1. Introduction

The Environmental Protection Agency estimates that 15 million tons of textile waste are generated annually in the US [

1]. Approximately 15% of this waste is recycled [

2]. When considering that the average landfill tipping fee is

$55 per ton, the cost associated with dumping textile materials into landfills would be approximately USD 700 million annually across the US [

3]. Some studies estimate much higher figures, even reaching over USD 3 billion [

3]. According to the international trade association, SMART, which supports businesses that deal with secondary materials and recycled textiles, much of the waste that is landfilled could have been recycled using existing and newly proven technologies [

4]. These figures indicate that there are significant barriers to the scaling of these recycling options. Although the market indicators do not appear to be favorable for post-consumer textile waste as a monetizable input for textile-to-textile recycling, there are well-established, negative environmental impacts of this waste being landfilled or incinerated [

5]. Therefore, establishing a system for post-consumer textile waste valorization and enabling scale is crucial.

According to a recent National Public Radio report, “Is Recycling Worth It Anymore?”, a dichotomy exists in developing new recycling streams [

6]. Demand often needs to be secured before investment will funnel into the scaling of the processing technologies. At the same time, the ability to accumulate feedstocks is dependent upon having the ability to process and sell it at scale. In the case of textile-to-textile recycling, processing technologies need to be widely available to both sort and recycle the vast amount and array of fiber blends found in post-consumer textile waste streams [

7]. Given this dichotomy, the question is if and how the industry can progress beyond its current state. This research provides insights into the many challenges to scaling textile-to-textile recycling within the US context.

The purpose of this research is to investigate the business case for the use of post-consumer textile waste as an input to textile-to-textile recycling. There are three main research objectives. The first objective is to explore the dynamics between post-consumer waste traders and recyclers. The second objective is to investigate the challenges that prevent faster scaling of textile waste feedstock and the processing of this waste into new fibers. The third objective is to provide theoretical and practical foundations for effective interventions in this area. This paper is organized in the following way: the literature section reviews the current state of the textile waste market and questions of economic viability for newly developed recycling technologies; the methods and results section follows. Lastly, insights into the revealed challenges to creating a business case for post-consumer textile waste feedstock are discussed.

3. Methods

In-depth semi-structured interviews were conducted to qualitatively investigate the business case for the use of post-consumer textile waste as an input to textile-to-textile recycling. To gain a full picture of the economic considerations, trading dynamics, and factors internal to organizations that operate in the post-consumer textile waste business in the US, two classes of organizations were closely examined. The first group included the post-consumer textile waste sorters and aggregators. For clarity purposes, they have been termed the “traders” and they represented the entities selling the waste feedstock to the recyclers. The second group of textile market participants were both mechanical and chemical recycling entities who purchase the waste feedstock for further processing. For clarity purposes in this study, they have been termed “recyclers”. IRB approval was obtained to collect data for this qualitative study. The six participants in the trader group were recruited through the snowball method where the first subject was recruited and then referrals for other participants were gathered. The five participants in the recycler group were recruited through purposive sampling to represent a cross-section of technology types, maturity levels, company size, and years in operation. The total sample consisted of eleven participants who were all employed in senior management positions in organizations listed in

Table 1. The names of the interviewees are omitted to protect the respondents’ identities, but corporate names and missions are authentic.

Following ethnographic principles, semi-structured interviews were conducted at first, with representatives of both traders and recyclers, and when needed, additional clarifying questions were discussed in the follow-up interview [

30]. All interviews were conducted in an online setting throughout the month of October 2021.

The research protocol was organized in the following manner. Interview questions were developed to cover the following business aspects: organization details, textile volumes, pricing, perceptions of progress among industry players, drivers or inhibitors of competitiveness in the market; the presence of incentives for stakeholders in the circular textile value chain; strengths, weaknesses, opportunity, and threats based on the state of the infrastructure to support progress. Probing questions were used to confirm the effectiveness of the process flow in the current system and to understand the steps, considerations, and mindsets pertinent to creating contracts, partnerships, making sales decisions, and approaching negotiations between the textile traders and textile recyclers who are trading post-consumer textile waste. The list of questions covered is provided in

Supplementary Materials.

The interviews were transcribed using Otter ai pro software, which shows captions for live speakers and generates written transcriptions of the discussions. The transcripts were analyzed by applying the grounded theory approach in which transcripts were manually coded into the emerging themes [

41]. The findings were constantly compared to each other to isolate emerging concepts. These concepts were compared to each other to distill key findings. Throughout the analysis process, memos were actively used to capture all thoughts that support the emerging concepts, thematic categories, and their relationships [

41]. Credibility of findings was secured by triangulating two different sources of information (traders and recyclers) and through rich and thick descriptions of the emerging themes.

4. Results

From the interviews, 224 unique discussion points were found. These were further consolidated into 40 groups. Five key thematic categories emerged from the data (

Figure 3).

These key thematic categories could be described as the five most significant factors that fuel or inhibit the business case for post-consumer textile waste in the US. Nineteen sub-thematic categories were distilled within the five key thematic sections. All themes and sub-themes are listed and discussed below.

Negative process economics:

- ○

Managing system sensitivity;

- ○

Waste procurement strategies;

- ○

Building verticality;

- ○

Strategic geographic positioning.

Commercialization struggles:

- ○

Misalignment of pricing levels;

- ○

The role of off-take agreements;

- ○

Restricted substance lists;

- ○

Varying feedstock specifications.

Blocks due to current market dynamics:

- ○

The existing markets;

- ○

Legacy partnerships;

- ○

Misalignment of definitions;

- ○

Small vs. big circles in the circular economy.

Competitive advantages:

- ○

IP positions;

- ○

Technology gaps;

- ○

Delivering success;

- ○

White space opportunities;

- ○

(Fashion) business know-how.

Establishing accountability for leading change:

- ○

Role of regulation;

- ○

Accountable parties.

