −2.574 | −4.940 | 1.214 |

| (−0.22) | (−1.62) | (0.11) | |

| TDR | 127.303 *** | 18.771 *** | 96.616 *** |

| (5.16) | (2.88) | (3.94) | |

| YEAR | Omission | ||

| ER*STATE | −143.437 *** | 22.357 | |

| (−2.69) | (1.58) | ||

| Constant | −61.812 | 7.273 | −72.441 |

| (−0.89) | (0.39) | (−1.11) | |

| Observations | 102 | 102 | 102 |

| R-squared | 0.456 | 0.298 | 0.524 |

| GRE | INPUT | GRE | |

|---|---|---|---|

| Variables | Model 7 | Model 8 | Model 9 |

| INPUT | 1.237 ** | ||

| (2.38) | |||

| ER | 123.923 *** | 21.316 *** | 86.323 ** |

| (3.48) | (2.68) | (2.12) | |

| INPUT*INTE | −2.872 | ||

| (−0.75) | |||

| INTE | 5.386 | −0.362 | 8.144 |

| (0.16) | (−0.05) | (0.27) | |

| SALA | 0.587 | 1.022 | −1.731 |

| (0.15) | (1.15) | (−0.40) | |

| DIRE | −54.462 | 60.595 ** | −138.879 |

| (−0.47) | (2.34) | (−1.17) | |

| RATE | −2.121 | −7.719 ** | 10.059 |

| (−0.15) | (−2.39) | (0.66) | |

| TDR | 145.635 *** | 2.169 | 145.530 *** |

| (3.99) | (0.27) | (4.13) | |

| YEAR | Omission | ||

| ER*INTE | −56.027 | −166.691 *** | |

| (−0.21) | (−2.79) | ||

| Constant | −103.987 | −39.089 ** | −31.848 |

| (−1.33) | (−2.24) | (−0.35) | |

| Observations | 83 | 83 | 83 |

| R-squared | 0.435 | 0.368 | 0.479 |

| GAPA | INPUT | GAPA | |

|---|---|---|---|

| Variables | Model 1 | Model 2 | Model 3 |

| INPUT | 0.804 *** | ||

| (2.86) | |||

| ER | 76.796 *** | 18.866 ** | 61.626 *** |

| (3.62) | (2.45) | (2.92) | |

| SALA | 0.719 | −0.832 | 1.389 |

| (0.34) | (−1.08) | (0.67) | |

| DIRE | −37.906 | 54.551 ** | −81.770 |

| (−0.51) | (2.03) | (−1.12) | |

| RATE | 1.756 | −5.078 | 5.840 |

| (0.20) | (−1.63) | (0.70) | |

| TDR | 81.955 *** | 17.264 ** | 68.074 *** |

| (4.49) | (2.61) | (3.74) | |

| YEAR | Omission | ||

| Constant | −64.130 | −12.918 | −53.743 |

| (−1.39) | (−0.77) | (−1.21) | |

| Observations | 102 | 102 | 102 |

| R-squared | 0.394 | 0.251 | 0.446 |

| GAPA | INPUT | GAPA | |

|---|---|---|---|

| Variables | Model 1 | Model 2 | Model 3 |

| INPUT | 0.059 *** | ||

| (15.84) | |||

| ER | 1.946 *** | 18.866 ** | 0.827 *** |

| (9.67) | (2.45) | (3.81) | |

| SALA | 0.340 *** | −0.832 | 0.326 *** |

| (10.09) | (−1.08) | (9.89) | |

| DIRE | −1.038 | 54.551 ** | −2.525 *** |

| (−1.46) | (2.03) | (−3.69) | |

| RATE | −0.738 *** | −5.078 | −0.375 *** |

| (−7.10) | (−1.63) | (−3.67) | |

| TDR | 4.778 *** | 17.264 ** | 3.872 *** |

| (24.22) | (2.61) | (18.68) | |

| YEAR | Omission | ||

| Constant | −6.592 *** | −12.918 | −5.621 *** |

| (−10.29) | (−0.77) | (−9.00) | |

| Observations | 102 | 102 | 102 |

| R-squared | 0.546 | 0.251 | 0.614 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, H.; Zhu, H.; Sun, T.; Chen, X.; Wang, T.; Li, W. Does Environmental Regulation Promote Corporate Green Innovation? Empirical Evidence from Chinese Carbon Capture Companies. Sustainability 2023, 15, 1640. https://doi.org/10.3390/su15021640

Chen H, Zhu H, Sun T, Chen X, Wang T, Li W. Does Environmental Regulation Promote Corporate Green Innovation? Empirical Evidence from Chinese Carbon Capture Companies. Sustainability. 2023; 15(2):1640. https://doi.org/10.3390/su15021640

Chicago/Turabian StyleChen, Hong, Haowen Zhu, Tianchen Sun, Xiangyu Chen, Tao Wang, and Wenhong Li. 2023. "Does Environmental Regulation Promote Corporate Green Innovation? Empirical Evidence from Chinese Carbon Capture Companies" Sustainability 15, no. 2: 1640. https://doi.org/10.3390/su15021640

APA StyleChen, H., Zhu, H., Sun, T., Chen, X., Wang, T., & Li, W. (2023). Does Environmental Regulation Promote Corporate Green Innovation? Empirical Evidence from Chinese Carbon Capture Companies. Sustainability, 15(2), 1640. https://doi.org/10.3390/su15021640