4.1. Negative Process Economics

This theme refers to the operations of a company that impact its ability to generate sufficient profit from its owned and operated processes [

10]. As discussed in the literature review, economic viability was a consistent undercurrent [

10,

14]. Although each recycling solution is presumed to be viable economically, there is broad skepticism that this can be maintained if the amount of post-consumer textile waste inputs is increasing. Traders and recyclers both provided input from their experiences either selling or buying post-consumer waste. There were four sub-thematic categories; they are listed and described below:

Managing System Sensitivity: Interviewees discussed their process routing (excluding any trade secrets or other intellectual property), and how efficiently post-consumer waste could be run on this system, if at all. For example, some traders noted that recyclers’ specifications are often nuanced and highly specific due to the high level of sensitivity of their processes, with sensitivity referring to the ability of their system to manage variations within the feedstocks and to remove potential contaminants: for example, plastisol prints, certain textile finishes, and color were repeatedly discussed as factors impeding their potential to process post-consumer waste. For the traders’ sorting of feedstocks, myriad levels of specificity to address the needs of various recycling technologies reduces profitability and fragments their stock. For recyclers, on the other hand, of all plans discussed for either testing or scaling the use of post-consumer textile waste, only half were able to confirm how this process would operate profitably, and none were scaled at the time of these discussions. These conversations revealed that the ability to provide or source textile waste feedstock to the required specification has an immense and higher-than-anticipated impact on profitability.

Waste Procurement Strategies: Interviewees agreed that there are wide differences in methods, percentages, and types of textile waste that different companies source; however, the perspective of recyclers was very different from that of traders. Generally, the traders had very strong relationships with non-profits but also collected textile waste from fashion brands’ “take-back” programs. An additional and complicating factor in assessing the impact of waste procurement strategies on process economics was also discovered. Currently, some recyclers and traders are not buying their textile waste inputs; they are receiving donations or, in some cases, being paid by fashion brands to handle them. This was a complicating factor in these discussions as it did not allow for an in-depth discussion with 30% of the interviewees regarding the impact on the profitability of waste procurement.

Concern was expressed from the traders’ side that new entrants will expect traders to sell their highest-value waste streams below market value. This confirms a trend noted in the economic viability section of the literature review section [

10,

14]. Additionally, several traders expressed skepticism that three to four times the amount of waste would start flowing through the system, indicating that the volume assumptions some recyclers have made may be flawed.

Building Verticality: Nearly 40% of the interviewees had plans to expand the breadth of operations or strengthen partnerships to operate in a “virtually” vertical model; this trend was somewhat more prominent among recyclers (50% of recyclers versus 30% of traders). For this group, verticality was usually discussed in reference to having better access or ownership of the textile waste closer to their processing plants. Ownership over the sorting specifications, cutting out middlemen, and eliminating competitors was also mentioned in this context. The approach to waste ownership was highly varied across the interviewees, and verticality was one way in which that manifested in the conversations.

Strategic Geographic Positioning: Interviewees were prompted to discuss the relevance of post-consumer textile waste originating from the US. Whether close to the source of the waste or close to the cheapest source of labor, there was a low level of consistency amongst traders regarding the best location of the operations. All indicated that they currently rely on manual labor for sortation. Beyond this, traders had little alignment regarding the most profitable approach. Some expressed a high level of skepticism that they could be profitable keeping more than one level of sorting operations in the US. In general, traders argued that textile waste is a global problem that requires a global solution, meaning that geographic positioning is an important business consideration. For the recycler group, most had or planned to have sourcing and/or processing capabilities in the EU in anticipation of the 2025 textile waste mandate. For this group, the USA was considered a potential region for further expansion, but not a region of primary business consideration.

4.2. Commercialization Struggles

The challenges to securing commercial partnerships were commonly discussed among interviewees across both groups and included both “up and downstream” considerations, inclusive of: pulps, monomers, yarns, or fibers that recyclers sell, as well as the sorted feedstocks that the traders sell. Opposing forces were at play; for example, target feedstock costs were being determined based on maintaining a competitive fiber price versus the necessary cost for targets to secure profitability. One trader noted that offer prices from new entrants for their highest quality feedstocks have been as low as 20% of the current market value. This trader also noted increased competition for this type of feedstock, which represents a very small percentage of what they process, and that this approach is increasing pricing but not solving the textile waste problem. This example illustrates an inability, particularly for new entrants, to fit into the existing market and, therefore, is likely to negatively impact scalability.

Misalignment of Pricing Levels: Pricing was a consistent theme emerging among recyclers. This manifested in two ways. First, it included a discussion on how to secure feedstock prices and offer competitive fiber prices as noted above. Feedstock prices were projected to continue trending higher than in previous years due to the increased demand for this waste; however, this often did not translate into an appetite from the market for higher fiber prices. So, existing recyclers noted being faced with increased competition for textile waste feedstocks, decreased profits, and downward pressure on fiber prices. Between chemical and mechanical recyclers, the market positioning, in response, differed with the former relying on premium pricing and the latter competing against “virgin” fiber prices. Both groups speculated about the government taking the lead to make recycled fibers more competitive through regulations; although, there was little alignment on what those regulations would be. Some of the strategies proposed were recycled content requirements, punitive duties for virgin content, or subsidy schemes.

The Role of Off-Take Agreements: Premiums on fiber prices were mentioned by every recycler as a barrier to forming off-take agreements with apparel brands. Regulations were often referred to as the best way to correct this by making recycled fibers more competitive in comparison to virgin alternatives. Less expected, however, was a discussion surrounding the direct purchasing of fibers. Several interviewees indicated that sourcing strategies by brands that push procurement and quality control risks to the suppliers make fiber off-take more difficult to secure because the off-take would require a shift of the risk of ownership to the brands. It was broadly agreed among the interviewees that a disjointed risk structure exists making suppliers hesitant to try new things. This sentiment was consistent unless a brand’s intent was to use its own waste to make its own fibers. Only one trader and one recycler indicated they were executing this model and sited the following implications: (1) the post-consumer waste from an institutional source had a higher level of uniformity and therefore was easier to sort than other post-consumer sources; (2) this model required a significant premium due to high reverse logistics costs; and (3) the reasons for a high premium for this model were not widely understood by the brands. Mass balance was somewhat preferred by the interviewees over this small circle [

2] approach, because the small circle model was considered a system of negative economics and an area of both misinformation and misalignment. One recycler noted an additional barrier to securing off-take as color contamination in recycled fiber being undesirable aesthetically and causing the process economics downstream to be unfavorable. Therefore, the price of fiber recyclers offered did not necessarily translate into a low-cost product. Participants felt this downstream cost impact was also not well understood within the brands.

Restricted Substance Lists: Restricted substances were discussed as a significant hurdle when considering post-consumer textile waste as an input to mechanical recycling. However, adherence to these standards is required by brands and mandated by governments. This is particularly acute for the post-consumer inputs because the dyes and finishes are unknown, and their use may have become restricted since the time of their manufacture or due to being in a different country. The chemical recyclers indicated that these chemicals are generally removed during their processing. Several mechanical recyclers provided examples of diluting contaminated feedstocks to ensure that levels of restricted substances were below the required limits. This finding reiterates the findings from previous studies on this topic.

Varying Feedstock Specifications: Varying perceptions and misalignment are dynamics at play in many of the categories discussed in this section. For post-consumer feedstocks, there is an evident dichotomy as discussed in the introduction. New types of recycling need feedstocks at scale in order to scale themselves, but feedstocks will not be accumulated until the recycling technologies have scaled [

7]. Further, a lack of clarity surrounding feedstock specifications was recognized as the common barrier, particularly among traders. This was less discussed within the recycler group, particularly for mechanical recyclers who have well-established, commercial processes and tend to use less post-consumer textile waste feedstocks. Most traders noted that across the new entrants in the chemical recycling of cotton-rich post-consumer textile waste, there is a lack of consistency in specifications for their feedstocks. It is not likely that the feedstock requirements for these new entrants will align with current sorting, which was developed for the recycling options, which are already commercial. However, a high level of variation from buyer to buyer is likely to hold back progress.

4.3. Blocks Due to Current Market Dynamics

This section discusses the existing profit structures that exist between current actors in the textile recycling sector. The type of businesses in the space—traditionally for-profit businesses—is important to consider. Of the 11 people interviewed, eight explicitly referred to themselves as “business persons” who need to prioritize profit. Only one interviewee explicitly said that having an environmental purpose is integral to their business model. All other interviewees indicated that their business is focused on eliminating textile waste, but none expressed that they were operating an impact-focused model in which the profit structure is built with a social or environmental mission at its heart. Each was focused on maximizing the value of the waste they trade or process, including avoiding the expense of landfilling; however, strong commitments to solving the post-consumer waste problem were not universal and were more broadly discussed by traders than recyclers. There were four sub-thematic categories within this thematic section. They are listed and described below:

The Existing Markets. Several textile waste handlers, all having decades of experience, expressed concern about the proper appropriation of funds by private players in the waste industry, which was called out as being dominated by “greed” as opposed to a desire to “do the right thing”. These players, for example, are often paid multiple times for the same waste (i.e., by the municipalities, the government, and the buyer of the waste if they do not landfill it). According to several interviewees, there is a historical precedent to “grab” the waste, and, therefore, it would be naive to assume that because there is a textile waste problem, good graces will influence market dynamics. Rather, there was alignment across interviewees that cost minimization and profit maximization would need to align with the appropriate actions to reduce environmental impact. Therefore, a compelling business case must exist to inspire lasting collaboration among actors to scale the textile circular value chain. A further complicating factor is the informal nature of the textile trading level of the value chain. One of the participants indicated that all their contracts have been “gentlemen’s agreements” solidified with a handshake and that in 25 years the informal nature of the relationships did not cause disruptions to their business but acknowledged that they may make it harder for new entrants to understand the market.

Legacy Partnerships. It was evident in the interviews that most traders have established partnerships and resulting margin expectations. These margins are the backbone of their operations and profitability. They are sorting to suit the current markets/customers’ needs. Some participants in this study indicated that new entrants do not appear to have an in-depth understanding of what current standardized feedstock specifications are. Traders shared some examples of requests for slices of stocks that would render the balance unprofitable to trade. The participants indicated that seemingly small changes in the specification for the feedstock could have massive implications on the amount of sorting required and that by not aligning with current specifications, they risk creating more waste as well as negatively impacting the profitability of another actor in the value chain. Further, the offer prices from new entrants were noted as “unrealistic”, highlighting skepticism by traders about the economic viability of newer textile-to-textile recycling systems. Traders indicated that a clear area of business opportunity would be low-value stocks such as mixed colors and mixed fibers that do not have strong existing markets.

Misalignment of Definitions. Across participants, there was a notable lack of alignment on definitions for high value and recycling. Some referenced “high value” to mean able to be used in a higher priced item such as apparel, as opposed to downcycling, which was often used to describe applications in which recycled fibers were used for lower cost items such as wipers or insulation. This was more common on the recycler’s side, but not unanimous. High value was not mentioned in this same context by most of the textile traders. Instead, the profitability of a textile waste stream was discussed in reference to creating revenue. Two recyclers did discuss pivoting this definition to reference the grade of the fiber and its applicability for different products as a potential defining characteristic. Recycling was usually used to refer to the regeneration of fibers chemically or mechanically into products applicable to the same market, i.e., apparel. However, traders often referred to themselves as recyclers since they were actively finding new uses for products to prevent incineration and landfilling. Establishing stronger definitions was found to be an opportunity to further clarify shared goals and facilitate cooperation across stakeholders.

Small vs. Big Circles in the Circular Economy. As discussed in the commercial barriers section above, a majority of interviewees felt that encouraging a “small circle” approach to scaling the use of post-consumer textile waste did not have a strong business case and, therefore, would not unlock systemic change. A total of 90% of the interviewees across both groups indicated support for a different approach, which was sometimes referred to as “creating big circles”; some interviewees indicated that a “small circle” approach would be unrealistic logistically, not economically viable, and would negate that fiber use in other markets could still fulfill the virgin fiber off-setting to lower the textile industry’s overall impact. Not all interviewees agreed that the “big circle” approach necessarily meant mass balancing; however, it was broadly agreed that traders and recyclers should not be limited in terms of potential end-use and therefore potential market partners. Not having the liberty to recycle different waste types (from a brand or other source) into an ideal market/product could negatively impact the process economics and, therefore, the system’s scalability. What end markets would be ideal from an LCA point of view should be explored in further research.

4.4. Competitive Advantages

This section discusses the aspects of the businesses of those interviewed, which create competitive advantages. These findings were discussed as trends, avoiding any confidential information and were inferred as applicable to other, similar businesses. There were five sub-thematic categories within the competitive advantage theme. They are listed and described below:

IP Positions. Less than half of the companies represented in this research possess strong intellectual property positions. PurFi, for example, which combines chemical preprocessing and mechanical recycling, has 23 patents and 38 registered trade secrets. On the contrary, four out of 11 companies included in this study possess little to no protected intellectual property. The influence of a robust IP portfolio on the ability to secure investment and drive scale versus the ability of a pre-competitive, open-source approach to IP to impact systemic change is an area to explore in future research.

Technology Gaps. Technology does not appear to be the predominant gap when considering the business case (or lack thereof) for using post-consumer textile waste as a feedstock. Results showed that technology barriers were noted less often across all interviewees than commercial barriers (four times less often), process economics (seven times less often), and market dynamics (nine times less often). For traders, technology barriers were mentioned even less frequently compared to other above-mentioned concepts. While mechanical cotton and polyester recycling is well-established, and depolymerization systems are well underway to achieve scale, solvent recycling for cotton waste is still struggling to achieve the necessary process economics due to limitations in its feedstock requirements/system sensitivity and solvent costs. Most of the discussion surrounding these barriers was in reference to incremental technology improvements that could continue to improve process economics, such as those that might allow more recyclers to remove spandex or decolorization methods that would work across many fibers without degradation; this type of feedstock is also discussed in the market dynamics section as an area of opportunity. In these areas, feedback from recyclers indicated that:

- -

Continued development of pre-processing systems that allow for the “dissolution of spandex and automated removal of trims” will improve the ability to scale up post-consumer textile waste inputs. Half of the recyclers interviewed indicated they are able to manage some level of spandex.

- -

“Widespread use of decolorization” would be a benefit for both solvent and mechanical recyclers. However, at what point it would best be implemented was not discussed. A total of 60% of the recyclers mentioned being able to remove color at some point in their processes but still indicated color removal or color sorting as an overall challenge. Mechanical recyclers expressed some concerns that bleaching would damage the already shortened fibers and that sorting by color would be less expensive. However, uniform white was discussed as having a positive impact on downstream costs associated with production by creating a more uniform yarn/fabric position for spinners or mills (i.e., they may currently have three recycled yarn colors each suitable to be overdyed in a different shade range: light, medium, or dark). Traders indicated that white feedstocks can command upwards of a 200% premium.

- -

“Automated sorting technologies” will improve sortation for recyclability but would not replace manual labor to select items best for types of resales. Ultimately, chemical recycling for mixed blends will “crack the code” of post-consumer waste and offer new markets for traders.

Delivering Success. All participants were asked how they deliver success against the competitive set. Many topics were discussed in response to this question: verticality, technology, process efficiencies, incumbent advantages, etc. Each description was clear in terms of unique positioning whether or not the company possessed a strong IP position. There were three commonly occurring topics that appeared in this section of the interviews: The first topic is “scalability”. Participants often noted that it is very difficult to scale technology that is not “off-the-shelf”. Likewise, they also noted that building upon an established business is an advantage based on access to funding and facilities. The second topic was “waste ownership”. Within the context of competitive advantages, ownership of the waste stream through vertical integration was found to be a strategy among both traders and recyclers. It is perhaps less obvious but was mentioned most frequently in reference to competitive advantage. The third topic was “technologies” that decrease system sensitivity and allow for minimal additional processing steps (i.e., cleaning, separation, etc.) for the post-consumer feedstocks. Chemical recycling for cotton/polyester blended textiles with the ability to remove chemical or biological contaminants gained unanimous support across participants as representing a clear advantage in relation to post-consumer waste and was noted as the most promising way to further reduce the post-consumer textile waste heading to landfill. Technology was discussed as a way to compliment current higher-value markets by allowing the lower value feedstocks to be recycled into fibers; although half of the recyclers interviewed had at least some chemical technology within their operations, none of the traders indicated that they were trading waste with these companies at the time when these interviews were conducted.

White Space Opportunities. When asked about specific opportunities for the USA, several participants noted the large volumes of waste by category as an opportunity for the country. One interviewee expressed the view that the “low-hanging fruit” in the USA has not yet been captured. Other participants also commented on the advantages of the country being the size of the population, the enormity of the waste problem, and the presence of large corporations in the waste management space. These were broadly considered to put the USA in a beneficial position should the circular economy for textiles become a top priority. To illustrate the enormity of the opportunity, one interviewee suggested that a nationwide recycling drive of just one category of clothing (i.e., jeans) would create an immense and uniform feedstock that could be recycled using current technologies. The presence of color in post-consumer textile feedstocks was brought up by every interviewee either as a challenge or an advantage. Seeing that it is felt acutely along the value chain, broader application of decolorization for post-consumer feedstocks is likely to increase the valorization potential of this waste; therefore, it has been noted as both a technology gap and white space opportunity. To gain insight into potential opportunities, Harrie Schoots, who was the president of the American Association of Textile Chemists and Colorists at the time of this study, was consulted. He discussed how a reduction system such as the one used in mechanical paper recycling could be used in addition to bleaching to remove the chromophores. He indicated that this method has also been applied to decolorize the various chromophores present in textiles usually without quality degradation as seen with bleaching [

42]. Finding adjacencies such as this to tackle the challenges of color could be an area of opportunity. Having an effective decolorization process to increase the availability of preferred feedstocks would improve downstream process efficiencies [

23], reduce barriers to off-take, and further expand market opportunities for trading textile wastes.

Understanding the optimal point within the value chain in which to apply this type of technique would be necessary to fully assess the opportunity. Additionally, a financial comparison between trading and manufacturing using waste that is sorted by color versus applying a reduction technique remains an area for further research. Nearly half of the participants across both groups suggested new approaches to trading feedstocks in which mechanical and chemical recyclers become suppliers and customers of each other. Similarly, the belief that every part of an item should be repurposed and that fibers should be viewed as an asset whose quality should be maintained for as long as possible was broadly agreed upon. In keeping with this approach, the method of recycling that keeps the highest fiber integrity would be prioritized over those that degrade it at the polymer level. This would be consistent with the findings presented in the literature review [

23]. One trader provided an example of how this could be implemented; he referenced a “rags as service” model in which white, cotton, post-consumer waste is sold as wipers to a company that provides rags to clients as a service. After degradation from repeated use and industrial laundering, they could be sold as feedstock for chemical recyclers. Another aspect of this opportunity is sorting by wear and tear. However, two participants with experience in testing sortation systems expressed doubt that either FIR or manual sorting by garment condition would accurately sort by fiber condition. As discussed in the literature review section, wear and tear have a substantial impact on the quality of the fiber and its resulting recyclability [

33].

(Fashion) Business Know-How. The participants with resale either directly in their business model or those that sold directly to re-commerce businesses indicated that it was their primary source of revenue but, that, like other fashion businesses, resale is nuanced. Understanding what will sell in different channels and different regions is the merchandising nuance that drives success. This is less linear than the technological approach of how to sort by category, condition, color, fiber, etc. Instead, the qualifying factors determining if a used garment is or is not suited for resale is not a simple equation. According to the interviewees, the first consideration should be if an item can be sold regardless of quality; there are new items that will not sell and worn-out items that will be optimal to resell. Two participants suggested that items that cannot sell should be able to meet recycling outcomes: most traders indicated that only about 25% of used garments that are collected are sold in a primary market, further supporting the above finding that sorting using a merchandising method is an opportunity. Restricting what is suitable for recycling based only on technology definitions could be a failure to understand the nuance of fashion and to maximize the resale potential and value of used garments, which could, in turn, impede the business case for recycling post-consumer textile waste.

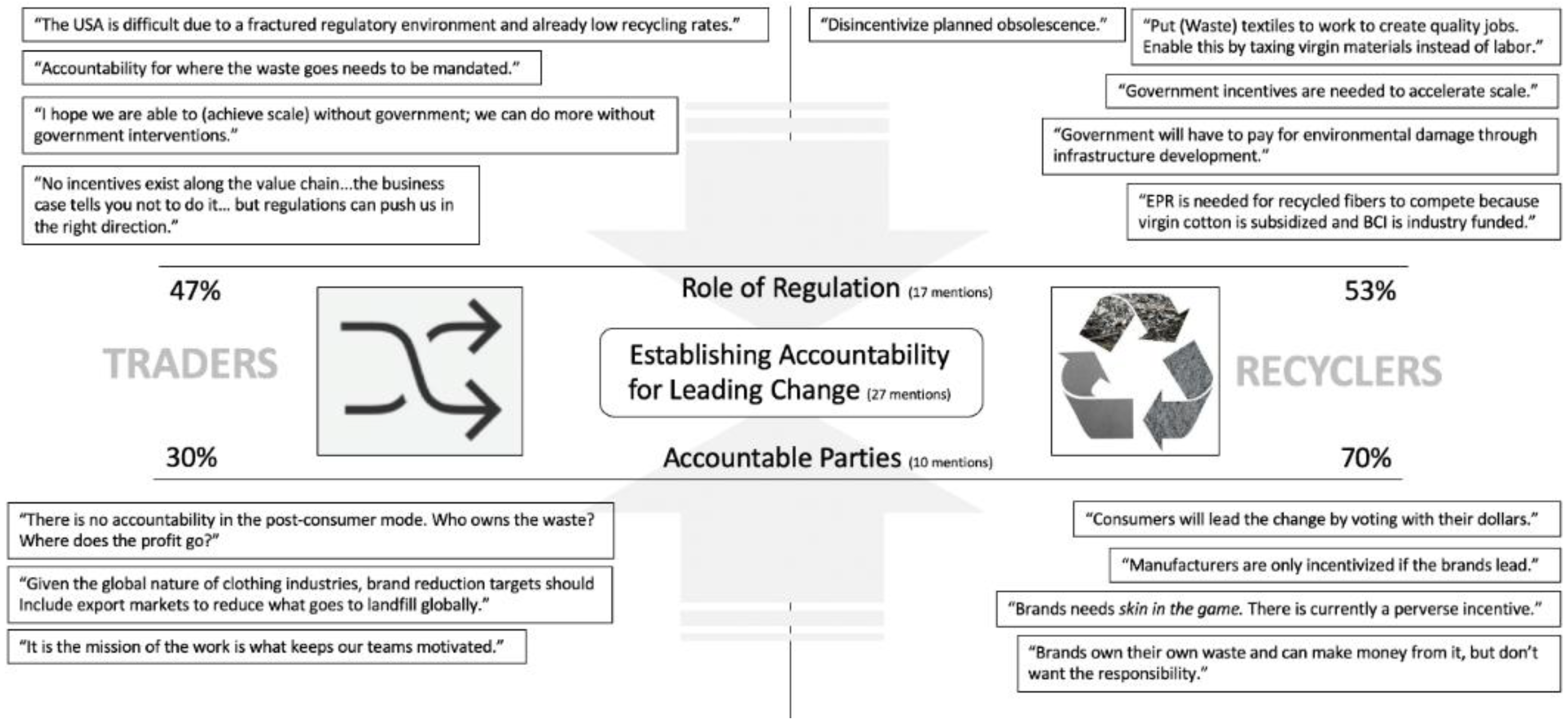

4.5. Establishing Accountability for Leading Change

Defining a clear front-runner to lead the development of a robust system of textile recovery and recycling within the US was harder to pin down, highlighting the level of codependency amongst players. Those interviewed tended to express the sentiment that change will require an external push. Two sub-thematic categories emerged when probing this topic: the role of regulations and external accountable parties (

Figure 4).

Role of Regulation. Nine out of eleven participants referenced regulation as a necessary step to push textile-to-textile recycling forward. Eight out of eleven interviewees mentioned “extended producer responsibility (ERP) schemes for apparel” as the optimal form of regulation to fund infrastructure development. Additional regulations referenced were punitive taxes on virgin fibers and mandatory recycled content thresholds for new products. Despite the wide support for extended producer responsibility, there was little clarity regarding how the mechanism would work and how it might impact market dynamics. It was not clear if this would be implemented just as a tax or could truly push accountability by defining the owner of the waste, as the name suggests. Support for regulation and government leading was not unanimous; several participants expressed a preference for businesses to solve the problem, with one participant even stating that more can be accomplished without government intervention. Another participant suggested a shift in taxation from labor to materials to aid in the creation of quality jobs focused on a domestic textile reverse logistics and sortation system.

Accountable Parties. After the role of regulation, nearly half of the participants indicated that apparel brands are accountable for leading the change. It is notable that brands were not present in the groups interviewed, and no participants indicated themselves as accountable; however, shared accountability was referenced with the next level of frequency. This confirms the earlier findings from the literature review that stakeholders in the circular economy tend to feel change is outside of their sphere of influence [

18]. One participant said that apparel brands are the owners of the textile waste (post-consumer, pre-consumer, and post-industrial types) and could make money from it; however, they are not interested in taking responsibility, perhaps because the business case for it is still unclear.

5. Discussion

Our study findings reveal that the scale of the textile waste problem is larger than the existing sector can handle, and it is not scaling fast enough, particularly outside of the European Union. It is still unclear how a robust system for textile recovery and textile-to-textile recycling will be financed or further developed in the US to ensure that post-consumer waste is kept out of landfills. As with any circular system, there are many actors who must participate to make it work. To secure participation, all stakeholders need to be incentivized financially or through other, unique value propositions. Without sufficient incentives, the businesses needed to scale the textile recycling sector will not fully develop, meaning textile waste will continue to accumulate. Considering there is no profit margin in trading post-consumer textiles for use only in textile-to-textile recycling, it must be built alongside other markets to be profitable for traders. When considering the point of view of a recycler using post-consumer textile waste feedstocks, predictability and low feedstock costs are key to securing profitability.

Technology gaps are no longer the primary barriers to progress; the textile circular value chain faces challenges to scaling that are commercial in nature. These relate to securing stable market partners, achieving optimal process economics, proving long-term financial viability, and resolving foundational misalignments regarding ownership. The system being developed must be created with post-consumer waste as a primary consideration because the textile waste problem shows no signs of slowing down and cannot be solved unless it provides solutions for post-consumer textile waste. New market approaches could be employed to maximize the valorization potential of textile wastes. However, even with scaled technologies and new systems for trading, a fundamental misalignment regarding ownership and accountability of textile waste poses risk to progress. As shown in this study, accountability for and ownership of the textile waste problem is not broadly agreed upon. Establishing clarity surrounding ownership roles and responsibilities across stakeholders could support the development of textile trading and recycling sectors by providing greater clarity on necessary actions and could enable business development in this space.

5.1. Theoretical and Practical Implications

As discussed in the results section, “feedstock standardization” is needed because there appears to be a disconnect between new recyclers and current traders; traders are sorting for their known and understood markets whereas these new recyclers are asking for different specifications and at different prices. The trader is not able to service this new customer type because doing so would create a loss for them. Greater standardization of feedstocks should also bring predictability to the recyclers’ feedstock prices and further the establishment of viable process economics for recycling. Thus, a collaborative effort to standardize the feedstocks to serve both markets would be a meaningful step forward and would allow the new and old to move together to grow this sector. Open-source solutions that would contribute to the standardization of feedstocks, such as decolorization, would also contribute to a more efficient and financially robust system of textile waste trading that would include many types of recycling.

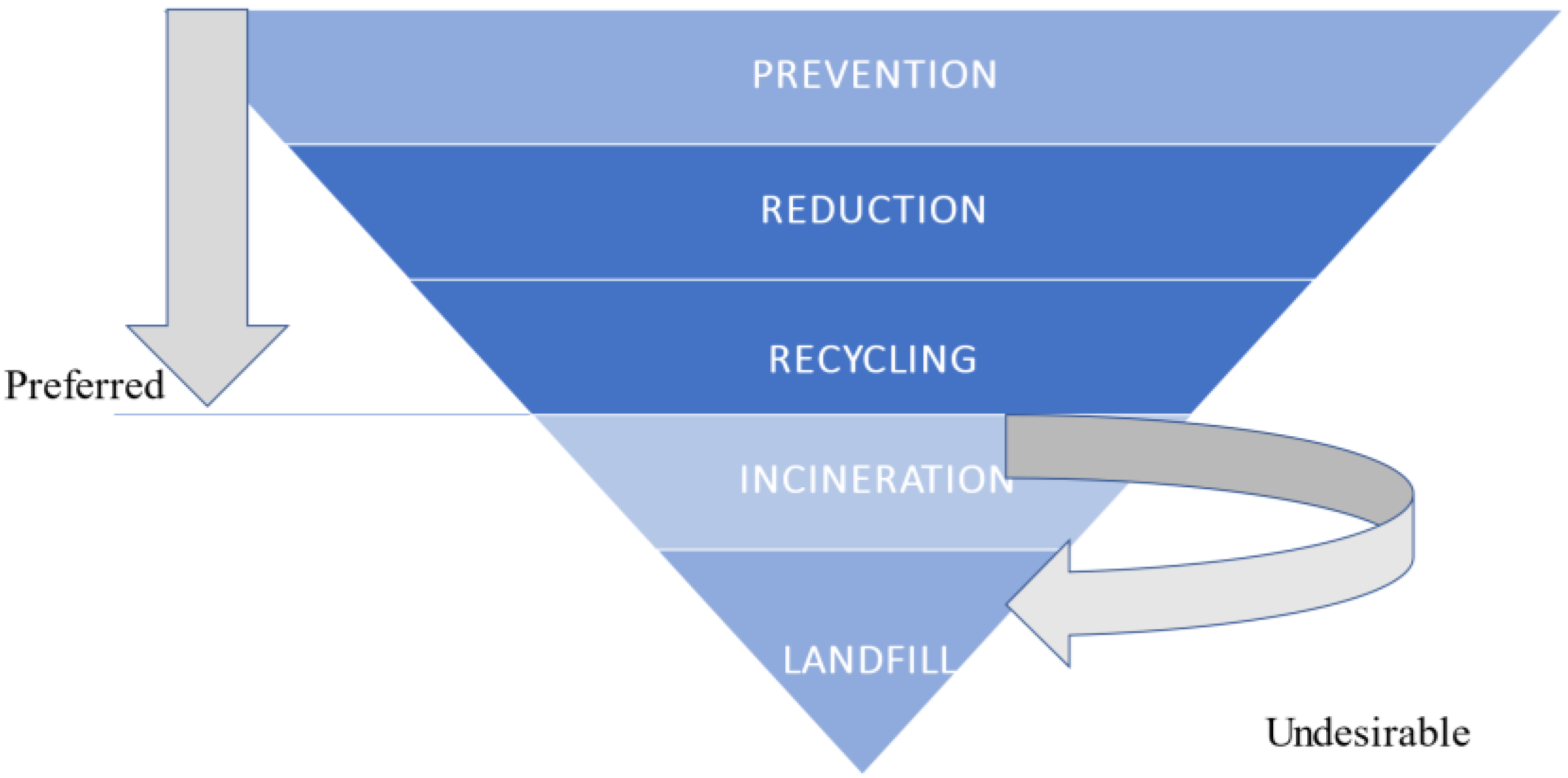

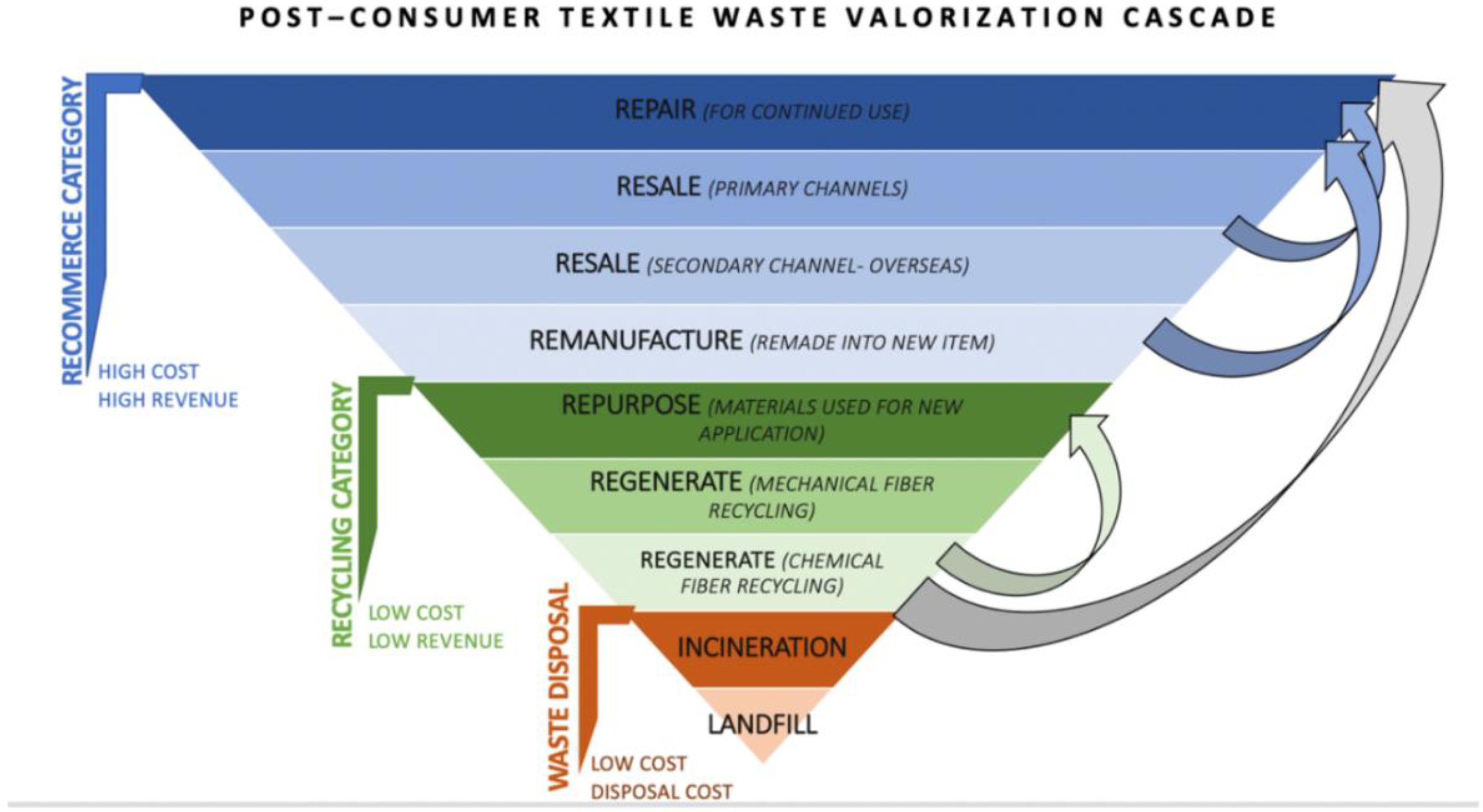

Further, as suggested in this paper, a “cascading approach to textile waste diversion” should be considered more seriously to better align financial incentives and ideal environmental outcomes. Competition for a small percentage of available post-consumer textile waste specifications and risks to put upward pressure on feedstock and recycled fiber costs jeopardizes the financial viability of recycled fibers and reduces the speed with which new technologies are applied to reduce textile waste destined for landfill. Considering the various limitations due to different levels of system sensitivity across new and existing recycling options, process losses could be captured and traded to improve profitability as illustrated in

Figure 5 below. For example, as one interviewee suggested, they could sell the degraded fibers that are a by-product of their process to chemical recyclers for regeneration. This suggestion reveals a snapshot of a cascading approach’s full potential. This method was reiterated in half of the interviews conducted. Thus, we are proposing consideration of a “postconsumer textile waste valorization cascade” (

Figure 5) as a reconsidered version of the waste hierarchy from the literature review section.

As shown in

Figure 5, the higher the level is of the inverted triangle, the higher the revenue potential, and the larger the environmental benefit. In this model, the fiber itself is considered an asset, and the progression of markets is organized to maximize its use. Because of this, there may be differences in how certain fiber types flow through the cascade because recycling methods should be logically sequenced to maintain the integrity of the fiber for as long as possible. Recycling is not used as a primary descriptor; instead, the term is used to refer to a group of collective activities. In the chart, there are three groups of collective activities: re-commerce, recycling, and waste disposal. Three arrows are placed on the right-hand side to indicate where fibers have the opportunity to continue to recirculate.

This approach reframes the conversation from downcycling to the longevity of the fiber and polymer use or regeneration through a cascading system. For example, wipers would qualify as a repurposed material; that end-market, then, assumes a higher level than regeneration through chemical recycling. This framework also proposes a different market structure; for example, recyclers would become buyers of each other’s by-products; textile traders would sell to networks of workshops that repurpose materials into new products, and the waste from that process would then be sold to chemical recyclers that can regenerate even the polymers present in the trims. It would become an intricate web of buyers and sellers trading to maintain fiber assets to maximize the times these polymers can generate value across many different owners. Having proper tracking systems would be important to making this reconsidered market structure work.

This research indicates that both theoretical and practical considerations are needed to determine who owns the textile waste. Throughout this research, there was a consistent, underlying correlation between the perceived waste owner and the entity held accountable for leading change. In these interviews, accountability was usually discussed as external to the individual speaking; however, there were exceptions. It appeared that the possibility of profit led to more claims of ownership. One interviewee referred to this dynamic as a “war on waste.” In that context, the interviewee provided an example of a brand that historically left full accountability for cutting room waste disposal with the supplier, requesting discounts on per item costs because they became aware that the waste was being sold-on for mechanical recycling. Interestingly, not all the study participants were aligned on waste ownership; some believe the brands own it, others believe the suppliers, and others themselves. They frequently noted that there is no accountability in the post-consumer textile waste model; whoever has the waste can profit from it but may not feel responsible to take the lead through systemic change. They also noted that this contrasts with pre-consumer waste trading, where the accountability is clearly tied to the originator of the waste who must pay to dispose of it. Similarly, another participant noted that waste is sometimes sold back to the original owner of the raw material, representing a financial loss for the original owner. Participants also indicated that owning the waste and its revalorization potential represents a substantial opportunity; however, most brands do not want to assume the associated responsibility. Instead, in the current post-consumer textile waste system, private enterprises often assume ownership, collect subsidies, and profit from selling the waste, but are not necessarily investing in systemic change. The division of ownership and responsibility is a difficult dynamic because it risks allowing the approach to waste, and therefore system development efforts, to be splintered.

In the case of post-consumer textile waste, the person or entity who holds an item, in actuality, determines the item’s end-of-life outcome; how can they be incentivized to maximize the waste’s valorization potential before disposal? This question is worth further consideration and research. Additionally, with the higher degree of variation between municipalities in the US, there was skepticism from the groups interviewed that penalties for improper disposal would be as effective as consumer and business incentives. The “owner,” in a sense, is actually the custodian of the garment/waste with an important role to play in creating a circular outcome; could each custodian, or stakeholder, be held accountable? A system of joint accountability requires clarity on roles at each point and necessitates joint value creation to motivate stakeholders by building suitable incentives into systems and interactions. When considering joint accountability, both the traders and recyclers, through the execution of their business models, are fulfilling their roles as custodians by preventing waste from going to landfill. However, as one of the study participants noted, this is happening only on a national level. More could be done to tackle this problem on a global scale, particularly in the overseas resale markets. Furthermore, government and businesses could collaborate to ensure consumers have convenient access to recycling and that items are designed to be more suitable for valorization, meaning they are developed to facilitate repurposing into new uses at the highest possible feedstock value.

5.2. Future Research

Extended producer responsibility (EPR) was the most commonly referenced policy throughout this study, which addressed the accountability of brands through government-imposed financial penalties for non-recyclable items. Although frequently referenced, the details of this policy were not well understood. Many questions were unanswered, for example: how its implementation would influence the market dynamics within the value chain; how exactly it would be funded; how those funds could be allocated; would the funding and incentives created be sufficient to finance the necessary infrastructure to divert post-consumer textile waste from the landfill; if the brand’s funding would become the owners of the accumulated waste. Establishing clarity surrounding ownership roles and responsibilities would support further development of textile trading and recycling sectors; clarity and structure would have a strong influence on the market dynamics, provide greater clarity on necessary actions across stakeholder groups, and enable business development in this space. As participants noted, “entity that accumulates the profit is key when actors in the system need to be held accountable for where the waste goes.” Mandates defining levels of ownership and corresponding responsibilities throughout the existing market appear to be an opportunity to further facilitate progress. With this clarity, a system of joint accountability could co-develop and co-exist with one of joint value creation. Research is needed to provide insights into how policy and regulation could contribute to joint value through the creation of financial incentives across stakeholder groups in the circular textile value chain; this would help fuel business development and sector growth in the US and beyond.

5.3. Limitations

This research explores business challenges to scaling textile-to-textile recycling within the US market, mainly from trader and recycler perspectives. Other types of textile waste are not within the scope of this study. To minimize regulatory and infrastructure variation, the scope of the study was confined to the US and the state of its infrastructure for trading post-consumer textile waste.